Injectable Nanomedicine Market Forecast

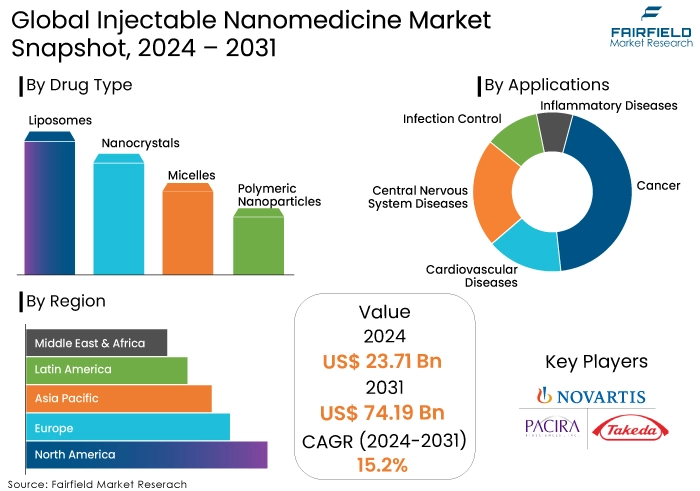

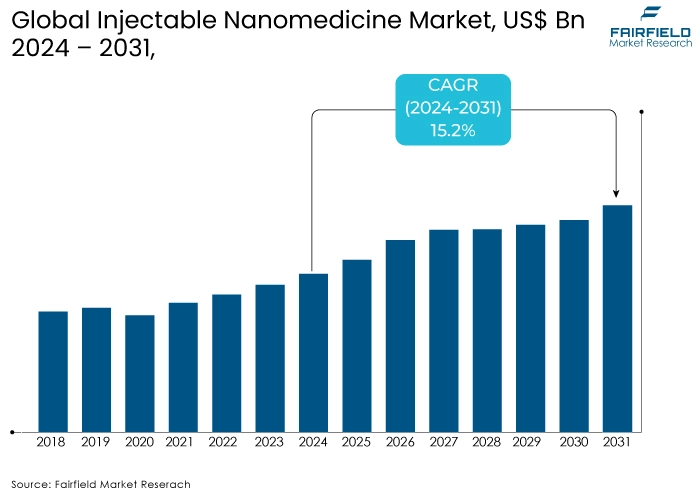

- The injectable nanomedicine market is projected to reach a size of US$ 74.19 Bn by 2031, showing significant growth from the US$ 23.71 Bn achieved in 2024.

- The market revenue is expected to exhibit a remarkable expansion rate, with an estimated CAGR of 15.2% from 2024 to 2031.

Injectable Nanomedicine Market Insights

- Advancements in drug delivery systems, including targeted delivery and improved bioavailability, are major growth drivers.

- Increasing prevalence of chronic diseases like cancer and cardiovascular disorders boosts demand for injectable nanomedicines.

- Growing investments in R&D activities by pharmaceutical companies and research institutions are fueling market expansion.

- Regulatory hurdles and safety concerns pose significant challenges to the injectable nanomedicine market growth.

- Manufacturing complexities and high production costs are additional barriers for market players.

- Nanomedicines have diversified applications, including chemotherapy, gene therapy, and immunotherapy, enhancing their market appeal.

- Injectable nanomedicines offer promising solutions for overcoming drug-resistant cancers, driving further adoption.

- Polymeric nanoparticles dominate the market, especially in cancer treatment, due to their transformative advances and FDA approval for oral drug delivery.

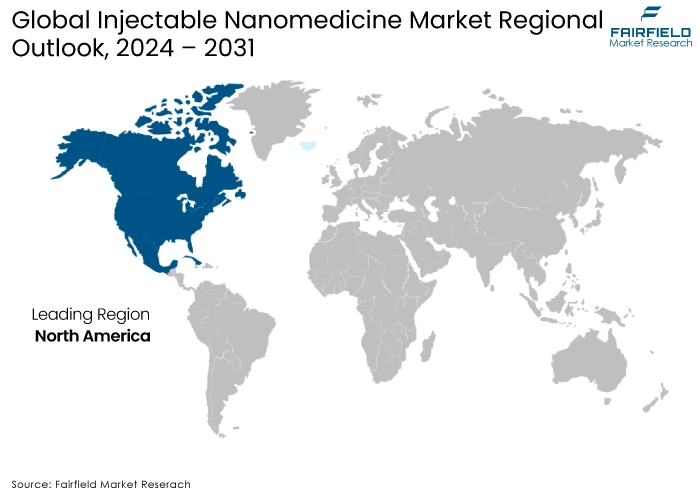

- North America, and Europe dominate the market due to advanced healthcare infrastructure and significant research collaborations.

- Asia Pacific is emerging as the fastest-growing regional market, driven by increasing healthcare investments and a rising prevalence of chronic diseases.

A Look Back and a Look Forward - Comparative Analysis

The market for injectable nanomedicines has been steadily growing in recent years, driven by emerging innovative technologies for drug delivery and the advantages of nanomedicine in various healthcare applications. The American Health Association predicts that about 60% of Americans will suffer from chronic diseases by 2030. The market size was valued at US$19.18 Bn in 2023. The market is expected to grow due to rising chronic disease incidence, demand, and funding.

As per the injectable nanomedicine market overview, it is likely to reach from US$ 23.71 Bn in 2024 to US$ 74.19 Bn by 2031, exhibiting a CAGR of 15.2% during the forecast period. It is worth mentioning that nanomedicines finds extensive applications for drug delivery, diagnostic imaging, vaccines, regenerative medicines, and implants. The increasing prevalence of chronic medical ailments across the globe, along with various technological advancements in nanoscale technologies, are driving factors for the market growth.

Key Growth Determinants

- Advancements in Drug Delivery Systems

One of the major growth drivers for the injectable nanomedicine market expansion is the continuous advancements in drug delivery systems. Injectable nanomedicine products offer unique advantages such as targeted drug delivery, improved bioavailability, sustained release, and reduced side effects. These systems utilize nanoscale materials and technologies to enhance the therapeutic efficacy of drugs.

As per Fairfield's industry assessment, the ability of injectable nanomedicines to overcome biological barriers, such as the blood-brain barrier, and effectively deliver drugs to specific targeted sites in the body has opened new avenues for the treatment of various diseases. As research and development in nanotechnology and drug delivery systems continue to progress, the market growth is expected to rise.

- Increasing Prevalence of Chronic Diseases

The rising prevalence of chronic diseases, such as cancer, cardiovascular disorders, and neurological disorders, is another significant growth driver for the injectable nanomedicine market revenue. Injectable nanomedicines have shown great potential in the treatment of these diseases by providing targeted and personalized therapies. The ability of injectable nanomedicines to carry and deliver drugs directly to the affected tissues or cells while minimizing systemic toxicity has gained attention from healthcare professionals and pharmaceutical companies. With the increasing burden of chronic diseases worldwide, the demand for effective and efficient treatment options, such as injectable nanomedicines, is expected to drive the industry growth.

- Growing Investments in Research and Development

The injectable nanomedicine market demand is also driven by the growing investment in research and development (R&D) activities. Pharmaceutical companies, research institutions, and government organizations are actively investing in the development of nanomedicine-based products, including injectable nanomedicines.

The potential of nanomedicines to revolutionize healthcare by improving drug delivery, enhancing therapeutic outcomes, and enabling personalized medicine has attracted significant R&D investments. These investments are focused on developing innovative formulations, improving manufacturing processes, and conducting clinical trials to demonstrate the safety and efficacy of injectable nanomedicines.

Key Growth Barriers

- Regulatory Hurdles, and Safety Concerns

One of the major growth restraints for the injectable nanomedicine market shares is the presence of regulatory hurdles and safety concerns. The unique characteristics and complex nature of nanomedicines pose challenges for regulatory bodies in terms of evaluation, approval, and standardization.

The regulatory landscape for nanomedicines is still evolving, and there is a need for clear guidelines and harmonization efforts among different stakeholders. The safety of nanomedicines, including injectable nanomedicines, is also a concern, as their long-term effects and potential toxicity need to be thoroughly evaluated.

- Manufacturing Challenges, and Cost Considerations

Another restraint for the injectable nanomedicine market sales is the manufacturing challenges and cost considerations associated with nanomedicine production. The manufacturing processes for nanomedicines can be complex and require specialized equipment and expertise. Scaling up the production of nanomedicines while maintaining quality and consistency can be challenging.

Injectable Nanomedicine Market Trends and Opportunities

- Diversified Applications and Mechanisms of Action

One notable industry trend in the market is the diversified applications and mechanisms of action of nanomedicines. Nanomedicines exhibit intriguing biological features that increase therapeutic efficiency, reduce toxicity, and achieve targeted delivery. They have shown versatility in various disease areas, including cancer, infections, blood disorders, cardiovascular diseases, immuno-associated diseases, and nervous system diseases.

The applications of nanomedicines extend beyond traditional drug therapy, encompassing chemotherapy, gene therapy, immunotherapy, photothermal therapy, hyperthermia, radiotherapy, combination therapy, and integration of diagnosis and treatment. These trends in the injectable nanomedicine market underscore the versatility of nanotechnology in healthcare.

- Eradication of Drug-Resistant Cancers

An opportunity for the injectable nanomedicine market lies in the rapid adoption of injectable nano-formulations to combat drug-resistant cancers. Nanomedicines have shown promise in overcoming drug resistance, a significant challenge in cancer treatment.

The unique properties of nanomedicines, such as their ability to deliver drugs directly to tumor sites and bypass efflux pumps, can enhance the efficacy of anticancer therapies. By incorporating nanoparticles in injectable formulations, nanomedicines can target cancer cells more effectively, reduce systemic toxicity, and improve treatment outcomes. These market opportunities align with the growing importance and interest in nanomedicines, as evidenced by increased funding and research initiatives in the field.

How Does Regulatory Scenario Shape this Industry?

Fairfield's injectable nanomedicine market analysis shows that the regulatory scenario is an important aspect to consider for the development, approval, and commercialization of nanomedicine products. The regulatory evaluation and approval processes for nanomedicines, including injectable nanomedicines, present certain challenges due to their complex nature and unique characteristics. The complexity in the structure, form, size, and clinical application of nanomedicines poses challenges for regulatory bodies in terms of characterization and categorization. The heterogeneous structures of nanomedicines make it difficult to fully characterize their physicochemical quality, especially when comparing follow-on versions with reference products.

Despite these challenges, nanomedicines have been approved and are accessible in the market for clinical interventions. The United States Food and Drug Administration (USFDA) and other regulatory agencies have approved more than 30 different nano-based treatments. However, it is important to note that the regulatory landscape for nanomedicines is still evolving, and there is a need for clear guidelines and harmonization efforts among different stakeholders.

The development of guidelines for the development and evaluation of nanomedicines is considered crucial to support the approval of new and innovative nanomedicines in the pharmaceutical market. These guidelines would help ensure the safety, efficacy, and quality of nanomedicines, including injectable nanomedicines, and provide a common understanding among different stakeholders.

Segments Covered in Injectable Nanomedicine Market Report

- Dominance of Polymeric Nanoparticles Prevails

The global injectable nanomedicine market is segmented into various drug types such as liposomes, micelles, nanocrystals, polymeric nanoparticles, metallic nanoparticles, Mesoporous silica nanoparticles, and others. Among them, the demand for polymeric nanoparticles has significantly increased in recent years and is expected to grow further. These nanoparticles have shown transformative advances in the treatment of cancer, neurodegenerative disorders, and cardiovascular diseases, pushing scientific boundaries. Moreover, polymeric nanoparticles used in oral drug delivery have received FDA approval as safe for human use.

- Cancer Leads the Application Segment, Promising Research Initiatives Drive Demand

In the applications category, the cancer segment held the highest industry shares in 2023. Ongoing research initiatives in Europe have led to the development and launch of nanomedicines for cancer treatment, focusing on intractable cancers. Additionally, the National Cancer Institute's integrated program on cancer nanotechnology aims to eliminate the burden of cancer through innovative advancements. The rapid discovery and translation of new technologies into clinical practice present significant opportunities for the injectable nanomedicine market growth in the coming years.

Regional Analysis

- North America Continues to Gain from Research Collaborations, and Progressive Healthcare Facilities

North America is poised to dominate the injectable nanomedicine market shares, driven by rising research collaborations between pharmaceutical and academic institutions, a higher prevalence of chronic diseases, and the presence of advanced healthcare facilities. Notably, an interdisciplinary research team at Northern Arizona University is collaborating with partners across the United States to streamline vaccine delivery through nanotechnology, exemplifying the region's commitment to innovation.

- Europe Poised to be the Second Largest Market

As per the injectable nanomedicine market forecast, Europe is expected to secure the second-largest market share in the global nanomedicine market. The region's growth will be driven by the presence of sterile GMP-approved sites for nanomedicine development and manufacturing, contributing to market expansion. Additionally, the region's improved healthcare infrastructure and the strong presence of key players are anticipated to further propel market growth throughout the forecast period.

- Asia Pacific Emerges as the Fastest-Growing Regional Market

Asia Pacific is projected to achieve the highest CAGR in the injectable nanomedicine market. The region's market growth is fueled by increasing healthcare investments in developing countries, a growing aging population, and the rising prevalence of infectious and chronic diseases. Research shows India alone has approximately 75 million individuals aged 60 and above suffering from various chronic diseases, showcasing the significant market potential in the region.

Recent Industry Developments

- In July 2024, Researchers at the Australian Institute for Bioengineering and Nanotechnology (AIBN) developed a new diagnostic device that can detect early signs of lung cancer using sugar molecules. The device, which uses a drop of blood, can identify small lung nodules, which are messenger particles that are called extracellular vesicles (EVs). The sugars on the surface of EVs serve as an excellent biomarker that can alert clinicians to the presence of small lung cancer cells. The technology could help thousands of lung cancer patients get ahead of the disease before it spreads, as lung cancer is the most common cause of cancer death in Australia.

- In January 2024, scientists developed a new way to supply the body with smart insulin, which can be eaten by taking a capsule or even with a piece of chocolate. The new insulin is encapsulated in tiny nano-carriers, which are 1/10,000th the width of a human hair and so small that they cannot even be seen under a normal microscope. This way of taking insulin is more precise because it delivers the insulin rapidly to the areas of the body that need it most.

Competitive Landscape Analysis

The competitive landscape of the injectable nanomedicine market is characterized by a growing number of players and a focus on innovation and research. The competitive landscape is likely to be influenced by factors such as technological advancements, research and development activities, regulatory compliance, and market penetration strategies.

Companies that can effectively navigate regulatory hurdles, address safety concerns, and demonstrate the clinical efficacy of their injectable nanomedicines are expected to gain a competitive edge.

Key Market Companies

- Pacira Pharmaceuticals

- Hospira (now part of Pfizer)

- Novartis

- Takeda Pharmaceuticals

- Hikma Pharmaceuticals

- Johnson & Johnson

- Merck & Co.

- Roche

- Sanofi

- AstraZeneca

- AbbVie

- Bristol Myers Squibb

An Expert’s Eye

- Injectable nanomedicine is poised to revolutionize healthcare, and its growth trajectory is undeniably promising. The convergence of nanotechnology, biotechnology, and pharmaceutical sciences is creating a fertile ground for innovation.

- Significant advancements in drug delivery systems, targeted therapies, and personalized medicine are expected in the years to come. However, regulatory hurdles and the complexities of nanomaterial characterization remain substantial challenges. Overcoming the obstacles will be crucial for the growth of the injectable nanomedicine market.

- The integration of AI and Big Data will play a pivotal role in accelerating drug development and optimizing treatment plans.

- The future of injectable nanomedicine is bright, with the potential to address unmet medical needs and improve patient outcomes on a global scale.

Global Injectable Nanomedicine Market is Segmented as-

By Drug Type

- Liposomes

- Nanocrystals

- Micelles

- Polymeric Nanoparticles

- Others

By Applications

- Cancer

- Cardiovascular Diseases

- Central Nervous System Diseases

- Infection Control

- Inflammatory Diseases

- Others

By Region

- North America

- Latin America

- Europe

- East Asia

- South Asia & Oceania

1. Executive Summary

1.1. Global Injectable Nanomedicines Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2023

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. COVID-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Global Injectable Nanomedicines Market Outlook, 2019 - 2031

3.1. Global Injectable Nanomedicines Market Outlook, by Drug, Value (US$ Bn), 2019 - 2031

3.1.1. Key Highlights

3.1.1.1. Liposomes

3.1.1.2. Micelles

3.1.1.3. Nanocrystals

3.1.1.4. Polymeric Nanoparticles

3.1.1.5. Metallic Nanoparticles

3.1.1.6. Mesoporous Silica Nanoparticles

3.1.1.7. Others

3.2. Global Injectable Nanomedicines Market Outlook, by Application, Value (US$ Bn), 2019 - 2031

3.2.1. Key Highlights

3.2.1.1. Cancers

3.2.1.2. Central Nervous System Diseases

3.2.1.3. Cardiovascular diseases

3.2.1.4. Infection Control

3.2.1.5. Inflammatory Diseases

3.2.1.6. Others

3.3. Global Injectable Nanomedicines Market Outlook, by End User, Value (US$ Bn), 2019 - 2031

3.3.1. Key Highlights

3.3.1.1. Hospitals

3.3.1.2. Ambulatory Surgical Centers

3.3.1.3. Clinics

3.3.1.4. Specialized Drugs R&D Institutes

3.3.1.5. Managed Care Organizations

3.4. Global Injectable Nanomedicines Market Outlook, by Region, Value (US$ Bn), 2019 - 2031

3.4.1. Key Highlights

3.4.1.1. North America

3.4.1.2. Europe

3.4.1.3. Asia Pacific

3.4.1.4. Latin America

3.4.1.5. Middle East & Africa

4. North America Injectable Nanomedicines Market Outlook, 2019 - 2031

4.1. North America Injectable Nanomedicines Market Outlook, by Drug, Value (US$ Bn), 2019 - 2031

4.1.1. Key Highlights

4.1.1.1. Liposomes

4.1.1.2. Micelles

4.1.1.3. Nanocrystals

4.1.1.4. Polymeric Nanoparticles

4.1.1.5. Metallic Nanoparticles

4.1.1.6. Mesoporous Silica Nanoparticles

4.1.1.7. Others

4.2. North America Injectable Nanomedicines Market Outlook, by Application, Value (US$ Bn), 2019 - 2031

4.2.1. Key Highlights

4.2.1.1. Cancers

4.2.1.2. Central Nervous System Diseases

4.2.1.3. Cardiovascular diseases

4.2.1.4. Infection Control

4.2.1.5. Inflammatory Diseases

4.2.1.6. Others

4.3. North America Injectable Nanomedicines Market Outlook, by End User, Value (US$ Bn), 2019 - 2031

4.3.1. Key Highlights

4.3.1.1. Hospitals

4.3.1.2. Ambulatory Surgical Centers

4.3.1.3. Clinics

4.3.1.4. Specialized Drugs R&D Institutes

4.3.1.5. Managed Care Organizations

4.3.2. BPS Analysis/Market Attractiveness Analysis

4.4. North America Injectable Nanomedicines Market Outlook, by Country, Value (US$ Bn), 2019 - 2031

4.4.1. Key Highlights

4.4.1.1. U.S. Injectable Nanomedicines Market by Drug, Value (US$ Bn), 2019 - 2031

4.4.1.2. U.S. Injectable Nanomedicines Market by Application, Value (US$ Bn), 2019 - 2031

4.4.1.3. U.S. Injectable Nanomedicines Market by End User, Value (US$ Bn), 2019 - 2031

4.4.1.4. Canada Injectable Nanomedicines Market by Drug, Value (US$ Bn), 2019 - 2031

4.4.1.5. Canada Injectable Nanomedicines Market by Application, Value (US$ Bn), 2019 - 2031

4.4.1.6. Canada Injectable Nanomedicines Market by End User, Value (US$ Bn), 2019 - 2031

4.4.2. BPS Analysis/Market Attractiveness Analysis

5. Europe Injectable Nanomedicines Market Outlook, 2019 - 2031

5.1. Europe Injectable Nanomedicines Market Outlook, by Drug, Value (US$ Bn), 2019 - 2031

5.1.1. Key Highlights

5.1.1.1. Liposomes

5.1.1.2. Micelles

5.1.1.3. Nanocrystals

5.1.1.4. Polymeric Nanoparticles

5.1.1.5. Metallic Nanoparticles

5.1.1.6. Mesoporous Silica Nanoparticles

5.1.1.7. Others

5.2. Europe Injectable Nanomedicines Market Outlook, by Application, Value (US$ Bn), 2019 - 2031

5.2.1. Key Highlights

5.2.1.1. Cancers

5.2.1.2. Central Nervous System Diseases

5.2.1.3. Cardiovascular diseases

5.2.1.4. Infection Control

5.2.1.5. Inflammatory Diseases

5.2.1.6. Others

5.3. Europe Injectable Nanomedicines Market Outlook, by End User, Value (US$ Bn), 2019 - 2031

5.3.1. Key Highlights

5.3.1.1. Hospitals

5.3.1.2. Ambulatory Surgical Centers

5.3.1.3. Clinics

5.3.1.4. Specialized Drugs R&D Institutes

5.3.1.5. Managed Care Organizations

5.3.2. BPS Analysis/Market Attractiveness Analysis

5.4. Europe Injectable Nanomedicines Market Outlook, by Country, Value (US$ Bn), 2019 - 2031

5.4.1. Key Highlights

5.4.1.1. Germany Injectable Nanomedicines Market by Drug, Value (US$ Bn), 2019 - 2031

5.4.1.2. Germany Injectable Nanomedicines Market by Application, Value (US$ Bn), 2019 - 2031

5.4.1.3. Germany Injectable Nanomedicines Market by End User, Value (US$ Bn), 2019 - 2031

5.4.1.4. U.K. Injectable Nanomedicines Market by Drug, Value (US$ Bn), 2019 - 2031

5.4.1.5. U.K. Injectable Nanomedicines Market by Application, Value (US$ Bn), 2019 - 2031

5.4.1.6. U.K. Injectable Nanomedicines Market by End User, Value (US$ Bn), 2019 - 2031

5.4.1.7. France Injectable Nanomedicines Market by Drug, Value (US$ Bn), 2019 - 2031

5.4.1.8. France Injectable Nanomedicines Market by Application, Value (US$ Bn), 2019 - 2031

5.4.1.9. France Injectable Nanomedicines Market by End User, Value (US$ Bn), 2019 - 2031

5.4.1.10. Italy Injectable Nanomedicines Market by Drug, Value (US$ Bn), 2019 - 2031

5.4.1.11. Italy Injectable Nanomedicines Market by Application, Value (US$ Bn), 2019 - 2031

5.4.1.12. Italy Injectable Nanomedicines Market by End User, Value (US$ Bn), 2019 - 2031

5.4.1.13. Turkey Injectable Nanomedicines Market by Drug, Value (US$ Bn), 2019 - 2031

5.4.1.14. Turkey Injectable Nanomedicines Market by Application, Value (US$ Bn), 2019 - 2031

5.4.1.15. Turkey Injectable Nanomedicines Market by End User, Value (US$ Bn), 2019 - 2031

5.4.1.16. Russia Injectable Nanomedicines Market by Drug, Value (US$ Bn), 2019 - 2031

5.4.1.17. Russia Injectable Nanomedicines Market by Application, Value (US$ Bn), 2019 - 2031

5.4.1.18. Russia Injectable Nanomedicines Market by End User, Value (US$ Bn), 2019 - 2031

5.4.1.19. Rest of Europe Injectable Nanomedicines Market by Drug, Value (US$ Bn), 2019 - 2031

5.4.1.20. Rest of Europe Injectable Nanomedicines Market by Application, Value (US$ Bn), 2019 - 2031

5.4.1.21. Rest of Europe Injectable Nanomedicines Market by End User, Value (US$ Bn), 2019 - 2031

5.4.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Injectable Nanomedicines Market Outlook, 2019 - 2031

6.1. Asia Pacific Injectable Nanomedicines Market Outlook, by Drug, Value (US$ Bn), 2019 - 2031

6.1.1. Key Highlights

6.1.1.1. Liposomes

6.1.1.2. Micelles

6.1.1.3. Nanocrystals

6.1.1.4. Polymeric Nanoparticles

6.1.1.5. Metallic Nanoparticles

6.1.1.6. Mesoporous Silica Nanoparticles

6.1.1.7. Others

6.2. Asia Pacific Injectable Nanomedicines Market Outlook, by Application, Value (US$ Bn), 2019 - 2031

6.2.1. Key Highlights

6.2.1.1. Cancers

6.2.1.2. Central Nervous System Diseases

6.2.1.3. Cardiovascular diseases

6.2.1.4. Infection Control

6.2.1.5. Inflammatory Diseases

6.2.1.6. Others

6.3. Asia Pacific Injectable Nanomedicines Market Outlook, by End User, Value (US$ Bn), 2019 - 2031

6.3.1. Key Highlights

6.3.1.1. Hospitals

6.3.1.2. Ambulatory Surgical Centers

6.3.1.3. Clinics

6.3.1.4. Specialized Drugs R&D Institutes

6.3.1.5. Managed Care Organizations

6.3.2. BPS Analysis/Market Attractiveness Analysis

6.4. Asia Pacific Injectable Nanomedicines Market Outlook, by Country, Value (US$ Bn), 2019 - 2031

6.4.1. Key Highlights

6.4.1.1. China Injectable Nanomedicines Market by Drug, Value (US$ Bn), 2019 - 2031

6.4.1.2. China Injectable Nanomedicines Market by Application, Value (US$ Bn), 2019 - 2031

6.4.1.3. China Injectable Nanomedicines Market by End User, Value (US$ Bn), 2019 - 2031

6.4.1.4. Japan Injectable Nanomedicines Market by Drug, Value (US$ Bn), 2019 - 2031

6.4.1.5. Japan Injectable Nanomedicines Market by Application, Value (US$ Bn), 2019 - 2031

6.4.1.6. Japan Injectable Nanomedicines Market by End User, Value (US$ Bn), 2019 - 2031

6.4.1.7. South Korea Injectable Nanomedicines Market by Drug, Value (US$ Bn), 2019 - 2031

6.4.1.8. South Korea Injectable Nanomedicines Market by Application, Value (US$ Bn), 2019 - 2031

6.4.1.9. South Korea Injectable Nanomedicines Market by End User, Value (US$ Bn), 2019 - 2031

6.4.1.10. India Injectable Nanomedicines Market by Drug, Value (US$ Bn), 2019 - 2031

6.4.1.11. India Injectable Nanomedicines Market by Application, Value (US$ Bn), 2019 - 2031

6.4.1.12. India Injectable Nanomedicines Market by End User, Value (US$ Bn), 2019 - 2031

6.4.1.13. Southeast Asia Injectable Nanomedicines Market by Drug, Value (US$ Bn), 2019 - 2031

6.4.1.14. Southeast Asia Injectable Nanomedicines Market by Application, Value (US$ Bn), 2019 - 2031

6.4.1.15. Southeast Asia Injectable Nanomedicines Market by End User, Value (US$ Bn), 2019 - 2031

6.4.1.16. Rest of Asia Pacific Injectable Nanomedicines Market by Drug, Value (US$ Bn), 2019 - 2031

6.4.1.17. Rest of Asia Pacific Injectable Nanomedicines Market by Application, Value (US$ Bn), 2019 - 2031

6.4.1.18. Rest of Asia Pacific Injectable Nanomedicines Market by End User, Value (US$ Bn), 2019 - 2031

6.4.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America Injectable Nanomedicines Market Outlook, 2019 - 2031

7.1. Latin America Injectable Nanomedicines Market Outlook, by Drug, Value (US$ Bn), 2019 - 2031

7.1.1. Key Highlights

7.1.1.1. Liposomes

7.1.1.2. Micelles

7.1.1.3. Nanocrystals

7.1.1.4. Polymeric Nanoparticles

7.1.1.5. Metallic Nanoparticles

7.1.1.6. Mesoporous Silica Nanoparticles

7.1.1.7. Others

7.2. Latin America Injectable Nanomedicines Market Outlook, by Application, Value (US$ Bn), 2019 - 2031

7.2.1. Key Highlights

7.2.1.1. Cancers

7.2.1.2. Central Nervous System Diseases

7.2.1.3. Cardiovascular diseases

7.2.1.4. Infection Control

7.2.1.5. Inflammatory Diseases

7.2.1.6. Others

7.3. Latin America Injectable Nanomedicines Market Outlook, by End User, Value (US$ Bn), 2019 - 2031

7.3.1. Key Highlights

7.3.1.1. Hospitals

7.3.1.2. Ambulatory Surgical Centers

7.3.1.3. Clinics

7.3.1.4. Specialized Drugs R&D Institutes

7.3.1.5. Managed Care Organizations

7.3.2. BPS Analysis/Market Attractiveness Analysis

7.4. Latin America Injectable Nanomedicines Market Outlook, by Country, Value (US$ Bn), 2019 - 2031

7.4.1. Key Highlights

7.4.1.1. Brazil Injectable Nanomedicines Market by Drug, Value (US$ Bn), 2019 - 2031

7.4.1.2. Brazil Injectable Nanomedicines Market by Application, Value (US$ Bn), 2019 - 2031

7.4.1.3. Brazil Injectable Nanomedicines Market by End User, Value (US$ Bn), 2019 - 2031

7.4.1.4. Mexico Injectable Nanomedicines Market by Drug, Value (US$ Bn), 2019 - 2031

7.4.1.5. Mexico Injectable Nanomedicines Market by Application, Value (US$ Bn), 2019 - 2031

7.4.1.6. Mexico Injectable Nanomedicines Market by End User, Value (US$ Bn), 2019 - 2031

7.4.1.7. Argentina Injectable Nanomedicines Market by Drug, Value (US$ Bn), 2019 - 2031

7.4.1.8. Argentina Injectable Nanomedicines Market by Application, Value (US$ Bn), 2019 - 2031

7.4.1.9. Argentina Injectable Nanomedicines Market by End User, Value (US$ Bn), 2019 - 2031

7.4.1.10. Rest of Latin America Injectable Nanomedicines Market by Drug, Value (US$ Bn), 2019 - 2031

7.4.1.11. Rest of Latin America Injectable Nanomedicines Market by Application, Value (US$ Bn), 2019 - 2031

7.4.1.12. Rest of Latin America Injectable Nanomedicines Market by End User, Value (US$ Bn), 2019 - 2031

7.4.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Injectable Nanomedicines Market Outlook, 2019 - 2031

8.1. Middle East & Africa Injectable Nanomedicines Market Outlook, by Drug, Value (US$ Bn), 2019 - 2031

8.1.1. Key Highlights

8.1.1.1. Liposomes

8.1.1.2. Micelles

8.1.1.3. Nanocrystals

8.1.1.4. Polymeric Nanoparticles

8.1.1.5. Metallic Nanoparticles

8.1.1.6. Mesoporous Silica Nanoparticles

8.1.1.7. Others

8.2. Middle East & Africa Injectable Nanomedicines Market Outlook, by Application, Value (US$ Bn), 2019 - 2031

8.2.1. Key Highlights

8.2.1.1. Cancers

8.2.1.2. Central Nervous System Diseases

8.2.1.3. Cardiovascular diseases

8.2.1.4. Infection Control

8.2.1.5. Inflammatory Diseases

8.2.1.6. Others

8.3. Middle East & Africa Injectable Nanomedicines Market Outlook, by End User, Value (US$ Bn), 2019 - 2031

8.3.1. Key Highlights

8.3.1.1. Hospitals

8.3.1.2. Ambulatory Surgical Centers

8.3.1.3. Clinics

8.3.1.4. Specialized Drugs R&D Institutes

8.3.1.5. Managed Care Organizations

8.3.2. BPS Analysis/Market Attractiveness Analysis

8.4. Middle East & Africa Injectable Nanomedicines Market Outlook, by Country, Value (US$ Bn), 2019 - 2031

8.4.1. Key Highlights

8.4.1.1. GCC Injectable Nanomedicines Market by Drug, Value (US$ Bn), 2019 - 2031

8.4.1.2. GCC Injectable Nanomedicines Market by Application, Value (US$ Bn), 2019 - 2031

8.4.1.3. GCC Injectable Nanomedicines Market by End User, Value (US$ Bn), 2019 - 2031

8.4.1.4. South Africa Injectable Nanomedicines Market by Drug, Value (US$ Bn), 2019 - 2031

8.4.1.5. South Africa Injectable Nanomedicines Market by Application, Value (US$ Bn), 2019 - 2031

8.4.1.6. South Africa Injectable Nanomedicines Market by End User, Value (US$ Bn), 2019 - 2031

8.4.1.7. Egypt Injectable Nanomedicines Market by Drug, Value (US$ Bn), 2019 - 2031

8.4.1.8. Egypt Injectable Nanomedicines Market by Application, Value (US$ Bn), 2019 - 2031

8.4.1.9. Egypt Injectable Nanomedicines Market by End User, Value (US$ Bn), 2019 - 2031

8.4.1.10. Nigeria Injectable Nanomedicines Market by Drug, Value (US$ Bn), 2019 - 2031

8.4.1.11. Nigeria Injectable Nanomedicines Market by Application, Value (US$ Bn), 2019 - 2031

8.4.1.12. Nigeria Injectable Nanomedicines Market by End User, Value (US$ Bn), 2019 - 2031

8.4.1.13. Rest of Middle East & Africa Injectable Nanomedicines Market by Drug, Value (US$ Bn), 2019 - 2031

8.4.1.14. Rest of Middle East & Africa Injectable Nanomedicines Market by Application, Value (US$ Bn), 2019 - 2031

8.4.1.15. Rest of Middle East & Africa Injectable Nanomedicines Market by End User, Value (US$ Bn), 2019 - 2031

8.4.2. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. By End User vs by Application Heat map

9.2. Manufacturer vs by Application Heatmap

9.3. Company Market Share Analysis, 2023

9.4. Competitive Dashboard

9.5. Company Profiles

9.5.1. Merck & Co., Inc.

9.5.1.1. Company Overview

9.5.1.2. Product Portfolio

9.5.1.3. Financial Overview

9.5.1.4. Business Strategies and Development

9.5.2. Lupin

9.5.2.1. Company Overview

9.5.2.2. Product Portfolio

9.5.2.3. Financial Overview

9.5.2.4. Business Strategies and Development

9.5.3. Pacira Pharmaceuticals Inc.

9.5.3.1. Company Overview

9.5.3.2. Product Portfolio

9.5.3.3. Financial Overview

9.5.3.4. Business Strategies and Development

9.5.4. Celgene Pharmaceutical Co. Ltd.

9.5.4.1. Company Overview

9.5.4.2. Product Portfolio

9.5.4.3. Financial Overview

9.5.4.4. Business Strategies and Development

9.5.5. Amgen, Inc.

9.5.5.1. Company Overview

9.5.5.2. Product Portfolio

9.5.5.3. Financial Overview

9.5.5.4. Business Strategies and Development

9.5.6. Janssen Biotech Inc. (Sub. Johnson & Johnson Services, Inc.)

9.5.6.1. Company Overview

9.5.6.2. Product Portfolio

9.5.6.3. Financial Overview

9.5.6.4. Business Strategies and Development

9.5.7. Pfizer Inc.

9.5.7.1. Company Overview

9.5.7.2. Product Portfolio

9.5.7.3. Financial Overview

9.5.7.4. Business Strategies and Development

9.5.8. Hoffmann-La Roche Ltd.

9.5.8.1. Company Overview

9.5.8.2. Product Portfolio

9.5.8.3. Financial Overview

9.5.8.4. Business Strategies and Development

9.5.9. Teva Pharmaceutical Industries Ltd.

9.5.9.1. Company Overview

9.5.9.2. Product Portfolio

9.5.9.3. Financial Overview

9.5.9.4. Business Strategies and Development

9.5.10. Bausch & Lomb Incorporated.

9.5.10.1. Company Overview

9.5.10.2. Product Portfolio

9.5.10.3. Financial Overview

9.5.10.4. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2023 |

|

2019 - 2023 |

2024 - 2031 |

Value: US$ Billion |

||

|

REPORT FEATURES |

DETAILS |

|

Drug Type Coverage |

|

|

Application Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |