Global IV Tubing Sets and Accessories Market Forecast

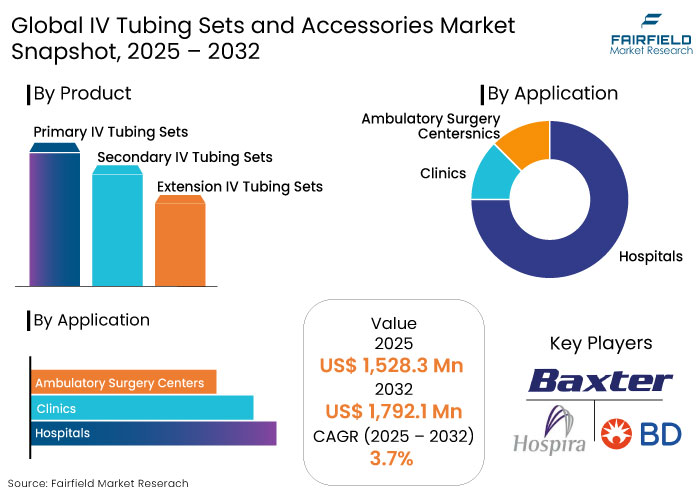

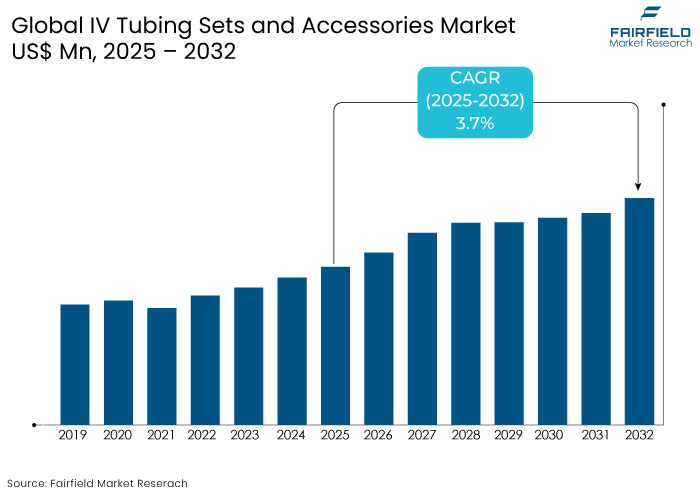

- The IV tubing sets and accessories market is projected to reach a size of US$ 1.7 Bn by 2032 from US$ 1.5 Bn estimated in 2025.

- The market for IV tubing sets and accessories is likely to show a significant CAGR of 3.7% from 2025 to 2032.

IV Tubing Sets and Accessories Market Insights

- Increasing incidence of chronic illnesses like cancer, diabetes, and cardiovascular diseases fuels demand for IV tubing systems globally.

- Innovations like antimicrobial coatings, air-eliminating filters, and smart infusion pumps boost product adoption in hospitals and home care.

- Rising preference for home-based IV therapies creates significant demand for portable and user-friendly IV tubing sets and accessories.

- North America is set to lead amid innovative healthcare infrastructure, followed by Europe, which emphasizes stringent safety standards.

- A growing elderly demographic worldwide is boosting the need for long-term intravenous therapies.

- Development of healthcare infrastructure in Latin America and Africa presents untapped opportunities for key players in the IV tubing sets and accessories market.

- The COVID-19 pandemic significantly boosted the market as hospitals and clinics required more tubing sets for respiratory and intravenous treatments.

- Launch of smart tubing sets with integrated sensors is anticipated to create new growth opportunities.

Key Growth Determinants

- Rising Prevalence of Renal Disorders and Diabetes to Augment Demand

The global rise in chronic diseases is a key driver for the IV tubing sets and accessories market. Conditions such as diabetes, cancer, cardiovascular diseases, and renal disorders often require ongoing intravenous (IV) therapy to administer essential treatments like hydration, medications, or nutritional support.

Increasing incidence of these diseases is closely linked to aging populations and lifestyle factors, such as poor diet, lack of exercise, and increased stress levels. According to the World Health Organization (WHO), chronic diseases are responsible for over 70% of global deaths annually, with cardiovascular diseases alone accounting for 17.9 million deaths per year. Such alarming statistics highlight the critical need for innovative healthcare solutions to manage these conditions effectively.

- Surging Preference for Home Healthcare Owing to High Affordability

Growing preference for home healthcare due to cost efficiency and convenience is a key driver for the IV tubing sets and accessories market. As more patients opt for at-home intravenous therapies, such as hydration, antibiotic administration, or chemotherapy, demand for portable and user-friendly IV tubing systems has surged.

Technological developments that make IV therapy safe and easy to manage outside hospital settings further support this trend. The rise in outpatient care facilities and supportive insurance policies has encouraged the shift toward home-based care.

Key Growth Barriers

- Stringent Regulatory Requirements for IV Tubing Sets

One of the primary restraints for the IV tubing sets and accessories market is the stringent regulatory landscape. Medical devices, including tubing sets, are subject to rigorous standards and approvals from agencies such as the FDA in the U.S. and the EMA in Europe. These regulations are implemented to ensure patient safety. However, these can pose significant challenges for manufacturers.

The lengthy approval processes, coupled with the need for extensive clinical testing, can delay the introduction of new products to the market. The high costs associated with compliance can be a barrier, especially for small-scale companies. These regulatory hurdles may limit innovation and slow market growth as manufacturers must navigate complex requirements before bringing their products to market.

IV Tubing Sets and Accessories Market Trends and Opportunities

- Emergence of Smart Tubing Systems to Obtain Real-time Information

A significant trend in the IV tubing sets and accessories market is the rising adoption of smart tubing systems. Such innovative systems integrate sensors and monitoring technologies into traditional tubing sets, providing real-time data on fluid flow, pressure, and other critical parameters.

The innovation is driven by rising demand for enhanced patient safety and treatment efficacy. Smart tubing systems offer several benefits, including early detection of issues such as blockages or leaks as well as the ability to monitor patient responses accurately. This real-time data enables healthcare providers to make more informed decisions and adjust treatments promptly, improving patient outcomes.

- Launch of Antimicrobial-coated Tubing to Reduce Risks of HAIs

The healthcare industry’s emphasis on reducing Hospital-Acquired Infections (HAIs) and improving patient safety is a transformative opportunity for the IV tubing sets and accessories market. Innovations such as antimicrobial-coated tubing, closed system connectors, and air-eliminating filters address critical infection risks associated with IV therapy. Unique safety features are significant in high-risk environments like Intensive Care Units (ICUs) and oncology wards.

Regulatory mandates and guidelines promoting infection-prevention technologies further drive the adoption of novel IV tubing sets. By prioritizing safety, manufacturers can differentiate their products and cater to the increasing demand for infection-resistant solutions in hospital and homecare settings.

Segments Covered in the Report

- Primary IV Tubing Sets to Lead Amid Enhancements in Product Design

The dominance of primary IV tubing sets is mainly attributed to their key role in several medical operations, constant improvements in product design and materials, and their cost-effectiveness. This segment is estimated to account for 32% of market share in 2025.

The importance of primary IV tubing sets in acute and chronic care settings highlights their importance. In emergency care, these help facilitate the prompt delivery of significant drugs and fluids. In the field of chronic care, these enable the administration of long-term treatments for illnesses such as cancer, in which patients necessitate frequent infusions of chemotherapy medications.

Primary Intravenous (IV) tubing sets are comparatively cost-effective in comparison to specialist IV accessories and complex medical devices. Their cost-effectiveness is a vital consideration, particularly in hospital settings with limited resources.

Hospitals and clinics can get these vital supplies in bulk without incurring substantial financial burden, guaranteeing their availability for a range of medical treatments. Their cost and crucial patient care function are key factors contributing to their significant market share.

- Peripheral Intravenous Catheter Insertion Application to Dominate the Market

The peripheral intravenous catheter insertion segment dominates the market, which is primarily attributed to its extensive utilization across different medical settings, changing catheter design, and growing acceptance of minimally invasive procedures. Progress in technology has resulted in the development of peripheral IV catheters that have been enhanced in terms of their designs and materials, thereby improving patient safety and comfort. Modern catheters are made using biocompatible materials, which effectively decrease the likelihood of phlebitis and other associated issues.

New developments, such as closed-system intravenous catheters equipped with integrated safety characteristics like needleless connectors and anti-reflux valves effectively reduce the likelihood of infections and needle-stick accidents. Becton Dickinson (BD) and Smiths Medical have created innovative peripheral IV catheters with integrated safety features, resulting in improved clinical outcomes and stimulating market growth.

Regional Analysis

- North America Remains Lucrative with Increasing Investments in Healthcare Infrastructure

North America dominates the IV tubing sets and accessories market and is set to hold a 45% share in 2025, driven by its novel healthcare infrastructure and high healthcare expenditure. The region’s significant burden of chronic diseases, including diabetes, cancer, and cardiovascular conditions, has created a rising demand for intravenous therapies.

The aging population, which constitutes a considerable portion of healthcare consumers, further boosts the need for IV tubing systems to administer medications, hydration, and nutritional support. Increasing trend of outpatient care and home-based therapies has also amplified the demand for portable and user-friendly IV tubing solutions.

The region’s stringent regulatory standards prioritize patient safety, augmenting the adoption of high-quality and infection-resistant products. North America remains a lucrative market, with continuous investments in healthcare infrastructure ensuring sustained growth. The U.S. leads the region, followed by Canada, where healthcare accessibility and spending further support market growth.

- Europe Sees Steady Growth with Launch of Closed System Connectors

Europe accounts for a substantial share of the IV tubing sets and accessories market, driven by the region's strong focus on patient safety. Increasing prevalence of chronic diseases, particularly among the aging population, has significantly contributed to the demand for IV therapies.

Europe's stringent regulatory frameworks and healthcare policies emphasize infection prevention and high-quality standards, encouraging the widespread adoption of innovative IV tubing systems with features like antimicrobial coatings and closed system connectors.

The regional market further benefits from extensive healthcare investments and research initiatives across leading countries such as Germany, France, and the U.K. Expansion of home healthcare services and outpatient care facilities has increased the demand for portable and user-friendly IV tubing accessories. These solutions align with Europe's rising focus on cost-efficient and patient-centric care models.

Fairfield’s Competitive Landscape Analysis

The presence of several key players, including global medical device manufacturers and specialized suppliers, characterizes the competitive landscape of the IV tubing sets and accessories market. Leading companies like Medtronic, Baxter International, and B. Braun dominate the market with a broad portfolio of products and extensive distribution networks.

Key players invest heavily in research and development to innovate and enhance product performance, such as developing smart tubing systems and using novel materials. A few other companies are increasingly engaging in strategic partnerships, mergers, and acquisitions to broaden their market presence and leverage complementary strengths, thereby intensifying the competitive dynamics in the industry.

Key Market Companies

- Baxter International Inc.

- Hospira Inc. (Pfizer Inc.)

- Becton, Dickinson Company (CareFusion)

- B. Braun Melsungen AG

- Fresenius Kabi AG

- Smiths Medical

- C.R. Bard, Inc.

- ICU Medical Inc.

- Zyno Medical

- Nipro Corporation

- Poly Medicure Ltd.

- Vygon U.S.A

- Health Line International Corporation

- Perfect Medical Ind. Co., Ltd

- Dynarex Corporation

Recent Industry Developments

- In May 2024, Braun Medical Inc. introduced the B Braun Primary IV Administration Set, which features an 85-inch tubing solution and a drip rate of 15 drops per milliliter.

- In January 2024, Convatec Group Plc extended its Neria Guard subcutaneous infusion set for Parkinson's disease patients. The all-in-one infusion set links to a pump and the user's infusion site as well as provides automated insertion with a simple button press, facilitating usage for patients with limited hand coordination.

Global IV Tubing Sets and Accessories Market is Segmented as-

By Product

- Primary IV Tubing Sets

- Secondary IV Tubing Sets

- Extension IV Tubing Sets

By Application

- Peripheral Intravenous Catheter Insertion

- Central Venous Catheter Placement

- PICC Line Insertion

By End Use

- Hospitals

- Clinics

- Ambulatory Surgery Centers

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- The Middle East & Africa

1. Executive Summary

1.1. Global IV Tubing Sets and Accessories Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2025

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. COVID-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Global IV Tubing Sets and Accessories Market Outlook, 2019 - 2032

3.1. Global IV Tubing Sets and Accessories Market Outlook, by Product, Value (US$ Bn) and Volume (Units), 2019 - 2032

3.1.1. Key Highlights

3.1.1.1. Primary IV Tubing Sets

3.1.1.2. Secondary IV Tubing Sets

3.1.1.3. Extension IV Tubing Sets

3.2. Global IV Tubing Sets and Accessories Market Outlook, by Application, Value (US$ Bn) and Volume (Units), 2019 - 2032

3.2.1. Key Highlights

3.2.1.1. Peripheral Intravenous Catheter Insertion

3.2.1.2. Central Venous Catheter Placement

3.2.1.3. PICC Line Insertion

3.3. Global IV Tubing Sets and Accessories Market Outlook, by End Use, Value (US$ Bn) and Volume (Units), 2019 - 2032

3.3.1. Key Highlights

3.3.1.1. Hospitals

3.3.1.2. Clinics

3.3.1.3. Ambulatory Surgery Centers

3.4. Global IV Tubing Sets and Accessories Market Outlook, by Region, Value (US$ Bn) and Volume (Units), 2019 - 2032

3.4.1. Key Highlights

3.4.1.1. North America

3.4.1.2. Europe

3.4.1.3. Asia Pacific

3.4.1.4. Latin America

3.4.1.5. Middle East & Africa

4. North America IV Tubing Sets and Accessories Market Outlook, 2019 - 2032

4.1. North America IV Tubing Sets and Accessories Market Outlook, by Product, Value (US$ Bn) and Volume (Units), 2019 - 2032

4.1.1. Key Highlights

4.1.1.1. Primary IV Tubing Sets

4.1.1.2. Secondary IV Tubing Sets

4.1.1.3. Extension IV Tubing Sets

4.2. North America IV Tubing Sets and Accessories Market Outlook, by Application, Value (US$ Bn) and Volume (Units), 2019 - 2032

4.2.1. Key Highlights

4.2.1.1. Peripheral Intravenous Catheter Insertion

4.2.1.2. Central Venous Catheter Placement

4.2.1.3. PICC Line Insertion

4.3. North America IV Tubing Sets and Accessories Market Outlook, by End Use, Value (US$ Bn) and Volume (Units), 2019 - 2032

4.3.1. Key Highlights

4.3.1.1. Hospitals

4.3.1.2. Clinics

4.3.1.3. Ambulatory Surgery Centers

4.3.2. BPS Analysis/Market Attractiveness Analysis

4.4. North America IV Tubing Sets and Accessories Market Outlook, by Country, Value (US$ Bn) and Volume (Units), 2019 - 2032

4.4.1. Key Highlights

4.4.1.1. U.S. IV Tubing Sets and Accessories Market by Product, Value (US$ Bn) and Volume (Units), 2019 - 2032

4.4.1.2. U.S. IV Tubing Sets and Accessories Market by Application, Value (US$ Bn) and Volume (Units), 2019 - 2032

4.4.1.3. U.S. IV Tubing Sets and Accessories Market by Material, Value (US$ Bn) and Volume (Units), 2019 - 2032

4.4.1.4. U.S. IV Tubing Sets and Accessories Market by End Use, Value (US$ Bn) and Volume (Units), 2019 - 2032

4.4.1.5. Canada IV Tubing Sets and Accessories Market by Product, Value (US$ Bn) and Volume (Units), 2019 - 2032

4.4.1.6. Canada IV Tubing Sets and Accessories Market by Application, Value (US$ Bn) and Volume (Units), 2019 - 2032

4.4.1.7. Canada IV Tubing Sets and Accessories Market by Material, Value (US$ Bn) and Volume (Units), 2019 - 2032

4.4.1.8. Canada IV Tubing Sets and Accessories Market by End Use, Value (US$ Bn) and Volume (Units), 2019 - 2032

4.4.2. BPS Analysis/Market Attractiveness Analysis

5. Europe IV Tubing Sets and Accessories Market Outlook, 2019 - 2032

5.1. Europe IV Tubing Sets and Accessories Market Outlook, by Product, Value (US$ Bn) and Volume (Units), 2019 - 2032

5.1.1. Key Highlights

5.1.1.1. Primary IV Tubing Sets

5.1.1.2. Secondary IV Tubing Sets

5.1.1.3. Extension IV Tubing Sets

5.2. Europe IV Tubing Sets and Accessories Market Outlook, by Application, Value (US$ Bn) and Volume (Units), 2019 - 2032

5.2.1. Key Highlights

5.2.1.1. Peripheral Intravenous Catheter Insertion

5.2.1.2. Central Venous Catheter Placement

5.2.1.3. PICC Line Insertion

5.3. Europe IV Tubing Sets and Accessories Market Outlook, by End Use, Value (US$ Bn) and Volume (Units), 2019 - 2032

5.3.1. Key Highlights

5.3.1.1. Hospitals

5.3.1.2. Clinics

5.3.1.3. Ambulatory Surgery Centers

5.3.2. BPS Analysis/Market Attractiveness Analysis

5.4. Europe IV Tubing Sets and Accessories Market Outlook, by Country, Value (US$ Bn) and Volume (Units), 2019 - 2032

5.4.1. Key Highlights

5.4.1.1. Germany IV Tubing Sets and Accessories Market by Product, Value (US$ Bn) and Volume (Units), 2019 - 2032

5.4.1.2. Germany IV Tubing Sets and Accessories Market by Application, Value (US$ Bn) and Volume (Units), 2019 - 2032

5.4.1.3. Germany IV Tubing Sets and Accessories Market by Material, Value (US$ Bn) and Volume (Units), 2019 - 2032

5.4.1.4. Germany IV Tubing Sets and Accessories Market by End Use, Value (US$ Bn) and Volume (Units), 2019 - 2032

5.4.1.5. U.K. IV Tubing Sets and Accessories Market by Product, Value (US$ Bn) and Volume (Units), 2019 - 2032

5.4.1.6. U.K. IV Tubing Sets and Accessories Market by Application, Value (US$ Bn) and Volume (Units), 2019 - 2032

5.4.1.7. U.K. IV Tubing Sets and Accessories Market by Material, Value (US$ Bn) and Volume (Units), 2019 - 2032

5.4.1.8. U.K. IV Tubing Sets and Accessories Market by End Use, Value (US$ Bn) and Volume (Units), 2019 - 2032

5.4.1.9. France IV Tubing Sets and Accessories Market by Product, Value (US$ Bn) and Volume (Units), 2019 - 2032

5.4.1.10. France IV Tubing Sets and Accessories Market by Application, Value (US$ Bn) and Volume (Units), 2019 - 2032

5.4.1.11. France IV Tubing Sets and Accessories Market by Material, Value (US$ Bn) and Volume (Units), 2019 - 2032

5.4.1.12. France IV Tubing Sets and Accessories Market by End Use, Value (US$ Bn) and Volume (Units), 2019 - 2032

5.4.1.13. Italy IV Tubing Sets and Accessories Market by Product, Value (US$ Bn) and Volume (Units), 2019 - 2032

5.4.1.14. Italy IV Tubing Sets and Accessories Market by Application, Value (US$ Bn) and Volume (Units), 2019 - 2032

5.4.1.15. Italy IV Tubing Sets and Accessories Market by Material, Value (US$ Bn) and Volume (Units), 2019 - 2032

5.4.1.16. Italy IV Tubing Sets and Accessories Market by End Use, Value (US$ Bn) and Volume (Units), 2019 - 2032

5.4.1.17. Turkey IV Tubing Sets and Accessories Market by Product, Value (US$ Bn) and Volume (Units), 2019 - 2032

5.4.1.18. Turkey IV Tubing Sets and Accessories Market by Application, Value (US$ Bn) and Volume (Units), 2019 - 2032

5.4.1.19. Turkey IV Tubing Sets and Accessories Market by Material, Value (US$ Bn) and Volume (Units), 2019 - 2032

5.4.1.20. Turkey IV Tubing Sets and Accessories Market by End Use, Value (US$ Bn) and Volume (Units), 2019 - 2032

5.4.1.21. Russia IV Tubing Sets and Accessories Market by Product, Value (US$ Bn) and Volume (Units), 2019 - 2032

5.4.1.22. Russia IV Tubing Sets and Accessories Market by Application, Value (US$ Bn) and Volume (Units), 2019 - 2032

5.4.1.23. Russia IV Tubing Sets and Accessories Market by Material, Value (US$ Bn) and Volume (Units), 2019 - 2032

5.4.1.24. Russia IV Tubing Sets and Accessories Market by End Use, Value (US$ Bn) and Volume (Units), 2019 - 2032

5.4.1.25. Rest of Europe IV Tubing Sets and Accessories Market by Product, Value (US$ Bn) and Volume (Units), 2019 - 2032

5.4.1.26. Rest of Europe IV Tubing Sets and Accessories Market by Application, Value (US$ Bn) and Volume (Units), 2019 - 2032

5.4.1.27. Rest of Europe IV Tubing Sets and Accessories Market by Material, Value (US$ Bn) and Volume (Units), 2019 - 2032

5.4.1.28. Rest of Europe IV Tubing Sets and Accessories Market by End Use, Value (US$ Bn) and Volume (Units), 2019 - 2032

5.4.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific IV Tubing Sets and Accessories Market Outlook, 2019 - 2032

6.1. Asia Pacific IV Tubing Sets and Accessories Market Outlook, by Product, Value (US$ Bn) and Volume (Units), 2019 - 2032

6.1.1. Key Highlights

6.1.1.1. Primary IV Tubing Sets

6.1.1.2. Secondary IV Tubing Sets

6.1.1.3. Extension IV Tubing Sets

6.2. Asia Pacific IV Tubing Sets and Accessories Market Outlook, by Application, Value (US$ Bn) and Volume (Units), 2019 - 2032

6.2.1. Key Highlights

6.2.1.1. Peripheral Intravenous Catheter Insertion

6.2.1.2. Central Venous Catheter Placement

6.2.1.3. PICC Line Insertion

6.3. Asia Pacific IV Tubing Sets and Accessories Market Outlook, by End Use, Value (US$ Bn) and Volume (Units), 2019 - 2032

6.3.1. Key Highlights

6.3.1.1. Hospitals

6.3.1.2. Clinics

6.3.1.3. Ambulatory Surgery Centers

6.3.2. BPS Analysis/Market Attractiveness Analysis

6.4. Asia Pacific IV Tubing Sets and Accessories Market Outlook, by Country, Value (US$ Bn) and Volume (Units), 2019 - 2032

6.4.1. Key Highlights

6.4.1.1. China IV Tubing Sets and Accessories Market by Product, Value (US$ Bn) and Volume (Units), 2019 - 2032

6.4.1.2. China IV Tubing Sets and Accessories Market by Application, Value (US$ Bn) and Volume (Units), 2019 - 2032

6.4.1.3. China IV Tubing Sets and Accessories Market by Material, Value (US$ Bn) and Volume (Units), 2019 - 2032

6.4.1.4. China IV Tubing Sets and Accessories Market by End Use, Value (US$ Bn) and Volume (Units), 2019 - 2032

6.4.1.5. Japan IV Tubing Sets and Accessories Market by Product, Value (US$ Bn) and Volume (Units), 2019 - 2032

6.4.1.6. Japan IV Tubing Sets and Accessories Market by Application, Value (US$ Bn) and Volume (Units), 2019 - 2032

6.4.1.7. Japan IV Tubing Sets and Accessories Market by Material, Value (US$ Bn) and Volume (Units), 2019 - 2032

6.4.1.8. Japan IV Tubing Sets and Accessories Market by End Use, Value (US$ Bn) and Volume (Units), 2019 - 2032

6.4.1.9. South Korea IV Tubing Sets and Accessories Market by Product, Value (US$ Bn) and Volume (Units), 2019 - 2032

6.4.1.10. South Korea IV Tubing Sets and Accessories Market by Application, Value (US$ Bn) and Volume (Units), 2019 - 2032

6.4.1.11. South Korea IV Tubing Sets and Accessories Market by Material, Value (US$ Bn) and Volume (Units), 2019 - 2032

6.4.1.12. South Korea IV Tubing Sets and Accessories Market by End Use, Value (US$ Bn) and Volume (Units), 2019 - 2032

6.4.1.13. India IV Tubing Sets and Accessories Market by Product, Value (US$ Bn) and Volume (Units), 2019 - 2032

6.4.1.14. India IV Tubing Sets and Accessories Market by Application, Value (US$ Bn) and Volume (Units), 2019 - 2032

6.4.1.15. India IV Tubing Sets and Accessories Market by Material, Value (US$ Bn) and Volume (Units), 2019 - 2032

6.4.1.16. India IV Tubing Sets and Accessories Market by End Use, Value (US$ Bn) and Volume (Units), 2019 - 2032

6.4.1.17. Southeast Asia IV Tubing Sets and Accessories Market by Product, Value (US$ Bn) and Volume (Units), 2019 - 2032

6.4.1.18. Southeast Asia IV Tubing Sets and Accessories Market by Application, Value (US$ Bn) and Volume (Units), 2019 - 2032

6.4.1.19. Southeast Asia IV Tubing Sets and Accessories Market by Material, Value (US$ Bn) and Volume (Units), 2019 - 2032

6.4.1.20. Southeast Asia IV Tubing Sets and Accessories Market by End Use, Value (US$ Bn) and Volume (Units), 2019 - 2032

6.4.1.21. Rest of Asia Pacific IV Tubing Sets and Accessories Market by Product, Value (US$ Bn) and Volume (Units), 2019 - 2032

6.4.1.22. Rest of Asia Pacific IV Tubing Sets and Accessories Market by Application, Value (US$ Bn) and Volume (Units), 2019 - 2032

6.4.1.23. Rest of Asia Pacific IV Tubing Sets and Accessories Market by Material, Value (US$ Bn) and Volume (Units), 2019 - 2032

6.4.1.24. Rest of Asia Pacific IV Tubing Sets and Accessories Market by End Use, Value (US$ Bn) and Volume (Units), 2019 - 2032

6.4.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America IV Tubing Sets and Accessories Market Outlook, 2019 - 2032

7.1. Latin America IV Tubing Sets and Accessories Market Outlook, by Product, Value (US$ Bn) and Volume (Units), 2019 - 2032

7.1.1. Key Highlights

7.1.1.1. Primary IV Tubing Sets

7.1.1.2. Secondary IV Tubing Sets

7.1.1.3. Extension IV Tubing Sets

7.2. Latin America IV Tubing Sets and Accessories Market Outlook, by Application, Value (US$ Bn) and Volume (Units), 2019 - 2032

7.2.1. Key Highlights

7.2.1.1. Peripheral Intravenous Catheter Insertion

7.2.1.2. Central Venous Catheter Placement

7.2.1.3. PICC Line Insertion

7.3. Latin America IV Tubing Sets and Accessories Market Outlook, by End Use, Value (US$ Bn) and Volume (Units), 2019 - 2032

7.3.1. Key Highlights

7.3.1.1. Hospitals

7.3.1.2. Clinics

7.3.1.3. Ambulatory Surgery Centers

7.3.2. BPS Analysis/Market Attractiveness Analysis

7.4. Latin America IV Tubing Sets and Accessories Market Outlook, by Country, Value (US$ Bn) and Volume (Units), 2019 - 2032

7.4.1. Key Highlights

7.4.1.1. Brazil IV Tubing Sets and Accessories Market by Product, Value (US$ Bn) and Volume (Units), 2019 - 2032

7.4.1.2. Brazil IV Tubing Sets and Accessories Market by Application, Value (US$ Bn) and Volume (Units), 2019 - 2032

7.4.1.3. Brazil IV Tubing Sets and Accessories Market by Material, Value (US$ Bn) and Volume (Units), 2019 - 2032

7.4.1.4. Brazil IV Tubing Sets and Accessories Market by End Use, Value (US$ Bn) and Volume (Units), 2019 - 2032

7.4.1.5. Mexico IV Tubing Sets and Accessories Market by Product, Value (US$ Bn) and Volume (Units), 2019 - 2032

7.4.1.6. Mexico IV Tubing Sets and Accessories Market by Application, Value (US$ Bn) and Volume (Units), 2019 - 2032

7.4.1.7. Mexico IV Tubing Sets and Accessories Market by Material, Value (US$ Bn) and Volume (Units), 2019 - 2032

7.4.1.8. Mexico IV Tubing Sets and Accessories Market by End Use, Value (US$ Bn) and Volume (Units), 2019 - 2032

7.4.1.9. Argentina IV Tubing Sets and Accessories Market by Product, Value (US$ Bn) and Volume (Units), 2019 - 2032

7.4.1.10. Argentina IV Tubing Sets and Accessories Market by Application, Value (US$ Bn) and Volume (Units), 2019 - 2032

7.4.1.11. Argentina IV Tubing Sets and Accessories Market by Material, Value (US$ Bn) and Volume (Units), 2019 - 2032

7.4.1.12. Argentina IV Tubing Sets and Accessories Market by End Use, Value (US$ Bn) and Volume (Units), 2019 - 2032

7.4.1.13. Rest of Latin America IV Tubing Sets and Accessories Market by Product, Value (US$ Bn) and Volume (Units), 2019 - 2032

7.4.1.14. Rest of Latin America IV Tubing Sets and Accessories Market by Application, Value (US$ Bn) and Volume (Units), 2019 - 2032

7.4.1.15. Rest of Latin America IV Tubing Sets and Accessories Market by Material, Value (US$ Bn) and Volume (Units), 2019 - 2032

7.4.1.16. Rest of Latin America IV Tubing Sets and Accessories Market by End Use, Value (US$ Bn) and Volume (Units), 2019 - 2032

7.4.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa IV Tubing Sets and Accessories Market Outlook, 2019 - 2032

8.1. Middle East & Africa IV Tubing Sets and Accessories Market Outlook, by Product, Value (US$ Bn) and Volume (Units), 2019 - 2032

8.1.1. Key Highlights

8.1.1.1. Primary IV Tubing Sets

8.1.1.2. Secondary IV Tubing Sets

8.1.1.3. Extension IV Tubing Sets

8.2. Middle East & Africa IV Tubing Sets and Accessories Market Outlook, by Application, Value (US$ Bn) and Volume (Units), 2019 - 2032

8.2.1. Key Highlights

8.2.1.1. Peripheral Intravenous Catheter Insertion

8.2.1.2. Central Venous Catheter Placement

8.2.1.3. PICC Line Insertion

8.3. Middle East & Africa IV Tubing Sets and Accessories Market Outlook, by End Use, Value (US$ Bn) and Volume (Units), 2019 - 2032

8.3.1. Key Highlights

8.3.1.1. Hospitals

8.3.1.2. Clinics

8.3.1.3. Ambulatory Surgery Centers

8.3.2. BPS Analysis/Market Attractiveness Analysis

8.4. Middle East & Africa IV Tubing Sets and Accessories Market Outlook, by Country, Value (US$ Bn) and Volume (Units), 2019 - 2032

8.4.1. Key Highlights

8.4.1.1. GCC IV Tubing Sets and Accessories Market by Product, Value (US$ Bn) and Volume (Units), 2019 - 2032

8.4.1.2. GCC IV Tubing Sets and Accessories Market by Application, Value (US$ Bn) and Volume (Units), 2019 - 2032

8.4.1.3. GCC IV Tubing Sets and Accessories Market by Material, Value (US$ Bn) and Volume (Units), 2019 - 2032

8.4.1.4. GCC IV Tubing Sets and Accessories Market by End Use, Value (US$ Bn) and Volume (Units), 2019 - 2032

8.4.1.5. South Africa IV Tubing Sets and Accessories Market by Product, Value (US$ Bn) and Volume (Units), 2019 - 2032

8.4.1.6. South Africa IV Tubing Sets and Accessories Market by Application, Value (US$ Bn) and Volume (Units), 2019 - 2032

8.4.1.7. South Africa IV Tubing Sets and Accessories Market by Material, Value (US$ Bn) and Volume (Units), 2019 - 2032

8.4.1.8. South Africa IV Tubing Sets and Accessories Market by End Use, Value (US$ Bn) and Volume (Units), 2019 - 2032

8.4.1.9. Egypt IV Tubing Sets and Accessories Market by Product, Value (US$ Bn) and Volume (Units), 2019 - 2032

8.4.1.10. Egypt IV Tubing Sets and Accessories Market by Application, Value (US$ Bn) and Volume (Units), 2019 - 2032

8.4.1.11. Egypt IV Tubing Sets and Accessories Market by Material, Value (US$ Bn) and Volume (Units), 2019 - 2032

8.4.1.12. Egypt IV Tubing Sets and Accessories Market by End Use, Value (US$ Bn) and Volume (Units), 2019 - 2032

8.4.1.13. Nigeria IV Tubing Sets and Accessories Market by Product, Value (US$ Bn) and Volume (Units), 2019 - 2032

8.4.1.14. Nigeria IV Tubing Sets and Accessories Market by Application, Value (US$ Bn) and Volume (Units), 2019 - 2032

8.4.1.15. Nigeria IV Tubing Sets and Accessories Market by Material, Value (US$ Bn) and Volume (Units), 2019 - 2032

8.4.1.16. Nigeria IV Tubing Sets and Accessories Market by End Use, Value (US$ Bn) and Volume (Units), 2019 - 2032

8.4.1.17. Rest of Middle East & Africa IV Tubing Sets and Accessories Market by Product, Value (US$ Bn) and Volume (Units), 2019 - 2032

8.4.1.18. Rest of Middle East & Africa IV Tubing Sets and Accessories Market by Application, Value (US$ Bn) and Volume (Units), 2019 - 2032

8.4.1.19. Rest of Middle East & Africa IV Tubing Sets and Accessories Market by Material, Value (US$ Bn) and Volume (Units), 2019 - 2032

8.4.1.20. Rest of Middle East & Africa IV Tubing Sets and Accessories Market by End Use, Value (US$ Bn) and Volume (Units), 2019 - 2032

8.4.2. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. Manufacturer vs by Application Heat Map

9.2. Company Market Share Analysis, 2025

9.3. Competitive Dashboard

9.4. Company Profiles

9.4.1. Baxter International Inc.

9.4.1.1. Company Overview

9.4.1.2. Product Portfolio

9.4.1.3. Financial Overview

9.4.1.4. Business Strategies and Development

9.4.2. Hospira Inc. (Pfizer Inc.)

9.4.2.1. Company Overview

9.4.2.2. Product Portfolio

9.4.2.3. Financial Overview

9.4.2.4. Business Strategies and Development

9.4.3. Becton, Dickinson Company (CareFusion)

9.4.3.1. Company Overview

9.4.3.2. Product Portfolio

9.4.3.3. Financial Overview

9.4.3.4. Business Strategies and Development

9.4.4. B. Braun Melsungen AG

9.4.4.1. Company Overview

9.4.4.2. Product Portfolio

9.4.4.3. Financial Overview

9.4.4.4. Business Strategies and Development

9.4.5. Fresenius Kabi AG

9.4.5.1. Company Overview

9.4.5.2. Product Portfolio

9.4.5.3. Financial Overview

9.4.5.4. Business Strategies and Development

9.4.6. Smiths Medical

9.4.6.1. Company Overview

9.4.6.2. Product Portfolio

9.4.6.3. Financial Overview

9.4.6.4. Business Strategies and Development

9.4.7. C.R. Bard, Inc.

9.4.7.1. Company Overview

9.4.7.2. Product Portfolio

9.4.7.3. Financial Overview

9.4.7.4. Business Strategies and Development

9.4.8. ICU Medical Inc.

9.4.8.1. Company Overview

9.4.8.2. Product Portfolio

9.4.8.3. Financial Overview

9.4.8.4. Business Strategies and Development

9.4.9. Zyno Medical

9.4.9.1. Company Overview

9.4.9.2. Product Portfolio

9.4.9.3. Financial Overview

9.4.9.4. Business Strategies and Development

9.4.10. Nipro Corporation

9.4.10.1. Company Overview

9.4.10.2. Product Portfolio

9.4.10.3. Financial Overview

9.4.10.4. Business Strategies and Development

9.4.11. Poly Medicure Ltd.

9.4.11.1. Company Overview

9.4.11.2. Product Portfolio

9.4.11.3. Financial Overview

9.4.11.4. Business Strategies and Development

9.4.12. Vygon U.S.A

9.4.12.1. Company Overview

9.4.12.2. Product Portfolio

9.4.12.3. Financial Overview

9.4.12.4. Business Strategies and Development

9.4.13. Health Line International Corporation

9.4.13.1. Company Overview

9.4.13.2. Product Portfolio

9.4.13.3. Financial Overview

9.4.13.4. Business Strategies and Development

9.4.14. Perfect Medical Ind. Co., Ltd

9.4.14.1. Company Overview

9.4.14.2. Product Portfolio

9.4.14.3. Financial Overview

9.4.14.4. Business Strategies and Development

9.4.15. Dynarex Corporation

9.4.15.1. Company Overview

9.4.15.2. Product Portfolio

9.4.15.3. Financial Overview

9.4.15.4. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2023 |

|

2019 - 2023 |

2025 - 2032 |

Value: US$ Billion |

||

|

REPORT FEATURES |

DETAILS |

|

Product Coverage |

|

|

Application Coverage |

|

|

End Use Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2024), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |