Global Liquid-Filled Hard Capsules Market Forecast

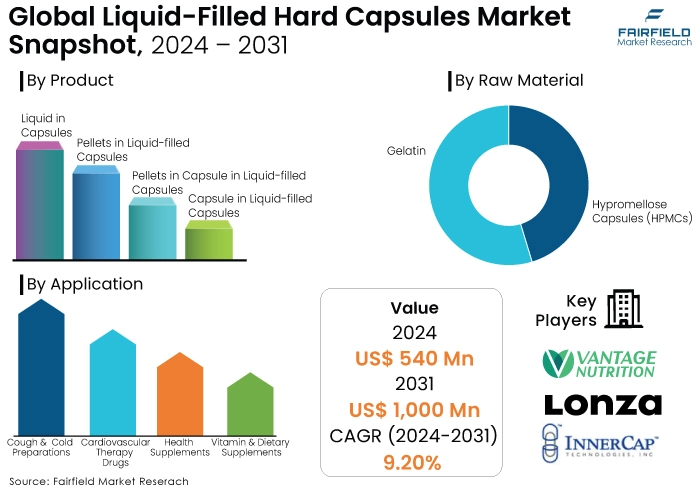

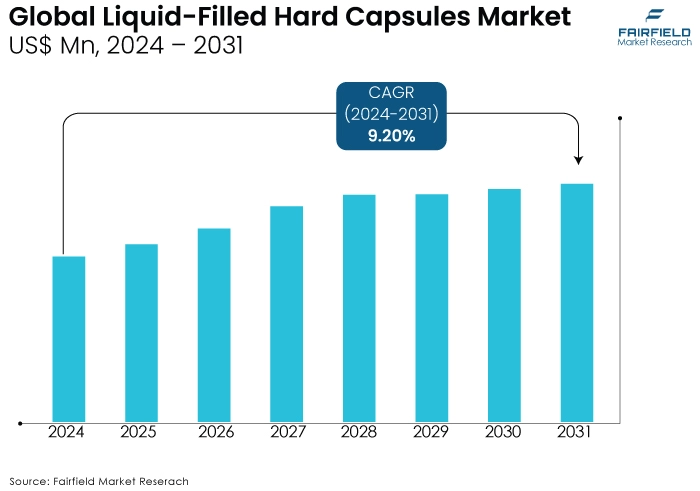

- Global liquid-filled hard capsules market size to reach US$1,000 Mn in 2031, up from US$540 Mn attained in 2024

- Market revenue projected to exhibit a remarkable rate of expansion, at an estimated CAGR of 9.20% during 2024 - 2031

Quick Report Digest

- The global liquid-filled hard capsules market revenue will nearly double between the years of forecast, i.e., 2024 and 2031.

- Demand for oral drug delivery systems, pharmaceutical industry expansion, technological advancements.

- Regulatory hurdles, technical challenges, competition from alternative forms.

- Expansion of therapeutic applications, and the accelerating R&D investments are predominantly driving growth in the market.

- Stringent regulations shape market dynamics.

- Pharmaceuticals, nutraceuticals, and cosmeceuticals represent the top performing segments as demand from these sectors continues to be the

- Regional frontrunners in this market are North America, and Asia Pacific.

- Some of the industry leaders in the liquid-filled hard capsules market include Vantage Nutrition, INNERCAP Technologies, Liquidcapsule Manufacturing LLC, Lonza, SuHeung, and Altasciences.

A Look Back and a Look Forward - Comparative Analysis

The liquid-filled hard capsules market witnessed steady growth from 2019 to 2023, driven by factors like rising demand for oral medications, increasing preference for patient convenience, and growing adoption in pharmaceutical and nutraceutical industries.

Compared to traditional tablets, liquid-filled capsules offer several advantages, including faster dissolution rates, improved bioavailability of drugs, and the ability to administer taste-masked medications. This has led to their widespread adoption across various therapeutic areas. The COVID-19 pandemic further influenced market growth as the demand for pharmaceuticals and dietary supplements surged. The market also saw increased investment in research and development activities focused on novel drug delivery systems utilising liquid-filled capsules.

The market is expected to maintain its growth trajectory during the forecast period 2024-2031. This growth can be attributed to the rising geriatric population, who often require medications that are easier to swallow, along with an expanding pharmaceutical industry and the introduction of new drugs. Furthermore, advancements in technology, such as the development of tamper-evident and child-resistant capsules, are expected to create lucrative opportunities for market participants. However, stringent regulations regarding the manufacturing and safety of liquid-filled capsules might pose a challenge to market growth.

Key Growth Determinants

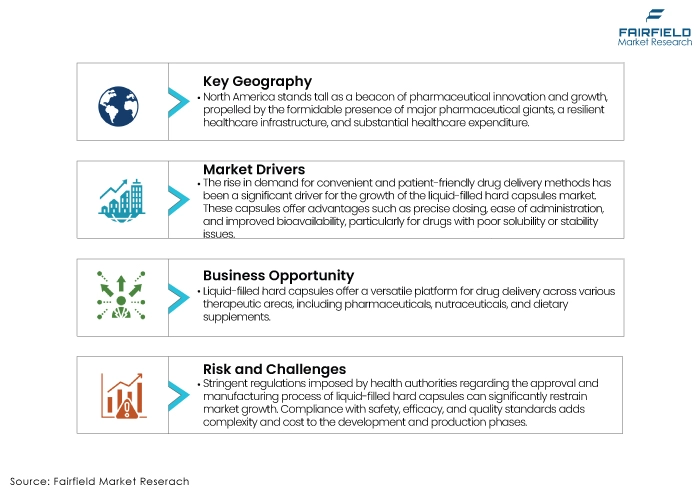

- Increasing Demand for Oral Drug Delivery Systems

The rise in demand for convenient and patient-friendly drug delivery methods has been a significant driver for the growth of the liquid-filled hard capsules market. These capsules offer advantages such as precise dosing, ease of administration, and improved bioavailability, particularly for drugs with poor solubility or stability issues.

- Expanding Pharmaceutical Industry

The pharmaceutical industry's continuous growth, driven by factors such as population ageing, increasing prevalence of chronic diseases, and advancements in drug development, has fuelled the demand for innovative dosage forms like liquid-filled hard capsules. Pharmaceutical companies are increasingly adopting these capsules for both new drug formulations and reformulations of existing drugs to enhance their efficacy and patient compliance.

- Technological Advancements, and Product Innovations

Ongoing advancements in capsule manufacturing technologies, including improvements in capsule shell materials, filling processes, and sealing techniques, have led to the development of more sophisticated and versatile liquid-filled hard capsules. These innovations have expanded the applicability of liquid-filled capsules across a wide range of therapeutic areas and formulations, driving market growth through enhanced performance and functionality.

Major Growth Barriers

- Regulatory Hurdles

Stringent regulations imposed by health authorities regarding the approval and manufacturing process of liquid-filled hard capsules can significantly restrain market growth. Compliance with safety, efficacy, and quality standards adds complexity and cost to the development and production phases.

- Technical Challenges

Complex formulations and the need for precise encapsulation of liquids pose technical challenges in manufacturing liquid-filled hard capsules. Issues such as stability, uniformity, and compatibility between capsule materials and liquid formulations can limit scalability and hinder market expansion.

- Competition from Alternative Dosage Forms

Competition from alternative dosage forms like tablets, softgels, and traditional hard capsules can impede the growth of the liquid-filled hard capsules market. Each dosage form offers unique advantages and may be preferred by pharmaceutical companies and consumers for specific applications, affecting the market share and adoption of liquid-filled hard capsules.

Key Trends and Opportunities to Look at -

- Expansion of Therapeutic Applications

Liquid-filled hard capsules offer a versatile platform for drug delivery across various therapeutic areas, including pharmaceuticals, nutraceuticals, and dietary supplements. Market players can capitalise on this opportunity by developing innovative formulations targeting unmet medical needs in areas such as oncology, central nervous system disorders, and autoimmune diseases. By expanding the therapeutic applications of liquid-filled hard capsules, companies can tap into new markets and drive revenue growth.

- Investment in Research and Development

With the increasing demand for customised formulations and plant-based capsules, investment in research and development (R&D) is crucial for maintaining a competitive edge in the market. Market players can differentiate themselves by investing in R&D initiatives aimed at developing novel capsule formulations, improving manufacturing processes, and enhancing product performance.

Additionally, investment in R&D enables companies to stay abreast of emerging trends, such as personalised medicine and advanced drug delivery systems, ensuring long-term sustainability and market leadership. By prioritising R&D investment, market players can drive innovation and seize opportunities for growth in the dynamic liquid-filled hard capsules market.

How Does the Regulatory Scenario Shape this Industry?

The regulatory landscape significantly impacts the liquid-filled hard capsules market. Stringent regulations imposed by agencies like the US Food and Drug Administration (FDA) ensure the safety, efficacy, and quality of these capsules. While this fosters consumer trust, it also presents challenges for manufacturers. Strict compliance procedures can be time-consuming and expensive, potentially slowing down product development and launch. This can be especially burdensome for smaller companies.

However, regulations also play a role in driving innovation. The need to meet specific safety and quality standards pushes manufacturers to develop advanced manufacturing processes and capsule materials. This ongoing pursuit of improvement benefits the entire market by producing higher-performing capsules with features like controlled release or improved bioavailability.

The regulatory environment is expected to remain a key factor shaping the liquid-filled hard capsules market. Manufacturers will need to navigate this complex landscape while staying focused on research and development to capitalise on the market's growth potential. This might involve strategic partnerships or acquisitions to access cutting-edge technologies and expertise. By remaining adaptable and compliant, manufacturers can ensure their place in this dynamic and promising market.

Fairfield’s Ranking Board

Top Segments

- Pharmaceuticals Industry Registers the Maximum Uptake

Liquid-filled hard capsules are extensively utilised in the pharmaceutical industry due to their versatility, ease of swallowing, and precise dosage capabilities. They are commonly used for delivering liquid formulations, such as oils, suspensions, and solutions, of various drugs including vitamins, supplements, and prescription medications.

The pharmaceutical segment is witnessing robust growth driven by the increasing demand for innovative drug delivery systems, especially for poorly soluble drugs. Additionally, the rising prevalence of chronic diseases and the ageing population further bolster the demand for liquid-filled hard capsules in pharmaceutical applications.

- The Growing Boom Around Nutraceuticals Creates Ample Opportunity

Liquid-filled hard capsules are gaining traction in the nutraceutical sector owing to their ability to encapsulate liquid ingredients, such as oils, botanical extracts, and vitamins, effectively preserving their potency and enhancing bioavailability.

The growing consumer awareness regarding preventive healthcare and wellness supplements fuels the demand for nutraceutical products encapsulated in liquid-filled hard capsules. Moreover, the expanding market for dietary supplements and functional foods, coupled with the preference for convenient dosage forms, drives the adoption of liquid-filled hard capsules in the nutraceutical segment.

- The Ballooning Skincare Sector Provides Tailwinds to Demand from Cosmeceuticals

Liquid-filled hard capsules are increasingly being utilised in the cosmeceutical industry for encapsulating liquid formulations of skincare ingredients, such as oils, serums, and active compounds, to enhance their stability, and efficacy. These capsules offer precise dosing and enable the incorporation of a wide range of cosmetic actives, catering to diverse skincare needs, including hydration, anti-ageing, and skin brightening.

The rising consumer inclination towards personalised skincare solutions and premium beauty products drives the demand for cosmeceutical formulations encapsulated in liquid-filled hard capsules. Additionally, technological advancements in capsule manufacturing processes and formulation techniques further propel the growth of liquid-filled hard capsules in the cosmeceutical market.

Regional Frontrunners

- North America Develops a Hub of Pharmaceutical Innovation and Growth

This market is driven by the presence of major pharmaceutical companies, robust healthcare infrastructure, and high healthcare expenditure. The region's focus on innovation and R&D further fuels growth. North America stands tall as a beacon of pharmaceutical innovation and growth, propelled by the formidable presence of major pharmaceutical giants, a resilient healthcare infrastructure, and substantial healthcare expenditure.

- Asia Pacific Leverages Accelerating Pharmaceutical Innovation

Rapid urbanisation, increasing healthcare awareness, and rising disposable income are driving the demand for pharmaceuticals, including liquid-filled hard capsules, in countries like China, India, and Japan. Accelerated urbanisation, coupled with a growing awareness of healthcare, is reshaping the demand dynamics for pharmaceuticals, including liquid-filled hard capsules. Nations like China, India, and Japan are witnessing a surge in demand, propelled by rising disposable incomes and a burgeoning emphasis on healthcare.

Fairfield’s Competitive Landscape Analysis

The competition landscape within the liquid-filled hard capsules market is robust, characterised by a mix of established pharmaceutical giants and emerging players vying for market share. Leading players include Capsugel (now Lonza Group), Catalent, ACG Capsules, Sirio Pharma, and Qualicaps, among others.

These companies employ various growth strategies to maintain their competitive edge, including extensive R&D investments to develop innovative formulations, strategic partnerships, and collaborations to expand their geographical presence and market penetration, and mergers and acquisitions to enhance their product portfolios and diversify their offerings.

Furthermore, a focus on technological advancements, such as improvements in capsule shell materials and manufacturing processes, is also a key strategy to meet evolving customer demands and regulatory standards. Overall, competition in the Liquid-Filled Hard Capsules market is intense, driving continuous innovation and expansion efforts among key industry players.

Who are the Leaders in the Liquid-Filled Hard Capsules Market Space?

- Vantage Nutrition

- INNERCAP Technologies, Inc.

- Liquidcapsule Manufacturing LLC

- Lonza

- SuHeung

- Altasciences

Significant Company Developments

March 2024:

In March 2024, CapsuGen, a leading provider of pharmaceutical encapsulation solutions, introduced a groundbreaking line of liquid-filled hard capsules. These capsules boast enhanced stability, bioavailability, and customisable release profiles, addressing the evolving needs of drug developers for advanced delivery systems.

July 2023:

July 2023 witnessed the unveiling of LiquidPure by PharmaCaps, a novel series of liquid-filled hard capsules designed for nutraceutical and dietary supplement applications. This innovative range offers improved formulation flexibility and bioactive ingredient protection, catering to consumer demands for effective and convenient health solutions.

September 2023:

In September 2023, Gelco Pharmaceuticals forged a strategic distribution partnership with CapsuTech, granting exclusive rights to distribute its liquid-filled hard capsules in key global markets. This agreement strengthens Gelco's market presence and accelerates CapsuTech's expansion initiatives, fostering broader accessibility to advanced encapsulation technologies.

An Expert’s Eye

- Growing Demand for Advanced Drug Delivery Systems: The pharmaceutical industry's need for efficient drug delivery systems is propelling the adoption of liquid-filled hard capsules due to their enhanced bioavailability and controlled release properties. pharmaceutical sector, there's a palpable shift towards advanced drug delivery systems. Liquid-filled hard capsules are emerging as a preferred choice due to their unparalleled attributes, notably superior bioavailability and controlled release capabilities.

- Expanding Nutraceutical Market: Increasing consumer interest in preventive healthcare and nutraceuticals is driving the demand for liquid-filled hard capsules, as they offer a convenient and effective way to encapsulate liquid formulations of vitamins, minerals, and herbal extracts. nutraceutical market is undergoing rapid expansion, driven by escalating consumer interest in preventive healthcare and wellness products. Liquid-filled hard capsules are witnessing soaring demand in this realm owing to their convenience and efficiency in encapsulating liquid formulations of essential nutrients, including vitamins, minerals, and herbal extracts.

The Global Liquid-Filled Hard Capsules Market is Segmented as Below:

By Product:

- Liquid in Capsules

- Pellets in Liquid-Filled Capsules

- Pellets in Capsule in Liquid-Filled Capsules

- Capsule in Liquid-Filled Capsules

- Tablet in Liquid-Filled Capsules

By Raw Material:

- Gelatin

- Hypromellose Capsules (HPMCs)

By Application:

- Cough & Cold Preparations

- Cardiovascular Therapy Drugs

- Health Supplements

- Vitamin & Dietary Supplements

- Other Therapeutic Applications

By End User:

- Pharmaceutical Companies

- Nutraceutical Companies

- Cosmeceutical Companies

- Contract Manufacturing Organisations

By Region:

- North America

- Latin America

- Europe

- South Asia

- East Asia

- Oceania

- Middle East and Africa

1. Executive Summary

1.1. Global Liquid-Filled Hard Capsules Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value and Volume, 2023

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. COVID-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Production Output and Trade Statistics, 2019 - 2023

3.1. Global Liquid-Filled Hard Capsules Market Production Output, by Region, Value (US$ Bn) and Volume (Million Units), 2019 - 2023

3.1.1. North America

3.1.2. Europe

3.1.3. Asia Pacific

3.1.4. Latin America

3.1.5. Middle East and Africa

4. Pricing Analysis, 2019 - 2023

4.1. Global Average Price Analysis, by Product/ Application, US$ Per Unit, 2019 - 2023

4.2. Prominent Factor Affecting Liquid-Filled Hard Capsules Prices

4.3. Global Average Price Analysis, by Region, US$ Per Unit

5. Global Liquid-Filled Hard Capsules Market Outlook, 2019 - 2031

5.1. Global Liquid-Filled Hard Capsules Market Outlook, by Product, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

5.1.1. Key Highlights

5.1.1.1. Liquid in Capsules

5.1.1.2. Pellets in Liquid-filled Capsules

5.1.1.3. Pellets in Capsule in Liquid-filled Capsules

5.1.1.4. Capsule in Liquid-filled Capsules

5.1.1.5. Tablet in Liquid-filled Capsules

5.2. Global Liquid-Filled Hard Capsules Market Outlook, by Raw Material, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

5.2.1. Key Highlights

5.2.1.1. Gelatin

5.2.1.2. Hypromellose Capsules (HPMCs)

5.3. Global Liquid-Filled Hard Capsules Market Outlook, by Application, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

5.3.1. Key Highlights

5.3.1.1. Cough & Cold Preparations

5.3.1.2. Cardiovascular Therapy Drugs

5.3.1.3. Health Supplements

5.3.1.4. Vitamin & Dietary Supplements

5.3.1.5. Other Therapeutic Applications

5.4. Global Liquid-Filled Hard Capsules Market Outlook, by End User, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

5.4.1. Key Highlights

5.4.1.1. Pharmaceutical Companies

5.4.1.2. Nutraceutical Companies

5.4.1.3. Cosmeceutical Companies

5.4.1.4. Contract Manufacturing Organizations

5.5. Global Liquid-Filled Hard Capsules Market Outlook, by Region, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

5.5.1. Key Highlights

5.5.1.1. North America

5.5.1.2. Europe

5.5.1.3. Asia Pacific

5.5.1.4. Latin America

5.5.1.5. Middle East & Africa

6. North America Liquid-Filled Hard Capsules Market Outlook, 2019 - 2031

6.1. North America Liquid-Filled Hard Capsules Market Outlook, by Product, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

6.1.1. Key Highlights

6.1.1.1. Liquid in Capsules

6.1.1.2. Pellets in Liquid-filled Capsules

6.1.1.3. Pellets in Capsule in Liquid-filled Capsules

6.1.1.4. Capsule in Liquid-filled Capsules

6.1.1.5. Tablet in Liquid-filled Capsules

6.2. North America Liquid-Filled Hard Capsules Market Outlook, by Raw Material, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

6.2.1. Key Highlights

6.2.1.1. Gelatin

6.2.1.2. Hypromellose Capsules (HPMCs)

6.3. North America Liquid-Filled Hard Capsules Market Outlook, by Application, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

6.3.1. Key Highlights

6.3.1.1. Cough & Cold Preparations

6.3.1.2. Cardiovascular Therapy Drugs

6.3.1.3. Health Supplements

6.3.1.4. Vitamin & Dietary Supplements

6.3.1.5. Other Therapeutic Applications

6.4. North America Liquid-Filled Hard Capsules Market Outlook, by End User, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

6.4.1. Key Highlights

6.4.1.1. Pharmaceutical Companies

6.4.1.2. Nutraceutical Companies

6.4.1.3. Cosmeceutical Companies

6.4.1.4. Contract Manufacturing Organizations

6.5. North America Liquid-Filled Hard Capsules Market Outlook, by Country, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

6.5.1. Key Highlights

6.5.1.1. U.S. Liquid-Filled Hard Capsules Market by Product, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

6.5.1.2. U.S. Liquid-Filled Hard Capsules Market by Raw Material, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

6.5.1.3. U.S. Liquid-Filled Hard Capsules Market by Application, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

6.5.1.4. U.S. Liquid-Filled Hard Capsules Market by End User, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

6.5.1.5. Canada Liquid-Filled Hard Capsules Market by Product, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

6.5.1.6. Canada Liquid-Filled Hard Capsules Market by Raw Material, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

6.5.1.7. Canada Liquid-Filled Hard Capsules Market by Application, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

6.5.1.8. Canada Liquid-Filled Hard Capsules Market by End User, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

6.5.2. BPS Analysis/Market Attractiveness Analysis

7. Europe Liquid-Filled Hard Capsules Market Outlook, 2019 - 2031

7.1. Europe Liquid-Filled Hard Capsules Market Outlook, by Product, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

7.1.1. Key Highlights

7.1.1.1. Liquid in Capsules

7.1.1.2. Pellets in Liquid-filled Capsules

7.1.1.3. Pellets in Capsule in Liquid-filled Capsules

7.1.1.4. Capsule in Liquid-filled Capsules

7.1.1.5. Tablet in Liquid-filled Capsules

7.2. Europe Liquid-Filled Hard Capsules Market Outlook, by Raw Material, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

7.2.1. Key Highlights

7.2.1.1. Gelatin

7.2.1.2. Hypromellose Capsules (HPMCs)

7.3. Europe Liquid-Filled Hard Capsules Market Outlook, by Application, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

7.3.1. Key Highlights

7.3.1.1. Cough & Cold Preparations

7.3.1.2. Cardiovascular Therapy Drugs

7.3.1.3. Health Supplements

7.3.1.4. Vitamin & Dietary Supplements

7.3.1.5. Other Therapeutic Applications

7.4. Europe Liquid-Filled Hard Capsules Market Outlook, by End User, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

7.4.1. Key Highlights

7.4.1.1. Pharmaceutical Companies

7.4.1.2. Nutraceutical Companies

7.4.1.3. Cosmeceutical Companies

7.4.1.4. Contract Manufacturing Organizations

7.5. Europe Liquid-Filled Hard Capsules Market Outlook, by Country, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

7.5.1. Key Highlights

7.5.1.1. Germany Liquid-Filled Hard Capsules Market by Product, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

7.5.1.2. Germany Liquid-Filled Hard Capsules Market by Raw Material, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

7.5.1.3. Germany Liquid-Filled Hard Capsules Market by Application, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

7.5.1.4. Germany Liquid-Filled Hard Capsules Market by End User, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

7.5.1.5. U.K. Liquid-Filled Hard Capsules Market by Product, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

7.5.1.6. U.K. Liquid-Filled Hard Capsules Market by Raw Material, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

7.5.1.7. U.K. Liquid-Filled Hard Capsules Market by Application, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

7.5.1.8. U.K. Liquid-Filled Hard Capsules Market by End User, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

7.5.1.9. France Liquid-Filled Hard Capsules Market by Product, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

7.5.1.10. France Liquid-Filled Hard Capsules Market by Raw Material, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

7.5.1.11. France Liquid-Filled Hard Capsules Market by Application, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

7.5.1.12. France Liquid-Filled Hard Capsules Market by End User, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

7.5.1.13. Italy Liquid-Filled Hard Capsules Market by Product, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

7.5.1.14. Italy Liquid-Filled Hard Capsules Market by Raw Material, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

7.5.1.15. Italy Liquid-Filled Hard Capsules Market by Application, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

7.5.1.16. Italy Liquid-Filled Hard Capsules Market by End User, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

7.5.1.17. Turkey Liquid-Filled Hard Capsules Market by Product, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

7.5.1.18. Turkey Liquid-Filled Hard Capsules Market by Raw Material, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

7.5.1.19. Turkey Liquid-Filled Hard Capsules Market by Application, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

7.5.1.20. Turkey Liquid-Filled Hard Capsules Market by End User, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

7.5.1.21. Russia Liquid-Filled Hard Capsules Market by Product, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

7.5.1.22. Russia Liquid-Filled Hard Capsules Market by Raw Material, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

7.5.1.23. Russia Liquid-Filled Hard Capsules Market by Application, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

7.5.1.24. Russia Liquid-Filled Hard Capsules Market by End User, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

7.5.1.25. Rest of Europe Liquid-Filled Hard Capsules Market by Product, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

7.5.1.26. Rest of Europe Liquid-Filled Hard Capsules Market by Raw Material, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

7.5.1.27. Rest of Europe Liquid-Filled Hard Capsules Market by Application, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

7.5.1.28. Rest of Europe Liquid-Filled Hard Capsules Market by End User, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

7.5.2. BPS Analysis/Market Attractiveness Analysis

8. Asia Pacific Liquid-Filled Hard Capsules Market Outlook, 2019 - 2031

8.1. Asia Pacific Liquid-Filled Hard Capsules Market Outlook, by Product, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

8.1.1. Key Highlights

8.1.1.1. Liquid in Capsules

8.1.1.2. Pellets in Liquid-filled Capsules

8.1.1.3. Pellets in Capsule in Liquid-filled Capsules

8.1.1.4. Capsule in Liquid-filled Capsules

8.1.1.5. Tablet in Liquid-filled Capsules

8.2. Asia Pacific Liquid-Filled Hard Capsules Market Outlook, by Raw Material, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

8.2.1. Key Highlights

8.2.1.1. Gelatin

8.2.1.2. Hypromellose Capsules (HPMCs)

8.3. Asia Pacific Liquid-Filled Hard Capsules Market Outlook, by Application, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

8.3.1. Key Highlights

8.3.1.1. Cough & Cold Preparations

8.3.1.2. Cardiovascular Therapy Drugs

8.3.1.3. Health Supplements

8.3.1.4. Vitamin & Dietary Supplements

8.3.1.5. Other Therapeutic Applications

8.4. Asia Pacific Liquid-Filled Hard Capsules Market Outlook, by End User, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

8.4.1. Key Highlights

8.4.1.1. Pharmaceutical Companies

8.4.1.2. Nutraceutical Companies

8.4.1.3. Cosmeceutical Companies

8.4.1.4. Contract Manufacturing Organizations

8.5. Asia Pacific Liquid-Filled Hard Capsules Market Outlook, by Country, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

8.5.1. Key Highlights

8.5.1.1. China Liquid-Filled Hard Capsules Market by Product, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

8.5.1.2. China Liquid-Filled Hard Capsules Market by Raw Material, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

8.5.1.3. China Liquid-Filled Hard Capsules Market by Application, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

8.5.1.4. China Liquid-Filled Hard Capsules Market by End User, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

8.5.1.5. Japan Liquid-Filled Hard Capsules Market by Product, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

8.5.1.6. Japan Liquid-Filled Hard Capsules Market by Raw Material, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

8.5.1.7. Japan Liquid-Filled Hard Capsules Market by Application, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

8.5.1.8. Japan Liquid-Filled Hard Capsules Market by End User, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

8.5.1.9. South Korea Liquid-Filled Hard Capsules Market by Product, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

8.5.1.10. South Korea Liquid-Filled Hard Capsules Market by Raw Material, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

8.5.1.11. South Korea Liquid-Filled Hard Capsules Market by Application, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

8.5.1.12. South Korea Liquid-Filled Hard Capsules Market by End User, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

8.5.1.13. India Liquid-Filled Hard Capsules Market by Product, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

8.5.1.14. India Liquid-Filled Hard Capsules Market by Raw Material, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

8.5.1.15. India Liquid-Filled Hard Capsules Market by Application, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

8.5.1.16. India Liquid-Filled Hard Capsules Market by End User, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

8.5.1.17. Southeast Asia Liquid-Filled Hard Capsules Market by Product, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

8.5.1.18. Southeast Asia Liquid-Filled Hard Capsules Market by Raw Material, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

8.5.1.19. Southeast Asia Liquid-Filled Hard Capsules Market by Application, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

8.5.1.20. Southeast Asia Liquid-Filled Hard Capsules Market by End User, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

8.5.1.21. Rest of Asia Pacific Liquid-Filled Hard Capsules Market by Product, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

8.5.1.22. Rest of Asia Pacific Liquid-Filled Hard Capsules Market by Raw Material, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

8.5.1.23. Rest of Asia Pacific Liquid-Filled Hard Capsules Market by Application, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

8.5.1.24. Rest of Asia Pacific Liquid-Filled Hard Capsules Market by End User, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

8.5.2. BPS Analysis/Market Attractiveness Analysis

9. Latin America Liquid-Filled Hard Capsules Market Outlook, 2019 - 2031

9.1. Latin America Liquid-Filled Hard Capsules Market Outlook, by Product, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

9.1.1. Key Highlights

9.1.1.1. Liquid in Capsules

9.1.1.2. Pellets in Liquid-filled Capsules

9.1.1.3. Pellets in Capsule in Liquid-filled Capsules

9.1.1.4. Capsule in Liquid-filled Capsules

9.1.1.5. Tablet in Liquid-filled Capsules

9.2. Latin America Liquid-Filled Hard Capsules Market Outlook, by Raw Material, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

9.2.1. Key Highlights

9.2.1.1. Gelatin

9.2.1.2. Hypromellose Capsules (HPMCs)

9.3. Latin America Liquid-Filled Hard Capsules Market Outlook, by Application, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

9.3.1. Key Highlights

9.3.1.1. Cough & Cold Preparations

9.3.1.2. Cardiovascular Therapy Drugs

9.3.1.3. Health Supplements

9.3.1.4. Vitamin & Dietary Supplements

9.3.1.5. Other Therapeutic Applications

9.4. Latin America Liquid-Filled Hard Capsules Market Outlook, by End User, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

9.4.1. Key Highlights

9.4.1.1. Pharmaceutical Companies

9.4.1.2. Nutraceutical Companies

9.4.1.3. Cosmeceutical Companies

9.4.1.4. Contract Manufacturing Organizations

9.5. Latin America Liquid-Filled Hard Capsules Market Outlook, by Country, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

9.5.1. Key Highlights

9.5.1.1. Brazil Liquid-Filled Hard Capsules Market by Product, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

9.5.1.2. Brazil Liquid-Filled Hard Capsules Market by Raw Material, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

9.5.1.3. Brazil Liquid-Filled Hard Capsules Market by Application, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

9.5.1.4. Brazil Liquid-Filled Hard Capsules Market by End User, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

9.5.1.5. Mexico Liquid-Filled Hard Capsules Market by Product, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

9.5.1.6. Mexico Liquid-Filled Hard Capsules Market by Raw Material, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

9.5.1.7. Mexico Liquid-Filled Hard Capsules Market by Application, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

9.5.1.8. Mexico Liquid-Filled Hard Capsules Market by End User, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

9.5.1.9. Argentina Liquid-Filled Hard Capsules Market by Product, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

9.5.1.10. Argentina Liquid-Filled Hard Capsules Market by Raw Material, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

9.5.1.11. Argentina Liquid-Filled Hard Capsules Market by Application, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

9.5.1.12. Argentina Liquid-Filled Hard Capsules Market by End User, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

9.5.1.13. Rest of Latin America Liquid-Filled Hard Capsules Market by Product, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

9.5.1.14. Rest of Latin America Liquid-Filled Hard Capsules Market by Raw Material, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

9.5.1.15. Rest of Latin America Liquid-Filled Hard Capsules Market by Application, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

9.5.1.16. Rest of Latin America Liquid-Filled Hard Capsules Market by End User, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

9.5.2. BPS Analysis/Market Attractiveness Analysis

10. Middle East & Africa Liquid-Filled Hard Capsules Market Outlook, 2019 - 2031

10.1. Middle East & Africa Liquid-Filled Hard Capsules Market Outlook, by Product, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

10.1.1. Key Highlights

10.1.1.1. Liquid in Capsules

10.1.1.2. Pellets in Liquid-filled Capsules

10.1.1.3. Pellets in Capsule in Liquid-filled Capsules

10.1.1.4. Capsule in Liquid-filled Capsules

10.1.1.5. Tablet in Liquid-filled Capsules

10.2. Middle East & Africa Liquid-Filled Hard Capsules Market Outlook, by Raw Material, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

10.2.1. Key Highlights

10.2.1.1. Gelatin

10.2.1.2. Hypromellose Capsules (HPMCs)

10.3. Middle East & Africa Liquid-Filled Hard Capsules Market Outlook, by Application, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

10.3.1. Key Highlights

10.3.1.1. Cough & Cold Preparations

10.3.1.2. Cardiovascular Therapy Drugs

10.3.1.3. Health Supplements

10.3.1.4. Vitamin & Dietary Supplements

10.3.1.5. Other Therapeutic Applications

10.4. Middle East & Africa Liquid-Filled Hard Capsules Market Outlook, by End User, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

10.4.1. Key Highlights

10.4.1.1. Pharmaceutical Companies

10.4.1.2. Nutraceutical Companies

10.4.1.3. Cosmeceutical Companies

10.4.1.4. Contract Manufacturing Organizations

10.5. Middle East & Africa Liquid-Filled Hard Capsules Market Outlook, by Country, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

10.5.1. Key Highlights

10.5.1.1. GCC Liquid-Filled Hard Capsules Market by Product, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

10.5.1.2. GCC Liquid-Filled Hard Capsules Market by Raw Material, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

10.5.1.3. GCC Liquid-Filled Hard Capsules Market by Application, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

10.5.1.4. GCC Liquid-Filled Hard Capsules Market by End User, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

10.5.1.5. South Africa Liquid-Filled Hard Capsules Market by Product, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

10.5.1.6. South Africa Liquid-Filled Hard Capsules Market by Raw Material, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

10.5.1.7. South Africa Liquid-Filled Hard Capsules Market by Application, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

10.5.1.8. South Africa Liquid-Filled Hard Capsules Market by End User, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

10.5.1.9. Egypt Liquid-Filled Hard Capsules Market by Product, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

10.5.1.10. Egypt Liquid-Filled Hard Capsules Market by Raw Material, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

10.5.1.11. Egypt Liquid-Filled Hard Capsules Market by Application, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

10.5.1.12. Egypt Liquid-Filled Hard Capsules Market by End User, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

10.5.1.13. Nigeria Liquid-Filled Hard Capsules Market by Product, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

10.5.1.14. Nigeria Liquid-Filled Hard Capsules Market by Raw Material, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

10.5.1.15. Nigeria Liquid-Filled Hard Capsules Market by Application, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

10.5.1.16. Nigeria Liquid-Filled Hard Capsules Market by End User, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

10.5.1.17. Rest of Middle East & Africa Liquid-Filled Hard Capsules Market by Product, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

10.5.1.18. Rest of Middle East & Africa Liquid-Filled Hard Capsules Market by Raw Material, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

10.5.1.19. Rest of Middle East & Africa Liquid-Filled Hard Capsules Market by Application, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

10.5.1.20. Rest of Middle East & Africa Liquid-Filled Hard Capsules Market by End User, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

10.5.2. BPS Analysis/Market Attractiveness Analysis

11. Competitive Landscape

11.1. Artery Type vs Indication Heatmap

11.2. Manufacturer vs Indication Heatmap

11.3. Company Market Share Analysis, 2023

11.4. Competitive Dashboard

11.5. Company Profiles

11.5.1. Vantage Nutrition

11.5.1.1. Company Overview

11.5.1.2. Product Portfolio

11.5.1.3. Financial Overview

11.5.1.4. Business Strategies and Development

11.5.2. INNERCAP Technologies, Inc.

11.5.2.1. Company Overview

11.5.2.2. Product Portfolio

11.5.2.3. Financial Overview

11.5.2.4. Business Strategies and Development

11.5.3. Liquidcapsule Manufacturing LLC

11.5.3.1. Company Overview

11.5.3.2. Product Portfolio

11.5.3.3. Financial Overview

11.5.3.4. Business Strategies and Development

11.5.4. Lonza

11.5.4.1. Company Overview

11.5.4.2. Product Portfolio

11.5.4.3. Financial Overview

11.5.4.4. Business Strategies and Development

11.5.5. SuHeung

11.5.5.1. Company Overview

11.5.5.2. Product Portfolio

11.5.5.3. Financial Overview

11.5.5.4. Business Strategies and Development

11.5.6. Altasciences

11.5.6.1. Company Overview

11.5.6.2. Product Portfolio

11.5.6.3. Financial Overview

11.5.6.4. Business Strategies and Development

12. Appendix

12.1. Research Methodology

12.2. Report Assumptions

12.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2023 |

|

2019 - 2023 |

2024 - 2031 |

Value: US$ Million |

||

|

REPORT FEATURES |

DETAILS |

|

Product Coverage |

|

|

Raw Material Coverage |

|

|

Application Coverage |

|

|

End User Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |