Global Immune Repertoire Sequencing Market Forecast

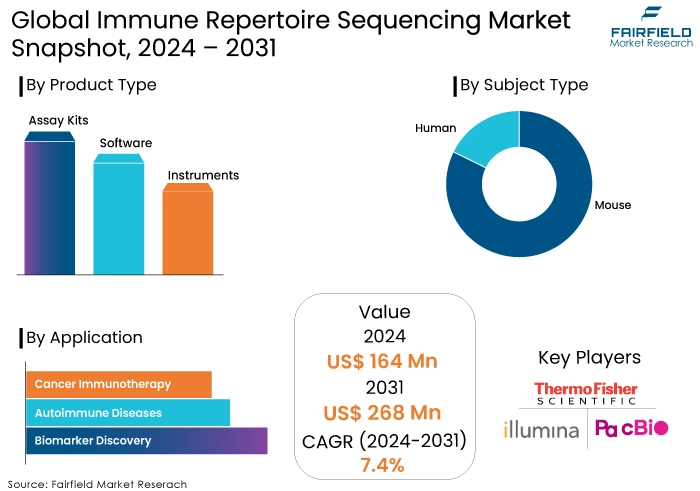

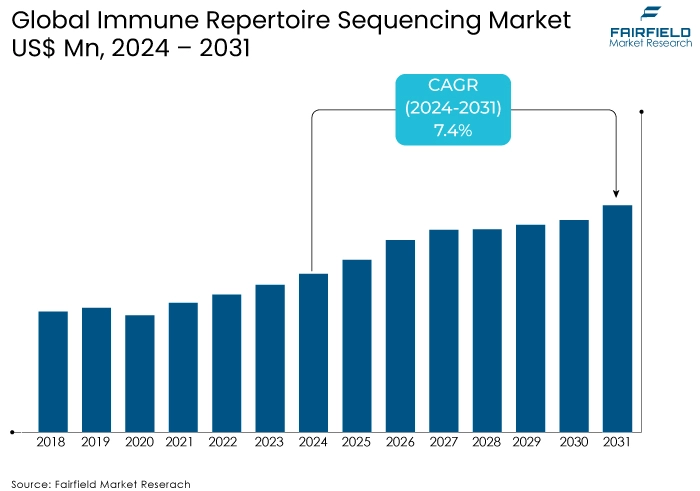

- Immune repertoire sequencing market size poised to reach US$268 Mn in 2031, up from US$164 Mn attained in 2024

- Global immune repertoire sequencing market revenue is projected to witness a CAGR of 7.4% during 2024-2031

Immune Repertoire Sequencing Market Insights

- The market driven by NGS advancements, personalized medicine, and expanding disease research applications.

- High sequencing costs, complex data analysis, and limited standardization hinder market growth.

- AI and ML integration enhances data analysis and interpretation, driving market expansion.

- Clinical diagnostics and therapeutics offer significant growth opportunities.

- Assay kits dominate product category due to growing demand for comprehensive solutions.

- Human subjects research drives the growth of the immune repertoire sequencing market due to focus on understanding human immune responses.

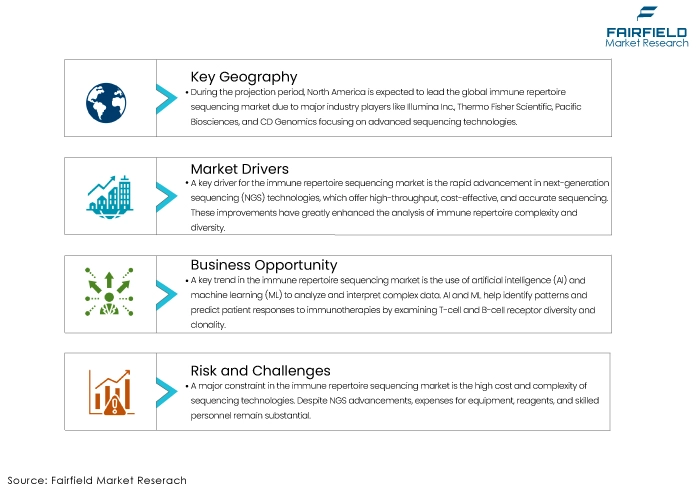

- North America leads market due to major industry players and technological advancements.

- Europe poised for growth due to government funding and focus on innovative solutions.

- Market dominated by established biotech firms and emerging startups.

- Competition driven by technological innovation, data analysis capabilities, and personalized medicine focus.

A Look Back and a Look Forward - Comparative Analysis

Before 2023, the immune repertoire sequencing market experienced steady growth, driven by advancements in next-generation sequencing (NGS) technologies and increasing research in immunology and oncology. The ability to deeply profile T-cell and B-cell receptors provided critical insights into immune system function and disease mechanisms. Applications in cancer immunotherapy, autoimmune diseases, and infectious diseases fueled market demand as researchers sought to understand immune diversity and response. Significant investments from both public and private sectors, alongside academic collaborations, bolstered market expansion.

However, challenges such as high costs of sequencing, complex data analysis, and limited standardization in protocols and data interpretation somewhat restrained the market’s full potential. Post-2024, the immune repertoire sequencing market is expected to witness accelerated growth, propelled by technological innovations and expanding clinical applications. Advancements in bioinformatics and AI-driven data analysis will likely overcome previous barriers, making sequencing more accessible and interpretable.

The increasing prevalence of personalized medicine will drive demand as immune repertoire sequencing becomes integral to developing tailored therapies for cancer, autoimmune diseases, and infectious diseases. Emerging markets, particularly in Asia Pacific, are expected to contribute significantly to market expansion due to improving healthcare infrastructure and rising research investments. Regulatory approvals and standardization efforts will further enhance clinical adoption, while collaborations between biotech companies and research institutions will spur innovation. The market is poised for robust growth, supported by technological advancements, broader clinical applications, and expanding geographical reach.

Key Growth Determinants

- Advancements in Next-Generation Sequencing (NGS) Technologies

One of the primary drivers for the immune repertoire sequencing market is the rapid advancement in next-generation sequencing (NGS) technologies. NGS has revolutionized genomic research by providing high-throughput, cost-effective, and accurate sequencing capabilities. These advancements have significantly enhanced our ability to analyse the complexity and diversity of immune repertoires.

New developments like single-cell and long-read sequencing allow for more detailed and comprehensive profiling of T-cell and B-cell receptors. These technologies facilitate the identification of novel biomarkers, the understanding of disease mechanisms, and the development of targeted therapies. As NGS technology evolves, it will reduce costs, increase accessibility, and improve data accuracy, thereby driving the adoption of immune repertoire sequencing in research and clinical settings.

- Increasing Focus on Personalized Medicine

The growing emphasis on personalized medicine is crucial for the immune repertoire sequencing market. Personalized medicine aims to tailor medical treatment to the individual characteristics of each patient, and immune repertoire sequencing plays a vital role in this approach. By providing detailed insights into an individual's immune system, this technology helps develop personalized therapies for various conditions, including cancer, autoimmune diseases, and infectious diseases.

For instance, immune repertoire sequencing in oncology can identify specific T-cell receptors that are effective against a patient's tumour, leading to personalized cancer immunotherapies. The ability to tailor treatments based on an individual's immune profile enhances therapeutic efficacy and minimizes adverse effects, thereby driving the demand for immune repertoire sequencing in personalized medicine.

- Expanding Applications in Disease Research and Diagnosis

The expanding applications of immune repertoire sequencing in disease research and diagnosis significantly drive market growth. This technology provides valuable insights into the immune response to various diseases, aiding in identifying disease-specific immune signatures and novel therapeutic targets.

In cancer research, immune repertoire sequencing studies tumour-infiltrating lymphocytes and monitors immune responses to immunotherapies. Infectious disease research helps understand immune responses to pathogens and vaccine development.

Additionally, immune repertoire sequencing is used to diagnose and monitor autoimmune diseases by identifying aberrant immune responses. The broadening scope of applications in disease research and diagnostics enhances the market's appeal, encouraging investment and adoption across academic, clinical, and pharmaceutical research sectors. As research continues to uncover new applications, the demand in the immune repertoire sequencing market is expected to grow.

Key Growth Barriers

- High Costs and Complexity of Sequencing

One significant constraint for the immune repertoire sequencing market is the high cost and complexity associated with sequencing technologies. Despite advancements in next-generation sequencing (NGS), the expenses of acquiring, maintaining, and operating advanced sequencing equipment remain substantial.

Additionally, the cost of reagents and the need for highly skilled personnel to perform and interpret the sequencing further elevate the overall expenditure.

Small and medium-sized research institutions and healthcare facilities, particularly in developing regions, often need help to afford these costs, limiting the widespread adoption of immune repertoire sequencing. Moreover, data analysis and interpretation complexity require advanced bioinformatics tools and expertise, which adds another layer of cost and difficulty, restraining market growth.

- Limited Standardization and Regulatory Challenges

Limited standardization and regulatory challenges also significantly restrain the immune repertoire sequencing market. There needs to be standardized protocols and guidelines for immune repertoire sequencing, leading to variability in data quality and interpretation across different laboratories and studies. This inconsistency hinders the reproducibility and comparability of results, impacting the clinical utility of the technology.

Additionally, navigating the complex regulatory landscape for diagnostic and therapeutic applications of immune repertoire sequencing can be challenging. Obtaining regulatory approvals for new sequencing methods and applications involves rigorous validation and compliance with stringent regulations, which can be time-consuming and costly. These regulatory hurdles slow the commercialization and clinical adoption of immune repertoire sequencing, restraining market growth.

Immune Repertoire Sequencing Market Trends and Opportunities

- Integration with Artificial Intelligence and Machine Learning

A prominent trend in the immune repertoire sequencing market is the integration of artificial intelligence (AI) and machine learning (ML) technologies. As immune repertoire sequencing generates vast amounts of complex data, AI and ML are increasingly used to enhance data analysis, interpretation, and predictive modelling. These technologies can identify patterns and correlations within immune repertoires that may not be apparent through traditional analysis methods. For example, AI algorithms can predict patient responses to immunotherapies by analysing the diversity and clonality of T-cell and B-cell receptors.

Machine learning models can also help identify novel biomarkers for disease diagnosis and prognosis, leading to more personalized and effective treatments. This integration improves the accuracy and efficiency of immune repertoire analysis and expands the scope of its applications. As AI and ML technologies evolve, they are expected to play an even more significant role in advancing immune repertoire sequencing, driving market growth by providing deeper insights and enabling more precise medical interventions.

- Expansion into Clinical Diagnostics and Therapeutics

Expanding immune repertoire sequencing into clinical diagnostics and therapeutics presents a significant growth opportunity for the market. While traditionally used in research settings, there is a growing recognition of the clinical utility of immune repertoire sequencing in diagnosing and monitoring various diseases. For instance, in oncology, immune repertoire sequencing can detect minimal residual disease (MRD) in leukemia patients, providing a susceptible method for early detection of relapse. In autoimmune diseases, it can help identify specific autoreactive clones, aiding in precise diagnosis and monitoring of disease progression. Additionally, the technology holds promise in infectious disease management by tracking the immune response to infections and vaccines.

Another exciting avenue is the potential for developing personalized immunotherapies based on an individual’s immune repertoire. As healthcare systems increasingly adopt precision medicine approaches, the clinical applications of immune repertoire sequencing are expected to expand, creating substantial opportunities for the growth of the immune repertoire sequencing market. Companies that invest in developing clinically validated sequencing platforms and obtaining regulatory approvals will be well-positioned to capitalize on this opportunity, driving innovation and market expansion.

Segments Covered in Immune Repertoire Sequencing Market Report

- Assay Kits Continue to Dominate Other Product Categories

The assay kits segment is projected to have the highest revenue share throughout the forecast period among the different product type categories.

Assay kits, such as TCR and BCR Kits, are essential for analysing the immune repertoire. The growing need for comprehensive and user-friendly solutions for T-cell and B-cell receptor analysis is increasing demand for these kits in research institutions, diagnostic labs, pharmaceutical and biotech companies, and other sectors.

The wide range of applications in biomarker discovery, autoimmune diseases, cancer immunotherapy, infectious disease research, asthma and allergy studies, vaccine development, and immunodeficiency identification, along with the increasing use of immunogenic techniques, are anticipated to contribute to the ongoing revenue growth of this sector.

- Human Subject Type Owns a Substantial Market Share

Out of all the many types of subjects, the human segment is projected to continue being the most dominant in terms of revenue share. The constant focus and interest in understanding human immune responses for therapeutic purposes, such as cancer immunotherapy and autoimmune disease research, has led to a continuous demand for immune repertoire sequencing in human subjects. This is driven by the need to further study initiatives and achieve medical breakthroughs.

Regional Analysis

North America Continues to be at the Forefront

During the projection period, North America is projected to maintain a leading position in the worldwide immune repertoire sequencing market due to the significant presence of major industry players in the region, such as Illumina Inc., Thermo Fisher Scientific, Pacific Biosciences, and CD Genomics. These players of the industry are progressively prioritizing the advancement of innovative technologies for sequencing the immunological repertoire. In 2017, 10x Genomics Inc., a business based in the US, expanded its chromium immune repertoire profiling product known as immune repertoire sequencing by introducing the B-Cell and 5’Unbiased Enrichment Kit.

Europe is anticipated to expand the immunological repertoire sequencing market significantly. During the projected period, the European market is anticipated to experience growth due to increased government financing for international creative projects and marketable innovative goods, processes, and services to address unmet medical needs. The Eurostars program, a collaboration between EUREKA and the European Commission, awarded OSE Immunotherapeutic SA a grant of US$ 495,000 for their project, titled, ‘Treatment Response Monitoring for Cancer Immunotherapies Using Immune Repertoire Analysis’.

Fairfield’s Competitive Landscape Analysis

The immune repertoire sequencing market features a competitive landscape dominated by a mix of established biotechnology firms and emerging start-ups. Key players include Illumina, Adaptive Biotechnologies, Thermo Fisher Scientific, and Oxford Nanopore Technologies, all of which offer advanced sequencing platforms and comprehensive analytical solutions. These companies compete on technological innovation, accuracy, and the ability to handle large datasets.

Emerging players like ArcherDX and Repertoire Immune Medicines focus on niche applications and novel methodologies. Strategic collaborations, acquisitions, and significant investments in R&D characterize the market, aimed at expanding product portfolios and enhancing clinical applications. The competitive environment is driven by advancements in sequencing technology, integration of AI for data analysis, and increasing demand for personalized medicine.

Key Market Companies

- Illumina Inc.

- Thermo Fisher Scientific

- PacBio

- CD Genomics

- Agilent Technologies, Inc.

- F. Hoffmann-La Roche Ltd.

- BGI Group Guangdong

- Takara Bio, Inc.

- Adaptive Biotechnologies

- Juno Therapeutics

- Atreca, Inc.

- irepertoire, Inc.

Recent Industry Developments

- In August 2023, Illumina Inc., a prominent company in the field of DNA sequencing and array-based technologies, unveiled the Illumina Solutions Center in Bengaluru, India.

- In May 2023, Pfizer and Thermo Fisher Scientific Inc. announced a collaborative agreement to test next-generation sequencing for lung and breast cancer patients.

An Expert’s Eye

- The immune repertoire sequencing market is poised for explosive growth.

- Advances in sequencing technologies and computational biology are unlocking the potential of this field. Its applications in drug discovery, immunotherapy, vaccine development, and diagnostics are vast.

- Significant investments in research and development to refine sequencing techniques and data analysis.

- Challenges such as data interpretation, standardization, and intellectual property rights need to be addressed.

- The market is primed for rapid expansion as the understanding of the immune system deepens, leading to groundbreaking medical advancements.

Global Immune Repertoire Sequencing Market is Segmented as Below -

By Product Type

- Assay Kits

- Software

- Instruments

By Subject Type

- Human

- Mouse

By Application

- Biomarker Discovery

- Autoimmune Diseases

- Cancer Immunotherapy

By End User

- Diagnostic Labs

- Pharmaceuticals Companies

- Institutes

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

1. Executive Summary

1.1. Global Immune Repertoire Sequencing Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2022

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. COVID-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Global Immune Repertoire Sequencing Market Outlook, 2018 - 2030

3.1. Global Immune Repertoire Sequencing Market Outlook, by Component, Value (US$ Bn), 2018 - 2030

3.1.1. Key Highlights

3.1.1.1. Assay Kits

3.1.1.1.1. TCR Kits

3.1.1.1.2. BCR Kits

3.1.1.2. Software & Services

3.1.1.2.1. Analytical Software

3.1.1.2.2. Sequencing Services

3.1.1.2.3. Data Analysis Services

3.2. Global Immune Repertoire Sequencing Market Outlook, by Application, Value (US$ Bn), 2018 - 2030

3.2.1. Key Highlights

3.2.1.1. Biomarker Discovery

3.2.1.2. Infectious Diseases

3.2.1.3. Vaccine Development and efficacy

3.2.1.4. Cancer Immunotherapy

3.2.1.5. Autoimmune Disease

3.2.1.6. Transplant Rejection and Tolerance

3.2.1.7. Others

3.3. Global Immune Repertoire Sequencing Market Outlook, by End User, Value (US$ Bn), 2018 - 2030

3.3.1. Key Highlights

3.3.1.1. Academic Institutes

3.3.1.2. Research Centres

3.4. Global Immune Repertoire Sequencing Market Outlook, by Region, Value (US$ Bn), 2018 - 2030

3.4.1. Key Highlights

3.4.1.1. North America

3.4.1.2. Europe

3.4.1.3. Asia Pacific

3.4.1.4. Latin America

3.4.1.5. Middle East & Africa

4. North America Immune Repertoire Sequencing Market Outlook, 2018 - 2030

4.1. North America Immune Repertoire Sequencing Market Outlook, by Component, Value (US$ Bn), 2018 - 2030

4.1.1. Key Highlights

4.1.1.1. Assay Kits

4.1.1.1.1. TCR Kits

4.1.1.1.2. BCR Kits

4.1.1.2. Software & Services

4.1.1.2.1. Analytical Software

4.1.1.2.2. Sequencing Services

4.1.1.2.3. Data Analysis Services

4.2. North America Immune Repertoire Sequencing Market Outlook, by Application, Value (US$ Bn), 2018 - 2030

4.2.1. Key Highlights

4.2.1.1. Biomarker Discovery

4.2.1.2. Infectious Diseases

4.2.1.3. Vaccine Development and efficacy

4.2.1.4. Cancer Immunotherapy

4.2.1.5. Autoimmune Disease

4.2.1.6. Transplant Rejection and Tolerance

4.2.1.7. Others

4.3. North America Immune Repertoire Sequencing Market Outlook, by End User, Value (US$ Bn), 2018 - 2030

4.3.1. Key Highlights

4.3.1.1. Academic Institutes

4.3.1.2. Research Centres

4.3.2. BPS Analysis/Market Attractiveness Analysis

4.4. North America Immune Repertoire Sequencing Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

4.4.1. Key Highlights

4.4.1.1. U.S. Immune Repertoire Sequencing Market by Component, Value (US$ Bn), 2018 - 2030

4.4.1.2. U.S. Immune Repertoire Sequencing Market by Application, Value (US$ Bn), 2018 - 2030

4.4.1.3. U.S. Immune Repertoire Sequencing Market by End User, Value (US$ Bn), 2018 - 2030

4.4.1.4. Canada Immune Repertoire Sequencing Market by Component, Value (US$ Bn), 2018 - 2030

4.4.1.5. Canada Immune Repertoire Sequencing Market by Application, Value (US$ Bn), 2018 - 2030

4.4.1.6. Canada Immune Repertoire Sequencing Market by End User, Value (US$ Bn), 2018 - 2030

4.4.2. BPS Analysis/Market Attractiveness Analysis

5. Europe Immune Repertoire Sequencing Market Outlook, 2018 - 2030

5.1. Europe Immune Repertoire Sequencing Market Outlook, by Component, Value (US$ Bn), 2018 - 2030

5.1.1. Key Highlights

5.1.1.1. Assay Kits

5.1.1.1.1. TCR Kits

5.1.1.1.2. BCR Kits

5.1.1.2. Software & Services

5.1.1.2.1. Analytical Software

5.1.1.2.2. Sequencing Services

5.1.1.2.3. Data Analysis Services

5.2. Europe Immune Repertoire Sequencing Market Outlook, by Application, Value (US$ Bn), 2018 - 2030

5.2.1. Key Highlights

5.2.1.1. Biomarker Discovery

5.2.1.2. Infectious Diseases

5.2.1.3. Vaccine Development and efficacy

5.2.1.4. Cancer Immunotherapy

5.2.1.5. Autoimmune Disease

5.2.1.6. Transplant Rejection and Tolerance

5.2.1.7. Others

5.3. Europe Immune Repertoire Sequencing Market Outlook, by End User, Value (US$ Bn), 2018 - 2030

5.3.1. Key Highlights

5.3.1.1. Academic Institutes

5.3.1.2. Research Centres

5.3.2. BPS Analysis/Market Attractiveness Analysis

5.4. Europe Immune Repertoire Sequencing Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

5.4.1. Key Highlights

5.4.1.1. Germany Immune Repertoire Sequencing Market by Component, Value (US$ Bn), 2018 - 2030

5.4.1.2. Germany Immune Repertoire Sequencing Market by Application, Value (US$ Bn), 2018 - 2030

5.4.1.3. Germany Immune Repertoire Sequencing Market by End User, Value (US$ Bn), 2018 - 2030

5.4.1.4. U.K. Immune Repertoire Sequencing Market by Component, Value (US$ Bn), 2018 - 2030

5.4.1.5. U.K. Immune Repertoire Sequencing Market by Application, Value (US$ Bn), 2018 - 2030

5.4.1.6. U.K. Immune Repertoire Sequencing Market by End User, Value (US$ Bn), 2018 - 2030

5.4.1.7. France Immune Repertoire Sequencing Market by Component, Value (US$ Bn), 2018 - 2030

5.4.1.8. France Immune Repertoire Sequencing Market by Application, Value (US$ Bn), 2018 - 2030

5.4.1.9. France Immune Repertoire Sequencing Market by End User, Value (US$ Bn), 2018 - 2030

5.4.1.10. Italy Immune Repertoire Sequencing Market by Component, Value (US$ Bn), 2018 - 2030

5.4.1.11. Italy Immune Repertoire Sequencing Market by Application, Value (US$ Bn), 2018 - 2030

5.4.1.12. Italy Immune Repertoire Sequencing Market by End User, Value (US$ Bn), 2018 - 2030

5.4.1.13. Turkey Immune Repertoire Sequencing Market by Component, Value (US$ Bn), 2018 - 2030

5.4.1.14. Turkey Immune Repertoire Sequencing Market by Application, Value (US$ Bn), 2018 - 2030

5.4.1.15. Turkey Immune Repertoire Sequencing Market by End User, Value (US$ Bn), 2018 - 2030

5.4.1.16. Russia Immune Repertoire Sequencing Market by Component, Value (US$ Bn), 2018 - 2030

5.4.1.17. Russia Immune Repertoire Sequencing Market by Application, Value (US$ Bn), 2018 - 2030

5.4.1.18. Russia Immune Repertoire Sequencing Market by End User, Value (US$ Bn), 2018 - 2030

5.4.1.19. Rest of Europe Immune Repertoire Sequencing Market by Component, Value (US$ Bn), 2018 - 2030

5.4.1.20. Rest of Europe Immune Repertoire Sequencing Market by Application, Value (US$ Bn), 2018 - 2030

5.4.1.21. Rest of Europe Immune Repertoire Sequencing Market by End User, Value (US$ Bn), 2018 - 2030

5.4.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Immune Repertoire Sequencing Market Outlook, 2018 - 2030

6.1. Asia Pacific Immune Repertoire Sequencing Market Outlook, by Component, Value (US$ Bn), 2018 - 2030

6.1.1. Key Highlights

6.1.1.1. Assay Kits

6.1.1.1.1. TCR Kits

6.1.1.1.2. BCR Kits

6.1.1.2. Software & Services

6.1.1.2.1. Analytical Software

6.1.1.2.2. Sequencing Services

6.1.1.2.3. Data Analysis Services

6.2. Asia Pacific Immune Repertoire Sequencing Market Outlook, by Application, Value (US$ Bn), 2018 - 2030

6.2.1. Key Highlights

6.2.1.1. Biomarker Discovery

6.2.1.2. Infectious Diseases

6.2.1.3. Vaccine Development and efficacy

6.2.1.4. Cancer Immunotherapy

6.2.1.5. Autoimmune Disease

6.2.1.6. Transplant Rejection and Tolerance

6.2.1.7. Others

6.3. Asia Pacific Immune Repertoire Sequencing Market Outlook, by End User, Value (US$ Bn), 2018 - 2030

6.3.1. Key Highlights

6.3.1.1. Academic Institutes

6.3.1.2. Research Centres

6.3.2. BPS Analysis/Market Attractiveness Analysis

6.4. Asia Pacific Immune Repertoire Sequencing Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

6.4.1. Key Highlights

6.4.1.1. China Immune Repertoire Sequencing Market by Component, Value (US$ Bn), 2018 - 2030

6.4.1.2. China Immune Repertoire Sequencing Market by Application, Value (US$ Bn), 2018 - 2030

6.4.1.3. China Immune Repertoire Sequencing Market by End User, Value (US$ Bn), 2018 - 2030

6.4.1.4. Japan Immune Repertoire Sequencing Market by Component, Value (US$ Bn), 2018 - 2030

6.4.1.5. Japan Immune Repertoire Sequencing Market by Application, Value (US$ Bn), 2018 - 2030

6.4.1.6. Japan Immune Repertoire Sequencing Market by End User, Value (US$ Bn), 2018 - 2030

6.4.1.7. South Korea Immune Repertoire Sequencing Market by Component, Value (US$ Bn), 2018 - 2030

6.4.1.8. South Korea Immune Repertoire Sequencing Market by Application, Value (US$ Bn), 2018 - 2030

6.4.1.9. South Korea Immune Repertoire Sequencing Market by End User, Value (US$ Bn), 2018 - 2030

6.4.1.10. India Immune Repertoire Sequencing Market by Component, Value (US$ Bn), 2018 - 2030

6.4.1.11. India Immune Repertoire Sequencing Market by Application, Value (US$ Bn), 2018 - 2030

6.4.1.12. India Immune Repertoire Sequencing Market by End User, Value (US$ Bn), 2018 - 2030

6.4.1.13. Southeast Asia Immune Repertoire Sequencing Market by Component, Value (US$ Bn), 2018 - 2030

6.4.1.14. Southeast Asia Immune Repertoire Sequencing Market by Application, Value (US$ Bn), 2018 - 2030

6.4.1.15. Southeast Asia Immune Repertoire Sequencing Market by End User, Value (US$ Bn), 2018 - 2030

6.4.1.16. Rest of Asia Pacific Immune Repertoire Sequencing Market by Component, Value (US$ Bn), 2018 - 2030

6.4.1.17. Rest of Asia Pacific Immune Repertoire Sequencing Market by Application, Value (US$ Bn), 2018 - 2030

6.4.1.18. Rest of Asia Pacific Immune Repertoire Sequencing Market by End User, Value (US$ Bn), 2018 - 2030

6.4.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America Immune Repertoire Sequencing Market Outlook, 2018 - 2030

7.1. Latin America Immune Repertoire Sequencing Market Outlook, by Component, Value (US$ Bn), 2018 - 2030

7.1.1. Key Highlights

7.1.1.1. Assay Kits

7.1.1.1.1. TCR Kits

7.1.1.1.2. BCR Kits

7.1.1.2. Software & Services

7.1.1.2.1. Analytical Software

7.1.1.2.2. Sequencing Services

7.1.1.2.3. Data Analysis Services

7.2. Latin America Immune Repertoire Sequencing Market Outlook, by Application, Value (US$ Bn), 2018 - 2030

7.2.1. Key Highlights

7.2.1.1. Biomarker Discovery

7.2.1.2. Infectious Diseases

7.2.1.3. Vaccine Development and efficacy

7.2.1.4. Cancer Immunotherapy

7.2.1.5. Autoimmune Disease

7.2.1.6. Transplant Rejection and Tolerance

7.2.1.7. Others

7.3. Latin America Immune Repertoire Sequencing Market Outlook, by End User, Value (US$ Bn), 2018 - 2030

7.3.1. Key Highlights

7.3.1.1. Academic Institutes

7.3.1.2. Research Centres

7.3.2. BPS Analysis/Market Attractiveness Analysis

7.4. Latin America Immune Repertoire Sequencing Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

7.4.1. Key Highlights

7.4.1.1. Brazil Immune Repertoire Sequencing Market by Component, Value (US$ Bn), 2018 - 2030

7.4.1.2. Brazil Immune Repertoire Sequencing Market by Application, Value (US$ Bn), 2018 - 2030

7.4.1.3. Brazil Immune Repertoire Sequencing Market by End User, Value (US$ Bn), 2018 - 2030

7.4.1.4. Mexico Immune Repertoire Sequencing Market by Component, Value (US$ Bn), 2018 - 2030

7.4.1.5. Mexico Immune Repertoire Sequencing Market by Application, Value (US$ Bn), 2018 - 2030

7.4.1.6. Mexico Immune Repertoire Sequencing Market by End User, Value (US$ Bn), 2018 - 2030

7.4.1.7. Argentina Immune Repertoire Sequencing Market by Component, Value (US$ Bn), 2018 - 2030

7.4.1.8. Argentina Immune Repertoire Sequencing Market by Application, Value (US$ Bn), 2018 - 2030

7.4.1.9. Argentina Immune Repertoire Sequencing Market by End User, Value (US$ Bn), 2018 - 2030

7.4.1.10. Rest of Latin America Immune Repertoire Sequencing Market by Component, Value (US$ Bn), 2018 - 2030

7.4.1.11. Rest of Latin America Immune Repertoire Sequencing Market by Application, Value (US$ Bn), 2018 - 2030

7.4.1.12. Rest of Latin America Immune Repertoire Sequencing Market by End User, Value (US$ Bn), 2018 - 2030

7.4.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Immune Repertoire Sequencing Market Outlook, 2018 - 2030

8.1. Middle East & Africa Immune Repertoire Sequencing Market Outlook, by Component, Value (US$ Bn), 2018 - 2030

8.1.1. Key Highlights

8.1.1.1. Assay Kits

8.1.1.1.1. TCR Kits

8.1.1.1.2. BCR Kits

8.1.1.2. Software & Services

8.1.1.2.1. Analytical Software

8.1.1.2.2. Sequencing Services

8.1.1.2.3. Data Analysis Services

8.2. Middle East & Africa Immune Repertoire Sequencing Market Outlook, by Application, Value (US$ Bn), 2018 - 2030

8.2.1. Key Highlights

8.2.1.1. Biomarker Discovery

8.2.1.2. Infectious Diseases

8.2.1.3. Vaccine Development and efficacy

8.2.1.4. Cancer Immunotherapy

8.2.1.5. Autoimmune Disease

8.2.1.6. Transplant Rejection and Tolerance

8.2.1.7. Others

8.3. Middle East & Africa Immune Repertoire Sequencing Market Outlook, by End User, Value (US$ Bn), 2018 - 2030

8.3.1. Key Highlights

8.3.1.1. Academic Institutes

8.3.1.2. Research Centres

8.3.2. BPS Analysis/Market Attractiveness Analysis

8.4. Middle East & Africa Immune Repertoire Sequencing Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

8.4.1. Key Highlights

8.4.1.1. GCC Immune Repertoire Sequencing Market by Component, Value (US$ Bn), 2018 - 2030

8.4.1.2. GCC Immune Repertoire Sequencing Market by Application, Value (US$ Bn), 2018 - 2030

8.4.1.3. GCC Immune Repertoire Sequencing Market by End User, Value (US$ Bn), 2018 - 2030

8.4.1.4. South Africa Immune Repertoire Sequencing Market by Component, Value (US$ Bn), 2018 - 2030

8.4.1.5. South Africa Immune Repertoire Sequencing Market by Application, Value (US$ Bn), 2018 - 2030

8.4.1.6. South Africa Immune Repertoire Sequencing Market by End User, Value (US$ Bn), 2018 - 2030

8.4.1.7. Egypt Immune Repertoire Sequencing Market by Component, Value (US$ Bn), 2018 - 2030

8.4.1.8. Egypt Immune Repertoire Sequencing Market by Application, Value (US$ Bn), 2018 - 2030

8.4.1.9. Egypt Immune Repertoire Sequencing Market by End User, Value (US$ Bn), 2018 - 2030

8.4.1.10. Nigeria Immune Repertoire Sequencing Market by Component, Value (US$ Bn), 2018 - 2030

8.4.1.11. Nigeria Immune Repertoire Sequencing Market by Application, Value (US$ Bn), 2018 - 2030

8.4.1.12. Nigeria Immune Repertoire Sequencing Market by End User, Value (US$ Bn), 2018 - 2030

8.4.1.13. Rest of Middle East & Africa Immune Repertoire Sequencing Market by Component, Value (US$ Bn), 2018 - 2030

8.4.1.14. Rest of Middle East & Africa Immune Repertoire Sequencing Market by Application, Value (US$ Bn), 2018 - 2030

8.4.1.15. Rest of Middle East & Africa Immune Repertoire Sequencing Market by End User, Value (US$ Bn), 2018 - 2030

8.4.2. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. By End User vs by Application Heat map

9.2. Manufacturer vs by Application Heatmap

9.3. Company Market Share Analysis, 2022

9.4. Competitive Dashboard

9.5. Company Profiles

9.5.1. Illumina, Inc.

9.5.1.1. Company Overview

9.5.1.2. Product Portfolio

9.5.1.3. Financial Overview

9.5.1.4. Business Strategies and Development

9.5.2. Pacific Biosciences of California, Inc

9.5.2.1. Company Overview

9.5.2.2. Product Portfolio

9.5.2.3. Financial Overview

9.5.2.4. Business Strategies and Development

9.5.3. Agilent Technologies, Inc

9.5.3.1. Company Overview

9.5.3.2. Product Portfolio

9.5.3.3. Financial Overview

9.5.3.4. Business Strategies and Development

9.5.4. Oxford Nanopore Technologies, Ltd

9.5.4.1. Company Overview

9.5.4.2. Product Portfolio

9.5.4.3. Financial Overview

9.5.4.4. Business Strategies and Development

9.5.5. QIAGEN N.V.

9.5.5.1. Company Overview

9.5.5.2. Product Portfolio

9.5.5.3. Financial Overview

9.5.5.4. Business Strategies and Development

9.5.6. Thermo Fisher Scientific

9.5.6.1. Company Overview

9.5.6.2. Product Portfolio

9.5.6.3. Financial Overview

9.5.6.4. Business Strategies and Development

9.5.7. BGI

9.5.7.1. Company Overview

9.5.7.2. Product Portfolio

9.5.7.3. Financial Overview

9.5.7.4. Business Strategies and Development

9.5.8. Takara Bio, Inc

9.5.8.1. Company Overview

9.5.8.2. Product Portfolio

9.5.8.3. Financial Overview

9.5.8.4. Business Strategies and Development

9.5.9. F. Hoffmann-La Roche Ltd

9.5.9.1. Company Overview

9.5.9.2. Product Portfolio

9.5.9.3. Financial Overview

9.5.9.4. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2023 |

|

2019 - 2023 |

2024 - 2031 |

Value: US$ Million |

||

|

REPORT FEATURES |

DETAILS |

|

Product Type Coverage |

|

|

Subject Type Coverage |

|

|

Application Coverage |

|

|

End User Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |