Global Medical Tourism Market Forecast

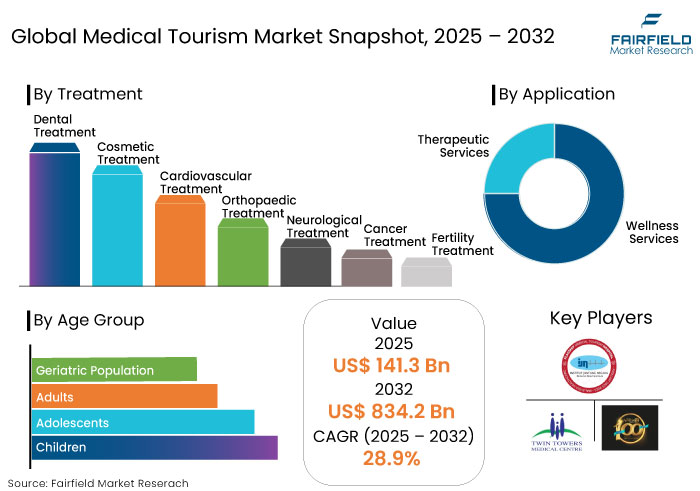

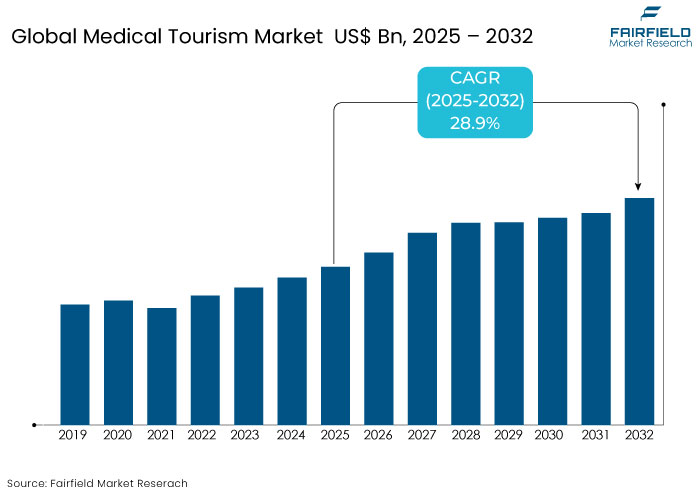

- The medical tourism market is projected to reach a size of US$ 834.2 Bn by 2032, showing significant growth from the US$ 141.3 Bn achieved in 2025.

- The market for medical tourism is expected to show a significant expansion rate, with an estimated CAGR of 28.9% from 2025 to 2032.

Medical Tourism Market Insights

- Increasing cost of healthcare in developed nations is a key reason for patients to seek affordable treatment options abroad.

- Countries like India, Thailand, and Mexico provide high-quality treatments at a fraction of the cost, attracting medical tourists.

- Procedures like cosmetic surgery, dental treatments, and fertility treatments are in high demand among medical tourists.

- Wellness tourism, including spa treatments, detox programs, and preventive health screenings, is becoming a significant segment of the medical tourism market.

- Growing global geriatric population is fueling the demand for medical tourism, particularly for surgeries, rehabilitation, and eldercare.

- Improved global transportation infrastructure and reduced airfare costs make international medical travel feasible for patients worldwide.

- Asia Pacific leads the medical tourism industry with a share of 26% in 2025.

- Despite disruptions caused by the pandemic, the medical tourism industry is recovering with improved safety measures and digital healthcare services.

A Look Back and a Look Forward - Comparative Analysis

The medical tourism market experienced significant growth during the historical period from 2019 to 2023. Growth in the period was prominently driven by increasing healthcare costs, rising demand for high-quality treatments, and the desire for affordable alternatives in developed nations.

The industry was characterized by steady expansion, with countries like India, Thailand, and Mexico emerging as prominent destinations for medical tourists. Primary drivers of growth included the rising cost of healthcare in developed countries, technological advancements in healthcare, and the globalization of healthcare services.

Patients increasingly sought affordable options for elective surgeries, dental treatments, and cosmetic procedures abroad. They took full advantage of the cost savings of up to 80% compared to their home countries.

Despite the COVID 19 pandemic, the market showed resilience as countries adapted to the post-pandemic landscape by enhancing their digital healthcare services. They industry started offering virtual consultations to ensure better health and safety protocols for medical tourists.

Over the forecast period, the medical tourism market is anticipated to witness accelerated growth. Advancements in telemedicine, growing focus on wellness and preventive care, and improvements in healthcare infrastructure in emerging markets is likely to drive the recovery and expansion of the market. Countries are also streamlining visa their processes, offering medical visas, and creating dedicated medical tourism hubs, further attracting international patients.

Key Growth Determinants

- Advances in Medical Technology and Expertise

Medical tourism is driven by the growing availability of state-of-the-art healthcare technologies and highly skilled medical professionals in emerging healthcare destinations. Several countries have made heavy investments in upgrading their medical infrastructure, ensuring they offer the latest treatments, equipment, and technologies.

Countries like India and Thailand have improved their healthcare sectors, often offering cutting-edge procedures in cardiology, orthopaedics, and fertility treatments. Healthcare professionals in these countries are trained in Western institutions or have international certifications, enhancing the quality of care while attracting foreign patients.

The availability of world-class medical treatments along with the expertise of specialized doctors have made medical tourism an increasingly viable option for patients looking for advanced care, and not just cost-effective alternatives.

- Over 80% of hospitals in India (like the Medanta Medicity) are accredited by JCI (Joint Commission International), thereby enhancing the country’s reputation as a global leader in medical tourism. Nearly 40% of hospitals in Thailand are JCI-accredited as well.

- Increased Accessibility and Global Travel

Increasing accessibility of international travel is the key driving factor. Advancements in transportation and affordable airfare options has made it easier for patients to travel to countries that offer high-quality medical care.

Medical tourism destinations are often well-connected with major international airports, making it easier for international patients to reach them. Several countries have introduced special medical visa programs, which streamline the process for patients traveling for treatment.

Medical tourists face fewer logistical barriers, encouraging them to seek care abroad. The convenience of online consultations, telemedicine services, and digital platforms that connect patients with healthcare providers in other countries have enhanced the accessibility of medical tourism. Such improvements in global travel infrastructure along with seamless administrative processes has significantly boosted the flow of medical tourists across the globe.

- Countries popular for medical tourism, like Thailand, India, and Mexico, are served by over 200 international airports, making them easily accessible for medical tourists worldwide. For example, India has over 30 international airports catering to a global patient base.

Key Growth Barriers

- Cultural and Language Barriers

Cultural and language differences present a restraint to the growth of the medical tourism market. Patients traveling abroad may encounter difficulties in communication with healthcare providers, leading to misunderstandings, dissatisfaction, or errors in treatment.

In some countries, medical professionals may not be fluent in English or other widely spoken languages. This may complicate the process of explaining diagnoses, treatment options, and aftercare instructions. Cultural differences in healthcare practices, patient expectations, and treatment approaches can create patient discomfort.

Patients may have different expectations regarding the patient-caregiver relationship, privacy, or the level of involvement they want in medical decisions. These barriers can make medical tourists hesitant to travel to countries where they are not familiar with the language or culture, limiting their options for treatment. Addressing these barriers requires improvements in language services, cultural sensitivity training, and clear communication between patients and healthcare providers.

Key Growth Opportunities

- Growth of Telemedicine and Virtual Consultations

Telemedicine and virtual consultations present a transformative opportunity for the medical tourism market, especially in a post-pandemic period. Several patients are now comfortable with online consultations, enabling them to consult with healthcare providers in medical tourism destinations before traveling.

Telemedicine also helps patients understand medical travel logistics, including treatment costs, recovery processes, and post-treatment care. By offering remote consultations, healthcare providers can expand their reach to international patients, build trust, and streamline the patient experience.

Virtual consultations facilitate smoother transitions to in-person treatments, enabling better pre- and post-treatment care coordination. The growth of telemedicine is particularly advantageous for patients in remote areas or those who face difficulties in traveling, making medical tourism more accessible than before.

- A survey showed that 55% of medical tourists now opt for online consultations before deciding to travel abroad for treatment. This enables them to better understand treatment plans, costs, and recovery procedures.

- Emerging Markets as Medical Tourism Hubs

Emerging markets in Latin America, Southeast Asia, and Eastern Europe present a significant opportunity for the medical tourism market. These regions are becoming major hubs for medical travellers due to their affordable yet high-quality healthcare services.

Countries like Mexico, Turkey, and Malaysia are attracting medical tourists by offering specialized treatments that may be unavailable or too expensive in developed nations. For example, dental care, fertility treatments, and cosmetic surgeries are highly popular in these destinations.

Governments in these regions also support medical tourism by offering medical visas, reducing bureaucratic hurdles, and promoting their healthcare services internationally. As a result, emerging markets are expected to grow as top medical tourism destinations, benefiting from the increasing shift toward global healthcare mobility.

How is Regulatory Scenario Shaping this Industry?

The regulatory scenario is significantly shaping the medical tourism market by influencing the attractiveness and accessibility of international healthcare destinations. Governments worldwide are focusing on creating favourable regulations to boost medical tourism.

Countries like Thailand, India, and Malaysia have developed comprehensive frameworks that ensure high-quality healthcare services, hospital accreditation, and medical professional training. This further helps in boosting the confidence of international patients.

Governments are addressing rising concerns by setting up regulatory bodies and partnerships with international accreditation organizations, such as the Joint Commission International (JCI), to ensure standards. Visa policies and ease of travel play a crucial role in expansion.

Several countries have introduced medical or healthcare-specific visa categories, facilitating smoother travel for medical tourists. A harmonized and robust regulatory environment fosters growth, but governments must continually adapt to ensure patient safety, legal protection, and the quality of care to sustain growth.

Segment Covered in the Report

- Patients Prefer Cosmetic Treatments owing to their Brief Recuperation Periods

Cosmetic treatments are anticipated to hold a share of 25% in 2025 owing to the combination of cost-effectiveness, proficiency, and availability that is provided by numerous medical tourism locales. Patients from developed nations pursue these treatments overseas to take advantage of economical procedures, cutting-edge technologies, and globally recognized healthcare institutions.

The extensive variety of cosmetic procedures, such as rhinoplasty, liposuction, facelifts, breast augmentation, and hair restoration, is a principal element contributing to the popularity of these treatments. Thailand, South Korea, Turkey, and Mexico have emerged as global centers for cosmetic treatments, providing advanced facilities and proficient surgeons.

South Korea is notably recognized for its proficiency in facial aesthetics and reconstructive operations and is commonly termed the "plastic surgery capital of the world." Brief recuperation periods and the capacity to integrate medical travel with recreational tourism augment its appeal. Many patients select "medical tourism packages," encompassing surgery, post-operative treatment, and vacation alternatives, facilitating a cohesive experience.

- Adults Prioritize Healthcare Measures, thereby Fostering Growth

Adults are anticipated to hold a share of 45% in 2025. Individuals in the age range of 40 to 60 years often prioritize preventive healthcare measures, including regular check-ups, screenings, and early interventions to maintain health and detect potential issues early.

Individuals in this demographic seek specialized treatments for chronic conditions such as diabetes, hypertension, and cardiovascular diseases. Medical tourism offers access to advanced therapies and procedures that may not be readily available or are more expensive in their home countries.

Rising healthcare costs in developed nations prompt individuals to seek affordable medical options abroad. Countries like Thailand, India, and Mexico offer high-quality medical services at a fraction of the cost, making them attractive destinations for medical tourists.

The combination of health needs, management of chronic conditions, interest in cosmetic enhancements, and the pursuit of cost-effective healthcare solutions contributes to the dominance of the adult age group.

Regional Analysis

- Availability of Affordable yet Advanced Healthcare Infrastructure of Asia Pacific to Foster Growth

Asia Pacific is anticipated to hold a share of 26% in 2025. This growth is attributed to the region’s combination of specialized expertise, advanced healthcare infrastructure, and affordability.

Patients worldwide travel to countries like India, Thailand, Malaysia, and South Korea to obtain high-quality medical services at substantially lower costs. India has emerged as a preferred location for intricate procedures, including orthopaedic care, oncology treatments, and cardiac interventions.

Compared to developed nations, India provides world-class healthcare services at a significantly lower cost. The country’s appeal is further bolstered by the extensive network of English-speaking medical personnel and hospitals accredited by international organizations like JCI (Joint Commission International).

Numerous medical travellers incorporate wellness retreats in their treatment regimens, taking advantage of India's extensive Ayurveda and yoga traditions. Supportive government policies, availability of medical visas, and the integration of traditional wellness programs with modern healthcare further bolster Asia Pacific's success in medical tourism. These factors collectively position the region as the leading region for medical tourists worldwide.

- North America Plays a Dual Role as a Source and Destination

North America serves a distinctive dual function in the medical tourism sector, functioning as both a source location for outgoing medical tourists and an emerging destination for inbound medical tourism. The region's dynamics are influenced by increasing healthcare expenses in the U.S. The availability of cost-effective treatments in adjacent nations along with the existence of sophisticated medical facilities serving international patients further bolster expansion.

The cost of healthcare in the U.S. often drives residents to seek affordable treatments abroad. The country, however, attracts international patients due to its highly specialized medical centres, particularly oncology, neurology, and orthopaedics.

North America's medical tourism market benefits from its close integration with Latin America and the Caribbean, where patients seek cost-effective treatments in nearby destinations. The region's world-class medical facilities and advanced research capabilities ensure that it remains a critical player in the global medical tourism ecosystem.

Fairfield’s Competitive Landscape Analysis

The medical tourism market is highly competitive, with key players focusing on offering cost-effective treatments, advanced medical technologies, and seamless patient experiences. Prominent players include Apollo Hospitals (India), Bumrungrad International Hospital (Thailand), and Seoul National University Hospital (South Korea). These institutions prioritize international accreditation, multilingual staff, and tailored medical packages.

Turkey, India, and Thailand dominate the market, offering affordability and expertise in cosmetic, cardiac, and orthopedic procedures. Mexico and Malaysia attract patients with proximity and diverse treatment options.

Providers are adopting digital tools for telemedicine consultations and post-treatment care to remain competitive. Strategic partnerships with travel agencies and insurance companies further enhance their global outreach. The industry is poised for significant growth owing to technological advancements and supportive government policies.

Key Market Companies

- Twin Towers Medical Center

- Penang Adventist Hospital

- Institute Jantung Negara National Heart Institute

- Max Superspeciality Hospital

- Fortis Healthcare

- Apollo Hospital

- Morula IVF

- Mother & Child Hospital

- Bundamedik Healthcare System

- Bali Mandara Hospital

- Bali Royal Hospital

- BIMC Siloam Nusa

- Love the Mother of Kedonganan Hospital

- Love Tabanan Hospital Mo

- Singapore General Hospital

- Changi General Hospital

- Johns Hopkins Singapore International Medical Centre

- Tan Tock Seng Hospital

Recent Industry Developments

- In January 2024, Sunway Healthcare Group signed a collaboration agreement with PT JCB International Indonesia and its parent company, JCB International Co., Ltd., to enhance medical tourism in Malaysia by presenting Sunway Healthcare Group's services to over 156 million JCB cardholders globally.

- In June 2024, Thailand and Bhutan established memoranda of understanding (MOUs) regarding medical and tourism collaboration. An initial MOU was made between the Medical Services Department and the Khesar Gyalpo University of Medical Sciences of Bhutan to facilitate academic and research collaboration and the exchange of medical personnel.

An Expert’s Eye

- Experts predict significant growth in the medical tourism market, driven by rising healthcare costs and increasing demand for affordable yet high-quality treatments abroad.

- Countries like India, Mexico, and Thailand are expected to maintain their dominance as medical tourism hubs due to their cost-effectiveness, skilled healthcare professionals, and international accreditations.

- Governments are increasingly improving regulations, offering medical visas, and partnering with accreditation bodies to enhance safety and quality, boosting patient confidence.

- Virtual consultations and telemedicine are transforming the market, enabling patients to make informed decisions remotely and ensuring better coordination for international care.

Global Medical Tourism Market is Segmented as-

By Treatment

- Dental Treatment

- Cosmetic Treatment

- Cardiovascular Treatment

- Orthopaedic Treatment

- Neurological Treatment

- Cancer Treatment

- Fertility Treatment

By Age Group

- Children

- Adolescents

- Adults

- Geriatric Population

By Application

- Wellness Services

- Therapeutic Services

By Travelers

- Independent Travelers

- Group Travelers

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

1. Executive Summary

1.1. Global Medical Tourism Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2025

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. COVID-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Global Medical Tourism Market Outlook, 2019 - 2032

3.1. Global Medical Tourism Market Outlook, by Treatment, Value (US$ Bn), 2019 - 2032

3.1.1. Key Highlights

3.1.1.1. Dental Treatment

3.1.1.2. Cosmetic Treatment

3.1.1.3. Cardiovascular Treatment

3.1.1.4. Orthopaedic Treatment

3.1.1.5. Neurological Treatment

3.1.1.6. Cancer Treatment

3.1.1.7. Fertility Treatment

3.1.1.8. Others

3.2. Global Medical Tourism Market Outlook, by Age group, Value (US$ Bn), 2019 - 2032

3.2.1. Key Highlights

3.2.1.1. Medical Tourism for Children

3.2.1.2. Medical Tourism for Adolescents

3.2.1.3. Medical Tourism for Adults

3.2.1.4. Medical Tourism for Geriatric Population

3.3. Global Medical Tourism Market Outlook, by Application, Value (US$ Bn), 2019 - 2032

3.3.1. Key Highlights

3.3.1.1. Wellness Services

3.3.1.2. Therapeutic Services

3.4. Global Medical Tourism Market Outlook, by Travelers, Value (US$ Bn), 2019 - 2032

3.4.1. Key Highlights

3.4.1.1. Independent Travelers

3.4.1.2. Group Travelers

3.5. Global Medical Tourism Market Outlook, by Region, Value (US$ Bn), 2019 - 2032

3.5.1. Key Highlights

3.5.1.1. North America

3.5.1.2. Europe

3.5.1.3. Asia Pacific

3.5.1.4. Latin America

3.5.1.5. Middle East & Africa

4. North America Medical Tourism Market Outlook, 2019 - 2032

4.1. North America Medical Tourism Market Outlook, by Treatment, Value (US$ Bn), 2019 - 2032

4.1.1. Key Highlights

4.1.1.1. Dental Treatment

4.1.1.2. Cosmetic Treatment

4.1.1.3. Cardiovascular Treatment

4.1.1.4. Orthopaedic Treatment

4.1.1.5. Neurological Treatment

4.1.1.6. Cancer Treatment

4.1.1.7. Fertility Treatment

4.1.1.8. Others

4.2. North America Medical Tourism Market Outlook, by Age group, Value (US$ Bn), 2019 - 2032

4.2.1. Key Highlights

4.2.1.1. Medical Tourism for Children

4.2.1.2. Medical Tourism for Adolescents

4.2.1.3. Medical Tourism for Adults

4.2.1.4. Medical Tourism for Geriatric Population

4.3. North America Medical Tourism Market Outlook, by Application, Value (US$ Bn), 2019 - 2032

4.3.1. Key Highlights

4.3.1.1. Wellness Services

4.3.1.2. Therapeutic Services

4.4. North America Medical Tourism Market Outlook, by Travelers, Value (US$ Bn), 2019 - 2032

4.4.1. Key Highlights

4.4.1.1. Independent Travelers

4.4.1.2. Group Travelers

4.4.2. BPS Analysis/Market Attractiveness Analysis

4.5. North America Medical Tourism Market Outlook, by Country, Value (US$ Bn), 2019 - 2032

4.5.1. Key Highlights

4.5.1.1. U.S. Medical Tourism Market by Treatment, Value (US$ Bn), 2019 - 2032

4.5.1.2. U.S. Medical Tourism Market by Age group, Value (US$ Bn), 2019 - 2032

4.5.1.3. U.S. Medical Tourism Market by Application, Value (US$ Bn), 2019 - 2032

4.5.1.4. U.S. Medical Tourism Market by Travelers, Value (US$ Bn), 2019 - 2032

4.5.1.5. Canada Medical Tourism Market by Treatment, Value (US$ Bn), 2019 - 2032

4.5.1.6. Canada Medical Tourism Market by Age group, Value (US$ Bn), 2019 - 2032

4.5.1.7. Canada Medical Tourism Market by Application, Value (US$ Bn), 2019 - 2032

4.5.1.8. Canada Medical Tourism Market by Travelers, Value (US$ Bn), 2019 - 2032

4.5.2. BPS Analysis/Market Attractiveness Analysis

5. Europe Medical Tourism Market Outlook, 2019 - 2032

5.1. Europe Medical Tourism Market Outlook, by Treatment, Value (US$ Bn), 2019 - 2032

5.1.1. Key Highlights

5.1.1.1. Dental Treatment

5.1.1.2. Cosmetic Treatment

5.1.1.3. Cardiovascular Treatment

5.1.1.4. Orthopaedic Treatment

5.1.1.5. Neurological Treatment

5.1.1.6. Cancer Treatment

5.1.1.7. Fertility Treatment

5.1.1.8. Others

5.2. Europe Medical Tourism Market Outlook, by Age group, Value (US$ Bn), 2019 - 2032

5.2.1. Key Highlights

5.2.1.1. Medical Tourism for Children

5.2.1.2. Medical Tourism for Adolescents

5.2.1.3. Medical Tourism for Adults

5.2.1.4. Medical Tourism for Geriatric Population

5.3. Europe Medical Tourism Market Outlook, by Application, Value (US$ Bn), 2019 - 2032

5.3.1. Key Highlights

5.3.1.1. Wellness Services

5.3.1.2. Therapeutic Services

5.4. Europe Medical Tourism Market Outlook, by Travelers, Value (US$ Bn), 2019 - 2032

5.4.1. Key Highlights

5.4.1.1. Independent Travelers

5.4.1.2. Group Travelers

5.4.2. BPS Analysis/Market Attractiveness Analysis

5.5. Europe Medical Tourism Market Outlook, by Country, Value (US$ Bn), 2019 - 2032

5.5.1. Key Highlights

5.5.1.1. Germany Medical Tourism Market by Treatment, Value (US$ Bn), 2019 - 2032

5.5.1.2. Germany Medical Tourism Market by Age group, Value (US$ Bn), 2019 - 2032

5.5.1.3. Germany Medical Tourism Market by Application, Value (US$ Bn), 2019 - 2032

5.5.1.4. Germany Medical Tourism Market by Travelers, Value (US$ Bn), 2019 - 2032

5.5.1.5. U.K. Medical Tourism Market by Treatment, Value (US$ Bn), 2019 - 2032

5.5.1.6. U.K. Medical Tourism Market by Age group, Value (US$ Bn), 2019 - 2032

5.5.1.7. U.K. Medical Tourism Market by Application, Value (US$ Bn), 2019 - 2032

5.5.1.8. U.K. Medical Tourism Market by Travelers, Value (US$ Bn), 2019 - 2032

5.5.1.9. France Medical Tourism Market by Treatment, Value (US$ Bn), 2019 - 2032

5.5.1.10. France Medical Tourism Market by Age group, Value (US$ Bn), 2019 - 2032

5.5.1.11. France Medical Tourism Market by Application, Value (US$ Bn), 2019 - 2032

5.5.1.12. France Medical Tourism Market by Travelers, Value (US$ Bn), 2019 - 2032

5.5.1.13. Italy Medical Tourism Market by Treatment, Value (US$ Bn), 2019 - 2032

5.5.1.14. Italy Medical Tourism Market by Age group, Value (US$ Bn), 2019 - 2032

5.5.1.15. Italy Medical Tourism Market by Application, Value (US$ Bn), 2019 - 2032

5.5.1.16. Italy Medical Tourism Market by Travelers, Value (US$ Bn), 2019 - 2032

5.5.1.17. Turkey Medical Tourism Market by Treatment, Value (US$ Bn), 2019 - 2032

5.5.1.18. Turkey Medical Tourism Market by Age group, Value (US$ Bn), 2019 - 2032

5.5.1.19. Turkey Medical Tourism Market by Application, Value (US$ Bn), 2019 - 2032

5.5.1.20. Turkey Medical Tourism Market by Travelers, Value (US$ Bn), 2019 - 2032

5.5.1.21. Russia Medical Tourism Market by Treatment, Value (US$ Bn), 2019 - 2032

5.5.1.22. Russia Medical Tourism Market by Age group, Value (US$ Bn), 2019 - 2032

5.5.1.23. Russia Medical Tourism Market by Application, Value (US$ Bn), 2019 - 2032

5.5.1.24. Russia Medical Tourism Market by Travelers, Value (US$ Bn), 2019 - 2032

5.5.1.25. Rest of Europe Medical Tourism Market by Treatment, Value (US$ Bn), 2019 - 2032

5.5.1.26. Rest of Europe Medical Tourism Market by Age group, Value (US$ Bn), 2019 - 2032

5.5.1.27. Rest of Europe Medical Tourism Market by Application, Value (US$ Bn), 2019 - 2032

5.5.1.28. Rest of Europe Medical Tourism Market by Travelers, Value (US$ Bn), 2019 - 2032

5.5.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Medical Tourism Market Outlook, 2019 - 2032

6.1. Asia Pacific Medical Tourism Market Outlook, by Treatment, Value (US$ Bn), 2019 - 2032

6.1.1. Key Highlights

6.1.1.1. Dental Treatment

6.1.1.2. Cosmetic Treatment

6.1.1.3. Cardiovascular Treatment

6.1.1.4. Orthopaedic Treatment

6.1.1.5. Neurological Treatment

6.1.1.6. Cancer Treatment

6.1.1.7. Fertility Treatment

6.1.1.8. Others

6.2. Asia Pacific Medical Tourism Market Outlook, by Age group, Value (US$ Bn), 2019 - 2032

6.2.1. Key Highlights

6.2.2. Key Highlights

6.2.2.1. Medical Tourism for Children

6.2.2.2. Medical Tourism for Adolescents

6.2.2.3. Medical Tourism for Adults

6.2.2.4. Medical Tourism for Geriatric Population

6.3. Asia Pacific Medical Tourism Market Outlook, by Application, Value (US$ Bn), 2019 - 2032

6.3.1. Key Highlights

6.3.1.1. Wellness Services

6.3.1.2. Therapeutic Services

6.4. Asia Pacific Medical Tourism Market Outlook, by Travelers, Value (US$ Bn), 2019 - 2032

6.4.1. Key Highlights

6.4.1.1. Independent Travelers

6.4.1.2. Group Travelers

6.4.2. BPS Analysis/Market Attractiveness Analysis

6.5. Asia Pacific Medical Tourism Market Outlook, by Country, Value (US$ Bn), 2019 - 2032

6.5.1. Key Highlights

6.5.1.1. China Medical Tourism Market by Treatment, Value (US$ Bn), 2019 - 2032

6.5.1.2. China Medical Tourism Market by Age group, Value (US$ Bn), 2019 - 2032

6.5.1.3. China Medical Tourism Market by Application, Value (US$ Bn), 2019 - 2032

6.5.1.4. China Medical Tourism Market by Travelers, Value (US$ Bn), 2019 - 2032

6.5.1.5. Japan Medical Tourism Market by Treatment, Value (US$ Bn), 2019 - 2032

6.5.1.6. Japan Medical Tourism Market by Age group, Value (US$ Bn), 2019 - 2032

6.5.1.7. Japan Medical Tourism Market by Application, Value (US$ Bn), 2019 - 2032

6.5.1.8. Japan Medical Tourism Market by Travelers, Value (US$ Bn), 2019 - 2032

6.5.1.9. South Korea Medical Tourism Market by Treatment, Value (US$ Bn), 2019 - 2032

6.5.1.10. South Korea Medical Tourism Market by Age group, Value (US$ Bn), 2019 - 2032

6.5.1.11. South Korea Medical Tourism Market by Application, Value (US$ Bn), 2019 - 2032

6.5.1.12. South Korea Medical Tourism Market by Travelers, Value (US$ Bn), 2019 - 2032

6.5.1.13. India Medical Tourism Market by Treatment, Value (US$ Bn), 2019 - 2032

6.5.1.14. India Medical Tourism Market by Age group, Value (US$ Bn), 2019 - 2032

6.5.1.15. India Medical Tourism Market by Application, Value (US$ Bn), 2019 - 2032

6.5.1.16. India Medical Tourism Market by Travelers, Value (US$ Bn), 2019 - 2032

6.5.1.17. Southeast Asia Medical Tourism Market by Treatment, Value (US$ Bn), 2019 - 2032

6.5.1.18. Southeast Asia Medical Tourism Market by Age group, Value (US$ Bn), 2019 - 2032

6.5.1.19. Southeast Asia Medical Tourism Market by Application, Value (US$ Bn), 2019 - 2032

6.5.1.20. Southeast Asia Medical Tourism Market by Travelers, Value (US$ Bn), 2019 - 2032

6.5.1.21. Rest of Asia Pacific Medical Tourism Market by Treatment, Value (US$ Bn), 2019 - 2032

6.5.1.22. Rest of Asia Pacific Medical Tourism Market by Age group, Value (US$ Bn), 2019 - 2032

6.5.1.23. Rest of Asia Pacific Medical Tourism Market by Application, Value (US$ Bn), 2019 - 2032

6.5.1.24. Rest of Asia Pacific Medical Tourism Market by Travelers, Value (US$ Bn), 2019 - 2032

6.5.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America Medical Tourism Market Outlook, 2019 - 2032

7.1. Latin America Medical Tourism Market Outlook, by Treatment, Value (US$ Bn), 2019 - 2032

7.1.1. Key Highlights

7.1.2. Key Highlights

7.1.2.1. Dental Treatment

7.1.2.2. Cosmetic Treatment

7.1.2.3. Cardiovascular Treatment

7.1.2.4. Orthopaedic Treatment

7.1.2.5. Neurological Treatment

7.1.2.6. Cancer Treatment

7.1.2.7. Fertility Treatment

7.1.2.8. Others

7.2. Latin America Medical Tourism Market Outlook, by Age group, Value (US$ Bn), 2019 - 2032

7.2.1. Key Highlights

7.2.1.1. Medical Tourism for Children

7.2.1.2. Medical Tourism for Adolescents

7.2.1.3. Medical Tourism for Adults

7.2.1.4. Medical Tourism for Geriatric Population

7.3. Latin America Medical Tourism Market Outlook, by Application, Value (US$ Bn), 2019 - 2032

7.3.1. Key Highlights

7.3.1.1. Wellness Services

7.3.1.2. Therapeutic Services

7.4. Latin America Medical Tourism Market Outlook, by Travelers, Value (US$ Bn), 2019 - 2032

7.4.1. Key Highlights

7.4.1.1. Independent Travelers

7.4.1.2. Group Travelers

7.4.2. BPS Analysis/Market Attractiveness Analysis

7.5. Latin America Medical Tourism Market Outlook, by Country, Value (US$ Bn), 2019 - 2032

7.5.1. Key Highlights

7.5.1.1. Brazil Medical Tourism Market by Treatment, Value (US$ Bn), 2019 - 2032

7.5.1.2. Brazil Medical Tourism Market by Age group, Value (US$ Bn), 2019 - 2032

7.5.1.3. Brazil Medical Tourism Market by Application, Value (US$ Bn), 2019 - 2032

7.5.1.4. Brazil Medical Tourism Market by Travelers, Value (US$ Bn), 2019 - 2032

7.5.1.5. Mexico Medical Tourism Market by Treatment, Value (US$ Bn), 2019 - 2032

7.5.1.6. Mexico Medical Tourism Market by Age group, Value (US$ Bn), 2019 - 2032

7.5.1.7. Mexico Medical Tourism Market by Application, Value (US$ Bn), 2019 - 2032

7.5.1.8. Mexico Medical Tourism Market by Travelers, Value (US$ Bn), 2019 - 2032

7.5.1.9. Argentina Medical Tourism Market by Treatment, Value (US$ Bn), 2019 - 2032

7.5.1.10. Argentina Medical Tourism Market by Age group, Value (US$ Bn), 2019 - 2032

7.5.1.11. Argentina Medical Tourism Market by Application, Value (US$ Bn), 2019 - 2032

7.5.1.12. Argentina Medical Tourism Market by Travelers, Value (US$ Bn), 2019 - 2032

7.5.1.13. Rest of Latin America Medical Tourism Market by Treatment, Value (US$ Bn), 2019 - 2032

7.5.1.14. Rest of Latin America Medical Tourism Market by Age group, Value (US$ Bn), 2019 - 2032

7.5.1.15. Rest of Latin America Medical Tourism Market by Application, Value (US$ Bn), 2019 - 2032

7.5.1.16. Rest of Latin America Medical Tourism Market by Travelers, Value (US$ Bn), 2019 - 2032

7.5.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Medical Tourism Market Outlook, 2019 - 2032

8.1. Middle East & Africa Medical Tourism Market Outlook, by Treatment, Value (US$ Bn), 2019 - 2032

8.1.1. Key Highlights

8.1.2. Key Highlights

8.1.2.1. Dental Treatment

8.1.2.2. Cosmetic Treatment

8.1.2.3. Cardiovascular Treatment

8.1.2.4. Orthopaedic Treatment

8.1.2.5. Neurological Treatment

8.1.2.6. Cancer Treatment

8.1.2.7. Fertility Treatment

8.1.2.8. Others

8.2. Middle East & Africa Medical Tourism Market Outlook, by Age group, Value (US$ Bn), 2019 - 2032

8.2.1. Key Highlights

8.2.1.1. Medical Tourism for Children

8.2.1.2. Medical Tourism for Adolescents

8.2.1.3. Medical Tourism for Adults

8.2.1.4. Medical Tourism for Geriatric Population

8.3. Middle East & Africa Medical Tourism Market Outlook, by Application, Value (US$ Bn), 2019 - 2032

8.3.1. Key Highlights

8.3.1.1. Wellness Services

8.3.1.2. Therapeutic Services

8.4. Middle East & Africa Medical Tourism Market Outlook, by Travelers, Value (US$ Bn), 2019 - 2032

8.4.1. Key Highlights

8.4.1.1. Independent Travelers

8.4.1.2. Group Travelers

8.4.2. BPS Analysis/Market Attractiveness Analysis

8.5. Middle East & Africa Medical Tourism Market Outlook, by Country, Value (US$ Bn), 2019 - 2032

8.5.1. Key Highlights

8.5.1.1. GCC Medical Tourism Market by Treatment, Value (US$ Bn), 2019 - 2032

8.5.1.2. GCC Medical Tourism Market by Age group, Value (US$ Bn), 2019 - 2032

8.5.1.3. GCC Medical Tourism Market by Application, Value (US$ Bn), 2019 - 2032

8.5.1.4. GCC Medical Tourism Market by Travelers, Value (US$ Bn), 2019 - 2032

8.5.1.5. South Africa Medical Tourism Market by Treatment, Value (US$ Bn), 2019 - 2032

8.5.1.6. South Africa Medical Tourism Market by Age group, Value (US$ Bn), 2019 - 2032

8.5.1.7. South Africa Medical Tourism Market by Application, Value (US$ Bn), 2019 - 2032

8.5.1.8. South Africa Medical Tourism Market by Travelers, Value (US$ Bn), 2019 - 2032

8.5.1.9. Egypt Medical Tourism Market by Treatment, Value (US$ Bn), 2019 - 2032

8.5.1.10. Egypt Medical Tourism Market by Age group, Value (US$ Bn), 2019 - 2032

8.5.1.11. Egypt Medical Tourism Market by Application, Value (US$ Bn), 2019 - 2032

8.5.1.12. Egypt Medical Tourism Market by Travelers, Value (US$ Bn), 2019 - 2032

8.5.1.13. Nigeria Medical Tourism Market by Treatment, Value (US$ Bn), 2019 - 2032

8.5.1.14. Nigeria Medical Tourism Market by Age group, Value (US$ Bn), 2019 - 2032

8.5.1.15. Nigeria Medical Tourism Market by Application, Value (US$ Bn), 2019 - 2032

8.5.1.16. Nigeria Medical Tourism Market by Travelers, Value (US$ Bn), 2019 - 2032

8.5.1.17. Rest of Middle East & Africa Medical Tourism Market by Treatment, Value (US$ Bn), 2019 - 2032

8.5.1.18. Rest of Middle East & Africa Medical Tourism Market by Age group, Value (US$ Bn), 2019 - 2032

8.5.1.19. Rest of Middle East & Africa Medical Tourism Market by Application, Value (US$ Bn), 2019 - 2032

8.5.1.20. Rest of Middle East & Africa Medical Tourism Market by Travelers, Value (US$ Bn), 2019 - 2032

8.5.2. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. Manufacturer vs by Age group Heatmap

9.2. Company Market Share Analysis, 2025

9.3. Competitive Dashboard

9.4. Company Profiles

9.4.1. Twin Towers Medical Center

9.4.1.1. Company Overview

9.4.1.2. Product Portfolio

9.4.1.3. Financial Overview

9.4.1.4. Business Strategies and Development

9.4.2. Penang Adventist Hospital

9.4.2.1. Company Overview

9.4.2.2. Product Portfolio

9.4.2.3. Financial Overview

9.4.2.4. Business Strategies and Development

9.4.3. Institute Jantung Negara National Heart Institute

9.4.3.1. Company Overview

9.4.3.2. Product Portfolio

9.4.3.3. Financial Overview

9.4.3.4. Business Strategies and Development

9.4.4. Max Superspeciality Hospital

9.4.4.1. Company Overview

9.4.4.2. Product Portfolio

9.4.4.3. Financial Overview

9.4.4.4. Business Strategies and Development

9.4.5. Fortis Healthcare

9.4.5.1. Company Overview

9.4.5.2. Product Portfolio

9.4.5.3. Financial Overview

9.4.5.4. Business Strategies and Development

9.4.6. Apollo Hospital

9.4.6.1. Company Overview

9.4.6.2. Product Portfolio

9.4.6.3. Financial Overview

9.4.6.4. Business Strategies and Development

9.4.7. Morula IVF

9.4.7.1. Company Overview

9.4.7.2. Product Portfolio

9.4.7.3. Financial Overview

9.4.7.4. Business Strategies and Development

9.4.8. Mother & Child Hospital

9.4.8.1. Company Overview

9.4.8.2. Product Portfolio

9.4.8.3. Financial Overview

9.4.8.4. Business Strategies and Development

9.4.9. Bundamedik Healthcare System

9.4.9.1. Company Overview

9.4.9.2. Product Portfolio

9.4.9.3. Financial Overview

9.4.9.4. Business Strategies and Development

9.4.10. Bali Mandara Hospital

9.4.10.1. Company Overview

9.4.10.2. Product Portfolio

9.4.10.3. Financial Overview

9.4.10.4. Business Strategies and Development

9.4.11. Bali Royal Hospital

9.4.11.1. Company Overview

9.4.11.2. Product Portfolio

9.4.11.3. Financial Overview

9.4.11.4. Business Strategies and Development

9.4.12. BIMC Siloam Nusa

9.4.12.1. Company Overview

9.4.12.2. Product Portfolio

9.4.12.3. Financial Overview

9.4.12.4. Business Strategies and Development

9.4.13. Love the Mother of Kedonganan Hospital

9.4.13.1. Company Overview

9.4.13.2. Product Portfolio

9.4.13.3. Financial Overview

9.4.13.4. Business Strategies and Development

9.4.14. Love Tabanan Hospital Mo

9.4.14.1. Company Overview

9.4.14.2. Product Portfolio

9.4.14.3. Financial Overview

9.4.14.4. Business Strategies and Development

9.4.15. Singapore General Hospital

9.4.15.1. Company Overview

9.4.15.2. Product Portfolio

9.4.15.3. Financial Overview

9.4.15.4. Business Strategies and Development

9.4.16. Changi General Hospital

9.4.16.1. Company Overview

9.4.16.2. Product Portfolio

9.4.16.3. Financial Overview

9.4.16.4. Business Strategies and Development

9.4.17. Johns Hopkins Singapore International Medical Centre

9.4.17.1. Company Overview

9.4.17.2. Product Portfolio

9.4.17.3. Financial Overview

9.4.17.4. Business Strategies and Development

9.4.18. Tan Tock Seng Hospital

9.4.18.1. Company Overview

9.4.18.2. Product Portfolio

9.4.18.3. Financial Overview

9.4.18.4. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2023 |

|

2019 - 2023 |

2025 - 2032 |

Value: US$ Billion |

||

|

REPORT FEATURES |

DETAILS |

|

Treatment Coverage |

|

|

Age Group Coverage |

|

|

Application Coverage |

|

|

Travelers Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |