Global Lactose Free Butter Market Forecast

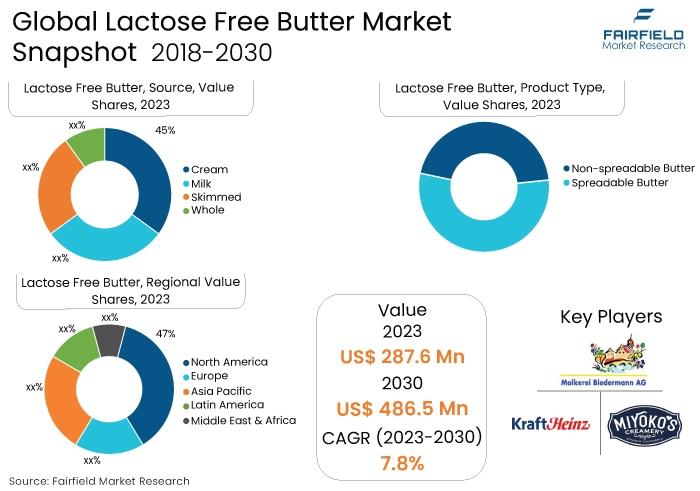

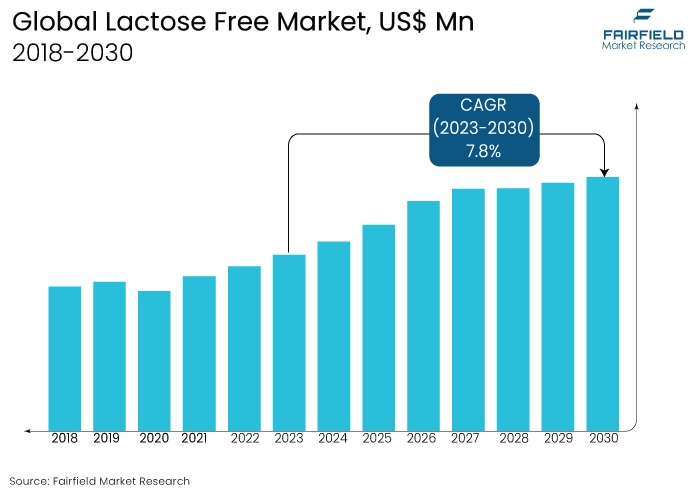

- Lactose free butter market size projected to soar high from US$287.6 Mn in 2023 to US$486.5 Mn in 2030

- Lactose free butter market valuation to witness a CAGR of 7.8% during 2023-2030

Quick Report Digest

- The key trend driving the lactose-free butter market is the increasing prevalence of lactose intolerance and dairy allergies, prompting consumers to seek dairy-free alternatives. This trend is fueled by growing health consciousness and dietary preferences for products that cater to specific dietary needs and restrictions.

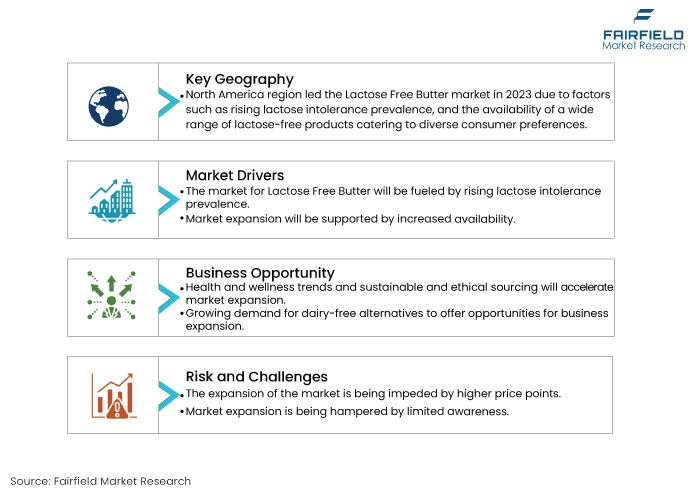

- Rising lactose intolerance prevalence is expected to drive the lactose-free butter market as more individuals seek dairy-free alternatives to alleviate digestive discomfort. This increasing awareness of lactose intolerance prompts consumers to opt for lactose-free butter, driving demand for products that cater to their dietary preferences and restrictions

- Increased availability is expected to drive the lactose-free butter market by making products more accessible to consumers. Expanded distribution networks, including online platforms and retail outlets, allow lactose-free butter to reach a wider audience, catering to the growing demand for dairy-free alternatives and driving market growth.

- Health-conscious consumers are expected to drive the lactose-free butter market due to their preference for cleaner eating habits, and dietary choices. With increasing awareness of lactose intolerance and dairy allergies, health-conscious individuals seek dairy-free alternatives like lactose-free butter, contributing to the market's growth.

- Spreadable butter product types have captured the largest market share in the lactose-free butter market due to their convenience and versatility. Spreadable butter offers ease of use for spreading on bread, toast, or crackers, making it a popular choice for everyday consumption among lactose-intolerant individuals.

- Organic butter nature has captured the largest market share in the lactose-free butter market due to increasing consumer demand for natural and organic products. With growing concerns about health and environmental sustainability, consumers are seeking dairy-free alternatives that are free from synthetic chemicals and pesticides, driving the popularity of organic butter nature.

- The Asia Pacific region is experiencing growth in the lactose-free butter market due to increasing lactose intolerance prevalence, rising consumer awareness of dietary restrictions, and shifting dietary habits towards healthier alternatives. Additionally, expanding retail channels and a growing population contribute to the market's expansion in the region.

- The North America region is growing in the lactose-free butter market due to factors such as rising lactose intolerance prevalence, increasing consumer awareness of dietary restrictions, and the availability of a wide range of lactose-free products catering to diverse consumer preferences. Additionally, strong distribution networks and marketing efforts drive market growth in North America.

A Look Back and a Look Forward - Comparative Analysis

The lactose-free butter market is experiencing growth due to rising lactose intolerance prevalence and increasing consumer awareness of dairy-related dietary restrictions. Manufacturers are responding to this demand by offering lactose-free butter alternatives, catering to health-conscious consumers seeking dairy products that are easier to digest. Additionally, innovations in dairy processing techniques and product formulations are expanding the availability and variety of lactose-free butter options, driving market growth.

The growth of the lactose-free butter market is primarily driven by applications in the food and beverage industry. With rising lactose intolerance prevalence and increasing consumer demand for dairy-free alternatives, lactose-free butter finds extensive use in baking, cooking, and spreading on bread and toast. Additionally, its versatility in various recipes and its ability to provide a similar taste and texture to traditional butter contribute to its growth in the market.

The future of the lactose-free butter market appears promising, with continued growth anticipated due to several factors. These include increasing lactose intolerance prevalence, rising consumer demand for dairy-free alternatives, and ongoing innovations in dairy processing technologies. Additionally, as health-conscious consumers continue to prioritise dietary restrictions and seek healthier alternatives, lactose-free butter is expected to maintain its popularity and expand its market presence in the future.

Key Growth Determinants

- Rising Prevalence of Lactose Intolerance Worldwide

The rising prevalence of lactose intolerance is expected to be a significant driver of the lactose-free butter market. As more individuals become aware of their lactose intolerance or sensitivity to dairy products, there is a growing demand for alternatives like lactose-free butter. Consumers with lactose intolerance seek products that provide the taste and texture of traditional butter without the discomfort or digestive issues associated with lactose-containing dairy products.

The increasing awareness and demand for lactose-free options create opportunities for manufacturers to innovate and expand their product offerings in the lactose-free butter market. As a result, the market is expected to experience steady growth as more consumers prioritise products that align with their dietary needs and preferences for lactose-free alternatives.

- Increased Availability

Increased availability is expected to drive the lactose-free butter market by making products more accessible to consumers. Expanded distribution networks, including online platforms and grocery stores, allow lactose-free butter to reach a wider audience. As availability improves, consumers with lactose intolerance or dairy allergies have greater access to alternative options that meet their dietary needs.

Moreover, increased availability encourages trial and adoption among consumers who may be unfamiliar with lactose-free alternatives. Retailers and manufacturers may also invest in marketing and promotional efforts to raise awareness and educate consumers about the benefits of lactose-free butter. Overall, improved availability contributes to the growth of the lactose-free butter market by meeting consumer demand and expanding market reach, driving sales and market penetration in various regions.

- Expansion of Health-conscious Consumer Population

Health-conscious consumers are anticipated to drive the lactose-free butter market due to their growing awareness of dietary restrictions and preferences for healthier alternatives. As more individuals prioritise their health and well-being, they seek products that align with their specific dietary needs, including lactose-free options. Lactose-free butter appeals to health-conscious consumers seeking to avoid discomfort associated with lactose intolerance or dairy allergies while still enjoying the taste and versatility of butter.

Additionally, with increasing concerns about the health effects of certain ingredients, such as lactose, consumers are actively seeking out products that offer cleaner ingredient profiles. This growing demand for lactose-free butter among health-conscious consumers creates opportunities for manufacturers to innovate and expand their product offerings, driving growth in the lactose-free butter market.

Major Growth Barriers

- Higher Price Point

The higher price point of lactose-free butter presents a challenge for the market as it may deter price-sensitive consumers from purchasing the product. Compared to conventional butter, lactose-free alternatives often command a premium due to the specialised production process and niche market positioning. This pricing discrepancy may limit adoption rates and market penetration, particularly among budget-conscious consumers, thus impeding the overall growth potential of the lactose-free butter market.

- Limited Awareness

Limited awareness poses a challenge for the lactose-free butter market as many consumers may not be aware of lactose intolerance or the availability of lactose-free alternatives. This lack of awareness can result in lower demand for lactose-free butter, as consumers may continue to purchase traditional butter without considering alternatives. Increasing consumer education and marketing efforts to raise awareness about lactose intolerance and the benefits of lactose-free butter are essential to overcome this challenge.

Key Trends and Opportunities to Look at

- Growing Demand for Dairy-Free Alternatives

The lactose-free butter market is experiencing a growing demand for dairy-free alternatives, driven by increasing prevalence of lactose intolerance and dairy allergies. Consumers seeking healthier and more inclusive dietary options are turning to lactose-free butter as a suitable alternative to traditional dairy butter.

- Health and Wellness Trend

Health and wellness trends are influencing the lactose-free butter market, as consumers prioritise cleaner eating habits and seek products aligned with their dietary preferences. Lactose-free butter appeals to health-conscious individuals seeking dairy-free alternatives, offering a solution that supports their wellness goals while accommodating lactose intolerance or dairy allergies.

- Sustainable and Ethical Sourcing

Sustainable and ethical sourcing practices are becoming increasingly important in the lactose-free butter market. Consumers are seeking products that are sourced responsibly, with a focus on environmental stewardship and fair labour practices. Manufacturers are responding by emphasizing transparent sourcing and production methods to meet consumer demand for ethical products.

How Does the Regulatory Scenario Shape this Industry?

The regulatory framework for lactose-free butter varies by region, but generally includes standards for food safety, labeling, and manufacturing practices. In the United States, the Food and Drug Administration (FDA) regulates dairy products, including lactose-free butter, ensuring compliance with labeling requirements and safety standards. Similarly, the European Food Safety Authority (EFSA) sets regulations for food safety and labeling in the European Union.

Region-specific regulatory changes may include updates to labeling requirements, such as allergen labeling laws, to ensure clear identification of lactose-free products. Additionally, regulatory agencies may impose standards for lactose-free claims, requiring manufacturers to meet specific criteria for product formulation and testing. These regulations influence the lactose-free butter market by ensuring consumer safety, providing transparency in labeling, and establishing guidelines for product quality and consistency, ultimately shaping consumer perceptions and market dynamics. Compliance with regulatory requirements is essential for manufacturers to maintain market access and consumer trust.

Fairfield’s Ranking Board

Top Segments

- Sales of Spreadable Butter Dominant

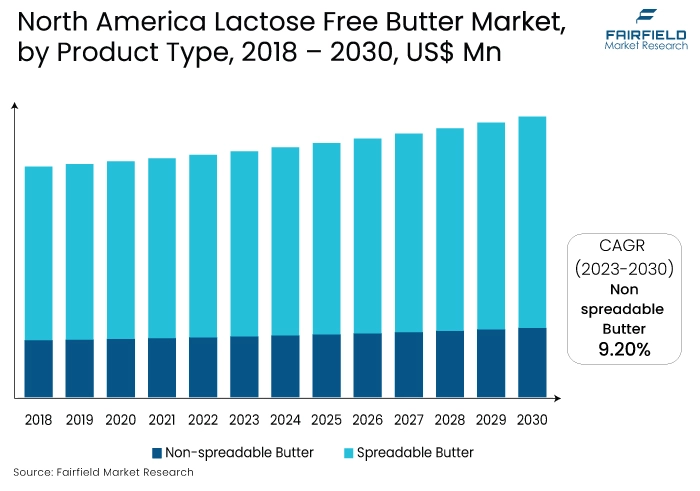

Spreadable butter products have captured the largest market share in the lactose-free butter market due to their convenience and versatility. Spreadable butter offers ease of use for spreading on bread, toast, or crackers, making it a popular choice for everyday consumption. Additionally, spreadable butter's soft texture and creamy consistency appeal to consumers seeking a familiar taste and experience, driving its preference over other forms of lactose-free butter such as blocks or sticks.

On the other hand, non-spreadable butter sales are likely to take off in the upcoming years, mostly for their versatility and suitability for various culinary applications. Non-spreadable butter, such as blocks or sticks, appeals to consumers who prefer to use butter for cooking, baking, or frying. Additionally, as consumers become more adventurous in the kitchen and seek high-quality ingredients, the demand for non-spreadable lactose-free butter options continues to rise.

- Popularity of Organic Butter Highest

Organic butter nature has captured the largest market share in the lactose-free butter market due to increasing consumer preference for natural and organic products. With growing concerns about health and environmental sustainability, consumers are seeking dairy-free alternatives that are free from synthetic chemicals and pesticides. Organic butter nature appeals to these consumers by offering a clean label product made from organic ingredients, thus driving its dominance in the lactose-free butter market.

However, conventional butter continues to be the favoured category. The growth is clearly attributable to its widespread availability, and competitive pricing. While organic options appeal to niche markets, conventional butter nature remains the preferred choice for mainstream consumers due to its affordability and familiarity. This broad appeal, coupled with efficient production methods, contributes to the rapid growth of conventional butter nature within the lactose-free butter market.

- Cream to be the Most Favoured Source

Cream source has captured the largest market share in the lactose-free butter market due to its high-quality and rich flavour profile. As a primary ingredient in butter production, cream source ensures the superior taste and texture of lactose-free butter products, appealing to discerning consumers seeking a premium dairy-free alternative. Additionally, cream source offers versatility in formulation, allowing manufacturers to create a wide range of lactose-free butter varieties to cater to diverse consumer preferences.

Milk also represents a popular source of butter and plays an essential role in dairy-free butter production. As a key ingredient, milk source serves as the foundation for lactose-free butter, contributing to its taste, texture, and nutritional profile. With increasing consumer demand for dairy alternatives, the demand for milk source in lactose-free butter production is rising, driving its growth within the market.

- HoReCa Holds Maximum Opportunity

Hotels, restaurants, and cafés (HoReCa) will remain the primary end-use sector of lactose free butter because of its widespread usage in the foodservice industry. Hotels, restaurants, and cafes utilize lactose-free butter extensively in various culinary applications, including cooking, baking, and food preparation. The demand for lactose-free butter in the HoReCa sector is driven by the need to cater to diverse dietary preferences and accommodate lactose-intolerant customers, thus solidifying its dominance in the market.

Household retail is emerging as a key end-use sector in the lactose-free butter market due to increasing consumer awareness and demand for dairy-free alternatives. With more individuals opting for lactose-free options at home due to health concerns or dietary restrictions, the household retail sector has seen a surge in sales of lactose-free butter products. This trend is expected to continue as consumers prioritise convenience and healthier eating habits.

- Lactose Free Butter Market Gains Maximum from Direct Sales

Direct sales distribution channels have captured the largest market share in the lactose-free butter market due to the ability of producers to establish direct relationships with consumers. By bypassing intermediaries, producers can offer fresher products, maintain greater control over pricing, and communicate directly with consumers to meet their preferences. Additionally, direct sales channels enable producers to differentiate their products, provide personalised customer experiences, and adapt quickly to changing market demands, solidifying their dominance in the market.

Indirect sales distribution channels are experiencing the highest compound annual growth rate (CAGR) in the lactose-free butter market due to expanding partnerships with retailers and distributors. Through indirect channels, manufacturers can reach a wider audience and penetrate new markets more efficiently. As demand for lactose-free butter increases, retailers are seeking to expand their product offerings to cater to consumer preferences, driving the growth of indirect sales channels within the lactose-free butter market.

Regional Frontrunners

North America’s Revenue Contribution Remarkably High

North America has captured the largest market share in the lactose-free butter market due to several factors. The region has a well-developed food and beverage industry with a high demand for dairy-free alternatives. Additionally, increasing lactose intolerance prevalence and growing consumer awareness of dietary restrictions drive the demand for lactose-free products.

Moreover, North American consumers prioritise health and wellness, further boosting the adoption of lactose-free butter. Furthermore, the presence of major players in the region, coupled with effective marketing strategies and widespread availability of lactose-free butter products, solidifies North America's dominance in the lactose-free butter market.

Opportunity Abound in Asia Pacific as Westernised Dietary Lifestyle Firms up

The Asia Pacific region is experiencing the highest compound annual growth rate (CAGR) in the lactose-free butter market due to several factors. These include increasing awareness of lactose intolerance, changing dietary habits, and rising disposable incomes in emerging economies. Additionally, the growing adoption of Western dietary patterns and the expansion of retail channels contribute to the increasing demand for lactose-free butter products, driving market growth in the Asia Pacific region.

Fairfield’s Competitive Landscape Analysis

The competitive landscape of the lactose-free butter market is characterised by a mix of global and regional players. Key companies like Arla Foods, Kerry Group, and Lactalis International dominate the market with their extensive product portfolios and distribution networks.

Additionally, smaller players often focus on niche markets or specialty products to differentiate themselves. Intense competition drives innovation, pricing strategies, and marketing initiatives as companies vie for market share in the growing lactose-free butter market.

Who are the Leaders in Global Lactose Free Butter Space?

- Miyoko’s Creamery

- Molkerei Biedermann AG

- The Kraft Heinz Company

- The Hain Celestial Group, Inc.

- Cargill Inc.

- Corbion Inc.

- Kerry Group PLC

- Ingredion Incorporated

- Chr Hasen A/S

- Kellogg Company

- General Mills, Inc.

- Arla Foods

- Land O'Lakes

- Lactalis International

- Green Valley Creamery

Significant Company Developments

New Product Launch

- October 2022: EATNUF, a Singaporean brand specialising in natural nut butter, revealed its intentions to broaden its market reach in China and Malaysia by 2023. The company disclosed its upcoming introduction of black sesame seed spread on various e-commerce platforms, complementing its existing lineup of almond and cashew nut butter offerings.

- April 2022: The New Zealand Dairy Co-operative and Anchor Fonterra unveiled their organic carbon zero-certified butter, verified independently by ToitūEnvirocare to minimise and compensate for carbon emissions.

An Expert’s Eye

Demand and Future Growth

The lactose-free butter market is poised for significant growth driven by increasing lactose intolerance prevalence and growing consumer awareness of dietary restrictions. As more individuals seek dairy-free alternatives for health reasons, demand for lactose-free butter is rising.

Additionally, the expanding health and wellness trend and the availability of innovative product formulations contribute to market growth. Future prospects for the lactose-free butter market remain promising, with opportunities for manufacturers to innovate, expand product offerings, and capitalise on consumer preferences for healthier and more inclusive dietary options.

Supply Side of the Market

The demand-supply dynamics in the lactose-free butter market are influenced by several factors. Increasing lactose intolerance prevalence and growing consumer awareness of dietary restrictions drive demand, while the availability of dairy-free alternatives impacts supply. Current pricing structures reflect factors such as production costs, ingredient sourcing, and competitive positioning, shaping market dynamics. Pricing will continue to influence long-term growth as manufacturers navigate cost pressures and consumer price sensitivity.

Major trends driving competition include product innovation, such as new flavours and formulations, branding strategies emphasizing health benefits and sustainability, and expansion into new markets. Supply chain analysis involves sourcing raw materials, manufacturing processes, distribution channels, and retailing. Efficient supply chains that prioritise quality control, sustainability, and responsiveness to consumer demand will be crucial for success in the lactose-free butter market.

Global Lactose Free Butter Market is Segmented as Below:

By Product Type:

- Spreadable Butter

- Non-spreadable Butter

By Nature:

- Organic Butter

- Conventional Butter

By Source:

- Cream

- Milk

- Skimmed

- Whole

By End Use:

- HoReCa

- Household Retail

- Bakery and Confectionery

- Meat Products

- Infant Formula

By Distribution Channel:

- Direct Sales

- Indirect Sales

- Hypermarkets /Supermarkets

- Convenience Stores

- Specialty Stores

- Independent Retailers

- Online Retailers

By Geographic Coverage:

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Turkey

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Egypt

- Nigeria

- Rest of Middle East & Africa

1. Executive Summary

1.1. Global Lactose Free Butter Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2022

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. Covid-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Global Lactose Free Butter Market Outlook, 2018 - 2030

3.1. Global Lactose Free Butter Market Outlook, by Product Type, Value (US$ Mn), 2018 - 2030

3.1.1. Key Highlights

3.1.1.1. Spreadable Butter

3.1.1.2. Non-spreadable Butter

3.2. Global Lactose Free Butter Market Outlook, by Nature, Value (US$ Mn), 2018 - 2030

3.2.1. Key Highlights

3.2.1.1. Organic Lactose Free Butter

3.2.1.2. Conventional Lactose Free Butter

3.3. Global Lactose Free Butter Market Outlook, by Source, Value (US$ Mn), 2018 - 2030

3.3.1. Key Highlights

3.3.1.1. Cream

3.3.1.2. Milk

3.3.1.3. Skimmed

3.3.1.4. Whole

3.4. Global Lactose Free Butter Market Outlook, by End-Use, Value (US$ Mn), 2018 - 2030

3.4.1. Key Highlights Snacks

3.4.1.1. HoReCa

3.4.1.2. Household Retail

3.4.1.3. Bakery and Confectionery

3.4.1.4. Meat Products

3.4.1.5. Infant Formula

3.5. Global Lactose Free Butter Market Outlook, by Distribution Channel, Value (US$ Mn), 2018 - 2030

3.5.1. Key Highlights Snacks

3.5.1.1. Direct Sales

3.5.1.2. Indirect Sales

3.5.1.3. Hypermarkets /Supermarkets

3.5.1.4. Convenience Stores

3.5.1.5. Specialty Stores

3.5.1.6. Independent Retailers

3.5.1.7. Online Retailers

3.6. Global Lactose Free Butter Market Outlook, by Region, Value (US$ Mn), 2018 - 2030

3.6.1. Key Highlights

3.6.1.1. North America

3.6.1.2. Europe

3.6.1.3. Asia Pacific

3.6.1.4. Latin America

3.6.1.5. Middle East & Africa

4. North America Lactose Free Butter Market Outlook, 2018 - 2030

4.1. North America Lactose Free Butter Market Outlook, by Product Type, Value (US$ Mn), 2018 - 2030

4.1.1. Key Highlights

4.1.1.1. Spreadable Butter

4.1.1.2. Non-spreadable Butter

4.2. North America Lactose Free Butter Market Outlook, by Nature, Value (US$ Mn), 2018 - 2030

4.2.1. Key Highlights

4.2.1.1. Organic Lactose Free Butter

4.2.1.2. Conventional Lactose Free Butter

4.3. North America Lactose Free Butter Market Outlook, by Source, Value (US$ Mn), 2018 - 2030

4.3.1. Key Highlights

4.3.1.1. Cream

4.3.1.2. Milk

4.3.1.3. Skimmed

4.3.1.4. Whole

4.4. North America Lactose Free Butter Market Outlook, by End-Use, Value (US$ Mn), 2018 - 2030

4.4.1. Key Highlights

4.4.1.1. HoReCa

4.4.1.2. Household Retail

4.4.1.3. Bakery and Confectionery

4.4.1.4. Meat Products

4.4.1.5. Infant Formula

4.5. North America Lactose Free Butter Market Outlook, by Distribution Channel, Value (US$ Mn), 2018 - 2030

4.5.1. Key Highlights

4.5.1.1. Direct Sales

4.5.1.2. Indirect Sales

4.5.1.3. Hypermarkets /Supermarkets

4.5.1.4. Convenience Stores

4.5.1.5. Specialty Stores

4.5.1.6. Independent Retailers

4.5.1.7. Online Retailers

4.5.2. BPS Analysis/Market Attractiveness Analysis

4.6. North America Lactose Free Butter Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

4.6.1. Key Highlights

4.6.1.1. U.S. Lactose Free Butter Market by Product Type, Value (US$ Mn), 2018 - 2030

4.6.1.2. U.S. Lactose Free Butter Market Nature, Value (US$ Mn), 2018 - 2030

4.6.1.3. U.S. Lactose Free Butter Market Source, Value (US$ Mn), 2018 - 2030

4.6.1.4. U.S. Lactose Free Butter Market End-Use, Value (US$ Mn), 2018 - 2030

4.6.1.5. U.S. Lactose Free Butter Market Distribution Channel, Value (US$ Mn), 2018 - 2030

4.6.1.6. Canada Lactose Free Butter Market by Product Type, Value (US$ Mn), 2018 - 2030

4.6.1.7. Canada Lactose Free Butter Market Nature, Value (US$ Mn), 2018 - 2030

4.6.1.8. Canada Lactose Free Butter Market Source, Value (US$ Mn), 2018 - 2030

4.6.1.9. Canada Lactose Free Butter Market End-Use, Value (US$ Mn), 2018 - 2030

4.6.1.10. Canada Lactose Free Butter Market Distribution Channel, Value (US$ Mn), 2018 - 2030

4.6.2. BPS Analysis/Market Attractiveness Analysis

5. Europe Lactose Free Butter Market Outlook, 2018 - 2030

5.1. Europe Lactose Free Butter Market Outlook, by Product Type, Value (US$ Mn), 2018 - 2030

5.1.1. Key Highlights

5.1.1.1. Spreadable Butter

5.1.1.2. Non-spreadable Butter

5.2. Europe Lactose Free Butter Market Outlook, by Nature, Value (US$ Mn), 2018 - 2030

5.2.1. Key Highlights

5.2.1.1. Organic Lactose Free Butter

5.2.1.2. Conventional Lactose Free Butter

5.3. Europe Lactose Free Butter Market Outlook, by Source, Value (US$ Mn), 2018 - 2030

5.3.1. Key Highlights

5.3.1.1. Cream

5.3.1.2. Milk

5.3.1.3. Skimmed

5.3.1.4. Whole

5.4. Europe Lactose Free Butter Market Outlook, by End-Use, Value (US$ Mn), 2018 - 2030

5.4.1. Key Highlights

5.4.1.1. HoReCa

5.4.1.2. Household Retail

5.4.1.3. Bakery and Confectionery

5.4.1.4. Meat Products

5.4.1.5. Infant Formula

5.5. Europe Lactose Free Butter Market Outlook, by Distribution Channel, Value (US$ Mn), 2018 - 2030

5.5.1. Key Highlights

5.5.1.1. Direct Sales

5.5.1.2. Indirect Sales

5.5.1.3. Hypermarkets /Supermarkets

5.5.1.4. Convenience Stores

5.5.1.5. Specialty Stores

5.5.1.6. Independent Retailers

5.5.1.7. Online Retailers

5.5.2. BPS Analysis/Market Attractiveness Analysis

5.6. Europe Lactose Free Butter Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

5.6.1. Key Highlights

5.6.1.1. Germany Lactose Free Butter Market by Product Type, Value (US$ Mn), 2018 - 2030

5.6.1.2. Germany Lactose Free Butter Market Nature, Value (US$ Mn), 2018 - 2030

5.6.1.3. Germany Lactose Free Butter Market Source, Value (US$ Mn), 2018 - 2030

5.6.1.4. Germany Lactose Free Butter Market End-Use, Value (US$ Mn), 2018 - 2030

5.6.1.5. Germany Lactose Free Butter Market Distribution Channel, Value (US$ Mn), 2018 - 2030

5.6.1.6. U.K. Lactose Free Butter Market by Product Type, Value (US$ Mn), 2018 - 2030

5.6.1.7. U.K. Lactose Free Butter Market Nature, Value (US$ Mn), 2018 - 2030

5.6.1.8. U.K. Lactose Free Butter Market Source, Value (US$ Mn), 2018 - 2030

5.6.1.9. U.K. Lactose Free Butter Market End-Use, Value (US$ Mn), 2018 - 2030

5.6.1.10. U.K. Lactose Free Butter Market Distribution Channel, Value (US$ Mn), 2018 - 2030

5.6.1.11. France Lactose Free Butter Market by Product Type, Value (US$ Mn), 2018 - 2030

5.6.1.12. France Lactose Free Butter Market Nature, Value (US$ Mn), 2018 - 2030

5.6.1.13. France Lactose Free Butter Market Source, Value (US$ Mn), 2018 - 2030

5.6.1.14. France Lactose Free Butter Market End-Use, Value (US$ Mn), 2018 - 2030

5.6.1.15. France Lactose Free Butter Market Distribution Channel, Value (US$ Mn), 2018 - 2030

5.6.1.16. Italy Lactose Free Butter Market by Product Type, Value (US$ Mn), 2018 - 2030

5.6.1.17. Italy Lactose Free Butter Market Nature, Value (US$ Mn), 2018 - 2030

5.6.1.18. Italy Lactose Free Butter Market Source, Value (US$ Mn), 2018 - 2030

5.6.1.19. Italy Lactose Free Butter Market End-Use, Value (US$ Mn), 2018 - 2030

5.6.1.20. Italy Lactose Free Butter Market Distribution Channel, Value (US$ Mn), 2018 - 2030

5.6.1.21. Turkey Lactose Free Butter Market by Product Type, Value (US$ Mn), 2018 - 2030

5.6.1.22. Turkey Lactose Free Butter Market Nature, Value (US$ Mn), 2018 - 2030

5.6.1.23. Turkey Lactose Free Butter Market Source, Value (US$ Mn), 2018 - 2030

5.6.1.24. Turkey Lactose Free Butter Market End-Use, Value (US$ Mn), 2018 - 2030

5.6.1.25. Turkey Lactose Free Butter Market Distribution Channel, Value (US$ Mn), 2018 - 2030

5.6.1.26. Russia Lactose Free Butter Market by Product Type, Value (US$ Mn), 2018 - 2030

5.6.1.27. Russia Lactose Free Butter Market Nature, Value (US$ Mn), 2018 - 2030

5.6.1.28. Russia Lactose Free Butter Market Source, Value (US$ Mn), 2018 - 2030

5.6.1.29. Russia Lactose Free Butter Market End-Use, Value (US$ Mn), 2018 - 2030

5.6.1.30. Russia Lactose Free Butter Market Distribution Channel, Value (US$ Mn), 2018 - 2030

5.6.1.31. Rest of Europe Lactose Free Butter Market by Product Type, Value (US$ Mn), 2018 - 2030

5.6.1.32. Rest of Europe Lactose Free Butter Market Nature, Value (US$ Mn), 2018 - 2030

5.6.1.33. Rest of Europe Lactose Free Butter Market Source, Value (US$ Mn), 2018 - 2030

5.6.1.34. Rest of Europe Lactose Free Butter Market End-Use, Value (US$ Mn), 2018 - 2030

5.6.1.35. Rest of Europe Lactose Free Butter Market Distribution Channel, Value (US$ Mn), 2018 - 2030

5.6.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Lactose Free Butter Market Outlook, 2018 - 2030

6.1. Asia Pacific Lactose Free Butter Market Outlook, by Product Type, Value (US$ Mn), 2018 - 2030

6.1.1. Key Highlights

6.1.1.1. Spreadable Butter

6.1.1.2. Non-spreadable Butter

6.2. Asia Pacific Lactose Free Butter Market Outlook, by Nature, Value (US$ Mn), 2018 - 2030

6.2.1. Key Highlights

6.2.1.1. Organic Lactose Free Butter

6.2.1.2. Conventional Lactose Free Butter

6.3. Asia Pacific Lactose Free Butter Market Outlook, by Source, Value (US$ Mn), 2018 - 2030

6.3.1. Key Highlights

6.3.1.1. Cream

6.3.1.2. Milk

6.3.1.3. Skimmed

6.3.1.4. Whole

6.4. Asia Pacific Lactose Free Butter Market Outlook, by End-Use, Value (US$ Mn), 2018 - 2030

6.4.1. Key Highlights

6.4.1.1. HoReCa

6.4.1.2. Household Retail

6.4.1.3. Bakery and Confectionery

6.4.1.4. Meat Products

6.4.1.5. Infant Formula

6.5. Asia Pacific Lactose Free Butter Market Outlook, by Distribution Channel, Value (US$ Mn), 2018 - 2030

6.5.1. Key Highlights

6.5.1.1. Direct Sales

6.5.1.2. Indirect Sales

6.5.1.3. Hypermarkets /Supermarkets

6.5.1.4. Convenience Stores

6.5.1.5. Specialty Stores

6.5.1.6. Independent Retailers

6.5.1.7. Online Retailers

6.5.2. BPS Analysis/Market Attractiveness Analysis

6.6. Asia Pacific Lactose Free Butter Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

6.6.1. Key Highlights

6.6.1.1. China Lactose Free Butter Market by Product Type, Value (US$ Mn), 2018 - 2030

6.6.1.2. China Lactose Free Butter Market Nature, Value (US$ Mn), 2018 - 2030

6.6.1.3. China Lactose Free Butter Market Source, Value (US$ Mn), 2018 - 2030

6.6.1.4. China Lactose Free Butter Market End-Use, Value (US$ Mn), 2018 - 2030

6.6.1.5. China Lactose Free Butter Market Distribution Channel, Value (US$ Mn), 2018 - 2030

6.6.1.6. Japan Lactose Free Butter Market by Product Type, Value (US$ Mn), 2018 - 2030

6.6.1.7. Japan Lactose Free Butter Market Nature, Value (US$ Mn), 2018 - 2030

6.6.1.8. Japan Lactose Free Butter Market Source, Value (US$ Mn), 2018 - 2030

6.6.1.9. Japan Lactose Free Butter Market End-Use, Value (US$ Mn), 2018 - 2030

6.6.1.10. Japan Lactose Free Butter Market Distribution Channel, Value (US$ Mn), 2018 - 2030

6.6.1.11. South Korea Lactose Free Butter Market by Product Type, Value (US$ Mn), 2018 - 2030

6.6.1.12. South Korea Lactose Free Butter Market Nature, Value (US$ Mn), 2018 - 2030

6.6.1.13. South Korea Lactose Free Butter Market Source, Value (US$ Mn), 2018 - 2030

6.6.1.14. South Korea Lactose Free Butter Market End-Use, Value (US$ Mn), 2018 - 2030

6.6.1.15. South Korea Lactose Free Butter Market Distribution Channel, Value (US$ Mn), 2018 - 2030

6.6.1.16. India Lactose Free Butter Market by Product Type, Value (US$ Mn), 2018 - 2030

6.6.1.17. India Lactose Free Butter Market Nature, Value (US$ Mn), 2018 - 2030

6.6.1.18. India Lactose Free Butter Market Source, Value (US$ Mn), 2018 - 2030

6.6.1.19. India Lactose Free Butter Market End-Use, Value (US$ Mn), 2018 - 2030

6.6.1.20. India Lactose Free Butter Market Distribution Channel, Value (US$ Mn), 2018 - 2030

6.6.1.21. Southeast Asia Lactose Free Butter Market by Product Type, Value (US$ Mn), 2018 - 2030

6.6.1.22. Southeast Asia Lactose Free Butter Market Nature, Value (US$ Mn), 2018 - 2030

6.6.1.23. Southeast Asia Lactose Free Butter Market Source, Value (US$ Mn), 2018 - 2030

6.6.1.24. Southeast Asia Lactose Free Butter Market End-Use, Value (US$ Mn), 2018 - 2030

6.6.1.25. Southeast Asia Lactose Free Butter Market Distribution Channel, Value (US$ Mn), 2018 - 2030

6.6.1.26. Rest of Asia Pacific Lactose Free Butter Market by Product Type, Value (US$ Mn), 2018 - 2030

6.6.1.27. Rest of Asia Pacific Lactose Free Butter Market Nature, Value (US$ Mn), 2018 - 2030

6.6.1.28. Rest of Asia Pacific Lactose Free Butter Market Source, Value (US$ Mn), 2018 - 2030

6.6.1.29. Rest of Asia Pacific Lactose Free Butter Market End-Use, Value (US$ Mn), 2018 - 2030

6.6.1.30. Rest of Asia Pacific Lactose Free Butter Market Distribution Channel, Value (US$ Mn), 2018 - 2030

6.6.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America Lactose Free Butter Market Outlook, 2018 - 2030

7.1. Latin America Lactose Free Butter Market Outlook, by Product Type, Value (US$ Mn), 2018 - 2030

7.1.1. Key Highlights

7.1.1.1. Spreadable Butter

7.1.1.2. Non-spreadable Butter

7.2. Latin America Lactose Free Butter Market Outlook, by Nature, Value (US$ Mn), 2018 - 2030

7.2.1. Key Highlights

7.2.1.1. Organic Lactose Free Butter

7.2.1.2. Conventional Lactose Free Butter

7.3. Latin America Lactose Free Butter Market Outlook, by Source, Value (US$ Mn), 2018 - 2030

7.3.1. Key Highlights

7.3.1.1. Cream

7.3.1.2. Milk

7.3.1.3. Skimmed

7.3.1.4. Whole

7.4. Latin America Lactose Free Butter Market Outlook, by End-Use, Value (US$ Mn), 2018 - 2030

7.4.1. Key Highlights

7.4.1.1. HoReCa

7.4.1.2. Household Retail

7.4.1.3. Bakery and Confectionery

7.4.1.4. Meat Products

7.4.1.5. Infant Formula

7.5. Latin America Lactose Free Butter Market Outlook, by Distribution Channel, Value (US$ Mn), 2018 - 2030

7.5.1. Key Highlights

7.5.1.1. Direct Sales

7.5.1.2. Indirect Sales

7.5.1.3. Hypermarkets /Supermarkets

7.5.1.4. Convenience Stores

7.5.1.5. Specialty Stores

7.5.1.6. Independent Retailers

7.5.1.7. Online Retailers

7.5.2. BPS Analysis/Market Attractiveness Analysis

7.6. Latin America Lactose Free Butter Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

7.6.1. Key Highlights

7.6.1.1. Brazil Lactose Free Butter Market by Product Type, Value (US$ Mn), 2018 - 2030

7.6.1.2. Brazil Lactose Free Butter Market Nature, Value (US$ Mn), 2018 - 2030

7.6.1.3. Brazil Lactose Free Butter Market Source, Value (US$ Mn), 2018 - 2030

7.6.1.4. Brazil Lactose Free Butter Market End-Use, Value (US$ Mn), 2018 - 2030

7.6.1.5. Brazil Lactose Free Butter Market Distribution Channel, Value (US$ Mn), 2018 - 2030

7.6.1.6. Mexico Lactose Free Butter Market by Product Type, Value (US$ Mn), 2018 - 2030

7.6.1.7. Mexico Lactose Free Butter Market Nature, Value (US$ Mn), 2018 - 2030

7.6.1.8. Mexico Lactose Free Butter Market Source, Value (US$ Mn), 2018 - 2030

7.6.1.9. Mexico Lactose Free Butter Market End-Use, Value (US$ Mn), 2018 - 2030

7.6.1.10. Mexico Lactose Free Butter Market Distribution Channel, Value (US$ Mn), 2018 - 2030

7.6.1.11. Argentina Lactose Free Butter Market by Product Type, Value (US$ Mn), 2018 - 2030

7.6.1.12. Argentina Lactose Free Butter Market Nature, Value (US$ Mn), 2018 - 2030

7.6.1.13. Argentina Lactose Free Butter Market Source, Value (US$ Mn), 2018 - 2030

7.6.1.14. Argentina Lactose Free Butter Market End-Use, Value (US$ Mn), 2018 - 2030

7.6.1.15. Argentina Lactose Free Butter Market Distribution Channel, Value (US$ Mn), 2018 - 2030

7.6.1.16. Rest of Latin America Lactose Free Butter Market by Product Type, Value (US$ Mn), 2018 - 2030

7.6.1.17. Rest of Latin America Lactose Free Butter Market Nature, Value (US$ Mn), 2018 - 2030

7.6.1.18. Rest of Latin America Lactose Free Butter Market Source, Value (US$ Mn), 2018 - 2030

7.6.1.19. Rest of Latin America Lactose Free Butter Market End-Use, Value (US$ Mn), 2018 - 2030

7.6.1.20. Rest of Latin America Lactose Free Butter Market Distribution Channel, Value (US$ Mn), 2018 - 2030

7.6.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Lactose Free Butter Market Outlook, 2018 - 2030

8.1. Middle East & Africa Lactose Free Butter Market Outlook, by Product Type, Value (US$ Mn), 2018 - 2030

8.1.1. Key Highlights

8.1.1.1. Spreadable Butter

8.1.1.2. Non-spreadable Butter

8.2. Middle East & Africa Lactose Free Butter Market Outlook, by Nature, Value (US$ Mn), 2018 - 2030

8.2.1. Key Highlights

8.2.1.1. Organic Lactose Free Butter

8.2.1.2. Conventional Lactose Free Butter

8.3. Middle East & Africa Lactose Free Butter Market Outlook, by Source, Value (US$ Mn), 2018 - 2030

8.3.1. Key Highlights

8.3.1.1. Cream

8.3.1.2. Milk

8.3.1.3. Skimmed

8.3.1.4. Whole

8.4. Middle East & Africa Lactose Free Butter Market Outlook, by End-Use, Value (US$ Mn), 2018 - 2030

8.4.1. Key Highlights

8.4.1.1. HoReCa

8.4.1.2. Household Retail

8.4.1.3. Bakery and Confectionery

8.4.1.4. Meat Products

8.4.1.5. Infant Formula

8.5. Middle East & Africa Lactose Free Butter Market Outlook, by Distribution Channel, Value (US$ Mn), 2018 - 2030

8.5.1. Key Highlights

8.5.1.1. Direct Sales

8.5.1.2. Indirect Sales

8.5.1.3. Hypermarkets /Supermarkets

8.5.1.4. Convenience Stores

8.5.1.5. Specialty Stores

8.5.1.6. Independent Retailers

8.5.1.7. Online Retailers

8.5.2. BPS Analysis/Market Attractiveness Analysis

8.6. Middle East & Africa Lactose Free Butter Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

8.6.1. Key Highlights

8.6.1.1. GCC Lactose Free Butter Market by Product Type, Value (US$ Mn), 2018 - 2030

8.6.1.2. GCC Lactose Free Butter Market Nature, Value (US$ Mn), 2018 - 2030

8.6.1.3. GCC Lactose Free Butter Market Source, Value (US$ Mn), 2018 - 2030

8.6.1.4. GCC Lactose Free Butter Market End-Use, Value (US$ Mn), 2018 - 2030

8.6.1.5. GCC Lactose Free Butter Market Distribution Channel, Value (US$ Mn), 2018 - 2030

8.6.1.6. South Africa Lactose Free Butter Market by Product Type, Value (US$ Mn), 2018 - 2030

8.6.1.7. South Africa Lactose Free Butter Market Nature, Value (US$ Mn), 2018 - 2030

8.6.1.8. South Africa Lactose Free Butter Market Source, Value (US$ Mn), 2018 - 2030

8.6.1.9. South Africa Lactose Free Butter Market End-Use, Value (US$ Mn), 2018 - 2030

8.6.1.10. South Africa Lactose Free Butter Market Distribution Channel, Value (US$ Mn), 2018 - 2030

8.6.1.11. Egypt Lactose Free Butter Market by Product Type, Value (US$ Mn), 2018 - 2030

8.6.1.12. Egypt Lactose Free Butter Market Nature, Value (US$ Mn), 2018 - 2030

8.6.1.13. Egypt Lactose Free Butter Market Source, Value (US$ Mn), 2018 - 2030

8.6.1.14. Egypt Lactose Free Butter Market End-Use, Value (US$ Mn), 2018 - 2030

8.6.1.15. Egypt Lactose Free Butter Market Distribution Channel, Value (US$ Mn), 2018 - 2030

8.6.1.16. Nigeria Lactose Free Butter Market by Product Type, Value (US$ Mn), 2018 - 2030

8.6.1.17. Nigeria Lactose Free Butter Market Nature, Value (US$ Mn), 2018 - 2030

8.6.1.18. Nigeria Lactose Free Butter Market Source, Value (US$ Mn), 2018 - 2030

8.6.1.19. Nigeria Lactose Free Butter Market End-Use, Value (US$ Mn), 2018 - 2030

8.6.1.20. Nigeria Lactose Free Butter Market Distribution Channel, Value (US$ Mn), 2018 - 2030

8.6.1.21. Rest of Middle East & Africa Lactose Free Butter Market by Product Type, Value (US$ Mn), 2018 - 2030

8.6.1.22. Rest of Middle East & Africa Lactose Free Butter Market Nature, Value (US$ Mn), 2018 - 2030

8.6.1.23. Rest of Middle East & Africa Lactose Free Butter Market Source, Value (US$ Mn), 2018 - 2030

8.6.1.24. Rest of Middle East & Africa Lactose Free Butter Market End-Use, Value (US$ Mn), 2018 - 2030

8.6.1.25. Rest of Middle East & Africa Lactose Free Butter Market Distribution Channel, Value (US$ Mn), 2018 - 2030

8.6.2. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. Source vs Source Heatmap

9.2. Manufacturer vs Source Heatmap

9.3. Company Market Share Analysis, 2022

9.4. Competitive Dashboard

9.5. Company Profiles

9.5.1. Miyoko’s Creamery

9.5.1.1. Company Overview

9.5.1.2. Product Portfolio

9.5.1.3. Financial Overview

9.5.1.4. Business Strategies and Development

9.5.2. Molkerei Biedermann AG

9.5.2.1. Company Overview

9.5.2.2. Product Portfolio

9.5.2.3. Financial Overview

9.5.2.4. Business Strategies and Development

9.5.3. The Kraft Heinz Company

9.5.3.1. Company Overview

9.5.3.2. Product Portfolio

9.5.3.3. Financial Overview

9.5.3.4. Business Strategies and Development

9.5.4. The Hain Celestial Group, Inc.

9.5.4.1. Company Overview

9.5.4.2. Product Portfolio

9.5.4.3. Financial Overview

9.5.4.4. Business Strategies and Development

9.5.5. Cargill Inc.

9.5.5.1. Company Overview

9.5.5.2. Product Portfolio

9.5.5.3. Financial Overview

9.5.5.4. Business Strategies and Development

9.5.6. Corbion Inc.

9.5.6.1. Company Overview

9.5.6.2. Product Portfolio

9.5.6.3. Financial Overview

9.5.6.4. Business Strategies and Development

9.5.7. Kerry Group PLC

9.5.7.1. Company Overview

9.5.7.2. Product Portfolio

9.5.7.3. Financial Overview

9.5.7.4. Business Strategies and Development

9.5.8. Ingredion Incorporated

9.5.8.1. Company Overview

9.5.8.2. Product Portfolio

9.5.8.3. Business Strategies and Development

9.5.9. Chr Hasen A/S

9.5.9.1. Company Overview

9.5.9.2. Product Portfolio

9.5.9.3. Financial Overview

9.5.9.4. Business Strategies and Development

9.5.10. Kellog Company

9.5.10.1. Company Overview

9.5.10.2. Product Portfolio

9.5.10.3. Financial Overview

9.5.10.4. Business Strategies and Development

9.5.11. General Mills

9.5.11.1. Company Overview

9.5.11.2. Product Portfolio

9.5.11.3. Financial Overview

9.5.11.4. Business Strategies and Development

9.5.12. Arla Foods

9.5.12.1. Company Overview

9.5.12.2. Product Portfolio

9.5.12.3. Financial Overview

9.5.12.4. Business Strategies and Development

9.5.13. Land O’Lakes

9.5.13.1. Company Overview

9.5.13.2. Product Portfolio

9.5.13.3. Financial Overview

9.5.13.4. Business Strategies and Development

9.5.14. Lactalis International

9.5.14.1. Company Overview

9.5.14.2. Product Portfolio

9.5.14.3. Financial Overview

9.5.14.4. Business Strategies and Development

9.5.15. Green Valley Creamery

9.5.15.1. Company Overview

9.5.15.2. Product Portfolio

9.5.15.3. Financial Overview

9.5.15.4. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2022 |

|

2018 - 2022 |

2023 - 2030 |

Value: US$ Million |

||

|

REPORT FEATURES |

DETAILS |

|

Product Type Coverage |

|

|

Nature Coverage |

|

|

Source Coverage |

|

|

End Use Coverage |

|

|

Distribution Channel Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |