Lithium-ion Battery Recycling Market Growth and Industry Forecast

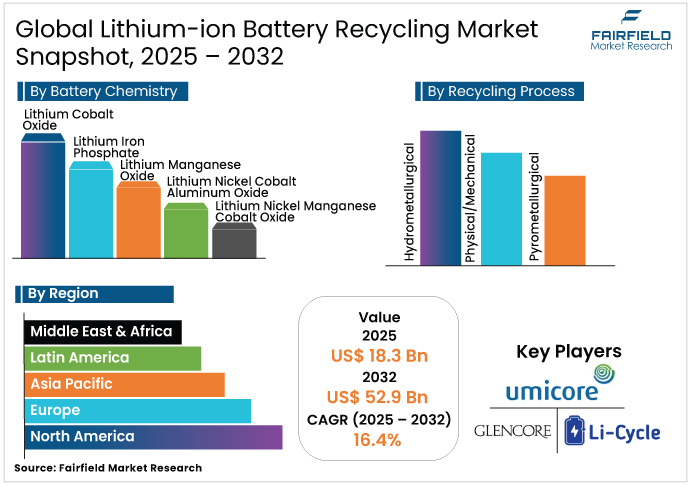

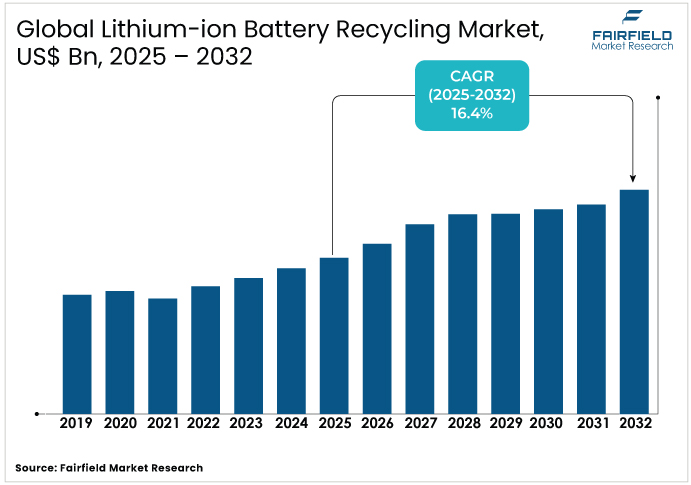

- The global lithium-ion battery recycling market is anticipated to be valued at US$ 18.3 Bn in 2025.

- The market is estimated to reach US$ 52.9 Bn by 2032, expanding at a CAGR of 16.4% between 2025 and 2032.

Lithium-ion Battery Recycling Market Summary: Key Insights & Trends

- NMC leads battery chemistry, contributing over 50% of recycled volumes with cobalt and nickel recovery rates exceeding 95%.

- LFP is the fastest-growing chemistry, expanding at 23.1% CAGR driven by cost, safety, and rising EV adoption in China.

- Automotive batteries dominate by source, accounting for 64% of volumes as millions of EVs reach end-of-life annually.

- Hydrometallurgical processes lead recycling methods, holding 57.3% share with >95% recovery efficiency and 20% cost reductions.

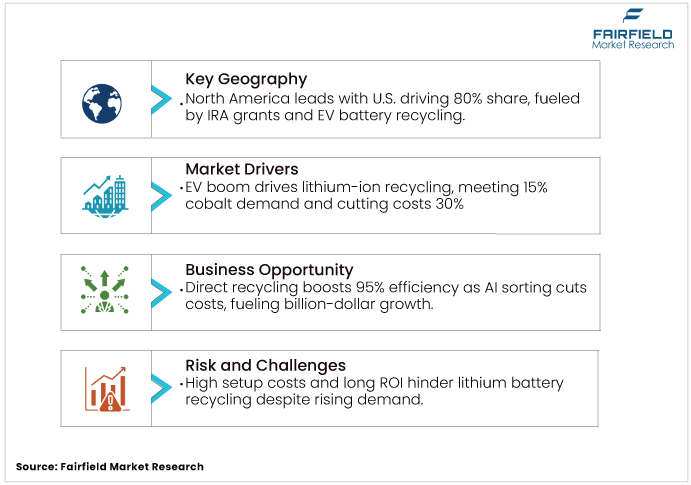

- Rising EV adoption drives demand, with 17 million units in 2025 generating 500,000 tons of recyclable batteries.

- Technological breakthroughs create opportunities, as AI sorting cuts contamination by 30% and black mass processing boosts lithium recovery.

- Asia Pacific leads globally, with 50%+ share, 1 TWh annual battery production, and China targeting 80% recycling rates.

- North America and Europe accelerate growth, supported by U.S. grants of US$3.5 billion and the EU’s 90% collection mandate by 2027.

A Look Back and a Look Forward - Comparative Analysis

From 2019 to 2024, the lithium-ion battery recycling market navigated significant challenges and phases of growth. Early in the period, the market was relatively small but began expanding rapidly as demand for electric vehicles and energy storage solutions increased. The COVID-19 pandemic disrupted supply chains in 2020–2021, causing a temporary slowdown with reduced EV sales and delayed recycling operations due to lockdowns, labor shortages, and halted manufacturing. However, recovery gained momentum after 2021, supported by accelerating EV adoption and government initiatives promoting green technologies. This drove greater investments in recycling infrastructure and advancements in hydrometallurgical processes. The period also highlighted vulnerabilities in global supply chains for critical minerals, prompting stronger emphasis on domestic recycling capabilities and strategic collaborations between automakers and recyclers to mitigate future risks.

Looking ahead to 2025–2032, the Lithium-ion battery recycling industry is poised for exponential growth, driven by the surge in end-of-life batteries from the booming EV sector and advancements in efficient recycling technologies such as direct recycling methods. Regulatory pressures for sustainable practices, coupled with innovations in AI-driven sorting and closed-loop systems, will drive market maturation, with Asia-Pacific leading due to high battery production volumes; opportunities in black mass processing and material recovery rates exceeding 95% will enhance economic viability, reducing reliance on virgin materials and supporting global net-zero goals amid rising demand for energy storage solutions.

Key Growth Drivers

- Rising EV Adoption and Electronics Waste Fuel Lithium-ion Battery Recycling

The Lithium-ion battery recycling market is significantly propelled by the rapid proliferation of electric vehicles (EVs) and portable electronics, which are generating an unprecedented volume of spent batteries. The EV sector alone accounts for over 70% of the industry demand, with global EV sales projected to reach 17 million units in 2024, leading to an estimated 500,000 tons of recyclable batteries. This surge is justified by the need to recover valuable materials such as cobalt and nickel, which recycling can supply up to 15% of global needs by 2025, reducing mining dependencies and cutting costs by 20-30% for manufacturers.

Furthermore, consumer electronics, including smartphones and laptops, contribute non-automotive waste, with over one billion devices discarded annually, emphasizing the market's role in sustainable resource management. Governments' push for electrification, such as China's subsidies and the U.S.'s EV tax credits, further strengthens this trend, ensuring steady progress through expanded collection networks and advanced technological integrations.

- Environmental Regulations and Sustainability Mandates Accelerate Global Recycling Demand

Regulatory frameworks are a core driver mandating higher recycling rates to curb environmental hazards from battery waste. The European Union's Battery Regulation requires 95% recycling efficiency for cobalt and nickel by 2030, driving investments in the Lithium-ion Battery Recycling Market and justifying a projected 20% annual increase in European capacity.

In the U.S., the Bipartisan Infrastructure Law allocates billions for recycling infrastructure, supported by statistics showing that improper disposal contributes to 5-10% of global e-waste pollution. These policies not only enforce compliance but also incentivize innovation, with recyclers achieving 90%+ material recovery rates through advanced processes, bolstering the industry's economic appeal. Justification lies in long-term cost savings and risk mitigation, as non-compliance fines can exceed millions.

- Critical Raw Material Shortages Strengthen Supply Chain Role of Recycling

The Lithium-ion battery recycling market benefits from the growing scarcity of raw materials such as lithium and cobalt, where mining output struggles to match demand, projected to shortfall by 30% by 2030. Recycling addresses this by recovering up to 95% of these materials, as per industry reports, justifying its role in stabilizing prices that have fluctuated 50-100% in recent years due to geopolitical tensions.

For instance, China's dominance in mining (over 60% of global lithium) underscores the need for diversified sources, with recycling reducing import reliance and enhancing national security in regions such as North America. Statistics from the International Energy Agency indicate that recycled materials could meet 10–15% of demand by 2025, encouraging fresh investments and supporting closed-loop systems that cut environmental impacts while strengthening supply chains for the rapidly growing EV and energy storage sectors.

Key Growth Restraints

- High Capital Costs and Complex Technologies Challenge Recycling Market Growth

The Lithium-ion battery recycling market faces hurdles from elevated capital requirements for establishing advanced facilities, with setup costs ranging from US$ 50-100 million per plant, deterring small-scale entrants. Justification stems from the need for specialized equipment in processes such as hydrometallurgy, which involves hazardous chemicals and energy-intensive steps, leading to operational expenses 20-30% higher than traditional mining. Market data shows that profitability remains challenging until economies of scale are achieved, with return on investment periods extending 5-7 years amid fluctuating material prices.

- Weak Collection Networks and Costly Logistics Limit Global Recycling Potential

Limited infrastructure for battery collection poses a significant restraint in the Lithium-ion battery recycling, with only 5-10% of global lithium-ion batteries currently recycled due to fragmented reverse logistics. Justification includes high transportation costs for hazardous materials, regulated under international standards such as UN 3480, which can add 15-20% to overall expenses. In regions such as North America, rural areas lack drop-off points, leading to stockpiling and environmental risks, as per EPA reports. This inefficiency hampers scalability, with statistics indicating that 50–60% of potential recyclable volumes are lost to landfills, limiting the ability to address rising EV waste projections without significant policy support and increased investment.

Lithium-ion Battery Recycling Market Trends and Opportunities

- Innovative Recycling Technologies and AI Integration Boost Market Efficiency

The Lithium-ion Battery Recycling Market holds immense potential through technological breakthroughs, such as direct recycling methods that preserve cathode structures for 95%+ efficiency, bypassing traditional smelting. Justification is evident in AI-integrated sorting systems reducing contamination by 30%, as per recent developments, enabling cost reductions of 20-25% and attracting investments exceeding US$ 1 billion in 2025. Opportunities extend to black mass processing, where hydrometallurgical refinements recover lithium at unprecedented rates, reinforcing alignment with circular economy goals. With patents surging 40% annually, companies can capitalize on scalable solutions for LFP batteries, driving the market toward sustainability and profitability amid EV growth.

- Emerging Markets and Strategic Partnerships Drive Global Recycling Expansion

Emerging economies offer vast opportunities, particularly in Asia-Pacific, where battery production hubs such as China project 40% market share by 2030. Justification includes government incentives, such as India's PLI scheme allocating US$ 2.4 billion for recycling, fostering partnerships between OEMs and recyclers to close supply loops. Collaborations, such as those between automakers and startups, can unlock 25-30% efficiency gains through shared infrastructure, as seen in joint ventures recovering 100,000 tons annually.

Segment-wise Trends & Analysis

- NMC Leads Recycling Market While LFP Gains Strong Growth Momentum

Lithium Nickel Manganese Cobalt Oxide (NMC) holds the leading position due to its widespread use in EVs, accounting for over 50% of recycled volumes with high recovery values for cobalt and nickel. NMC's dominance is justified by its energy density, driving recycling efficiencies up to 95% in hydrometallurgical processes.

Conversely, Lithium Iron Phosphate (LFP) is the fastest-growing segment, expanding at a CAGR of 23.1%, fueled by its safety and cost advantages in emerging EV markets such as China, where LFP adoption surged 40% in 2024. The Lithium-ion battery recycling market benefits from LFP's simpler chemistry, enabling cheaper direct recycling methods and reducing environmental impacts, positioning it for overtaking NMC in volume by 2030 amid sustainability trends.

- Automotive Batteries Dominate Recycling Market with Rapidly Rising Volumes

The Automotive segment leads, comprising 64% of the market share, driven by the EV boom generating millions of end-of-life batteries annually. This leadership is supported by regulations mandating OEM responsibility, with recycled automotive batteries supplying 15% of critical materials by 2025. The Automotive source is also the fastest-growing, at a CAGR of 18.9%, as EV fleets age and volumes spike from 500,000 tons in 2025 onward. Non-automotive, including electronics, trails but contributes steady waste; however, automotive growth outpaces it due to scalable collection systems, bolstering the market's overall expansion.

- Hydrometallurgical Methods Lead Recycling Market with Expanding Adoption Globally

Hydrometallurgical processes dominate the Lithium-ion Battery Recycling Market, holding 57.3% share for their high purity recovery rates exceeding 95% for metals such as lithium. This leadership stems from environmental advantages over pyrometallurgy, with lower emissions and energy use, justified by adoption in facilities processing 100,000 tons yearly. Hydrometallurgical is also the fastest-growing at 18% CAGR, driven by innovations that reduce costs by 20%. Physical/Mechanical and Pyrometallurgical follow, but hydrometallurgical's versatility for diverse chemistries accelerates efficiency and sustainability.

Regional Trends & Analysis

- North America Strengthens Recycling Industry with U.S. Policy Support and Innovation

North America's market is thriving, with the U.S. leading at over 80% regional share driven by the Inflation Reduction Act's US$ 3.5 billion in grants for recycling infrastructure. U.S. trends include AI-enhanced sorting and direct recycling adoption, boosting recovery rates to 95%, as companies such as Redwood Materials expand facilities to handle 100,000 tons annually. Key drivers encompass EV incentives spurring battery waste from 10 million vehicles by 2030 and supply chain localization to counter import dependencies.

- Europe Advances Circular Economy Through Strict Battery Regulations and Investments

Europe's market is led by Germany, France, and Sweden, collectively holding a 60% share, driven by the EU Battery Regulation mandating 90% collection rates by 2027. Germany's dominance stems from automotive giants such as Volkswagen investing in closed-loop systems, with drivers including stringent e-waste laws and a projected 30% CAGR amid gigafactory expansions. France benefits from nuclear energy synergies for low-carbon recycling, while Sweden's Northvolt hubs leverage mineral resources. These drivers including regulatory compliance, innovation funding, and circular economy initiatives, position Europe's market for robust growth.

- Asia Pacific Dominates Global Recycling Landscape with Strong Regional Leadership

Asia-Pacific dominates the global Lithium-ion battery recycling market with 50%+ share, led by China, Japan, and South Korea, driven by massive battery production exceeding 1 TWh annually. China's leadership is fueled by government subsidies and policies targeting 80% recycling rates, addressing 40% of global EV waste. Japan's drivers include technological prowess in hydrometallurgy, while South Korea's LG and Samsung partnerships enhance efficiency.

Competitive Landscape Analysis

The Lithium-ion Battery Recycling Market features intense competition among key players focusing on technological innovation, strategic partnerships, and capacity expansions. Companies such as Umicore and Li-Cycle emphasize hydrometallurgical advancements for high-purity outputs, while Redwood Materials pursues closed-loop integrations with EV makers. Strategies include M&As for market consolidation, R&D in AI sorting, and sustainability certifications to meet regulatory demands.

Key Companies

- Umicore

- Glencore

- Li-Cycle

- American Battery Technology Company (ABTC)

- RecycLiCo Battery Materials Inc.

- Cirba Solutions

- Ecobat

- CATL (Brunp Recycling)

- LG Energy Solution

- Panasonic Corporation

- Samsung SDI

- Ganfeng Lithium

- Retriev Technologies

- Lithion Recycling

- Redwood Materials

Recent Development

- In March 2025, during its Capital Markets Day, Umicore announced a new strategy focusing on maximizing cash from existing assets, which included postponing new investments in battery recycling. Instead of acquiring a direct recycling startup, the company plans to optimize its pilot plant technology for the next two years.

- In April 2025, Redwood began commercial production of cathode active material (CAM) from recycled batteries at its Nevada facility. Its hydrometallurgical processes achieve around 98% recovery of critical metals, including lithium, from end-of-life batteries and manufacturing scrap.

Global Lithium-ion Battery Recycling Market Segmentation-

By Battery Chemistry

- Lithium Cobalt Oxide

- Lithium Iron Phosphate

- Lithium Manganese Oxide

- Lithium Nickel Cobalt Aluminum Oxide

- Lithium Nickel Manganese Cobalt Oxide

By Source

- Automotive

- Non-automotive

By Recycling Process

- Hydrometallurgical

- Physical/Mechanical

- Pyrometallurgical

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

1. Executive Summary

1.1. Global Lithium-ion Battery Recycling Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2025

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. COVID-19 Impact Analysis

2.5. Porter's Fiver Forces Analysis

2.6. Impact of Russia-Ukraine Conflict

2.7. PESTLE Analysis

2.8. Regulatory Analysis

2.9. Price Trend Analysis

2.9.1. Current Prices and Future Projections, 2024 - 2032

2.9.2. Price Impact Factors

3. Global Lithium-ion Battery Recycling Market Outlook, 2019 - 2032

3.1. Global Lithium-ion Battery Recycling Market Outlook, by Battery Chemistry, Value (US$ Bn), 2019 - 2032

3.1.1. Lithium Cobalt Oxide

3.1.2. Lithium Iron Phosphate

3.1.3. Lithium Manganese Oxide

3.1.4. Lithium Nickel Cobalt Aluminum Oxide

3.1.5. Lithium Nickel Manganese Cobalt Oxide

3.2. Global Lithium-ion Battery Recycling Market Outlook, by Source, Value (US$ Bn), 2019 - 2032

3.2.1. Automotive

3.2.2. Non-automotive

3.3. Global Lithium-ion Battery Recycling Market Outlook, by Recycling Process, Value (US$ Bn), 2019 - 2032

3.3.1. Hydrometallurgical

3.3.2. Physical/Mechanical

3.3.3. Pyrometallurgical

3.4. Global Lithium-ion Battery Recycling Market Outlook, by Region, Value (US$ Bn), 2019 - 2032

3.4.1. North America

3.4.2. Europe

3.4.3. Asia Pacific

3.4.4. Latin America

3.4.5. Middle East & Africa

4. North America Lithium-ion Battery Recycling Market Outlook, 2019 - 2032

4.1. North America Lithium-ion Battery Recycling Market Outlook, by Battery Chemistry, Value (US$ Bn), 2019 - 2032

4.1.1. Lithium Cobalt Oxide

4.1.2. Lithium Iron Phosphate

4.1.3. Lithium Manganese Oxide

4.1.4. Lithium Nickel Cobalt Aluminum Oxide

4.1.5. Lithium Nickel Manganese Cobalt Oxide

4.2. North America Lithium-ion Battery Recycling Market Outlook, by Source, Value (US$ Bn), 2019 - 2032

4.2.1. Automotive

4.2.2. Non-automotive

4.3. North America Lithium-ion Battery Recycling Market Outlook, by Recycling Process, Value (US$ Bn), 2019 - 2032

4.3.1. Hydrometallurgical

4.3.2. Physical/Mechanical

4.3.3. Pyrometallurgical

4.4. North America Lithium-ion Battery Recycling Market Outlook, by Country, Value (US$ Bn), 2019 - 2032

4.4.1. U.S. Lithium-ion Battery Recycling Market Outlook, by Battery Chemistry, 2019 - 2032

4.4.2. U.S. Lithium-ion Battery Recycling Market Outlook, by Source, 2019 - 2032

4.4.3. U.S. Lithium-ion Battery Recycling Market Outlook, by Recycling Process, 2019 - 2032

4.4.4. Canada Lithium-ion Battery Recycling Market Outlook, by Battery Chemistry, 2019 - 2032

4.4.5. Canada Lithium-ion Battery Recycling Market Outlook, by Source, 2019 - 2032

4.4.6. Canada Lithium-ion Battery Recycling Market Outlook, by Recycling Process, 2019 - 2032

4.5. BPS Analysis/Market Attractiveness Analysis

5. Europe Lithium-ion Battery Recycling Market Outlook, 2019 - 2032

5.1. Europe Lithium-ion Battery Recycling Market Outlook, by Battery Chemistry, Value (US$ Bn), 2019 - 2032

5.1.1. Lithium Cobalt Oxide

5.1.2. Lithium Iron Phosphate

5.1.3. Lithium Manganese Oxide

5.1.4. Lithium Nickel Cobalt Aluminum Oxide

5.1.5. Lithium Nickel Manganese Cobalt Oxide

5.2. Europe Lithium-ion Battery Recycling Market Outlook, by Source, Value (US$ Bn), 2019 - 2032

5.2.1. Automotive

5.2.2. Non-automotive

5.3. Europe Lithium-ion Battery Recycling Market Outlook, by Recycling Process, Value (US$ Bn), 2019 - 2032

5.3.1. Hydrometallurgical

5.3.2. Physical/Mechanical

5.3.3. Pyrometallurgical

5.4. Europe Lithium-ion Battery Recycling Market Outlook, by Country, Value (US$ Bn), 2019 - 2032

5.4.1. Germany Lithium-ion Battery Recycling Market Outlook, by Battery Chemistry, 2019 - 2032

5.4.2. Germany Lithium-ion Battery Recycling Market Outlook, by Source, 2019 - 2032

5.4.3. Germany Lithium-ion Battery Recycling Market Outlook, by Recycling Process, 2019 - 2032

5.4.4. Italy Lithium-ion Battery Recycling Market Outlook, by Battery Chemistry, 2019 - 2032

5.4.5. Italy Lithium-ion Battery Recycling Market Outlook, by Source, 2019 - 2032

5.4.6. Italy Lithium-ion Battery Recycling Market Outlook, by Recycling Process, 2019 - 2032

5.4.7. France Lithium-ion Battery Recycling Market Outlook, by Battery Chemistry, 2019 - 2032

5.4.8. France Lithium-ion Battery Recycling Market Outlook, by Source, 2019 - 2032

5.4.9. France Lithium-ion Battery Recycling Market Outlook, by Recycling Process, 2019 - 2032

5.4.10. U.K. Lithium-ion Battery Recycling Market Outlook, by Battery Chemistry, 2019 - 2032

5.4.11. U.K. Lithium-ion Battery Recycling Market Outlook, by Source, 2019 - 2032

5.4.12. U.K. Lithium-ion Battery Recycling Market Outlook, by Recycling Process, 2019 - 2032

5.4.13. Spain Lithium-ion Battery Recycling Market Outlook, by Battery Chemistry, 2019 - 2032

5.4.14. Spain Lithium-ion Battery Recycling Market Outlook, by Source, 2019 - 2032

5.4.15. Spain Lithium-ion Battery Recycling Market Outlook, by Recycling Process, 2019 - 2032

5.4.16. Russia Lithium-ion Battery Recycling Market Outlook, by Battery Chemistry, 2019 - 2032

5.4.17. Russia Lithium-ion Battery Recycling Market Outlook, by Source, 2019 - 2032

5.4.18. Russia Lithium-ion Battery Recycling Market Outlook, by Recycling Process, 2019 - 2032

5.4.19. Rest of Europe Lithium-ion Battery Recycling Market Outlook, by Battery Chemistry, 2019 - 2032

5.4.20. Rest of Europe Lithium-ion Battery Recycling Market Outlook, by Source, 2019 - 2032

5.4.21. Rest of Europe Lithium-ion Battery Recycling Market Outlook, by Recycling Process, 2019 - 2032

5.5. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Lithium-ion Battery Recycling Market Outlook, 2019 - 2032

6.1. Asia Pacific Lithium-ion Battery Recycling Market Outlook, by Battery Chemistry, Value (US$ Bn), 2019 - 2032

6.1.1. Lithium Cobalt Oxide

6.1.2. Lithium Iron Phosphate

6.1.3. Lithium Manganese Oxide

6.1.4. Lithium Nickel Cobalt Aluminum Oxide

6.1.5. Lithium Nickel Manganese Cobalt Oxide

6.2. Asia Pacific Lithium-ion Battery Recycling Market Outlook, by Source, Value (US$ Bn), 2019 - 2032

6.2.1. Automotive

6.2.2. Non-automotive

6.3. Asia Pacific Lithium-ion Battery Recycling Market Outlook, by Recycling Process, Value (US$ Bn), 2019 - 2032

6.3.1. Hydrometallurgical

6.3.2. Physical/Mechanical

6.3.3. Pyrometallurgical

6.4. Asia Pacific Lithium-ion Battery Recycling Market Outlook, by Country, Value (US$ Bn), 2019 - 2032

6.4.1. China Lithium-ion Battery Recycling Market Outlook, by Battery Chemistry, 2019 - 2032

6.4.2. China Lithium-ion Battery Recycling Market Outlook, by Source, 2019 - 2032

6.4.3. China Lithium-ion Battery Recycling Market Outlook, by Recycling Process, 2019 - 2032

6.4.4. Japan Lithium-ion Battery Recycling Market Outlook, by Battery Chemistry, 2019 - 2032

6.4.5. Japan Lithium-ion Battery Recycling Market Outlook, by Source, 2019 - 2032

6.4.6. Japan Lithium-ion Battery Recycling Market Outlook, by Recycling Process, 2019 - 2032

6.4.7. South Korea Lithium-ion Battery Recycling Market Outlook, by Battery Chemistry, 2019 - 2032

6.4.8. South Korea Lithium-ion Battery Recycling Market Outlook, by Source, 2019 - 2032

6.4.9. South Korea Lithium-ion Battery Recycling Market Outlook, by Recycling Process, 2019 - 2032

6.4.10. India Lithium-ion Battery Recycling Market Outlook, by Battery Chemistry, 2019 - 2032

6.4.11. India Lithium-ion Battery Recycling Market Outlook, by Source, 2019 - 2032

6.4.12. India Lithium-ion Battery Recycling Market Outlook, by Recycling Process, 2019 - 2032

6.4.13. Southeast Asia Lithium-ion Battery Recycling Market Outlook, by Battery Chemistry, 2019 - 2032

6.4.14. Southeast Asia Lithium-ion Battery Recycling Market Outlook, by Source, 2019 - 2032

6.4.15. Southeast Asia Lithium-ion Battery Recycling Market Outlook, by Recycling Process, 2019 - 2032

6.4.16. Rest of SAO Lithium-ion Battery Recycling Market Outlook, by Battery Chemistry, 2019 - 2032

6.4.17. Rest of SAO Lithium-ion Battery Recycling Market Outlook, by Source, 2019 - 2032

6.4.18. Rest of SAO Lithium-ion Battery Recycling Market Outlook, by Recycling Process, 2019 - 2032

6.5. BPS Analysis/Market Attractiveness Analysis

7. Latin America Lithium-ion Battery Recycling Market Outlook, 2019 - 2032

7.1. Latin America Lithium-ion Battery Recycling Market Outlook, by Battery Chemistry, Value (US$ Bn), 2019 - 2032

7.1.1. Lithium Cobalt Oxide

7.1.2. Lithium Iron Phosphate

7.1.3. Lithium Manganese Oxide

7.1.4. Lithium Nickel Cobalt Aluminum Oxide

7.1.5. Lithium Nickel Manganese Cobalt Oxide

7.2. Latin America Lithium-ion Battery Recycling Market Outlook, by Source, Value (US$ Bn), 2019 - 2032

7.2.1. Automotive

7.2.2. Non-automotive

7.3. Latin America Lithium-ion Battery Recycling Market Outlook, by Recycling Process, Value (US$ Bn), 2019 - 2032

7.3.1. Hydrometallurgical

7.3.2. Physical/Mechanical

7.3.3. Pyrometallurgical

7.4. Latin America Lithium-ion Battery Recycling Market Outlook, by Country, Value (US$ Bn), 2019 - 2032

7.4.1. Brazil Lithium-ion Battery Recycling Market Outlook, by Battery Chemistry, 2019 - 2032

7.4.2. Brazil Lithium-ion Battery Recycling Market Outlook, by Source, 2019 - 2032

7.4.3. Brazil Lithium-ion Battery Recycling Market Outlook, by Recycling Process, 2019 - 2032

7.4.4. Mexico Lithium-ion Battery Recycling Market Outlook, by Battery Chemistry, 2019 - 2032

7.4.5. Mexico Lithium-ion Battery Recycling Market Outlook, by Source, 2019 - 2032

7.4.6. Mexico Lithium-ion Battery Recycling Market Outlook, by Recycling Process, 2019 - 2032

7.4.7. Argentina Lithium-ion Battery Recycling Market Outlook, by Battery Chemistry, 2019 - 2032

7.4.8. Argentina Lithium-ion Battery Recycling Market Outlook, by Source, 2019 - 2032

7.4.9. Argentina Lithium-ion Battery Recycling Market Outlook, by Recycling Process, 2019 - 2032

7.4.10. Rest of LATAM Lithium-ion Battery Recycling Market Outlook, by Battery Chemistry, 2019 - 2032

7.4.11. Rest of LATAM Lithium-ion Battery Recycling Market Outlook, by Source, 2019 - 2032

7.4.12. Rest of LATAM Lithium-ion Battery Recycling Market Outlook, by Recycling Process, 2019 - 2032

7.5. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Lithium-ion Battery Recycling Market Outlook, 2019 - 2032

8.1. Middle East & Africa Lithium-ion Battery Recycling Market Outlook, by Battery Chemistry, Value (US$ Bn), 2019 - 2032

8.1.1. Lithium Cobalt Oxide

8.1.2. Lithium Iron Phosphate

8.1.3. Lithium Manganese Oxide

8.1.4. Lithium Nickel Cobalt Aluminum Oxide

8.1.5. Lithium Nickel Manganese Cobalt Oxide

8.2. Middle East & Africa Lithium-ion Battery Recycling Market Outlook, by Source, Value (US$ Bn), 2019 - 2032

8.2.1. Automotive

8.2.2. Non-automotive

8.3. Middle East & Africa Lithium-ion Battery Recycling Market Outlook, by Recycling Process, Value (US$ Bn), 2019 - 2032

8.3.1. Hydrometallurgical

8.3.2. Physical/Mechanical

8.3.3. Pyrometallurgical

8.4. Middle East & Africa Lithium-ion Battery Recycling Market Outlook, by Country, Value (US$ Bn), 2019 - 2032

8.4.1. GCC Lithium-ion Battery Recycling Market Outlook, by Battery Chemistry, 2019 - 2032

8.4.2. GCC Lithium-ion Battery Recycling Market Outlook, by Source, 2019 - 2032

8.4.3. GCC Lithium-ion Battery Recycling Market Outlook, by Recycling Process, 2019 - 2032

8.4.4. South Africa Lithium-ion Battery Recycling Market Outlook, by Battery Chemistry, 2019 - 2032

8.4.5. South Africa Lithium-ion Battery Recycling Market Outlook, by Source, 2019 - 2032

8.4.6. South Africa Lithium-ion Battery Recycling Market Outlook, by Recycling Process, 2019 - 2032

8.4.7. Egypt Lithium-ion Battery Recycling Market Outlook, by Battery Chemistry, 2019 - 2032

8.4.8. Egypt Lithium-ion Battery Recycling Market Outlook, by Source, 2019 - 2032

8.4.9. Egypt Lithium-ion Battery Recycling Market Outlook, by Recycling Process, 2019 - 2032

8.4.10. Nigeria Lithium-ion Battery Recycling Market Outlook, by Battery Chemistry, 2019 - 2032

8.4.11. Nigeria Lithium-ion Battery Recycling Market Outlook, by Source, 2019 - 2032

8.4.12. Nigeria Lithium-ion Battery Recycling Market Outlook, by Recycling Process, 2019 - 2032

8.4.13. Rest of Middle East Lithium-ion Battery Recycling Market Outlook, by Battery Chemistry, 2019 - 2032

8.4.14. Rest of Middle East Lithium-ion Battery Recycling Market Outlook, by Source, 2019 - 2032

8.4.15. Rest of Middle East Lithium-ion Battery Recycling Market Outlook, by Recycling Process, 2019 - 2032

8.5. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. Company Vs Segment Heatmap

9.2. Company Market Share Analysis, 2024

9.3. Competitive Dashboard

9.4. Company Profiles

9.4.1. Umicore

9.4.1.1. Company Overview

9.4.1.2. Product Portfolio

9.4.1.3. Financial Overview

9.4.1.4. Business Strategies and Developments

9.4.2. Glencore

9.4.2.1. Company Overview

9.4.2.2. Product Portfolio

9.4.2.3. Financial Overview

9.4.2.4. Business Strategies and Developments

9.4.3. Li-Cycle

9.4.3.1. Company Overview

9.4.3.2. Product Portfolio

9.4.3.3. Financial Overview

9.4.3.4. Business Strategies and Developments

9.4.4. American Battery Technology Company (ABTC)

9.4.4.1. Company Overview

9.4.4.2. Product Portfolio

9.4.4.3. Financial Overview

9.4.4.4. Business Strategies and Developments

9.4.5. RecycLiCo Battery Materials Inc.

9.4.5.1. Company Overview

9.4.5.2. Product Portfolio

9.4.5.3. Financial Overview

9.4.5.4. Business Strategies and Developments

9.4.6. Cirba Solutions

9.4.6.1. Company Overview

9.4.6.2. Product Portfolio

9.4.6.3. Financial Overview

9.4.6.4. Business Strategies and Developments

9.4.7. Ecobat

9.4.7.1. Company Overview

9.4.7.2. Product Portfolio

9.4.7.3. Financial Overview

9.4.7.4. Business Strategies and Developments

9.4.8. CATL (Brunp Recycling)

9.4.8.1. Company Overview

9.4.8.2. Product Portfolio

9.4.8.3. Financial Overview

9.4.8.4. Business Strategies and Developments

9.4.9. LG Energy Solution

9.4.9.1. Company Overview

9.4.9.2. Product Portfolio

9.4.9.3. Financial Overview

9.4.9.4. Business Strategies and Developments

9.4.10. Panasonic Corporation

9.4.10.1. Company Overview

9.4.10.2. Product Portfolio

9.4.10.3. Financial Overview

9.4.10.4. Business Strategies and Developments

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2024 |

|

2019 - 2024 |

2025 - 2032 |

Value: US$ Billion |

||

|

REPORT FEATURES |

DETAILS |

|

Battery Chemistry Coverage |

|

|

Source Coverage |

|

|

Recycling Process Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2024), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |