Global Human Organoids Market Forecast

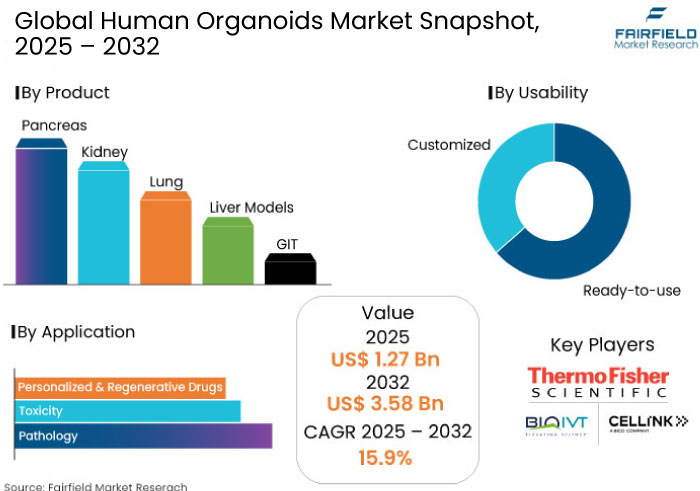

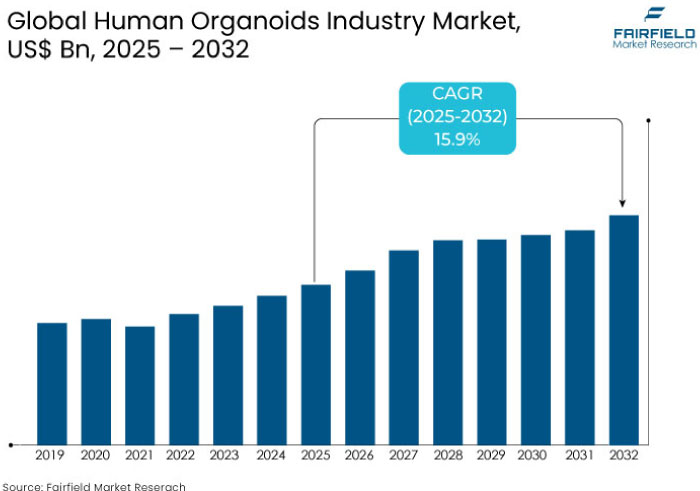

- The human organoids market is projected to reach US$ 3.58 Bn by 2032, from US$ 1.27 Bn in 2025.

- The market for human organoids is likely to exhibit a CAGR of 15.9% from 2025 to 2032.

Human Organoids Market Insights

- Increasing applications in drug discovery, regenerative medicine, and personalized medicine are set to boost demand.

- Pharma and biotech companies are using organoids for toxicity testing and disease modelling.

- Rising prevalence of cancer, liver, and neurological disorders is anticipated to push the market forward.

- Organoids are being used to develop therapies for organ regeneration and tissue repair.

- North America leads the market due to strong pharma-biotech presence and government support.

- Collaboration between academic institutions, biotech firms, and research organizations to foster breakthroughs.

- Liver models are set to lead the market by product with a 30% share in 2025.

- Significant funding from government agencies and private investors accelerates organoid research.

Key Growth Determinants

- Rising Adoption in Drug Discovery and Personalized Medicine

Surging adoption of human organoids in drug discovery and personalized medicine is a key growth driver for the human organoids market. Organoids provide a more accurate representation of human physiology compared to traditional 2D cell cultures or animal models, enabling better predictions of drug efficacy and toxicity.

Pharmaceutical companies and researchers are leveraging organoids to streamline preclinical trials, reducing costs and timelines for drug development. Studies suggest that organoid models can improve drug efficacy prediction rates by up to 80%, compared to the 30 to 40% accuracy of traditional 2D cell cultures.

- Increasing Support from Regulatory Bodies and Funding Agencies

Rising support from regulatory bodies and funding agencies is a critical driver for the human organoids market. Authorities like the FDA and EMA recognize organoids as innovative tools for preclinical studies and encourage their integration into drug development pipelines.

Global research initiatives and government grants provide financial backing for organoid research, especially in areas like cancer and neurological disorders. In the past five years, over US$ 500 Mn in funding has been directed globally to organoid research specific to cancer, emphasizing their use in improving drug discovery and treatment protocols.

Key Growth Barriers

- Ethical Concerns and Lack of Standardization

Despite their advantages, using human organoids raises ethical concerns, particularly around sourcing human-derived tissues and stem cells. These issues can create public and regulatory scrutiny, slowing research and development.

The lack of global standardization in organoid protocols presents another challenge for the human organoids market. Variations in the methodologies used to create organoids result in inconsistent outcomes, limiting their broader application in drug testing and disease modelling.

Human Organoids Market Trends and Opportunities

- Integration of Artificial Intelligence in Organoid Research

The integration of artificial intelligence (AI) is emerging as a transformative trend in the human organoids market. AI-powered tools are being increasingly used to analyze huge datasets generated from organoid experiments, enabling researchers to identify patterns, predict outcomes, and streamline processes.

AI algorithms can analyze cellular behavior in organoids to predict drug responses or disease progression more accurately. Studies show that AI tools improve accuracy in predicting cellular drug responses by up to 85%, surpassing the performance of conventional manual analyses.

- Rising Applications in Regenerative Medicine

The surging potential of organoids in regenerative medicine presents a significant human organoids market opportunity. Organoids are being explored as building blocks for repairing or replacing damaged tissues and organs, offering hope for patients with chronic diseases or organ failure.

For instance, liver organoids have shown promise in treating liver diseases by providing functional cells for transplantation. Similarly, brain organoids are being studied for repairing neurological damage caused by conditions like stroke or Alzheimer’s disease. The opportunity is further amplified by increasing investments in regenerative medicine research, valued at over US$ 35 Bn in 2023 and projected to rise rapidly.

Segments Covered in the Report

- Liver Models Dominate Amid Potential in Regenerative Medicine

Among the various human organoid models used in biomedical research, liver organoids have emerged as the dominant segment in the human organoids market. Liver models are becoming increasingly popular due to their potential in drug development, toxicity testing, and regenerative medicine.

Liver models closely mimic the functional and structural properties of the human liver, making them invaluable tools for studying liver diseases. One of the primary drivers of the liver model’s dominance is its ability to provide more accurate and reliable data for preclinical drug testing compared to traditional 2D cultures and animal models.

- Pharma-biotech Leads due to Rising Adoption in Preclinical Testing

The pharma-biotech industry is the dominant end user in the global human organoids market, accounting for approximately 45% of the total revenue share. Pharma and biotech companies are increasingly utilizing organoids as unique models for preclinical testing.

Organoids offer more realistic representations of human tissue and disease models than traditional methods. One of the primary reasons the pharma-biotech industry leads the market is its focus on developing targeted therapies and reducing the high failure rates in clinical trials.

Regional Analysis

- North America Dominates Owing to Presence of Biotech Companies

North America is projected to hold the largest share, accounting for over 40% of the global human organoids market in 2025. The region's dominance can be attributed to the strong presence of pharmaceutical and biotech companies, universities, and research institutions that are heavily investing in organoid technology.

The U.S. is home to few of the world's top pharmaceutical giants, which have increasingly adopted organoids for drug discovery, toxicity testing, and personalized medicine. Government agencies like the FDA and NIH support innovations in human organoids, providing research grants and regulatory frameworks to accelerate developments. North America's leading market position is also driven by its surging healthcare needs, with organoids offering solutions for complex diseases such as cancer, liver disease, and neurodegenerative disorders.

- Europe Follows Backed by Surging Investments in Novel Therapies

Europe holds the second-largest human organoids market share, with countries like Germany, France, and the U.K. making significant strides in research studies. The region’s strong emphasis on regenerative medicine, biotech innovation, and ethical research practices has propelled the demand for human organoids.

The European Union (EU) has also been a key player in funding cutting-edge research. Its projects mainly focus on organoid-based therapies for various diseases, including cystic fibrosis, Alzheimer’s, and liver failure. Europe’s commitment to reducing animal testing and improving drug efficacy has led to a rise in the adoption of organoid technologies.

Fairfield’s Competitive Landscape Analysis

The human organoids market is witnessing significant competition as leading players focus on innovation to gain a competitive edge. Key companies are bolstering research and development to enhance organoid models for drug discovery, disease modelling, and personalized medicine.

Strategic partnerships, mergers, and acquisitions are common as companies strive to broaden their portfolios and market reach. Emerging start-ups also contribute with niche technologies and solutions, intensifying the competition.

Key Market Companies

- BioIVT

- ZenBio

- Thermo Fisher Scientific

- CELLINK

- Biopredic International

- Hurel Corporation

- Emulate

- Kerafast

- InSphero

- MIMETAS

- Cyprio

- Corning

- Kirkstall

Recent Industry Developments

- In August 2024, BioIVT signed an acquisition deal with ZenBio, to produce an enhanced array of skin-related expertise, primary cell and exosome isolation, and blood products for the pharmaceutical and cosmetics sectors.

- In July 2024, Merck KGaA introduced the commencement of its first GMP-compliant cell culture media (CCM) manufacturing line.

Global Human Organoids Market is Segmented as-

By Product

- Pancreas

- Kidney

- Lung

- Liver Models

- GIT

By Usability

- Ready-to-use

- Customized

By Application

- Pathology

- Toxicity

- Personalized & Regenerative Drugs

By End User

- Academia

- Pharma-biotech

- CROs

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

1. Executive Summary

1.1. Global Human Organoids Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value and Volume, 2025

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. COVID-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Economic Overview

2.6.1. World Economic Projections

2.7. PESTLE Analysis

3. Global Human Organoids Market Outlook, 2019 - 2032

3.1. Global Human Organoids Market Outlook, by Product, Value (US$ Bn), 2019 - 2032

3.1.1. Key Highlights

3.1.1.1. Pancreas

3.1.1.2. Kidney

3.1.1.3. Lung

3.1.1.4. Liver Models

3.1.1.5. GIT

3.2. Global Human Organoids Market Outlook, by Usability, Value (US$ Bn), 2019 - 2032

3.2.1. Key Highlights

3.2.1.1. Ready-To-Use

3.2.1.2. Customized

3.3. Global Human Organoids Market Outlook, by Application, Value (US$ Bn), 2019 - 2032

3.3.1. Key Highlights

3.3.1.1. Pathology

3.3.1.2. Toxicity

3.3.1.3. Personalized & Regenerative Drugs

3.4. Global Human Organoids Market Outlook, by End User, Value (US$ Bn), 2019 - 2032

3.4.1. Key Highlights

3.4.1.1. Academia

3.4.1.2. Pharma-Biotech

3.4.1.3. CROs

3.5. Global Human Organoids Market Outlook, by Region, Value (US$ Bn), 2019 - 2032

3.5.1. Key Highlights

3.5.1.1. North America

3.5.1.2. Europe

3.5.1.3. Asia Pacific

3.5.1.4. Latin America

3.5.1.5. Middle East & Africa

4. North America Human Organoids Market Outlook, 2019 - 2032

4.1. North America Human Organoids Market Outlook, by Product, Value (US$ Bn), 2019 - 2032

4.1.1. Key Highlights

4.1.1.1. Pancreas

4.1.1.2. Kidney

4.1.1.3. Lung

4.1.1.4. Liver Models

4.1.1.5. GIT

4.2. North America Human Organoids Market Outlook, by Usability, Value (US$ Bn), 2019 - 2032

4.2.1. Key Highlights

4.2.1.1. Ready-To-Use

4.2.1.2. Customized

4.3. North America Human Organoids Market Outlook, by Application, Value (US$ Bn), 2019 - 2032

4.3.1. Key Highlights

4.3.1.1. Pathology

4.3.1.2. Toxicity

4.3.1.3. Personalized & Regenerative Drugs

4.4. North America Human Organoids Market Outlook, by End User, Value (US$ Bn), 2019 - 2032

4.4.1. Key Highlights

4.4.1.1. Academia

4.4.1.2. Pharma-Biotech

4.4.1.3. CROs

4.4.2. Attractiveness Analysis

4.5. North America Human Organoids Market Outlook, by Country, Value (US$ Bn), 2019 - 2032

4.5.1. Key Highlights

4.5.1.1. U.S. Human Organoids Market by Product, Value (US$ Bn), 2019 - 2032

4.5.1.2. U.S. Human Organoids Market by Usability, Value (US$ Bn), 2019 - 2032

4.5.1.3. U.S. Human Organoids Market by Application, Value (US$ Bn), 2019 - 2032

4.5.1.4. U.S. Human Organoids Market by End User, Value (US$ Bn), 2019 - 2032

4.5.1.5. Canada Human Organoids Market by Product, Value (US$ Bn), 2019 - 2032

4.5.1.6. Canada Human Organoids Market by Usability, Value (US$ Bn), 2019 - 2032

4.5.1.7. Canada Human Organoids Market by Application, Value (US$ Bn), 2019 - 2032

4.5.1.8. Canada Human Organoids Market by End User, Value (US$ Bn), 2019 - 2032

5. Europe Human Organoids Market Outlook, 2019 - 2032

5.1. Europe Human Organoids Market Outlook, by Product, Value (US$ Bn), 2019 - 2032

5.1.1. Key Highlights

5.1.1.1. Pancreas

5.1.1.2. Kidney

5.1.1.3. Lung

5.1.1.4. Liver Models

5.1.1.5. GIT

5.2. Europe Human Organoids Market Outlook, by Usability, Value (US$ Bn), 2019 - 2032

5.2.1. Key Highlights

5.2.1.1. Ready-To-Use

5.2.1.2. Customized

5.3. Europe Human Organoids Market Outlook, by Application, Value (US$ Bn), 2019 - 2032

5.3.1. Key Highlights

5.3.1.1. Pathology

5.3.1.2. Toxicity

5.3.1.3. Personalized & Regenerative Drugs

5.4. Europe Human Organoids Market Outlook, by End User, Value (US$ Bn), 2019 - 2032

5.4.1. Key Highlights

5.4.1.1. Academia

5.4.1.2. Pharma-Biotech

5.4.1.3. CROs

5.4.2. Attractiveness Analysis

5.5. Europe Human Organoids Market Outlook, by Country, Value (US$ Bn), 2019 - 2032

5.5.1. Key Highlights

5.5.1.1. Germany Human Organoids Market by Product, Value (US$ Bn), 2019 - 2032

5.5.1.2. Germany Human Organoids Market by Usability, Value (US$ Bn), 2019 - 2032

5.5.1.3. Germany Human Organoids Market by Application, Value (US$ Bn), 2019 - 2032

5.5.1.4. Germany Human Organoids Market by End User, Value (US$ Bn), 2019 - 2032

5.5.1.5. U.K. Human Organoids Market by Product, Value (US$ Bn), 2019 - 2032

5.5.1.6. U.K. Human Organoids Market by Usability, Value (US$ Bn), 2019 - 2032

5.5.1.7. U.K. Human Organoids Market by Application, Value (US$ Bn), 2019 - 2032

5.5.1.8. U.K. Human Organoids Market by End User, Value (US$ Bn), 2019 - 2032

5.5.1.9. France Human Organoids Market by Product, Value (US$ Bn), 2019 - 2032

5.5.1.10. France Human Organoids Market by Usability, Value (US$ Bn), 2019 - 2032

5.5.1.11. France Human Organoids Market by Application, Value (US$ Bn), 2019 - 2032

5.5.1.12. France Human Organoids Market by End User, Value (US$ Bn), 2019 - 2032

5.5.1.13. Italy Human Organoids Market by Product, Value (US$ Bn), 2019 - 2032

5.5.1.14. Italy Human Organoids Market by Usability, Value (US$ Bn), 2019 - 2032

5.5.1.15. Italy Human Organoids Market by Application, Value (US$ Bn), 2019 - 2032

5.5.1.16. Italy Human Organoids Market by End User, Value (US$ Bn), 2019 - 2032

5.5.1.17. Turkey Human Organoids Market by Product, Value (US$ Bn), 2019 - 2032

5.5.1.18. Turkey Human Organoids Market by Usability, Value (US$ Bn), 2019 - 2032

5.5.1.19. Turkey Human Organoids Market by Application, Value (US$ Bn), 2019 - 2032

5.5.1.20. Turkey Human Organoids Market by End User, Value (US$ Bn), 2019 - 2032

5.5.1.21. Russia Human Organoids Market by Product, Value (US$ Bn), 2019 - 2032

5.5.1.22. Russia Human Organoids Market by Usability, Value (US$ Bn), 2019 - 2032

5.5.1.23. Russia Human Organoids Market by Application, Value (US$ Bn), 2019 - 2032

5.5.1.24. Russia Human Organoids Market by End User, Value (US$ Bn), 2019 - 2032

5.5.1.25. Rest of Europe Human Organoids Market by Product, Value (US$ Bn), 2019 - 2032

5.5.1.26. Rest of Europe Human Organoids Market by Usability, Value (US$ Bn), 2019 - 2032

5.5.1.27. Rest of Europe Human Organoids Market by Application, Value (US$ Bn), 2019 - 2032

5.5.1.28. Rest of Europe Human Organoids Market by End User, Value (US$ Bn), 2019 - 2032

6. Asia Pacific Human Organoids Market Outlook, 2019 - 2032

6.1. Asia Pacific Human Organoids Market Outlook, by Product, Value (US$ Bn), 2019 - 2032

6.1.1. Key Highlights

6.1.1.1. Pancreas

6.1.1.2. Kidney

6.1.1.3. Lung

6.1.1.4. Liver Models

6.1.1.5. GIT

6.2. Asia Pacific Human Organoids Market Outlook, by Usability, Value (US$ Bn), 2019 - 2032

6.2.1. Key Highlights

6.2.1.1. Ready-To-Use

6.2.1.2. Customized

6.3. Asia Pacific Human Organoids Market Outlook, by Application, Value (US$ Bn), 2019 - 2032

6.3.1. Key Highlights

6.3.1.1. Pathology

6.3.1.2. Toxicity

6.3.1.3. Personalized & Regenerative Drugs

6.4. Asia Pacific Human Organoids Market Outlook, by End User, Value (US$ Bn), 2019 - 2032

6.4.1. Key Highlights

6.4.1.1. Academia

6.4.1.2. Pharma-Biotech

6.4.1.3. CROs

6.4.2. Attractiveness Analysis

6.5. Asia Pacific Human Organoids Market Outlook, by Country, Value (US$ Bn), 2019 - 2032

6.5.1. Key Highlights

6.5.1.1. China Human Organoids Market by Product, Value (US$ Bn), 2019 - 2032

6.5.1.2. China Human Organoids Market by Usability, Value (US$ Bn), 2019 - 2032

6.5.1.3. China Human Organoids Market by Application, Value (US$ Bn), 2019 - 2032

6.5.1.4. China Human Organoids Market by End User, Value (US$ Bn), 2019 - 2032

6.5.1.5. Japan Human Organoids Market by Product, Value (US$ Bn), 2019 - 2032

6.5.1.6. Japan Human Organoids Market by Usability, Value (US$ Bn), 2019 - 2032

6.5.1.7. Japan Human Organoids Market by Application, Value (US$ Bn), 2019 - 2032

6.5.1.8. Japan Human Organoids Market by End User, Value (US$ Bn), 2019 - 2032

6.5.1.9. South Korea Human Organoids Market by Product, Value (US$ Bn), 2019 - 2032

6.5.1.10. South Korea Human Organoids Market by Usability, Value (US$ Bn), 2019 - 2032

6.5.1.11. South Korea Human Organoids Market by Application, Value (US$ Bn), 2019 - 2032

6.5.1.12. South Korea Human Organoids Market by End User, Value (US$ Bn), 2019 - 2032

6.5.1.13. India Human Organoids Market by Product, Value (US$ Bn), 2019 - 2032

6.5.1.14. India Human Organoids Market by Usability, Value (US$ Bn), 2019 - 2032

6.5.1.15. India Human Organoids Market by Application, Value (US$ Bn), 2019 - 2032

6.5.1.16. India Human Organoids Market by End User, Value (US$ Bn), 2019 - 2032

6.5.1.17. Southeast Asia Human Organoids Market by Product, Value (US$ Bn), 2019 - 2032

6.5.1.18. Southeast Asia Human Organoids Market by Usability, Value (US$ Bn), 2019 - 2032

6.5.1.19. Southeast Asia Human Organoids Market by Application, Value (US$ Bn), 2019 - 2032

6.5.1.20. Southeast Asia Human Organoids Market by End User, Value (US$ Bn), 2019 - 2032

6.5.1.21. Rest of Asia Pacific Human Organoids Market by Product, Value (US$ Bn), 2019 - 2032

6.5.1.22. Rest of Asia Pacific Human Organoids Market by Usability, Value (US$ Bn), 2019 - 2032

6.5.1.23. Rest of Asia Pacific Human Organoids Market by Application, Value (US$ Bn), 2019 - 2032

6.5.1.24. Rest of Asia Pacific Human Organoids Market by End User, Value (US$ Bn), 2019 - 2032

7. Latin America Human Organoids Market Outlook, 2019 - 2032

7.1. Latin America Human Organoids Market Outlook, by Product, Value (US$ Bn), 2019 - 2032

7.1.1. Key Highlights

7.1.1.1. Pancreas

7.1.1.2. Kidney

7.1.1.3. Lung

7.1.1.4. Liver Models

7.1.1.5. GIT

7.2. Latin America Human Organoids Market Outlook, by Usability, Value (US$ Bn), 2019 - 2032

7.2.1. Key Highlights

7.2.1.1. Ready-To-Use

7.2.1.2. Customized

7.3. Latin America Human Organoids Market Outlook, by Application, Value (US$ Bn), 2019 - 2032

7.3.1. Key Highlights

7.3.1.1. Pathology

7.3.1.2. Toxicity

7.3.1.3. Personalized & Regenerative Drugs

7.4. Latin America Human Organoids Market Outlook, by End User, Value (US$ Bn), 2019 - 2032

7.4.1. Key Highlights

7.4.1.1. Academia

7.4.1.2. Pharma-Biotech

7.4.1.3. CROs

7.4.2. Attractiveness Analysis

7.5. Latin America Human Organoids Market Outlook, by Country, Value (US$ Bn), 2019 - 2032

7.5.1. Key Highlights

7.5.1.1. Brazil Human Organoids Market by Product, Value (US$ Bn), 2019 - 2032

7.5.1.2. Brazil Human Organoids Market by Usability, Value (US$ Bn), 2019 - 2032

7.5.1.3. Brazil Human Organoids Market by Application, Value (US$ Bn), 2019 - 2032

7.5.1.4. Brazil Human Organoids Market by End User, Value (US$ Bn), 2019 - 2032

7.5.1.5. Mexico Human Organoids Market by Product, Value (US$ Bn), 2019 - 2032

7.5.1.6. Mexico Human Organoids Market by Usability, Value (US$ Bn), 2019 - 2032

7.5.1.7. Mexico Human Organoids Market by Application, Value (US$ Bn), 2019 - 2032

7.5.1.8. Mexico Human Organoids Market by End User, Value (US$ Bn), 2019 - 2032

7.5.1.9. Argentina Human Organoids Market by Product, Value (US$ Bn), 2019 - 2032

7.5.1.10. Argentina Human Organoids Market by Usability, Value (US$ Bn), 2019 - 2032

7.5.1.11. Argentina Human Organoids Market by Application, Value (US$ Bn), 2019 - 2032

7.5.1.12. Argentina Human Organoids Market by End User, Value (US$ Bn), 2019 - 2032

7.5.1.13. Rest of Latin America Human Organoids Market by Product, Value (US$ Bn), 2019 - 2032

7.5.1.14. Rest of Latin America Human Organoids Market by Usability, Value (US$ Bn), 2019 - 2032

7.5.1.15. Rest of Latin America Human Organoids Market by Application, Value (US$ Bn), 2019 - 2032

7.5.1.16. Rest of Latin America Human Organoids Market by End User, Value (US$ Bn), 2019 - 2032

8. Middle East & Africa Human Organoids Market Outlook, 2019 - 2032

8.1. Middle East & Africa Human Organoids Market Outlook, by Product, Value (US$ Bn), 2019 - 2032

8.1.1. Key Highlights

8.1.1.1. Pancreas

8.1.1.2. Kidney

8.1.1.3. Lung

8.1.1.4. Liver Models

8.1.1.5. GIT

8.2. Middle East & Africa Human Organoids Market Outlook, by Usability, Value (US$ Bn), 2019 - 2032

8.2.1. Key Highlights

8.2.1.1. Ready-To-Use

8.2.1.2. Customized

8.3. Middle East & Africa Human Organoids Market Outlook, by Application, Value (US$ Bn), 2019 - 2032

8.3.1. Key Highlights

8.3.1.1. Pathology

8.3.1.2. Toxicity

8.3.1.3. Personalized & Regenerative Drugs

8.4. Middle East & Africa Human Organoids Market Outlook, by End User, Value (US$ Bn), 2019 - 2032

8.4.1. Key Highlights

8.4.1.1. Academia

8.4.1.2. Pharma-Biotech

8.4.1.3. CROs

8.4.2. Attractiveness Analysis

8.5. Middle East & Africa Human Organoids Market Outlook, by Country, Value (US$ Bn), 2019 - 2032

8.5.1. Key Highlights

8.5.1.1. GCC Human Organoids Market by Product, Value (US$ Bn), 2019 - 2032

8.5.1.2. GCC Human Organoids Market by Usability, Value (US$ Bn), 2019 - 2032

8.5.1.3. GCC Human Organoids Market by Application, Value (US$ Bn), 2019 - 2032

8.5.1.4. GCC Human Organoids Market by End User, Value (US$ Bn), 2019 - 2032

8.5.1.5. South Africa Human Organoids Market by Product, Value (US$ Bn), 2019 - 2032

8.5.1.6. South Africa Human Organoids Market by Usability, Value (US$ Bn), 2019 - 2032

8.5.1.7. South Africa Human Organoids Market by Application, Value (US$ Bn), 2019 - 2032

8.5.1.8. South Africa Human Organoids Market by End User, Value (US$ Bn), 2019 - 2032

8.5.1.9. Egypt Human Organoids Market by Product, Value (US$ Bn), 2019 - 2032

8.5.1.10. Egypt Human Organoids Market by Usability, Value (US$ Bn), 2019 - 2032

8.5.1.11. Egypt Human Organoids Market by Application, Value (US$ Bn), 2019 - 2032

8.5.1.12. Egypt Human Organoids Market by End User, Value (US$ Bn), 2019 - 2032

8.5.1.13. Nigeria Human Organoids Market by Product, Value (US$ Bn), 2019 - 2032

8.5.1.14. Nigeria Human Organoids Market by Usability, Value (US$ Bn), 2019 - 2032

8.5.1.15. Nigeria Human Organoids Market by Application, Value (US$ Bn), 2019 - 2032

8.5.1.16. Nigeria Human Organoids Market by End User, Value (US$ Bn), 2019 - 2032

8.5.1.17. Rest of Middle East & Africa Human Organoids Market by Product, Value (US$ Bn), 2019 - 2032

8.5.1.18. Rest of Middle East & Africa Human Organoids Market by Usability, Value (US$ Bn), 2019 - 2032

8.5.1.19. Rest of Middle East & Africa Human Organoids Market by Application, Value (US$ Bn), 2019 - 2032

8.5.1.20. Rest of Middle East & Africa Human Organoids Market by End User, Value (US$ Bn), 2019 - 2032

9. Competitive Landscape

9.1. By Product vs by Usability Heatmap

9.2. Company Market Share Analysis, 2025

9.3. Competitive Dashboard

9.4. Company Profiles

9.4.1. BioIVT

9.4.1.1. Company Overview

9.4.1.2. Product Portfolio

9.4.1.3. Financial Overview

9.4.1.4. Business Strategies and Development

9.4.2. ZenBio

9.4.2.1. Company Overview

9.4.2.2. Product Portfolio

9.4.2.3. Financial Overview

9.4.2.4. Business Strategies and Development

9.4.3. Thermo Fisher Scientific

9.4.3.1. Company Overview

9.4.3.2. Product Portfolio

9.4.3.3. Financial Overview

9.4.3.4. Business Strategies and Development

9.4.4. CELLINK

9.4.4.1. Company Overview

9.4.4.2. Product Portfolio

9.4.4.3. Financial Overview

9.4.4.4. Business Strategies and Development

9.4.5. Biopredic International

9.4.5.1. Company Overview

9.4.5.2. Product Portfolio

9.4.5.3. Financial Overview

9.4.5.4. Business Strategies and Development

9.4.6. Hurel Corporation

9.4.6.1. Company Overview

9.4.6.2. Product Portfolio

9.4.6.3. Financial Overview

9.4.6.4. Business Strategies and Development

9.4.7. Emulate

9.4.7.1. Company Overview

9.4.7.2. Product Portfolio

9.4.7.3. Financial Overview

9.4.7.4. Business Strategies and Development

9.4.8. Kerafast

9.4.8.1. Company Overview

9.4.8.2. Product Portfolio

9.4.8.3. Financial Overview

9.4.8.4. Business Strategies and Development

9.4.9. InSphero

9.4.9.1. Company Overview

9.4.9.2. Product Portfolio

9.4.9.3. Financial Overview

9.4.9.4. Business Strategies and Development

9.4.10. MIMETAS

9.4.10.1. Company Overview

9.4.10.2. Product Portfolio

9.4.10.3. Financial Overview

9.4.10.4. Business Strategies and Development

9.4.11. Cyprio

9.4.11.1. Company Overview

9.4.11.2. Product Portfolio

9.4.11.3. Financial Overview

9.4.11.4. Business Strategies and Development

9.4.12. Corning

9.4.12.1. Company Overview

9.4.12.2. Product Portfolio

9.4.12.3. Financial Overview

9.4.12.4. Business Strategies and Development

9.4.13. Kirkstall

9.4.13.1. Company Overview

9.4.13.2. Product Portfolio

9.4.13.3. Financial Overview

9.4.13.4. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2023 |

|

2019 - 2023 |

2025 - 2032 |

Value: US$ Billion |

||

|

REPORT FEATURES |

DETAILS |

|

Product Coverage |

|

|

Usability Coverage |

|

|

Application Coverage |

|

|

End User Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2023), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |