Global Industrial Rubber Market Forecast

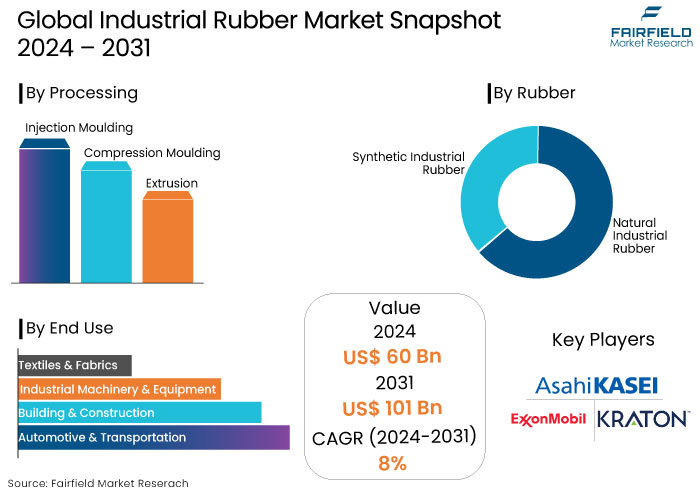

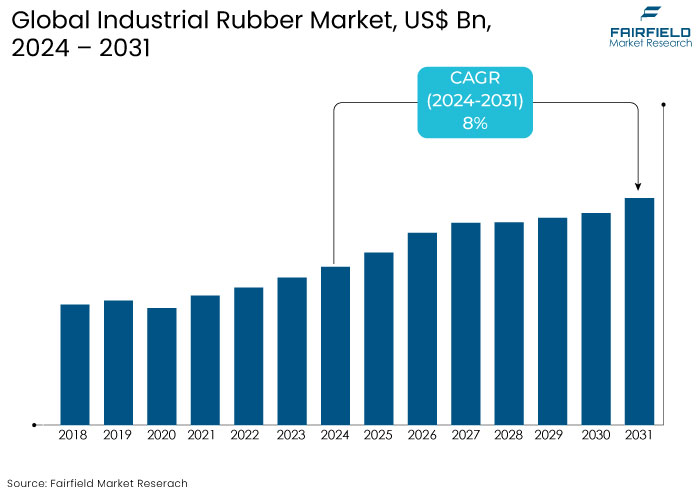

- The industrial rubber market is estimated to hit US$101 Bn by 2031, showing significant growth from the US$60 Bn attained in 2024.

- The market for industrial rubber is expected to exhibit a notable expansion rate, with projected CAGR of 8% from 2024 to 2031.

Industrial Rubber Market Insights

- Increased investments in recycling and bio-based products drive the market forward.

- Regulatory pressures and consumer demand for eco-friendly solutions are vital to the market growth.

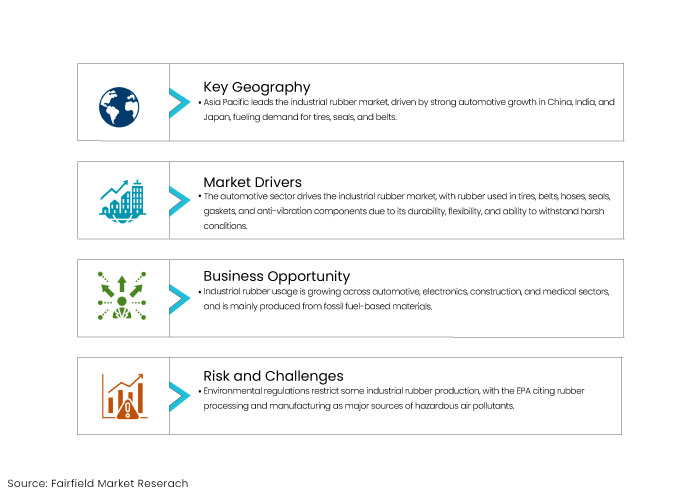

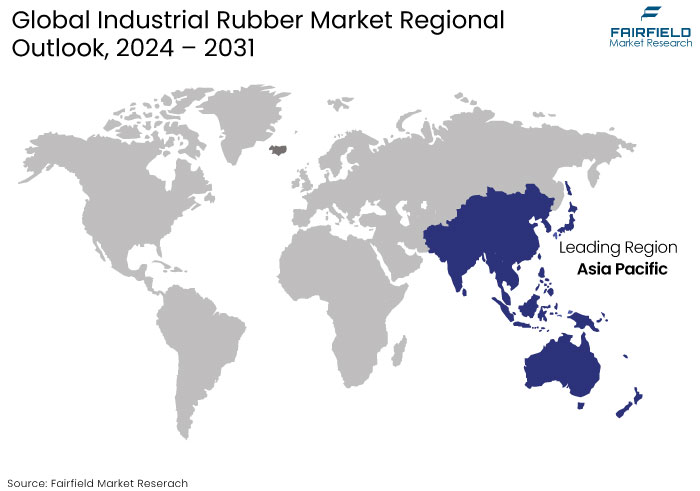

- Asia Pacific industrial rubber market will dominate global sales due to rapid industrialization in India & China.

- Growing automotive demand and infrastructure development to boost the market's growth.

- Ongoing research in high-performance rubber, including heat and wear-resistant materials, is expanding potential applications in aerospace, automotive, and heavy machinerysectors.

- Introducing smart rubber products embedded with sensors and monitoring capabilities is a growing trend driving the market.

- Synthetic industrial rubbers are estimated to dominate the rubber-type segmentation of the market.

- The construction and infrastructure industries contribute significantly to the market growth over the forecast period.

A Look Back and a Look Forward - Comparative Analysis

The market experienced steady growth during the period from 2019 to 2023, primarily fueled by the automotive industry's demand for durable, flexible materials for tires and components. The rapid urbanization and expansion of infrastructure projects in emerging economies further augment the demand for industrial rubber in construction applications like sealing, roofing, and insulation.

Technological advancements, such as eco-friendly rubber production and improved material performance, further support the market expansion. The market is projected to witness significant growth, driven by sustainable innovations and the adoption of green rubber technologies.

The rising demand for electric vehicles (EVs) is anticipated to boost the demand for high-performance rubber in tires and lightweight components. Stringent environmental regulations will likely shift the industry toward bio-based and recyclable rubber products.

Automation in manufacturing and advancements in rubber compounding techniques are predicted to increase productivity, driving cost efficiency and expanding market opportunities.

Key Growth Determinants

- Rising Demand for Industrial Rubbers from the Automotive Sector

The automotive sector is fundamental to the industrial rubber market, propelled by the critical function of rubber in vehicle production. Rubber is extensively utilized in tires, belts, hoses, seals, gaskets, and anti-vibration components because of its toughness, flexibility, and capacity to endure extreme situations.

The demand for high-performance rubber has recently increased, with the global proliferation of electric vehicles (EVs). Electric vehicle tires must minimize rolling resistance while maintaining durability, and rubber formulas are consistently being developed to satisfy these requirements.

The emergence of self-driving vehicles and advanced driver-assistance systems (ADAS) has increased the demand for precision-engineered rubber components. Such technologies depend on rubber for efficient sealing and vibration isolation to safeguard delicate electrical equipment.

The automotive industry's transition to sustainability propels the utilization of environment- friendly rubber materials, including bio-based and recycled rubber. Collectively, these elements are driving the sustained rise in rubber used in the automotive industry.

- Growing Infrastructure Development Activities Remains a Key Driver

The construction and infrastructure sectors significantly influence the industrial rubber market in developing countries with ongoing urbanization. Rubber materials are crucial for several applications, such as roofing membranes, expansion joints, seals, and insulation, all of which enhance ' energy efficiency and durability of buildings.

The constant demand for industrial rubbers can be attributed to the huge investments from various governments across the world for large-scale infrastructure projects, which include bridges, highways, airports, and other residential developments.

The growing emphasis on sustainable building practices is another important factor contributing to the market growth. To improve energy efficiency and mitigate the environmental impact of construction projects, rubber products, including weather-resistant seals and recycled rubber insulation are implemented.

Key properties of rubber such as its capacity to resist degradation, reduce noise, and offer thermal insulation, make it an essential component of modern urban developments. The role of industrial rubber in ensuring safety, functionality, and sustainability is predicted to expand as major cities expand and infrastructure modernizes.

Key Growth Barriers

- Environmental Regulations and Health Risks Related to Industrial Rubber

Stringent environmental restrictions have imposed limitations on the manufacturing of some categories of industrial rubbers. The Environmental Protection Agency (EPA) has identified rubber processing, rubber products manufacturing facilities, and sealant applications as key sources of hazardous air pollutants (HAP) emissions.

Butyl rubber (BR), an industrial rubber variant, generates harmful compounds, including carbon dioxide, carbon monoxide, and other toxic emissions throughout its manufacturing process. Chemicals used in industrial rubber manufacturing are butadiene, styrene, acrylonitrile, and polymerization catalysts, such as hydrogen peroxide, sodium perborate, and organic peroxides.

Acrylonitrile is very hazardous to humans at comparatively low concentrations, and its excessive exposure can be fatal to people. Exposure to BR also results in detrimental health effects. It is considered a special health hazard substance. When inhaled, it can cause irritation in the nose, throat, and lungs. When it comes in contact with the skin, it can cause irritation and is considered carcinogenic.

Prolonged exposure to polybutadiene impacts the central nervous system and may result in impaired vision, vertigo, fatigue, and syncope. All these issues impede the expansion of the industrial rubber industry.

- Fluctuating Raw Material Prices to Impede Market Growth

Industrial rubber production is significantly dependent on raw materials, including natural rubber and synthetic rubber derived from petrochemicals. One of the significant challenges that rubber manufacturers face is the fluctuating prices of these materials, which are a result of supply chain disruptions, geopolitical tensions, and fluctuations in crude oil prices.

The cost of natural rubber is subject to fluctuations resulting from agricultural conditions and weather patterns, whereas synthetic rubber is associated with fluctuations in hydrocarbon prices. Budgeting and cost management for producers are complexities by this unpredictability.

The profit margins are frequently reduced due to competitive pricing pressures, which prevent the increased costs from being directly passed on to end users. Such cost instability, particularly for smaller companies that lack the financial resilience to absorb these fluctuations, discourages new investments in the sector and disrupts long-term development planning.

Industrial Rubber Market Trends and Opportunities

- Increasing Demand for Sustainable Rubber Products

The utilization of industrial rubber is steadily increasing and is being commercialized in the automotive, electrical & electronics, construction, and medical sectors. Industrial rubber is predominantly compounded and produced from fossil fuel-based basic materials.

The increasing environmental consciousness and fluctuating petroleum prices are prompting the industrial rubber sector to embrace sustainable and eco-friendly initiatives. Europe, North America, and Japan have established guidelines that favor the procurement of bio-preferred products by public institutions. Industrial rubber producers are creating bio-based products sourced from renewable resources and optimized by environmental laws.

- Advancements in Polymer Technologies

Advancements in polymer technology are significantly influencing the development of the industrial rubber industry. Advancements in synthetic rubber formulations have resulted in materials exhibiting higher performance attributes, including increased durability, thermal resistance, and chemical resilience.

Advanced polymers are increasingly utilized in high-performance applications across multiple industries, including automotive, aerospace, and industrial machinery. The advancement of novel elastomers has facilitated the manufacture of tires and mechanical rubber products, providing enhanced fuel efficiency, extended durability, and superior safety.

The European Commission’s Horizon 2020 program has allocated nearly US$80 million to research projects focused on innovative polymer materials, including high-performance elastomers for industrial applications. Technological improvements will substantially enhance industrial rubber market revenue by addressing the increasing need for high-quality, durable rubber goods across diverse sectors.

How Does Regulatory Scenario Shaping the Industry?

The regulatory landscape significantly influences the industrial rubber market growth with a strong emphasis on environmental sustainability, worker safety, and quality standards. Governments globally are enforcing strict regulations to address the environmental impact of rubber production, especially concerning emissions, waste disposal, and the use of hazardous chemicals.

Stringent regulations like the European Union’s REACH (Registration, Evaluation, Authorisation, and Restriction of Chemicals) legislation mandate safe chemicals and sustainable practices in rubber manufacturing. Regulations compel companies to invest in green technologies, which increases operational costs but fosters innovation.

Safety regulations in sectors such as automotive and construction, which are key consumers of industrial rubber, demand high quality and performance standards for rubber components. Compliance with such standards ensures product reliability but adds to manufacturing complexities.

Governments are also introducing initiatives to promote sustainable natural rubber cultivation in emerging markets. While these efforts aim to balance environmental and economic goals, they require significant time and investment. The regulatory scenario is both a challenge and an opportunity, pushing the industry toward cleaner, safer, and more sustainable practices.

Segments Covered in the Report

- Synthetic Rubbers with its Prevalent Use in Industries Maintain Primacy in the Market

Synthetic rubber is becoming a prevalent type of industrial rubber. It has the potential to transform market dynamics in the forthcoming years, notably within the automobile tire manufacturing sector and other industrial applications.

Natural rubber constitutes 40% of the rubber used in the tire business, while synthetic rubber, produced from petroleum-derived hydrocarbons, comprises 60%. Synthetic elastomers undergo deformation under tension and revert to their original shape after removing that stress.

The characteristics of synthetic rubber confer a competitive advantage over natural rubber in the manufacturing of high-performance tires, which are in significant demand. Synthetic industrial rubber possesses various distinctive features, particularly in terms of durability and rolling resistance. It is mostly utilized for passenger vehicles and motorbike tires due to its superior traction capability.

- Highest Sales Come from Automotive Industry

The automotive sector dominates the end use segment in the global industrial rubber market owing to its significant utilization of rubber in numerous components, including tires, seals, gaskets, belts, and hoses.

The demand for rubber is propelled by the automotive industry's requirement for resilient, pliable, and heat-resistant materials to guarantee vehicle performance and safety. The expansion of the global automotive industry, particularly in emerging nations markedly enhances rubber consumption and plays a crucial role in the market share.

The rising production of electric vehicles and innovations in automotive technology necessitate specialist rubber materials. The continuous emphasis on vehicle efficiency, durability, and maintenance enhances product demand in the market.

Regional Analysis

- Asia Pacific’s Prevails Dominance in the Industrial Rubber Market

Asia Pacific dominates the industrial rubber market, accounting for the largest market share. The growth in the automotive industries in countries like China, India, and Japan, which have significant automotive production, drives the demand for industrial rubber in tires, seals, and belts.

The infrastructural development in the emerging economies in Asia Pacific also leads the market to grow. Rapid urbanization and large-scale infrastructure projects in nations like India, China, and Japan boost the construction industry's demand for industrial rubber.

The availability of raw materials such as natural and synthetic rubber and low labour costs make Asia Pacific a hub for industrial rubber manufacturing, which eventually drives the market forward.

- North America Industrial Rubber Market Emerges Lucrative

The market in North America is driven by strong industrial sectors such as automotive, construction, healthcare, and manufacturing. North America includes major economies, including the United States, Canada, and Mexico, with the U.S. being the largest contributor to the regional market.

The construction industry in North America is one of the prime consumers of industrial rubbers. Rubber is an essential material in the construction industry, used for seals and gaskets in pipes, windows, doors, and building components to ensure durability and prevent leaks.

The demand for medical rubber products, including gloves, catheters, and medical tubing, has been increasing due to the rise in healthcare services and medical technology advancements.

Fairfield’s Competitive Landscape Analysis

The industrial rubber market features a competitive landscape comprising established and developing firms. Prominent market leaders in the market include Goodyear Tire & Rubber, Bridgestone Americas, Michelin North America, and Continental, which prevail in the tire and rubber component industries.

Key companies emphasize innovation, namely in sustainable rubber solutions and high-performance materials. The industry is additionally impacted by regional producers in Asia Pacific, who provide economical solutions to their target consumers.

Minor competitors use technological innovations such as intelligent rubber products and recycling technology to distinguish themselves. Competition is escalating due to pricing pressures, unpredictability in raw material supply chains, and the transition to electric vehicle (EV) components. Consequently, presenting the potential for businesses to develop environmentally sustainable and specialty rubber goods.

Key Market Companies

- Asahi Kasei Corporation

- Exxon Mobil Corporation

- Greenville Industrial Rubber & Gasket Co.

- Eni S.p.A.

- Kraton Corporation

- BRP Manufacturing

- Sinopec Corporation

- JSR Corporation

- Sumitomo Chemical Co. Ltd

- Denka Company Limited

- Ube Industries, Ltd.

- Zeon Corporation

- Bridgestone Corporation

- Goodyear Tire & Rubber Corporation

- Ansell Limited

- Kossan Rubber Industries Bhd

- Yokohama Rubber Company Ltd.

- Tokyo Zairyo Co., Ltd.

- Kuraray Co., Ltd

- Kumho Polychem

- LG Chem Ltd

- Industrial Rubber & Gasket Inc

- Indag Rubber Limited

- Harrisons Malayalam LTD

- GRP Ltd

- Bangkok Synthetics Co., Ltd. (BST)

- Assco, s.r.o.

- SIBUR

- DuPont de Nemours, Inc.

Recent Industry Developments

In June 2024, The Yokohama Rubber Co., Ltd. focused on enhancing its rubber product line, especially in terms of durability and resistance. It has also been focusing on strengthening its presence in North American markets through partnerships and acquisitions.

In December 2023, Bridgestone Corporation expanded its production of eco-friendly rubber materials and made strategic investments in sustainable manufacturing processes.

An Expert’s Eye

Environmental concerns and regulations drive the shift toward sustainable, eco-friendly rubber production methods.

Ongoing research into high-performance rubber materials, such as heat-resistant and durable rubber compounds, is paving the way for new applications in the aerospace, automotive, and heavy machinery sectors.

The demand for lightweight, durable, and high-performance rubber products is increasing, particularly in the electric vehicle (EV) sector, where manufacturers seek sustainable and efficient components.

The industrial rubber market is witnessing strong growth in regions like Asia-Pacific, particularly in countries like China and India, due to rapid industrialization, rising demand in automotive, and infrastructure development.

Global Industrial Rubber Market is Segmented as-

By Rubber Type

- Natural Industrial Rubber

- Synthetic Industrial Rubber

By Processing Type

- Injection Moulding

- Compression Moulding

- Extrusion

By End Use

- Automotive & Transportation

- Building & Construction

- Industrial Machinery & Equipment

- Textiles & Fabrics

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- The Middle East & Africa

1. Executive Summary

1.1. Global Industrial Rubber Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2024

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. COVID-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Production Output and Trade Statistics, 2019 - 2031

3.1. Global Industrial Rubber, Production Output, by Region, 2019 - 2031

3.1.1. North America

3.1.2. Europe

3.1.3. Asia Pacific

3.1.4. Latin America

3.1.5. Middle East & Africa

4. Global Industrial Rubber Market Outlook, 2019 - 2031

4.1. Global Industrial Rubber Market Outlook, by Rubber Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

4.1.1. Key Highlights

4.1.1.1. Natural Industrial Rubber

4.1.1.2. Synthetic Industrial Rubber

4.1.1.2.1. SBR

4.1.1.2.2. Polybutadiene Rubber

4.1.1.2.3. Butyl Rubber

4.1.1.2.4. Nitrile Rubber

4.1.1.2.5. Chloroprene Rubber

4.1.1.2.6. EPDM

4.1.1.2.7. Silicone Rubber

4.1.1.2.8. Others

4.2. Global Industrial Rubber Market Outlook, by Processing Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

4.2.1. Key Highlights

4.2.1.1. Injection Melding

4.2.1.2. Compression Melding

4.2.1.3. Extrusion

4.2.1.4. Others

4.3. Global Industrial Rubber Market Outlook, by End Use, Volume (Tons) and Value (US$ Bn), 2019 - 2031

4.3.1. Key Highlights

4.3.1.1. Automotive & Transportation

4.3.1.2. Marine

4.3.1.3. Aerospace and Aviation

4.3.1.4. Railways

4.3.1.5. Automobile

4.3.1.6. Building & Construction

4.3.1.7. Industrial Machinery & Equipment

4.3.1.8. Textiles & Fabrics

4.3.1.9. Others

4.4. Global Industrial Rubber Market Outlook, by Region, Volume (Tons) and Value (US$ Bn), 2019 - 2031

4.4.1. Key Highlights

4.4.1.1. North America

4.4.1.2. Europe

4.4.1.3. Asia Pacific

4.4.1.4. Latin America

4.4.1.5. Middle East & Africa

5. North America Industrial Rubber Market Outlook, 2019 - 2031

5.1. North America Industrial Rubber Market Outlook, by Rubber Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

5.1.1. Key Highlights

5.1.1.1. Natural Industrial Rubber

5.1.1.2. Synthetic Industrial Rubber

5.1.1.2.1. SBR

5.1.1.2.2. Polybutadiene Rubber

5.1.1.2.3. Butyl Rubber

5.1.1.2.4. Nitrile Rubber

5.1.1.2.5. Chloroprene Rubber

5.1.1.2.6. EPDM

5.1.1.2.7. Silicone Rubber

5.1.1.2.8. Others

5.2. North America Industrial Rubber Market Outlook, by Processing Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

5.2.1. Key Highlights

5.2.1.1. Injection Melding

5.2.1.2. Compression Melding

5.2.1.3. Extrusion

5.2.1.4. Others

5.3. North America Industrial Rubber Market Outlook, by End Use, Volume (Tons) and Value (US$ Bn), 2019 - 2031

5.3.1. Key Highlights

5.3.1.1. Automotive & Transportation

5.3.1.2. Marine

5.3.1.3. Aerospace and Aviation

5.3.1.4. Railways

5.3.1.5. Automobile

5.3.1.6. Building & Construction

5.3.1.7. Industrial Machinery & Equipment

5.3.1.8. Textiles & Fabrics

5.3.1.9. Others

5.4. North America Industrial Rubber Market Outlook, by Country, Volume (Tons) and Value (US$ Bn), 2019 - 2031

5.4.1. Key Highlights

5.4.1.1. U.S. Industrial Rubber Market by Rubber Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

5.4.1.2. U.S. Industrial Rubber Market Processing Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

5.4.1.3. U.S. Industrial Rubber Market End Use, Volume (Tons) and Value (US$ Bn), 2019 - 2031

5.4.1.4. Canada Industrial Rubber Market by Rubber Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

5.4.1.5. Canada Industrial Rubber Market Processing Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

5.4.1.6. Canada Industrial Rubber Market End Use, Volume (Tons) and Value (US$ Bn), 2019 - 2031

5.4.2. BPS Analysis/Market Attractiveness Analysis

6. Europe Industrial Rubber Market Outlook, 2019 - 2031

6.1. Europe Industrial Rubber Market Outlook, by Rubber Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

6.1.1. Key Highlights

6.1.1.1. Natural Industrial Rubber

6.1.1.2. Synthetic Industrial Rubber

6.1.1.2.1. SBR

6.1.1.2.2. Polybutadiene Rubber

6.1.1.2.3. Butyl Rubber

6.1.1.2.4. Nitrile Rubber

6.1.1.2.5. Chloroprene Rubber

6.1.1.2.6. EPDM

6.1.1.2.7. Silicone Rubber

6.1.1.2.8. Others

6.2. Europe Industrial Rubber Market Outlook, by Processing Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

6.2.1. Key Highlights

6.2.1.1. Injection Melding

6.2.1.2. Compression Melding

6.2.1.3. Extrusion

6.2.1.4. Others

6.3. Europe Industrial Rubber Market Outlook, by End Use, Volume (Tons) and Value (US$ Bn), 2019 - 2031

6.3.1. Key Highlights

6.3.1.1. Automotive & Transportation

6.3.1.2. Marine

6.3.1.3. Aerospace and Aviation

6.3.1.4. Railways

6.3.1.5. Automobile

6.3.1.6. Building & Construction

6.3.1.7. Industrial Machinery & Equipment

6.3.1.8. Textiles & Fabrics

6.3.1.9. Others

6.4. Europe Industrial Rubber Market Outlook, by Country, Volume (Tons) and Value (US$ Bn), 2019 - 2031

6.4.1. Key Highlights

6.4.1.1. Germany Industrial Rubber Market by Rubber Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

6.4.1.2. Germany Industrial Rubber Market Processing Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

6.4.1.3. Germany Industrial Rubber Market End Use, Volume (Tons) and Value (US$ Bn), 2019 - 2031

6.4.1.4. U.K. Industrial Rubber Market by Rubber Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

6.4.1.5. U.K. Industrial Rubber Market Processing Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

6.4.1.6. U.K. Industrial Rubber Market End Use, Volume (Tons) and Value (US$ Bn), 2019 - 2031

6.4.1.7. France Industrial Rubber Market by Rubber Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

6.4.1.8. France Industrial Rubber Market Processing Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

6.4.1.9. France Industrial Rubber Market End Use, Volume (Tons) and Value (US$ Bn), 2019 - 2031

6.4.1.10. Italy Industrial Rubber Market by Rubber Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

6.4.1.11. Italy Industrial Rubber Market Processing Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

6.4.1.12. Italy Industrial Rubber Market End Use, Volume (Tons) and Value (US$ Bn), 2019 - 2031

6.4.1.13. Turkey Industrial Rubber Market by Rubber Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

6.4.1.14. Turkey Industrial Rubber Market Processing Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

6.4.1.15. Turkey Industrial Rubber Market End Use, Volume (Tons) and Value (US$ Bn), 2019 - 2031

6.4.1.16. Russia Industrial Rubber Market by Rubber Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

6.4.1.17. Russia Industrial Rubber Market Processing Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

6.4.1.18. Russia Industrial Rubber Market End Use, Volume (Tons) and Value (US$ Bn), 2019 - 2031

6.4.1.19. Rest of Europe Industrial Rubber Market by Rubber Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

6.4.1.20. Rest of Europe Industrial Rubber Market Processing Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

6.4.1.21. Rest of Europe Industrial Rubber Market End Use, Volume (Tons) and Value (US$ Bn), 2019 - 2031

6.4.2. BPS Analysis/Market Attractiveness Analysis

7. Asia Pacific Industrial Rubber Market Outlook, 2019 - 2031

7.1. Asia Pacific Industrial Rubber Market Outlook, by Rubber Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

7.1.1. Key Highlights

7.1.1.1. Natural Industrial Rubber

7.1.1.2. Synthetic Industrial Rubber

7.1.1.2.1. SBR

7.1.1.2.2. Polybutadiene Rubber

7.1.1.2.3. Butyl Rubber

7.1.1.2.4. Nitrile Rubber

7.1.1.2.5. Chloroprene Rubber

7.1.1.2.6. EPDM

7.1.1.2.7. Silicone Rubber

7.1.1.2.8. Others

7.2. Asia Pacific Industrial Rubber Market Outlook, by Processing Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

7.2.1. Key Highlights

7.2.1.1. Injection Melding

7.2.1.2. Compression Melding

7.2.1.3. Extrusion

7.2.1.4. Others

7.3. Asia Pacific Industrial Rubber Market Outlook, by End Use, Volume (Tons) and Value (US$ Bn), 2019 - 2031

7.3.1. Key Highlights

7.3.1.1. Automotive & Transportation

7.3.1.2. Marine

7.3.1.3. Aerospace and Aviation

7.3.1.4. Railways

7.3.1.5. Automobile

7.3.1.6. Building & Construction

7.3.1.7. Industrial Machinery & Equipment

7.3.1.8. Textiles & Fabrics

7.3.1.9. Others

7.4. Asia Pacific Industrial Rubber Market Outlook, by Country, Volume (Tons) and Value (US$ Bn), 2019 - 2031

7.4.1. Key Highlights

7.4.1.1. China Industrial Rubber Market by Rubber Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

7.4.1.2. China Industrial Rubber Market Processing Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

7.4.1.3. China Industrial Rubber Market End Use, Volume (Tons) and Value (US$ Bn), 2019 - 2031

7.4.1.4. Japan Industrial Rubber Market by Rubber Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

7.4.1.5. Japan Industrial Rubber Market Processing Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

7.4.1.6. Japan Industrial Rubber Market End Use, Volume (Tons) and Value (US$ Bn), 2019 - 2031

7.4.1.7. South Korea Industrial Rubber Market by Rubber Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

7.4.1.8. South Korea Industrial Rubber Market Processing Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

7.4.1.9. South Korea Industrial Rubber Market End Use, Volume (Tons) and Value (US$ Bn), 2019 - 2031

7.4.1.10. India Industrial Rubber Market by Rubber Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

7.4.1.11. India Industrial Rubber Market Processing Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

7.4.1.12. India Industrial Rubber Market End Use, Volume (Tons) and Value (US$ Bn), 2019 - 2031

7.4.1.13. Southeast Asia Industrial Rubber Market by Rubber Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

7.4.1.14. Southeast Asia Industrial Rubber Market Processing Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

7.4.1.15. Southeast Asia Industrial Rubber Market End Use, Volume (Tons) and Value (US$ Bn), 2019 - 2031

7.4.1.16. Rest of Asia Pacific Industrial Rubber Market by Rubber Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

7.4.1.17. Rest of Asia Pacific Industrial Rubber Market Processing Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

7.4.1.18. Rest of Asia Pacific Industrial Rubber Market End Use, Volume (Tons) and Value (US$ Bn), 2019 - 2031

7.4.2. BPS Analysis/Market Attractiveness Analysis

8. Latin America Industrial Rubber Market Outlook, 2019 - 2031

8.1. Latin America Industrial Rubber Market Outlook, by Rubber Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

8.1.1. Key Highlights

8.1.1.1. Natural Industrial Rubber

8.1.1.2. Synthetic Industrial Rubber

8.1.1.2.1. SBR

8.1.1.2.2. Polybutadiene Rubber

8.1.1.2.3. Butyl Rubber

8.1.1.2.4. Nitrile Rubber

8.1.1.2.5. Chloroprene Rubber

8.1.1.2.6. EPDM

8.1.1.2.7. Silicone Rubber

8.1.1.2.8. Others

8.2. Latin America Industrial Rubber Market Outlook, by Processing Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

8.2.1. Key Highlights

8.2.1.1. Injection Melding

8.2.1.2. Compression Melding

8.2.1.3. Extrusion

8.2.1.4. Others

8.3. Latin America Industrial Rubber Market Outlook, by End Use, Volume (Tons) and Value (US$ Bn), 2019 - 2031

8.3.1. Key Highlights

8.3.1.1. Automotive & Transportation

8.3.1.2. Marine

8.3.1.3. Aerospace and Aviation

8.3.1.4. Railways

8.3.1.5. Automobile

8.3.1.6. Building & Construction

8.3.1.7. Industrial Machinery & Equipment

8.3.1.8. Textiles & Fabrics

8.3.1.9. Others

8.4. Latin America Industrial Rubber Market Outlook, by Country, Volume (Tons) and Value (US$ Bn), 2019 - 2031

8.4.1. Key Highlights

8.4.1.1. Brazil Industrial Rubber Market by Rubber Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

8.4.1.2. Brazil Industrial Rubber Market Processing Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

8.4.1.3. Brazil Industrial Rubber Market End Use, Volume (Tons) and Value (US$ Bn), 2019 - 2031

8.4.1.4. Mexico Industrial Rubber Market by Rubber Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

8.4.1.5. Mexico Industrial Rubber Market Processing Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

8.4.1.6. Mexico Industrial Rubber Market End Use, Volume (Tons) and Value (US$ Bn), 2019 - 2031

8.4.1.7. Argentina Industrial Rubber Market by Rubber Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

8.4.1.8. Argentina Industrial Rubber Market Processing Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

8.4.1.9. Argentina Industrial Rubber Market End Use, Volume (Tons) and Value (US$ Bn), 2019 - 2031

8.4.1.10. Rest of Latin America Industrial Rubber Market by Rubber Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

8.4.1.11. Rest of Latin America Industrial Rubber Market Processing Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

8.4.1.12. Rest of Latin America Industrial Rubber Market End Use, Volume (Tons) and Value (US$ Bn), 2019 - 2031

8.4.2. BPS Analysis/Market Attractiveness Analysis

9. Middle East & Africa Industrial Rubber Market Outlook, 2019 - 2031

9.1. Middle East & Africa Industrial Rubber Market Outlook, by Rubber Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

9.1.1. Key Highlights

9.1.1.1. Natural Industrial Rubber

9.1.1.2. Synthetic Industrial Rubber

9.1.1.2.1. SBR

9.1.1.2.2. Polybutadiene Rubber

9.1.1.2.3. Butyl Rubber

9.1.1.2.4. Nitrile Rubber

9.1.1.2.5. Chloroprene Rubber

9.1.1.2.6. EPDM

9.1.1.2.7. Silicone Rubber

9.1.1.2.8. Others

9.2. Middle East & Africa Industrial Rubber Market Outlook, by Processing Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

9.2.1. Key Highlights

9.2.1.1. Injection Melding

9.2.1.2. Compression Melding

9.2.1.3. Extrusion

9.2.1.4. Others

9.3. Middle East & Africa Industrial Rubber Market Outlook, by End Use, Volume (Tons) and Value (US$ Bn), 2019 - 2031

9.3.1. Key Highlights

9.3.1.1. Automotive & Transportation

9.3.1.2. Marine

9.3.1.3. Aerospace and Aviation

9.3.1.4. Railways

9.3.1.5. Automobile

9.3.1.6. Building & Construction

9.3.1.7. Industrial Machinery & Equipment

9.3.1.8. Textiles & Fabrics

9.3.1.9. Others

9.4. Middle East & Africa Industrial Rubber Market Outlook, by Country, Volume (Tons) and Value (US$ Bn), 2019 - 2031

9.4.1. Key Highlights

9.4.1.1. GCC Industrial Rubber Market by Rubber Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

9.4.1.2. GCC Industrial Rubber Market Processing Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

9.4.1.3. GCC Industrial Rubber Market End Use, Volume (Tons) and Value (US$ Bn), 2019 - 2031

9.4.1.4. South Africa Industrial Rubber Market by Rubber Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

9.4.1.5. South Africa Industrial Rubber Market Processing Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

9.4.1.6. South Africa Industrial Rubber Market End Use, Volume (Tons) and Value (US$ Bn), 2019 - 2031

9.4.1.7. Egypt Industrial Rubber Market by Rubber Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

9.4.1.8. Egypt Industrial Rubber Market Processing Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

9.4.1.9. Egypt Industrial Rubber Market End Use, Volume (Tons) and Value (US$ Bn), 2019 - 2031

9.4.1.10. Nigeria Industrial Rubber Market by Rubber Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

9.4.1.11. Nigeria Industrial Rubber Market Processing Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

9.4.1.12. Nigeria Industrial Rubber Market End Use, Volume (Tons) and Value (US$ Bn), 2019 - 2031

9.4.1.13. Rest of Middle East & Africa Industrial Rubber Market by Rubber Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

9.4.1.14. Rest of Middle East & Africa Industrial Rubber Market Processing Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

9.4.1.15. Rest of Middle East & Africa Industrial Rubber Market End Use, Volume (Tons) and Value (US$ Bn), 2019 - 2031

9.4.2. BPS Analysis/Market Attractiveness Analysis

10. Competitive Landscape

10.1. End Use vs Processing Type Heatmap

10.2. Manufacturer vs Processing Type Heatmap

10.3. Company Market Share Analysis, 2024

10.4. Competitive Dashboard

10.5. Company Profiles

10.5.1. Asahi Kasei Corporation

10.5.1.1. Company Overview

10.5.1.2. Product Portfolio

10.5.1.3. Financial Overview

10.5.1.4. Business Strategies and Development

10.5.2. Exxon Mobil Corporation

10.5.2.1. Company Overview

10.5.2.2. Product Portfolio

10.5.2.3. Financial Overview

10.5.2.4. Business Strategies and Development

10.5.3. Greenville Industrial Rubber & Gasket Co.

10.5.3.1. Company Overview

10.5.3.2. Product Portfolio

10.5.3.3. Financial Overview

10.5.3.4. Business Strategies and Development

10.5.4. Eni S.p.A.

10.5.4.1. Company Overview

10.5.4.2. Product Portfolio

10.5.4.3. Financial Overview

10.5.4.4. Business Strategies and Development

10.5.5. Kraton Corporation

10.5.5.1. Company Overview

10.5.5.2. Product Portfolio

10.5.5.3. Financial Overview

10.5.5.4. Business Strategies and Development

10.5.6. BRP Manufacturing

10.5.6.1. Company Overview

10.5.6.2. Product Portfolio

10.5.6.3. Financial Overview

10.5.6.4. Business Strategies and Development

10.5.7. Sinopec Corporation

10.5.7.1. Company Overview

10.5.7.2. Product Portfolio

10.5.7.3. Financial Overview

10.5.7.4. Business Strategies and Development

10.5.8. JSR Corporation

10.5.8.1. Company Overview

10.5.8.2. Product Portfolio

10.5.8.3. Financial Overview

10.5.8.4. Business Strategies and Development

10.5.9. Sumitomo Chemical Co. Ltd

10.5.9.1. Company Overview

10.5.9.2. Product Portfolio

10.5.9.3. Financial Overview

10.5.9.4. Business Strategies and Development

10.5.10. Denka Company Limited

10.5.10.1. Company Overview

10.5.10.2. Product Portfolio

10.5.10.3. Financial Overview

10.5.10.4. Business Strategies and Development

10.5.11. Ube Industries, Ltd.

10.5.11.1. Company Overview

10.5.11.2. Product Portfolio

10.5.11.3. Financial Overview

10.5.11.4. Business Strategies and Development

10.5.12. Zeon Corporation

10.5.12.1. Company Overview

10.5.12.2. Product Portfolio

10.5.12.3. Financial Overview

10.5.12.4. Business Strategies and Development

10.5.13. Bridgestone Corporation

10.5.13.1. Company Overview

10.5.13.2. Product Portfolio

10.5.13.3. Financial Overview

10.5.13.4. Business Strategies and Development

10.5.14. Goodyear Tire & Rubber Corporation

10.5.14.1. Company Overview

10.5.14.2. Product Portfolio

10.5.14.3. Financial Overview

10.5.14.4. Business Strategies and Development

10.5.15. Ansell Limited

10.5.15.1. Company Overview

10.5.15.2. Product Portfolio

10.5.15.3. Financial Overview

10.5.15.4. Business Strategies and Development

10.5.16. Kossan Rubber Industries Bhd

10.5.16.1. Company Overview

10.5.16.2. Product Portfolio

10.5.16.3. Financial Overview

10.5.16.4. Business Strategies and Development

10.5.17. Yokohama Rubber Company Ltd.

10.5.17.1. Company Overview

10.5.17.2. Product Portfolio

10.5.17.3. Financial Overview

10.5.17.4. Business Strategies and Development

10.5.18. Tokyo Zairyo Co., Ltd.

10.5.18.1. Company Overview

10.5.18.2. Product Portfolio

10.5.18.3. Financial Overview

10.5.18.4. Business Strategies and Development

10.5.19. Kuraray Co., Ltd

10.5.19.1. Company Overview

10.5.19.2. Product Portfolio

10.5.19.3. Financial Overview

10.5.19.4. Business Strategies and Development

10.5.20. Kumho Polychem

10.5.20.1. Company Overview

10.5.20.2. Product Portfolio

10.5.20.3. Financial Overview

10.5.20.4. Business Strategies and Development

10.5.21. LG Chem Ltd

10.5.21.1. Company Overview

10.5.21.2. Product Portfolio

10.5.21.3. Financial Overview

10.5.21.4. Business Strategies and Development

10.5.22. Industrial Rubber & Gasket Inc

10.5.22.1. Company Overview

10.5.22.2. Product Portfolio

10.5.22.3. Financial Overview

10.5.22.4. Business Strategies and Development

10.5.23. Indag Rubber Limited

10.5.23.1. Company Overview

10.5.23.2. Product Portfolio

10.5.23.3. Financial Overview

10.5.23.4. Business Strategies and Development

10.5.24. Harrisons Malayalam LTD

10.5.24.1. Company Overview

10.5.24.2. Product Portfolio

10.5.24.3. Financial Overview

10.5.24.4. Business Strategies and Development

10.5.25. GRP Ltd

10.5.25.1. Company Overview

10.5.25.2. Product Portfolio

10.5.25.3. Financial Overview

10.5.25.4. Business Strategies and Development

10.5.26. Bangkok Synthetics Co., Ltd. (BST)

10.5.26.1. Company Overview

10.5.26.2. Product Portfolio

10.5.26.3. Financial Overview

10.5.26.4. Business Strategies and Development

10.5.27. Assco, s.r.o.

10.5.27.1. Company Overview

10.5.27.2. Product Portfolio

10.5.27.3. Financial Overview

10.5.27.4. Business Strategies and Development

10.5.28. SIBUR

10.5.28.1. Company Overview

10.5.28.2. Product Portfolio

10.5.28.3. Financial Overview

10.5.28.4. Business Strategies and Development

10.5.29. DuPont de Nemours, Inc.

10.5.29.1. Company Overview

10.5.29.2. Product Portfolio

10.5.29.3. Financial Overview

10.5.29.4. Business Strategies and Development

11. Appendix

11.1. Research Methodology

11.2. Report Assumptions

11.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2023 |

|

2019 - 2023 |

2024 - 2031 |

Value: US$ Million |

||

|

REPORT FEATURES |

DETAILS |

|

Rubber Type Coverage |

|

|

Processing Type Coverage |

|

|

End Use Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |