Global Location-Based VR Entertainment (LBE) Market Forecast

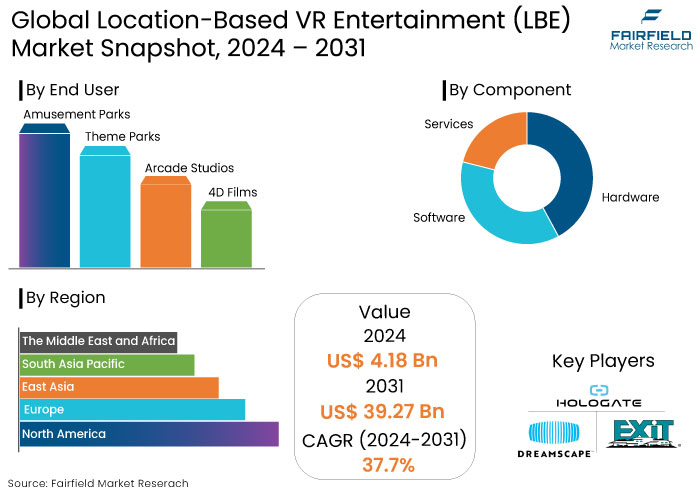

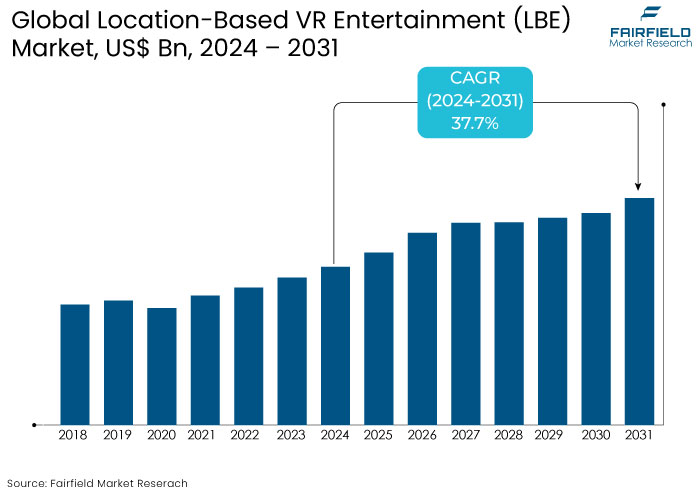

- The global location-based VR entertainment (LBE) market is projected to reach a size of US$39.27 Bn by 2031, showing significant growth from the US$4.18 Bn achieved in 2024.

- The market is projected to exhibit a remarkable rate of expansion with an estimated remarkable CAGR of 37.7% during the period from 2024 to 2031.

Location-Based VR Entertainment (LBE) Market Insights

- Rapid VR hardware and software developments have made immersive experiences more accessible and appealing.

- The hardware segment is anticipated to dominate the market with a 68.5% revenue share.

- Integrating haptic feedback devices and advanced gaming engines has enhanced user engagement.

- The United States is poised to lead the market with an 18.4% share in 2024.

- The rise of immersive experiences in LBE attracts a broader demographic from casual gamers to thrill-seekers.

- India is set to dominate the market with an estimated CAGR of 30.3% during the forecast period.

- Government support through grants or incentives for tech-driven entertainment ventures can further stimulate the sector.

- Partnerships between technology providers and entertainment operators are becoming more common fostering collaboration and innovation.

A Look Back and a Look Forward - Comparative Analysis

The location-based VR entertainment (LBE) market has shown notable growth leading up to 2023 driven by advancements in VR technology and increasing consumer demand for immersive experiences. Pre-2023, the market was characterized by the emergence of innovative venues and attractions that combined physical and virtual elements attracting a diverse audience. The rise of social media also played a crucial role, as users shared their experiences, creating buzz and encouraging more visitors.

The LBE market is projected to expand at an impressive rate of 37.7% during the forecast period, fueled by several key trends and factors. One key trend is integrating social experiences within VR environments, enhancing user engagement, and encouraging repeat visits.

The expansion into educational and training applications presents several location-based VR entertainment (LBE) market opportunities as institutions seek immersive solutions for skill development. The increasing availability of high-quality VR hardware and software along with the growing interest in multiplayer experiences further supports market growth.

As LBE venues continue to innovate and diversify their offerings, they are well-positioned to capitalize on these trends ensuring sustained expansion in the coming years.

Key Growth Determinants

- Technological Advancements

Technological advancements are a primary driver for the location-based VR entertainment (LBE) market growth. Rapid developments in VR hardware such as improved headsets with high resolution, light weight, and enhanced motion tracking capabilities have made immersive experiences more accessible and appealing to consumers.

Integrating haptic feedback devices further enriches user engagement allowing individuals to feel physical sensations during their virtual experiences, heightening realism. Additionally, advancements in software including more sophisticated gaming engines and artificial intelligence enable the creation of complex, and interactive environments that captivate audience. As these technologies evolve, they pave the way for innovative applications in LBE, attracting a broader demographic, from casual gamers to thrill-seekers.

- Rising Consumer Demand for Unique Experiences

The growing consumer demand for unique and immersive entertainment experiences is another significant driver propelling location-based VR entertainment (LBE) market. As people seek novel forms of leisure, traditional entertainment options such as movies and theme parks are increasingly being supplemented by immersive experiences that offer interactive opportunities.

LBE venues such as VR arcades and escape rooms provide an escape from everyday life, allowing customers to engage in experiences that are both entertaining and memorable. This shift in consumer preferences reflects a broad trend toward experiential consumption, where individuals value experiences over material goods.

As LBE venues continue to innovate and offer diverse, high-quality experiences, they are well-positioned to capitalize on this growing consumer trend ensuring sustained market growth.

- Increased Investment in the Sector

Increased investment in the location-based VR entertainment (LBE) market is a critical growth driver reflecting a growing recognition of its potential within the broad entertainment landscape. Venture capitalists, entertainment companies, and technology firms are pouring resources into the development of LBE venues, technologies, and content.

Partnerships between technology providers and entertainment operators are becoming more common, fostering collaboration and innovation. These investments enhance the quality of offerings and facilitate the introduction of new concepts such as multi-sensory experiences and theme park integrations.

Government support through grants or incentives for tech-driven entertainment ventures can further stimulate the sector. As a result, increased investment is vital to driving innovation, expanding market reach, and ensuring the long-term viability of the LBE market.

Key Growth Barriers

- High Initial Investment Costs

One of the significant growth restraints for the location-based VR entertainment (LBE) market is the high initial investment costs associated with setting up and operating VR venues. Establishing an LBE facility requires substantial capital to purchase advanced VR equipment, develop immersive content, and create a suitable physical environment. This includes costs for high-quality VR headsets, motion tracking systems, and other hardware that can provide a seamless experience.

Ongoing expenses such as maintenance, software updates, and staffing further strain financial resources. As a result, the high financial barrier may deter investment in the sector, slowing overall growth and innovation.

Without a diverse range of operators, the market may struggle to reach its full potential, impacting the variety of experiences available to consumers and hindering the overall development of the LBE landscape.

- Regulatory Challenges

Regulatory challenges also pose a significant restraint on the growth of the location-based VR entertainment (LBE) market. As the industry evolves, governments and regulatory bodies are increasingly focused on establishing guidelines to ensure safety, privacy, and consumer protection.

Compliance with regulations can be complex and costly for LBE operators. Furthermore, data privacy laws such as the General Data Protection Regulation (GDPR) necessitate that operators handle user data responsibly adding another layer of complexity and potential liability.

Regulatory hurdles can deter new entrants and slow down the expansion of existing businesses, as operators must allocate resources to navigate compliance rather than focusing on innovation and customer experience. Consequently, while regulations are essential for consumer safety, they can inadvertently stifle growth in the LBE market.

Location-Based VR Entertainment (LBE) Market Trends and Opportunities

- Integration of Social Experiences

A prominent trend in the industry is the integration of social experiences within virtual environments. As consumers increasingly seek out shared experiences, LBE venues are evolving to facilitate social interactions among participants. This trend is driven by the understanding that immersive entertainment is often enjoyable when shared with friends or family.

Venues are incorporating multiplayer games, collaborative challenges, and social spaces where users can interact before and after their VR experiences. Additionally, the rise of social media has amplified this trend as users are motivated to capture and share their experiences online, further promoting the venue and location-based VR entertainment (LBE) market value.

- Use in Educational and Training Applications

Several location-based VR entertainment (LBE) market opportunities lie in the expansion into educational and training applications. As educational institutions and businesses increasingly recognize the value of immersive learning experiences, LBE venues can leverage their technology to offer specialized programs. This could include VR simulations for training in fields such as healthcare, aviation, and emergency response, where realistic scenarios can enhance skill development and retention.

Educational institutions can partner with LBE operators to create field trips or interactive learning experiences that engage students in a unique way.

How Does Regulatory Scenario Shape this Industry?

The regulatory landscape is playing a crucial role in shaping the location-based VR entertainment (LBE) market growth. As this sector grows, governments and regulatory bodies are increasingly focusing on establishing guidelines to ensure safety, privacy, and consumer protection.

One significant aspect is the safety regulations concerning the use of VR equipment in public spaces. These regulations aim to mitigate risks associated with physical injuries and ensure that venues are equipped to handle emergencies effectively. Compliance with these safety standards is essential for LBE operators to maintain their licenses and avoid legal liabilities.

As per the location-based VR entertainment (LBE) market analysis, data privacy laws are becoming more stringent particularly with the collection of user data in VR experiences. Operators must navigate regulations like the General Data Protection Regulation (GDPR) in Europe, which mandates transparency in data handling and user consent. This has led to increased operational costs as businesses invest in compliance measures.

The intellectual property rights surrounding VR content are also under scrutiny, influencing how companies develop and distribute their offerings. As the market evolves, regulatory frameworks will likely to adapt impacting innovation and investment in the LBE sector.

Segments Covered in the Report

Hardware Segment to Stand Out in the Market

Hardware is vital for location-based VR systems as it creates the immersive environments that distinguish them from standard VR experiences. This hardware generates sensations that engage the user's emotions and senses.

Sensors track user movements such as button presses, controller actions, and eye movements to enhance interaction. Consequently, based on component, hardware segment dominates the location-based VR entertainment (LBE) market and is expected to account for an impressive 68.5% share. This emphasizes the importance of advanced technology in delivering compelling and immersive experiences in location-based virtual reality.

Amusement Parks to Lead the Market

During the forecast period, the amusement parks segment is leading end user that is expected to dominate the location-based VR entertainment (LBE) market. This category encompasses virtual galleries, theaters, cinemas, theme parks, and museums, allowing users to interact with pristine museum artifacts through VR technology.

Renowned masterpieces like Michelangelo's David and the Head of Nefertiti have been virtualized, enabling users to "touch" them using specially designed gloves that simulate different materials and provide haptic feedback. This innovative approach offers a unique experience particularly for individuals who are blind or have limited vision enhancing accessibility to cultural experiences.

Regional Analysis

The United States Turns Lucrative Accounting for 18.4% Market Share

The entertainment and gaming industries have been at the forefront in the United States by leveraging VR and AR. It offers crafting unparalleled gaming experiences only made possible by these cutting-edge technologies.

Players can now engage in interactive 3D environments, transforming games into social hubs reminiscent of chat rooms. This social dimension has significantly boosted user engagement. Consequently, the United States is projected to emerge as a global leader in the location-based VR entertainment (LBE) market securing an impressive 18.4% share in 2024. These developments underscore the increasing role of immersive technology in shaping the future of gaming and entertainment.

India Set to Dominate the Market Capturing Healthy CAGR of 30.3%

Virtual reality (VR) is gaining traction in India due to its notable educational benefits. VR offers significant advantages in training and education by simulating real-world environments. Imagine geography lessons featuring virtual field trips and interactive timelines that bring historical events to life.

VR and AR technologies make traditional content engaging and memorable enhancing student motivation and curiosity. As a result, India market is projected to experience remarkable growth, with an estimated healthy CAGR of 30.3% during the forecast period. This transformation highlights the potential of immersive technologies to revolutionize educational experiences.

Fairfield’s Competitive Landscape Analysis

The location-based VR entertainment (LBE) market is characterized by intense competition among various players striving to innovate and capture market share. Companies like The VOID known for its immersive VR experiences have expanded their offerings by launching new attractions that blend physical and virtual elements. In 2023, The VOID introduced a groundbreaking experience called "Star Wars: Secrets of the Empire," which allows participants to engage in a fully immersive narrative while interacting with physical props.

Key Market Companies

- HTC Vive (HTC Corporation)

- Oculus VR (Meta)

- Hologate

- Survios Inc.

- The Void LLC

- Dreamscape Immersive

- VRstudios Inc.

- Zero Latency VR

- Exit Reality VR

- Positron

- Others

Recent Industry Developments

- June 2024

Draw & Code and 302 Interactive have partnered to launch FanPort, a social mixed-reality (MR) attraction for immersive and interactive fan and brand engagement. FanPort is a scalable spatial experience that combines the deep immersion of VR with the accessibility and social connection of open space. It uses mixed reality glasses, dynamic lighting, and spatial audio to place audiences in the heart of brands' stories.

- May 2024

HTC VIVE has announced the availability of a five-port USB-C charging dock for the VIVE Ultimate Tracker. This accessory ensures all VIVE Ultimate Trackers are always charged, organized, and ready for use making them suitable for various VR settings. The VIVE USB-C Dock can charge up to five trackers simultaneously reaching a full charge in 3.5 hours with a 45W USB-C power adapter.

An Expert’s Eye

- Consumers increasingly seek unique and immersive entertainment experiences, supplementing traditional entertainment options.

- LBE venues, such as VR arcades and escape rooms, provide an escape from everyday life, allowing customers to engage in entertaining and memorable experiences.

- Venture capitalists, entertainment companies, and technology firms are investing in developing LBE venues, technologies, and content.

- Governments and regulatory bodies are establishing guidelines to ensure safety, privacy, and consumer protection.

- Data privacy laws are becoming more stringent, particularly with user data collection in VR experiences, boosting industry demand.

Global Location-Based VR Entertainment (LBE) Market is Segmented as-

By Component

- Hardware

- Head-Mount Displays

- Sensors

- Head-Up Displays

- Cameras

- Others

- Software

- Services

By End User

- Amusement Parks

- Theme Parks

- Arcade Studios

- 4D Films

- Others

By Region

- North America

- Europe

- East Asia

- South Asia Pacific

- The Middle East and Africa

1. Executive Summary

1.1. Global Location-based VR Entertainment (LBE) Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2024

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. Covid-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact Of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. Pestle Analysis

3. Global Location-based VR Entertainment (LBE) Market Outlook, 2019 - 2031

3.1. Global Location-based VR Entertainment (LBE) Market Outlook, by Component, Value (US$ Mn), 2019 - 2031

3.1.1. Key Highlights

3.1.1.1. Hardware

3.1.1.1.1. Head-Mount Displays

3.1.1.1.2. Sensors

3.1.1.1.3. Head-Up Displays

3.1.1.1.4. Cameras

3.1.1.1.5. Others

3.1.1.2. Software

3.1.1.3. Services

3.2. Global Location-based VR Entertainment (LBE) Market Outlook, by Technology, Value (US$ Mn), 2019 - 2031

3.2.1. Key Highlights

3.2.1.1. 2D

3.2.1.2. 3D

3.2.1.3. Cloud-Merged Reality

3.3. Global Location-based VR Entertainment (LBE) Market Outlook, by End User, Value (US$ Mn), 2019 - 2031

3.3.1. Key Highlights

3.3.1.1. Amusement Parks

3.3.1.2. Theme Parks

3.3.1.3. Arcade Studios

3.3.1.4. 4D Films

3.3.1.5. Others

3.4. Global Location-based VR Entertainment (LBE) Market Outlook, by Region, Value (US$ Mn), 2019 - 2031

3.4.1. Key Highlights

3.4.1.1. North America

3.4.1.2. Europe

3.4.1.3. Asia Pacific

3.4.1.4. Latin America

3.4.1.5. Middle East & Africa

4. North America Location-based VR Entertainment (LBE) Market Outlook, 2019 - 2031

4.1. North America Location-based VR Entertainment (LBE) Market Outlook, by Component, Value (US$ Mn), 2019 - 2031

4.1.1. Key Highlights

4.1.1.1. Hardware

4.1.1.1.1. Head-Mount Displays

4.1.1.1.2. Sensors

4.1.1.1.3. Head-Up Displays

4.1.1.1.4. Cameras

4.1.1.1.5. Others

4.1.1.2. Software

4.1.1.3. Services

4.2. North America Location-based VR Entertainment (LBE) Market Outlook, by Technology, Value (US$ Mn), 2019 - 2031

4.2.1. Key Highlights

4.2.1.1. 2D

4.2.1.2. 3D

4.2.1.3. Cloud-Merged Reality

4.3. North America Location-based VR Entertainment (LBE) Market Outlook, by End User, Value (US$ Mn), 2019 - 2031

4.3.1. Key Highlights

4.3.1.1. Amusement Parks

4.3.1.2. Theme Parks

4.3.1.3. Arcade Studios

4.3.1.4. 4D Films

4.3.1.5. Others

4.4. North America Location-based VR Entertainment (LBE) Market Outlook, by Country, Value (US$ Mn), 2019 - 2031

4.4.1. Key Highlights

4.4.1.1. U.S. Location-based VR Entertainment (LBE) Market by Component, Value (US$ Mn), 2019 - 2031

4.4.1.2. U.S. Location-based VR Entertainment (LBE) Market by Technology, Value (US$ Mn), 2019 - 2031

4.4.1.3. U.S. Location-based VR Entertainment (LBE) Market by Organization Size, Value (US$ Mn), 2019 - 2031

4.4.1.4. U.S. Location-based VR Entertainment (LBE) Market by End User, Value (US$ Mn), 2019 - 2031

4.4.1.5. Canada Location-based VR Entertainment (LBE) Market by Component, Value (US$ Mn), 2019 - 2031

4.4.1.6. Canada Location-based VR Entertainment (LBE) Market by Technology, Value (US$ Mn), 2019 - 2031

4.4.1.7. Canada Location-based VR Entertainment (LBE) Market by Organization Size, Value (US$ Mn), 2019 - 2031

4.4.1.8. Canada Location-based VR Entertainment (LBE) Market by End User, Value (US$ Mn), 2019 - 2031

4.4.2. BPS Analysis/Market Attractiveness Analysis

5. Europe Location-based VR Entertainment (LBE) Market Outlook, 2019 - 2031

5.1. Europe Location-based VR Entertainment (LBE) Market Outlook, by Component, Value (US$ Mn), 2019 - 2031

5.1.1. Key Highlights

5.1.1.1. Hardware

5.1.1.1.1. Head-Mount Displays

5.1.1.1.2. Sensors

5.1.1.1.3. Head-Up Displays

5.1.1.1.4. Cameras

5.1.1.1.5. Others

5.1.1.2. Software

5.1.1.3. Services

5.2. Europe Location-based VR Entertainment (LBE) Market Outlook, by Technology, Value (US$ Mn), 2019 - 2031

5.2.1. Key Highlights

5.2.1.1. 2D

5.2.1.2. 3D

5.2.1.3. Cloud-Merged Reality

5.3. Europe Location-based VR Entertainment (LBE) Market Outlook, by End User, Value (US$ Mn), 2019 - 2031

5.3.1. Key Highlights

5.3.1.1. Amusement Parks

5.3.1.2. Theme Parks

5.3.1.3. Arcade Studios

5.3.1.4. 4D Films

5.3.1.5. Others

5.4. Europe Location-based VR Entertainment (LBE) Market Outlook, by Country, Value (US$ Mn), 2019 - 2031

5.4.1. Key Highlights

5.4.1.1. Germany Location-based VR Entertainment (LBE) Market by Component, Value (US$ Mn), 2019 - 2031

5.4.1.2. Germany Location-based VR Entertainment (LBE) Market by Technology, Value (US$ Mn), 2019 - 2031

5.4.1.3. Germany Location-based VR Entertainment (LBE) Market by Organization Size, Value (US$ Mn), 2019 - 2031

5.4.1.4. Germany Location-based VR Entertainment (LBE) Market by End User, Value (US$ Mn), 2019 - 2031

5.4.1.5. U.K. Location-based VR Entertainment (LBE) Market by Component, Value (US$ Mn), 2019 - 2031

5.4.1.6. U.K. Location-based VR Entertainment (LBE) Market by Technology, Value (US$ Mn), 2019 - 2031

5.4.1.7. U.K. Location-based VR Entertainment (LBE) Market by Organization Size, Value (US$ Mn), 2019 - 2031

5.4.1.8. U.K. Location-based VR Entertainment (LBE) Market by End User, Value (US$ Mn), 2019 - 2031

5.4.1.9. France Location-based VR Entertainment (LBE) Market by Component, Value (US$ Mn), 2019 - 2031

5.4.1.10. France Location-based VR Entertainment (LBE) Market by Technology, Value (US$ Mn), 2019 - 2031

5.4.1.11. France Location-based VR Entertainment (LBE) Market by Organization Size, Value (US$ Mn), 2019 - 2031

5.4.1.12. France Location-based VR Entertainment (LBE) Market by End User, Value (US$ Mn), 2019 - 2031

5.4.1.13. Italy Location-based VR Entertainment (LBE) Market by Component, Value (US$ Mn), 2019 - 2031

5.4.1.14. Italy Location-based VR Entertainment (LBE) Market by Technology, Value (US$ Mn), 2019 - 2031

5.4.1.15. Italy Location-based VR Entertainment (LBE) Market by Organization Size, Value (US$ Mn), 2019 - 2031

5.4.1.16. Italy Location-based VR Entertainment (LBE) Market by End User, Value (US$ Mn), 2019 - 2031

5.4.1.17. Turkey Location-based VR Entertainment (LBE) Market by Component, Value (US$ Mn), 2019 - 2031

5.4.1.18. Turkey Location-based VR Entertainment (LBE) Market by Technology, Value (US$ Mn), 2019 - 2031

5.4.1.19. Turkey Location-based VR Entertainment (LBE) Market by Organization Size, Value (US$ Mn), 2019 - 2031

5.4.1.20. Turkey Location-based VR Entertainment (LBE) Market by End User, Value (US$ Mn), 2019 - 2031

5.4.1.21. Russia Location-based VR Entertainment (LBE) Market by Component, Value (US$ Mn), 2019 - 2031

5.4.1.22. Russia Location-based VR Entertainment (LBE) Market by Technology, Value (US$ Mn), 2019 - 2031

5.4.1.23. Russia Location-based VR Entertainment (LBE) Market by Organization Size, Value (US$ Mn), 2019 - 2031

5.4.1.24. Russia Location-based VR Entertainment (LBE) Market by End User, Value (US$ Mn), 2019 - 2031

5.4.1.25. Rest Of Europe Location-based VR Entertainment (LBE) Market by Component, Value (US$ Mn), 2019 - 2031

5.4.1.26. Rest Of Europe Location-based VR Entertainment (LBE) Market by Technology, Value (US$ Mn), 2019 - 2031

5.4.1.27. Rest Of Europe Location-based VR Entertainment (LBE) Market by Organization Size, Value (US$ Mn), 2019 - 2031

5.4.1.28. Rest of Europe Location-based VR Entertainment (LBE) Market by End User, Value (US$ Mn), 2019 - 2031

5.4.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Location-based VR Entertainment (LBE) Market Outlook, 2019 - 2031

6.1. Asia Pacific Location-based VR Entertainment (LBE) Market Outlook, by Component, Value (US$ Mn), 2019 - 2031

6.1.1. Key Highlights

6.1.1.1. Hardware

6.1.1.1.1. Head-Mount Displays

6.1.1.1.2. Sensors

6.1.1.1.3. Head-Up Displays

6.1.1.1.4. Cameras

6.1.1.1.5. Others

6.1.1.2. Software

6.1.1.3. Services

6.2. Asia Pacific Location-based VR Entertainment (LBE) Market Outlook, by Technology, Value (US$ Mn), 2019 - 2031

6.2.1. Key Highlights

6.2.1.1. 2D

6.2.1.2. 3D

6.2.1.3. Cloud-Merged Reality

6.3. Asia Pacific Location-based VR Entertainment (LBE) Market Outlook, by End User, Value (US$ Mn), 2019 - 2031

6.3.1. Key Highlights

6.3.1.1. Amusement Parks

6.3.1.2. Theme Parks

6.3.1.3. Arcade Studios

6.3.1.4. 4D Films

6.3.1.5. Others

6.4. Asia Pacific Location-based VR Entertainment (LBE) Market Outlook, by Country, Value (US$ Mn), 2019 - 2031

6.4.1. Key Highlights

6.4.1.1. China Location-based VR Entertainment (LBE) Market by Component, Value (US$ Mn), 2019 - 2031

6.4.1.2. China Location-based VR Entertainment (LBE) Market by Technology, Value (US$ Mn), 2019 - 2031

6.4.1.3. China Location-based VR Entertainment (LBE) Market by Organization Size, Value (US$ Mn), 2019 - 2031

6.4.1.4. China Location-based VR Entertainment (LBE) Market by End User, Value (US$ Mn), 2019 - 2031

6.4.1.5. Japan Location-based VR Entertainment (LBE) Market by Component, Value (US$ Mn), 2019 - 2031

6.4.1.6. Japan Location-based VR Entertainment (LBE) Market by Technology, Value (US$ Mn), 2019 - 2031

6.4.1.7. Japan Location-based VR Entertainment (LBE) Market by Organization Size, Value (US$ Mn), 2019 - 2031

6.4.1.8. Japan Location-based VR Entertainment (LBE) Market by End User, Value (US$ Mn), 2019 - 2031

6.4.1.9. South Korea Location-based VR Entertainment (LBE) Market by Component, Value (US$ Mn), 2019 - 2031

6.4.1.10. South Korea Location-based VR Entertainment (LBE) Market by Technology, Value (US$ Mn), 2019 - 2031

6.4.1.11. South Korea Location-based VR Entertainment (LBE) Market by Organization Size, Value (US$ Mn), 2019 - 2031

6.4.1.12. South Korea Location-based VR Entertainment (LBE) Market by End User, Value (US$ Mn), 2019 - 2031

6.4.1.13. India Location-based VR Entertainment (LBE) Market by Component, Value (US$ Mn), 2019 - 2031

6.4.1.14. India Location-based VR Entertainment (LBE) Market by Technology, Value (US$ Mn), 2019 - 2031

6.4.1.15. India Location-based VR Entertainment (LBE) Market by Organization Size, Value (US$ Mn), 2019 - 2031

6.4.1.16. India Location-based VR Entertainment (LBE) Market by End User, Value (US$ Mn), 2019 - 2031

6.4.1.17. Southeast Asia Location-based VR Entertainment (LBE) Market by Component, Value (US$ Mn), 2019 - 2031

6.4.1.18. Southeast Asia Location-based VR Entertainment (LBE) Market by Technology, Value (US$ Mn), 2019 - 2031

6.4.1.19. Southeast Asia Location-based VR Entertainment (LBE) Market by Organization Size, Value (US$ Mn), 2019 - 2031

6.4.1.20. Southeast Asia Location-based VR Entertainment (LBE) Market by End User, Value (US$ Mn), 2019 - 2031

6.4.1.21. Rest Of Asia Pacific Location-based VR Entertainment (LBE) Market by Component, Value (US$ Mn), 2019 - 2031

6.4.1.22. Rest Of Asia Pacific Location-based VR Entertainment (LBE) Market by Technology, Value (US$ Mn), 2019 - 2031

6.4.1.23. Rest Of Asia Pacific Location-based VR Entertainment (LBE) Market by Organization Size, Value (US$ Mn), 2019 - 2031

6.4.1.24. Rest of Asia Location-based VR Entertainment (LBE) Market by End User, Value (US$ Mn), 2019 - 2031

6.4.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America Location-based VR Entertainment (LBE) Market Outlook, 2019 - 2031

7.1. Latin America Location-based VR Entertainment (LBE) Market Outlook, by Component, Value (US$ Mn), 2019 - 2031

7.1.1. Key Highlights

7.1.1.1. Hardware

7.1.1.1.1. Head-Mount Displays

7.1.1.1.2. Sensors

7.1.1.1.3. Head-Up Displays

7.1.1.1.4. Cameras

7.1.1.1.5. Others

7.1.1.2. Software

7.1.1.3. Services

7.2. Latin America Location-based VR Entertainment (LBE) Market Outlook, by Technology, Value (US$ Mn), 2019 - 2031

7.2.1. Key Highlights

7.2.1.1. 2D

7.2.1.2. 3D

7.2.1.3. Cloud-Merged Reality

7.3. Latin America Location-based VR Entertainment (LBE) Market Outlook, by End User, Value (US$ Mn), 2019 - 2031

7.3.1. Key Highlights

7.3.1.1. Amusement Parks

7.3.1.2. Theme Parks

7.3.1.3. Arcade Studios

7.3.1.4. 4D Films

7.3.1.5. Others

7.4. Latin America Location-based VR Entertainment (LBE) Market Outlook, by Country, Value (US$ Mn), 2019 - 2031

7.4.1. Key Highlights

7.4.1.1. Brazil Location-based VR Entertainment (LBE) Market by Component, Value (US$ Mn), 2019 - 2031

7.4.1.2. Brazil Location-based VR Entertainment (LBE) Market by Technology, Value (US$ Mn), 2019 - 2031

7.4.1.3. Brazil Location-based VR Entertainment (LBE) Market by Organization Size, Value (US$ Mn), 2019 - 2031

7.4.1.4. Brazil Location-based VR Entertainment (LBE) Market by End User, Value (US$ Mn), 2019 - 2031

7.4.1.5. Mexico Location-based VR Entertainment (LBE) Market by Component, Value (US$ Mn), 2019 - 2031

7.4.1.6. Mexico Location-based VR Entertainment (LBE) Market by Technology, Value (US$ Mn), 2019 - 2031

7.4.1.7. Mexico Location-based VR Entertainment (LBE) Market by Organization Size, Value (US$ Mn), 2019 - 2031

7.4.1.8. Mexico Location-based VR Entertainment (LBE) Market by End User, Value (US$ Mn), 2019 - 2031

7.4.1.9. Argentina Location-based VR Entertainment (LBE) Market by Component, Value (US$ Mn), 2019 - 2031

7.4.1.10. Argentina Location-based VR Entertainment (LBE) Market by Technology, Value (US$ Mn), 2019 - 2031

7.4.1.11. Argentina Location-based VR Entertainment (LBE) Market by Organization Size, Value (US$ Mn), 2019 - 2031

7.4.1.12. Argentina Location-based VR Entertainment (LBE) Market by End User, Value (US$ Mn), 2019 - 2031

7.4.1.13. Rest Of Latin America Location-based VR Entertainment (LBE) Market by Component, Value (US$ Mn), 2019 - 2031

7.4.1.14. Rest Of Latin America Location-based VR Entertainment (LBE) Market by Technology, Value (US$ Mn), 2019 - 2031

7.4.1.15. Rest Of Latin America Location-based VR Entertainment (LBE) Market by Organization Size, Value (US$ Mn), 2019 - 2031

7.4.1.16. Rest of Latin America Location-based VR Entertainment (LBE) Market by End User, Value (US$ Mn), 2019 - 2031

7.4.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Location-based VR Entertainment (LBE) Market Outlook, 2019 - 2031

8.1. Middle East & Africa Location-based VR Entertainment (LBE) Market Outlook, by Component, Value (US$ Mn), 2019 - 2031

8.1.1. Key Highlights

8.1.1.1. Hardware

8.1.1.1.1. Head-Mount Displays

8.1.1.1.2. Sensors

8.1.1.1.3. Head-Up Displays

8.1.1.1.4. Cameras

8.1.1.1.5. Others

8.1.1.2. Software

8.1.1.3. Services

8.2. Middle East & Africa Location-based VR Entertainment (LBE) Market Outlook, by Technology, Value (US$ Mn), 2019 - 2031

8.2.1. Key Highlights

8.2.1.1. 2D

8.2.1.2. 3D

8.2.1.3. Cloud-Merged Reality

8.3. Middle East & Africa Location-based VR Entertainment (LBE) Market Outlook, by End User, Value (US$ Mn), 2019 - 2031

8.3.1. Key Highlights

8.3.1.1. Amusement Parks

8.3.1.2. Theme Parks

8.3.1.3. Arcade Studios

8.3.1.4. 4D Films

8.3.1.5. Others

8.4. Middle East & Africa Location-based VR Entertainment (LBE) Market Outlook, by Country, Value (US$ Mn), 2019 - 2031

8.4.1. Key Highlights

8.4.1.1. GCC Location-based VR Entertainment (LBE) Market by Component, Value (US$ Mn), 2019 - 2031

8.4.1.2. GCC Location-based VR Entertainment (LBE) Market by Technology, Value (US$ Mn), 2019 - 2031

8.4.1.3. GCC Location-based VR Entertainment (LBE) Market by Organization Size, Value (US$ Mn), 2019 - 2031

8.4.1.4. GCC Location-based VR Entertainment (LBE) Market by End User, Value (US$ Mn), 2019 - 2031

8.4.1.5. South Africa Location-based VR Entertainment (LBE) Market by Component, Value (US$ Mn), 2019 - 2031

8.4.1.6. South Africa Location-based VR Entertainment (LBE) Market by Technology, Value (US$ Mn), 2019 - 2031

8.4.1.7. South Africa Location-based VR Entertainment (LBE) Market by Organization Size, Value (US$ Mn), 2019 - 2031

8.4.1.8. South Africa Location-based VR Entertainment (LBE) Market by End User, Value (US$ Mn), 2019 - 2031

8.4.1.9. Egypt Location-based VR Entertainment (LBE) Market by Component, Value (US$ Mn), 2019 - 2031

8.4.1.10. Egypt Location-based VR Entertainment (LBE) Market by Technology, Value (US$ Mn), 2019 - 2031

8.4.1.11. Egypt Location-based VR Entertainment (LBE) Market by Organization Size, Value (US$ Mn), 2019 - 2031

8.4.1.12. Egypt Location-based VR Entertainment (LBE) Market by End User, Value (US$ Mn), 2019 - 2031

8.4.1.13. Nigeria Location-based VR Entertainment (LBE) Market by Component, Value (US$ Mn), 2019 - 2031

8.4.1.14. Nigeria Location-based VR Entertainment (LBE) Market by Technology, Value (US$ Mn), 2019 - 2031

8.4.1.15. Nigeria Location-based VR Entertainment (LBE) Market by Organization Size, Value (US$ Mn), 2019 - 2031

8.4.1.16. Nigeria Location-based VR Entertainment (LBE) Market by End User, Value (US$ Mn), 2019 - 2031

8.4.1.17. Rest Of Middle East & Africa Location-based VR Entertainment (LBE) Market by Component, Value (US$ Mn), 2019 - 2031

8.4.1.18. Rest Of Middle East & Africa Location-based VR Entertainment (LBE) Market by Technology, Value (US$ Mn), 2019 - 2031

8.4.1.19. Rest Of Middle East & Africa Location-based VR Entertainment (LBE) Market by Organization Size, Value (US$ Mn), 2019 - 2031

8.4.1.20. Rest of Middle East & Africa Location-based VR Entertainment (LBE) Market by End User, Value (US$ Mn), 2019 - 2031

8.4.2. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. Organization Size Vs Technology Heat Map

9.2. Manufacturer Vs by Technology Heatmap

9.3. Company Market Share Analysis, 2024

9.4. Competitive Dashboard

9.5. Company Profiles

9.5.1. HTC Vive (HTC Corporation)

9.5.1.1. Company Overview

9.5.1.2. Component Portfolio

9.5.1.3. Financial Overview

9.5.1.4. Business Strategies and Development

9.5.2. Oculus VR (Meta)

9.5.2.1. Company Overview

9.5.2.2. Component Portfolio

9.5.2.3. Financial Overview

9.5.2.4. Business Strategies and Development

9.5.3. Hologate

9.5.3.1. Company Overview

9.5.3.2. Component Portfolio

9.5.3.3. Financial Overview

9.5.3.4. Business Strategies and Development

9.5.4. Survios Inc.

9.5.4.1. Company Overview

9.5.4.2. Component Portfolio

9.5.4.3. Financial Overview

9.5.4.4. Business Strategies and Development

9.5.5. The Void LLC

9.5.5.1. Company Overview

9.5.5.2. Component Portfolio

9.5.5.3. Financial Overview

9.5.5.4. Business Strategies and Development

9.5.6. VRstudios Inc.

9.5.6.1. Company Overview

9.5.6.2. Component Portfolio

9.5.6.3. Financial Overview

9.5.6.4. Business Strategies and Development

9.5.7. Zero Latency VR

9.5.7.1. Company Overview

9.5.7.2. Component Portfolio

9.5.7.3. Financial Overview

9.5.7.4. Business Strategies and Development

9.5.8. Positron

9.5.8.1. Company Overview

9.5.8.2. Component Portfolio

9.5.8.3. Financial Overview

9.5.8.4. Business Strategies and Development

9.5.9. Exit Reality VR

9.5.9.1. Company Overview

9.5.9.2. Component Portfolio

9.5.9.3. Financial Overview

9.5.9.4. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms And Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2023 |

|

2019 - 2023 |

2024 - 2031 |

Value: US$ Billion |

||

|

REPORT FEATURES |

DETAILS |

|

Component Coverage |

|

|

End User Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |