Global Makeup Remover Products Market Forecast

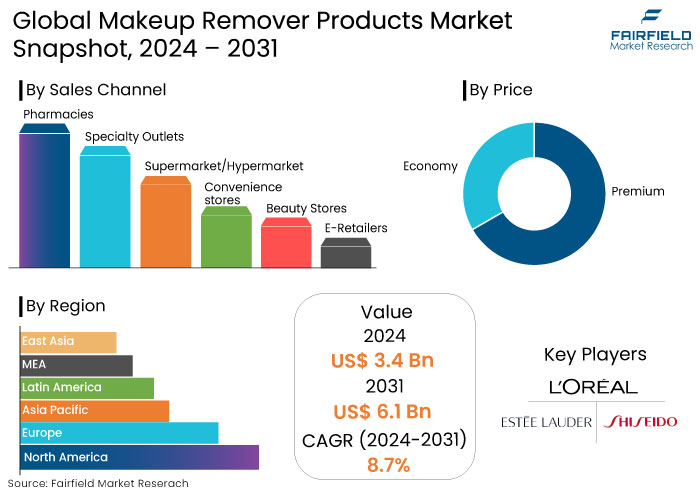

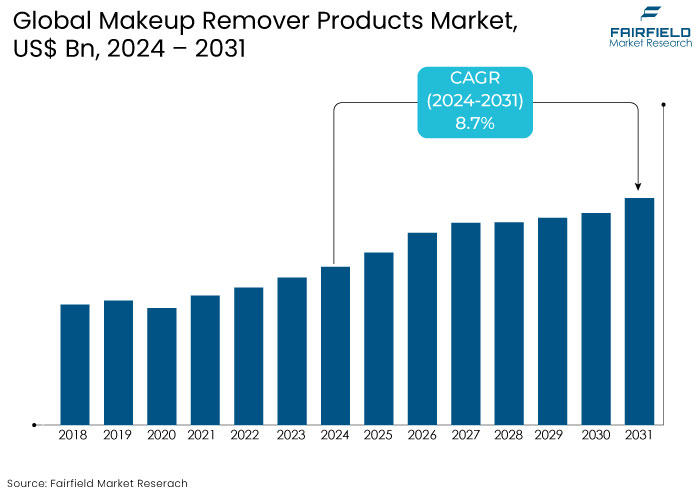

- The makeup remover products market is projected to reach a valuation of US$6.1 Bn by 2031, showing significant growth from the US$3.4 Bn achieved in 2024.

- The market for makeup remover products is expected to show a significant expansion rate, with an estimated CAGR of 8.7% from 2024 to 2031.

Makeup Remover Products Market Insights

- A notable shift toward natural and organic ingredient drives the market forward, with consumers seeking products free from harmful chemicals.

- Eco-friendly and sustainable packaging is becoming a vital selling point as consumers prioritize environmentally responsible products.

- The rise of e-commerce is reshaping purchasing behaviours, allowing consumers to access a wider range of products and brands.

- Consumers increasingly favour makeup removers that offer additional skincare benefits, such as hydration and anti-aging properties.

- Social media and influencer partnerships are essential for brand visibility, particularly among younger demographics.

- Increasing skin health awareness is driving consumers to invest in high-quality makeup removers that prevent skin issues.

- Continuous product innovation, including new textures and formulations, is key to capturing consumer interest and loyalty.

- The global makeup remover products market is projected to grow significantly, driven by increasing skincare awareness and demand for effective cleansing solutions.

A Look Back and a Look Forward - Comparative Analysis

The makeup remover products market showed steady growth during the historical period from 2019 to 2023 primarily fueled by increased awareness of skincare, growth in the beauty industry, and consumer demand for effective and convenient makeup removal solutions.

Rising skin sensitivity concerns and a preference for gentle, and skin-friendly ingredients also encouraged product development in wipes, micellar waters, and oil-based removers. The market witnessed expansion in emerging economies, where urbanization and disposable income were rising, leading to increased demand for personal care products.

Trends toward organic and natural ingredients shaped consumer preferences with brands responding with the launch of eco-friendly and hypoallergenic options. Over the forecast period, the market is projected to experience accelerated growth due to technological advancements like sustainable packaging and innovative formulations.

Increasing concerns about the environmental impact of single-use products may shift demand toward reusable and biodegradable options. Additionally, as consumers seek multifunctional skincare products, companies may focus on combining makeup removal with other skin benefits such as hydration and anti-aging.

The market is anticipated to benefit from e-commerce expansion allowing brands to reach wider demographics globally. Further, evolving consumer awareness about dermatological health will likely push brands toward ingredient transparency and more targeted solutions for different skin types.

Key Growth Determinants

- Growing Skincare Awareness and Health-Conscious Consumer Preferences

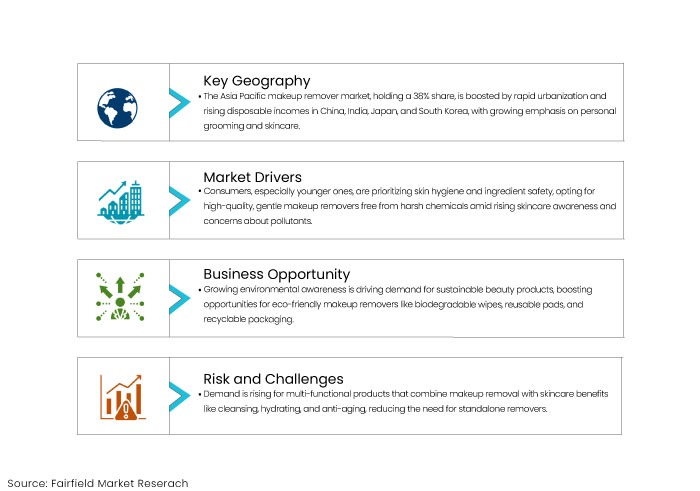

Consumers are increasingly prioritizing skin hygiene and ingredient safety with heightened awareness around skincare health and wellness. The rise in dermatological concerns, including sensitivity and acne due to environmental pollutants has led to a preference for high-quality makeup removers that thoroughly cleanse while being gentle on the skin. This shift is especially pronounced in young generations, who are highly informed about skincare routines and prioritize products free from harsh chemicals like parabens, sulphates, and artificial fragrances.

Brands are investing in developing makeup removers with natural and organic ingredients that remove makeup effectively and offer skin-soothing benefits. This trend drives makeup remover products market growth as consumers seek reliable products supporting skin health.

- Product Innovation and Expansion of Sustainable Offerings

Innovation is a key driver in the makeup remover products market as brands aim to meet evolving consumer demands with advanced formulations and sustainable packaging. Companies are developing products like micellar water, oil-based removers, and wipes infused with additional skincare benefits such as hydration, anti-aging, and antioxidants.

Brands are focusing on sustainable, and biodegradable options with increasing awareness of the environmental impact of disposable products. These products include reusable makeup remover pads and eco-friendly packaging materials that cater to the eco-conscious consumer segment. As a result, companies that emphasize sustainability and innovation are gaining competitive advantages and capturing a growing customer base that values responsible consumption.

Key Growth Barriers

- Growing Preference for Multi-Functional Skincare Products

There is a rising demand for multi-functional products combining makeup removal with other skincare benefits, such as cleansing, hydrating, or anti-aging as consumers become more skincare-savvy. This trend toward all-in-one products like cleansing balms or micellar waters that tone and moisturize, reduces the need for standalone makeup removers.

Consumers increasingly seek minimalistic routines and prefer products that simplify their regimen without sacrificing effectiveness particularly as minimalism gains popularity. Such preference is a restraint for the makeup remover products market as single-purpose products face declining demand compared to multi-functional alternatives, which can slow down market growth.

- Environmental Concerns Regarding Disposable Makeup Remover Wipes

Disposable makeup remover wipes, a popular and convenient choice among consumers have been scrutinized for their environmental impact. These wipes often contain non-biodegradable materials that contribute to pollution and landfill waste, and their production and disposal have raised concerns about sustainability.

Growing awareness of environmental issues and an increasing shift toward eco-friendly products have prompted some consumers to avoid single-use wipes instead of reusable or biodegradable alternatives.

Shift poses a restraint for the makeup remover products market growth, as brands may need to invest in sustainable innovations and materials, which can raise production costs and affect profit margins in a highly competitive market.

Makeup Remover Products Market Trends and Opportunities

- Rising Demand for Eco-Friendly and Sustainable Products

As consumer awareness of environmental issues grows, there is a strong shift toward sustainable beauty products, opening up a key opportunity for eco-friendly makeup removers. These removers include biodegradable wipes, reusable makeup removal pads, and products in recyclable packaging.

Brands investing in sustainable ingredients and zero-waste options are attracting eco-conscious consumers especially in the millennial and Gen Z demographics. This factor enables brands to stand out in a competitive market by aligning with consumer values around environmental responsibility. As sustainability becomes a priority, eco-friendly offerings have the potential to drive brand loyalty and capture a significant market share.

- Innovative Formulations and Skincare-Integrated Removers

The demand for skincare products with additional benefits such as hydration, anti-aging, or soothing effects creates an opportunity for multifunctional makeup removers beyond simple cleansing.

Consumers are increasingly interested in formulations with natural ingredients like aloe vera, hyaluronic acid, or antioxidants, which provide a gentle and nourishing experience. Such a trend allows companies to introduce new formulations that cater to diverse skin needs, capturing the interest of customers looking for products that support skin health while removing makeup. Such fusion of makeup removal and skincare offers brands a premium positioning in the makeup remover products market and allows for high pricing due to perceived added value.

How Does Regulatory Scenario Shape this Industry?

The regulatory landscape is increasingly significant in shaping the makeup remover products market particularly in response to heightened concerns over ingredient safety, environmental impact, and transparency.

Authorities like the FDA in the U.S. and the European Medicines Agency (EMA) in Europe have strict guidelines for cosmetic and skincare products including makeup removers to ensure product safety and efficacy.

Regulations mandate detailed labelling and discourage the use of potentially harmful chemicals such as parabens, sulphates, and artificial fragrances. This shift is driving manufacturers to adopt “clean beauty” standards, leading to a focus on natural and hypoallergenic formulations to meet regulatory and consumer demands.

Environmental regulations influence packaging and waste management practices, especially in regions with strict sustainability laws, like the EU. Companies are moving toward recyclable and biodegradable packaging to align with these regulations and reduce their environmental footprint. Compliance with such regulations is essential for market access and serves as a competitive advantage, as eco-conscious consumers prefer brands committed to safety and sustainability.

Segments Covered in the Report

- Demand to Remain High for Liquid Product Type

Liquid products commanded a 46% market share driven by a growing customer inclination toward items that provide both effectiveness and ease. Liquid makeup removers especially those containing micellar water are exceptionally efficient in eliminating makeup without requiring extensive scrubbing, rendering them a favored option among consumers. These solutions are particularly esteemed for their capacity to cleanse the skin delicately while preserving its natural moisture equilibrium, which is essential for those with sensitive skin.

Liquid makeup removers containing natural oils and plant extracts have garnered considerable popularity due to their alignment with the increasing trend of clean beauty and sustainability. The growing accessibility of information regarding the potential long-term impacts of synthetic chemicals on skin health also propels this transition.

- Economy Price Products Commanded a Market Share of 48%

Consumers in the makeup remover products market seek effective makeup removers that provide satisfactory results at reasonable prices. Moreover, economical makeup removers possess sophisticated formulations that efficiently wash skin and prevent irritation and acne.

Manufacturers have progressively launched products within this price range to appeal to a broader consumer demographic, encompassing budget-conscious folks and those prepared to invest more in excellent skin care. As consumers grow increasingly budget-conscious due to economic uncertainty, the market has noted a rising inclination toward economical makeup removers that provide adequate outcomes.

Discount retailers, pharmacies, and grocery stores provide an extensive array of economical choices, rendering these products readily accessible to a diverse consumer base.

Regional Analysis

- Asia Pacific Maintains Primacy in the Market

Asia Pacific makeup remover products market held a 38% share driven by swift urbanization and increasing disposable incomes in countries like China, India, Japan, and South Korea. An increased focus on personal grooming and skincare propelled the market.

Consumers have grown increasingly cognizant of the significance of adequate makeup removal as international beauty trends significantly sway them. Such understanding is especially pronounced among young populations, who are significantly swayed by beauty influencers and online tutorials that underscore the necessity of comprehensive washing for skin health.

- North America Makeup Remover Products Market to Grow Substantially

The market in North America captured a substantial market share and is projected to experience a considerable increase during the forecast period. This growth is due to heightened beauty consciousness and skincare knowledge among consumers.

Consumers have progressively pursued makeup removers devoid of abrasive chemicals and synthetic additives. They have selected items that incorporate natural oils and plant extracts. Such transition is motivated by apprehensions regarding the possible enduring impacts of synthetic components on dermal health and ecological well-being. Brands emphasizing clean beauty and sustainability have markedly acquired a competitive advantage in the makeup remover products market.

Fairfield’s Competitive Landscape Analysis

The presence of several key players, including L'Oréal, Unilever, Estée Lauder, and Procter & Gamble, characterizes the competitive landscape of the makeup remover products market. These companies dominate the market through strong brand recognition, extensive product portfolios, and innovative marketing strategies.

The rise of indie brands and clean beauty labels, such as Biossance and Garnier, reshapes competition by emphasizing eco-friendly ingredients and sustainable packaging. The market is also witnessing collaborations and partnerships to expand distribution channels and enhance product offerings.

Companies increasingly focus on product innovation, targeting specific consumer needs, and adopting digital marketing strategies to engage with young demographics to remain competitive. The shift toward e-commerce platforms has intensified competition, allowing brands to reach a broad audience and enhance customer engagement through targeted campaigns.

Key Market Companies

- L’Oréal SA

- Johnsons & Johnsons

- Estee Lauder

- Shiseido Company, Limited.

- The Procter and Gamble Company

- Unilever

- Urban Decay Cosmetics

- Bobbi Brown Professional Cosmetics Inc.

- Avon Products Inc.

- LVMH

- Kimberly –Clark Corporation

- Beiersdorf

- Kao Corporation

- Revlon Inc.

Recent Industry Developments

November 2023 –

L'Oréal Paris patented a cosmetic formulation makeup remover that includes an antibacterial ingredient and is devoid of surfactants and salicylic acid, which effectively alleviates eye irritation during product use.

November 2023 -

Neutrogena, a subsidiary of Johnson & Johnson, finalized its collaboration with Lenzing's Veocal fiber brand to manufacture makeup removal wipes that are entirely plant-based and environmentally sustainable.

An Expert’s Eye

- Growing consumer preference for makeup removers made with natural and organic ingredients caters to the market growth.

- The increased awareness about skincare and health pushing brands to formulate gentle and safe products for all skin types drives the makeup remover products market.

- Analysts predict that sustainability will be a critical driver for market growth over the forecast period.

- Brands investing in eco-friendly packaging and biodegradable formulations will likely resonate more with environmentally-conscious consumers.

Global Makeup Remover Products Market is Segmented as-

By Product Type

- Wipes/Pads/Cloths

- Liquids

- Lotion/Cream

By Purpose

- Face

- Eyes

- Lips

By Price

- Premium

- Economy

By Sales Channel

- Pharmacies

- Specialty Outlets

- Supermarket/Hypermarket

- Convenience stores

- Beauty Stores

- E-Retailers

By Region

- North America

- Europe

- Latin America

- Asia Pacific

- The Middle East and Africa

1. Executive Summary

1.1. Global Makeup Remover Products Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2024

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. COVID-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Global Makeup Remover Products Market Outlook, 2019-2031

3.1. Global Makeup Remover Products Market Outlook, by Product Type, Value (US$ Bn), 2019-2031

3.1.1. Key Highlights

3.1.1.1. Wipes/Pads/Cloths

3.1.1.2. Liquids

3.1.1.3. Lotion/Cream

3.1.1.4. Others (Sticks, Bars, Balms, etc.)

3.2. Global Makeup Remover Products Market Outlook, by Purpose, Value (US$ Bn), 2019-2031

3.2.1. Key Highlights

3.2.1.1. Face

3.2.1.2. Eyes

3.2.1.3. Lips

3.3. Global Makeup Remover Products Market Outlook, by Price, Value (US$ Bn), 2019-2031

3.3.1. Key Highlights

3.3.1.1. High/Premium

3.3.1.2. Mid-range/ Economy

3.4. Global Makeup Remover Products Market Outlook, by Sales Channel, Value (US$ Bn), 2019-2031

3.4.1. Key Highlights

3.4.1.1. Pharmacies

3.4.1.2. Specialty Outlets

3.4.1.3. Supermarket/Hypermarket

3.4.1.4. Convenience stores

3.4.1.5. Beauty Stores

3.4.1.6. E-Retailers

3.4.1.7. Others

3.5. Global Makeup Remover Products Market Outlook, by Region, Value (US$ Bn), 2019-2031

3.5.1. Key Highlights

3.5.1.1. North America

3.5.1.2. Europe

3.5.1.3. Asia Pacific

3.5.1.4. Latin America

3.5.1.5. Middle East & Africa

4. North America Makeup Remover Products Market Outlook, 2019-2031

4.1. North America Makeup Remover Products Market Outlook, by Product Type, Value (US$ Bn), 2019-2031

4.1.1. Key Highlights

4.1.1.1. Wipes/Pads/Cloths

4.1.1.2. Liquids

4.1.1.3. Lotion/Cream

4.1.1.4. Others (Sticks, Bars, Balms, etc.)

4.2. North America Makeup Remover Products Market Outlook, by Purpose, Value (US$ Bn), 2019-2031

4.2.1. Key Highlights

4.2.1.1. Face

4.2.1.2. Eyes

4.2.1.3. Lips

4.3. North America Makeup Remover Products Market Outlook, by Price, Value (US$ Bn), 2019-2031

4.3.1. Key Highlights

4.3.1.1. High/Premium

4.3.1.2. Mid-range/ Economy

4.3.2. BPS Analysis/Market Attractiveness Analysis

4.4. North America Makeup Remover Products Market Outlook, by Sales Channel, Value (US$ Bn), 2019-2031

4.4.1. Key Highlights

4.4.1.1. Pharmacies

4.4.1.2. Specialty Outlets

4.4.1.3. Supermarket/Hypermarket

4.4.1.4. Convenience stores

4.4.1.5. Beauty Stores

4.4.1.6. E-Retailers

4.4.1.7. Others

4.4.2. BPS Analysis/Market Attractiveness Analysis

4.5. North America Makeup Remover Products Market Outlook, by Country, Value (US$ Bn), 2019-2031

4.5.1. Key Highlights

4.5.1.1. U.S. Makeup Remover Products Market by Product Type, Value (US$ Bn), 2019-2031

4.5.1.2. U.S. Makeup Remover Products Market by Purpose, Value (US$ Bn), 2019-2031

4.5.1.3. U.S. Makeup Remover Products Market by Price, Value (US$ Bn), 2019-2031

4.5.1.4. U.S. Makeup Remover Products Market by Sales Channel, Value (US$ Bn), 2019-2031

4.5.1.5. Canada Makeup Remover Products Market by Product Type, Value (US$ Bn), 2019-2031

4.5.1.6. Canada Makeup Remover Products Market by Purpose, Value (US$ Bn), 2019-2031

4.5.1.7. Canada Makeup Remover Products Market by Price, Value (US$ Bn), 2019-2031

4.5.1.8. Canada Makeup Remover Products Market by Sales Channel, Value (US$ Bn), 2019-2031

4.5.2. BPS Analysis/Market Attractiveness Analysis

5. Europe Makeup Remover Products Market Outlook, 2019-2031

5.1. Europe Makeup Remover Products Market Outlook, by Product Type, Value (US$ Bn), 2019-2031

5.1.1. Key Highlights

5.1.1.1. Wipes/Pads/Cloths

5.1.1.2. Liquids

5.1.1.3. Lotion/Cream

5.1.1.4. Others (Sticks, Bars, Balms, etc.)

5.2. Europe Makeup Remover Products Market Outlook, by Purpose, Value (US$ Bn), 2019-2031

5.2.1. Key Highlights

5.2.1.1. Face

5.2.1.2. Eyes

5.2.1.3. Lips

5.3. Europe Makeup Remover Products Market Outlook, by Price, Value (US$ Bn), 2019-2031

5.3.1. Key Highlights

5.3.1.1. High/Premium

5.3.1.2. Mid-range/ Economy

5.3.2. BPS Analysis/Market Attractiveness Analysis

5.4. Europe Makeup Remover Products Market Outlook, by Sales Channel, Value (US$ Bn), 2019-2031

5.4.1. Key Highlights

5.4.1.1. Pharmacies

5.4.1.2. Specialty Outlets

5.4.1.3. Supermarket/Hypermarket

5.4.1.4. Convenience stores

5.4.1.5. Beauty Stores

5.4.1.6. E-Retailers

5.4.1.7. Others

5.4.2. BPS Analysis/Market Attractiveness Analysis

5.5. Europe Makeup Remover Products Market Outlook, by Country, Value (US$ Bn), 2019-2031

5.5.1. Key Highlights

5.5.1.1. Germany Makeup Remover Products Market by Product Type, Value (US$ Bn), 2019-2031

5.5.1.2. Germany Makeup Remover Products Market by Purpose, Value (US$ Bn), 2019-2031

5.5.1.3. Germany Makeup Remover Products Market by Price, Value (US$ Bn), 2019-2031

5.5.1.4. Germany Makeup Remover Products Market by Sales Channel, Value (US$ Bn), 2019-2031

5.5.1.5. U.K. Makeup Remover Products Market by Product Type, Value (US$ Bn), 2019-2031

5.5.1.6. U.K. Makeup Remover Products Market by Purpose, Value (US$ Bn), 2019-2031

5.5.1.7. U.K. Makeup Remover Products Market by Price, Value (US$ Bn), 2019-2031

5.5.1.8. U.K. Makeup Remover Products Market by Sales Channel, Value (US$ Bn), 2019-2031

5.5.1.9. France Makeup Remover Products Market by Product Type, Value (US$ Bn), 2019-2031

5.5.1.10. France Makeup Remover Products Market by Purpose, Value (US$ Bn), 2019-2031

5.5.1.11. France Makeup Remover Products Market by Price, Value (US$ Bn), 2019-2031

5.5.1.12. France Makeup Remover Products Market by Sales Channel, Value (US$ Bn), 2019-2031

5.5.1.13. Italy Makeup Remover Products Market by Product Type, Value (US$ Bn), 2019-2031

5.5.1.14. Italy Makeup Remover Products Market by Purpose, Value (US$ Bn), 2019-2031

5.5.1.15. Italy Makeup Remover Products Market by Price, Value (US$ Bn), 2019-2031

5.5.1.16. Italy Makeup Remover Products Market by Sales Channel, Value (US$ Bn), 2019-2031

5.5.1.17. Turkey Makeup Remover Products Market by Product Type, Value (US$ Bn), 2019-2031

5.5.1.18. Turkey Makeup Remover Products Market by Purpose, Value (US$ Bn), 2019-2031

5.5.1.19. Turkey Makeup Remover Products Market by Price, Value (US$ Bn), 2019-2031

5.5.1.20. Turkey Makeup Remover Products Market by Sales Channel, Value (US$ Bn), 2019-2031

5.5.1.21. Russia Makeup Remover Products Market by Product Type, Value (US$ Bn), 2019-2031

5.5.1.22. Russia Makeup Remover Products Market by Purpose, Value (US$ Bn), 2019-2031

5.5.1.23. Russia Makeup Remover Products Market by Price, Value (US$ Bn), 2019-2031

5.5.1.24. Russia Makeup Remover Products Market by Sales Channel, Value (US$ Bn), 2019-2031

5.5.1.25. Rest of Europe Makeup Remover Products Market by Product Type, Value (US$ Bn), 2019-2031

5.5.1.26. Rest of Europe Makeup Remover Products Market by Purpose, Value (US$ Bn), 2019-2031

5.5.1.27. Rest of Europe Makeup Remover Products Market by Price, Value (US$ Bn), 2019-2031

5.5.1.28. Rest of Europe Makeup Remover Products Market by Sales Channel, Value (US$ Bn), 2019-2031

5.5.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Makeup Remover Products Market Outlook, 2019-2031

6.1. Asia Pacific Makeup Remover Products Market Outlook, by Product Type, Value (US$ Bn), 2019-2031

6.1.1. Key Highlights

6.1.1.1. Wipes/Pads/Cloths

6.1.1.2. Liquids

6.1.1.3. Lotion/Cream

6.1.1.4. Others (Sticks, Bars, Balms, etc.)

6.2. Asia Pacific Makeup Remover Products Market Outlook, by Purpose, Value (US$ Bn), 2019-2031

6.2.1. Key Highlights

6.2.1.1. Face

6.2.1.2. Eyes

6.2.1.3. Lips

6.3. Asia Pacific Makeup Remover Products Market Outlook, by Price, Value (US$ Bn), 2019-2031

6.3.1. Key Highlights

6.3.1.1. High/Premium

6.3.1.2. Mid-range/ Economy

6.3.2. BPS Analysis/Market Attractiveness Analysis

6.4. Asia Pacific Makeup Remover Products Market Outlook, by Sales Channel, Value (US$ Bn), 2019-2031

6.4.1. Key Highlights

6.4.1.1. Pharmacies

6.4.1.2. Specialty Outlets

6.4.1.3. Supermarket/Hypermarket

6.4.1.4. Convenience stores

6.4.1.5. Beauty Stores

6.4.1.6. E-Retailers

6.4.1.7. Others

6.4.2. BPS Analysis/Market Attractiveness Analysis

6.5. Asia Pacific Makeup Remover Products Market Outlook, by Country, Value (US$ Bn), 2019-2031

6.5.1. Key Highlights

6.5.1.1. China Makeup Remover Products Market by Product Type, Value (US$ Bn), 2019-2031

6.5.1.2. China Makeup Remover Products Market by Purpose, Value (US$ Bn), 2019-2031

6.5.1.3. China Makeup Remover Products Market by Price, Value (US$ Bn), 2019-2031

6.5.1.4. China Makeup Remover Products Market by Sales Channel, Value (US$ Bn), 2019-2031

6.5.1.5. Japan Makeup Remover Products Market by Product Type, Value (US$ Bn), 2019-2031

6.5.1.6. Japan Makeup Remover Products Market by Purpose, Value (US$ Bn), 2019-2031

6.5.1.7. Japan Makeup Remover Products Market by Price, Value (US$ Bn), 2019-2031

6.5.1.8. Japan Makeup Remover Products Market by Sales Channel, Value (US$ Bn), 2019-2031

6.5.1.9. South Korea Makeup Remover Products Market by Product Type, Value (US$ Bn), 2019-2031

6.5.1.10. South Korea Makeup Remover Products Market by Purpose, Value (US$ Bn), 2019-2031

6.5.1.11. South Korea Makeup Remover Products Market by Price, Value (US$ Bn), 2019-2031

6.5.1.12. South Korea Makeup Remover Products Market by Sales Channel, Value (US$ Bn), 2019-2031

6.5.1.13. India Makeup Remover Products Market by Product Type, Value (US$ Bn), 2019-2031

6.5.1.14. India Makeup Remover Products Market by Purpose, Value (US$ Bn), 2019-2031

6.5.1.15. India Makeup Remover Products Market by Price, Value (US$ Bn), 2019-2031

6.5.1.16. India Makeup Remover Products Market by Sales Channel, Value (US$ Bn), 2019-2031

6.5.1.17. Southeast Asia Makeup Remover Products Market by Product Type, Value (US$ Bn), 2019-2031

6.5.1.18. Southeast Asia Makeup Remover Products Market by Purpose, Value (US$ Bn), 2019-2031

6.5.1.19. Southeast Asia Makeup Remover Products Market by Price, Value (US$ Bn), 2019-2031

6.5.1.20. Southeast Asia Makeup Remover Products Market by Sales Channel, Value (US$ Bn), 2019-2031

6.5.1.21. Rest of Asia Pacific Makeup Remover Products Market by Product Type, Value (US$ Bn), 2019-2031

6.5.1.22. Rest of Asia Pacific Makeup Remover Products Market by Purpose, Value (US$ Bn), 2019-2031

6.5.1.23. Rest of Asia Pacific Makeup Remover Products Market by Price, Value (US$ Bn), 2019-2031

6.5.1.24. Rest of Asia Pacific Makeup Remover Products Market by Sales Channel, Value (US$ Bn), 2019-2031

6.5.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America Makeup Remover Products Market Outlook, 2019-2031

7.1. Latin America Makeup Remover Products Market Outlook, by Product Type, Value (US$ Bn), 2019-2031

7.1.1. Key Highlights

7.1.1.1. Wipes/Pads/Cloths

7.1.1.2. Liquids

7.1.1.3. Lotion/Cream

7.1.1.4. Others (Sticks, Bars, Balms, etc.)

7.2. Latin America Makeup Remover Products Market Outlook, by Purpose, Value (US$ Bn), 2019-2031

7.2.1. Key Highlights

7.2.1.1. Face

7.2.1.2. Eyes

7.2.1.3. Lips

7.3. Latin America Makeup Remover Products Market Outlook, by Price, Value (US$ Bn), 2019-2031

7.3.1. Key Highlights

7.3.1.1. High/Premium

7.3.1.2. Mid-range/ Economy

7.3.2. BPS Analysis/Market Attractiveness Analysis

7.4. Latin America Makeup Remover Products Market Outlook, by Sales Channel, Value (US$ Bn), 2019-2031

7.4.1. Key Highlights

7.4.1.1. Pharmacies

7.4.1.2. Specialty Outlets

7.4.1.3. Supermarket/Hypermarket

7.4.1.4. Convenience stores

7.4.1.5. Beauty Stores

7.4.1.6. E-Retailers

7.4.1.7. Others

7.4.2. BPS Analysis/Market Attractiveness Analysis

7.5. Latin America Makeup Remover Products Market Outlook, by Country, Value (US$ Bn), 2019-2031

7.5.1. Key Highlights

7.5.1.1. Brazil Makeup Remover Products Market by Product Type, Value (US$ Bn), 2019-2031

7.5.1.2. Brazil Makeup Remover Products Market by Purpose, Value (US$ Bn), 2019-2031

7.5.1.3. Brazil Makeup Remover Products Market by Price, Value (US$ Bn), 2019-2031

7.5.1.4. Brazil Makeup Remover Products Market by Sales Channel, Value (US$ Bn), 2019-2031

7.5.1.5. Mexico Makeup Remover Products Market by Product Type, Value (US$ Bn), 2019-2031

7.5.1.6. Mexico Makeup Remover Products Market by Purpose, Value (US$ Bn), 2019-2031

7.5.1.7. Mexico Makeup Remover Products Market by Price, Value (US$ Bn), 2019-2031

7.5.1.8. Mexico Makeup Remover Products Market by Sales Channel, Value (US$ Bn), 2019-2031

7.5.1.9. Argentina Makeup Remover Products Market by Product Type, Value (US$ Bn), 2019-2031

7.5.1.10. Argentina Makeup Remover Products Market by Purpose, Value (US$ Bn), 2019-2031

7.5.1.11. Argentina Makeup Remover Products Market by Price, Value (US$ Bn), 2019-2031

7.5.1.12. Argentina Makeup Remover Products Market by Sales Channel, Value (US$ Bn), 2019-2031

7.5.1.13. Rest of Latin America Makeup Remover Products Market by Product Type, Value (US$ Bn), 2019-2031

7.5.1.14. Rest of Latin America Makeup Remover Products Market by Purpose, Value (US$ Bn), 2019-2031

7.5.1.15. Rest of Latin America Makeup Remover Products Market by Price, Value (US$ Bn), 2019-2031

7.5.1.16. Rest of Latin America Makeup Remover Products Market by Sales Channel, Value (US$ Bn), 2019-2031

7.5.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Makeup Remover Products Market Outlook, 2019-2031

8.1. Middle East & Africa Makeup Remover Products Market Outlook, by Product Type, Value (US$ Bn), 2019-2031

8.1.1. Key Highlights

8.1.1.1. Wipes/Pads/Cloths

8.1.1.2. Liquids

8.1.1.3. Lotion/Cream

8.1.1.4. Others (Sticks, Bars, Balms, etc.)

8.2. Middle East & Africa Makeup Remover Products Market Outlook, by Purpose, Value (US$ Bn), 2019-2031

8.2.1. Key Highlights

8.2.1.1. Face

8.2.1.2. Eyes

8.2.1.3. Lips

8.3. Middle East & Africa Makeup Remover Products Market Outlook, by Price, Value (US$ Bn), 2019-2031

8.3.1. Key Highlights

8.3.1.1. High/Premium

8.3.1.2. Mid-range/ Economy

8.3.2. BPS Analysis/Market Attractiveness Analysis

8.4. Middle East & Africa Makeup Remover Products Market Outlook, by Sales Channel, Value (US$ Bn), 2019-2031

8.4.1. Key Highlights

8.4.1.1. Pharmacies

8.4.1.2. Specialty Outlets

8.4.1.3. Supermarket/Hypermarket

8.4.1.4. Convenience stores

8.4.1.5. Beauty Stores

8.4.1.6. E-Retailers

8.4.1.7. Others

8.4.2. BPS Analysis/Market Attractiveness Analysis

8.5. Middle East & Africa Makeup Remover Products Market Outlook, by Country, Value (US$ Bn), 2019-2031

8.5.1. Key Highlights

8.5.1.1. GCC Makeup Remover Products Market by Product Type, Value (US$ Bn), 2019-2031

8.5.1.2. GCC Makeup Remover Products Market by Purpose, Value (US$ Bn), 2019-2031

8.5.1.3. GCC Makeup Remover Products Market by Price, Value (US$ Bn), 2019-2031

8.5.1.4. GCC Makeup Remover Products Market by Sales Channel, Value (US$ Bn), 2019-2031

8.5.1.5. South Africa Makeup Remover Products Market by Product Type, Value (US$ Bn), 2019-2031

8.5.1.6. South Africa Makeup Remover Products Market by Purpose, Value (US$ Bn), 2019-2031

8.5.1.7. South Africa Makeup Remover Products Market by Price, Value (US$ Bn), 2019-2031

8.5.1.8. South Africa Makeup Remover Products Market by Sales Channel, Value (US$ Bn), 2019-2031

8.5.1.9. Egypt Makeup Remover Products Market by Product Type, Value (US$ Bn), 2019-2031

8.5.1.10. Egypt Makeup Remover Products Market by Purpose, Value (US$ Bn), 2019-2031

8.5.1.11. Egypt Makeup Remover Products Market by Price, Value (US$ Bn), 2019-2031

8.5.1.12. Egypt Makeup Remover Products Market by Sales Channel, Value (US$ Bn), 2019-2031

8.5.1.13. Nigeria Makeup Remover Products Market by Product Type, Value (US$ Bn), 2019-2031

8.5.1.14. Nigeria Makeup Remover Products Market by Purpose, Value (US$ Bn), 2019-2031

8.5.1.15. Nigeria Makeup Remover Products Market by Price, Value (US$ Bn), 2019-2031

8.5.1.16. Nigeria Makeup Remover Products Market by Sales Channel, Value (US$ Bn), 2019-2031

8.5.1.17. Rest of Middle East & Africa Makeup Remover Products Market by Product Type, Value (US$ Bn), 2019-2031

8.5.1.18. Rest of Middle East & Africa Makeup Remover Products Market by Purpose, Value (US$ Bn), 2019-2031

8.5.1.19. Rest of Middle East & Africa Makeup Remover Products Market by Price, Value (US$ Bn), 2019-2031

8.5.1.20. Rest of Middle East & Africa Makeup Remover Products Market by Sales Channel, Value (US$ Bn), 2019-2031

8.5.2. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. By Type vs by Purpose Heat map

9.2. Manufacturer vs by Purpose Heatmap

9.3. Company Market Share Analysis, 2024

9.4. Competitive Dashboard

9.5. Company Profiles

9.5.1. L'Oréal SA

9.5.1.1. Company Overview

9.5.1.2. Product Portfolio

9.5.1.3. Financial Overview

9.5.1.4. Business Strategies and Development

9.5.2. Johnsons & Johnsons

9.5.2.1. Company Overview

9.5.2.2. Product Portfolio

9.5.2.3. Financial Overview

9.5.2.4. Business Strategies and Development

9.5.3. Estee Lauder

9.5.3.1. Company Overview

9.5.3.2. Product Portfolio

9.5.3.3. Financial Overview

9.5.3.4. Business Strategies and Development

9.5.4. Shiseido Company, Limited.

9.5.4.1. Company Overview

9.5.4.2. Product Portfolio

9.5.4.3. Financial Overview

9.5.4.4. Business Strategies and Development

9.5.5. The Procter and Gamble Company

9.5.5.1. Company Overview

9.5.5.2. Product Portfolio

9.5.5.3. Financial Overview

9.5.5.4. Business Strategies and Development

9.5.6. Unilever

9.5.6.1. Company Overview

9.5.6.2. Product Portfolio

9.5.6.3. Financial Overview

9.5.6.4. Business Strategies and Development

9.5.7. Urban Decay Cosmetics

9.5.7.1. Company Overview

9.5.7.2. Product Portfolio

9.5.7.3. Financial Overview

9.5.7.4. Business Strategies and Development

9.5.8. Bobbi Brown Professional Cosmetics Inc.

9.5.8.1. Company Overview

9.5.8.2. Product Portfolio

9.5.8.3. Financial Overview

9.5.8.4. Business Strategies and Development

9.5.9. Avon Products Inc.

9.5.9.1. Company Overview

9.5.9.2. Product Portfolio

9.5.9.3. Financial Overview

9.5.9.4. Business Strategies and Development

9.5.10. LVMH

9.5.10.1. Company Overview

9.5.10.2. Product Portfolio

9.5.10.3. Financial Overview

9.5.10.4. Business Strategies and Development

9.5.11. Kimberly-Clark Corporation

9.5.11.1. Company Overview

9.5.11.2. Product Portfolio

9.5.11.3. Financial Overview

9.5.11.4. Business Strategies and Development

9.5.12. Beiersdorf

9.5.12.1. Company Overview

9.5.12.2. Product Portfolio

9.5.12.3. Financial Overview

9.5.12.4. Business Strategies and Development

9.5.13. Kao Corporation

9.5.13.1. Company Overview

9.5.13.2. Product Portfolio

9.5.13.3. Financial Overview

9.5.13.4. Business Strategies and Development

9.5.14. Revlon Inc.

9.5.14.1. Company Overview

9.5.14.2. Product Portfolio

9.5.14.3. Financial Overview

9.5.14.4. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2023 |

|

2019 - 2023 |

2024 - 2031 |

Value: US$ Billion |

||

|

REPORT FEATURES |

DETAILS |

|

Product Type Coverage |

|

|

Purpose Coverage |

|

|

Sales Channel |

|

|

Price Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |