Global Machine Tools Market Forecast

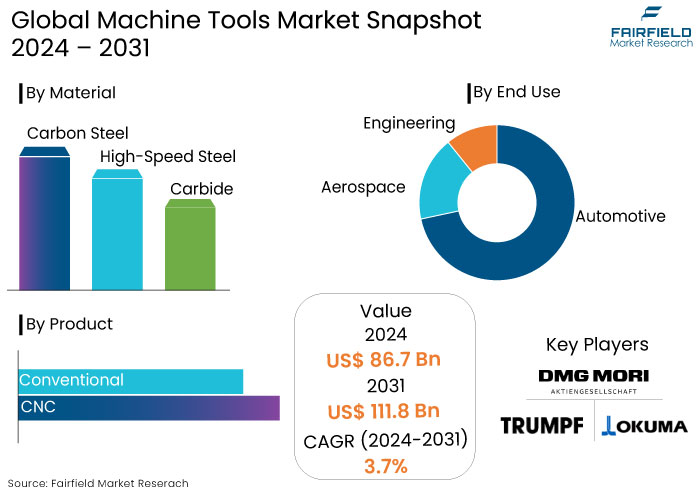

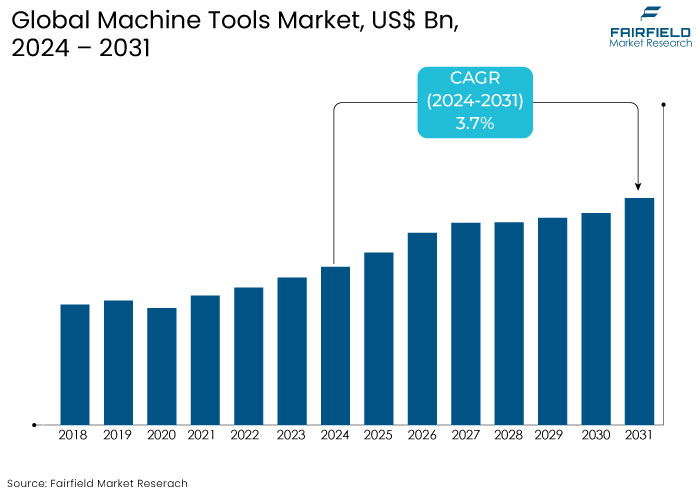

- Sales of machine tools are expected to be worth US$111.8 Bn by 2031, showing significant growth from the US$86.7 Bn achieved in 2024.

- The machine tools market is expected to showcase a notable expansion rate, with an estimated CAGR of 3.7% from 2024 to 2031.

Machine Tools Market Insights

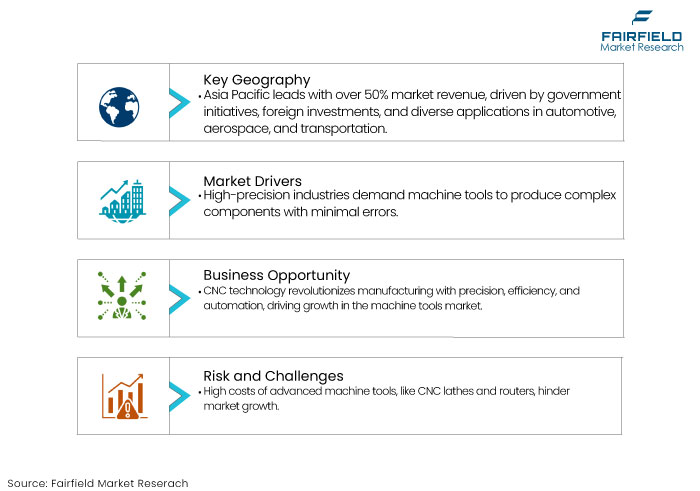

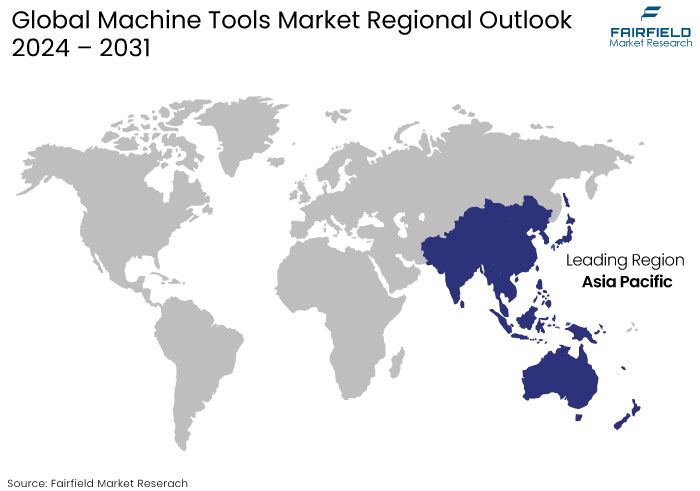

- Asia Pacific leads the machine tools market, with China and India driving demand due to industrial expansion and government initiatives.

- IoT-enabled and CNC machine tools are gaining traction for their precision, efficiency, and real-time monitoring capabilities.

- The electric vehicle (EV) industry is creating demand for specialized machine tools for battery and motor production.

- Flexible and multi-functional machine tools are becoming essential for dynamic production processes.

- Regulatory requirements for energy-efficient and low-emission tools are influencing product innovation.

- The market is rebounding as industries increase investments in advanced manufacturing equipment.

- Carbide dominates the material type segmentation due to its exceptional hardness & wear resistance.

- CNC machines lead the market share owing to their efficiency & high productivity as compared to conventional machines.

A Look Back and a Look Forward - Comparative Analysis

The machine tools market experienced moderate growth during the period from 2019 to 2023. The market is driven primarily by industrial expansion in emerging economies and increasing automation in manufacturing.

Asia Pacific led by China, India, and Japan, dominated the market, contributing significantly to government support for industrialization and infrastructure development. Growth was mainly fueled by demand from the automotive, aerospace, and construction industries, which required precise and efficient tools.

The market faced challenges during the COVID-19 pandemic, with supply chain disruptions and reduced manufacturing activity. By late 2022, recovery was evident, with renewed investments in advanced technologies like CNC machines and 3D printing integration.

The market is expected to accelerate, driven by advancements in smart manufacturing and Industry 4.0 technologies over the forecast period, Automation and IoT-enabled machine tools will be in high demand, allowing real-time monitoring, predictive maintenance, and enhanced productivity.

The shift toward electric vehicles (EVs) will spur demand for specialized machine tools in automotive manufacturing. Sustainability trends will also drive innovation in energy-efficient and eco-friendly machining processes.

Emerging economies in Asia-Pacific and Latin America will contribute significantly to market expansion, while North America and Europe will focus on high-precision and customized tools. Technological advancements and sector-specific demand will sustain robust growth in the market.

Key Growth Determinants

- Rising Desire for Accuracy and Efficacy Fuels Sales

Industries, including automotive, aircraft, electronics, and healthcare, require high-precision components with strict specifications. Machine tools must fulfil these criteria to guarantee the fabrication of complex components with minimum error margins.

As product designs increase in complexity and sophistication, the demand for stringent tolerances and immaculate quality standards escalates. Machine equipment equipped with advanced technology, such as computer numerical control (CNC), delivers the precision required to fulfil these exact standards.

The accuracy in production is closely related to reduced waste and rework. High-precision machine tools guarantee the accurate manufacturing of items on the initial attempt, minimizing material waste and the necessity for expensive reworking procedures.

Using digital technologies and data-driven solutions in machine tools facilitates predictive maintenance, real-time monitoring, and adaptive control. The global machine tools market addresses these expectations through ongoing innovation and advanced technology development.

Manufacturers allocate resources to research and development to produce more accurate, efficient, and versatile instruments to address the changing demands of contemporary manufacturing. The emphasis on precision and efficiency continues to be a primary catalyst, steering the market towards innovations that expand the limits of manufactural capabilities.

- Expansion of the Electric Vehicle (EV) Industry Surges the Demand

The rapid growth of the electric vehicle (EV) industry is reshaping the machine tools market. EV manufacturing requires specialized tools for components like batteries, motors, and lightweight structures.

Machine tools capable of precision machining for aluminum and composite materials are in high demand to meet the requirements of EV production. Moreover, the focus on lightweight vehicle designs to improve efficiency has led to increased adoption of advanced machining technologies.

The demand for machine tools tailored to this sector is expected to grow exponentially, driving market expansion as governments worldwide push for green transportation and automakers transition to EVs,

Key Growth Barriers

- High Initial Investment Remains a Significant Obstacle

The expense of acquiring sophisticated machine tools is high, which is a significant obstacle hindering the machine tools market growth. New CNC lathes and routers can cost thousands of dollars, varying by brand and type.

The costs incurred by firms utilizing CNC machines are subsequently increased by these investments, encompassing shipping, installation, operational, and maintenance fees. CNC machines have a substantial weight range, ranging from 100 pounds to several tons. Purchase agreements generally include transportation costs; if they do not, clients may incur additional fees amounting to hundreds of dollars.

Machines can be customized to fulfil the requirements and specifications of end users. The applications for which machines are designed differ in their specifications. Machines require updates when manufacturing processes or goods experience substantial changes that increase costs.

The substantial expenses related to the operation of machining tools are critical elements in buying choices. They are anticipated to obstruct the implementation of machines, particularly in cost-sensitive areas and sectors. Elevated installation and maintenance expenses associated with machine tools are anticipated to hinder the expansion of the market.

- Lack of Skilled Workforce to Restrain Market Growth

The shortage of skilled workers proficient in operating and maintaining modern machine tools is another critical restraint for the machine tools market. Advanced tools, such as CNC and multi-axis machines require operators with specialized knowledge in programming, operation, and troubleshooting.

The growing complexity of smart manufacturing systems under Industry 4.0 intensifies this skill gap. The lack of adequate training infrastructure in developing regions exacerbates the problem, creating technological adoption bottlenecks.

Even in developed economies, high demand for skilled technician’s increases labour costs, increasing manufacturers' operational expenses. The said skills gap hinders the full potential of machine tool utilization, slowing market growth.

Machine Tools Market Trends and Opportunities

- Growing Utilization of CNC Technology to Provide Transformative Opportunities

The implementation of computer numerical control (CNC) technology in machine tools has revolutionized the manufacturing sector. CNC technology has transformed machining processes by providing precision, efficiency, and automation. This technology facilitates exceptionally precise and accurate machining processes and provide key opportunities in the machine tools market.

Computer-controlled machines provide uniform quality, minimizing errors and enhancing the overall accuracy of produced components. CNC machines function autonomously and may execute numerous jobs simultaneously, increasing production.

Automated tool modifications, accelerated cutting velocities, and diminished setup durations enhance production efficiency. This technology facilitates the fabrication of delicate and complicated components that may be difficult or unfeasible to produce with traditional methods. It is particularly vital in sectors such as aircraft, automotive, and medical devices.

CNC machines are frequently used with Computer-Aided Design (CAD) and Computer-Aided Manufacturing (CAM) software. This integration facilitates the effortless conversion of design criteria into machine instructions, enhancing manufacturing. Manufacturers are innovating new products. For example,

- In April 2023, Okuma Corporation introduced the LB3000 EX CNC lathe and the MB-46V vertical machining centre, which are exemplary Green-Smart Machines characterized by great precision and energy efficiency.

- Increasing Demand for Automation in Manufacturing Propel Market Expansion

The machine tools market is progressively shaped by the growing demand for automation in manufacturing processes. Automation is increasingly vital for manufacturers aiming to enhance productivity, lower operational expenses, and sustain competitiveness in the global marketplace.

Incorporating machine tools with automated systems, including robotics and AI-driven solutions, facilitates accelerated production times, uniform quality, and reduced human error. Also, the increasing trend of Industry 4.0, which highlights the digitalization of production processes, intensifies the demand for automated machine tools.

Companies are investing in intelligent and interconnected machine tools that may enhance production processes, deliver predictive maintenance, and furnish real-time data analysis. Thus, creating a compelling opportunity for market players and propelling market expansion.

How Does Regulatory Scenario Shape the Industry?

The regulatory landscape is pivotal in shaping the machine tools market by influencing product standards, manufacturing practices, and technological innovation. In developed regions such as North America and Europe, stringent safety and environmental regulations drive manufacturers to develop energy-efficient, low-emission, and compliant machine tools.

The European Union’s Eco-Design Directive promotes the development of sustainable and energy-efficient manufacturing equipment, pushing companies to adopt advanced technologies in machine tools.

In emerging economies, governments are establishing initiatives to modernize manufacturing sectors, such as India’s Make in India and China’s Made in China 2025, emphasizing adopting high-precision, automated machine tools. These policies are encouraging local production and increasing investments in advanced manufacturing equipment.

Globally, compliance with ISO standards, such as ISO 9001 for quality management and ISO 14001 for environmental management, has become a benchmark for machine tool manufacturers. However, navigating diverse regulatory requirements across regions can increase operational costs and complexity for global manufacturers.

Industry 4.0-related policies, such as Germany’s Industry 4.0, are promoting the integration of smart and IoT-enabled machine tools, shaping the industry toward more digital and automated solutions. The evolving regulatory scenario steers the market toward sustainability, technological advancement, and improved global competitiveness.

Segments Covered in the Report

- Carbide Takes the Lead with its Exceptional Hardness & Wear Resistance

Carbide has outstanding hardness, abrasion resistance, and thermal stability, rendering it ideal for diverse machining applications across several sectors. Its adaptability facilitates the efficient cutting, shaping, and forming of metals, polymers, and composites, addressing the varied requirements of producers.

Carbide tools are especially used in the automotive, aerospace, and engineering industries owing to their capacity to endure high-speed machining while preserving precision.

Ceramic materials possess a substantial market share, particularly in specialist applications requiring high-temperature resistance and chemical inertness, such as in the aerospace and electrical sectors. Although carbon steel and high-speed steel are still widely used, their market shares are progressively overshadowed by carbide and ceramic materials' higher performance and durability.

- CNC Machines Lead the Market owing to its Efficiency & High Productivity

CNC machines accumulate significant share in the machine tools market due to their exceptional precision, repeatability, and automation features, enhancing efficiency and productivity in industrial operations. Metal-cutting CNC machines are extensively utilized in several industries due to their capacity to produce intricate geometries with exceptional precision and rapidity.

The transition to CNC technology is apparent in the metal cutting and metal forming sectors, as manufacturers increasingly emphasize automation and digitalization to optimize production processes. Although traditional machines remain pertinent in specific applications, the need for CNC machines is increasing, driven by software, controls, and connectivity developments. These address the changing requirements of contemporary manufacturing.

Regional Analysis

- Asia Pacific to Dominate the Machine Tools Market with Significant Market Share

Asia Pacific dominates the market representing over 50% of market revenue. Government initiatives, foreign investments, collaborations, and diverse automotive, aerospace, and transportation applications are driving regional prosperity.

The focus on electrification in the automotive sector, numerous efforts supporting sustainable vehicle development, increasing attention to automated production, and investment in integrated technologies are anticipated to drive machine tools market expansion.

Regulatory regulations and supplementary tax incentives will increase market demand in various locations. In 2023, China’s Ministry of Finance and State Administration of Taxation established a super deduction policy for research and development expenses.

China advocates for and highlights the requirement for high-precision and intelligent machinery due to the increasing need for superior-quality components and parts. Suppliers and manufacturers are forming strategic partnerships with local entities and concentrating on advanced machine tool technology to address the changing needs of clients. Numerous organizations are identifying opportunities in developing technologies, including smart machining centres and precise engineering, solidifying their market presence.

- Robust Industrial Base in Europe to Lead Market

The increasing need for innovative and precise machinery among small and medium-sized firms drives the machine tools market in Europe. These economies, characterized by high productivity, consistently prioritize sustainable and environmentally friendly tooling solutions that minimize energy usage and ecological impact.

Digitalization and integrated technological solutions, such as CNC machine tools, are seeing significant market momentum in the region to enhance production capacity and produce high-quality components. In 2023, Germany held the predominant market share, succeeded by other European nations.

The expansion of manufacturing facilities and the increasing need for high-precision machine tools for component manufacturing are driving sales volume in the region. Automation in industrial facilities, technical innovations, and an emphasis on efficient production methods to enhance market demand.

Fairfield’s Competitive Landscape Analysis

The machine tools market is highly competitive, driven by global and regional players focusing on innovation, automation, and precision. Key companies such as DMG MORI, Yamazaki Mazak Corporation, Okuma Corporation, Haas Automation, and Makino Milling Machine Co. dominate the market with extensive CNC and advanced multi-axis tool portfolios.

Companies emphasize Industry 4.0 integration, offering IoT-enabled tools with predictive maintenance and real-time monitoring capabilities. Regional players in Asia Pacific, including Hyundai WIA and AMADA, cater to cost-sensitive markets with affordable yet efficient solutions.

Partnerships, research and development investments, and acquisitions are common strategies to enhance market share. Small firms face challenges competing with established players due to high capital and technological barriers.

Key Market Companies

- Amada Co. Ltd.

- DMG Mori Aktiengesellschaft

- Trumpf Group

- MAG

- Makino

- Okuma Corporation

- Shenyang Machine Tool Group Co Ltd

- Haas Automation Inc.

- Dalian Machine Tool Group Corporation

- EMAG

Recent Industry Developments

- In February 2024, Nidec Machine Tool launched a new compact and powerful universal head, a light, thin, short and small product that is capable of catering to various machining needs.

- In March 2023, Yasda Precision Machining Tools signed a partnership deal with Methods Machine Tools as a precision machining centre across the United States.

- In August 2023, Okuma America Corporation, launched its next-gen machine control for CNC machine tools to improve user experience and high-speed operations.

An Expert’s Eye

- Developing regions like Asia Pacific is expected to lead the market due to industrial expansion and supportive government policies.

- Regulatory demands for energy efficiency and low-emission tools steer innovation toward eco-friendly machine tools.

- The rise of EV manufacturing is creating a significant demand for specialized, high-precision machine tools.

- Increasing demand for flexible and multi-functional tools is reshaping machine tools market

Global Machine Tools Market is Segmented as-

By Material Type

- Carbon Steel

- High-Speed Steel

- Carbide

By Product Type

- CNC

- Conventional

By End Use

- Automotive

- Aerospace

- Engineering

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- The Middle East & Africa

1. Executive Summary

1.1. Global Machine Tools Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value and Volume, 2023

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. COVID-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Global Machine Tools Market Outlook, 2019 - 2031

3.1. Global Machine Tools Market Outlook, by Material Type, Value (US$ Bn) , 2019 - 2031

3.1.1. Key Highlights

3.1.1.1. Carbon Steel

3.1.1.2. High-Speed Steel

3.1.1.3. Carbide

3.2. Global Machine Tools Market Outlook, by Product Type, Value (US$ Bn) , 2019 - 2031

3.2.1. Key Highlights

3.2.1.1. CNC

3.2.1.2. Conventional

3.3. Global Machine Tools Market Outlook, by End Use, Value (US$ Bn) , 2019 - 2031

3.3.1. Key Highlights

3.3.1.1. Automotive

3.3.1.2. Aerospace

3.3.1.3. Engineering

3.4. Global Machine Tools Market Outlook, by Region, Value (US$ Bn) , 2019 - 2031

3.4.1. Key Highlights

3.4.1.1. North America

3.4.1.2. Europe

3.4.1.3. Asia Pacific

3.4.1.4. Latin America

3.4.1.5. Middle East & Africa

4. North America Machine Tools Market Outlook, 2019 - 2031

4.1. North America Machine Tools Market Outlook, by Material Type, Value (US$ Bn) , 2019 - 2031

4.1.1. Key Highlights

4.1.1.1. Carbon Steel

4.1.1.2. High-Speed Steel

4.1.1.3. Carbide

4.2. North America Machine Tools Market Outlook, by Product Type, Value (US$ Bn) , 2019 - 2031

4.2.1. Key Highlights

4.2.1.1. CNC

4.2.1.2. Conventional

4.3. North America Machine Tools Market Outlook, by End Use, Value (US$ Bn) , 2019 - 2031

4.3.1. Key Highlights

4.3.1.1. Automotive

4.3.1.2. Aerospace

4.3.1.3. Engineering

4.4. North America Machine Tools Market Outlook, by Country, Value (US$ Bn) , 2019 - 2031

4.4.1. Key Highlights

4.4.1.1. U.S. Machine Tools Market by Material Type, Value (US$ Bn) , 2019 - 2031

4.4.1.2. U.S. Machine Tools Market by Product Type, Value (US$ Bn) , 2019 - 2031

4.4.1.3. U.S. Machine Tools Market by End Use, Value (US$ Bn) , 2019 - 2031

4.4.1.4. Canada Machine Tools Market by Material Type, Value (US$ Bn) , 2019 - 2031

4.4.1.5. Canada Machine Tools Market by Product Type, Value (US$ Bn) , 2019 - 2031

4.4.1.6. Canada Machine Tools Market by End Use, Value (US$ Bn) , 2019 - 2031

4.4.2. BPS Analysis/Market Attractiveness Analysis

5. Europe Machine Tools Market Outlook, 2019 - 2031

5.1. Europe Machine Tools Market Outlook, by Material Type, Value (US$ Bn) , 2019 - 2031

5.1.1. Key Highlights

5.1.1.1. Carbon Steel

5.1.1.2. High-Speed Steel

5.1.1.3. Carbide

5.2. Europe Machine Tools Market Outlook, by Product Type, Value (US$ Bn) , 2019 - 2031

5.2.1. Key Highlights

5.2.1.1. CNC

5.2.1.2. Conventional

5.3. Europe Machine Tools Market Outlook, by End Use, Value (US$ Bn) , 2019 - 2031

5.3.1. Key Highlights

5.3.1.1. Automotive

5.3.1.2. Aerospace

5.3.1.3. Engineering

5.4. Europe Machine Tools Market Outlook, by Country, Value (US$ Bn) , 2019 - 2031

5.4.1. Key Highlights

5.4.1.1. Germany Machine Tools Market by Material Type, Value (US$ Bn) , 2019 - 2031

5.4.1.2. Germany Machine Tools Market by Product Type, Value (US$ Bn) , 2019 - 2031

5.4.1.3. Germany Machine Tools Market by End Use, Value (US$ Bn) , 2019 - 2031

5.4.1.4. U.K. Machine Tools Market by Material Type, Value (US$ Bn) , 2019 - 2031

5.4.1.5. U.K. Machine Tools Market by Product Type, Value (US$ Bn) , 2019 - 2031

5.4.1.6. U.K. Machine Tools Market by End Use, Value (US$ Bn) , 2019 - 2031

5.4.1.7. France Machine Tools Market by Material Type, Value (US$ Bn) , 2019 - 2031

5.4.1.8. France Machine Tools Market by Product Type, Value (US$ Bn) , 2019 - 2031

5.4.1.9. France Machine Tools Market by End Use, Value (US$ Bn) , 2019 - 2031

5.4.1.10. Italy Machine Tools Market by Material Type, Value (US$ Bn) , 2019 - 2031

5.4.1.11. Italy Machine Tools Market by Product Type, Value (US$ Bn) , 2019 - 2031

5.4.1.12. Italy Machine Tools Market by End Use, Value (US$ Bn) , 2019 - 2031

5.4.1.13. Turkey Machine Tools Market by Material Type, Value (US$ Bn) , 2019 - 2031

5.4.1.14. Turkey Machine Tools Market by Product Type, Value (US$ Bn) , 2019 - 2031

5.4.1.15. Turkey Machine Tools Market by End Use, Value (US$ Bn) , 2019 - 2031

5.4.1.16. Russia Machine Tools Market by Material Type, Value (US$ Bn) , 2019 - 2031

5.4.1.17. Russia Machine Tools Market by Product Type, Value (US$ Bn) , 2019 - 2031

5.4.1.18. Russia Machine Tools Market by End Use, Value (US$ Bn) , 2019 - 2031

5.4.1.19. Rest of Europe Machine Tools Market by Material Type, Value (US$ Bn) , 2019 - 2031

5.4.1.20. Rest of Europe Machine Tools Market by Product Type, Value (US$ Bn) , 2019 - 2031

5.4.1.21. Rest of Europe Machine Tools Market by End Use, Value (US$ Bn) , 2019 - 2031

5.4.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Machine Tools Market Outlook, 2019 - 2031

6.1. Asia Pacific Machine Tools Market Outlook, by Material Type, Value (US$ Bn) , 2019 - 2031

6.1.1. Key Highlights

6.1.1.1. Carbon Steel

6.1.1.2. High-Speed Steel

6.1.1.3. Carbide

6.2. Asia Pacific Machine Tools Market Outlook, by Product Type, Value (US$ Bn) , 2019 - 2031

6.2.1. Key Highlights

6.2.1.1. CNC

6.2.1.2. Conventional

6.3. Asia Pacific Machine Tools Market Outlook, by End Use, Value (US$ Bn) , 2019 - 2031

6.3.1. Key Highlights

6.3.1.1. Automotive

6.3.1.2. Aerospace

6.3.1.3. Engineering

6.4. Asia Pacific Machine Tools Market Outlook, by Country, Value (US$ Bn) , 2019 - 2031

6.4.1. Key Highlights

6.4.1.1. China Machine Tools Market by Material Type, Value (US$ Bn) , 2019 - 2031

6.4.1.2. China Machine Tools Market by Product Type, Value (US$ Bn) , 2019 - 2031

6.4.1.3. China Machine Tools Market by End Use, Value (US$ Bn) , 2019 - 2031

6.4.1.4. Japan Machine Tools Market by Material Type, Value (US$ Bn) , 2019 - 2031

6.4.1.5. Japan Machine Tools Market by Product Type, Value (US$ Bn) , 2019 - 2031

6.4.1.6. Japan Machine Tools Market by End Use, Value (US$ Bn) , 2019 - 2031

6.4.1.7. South Korea Machine Tools Market by Material Type, Value (US$ Bn) , 2019 - 2031

6.4.1.8. South Korea Machine Tools Market by Product Type, Value (US$ Bn) , 2019 - 2031

6.4.1.9. South Korea Machine Tools Market by End Use, Value (US$ Bn) , 2019 - 2031

6.4.1.10. India Machine Tools Market by Material Type, Value (US$ Bn) , 2019 - 2031

6.4.1.11. India Machine Tools Market by Product Type, Value (US$ Bn) , 2019 - 2031

6.4.1.12. India Machine Tools Market by End Use, Value (US$ Bn) , 2019 - 2031

6.4.1.13. Southeast Asia Machine Tools Market by Material Type, Value (US$ Bn) , 2019 - 2031

6.4.1.14. Southeast Asia Machine Tools Market by Product Type, Value (US$ Bn) , 2019 - 2031

6.4.1.15. Southeast Asia Machine Tools Market by End Use, Value (US$ Bn) , 2019 - 2031

6.4.1.16. Rest of Asia Pacific Machine Tools Market by Material Type, Value (US$ Bn) , 2019 - 2031

6.4.1.17. Rest of Asia Pacific Machine Tools Market by Product Type, Value (US$ Bn) , 2019 - 2031

6.4.1.18. Rest of Asia Pacific Machine Tools Market by End Use, Value (US$ Bn) , 2019 - 2031

6.4.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America Machine Tools Market Outlook, 2019 - 2031

7.1. Latin America Machine Tools Market Outlook, by Material Type, Value (US$ Bn) , 2019 - 2031

7.1.1. Carbon Steel

7.1.2. High-Speed Steel

7.1.3. Carbide

7.2. Latin America Machine Tools Market Outlook, by Product Type, Value (US$ Bn) , 2019 - 2031

7.2.1. CNC

7.2.2. Conventional

7.3. Latin America Machine Tools Market Outlook, by End Use, Value (US$ Bn) , 2019 - 2031

7.3.1. Key Highlights

7.3.1.1. Automotive

7.3.1.2. Aerospace

7.3.1.3. Engineering

7.4. Latin America Machine Tools Market Outlook, by Country, Value (US$ Bn) , 2019 - 2031

7.4.1. Key Highlights

7.4.1.1. Brazil Machine Tools Market by Material Type, Value (US$ Bn) , 2019 - 2031

7.4.1.2. Brazil Machine Tools Market by Product Type, Value (US$ Bn) , 2019 - 2031

7.4.1.3. Brazil Machine Tools Market by End Use, Value (US$ Bn) , 2019 - 2031

7.4.1.4. Mexico Machine Tools Market by Material Type, Value (US$ Bn) , 2019 - 2031

7.4.1.5. Mexico Machine Tools Market by Product Type, Value (US$ Bn) , 2019 - 2031

7.4.1.6. Mexico Machine Tools Market by End Use, Value (US$ Bn) , 2019 - 2031

7.4.1.7. Argentina Machine Tools Market by Material Type, Value (US$ Bn) , 2019 - 2031

7.4.1.8. Argentina Machine Tools Market by Product Type, Value (US$ Bn) , 2019 - 2031

7.4.1.9. Argentina Machine Tools Market by End Use, Value (US$ Bn) , 2019 - 2031

7.4.1.10. Rest of Latin America Machine Tools Market by Material Type, Value (US$ Bn) , 2019 - 2031

7.4.1.11. Rest of Latin America Machine Tools Market by Product Type, Value (US$ Bn) , 2019 - 2031

7.4.1.12. Rest of Latin America Machine Tools Market by End Use, Value (US$ Bn) , 2019 - 2031

7.4.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Machine Tools Market Outlook, 2019 - 2031

8.1. Middle East & Africa Machine Tools Market Outlook, by Material Type, Value (US$ Bn) , 2019 - 2031

8.1.1. Key Highlights

8.1.1.1. Carbon Steel

8.1.1.2. High-Speed Steel

8.1.1.3. Carbide

8.2. Middle East & Africa Machine Tools Market Outlook, by Product Type, Value (US$ Bn) , 2019 - 2031

8.2.1. Key Highlights

8.2.1.1. CNC

8.2.1.2. Conventional

8.3. Middle East & Africa Machine Tools Market Outlook, by End Use, Value (US$ Bn) , 2019 - 2031

8.3.1. Key Highlights

8.3.1.1. Automotive

8.3.1.2. Aerospace

8.3.1.3. Engineering

8.4. Middle East & Africa Machine Tools Market Outlook, by Country, Value (US$ Bn) , 2019 - 2031

8.4.1. Key Highlights

8.4.1.1. GCC Machine Tools Market by Material Type, Value (US$ Bn) , 2019 - 2031

8.4.1.2. GCC Machine Tools Market by Product Type, Value (US$ Bn) , 2019 - 2031

8.4.1.3. GCC Machine Tools Market by End Use, Value (US$ Bn) , 2019 - 2031

8.4.1.4. South Africa Machine Tools Market by Material Type, Value (US$ Bn) , 2019 - 2031

8.4.1.5. South Africa Machine Tools Market by Product Type, Value (US$ Bn) , 2019 - 2031

8.4.1.6. South Africa Machine Tools Market by End Use, Value (US$ Bn) , 2019 - 2031

8.4.1.7. Egypt Machine Tools Market by Material Type, Value (US$ Bn) , 2019 - 2031

8.4.1.8. Egypt Machine Tools Market by Product Type, Value (US$ Bn) , 2019 - 2031

8.4.1.9. Egypt Machine Tools Market by End Use, Value (US$ Bn) , 2019 - 2031

8.4.1.10. Nigeria Machine Tools Market by Material Type, Value (US$ Bn) , 2019 - 2031

8.4.1.11. Nigeria Machine Tools Market by Product Type, Value (US$ Bn) , 2019 - 2031

8.4.1.12. Nigeria Machine Tools Market by End Use, Value (US$ Bn) , 2019 - 2031

8.4.1.13. Rest of Middle East & Africa Machine Tools Market by Material Type, Value (US$ Bn) , 2019 - 2031

8.4.1.14. Rest of Middle East & Africa Machine Tools Market by Product Type, Value (US$ Bn) , 2019 - 2031

8.4.1.15. Rest of Middle East & Africa Machine Tools Market by End Use, Value (US$ Bn) , 2019 - 2031

8.4.2. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. by End Use vs by Product Type Heat map

9.2. Manufacturer vs by Product Type Heat map

9.3. Company Market Share Analysis, 2023

9.4. Competitive Dashboard

9.5. Company Profiles

9.5.1. Amada Co. Ltd.

9.5.1.1. Company Overview

9.5.1.2. Product Portfolio

9.5.1.3. Financial Overview

9.5.1.4. Business Strategies and Development

9.5.2. DMG Mori Aktiengesellschaft

9.5.3. Trumpf Group

9.5.4. MAG

9.5.5. Makino

9.5.6. Okuma Corporation

9.5.7. Shenyang Machine Tool Group Co Ltd

9.5.8. Haas Automation Inc.

9.5.9. Dalian Machine Tool Group Corporation

9.5.10. EMAG

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2023 |

|

2019 - 2023 |

2024 - 2031 |

Value: US$ Million |

||

|

REPORT FEATURES |

DETAILS |

|

Material Type Coverage |

|

|

Product Type Coverage |

|

|

End Use Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |