Global Industrial Carbon Dioxide Market Forecast

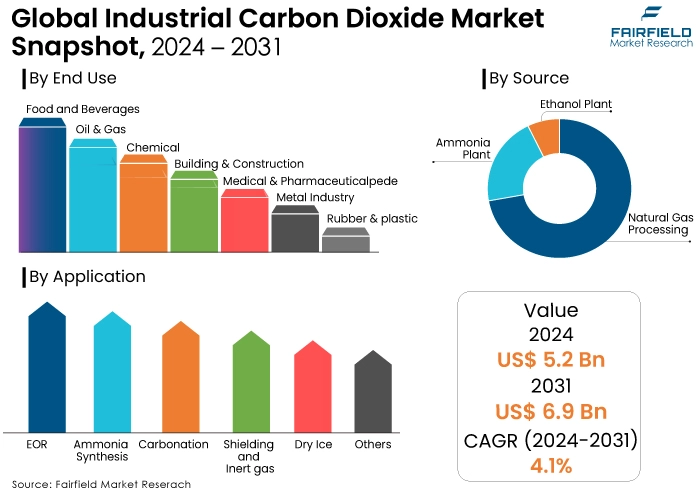

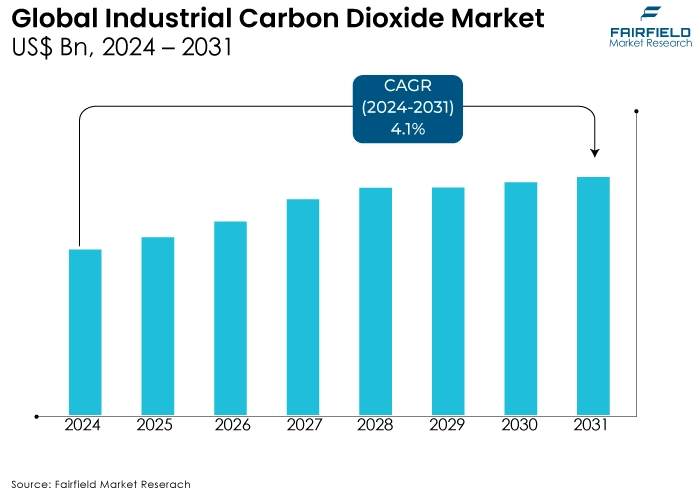

• Global industrial carbon dioxide market size to reach US$6.9 Bn in 2031, up from US$5.2 Bn attained in 2024

• Market revenue projected to exhibit a remarkable rate of expansion, at an estimated CAGR of 4.1% during 2024 - 2031

Quick Report Digest

- Pre-pandemic years saw rising emissions, while forecasts predict a 6% annual increase from 2024 to 2031.

- Key growth drivers include demand from the food and beverage industry, medical sector, and greenhouse cultivation.

- Regulatory constraints, feedstock price volatility, and competitive substitutes pose significant barriers to growth.

- Trends include the rise in carbon capture and utilisation (CCU) technologies, demand for sustainable packaging solutions, and expansion of carbon capture and storage (CCS) projects.

- Environmental regulations are reshaping the industry, balancing emission reduction goals with economic realities.

- Top market segments include natural gas processing, ammonia plants, and ethanol plants.

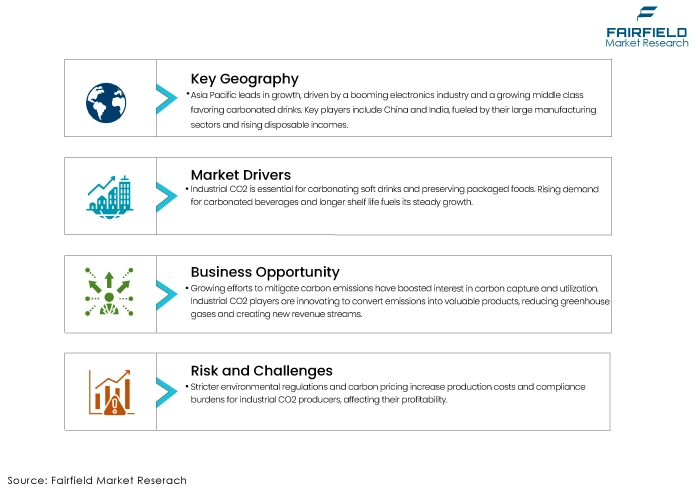

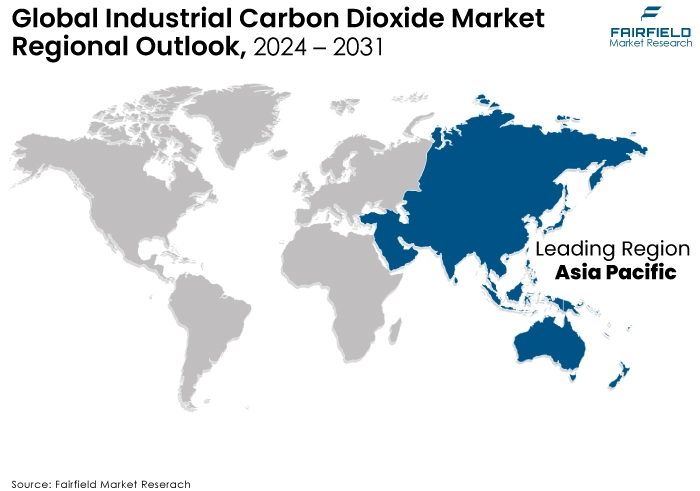

- Asia Pacific leads market growth, followed by North America, Europe, Latin America, and the Middle East & Africa.

- Market leaders include Linde Group, Air Liquide, Praxair Inc., and others, with extensive production capabilities and global reach.

- Recent developments include Air Liquide introducing high-purity industrial CO2, Linde plc unveiling breakthrough CO2 capture technology, and Praxair Inc. signing a distribution agreement for CO2 supply.

A Look Back and a Look Forward - Comparative Analysis

Industrial carbon dioxide emissions for 2019-2023 are likely a story of two halves. Pre-pandemic years might have seen a rise due to industrial growth, but the COVID-19 slump in 2020 likely caused a temporary dip. Looking forward (2024-2031), forecasts predict a potential 6% annual increase driven by economic recovery and continued demand for CO2 across various industries.

However, this growth faces challenges. Stricter environmental regulations and a growing focus on decarbonisation within industries could push for cleaner technologies and carbon capture, potentially reducing emissions. The outcome hinges on which force prevails. If environmental regulations and decarbonisation efforts gain traction, the projected rise could be curbed or even reversed. Conversely, if economic growth takes priority, the increase could be steeper.

Key Growth Determinants

- Increased Demand in Food and Beverages Industry

Industrial carbon dioxide finds extensive application in the food and beverage sector, primarily for carbonation in soft drinks and as a preservative in food packaging. With growing consumer preferences for carbonated beverages and the need for extended shelf life in packaged foods, the demand for industrial CO2 continues to rise steadily.

- Expanding Applications in Medical Sector

The medical industry relies on industrial CO2 for various applications, including cryotherapy, respiratory therapy, and minimally invasive surgeries. As advancements in medical technology continue and the need for medical gases expands, the demand for industrial CO2 in the medical sector is expected to witness significant growth.

- Growing Adoption in Greenhouse Cultivation

Carbon dioxide is a crucial component for photosynthesis in plants, and controlled CO2 enrichment in greenhouses can significantly enhance crop yields. As the demand for high-quality produce increases globally, there is a growing trend towards greenhouse cultivation, driving the demand for industrial CO2 as a key input for plant growth optimisation.

Major Growth Barriers

- Regulatory Constraints

Increasing environmental regulations aimed at reducing greenhouse gas emissions pose challenges for industrial carbon dioxide producers. Stricter emission standards and carbon pricing mechanisms can lead to higher production costs and compliance burdens, impacting the profitability of industrial CO2 manufacturers.

- Volatility in Feedstock Prices

Industrial carbon dioxide is primarily produced as a byproduct of various industrial processes, such as ammonia and ethanol production. Fluctuations in the prices of these feedstocks, influenced by factors like energy costs and raw material availability, can directly impact the production economics of industrial CO2. Volatile feedstock prices may hinder investment in new production capacity and limit market growth.

- Competitive Substitutes

Alternatives to industrial carbon dioxide, such as synthetic CO2 produced from fossil fuels or renewable sources, and other gases like nitrogen and argon, pose competitive challenges. Market substitution driven by factors like price, performance, and environmental considerations can restrain the growth of industrial CO2 in certain applications and regions.

Key Trends and Opportunities to Look at

- Rise in CCU Technologies

The increasing focus on mitigating carbon emissions and addressing climate change has led to a surge in interest and investment in carbon capture and utilisation technologies.

Industrial carbon dioxide players are exploring innovative methods to capture CO2 emissions from industrial processes and convert them into valuable products such as chemicals, fuels, and building materials. This trend not only helps reduce greenhouse gas emissions but also creates new revenue streams for industrial CO2 producers.

- Growing Demand for Sustainable Packaging Solutions

With rising consumer awareness about environmental sustainability, there is a growing demand for sustainable packaging solutions across various industries. Industrial carbon dioxide is utilised in the production of bio-based polymers, such as polylactic acid (PLA), which are biodegradable and offer a renewable alternative to traditional plastics.

As the demand for eco-friendly packaging continues to increase, industrial CO2 players are well-positioned to capitalise on this trend by providing sustainable solutions to packaging manufacturers.

- Expansion of CCS Projects

As governments and industries worldwide intensify efforts to reduce carbon emissions, there is a significant opportunity for industrial carbon dioxide players to participate in carbon capture and storage projects. CCS involves capturing CO2 emissions from industrial processes and storing them underground or utilising them in enhanced oil recovery (EOR) operations.

Industrial CO2 producers can leverage their expertise and infrastructure to supply captured CO2 for CCS projects, thereby contributing to carbon mitigation efforts while generating additional revenue streams.

How Does the Regulatory Scenario Shape this Industry?

Environmental regulations are reshaping the industrial carbon dioxide industry. Stricter limits on greenhouse gas emissions, including CO2, are forcing a transformation. These regulations, like carbon pricing or emission caps, incentivise industries to adopt cleaner technologies like renewables or invest in CCS.

CCS captures CO2 emissions from industrial processes, either storing them underground or repurposing them. By making CO2 use costlier, regulations can drive down overall emissions.

However, this isn't a one-way street. Regulations can also spur innovation. As industries face pressure to reduce their CO2 footprint, they're actively seeking cleaner production methods and alternative materials. This can lead to the development of more efficient technologies and cleaner CO2 capture methods.

The challenge lies in balancing environmental goals with economic realities. Overly lenient regulations might not achieve significant emission reductions, while overly stringent ones could stifle industrial growth. The future of the CO2 industry depends on finding this balance - ensuring environmental sustainability while allowing the industry to adapt and thrive.

Fairfield’s Ranking Board

Top Segments

- Natural Gas Processing Segment Takes the Charge

The natural gas processing segment is witnessing significant growth due to the increasing demand for natural gas as a cleaner alternative to traditional fossil fuels. As countries aim to reduce their carbon footprint, there is a heightened emphasis on processing natural gas efficiently, leading to higher production of industrial carbon dioxide.

Technological advancements in natural gas processing have enabled more efficient capture and utilisation of carbon dioxide. Processes like CCS are becoming more prevalent, driving the growth of this segment. These advancements not only contribute to reducing emissions but also create additional revenue streams through the sale of captured carbon dioxide.

Regulatory support for reducing greenhouse gas emissions further propels the natural gas processing segment. Governments worldwide are implementing stringent regulations to curb emissions, incentivising industries to invest in cleaner production methods. This regulatory push acts as a catalyst for the adoption of carbon capture technologies, bolstering the growth of this market segment.

- Ammonia Plants Remain Pivotal

Ammonia plants are crucial for ammonia production - ammonia being a primary component in fertilizers, industrial chemicals, and pharmaceuticals. With the global population steadily rising, the demand for food and agricultural products continues to grow, driving the need for ammonia production and consequently, industrial carbon dioxide emissions.

Continuous efforts to enhance the efficiency of ammonia production processes contribute to increased carbon dioxide emissions. While efficiency improvements aim to reduce overall energy consumption, they often result in higher carbon dioxide emissions per unit of ammonia produced, thus fuelling the growth of this market segment.

Shifts in global agriculture trends, such as the increasing adoption of intensive farming practices and the expansion of agricultural land, drive the demand for ammonia-based fertilizers. As agricultural output needs to meet the demands of a growing population, the demand for ammonia production from ammonia plants remains robust, sustaining the growth of this segment in the industrial carbon dioxide market.

- Ethanol Plants Emerge as a Significant Segment

Ethanol plants play a pivotal role in the production of ethanol, a biofuel used as a renewable alternative to gasoline. With a growing focus on reducing dependence on fossil fuels and mitigating climate change, there is a rising demand for ethanol as a cleaner fuel source. Consequently, the ethanol plant segment experiences significant growth, leading to higher industrial carbon dioxide emissions.

Government initiatives, and policies promoting renewable energy sources further stimulate the growth of ethanol plants. As countries strive to achieve their renewable energy targets, investments in ethanol production facilities increase, driving up carbon dioxide emissions from these plants.

The availability of feedstocks, such as corn and sugarcane, influences the growth of ethanol plants. Regions with abundant agricultural resources are more likely to witness the expansion of ethanol production capacity, resulting in higher industrial carbon dioxide emissions. Additionally, advancements in biofuel technology and process optimisation contribute to the growth of this market segment.

Regional Frontrunners

- Asia Pacific at the Forefront of Growth

Asia Pacific leads the pack with its explosive growth, fuelled by a booming electronics industry and a growing middle class with a taste for carbonated drinks. China, and India are key players here, driven by their massive manufacturing sectors and rising disposable incomes.

- North America Represents a Noteworthy Market Share

North America, currently holding the largest market share, boasts well-established industrial sectors, and a strong healthcare system that utilises CO2 for various purposes. Europe presents a mature market with a focus on CO2 utilisation in the food & beverages industry, particularly for carbonation.

Latin America, and the Middle East & Africa represent emerging regions with significant potential. Their growth is expected to be driven by a rise in oil & gas exploration activities that can leverage CO2 for enhanced recovery techniques.

Fairfield’s Competitive Landscape Analysis

In the competitive landscape of the industrial carbon dioxide market, key players like Air Liquide, Linde plc, Praxair Inc. (a subsidiary of Linde), Air Products and Chemicals, Inc., and Messer Group GmbH dominate through extensive production capabilities and global reach. These industry leaders continuously strive to expand their market share and solidify their positions through strategic manoeuvres.

One prominent strategy involves expanding production capacities, particularly in burgeoning markets where demand for industrial carbon dioxide is escalating. Additionally, strategic partnerships and acquisitions play a pivotal role in strengthening market presence, enhancing product portfolios, and extending geographic footprints. Recognising the growing importance of sustainability, companies are increasingly focusing on eco-friendly solutions.

Research and development efforts are directed towards developing sustainable production processes and exploring innovative applications such as carbon capture and utilisation technologies. Through these concerted efforts, leading players navigate the competitive landscape adeptly, ensuring they remain at the forefront of the industrial carbon dioxide market, ready to seize emerging opportunities and address evolving challenges.Top of Form

Who are the Leaders in Global Industrial Carbon Dioxide Space?

- Linde Group

- Abdullah Hashim Industrial & Equipment Co.

- Bristol Gases

- Dubai Industrial Gases

- Mohsin Hiader LLC

- Ellenbarrie Industrial Gases

- Matheson Tri Gas Inc.

- SICGIL India Limited

- Air Products and Chemicals Ltd.

- Air Water Inc.

- Buzwair Industrial Gases

- Continental carbonic products

- Cosmo Engineering

- Gulf Crypo

- Iwatani corporation

Significant Company Developments

- November 2023

Air Liquide introduced a new line of high-purity industrial carbon dioxide aimed at meeting the stringent requirements of the food and beverage industry. The product, developed using advanced purification technologies, ensures exceptional quality and consistency, catering to the growing demand for premium-grade CO2 in carbonation and food preservation applications.

- March 2024

Linde plc unveiled a breakthrough CO2 capture technology designed for industrial applications. The innovative system boasts higher efficiency and lower energy consumption compared to traditional methods, offering industrial facilities a cost-effective solution for reducing carbon emissions and achieving sustainability goals.

- August 2023

Praxair Inc. (a subsidiary of Linde) signed a distribution agreement with a leading beverage manufacturer to supply industrial carbon dioxide for its production facilities across North America. The partnership aims to ensure a reliable and consistent supply of CO2 to support the beverage company's expanding operations and meet growing consumer demand for carbonated beverages.

An Expert’s Eye

Industry analysts are generally optimistic about the growth outlook of the global industrial carbon dioxide market, citing several key factors driving expansion. The increasing demand for industrial carbon dioxide across diverse end-user industries such as food and beverage, healthcare, and agriculture is expected to fuel market growth.

With rising population and urbanisation, coupled with changing consumer preferences, the demand for carbonated beverages, packaged foods, medical gases, and greenhouse cultivation is on the rise, driving the need for industrial CO2.

Moreover, the growing emphasis on sustainability and environmental regulations is anticipated to bolster market expansion. As industries strive to reduce their carbon footprint and adopt eco-friendly practices, there is a growing interest in carbon capture and utilisation technologies, creating new avenues for industrial CO2 utilisation.

Additionally, technological advancements and innovations in CO2 capture, purification, and utilisation processes are expected to further propel market growth. Companies are investing in research and development to develop more efficient and cost-effective CO2 capture technologies, as well as exploring new applications for industrial CO2 in areas such as carbonation, enhanced oil recovery, and chemical synthesis.

Overall, industry experts foresee a positive growth trajectory for the global industrial carbon dioxide market, driven by increasing demand, sustainability initiatives, and technological advancements. However, market participants must remain agile and adaptable to navigate evolving market dynamics and capitalise on emerging opportunities.

Global Industrial Carbon Dioxide Market is Segmented as Below:

By Source:

- Natural Gas Processing

- Ammonia Plant

- Ethanol Plant

- Others

By Application:

- EOR

- Ammonia Synthesis

- Carbonation

- Shielding and Inert gas

- Dry Ice

- Others

By End Use:

- Food and Beverages

- Oil & Gas

- Chemical

- Building & Construction

- Medical & Pharmaceutical

- Metal Industry

- Rubber & plastic

- Others

By Region:

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Turkey

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Egypt

- Nigeria

- Rest of the Middle East & Africa

1. Executive Summary

1.1. Global Industrial Carbon Dioxide Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2022

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. COVID-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Global Industrial Carbon Dioxide Market Outlook, 2018 - 2030

3.1. Global Industrial Carbon Dioxide Market Outlook, by Source, Value (US$ Bn), 2018 - 2030

3.1.1. Key Highlights

3.1.1.1. Natural Gas Processing

3.1.1.2. Ammonia Plants

3.1.1.3. Ethanol Plants

3.1.1.4. Production Wells

3.1.1.5. Others

3.2. Global Industrial Carbon Dioxide Market Outlook, by End Use, Value (US$ Bn), 2018 - 2030

3.2.1. Key Highlights

3.2.1.1. Food and Beverages

3.2.1.2. Oil and Gas

3.2.1.3. Chemicals

3.2.1.4. Building & Construction

3.2.1.5. Medical and Pharmaceuticals

3.2.1.6. Metal Industry

3.2.1.7. Rubber & Plastic

3.2.1.8. Others

3.3. Global Industrial Carbon Dioxide Market Outlook, by Region, Value (US$ Bn), 2018 - 2030

3.3.1. Key Highlights

3.3.1.1. North America

3.3.1.2. Europe

3.3.1.3. Asia Pacific

3.3.1.4. Latin America

3.3.1.5. Middle East & Africa

4. North America Industrial Carbon Dioxide Market Outlook, 2018 - 2030

4.1. North America Industrial Carbon Dioxide Market Outlook, by Source, Value (US$ Bn), 2018 - 2030

4.1.1. Key Highlights

4.1.1.1. Natural Gas Processing

4.1.1.2. Ammonia Plants

4.1.1.3. Ethanol Plants

4.1.1.4. Production Wells

4.1.1.5. Others

4.2. North America Industrial Carbon Dioxide Market Outlook, by End Use, Value (US$ Bn), 2018 - 2030

4.2.1. Key Highlights

4.2.1.1. Food and Beverages

4.2.1.2. Oil and Gas

4.2.1.3. Chemicals

4.2.1.4. Building & Construction

4.2.1.5. Medical and Pharmaceuticals

4.2.1.6. Metal Industry

4.2.1.7. Rubber & Plastic

4.2.1.8. Others

4.2.2. BPS Analysis/Market Attractiveness Analysis

4.3. North America Industrial Carbon Dioxide Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

4.3.1. Key Highlights

4.3.1.1. U.S. Industrial Carbon Dioxide Market by Source, Value (US$ Bn), 2018 - 2030

4.3.1.2. U.S. Industrial Carbon Dioxide Market by End Use, Value (US$ Bn), 2018 - 2030

4.3.1.3. Canada Industrial Carbon Dioxide Market by Source, Value (US$ Bn), 2018 - 2030

4.3.1.4. Canada Industrial Carbon Dioxide Market by End Use, Value (US$ Bn), 2018 - 2030

4.3.2. BPS Analysis/Market Attractiveness Analysis

5. Europe Industrial Carbon Dioxide Market Outlook, 2018 - 2030

5.1. Europe Industrial Carbon Dioxide Market Outlook, by Source, Value (US$ Bn), 2018 - 2030

5.1.1. Key Highlights

5.1.1.1. Natural Gas Processing

5.1.1.2. Ammonia Plants

5.1.1.3. Ethanol Plants

5.1.1.4. Production Wells

5.1.1.5. Others

5.2. Europe Industrial Carbon Dioxide Market Outlook, by End Use, Value (US$ Bn), 2018 - 2030

5.2.1. Key Highlights

5.2.1.1. Food and Beverages

5.2.1.2. Oil and Gas

5.2.1.3. Chemicals

5.2.1.4. Building & Construction

5.2.1.5. Medical and Pharmaceuticals

5.2.1.6. Metal Industry

5.2.1.7. Rubber & Plastic

5.2.1.8. Others

5.2.2. BPS Analysis/Market Attractiveness Analysis

5.3. Europe Industrial Carbon Dioxide Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

5.3.1. Key Highlights

5.3.1.1. Germany Industrial Carbon Dioxide Market by Source, Value (US$ Bn), 2018 - 2030

5.3.1.2. Germany Industrial Carbon Dioxide Market by End Use, Value (US$ Bn), 2018 - 2030

5.3.1.3. U.K. Industrial Carbon Dioxide Market by Source, Value (US$ Bn), 2018 - 2030

5.3.1.4. U.K. Industrial Carbon Dioxide Market by End Use, Value (US$ Bn), 2018 - 2030

5.3.1.5. France Industrial Carbon Dioxide Market by Source, Value (US$ Bn), 2018 - 2030

5.3.1.6. France Industrial Carbon Dioxide Market by End Use, Value (US$ Bn), 2018 - 2030

5.3.1.7. Italy Industrial Carbon Dioxide Market by Source, Value (US$ Bn), 2018 - 2030

5.3.1.8. Italy Industrial Carbon Dioxide Market by End Use, Value (US$ Bn), 2018 - 2030

5.3.1.9. Turkey Industrial Carbon Dioxide Market by Source, Value (US$ Bn), 2018 - 2030

5.3.1.10. Turkey Industrial Carbon Dioxide Market by End Use, Value (US$ Bn), 2018 - 2030

5.3.1.11. Russia Industrial Carbon Dioxide Market by Source, Value (US$ Bn), 2018 - 2030

5.3.1.12. Russia Industrial Carbon Dioxide Market by End Use, Value (US$ Bn), 2018 - 2030

5.3.1.13. Rest of Europe Industrial Carbon Dioxide Market by Source, Value (US$ Bn), 2018 - 2030

5.3.1.14. Rest of Europe Industrial Carbon Dioxide Market by End Use, Value (US$ Bn), 2018 - 2030

5.3.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Industrial Carbon Dioxide Market Outlook, 2018 - 2030

6.1. Asia Pacific Industrial Carbon Dioxide Market Outlook, by Source, Value (US$ Bn), 2018 - 2030

6.1.1. Key Highlights

6.1.1.1. Natural Gas Processing

6.1.1.2. Ammonia Plants

6.1.1.3. Ethanol Plants

6.1.1.4. Production Wells

6.1.1.5. Others

6.2. Asia Pacific Industrial Carbon Dioxide Market Outlook, by End Use, Value (US$ Bn), 2018 - 2030

6.2.1. Key Highlights

6.2.1.1. Food and Beverages

6.2.1.2. Oil and Gas

6.2.1.3. Chemicals

6.2.1.4. Building & Construction

6.2.1.5. Medical and Pharmaceuticals

6.2.1.6. Metal Industry

6.2.1.7. Rubber & Plastic

6.2.1.8. Others

6.2.2. Others BPS Analysis/Market Attractiveness Analysis

6.3. Asia Pacific Industrial Carbon Dioxide Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

6.3.1. Key Highlights

6.3.1.1. China Industrial Carbon Dioxide Market by Source, Value (US$ Bn), 2018 - 2030

6.3.1.2. China Industrial Carbon Dioxide Market by End Use, Value (US$ Bn), 2018 - 2030

6.3.1.3. Japan Industrial Carbon Dioxide Market by Source, Value (US$ Bn), 2018 - 2030

6.3.1.4. Japan Industrial Carbon Dioxide Market by End Use, Value (US$ Bn), 2018 - 2030

6.3.1.5. South Korea Industrial Carbon Dioxide Market by Source, Value (US$ Bn), 2018 - 2030

6.3.1.6. South Korea Industrial Carbon Dioxide Market by End Use, Value (US$ Bn), 2018 - 2030

6.3.1.7. India Industrial Carbon Dioxide Market by Source, Value (US$ Bn), 2018 - 2030

6.3.1.8. India Industrial Carbon Dioxide Market by End Use, Value (US$ Bn), 2018 - 2030

6.3.1.9. Southeast Asia Industrial Carbon Dioxide Market by Source, Value (US$ Bn), 2018 - 2030

6.3.1.10. Southeast Asia Industrial Carbon Dioxide Market by End Use, Value (US$ Bn), 2018 - 2030

6.3.1.11. Rest of Asia Pacific Industrial Carbon Dioxide Market by Source, Value (US$ Bn), 2018 - 2030

6.3.1.12. Rest of Asia Pacific Industrial Carbon Dioxide Market by End Use, Value (US$ Bn), 2018 - 2030

6.3.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America Industrial Carbon Dioxide Market Outlook, 2018 - 2030

7.1. Latin America Industrial Carbon Dioxide Market Outlook, by Source, Value (US$ Bn), 2018 - 2030

7.1.1. Key Highlights

7.1.1.1. Natural Gas Processing

7.1.1.2. Ammonia Plants

7.1.1.3. Ethanol Plants

7.1.1.4. Production Wells

7.1.1.5. Others

7.2. Latin America Industrial Carbon Dioxide Market Outlook, by End Use, Value (US$ Bn), 2018 - 2030

7.2.1. Key Highlights

7.2.1.1. Food and Beverages

7.2.1.2. Oil and Gas

7.2.1.3. Chemicals

7.2.1.4. Building & Construction

7.2.1.5. Medical and Pharmaceuticals

7.2.1.6. Metal Industry

7.2.1.7. Rubber & Plastic

7.2.1.8. Others

7.2.2. BPS Analysis/Market Attractiveness Analysis

7.3. Latin America Industrial Carbon Dioxide Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

7.3.1. Key Highlights

7.3.1.1. Brazil Industrial Carbon Dioxide Market by Source, Value (US$ Bn), 2018 - 2030

7.3.1.2. Brazil Industrial Carbon Dioxide Market by End Use, Value (US$ Bn), 2018 - 2030

7.3.1.3. Mexico Industrial Carbon Dioxide Market by Source, Value (US$ Bn), 2018 - 2030

7.3.1.4. Mexico Industrial Carbon Dioxide Market by End Use, Value (US$ Bn), 2018 - 2030

7.3.1.5. Argentina Industrial Carbon Dioxide Market by Source, Value (US$ Bn), 2018 - 2030

7.3.1.6. Argentina Industrial Carbon Dioxide Market by End Use, Value (US$ Bn), 2018 - 2030

7.3.1.7. Rest of Latin America Industrial Carbon Dioxide Market by Source, Value (US$ Bn), 2018 - 2030

7.3.1.8. Rest of Latin America Industrial Carbon Dioxide Market by End Use, Value (US$ Bn), 2018 - 2030

7.3.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Industrial Carbon Dioxide Market Outlook, 2018 - 2030

8.1. Middle East & Africa Industrial Carbon Dioxide Market Outlook, by Source, Value (US$ Bn), 2018 - 2030

8.1.1. Key Highlights

8.1.1.1. Natural Gas Processing

8.1.1.2. Ammonia Plants

8.1.1.3. Ethanol Plants

8.1.1.4. Production Wells

8.1.1.5. Others

8.2. Middle East & Africa Industrial Carbon Dioxide Market Outlook, by End Use, Value (US$ Bn), 2018 - 2030

8.2.1. Key Highlights

8.2.1.1. Food and Beverages

8.2.1.2. Oil and Gas

8.2.1.3. Chemicals

8.2.1.4. Building & Construction

8.2.1.5. Medical and Pharmaceuticals

8.2.1.6. Metal Industry

8.2.1.7. Rubber & Plastic

8.2.1.8. Others

8.2.2. BPS Analysis/Market Attractiveness Analysis

8.3. Middle East & Africa Industrial Carbon Dioxide Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

8.3.1. Key Highlights

8.3.1.1. GCC Industrial Carbon Dioxide Market by Source, Value (US$ Bn), 2018 - 2030

8.3.1.2. GCC Industrial Carbon Dioxide Market by End Use, Value (US$ Bn), 2018 - 2030

8.3.1.3. South Africa Industrial Carbon Dioxide Market by Source, Value (US$ Bn), 2018 - 2030

8.3.1.4. South Africa Industrial Carbon Dioxide Market by End Use, Value (US$ Bn), 2018 - 2030

8.3.1.5. Egypt Industrial Carbon Dioxide Market by Source, Value (US$ Bn), 2018 - 2030

8.3.1.6. Egypt Industrial Carbon Dioxide Market by End Use, Value (US$ Bn), 2018 - 2030

8.3.1.7. Nigeria Industrial Carbon Dioxide Market by Source, Value (US$ Bn), 2018 - 2030

8.3.1.8. Nigeria Industrial Carbon Dioxide Market by End Use, Value (US$ Bn), 2018 - 2030

8.3.1.9. Rest of Middle East & Africa Industrial Carbon Dioxide Market by Source, Value (US$ Bn), 2018 - 2030

8.3.1.10. Rest of Middle East & Africa Industrial Carbon Dioxide Market by End Use, Value (US$ Bn), 2018 - 2030

8.3.2. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. Manufacturer vs by End Use Heatmap

9.2. Company Market Share Analysis, 2022

9.3. Competitive Dashboard

9.4. Company Profiles

9.4.1. Air Liquide

9.4.1.1. Company Overview

9.4.1.2. Product Portfolio

9.4.1.3. Financial Overview

9.4.1.4. Business Strategies and Development

9.4.2. Abdullah Hashim Industrial & Equipment Co.

9.4.3. Bristol Gases - Concorde Corodex Group

9.4.4. Dubai Industrial Gases

9.4.5. Mohsin Haider Darwish LLC

9.4.6. Ellenbarrie Industrial Gases Ltd

9.4.7. Matheson Tri-Gas Inc.

9.4.8. SICGIL INDIA LIMITED

9.4.9. Air Products and Chemicals Inc.

9.4.10. AIR WATER INC

9.4.11. Buzwair Industrial Gases Factories

9.4.12. Cosmo Engineering

9.4.13. Gulf Cryo

9.4.14. Iwatani Corporation

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2023 |

|

2019 - 2023 |

2024 - 2031 |

Value: US$ Billion |

||

|

REPORT FEATURES |

DETAILS |

|

Source Coverage |

|

|

Application Coverage |

|

|

End Use Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |