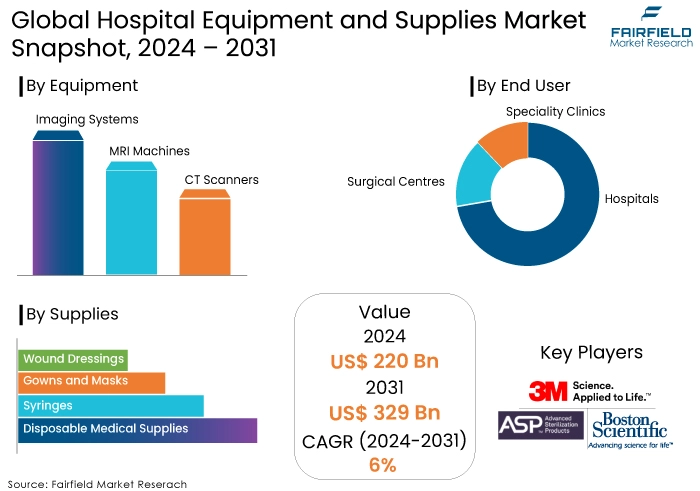

Global Hospital Equipment and Supplies Market Forecast

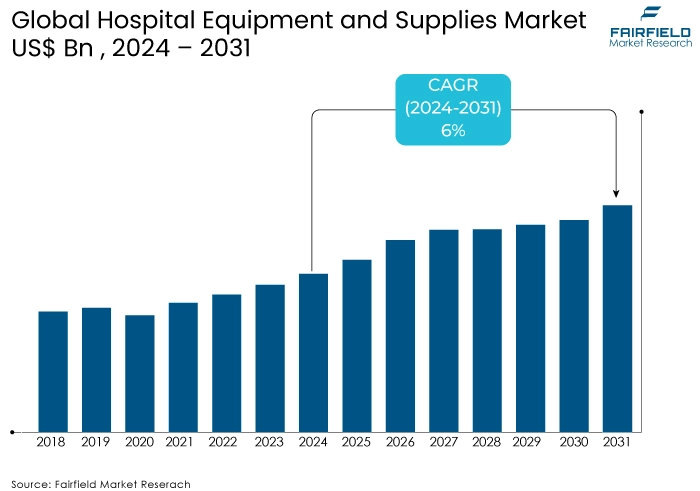

- Hospital equipment and supplies market size poised to reach US$329 Bn in 2031, up from US$220 Bn attained in 2024

- Global hospital equipment and supplies market revenue projected to witness a CAGR of 6% during 2024-2031

Hospital Equipment and Supplies Market Insights

- The effective operation of hospitals and clinics is contingent upon availability of hospital equipment and supplies. They are a diverse array of medical supplies, instruments, and devices employed in hospitals and other healthcare facilities.

- Treating, disinfecting, sterilizing, transporting, and conducting preliminary diagnoses of patients are among the numerous applications for which they are employed. The hospital equipment and supplies market has experienced substantial expansion in recent years.

- Technologically sophisticated medical equipment is being introduced by prominent manufacturers of medical supplies to aid physicians in the more effective management of their patients.

- In hospitals, medical apparatus is essential for the treatment of a variety of medical conditions. Quality medical supplies are necessary for hospitals to deliver exceptional patient care and reduce costs.

- Products such as gloves, syringes, wound care products, feeding tubes, surgical packs, and PPE packages, among others, are employed extensively in the healthcare sector and fall under the disposable products category.

- The demand for disposable items experienced a significant increase during the COVID-19 pandemic to prevent unnecessarily exposing oneself to the virus.

- The healthcare industry's increasing demand has resulted in a highly fragmented market, with many actors engaged in developing cost-effective products.

- Budding participants who aspire to participate in the medical device sector are anticipated to capitalize on substantial opportunities during market expansion.

A Look Back and a Look Forward - Comparative Analysis

The hospital equipment and supplies market experienced substantial growth up to 2023, driven by increasing healthcare needs and technological advancements. Factors such as the rising prevalence of chronic diseases, an aging global population, and increased surgical procedures increased demand for advanced medical equipment and supplies.

Innovations in medical technology, such as minimally invasive surgical instruments, advanced diagnostic devices, and enhanced patient monitoring systems, played a crucial role in market expansion. Moreover, the COVID-19 pandemic acted as a catalyst, significantly boosting the demand for hospital supplies, including personal protective equipment (PPE), ventilators, and diagnostic tests. However, supply chain disruptions and regulatory challenges occasionally hindered market growth during this period.

Post-2024, the hospital equipment and supplies market is expected to enter a phase of accelerated growth, with a projected CAGR of 6%. This growth is said to be fueled by ongoing advancements in medical technology, including the integration of Artificial Intelligence (AI), and machine learning (ML) in diagnostic and therapeutic devices. The increasing adoption of telemedicine and remote patient monitoring systems will drive demand for innovative hospital equipment.

Emerging markets, particularly in Asia and Africa, are expected to contribute significantly to market expansion due to improving healthcare infrastructure and rising healthcare expenditure. Furthermore, a growing focus on personalized medicine and precision healthcare will spur demand for specialized medical devices and supplies. However, potential challenges such as regulatory hurdles, high costs of advanced equipment, and economic uncertainties could impact market growth. Efforts to improve affordability and accessibility, particularly in developing regions, will be crucial for sustained market advancement.

Key Growth Determinants

- Technological Advancements

Technological advancements are a significant growth driver in the hospital equipment and supplies market. Innovations in medical technology, such as the development of minimally invasive surgical instruments, advanced diagnostic imaging devices, and state-of-the-art patient monitoring systems, have significantly enhanced the efficiency and effectiveness of healthcare delivery.

For instance, integrating Artificial Intelligence (AI), and machine learning (ML) into diagnostic equipment has improved the accuracy and speed of disease detection, enabling earlier and more precise treatment.

Additionally, advancements in telemedicine and remote monitoring technologies have revolutionized patient care, allowing for real-time data collection and analysis, which improves patient outcomes and reduces hospital readmissions. These technological innovations improve patient care and drive demand for new and upgraded hospital equipment and supplies, contributing to market growth.

- Expansion of Healthcare Infrastructure in Developing Markets

Expanding healthcare infrastructure in emerging markets is a key growth driver for the hospital equipment and supplies market. Countries in regions such as Asia, Africa, and Latin America are experiencing rapid economic growth, leading to increased healthcare expenditure and the development of new healthcare facilities. Governments and private sectors in these regions invest heavily in healthcare infrastructure to improve access to quality care for their populations; this includes the construction of new hospitals, clinics, and diagnostic centres, as well as upgrading existing facilities.

Additionally, international and local manufacturers increasingly focus on these emerging markets, offering cost-effective and technologically advanced products to meet the growing needs, this trend is expected to drive significant market growth as emerging economies continue to develop their healthcare systems and increase their capacity to deliver advanced medical care.

Key Growth Barriers

- High Costs of Advanced Equipment

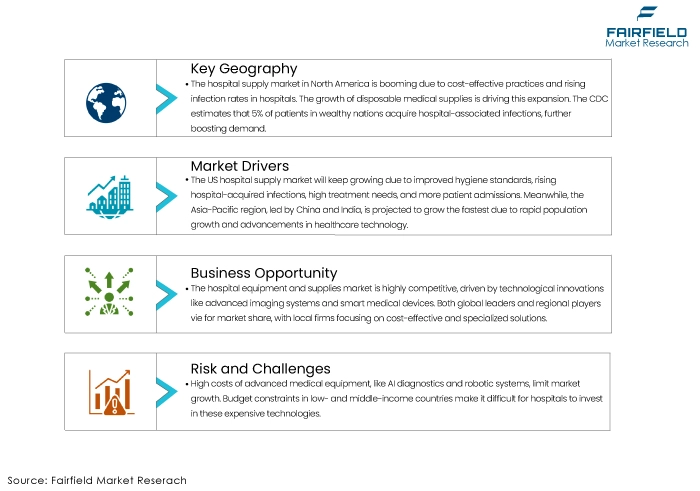

The high costs associated with advanced medical equipment and supplies significantly restrain the growth of the hospital equipment and supplies market.

Cutting-edge technologies, such as AI-integrated diagnostic tools, robotic surgical systems, and advanced imaging devices, come with substantial price tags. This financial burden is particularly challenging for hospitals and healthcare facilities in low- and middle-income countries, where budget constraints limit their ability to invest in new technologies.

Even in more developed regions, healthcare providers often face strict budgetary restrictions, making it easier to justify the high costs of the latest equipment with clear and immediate cost-benefit evidence. Consequently, the high initial investment required for advanced medical equipment can slow the adoption rate and impede market growth, as healthcare facilities may opt for more affordable, albeit less advanced, alternatives.

- Stringent Regulatory and Approval Processes

Stringent regulatory and approval processes also significantly restrain the growth of the hospital equipment and supplies market. The medical device industry is heavily regulated to ensure patient safety and product efficacy.

Regulatory approval for new medical devices involves lengthy, complex, and costly procedures that vary significantly across different regions. The said barrier delays the introduction of innovative products to the market, hindering the ability of manufacturers to respond to emerging healthcare needs quickly.

Additionally, the need for global harmonization in regulatory standards complicates the process for companies looking to expand their market reach.

These regulatory hurdles increase the time and cost of bringing new products to market and pose a barrier to smaller companies and start-ups, limiting overall innovation and growth within the industry. Addressing these regulatory and reimbursement hurdles is crucial for facilitating market growth and ensuring patients can access the latest and most effective compression therapy solutions.

Hospital Equipment and Supplies Market Trends and Opportunities

- Shift Towards Telemedicine and Remote Monitoring

A significant trend in the hospital equipment and supplies market is the shift towards telemedicine and remote monitoring, this trend has been accelerated by the COVID-19 pandemic, highlighting the need for remote healthcare solutions to reduce the risk of infection and ensure continuous care. Telemedicine allows healthcare providers to consult with patients virtually, eliminating the need for in-person visits. This shift has driven demand for a range of equipment and supplies, including high-quality cameras, secure communication platforms, and diagnostic tools that can be used remotely.

Additionally, remote monitoring devices, such as wearable health trackers and home-based diagnostic kits, have become increasingly popular. These devices enable continuous monitoring of patient's health metrics, such as heart rate, blood pressure, and glucose levels, providing real-time data to healthcare providers, this improves patient outcomes by facilitating early detection and intervention and reduces the burden on healthcare facilities.

Integrating AI and ML in these devices further enhances their capabilities, allowing for more accurate data analysis and predictive healthcare. As technology advances, the adoption of telemedicine and remote monitoring is expected to grow, driving demand for innovative hospital equipment and supplies that support these healthcare delivery models.

- Expansion into Developing Markets

Expansion into emerging markets represents a significant opportunity for the hospital equipment and supplies market. Countries in regions such as Asia, Africa, and Latin America are undergoing rapid economic growth, leading to increased healthcare expenditure and the development of new healthcare facilities. As these regions invest in improving their healthcare infrastructure, there is a growing demand for a wide range of medical devices and supplies, from essential equipment to advanced technologies.

For instance, the construction of new hospitals and clinics and the modernization of existing facilities drive the need for diagnostic equipment, surgical instruments, and patient monitoring systems. Moreover, these regions' increasing prevalence of chronic diseases and the rising aging population further boost the demand for medical equipment and supplies. To capitalize on this opportunity, companies can focus on developing cost-effective and scalable solutions tailored to the specific needs of these emerging markets.

Strategic partnerships with local distributors and healthcare providers can facilitate market entry and expansion. Additionally, investing in educational initiatives to raise awareness about the benefits of advanced medical equipment can drive adoption. By tapping into the unmet healthcare needs and leveraging the growing economic potential of emerging markets, manufacturers can significantly enhance their market presence and drive substantial growth in the hospital equipment and supplies sector.

How is Regulatory Scenario Shaping this Industry?

The regulatory landscape significantly impacts the hospital equipment and supplies market. Stringent regulations, such as those governing product safety, efficacy, and quality, are essential to protect patient safety and ensure market integrity. Bodies like the FDA in the US, EMA in Europe, and CDSCO in India play pivotal roles in setting standards and approving medical devices.

Compliance with these regulations is mandatory for market entry and sustained operations. However, the complex and evolving regulatory environment can increase costs, delay product launches, and hinder innovation. On the other hand, robust regulations can foster consumer trust and create a level playing field for market participants. Additionally, reimbursement policies and healthcare reforms influence the demand for medical equipment and supplies. These factors can impact product pricing, adoption rates, and overall market dynamics.

Segments Covered in Hospital Equipment and Supplies Market Report

- Diagnostic Imaging Systems Remain Dominant

The demand for diagnostic imaging systems is driven by the increasing prevalence of chronic diseases, such as cancer and cardiovascular disorders, which require advanced imaging techniques for effective diagnosis and monitoring. Technological advancements, such as the development of high-resolution imaging and functional imaging techniques, have further boosted the demand for these systems.

Additionally, the growing emphasis on early detection and preventive healthcare contributes to the high utilization of diagnostic imaging systems. The integration of AI and ML in imaging systems has enhanced diagnostic accuracy and efficiency, leading to their increased adoption in hospitals and diagnostic centres. As healthcare providers continue to seek advanced diagnostic solutions to improve patient outcomes, diagnostic imaging systems remain a key segment driving growth in the hospital equipment and supplies market.

- Demand for Disposable Medical Supplies to be Maximum

The need for infection control and patient safety drives the demand for disposable medical supplies. Disposable items are preferred due to their single-use nature, which helps prevent cross-contamination and reduces the risk of healthcare-associated infections. The COVID-19 pandemic significantly accelerated the demand for disposable supplies, especially personal protective equipment (PPE) such as masks and gloves, highlighting their critical role in infection prevention.

Additionally, the convenience and cost-effectiveness of disposable supplies contribute to their widespread use in hospitals. As healthcare facilities prioritize infection control and efficiency, disposable medical supplies remain dominant and essential in the hospital supplies market.

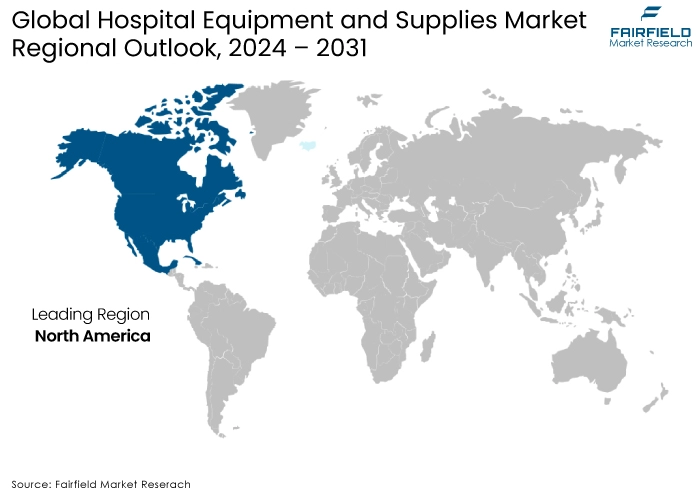

Regional Analysis

- North America Retains the Largest Revenue Share

The hospital supply market has expanded due to the ongoing emphasis on the creative and cost-effective practices employed in the US, which has contributed to North America's dominant position. It is also anticipated that the hospital equipment and supplies market for hospital supplies will expand due to the increasing prevalence of infectious diseases and infections that are acquired in hospitals. In recent years, disposable medical supplies have experienced extraordinary growth, which is anticipated further to accelerate the market's expansion in North America. The CDC predicts that 5% of patients in affluent nations contract infections associated with hospitals.

Consequently, the US hospital supply market will continue to be stimulated by the adoption of medical hygiene standards, the expansion of the prevalence of hospital-acquired infections, the high treatment requirements, and the increase in patient admissions. The Asia Pacific region, which encompasses countries such as China, and India, is anticipated to experience the highest CAGR during the forecast period due to the extraordinary population growth rate. The healthcare industry's technological advancements and increasing R&D expenditures are the primary drivers of China's growth. China is expected to dominate East Asia's growth due to its extensive supply of consumable medical supplies, rapid technological advancements, and many healthcare industry companies.

Fairfield’s Competitive Landscape Analysis

The hospital equipment and supplies market is highly competitive, with technological innovations, such as advanced imaging systems and intelligent medical devices drive major global players and the competition. Regional and local players also contribute to the market, focusing on cost-effective solutions and specialized products.

Strategic initiatives, including mergers and acquisitions, partnerships, and regional expansions, are expected as companies seek to enhance their market presence. Regulatory compliance and supply chain management are critical factors influencing competitive positioning, alongside efforts to meet evolving healthcare needs and standards.

Key Market Companies

- 3M Health Care Corporation

- Advanced Sterilization Products Services Inc.

- Boston Scientific Corporation

- Braun Melsungen AG

- Becton Dickinson Corporation

- Baxter International Inc.

- Cardinal Heath

- Covidien Corporation

- Dickinson and Company

- Getinge AB

- Kimberly-Clark Corporation

- Medtronic PLC

- Terumo Corporation

- Thermo Fisher Scientific Inc.

Recent Industry Developments

- In June 2022, Boston Scientific Corporation received 510(k) approval from the US Food and Drug Administration (FDA) for its EMBOLD Fibered Detachable Coil, a device that is employed to restrict or limit the rate at which blood flows in the peripheral circulation.

- In June 2022, BD acquired Parata Systems, a pharmacy automation technology supplier at the forefront of the industry. Integrating Parata's state-of-the-art pharmacy automation solutions portfolio will enhance BD's product line.

- In February 2022, the FDA approved the NuVent Eustachian tube dilation balloons for the diagnosis of chronic, obstructive Eustachian Tube Dysfunction, as Medtronic plc announced.

An Expert’s Eye

- Robust market growth is expected due to increasing healthcare expenditure, aging population, and rising prevalence of chronic diseases.

- Technological advancements are driving demand for sophisticated equipment and supplies.

- Significant growth potential is spotted in developing countries.

- Stringent regulations, though slow down the market entry, tend to ensure product safety.

- Focus on affordable equipment and supplies will be the prime area of focus for wider adoption.

- Growing demand for connected medical devices and digital health solutions will mark an important trend in market.

- The supply chain resilience is crucial for ensuring uninterrupted supply of essential equipment and supplies.

- Growing emphasis on eco-friendly and sustainable products is a strongly thriving trend shaping market dynamics.

Global Hospital Equipment and Supplies Market is Segmented as-

By Equipment

- Imaging Systems

- MRI Machines

- CT Scanners

By Supplies

- Disposable Medical Supplies

- Syringes

- Gowns and Masks

- Wound Dressings

By End User

- Hospitals

- Surgical Centres

- Speciality Clinics

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

1. Executive Summary

1.1. Global Hospital Equipment and Supplies Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2022

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. Covid-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact Of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. Pestle Analysis

3. Global Hospital Equipment and Supplies Market Outlook, 2018 – 2030

3.1. Global Hospital Equipment and Supplies Market Outlook, by Product, Value (US$ Bn) and Volume (Million Units), 2018 – 2030

3.1.1. Key Highlights

3.1.1.1. Sterilization Consumables

3.1.1.1.1. Single-Use Sterilization Wrap

3.1.1.1.2. Sterile Containers

3.1.1.1.3. Sterilization Paper Bag

3.1.1.1.4. Sterile Indicators Tape

3.1.1.1.5. Sterilization Reels

3.1.1.1.6. Sterilization Pouches

3.1.1.2. Wound Care Products

3.1.1.2.1. Disposable Wound Care Devices

3.1.1.2.1.1. Disposable Wound Irrigation Device

3.1.1.2.1.2. Disposable Surgical Wound Drainage/ Evacuator

3.1.1.2.2. Negative Pressure Wound Therapy Devices (NPWT)

3.1.1.2.2.1. Disposable Negative Pressure Wound Therapy Devices (NPWT)

3.1.1.2.2.2. Disposable NPWT Accessories / Dressing Kits

3.1.1.2.3. Traditional Wound Care Product

3.1.1.2.4. Advanced Wound Care Products

3.1.1.2.4.1. Hydrogel Dressing

3.1.1.2.4.2. Semi Permeable Films Dressing

3.1.1.2.4.3. Foam Dressings

3.1.1.2.4.4. Alginate Dressings

3.1.1.2.4.5. Hydrocolloid Dressings

3.1.1.2.4.6. Collagen Dressings

3.1.1.2.4.7. Wound Contact Layer

3.1.1.2.4.8. Super Absorbent Dressings

3.1.1.2.4.9. Hydrofibers

3.1.1.3. Dialysis Products

3.1.1.3.1. Concentrates & Solutions

3.1.1.3.2. Bloodlines System & Disposable Catheters

3.1.1.3.2.1. Foley Urinary Catheter

3.1.1.3.2.2. Dialysis Catheters

3.1.1.3.2.2.1. PICC- Peripherally Inserted Central Catheter

3.1.1.3.2.2.2. Peripheral Intravenous Catheters (PIVC)

3.1.1.3.2.2.3. Central Venous Catheter (CVC)

3.1.1.3.3. Disposable Dialyzers

3.1.1.3.3.1. Low Flux Single Use Dialyzers

3.1.1.3.3.2. High Flux Single Use Dialyzers

3.1.1.3.4. Dialysis Consumables

3.1.1.3.4.1. Dialysis Fistula Needle

3.1.1.3.4.2. Dialysis Drainage Bag/ Urine Collection Bags

3.1.1.3.5. Critical Care Products

3.1.1.3.5.1. Dialysis Care Kit

3.1.1.3.5.2. Disposable Blood Pressure Transducer

3.1.1.4. Infusion Products

3.1.1.4.1. Disposable Infusion Set

3.1.1.4.2. Disposable Infusion Pump

3.1.1.4.3. Disposable Accessories

3.1.1.4.3.1. Disposable Needles

3.1.1.4.3.2. IV Catheters & Cannulas

3.1.1.4.3.3. Disposable Syringes

3.1.1.4.3.3.1. Smart Syringes

3.1.1.4.3.3.2. Prefilled Syringes

3.1.1.4.4. Disposable Pressure Infusion Bags

3.1.1.5. Hypodermic Products & Radiology Products

3.1.1.5.1. Hypodermic Products

3.1.1.5.1.1. Hypodermic Needles & Syringes

3.1.1.5.1.2. Safety Disposable Needles

3.1.1.5.2. Radiology Products

3.1.1.6. Intubation & Respiratory Supplies

3.1.1.6.1. Airway Management Tubes

3.1.1.6.1.1. Surgical Suction Product

3.1.1.6.1.1.1. Suction Tubing

3.1.1.6.1.1.2. Yankeur Suction Set

3.1.1.6.1.1.3. Suction Catheter

3.1.1.6.1.2. Endobronchial Tubes

3.1.1.6.1.3. Endotracheal Tubes

3.1.1.6.1.4. Nasal Airway Tubes

3.1.1.6.1.5. Oral Airway Tubes (Guedel Airway)

3.1.1.6.1.6. Tracheostomy Tubes

3.1.1.6.1.7. Laryngeal Mask Airway

3.1.1.6.2. Intubation Accessories

3.1.1.6.3. Nasal Cannula

3.1.1.6.3.1. Standard Nasal Cannula

3.1.1.6.3.2. High Flow Nasal Cannula

3.1.1.6.3.3. etCO2 Sampling Cannula

3.1.1.6.4. Breathing Circuits

3.1.1.6.5. Breathing Filters

3.1.1.6.6. Respiratory Masks

3.1.1.6.6.1. Anesthesia Mask

3.1.1.6.6.2. Oxygen Mask

3.1.1.6.6.3. High Flow Oxygen Mask

3.1.1.6.6.4. CPAP Mask

3.1.1.6.6.5. Nebulizer Mask

3.1.1.6.7. Manual Resuscitator Bag

3.1.1.6.8. Tracheal Swivel Connector

3.1.1.6.9. Catheter Mount

3.1.1.6.10. Oxygen Tubing

3.1.1.7. Surgical Procedure Kits & Trays

3.1.1.7.1. Disposable Surgical Trays

3.1.1.7.1.1. Laparoscopic Trays

3.1.1.7.1.2. Laceration Trays

3.1.1.7.1.3. Ent and Ophthalmic Custom Trays

3.1.1.7.1.4. Custom Ob/Gynae Kits

3.1.1.7.1.5. Hysterectomy Kits

3.1.1.7.1.6. Open Heart Surgery Kits & Angiography/ Angioplasty/ Catheterization Kits

3.1.1.7.1.7. Lumbar Puncture Trays

3.1.1.7.1.8. Biopsy Trays

3.1.1.7.2. Disposable Surgical Kits

3.1.1.7.2.1. Suture Removal Kits

3.1.1.7.2.2. Dressing Kits

3.1.1.7.2.3. Orthopedic Kits & Trays

3.1.1.7.2.4. Anesthesia Kits

3.1.1.7.3. Surgical Pack0073x

3.1.1.7.3.1. Angiography Surgical Packs

3.1.1.7.3.2. Laparotomy Surgical Packs

3.1.1.7.3.3. Universal Surgical Packs

3.1.1.7.3.4. C-Section Surgical Packs

3.1.1.7.3.5. Lithotomy Surgical Packs

3.1.1.7.3.6. Orthopedic Surgical Packs

3.1.1.7.4. Others

3.1.1.8. Blood Management & Diagnostic Supplies

3.1.1.8.1. Disposable Blood Bags

3.1.1.8.1.1. Collection Bags

3.1.1.8.1.1.1. Single Collection Bags

3.1.1.8.1.1.2. Double Collection Bags

3.1.1.8.1.1.3. Triple Collection Bags

3.1.1.8.1.1.4. Quadruple Collection Bags

3.1.1.8.1.2. Transfer Bags

3.1.1.8.2. Diagnostic Kits

3.1.1.8.2.1. Glucose Monitoring Strips

3.1.1.8.2.2. Blood Lancets

3.1.1.8.2.3. Blood Collection Needle

3.1.1.8.2.4. Blood/Specimen Collection Test Tubes

3.1.1.8.2.5. Swabs

3.1.1.8.2.6. Disposable ECG Consumables

3.1.1.8.2.7. Non-Invasive Blood Pressure (NIBP) Cuff

3.1.1.8.2.8. Sp02 Sensor

3.1.1.8.2.9. Ultrasound Disposables

3.1.1.9. General Disposable Products

3.1.1.9.1. Disposable Apparel/Medical Protective Equipment

3.1.1.9.1.1. Disposable Masks

3.1.1.9.1.1.1. Surgical Masks

3.1.1.9.1.1.1.1. Basic Surgical Masks

3.1.1.9.1.1.1.2. Anti-Fog Foam Surgical Masks

3.1.1.9.1.1.1.3. Fluid/Splash Resistant Surgical Masks

3.1.1.9.1.1.1.4. Anesthesia Masks

3.1.1.9.1.1.1.5. Others

3.1.1.9.1.1.2. Respirator Masks

3.1.1.9.1.1.2.1. Single Strap Masks

3.1.1.9.1.1.2.2. Filter Dust Masks

3.1.1.9.1.1.2.3. Half-Face Masks

3.1.1.9.1.1.2.4. Full-Face Masks

3.1.1.9.1.1.2.5. PAPRs

3.1.1.9.1.2. Disposable Gowns

3.1.1.9.1.2.1. Surgical Gowns

3.1.1.9.1.2.2. Non-Surgical Gowns

3.1.1.9.1.2.3. Isolation Gowns

3.1.1.9.1.3. Disposable Drapes and Aprons

3.1.1.9.1.3.1. Incise

3.1.1.9.1.3.2. Sheets/Bedsheets

3.1.1.9.1.3.3. Laparoscopy

3.1.1.9.1.3.4. Lithotomy

3.1.1.9.1.3.5. Laparotomy

3.1.1.9.1.3.6. Leggings

3.1.1.9.1.3.7. Others

3.1.1.9.1.4. Face Shields

3.1.1.9.1.4.1. Anti-Fog Face Shields

3.1.1.9.1.4.2. Anti-Glares Face Shields

3.1.1.9.1.4.3. Others

3.1.1.9.1.5. Disposable Gloves

3.1.1.9.1.5.1. Examination Gloves

3.1.1.9.1.5.2. Surgical Gloves

3.1.1.9.1.6. Surgeon Caps

3.1.1.9.1.7. Others

3.1.1.9.2. Disposable Incontinence Products

3.1.1.9.2.1. Maceratable Products

3.1.1.9.2.2. Adult Diapers

3.1.1.9.2.3. Underpads

3.1.1.9.2.4. Others

3.1.1.9.3. Gastroenterology Disposables

3.1.1.9.3.1. Feeding Bags

3.1.1.9.3.2. Feeding Tubes

3.1.1.9.4. Holloware

3.1.1.10. Equipment

3.1.1.10.1. Digital Flat Scale

3.1.1.10.2. Digital Baby Scale

3.1.1.10.3. Infantometer

3.1.1.10.4. Stadiometer

3.1.1.10.5. Measuring Tape

3.1.1.10.6. Rotatory Sealer

3.1.1.10.7. Blood Pressure Monitor

3.1.1.10.8. Wireless Fetal Monitoring Systems

3.1.1.10.9. Vein Viewer

3.1.1.10.10. Glucose Monitor

3.2. Global Hospital Equipment and Supplies Market Outlook, by Application, Value (US$ Bn) and Volume (Million Units), 2018 – 2030

3.2.1. Key Highlights

3.2.1.1. Cardiovascular

3.2.1.2. Cerebrovascular

3.2.1.3. Dental

3.2.1.4. Laparoscopy

3.2.1.5. Gynecology

3.2.1.6. Urology

3.2.1.7. Orthopedics

3.2.1.8. Others

3.3. Global Hospital Equipment and Supplies Market Outlook, by End User, Value (US$ Bn) and Volume (Million Units), 2018 – 2030

3.3.1. Key Highlights

3.3.1.1. Hospitals

3.3.1.1.1. Tier 1 Hospital (>500 Beds)

3.3.1.1.2. Tier 2 Hospitals (250-500 Beds)

3.3.1.1.3. Tier 3 Hospitals (3.3.1.2. Ambulatory Surgical Centers

3.3.1.3. Clinics

3.3.1.4. Diagnostic Centers

3.3.1.5. Long Term Care Centers

3.3.1.6. Nursing Facilities

3.4. Global Hospital Equipment and Supplies Market Outlook, by Region, Value (US$ Bn) and Volume (Million Units), 2018 – 2030

3.4.1. Key Highlights

3.4.1.1. North America

3.4.1.2. Europe

3.4.1.3. Asia Pacific

3.4.1.4. Latin America

3.4.1.5. Middle East & Africa

4. North America Hospital Equipment and Supplies Market Outlook, 2018 – 2030

4.1. North America Hospital Equipment and Supplies Market Outlook, by Product, Value (US$ Bn) and Volume (Million Units), 2018 – 2030

4.1.1. Key Highlights

4.1.1.1. Sterilization Consumables

4.1.1.1.1. Single-Use Sterilization Wrap

4.1.1.1.2. Sterile Containers

4.1.1.1.3. Sterilization Paper Bag

4.1.1.1.4. Sterile Indicators Tape

4.1.1.1.5. Sterilization Reels

4.1.1.1.6. Sterilization Pouches

4.1.1.2. Wound Care Products

4.1.1.2.1. Disposable Wound Care Devices

4.1.1.2.1.1. Disposable Wound Irrigation Device

4.1.1.2.1.2. Disposable Surgical Wound Drainage/ Evacuator

4.1.1.2.2. Negative Pressure Wound Therapy Devices (NPWT)

4.1.1.2.2.1. Disposable Negative Pressure Wound Therapy Devices (NPWT)

4.1.1.2.2.2. Disposable NPWT Accessories / Dressing Kits

4.1.1.2.3. Traditional Wound Care Product

4.1.1.2.4. Advanced Wound Care Products

4.1.1.2.4.1. Hydrogel Dressing

4.1.1.2.4.2. Semi Permeable Films Dressing

4.1.1.2.4.3. Foam Dressings

4.1.1.2.4.4. Alginate Dressings

4.1.1.2.4.5. Hydrocolloid Dressings

4.1.1.2.4.6. Collagen Dressings

4.1.1.2.4.7. Wound Contact Layer

4.1.1.2.4.8. Super Absorbent Dressings

4.1.1.2.4.9. Hydrofibers

4.1.1.3. Dialysis Products

4.1.1.3.1. Concentrates & Solutions

4.1.1.3.2. Bloodlines System & Disposable Catheters

4.1.1.3.2.1. Foley Urinary Catheter

4.1.1.3.2.2. Dialysis Catheters

4.1.1.3.2.2.1. PICC- Peripherally Inserted Central Catheter

4.1.1.3.2.2.2. Peripheral Intravenous Catheters (PIVC)

4.1.1.3.2.2.3. Central Venous Catheter (CVC)

4.1.1.3.3. Disposable Dialyzers

4.1.1.3.3.1. Low Flux Single Use Dialyzers

4.1.1.3.3.2. High Flux Single Use Dialyzers

4.1.1.3.4. Dialysis Consumables

4.1.1.3.4.1. Dialysis Fistula Needle

4.1.1.3.4.2. Dialysis Drainage Bag/ Urine Collection Bags

4.1.1.3.5. Critical Care Products

4.1.1.3.5.1. Dialysis Care Kit

4.1.1.3.5.2. Disposable Blood Pressure Transducer

4.1.1.4. Infusion Products

4.1.1.4.1. Disposable Infusion Set

4.1.1.4.2. Disposable Infusion Pump

4.1.1.4.3. Disposable Accessories

4.1.1.4.3.1. Disposable Needles

4.1.1.4.3.2. IV Catheters & Cannulas

4.1.1.4.3.3. Disposable Syringes

4.1.1.4.3.3.1. Smart Syringes

4.1.1.4.3.3.2. Prefilled Syringes

4.1.1.4.4. Disposable Pressure Infusion Bags

4.1.1.5. Hypodermic Products & Radiology Products

4.1.1.5.1. Hypodermic Products

4.1.1.5.1.1. Hypodermic Needles & Syringes

4.1.1.5.1.2. Safety Disposable Needles

4.1.1.5.2. Radiology Products

4.1.1.6. Intubation & Respiratory Supplies

4.1.1.6.1. Airway Management Tubes

4.1.1.6.1.1. Surgical Suction Product

4.1.1.6.1.1.1. Suction Tubing

4.1.1.6.1.1.2. Yankeur Suction Set

4.1.1.6.1.1.3. Suction Catheter

4.1.1.6.1.2. Endobronchial Tubes

4.1.1.6.1.3. Endotracheal Tubes

4.1.1.6.1.4. Nasal Airway Tubes

4.1.1.6.1.5. Oral Airway Tubes (Guedel Airway)

4.1.1.6.1.6. Tracheostomy Tubes

4.1.1.6.1.7. Laryngeal Mask Airway

4.1.1.6.2. Intubation Accessories

4.1.1.6.3. Nasal Cannula

4.1.1.6.3.1. Standard Nasal Cannula

4.1.1.6.3.2. High Flow Nasal Cannula

4.1.1.6.3.3. etCO2 Sampling Cannula

4.1.1.6.4. Breathing Circuits

4.1.1.6.5. Breathing Filters

4.1.1.6.6. Respiratory Masks

4.1.1.6.6.1. Anesthesia Mask

4.1.1.6.6.2. Oxygen Mask

4.1.1.6.6.3. High Flow Oxygen Mask

4.1.1.6.6.4. CPAP Mask

4.1.1.6.6.5. Nebulizer Mask

4.1.1.6.7. Manual Resuscitator Bag

4.1.1.6.8. Tracheal Swivel Connector

4.1.1.6.9. Catheter Mount

4.1.1.6.10. Oxygen Tubing

4.1.1.7. Surgical Procedure Kits & Trays

4.1.1.7.1. Disposable Surgical Trays

4.1.1.7.1.1. Laparoscopic Trays

4.1.1.7.1.2. Laceration Trays

4.1.1.7.1.3. Ent and Ophthalmic Custom Trays

4.1.1.7.1.4. Custom Ob/Gynae Kits

4.1.1.7.1.5. Hysterectomy Kits

4.1.1.7.1.6. Open Heart Surgery Kits & Angiography/ Angioplasty/ Catheterization Kits

4.1.1.7.1.7. Lumbar Puncture Trays

4.1.1.7.1.8. Biopsy Trays

4.1.1.7.2. Disposable Surgical Kits

4.1.1.7.2.1. Suture Removal Kits

4.1.1.7.2.2. Dressing Kits

4.1.1.7.2.3. Orthopedic Kits & Trays

4.1.1.7.2.4. Anesthesia Kits

4.1.1.7.3. Surgical Pack0073x

4.1.1.7.3.1. Angiography Surgical Packs

4.1.1.7.3.2. Laparotomy Surgical Packs

4.1.1.7.3.3. Universal Surgical Packs

4.1.1.7.3.4. C-Section Surgical Packs

4.1.1.7.3.5. Lithotomy Surgical Packs

4.1.1.7.3.6. Orthopedic Surgical Packs

4.1.1.7.4. Others

4.1.1.8. Blood Management & Diagnostic Supplies

4.1.1.8.1. Disposable Blood Bags

4.1.1.8.1.1. Collection Bags

4.1.1.8.1.1.1. Single Collection Bags

4.1.1.8.1.1.2. Double Collection Bags

4.1.1.8.1.1.3. Triple Collection Bags

4.1.1.8.1.1.4. Quadruple Collection Bags

4.1.1.8.1.2. Transfer Bags

4.1.1.8.2. Diagnostic Kits

4.1.1.8.2.1. Glucose Monitoring Strips

4.1.1.8.2.2. Blood Lancets

4.1.1.8.2.3. Blood Collection Needle

4.1.1.8.2.4. Blood/Specimen Collection Test Tubes

4.1.1.8.2.5. Swabs

4.1.1.8.2.6. Disposable ECG Consumables

4.1.1.8.2.7. Non-Invasive Blood Pressure (NIBP) Cuff

4.1.1.8.2.8. Sp02 Sensor

4.1.1.8.2.9. Ultrasound Disposables

4.1.1.9. General Disposable Products

4.1.1.9.1. Disposable Apparel/Medical Protective Equipment

4.1.1.9.1.1. Disposable Masks

4.1.1.9.1.1.1. Surgical Masks

4.1.1.9.1.1.1.1. Basic Surgical Masks

4.1.1.9.1.1.1.2. Anti-Fog Foam Surgical Masks

4.1.1.9.1.1.1.3. Fluid/Splash Resistant Surgical Masks

4.1.1.9.1.1.1.4. Anesthesia Masks

4.1.1.9.1.1.1.5. Others

4.1.1.9.1.1.2. Respirator Masks

4.1.1.9.1.1.2.1. Single Strap Masks

4.1.1.9.1.1.2.2. Filter Dust Masks

4.1.1.9.1.1.2.3. Half-Face Masks

4.1.1.9.1.1.2.4. Full-Face Masks

4.1.1.9.1.1.2.5. PAPRs

4.1.1.9.1.2. Disposable Gowns

4.1.1.9.1.2.1. Surgical Gowns

4.1.1.9.1.2.2. Non-Surgical Gowns

4.1.1.9.1.2.3. Isolation Gowns

4.1.1.9.1.3. Disposable Drapes and Aprons

4.1.1.9.1.3.1. Incise

4.1.1.9.1.3.2. Sheets/Bedsheets

4.1.1.9.1.3.3. Laparoscopy

4.1.1.9.1.3.4. Lithotomy

4.1.1.9.1.3.5. Laparotomy

4.1.1.9.1.3.6. Leggings

4.1.1.9.1.3.7. Others

4.1.1.9.1.4. Face Shields

4.1.1.9.1.4.1. Anti-Fog Face Shields

4.1.1.9.1.4.2. Anti-Glares Face Shields

4.1.1.9.1.4.3. Others

4.1.1.9.1.5. Disposable Gloves

4.1.1.9.1.5.1. Examination Gloves

4.1.1.9.1.5.2. Surgical Gloves

4.1.1.9.1.6. Surgeon Caps

4.1.1.9.1.7. Others

4.1.1.9.2. Disposable Incontinence Products

4.1.1.9.2.1. Maceratable Products

4.1.1.9.2.2. Adult Diapers

4.1.1.9.2.3. Underpads

4.1.1.9.2.4. Others

4.1.1.9.3. Gastroenterology Disposables

4.1.1.9.3.1. Feeding Bags

4.1.1.9.3.2. Feeding Tubes

4.1.1.9.4. Holloware

4.1.1.10. Equipment

4.1.1.10.1. Digital Flat Scale

4.1.1.10.2. Digital Baby Scale

4.1.1.10.3. Infantometer

4.1.1.10.4. Stadiometer

4.1.1.10.5. Measuring Tape

4.1.1.10.6. Rotatory Sealer

4.1.1.10.7. Blood Pressure Monitor

4.1.1.10.8. Wireless Fetal Monitoring Systems

4.1.1.10.9. Vein Viewer

4.1.1.10.10. Glucose Monitor

4.2. North America Hospital Equipment and Supplies Market Outlook, by Application, Value (US$ Bn) and Volume (Million Units), 2018 – 2030

4.2.1. Key Highlights

4.2.1.1. Cardiovascular

4.2.1.2. Cerebrovascular

4.2.1.3. Dental

4.2.1.4. Laparoscopy

4.2.1.5. Gynecology

4.2.1.6. Urology

4.2.1.7. Orthopedics

4.2.1.8. Others

4.3. North America Hospital Equipment and Supplies Market Outlook, by End User, Value (US$ Bn) and Volume (Million Units), 2018 – 2030

4.3.1. Key Highlights

4.3.1.1. Hospitals

4.3.1.1.1. Tier 1 Hospital (>500 Beds)

4.3.1.1.2. Tier 2 Hospitals (250-500 Beds)

4.3.1.1.3. Tier 3 Hospitals (4.3.1.2. Ambulatory Surgical Centers

4.3.1.3. Clinics

4.3.1.4. Diagnostic Centers

4.3.1.5. Long Term Care Centers

4.3.1.6. Nursing Facilities

4.3.2. BPS Analysis/Market Attractiveness Analysis

4.4. North America Hospital Equipment and Supplies Market Outlook, by Country, Value (US$ Bn) and Volume (Million Units), 2018 – 2030

4.4.1. Key Highlights

4.4.1.1. U.S. Hospital Equipment and Supplies Market by Product, Value (US$ Bn) and Volume (Million Units), 2018 – 2030

4.4.1.2. U.S. Hospital Equipment and Supplies Market by Application, Value (US$ Bn) and Volume (Million Units), 2018 – 2030

4.4.1.3. U.S. Hospital Equipment and Supplies Market by End User, Value (US$ Bn) and Volume (Million Units), 2018 – 2030

4.4.1.4. Canada Hospital Equipment and Supplies Market by Product, Value (US$ Bn) and Volume (Million Units), 2018 – 2030

4.4.1.5. Canada Hospital Equipment and Supplies Market by Application, Value (US$ Bn) and Volume (Million Units), 2018 – 2030

4.4.1.6. Canada Hospital Equipment and Supplies Market by End User, Value (US$ Bn) and Volume (Million Units), 2018 – 2030

4.4.2. BPS Analysis/Market Attractiveness Analysis

5. Europe Hospital Equipment and Supplies Market Outlook, 2018 – 2030

5.1. Europe Hospital Equipment and Supplies Market Outlook, by Product, Value (US$ Bn) and Volume (Million Units), 2018 – 2030

5.1.1. Key Highlights

5.1.1.1. Sterilization Consumables

5.1.1.1.1. Single-Use Sterilization Wrap

5.1.1.1.2. Sterile Containers

5.1.1.1.3. Sterilization Paper Bag

5.1.1.1.4. Sterile Indicators Tape

5.1.1.1.5. Sterilization Reels

5.1.1.1.6. Sterilization Pouches

5.1.1.2. Wound Care Products

5.1.1.2.1. Disposable Wound Care Devices

5.1.1.2.1.1. Disposable Wound Irrigation Device

5.1.1.2.1.2. Disposable Surgical Wound Drainage/ Evacuator

5.1.1.2.2. Negative Pressure Wound Therapy Devices (NPWT)

5.1.1.2.2.1. Disposable Negative Pressure Wound Therapy Devices (NPWT)

5.1.1.2.2.2. Disposable NPWT Accessories / Dressing Kits

5.1.1.2.3. Traditional Wound Care Product

5.1.1.2.4. Advanced Wound Care Products

5.1.1.2.4.1. Hydrogel Dressing

5.1.1.2.4.2. Semi Permeable Films Dressing

5.1.1.2.4.3. Foam Dressings

5.1.1.2.4.4. Alginate Dressings

5.1.1.2.4.5. Hydrocolloid Dressings

5.1.1.2.4.6. Collagen Dressings

5.1.1.2.4.7. Wound Contact Layer

5.1.1.2.4.8. Super Absorbent Dressings

5.1.1.2.4.9. Hydrofibers

5.1.1.3. Dialysis Products

5.1.1.3.1. Concentrates & Solutions

5.1.1.3.2. Bloodlines System & Disposable Catheters

5.1.1.3.2.1. Foley Urinary Catheter

5.1.1.3.2.2. Dialysis Catheters

5.1.1.3.2.2.1. PICC- Peripherally Inserted Central Catheter

5.1.1.3.2.2.2. Peripheral Intravenous Catheters (PIVC)

5.1.1.3.2.2.3. Central Venous Catheter (CVC)

5.1.1.3.3. Disposable Dialyzers

5.1.1.3.3.1. Low Flux Single Use Dialyzers

5.1.1.3.3.2. High Flux Single Use Dialyzers

5.1.1.3.4. Dialysis Consumables

5.1.1.3.4.1. Dialysis Fistula Needle

5.1.1.3.4.2. Dialysis Drainage Bag/ Urine Collection Bags

5.1.1.3.5. Critical Care Products

5.1.1.3.5.1. Dialysis Care Kit

5.1.1.3.5.2. Disposable Blood Pressure Transducer

5.1.1.4. Infusion Products

5.1.1.4.1. Disposable Infusion Set

5.1.1.4.2. Disposable Infusion Pump

5.1.1.4.3. Disposable Accessories

5.1.1.4.3.1. Disposable Needles

5.1.1.4.3.2. IV Catheters & Cannulas

5.1.1.4.3.3. Disposable Syringes

5.1.1.4.3.3.1. Smart Syringes

5.1.1.4.3.3.2. Prefilled Syringes

5.1.1.4.4. Disposable Pressure Infusion Bags

5.1.1.5. Hypodermic Products & Radiology Products

5.1.1.5.1. Hypodermic Products

5.1.1.5.1.1. Hypodermic Needles & Syringes

5.1.1.5.1.2. Safety Disposable Needles

5.1.1.5.2. Radiology Products

5.1.1.6. Intubation & Respiratory Supplies

5.1.1.6.1. Airway Management Tubes

5.1.1.6.1.1. Surgical Suction Product

5.1.1.6.1.1.1. Suction Tubing

5.1.1.6.1.1.2. Yankeur Suction Set

5.1.1.6.1.1.3. Suction Catheter

5.1.1.6.1.2. Endobronchial Tubes

5.1.1.6.1.3. Endotracheal Tubes

5.1.1.6.1.4. Nasal Airway Tubes

5.1.1.6.1.5. Oral Airway Tubes (Guedel Airway)

5.1.1.6.1.6. Tracheostomy Tubes

5.1.1.6.1.7. Laryngeal Mask Airway

5.1.1.6.2. Intubation Accessories

5.1.1.6.3. Nasal Cannula

5.1.1.6.3.1. Standard Nasal Cannula

5.1.1.6.3.2. High Flow Nasal Cannula

5.1.1.6.3.3. etCO2 Sampling Cannula

5.1.1.6.4. Breathing Circuits

5.1.1.6.5. Breathing Filters

5.1.1.6.6. Respiratory Masks

5.1.1.6.6.1. Anesthesia Mask

5.1.1.6.6.2. Oxygen Mask

5.1.1.6.6.3. High Flow Oxygen Mask

5.1.1.6.6.4. CPAP Mask

5.1.1.6.6.5. Nebulizer Mask

5.1.1.6.7. Manual Resuscitator Bag

5.1.1.6.8. Tracheal Swivel Connector

5.1.1.6.9. Catheter Mount

5.1.1.6.10. Oxygen Tubing

5.1.1.7. Surgical Procedure Kits & Trays

5.1.1.7.1. Disposable Surgical Trays

5.1.1.7.1.1. Laparoscopic Trays

5.1.1.7.1.2. Laceration Trays

5.1.1.7.1.3. Ent and Ophthalmic Custom Trays

5.1.1.7.1.4. Custom Ob/Gynae Kits

5.1.1.7.1.5. Hysterectomy Kits

5.1.1.7.1.6. Open Heart Surgery Kits & Angiography/ Angioplasty/ Catheterization Kits

5.1.1.7.1.7. Lumbar Puncture Trays

5.1.1.7.1.8. Biopsy Trays

5.1.1.7.2. Disposable Surgical Kits

5.1.1.7.2.1. Suture Removal Kits

5.1.1.7.2.2. Dressing Kits

5.1.1.7.2.3. Orthopedic Kits & Trays

5.1.1.7.2.4. Anesthesia Kits

5.1.1.7.3. Surgical Pack0073x

5.1.1.7.3.1. Angiography Surgical Packs

5.1.1.7.3.2. Laparotomy Surgical Packs

5.1.1.7.3.3. Universal Surgical Packs

5.1.1.7.3.4. C-Section Surgical Packs

5.1.1.7.3.5. Lithotomy Surgical Packs

5.1.1.7.3.6. Orthopedic Surgical Packs

5.1.1.7.4. Others

5.1.1.8. Blood Management & Diagnostic Supplies

5.1.1.8.1. Disposable Blood Bags

5.1.1.8.1.1. Collection Bags

5.1.1.8.1.1.1. Single Collection Bags

5.1.1.8.1.1.2. Double Collection Bags

5.1.1.8.1.1.3. Triple Collection Bags

5.1.1.8.1.1.4. Quadruple Collection Bags

5.1.1.8.1.2. Transfer Bags

5.1.1.8.2. Diagnostic Kits

5.1.1.8.2.1. Glucose Monitoring Strips

5.1.1.8.2.2. Blood Lancets

5.1.1.8.2.3. Blood Collection Needle

5.1.1.8.2.4. Blood/Specimen Collection Test Tubes

5.1.1.8.2.5. Swabs

5.1.1.8.2.6. Disposable ECG Consumables

5.1.1.8.2.7. Non-Invasive Blood Pressure (NIBP) Cuff

5.1.1.8.2.8. Sp02 Sensor

5.1.1.8.2.9. Ultrasound Disposables

5.1.1.9. General Disposable Products

5.1.1.9.1. Disposable Apparel/Medical Protective Equipment

5.1.1.9.1.1. Disposable Masks

5.1.1.9.1.1.1. Surgical Masks

5.1.1.9.1.1.1.1. Basic Surgical Masks

5.1.1.9.1.1.1.2. Anti-Fog Foam Surgical Masks

5.1.1.9.1.1.1.3. Fluid/Splash Resistant Surgical Masks

5.1.1.9.1.1.1.4. Anesthesia Masks

5.1.1.9.1.1.1.5. Others

5.1.1.9.1.1.2. Respirator Masks

5.1.1.9.1.1.2.1. Single Strap Masks

5.1.1.9.1.1.2.2. Filter Dust Masks

5.1.1.9.1.1.2.3. Half-Face Masks

5.1.1.9.1.1.2.4. Full-Face Masks

5.1.1.9.1.1.2.5. PAPRs

5.1.1.9.1.2. Disposable Gowns

5.1.1.9.1.2.1. Surgical Gowns

5.1.1.9.1.2.2. Non-Surgical Gowns

5.1.1.9.1.2.3. Isolation Gowns

5.1.1.9.1.3. Disposable Drapes and Aprons

5.1.1.9.1.3.1. Incise

5.1.1.9.1.3.2. Sheets/Bedsheets

5.1.1.9.1.3.3. Laparoscopy

5.1.1.9.1.3.4. Lithotomy

5.1.1.9.1.3.5. Laparotomy

5.1.1.9.1.3.6. Leggings

5.1.1.9.1.3.7. Others

5.1.1.9.1.4. Face Shields

5.1.1.9.1.4.1. Anti-Fog Face Shields

5.1.1.9.1.4.2. Anti-Glares Face Shields

5.1.1.9.1.4.3. Others

5.1.1.9.1.5. Disposable Gloves

5.1.1.9.1.5.1. Examination Gloves

5.1.1.9.1.5.2. Surgical Gloves

5.1.1.9.1.6. Surgeon Caps

5.1.1.9.1.7. Others

5.1.1.9.2. Disposable Incontinence Products

5.1.1.9.2.1. Maceratable Products

5.1.1.9.2.2. Adult Diapers

5.1.1.9.2.3. Underpads

5.1.1.9.2.4. Others

5.1.1.9.3. Gastroenterology Disposables

5.1.1.9.3.1. Feeding Bags

5.1.1.9.3.2. Feeding Tubes

5.1.1.9.4. Holloware

5.1.1.10. Equipment

5.1.1.10.1. Digital Flat Scale

5.1.1.10.2. Digital Baby Scale

5.1.1.10.3. Infantometer

5.1.1.10.4. Stadiometer

5.1.1.10.5. Measuring Tape

5.1.1.10.6. Rotatory Sealer

5.1.1.10.7. Blood Pressure Monitor

5.1.1.10.8. Wireless Fetal Monitoring Systems

5.1.1.10.9. Vein Viewer

5.1.1.10.10. Glucose Monitor

5.2. Europe Hospital Equipment and Supplies Market Outlook, by Application, Value (US$ Bn) and Volume (Million Units), 2018 – 2030

5.2.1. Key Highlights

5.2.1.1. Cardiovascular

5.2.1.2. Cerebrovascular

5.2.1.3. Dental

5.2.1.4. Laparoscopy

5.2.1.5. Gynecology

5.2.1.6. Urology

5.2.1.7. Orthopedics

5.2.1.8. Others

5.3. Europe Hospital Equipment and Supplies Market Outlook, by End User, Value (US$ Bn) and Volume (Million Units), 2018 – 2030

5.3.1. Key Highlights

5.3.1.1. Hospitals

5.3.1.1.1. Tier 1 Hospital (>500 Beds)

5.3.1.1.2. Tier 2 Hospitals (250-500 Beds)

5.3.1.1.3. Tier 3 Hospitals (5.3.1.2. Ambulatory Surgical Centers

5.3.1.3. Clinics

5.3.1.4. Diagnostic Centers

5.3.1.5. Long Term Care Centers

5.3.1.6. Nursing Facilities

5.3.2. BPS Analysis/Market Attractiveness Analysis

5.4. Europe Hospital Equipment and Supplies Market Outlook, by Country, Value (US$ Bn) and Volume (Million Units), 2018 – 2030

5.4.1. Key Highlights

5.4.1.1. Germany Hospital Equipment and Supplies Market by Product, Value (US$ Bn) and Volume (Million Units), 2018 – 2030

5.4.1.2. Germany Hospital Equipment and Supplies Market by Application, Value (US$ Bn) and Volume (Million Units), 2018 – 2030

5.4.1.3. Germany Hospital Equipment and Supplies Market by End User, Value (US$ Bn) and Volume (Million Units), 2018 – 2030

5.4.1.4. U.K. Hospital Equipment and Supplies Market by Product, Value (US$ Bn) and Volume (Million Units), 2018 – 2030

5.4.1.5. U.K. Hospital Equipment and Supplies Market by Application, Value (US$ Bn) and Volume (Million Units), 2018 – 2030

5.4.1.6. U.K. Hospital Equipment and Supplies Market by End User, Value (US$ Bn) and Volume (Million Units), 2018 – 2030

5.4.1.7. France Hospital Equipment and Supplies Market by Product, Value (US$ Bn) and Volume (Million Units), 2018 – 2030

5.4.1.8. France Hospital Equipment and Supplies Market by Application, Value (US$ Bn) and Volume (Million Units), 2018 – 2030

5.4.1.9. France Hospital Equipment and Supplies Market by End User, Value (US$ Bn) and Volume (Million Units), 2018 – 2030

5.4.1.10. Italy Hospital Equipment and Supplies Market by Product, Value (US$ Bn) and Volume (Million Units), 2018 – 2030

5.4.1.11. Italy Hospital Equipment and Supplies Market by Application, Value (US$ Bn) and Volume (Million Units), 2018 – 2030

5.4.1.12. Italy Hospital Equipment and Supplies Market by End User, Value (US$ Bn) and Volume (Million Units), 2018 – 2030

5.4.1.13. Turkey Hospital Equipment and Supplies Market by Product, Value (US$ Bn) and Volume (Million Units), 2018 – 2030

5.4.1.14. Turkey Hospital Equipment and Supplies Market by Application, Value (US$ Bn) and Volume (Million Units), 2018 – 2030

5.4.1.15. Turkey Hospital Equipment and Supplies Market by End User, Value (US$ Bn) and Volume (Million Units), 2018 – 2030

5.4.1.16. Russia Hospital Equipment and Supplies Market by Product, Value (US$ Bn) and Volume (Million Units), 2018 – 2030

5.4.1.17. Russia Hospital Equipment and Supplies Market by Application, Value (US$ Bn) and Volume (Million Units), 2018 – 2030

5.4.1.18. Russia Hospital Equipment and Supplies Market by End User, Value (US$ Bn) and Volume (Million Units), 2018 – 2030

5.4.1.19. Rest Of Europe Hospital Equipment and Supplies Market by Product, Value (US$ Bn) and Volume (Million Units), 2018 – 2030

5.4.1.20. Rest Of Europe Hospital Equipment and Supplies Market by Application, Value (US$ Bn) and Volume (Million Units), 2018 – 2030

5.4.1.21. Rest Of Europe Hospital Equipment and Supplies Market by End User, Value (US$ Bn) and Volume (Million Units), 2018 – 2030

5.4.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Hospital Equipment and Supplies Market Outlook, 2018 – 2030

6.1. Asia Pacific Hospital Equipment and Supplies Market Outlook, by Product, Value (US$ Bn) and Volume (Million Units), 2018 – 2030

6.1.1. Key Highlights

6.1.1.1. Sterilization Consumables

6.1.1.1.1. Single-Use Sterilization Wrap

6.1.1.1.2. Sterile Containers

6.1.1.1.3. Sterilization Paper Bag

6.1.1.1.4. Sterile Indicators Tape

6.1.1.1.5. Sterilization Reels

6.1.1.1.6. Sterilization Pouches

6.1.1.2. Wound Care Products

6.1.1.2.1. Disposable Wound Care Devices

6.1.1.2.1.1. Disposable Wound Irrigation Device

6.1.1.2.1.2. Disposable Surgical Wound Drainage/ Evacuator

6.1.1.2.2. Negative Pressure Wound Therapy Devices (NPWT)

6.1.1.2.2.1. Disposable Negative Pressure Wound Therapy Devices (NPWT)

6.1.1.2.2.2. Disposable NPWT Accessories / Dressing Kits

6.1.1.2.3. Traditional Wound Care Product

6.1.1.2.4. Advanced Wound Care Products

6.1.1.2.4.1. Hydrogel Dressing

6.1.1.2.4.2. Semi Permeable Films Dressing

6.1.1.2.4.3. Foam Dressings

6.1.1.2.4.4. Alginate Dressings

6.1.1.2.4.5. Hydrocolloid Dressings

6.1.1.2.4.6. Collagen Dressings

6.1.1.2.4.7. Wound Contact Layer

6.1.1.2.4.8. Super Absorbent Dressings

6.1.1.2.4.9. Hydrofibers

6.1.1.3. Dialysis Products

6.1.1.3.1. Concentrates & Solutions

6.1.1.3.2. Bloodlines System & Disposable Catheters

6.1.1.3.2.1. Foley Urinary Catheter

6.1.1.3.2.2. Dialysis Catheters

6.1.1.3.2.2.1. PICC- Peripherally Inserted Central Catheter

6.1.1.3.2.2.2. Peripheral Intravenous Catheters (PIVC)

6.1.1.3.2.2.3. Central Venous Catheter (CVC)

6.1.1.3.3. Disposable Dialyzers

6.1.1.3.3.1. Low Flux Single Use Dialyzers

6.1.1.3.3.2. High Flux Single Use Dialyzers

6.1.1.3.4. Dialysis Consumables

6.1.1.3.4.1. Dialysis Fistula Needle

6.1.1.3.4.2. Dialysis Drainage Bag/ Urine Collection Bags

6.1.1.3.5. Critical Care Products

6.1.1.3.5.1. Dialysis Care Kit

6.1.1.3.5.2. Disposable Blood Pressure Transducer

6.1.1.4. Infusion Products

6.1.1.4.1. Disposable Infusion Set

6.1.1.4.2. Disposable Infusion Pump

6.1.1.4.3. Disposable Accessories

6.1.1.4.3.1. Disposable Needles

6.1.1.4.3.2. IV Catheters & Cannulas

6.1.1.4.3.3. Disposable Syringes

6.1.1.4.3.3.1. Smart Syringes

6.1.1.4.3.3.2. Prefilled Syringes

6.1.1.4.4. Disposable Pressure Infusion Bags

6.1.1.5. Hypodermic Products & Radiology Products

6.1.1.5.1. Hypodermic Products

6.1.1.5.1.1. Hypodermic Needles & Syringes

6.1.1.5.1.2. Safety Disposable Needles

6.1.1.5.2. Radiology Products

6.1.1.6. Intubation & Respiratory Supplies

6.1.1.6.1. Airway Management Tubes

6.1.1.6.1.1. Surgical Suction Product

6.1.1.6.1.1.1. Suction Tubing

6.1.1.6.1.1.2. Yankeur Suction Set

6.1.1.6.1.1.3. Suction Catheter

6.1.1.6.1.2. Endobronchial Tubes

6.1.1.6.1.3. Endotracheal Tubes

6.1.1.6.1.4. Nasal Airway Tubes

6.1.1.6.1.5. Oral Airway Tubes (Guedel Airway)

6.1.1.6.1.6. Tracheostomy Tubes

6.1.1.6.1.7. Laryngeal Mask Airway

6.1.1.6.2. Intubation Accessories

6.1.1.6.3. Nasal Cannula

6.1.1.6.3.1. Standard Nasal Cannula

6.1.1.6.3.2. High Flow Nasal Cannula

6.1.1.6.3.3. etCO2 Sampling Cannula

6.1.1.6.4. Breathing Circuits

6.1.1.6.5. Breathing Filters

6.1.1.6.6. Respiratory Masks

6.1.1.6.6.1. Anesthesia Mask

6.1.1.6.6.2. Oxygen Mask

6.1.1.6.6.3. High Flow Oxygen Mask

6.1.1.6.6.4. CPAP Mask

6.1.1.6.6.5. Nebulizer Mask

6.1.1.6.7. Manual Resuscitator Bag

6.1.1.6.8. Tracheal Swivel Connector

6.1.1.6.9. Catheter Mount

6.1.1.6.10. Oxygen Tubing

6.1.1.7. Surgical Procedure Kits & Trays

6.1.1.7.1. Disposable Surgical Trays

6.1.1.7.1.1. Laparoscopic Trays

6.1.1.7.1.2. Laceration Trays

6.1.1.7.1.3. Ent and Ophthalmic Custom Trays

6.1.1.7.1.4. Custom Ob/Gynae Kits

6.1.1.7.1.5. Hysterectomy Kits

6.1.1.7.1.6. Open Heart Surgery Kits & Angiography/ Angioplasty/ Catheterization Kits

6.1.1.7.1.7. Lumbar Puncture Trays

6.1.1.7.1.8. Biopsy Trays

6.1.1.7.2. Disposable Surgical Kits

6.1.1.7.2.1. Suture Removal Kits

6.1.1.7.2.2. Dressing Kits

6.1.1.7.2.3. Orthopedic Kits & Trays

6.1.1.7.2.4. Anesthesia Kits

6.1.1.7.3. Surgical Pack0073x

6.1.1.7.3.1. Angiography Surgical Packs

6.1.1.7.3.2. Laparotomy Surgical Packs

6.1.1.7.3.3. Universal Surgical Packs

6.1.1.7.3.4. C-Section Surgical Packs

6.1.1.7.3.5. Lithotomy Surgical Packs

6.1.1.7.3.6. Orthopedic Surgical Packs

6.1.1.7.4. Others

6.1.1.8. Blood Management & Diagnostic Supplies

6.1.1.8.1. Disposable Blood Bags

6.1.1.8.1.1. Collection Bags

6.1.1.8.1.1.1. Single Collection Bags

6.1.1.8.1.1.2. Double Collection Bags

6.1.1.8.1.1.3. Triple Collection Bags

6.1.1.8.1.1.4. Quadruple Collection Bags

6.1.1.8.1.2. Transfer Bags

6.1.1.8.2. Diagnostic Kits

6.1.1.8.2.1. Glucose Monitoring Strips

6.1.1.8.2.2. Blood Lancets

6.1.1.8.2.3. Blood Collection Needle

6.1.1.8.2.4. Blood/Specimen Collection Test Tubes

6.1.1.8.2.5. Swabs

6.1.1.8.2.6. Disposable ECG Consumables

6.1.1.8.2.7. Non-Invasive Blood Pressure (NIBP) Cuff

6.1.1.8.2.8. Sp02 Sensor

6.1.1.8.2.9. Ultrasound Disposables

6.1.1.9. General Disposable Products

6.1.1.9.1. Disposable Apparel/Medical Protective Equipment

6.1.1.9.1.1. Disposable Masks

6.1.1.9.1.1.1. Surgical Masks

6.1.1.9.1.1.1.1. Basic Surgical Masks

6.1.1.9.1.1.1.2. Anti-Fog Foam Surgical Masks

6.1.1.9.1.1.1.3. Fluid/Splash Resistant Surgical Masks

6.1.1.9.1.1.1.4. Anesthesia Masks

6.1.1.9.1.1.1.5. Others

6.1.1.9.1.1.2. Respirator Masks

6.1.1.9.1.1.2.1. Single Strap Masks

6.1.1.9.1.1.2.2. Filter Dust Masks

6.1.1.9.1.1.2.3. Half-Face Masks

6.1.1.9.1.1.2.4. Full-Face Masks

6.1.1.9.1.1.2.5. PAPRs

6.1.1.9.1.2. Disposable Gowns

6.1.1.9.1.2.1. Surgical Gowns

6.1.1.9.1.2.2. Non-Surgical Gowns

6.1.1.9.1.2.3. Isolation Gowns

6.1.1.9.1.3. Disposable Drapes and Aprons

6.1.1.9.1.3.1. Incise

6.1.1.9.1.3.2. Sheets/Bedsheets

6.1.1.9.1.3.3. Laparoscopy

6.1.1.9.1.3.4. Lithotomy

6.1.1.9.1.3.5. Laparotomy

6.1.1.9.1.3.6. Leggings

6.1.1.9.1.3.7. Others

6.1.1.9.1.4. Face Shields

6.1.1.9.1.4.1. Anti-Fog Face Shields

6.1.1.9.1.4.2. Anti-Glares Face Shields

6.1.1.9.1.4.3. Others

6.1.1.9.1.5. Disposable Gloves

6.1.1.9.1.5.1. Examination Gloves

6.1.1.9.1.5.2. Surgical Gloves

6.1.1.9.1.6. Surgeon Caps

6.1.1.9.1.7. Others

6.1.1.9.2. Disposable Incontinence Products

6.1.1.9.2.1. Maceratable Products

6.1.1.9.2.2. Adult Diapers

6.1.1.9.2.3. Underpads

6.1.1.9.2.4. Others

6.1.1.9.3. Gastroenterology Disposables

6.1.1.9.3.1. Feeding Bags

6.1.1.9.3.2. Feeding Tubes

6.1.1.9.4. Holloware

6.1.1.10. Equipment

6.1.1.10.1. Digital Flat Scale

6.1.1.10.2. Digital Baby Scale

6.1.1.10.3. Infantometer

6.1.1.10.4. Stadiometer

6.1.1.10.5. Measuring Tape

6.1.1.10.6. Rotatory Sealer

6.1.1.10.7. Blood Pressure Monitor

6.1.1.10.8. Wireless Fetal Monitoring Systems

6.1.1.10.9. Vein Viewer

6.1.1.10.10. Glucose Monitor

6.2. Asia Pacific Hospital Equipment and Supplies Market Outlook, by Application, Value (US$ Bn) and Volume (Million Units), 2018 – 2030

6.2.1. Key Highlights

6.2.1.1. Cardiovascular

6.2.1.2. Cerebrovascular

6.2.1.3. Dental

6.2.1.4. Laparoscopy

6.2.1.5. Gynecology

6.2.1.6. Urology

6.2.1.7. Orthopedics

6.2.1.8. Others

6.3. Asia Pacific Hospital Equipment and Supplies Market Outlook, by End User, Value (US$ Bn) and Volume (Million Units), 2018 – 2030

6.3.1. Key Highlights

6.3.1.1. Hospitals

6.3.1.1.1. Tier 1 Hospital (>500 Beds)

6.3.1.1.2. Tier 2 Hospitals (250-500 Beds)

6.3.1.1.3. Tier 3 Hospitals (6.3.1.2. Ambulatory Surgical Centers

6.3.1.3. Clinics

6.3.1.4. Diagnostic Centers

6.3.1.5. Long Term Care Centers

6.3.1.6. Nursing Facilities

6.3.2. BPS Analysis/Market Attractiveness Analysis

6.4. Asia Pacific Hospital Equipment and Supplies Market Outlook, by Country, Value (US$ Bn) and Volume (Million Units), 2018 – 2030

6.4.1. Key Highlights

6.4.1.1. China Hospital Equipment and Supplies Market by Product, Value (US$ Bn) and Volume (Million Units), 2018 – 2030

6.4.1.2. China Hospital Equipment and Supplies Market by Application, Value (US$ Bn) and Volume (Million Units), 2018 – 2030

6.4.1.3. China Hospital Equipment and Supplies Market by End User, Value (US$ Bn) and Volume (Million Units), 2018 – 2030

6.4.1.4. Japan Hospital Equipment and Supplies Market by Product, Value (US$ Bn) and Volume (Million Units), 2018 – 2030

6.4.1.5. Japan Hospital Equipment and Supplies Market by Application, Value (US$ Bn) and Volume (Million Units), 2018 – 2030

6.4.1.6. Japan Hospital Equipment and Supplies Market by End User, Value (US$ Bn) and Volume (Million Units), 2018 – 2030

6.4.1.7. South Korea Hospital Equipment and Supplies Market by Product, Value (US$ Bn) and Volume (Million Units), 2018 – 2030

6.4.1.8. South Korea Hospital Equipment and Supplies Market by Application, Value (US$ Bn) and Volume (Million Units), 2018 – 2030

6.4.1.9. South Korea Hospital Equipment and Supplies Market by End User, Value (US$ Bn) and Volume (Million Units), 2018 – 2030

6.4.1.10. India Hospital Equipment and Supplies Market by Product, Value (US$ Bn) and Volume (Million Units), 2018 – 2030

6.4.1.11. India Hospital Equipment and Supplies Market by Application, Value (US$ Bn) and Volume (Million Units), 2018 – 2030

6.4.1.12. India Hospital Equipment and Supplies Market by End User, Value (US$ Bn) and Volume (Million Units), 2018 – 2030

6.4.1.13. Southeast Asia Hospital Equipment and Supplies Market by Product, Value (US$ Bn) and Volume (Million Units), 2018 – 2030

6.4.1.14. Southeast Asia Hospital Equipment and Supplies Market by Application, Value (US$ Bn) and Volume (Million Units), 2018 – 2030

6.4.1.15. Southeast Asia Hospital Equipment and Supplies Market by End User, Value (US$ Bn) and Volume (Million Units), 2018 – 2030

6.4.1.16. Rest Of Asia Pacific Hospital Equipment and Supplies Market by Product, Value (US$ Bn) and Volume (Million Units), 2018 – 2030

6.4.1.17. Rest Of Asia Pacific Hospital Equipment and Supplies Market by Application, Value (US$ Bn) and Volume (Million Units), 2018 – 2030

6.4.1.18. Rest Of Asia Pacific Hospital Equipment and Supplies Market by End User, Value (US$ Bn) and Volume (Million Units), 2018 – 2030

6.4.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America Hospital Equipment and Supplies Market Outlook, 2018 – 2030

7.1. Latin America Hospital Equipment and Supplies Market Outlook, by Product, Value (US$ Bn) and Volume (Million Units), 2018 – 2030

7.1.1. Key Highlights

7.1.1.1. Sterilization Consumables

7.1.1.1.1. Single-Use Sterilization Wrap

7.1.1.1.2. Sterile Containers

7.1.1.1.3. Sterilization Paper Bag

7.1.1.1.4. Sterile Indicators Tape

7.1.1.1.5. Sterilization Reels

7.1.1.1.6. Sterilization Pouches

7.1.1.2. Wound Care Products

7.1.1.2.1. Disposable Wound Care Devices

7.1.1.2.1.1. Disposable Wound Irrigation Device

7.1.1.2.1.2. Disposable Surgical Wound Drainage/ Evacuator

7.1.1.2.2. Negative Pressure Wound Therapy Devices (NPWT)

7.1.1.2.2.1. Disposable Negative Pressure Wound Therapy Devices (NPWT)

7.1.1.2.2.2. Disposable NPWT Accessories / Dressing Kits

7.1.1.2.3. Traditional Wound Care Product

7.1.1.2.4. Advanced Wound Care Products

7.1.1.2.4.1. Hydrogel Dressing

7.1.1.2.4.2. Semi Permeable Films Dressing

7.1.1.2.4.3. Foam Dressings

7.1.1.2.4.4. Alginate Dressings

7.1.1.2.4.5. Hydrocolloid Dressings

7.1.1.2.4.6. Collagen Dressings

7.1.1.2.4.7. Wound Contact Layer

7.1.1.2.4.8. Super Absorbent Dressings

7.1.1.2.4.9. Hydrofibers

7.1.1.3. Dialysis Products

7.1.1.3.1. Concentrates & Solutions

7.1.1.3.2. Bloodlines System & Disposable Catheters

7.1.1.3.2.1. Foley Urinary Catheter

7.1.1.3.2.2. Dialysis Catheters

7.1.1.3.2.2.1. PICC- Peripherally Inserted Central Catheter

7.1.1.3.2.2.2. Peripheral Intravenous Catheters (PIVC)

7.1.1.3.2.2.3. Central Venous Catheter (CVC)

7.1.1.3.3. Disposable Dialyzers

7.1.1.3.3.1. Low Flux Single Use Dialyzers

7.1.1.3.3.2. High Flux Single Use Dialyzers

7.1.1.3.4. Dialysis Consumables

7.1.1.3.4.1. Dialysis Fistula Needle

7.1.1.3.4.2. Dialysis Drainage Bag/ Urine Collection Bags

7.1.1.3.5. Critical Care Products

7.1.1.3.5.1. Dialysis Care Kit

7.1.1.3.5.2. Disposable Blood Pressure Transducer

7.1.1.4. Infusion Products

7.1.1.4.1. Disposable Infusion Set

7.1.1.4.2. Disposable Infusion Pump

7.1.1.4.3. Disposable Accessories

7.1.1.4.3.1. Disposable Needles

7.1.1.4.3.2. IV Catheters & Cannulas

7.1.1.4.3.3. Disposable Syringes

7.1.1.4.3.3.1. Smart Syringes

7.1.1.4.3.3.2. Prefilled Syringes

7.1.1.4.4. Disposable Pressure Infusion Bags

7.1.1.5. Hypodermic Products & Radiology Products

7.1.1.5.1. Hypodermic Products

7.1.1.5.1.1. Hypodermic Needles & Syringes

7.1.1.5.1.2. Safety Disposable Needles

7.1.1.5.2. Radiology Products

7.1.1.6. Intubation & Respiratory Supplies

7.1.1.6.1. Airway Management Tubes

7.1.1.6.1.1. Surgical Suction Product

7.1.1.6.1.1.1. Suction Tubing

7.1.1.6.1.1.2. Yankeur Suction Set

7.1.1.6.1.1.3. Suction Catheter

7.1.1.6.1.2. Endobronchial Tubes

7.1.1.6.1.3. Endotracheal Tubes

7.1.1.6.1.4. Nasal Airway Tubes

7.1.1.6.1.5. Oral Airway Tubes (Guedel Airway)

7.1.1.6.1.6. Tracheostomy Tubes

7.1.1.6.1.7. Laryngeal Mask Airway

7.1.1.6.2. Intubation Accessories

7.1.1.6.3. Nasal Cannula

7.1.1.6.3.1. Standard Nasal Cannula

7.1.1.6.3.2. High Flow Nasal Cannula

7.1.1.6.3.3. etCO2 Sampling Cannula

7.1.1.6.4. Breathing Circuits

7.1.1.6.5. Breathing Filters

7.1.1.6.6. Respiratory Masks

7.1.1.6.6.1. Anesthesia Mask

7.1.1.6.6.2. Oxygen Mask

7.1.1.6.6.3. High Flow Oxygen Mask

7.1.1.6.6.4. CPAP Mask

7.1.1.6.6.5. Nebulizer Mask

7.1.1.6.7. Manual Resuscitator Bag

7.1.1.6.8. Tracheal Swivel Connector

7.1.1.6.9. Catheter Mount

7.1.1.6.10. Oxygen Tubing

7.1.1.7. Surgical Procedure Kits & Trays

7.1.1.7.1. Disposable Surgical Trays

7.1.1.7.1.1. Laparoscopic Trays

7.1.1.7.1.2. Laceration Trays

7.1.1.7.1.3. Ent and Ophthalmic Custom Trays

7.1.1.7.1.4. Custom Ob/Gynae Kits

7.1.1.7.1.5. Hysterectomy Kits

7.1.1.7.1.6. Open Heart Surgery Kits & Angiography/ Angioplasty/ Catheterization Kits

7.1.1.7.1.7. Lumbar Puncture Trays

7.1.1.7.1.8. Biopsy Trays

7.1.1.7.2. Disposable Surgical Kits

7.1.1.7.2.1. Suture Removal Kits

7.1.1.7.2.2. Dressing Kits

7.1.1.7.2.3. Orthopedic Kits & Trays

7.1.1.7.2.4. Anesthesia Kits

7.1.1.7.3. Surgical Pack0073x

7.1.1.7.3.1. Angiography Surgical Packs

7.1.1.7.3.2. Laparotomy Surgical Packs

7.1.1.7.3.3. Universal Surgical Packs

7.1.1.7.3.4. C-Section Surgical Packs

7.1.1.7.3.5. Lithotomy Surgical Packs

7.1.1.7.3.6. Orthopedic Surgical Packs

7.1.1.7.4. Others

7.1.1.8. Blood Management & Diagnostic Supplies

7.1.1.8.1. Disposable Blood Bags

7.1.1.8.1.1. Collection Bags

7.1.1.8.1.1.1. Single Collection Bags

7.1.1.8.1.1.2. Double Collection Bags

7.1.1.8.1.1.3. Triple Collection Bags

7.1.1.8.1.1.4. Quadruple Collection Bags

7.1.1.8.1.2. Transfer Bags

7.1.1.8.2. Diagnostic Kits

7.1.1.8.2.1. Glucose Monitoring Strips

7.1.1.8.2.2. Blood Lancets

7.1.1.8.2.3. Blood Collection Needle

7.1.1.8.2.4. Blood/Specimen Collection Test Tubes

7.1.1.8.2.5. Swabs

7.1.1.8.2.6. Disposable ECG Consumables

7.1.1.8.2.7. Non-Invasive Blood Pressure (NIBP) Cuff

7.1.1.8.2.8. Sp02 Sensor

7.1.1.8.2.9. Ultrasound Disposables

7.1.1.9. General Disposable Products

7.1.1.9.1. Disposable Apparel/Medical Protective Equipment

7.1.1.9.1.1. Disposable Masks

7.1.1.9.1.1.1. Surgical Masks

7.1.1.9.1.1.1.1. Basic Surgical Masks

7.1.1.9.1.1.1.2. Anti-Fog Foam Surgical Masks

7.1.1.9.1.1.1.3. Fluid/Splash Resistant Surgical Masks

7.1.1.9.1.1.1.4. Anesthesia Masks

7.1.1.9.1.1.1.5. Others

7.1.1.9.1.1.2. Respirator Masks

7.1.1.9.1.1.2.1. Single Strap Masks

7.1.1.9.1.1.2.2. Filter Dust Masks

7.1.1.9.1.1.2.3. Half-Face Masks

7.1.1.9.1.1.2.4. Full-Face Masks

7.1.1.9.1.1.2.5. PAPRs

7.1.1.9.1.2. Disposable Gowns

7.1.1.9.1.2.1. Surgical Gowns

7.1.1.9.1.2.2. Non-Surgical Gowns

7.1.1.9.1.2.3. Isolation Gowns

7.1.1.9.1.3. Disposable Drapes and Aprons

7.1.1.9.1.3.1. Incise

7.1.1.9.1.3.2. Sheets/Bedsheets

7.1.1.9.1.3.3. Laparoscopy

7.1.1.9.1.3.4. Lithotomy

7.1.1.9.1.3.5. Laparotomy

7.1.1.9.1.3.6. Leggings

7.1.1.9.1.3.7. Others

7.1.1.9.1.4. Face Shields

7.1.1.9.1.4.1. Anti-Fog Face Shields

7.1.1.9.1.4.2. Anti-Glares Face Shields

7.1.1.9.1.4.3. Others

7.1.1.9.1.5. Disposable Gloves

7.1.1.9.1.5.1. Examination Gloves

7.1.1.9.1.5.2. Surgical Gloves

7.1.1.9.1.6. Surgeon Caps

7.1.1.9.1.7. Others

7.1.1.9.2. Disposable Incontinence Products

7.1.1.9.2.1. Maceratable Products

7.1.1.9.2.2. Adult Diapers

7.1.1.9.2.3. Underpads

7.1.1.9.2.4. Others

7.1.1.9.3. Gastroenterology Disposables

7.1.1.9.3.1. Feeding Bags

7.1.1.9.3.2. Feeding Tubes

7.1.1.9.4. Holloware

7.1.1.10. Equipment

7.1.1.10.1. Digital Flat Scale

7.1.1.10.2. Digital Baby Scale

7.1.1.10.3. Infantometer

7.1.1.10.4. Stadiometer

7.1.1.10.5. Measuring Tape

7.1.1.10.6. Rotatory Sealer

7.1.1.10.7. Blood Pressure Monitor

7.1.1.10.8. Wireless Fetal Monitoring Systems

7.1.1.10.9. Vein Viewer

7.1.1.10.10. Glucose Monitor

7.2. Latin America Hospital Equipment and Supplies Market Outlook, by Application, Value (US$ Bn) and Volume (Million Units), 2018 – 2030

7.2.1.1. Cardiovascular

7.2.1.2. Cerebrovascular

7.2.1.3. Dental

7.2.1.4. Laparoscopy

7.2.1.5. Gynecology

7.2.1.6. Urology

7.2.1.7. Orthopedics

7.2.1.8. Others

7.3. Latin America Hospital Equipment and Supplies Market Outlook, by End User, Value (US$ Bn) and Volume (Million Units), 2018 – 2030

7.3.1. Key Highlights

7.3.1.1. Hospitals

7.3.1.1.1. Tier 1 Hospital (>500 Beds)

7.3.1.1.2. Tier 2 Hospitals (250-500 Beds)

7.3.1.1.3. Tier 3 Hospitals (7.3.1.2. Ambulatory Surgical Centers

7.3.1.3. Clinics

7.3.1.4. Diagnostic Centers

7.3.1.5. Long Term Care Centers

7.3.1.6. Nursing Facilities

7.3.2. BPS Analysis/Market Attractiveness Analysis

7.4. Latin America Hospital Equipment and Supplies Market Outlook, by Country, Value (US$ Bn) and Volume (Million Units), 2018 – 2030

7.4.1. Key Highlights

7.4.1.1. Brazil Hospital Equipment and Supplies Market by Product, Value (US$ Bn) and Volume (Million Units), 2018 – 2030

7.4.1.2. Brazil Hospital Equipment and Supplies Market by Application, Value (US$ Bn) and Volume (Million Units), 2018 – 2030

7.4.1.3. Brazil Hospital Equipment and Supplies Market by End User, Value (US$ Bn) and Volume (Million Units), 2018 – 2030

7.4.1.4. Mexico Hospital Equipment and Supplies Market by Product, Value (US$ Bn) and Volume (Million Units), 2018 – 2030

7.4.1.5. Mexico Hospital Equipment and Supplies Market by Application, Value (US$ Bn) and Volume (Million Units), 2018 – 2030

7.4.1.6. Mexico Hospital Equipment and Supplies Market by End User, Value (US$ Bn) and Volume (Million Units), 2018 – 2030

7.4.1.7. Argentina Hospital Equipment and Supplies Market by Product, Value (US$ Bn) and Volume (Million Units), 2018 – 2030

7.4.1.8. Argentina Hospital Equipment and Supplies Market by Application, Value (US$ Bn) and Volume (Million Units), 2018 – 2030

7.4.1.9. Argentina Hospital Equipment and Supplies Market by End User, Value (US$ Bn) and Volume (Million Units), 2018 – 2030

7.4.1.10. Rest Of Latin America Hospital Equipment and Supplies Market by Product, Value (US$ Bn) and Volume (Million Units), 2018 – 2030

7.4.1.11. Rest Of Latin America Hospital Equipment and Supplies Market by Application, Value (US$ Bn) and Volume (Million Units), 2018 – 2030

7.4.1.12. Rest Of Latin America Hospital Equipment and Supplies Market by End User, Value (US$ Bn) and Volume (Million Units), 2018 – 2030

7.4.2. Bps Analysis/Market Attractiveness Analysis

8. Middle East & Africa Hospital Equipment and Supplies Market Outlook, 2018 – 2030

8.1. Middle East & Africa Hospital Equipment and Supplies Market Outlook, by Product, Value (US$ Bn) and Volume (Million Units), 2018 – 2030

8.1.1. Key Highlights

8.1.1.1. Sterilization Consumables

8.1.1.1.1. Single-Use Sterilization Wrap

8.1.1.1.2. Sterile Containers

8.1.1.1.3. Sterilization Paper Bag

8.1.1.1.4. Sterile Indicators Tape

8.1.1.1.5. Sterilization Reels

8.1.1.1.6. Sterilization Pouches

8.1.1.2. Wound Care Products

8.1.1.2.1. Disposable Wound Care Devices

8.1.1.2.1.1. Disposable Wound Irrigation Device

8.1.1.2.1.2. Disposable Surgical Wound Drainage/ Evacuator

8.1.1.2.2. Negative Pressure Wound Therapy Devices (NPWT)

8.1.1.2.2.1. Disposable Negative Pressure Wound Therapy Devices (NPWT)

8.1.1.2.2.2. Disposable NPWT Accessories / Dressing Kits

8.1.1.2.3. Traditional Wound Care Product

8.1.1.2.4. Advanced Wound Care Products

8.1.1.2.4.1. Hydrogel Dressing

8.1.1.2.4.2. Semi Permeable Films Dressing

8.1.1.2.4.3. Foam Dressings

8.1.1.2.4.4. Alginate Dressings

8.1.1.2.4.5. Hydrocolloid Dressings

8.1.1.2.4.6. Collagen Dressings

8.1.1.2.4.7. Wound Contact Layer

8.1.1.2.4.8. Super Absorbent Dressings

8.1.1.2.4.9. Hydrofibers

8.1.1.3. Dialysis Products

8.1.1.3.1. Concentrates & Solutions

8.1.1.3.2. Bloodlines System & Disposable Catheters

8.1.1.3.2.1. Foley Urinary Catheter

8.1.1.3.2.2. Dialysis Catheters

8.1.1.3.2.2.1. PICC- Peripherally Inserted Central Catheter

8.1.1.3.2.2.2. Peripheral Intravenous Catheters (PIVC)

8.1.1.3.2.2.3. Central Venous Catheter (CVC)

8.1.1.3.3. Disposable Dialyzers

8.1.1.3.3.1. Low Flux Single Use Dialyzers

8.1.1.3.3.2. High Flux Single Use Dialyzers

8.1.1.3.4. Dialysis Consumables

8.1.1.3.4.1. Dialysis Fistula Needle

8.1.1.3.4.2. Dialysis Drainage Bag/ Urine Collection Bags

8.1.1.3.5. Critical Care Products

8.1.1.3.5.1. Dialysis Care Kit

8.1.1.3.5.2. Disposable Blood Pressure Transducer

8.1.1.4. Infusion Products

8.1.1.4.1. Disposable Infusion Set

8.1.1.4.2. Disposable Infusion Pump

8.1.1.4.3. Disposable Accessories

8.1.1.4.3.1. Disposable Needles

8.1.1.4.3.2. IV Catheters & Cannulas

8.1.1.4.3.3. Disposable Syringes

8.1.1.4.3.3.1. Smart Syringes

8.1.1.4.3.3.2. Prefilled Syringes

8.1.1.4.4. Disposable Pressure Infusion Bags

8.1.1.5. Hypodermic Products & Radiology Products

8.1.1.5.1. Hypodermic Products

8.1.1.5.1.1. Hypodermic Needles & Syringes

8.1.1.5.1.2. Safety Disposable Needles

8.1.1.5.2. Radiology Products

8.1.1.6. Intubation & Respiratory Supplies

8.1.1.6.1. Airway Management Tubes

8.1.1.6.1.1. Surgical Suction Product

8.1.1.6.1.1.1. Suction Tubing

8.1.1.6.1.1.2. Yankeur Suction Set

8.1.1.6.1.1.3. Suction Catheter

8.1.1.6.1.2. Endobronchial Tubes

8.1.1.6.1.3. Endotracheal Tubes

8.1.1.6.1.4. Nasal Airway Tubes

8.1.1.6.1.5. Oral Airway Tubes (Guedel Airway)

8.1.1.6.1.6. Tracheostomy Tubes

8.1.1.6.1.7. Laryngeal Mask Airway

8.1.1.6.2. Intubation Accessories

8.1.1.6.3. Nasal Cannula

8.1.1.6.3.1. Standard Nasal Cannula

8.1.1.6.3.2. High Flow Nasal Cannula

8.1.1.6.3.3. etCO2 Sampling Cannula

8.1.1.6.4. Breathing Circuits

8.1.1.6.5. Breathing Filters

8.1.1.6.6. Respiratory Masks

8.1.1.6.6.1. Anesthesia Mask

8.1.1.6.6.2. Oxygen Mask

8.1.1.6.6.3. High Flow Oxygen Mask

8.1.1.6.6.4. CPAP Mask

8.1.1.6.6.5. Nebulizer Mask

8.1.1.6.7. Manual Resuscitator Bag

8.1.1.6.8. Tracheal Swivel Connector

8.1.1.6.9. Catheter Mount

8.1.1.6.10. Oxygen Tubing

8.1.1.7. Surgical Procedure Kits & Trays

8.1.1.7.1. Disposable Surgical Trays

8.1.1.7.1.1. Laparoscopic Trays

8.1.1.7.1.2. Laceration Trays

8.1.1.7.1.3. Ent and Ophthalmic Custom Trays

8.1.1.7.1.4. Custom Ob/Gynae Kits

8.1.1.7.1.5. Hysterectomy Kits

8.1.1.7.1.6. Open Heart Surgery Kits & Angiography/ Angioplasty/ Catheterization Kits

8.1.1.7.1.7. Lumbar Puncture Trays

8.1.1.7.1.8. Biopsy Trays

8.1.1.7.2. Disposable Surgical Kits

8.1.1.7.2.1. Suture Removal Kits

8.1.1.7.2.2. Dressing Kits

8.1.1.7.2.3. Orthopedic Kits & Trays

8.1.1.7.2.4. Anesthesia Kits

8.1.1.7.3. Surgical Pack0073x

8.1.1.7.3.1. Angiography Surgical Packs

8.1.1.7.3.2. Laparotomy Surgical Packs

8.1.1.7.3.3. Universal Surgical Packs

8.1.1.7.3.4. C-Section Surgical Packs

8.1.1.7.3.5. Lithotomy Surgical Packs

8.1.1.7.3.6. Orthopedic Surgical Packs

8.1.1.7.4. Others

8.1.1.8. Blood Management & Diagnostic Supplies

8.1.1.8.1. Disposable Blood Bags

8.1.1.8.1.1. Collection Bags

8.1.1.8.1.1.1. Single Collection Bags

8.1.1.8.1.1.2. Double Collection Bags

8.1.1.8.1.1.3. Triple Collection Bags

8.1.1.8.1.1.4. Quadruple Collection Bags

8.1.1.8.1.2. Transfer Bags

8.1.1.8.2. Diagnostic Kits

8.1.1.8.2.1. Glucose Monitoring Strips

8.1.1.8.2.2. Blood Lancets

8.1.1.8.2.3. Blood Collection Needle

8.1.1.8.2.4. Blood/Specimen Collection Test Tubes

8.1.1.8.2.5. Swabs

8.1.1.8.2.6. Disposable ECG Consumables

8.1.1.8.2.7. Non-Invasive Blood Pressure (NIBP) Cuff

8.1.1.8.2.8. Sp02 Sensor

8.1.1.8.2.9. Ultrasound Disposables

8.1.1.9. General Disposable Products

8.1.1.9.1. Disposable Apparel/Medical Protective Equipment

8.1.1.9.1.1. Disposable Masks

8.1.1.9.1.1.1. Surgical Masks

8.1.1.9.1.1.1.1. Basic Surgical Masks

8.1.1.9.1.1.1.2. Anti-Fog Foam Surgical Masks

8.1.1.9.1.1.1.3. Fluid/Splash Resistant Surgical Masks

8.1.1.9.1.1.1.4. Anesthesia Masks

8.1.1.9.1.1.1.5. Others

8.1.1.9.1.1.2. Respirator Masks

8.1.1.9.1.1.2.1. Single Strap Masks

8.1.1.9.1.1.2.2. Filter Dust Masks

8.1.1.9.1.1.2.3. Half-Face Masks

8.1.1.9.1.1.2.4. Full-Face Masks

8.1.1.9.1.1.2.5. PAPRs

8.1.1.9.1.2. Disposable Gowns

8.1.1.9.1.2.1. Surgical Gowns

8.1.1.9.1.2.2. Non-Surgical Gowns

8.1.1.9.1.2.3. Isolation Gowns

8.1.1.9.1.3. Disposable Drapes and Aprons

8.1.1.9.1.3.1. Incise

8.1.1.9.1.3.2. Sheets/Bedsheets

8.1.1.9.1.3.3. Laparoscopy

8.1.1.9.1.3.4. Lithotomy

8.1.1.9.1.3.5. Laparotomy

8.1.1.9.1.3.6. Leggings

8.1.1.9.1.3.7. Others

8.1.1.9.1.4. Face Shields

8.1.1.9.1.4.1. Anti-Fog Face Shields

8.1.1.9.1.4.2. Anti-Glares Face Shields

8.1.1.9.1.4.3. Others

8.1.1.9.1.5. Disposable Gloves

8.1.1.9.1.5.1. Examination Gloves

8.1.1.9.1.5.2. Surgical Gloves

8.1.1.9.1.6. Surgeon Caps

8.1.1.9.1.7. Others

8.1.1.9.2. Disposable Incontinence Products

8.1.1.9.2.1. Maceratable Products

8.1.1.9.2.2. Adult Diapers

8.1.1.9.2.3. Underpads

8.1.1.9.2.4. Others

8.1.1.9.3. Gastroenterology Disposables

8.1.1.9.3.1. Feeding Bags

8.1.1.9.3.2. Feeding Tubes

8.1.1.9.4. Holloware

8.1.1.10. Equipment

8.1.1.10.1. Digital Flat Scale

8.1.1.10.2. Digital Baby Scale

8.1.1.10.3. Infantometer

8.1.1.10.4. Stadiometer

8.1.1.10.5. Measuring Tape

8.1.1.10.6. Rotatory Sealer

8.1.1.10.7. Blood Pressure Monitor

8.1.1.10.8. Wireless Fetal Monitoring Systems

8.1.1.10.9. Vein Viewer

8.1.1.10.10. Glucose Monitor