Global Live Streaming Market Forecast

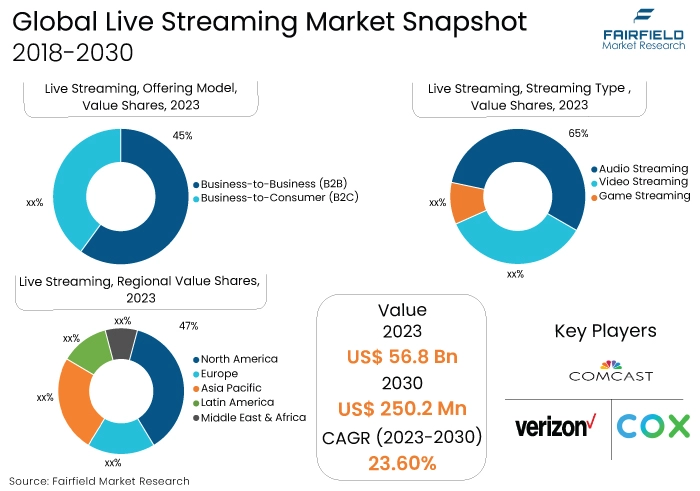

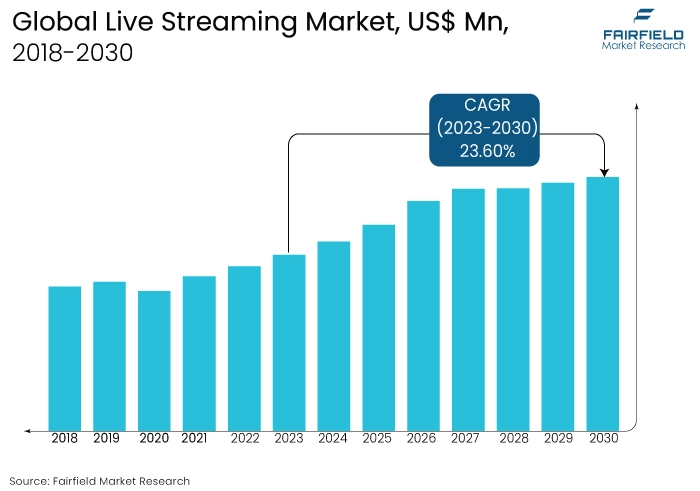

- Global live streaming market size slated for a solid rise from US$56.8 Mn in 2023 to US$250.2 Mn by 2030

- Live streaming market revenue poised to experience a CAGR of 23.6% over 2023-2030

Quick Report Digest

- The live streaming market is thriving due to increasing internet accessibility, technological advancements, and rising demand for real-time content. With the proliferation of smartphones and high-speed internet, users can easily engage with live content, fostering a dynamic and interactive online experience across various sectors, including entertainment, gaming, education, and business.

- Another major market trend expected to fuel the growth of the live-streaming market is the rapidly expanding media and entertainment industry. The market is also predicted to profit from the expanding worldwide enterprise industries.

- Platform solutions dominate the live streaming market by offering comprehensive, end-to-end services. With user-friendly interfaces, broad audience reach, and robust infrastructure, platforms like Twitch, YouTube Live, and Facebook Live provide interactive features and diverse content types. The network effect solidifies their largest market share, attracting both content creators and audiences.

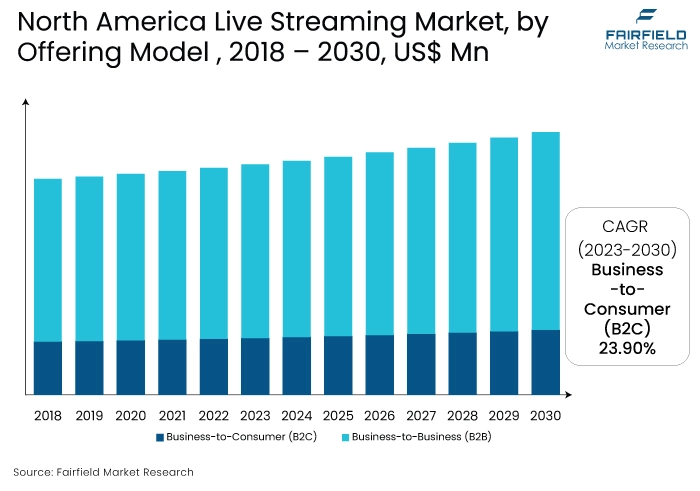

- The business-to-business (B2B) offering model leads the live streaming market, offering tailored, scalable solutions for enterprises and organisations. B2B models provide robust infrastructure, advanced features, and secure access controls, making them preferable for businesses with specific requirements. Their ability to cater to diverse industry needs solidifies their largest market share.

- Audio streaming dominates the live streaming market by offering versatile content like podcasts and music. With accessibility, ease of production, and diverse content categories, audio streaming platforms led by leaders like Spotify, and Apple Music attract a broad audience. Their widespread popularity and user-friendly features contribute to capturing the largest market share.

- Enterprises lead the live streaming market due to the adoption of live streaming for corporate communication, webinars, and training. The demand for customised, secure solutions and the integration of live streaming into business processes contribute to their dominance. Enterprises' substantial use across various sectors solidifies their largest market share.

- North America dominates the live streaming market due to widespread internet access, technological advancements, and a flourishing entertainment industry. Hosting major platforms like Twitch, YouTube Live, and Facebook Live, the region benefits from high smartphone penetration and a tech-savvy population, solidifying its largest market share in the dynamic live streaming industry.

- The Asia Pacific region experiences the highest CAGR in the live streaming market due to increasing internet penetration, a diverse population, and a growing tech-savvy demographic. Mobile device popularity, the rise of online gaming, and a vibrant entertainment industry contribute to the region's rapid growth, making it a key driver in the live-streaming landscape.

A Look Back and a Look Forward - Comparative Analysis

The live streaming market is experiencing rapid growth due to increasing internet accessibility, advancements in technology, and rising demand for real-time content. With the proliferation of smartphones and high-speed internet, users can easily engage with live content, fostering a dynamic and interactive online experience.

Additionally, the market benefits from the popularity of live events, gaming, and social media platforms, creating diverse opportunities for content creators and attracting a broad audience, contributing to the sector's continuous expansion.

The market witnessed staggered growth during the historical period 2018 – 2022. This is due to the substantial growth of the major end-use application sectors such as enetrprises, media & entertainment, and education & e-Learning Industry. However, in some applications, the demand for Live Streaming has increased, including sports & gaming industry, government, and fitness industry.

The future of the live streaming market looks promising as technological innovations, 5G expansion, and augmented reality (AR) integration enhance user experiences. Increasing demand for live content across diverse sectors, including gaming, sports, education, and business, will drive market growth.

Personalised and interactive features, along with monetisation strategies, are likely to evolve, attracting more content creators. As the market continues to expand globally, collaborations, improved infrastructure, and enhanced content quality will contribute to sustained growth in the live streaming industry.

Key Growth Determinants

- Increasing Internet Penetration

Increasing internet penetration is a critical driver for the live streaming market due to its direct impact on accessibility and user experience. As more regions gain access to high-speed internet, users can seamlessly engage with live streaming content, eliminating barriers such as buffering and low-quality streams. This widespread connectivity enables a broader audience reach, fostering the global expansion of live streaming platforms.

Moreover, improved internet infrastructure supports higher resolutions, reducing latency and enhancing the overall quality of live broadcasts. The combination of accessibility and enhanced user experience propels the adoption of live streaming across diverse sectors, including entertainment, education, gaming, and business, driving the market's sustained growth.

- Mounting Smartphone Adoption

The surge in smartphone adoption significantly propels the live streaming market by providing a ubiquitous platform for content consumption. With an increasing number of users relying on smartphones as their primary digital device, live streaming platforms benefit from a massive and diverse audience. Smartphones offer convenience, enabling users to access live content anytime, anywhere.

User-friendly interfaces, mobile apps, and seamless integration with social media platforms make live Streaming easily accessible. The portability and versatility of smartphones also empower content creators, facilitating on-the-go live broadcasts. As a result, the rise in smartphone adoption not only expands the potential audience base but also amplifies the overall impact and reach of live streaming content across various industries.

- Thriving Technology Trends

Technological advancements are a driving force behind the live streaming market, enhancing the overall user experience and expanding the capabilities of live streaming platforms. Innovations in compression algorithms optimise bandwidth usage, ensuring smoother streaming and reduced latency. Integration of augmented reality (AR), and virtual reality (VR) technologies elevates content quality, providing immersive and interactive experiences.

These advancements not only attract and retain audiences but also open new avenues for creative content production. Additionally, continuous improvements in streaming technologies contribute to better video resolutions and adaptive streaming, accommodating varying network conditions. As live streaming platforms leverage cutting-edge technologies, users enjoy richer, more engaging content, fostering sustained growth and innovation in the dynamic landscape of the live streaming market.

Major Growth Barriers

- Growing Bandwidth Limitations

Growing bandwidth limitations pose a challenge to the live streaming market by impeding the seamless delivery of high-quality content. In regions with inadequate internet infrastructure or during peak usage times, users may experience buffering and disruptions, leading to a suboptimal viewing experience.

This limitation hampers the market's potential reach and audience engagement, impacting both user satisfaction and the ability of live streaming platforms to deliver consistent, reliable services. Addressing this challenge requires infrastructure improvements and technological solutions to ensure uninterrupted, high-speed internet access for a broader audience base.

- Growing Privacy and Security Concerns

The growing privacy and security concerns present a challenge to the live streaming market as users share real-time content, raising apprehensions about data breaches, unauthorised access, and online harassment. Addressing these concerns is crucial to maintaining user trust and platform integrity.

Platforms must implement robust security measures, adhere to privacy regulations, and develop effective content moderation strategies to mitigate risks. Failure to adequately address these challenges can result in reputational damage, legal repercussions, and a decline in user confidence, impacting the growth and sustainability of the live streaming industry.

Key Trends and Opportunities to Look at

- 5G Technology

The rollout of 5G networks enables faster and more reliable internet connections, reducing latency and enhancing the quality of live streaming on mobile devices.

- EDGE Computing

Edge computing brings processing power closer to the user, reducing latency and enabling smoother live streaming experiences by processing data closer to the source.

- Virtual and Augmented Reality (VR/AR)

Integration of VR and AR technologies enhances interactivity and immersion, providing new possibilities for live streaming experiences, especially in gaming, events, and virtual concerts.

How Does the Regulatory Scenario Shape this Industry?

Regulatory frameworks for the live streaming market vary globally, impacting content, privacy, and data handling. In the United States, the Federal Communications Commission (FCC) oversees certain aspects. The European Union has data protection regulations like GDPR affecting user privacy. In China, the Cyberspace Administration regulates online content. India has guidelines under the IT Act and intermediary liability rules.

These regulations influence platform policies, content moderation, and user data protection. Local changes, such as China's increased scrutiny of live-streaming platforms or the EU's ongoing efforts in digital regulation, can shape industry practices. Compliance with these regulations is crucial for market players to navigate legal landscapes and maintain user trust in different regions.

Fairfield’s Ranking Board

Top Segments

- Platforms Category Continues to Dominate over Other Segments

Platform solutions dominate the live streaming market due to their comprehensive offerings. These solutions provide end-to-end services, including content creation, delivery, and monetisation features, making them attractive for content creators and businesses. Popular platforms such as Twitch, YouTube Live, and Facebook Live offer user-friendly interfaces, extensive audience reach, and robust infrastructure. Their ability to integrate interactive features, support various content types, and provide monetisation options positions them as preferred choices.

The network effect further strengthens their dominance as more users and content creators gravitate toward established platforms, solidifying their largest market share in the live-streaming industry. Video production and content creation services in the live streaming market are experiencing the highest CAGR due to the increasing demand for high-quality and engaging content.

As businesses and content creators seek to stand out in a competitive landscape, there's a growing reliance on professional video production services to enhance production values. The rise of diverse content genres, including gaming, events, and educational content, further fuels this demand. Additionally, evolving technologies, such as virtual and augmented reality, contribute to the expansion of video production services, making them a key driver of growth in the live-streaming industry.

- B2B Offering Model to Surge Ahead

The business-to-business (B2B) offering model dominates the live streaming market due to its appeal to enterprises and organisations seeking customisable, scalable, and feature-rich solutions. B2B models provide tailored live-streaming services for corporate events, webinars, and training sessions. These solutions often offer advanced features such as analytics, branding options, and secure access controls, making them preferable for businesses with specific requirements.

The B2B model's ability to cater to diverse industry needs and provide robust infrastructure positions it as a leader, capturing the largest market share in the live-streaming industry. The business-to-consumer (B2C) offering model is experiencing the highest CAGR in the live streaming market due to the surge in individual content creators, influencers, and small businesses leveraging live streaming for direct consumer engagement.

B2C models provide accessible platforms with user-friendly interfaces, enabling seamless content creation and monetisation. The rise of diverse content genres, including gaming, lifestyle, and entertainment, amplifies the demand for B2C solutions, attracting a broad user base. The model's simplicity, coupled with the increasing popularity of individual content creators, contributes to its rapid growth in the dynamic live-streaming industry.

- Audio Streaming Maintains the Leading Position

Audio streaming has captured the largest market share in the live streaming market due to its versatility and widespread adoption. Podcasts, music streaming, and live radio contribute to the popularity of audio content. The format offers convenience for users who can consume content on the go, even with limited bandwidth.

Additionally, audio streaming platforms often provide diverse monetisation options, attracting content creators. The accessibility, ease of production, and diverse content categories contribute to the dominant position of Audio Streaming in the market, making it a preferred choice for both creators and audiences.

Game streaming is experiencing the highest CAGR in the live streaming market due to the booming gaming industry and the rise of esports. The popularity of platforms like Twitch, and YouTube Gaming, coupled with the increasing number of gamers and gaming content creators, fuels this growth.

Game streaming provides interactive and engaging content, attracting a dedicated and global audience. Innovations in technology, such as cloud gaming and augmented reality features, further enhance the gaming live streaming experience, contributing to its rapid and sustained expansion in the dynamic live streaming landscape.

Regional Frontrunners

North America at the Forefront of Revenue Generation

North America has captured the largest market share in the live streaming market due to factors such as widespread internet access, technological advancements, and a thriving entertainment industry. The region hosts major live streaming platforms, including Twitch, YouTube Live, and Facebook Live, contributing to a robust ecosystem. High smartphone penetration, a tech-savvy population, and a strong culture of content creation have further propelled North America's dominance.

Additionally, the presence of major esports events and collaborations with celebrities and influencers adds to the popularity of live Streaming. The region's mature digital infrastructure and large user base make North America a focal point for live streaming market growth and innovation.

Asia Pacific Reflects Massive Market Potential

The Asia Pacific region is experiencing the highest CAGR in the live streaming market due to factors such as increasing internet penetration, a large and diverse population, and a growing tech-savvy youth demographic. The popularity of mobile devices, particularly smartphones, and the rise of online gaming and social media contribute to the surge in live streaming adoption.

Additionally, the region's vibrant entertainment industry, cultural events, and the emergence of local content creators fuel the demand. With a dynamic and rapidly expanding digital landscape, Asia Pacific presents significant growth opportunities for live streaming platforms, driving its highest CAGR in the market.

Fairfield’s Competitive Landscape Analysis

The live streaming market features a highly competitive landscape with key players such as Twitch (Amazon), YouTube Live (Google), and Facebook Live (Meta). These platforms dominate due to their extensive user bases and comprehensive offerings.

Other competitors like Vimeo, Dailymotion, and emerging players focus on niche markets or unique features. Continuous technological innovations, partnerships, and the global expansion of content creators drive the industry's dynamism. As the market evolves, competition intensifies, fostering innovation and diverse monetisation strategies across the competitive landscape.

Who are the Leaders in the Global Live Streaming Space?

- Amazon Webs Services

- Terso Solutions, Inc.

- Microsoft

- IBM

- Vimeo

- Stanley Innerspace

- Decast

- Wowza Media Systems

- Brightcove

- YouNow

- Zhangyu TV

- Douyu

Significant Industry Developments

New Product Launch

- January 2023: IndiaCast Media Distribution Pvt. Ltd., the multi-platform content asset monetisation entity jointly owned by TV18 and Viacom18, has collaborated with Amagi to introduce Desi Play TV, a free ad-supported streaming television (FAST) channel in HD. This channel will be available on Sling in the US and Plex across the US, Canada, and the Middle East regions. Amagi, a global leader in cloud-based SaaS technology for broadcast and connected TV, will contribute to this initiative. Desi Play TV's inaugural FAST channel will showcase popular Hindi series with English subtitles carefully selected from Viacom18's extensive catalog.

- January 2023: To manage the rising demand for the 2022 FIFA World Cup from both local and international audiences, Beyond Technology, a global leader in technology transformation, collaborated with Infinera to deploy a 3.6 Terabit network effectively. This initiative was carried out for a leading network operator based in the Middle East.

An Expert’s Eye

Demand and Future Growth

An increase in consumer demand for Enterprises is driving the market. The live streaming market is witnessing robust demand fueled by increasing internet penetration, rising consumer preference for real-time content, and technological advancements.

As businesses embrace live streaming for communication and events, and individual content creators continue to flourish, the market's future growth looks promising. The integration of interactive features, diverse content genres, and global accessibility further amplifies the market's potential, making it a dynamic and expanding industry poised for continued growth in the foreseeable future.

Supply Side of the Market

The demand-supply dynamics in the live streaming market are influenced by the increasing demand for real-time content and the growing number of content creators. This surge in demand has led to a competitive landscape where pricing structures play a crucial role. Current pricing structures reflect a mix of subscription-based models, ad-supported platforms, and premium content offerings.

As pricing evolves, long-term growth will be influenced by balancing monetisation strategies with user satisfaction. Major trends driving competition include innovations in technology, interactive features, and the globalisation of content. A thorough supply chain analysis reveals the importance of robust infrastructure, content delivery networks, and partnerships between platforms and content creators in ensuring a seamless live streaming experience, shaping the market's trajectory.

Global Live Streaming Market is Segmented as Below:

By Solution:

- Platforms

- Services

- Video Production & Content Creation Services

- Subscription Services

- Advertisement

By Offering Model:

- Business-to-Business (B2B)

- Business-to-Consumer (B2C)

By Streaming Type:

- Audio Streaming

- Video Streaming

- Game Streaming

By End-Use Industry:

- Enterprises

- Media & Entertainment

- Education& E-Learning Industry

- Sports & Gaming Industry

- Government

- Fitness Industry

- Religious Organisations

- Others

By Geographic Coverage:

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Turkey

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Egypt

- Nigeria

- Rest of Middle East & Africa

1. Executive Summary

1.1. Global Live Streaming Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2022

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. Covid-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Global Live Streaming Market Outlook, 2018 - 2030

3.1. Global Live Streaming Market Outlook, by Solution, Value (US$ Mn), 2018 - 2030

3.1.1. Key Highlights

3.1.1.1. Platforms

3.1.1.2. Services

3.1.1.3. Video Production & Content Creation Services

3.1.1.4. Subscription Services

3.1.1.5. Advertisement

3.2. Global Live Streaming Market Outlook, by Offering Model, Value (US$ Mn), 2018 - 2030

3.2.1. Key Highlights

3.2.1.1. Business-to-Business (B2B)

3.2.1.2. Business-to-Consumer (B2C)

3.3. Global Live Streaming Market Outlook, by Streaming Type, Value (US$ Mn), 2018 - 2030

3.3.1. Key Highlights

3.3.1.1. Audio Streaming

3.3.1.2. Video Streaming

3.3.1.3. Game Streaming

3.4. Global Live Streaming Market Outlook, by End-Use industry, Value (US$ Mn), 2018 - 2030

3.4.1. Key Highlights

3.4.1.1. Enterprises

3.4.1.2. Media & Entertainment

3.4.1.3. Education& E-Learning Industry

3.4.1.4. Sports & Gaming Industry

3.4.1.5. Government

3.4.1.6. Fitness Industry

3.4.1.7. Religious Organizations

3.4.1.8. Others

3.5. Global Live Streaming Market Outlook, by Region, Value (US$ Mn), 2018 - 2030

3.5.1. Key Highlights

3.5.1.1. North America

3.5.1.2. Europe

3.5.1.3. Asia Pacific

3.5.1.4. Latin America

3.5.1.5. Middle East & Africa

4. North America Live Streaming Market Outlook, 2018 - 2030

4.1. North America Live Streaming Market Outlook, by Solution, Value (US$ Mn), 2018 - 2030

4.1.1. Key Highlights

4.1.1.1. Platforms

4.1.1.2. Services

4.1.1.3. Video Production & Content Creation Services

4.1.1.4. Subscription Services

4.1.1.5. Advertisement

4.2. North America Live Streaming Market Outlook, by Offering Model, Value (US$ Mn), 2018 - 2030

4.2.1. Key Highlights

4.2.1.1. Business-to-Business (B2B)

4.2.1.2. Business-to-Consumer (B2C)

4.3. North America Live Streaming Market Outlook, by Streaming Type, Value (US$ Mn), 2018 - 2030

4.3.1. Key Highlights

4.3.1.1. Audio Streaming

4.3.1.2. Video Streaming

4.3.1.3. Game Streaming

4.4. North America Live Streaming Market Outlook, by End-Use industry, Value (US$ Mn), 2018 - 2030

4.4.1. Key Highlights

4.4.1.1. Enterprises

4.4.1.2. Media & Entertainment

4.4.1.3. Education& E-Learning Industry

4.4.1.4. Sports & Gaming Industry

4.4.1.5. Government

4.4.1.6. Fitness Industry

4.4.1.7. Religious Organizations

4.4.1.8. Others

4.4.2. BPS Analysis/Market Attractiveness Analysis

4.5. North America Live Streaming Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

4.5.1. Key Highlights

4.5.1.1. U.S. Live Streaming Market by Solution, Value (US$ Mn), 2018 - 2030

4.5.1.2. U.S. Live Streaming Market Offering Model, Value (US$ Mn), 2018 - 2030

4.5.1.3. U.S. Live Streaming Market Streaming Type, Value (US$ Mn), 2018 - 2030

4.5.1.4. U.S. Live Streaming Market End Use, Value (US$ Mn), 2018 - 2030

4.5.1.5. Canada Live Streaming Market by Solution, Value (US$ Mn), 2018 - 2030

4.5.1.6. Canada Live Streaming Market Offering Model, Value (US$ Mn), 2018 - 2030

4.5.1.7. Canada Live Streaming Market Streaming Type, Value (US$ Mn), 2018 - 2030

4.5.1.8. Canada Live Streaming Market End Use, Value (US$ Mn), 2018 - 2030

4.5.2. BPS Analysis/Market Attractiveness Analysis

5. Europe Live Streaming Market Outlook, 2018 - 2030

5.1. Europe Live Streaming Market Outlook, by Solution, Value (US$ Mn), 2018 - 2030

5.1.1. Key Highlights

5.1.1.1. Platforms

5.1.1.2. Services

5.1.1.3. Video Production & Content Creation Services

5.1.1.4. Subscription Services

5.1.1.5. Advertisement

5.2. Europe Live Streaming Market Outlook, by Offering Model, Value (US$ Mn), 2018 - 2030

5.2.1. Key Highlights

5.2.1.1. Business-to-Business (B2B)

5.2.1.2. Business-to-Consumer (B2C)

5.3. Europe Live Streaming Market Outlook, by Streaming Type, Value (US$ Mn), 2018 - 2030

5.3.1. Key Highlights

5.3.1.1. Audio Streaming

5.3.1.2. Video Streaming

5.3.1.3. Game Streaming

5.4. Europe Live Streaming Market Outlook, by End-Use industry, Value (US$ Mn), 2018 - 2030

5.4.1. Key Highlights

5.4.1.1. Enterprises

5.4.1.2. Media & Entertainment

5.4.1.3. Education& E-Learning Industry

5.4.1.4. Sports & Gaming Industry

5.4.1.5. Government

5.4.1.6. Fitness Industry

5.4.1.7. Religious Organizations

5.4.1.8. Others

5.4.2. BPS Analysis/Market Attractiveness Analysis

5.5. Europe Live Streaming Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

5.5.1. Key Highlights

5.5.1.1. Germany Live Streaming Market by Solution, Value (US$ Mn), 2018 - 2030

5.5.1.2. Germany Live Streaming Market Offering Model, Value (US$ Mn), 2018 - 2030

5.5.1.3. Germany Live Streaming Market Streaming Type, Value (US$ Mn), 2018 - 2030

5.5.1.4. Germany Live Streaming Market End Use, Value (US$ Mn), 2018 - 2030

5.5.1.5. U.K. Live Streaming Market by Solution, Value (US$ Mn), 2018 - 2030

5.5.1.6. U.K. Live Streaming Market Offering Model, Value (US$ Mn), 2018 - 2030

5.5.1.7. U.K. Live Streaming Market Streaming Type, Value (US$ Mn), 2018 - 2030

5.5.1.8. U.K. Live Streaming Market End Use, Value (US$ Mn), 2018 - 2030

5.5.1.9. France Live Streaming Market by Solution, Value (US$ Mn), 2018 - 2030

5.5.1.10. France Live Streaming Market Offering Model, Value (US$ Mn), 2018 - 2030

5.5.1.11. France Live Streaming Market Streaming Type, Value (US$ Mn), 2018 - 2030

5.5.1.12. France Live Streaming Market End Use, Value (US$ Mn), 2018 - 2030

5.5.1.13. Italy Live Streaming Market by Solution, Value (US$ Mn), 2018 - 2030

5.5.1.14. Italy Live Streaming Market Offering Model, Value (US$ Mn), 2018 - 2030

5.5.1.15. Italy Live Streaming Market Streaming Type, Value (US$ Mn), 2018 - 2030

5.5.1.16. Italy Live Streaming Market End Use, Value (US$ Mn), 2018 - 2030

5.5.1.17. Turkey Live Streaming Market by Solution, Value (US$ Mn), 2018 - 2030

5.5.1.18. Turkey Live Streaming Market Offering Model, Value (US$ Mn), 2018 - 2030

5.5.1.19. Turkey Live Streaming Market Streaming Type, Value (US$ Mn), 2018 - 2030

5.5.1.20. Turkey Live Streaming Market End Use, Value (US$ Mn), 2018 - 2030

5.5.1.21. Russia Live Streaming Market by Solution, Value (US$ Mn), 2018 - 2030

5.5.1.22. Russia Live Streaming Market Offering Model, Value (US$ Mn), 2018 - 2030

5.5.1.23. Russia Live Streaming Market Streaming Type, Value (US$ Mn), 2018 - 2030

5.5.1.24. Russia Live Streaming Market End Use, Value (US$ Mn), 2018 - 2030

5.5.1.25. Rest of Europe Live Streaming Market by Solution, Value (US$ Mn), 2018 - 2030

5.5.1.26. Rest of Europe Live Streaming Market Offering Model, Value (US$ Mn), 2018 - 2030

5.5.1.27. Rest of Europe Live Streaming Market Streaming Type, Value (US$ Mn), 2018 - 2030

5.5.1.28. Rest of Europe Live Streaming Market End Use, Value (US$ Mn), 2018 - 2030

5.5.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Live Streaming Market Outlook, 2018 - 2030

6.1. Asia Pacific Live Streaming Market Outlook, by Solution, Value (US$ Mn), 2018 - 2030

6.1.1. Key Highlights

6.1.1.1. Platforms

6.1.1.2. Services

6.1.1.3. Video Production & Content Creation Services

6.1.1.4. Subscription Services

6.1.1.5. Advertisement

6.2. Asia Pacific Live Streaming Market Outlook, by Offering Model, Value (US$ Mn), 2018 - 2030

6.2.1. Key Highlights

6.2.1.1. Business-to-Business (B2B)

6.2.1.2. Business-to-Consumer (B2C)

6.3. Asia Pacific Live Streaming Market Outlook, by Streaming Type, Value (US$ Mn), 2018 - 2030

6.3.1. Key Highlights

6.3.1.1. Audio Streaming

6.3.1.2. Video Streaming

6.3.1.3. Game Streaming

6.4. Asia Pacific Live Streaming Market Outlook, by End-Use industry, Value (US$ Mn), 2018 - 2030

6.4.1. Key Highlights

6.4.1.1. Enterprises

6.4.1.2. Media & Entertainment

6.4.1.3. Education& E-Learning Industry

6.4.1.4. Sports & Gaming Industry

6.4.1.5. Government

6.4.1.6. Fitness Industry

6.4.1.7. Religious Organizations

6.4.1.8. Others

6.4.2. BPS Analysis/Market Attractiveness Analysis

6.5. Asia Pacific Live Streaming Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

6.5.1. Key Highlights

6.5.1.1. China Live Streaming Market by Solution, Value (US$ Mn), 2018 - 2030

6.5.1.2. China Live Streaming Market Offering Model, Value (US$ Mn), 2018 - 2030

6.5.1.3. China Live Streaming Market Streaming Type, Value (US$ Mn), 2018 - 2030

6.5.1.4. China Live Streaming Market End Use, Value (US$ Mn), 2018 - 2030

6.5.1.5. Japan Live Streaming Market by Solution, Value (US$ Mn), 2018 - 2030

6.5.1.6. Japan Live Streaming Market Offering Model, Value (US$ Mn), 2018 - 2030

6.5.1.7. Japan Live Streaming Market Streaming Type, Value (US$ Mn), 2018 - 2030

6.5.1.8. Japan Live Streaming Market End Use, Value (US$ Mn), 2018 - 2030

6.5.1.9. South Korea Live Streaming Market by Solution, Value (US$ Mn), 2018 - 2030

6.5.1.10. South Korea Live Streaming Market Offering Model, Value (US$ Mn), 2018 - 2030

6.5.1.11. South Korea Live Streaming Market Streaming Type, Value (US$ Mn), 2018 - 2030

6.5.1.12. South Korea Live Streaming Market End Use, Value (US$ Mn), 2018 - 2030

6.5.1.13. India Live Streaming Market by Solution, Value (US$ Mn), 2018 - 2030

6.5.1.14. India Live Streaming Market Offering Model, Value (US$ Mn), 2018 - 2030

6.5.1.15. India Live Streaming Market Streaming Type, Value (US$ Mn), 2018 - 2030

6.5.1.16. India Live Streaming Market End Use, Value (US$ Mn), 2018 - 2030

6.5.1.17. Southeast Asia Live Streaming Market by Solution, Value (US$ Mn), 2018 - 2030

6.5.1.18. Southeast Asia Live Streaming Market Offering Model, Value (US$ Mn), 2018 - 2030

6.5.1.19. Southeast Asia Live Streaming Market Streaming Type, Value (US$ Mn), 2018 - 2030

6.5.1.20. Southeast Asia Live Streaming Market End Use, Value (US$ Mn), 2018 - 2030

6.5.1.21. Rest of Asia Pacific Live Streaming Market by Solution, Value (US$ Mn), 2018 - 2030

6.5.1.22. Rest of Asia Pacific Live Streaming Market Offering Model, Value (US$ Mn), 2018 - 2030

6.5.1.23. Rest of Asia Pacific Live Streaming Market Streaming Type, Value (US$ Mn), 2018 - 2030

6.5.1.24. Rest of Asia Pacific Live Streaming Market End Use, Value (US$ Mn), 2018 - 2030

6.5.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America Live Streaming Market Outlook, 2018 - 2030

7.1. Latin America Live Streaming Market Outlook, by Solution, Value (US$ Mn), 2018 - 2030

7.1.1. Key Highlights

7.1.1.1. Platforms

7.1.1.2. Services

7.1.1.3. Video Production & Content Creation Services

7.1.1.4. Subscription Services

7.1.1.5. Advertisement

7.2. Latin America Live Streaming Market Outlook, by Offering Model, Value (US$ Mn), 2018 - 2030

7.2.1. Key Highlights

7.2.1.1. Business-to-Business (B2B)

7.2.1.2. Business-to-Consumer (B2C)

7.3. Latin America Live Streaming Market Outlook, by Streaming Type, Value (US$ Mn), 2018 - 2030

7.3.1. Key Highlights

7.3.1.1. Audio Streaming

7.3.1.2. Video Streaming

7.3.1.3. Game Streaming

7.4. Latin America Live Streaming Market Outlook, by End-Use industry, Value (US$ Mn), 2018 - 2030

7.4.1. Key Highlights

7.4.1.1. Enterprises

7.4.1.2. Media & Entertainment

7.4.1.3. Education& E-Learning Industry

7.4.1.4. Sports & Gaming Industry

7.4.1.5. Government

7.4.1.6. Fitness Industry

7.4.1.7. Religious Organizations

7.4.1.8. Others

7.4.2. BPS Analysis/Market Attractiveness Analysis

7.5. Latin America Live Streaming Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

7.5.1. Key Highlights

7.5.1.1. Brazil Live Streaming Market by Solution, Value (US$ Mn), 2018 - 2030

7.5.1.2. Brazil Live Streaming Market Offering Model, Value (US$ Mn), 2018 - 2030

7.5.1.3. Brazil Live Streaming Market Streaming Type, Value (US$ Mn), 2018 - 2030

7.5.1.4. Brazil Live Streaming Market End Use, Value (US$ Mn), 2018 - 2030

7.5.1.5. Mexico Live Streaming Market by Solution, Value (US$ Mn), 2018 - 2030

7.5.1.6. Mexico Live Streaming Market Offering Model, Value (US$ Mn), 2018 - 2030

7.5.1.7. Mexico Live Streaming Market Streaming Type, Value (US$ Mn), 2018 - 2030

7.5.1.8. Mexico Live Streaming Market End Use, Value (US$ Mn), 2018 - 2030

7.5.1.9. Argentina Live Streaming Market by Solution, Value (US$ Mn), 2018 - 2030

7.5.1.10. Argentina Live Streaming Market Offering Model, Value (US$ Mn), 2018 - 2030

7.5.1.11. Argentina Live Streaming Market Streaming Type, Value (US$ Mn), 2018 - 2030

7.5.1.12. Argentina Live Streaming Market End Use, Value (US$ Mn), 2018 - 2030

7.5.1.13. Rest of Latin America Live Streaming Market by Solution, Value (US$ Mn), 2018 - 2030

7.5.1.14. Rest of Latin America Live Streaming Market Offering Model, Value (US$ Mn), 2018 - 2030

7.5.1.15. Rest of Latin America Live Streaming Market Streaming Type, Value (US$ Mn), 2018 - 2030

7.5.1.16. Rest of Latin America Live Streaming Market End Use, Value (US$ Mn), 2018 - 2030

7.5.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Live Streaming Market Outlook, 2018 - 2030

8.1. Middle East & Africa Live Streaming Market Outlook, by Solution, Value (US$ Mn), 2018 - 2030

8.1.1. Key Highlights

8.1.1.1. Platforms

8.1.1.2. Services

8.1.1.3. Video Production & Content Creation Services

8.1.1.4. Subscription Services

8.1.1.5. Advertisement

8.2. Middle East & Africa Live Streaming Market Outlook, by Offering Model, Value (US$ Mn), 2018 - 2030

8.2.1. Key Highlights

8.2.1.1. Business-to-Business (B2B)

8.2.1.2. Business-to-Consumer (B2C)

8.3. Middle East & Africa Live Streaming Market Outlook, by Streaming Type, Value (US$ Mn), 2018 - 2030

8.3.1. Key Highlights

8.3.1.1. Audio Streaming

8.3.1.2. Video Streaming

8.3.1.3. Game Streaming

8.4. Middle East & Africa Live Streaming Market Outlook, by End-Use industry, Value (US$ Mn), 2018 - 2030

8.4.1. Key Highlights

8.4.1.1. Enterprises

8.4.1.2. Media & Entertainment

8.4.1.3. Education& E-Learning Industry

8.4.1.4. Sports & Gaming Industry

8.4.1.5. Government

8.4.1.6. Fitness Industry

8.4.1.7. Religious Organizations

8.4.1.8. Others

8.4.2. BPS Analysis/Market Attractiveness Analysis

8.5. Middle East & Africa Live Streaming Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

8.5.1. Key Highlights

8.5.1.1. GCC Live Streaming Market by Solution, Value (US$ Mn), 2018 - 2030

8.5.1.2. GCC Live Streaming Market Offering Model, Value (US$ Mn), 2018 - 2030

8.5.1.3. GCC Live Streaming Market Streaming Type, Value (US$ Mn), 2018 - 2030

8.5.1.4. GCC Live Streaming Market End Use, Value (US$ Mn), 2018 - 2030

8.5.1.5. South Africa Live Streaming Market by Solution, Value (US$ Mn), 2018 - 2030

8.5.1.6. South Africa Live Streaming Market Offering Model, Value (US$ Mn), 2018 - 2030

8.5.1.7. South Africa Live Streaming Market Streaming Type, Value (US$ Mn), 2018 - 2030

8.5.1.8. South Africa Live Streaming Market End Use, Value (US$ Mn), 2018 - 2030

8.5.1.9. Egypt Live Streaming Market by Solution, Value (US$ Mn), 2018 - 2030

8.5.1.10. Egypt Live Streaming Market Offering Model, Value (US$ Mn), 2018 - 2030

8.5.1.11. Egypt Live Streaming Market Streaming Type, Value (US$ Mn), 2018 - 2030

8.5.1.12. Egypt Live Streaming Market End Use, Value (US$ Mn), 2018 - 2030

8.5.1.13. Nigeria Live Streaming Market by Solution, Value (US$ Mn), 2018 - 2030

8.5.1.14. Nigeria Live Streaming Market Offering Model, Value (US$ Mn), 2018 - 2030

8.5.1.15. Nigeria Live Streaming Market Streaming Type, Value (US$ Mn), 2018 - 2030

8.5.1.16. Nigeria Live Streaming Market End Use, Value (US$ Mn), 2018 - 2030

8.5.1.17. Rest of Middle East & Africa Live Streaming Market by Solution, Value (US$ Mn), 2018 - 2030

8.5.1.18. Rest of Middle East & Africa Live Streaming Market Offering Model, Value (US$ Mn), 2018 - 2030

8.5.1.19. Rest of Middle East & Africa Live Streaming Market Streaming Type, Value (US$ Mn), 2018 - 2030

8.5.1.20. Rest of Middle East & Africa Live Streaming Market End Use, Value (US$ Mn), 2018 - 2030

8.5.2. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. Streaming Type vs Application Heatmap

9.2. Manufacturer vs Application Heatmap

9.3. Company Market Share Analysis, 2022

9.4. Competitive Dashboard

9.5. Company Profiles

9.5.1. Amazon Web Services

9.5.1.1. Company Overview

9.5.1.2. Product Portfolio

9.5.1.3. Financial Overview

9.5.1.4. Business Strategies and Development

9.5.2. Google

9.5.2.1. Company Overview

9.5.2.2. Product Portfolio

9.5.2.3. Financial Overview

9.5.2.4. Business Strategies and Development

9.5.3. Facebook

9.5.3.1. Company Overview

9.5.3.2. Product Portfolio

9.5.3.3. Financial Overview

9.5.3.4. Business Strategies and Development

9.5.4. Terso Solutions, Inc.

9.5.4.1. Company Overview

9.5.4.2. Product Portfolio

9.5.4.3. Financial Overview

9.5.4.4. Business Strategies and Development

9.5.5. Twitter

9.5.5.1. Company Overview

9.5.5.2. Product Portfolio

9.5.5.3. Financial Overview

9.5.5.4. Business Strategies and Development

9.5.6. Microsoft

9.5.6.1. Company Overview

9.5.6.2. Product Portfolio

9.5.6.3. Financial Overview

9.5.6.4. Business Strategies and Development

9.5.7. IBM

9.5.7.1. Company Overview

9.5.7.2. Product Portfolio

9.5.7.3. Financial Overview

9.5.7.4. Business Strategies and Development

9.5.8. Vimeo

9.5.8.1. Company Overview

9.5.8.2. Product Portfolio

9.5.8.3. Business Strategies and Development

9.5.9. Stanley Innerspace

9.5.9.1. Company Overview

9.5.9.2. Product Portfolio

9.5.9.3. Financial Overview

9.5.9.4. Business Strategies and Development

9.5.10. Dacast

9.5.10.1. Company Overview

9.5.10.2. Product Portfolio

9.5.10.3. Financial Overview

9.5.10.4. Business Strategies and Development

9.5.11. Wowza Media Systems

9.5.11.1. Company Overview

9.5.11.2. Product Portfolio

9.5.11.3. Financial Overview

9.5.11.4. Business Strategies and Development

9.5.12. Brightcove

9.5.12.1. Company Overview

9.5.12.2. Product Portfolio

9.5.12.3. Financial Overview

9.5.12.4. Business Strategies and Development

9.5.13. YouNow

9.5.13.1. Company Overview

9.5.13.2. Product Portfolio

9.5.13.3. Financial Overview

9.5.13.4. Business Strategies and Development

9.5.14. Zhangyu TV

9.5.14.1. Company Overview

9.5.14.2. Product Portfolio

9.5.14.3. Financial Overview

9.5.14.4. Business Strategies and Development

9.5.15. Douyu

9.5.15.1. Company Overview

9.5.15.2. Product Portfolio

9.5.15.3. Financial Overview

9.5.15.4. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2022 |

|

2018 - 2022 |

2023 - 2030 |

Value: US$ Million |

||

|

REPORT FEATURES |

DETAILS |

|

Solution Coverage |

|

|

Offering Model Coverage |

|

|

Streaming Type Coverage |

|

|

End-Use Industry Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |