Global Membrane Filtration Market Forecast

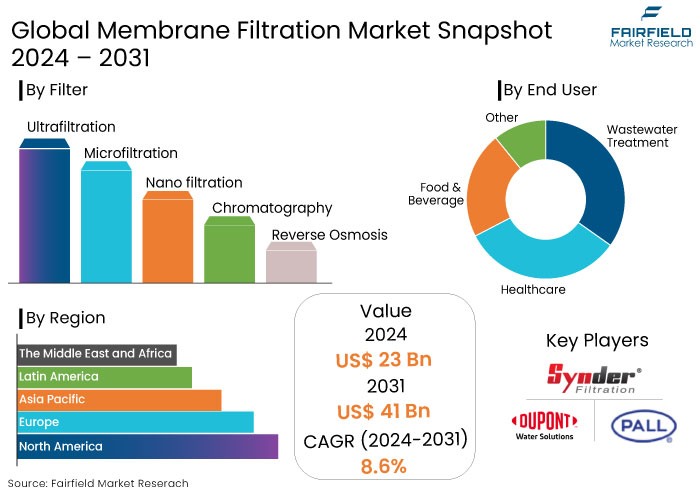

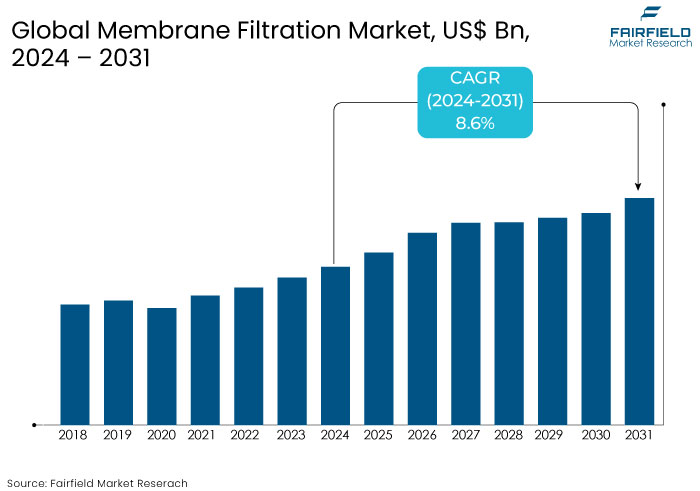

- The membrane filtration market is estimated to reach a size of US$41 Bn by 2031, showing significant growth from the US$23 Bn obtained in 2024.

- The market for membrane filtration is expected to show a significant expansion rate, with an estimated CAGR of 8.6% from 2024 to 2031.

Membrane Filtration Market Insights

- New developments in membrane materials and filtration technologies are improving efficiency, reducing fouling, and lowering operational costs.

- Membrane filtration technologies, especially reverse osmosis, are gaining popularity for minimizing energy use and waste while improving water recovery.

- The focus of food industry on improving product quality and extending shelf life is driving the use of membrane filtration technologies like ultrafiltration.

- Increased demand for dairy products, particularly in regions like Asia Pacific, is boosting the use of membrane filtration for product standardization and waste reduction.

- Increasing industrialization in emerging economies, particularly in Asia Pacific and Latin America, creates new opportunities.

- Reverse osmosis filter type is estimated to accumulate a notable market share with its high efficiency.

A Look Back and a Look Forward - Comparative Analysis

The membrane filtration market experienced steady growth, driven by increasing demand for advanced filtration solutions in water and wastewater treatment, food and beverage, and pharmaceutical industries. Stringent regulations regarding water quality and safety and rising concerns over water scarcity boosted the adoption of membrane technologies such as reverse osmosis, ultrafiltration, and nanofiltration.

Technological advancements improved membrane durability and efficiency, further supporting market growth. However, high initial costs and maintenance challenges limited adoption in price-sensitive markets.

The market is projected to grow significantly over the forecast period, fueled by advancements in membrane materials, including nanotechnology and bio-based membranes, enhancing efficiency and sustainability. Also, the adoption of membrane filtration in emerging markets is expected to accelerate due to urbanization, industrialization, and government initiatives to improve water infrastructure.

The increasing focus on product purity and safety is likely to drive demand in the food and beverage sector. The expansion of the pharmaceutical industry and the rise in biopharmaceutical production is likely create new opportunities.

Sustainable and energy-efficient solutions to gain prominence as environmental concerns become a central focus for industries. The market is anticipated to grow substantially underpinned by innovations and expanding applications globally.

Key Growth Determinants

- Rising Demand for Clean Water and Wastewater Treatment Boosts Sales

The increasing demand for clean and safe water is one of the primary drivers for the membrane filtration market. Rapid urbanization, industrialization, and population growth have heightened the need for advanced filtration technologies to address water scarcity and contamination issues.

Membrane filtration systems, such as reverse osmosis and ultrafiltration, provide effective solutions by removing contaminants, microorganisms, and dissolved solids. Government regulations emphasizing wastewater treatment and water reuse have further bolstered the adoption of these systems across municipal and industrial sectors.

Regions facing acute water stress, such as the Middle East and parts of Asia Pacific are mainly, investing in desalination plants and wastewater recycling technologies, creating significant opportunities for the membrane filtration industry.

- Advancements in Membrane Technology Accelerates Market Growth

Technological innovations in membrane materials and designs significantly drive the membrane filtration market. The development of nanostructured membranes, ceramic membranes, and bio-based membranes has enhanced filtration efficiency, durability, and resistance to fouling. Such advancements address limitations such as high operational costs and frequent maintenance associated with traditional membranes.

The integration of automation and monitoring systems in filtration processes has improved operational efficiency and reduced downtime. Industries like pharmaceuticals, which require ultra-pure water and sterile environments, benefit from these advancements, boosting demand for cutting-edge membrane systems.

The growing focus on sustainable and energy-efficient technologies is likely to further accelerate the adoption of advanced membrane solutions across diverse sectors.

Key Growth Barriers

- Membrane Fouling and Operational Challenges Remain a Key Barrier

Membrane fouling, caused by the accumulation of contaminants like biofilms, particles, or chemical deposits on the membrane surface, remains a critical issue. Fouling reduces filtration efficiency, increases energy consumption, and necessitates frequent cleaning or replacement, leading to operational disruptions.

Handling complex feedwater compositions, such as high salinity or chemical-laden wastewater, can compromise membrane performance. These operational challenges limit the effectiveness of membrane systems in certain applications and create reluctance among end-users to adopt them. While technological advancements are addressing these issues, the ongoing maintenance requirements and associated downtime remain significant restraints to membrane filtration market growth.

- High Initial Costs and Maintenance Expenses

The significant capital investment required for membrane filtration systems poses a challenge for widespread adoption, particularly in small- and medium-sized enterprises. Advanced systems like reverse osmosis or nanofiltration involve substantial upfront costs for procurement and installation.

Operational expenses such as energy consumption and regular maintenance to prevent fouling and scaling add to the financial burden. In developing regions, where industrialization and water treatment demand are increasing, these costs can deter businesses from adopting membrane filtration technologies. The need for periodic membrane replacement further escalates the lifecycle costs, limiting market penetration in cost-sensitive industries and regions.

Membrane Filtration Market Trends and Opportunities

- Shift Toward Sustainable and Energy-Efficient Membrane Filtration Systems

Sustainability and energy efficiency are emerging as critical trends in the membrane filtration market. Industries and governments are increasingly prioritizing eco-friendly technologies to reduce carbon footprints and comply with stringent environmental regulations.

Traditional filtration systems are often energy-intensive, increasing operational costs and environmental impact. In response, manufacturers are developing innovative membrane materials and energy-efficient filtration processes. Similarly, advancements in nanostructured membranes have enhanced fouling resistance, reducing the frequency of cleaning cycles and associated energy usage.

The trend is particularly evident in sectors like water treatment, where desalination plants and wastewater recycling facilities aim to reduce energy consumption while ensuring high-quality outputs. Moreover, adopting renewable energy sources, such as solar power, to operate membrane systems is gaining traction, further enhancing their sustainability. The shift aligns with global sustainability goals, making energy-efficient membrane filtration a focal point for future developments.

- Growth of Decentralized and Mobile Water Treatment Systems

Adopting decentralized water treatment systems, especially in remote and underserved areas, represents a prominent growth opportunity in the membrane filtration market. Mobile and compact membrane filtration units offer scalable solutions for providing clean water to communities and industrial sites with limited infrastructure. It is particularly critical in regions facing water scarcity or contamination crises.

Innovations such as modular membrane systems and energy-efficient operations make these solutions viable for addressing immediate water needs. Non-governmental organizations and disaster relief agencies increasingly incorporate mobile filtration units into their efforts, further driving demand. Expanding into this niche market could enable companies to address humanitarian needs while achieving growth.

How Does Regulatory Scenario Shape the Industry?

The regulatory environment is critical in adopting membrane filtration technologies, particularly in water treatment, food and beverage, and pharmaceutical sectors. Stringent guidelines established by organizations like the Environmental Protection Agency (EPA) and the World Health Organization (WHO) mandate advanced water purification and wastewater treatment processes. These address environmental concerns and public health risks.

Regulatory bodies such as the Food and Drug Administration (FDA) and the European Food Safety Authority (EFSA) emphasize product safety, hygiene, and purity in the food and beverage industry. These standards necessitate high-performance filtration systems to ensure compliance, especially in dairy, brewing, and bottled water production.

Pharmaceutical companies must adhere to stringent quality and purity standards set by regulatory authorities like the US Pharmacopeia (USP). Membrane filtration systems are essential for processes like sterilization and contamination prevention.

The market shifts toward sustainable, energy-efficient, and compliance-friendly membrane technologies as governments globally increase environmental and safety regulations.

Segments Covered in the Report

- Reverse Osmosis Filter Type Takes the Lead with its High Efficiency

Reverse osmosis is an effective technique for water purification, capable of eliminating approximately 99% of various mineral impurities. In the food and beverage sector, reverse osmosis is a widely utilized water filtering method that uses pressure to propel water through a semi-permeable membrane. This filter type is estimated to lead the membrane filtration market.

Conventional reverse osmosis systems are constructed with many stages, wherein each step filters fifty percent of the wastewater produced by the preceding stage. In the beverage business, water is generally obtained from municipal sources, which may contain hardness or heavy metal contaminants, frequently arising from transportation pipes.

The elements in the water can influence the flavour of both the water and the beverages made from it. Reverse osmosis is extensively employed in beverage production facilities to address this.

- Wastewater Treatment Segment Takes the Lead

The wastewater treatment segment to grow substantially in the membrane filtration market, driven by increasing global concerns over water scarcity, pollution, and stringent environmental regulations. Industries and municipalities are asdopting advanced filtration technologies such as reverse osmosis, ultrafiltration, and nanofiltration to meet compliance standards for water discharge and reuse.

Membrane filtration systems effectively remove contaminants, including suspended solids, microorganisms, and dissolved impurities, making them indispensable for wastewater treatment processes.

Government initiatives, such as the Clean Water Act in the United States and similar frameworks in the European Union and Asia Pacific, mandate strict wastewater management protocols. These regulations have led to significant investments in upgrading existing treatment facilities and implementing membrane-based systems.

Regional Analysis

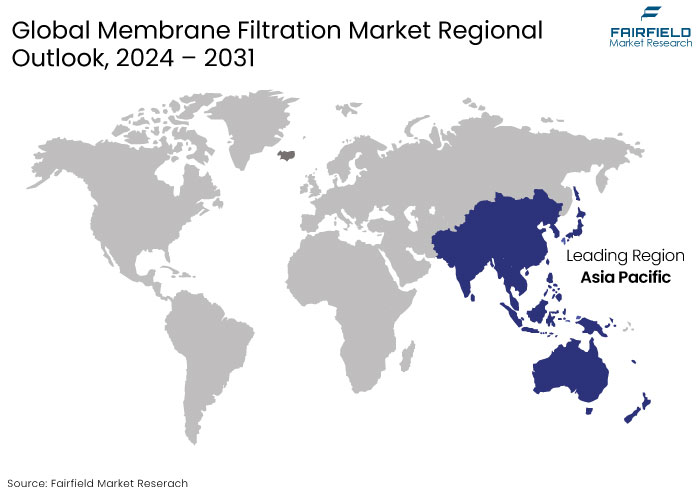

- Primacy of Asia Pacific Membrane Filtration Market Prevails

Asia Pacific is the dominant region in the global membrane filtration market, which is presently witnessing a substantial rise in demand for membrane filtering technology. This substantial demand is especially in the dairy, food and beverage, and wine and beer sectors.

The increase in demand for membrane filtration systems is due to several factors, including population growth, urbanization, increased consumer knowledge of food safety, and a rising preference for high-quality products.

In the dairy industry, membrane filtration techniques, including ultrafiltration and microfiltration, improve product quality, prolong shelf life, standardize compositions, and minimize waste. Membrane filtration is essential in the food and beverage sector for liquid clarification, taste and nutrient concentration, product quality preservation, and adherence to stringent safety standards.

In the region's growing wine and beer sector, membrane filtering is essential for clarity, stability, flavour preservation, quality assurance, and production efficiency. As these industries expand and adapt, membrane filtering technology is set to assume a progressively vital role in addressing the escalating demands of customers and regulatory standards.

- North America Membrane Filtration Market Retains the Top Position

North America is growing notably in the global membrane filtration market, driven by robust industrial infrastructure, stringent regulatory frameworks, and a strong focus on sustainability and innovation. The region’s adoption of advanced filtration technologies spans across water treatment, food and beverage, and healthcare sectors.

Stringent environmental policies, such as the Clean Water Act and other directives from the U.S. Environmental Protection Agency (EPA) and Environment Canada, mandate effective water management and pollution control. It drives the adoption of advanced membrane systems like reverse osmosis and nanofiltration for municipal and industrial applications.

Wastewater recycling and desalination projects, especially in water-scarce areas like California and parts of Canada, are significant growth drivers.

Fairfield’s Competitive Landscape Analysis

The membrane filtration market is highly competitive, with key players focused on innovation, technological advancements, and strategic partnerships. Key companies in the market invest significantly in research and development to enhance membrane performance, energy efficiency, and fouling resistance.

Collaborations with municipalities, industries, and water treatment facilities are common strategies to expand market reach. Regional players are emerging in developing economies to offer cost-effective solutions, intensifying competition.

The market is also influenced by the growing demand for sustainable and eco-friendly membrane technologies, prompting companies to develop products that comply with regulatory standards while optimizing operational costs.

Key Market Companies

- LG Chem

- Pall Corporation

- Koch Membrane Systems Inc.

- Merck KGaA

- SUEZ (Degremont)

- DuPont Water Solutions (DuPont De Numours)

- GEA Group Aktiengesellschaft

- Evoqua Water Technologies

- The 3M Company

- Veolia Waters Technologies

- Hydranautics (Nitto Denko Corporation)

- Synder Filtration, Inc.

- Pentair plc.

- DIC Corporation

- Sartorius AG

- Asahi Kasei Corporation

- Pervatech B.V.

Recent Industry Developments

- In January 2024, DuPont launched advanced reverse osmosis (RO) membranes designed to reduce energy consumption while maintaining high levels of water purification.

- In November 2023, GEA unveiled a new line of membrane filtration systems optimized for the dairy industry, designed to improve dairy products' quality and shelf life by utilizing ultrafiltration technology.

- In March 2024, 3M expanded its membrane filtration product portfolio by integrating high-performance materials into its water purification systems, enhancing both water quality and operational efficiency.

An Expert’s Eye

- Experts agree that membrane filtration technologies are crucial for addressing global water scarcity and pollution issues.

- As urbanization and industrialization rise, advanced water treatment systems are essential for ensuring safe and clean water.

- Innovations in membrane materials and designs are helping reduce energy consumption and operational costs.

- Stringent regulations in food & beverage, healthcare, and wastewater treatment industries are pushing companies to adopt efficient and eco-friendly filtration technologies.

Global Membrane Filtration Market is Segmented as-

By Filter Type

- Ultrafiltration

- Microfiltration

- Nano filtration

- Chromatography

- Reverse Osmosis

By End User

- Wastewater Treatment

- Healthcare

- Food & Beverage

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- The Middle East and Africa

1. Executive Summary

1.1. Global Membrane Filtration Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value and Volume, 2024

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. COVID-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Price Analysis, 2019 - 2023

3.1. Global Average Price Analysis, by Filter Type/ End User, US$ Per Unit, 2019 - 2023

3.2. Prominent Factor Affecting Membrane Filters Prices

3.3. Global Average Price Analysis, by Region, US$ Per Unit

4. Global Membrane Filtration Market Outlook, 2019 - 2031

4.1. Global Membrane Filtration Market Outlook, by Filter Type, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

4.1.1. Key Highlights

4.1.1.1. Ultrafiltration

4.1.1.2. Microfiltration

4.1.1.3. Nanofiltration

4.1.1.4. Chromatography

4.1.1.5. Reverse Osmosis

4.2. Global Membrane Filtration Market Outlook, by End User, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

4.2.1. Key Highlights

4.2.1.1. Wastewater Treatment

4.2.1.2. Healthcare

4.2.1.3. Food & Beverage

4.2.1.4. Others

4.3. Global Membrane Filtration Market Outlook, by Region, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

4.3.1. Key Highlights

4.3.1.1. North America

4.3.1.2. Europe

4.3.1.3. Asia Pacific

4.3.1.4. Latin America

4.3.1.5. Middle East & Africa

5. North America Membrane Filtration Market Outlook, 2019 - 2031

5.1. North America Membrane Filtration Market Outlook, by Filter Type, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

5.1.1. Key Highlights

5.1.1.1. Ultrafiltration

5.1.1.2. Microfiltration

5.1.1.3. Nanofiltration

5.1.1.4. Chromatography

5.1.1.5. Reverse Osmosis

5.2. North America Membrane Filtration Market Outlook, by End User, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

5.2.1. Key Highlights

5.2.1.1. Wastewater Treatment

5.2.1.2. Healthcare

5.2.1.3. Food & Beverage

5.2.1.4. Others

5.3. North America Membrane Filtration Market Outlook, by Country, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

5.3.1. Key Highlights

5.3.1.1. U.S. Membrane Filtration Market by Filter Type, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

5.3.1.2. U.S. Membrane Filtration Market by End User, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

5.3.1.3. Canada Membrane Filtration Market by Filter Type, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

5.3.1.4. Canada Membrane Filtration Market by End User, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

5.3.2. BPS Analysis/Market Attractiveness Analysis

6. Europe Membrane Filtration Market Outlook, 2019 - 2031

6.1. Europe Membrane Filtration Market Outlook, by Filter Type, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

6.1.1. Key Highlights

6.1.1.1. Ultrafiltration

6.1.1.2. Microfiltration

6.1.1.3. Nanofiltration

6.1.1.4. Chromatography

6.1.1.5. Reverse Osmosis

6.2. Europe Membrane Filtration Market Outlook, by End User, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

6.2.1. Key Highlights

6.2.1.1. Wastewater Treatment

6.2.1.2. Healthcare

6.2.1.3. Food & Beverage

6.2.1.4. Others

6.3. Europe Membrane Filtration Market Outlook, by Country, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

6.3.1. Key Highlights

6.3.1.1. Germany Membrane Filtration Market by Filter Type, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

6.3.1.2. Germany Membrane Filtration Market by End User, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

6.3.1.3. U.K. Membrane Filtration Market by Filter Type, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

6.3.1.4. U.K. Membrane Filtration Market by End User, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

6.3.1.5. France Membrane Filtration Market by Filter Type, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

6.3.1.6. France Membrane Filtration Market by End User, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

6.3.1.7. Italy Membrane Filtration Market by Filter Type, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

6.3.1.8. Italy Membrane Filtration Market by End User, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

6.3.1.9. Turkey Membrane Filtration Market by Filter Type, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

6.3.1.10. Turkey Membrane Filtration Market by End User, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

6.3.1.11. Russia Membrane Filtration Market by Filter Type, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

6.3.1.12. Russia Membrane Filtration Market by End User, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

6.3.1.13. Rest of Europe Membrane Filtration Market by Filter Type, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

6.3.1.14. Rest of Europe Membrane Filtration Market by End User, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

6.3.2. BPS Analysis/Market Attractiveness Analysis

7. Asia Pacific Membrane Filtration Market Outlook, 2019 - 2031

7.1. Asia Pacific Membrane Filtration Market Outlook, by Filter Type, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

7.1.1. Key Highlights

7.1.1.1. Ultrafiltration

7.1.1.2. Microfiltration

7.1.1.3. Nanofiltration

7.1.1.4. Chromatography

7.1.1.5. Reverse Osmosis

7.2. Asia Pacific Membrane Filtration Market Outlook, by End User, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

7.2.1. Key Highlights

7.2.1.1. Wastewater Treatment

7.2.1.2. Healthcare

7.2.1.3. Food & Beverage

7.2.1.4. Others

7.3. Asia Pacific Membrane Filtration Market Outlook, by Country, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

7.3.1. Key Highlights

7.3.1.1. China Membrane Filtration Market by Filter Type, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

7.3.1.2. China Membrane Filtration Market by End User, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

7.3.1.3. Japan Membrane Filtration Market by Filter Type, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

7.3.1.4. Japan Membrane Filtration Market by End User, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

7.3.1.5. South Korea Membrane Filtration Market by Filter Type, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

7.3.1.6. South Korea Membrane Filtration Market by End User, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

7.3.1.7. South Korea Membrane Filtration Market by End User, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

7.3.1.8. India Membrane Filtration Market by Filter Type, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

7.3.1.9. India Membrane Filtration Market by End User, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

7.3.1.10. Southeast Asia Membrane Filtration Market by Filter Type, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

7.3.1.11. Southeast Asia Membrane Filtration Market by End User, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

7.3.1.12. Rest of Asia Pacific Membrane Filtration Market by Filter Type, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

7.3.1.13. Rest of Asia Pacific Membrane Filtration Market by End User, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

7.3.2. BPS Analysis/Market Attractiveness Analysis

8. Latin America Membrane Filtration Market Outlook, 2019 - 2031

8.1. Latin America Membrane Filtration Market Outlook, by Filter Type, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

8.1.1. Key Highlights

8.1.1.1. Ultrafiltration

8.1.1.2. Microfiltration

8.1.1.3. Nanofiltration

8.1.1.4. Chromatography

8.1.1.5. Reverse Osmosis

8.2. Latin America Membrane Filtration Market Outlook, by End User, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

8.2.1. Key Highlights

8.2.1.1. Wastewater Treatment

8.2.1.2. Healthcare

8.2.1.3. Food & Beverage

8.2.1.4. Others

8.3. Latin America Membrane Filtration Market Outlook, by Country, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

8.3.1. Key Highlights

8.3.1.1. Brazil Membrane Filtration Market by Filter Type, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

8.3.1.2. Brazil Membrane Filtration Market by End User, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

8.3.1.3. Mexico Membrane Filtration Market by Filter Type, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

8.3.1.4. Mexico Membrane Filtration Market by End User, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

8.3.1.5. Argentina Membrane Filtration Market by Filter Type, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

8.3.1.6. Argentina Membrane Filtration Market by End User, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

8.3.1.7. Rest of Latin America Membrane Filtration Market by Filter Type, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

8.3.1.8. Rest of Latin America Membrane Filtration Market by End User, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

8.3.2. BPS Analysis/Market Attractiveness Analysis

9. Middle East & Africa Membrane Filtration Market Outlook, 2019 - 2031

9.1. Middle East & Africa Membrane Filtration Market Outlook, by Filter Type, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

9.1.1. Key Highlights

9.1.1.1. Ultrafiltration

9.1.1.2. Microfiltration

9.1.1.3. Nanofiltration

9.1.1.4. Chromatography

9.1.1.5. Reverse Osmosis

9.2. Middle East & Africa Membrane Filtration Market Outlook, by End User, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

9.2.1. Key Highlights

9.2.1.1. Wastewater Treatment

9.2.1.2. Healthcare

9.2.1.3. Food & Beverage

9.2.1.4. Others

9.3. Middle East & Africa Membrane Filtration Market Outlook, by Country, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

9.3.1. Key Highlights

9.3.1.1. GCC Membrane Filtration Market by Filter Type, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

9.3.1.2. GCC Membrane Filtration Market by End User, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

9.3.1.3. South Africa Membrane Filtration Market by Filter Type, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

9.3.1.4. South Africa Membrane Filtration Market by End User, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

9.3.1.5. Egypt Membrane Filtration Market by Filter Type, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

9.3.1.6. Egypt Membrane Filtration Market by End User, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

9.3.1.7. Nigeria Membrane Filtration Market by Filter Type, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

9.3.1.8. Nigeria Membrane Filtration Market by End User, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

9.3.1.9. Rest of Middle East & Africa Membrane Filtration Market by Filter Type, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

9.3.1.10. Rest of Middle East & Africa Membrane Filtration Market by End User, Value (US$ Bn) and Volume (Million Units), 2019 - 2031

9.3.2. BPS Analysis/Market Attractiveness Analysis

10. Competitive Landscape

10.1. Filter Type vs End User Heatmap

10.2. Company Market Share Analysis, 2024

10.3. Competitive Dashboard

10.4. Company Profiles

10.4.1. LG Chem

10.4.1.1. Company Overview

10.4.1.2. Product Portfolio

10.4.1.3. Financial Overview

10.4.1.4. Business Strategies and Development

10.4.2. Pall Corporation

10.4.2.1. Company Overview

10.4.2.2. Product Portfolio

10.4.2.3. Financial Overview

10.4.2.4. Business Strategies and Development

10.4.3. Koch Membrane Systems Inc.

10.4.3.1. Company Overview

10.4.3.2. Product Portfolio

10.4.3.3. Financial Overview

10.4.3.4. Business Strategies and Development

10.4.4. Merck KGaA

10.4.4.1. Company Overview

10.4.4.2. Product Portfolio

10.4.4.3. Financial Overview

10.4.4.4. Business Strategies and Development

10.4.5. SUEZ (Degremont)

10.4.5.1. Company Overview

10.4.5.2. Product Portfolio

10.4.5.3. Financial Overview

10.4.5.4. Business Strategies and Development

10.4.6. DuPont Water Solutions (DuPont De Numours)

10.4.6.1. Company Overview

10.4.6.2. Product Portfolio

10.4.6.3. Financial Overview

10.4.6.4. Business Strategies and Development

10.4.7. GEA Group Aktiengesellschaft

10.4.7.1. Company Overview

10.4.7.2. Product Portfolio

10.4.7.3. Financial Overview

10.4.7.4. Business Strategies and Development

10.4.8. Evoqua Water Technologies

10.4.8.1. Company Overview

10.4.8.2. Product Portfolio

10.4.8.3. Financial Overview

10.4.8.4. Business Strategies and Development

10.4.9. The 3M Company

10.4.9.1. Company Overview

10.4.9.2. Product Portfolio

10.4.9.3. Financial Overview

10.4.9.4. Business Strategies and Development

10.4.10. Veolia Waters Technologies

10.4.10.1. Company Overview

10.4.10.2. Product Portfolio

10.4.10.3. Financial Overview

10.4.10.4. Business Strategies and Development

10.4.11. Hydranautics (Nitto Denko Corporation)

10.4.11.1. Company Overview

10.4.11.2. Product Portfolio

10.4.11.3. Financial Overview

10.4.11.4. Business Strategies and Development

10.4.12. Synder Filtration, Inc.

10.4.12.1. Company Overview

10.4.12.2. Product Portfolio

10.4.12.3. Financial Overview

10.4.12.4. Business Strategies and Development

10.4.13. Pentair plc.

10.4.13.1. Company Overview

10.4.13.2. Product Portfolio

10.4.13.3. Financial Overview

10.4.13.4. Business Strategies and Development

10.4.14. DIC Corporation

10.4.14.1. Company Overview

10.4.14.2. Product Portfolio

10.4.14.3. Financial Overview

10.4.14.4. Business Strategies and Development

10.4.15. Sartorius AG

10.4.15.1. Company Overview

10.4.15.2. Product Portfolio

10.4.15.3. Financial Overview

10.4.15.4. Business Strategies and Development

11. Appendix

11.1. Research Methodology

11.2. Report Assumptions

11.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2023 |

|

2019 - 2023 |

2024 - 2031 |

Value: US$ Billion |

||

|

REPORT FEATURES |

DETAILS |

|

Filter Type Coverage |

|

|

End User Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |