Global ISO Tank Container Market Forecast

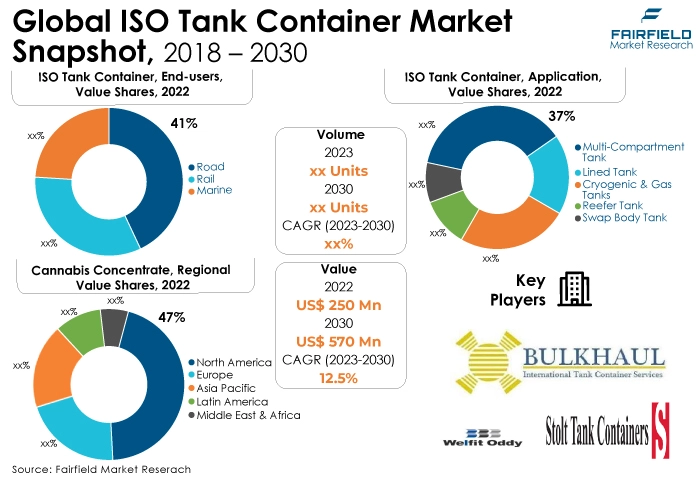

- Global ISO tank container market, worth around US$250 Mn as of 2022, to reach US$570 Mn by 2030

- etween 2023 and 2030, the Global ISO Tank Container market is anticipated to expand at a CAGR of 12.5%

Major Report Findings - Fairfield's Perspective

- The key trend anticipated to fuel the global ISO tank container market growth is the increasing demand for crude oil and gas as well as specialty chemicals.

- The growing chemical industry is driving the ISO tank container market due to increased demand for safe, compliant, and efficient transportation of various chemicals. ISO tank containers offer a reliable and cost-effective solution, ensuring the secure movement of hazardous and non-hazardous chemicals, aligning with industry safety and regulatory standards.

- Road transport mode captured the largest market share in the ISO tank container market due to its flexibility, accessibility, and versatility. It offers efficient, door-to-door delivery options, making it suitable for short to medium-distance transport of bulk liquids and gases, catering to various industries' logistics needs.

- Multi-compartment tanks captured the largest market share in the ISO tank container market because they offer versatile solutions for simultaneously transporting multiple liquids or gases within a single container. This optimizes cargo capacity, reduces transportation costs, and meets the diverse needs of industries requiring various products to be shipped together.

- The chemicals industry captured the largest market share in the ISO tank container market due to its extensive use of these containers for transporting various chemical products. ISO tank containers provide a safe, compliant, and cost-effective solution for both hazardous and non-hazardous chemicals, making them indispensable for chemical manufacturers and logistics providers.

- North America captured the largest market share in the ISO tank container market due to its robust chemical and food industries, which rely heavily on these containers for secure and efficient transportation. Stringent safety regulations and a well-developed infrastructure further promote their dominance in the region.

- Asia Pacific region is experiencing the highest CAGR in the ISO tank container market due to rapid industrialization, a booming chemical sector, and the region's role as a global manufacturing and trade hub. Expanding industries and increased international trade are driving the demand for ISO tank containers.

- Regulatory compliance is challenging the ISO tank container market due to the need to adhere to complex and evolving safety, environmental, and transportation regulations globally. Meeting these standards while ensuring cost-effective operations and avoiding legal issues poses significant challenges for manufacturers and operators.

A Look Back and a Look Forward - Comparative Analysis

The ISO tank container market is growing due to globalization, cost efficiency, safety, and environmental benefits. These containers streamline international trade by offering secure, compliant, and versatile solutions for transporting liquids and gases. The pharmaceutical and food industries, sustainability goals, and logistics efficiency further fuel this growth, making ISO tank containers a preferred choice for various industries driving their market expansion.

The market witnessed staggered growth during the historical period 2018 - 2022. This is due to the substantial growth of the major end-use application sectors, such as chemicals and Petrochemicals. The petrochemical industry's growth is contributing to the ISO tank container market expansion due to increased global demand for petrochemical products. ISO tank containers provide a safe, efficient, and compliant means of transporting petrochemicals, meeting stringent industry standards and ensuring secure international trade in these products.

The future of the ISO tank container market looks promising as industries increasingly recognize the benefits of these containers for safe, efficient, and eco-friendly bulk liquid transportation. Continued globalization, stricter regulations, sustainability initiatives, and the growth of sectors like chemicals, food, and pharmaceuticals are expected to drive sustained demand. Innovations in container design and technologies will further enhance their role in the global logistics chain.

Key Growth Determinants

- Growth of Chemical Industry

The global chemical industry's growth is a significant driver of the ISO tank container market. As the chemical industry continues to expand, the demand for efficient and safe transportation of chemicals grows in tandem.

ISO tank containers offer a secure and cost-effective means of transporting various chemical products, from hazardous chemicals to non-hazardous liquids and gases. Their ability to meet stringent safety and compliance standards makes them a preferred choice for chemical manufacturers and logistics providers.

Additionally, as chemical production becomes more globalized, ISO tank containers facilitate international trade by providing a standardized and versatile solution that can be transported via multiple modes, such as road, rail, and sea, further fueling their adoption and market growth.

- Unprecedented Expansion of Pharmaceutical and Food Industries

The growing pharmaceutical and food industries are driving the ISO tank container market due to their increasing need for efficient and safe transportation of sensitive products. ISO tank containers offer a reliable solution for shipping pharmaceuticals, chemicals, and food products, ensuring product integrity and compliance with stringent quality standards.

These industries also benefit from the reduced environmental impact and cost-effectiveness of ISO tank containers, making them an attractive choice for transporting a wide range of temperature-sensitive and high-value goods, thereby fueling market growth.

- Rising Environmental Concerns

Growing environmental concerns are driving the ISO tank container market as these containers offer eco-friendly and sustainable solutions for bulk liquid transportation. ISO tank containers reduce the environmental impact by minimizing packaging waste, promoting efficient logistics, and lowering emissions compared to traditional transportation methods.

As sustainability becomes a key focus for industries worldwide, the eco-friendly attributes of ISO tank containers align with environmental goals, making them a preferred choice and driving their adoption in various sectors, thus contributing to market growth.

Major Growth Barriers

- Complex Regulatory Landscape

Regulatory compliance is challenging the ISO Tank Container Market due to the complex and stringent international regulations governing the transportation of hazardous and non-hazardous materials. Tank container operators must navigate a web of rules, codes, and standards that vary from one country to another.

Ensuring compliance demands meticulous documentation, specialized training, and the adaptation of containers to meet evolving regulatory requirements. Failure to meet these compliance standards can result in legal and safety risks, making regulatory adherence a paramount concern for the industry, albeit a challenging one.

- High Maintenance Costs

High maintenance costs pose a challenge to the ISO Tank Container Market as ensuring the structural integrity and safety of tank containers requires regular inspections, repairs, and testing. These maintenance procedures can be costly, impacting the overall operational expenses for tank container operators.

Moreover, as regulations and industry standards evolve, container modifications and upgrades may be necessary, further adding to maintenance expenses. Balancing safety and cost-effectiveness is essential, making maintenance cost management a significant challenge for industry players.

Key Trends and Opportunities to Look at

- IoT Integration

IoT integration in the ISO tank container market involves equipping containers with sensors and devices that collect and transmit data in real time. This technology enables remote monitoring of cargo conditions, location tracking, and security measures.

IoT integration enhances asset management, improves cargo safety, and provides valuable insights for logistics optimization, making ISO tank containers more efficient and secure for transporting liquids and gases.

- Telematics and GPS

Telematics and GPS technology in the ISO tank container market involve the use of advanced tracking systems and global positioning system (GPS) devices. These technologies enable precise location monitoring and real-time data transmission for ISO tank containers.

Telematics and GPS enhance logistics efficiency by providing accurate location information, route optimization, and security measures. This technology ensures the safe and efficient transportation of liquids and gases in tank containers.

- Remote Diagnostics

Remote diagnostics technology in the ISO tank container market allows for the real-time monitoring and analysis of container conditions and performance. Through connected sensors and systems, it identifies and reports issues such as maintenance needs or anomalies in cargo conditions.

The proactive approach to maintenance reduces downtime, enhances safety, and ensures the integrity of transported liquids and gases, making ISO tank containers more reliable and cost-effective.

How Does the Regulatory Scenario Shape this Industry?

The regulatory scenario plays a crucial role in shaping the ISO tank container market. Governments and international bodies impose various regulations to ensure the safe and secure transportation of hazardous and non-hazardous materials. These regulations cover aspects such as container design, material compatibility, labeling, and documentation.

Compliance with these standards is mandatory for ISO tank container operators, and non-compliance can lead to legal and safety issues. Additionally, evolving environmental regulations are driving the adoption of eco-friendly technologies and materials in tank container manufacturing.

Stricter emissions standards and sustainability goals are prompting innovations in container design, focusing on reducing the environmental impact of transportation. Moreover, international trade agreements and customs regulations impact the ease of cross-border movement for ISO tank containers.

Harmonizing rules across countries and regions is essential to facilitate global trade and reduce barriers for tank container operators. The industry closely monitors regulatory developments and collaborates with authorities to ensure adherence while advocating for standardized and practical regulations that promote safety, sustainability, and efficient logistics in the ISO tank container market.

Fairfield’s Ranking Board

Top Segments

- Dominnance of Road Transport Mode Prevails over Top Load Segments

Road transport mode is expected to capture the largest market share in the ISO tank container market because of its flexibility, accessibility, and versatility. ISO tank containers can be easily transported on trucks, making them suitable for reaching locations with limited infrastructure.

Road transport is highly efficient for short to medium-distance journeys, which aligns with many industries' supply chain needs. Additionally, it provides door-to-door delivery options, reducing transshipment and ensuring the seamless movement of bulk liquids and gases, contributing to its dominant market share.

Marine transport mode is expected to grow at the highest CAGR in the ISO tank container market due to its suitability for long-distance international shipping. ISO tank containers can be easily loaded onto vessels, facilitating the efficient transportation of bulk liquids and gases across oceans and seas.

With the globalization of trade and the increasing demand for chemical and liquid products worldwide, marine transport offers a cost-effective and eco-friendly solution, driving its anticipated high growth rate in the market.

- Multi-compartment Tank Surges Ahead

Multi-compartment tanks are expected to capture the largest market share in the ISO tank container market because they offer versatility and cost-efficiency. These tanks allow for the simultaneous transportation of multiple types of liquids or gases within a single container, optimizing cargo capacity and reducing transportation costs.

Industries that require various products to be transported together, such as chemicals, benefit from multi-compartment tanks. This flexibility in accommodating diverse cargo types positions them as the preferred choice, driving their dominant market share.

Cryogenic and gas tanks are expected to grow at the highest CAGR in the ISO tank container market due to the rising demand for the transportation of liquefied gases, such as LNG, and industrial gases.

These specialized tanks are designed to handle extremely low temperatures and high-pressure conditions, making them essential for the growing energy and industrial gas sectors. As the global demand for clean energy sources and industrial gases increases, the market for cryogenic and gas tanks experiences rapid growth.

- Chemicals Industry Holds a Lion’s Share

The chemicals industry is expected to capture the largest market share in the ISO tank container market due to its extensive use of these containers for the transportation of various chemical products. ISO tank containers provide a safe, compliant, and cost-effective means of shipping both hazardous and non-hazardous chemicals.

With the global chemical industry continuing to expand and stringent safety and regulatory standards in place, these containers have become indispensable for chemical manufacturers and logistics providers, positioning the sector as a dominant market player.

The pharmaceutical industry is expected to grow at the highest CAGR in the ISO tank container market because of its increasing need for safe and efficient transportation of sensitive pharmaceutical products. ISO tank containers offer a reliable solution for the pharmaceutical sector, ensuring the integrity of temperature-sensitive medications and complying with strict quality standards.

With the growing global demand for pharmaceuticals and biopharmaceuticals, the industry requires secure and compliant logistics solutions, making ISO tank containers crucial and contributing to their high growth rate.

Regional Frontrunners

Heavy Reliance on ISO Tank Containers Secures North America’s Leadership Position

North America is expected to capture the largest market share in the ISO tank container market due to several key factors. Firstly, the region boasts a robust and diverse chemical industry, which relies heavily on ISO tank containers for the safe and efficient transport of chemicals.

Additionally, the pharmaceutical and food industries in North America are growing, further increasing the demand for these containers to transport sensitive and high-value products. The well-developed infrastructure, stringent safety regulations, and strong emphasis on environmental compliance also favor the adoption of ISO tank containers.

North America's position as a major global trade hub facilitates international trade, making it a prime market for ISO tank container operators and manufacturers.

Asia Pacific Expects Gains from Food and Pharma

The Asia Pacific region is anticipated to grow at the highest CAGR in the ISO tank container market due to several compelling factors. Firstly, the region's rapidly expanding chemical industry, driven by manufacturing and export activities, demands efficient and compliant transportation solutions.

Moreover, the pharmaceutical and food industries are flourishing, requiring safe and reliable logistics for their products. Moreover, the Asia Pacific's burgeoning population and urbanization drive the need for essential chemicals and goods, further boosting the market.

Additionally, increasing sustainability initiatives and the region's role in global trade contribute to the higher adoption rate of ISO tank containers. Finally, investments in infrastructure and intermodal transportation systems facilitate seamless container movement, positioning Asia Pacific as a high-growth market for ISO tank containers.

Fairfield’s Competitive Landscape Analysis

The global ISO tank container market is a consolidated market with fewer major players present globally. The key players are introducing new products and working on the distribution channels to enhance their worldwide presence. Moreover, Fairfield Market Research expects more consolidation over the coming years.

Who are the Leaders in the Global ISO Tank Container Market space?

- Hoover Ferguson Group

- Stolt Tank Containers

- Welfit Oddy

- CXIC Group

- Bulkhaul Ltd.

- Singamas Container Holdings

- Bertschi AG

- Seaco Global

- Nantong CIMC Tank Equipment Co., Ltd.

- Eurotainer

- Raffles Lease Pte. Ltd.

- Suretank Group

- Tankformator

- Klinge Corporation

- Uralcryomash

Significant Company Developments

New Product Launches

- May 2022: Phixman has collaborated with Detel to offer refurbished premium smartphones at an affordable cost, complete with a warranty and all accompanying accessories. Moreover, it delivers cost-effective services across all its PAN India centers.

- April 2022: Samsung's Renewed online store now includes the Galaxy S21 series in its pre-owned selection, allowing customers to purchase these previously owned and refurbished devices. The Renewed store features attractive offers on relatively recent Samsung products. This initiative provides an opportunity for users who initially found the S21 range's high prices prohibitive to acquire these devices at a more budget-friendly cost, with Samsung offering them at just USD 225.

Distribution Agreement

- March 2022: Apple has recently added the iPhone 12 and iPhone 12 Pro models to its official Certified Refurbished store. When you buy from Apple's Certified Refurbished store, you'll receive a brand-new battery, a fresh outer shell, and, if required, authentic Apple parts replacements. Additionally, these devices come with a comprehensive one-year warranty for added peace of mind.

An Expert’s Eye

Demand and Future Growth

As per Fairfield’s Analysis, growth in healthcare is driving the market. The ISO tank container market is experiencing robust demand and is poised for future growth. The globalization of trade, stringent safety regulations, and environmental concerns are driving the need for efficient and secure bulk liquid transportation. Industries like chemicals, pharmaceuticals, and food are key contributors to this demand.

Additionally, innovations in container technology, including IoT integration and sustainability measures, are expected to further fuel growth. As global trade continues to expand, the ISO tank container market is likely to see sustained demand and increased adoption in various industries.

Supply Side of the Market

Leading countries in the ISO tank container market include the US, China, Germany, Japan, India, and the Netherlands. China stands out as a significant market due to its substantial chemical and food industries, driving a consistent demand for ISO tank containers.

In China, rapid industrialization, coupled with a growing pharmaceutical sector, contributes to its market leadership. Germany, and the US are renowned for its chemical manufacturing and exports, making it a substantial market player. Japan, with strong chemical and pharmaceutical industries, has a consistent demand for ISO tank containers.

India is experiencing market growth as its chemical and pharmaceutical sectors expand. The Netherlands serves as a vital European hub for chemical logistics and exports, further contributing to the global prominence of these countries in the ISO tank container market.

The major raw materials required in the ISO tank container market include stainless steel, carbon steel, and insulation materials. Stainless steel is commonly used for the tank's inner shell due to its corrosion resistance, while carbon steel provides structural support. Insulation materials like polyurethane foam maintain cargo temperature.

Major suppliers of these raw materials include companies like Outokumpu (Finland), Nippon Steel & Sumitomo Metal Corporation (Japan), ArcelorMittal (Luxembourg), and Covestro AG (Germany). These suppliers provide high-quality materials to tank container manufacturers, ensuring the containers meet industry standards and safety regulations.

Global ISO Tank Container Market is Segmented as Below:

By Transport Mode:

- Road

- Rail

- Marine

By Container Type:

- Multi-compartment Tank

- Lined Tank

- Reefer Tank

- Cryogenic & Gas Tanks

- Swap Body Tank

By End-use Industry:

- Chemicals

- Petrochemicals

- Food & Beverage

- Pharmaceuticals

- Industrial Gas

- Miscellaneous

By Geographic Coverage:

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of the Middle East & Africa

1. Executive Summary

1.1. Global ISO Tank Container Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2022

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. Covid-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Global ISO Tank Container Market Outlook, 2018 - 2030

3.1. Global ISO Tank Container Market Outlook, by Transport Mode, Value (US$ Bn), 2018 - 2030

3.1.1. Key Highlights

3.1.1.1. Road

3.1.1.2. Rail

3.1.1.3. Marine

3.2. Global ISO Tank Container Market Outlook, by Container Type, Value (US$ Bn), 2018 - 2030

3.2.1. Key Highlights

3.2.1.1. Multi-Compartment Tank

3.2.1.2. Lined Tank

3.2.1.3. Reefer Tank

3.2.1.4. Cryogenic & Gas Tanks

3.2.1.5. Swap Body Tank

3.3. Global ISO Tank Container Market Outlook, by End-use Industry, Value (US$ Bn), 2018 - 2030

3.3.1. Key Highlights

3.3.1.1. Chemicals

3.3.1.2. Petrochemicals

3.3.1.3. Food & Beverage

3.3.1.4. Pharmaceuticals

3.3.1.5. Industrial Gas

3.3.1.6. Others (Paints)

3.4. Global ISO Tank Container Market Outlook, by Region, Value (US$ Bn), 2018 - 2030

3.4.1. Key Highlights

3.4.1.1. North America

3.4.1.2. Europe

3.4.1.3. Asia Pacific

3.4.1.4. Latin America

3.4.1.5. Middle East & Africa

4. North America ISO Tank Container Market Outlook, 2018 - 2030

4.1. North America ISO Tank Container Market Outlook, by Transport Mode, Value (US$ Bn), 2018 - 2030

4.1.1. Key Highlights

4.1.1.1. Road

4.1.1.2. Rail

4.1.1.3. Marine

4.2. North America ISO Tank Container Market Outlook, by Container Type, Value (US$ Bn), 2018 - 2030

4.2.1. Key Highlights

4.2.1.1. Multi-Compartment Tank

4.2.1.2. Lined Tank

4.2.1.3. Reefer Tank

4.2.1.4. Cryogenic & Gas Tanks

4.2.1.5. Swap Body Tank

4.3. North America ISO Tank Container Market Outlook, by End-use Industry, Value (US$ Bn), 2018 - 2030

4.3.1. Key Highlights

4.3.1.1. Chemicals

4.3.1.2. Petrochemicals

4.3.1.3. Food & Beverage

4.3.1.4. Pharmaceuticals

4.3.1.5. Industrial Gas

4.3.1.6. Others (Paints)

4.3.2. BPS Analysis/Market Attractiveness Analysis

4.4. North America ISO Tank Container Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

4.4.1. Key Highlights

4.4.1.1. U.S. ISO Tank Container Market by Transport Mode, Value (US$ Bn), 2018 - 2030

4.4.1.2. U.S. ISO Tank Container Market Container Type, Value (US$ Bn), 2018 - 2030

4.4.1.3. U.S. ISO Tank Container Market End-use Industry, Value (US$ Bn), 2018 - 2030

4.4.1.4. U.S. ISO Tank Container Market End Use, Value (US$ Bn), 2018 - 2030

4.4.1.5. Canada ISO Tank Container Market by Transport Mode, Value (US$ Bn), 2018 - 2030

4.4.1.6. Canada ISO Tank Container Market Container Type, Value (US$ Bn), 2018 - 2030

4.4.1.7. Canada ISO Tank Container Market End-use Industry, Value (US$ Bn), 2018 - 2030

4.4.1.8. Canada ISO Tank Container Market End Use, Value (US$ Bn), 2018 - 2030

4.4.2. BPS Analysis/Market Attractiveness Analysis

5. Europe ISO Tank Container Market Outlook, 2018 - 2030

5.1. Europe ISO Tank Container Market Outlook, by Transport Mode, Value (US$ Bn), 2018 - 2030

5.1.1. Key Highlights

5.1.1.1. Road

5.1.1.2. Rail

5.1.1.3. Marine

5.2. Europe ISO Tank Container Market Outlook, by Container Type, Value (US$ Bn), 2018 - 2030

5.2.1. Key Highlights

5.2.1.1. Multi-Compartment Tank

5.2.1.2. Lined Tank

5.2.1.3. Reefer Tank

5.2.1.4. Cryogenic & Gas Tanks

5.2.1.5. Swap Body Tank

5.3. Europe ISO Tank Container Market Outlook, by End-use Industry, Value (US$ Bn), 2018 - 2030

5.3.1. Key Highlights

5.3.1.1. Chemicals

5.3.1.2. Petrochemicals

5.3.1.3. Food & Beverage

5.3.1.4. Pharmaceuticals

5.3.1.5. Industrial Gas

5.3.1.6. Others (Paints)

5.3.2. BPS Analysis/Market Attractiveness Analysis

5.4. Europe ISO Tank Container Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

5.4.1. Key Highlights

5.4.1.1. Germany ISO Tank Container Market by Transport Mode, Value (US$ Bn), 2018 - 2030

5.4.1.2. Germany ISO Tank Container Market Container Type, Value (US$ Bn), 2018 - 2030

5.4.1.3. Germany ISO Tank Container Market End-use Industry, Value (US$ Bn), 2018 - 2030

5.4.1.4. U.K. ISO Tank Container Market by Transport Mode, Value (US$ Bn), 2018 - 2030

5.4.1.5. U.K. ISO Tank Container Market Container Type, Value (US$ Bn), 2018 - 2030

5.4.1.6. U.K. ISO Tank Container Market End-use Industry, Value (US$ Bn), 2018 - 2030

5.4.1.7. France ISO Tank Container Market by Transport Mode, Value (US$ Bn), 2018 - 2030

5.4.1.8. France ISO Tank Container Market Container Type, Value (US$ Bn), 2018 - 2030

5.4.1.9. France ISO Tank Container Market End-use Industry, Value (US$ Bn), 2018 - 2030

5.4.1.10. Italy ISO Tank Container Market by Transport Mode, Value (US$ Bn), 2018 - 2030

5.4.1.11. Italy ISO Tank Container Market Container Type, Value (US$ Bn), 2018 - 2030

5.4.1.12. Italy ISO Tank Container Market End-use Industry, Value (US$ Bn), 2018 - 2030

5.4.1.13. Turkey ISO Tank Container Market by Transport Mode, Value (US$ Bn), 2018 - 2030

5.4.1.14. Turkey ISO Tank Container Market Container Type, Value (US$ Bn), 2018 - 2030

5.4.1.15. Turkey ISO Tank Container Market End-use Industry, Value (US$ Bn), 2018 - 2030

5.4.1.16. Russia ISO Tank Container Market by Transport Mode, Value (US$ Bn), 2018 - 2030

5.4.1.17. Russia ISO Tank Container Market Container Type, Value (US$ Bn), 2018 - 2030

5.4.1.18. Russia ISO Tank Container Market End-use Industry, Value (US$ Bn), 2018 - 2030

5.4.1.19. Rest of Europe ISO Tank Container Market by Transport Mode, Value (US$ Bn), 2018 - 2030

5.4.1.20. Rest of Europe ISO Tank Container Market Container Type, Value (US$ Bn), 2018 - 2030

5.4.1.21. Rest of Europe ISO Tank Container Market End-use Industry, Value (US$ Bn), 2018 - 2030

5.4.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific ISO Tank Container Market Outlook, 2018 - 2030

6.1. Asia Pacific ISO Tank Container Market Outlook, by Transport Mode, Value (US$ Bn), 2018 - 2030

6.1.1. Key Highlights

6.1.1.1. Road

6.1.1.2. Rail

6.1.1.3. Marine

6.2. Asia Pacific ISO Tank Container Market Outlook, by Container Type, Value (US$ Bn), 2018 - 2030

6.2.1. Key Highlights

6.2.1.1. Multi-Compartment Tank

6.2.1.2. Lined Tank

6.2.1.3. Reefer Tank

6.2.1.4. Cryogenic & Gas Tanks

6.2.1.5. Swap Body Tank

6.3. Asia Pacific ISO Tank Container Market Outlook, by End-use Industry, Value (US$ Bn), 2018 - 2030

6.3.1. Key Highlights

6.3.1.1. Chemicals

6.3.1.2. Petrochemicals

6.3.1.3. Food & Beverage

6.3.1.4. Pharmaceuticals

6.3.1.5. Industrial Gas

6.3.1.6. Others (Paints)

6.3.2. BPS Analysis/Market Attractiveness Analysis

6.4. Asia Pacific ISO Tank Container Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

6.4.1. Key Highlights

6.4.1.1. China ISO Tank Container Market by Transport Mode, Value (US$ Bn), 2018 - 2030

6.4.1.2. China ISO Tank Container Market Container Type, Value (US$ Bn), 2018 - 2030

6.4.1.3. China ISO Tank Container Market End-use Industry, Value (US$ Bn), 2018 - 2030

6.4.1.4. Japan ISO Tank Container Market by Transport Mode, Value (US$ Bn), 2018 - 2030

6.4.1.5. Japan ISO Tank Container Market Container Type, Value (US$ Bn), 2018 - 2030

6.4.1.6. Japan ISO Tank Container Market End-use Industry, Value (US$ Bn), 2018 - 2030

6.4.1.7. South Korea ISO Tank Container Market by Transport Mode, Value (US$ Bn), 2018 - 2030

6.4.1.8. South Korea ISO Tank Container Market Container Type, Value (US$ Bn), 2018 - 2030

6.4.1.9. South Korea ISO Tank Container Market End-use Industry, Value (US$ Bn), 2018 - 2030

6.4.1.10. India ISO Tank Container Market by Transport Mode, Value (US$ Bn), 2018 - 2030

6.4.1.11. India ISO Tank Container Market Container Type, Value (US$ Bn), 2018 - 2030

6.4.1.12. India ISO Tank Container Market End-use Industry, Value (US$ Bn), 2018 - 2030

6.4.1.13. Southeast Asia ISO Tank Container Market by Transport Mode, Value (US$ Bn), 2018 - 2030

6.4.1.14. Southeast Asia ISO Tank Container Market Container Type, Value (US$ Bn), 2018 - 2030

6.4.1.15. Southeast Asia ISO Tank Container Market End-use Industry, Value (US$ Bn), 2018 - 2030

6.4.1.16. Rest of Asia Pacific ISO Tank Container Market by Transport Mode, Value (US$ Bn), 2018 - 2030

6.4.1.17. Rest of Asia Pacific ISO Tank Container Market Container Type, Value (US$ Bn), 2018 - 2030

6.4.1.18. Rest of Asia Pacific ISO Tank Container Market End-use Industry, Value (US$ Bn), 2018 - 2030

6.4.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America ISO Tank Container Market Outlook, 2018 - 2030

7.1. Latin America ISO Tank Container Market Outlook, by Transport Mode, Value (US$ Bn), 2018 - 2030

7.1.1. Key Highlights

7.1.1.1. Road

7.1.1.2. Rail

7.1.1.3. Marine

7.2. Latin America ISO Tank Container Market Outlook, by Container Type, Value (US$ Bn), 2018 - 2030

7.2.1. Key Highlights

7.2.1.1. Multi-Compartment Tank

7.2.1.2. Lined Tank

7.2.1.3. Reefer Tank

7.2.1.4. Cryogenic & Gas Tanks

7.2.1.5. Swap Body Tank

7.3. Latin America ISO Tank Container Market Outlook, by End-use Industry, Value (US$ Bn), 2018 - 2030

7.3.1. Key Highlights

7.3.1.1. Chemicals

7.3.1.2. Petrochemicals

7.3.1.3. Food & Beverage

7.3.1.4. Pharmaceuticals

7.3.1.5. Industrial Gas

7.3.1.6. Others (Paints)

7.3.2. BPS Analysis/Market Attractiveness Analysis

7.4. Latin America ISO Tank Container Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

7.4.1. Key Highlights

7.4.1.1. Brazil ISO Tank Container Market by Transport Mode, Value (US$ Bn), 2018 - 2030

7.4.1.2. Brazil ISO Tank Container Market Container Type, Value (US$ Bn), 2018 - 2030

7.4.1.3. Brazil ISO Tank Container Market End-use Industry, Value (US$ Bn), 2018 - 2030

7.4.1.4. Mexico ISO Tank Container Market by Transport Mode, Value (US$ Bn), 2018 - 2030

7.4.1.5. Mexico ISO Tank Container Market Container Type, Value (US$ Bn), 2018 - 2030

7.4.1.6. Mexico ISO Tank Container Market End-use Industry, Value (US$ Bn), 2018 - 2030

7.4.1.7. Argentina ISO Tank Container Market by Transport Mode, Value (US$ Bn), 2018 - 2030

7.4.1.8. Argentina ISO Tank Container Market Container Type, Value (US$ Bn), 2018 - 2030

7.4.1.9. Argentina ISO Tank Container Market End-use Industry, Value (US$ Bn), 2018 - 2030

7.4.1.10. Rest of Latin America ISO Tank Container Market by Transport Mode, Value (US$ Bn), 2018 - 2030

7.4.1.11. Rest of Latin America ISO Tank Container Market Container Type, Value (US$ Bn), 2018 - 2030

7.4.1.12. Rest of Latin America ISO Tank Container Market End-use Industry, Value (US$ Bn), 2018 - 2030

7.4.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa ISO Tank Container Market Outlook, 2018 - 2030

8.1. Middle East & Africa ISO Tank Container Market Outlook, by Transport Mode, Value (US$ Bn), 2018 - 2030

8.1.1. Key Highlights

8.1.1.1. Road

8.1.1.2. Rail

8.1.1.3. Marine

8.2. Middle East & Africa ISO Tank Container Market Outlook, by Container Type, Value (US$ Bn), 2018 - 2030

8.2.1. Key Highlights

8.2.1.1. Multi-Compartment Tank

8.2.1.2. Lined Tank

8.2.1.3. Reefer Tank

8.2.1.4. Cryogenic & Gas Tanks

8.2.1.5. Swap Body Tank

8.3. Middle East & Africa ISO Tank Container Market Outlook, by End-use Industry, Value (US$ Bn), 2018 - 2030

8.3.1. Key Highlights

8.3.1.1. Chemicals

8.3.1.2. Petrochemicals

8.3.1.3. Food & Beverage

8.3.1.4. Pharmaceuticals

8.3.1.5. Industrial Gas

8.3.1.6. Others (Paints)

8.3.2. BPS Analysis/Market Attractiveness Analysis

8.4. Middle East & Africa ISO Tank Container Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

8.4.1. Key Highlights

8.4.1.1. GCC ISO Tank Container Market by Transport Mode, Value (US$ Bn), 2018 - 2030

8.4.1.2. GCC ISO Tank Container Market Container Type, Value (US$ Bn), 2018 - 2030

8.4.1.3. GCC ISO Tank Container Market End-use Industry, Value (US$ Bn), 2018 - 2030

8.4.1.4. South Africa ISO Tank Container Market by Transport Mode, Value (US$ Bn), 2018 - 2030

8.4.1.5. South Africa ISO Tank Container Market Container Type, Value (US$ Bn), 2018 - 2030

8.4.1.6. South Africa ISO Tank Container Market End-use Industry, Value (US$ Bn), 2018 - 2030

8.4.1.7. Egypt ISO Tank Container Market by Transport Mode, Value (US$ Bn), 2018 - 2030

8.4.1.8. Egypt ISO Tank Container Market Container Type, Value (US$ Bn), 2018 - 2030

8.4.1.9. Egypt ISO Tank Container Market End-use Industry, Value (US$ Bn), 2018 - 2030

8.4.1.10. Nigeria ISO Tank Container Market by Transport Mode, Value (US$ Bn), 2018 - 2030

8.4.1.11. Nigeria ISO Tank Container Market Container Type, Value (US$ Bn), 2018 - 2030

8.4.1.12. Nigeria ISO Tank Container Market End-use Industry, Value (US$ Bn), 2018 - 2030

8.4.1.13. Rest of Middle East & Africa ISO Tank Container Market by Transport Mode, Value (US$ Bn), 2018 - 2030

8.4.1.14. Rest of Middle East & Africa ISO Tank Container Market Container Type, Value (US$ Bn), 2018 - 2030

8.4.1.15. Rest of Middle East & Africa ISO Tank Container Market End-use Industry, Value (US$ Bn), 2018 - 2030

8.4.2. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. End-use Industry vs Application Heatmap

9.2. Manufacturer vs Application Heatmap

9.3. Company Market Share Analysis, 2022

9.4. Competitive Dashboard

9.5. Company Profiles

9.5.1. Hoover Ferguson Group

9.5.1.1. Company Overview

9.5.1.2. Product Portfolio

9.5.1.3. Financial Overview

9.5.1.4. Business Strategies and Development

9.5.2. Stolt Tank Containers

9.5.2.1. Company Overview

9.5.2.2. Product Portfolio

9.5.2.3. Financial Overview

9.5.2.4. Business Strategies and Development

9.5.3. Welfit Oddy

9.5.3.1. Company Overview

9.5.3.2. Product Portfolio

9.5.3.3. Financial Overview

9.5.3.4. Business Strategies and Development

9.5.4. CXIC Group

9.5.4.1. Company Overview

9.5.4.2. Product Portfolio

9.5.4.3. Financial Overview

9.5.4.4. Business Strategies and Development

9.5.5. Bulkhaul Ltd.

9.5.5.1. Company Overview

9.5.5.2. Product Portfolio

9.5.5.3. Financial Overview

9.5.5.4. Business Strategies and Development

9.5.6. Singamas Container Holdings

9.5.6.1. Company Overview

9.5.6.2. Product Portfolio

9.5.6.3. Financial Overview

9.5.6.4. Business Strategies and Development

9.5.7. Bertschi AG

9.5.7.1. Company Overview

9.5.7.2. Product Portfolio

9.5.7.3. Financial Overview

9.5.7.4. Business Strategies and Development

9.5.8. Seaco Global

9.5.8.1. Company Overview

9.5.8.2. Product Portfolio

9.5.8.3. Financial Overview

9.5.8.4. Business Strategies and Development

9.5.9. Nantong CIMC Tank Equipment Co., Ltd.

9.5.9.1. Company Overview

9.5.9.2. Product Portfolio

9.5.9.3. Financial Overview

9.5.9.4. Business Strategies and Development

9.5.10. Eurotainer

9.5.10.1. Company Overview

9.5.10.2. Product Portfolio

9.5.10.3. Financial Overview

9.5.10.4. Business Strategies and Development

9.5.11. Raffles Lease Pte. Ltd.

9.5.11.1. Company Overview

9.5.11.2. Product Portfolio

9.5.11.3. Financial Overview

9.5.11.4. Business Strategies and Development

9.5.12. Suretank Group

9.5.12.1. Company Overview

9.5.12.2. Product Portfolio

9.5.12.3. Financial Overview

9.5.12.4. Business Strategies and Development

9.5.13. Tankformator

9.5.13.1. Company Overview

9.5.13.2. Product Portfolio

9.5.13.3. Financial Overview

9.5.13.4. Business Strategies and Development

9.5.14. Klinge Corporation

9.5.14.1. Company Overview

9.5.14.2. Product Portfolio

9.5.14.3. Financial Overview

9.5.14.4. Business Strategies and Development

9.5.15. Uralcryomash

9.5.15.1. Company Overview

9.5.15.2. Product Portfolio

9.5.15.3. Financial Overview

9.5.15.4. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2022 |

|

2018 - 2022 |

2023 - 2030 |

Value: US$ Million |

||

|

REPORT FEATURES |

DETAILS |

|

Transport Mode Coverage |

|

|

Container Type Coverage |

|

|

End-use Industry Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |