Global Lentiviral Vectors Market

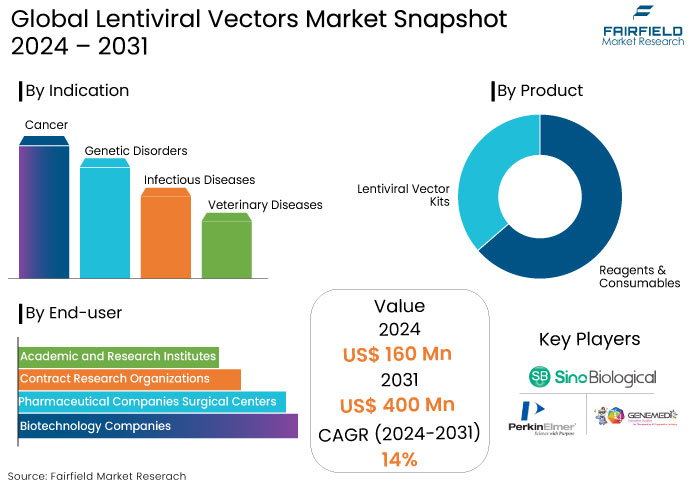

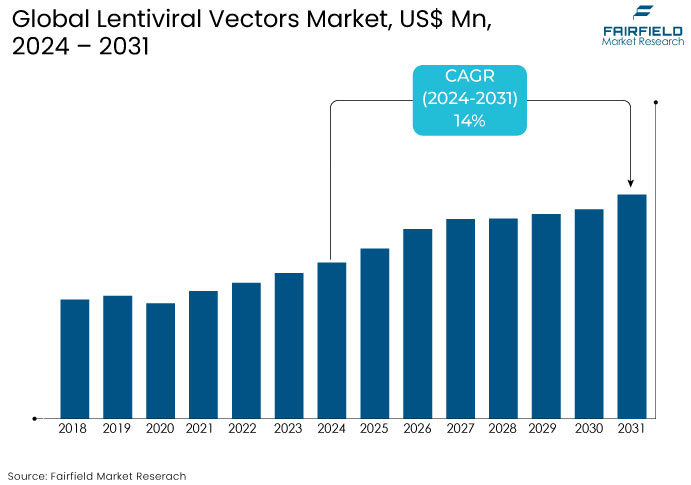

- The global sales of lentiviral vectors are projected to be worth US$160 Mn in 2024, and estimated to reach a value of US$400 Mn by 2031.

- The lentiviral vectors market is projected to exhibit a healthy CAGR of 14% over the projection period between 2024 and 2031.

Lentiviral Vectors Market Insights

- The global lentiviral vectors market is expanding notably, driven by the increasing adoption of gene therapies for genetic disorders, cancers, and chronic diseases.

- Lentiviral vectors are preferred for delivering gene therapies due to their efficiency in transducing both dividing and non-dividing cells, making them suitable for various therapeutic applications.

- Regulatory bodies like the FDA and EMA are expediting the approval process for gene therapies, accelerating the commercialization of lentiviral vector-based treatments.

- Technological advancements, including self-inactivating vectors, are enhancing the safety profiles of lentiviral vectors, addressing concerns about insertional mutagenesis.

- Partnerships between biotech, pharma companies, and contract manufacturers are fostering innovation and streamlining the development of lentiviral vector-based therapies.

- The demand for gene therapies delivered via lentiviral vectors is expected to grow, especially in oncology and rare diseases as personalized medicine becomes more prevalent.

- Asia Pacific particularly China and Japan, is seeing increased adoption of lentiviral vectors due to advancements in gene therapy and growing biotech investments.

- The rising number of clinical trials utilizing lentiviral vectors for gene therapy drives demand for these vectors, supporting their widespread use in developing new treatments.

A Look Back and a Look Forward - Comparative Analysis

The lentiviral vectors market, which plays a crucial role in gene therapy and the development of biologic drugs, has witnessed notable growth due to the increasing demand for advanced genetic therapies.

The market fueled by the growing adoption of lentiviral vectors in clinical trials from 2019 to 2023 particularly for treating tic disorders, cancer, and HIV. Key factors included advancements in vector engineering, improved safety profiles, and great efficiency in gene transfer, making them highly attractive for ex vivo and in vivo gene therapies.

The market is projected to experience significant growth, driven by ongoing innovation in lentiviral vector technology and the increasing number of approved gene therapies over the forecast period. The rise in the adoption of personalized medicine, CAR-T cell therapies, and advancements in genetic modifications for rare diseases and cancers will contribute to market expansion.

The growing number of collaborations between biotechnology firms and academic research institutions for lentiviral-based therapies will further accelerate growth. The increasing focus on viral vector manufacturing capacity, enhanced scalability, and cost-reduction strategies will likely drive further market penetration.

Key Growth Determinants

- Rising Demand for Gene Therapies

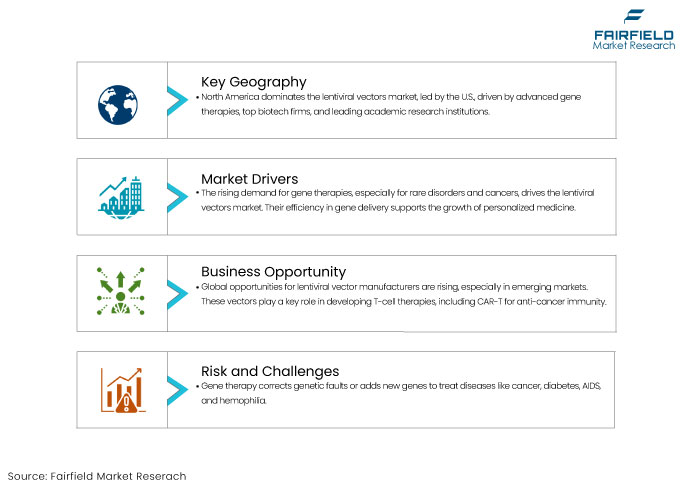

The growing demand for gene therapies, particularly for the treatment of rare genetic disorders and cancers, is a key driver for the lentiviral vectors market.

Lentiviral vectors are widely used for gene delivery due to their ability to efficiently transfer genetic material into both dividing and non-dividing cells, making them ideal for gene therapies targeting a wide range of diseases. As personalized medicine continues to gain momentum, with a focus on tailored treatments for individual patients, the need for efficient and reliable gene delivery systems like lentiviral vectors is accelerating.

The success of clinical trials and the approval of gene therapies using lentiviral vectors have further validated their potential, attracting investments and partnerships to develop next-generation therapies. This trend is expected to continue as advancements in gene-editing technologies like CRISPR and increased knowledge of genetic diseases lead to more targeted, effective treatments.

- Advancements in Lentiviral Vector Technology

Ongoing advancements in lentiviral vector technology are significantly boosting the lentiviral vectors market. Innovations aimed at improving vector efficiency, safety, and scalability have been pivotal in enhancing the overall effectiveness of gene therapies. For instance, next-generation lentiviral vectors, such as self-inactivating (SIN) vectors offer improved safety profiles by reducing the risk of insertional mutagenesis, a key concern in gene therapy.

Efforts to optimize manufacturing processes have helped reduce costs and increase the scalability of lentiviral vector production, making them more accessible for large-scale commercial use. Such advancements enhance the therapeutic potential of lentiviral vectors and open up new opportunities for their application in various clinical trials.

As new technologies emerge, such as synthetic biology approaches to vector design, the lentiviral vectors market will likely see continued growth driven by improved product offerings.

Key Growth Barriers

- High Expenses of Gene Therapy May Impede Market Growth Potential

Gene therapy seeks to rectify a genetic fault or introduce a novel gene to either cure an ailment or enhance the body's capacity to combat sickness. Gene therapy may assist those afflicted with heart disease, cancer, cystic fibrosis, AIDS, hemophilia, and diabetes, among various other conditions.

The expense of gene therapy is central to the issue. In numerous countries, drug prices are governed by current legislation. The pricing of gene therapies is predominantly unregulated and established on an individual basis, emphasizing a singular upfront payment.

Pharmaceutical manufacturers assess development costs, particular attributes of the condition, and related expenses that could be mitigated by alleviating the disease burden when determining pricing.

The pricing of gene therapies is affected by limited competition, as only a handful of companies are engaged in the development of such therapies for rare diseases. The restricted patient population eligible for treatment necessitates that profits from limited doses offset the comprehensive costs associated with drug development and manufacturing.

- Safety Concerns and Regulatory Hurdles

Safety concerns remain a significant barrier despite the promising potential of lentiviral vectors in gene therapy. The risks associated with inserting genetic material into the host genome could lead to insertional mutagenesis and unwanted genetic alterations.

Innovations like self-inactivating vectors aim to minimize these risks, but safety remains a key regulatory concern. As a result, the approval process for gene therapies utilizing lentiviral vectors is often lengthy and complex, involving rigorous testing and regulatory scrutiny.

Regulatory bodies like the FDA and EMA require comprehensive data on safety, efficacy, and long-term effects, which can delay market entry and increase the cost of development. These challenges in securing regulatory approval and addressing safety concerns may slow market growth.

Lentiviral Vectors Market Trends and Opportunities

- Increasing Demand for Lentiviral Vectors in T-Cell Engineering for Cancer Therapy

Numerous appealing opportunities for lentiviral vector manufacturers globally are anticipated during the forecast period. Emerging economies offer significant opportunities for key players to broaden their enterprises.

Lentiviral vectors have been beneficial in the development of gene-modified cell-based therapeutics, especially T-cell therapies. To establish anti-cancer immunity, such vectors are employed to deliver Chimeric Antigen Receptors (CARs) or cloned T-cell receptors to mature T cells.

The FDA approved the first genetically engineered cellular therapy with lentiviral vectors following the significant clinical efficacy demonstrated by CAR T-cell therapies. It is developed with these vectors in patients with B-cell malignancies.

Lentiviral vectors have progressed alongside CAR T-cell therapy, currently exhibiting their complete efficacy as an alternate treatment and a powerful adjunct in addressing various cancers.

- Expansion of Gene Editing Applications Remains a Transformative Opportunity

One of the most transformative opportunities in the lentiviral vectors market lies in their integration with gene-editing technologies like CRISPR. Lentiviral vectors are increasingly being used as delivery systems for CRISPR-based gene editing, which is revolutionizing the potential for treating genetic diseases.

CRISPR allows for precise modifications to DNA, and when coupled with lentiviral vectors, it provides an efficient means of delivering gene-editing tools into patient cells. The synergy holds immense promise for treating various conditions, such as sickle cell anemia, cystic fibrosis, and certain cancers.

As CRISPR and other gene-editing technologies advance, the demand for lentiviral vectors to safely and effectively deliver these tools will grow exponentially. It opens up a significant opportunity for companies in the lentiviral vector space to collaborate with gene-editing firms, further accelerating the commercialization of gene therapies.

How Does Regulatory Scenario Shape the Industry?

The regulatory scenario is critical in shaping the lentiviral vectors market, influencing innovation and market adoption. Given that lentiviral vectors are integral to gene therapies, which often involve altering the genetic makeup of human cells. They are subject to stringent regulatory oversight by authorities like the FDA, EMA, and other global health agencies.

The approval process for gene therapies utilizing lentiviral vectors can be lengthy, requiring comprehensive preclinical and clinical data to demonstrate safety, efficacy, and long-term outcomes. Regulatory bodies closely examine the risks associated with viral vectors, such as insertional mutagenesis and immunogenicity.

Innovations in vector design, such as self-inactivating lentiviral vectors, aim to address these concerns and facilitate regulatory approval. However, the complexity and variability of gene therapies can delay approval processes, increasing development costs.

Regulatory advancements are emerging, with regulators streamlining approvals for breakthrough therapies or granting orphan drug status to treatments for rare diseases despite these challenges. These changes are accelerating the adoption of lentiviral vectors in gene therapy, presenting growth opportunities as more products reach the market.

Segments Covered in the Report

- Demand to Remain High for Lentiviral Vector Kits

Lentiviral vector kits are progressively utilized in academic research institutions and biotechnology companies. The simplicity, reliability, and affordability of kits align with the preferences and requirements of diverse research organizations.

As academic and biotech research expands, so does the need for lentiviral vector kits as crucial tools for genetic study and medicinal development. Lentiviral vector kits are generally economical than individually acquired reagents. Acquiring a kit diminishes the necessity for research institutes to source and verify each component individually, hence reducing overall costs.

The cost-effectiveness is particularly appealing to smaller research teams or universities with constrained funds, hence increasing the market for lentiviral vector kits. Lentiviral vector kits comprise lentiviral packing systems, expression systems, promoter kits, and fusion tags, among others.

- Cancer Segment Dominates the Indication Segment

Lentiviral vectors have facilitated the development of gene-modified cell therapies, especially T-cell therapies. The vectors have been utilized to deliver chimeric antigen receptors (CARs) or cloned T-cell receptors to mature T cells, thereby fostering anti-cancer immunity.

Following the significant success of CAR T-cell therapies developed with lentiviral vectors in patients with B-cell malignancies, the FDA approved the first genetically engineered cellular therapy. Researchers are concentrating on advancing anti-cancer therapies utilizing lentiviral vectors.

The need for lentiviral vectors has surged due to advancements in gene editing technologies, such as CRISPR-Cas9, which facilitate the precise alteration of cancer-associated genes. Researchers and medical practitioners can precisely modify genetic information in cancer cells by utilizing these vectors as effective carriers of gene-editing instruments. Lentiviral vectors are increasingly sought after due to the expanding exploration of gene editing applications in cancer research and treatment.

Regional Analysis

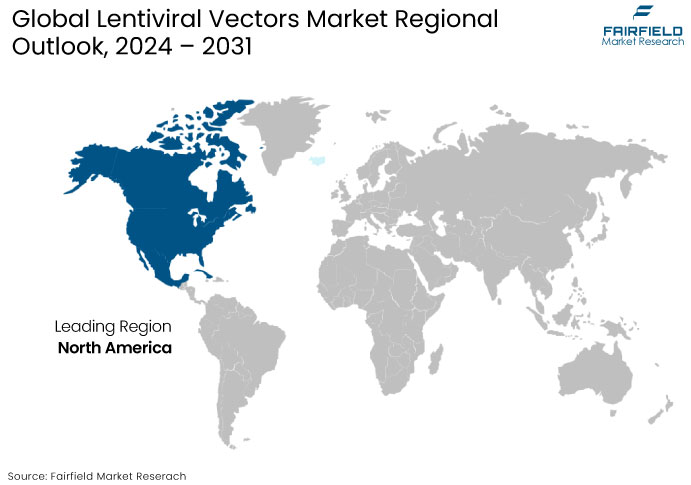

- North America Leads Global Market Share with High Adoption Rate of Gene Therapies

North America is currently the dominant region in the lentiviral vectors market, primarily driven by the United States, which leads due to the adoption of gene therapies and the development of advanced biotechnologies. The U.S. is home to numerous leading biotechnology and pharmaceutical companies and top-tier academic institutions, which conduct cutting-edge research on gene therapies and lentiviral vector technologies.

Key institutions and a robust network of biotech startups are at the forefront of innovation in gene delivery systems, driving the demand for lentiviral vectors. The proliferation of biotech centers around the United States, particularly in the Boston-Cambridge and San Francisco Bay areas, cultivates a cooperative climate conducive to commercial growth.

Organizations located in these centers benefit from access to a talent pool, enhanced networking opportunities, and information exchange. The aggregation of knowledge and resources in biotechnology hubs fosters innovation and facilitates the growth of the lentiviral vector sector in the United States.

The United States. has a well-established healthcare system that supports the rapid adoption of novel therapies. With the increasing approval of gene therapies for rare diseases, cancers, and genetic disorders, the demand for lentiviral vectors continues to grow.

- Asia Pacific Lentiviral Vectors Market to Witness High Growth Rate

Asia Pacific region is expected to witness significant growth in the lentiviral vectors market in the coming years. Regional market growth is driven by expanding healthcare infrastructure, increasing investments in biotechnology, and rising awareness of gene therapies.

Countries like China, Japan, South Korea, and India are significantly progressing in gene therapy research and clinical applications. Japan has a particularly strong regulatory framework for gene therapies. China is rapidly becoming a hub for gene therapy research, with increasing clinical trials and adopting new therapeutic approaches.

Challenges such as regulatory inconsistencies, varying levels of healthcare infrastructure, and cost barriers may slow the widespread adoption of lentiviral vector-based treatments across the region. Furthermore, the growing interest in personalized medicine and the treatment of rare genetic disorders is expected to drive the market’s growth in Asia Pacific.

Fairfield’s Competitive Landscape Analysis

The competitive environment of the lentiviral vector market is marked by strong rivalry among leading competitors vying for market domination and innovation leadership. Prominent pharmaceutical and biotechnology companies vie for substantial market share in this sector, accompanied by an increasing number of emerging biotech startups.

Strategic alliances, collaborations, mergers, and acquisitions are essential to the corporate landscape as companies seek to enhance their technological capabilities, broaden product portfolios, and expand global market reach.

Key Market Companies

- Thermo Fisher Scientific

- PerkinElmer Inc.

- GENEMEDI

- Takara Bio, Inc.

- Charles River Laboratories

- Sino Biological Inc.

- OriGene Technologies, Inc.

- Cell BioLabs, Inc.

- Applied Biological Materials Inc.

Recent Industry D Developments

- In April 2023, Yposkesi, the clinical and commercial viral vector manufacturing business of SK Pharmateco, announced the introduction of LentiSure, an advanced platform designed to enhance the robustness and efficacy of lentiviral vector production.

- In January 2024, Oxford Biomedica, a leader in lentiviral vector-based gene delivery systems, announced a collaboration with Novartis to produce lentiviral vectors for Novartis' clinical and commercial gene therapy programs.

An Expert’s Eye

- The lentiviral vectors market is poised for rapid growth due to the increasing demand for gene therapies, particularly for rare genetic disorders, cancers, and chronic diseases.

- Innovations in vector design, such as self-inactivating and modified lentiviral vectors, improve safety profiles, which will drive broader adoption in clinical settings.

- Despite growth prospects, the high cost and scalability challenges in lentiviral vector production remain significant barriers to widespread adoption.

- As personalized medicine becomes more prevalent, the need for tailored gene therapies delivered via lentiviral vectors will increase, creating long-term market opportunities.

Global Lentiviral Vectors Market is Segmented as-

By Product

- Lentiviral Vector Kits

- Reagents & Consumables

By Indication

- Cancer

- Genetic Disorders

- Infectious Diseases

- Veterinary Diseases

By End User

- Biotechnology Companies

- Pharmaceutical Companies

- Contract Research Organizations (CROs)

- Academic and Research Institutes

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- The Middle East & Africa

1. Executive Summary

1.1. Global Lentiviral Vectors Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2024

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. COVID-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Global Lentiviral Vectors Market Outlook, 2019 - 2031

3.1. Global Lentiviral Vectors Market Outlook, by Product, Value (US$ Bn), 2019 - 2031

3.1.1. Key Highlights

3.1.1.1. Lentiviral Vector Kits

3.1.1.1.1. Lentiviral Packing Systems

3.1.1.1.2. Lentiviral Expression Systems

3.1.1.1.3. Lentiviral Promoter Kits

3.1.1.1.4. Lentiviral Fusion Tags

3.1.1.2. Reagents & Consumables

3.2. Global Lentiviral Vectors Market Outlook, by Indication, Value (US$ Bn), 2019 - 2031

3.2.1. Key Highlights

3.2.1.1. Cancer

3.2.1.2. Genetic Disorders

3.2.1.3. Infectious Diseases

3.2.1.4. Veterinary Diseases

3.2.1.5. Others

3.3. Global Lentiviral Vectors Market Outlook, by End User, Value (US$ Bn), 2019 - 2031

3.3.1. Key Highlights

3.3.1.1. Biotechnology Companies

3.3.1.2. Pharmaceutical Companies

3.3.1.3. Contract Research Organizations (CROs)

3.3.1.4. Academic and Research Institutes

3.4. Global Lentiviral Vectors Market Outlook, by Region, Value (US$ Bn), 2019 - 2031

3.4.1. Key Highlights

3.4.1.1. North America

3.4.1.2. Europe

3.4.1.3. Asia Pacific

3.4.1.4. Latin America

3.4.1.5. Middle East & Africa

4. North America Lentiviral Vectors Market Outlook, 2019 - 2031

4.1. North America Lentiviral Vectors Market Outlook, by Product, Value (US$ Bn), 2019 - 2031

4.1.1. Key Highlights

4.1.1.1. Lentiviral Vector Kits

4.1.1.1.1. Lentiviral Packing Systems

4.1.1.1.2. Lentiviral Expression Systems

4.1.1.1.3. Lentiviral Promoter Kits

4.1.1.1.4. Lentiviral Fusion Tags

4.1.1.2. Reagents & Consumables

4.2. North America Lentiviral Vectors Market Outlook, by Indication, Value (US$ Bn), 2019 - 2031

4.2.1. Key Highlights

4.2.1.1. Cancer

4.2.1.2. Genetic Disorders

4.2.1.3. Infectious Diseases

4.2.1.4. Veterinary Diseases

4.2.1.5. Others

4.3. North America Lentiviral Vectors Market Outlook, by End User, Value (US$ Bn), 2019 - 2031

4.3.1. Key Highlights

4.3.1.1. Biotechnology Companies

4.3.1.2. Pharmaceutical Companies

4.3.1.3. Contract Research Organizations (CROs)

4.3.1.4. Academic and Research Institutes

4.3.2. BPS Analysis/Market Attractiveness Analysis

4.4. North America Lentiviral Vectors Market Outlook, by Country, Value (US$ Bn), 2019 - 2031

4.4.1. Key Highlights

4.4.1.1. U.S. Lentiviral Vectors Market by Product, Value (US$ Bn), 2019 - 2031

4.4.1.2. U.S. Lentiviral Vectors Market by Indication, Value (US$ Bn), 2019 - 2031

4.4.1.3. U.S. Lentiviral Vectors Market by End User, Value (US$ Bn), 2019 - 2031

4.4.1.4. Canada Lentiviral Vectors Market by Product, Value (US$ Bn), 2019 - 2031

4.4.1.5. Canada Lentiviral Vectors Market by Indication, Value (US$ Bn), 2019 - 2031

4.4.1.6. Canada Lentiviral Vectors Market by End User, Value (US$ Bn), 2019 - 2031

4.4.2. BPS Analysis/Market Attractiveness Analysis

5. Europe Lentiviral Vectors Market Outlook, 2019 - 2031

5.1. Europe Lentiviral Vectors Market Outlook, by Product, Value (US$ Bn), 2019 - 2031

5.1.1. Key Highlights

5.1.1.1. Lentiviral Vector Kits

5.1.1.1.1. Lentiviral Packing Systems

5.1.1.1.2. Lentiviral Expression Systems

5.1.1.1.3. Lentiviral Promoter Kits

5.1.1.1.4. Lentiviral Fusion Tags

5.1.1.2. Reagents & Consumables

5.2. Europe Lentiviral Vectors Market Outlook, by Indication, Value (US$ Bn), 2019 - 2031

5.2.1. Key Highlights

5.2.1.1. Cancer

5.2.1.2. Genetic Disorders

5.2.1.3. Infectious Diseases

5.2.1.4. Veterinary Diseases

5.2.1.5. Others

5.3. Europe Lentiviral Vectors Market Outlook, by End User, Value (US$ Bn), 2019 - 2031

5.3.1. Key Highlights

5.3.1.1. Biotechnology Companies

5.3.1.2. Pharmaceutical Companies

5.3.1.3. Contract Research Organizations (CROs)

5.3.1.4. Academic and Research Institutes

5.3.2. BPS Analysis/Market Attractiveness Analysis

5.4. Europe Lentiviral Vectors Market Outlook, by Country, Value (US$ Bn), 2019 - 2031

5.4.1. Key Highlights

5.4.1.1. Germany Lentiviral Vectors Market by Product, Value (US$ Bn), 2019 - 2031

5.4.1.2. Germany Lentiviral Vectors Market by Indication, Value (US$ Bn), 2019 - 2031

5.4.1.3. Germany Lentiviral Vectors Market by End User, Value (US$ Bn), 2019 - 2031

5.4.1.4. U.K. Lentiviral Vectors Market by Product, Value (US$ Bn), 2019 - 2031

5.4.1.5. U.K. Lentiviral Vectors Market by Indication, Value (US$ Bn), 2019 - 2031

5.4.1.6. U.K. Lentiviral Vectors Market by End User, Value (US$ Bn), 2019 - 2031

5.4.1.7. France Lentiviral Vectors Market by Product, Value (US$ Bn), 2019 - 2031

5.4.1.8. France Lentiviral Vectors Market by Indication, Value (US$ Bn), 2019 - 2031

5.4.1.9. France Lentiviral Vectors Market by End User, Value (US$ Bn), 2019 - 2031

5.4.1.10. Italy Lentiviral Vectors Market by Product, Value (US$ Bn), 2019 - 2031

5.4.1.11. Italy Lentiviral Vectors Market by Indication, Value (US$ Bn), 2019 - 2031

5.4.1.12. Italy Lentiviral Vectors Market by End User, Value (US$ Bn), 2019 - 2031

5.4.1.13. Turkey Lentiviral Vectors Market by Product, Value (US$ Bn), 2019 - 2031

5.4.1.14. Turkey Lentiviral Vectors Market by Indication, Value (US$ Bn), 2019 - 2031

5.4.1.15. Turkey Lentiviral Vectors Market by End User, Value (US$ Bn), 2019 - 2031

5.4.1.16. Russia Lentiviral Vectors Market by Product, Value (US$ Bn), 2019 - 2031

5.4.1.17. Russia Lentiviral Vectors Market by Indication, Value (US$ Bn), 2019 - 2031

5.4.1.18. Russia Lentiviral Vectors Market by End User, Value (US$ Bn), 2019 - 2031

5.4.1.19. Rest of Europe Lentiviral Vectors Market by Product, Value (US$ Bn), 2019 - 2031

5.4.1.20. Rest of Europe Lentiviral Vectors Market by Indication, Value (US$ Bn), 2019 - 2031

5.4.1.21. Rest of Europe Lentiviral Vectors Market by End User, Value (US$ Bn), 2019 - 2031

5.4.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Lentiviral Vectors Market Outlook, 2019 - 2031

6.1. Asia Pacific Lentiviral Vectors Market Outlook, by Product, Value (US$ Bn), 2019 - 2031

6.1.1. Key Highlights

6.1.1.1. Lentiviral Vector Kits

6.1.1.1.1. Lentiviral Packing Systems

6.1.1.1.2. Lentiviral Expression Systems

6.1.1.1.3. Lentiviral Promoter Kits

6.1.1.1.4. Lentiviral Fusion Tags

6.1.1.2. Reagents & Consumables

6.2. Asia Pacific Lentiviral Vectors Market Outlook, by Indication, Value (US$ Bn), 2019 - 2031

6.2.1. Key Highlights

6.2.1.1. Cancer

6.2.1.2. Genetic Disorders

6.2.1.3. Infectious Diseases

6.2.1.4. Veterinary Diseases

6.2.1.5. Others

6.3. Asia Pacific Lentiviral Vectors Market Outlook, by End User, Value (US$ Bn), 2019 - 2031

6.3.1. Key Highlights

6.3.1.1. Biotechnology Companies

6.3.1.2. Pharmaceutical Companies

6.3.1.3. Contract Research Organizations (CROs)

6.3.1.4. Academic and Research Institutes

6.3.2. BPS Analysis/Market Attractiveness Analysis

6.4. Asia Pacific Lentiviral Vectors Market Outlook, by Country, Value (US$ Bn), 2019 - 2031

6.4.1. Key Highlights

6.4.1.1. China Lentiviral Vectors Market by Product, Value (US$ Bn), 2019 - 2031

6.4.1.2. China Lentiviral Vectors Market by Indication, Value (US$ Bn), 2019 - 2031

6.4.1.3. China Lentiviral Vectors Market by End User, Value (US$ Bn), 2019 - 2031

6.4.1.4. Japan Lentiviral Vectors Market by Product, Value (US$ Bn), 2019 - 2031

6.4.1.5. Japan Lentiviral Vectors Market by Indication, Value (US$ Bn), 2019 - 2031

6.4.1.6. Japan Lentiviral Vectors Market by End User, Value (US$ Bn), 2019 - 2031

6.4.1.7. South Korea Lentiviral Vectors Market by Product, Value (US$ Bn), 2019 - 2031

6.4.1.8. South Korea Lentiviral Vectors Market by Indication, Value (US$ Bn), 2019 - 2031

6.4.1.9. South Korea Lentiviral Vectors Market by End User, Value (US$ Bn), 2019 - 2031

6.4.1.10. India Lentiviral Vectors Market by Product, Value (US$ Bn), 2019 - 2031

6.4.1.11. India Lentiviral Vectors Market by Indication, Value (US$ Bn), 2019 - 2031

6.4.1.12. India Lentiviral Vectors Market by End User, Value (US$ Bn), 2019 - 2031

6.4.1.13. Southeast Asia Lentiviral Vectors Market by Product, Value (US$ Bn), 2019 - 2031

6.4.1.14. Southeast Asia Lentiviral Vectors Market by Indication, Value (US$ Bn), 2019 - 2031

6.4.1.15. Southeast Asia Lentiviral Vectors Market by End User, Value (US$ Bn), 2019 - 2031

6.4.1.16. Rest of Asia Pacific Lentiviral Vectors Market by Product, Value (US$ Bn), 2019 - 2031

6.4.1.17. Rest of Asia Pacific Lentiviral Vectors Market by Indication, Value (US$ Bn), 2019 - 2031

6.4.1.18. Rest of Asia Pacific Lentiviral Vectors Market by End User, Value (US$ Bn), 2019 - 2031

6.4.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America Lentiviral Vectors Market Outlook, 2019 - 2031

7.1. Latin America Lentiviral Vectors Market Outlook, by Product, Value (US$ Bn), 2019 - 2031

7.1.1. Key Highlights

7.1.1.1. Lentiviral Vector Kits

7.1.1.1.1. Lentiviral Packing Systems

7.1.1.1.2. Lentiviral Expression Systems

7.1.1.1.3. Lentiviral Promoter Kits

7.1.1.1.4. Lentiviral Fusion Tags

7.1.1.2. Reagents & Consumables

7.2. Latin America Lentiviral Vectors Market Outlook, by Indication, Value (US$ Bn), 2019 - 2031

7.2.1. Key Highlights

7.2.1.1. Cancer

7.2.1.2. Genetic Disorders

7.2.1.3. Infectious Diseases

7.2.1.4. Veterinary Diseases

7.2.1.5. Others

7.3. Latin America Lentiviral Vectors Market Outlook, by End User, Value (US$ Bn), 2019 - 2031

7.3.1. Key Highlights

7.3.1.1. Biotechnology Companies

7.3.1.2. Pharmaceutical Companies

7.3.1.3. Contract Research Organizations (CROs)

7.3.1.4. Academic and Research Institutes

7.3.2. BPS Analysis/Market Attractiveness Analysis

7.4. Latin America Lentiviral Vectors Market Outlook, by Country, Value (US$ Bn), 2019 - 2031

7.4.1. Key Highlights

7.4.1.1. Brazil Lentiviral Vectors Market by Product, Value (US$ Bn), 2019 - 2031

7.4.1.2. Brazil Lentiviral Vectors Market by Indication, Value (US$ Bn), 2019 - 2031

7.4.1.3. Brazil Lentiviral Vectors Market by End User, Value (US$ Bn), 2019 - 2031

7.4.1.4. Mexico Lentiviral Vectors Market by Product, Value (US$ Bn), 2019 - 2031

7.4.1.5. Mexico Lentiviral Vectors Market by Indication, Value (US$ Bn), 2019 - 2031

7.4.1.6. Mexico Lentiviral Vectors Market by End User, Value (US$ Bn), 2019 - 2031

7.4.1.7. Argentina Lentiviral Vectors Market by Product, Value (US$ Bn), 2019 - 2031

7.4.1.8. Argentina Lentiviral Vectors Market by Indication, Value (US$ Bn), 2019 - 2031

7.4.1.9. Argentina Lentiviral Vectors Market by End User, Value (US$ Bn), 2019 - 2031

7.4.1.10. Rest of Latin America Lentiviral Vectors Market by Product, Value (US$ Bn), 2019 - 2031

7.4.1.11. Rest of Latin America Lentiviral Vectors Market by Indication, Value (US$ Bn), 2019 - 2031

7.4.1.12. Rest of Latin America Lentiviral Vectors Market by End User, Value (US$ Bn), 2019 - 2031

7.4.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Lentiviral Vectors Market Outlook, 2019 - 2031

8.1. Middle East & Africa Lentiviral Vectors Market Outlook, by Product, Value (US$ Bn), 2019 - 2031

8.1.1. Key Highlights

8.1.1.1. Lentiviral Vector Kits

8.1.1.1.1. Lentiviral Packing Systems

8.1.1.1.2. Lentiviral Expression Systems

8.1.1.1.3. Lentiviral Promoter Kits

8.1.1.1.4. Lentiviral Fusion Tags

8.1.1.2. Reagents & Consumables

8.2. Middle East & Africa Lentiviral Vectors Market Outlook, by Indication, Value (US$ Bn), 2019 - 2031

8.2.1. Key Highlights

8.2.1.1. Cancer

8.2.1.2. Genetic Disorders

8.2.1.3. Infectious Diseases

8.2.1.4. Veterinary Diseases

8.2.1.5. Others

8.3. Middle East & Africa Lentiviral Vectors Market Outlook, by End User, Value (US$ Bn), 2019 - 2031

8.3.1. Key Highlights

8.3.1.1. Biotechnology Companies

8.3.1.2. Pharmaceutical Companies

8.3.1.3. Contract Research Organizations (CROs)

8.3.1.4. Academic and Research Institutes

8.3.2. BPS Analysis/Market Attractiveness Analysis

8.4. Middle East & Africa Lentiviral Vectors Market Outlook, by Country, Value (US$ Bn), 2019 - 2031

8.4.1. Key Highlights

8.4.1.1. GCC Lentiviral Vectors Market by Product, Value (US$ Bn), 2019 - 2031

8.4.1.2. GCC Lentiviral Vectors Market by Indication, Value (US$ Bn), 2019 - 2031

8.4.1.3. GCC Lentiviral Vectors Market by End User, Value (US$ Bn), 2019 - 2031

8.4.1.4. South Africa Lentiviral Vectors Market by Product, Value (US$ Bn), 2019 - 2031

8.4.1.5. South Africa Lentiviral Vectors Market by Indication, Value (US$ Bn), 2019 - 2031

8.4.1.6. South Africa Lentiviral Vectors Market by End User, Value (US$ Bn), 2019 - 2031

8.4.1.7. Egypt Lentiviral Vectors Market by Product, Value (US$ Bn), 2019 - 2031

8.4.1.8. Egypt Lentiviral Vectors Market by Indication, Value (US$ Bn), 2019 - 2031

8.4.1.9. Egypt Lentiviral Vectors Market by End User, Value (US$ Bn), 2019 - 2031

8.4.1.10. Nigeria Lentiviral Vectors Market by Product, Value (US$ Bn), 2019 - 2031

8.4.1.11. Nigeria Lentiviral Vectors Market by Indication, Value (US$ Bn), 2019 - 2031

8.4.1.12. Nigeria Lentiviral Vectors Market by End User, Value (US$ Bn), 2019 - 2031

8.4.1.13. Rest of Middle East & Africa Lentiviral Vectors Market by Product, Value (US$ Bn), 2019 - 2031

8.4.1.14. Rest of Middle East & Africa Lentiviral Vectors Market by Indication, Value (US$ Bn), 2019 - 2031

8.4.1.15. Rest of Middle East & Africa Lentiviral Vectors Market by End User, Value (US$ Bn), 2019 - 2031

8.4.2. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. Product vs Indication Heatmap

9.2. Company Market Share Analysis, 2024

9.3. Competitive Dashboard

9.4. Company Profiles

9.4.1. Thermo Fisher Scientific

9.4.1.1. Company Overview

9.4.1.2. Product Portfolio

9.4.1.3. Financial Overview

9.4.1.4. Business Strategies and Development

9.4.2. PerkinElmer Inc. (Sirion-Biotech GmbH)

9.4.2.1. Company Overview

9.4.2.2. Product Portfolio

9.4.2.3. Financial Overview

9.4.2.4. Business Strategies and Development

9.4.3. GENEMEDI

9.4.3.1. Company Overview

9.4.3.2. Product Portfolio

9.4.3.3. Financial Overview

9.4.3.4. Business Strategies and Development

9.4.4. Takara Bio, Inc.

9.4.4.1. Company Overview

9.4.4.2. Product Portfolio

9.4.4.3. Financial Overview

9.4.4.4. Business Strategies and Development

9.4.5. Charles River Laboratories

9.4.5.1. Company Overview

9.4.5.2. Product Portfolio

9.4.5.3. Financial Overview

9.4.5.4. Business Strategies and Development

9.4.6. Sino Biological Inc.

9.4.6.1. Company Overview

9.4.6.2. Product Portfolio

9.4.6.3. Financial Overview

9.4.6.4. Business Strategies and Development

9.4.7. OriGene Technologies, Inc.

9.4.7.1. Company Overview

9.4.7.2. Product Portfolio

9.4.7.3. Financial Overview

9.4.7.4. Business Strategies and Development

9.4.8. Cell BioLabs, Inc.

9.4.8.1. Company Overview

9.4.8.2. Product Portfolio

9.4.8.3. Financial Overview

9.4.8.4. Business Strategies and Development

9.4.9. Applied Biological Materials Inc.

9.4.9.1. Company Overview

9.4.9.2. Product Portfolio

9.4.9.3. Financial Overview

9.4.9.4. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2022 |

|

2019 - 2022 |

2024 - 2031 |

Value: US$ Million |

||

|

REPORT FEATURES |

DETAILS |

|

Product Coverage |

|

|

Indication Coverage |

|

|

End User Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |