India Organic Fertilizer Market Forecast

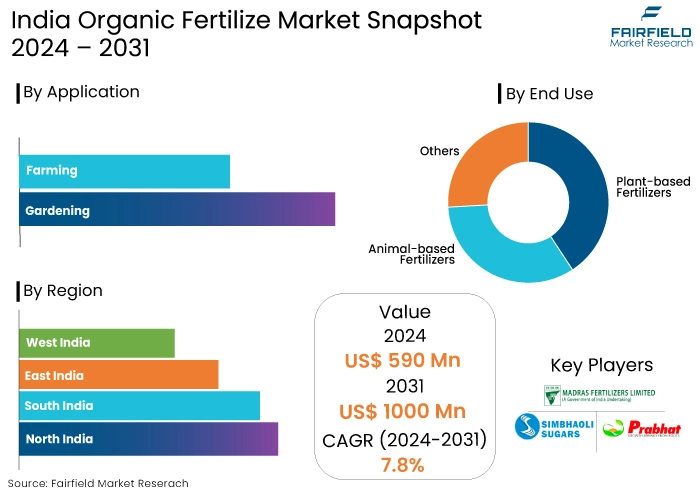

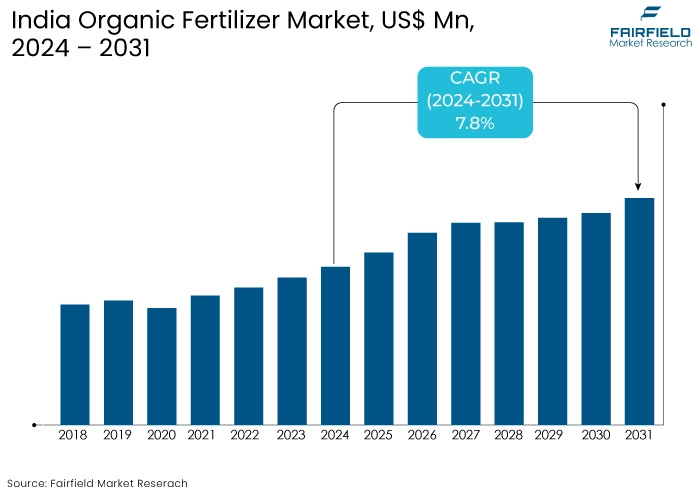

- India organic fertilizer market is projected to value at US$1000 Mn by 2031 showing significant growth from the US$590 Mn achieved in 2024.

- The market is expected to exhibit a remarkable rate of expansion with an estimated CAGR of 7.8% during the forecast period from 2024 to 2031.

India Organic Fertilizer Market Insights

- Consumers are increasingly seeking organic produce due to health and environmental concerns.

- The growing middle class and high disposable incomes encourage farmers to adopt organic farming practices.

- Plant-based organic fertilizers poised to lead the market with a CAGR of 7.0% from 2024 to 2031.

- The government recognizes the importance of sustainable agriculture for food security and environmental preservation.

- Farming segment is expected to generate an absolute dollar opportunity of US$470.7 Mn from 2024 to 2031.

- Financial assistance, training, and resources are provided to farmers to transition to organic methods.

- Increasing preference for organic fertilizers as safe and environment-friendly alternatives drives India Organic Fertilizer Market

- Government subsidies on organic fertilizers reduce the cost burden on farmers and incentivize the use of eco-friendly alternatives.

A Look Back and a Look Forward - Comparative Analysis

India organic fertilizer market overview has shown notable growth leading up to 2023, driven by increasing awareness of sustainable agricultural practices and the adverse effects of chemical fertilizers. The market experienced a CAGR reflecting a solid foundation for future expansion.

The demand for organic produce has surged as consumers become more health-conscious and environmentally aware prompting farmers to adopt organic fertilizers to meet this demand. The market is projected to grow at a CAGR of 7.8% from 2024 to 2031. This growth will be fueled by several factors and market trends including government initiatives promoting organic farming, rising food demand.

The increasing availability of organic fertilizers and establishing certification standards will further enhance market accessibility. The trend toward sustainable agriculture is expected to continue with more farmers transitioning to organic practices thereby solidifying the organic fertilizer market's role in India's agricultural landscape.

Key Growth Determinants

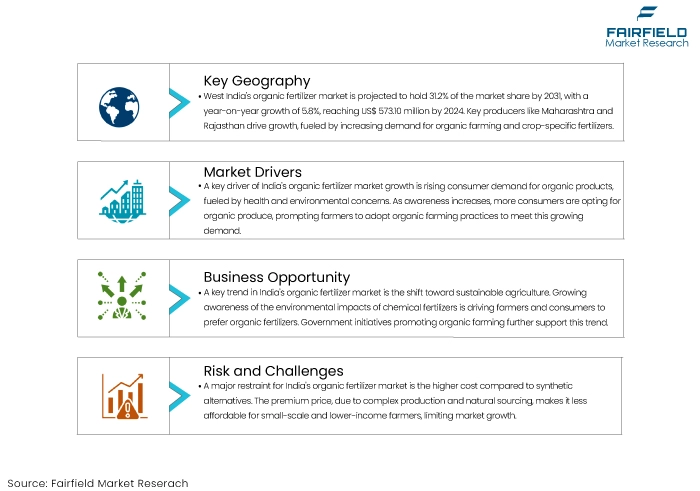

- Increasing Consumer Demand for Organic Products

One of the primary drivers for India organic fertilizer market growth is the rising consumer demand for organic products. As awareness of health and environmental issues grows, consumers are increasingly seeking out organic fruits, vegetables, and grains. This shift is largely influenced by concerns over the adverse effects of chemical fertilizers on health and the environment.

With growing middle class and high disposable incomes, consumers in India are willing to invest in organic produce, which is perceived as healthy and safe. Consequently, farmers are compelled to transition to organic farming practices to meet this burgeoning demand.

Rising consumer trend is not only contributing to the market expansion but also encouraging more farmers to adopt organic farming practices thereby creating a positive feedback loop for the organic fertilizer sector.

- Government Initiatives and Support

Government initiatives play a crucial role in driving India organic fertilizer market demand. The government has recognized the importance of sustainable agriculture for food security and environmental preservation, leading to the implementation of various policies aimed at promoting organic farming.

Programs such as the National Programme for Organic Production (NPOP) and the Soil Health Card Scheme encourage farmers to adopt organic fertilizers and sustainable practices. These initiatives provide financial assistance, training, and resources to farmers making it easy for them to transition to organic methods.

The government offers subsidies on organic fertilizers reducing the cost burden on farmers and incentivizing the use of eco-friendly alternatives. By creating a supportive regulatory framework, the government helps improve soil health and crop productivity and fosters market growth.

- Environmental Awareness and Sustainability Concerns

Growing environmental awareness among consumers and stakeholders is another significant driver of the India organic fertilizer market expansion. As issues like soil degradation, water pollution, and biodiversity loss become increasingly pressing, both consumers and farmers are seeking ways to mitigate their environmental impact.

Organic fertilizers, derived from natural sources, offer a sustainable alternative to chemical fertilizers that can harm ecosystems. The increasing emphasis on sustainable agricultural practices aligns well with these environmental concerns, prompting farmers to adopt organic fertilizers to enhance soil health and promote biodiversity.

Initiatives aimed at climate change mitigation are encouraging the agricultural sector to move towards more sustainable practices. This shift is reflected in the rising number of organic farms and the growing market for organic produce.

Key Growth Barriers

- High Cost of Organic Fertilizers

One of the significant restraints affecting India organic fertilizer market is the high cost associated with organic fertilizers compared to their synthetic counterparts. These fertilizers often come with a price premium due to the more complex production processes and the sourcing of natural materials.

Higher cost can be a barrier for many farmers particularly those in lower-income brackets or small-scale operations who may find it challenging to afford these products. As a result, they may continue to rely on cheaper synthetic fertilizers, which can undermine the growth potential of the organic fertilizer market.

- Inconsistent Nutrient Content

Another critical restraint for the India organic fertilizer market sales is the inconsistent nutrient content found in organic fertilizers. Unlike synthetic fertilizers, which provide precise nutrient formulations, organic fertilizers can vary significantly in their nutrient composition due to differences in raw materials and production methods. This inconsistency can lead to challenges in crop management as farmers may struggle to achieve the desired nutrient levels for optimal plant growth.

Some farmers may be hesitant to fully transition to organic fertilizers fearing that they may not deliver the same reliability and effectiveness as synthetic options. This concern is particularly pronounced in regions where agricultural productivity is crucial for food security.

India Organic Fertilizer Market Trends and Opportunities

Shift Towards Sustainable Agriculture

A significant trend shaping the India organic fertilizer market is the shift toward sustainable agriculture. This movement is driven by increasing awareness of the environmental impacts of conventional farming practices particularly the use of chemical fertilizers.

Farmers and consumers alike are becoming conscious of the need for sustainable practices that promote soil health, biodiversity, and environmental conservation. As a result, there is a growing preference for organic fertilizers, which are perceived as safer and more environmentally friendly alternatives. This trend is further supported by government initiatives aimed at promoting organic farming, which encourages farmers to adopt organic practices.

The expansion of organic farming areas and the increasing number of certified organic farmers in India reflect this shift.

Expansion of Export Markets

A key opportunity lies in the expansion of export markets for organic products. With global demand for organic food and fertilizers on the rise, manufacturers in India have the potential to tap into lucrative international markets.

Countries in Europe and North America are increasingly seeking organic fertilizers that meet stringent quality and sustainability standards. By aligning their products with international certifications and quality norms, producers in India can enhance their marketability and access these high-value markets.

The Indian government actively promotes organic farming and exports through various initiatives, which can further facilitate this growth. The increasing number of organic farmers and expanding organic farming areas in India provide a solid foundation for meeting international demand.

How Does Regulatory Scenario Shape this Industry?

The regulatory landscape in India is significantly influencing the growth and development of the India organic fertilizer market. The government has implemented various policies aimed at promoting sustainable agricultural practices, which include the use of organic fertilizers. These regulations are designed to encourage farmers to transition from chemical fertilizers to organic alternatives, thereby enhancing soil health and reducing environmental impact.

One of the key regulatory frameworks is the National Programme for organic production (NPOP), which sets standards for organic farming and certification processes. This initiative not only helps in maintaining the quality of organic fertilizers but also boosts consumer confidence in organic products. As a result, farmers are increasingly adopting organic fertilizers to comply with these standards and meet the rising consumer demand for organic produce.

The government provides subsidies and financial incentives to farmers who choose organic farming methods, further driving the market. The emphasis on sustainable practices is also reflected in various state-level initiatives that promote organic farming, thereby expanding the market reach.

Segments Covered in the Report

- Plant-Based Organic Fertilizers Poised to Lead the Market

As per the India organic fertilizer market update, sales of plant-based organic fertilizers are projected to expand at a CAGR of 7.0% from 2024 to 2031. Currently, over 40% of organic fertilizers are derived from plant materials with products like cotton seed meal and green manure leading in popularity.

There is a notable increase in the preference for these fertilizers particularly for cultivating flowers and leafy vegetables. This growing demand is driven by consumers' desire for sustainable and eco-friendly agricultural practices. As awareness of the benefits of plant-based fertilizers continues to rise, their sales are expected to see significant growth throughout the forecast period.

- Growing Awareness and Demand for Organic Food to Drive Farming Sector

As per the latest India organic fertilizer market forecast, the farming segment captures nearly 6/7 of the India organic fertilizer market. The rise in organic farming driven by increasing awareness and demand for organic food will significantly boost fertilizer sales during this period.

The growing population will elevate the demand for healthy food and agricultural produce, further driving market expansion. As organic farming continues to gain traction, the organic fertilizer market is poised for substantial growth.

Regional Analysis

- West India Paves the Path for the Market

West India organic fertilizer market is expected to hold around 31.2% of the organic fertilizer market share by 2031. The market is projected to expand by 5.8% year-on-year, reaching a valuation of US$ 573.10 million by 2024. The region's growth is attributed to the presence of key manufacturers focusing on crop-specific organic fertilizers.

States like Maharashtra and Rajasthan are leading producers, catering to both domestic consumption and exports. As organic farming gains traction due to rising awareness and demand for organic products, the regional market is poised for significant expansion in the coming years.

- North India Emerges Lucrative Market for Organic Fertilizer

North India organic fertilizer market is expected to capture nearly 43.1% of the organic fertilizer market share generating an incremental opportunity of US$ 242.5 million by 2031. The expansion of organic farming in this region has led to increased product consumption, with states like Madhya Pradesh, Uttar Pradesh, and Punjab driving demand for organic fertilizers.

The availability of raw materials and established trade activities are significant growth factors for North India market. As organic farming continues to expand, the region is well-positioned for substantial market development.

Fairfield’s Competitive Landscape Analysis

Key market players are concentrating on expanding their production capacities to meet the rising demand for India organic fertilizer market and enhance their presence. Additionally, competitors in India are proactively launching organic fertilizers tailored to specific customer needs designed to maximize yields for particular crops.

Key Market Companies

- Coromandel International

- Madras Fertilizers Limited

- Gujarat State Fertilizers

- Simbhaoli Sugars Inc.

- Eastern Organic Fertilizer Pvt. Limited

- Prabhat Agri

- Mangalore Chemicals and Fertilizers Limited

- Amruth Groups

- Chaitanya Agrochemicals

- NM India Biotech

- Krishna Agro Bio Products

Recent Industry Developments

- July 2024

The Indian Biogas Association (IBA) is advocating for the government to encourage state-owned fertilizer marketing companies to adopt fermented organic manure, which could reduce India's fertilizer import costs by at least $1.5 billion. Compressed biogas (CBG) produced from manure can also help the government meet cleaner energy targets before 2030. India currently produces 1 million metric tonnes per annum of fermented organic manure, with 570 plants upcoming, which could serve almost a state like Rajasthan fully.

- February 2024

India's focus on nano di-ammonia phosphate (nano-DAP) may help reduce phosphatic fertilizer subsidies substantially despite high global prices during FY23-24. The government has allocated ₹100 crore for the promotion of organic fertilizers during FY25, and a new scheme for the promotion of organic fertilizers providing Market Development Assistance (MDA) and promotion of Research and Development as GOBARdhan initiatives was introduced in 2023.

The decision to scale up nano-DAP is particularly beneficial as India imports 60% of its DAP requirement, whereas the share of DAP is 14-15% in the overall fertilizer subsidy.

An Expert’s Eye

- The government recognizes the importance of sustainable agriculture for food security and environmental preservation.

- Growing environmental awareness among consumers and stakeholders drives market expansion.

- Organic fertilizers, derived from natural sources, offer a sustainable alternative to chemical fertilizers.

- Government initiatives promoting organic farming encourage farmers to adopt organic practices.

- Initiatives aimed at climate change mitigation encourage the agricultural sector to move towards more sustainable practices.

India Organic Fertilizer Market is Segmented as-

By Raw Material

- Plant-based Fertilizers

- Molasses

- Seaweed

- Cottonseed Meal

- Green Manure

- Compost and Compost Tea

- Corn Gluten Meal

- Soybean Meal

- Animal-based Fertilizers

- Manure

- Fish Emulsion

- Urea

- Bone Meal and Blood Meal

- Milk

- Others (Limestone, Rock Phosphate, etc.)

By Application

- Farming

- Gardening

By Region

- North India

- South India

- East India

- West India

1. Executive Summary

1.1. India Organic Fertilizers Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2023

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. COVID-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. India Economic Projections

2.8. PESTLE Analysis

3. Production Output and Trade Statistics, 2018-2023

3.1. India Organic Fertilizers, Production Output, by Region, 2018 – 2023

3.1.1. North India

3.1.2. West India

3.1.3. East India

3.1.4. South India

4. India Organic Fertilizers Market Outlook, 2018 – 2031

4.1. India Organic Fertilizers Market Outlook, by Raw Material, Volume (Tons) and Value (US$ Bn), 2018 – 2031

4.1.1. Key Highlights

4.1.1.1. Plant-based Fertilizers

4.1.1.1.1. Molasses

4.1.1.1.2. Seaweed

4.1.1.1.3. Cottonseed Meal

4.1.1.1.4. Green Manure

4.1.1.1.5. Compost and Compost Tea

4.1.1.1.6. Corn Gluten Meal

4.1.1.1.7. Soybean Meal

4.1.1.2. Animal-based Fertilizers

4.1.1.2.1. Manure

4.1.1.2.2. Fish Emulsion

4.1.1.2.3. Urea

4.1.1.2.4. Bone Meal and Blood Meal

4.1.1.2.5. Milk

4.1.1.3. Others (Limestone, Rock Phosphate, etc.)

4.2. India Organic Fertilizers Market Outlook, by Application, Volume (Tons) and Value (US$ Bn), 2018 – 2031

4.2.1. Key Highlights

4.2.1.1. Farming

4.2.1.2. Gardening

4.3. India Organic Fertilizers Market Outlook, by Region, Volume (Tons) and Value (US$ Bn), 2018 – 2031

4.3.1. Key Highlights

4.3.1.1. North India

4.3.1.2. West India

4.3.1.3. East India

4.3.1.4. South India

5. North India Organic Fertilizers Market Outlook, 2018 – 2031

5.1. North India Organic Fertilizers Market Outlook, by Raw Material, Volume (Tons) and Value (US$ Bn), 2018 – 2031

5.1.1. Key Highlights

5.1.1.1. Plant-based Fertilizers

5.1.1.1.1. Molasses

5.1.1.1.2. Seaweed

5.1.1.1.3. Cottonseed Meal

5.1.1.1.4. Green Manure

5.1.1.1.5. Compost and Compost Tea

5.1.1.1.6. Corn Gluten Meal

5.1.1.1.7. Soybean Meal

5.1.1.2. Animal-based Fertilizers

5.1.1.2.1. Manure

5.1.1.2.2. Fish Emulsion

5.1.1.2.3. Urea

5.1.1.2.4. Bone Meal and Blood Meal

5.1.1.2.5. Milk

5.1.1.3. Others (Limestone, Rock Phosphate, etc.)

5.2. North India Organic Fertilizers Market Outlook, by Application, Volume (Tons) and Value (US$ Bn), 2018 – 2031

5.2.1. Key Highlights

5.2.1.1. Farming

5.2.1.2. Gardening

5.2.2. BPS Analysis/Market Attractiveness Analysis

6. West India Organic Fertilizers Market Outlook, 2018 – 2031

6.1. West India Organic Fertilizers Market Outlook, by Raw Material, Volume (Tons) and Value (US$ Bn), 2018 – 2031

6.1.1. Key Highlights

6.1.1.1. Plant-based Fertilizers

6.1.1.1.1. Molasses

6.1.1.1.2. Seaweed

6.1.1.1.3. Cottonseed Meal

6.1.1.1.4. Green Manure

6.1.1.1.5. Compost and Compost Tea

6.1.1.1.6. Corn Gluten Meal

6.1.1.1.7. Soybean Meal

6.1.1.2. Animal-based Fertilizers

6.1.1.2.1. Manure

6.1.1.2.2. Fish Emulsion

6.1.1.2.3. Urea

6.1.1.2.4. Bone Meal and Blood Meal

6.1.1.2.5. Milk

6.1.1.3. Others (Limestone, Rock Phosphate, etc.)

6.2. West India Organic Fertilizers Market Outlook, by Application, Volume (Tons) and Value (US$ Bn), 2018 – 2031

6.2.1. Key Highlights

6.2.1.1. Farming

6.2.1.2. Gardening

6.2.2. BPS Analysis/Market Attractiveness Analysis

7. East India Organic Fertilizers Market Outlook, 2018 – 2031

7.1. East India Organic Fertilizers Market Outlook, by Raw Material, Volume (Tons) and Value (US$ Bn), 2018 – 2031

7.1.1. Key Highlights

7.1.1.1. Plant-based Fertilizers

7.1.1.1.1. Molasses

7.1.1.1.2. Seaweed

7.1.1.1.3. Cottonseed Meal

7.1.1.1.4. Green Manure

7.1.1.1.5. Compost and Compost Tea

7.1.1.1.6. Corn Gluten Meal

7.1.1.1.7. Soybean Meal

7.1.1.2. Animal-based Fertilizers

7.1.1.2.1. Manure

7.1.1.2.2. Fish Emulsion

7.1.1.2.3. Urea

7.1.1.2.4. Bone Meal and Blood Meal

7.1.1.2.5. Milk

7.1.1.3. Others (Limestone, Rock Phosphate, etc.)

7.2. East India Organic Fertilizers Market Outlook, by Application, Volume (Tons) and Value (US$ Bn), 2018 – 2031

7.2.1. Key Highlights

7.2.1. Key Highlights

7.2.1.1. Farming

7.2.1.2. Gardening

7.2.2. BPS Analysis/Market Attractiveness Analysis

8. South India Organic Fertilizers Market Outlook, 2018 – 2031

8.1. South India Organic Fertilizers Market Outlook, by Raw Material, Volume (Tons) and Value (US$ Bn), 2018 – 2031

8.1.1. Key Highlights

8.1.1.1. Plant-based Fertilizers

8.1.1.1.1. Molasses

8.1.1.1.2. Seaweed

8.1.1.1.3. Cottonseed Meal

8.1.1.1.4. Green Manure

8.1.1.1.5. Compost and Compost Tea

8.1.1.1.6. Corn Gluten Meal

8.1.1.1.7. Soybean Meal

8.1.1.2. Animal-based Fertilizers

8.1.1.2.1. Manure

8.1.1.2.2. Fish Emulsion

8.1.1.2.3. Urea

8.1.1.2.4. Bone Meal and Blood Meal

8.1.1.2.5. Milk

8.1.1.3. Others (Limestone, Rock Phosphate, etc.)

8.2. South India Organic Fertilizers Market Outlook, by Application, Volume (Tons) and Value (US$ Bn), 2018 – 2031

8.2.1. Key Highlights

8.2.1.1. Farming

8.2.1.2. Gardening

9. Competitive Landscape

9.1. Purity vs Application Heatmap

9.2. Manufacturer vs Application Heatmap

9.3. Company Market Share Analysis, 2022

9.4. Competitive Dashboard

9.5. Company Profiles

9.5.1. Chaitanya Agrochemicals

9.5.1.1. Company Overview

9.5.1.2. Product Portfolio

9.5.1.3. Financial Overview

9.5.1.4. Business Strategies and Development

9.5.2. NM India Biotech

9.5.3. Prabhat Fertilizer

9.5.4. Madras Fertilizers Ltd

9.5.5. Coromandel International

9.5.6. Amruth Group

9.5.7. Eastern Organic Fertilizer Pvt. Ltd (EOFPL)

9.5.8. Simbhaoli Group

9.5.9. Mangalore Chemicals and Fertilizers Limited

9.5.10. Gujarat State Fertilizers

9.5.11. Krishna Agro Bio Products

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2023 |

|

2019 - 2023 |

2024 - 2031 |

Value: US$ Million |

||

|

REPORT FEATURES |

DETAILS |

|

Raw Material Coverage |

|

|

Application Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |