Global Material Handling Cart Market Forecast

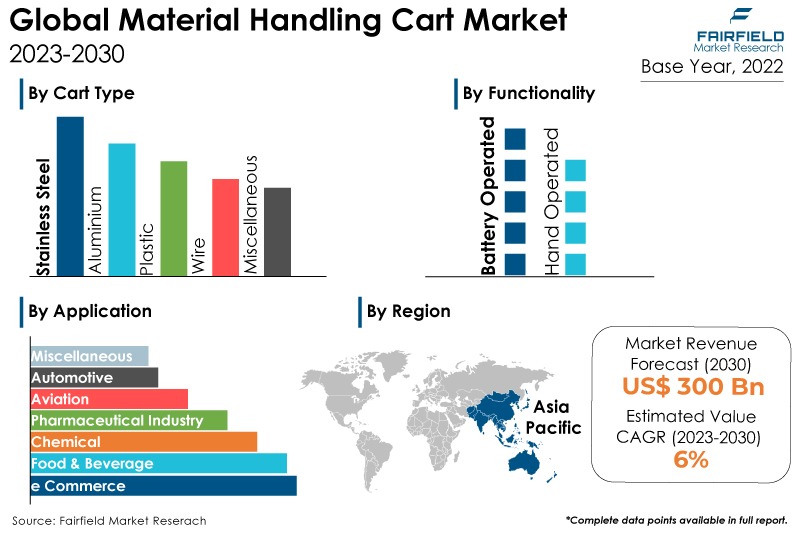

- Global material handling cart market size poised to reach nearly US$300 Bn by 2030-end

- Market revenue likely to rise high at a significant CAGR of 6% during 2023 - 2030

Market Analysis in Brief

Material handling carts are specialised wheeled vehicles or platforms designed to transport goods, equipment, and materials within a facility or between different locations. These carts are an essential component of material handling systems in various industries, as they provide a convenient and efficient way to move items without excessive manual labor. Material handling carts come in various sizes and shapes to suit the specific needs of different industries and applications.

Material handling carts have been incorporating more automation and technology features, such as automated guided vehicles (AGVs), and radio-frequency identification (RFID) tracking, to enhance efficiency and traceability in the movement of goods. Industries have been demanding more customizable solutions to meet their specific requirements. Material handling cart manufacturers have offered options to customise cart sizes, load capacities, and features to match diverse operational needs. Moreover, there has been a growing emphasis on designing carts with ergonomic features to reduce strain on workers and improve overall safety. This includes adjustable handles, ergonomic grips, and features that minimise the physical effort required to maneuver heavy loads.

Key Report Findings

- The market for material handling carts will demonstrate significant expansion in revenue by the end of this decade.

- Demand for carts with rubber tyres remains higher in the material handling cart market.

- Battery operated carts continue to dominate the material handling cart market through 2030.

- Stainless seel carts held the highest material handling cart market revenue share in 2022.

- Asia Pacific will continue to lead, whereas Latin America material handling cart market will experience the strongest growth till 2030.

Growth Drivers

Supply Chain Optimisation

Supply chain optimisation plays a significant role in driving the demand for material-handling carts. Efficient supply chain management focuses on reducing costs, minimising waste, improving productivity, and enhancing overall operational efficiency. Material handling carts are crucial tools within this optimisation process, as they contribute to several key aspects of a streamlined supply chain.

Material handling carts facilitate smooth movement of goods and materials within facilities. By quickly transporting items from one location to another, carts help minimise downtime and delays, ensuring that processes remain efficient and production schedules are met. Supply chain optimisation often involves implementing just-in-time (JIT) practices, where materials are delivered when needed to reduce excess inventory. Material handling carts aid in this process by enabling the timely and efficient movement of materials from storage to production areas, minimising the need for large storage spaces.

Material handling carts support lean manufacturing principles by providing a means to eliminate waste, streamline processes, and improve efficiency. Carts help organise materials, reduce unnecessary movements, and enhance the overall flow of materials throughout the production cycle. Effective inventory management is a key aspect of supply chain optimisation.

Material handling carts transport materials to and from inventory storage areas, enabling accurate tracking and reducing the risk of overstocking or stockouts. In distribution centers and warehouses, material handling carts aid in order picking and fulfillment. Carts move items from storage to packing and shipping areas, ensuring customer orders are processed quickly and accurately.

Automation and Industry 4.0 Expansion

Automation and Industry 4.0 are major drivers shaping the future of manufacturing and logistics, and they play a critical role in driving the demand for advanced material handling carts. Industry 4.0 concepts involve the integration of sensors, connectivity, and data analytics into manufacturing and logistics processes.

Material handling carts equipped with sensors and communication capabilities (often referred to as smart carts) can autonomously navigate within facilities using advanced technologies like automated guided vehicles (AGVs). These AGVs can optimise routes, avoid obstacles, and communicate with other equipment and systems, increasing material movement efficiency. This integration allows for real-time inventory tracking, efficient order processing, and dynamic allocation of resources, ensuring that material handling processes are synchronised with overall production and logistics operations.

Industry 4.0 emphasizes predictive maintenance, where equipment is monitored using sensors to predict when maintenance is needed. Material handling carts equipped with sensor technology can provide data about their condition, allowing maintenance teams to perform timely servicing, reduce downtime, and prolong the lifespan of the carts. Automation and Industry 4.0 generate vast amounts of data from various interconnected systems.

Material handling carts with embedded sensors can contribute data about usage patterns, operational efficiency, and performance. This data can be assessed to make informed decisions about process optimisation, resource allocation, and overall supply chain improvements. Automation-driven material handling carts can perform tasks that would otherwise require manual labor. This enhances efficiency and reduces labor costs and the associated risks of human error.

Growth Challenges

High Costs

The material handling carts market faces challenges and restraints that can impact its growth and development. These restraints vary based on economic conditions, technological advancements, and industry-specific dynamics. Depending on the features, automation level, and customisation, material-handling carts with advanced technologies can have high upfront costs. This might deter some businesses, especially smaller enterprises with limited budgets, from investing in these solutions.

While material-handling carts offer numerous benefits but require maintenance, servicing, and occasional repairs. These costs can add up over time and impact the overall cost-effectiveness of the carts. Advanced material handling carts with automation and IoT capabilities can be complex to implement and operate.

Different industries have their unique challenges and requirements. For example, industries with strict hygiene standards, like healthcare and food service, might require special cart designs that can withstand cleaning procedures.

Moreover, depending on the industry and region, there might be specific regulations and safety standards that material handling carts need to adhere to. Ensuring compliance with these regulations can be demanding. These factors are expected to limit the global material handling carts market growth during the forecast period.

Overview of Key Segments

Battery Operated Carts Witness Maximum Adoption

Battery operated material handling carts, also known as electric carts or powered carts, offer several benefits compared to traditional manually operated carts. These benefits stem from integrating electric motors and automation technologies into the design of the carts. Motor-operated carts can move heavier loads with less effort than manually pushed carts. This results in increased efficiency and reduced labour requirements for material movement.

Electric carts can handle larger and heavier loads than manually operated carts. This allows for transporting bulky or heavy items in a single trip, reducing the required trips. Operators of motor-operated carts experience less physical strain since they don't have to manually push or pull heavy loads. This contributes to improved ergonomics and reduces the risk of workplace injuries. Electric carts can move at consistent speeds and cover distances faster than manual carts. This can lead to faster material movement within facilities, improving overall productivity.

Electric carts often come equipped with variable speed control, allowing operators to control the cart's movement precisely. This is particularly useful in environments where accuracy is essential, such as assembly lines or storage areas. Many battery-operated carts can be integrated into automated material handling systems. They can follow predefined routes, be controlled remotely, and communicate with other automated equipment.

Some electric carts can be operated remotely using control panels or wireless devices. This remote operation capability is beneficial for moving materials where direct operator presence might be difficult or hazardous. Electric carts often have features like differential drive systems, allowing for better traction and maneuverability, even in tight spaces. This makes them suitable for navigating through crowded areas or narrow aisles.

Commercial Sector Contributes the Lion’s Share

The increased use of material handling carts in the commercial sector is driven by various factors that enhance efficiency, customer service, and operational effectiveness. As businesses try to optimise their processes and improve customer experiences, material-handling carts are critical in facilitating these goals. The expansion of e-commerce has led to a surge in demand for efficient order fulfilment.

Material handling carts are essential for quickly picking, packing, and shipping items, ensuring timely customer delivery. Material handling carts help retailers manage inventory more effectively by enabling employees to transport products from storage to the sales floor and back. This results in well-stocked shelves and a pleasant shopping experience for customers.

In sectors like retail and hospitality, material handling carts allow staff to provide personalised assistance to customers. Businesses can enhance customer satisfaction by quickly retrieving items, addressing customer inquiries, and delivering products.

Hospitals and healthcare facilities rely on material-handling carts to transport medical supplies, equipment, and medications. These carts ensure that patient care processes are streamlined and efficient.

Growth Opportunities Across Regions

Asia Pacific Dominant

The increased use of material handling carts in Asia can be attributed to economic growth, industrialisation, and technological advancements. As various industries across the region continue to expand, the demand for efficient material handling solutions has risen. Asia is home to some of the world's fastest-growing economies, including China, and India. This growth has increased manufacturing and industrial activities, creating a greater need for material movement within factories, warehouses, and distribution centers.

The rise of online retail in Asia has created a surge in demand for effective order fulfillment. Material handling carts are essential for swiftly picking, packing, and shipping products in fulfillment centers and warehouses. Rapid urbanisation in many Asian countries has driven infrastructure development, construction, and commercial activities.

Materia handling carts are used in construction sites, shopping malls, and other urban environments to transport materials, goods, and equipment. Asia has become a hub for manufacturing, from electronics and automotive industries to consumer goods production. Material handling carts assist in moving raw materials, components, and finished products within manufacturing facilities.

With growing trade and global supply chains, efficient logistics and transportation are crucial. Material handling carts play a role in loading and unloading cargo in airports, seaports, and distribution centers. These factors are expected to propel the growth of the material handling cart market in the region during the forecast period.

Latin America Develops a Lucrative Market

Due to several key factors, Latin America has been emerging as a growing and potentially lucrative market for material handling carts. Many countries in Latin America are experiencing economic growth, leading to increased industrialisation, urbanisation, and commercial activities. Economic expansion often triggers higher demand for material handling solutions, including carts, in various sectors.

Latin American countries have invested in infrastructure development, including manufacturing facilities, distribution centers, and logistics hubs. Material handling carts play a vital role in these environments for efficient material movement and distribution. Similar to other regions, Latin America has witnessed the growth of e-commerce. This has increased demand for efficient order fulfillment processes, driving the need for material handling carts in warehouses and distribution centers.

Some Latin American countries are becoming attractive destinations for manufacturing and export-oriented industries. Material handling carts are essential for moving raw materials, components, and finished products within these manufacturing facilities.

Moreover, Latin America has adopted automation and Industry 4.0 technologies, often including automated material handling solutions. These factors are expected to propel the growth of the material handling cart market in the region during the forecast period.

Material Handling Cart Market: Competitive Landscape

Some of the leading players at the forefront in the material handling cart market space include Beumer Group, FlexQube, Daifuku Co., Production Automation Corporation, Honeywell International, Inc., VMR International LLC, Kion Group AG, Global Lab supply, Mecalux S.A., Scaglia Indeva S.p.A., Murata Manufacturing Co., Ltd., Swisslog Holding AG, SSI Schaefer, Vanderlande Industries B.V., and Toyota Industries Corporation.

Recent Notable Developments

In June 2023, Beumer acquired The Hendrik Group Inc.'s environmentally friendly bulk material handling. With the company's acquisition, the Beumer Group expanded its portfolio in bulk material transport. In particular, handling alternative fuels and raw materials (AFR) confirms BEUMER's commitment to sustainability.

Similarly, in March 2023, Murata Machinery launched the newest range of automated material handling solutions for small product storage and retrieval –the new Ledger A3 mini-load is a high-density, four-tote carriage automated storage and retrieval system (AS/RS).

Global Material Handling Cart Market is Segmented as Below:

By Functionality

- Hand Operated

- Battery Operated

By Cart Type

- Aluminium

- Plastic

- Stainless Steel

- Wire

- Miscellaneous

By Tyre Material

- Pneumatic Rubber

- Filled Rubber

- Solid

By Application

- Food & Beverage

- Chemical

- Pharmaceutical Industry

- Aviation

- Automotive

- E-commerce

- Miscellaneous

By Geographic Coverage

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Turkey

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Egypt

- Nigeria

- Rest of the Middle East & Africa

1. Executive Summary

1.1. Global Material Handling Cart Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Volume/Value, 2022

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. Covid-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Global Material Handling Cart Market Outlook, 2018 - 2030

3.1. Global Material Handling Cart Market Outlook, by Functionality, Value (US$ Bn), 2018 - 2030

3.1.1. Key Highlights

3.1.1.1. Hand Operated

3.1.1.2. Battery Operated

3.2. Global Material Handling Cart Market Outlook, by Cart Material, Value (US$ Bn), 2018 - 2030

3.2.1. Key Highlights

3.2.1.1. Aluminium

3.2.1.2. Plastic

3.2.1.3. Stainless Steel

3.2.1.4. Wire

3.2.1.5. Misc.

3.3. Global Material Handling Cart Market Outlook, by Tyre Material, Value (US$ Bn), 2018 - 2030

3.3.1. Key Highlights

3.3.1.1. Pneumatic Rubber

3.3.1.2. Filled Rubber

3.3.1.3. Solid

3.4. Global Material Handling Cart Market Outlook, by Application, Value (US$ Bn), 2018 - 2030

3.4.1. Key Highlights

3.4.1.1. Food & Beverage

3.4.1.2. Chemical

3.4.1.3. Pharmaceutical Industry

3.4.1.4. Aviation

3.4.1.5. Automotive

3.4.1.6. E-commerce

3.4.1.7. Misc.

3.5. Global Material Handling Cart Market Outlook, by Region, Value (US$ Bn), 2018 - 2030

3.5.1. Key Highlights

3.5.1.1. North America

3.5.1.2. Europe

3.5.1.3. Asia Pacific

3.5.1.4. Latin America

3.5.1.5. Middle East & Africa

4. North America Material Handling Cart Market Outlook, 2018 - 2030

4.1. North America Material Handling Cart Market Outlook, by Functionality, Value (US$ Bn), 2018 - 2030

4.1.1. Key Highlights

4.1.1.1. Hand Operated

4.1.1.2. Battery Operated

4.2. North America Material Handling Cart Market Outlook, by Cart Material, Value (US$ Bn), 2018 - 2030

4.2.1. Key Highlights

4.2.1.1. Aluminium

4.2.1.2. Plastic

4.2.1.3. Stainless Steel

4.2.1.4. Wire

4.2.1.5. Misc.

4.3. North America Material Handling Cart Market Outlook, by Tyre Material, Value (US$ Bn), 2018 - 2030

4.3.1. Key Highlights

4.3.1.1. Pneumatic Rubber

4.3.1.2. Filled Rubber

4.3.1.3. Solid

4.4. North America Material Handling Cart Market Outlook, by Application, Value (US$ Bn), 2018 - 2030

4.4.1. Key Highlights

4.4.1.1. Food & Beverage

4.4.1.2. Chemical

4.4.1.3. Pharmaceutical Industry

4.4.1.4. Aviation

4.4.1.5. Automotive

4.4.1.6. E-commerce

4.4.1.7. Misc.

4.4.2. Market Attractiveness Analysis

4.5. North America Material Handling Cart Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

4.5.1. Key Highlights

4.5.1.1. U.S. Material Handling Cart Market, by Functionality, Value (US$ Bn), 2018 - 2030

4.5.1.2. U.S. Material Handling Cart Market, by Cart Material, Value (US$ Bn), 2018 - 2030

4.5.1.3. U.S. Material Handling Cart Market, by Tyre Material, Value (US$ Bn), 2018 - 2030

4.5.1.4. U.S. Material Handling Cart Market, by Application, Value (US$ Bn), 2018 - 2030

4.5.1.5. Canada Material Handling Cart Market, by Functionality, Value (US$ Bn), 2018 - 2030

4.5.1.6. Canada Material Handling Cart Market, by Cart Material, Value (US$ Bn), 2018 - 2030

4.5.1.7. Canada Material Handling Cart Market, by Tyre Material, Value (US$ Bn), 2018 - 2030

4.5.1.8. Canada Material Handling Cart Market, by Application, Value (US$ Bn), 2018 - 2030

4.5.2. BPS Analysis/Market Attractiveness Analysis

5. Europe Material Handling Cart Market Outlook, 2018 - 2030

5.1. Europe Material Handling Cart Market Outlook, by Functionality, Value (US$ Bn), 2018 - 2030

5.1.1. Key Highlights

5.1.1.1. Hand Operated

5.1.1.2. Battery Operated

5.2. Europe Material Handling Cart Market Outlook, by Cart Material, Value (US$ Bn), 2018 - 2030

5.2.1. Key Highlights

5.2.1.1. Aluminium

5.2.1.2. Plastic

5.2.1.3. Stainless Steel

5.2.1.4. Wire

5.2.1.5. Misc.

5.3. Europe Material Handling Cart Market Outlook, by Tyre Material, Value (US$ Bn), 2018 - 2030

5.3.1. Key Highlights

5.3.1.1. Pneumatic Rubber

5.3.1.2. Filled Rubber

5.3.1.3. Solid

5.4. Europe Material Handling Cart Market Outlook, by Application, Value (US$ Bn), 2018 - 2030

5.4.1. Key Highlights

5.4.1.1. Food & Beverage

5.4.1.2. Chemical

5.4.1.3. Pharmaceutical Industry

5.4.1.4. Aviation

5.4.1.5. Automotive

5.4.1.6. E-commerce

5.4.1.7. Misc.

5.5. Europe Material Handling Cart Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

5.5.1. Key Highlights

5.5.1.1. Germany Material Handling Cart Market, by Functionality, Value (US$ Bn), 2018 - 2030

5.5.1.2. Germany Material Handling Cart Market, by Cart Material, Value (US$ Bn), 2018 - 2030

5.5.1.3. Germany Material Handling Cart Market, by Tyre Material, Value (US$ Bn), 2018 - 2030

5.5.1.4. Germany Material Handling Cart Market, by Application, Value (US$ Bn), 2018 - 2030

5.5.1.5. U.K. Material Handling Cart Market, by Functionality, Value (US$ Bn), 2018 - 2030

5.5.1.6. U.K. Material Handling Cart Market, by Cart Material, Value (US$ Bn), 2018 - 2030

5.5.1.7. U.K. Material Handling Cart Market, by Tyre Material, Value (US$ Bn), 2018 - 2030

5.5.1.8. U.K. Material Handling Cart Market, by Application, Value (US$ Bn), 2018 - 2030

5.5.1.9. France Material Handling Cart Market, by Functionality, Value (US$ Bn), 2018 - 2030

5.5.1.10. France Material Handling Cart Market, by Cart Material, Value (US$ Bn), 2018 - 2030

5.5.1.11. France Material Handling Cart Market, by Tyre Material, Value (US$ Bn), 2018 - 2030

5.5.1.12. France Material Handling Cart Market, by Application, Value (US$ Bn), 2018 - 2030

5.5.1.13. Italy Material Handling Cart Market, by Functionality, Value (US$ Bn), 2018 - 2030

5.5.1.14. Italy Material Handling Cart Market, by Cart Material, Value (US$ Bn), 2018 - 2030

5.5.1.15. Italy Material Handling Cart Market, by Tyre Material, Value (US$ Bn), 2018 - 2030

5.5.1.16. Italy Material Handling Cart Market, by Application, Value (US$ Bn), 2018 - 2030

5.5.1.17. Turkey Material Handling Cart Market, by Functionality, Value (US$ Bn), 2018 - 2030

5.5.1.18. Turkey Material Handling Cart Market, by Cart Material, Value (US$ Bn), 2018 - 2030

5.5.1.19. Turkey Material Handling Cart Market, by Tyre Material, Value (US$ Bn), 2018 - 2030

5.5.1.20. Turkey Material Handling Cart Market, by Application, Value (US$ Bn), 2018 - 2030

5.5.1.21. Russia Material Handling Cart Market, by Functionality, Value (US$ Bn), 2018 - 2030

5.5.1.22. Russia Material Handling Cart Market, by Cart Material, Value (US$ Bn), 2018 - 2030

5.5.1.23. Russia Material Handling Cart Market, by Tyre Material, Value (US$ Bn), 2018 - 2030

5.5.1.24. Russia Material Handling Cart Market, by Application, Value (US$ Bn), 2018 - 2030

5.5.1.25. Rest of Europe Material Handling Cart Market, by Functionality, Value (US$ Bn), 2018 - 2030

5.5.1.26. Rest of Europe Material Handling Cart Market, by Cart Material, Value (US$ Bn), 2018 - 2030

5.5.1.27. Rest of Europe Material Handling Cart Market, by Tyre Material, Value (US$ Bn), 2018 - 2030

5.5.1.28. Rest of Europe Material Handling Cart Market, by Application, Value (US$ Bn), 2018 - 2030

5.5.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Material Handling Cart Market Outlook, 2018 - 2030

6.1. Asia Pacific Material Handling Cart Market Outlook, by Functionality, Value (US$ Bn), 2018 - 2030

6.1.1. Key Highlights

6.1.1.1. Hand Operated

6.1.1.2. Battery Operated

6.2. Asia Pacific Material Handling Cart Market Outlook, by Cart Material, Value (US$ Bn), 2018 - 2030

6.2.1. Key Highlights

6.2.1.1. Aluminium

6.2.1.2. Plastic

6.2.1.3. Stainless Steel

6.2.1.4. Wire

6.2.1.5. Misc.

6.3. Asia Pacific Material Handling Cart Market Outlook, by Tyre Material, Value (US$ Bn), 2018 - 2030

6.3.1. Key Highlights

6.3.1.1. Pneumatic Rubber

6.3.1.2. Filled Rubber

6.3.1.3. Solid

6.4. Asia Pacific Material Handling Cart Market Outlook, by Application, Value (US$ Bn), 2018 - 2030

6.4.1. Key Highlights

6.4.1.1. Food & Beverage

6.4.1.2. Chemical

6.4.1.3. Pharmaceutical Industry

6.4.1.4. Aviation

6.4.1.5. Automotive

6.4.1.6. E-commerce

6.4.1.7. Misc.

6.4.2. Market Attractiveness Analysis

6.5. Asia Pacific Material Handling Cart Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

6.5.1. Key Highlights

6.5.1.1. China Material Handling Cart Market, by Functionality, Value (US$ Bn), 2018 - 2030

6.5.1.2. China Material Handling Cart Market, by Cart Material, Value (US$ Bn), 2018 - 2030

6.5.1.3. China Material Handling Cart Market, by Tyre Material, Value (US$ Bn), 2018 - 2030

6.5.1.4. China Material Handling Cart Market, by Application, Value (US$ Bn), 2018 - 2030

6.5.1.5. Japan Material Handling Cart Market, by Functionality, Value (US$ Bn), 2018 - 2030

6.5.1.6. Japan Material Handling Cart Market, by Cart Material, Value (US$ Bn), 2018 - 2030

6.5.1.7. Japan Material Handling Cart Market, by Tyre Material, Value (US$ Bn), 2018 - 2030

6.5.1.8. Japan Material Handling Cart Market, by Application, Value (US$ Bn), 2018 - 2030

6.5.1.9. South Korea Material Handling Cart Market, by Functionality, Value (US$ Bn), 2018 - 2030

6.5.1.10. South Korea Material Handling Cart Market, by Cart Material, Value (US$ Bn), 2018 - 2030

6.5.1.11. South Korea Material Handling Cart Market, by Tyre Material, Value (US$ Bn), 2018 - 2030

6.5.1.12. South Korea Material Handling Cart Market, by Application, Value (US$ Bn), 2018 - 2030

6.5.1.13. India Material Handling Cart Market, by Functionality, Value (US$ Bn), 2018 - 2030

6.5.1.14. India Material Handling Cart Market, by Cart Material, Value (US$ Bn), 2018 - 2030

6.5.1.15. India Material Handling Cart Market, by Tyre Material, Value (US$ Bn), 2018 - 2030

6.5.1.16. India Material Handling Cart Market, by Application, Value (US$ Bn), 2018 - 2030

6.5.1.17. Southeast Asia Material Handling Cart Market, by Functionality, Value (US$ Bn), 2018 - 2030

6.5.1.18. Southeast Asia Material Handling Cart Market, by Cart Material, Value (US$ Bn), 2018 - 2030

6.5.1.19. Southeast Asia Material Handling Cart Market, by Tyre Material, Value (US$ Bn), 2018 - 2030

6.5.1.20. Southeast Asia Material Handling Cart Market, by Application, Value (US$ Bn), 2018 - 2030

6.5.1.21. Rest of Asia Pacific Material Handling Cart Market, by Functionality, Value (US$ Bn), 2018 - 2030

6.5.1.22. Rest of Asia Pacific Material Handling Cart Market, by Cart Material, Value (US$ Bn), 2018 - 2030

6.5.1.23. Rest of Asia Pacific Material Handling Cart Market, by Tyre Material, Value (US$ Bn), 2018 - 2030

6.5.1.24. Rest of Asia Pacific Material Handling Cart Market, by Application, Value (US$ Bn), 2018 - 2030

6.5.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America Material Handling Cart Market Outlook, 2018 - 2030

7.1. Latin America Material Handling Cart Market Outlook, by Functionality, Value (US$ Bn), 2018 - 2030

7.1.1. Key Highlights

7.1.1.1. Hand Operated

7.1.1.2. Battery Operated

7.2. Latin America Material Handling Cart Market Outlook, by Cart Material, Value (US$ Bn), 2018 - 2030

7.2.1. Key Highlights

7.2.1.1. Aluminium

7.2.1.2. Plastic

7.2.1.3. Stainless Steel

7.2.1.4. Wire

7.2.1.5. Misc.

7.3. Latin America Material Handling Cart Market Outlook, by Tyre Material, Value (US$ Bn), 2018 - 2030

7.3.1. Key Highlights

7.3.1.1. Pneumatic Rubber

7.3.1.2. Filled Rubber

7.3.1.3. Solid

7.4. Latin America Material Handling Cart Market Outlook, by Application, Value (US$ Bn), 2018 - 2030

7.4.1. Key Highlights

7.4.1.1. Food & Beverage

7.4.1.2. Chemical

7.4.1.3. Pharmaceutical Industry

7.4.1.4. Aviation

7.4.1.5. Automotive

7.4.1.6. E-commerce

7.4.1.7. Misc.

7.4.2. Market Attractiveness Analysis

7.5. Latin America Material Handling Cart Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

7.5.1. Key Highlights

7.5.1.1. Brazil Material Handling Cart Market, by Functionality, Value (US$ Bn), 2018 - 2030

7.5.1.2. Brazil Material Handling Cart Market, by Cart Material, Value (US$ Bn), 2018 - 2030

7.5.1.3. Brazil Material Handling Cart Market, by Tyre Material, Value (US$ Bn), 2018 - 2030

7.5.1.4. Brazil Material Handling Cart Market, by Application, Value (US$ Bn), 2018 - 2030

7.5.1.5. Mexico Material Handling Cart Market, by Functionality, Value (US$ Bn), 2018 - 2030

7.5.1.6. Mexico Material Handling Cart Market, by Cart Material, Value (US$ Bn), 2018 - 2030

7.5.1.7. Mexico Material Handling Cart Market, by Tyre Material, Value (US$ Bn), 2018 - 2030

7.5.1.8. Mexico Material Handling Cart Market, by Application, Value (US$ Bn), 2018 - 2030

7.5.1.9. Argentina Material Handling Cart Market, by Functionality, Value (US$ Bn), 2018 - 2030

7.5.1.10. Argentina Material Handling Cart Market, by Cart Material, Value (US$ Bn), 2018 - 2030

7.5.1.11. Argentina Material Handling Cart Market, by Tyre Material, Value (US$ Bn), 2018 - 2030

7.5.1.12. Argentina Material Handling Cart Market, by Application, Value (US$ Bn), 2018 - 2030

7.5.1.13. Rest of Latin America Material Handling Cart Market, by Functionality, Value (US$ Bn), 2018 - 2030

7.5.1.14. Rest of Latin America Material Handling Cart Market, by Cart Material, Value (US$ Bn), 2018 - 2030

7.5.1.15. Rest of Latin America Material Handling Cart Market, by Tyre Material, Value (US$ Bn), 2018 - 2030

7.5.1.16. Rest of Latin America Material Handling Cart Market, by Application, Value (US$ Bn), 2018 - 2030

7.5.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Material Handling Cart Market Outlook, 2018 - 2030

8.1. Middle East & Africa Material Handling Cart Market Outlook, by Functionality, Value (US$ Bn), 2018 - 2030

8.1.1. Hand Operated

8.1.2. Battery Operated

8.2. Middle East & Africa Material Handling Cart Market Outlook, by Cart Material, Value (US$ Bn), 2018 - 2030

8.2.1. Key Highlights

8.2.2. Aluminium

8.2.3. Plastic

8.2.4. Stainless Steel

8.2.5. Wire

8.2.6. Misc.

8.3. Middle East & Africa Material Handling Cart Market Outlook, by Tyre Material, Value (US$ Bn), 2018 - 2030

8.3.1. Key Highlights

8.3.2. Pneumatic Rubber

8.3.3. Filled Rubber

8.3.4. Solid

8.4. Middle East & Africa Material Handling Cart Market Outlook, by Application, Value (US$ Bn), 2018 - 2030

8.4.1. Key Highlights

8.4.1.1. Food & Beverage

8.4.1.2. Chemical

8.4.1.3. Pharmaceutical Industry

8.4.1.4. Aviation

8.4.1.5. Automotive

8.4.1.6. E-commerce

8.4.1.7. Misc.

8.4.2. Market Attractiveness Analysis

8.5. Middle East & Africa Material Handling Cart Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

8.5.1. Key Highlights

8.5.1.1. GCC Material Handling Cart Market, by Functionality, Value (US$ Bn), 2018 - 2030

8.5.1.2. GCC Material Handling Cart Market, by Cart Material, Value (US$ Bn), 2018 - 2030

8.5.1.3. GCC Material Handling Cart Market, by Tyre Material, Value (US$ Bn), 2018 - 2030

8.5.1.4. GCC Material Handling Cart Market, by Application, Value (US$ Bn), 2018 - 2030

8.5.1.5. South Africa Material Handling Cart Market, by Functionality, Value (US$ Bn), 2018 - 2030

8.5.1.6. South Africa Material Handling Cart Market, by Cart Material, Value (US$ Bn), 2018 - 2030

8.5.1.7. South Africa Material Handling Cart Market, by Tyre Material, Value (US$ Bn), 2018 - 2030

8.5.1.8. South Africa Material Handling Cart Market, by Application, Value (US$ Bn), 2018 - 2030

8.5.1.9. Egypt Material Handling Cart Market, by Functionality, Value (US$ Bn), 2018 - 2030

8.5.1.10. Egypt Material Handling Cart Market, by Cart Material, Value (US$ Bn), 2018 - 2030

8.5.1.11. Egypt Material Handling Cart Market, by Tyre Material, Value (US$ Bn), 2018 - 2030

8.5.1.12. Egypt Material Handling Cart Market, by Application, Value (US$ Bn), 2018 - 2030

8.5.1.13. Nigeria Material Handling Cart Market, by Functionality, Value (US$ Bn), 2018 - 2030

8.5.1.14. Nigeria Material Handling Cart Market, by Cart Material, Value (US$ Bn), 2018 - 2030

8.5.1.15. Nigeria Material Handling Cart Market, by Tyre Material, Value (US$ Bn), 2018 - 2030

8.5.1.16. Nigeria Material Handling Cart Market, by Application, Value (US$ Bn), 2018 - 2030

8.5.1.17. Rest of Middle East & Africa Material Handling Cart Market, by Functionality, Value (US$ Bn), 2018 - 2030

8.5.1.18. Rest of Middle East & Africa Material Handling Cart Market, by Cart Material, Value (US$ Bn), 2018 - 2030

8.5.1.19. Rest of Middle East & Africa Material Handling Cart Market, by Tyre Material, Value (US$ Bn), 2018 - 2030

8.5.1.20. Rest of Middle East & Africa Material Handling Cart Market, by Application, Value (US$ Bn), 2018 - 2030

8.5.2. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. Manufacturer vs Functionality Heatmap

9.2. Company Market Share Analysis, 2022

9.3. Competitive Dashboard

9.4. Company Profiles

9.4.1. Beumer Group

9.4.1.1. Company Overview

9.4.1.2. Product Portfolio

9.4.1.3. Financial Overview

9.4.1.4. Business Strategies and Development

9.4.2. FlexQube

9.4.2.1. Company Overview

9.4.2.2. Product Portfolio

9.4.2.3. Financial Overview

9.4.2.4. Business Strategies and Development

9.4.3. Daifuku Co., Ltd.

9.4.3.1. Company Overview

9.4.3.2. Product Portfolio

9.4.3.3. Financial Overview

9.4.3.4. Business Strategies and Development

9.4.4. VMR International LLC

9.4.4.1. Company Overview

9.4.4.2. Product Portfolio

9.4.4.3. Financial Overview

9.4.4.4. Business Strategies and Development

9.4.5. Honeywell International, Inc.

9.4.5.1. Company Overview

9.4.5.2. Product Portfolio

9.4.5.3. Financial Overview

9.4.5.4. Business Strategies and Development

9.4.6. Global Lab Supply

9.4.6.1. Company Overview

9.4.6.2. Product Portfolio

9.4.6.3. Financial Overview

9.4.6.4. Business Strategies and Development

9.4.7. Kion Group AG

9.4.7.1. Company Overview

9.4.7.2. Product Portfolio

9.4.7.3. Financial Overview

9.4.7.4. Business Strategies and Development

9.4.8. Production Automation Corporation

9.4.8.1. Company Overview

9.4.8.2. Product Portfolio

9.4.8.3. Financial Overview

9.4.8.4. Business Strategies and Development

9.4.9. Mecalux S.A.

9.4.9.1. Company Overview

9.4.9.2. Product Portfolio

9.4.9.3. Financial Overview

9.4.9.4. Business Strategies and Development

9.4.10. Scaglia Indeva S.p.A.

9.4.10.1. Company Overview

9.4.10.2. Product Portfolio

9.4.10.3. Financial Overview

9.4.10.4. Business Strategies and Development

9.4.11. SSI Schaefer

9.4.11.1. Company Overview

9.4.11.2. Product Portfolio

9.4.11.3. Financial Overview

9.4.11.4. Business Strategies and Development

9.4.12. Murata Manufacturing Co., Ltd.

9.4.12.1. Company Overview

9.4.12.2. Product Portfolio

9.4.12.3. Financial Overview

9.4.12.4. Business Strategies and Development

9.4.13. Toyota Industries Corporation

9.4.13.1. Company Overview

9.4.13.2. Product Portfolio

9.4.13.3. Financial Overview

9.4.13.4. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2022 |

|

2018 - 2022 |

2023 - 2030 |

Value: US$ Million |

||

|

REPORT FEATURES |

DETAILS |

|

Functionality Coverage |

|

|

Cart Type Coverage |

|

|

Application Coverage |

|

|

Tyre Material Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |