Global Kava Root Extract Market Forecast

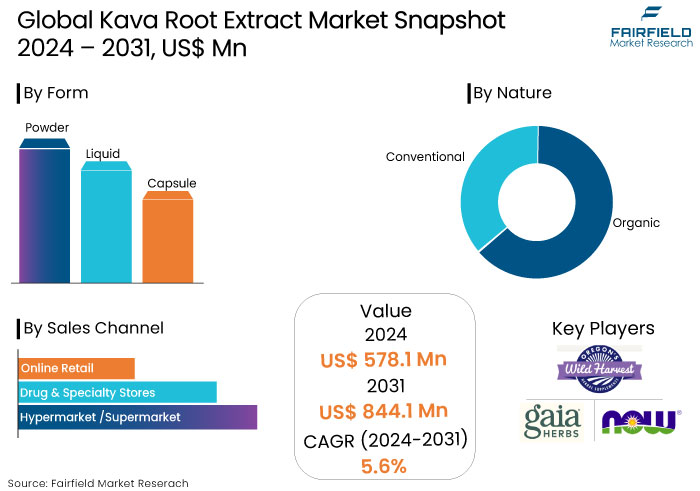

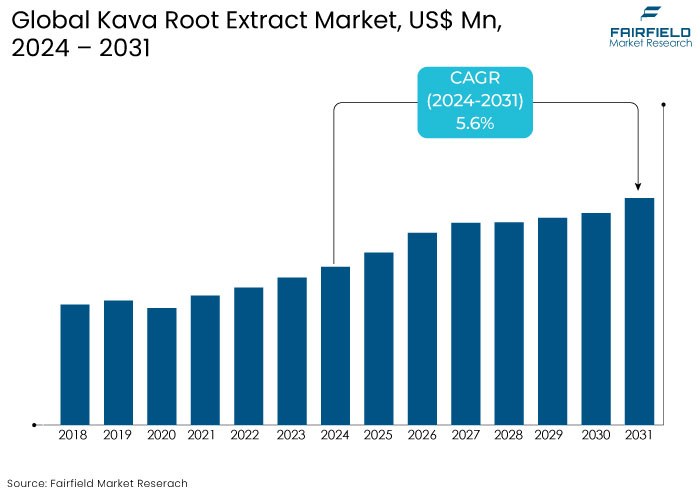

- The kava root extract market is projected to reach a valuation of US$844.1 Mn by 2031, showing significant growth from the US$578.1 Mn achieved in 2024.

- The market for kava root extract is estimated to showcase a CAGR of 5.6% during the period from 2024 to 2031.

Kava Root Extract Market Insights

- Rising consumer interest in natural stress and anxiety relief drives demand for kava root extract.

- Kava is gaining traction in supplements, functional beverages, and herbal wellness products.

- Powder form dominates, with growing interest in ready-to-drink kava beverages.

- High demand for organic kava, particularly in Europe and North America, aligns with consumer wellness trends.

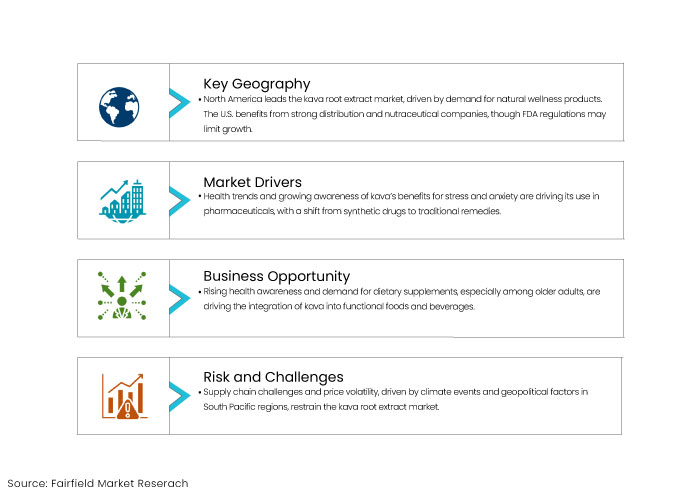

- North America leads the market, followed closely by Europe, while Asia Pacific shows strong growth potential.

- Environmental concerns and consumer preferences are crucial to sustainable sourcing and ethical production

- Increasing consumer preference for herbal remedies and natural wellness solutions fuels demand for Kava root extract.

A Look Back and a Look Forward - Comparative Analysis

The kava root extract market experienced a steady growth trajectory during the period from 2019 to 2023. Market growth primarily fueled by rising consumer interest in natural and plant-based supplements, as well as increasing awareness of Kava’s benefits for stress relief, anxiety reduction, and improved sleep.

Health and wellness trends fueled demand, especially in regions like North America and Europe, where consumers sought alternatives to synthetic relaxants. The expanding nutraceutical and herbal supplement sectors and Kava’s regulatory approval in various markets helped boost its popularity. However, regulatory challenges in specific regions and fluctuating raw material prices constrain broad market expansion.

The kava root extract market is anticipated to witness accelerated growth over the forecast period. The market growth is estimated to be driven by advancements in extraction technology, improved quality control, and rising consumer preference for traditional herbal remedies.

The global wellness trend is expected to sustain demand, particularly as consumers become more health-conscious and seek natural solutions for mental well-being. Expansion into new product forms, such as beverages and functional foods, and increasing penetration in emerging markets will likely fuel market growth.

Relaxing regulatory restrictions in some regions and investing in sustainable kava farming practices are expected to enhance supply stability, positioning the kava root extract market for robust growth in the coming years.

Key Growth Determinants

- Increasing Utilization in the Pharmaceutical Sector to Benefit the Market

The rising health and fitness trends among consumers have significantly propelled the expansion of the kava root extract market. The increasing health benefits of kava are leading to its growing use in the pharmaceutical industry to produce medical products.

The component is predominantly regarded as an herbal supplement with soothing properties that assist persons in managing stress and anxiety disorders. A global transition has occurred from synthetic drugs to traditional medicine, as the latter is perceived to be safer.

Herbal and traditional medicines remain the primary recourse for around 75-80% of the global population, particularly in underdeveloped nations. It is owing to the prevailing perception that herbal remedies are devoid of adverse effects and are cost-effective and readily accessible. The product is reportedly gaining favour as a nutraceutical component among pharmaceutical makers and health-conscious consumers.

- Increased Consumer Demand for Transparency and Traceability

Rising consumer awareness of body and health wellness supplements and their manufacturing has undergone an unforeseen transformation in recent years. Consumers are now understanding their consumption to optimize bodily function and enquire about ingredients, processing facilities, agricultural harvesting methods, and such topics.

Transparency and traceability fulfil consumers' demands for high-quality food products. The ethical standards of openness and traceability employed by firms enhance consumer awareness regarding product health advantages.

By differentiating products based on raw materials, freshness, anti-allergens, additives, and production procedures, transparency and traceability provide a means to select the most suitable product. The transparency and traceability of the supply chain have simplified its global complexity for customers.

Key Growth Barriers

- Fluctuating Raw Material Supply and Price Volatility

Supply chain challenges and price volatility restrain the kava root extract market. Kava is primarily grown in specific South Pacific regions, such as Fiji, Vanuatu, and Tonga, where climate conditions, agricultural practices, and geopolitical stability play significant roles in its production. Natural events such as cyclones and droughts, can disrupt the supply of kava roots, leading to reduced harvests and price spikes that affect global markets.

The demand for kava has risen sharply, putting pressure on supply chains and leading to competition among manufacturers, which drives prices up. Such fluctuations can impact production costs and lead to high end-consumer prices. Additionally, sustainable farming practices are limited, and without them, over-farming risks compromising kava quality and availability posing a restraint for companies aiming to meet rising demand.

- Regulatory and Safety Concerns

One significant restraint for the kava root extract market is the regulatory and safety scrutiny surrounding kava products. Kava has faced historical restrictions in several regions due to concerns over potential hepatotoxicity (liver toxicity), particularly with improper processing or excessive consumption.

Regulatory bodies such as the European Union and specific health agencies have imposed stringent standards or even temporary bans on kava imports in the past, influencing its market accessibility. Although many countries have lifted restrictions or established safety guidelines, ongoing health concerns create a cautious regulatory environment, which impacts market growth.

Consumer awareness of past safety issues may affect their willingness to purchase kava products, thereby slowing growth in regions where regulatory frameworks around herbal supplements are highly restrictive.

Kava Root Extract Market Trends and Opportunities

- Rapidly Expanding Supplements Sector to Enhance Growth

A healthy lifestyle is correlated with optimal sleep, exercise, and dietary choices, which also mitigates the danger of life-threatening diseases, hence affecting global consumer demand for dietary supplements to enhance overall well-being.

Supplement makers are targeting areas with an increasing elderly population and elevated adult consumption of dietary supplements to address their nutritional requirements. Moreover, the increasing trends in functional food consumption have prompted industry stakeholders to integrate kava into functional foods and beverages.

The market has gradually expanded in recent years due to the World Health Organization's (WHO) announcement affirming the safety of kava for ingestion. The roots have consequently been utilized to manufacture cosmetics, drinks, and dietary supplements.

- Evolving Consumer Preferences Enhance the Adoption of Kava Root Extract

The vulnerable disposition of customers has consistently influenced market dynamics. Consumers exercise considerable caution regarding supplements for mental health support. Such prudent health knowledge among customers is embracing pure and naturally derived supplements from kava root extracts.

The lack of genetically modified organisms, gluten, soy, and dairy in kava root-based goods is generating global consumer attention. The rising consumer desire for herbal supplements devoid of additives, preservatives, and chemicals conducive to mental well-being is anticipated to boost sales in the kava root extract market.

How Does Regulatory Scenario Shape the Industry?

The regulatory landscape is a critical factor shaping the growth and dynamics of the kava root extract market. In recent years, there has been a cautious shift in regulations, with several markets re-evaluating their stance on kava products after earlier restrictions were placed due to health concerns, particularly related to liver toxicity.

Countries in Europe, North America, and Asia Pacific have gradually introduced clear guidelines and safety standards, balancing the need for consumer protection with the growing demand for natural supplements.

Regulators are increasingly focusing on quality control, standardizing extraction methods, and ensuring that kava products meet safety thresholds, especially concerning the kava lactone compounds that can pose health risks if consumed in high quantities. This evolving regulatory clarity supports market expansion by enabling manufacturers to operate within defined safety parameters, enhancing consumer confidence.

There is potential for further regulatory relaxation as more evidence emerges supporting the therapeutic benefits of kava when used responsibly, However, compliance costs and ongoing scrutiny may still challenge companies, particularly in highly regulated markets, creating a dual impact on the kava root extract market.

Segments Covered in the Report

- Conventional Kava Root Extracts to Account for Notable Share

Considering the global kava root extract market, the conventional segment currently holds a dominant share, accounting for almost 65%. Conventional kava root extract production is more widespread due to lower production costs and established farming practices.

Conventional methods make kava more accessible to a broad consumer base, especially in regions where cost-sensitive consumers drive demand for affordable herbal supplements. However, organic kava root extract, which holds an estimated 35% market share, is experiencing rising demand as consumers become health-conscious and increasingly prefer products free from synthetic pesticides and fertilizers.

- Versatility Boosts Powdered Kava Extract Adoption

Powdered kava is favoured due to its versatility in various applications, ease of incorporation into dietary supplements, and traditional usage in beverages. Consumers often choose the powder form for its adaptability, allowing them to blend it into smoothies, teas, or functional drinks. Its popularity is also driven by cultural and traditional uses, especially in regions where kava is consumed in social settings.

Capsules are another form that consumers prefer for convenience, precise dosage, and ease of transport, making them popular in North America and Europe, where busy lifestyles and supplement routines drive demand. Further, the liquid form, although small in share, liquid kava extract is gaining traction due to its rapid absorption, making it appealing to users seeking quick relaxation effects. However, its growth is constrained by a short shelf life and higher production costs.

Regional Analysis

- North America’s Dominance Prevails in Kava Root Extract Market

North America holds a substantial share of the kava root extract market, primarily due to the high demand for natural health supplements, stress relief products, and herbal remedies. The U.S. is the largest contributor within this region, driven by consumers’ growing interest in plant-based solutions for mental wellness, relaxation, and sleep support.

The region also benefits from established distribution networks and the presence of leading nutraceutical companies that have incorporated kava into their product lines. However, stringent FDA regulations on dietary supplements require careful compliance by manufacturers, which can moderate growth.

The U.S. and Canada have well-developed nutraceutical industries, with established supply chains, research and development infrastructure, and a strong presence of major supplement companies. Leading companies are quick to innovate and incorporate trending ingredients like kava into their product lines, making kava more accessible to a wide consumer base.

The retail landscape in North America includes a variety of distribution channels, such as online platforms, health stores, and specialty supplement outlets, making kava products readily available and enhancing their reach.

- Europe Kava Root Extract Market to Stand out with Rise in Organic Foods Demand

Europe is another key region for kava root extract, where the market is gradually recovering and expanding after past regulatory restrictions in certain countries due to safety concerns. The demand for organic and natural products in countries such as Germany, France, and the U.K. is helping to boost kava’s popularity.

European consumers are increasingly inclined toward plant-based supplements and natural remedies, influenced by a strong cultural preference for holistic and sustainable wellness products. Kava, with its calming and anxiety-relieving properties, aligns well with this demand, particularly in countries like Germany, the U.K., France, and the Netherlands.

Consumers in the European region are particularly drawn to products that promote mental wellness and alternative stress-relief options, supporting market growth. However, the kava root extract market remains closely monitored by regulatory authorities, requiring companies to maintain strict quality standards.

Fairfield’s Competitive Landscape Analysis

The kava root extract market's competitive landscape includes a mix of established nutraceutical companies, specialty herbal supplement brands, and local suppliers primarily concentrated in the South Pacific.

Key players focus on product differentiation through organic certifications, high-quality sourcing, and diverse formulations such as powders, capsules, and liquid extracts. Companies increasingly invest in sustainable sourcing practices and supply chain transparency to meet rising consumer demand for organic and ethically produced kava.

Competitive strategies involve expanding product lines to include kava-infused functional beverages, targeting the growing wellness market. Brands also leverage partnerships with health-focused retailers and e-commerce channels for broader distribution. Market leaders emphasize safety, compliance, and consumer education to address past regulatory challenges and build trust with health-conscious consumers.

Key Market Companies

- Gaia Herbs

- Now Foods

- Natol, LLC

- Nature’s Answer

- Oregon’s Wild Harvest

- Kona Kava Farm

- Mountain Rose Herbs

- Eclectic Institute

- Natural Factors Nutritional Products Ltd

- Monsoon Beverages LLC

- Herb Pharm

- Kavafied

- Pure Mountain Botanicals

- Botany Evolution, LLC

- Fiji Kava Australia

- The Kava Roots

Recent Industry Developments

- In February 2024, Branded Legacy, Inc. allocated resources towards the study and development of innovative methods for the production of Kavalactones.

- January 2024, Mitra-9, a beverage manufacturing business, introduced the Kava 2.0 beverage, designed to promote relaxation among consumers. The beverage is offered in two formats: Seltzers and RelaxPaks, which is getting traction from consumers in the North American and European regions.

An Expert’s Eye

- The rising consumer preference for natural stress-relief supplements positions kava as a popular choice in the wellness sector.

- Increasing demand for convenient formats such as capsules and functional beverages is driving product diversification.

- Increased consumer focus on mental health and relaxation trends fuels market growth, particularly in North America and Europe.

- Continued investment in research and consumer education is crucial for addressing safety concerns and expanding market acceptance.

Global Kava Root Extract Market is Segmented as-

By Nature

- Organic

- Conventional

By Form

- Powder

- Liquid

- Capsule

By Sales Channel

- Hypermarket /Supermarket

- Drug & Specialty Stores

- Online Retail

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- The Middle East & Africa

1. Executive Summary

1.1. Global Kava Root Extract Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2024

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. COVID-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Production Output and Trade Statistics, 2019 - 2023

3.1. Global Kava Root Extract Production Output, by Region, Value (US$ Mn) and Volume (Tons), 2019 - 2023

3.1.1. North America

3.1.2. Europe

3.1.3. Asia Pacific

3.1.4. Latin America

3.1.5. Middle East and Africa

4. Price Analysis, 2024

4.1. Global Average Price Analysis, by Nature, US$ Per Tons, 2024

4.2. Prominent Factor Affecting Kava Root Extract Prices

4.3. Global Average Price Analysis, by Region, US$ Per Tons, 2024

5. Global Kava Root Extract Market Outlook, 2019 - 2031

5.1. Global Kava Root Extract Market Outlook, By Nature, Value (US$ Mn) and Volume (Tons), 2019 - 2031

5.1.1. Key Highlights

5.1.1.1. Conventional

5.1.1.2. Organic

5.2. Global Kava Root Extract Market Outlook, By Form, Value (US$ Mn) and Volume (Tons), 2019 - 2031

5.2.1. Key Highlights

5.2.1.1. Liquid

5.2.1.2. Powder

5.2.1.3. Capsule

5.3. Global Kava Root Extract Market Outlook, By Sales Channel, Value (US$ Mn) and Volume (Tons), 2019 - 2031

5.3.1. Key Highlights

5.3.1.1. Drug & Specialty Stores

5.3.1.2. Hypermarkets/Supermarkets

5.3.1.3. Online Retail

5.3.1.4. Others

5.4. Global Kava Root Extract Market Outlook, by Region, Value (US$ Mn) and Volume (Tons), 2019 - 2031

5.4.1. Key Highlights

5.4.1.1. North America

5.4.1.2. Europe

5.4.1.3. Asia Pacific

5.4.1.4. Latin America

5.4.1.5. Middle East & Africa

6. North America Kava Root Extract Market Outlook, 2019 - 2031

6.1. North America Kava Root Extract Market Outlook, By Nature, Value (US$ Mn) and Volume (Tons), 2019 - 2031

6.1.1. Key Highlights

6.1.1.1. Conventional

6.1.1.2. Organic

6.2. North America Kava Root Extract Market Outlook, By Form, Value (US$ Mn) and Volume (Tons), 2019 - 2031

6.2.1. Key Highlights

6.2.1.1. Liquid

6.2.1.2. Powder

6.2.1.3. Capsule

6.3. North America Kava Root Extract Market Outlook, By Sales Channel, Value (US$ Mn) and Volume (Tons), 2019 - 2031

6.3.1. Key Highlights

6.3.1.1. Drug & Specialty Stores

6.3.1.2. Hypermarkets/Supermarkets

6.3.1.3. Online Retail

6.3.1.4. Others

6.4. North America Kava Root Extract Market Outlook, by Country, Value (US$ Mn) and Volume (Tons), 2019 - 2031

6.4.1. Key Highlights

6.4.1.1. U.S. Kava Root Extract Market By Nature, Value (US$ Mn) and Volume (Tons), 2019 - 2031

6.4.1.2. U.S. Kava Root Extract Market By Form, Value (US$ Mn) and Volume (Tons), 2019 - 2031

6.4.1.3. U.S. Kava Root Extract Market By Sales Channel, Value (US$ Mn) and Volume (Tons), 2019 - 2031

6.4.1.4. Canada Kava Root Extract Market By Nature, Value (US$ Mn) and Volume (Tons), 2019 - 2031

6.4.1.5. Canada Kava Root Extract Market By Form, Value (US$ Mn) and Volume (Tons), 2019 - 2031

6.4.1.6. Canada Kava Root Extract Market By Sales Channel, Value (US$ Mn) and Volume (Tons), 2019 - 2031

6.4.2. BPS Analysis/Market Attractiveness Analysis

7. Europe Kava Root Extract Market Outlook, 2019 - 2031

7.1. Europe Kava Root Extract Market Outlook, By Nature, Value (US$ Mn) and Volume (Tons), 2019 - 2031

7.1.1. Key Highlights

7.1.1.1. Conventional

7.1.1.2. Organic

7.2. Europe Kava Root Extract Market Outlook, By Form, Value (US$ Mn) and Volume (Tons), 2019 - 2031

7.2.1. Key Highlights

7.2.1.1. Liquid

7.2.1.2. Powder

7.2.1.3. Capsule

7.3. Europe Kava Root Extract Market Outlook, By Sales Channel, Value (US$ Mn) and Volume (Tons), 2019 - 2031

7.3.1. Key Highlights

7.3.1.1. Drug & Specialty Stores

7.3.1.2. Hypermarkets/Supermarkets

7.3.1.3. Online Retail

7.3.1.4. Others

7.4. Europe Kava Root Extract Market Outlook, by Country, Value (US$ Mn) and Volume (Tons), 2019 - 2031

7.4.1. Key Highlights

7.4.1.1. Germany Kava Root Extract Market By Nature, Value (US$ Mn) and Volume (Tons), 2019 - 2031

7.4.1.2. Germany Kava Root Extract Market By Form, Value (US$ Mn) and Volume (Tons), 2019 - 2031

7.4.1.3. Germany Kava Root Extract Market By Sales Channel, Value (US$ Mn) and Volume (Tons), 2019 - 2031

7.4.1.4. U.K. Kava Root Extract Market By Nature, Value (US$ Mn) and Volume (Tons), 2019 - 2031

7.4.1.5. U.K. Kava Root Extract Market By Form, Value (US$ Mn) and Volume (Tons), 2019 - 2031

7.4.1.6. U.K. Kava Root Extract Market By Sales Channel, Value (US$ Mn) and Volume (Tons), 2019 - 2031

7.4.1.7. France Kava Root Extract Market By Nature, Value (US$ Mn) and Volume (Tons), 2019 - 2031

7.4.1.8. France Kava Root Extract Market By Form, Value (US$ Mn) and Volume (Tons), 2019 - 2031

7.4.1.9. France Kava Root Extract Market By Sales Channel, Value (US$ Mn) and Volume (Tons), 2019 - 2031

7.4.1.10. Italy Kava Root Extract Market By Nature, Value (US$ Mn) and Volume (Tons), 2019 - 2031

7.4.1.11. Italy Kava Root Extract Market By Form, Value (US$ Mn) and Volume (Tons), 2019 - 2031

7.4.1.12. Italy Kava Root Extract Market By Sales Channel, Value (US$ Mn) and Volume (Tons), 2019 - 2031

7.4.1.13. Türkiye Kava Root Extract Market By Nature, Value (US$ Mn) and Volume (Tons), 2019 - 2031

7.4.1.14. Türkiye Kava Root Extract Market By Form, Value (US$ Mn) and Volume (Tons), 2019 - 2031

7.4.1.15. Türkiye Kava Root Extract Market By Sales Channel, Value (US$ Mn) and Volume (Tons), 2019 - 2031

7.4.1.16. Russia Kava Root Extract Market By Nature, Value (US$ Mn) and Volume (Tons), 2019 - 2031

7.4.1.17. Russia Kava Root Extract Market By Form, Value (US$ Mn) and Volume (Tons), 2019 - 2031

7.4.1.18. Russia Kava Root Extract Market By Sales Channel, Value (US$ Mn) and Volume (Tons), 2019 - 2031

7.4.1.19. Rest of Europe Kava Root Extract Market By Nature, Value (US$ Mn) and Volume (Tons), 2019 - 2031

7.4.1.20. Rest of Europe Kava Root Extract Market By Form, Value (US$ Mn) and Volume (Tons), 2019 - 2031

7.4.1.21. Rest of Europe Kava Root Extract Market By Sales Channel, Value (US$ Mn) and Volume (Tons), 2019 - 2031

7.4.2. BPS Analysis/Market Attractiveness Analysis

8. Asia Pacific Kava Root Extract Market Outlook, 2019 - 2031

8.1. Asia Pacific Kava Root Extract Market Outlook, By Nature, Value (US$ Mn) and Volume (Tons), 2019 - 2031

8.1.1. Key Highlights

8.1.1.1. Conventional

8.1.1.2. Organic

8.2. Asia Pacific Kava Root Extract Market Outlook, By Form, Value (US$ Mn) and Volume (Tons), 2019 - 2031

8.2.1. Key Highlights

8.2.1.1. Liquid

8.2.1.2. Powder

8.2.1.3. Capsule

8.3. Asia Pacific Kava Root Extract Market Outlook, By Sales Channel, Value (US$ Mn) and Volume (Tons), 2019 - 2031

8.3.1. Key Highlights

8.3.1.1. Drug & Specialty Stores

8.3.1.2. Hypermarkets/Supermarkets

8.3.1.3. Online Retail

8.3.1.4. Others

8.4. Asia Pacific Kava Root Extract Market Outlook, by Country, Value (US$ Mn) and Volume (Tons), 2019 - 2031

8.4.1. Key Highlights

8.4.1.1. China Kava Root Extract Market By Nature, Value (US$ Mn) and Volume (Tons), 2019 - 2031

8.4.1.2. China Kava Root Extract Market By Form, Value (US$ Mn) and Volume (Tons), 2019 - 2031

8.4.1.3. China Kava Root Extract Market By Sales Channel, Value (US$ Mn) and Volume (Tons), 2019 - 2031

8.4.1.4. Japan Kava Root Extract Market By Nature, Value (US$ Mn) and Volume (Tons), 2019 - 2031

8.4.1.5. Japan Kava Root Extract Market By Form, Value (US$ Mn) and Volume (Tons), 2019 - 2031

8.4.1.6. Japan Kava Root Extract Market By Sales Channel, Value (US$ Mn) and Volume (Tons), 2019 - 2031

8.4.1.7. South Korea Kava Root Extract Market By Nature, Value (US$ Mn) and Volume (Tons), 2019 - 2031

8.4.1.8. South Korea Kava Root Extract Market By Form, Value (US$ Mn) and Volume (Tons), 2019 - 2031

8.4.1.9. South Korea Kava Root Extract Market By Sales Channel, Value (US$ Mn) and Volume (Tons), 2019 - 2031

8.4.1.10. India Kava Root Extract Market By Nature, Value (US$ Mn) and Volume (Tons), 2019 - 2031

8.4.1.11. India Kava Root Extract Market By Form, Value (US$ Mn) and Volume (Tons), 2019 - 2031

8.4.1.12. India Kava Root Extract Market By Sales Channel, Value (US$ Mn) and Volume (Tons), 2019 - 2031

8.4.1.13. Southeast Asia Kava Root Extract Market By Nature, Value (US$ Mn) and Volume (Tons), 2019 - 2031

8.4.1.14. Southeast Asia Kava Root Extract Market By Form, Value (US$ Mn) and Volume (Tons), 2019 - 2031

8.4.1.15. Southeast Asia Kava Root Extract Market By Sales Channel, Value (US$ Mn) and Volume (Tons), 2019 - 2031

8.4.1.16. Rest of Asia Pacific Kava Root Extract Market By Nature, Value (US$ Mn) and Volume (Tons), 2019 - 2031

8.4.1.17. Rest of Asia Pacific Kava Root Extract Market By Form, Value (US$ Mn) and Volume (Tons), 2019 - 2031

8.4.1.18. Rest of Asia Pacific Kava Root Extract Market By Sales Channel, Value (US$ Mn) and Volume (Tons), 2019 - 2031

8.4.2. BPS Analysis/Market Attractiveness Analysis

9. Latin America Kava Root Extract Market Outlook, 2019 - 2031

9.1. Latin America Kava Root Extract Market Outlook, By Nature, Value (US$ Mn) and Volume (Tons), 2019 - 2031

9.1.1. Key Highlights

9.1.1.1. Conventional

9.1.1.2. Organic

9.2. Latin America Kava Root Extract Market Outlook, By Form, Value (US$ Mn) and Volume (Tons), 2019 - 2031

9.2.1. Key Highlights

9.2.1.1. Liquid

9.2.1.2. Powder

9.2.1.3. Capsule

9.3. Latin America Kava Root Extract Market Outlook, By Sales Channel, Value (US$ Mn) and Volume (Tons), 2019 - 2031

9.3.1. Key Highlights

9.3.1.1. Drug & Specialty Stores

9.3.1.2. Hypermarkets/Supermarkets

9.3.1.3. Online Retail

9.3.1.4. Others

9.4. Latin America Kava Root Extract Market Outlook, by Country, Value (US$ Mn) and Volume (Tons), 2019 - 2031

9.4.1. Key Highlights

9.4.1.1. Brazil Kava Root Extract Market By Nature, Value (US$ Mn) and Volume (Tons), 2019 - 2031

9.4.1.2. Brazil Kava Root Extract Market By Form, Value (US$ Mn) and Volume (Tons), 2019 - 2031

9.4.1.3. Brazil Kava Root Extract Market By Sales Channel, Value (US$ Mn) and Volume (Tons), 2019 - 2031

9.4.1.4. Mexico Kava Root Extract Market By Nature, Value (US$ Mn) and Volume (Tons), 2019 - 2031

9.4.1.5. Mexico Kava Root Extract Market By Form, Value (US$ Mn) and Volume (Tons), 2019 - 2031

9.4.1.6. Mexico Kava Root Extract Market By Sales Channel, Value (US$ Mn) and Volume (Tons), 2019 - 2031

9.4.1.7. Argentina Kava Root Extract Market By Nature, Value (US$ Mn) and Volume (Tons), 2019 - 2031

9.4.1.8. Argentina Kava Root Extract Market By Form, Value (US$ Mn) and Volume (Tons), 2019 - 2031

9.4.1.9. Argentina Kava Root Extract Market By Sales Channel, Value (US$ Mn) and Volume (Tons), 2019 - 2031

9.4.1.10. Rest of Latin America Kava Root Extract Market By Nature, Value (US$ Mn) and Volume (Tons), 2019 - 2031

9.4.1.11. Rest of Latin America Kava Root Extract Market By Form, Value (US$ Mn) and Volume (Tons), 2019 - 2031

9.4.1.12. Rest of Latin America Kava Root Extract Market By Sales Channel, Value (US$ Mn) and Volume (Tons), 2019 - 2031

9.4.2. BPS Analysis/Market Attractiveness Analysis

10. Middle East & Africa Kava Root Extract Market Outlook, 2019 - 2031

10.1. Middle East & Africa Kava Root Extract Market Outlook, By Nature, Value (US$ Mn) and Volume (Tons), 2019 - 2031

10.1.1. Key Highlights

10.1.1.1. Conventional

10.1.1.2. Organic

10.2. Middle East & Africa Kava Root Extract Market Outlook, By Form, Value (US$ Mn) and Volume (Tons), 2019 - 2031

10.2.1. Key Highlights

10.2.1.1. Liquid

10.2.1.2. Powder

10.2.1.3. Capsule

10.3. Middle East & Africa Kava Root Extract Market Outlook, By Sales Channel, Value (US$ Mn) and Volume (Tons), 2019 - 2031

10.3.1. Key Highlights

10.3.1.1. Drug & Specialty Stores

10.3.1.2. Hypermarkets/Supermarkets

10.3.1.3. Online Retail

10.3.1.4. Others

10.4. Middle East & Africa Kava Root Extract Market Outlook, by Country, Value (US$ Mn) and Volume (Tons), 2019 - 2031

10.4.1. Key Highlights

10.4.1.1. GCC Kava Root Extract Market By Nature, Value (US$ Mn) and Volume (Tons), 2019 - 2031

10.4.1.2. GCC Kava Root Extract Market By Form, Value (US$ Mn) and Volume (Tons), 2019 - 2031

10.4.1.3. GCC Kava Root Extract Market By Sales Channel, Value (US$ Mn) and Volume (Tons), 2019 - 2031

10.4.1.4. South Africa Kava Root Extract Market By Nature, Value (US$ Mn) and Volume (Tons), 2019 - 2031

10.4.1.5. South Africa Kava Root Extract Market By Form, Value (US$ Mn) and Volume (Tons), 2019 - 2031

10.4.1.6. South Africa Kava Root Extract Market By Sales Channel, Value (US$ Mn) and Volume (Tons), 2019 - 2031

10.4.1.7. Egypt Kava Root Extract Market By Nature, Value (US$ Mn) and Volume (Tons), 2019 - 2031

10.4.1.8. Egypt Kava Root Extract Market By Form, Value (US$ Mn) and Volume (Tons), 2019 - 2031

10.4.1.9. Egypt Kava Root Extract Market By Sales Channel, Value (US$ Mn) and Volume (Tons), 2019 - 2031

10.4.1.10. Nigeria Kava Root Extract Market By Nature, Value (US$ Mn) and Volume (Tons), 2019 - 2031

10.4.1.11. Nigeria Kava Root Extract Market By Form, Value (US$ Mn) and Volume (Tons), 2019 - 2031

10.4.1.12. Nigeria Kava Root Extract Market By Sales Channel, Value (US$ Mn) and Volume (Tons), 2019 - 2031

10.4.1.13. Rest of Middle East & Africa Kava Root Extract Market By Nature, Value (US$ Mn) and Volume (Tons), 2019 - 2031

10.4.1.14. Rest of Middle East & Africa Kava Root Extract Market By Form, Value (US$ Mn) and Volume (Tons), 2019 - 2031

10.4.1.15. Rest of Middle East & Africa Kava Root Extract Market By Sales Channel, Value (US$ Mn) and Volume (Tons), 2019 - 2031

10.4.2. BPS Analysis/Market Attractiveness Analysis

11. Competitive Landscape

11.1. Company Market Share Analysis, 2024

11.2. Competitive Dashboard

11.3. Company Profiles

11.3.1. The Kava Roots

11.3.1.1. Company Overview

11.3.1.2. Product Portfolio

11.3.1.3. Financial Overview

11.3.1.4. Business Strategies and Development

11.3.2. Fiji Kava Australia

11.3.2.1. Company Overview

11.3.2.2. Product Portfolio

11.3.2.3. Financial Overview

11.3.2.4. Business Strategies and Development

11.3.3. Botany Evolution, LLC

11.3.3.1. Company Overview

11.3.3.2. Product Portfolio

11.3.3.3. Financial Overview

11.3.3.4. Business Strategies and Development

11.3.4. Pure Mountain Botanicals

11.3.4.1. Company Overview

11.3.4.2. Product Portfolio

11.3.4.3. Financial Overview

11.3.4.4. Business Strategies and Development

11.3.5. Kavafield

11.3.5.1. Company Overview

11.3.5.2. Product Portfolio

11.3.5.3. Financial Overview

11.3.5.4. Business Strategies and Development

11.3.6. Herb Pharm

11.3.6.1. Company Overview

11.3.6.2. Product Portfolio

11.3.6.3. Financial Overview

11.3.6.4. Business Strategies and Development

11.3.7. Monsoon Beverages LLC

11.3.7.1. Company Overview

11.3.7.2. Product Portfolio

11.3.7.3. Financial Overview

11.3.7.4. Business Strategies and Development

11.3.8. Natural Factors Nutritional Products Ltd.

11.3.8.1. Company Overview

11.3.8.2. Product Portfolio

11.3.8.3. Financial Overview

11.3.8.4. Business Strategies and Development

11.3.9. Eclectic Institute

11.3.9.1. Company Overview

11.3.9.2. Product Portfolio

11.3.9.3. Financial Overview

11.3.9.4. Business Strategies and Development

11.3.10. Mountain Rose Herbs

11.3.10.1. Company Overview

11.3.10.2. Product Portfolio

11.3.10.3. Financial Overview

11.3.10.4. Business Strategies and Development

11.3.11. Kona Kava Farm

11.3.11.1. Company Overview

11.3.11.2. Product Portfolio

11.3.11.3. Financial Overview

11.3.11.4. Business Strategies and Development

11.3.12. Origon’s Wild Harvest

11.3.12.1. Company Overview

11.3.12.2. Product Portfolio

11.3.12.3. Financial Overview

11.3.12.4. Business Strategies and Development

11.3.13. Nature’s Answer

11.3.13.1. Company Overview

11.3.13.2. Product Portfolio

11.3.13.3. Financial Overview

11.3.13.4. Business Strategies and Development

11.3.14. Natol, LLC

11.3.14.1. Company Overview

11.3.14.2. Product Portfolio

11.3.14.3. Financial Overview

11.3.14.4. Business Strategies and Development

11.3.15. Now Foods

11.3.15.1. Company Overview

11.3.15.2. Product Portfolio

11.3.15.3. Financial Overview

11.3.15.4. Business Strategies and Development

11.3.16. Gaia Herbs

11.3.16.1. Company Overview

11.3.16.2. Product Portfolio

11.3.16.3. Financial Overview

11.3.16.4. Business Strategies and Development

12. Appendix

12.1. Research Methodology

12.2. Report Assumptions

12.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2023 |

|

2019 - 2023 |

2024 - 2031 |

Value: US$ Million |

||

|

REPORT FEATURES |

DETAILS |

|

Nature Coverage |

|

|

Form Coverage |

|

|

Sales Channel Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |