Global Memory Chip Market Forecast

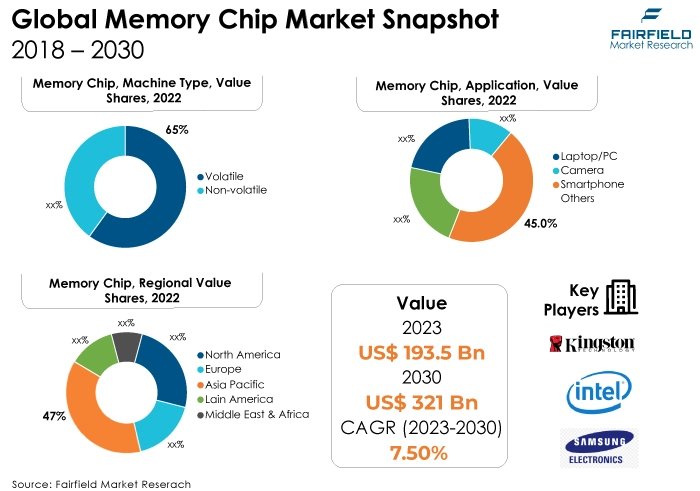

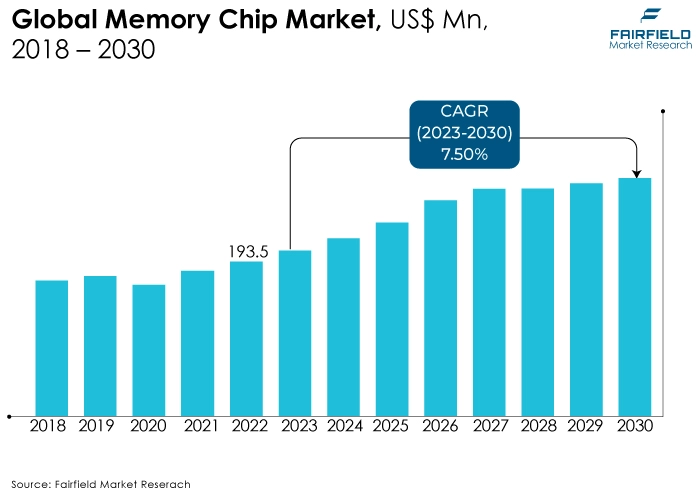

- Memory chip market size projected to jump from US$193.5 Bn in 2023 to US$321 Bn in 2030

- Global market for memory expects a CAGR of 7.5% between 2023 and 2030

Quick Report Digest

- One of the main reasons propelling the market is the increasing use of memory-based components in high-tech products like wearables, smartphones, and electrical devices.

- The market for memory chips is expected to grow quickly in the next years as a result of the increasing use of consumer electronics like laptops and tablets.

- A glut of chips piling up in warehouses, a fall in client orders, and a sharp dip in product pricing are all major obstacles facing the memory chip industry.

- Additionally, semiconductor devices like dynamic random-access memory (DRAM), and flash read-only memory (ROM) are used more often in automotive and electronics systems. This is driving the market's expansion and the electronics industry automation.

- In 2023, the DRAM category dominated the industry. DRAM offers quick, volatile storage that is essential for several uses. Scaling down to and beyond the 10 nm process presents issues for DRAM makers as technology develops and demands increased performance and memory density rise.

- In terms of market share for memory chips globally, the smartphone segment is anticipated to dominate. The market for cutting-edge memory chips is driven by the increasing popularity of smartphones and their ever-expanding features, which include gaming capabilities, AI-powered assistants, and high-resolution cameras.

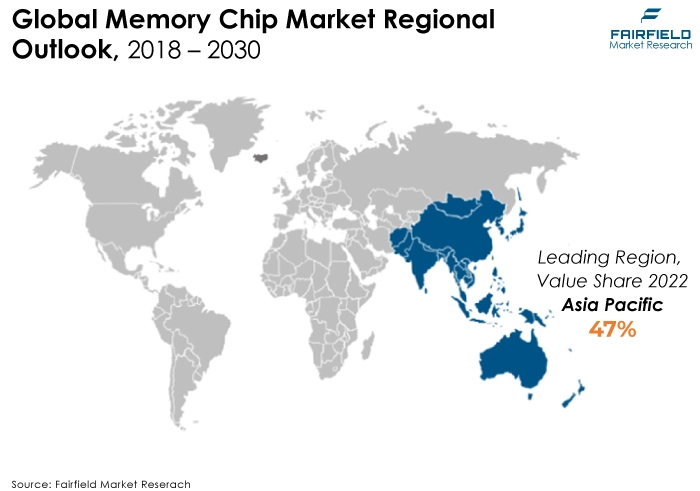

- The Asia-Pacific region is anticipated to account for the largest share of the global memory chip market, owing to its well-known centres for electronics production, including Taiwan, South Korea, and China. The nations are leading manufacturers of computers, smartphones, and other electronic gadgets, concurrently creating a great demand for memory chips.

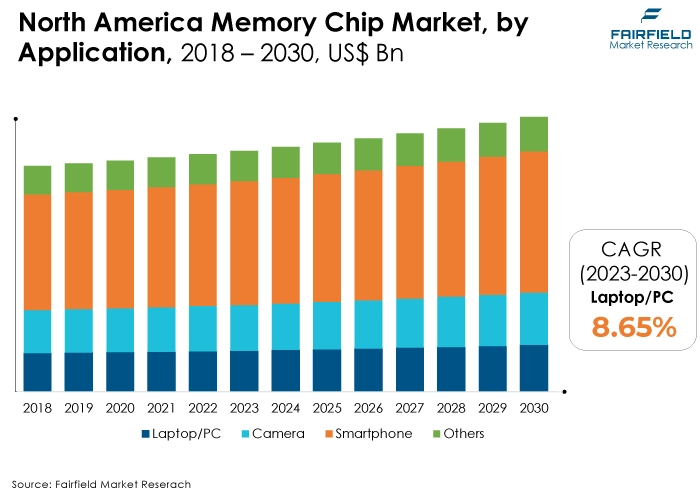

- The market for memory chips is expanding in North America due to higher data generation across businesses and rapidly evolving technologies, which drive the nation's need for more effective processing systems.

A Look Back and a Look Forward - Comparative Analysis

The market for memory chips has grown in popularity due to the growing need for memory and storage components in vehicle safety systems and next-generation connected autos. Since the systems use semiconductor memory to store digital data, semiconductor memory is necessary for every device with a processor or controller.

The market witnessed staggered growth during the historical period 2018 – 2022. Furthermore, the demand for semiconductor-based memory devices is driven by the growing number of data centres built, and the need for semiconductor memory is driven by colocation and hyperscale data centres, particularly in industrialised nations, to manage and store massive volumes of corporate data.

Developing smaller, more efficient, higher-capacity memory chips and ongoing advancements will propel the memory chip industry. Memory chips with higher performance and storage capacities may be produced due to manufacturing processes and miniaturisation innovation. The market is growing due to the smaller chips' uses in various devices, including data centres and smartphones. Furthermore, new non-volatile memory technologies and 3D stacking are reshaping the memory chip market.

Key Growth Determinants

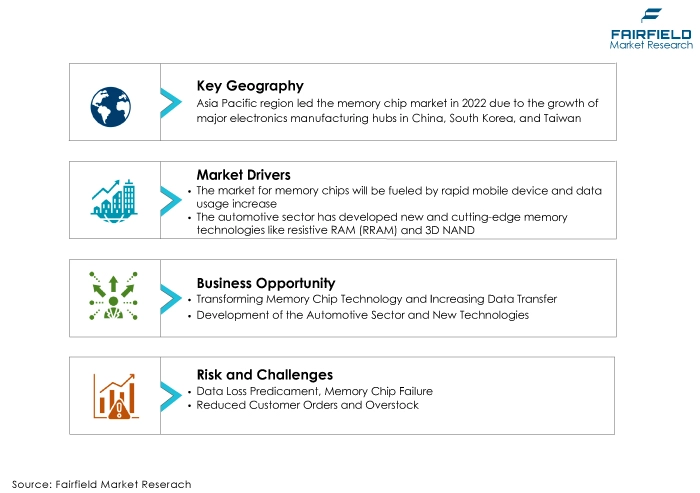

- Rapid Increase in Mobile Devices and Data Usage in Recent Years

The market for memory chips will be driven by growing data consumption and increasing penetration of mobile, tablet, and other electronics. The growing demand for memory chips to store data is caused by a surge in the production and consumption of digital information, fueled by the sales of electronic devices like smartphones and tablets.

In November 2022, 73% of people aged ten and over are expected to have access to a smartphone, which is 7% more than the percentage of the population that currently uses the Internet, according to the International Telecommunication Union, a United Nations department based in Switzerland that oversees a wide range of issues, including communication and information technology. It is anticipated that as smartphones become more commonplace, the need to store data will also grow.

- The Massive Consumer Electronics Wave

In the upcoming years, the market for memory chips is anticipated to increase rapidly due to the widespread use of consumer devices like laptops, and tablets. Consumer electronics, sometimes called domestic appliances, are electrical devices designed for everyday use by individuals who live in their own houses.

The three main purposes of these devices are productivity, entertainment, and communication. In consumer electronics, memory chips are used to process and store data. The demand for memory chips is being fueled by the requirement for modern consumer electronics products to have larger storage capacities, and better processing speeds.

- Improvements in Memory Chips

The market for memory chips is anticipated to be driven by ongoing technological advancements and the creation of memory chips that are more compact, efficient, and have larger capacities. Memory chips with higher storage capacities and improved performance may now be produced thanks to miniaturisation and cutting-edge manufacturing processes.

The market is growing because smaller chips are used in more products, like data centres and smartphones. Developments like 3D stacking and other non-volatile memory technologies are also shaping the landscape of memory chips.

Major Growth Barriers

- Data Loss Predicament, and Memory Chip Failure

The market for memory chips is growing more slowly due to memory chip corruption. Data on the memory card is lost as a result of memory chip corruption. Memory card corruption is often caused by unexpected power surges, formatting, virus attacks, and too quickly removing the memory card from any device.

Furthermore, taking pictures with limited battery life or shooting and erasing files quickly after the card is full might cause memory card corruption, ultimately resulting in losing the data saved on the chip. As a result, the possibility of data loss due to memory chip corruption inhibits market expansion.

- Reduced Customer Orders, and Overstock

The memory chip business is severely constrained by an abundance of chips piled high in warehouses, a decline in customer orders, and a significant drop in product prices. Due to the difficulties, this is the most difficult time in the memory chip industry's history. As a result, big memory chip makers have experienced severe financial losses, which exacerbates the problem of excess inventory and draws attention to the stark lack of demand in the market.

Key Trends and Opportunities to Look for

- Transforming Memory Chip Technology, and Increasing Data Transfer

Major technological advancements in memory chip development are being made by companies in the industry, which is driving up demand for memory chips. Researchers are developing memory chips that can store and process data to speed up computers, and decrease the time and energy needed to transfer data.

Samsung Electronics has announced the mass production of fifth-generation V-NAND memory chips, which have the fastest data write speed at 500 microseconds (µs), and quicker data transfer. This generation's read time has been drastically shortened to 50µs, while the write speed has increased by 30%. The market is expanding due to technological advancements that minimise the energy and time required for data transfer.

- Unprecedented Developments in Automotive Sector

The need for memory-intensive applications and the development of new technologies fuel the memory chip market's global expansion. The advancement of memory chip technology has resulted in a notable revolution in the automotive sector.

Non-volatile memory chips have proven essential for maintaining data integrity during power outages and improving car performance. Despite physical space limitations, high-density memory chips enable connected and autonomous vehicles to manage massive volumes of data efficiently.

- Cutting-edge Memory Technologies Like RRAM, and 3D NAND

The competitive dynamics are becoming more complex due to the emergence of novel memory technologies like resistive RAM (RRAM) and 3D NAND, as companies compete to take the lead in these cutting-edge markets.

Strategic alliances between original equipment manufacturers (OEMs), and end users become increasingly important as the demand for memory chips rises. These alliances allow market participants to customise their solutions to the various needs of the industry better and establish their positions in the always-changing memory chip market.

How Does the Regulatory Scenario Shape this Industry?

The memory chip industry is anticipated to be dynamic in the upcoming years due to shifting market dynamics, technical developments, and changing regulatory environments. Policymakers, business people, and consumers must keep up with these advancements to create a fair, competitive, and long-lasting market for memory chips.

Regulators from several nations, such as the US and EU, are looking into possible anti-competitive behavior by memory chip producers. Export restrictions on specific memory chips may be enforced by governments for strategic or national security purposes.

Trade conflicts between big economies like the US and China can disrupt supply chains and prices. More and more restrictions on the use of resources and the disposal of trash result from growing worries about the environmental impact of semiconductor manufacture.

Fairfield’s Ranking Board

Top Segments

- DRAM Category Maintains Dominance over Other Segments

The DRAM segment dominated the market in 2023. The market for memory chips is dominated by dynamic random access memory (DRAM), which is essential to modern computing. DRAM offers quick, volatile storage that is essential for several uses. Scaling down to and beyond the 10 nm process presents issues for DRAM makers as technology develops and demands increased performance and memory density rise. The main challenge is reducing cell capacitance without sacrificing memory density or data retention.

Furthermore, the NAND flash category is projected to experience the fastest market growth. Major players in the memory chip industry are concentrating on cutting-edge technologies like NAND flash technology to serve their current customer base better. An example of a memory chip is NAND flash technology. Compared to standard NAND flash memory, this non-volatile memory technology offers higher storage density and improved performance.

- Smartphone Surges Ahead, Laptop/PC Gears up for Substantial Growth

In 2022, the smartphone category dominated the industry. With their large consumption of DRAM and NAND flash memory chips, smartphones are one of the main drivers of the memory chip business. The capacity of a device to multitask and execute many applications at once is provided by DRAM chips.

At the same time, NAND flash memory stores data such as apps, movies, and images. More memory is required because smartphones with sophisticated cameras, potent processors, and high-resolution screens are becoming increasingly popular.

The laptop/PC category is anticipated to grow substantially throughout the projected period. Laptops mostly use memory chips, specifically NAND flash, for long-term storage, and dynamic random access memory (DRAM) for short-term data storage. The cost, performance, and availability of memory chips greatly impact laptops' features, production costs, and overall performance.

Regional Frontrunners

China, Taiwan, and South Korea Spearhead the Global Primacy of Asia Pacific

Asia Pacific holds the greatest proportion of the memory chip market, with its major electronics manufacturing hubs in China, South Korea, and Taiwan. The nations are major manufacturers of computers, smartphones, and other electronic gadgets, which at the same time is fueling the region's high need for memory chips.

India is quickly becoming a major hub for electronics production worldwide, with Invest India projecting that the sector will generate US$ 300 billion by 2025 and 2026. Government programs like the Production Linked Incentive Programme, which supports local electronics manufacturing, are the main drivers of the rise.

The US Data Centre Industry Boosts North America’s Market for Memory Chips

In recent years, US corporations have fully embraced extreme ultraviolet (EUV) technology, and the country has regained its competitiveness in memory chip manufacturing technology, particularly in DRAM and 3D-NAND. The US Department of Energy estimates that the country has roughly 3 million data centres. The modern computer unit is the data centre.

The key components of safe, contemporary accelerated data centres are DPUs (Data Processing Units), which allow GPUs, CPUs, and DPUs to merge into a single, completely programmable computing unit. According to Nvidia, data centres' primary processor cores might be depleted by up to 30% due to data management. Memory component demand is rising with the growing need for data centres.

Fairfield’s Competitive Landscape Analysis

The fact that there are numerous vendors offering memory chips to both domestic and foreign markets makes the memory chip business extremely competitive. The major vendors are using tactics for mergers and acquisitions and strategic partnerships, among other things, to increase their reach and maintain their competitiveness in the market, suggesting that the market is quite fragmented.

Who are the Leaders in the Global Memory Chip Space?

- Intel Corporation

- Kingston Technology Corporation

- Samsung Electronics Co Ltd.

- Taiwan Semiconductor Manufacturing Company Ltd

- Toshiba Corporation

- Transcend Information Inc.

- ADAT Technology Co Ltd.

- Sony Corporation

- Fujitsu Limited

Significant Company Developments

Expansion

- March 2022: Memory solutions provider Kioxia Corporation said it would begin building a state-of-the-art new fabrication facility at its Kitakami Plant in Japan in preparation for the potential growth of its in-house 3D Flash memory BiCSFLASHTM production. Construction on this facility is anticipated to begin in April 2022 and be finished in 2023.

- December 2021: With the announcement of plans for its new memory design centre in Midtown Atlanta, the business intends to increase its presence in the Southeast region of the US. Strong relationships with numerous local universities, such as Georgia Tech, Emory University, Spelman College, Morehouse College, and the University of Georgia, are among the many that Micron hopes to forge.

New Product Launch

- July 2023: The "world's most advanced" 3D NAND memory chip found in a consumer device was created by Yangtze Memory Technologies Co. (YMTC), China's top memory chip manufacturer. Though YMTC was placed on the US Commerce Department's Entity List and faced sanctions, the company secretly introduced this ground-breaking memory technology in a solid-state drive.

- October 2023: Apple unveiled a trio of groundbreaking chips for personal computers: M3, M3 Pro, and M3 Max. The chips are the industry's first to utilise 3-nanometer process technology, enabling more transistors to be packed into a smaller space, leading to significant speed and efficiency improvements.

An Expert’s Eye

Demand and Future Growth

Transforming memory chip technology, and increasing data transfer are driving the market. Rapid mobile device and data usage increase, powering the surge of consumer electronics and improving memory chips.

The automotive sector has developed new and cutting-edge memory technologies like resistive RAM (RRAM), and 3D NAND. However, the memory chip market is expected to face considerable challenges because of data loss, memory chip failure, reduced customer orders, and overstock.

Supply Side of the Market

According to our analysis, large players in the memory chip industry are concentrating on cutting-edge technologies, such as NAND flash technology, to serve their current customer base better. Memory chips come in the form of NAND flash technology. This non-volatile memory technology outperforms standard NAND flash memory regarding performance and storage density.

V-NAND is characterised by its vertical design, which increases storage capacity without increasing the chip's footprint by stacking memory cells on multiple levels. For example, in December 2022, the US-based memory chip and semiconductor manufacturer Samsung Semiconductor Inc. introduced the eighth version (V8) of V-NAND. The four fundamental characteristics of Samsung's V-NAND devices account for the tremendous growth of NAND flash.

Global Memory Chip Market is Segmented as Below:

By Type:

- Volatile

- DRAM

- SRAM

- Non-volatile

- PROM

- EEPROM

- NAND Flash

- Others

By Application:

- Laptop/PC

- Camera

- Smartphone

- Others

By Geographic Coverage:

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Turkey

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Egypt

- Nigeria

- Rest of the Middle East & Africa

1. Executive Summary

1.1. Global Memory Chip Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2022

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. Covid-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Global Memory Chip Market Outlook, 2018 - 2030

3.1. Global Memory Chip Market Outlook, by Type, Value (US$ Mn), 2018 - 2030

3.1.1. Key Highlights

3.1.1.1. Volatile

3.1.1.1.1. DRAM

3.1.1.1.2. SRAM

3.1.1.2. Non-volatile

3.1.1.2.1. PROM

3.1.1.2.2. EEPROM

3.1.1.2.3. NAND Flash

3.1.1.2.4. Others

3.2. Global Memory Chip Market Outlook, by Application, Value (US$ Mn), 2018 - 2030

3.2.1. Key Highlights

3.2.1.1. Laptop/PC

3.2.1.2. Camera

3.2.1.3. Smartphone

3.2.1.4. Others

3.3. Global Memory Chip Market Outlook, by Region, Value (US$ Mn), 2018 - 2030

3.3.1. Key Highlights

3.3.1.1. North America

3.3.1.2. Europe

3.3.1.3. Asia Pacific

3.3.1.4. Latin America

3.3.1.5. Middle East & Africa

4. North America Memory Chip Market Outlook, 2018 - 2030

4.1. North America Memory Chip Market Outlook, by Type, Value (US$ Mn), 2018 - 2030

4.1.1. Key Highlights

4.1.1.1. Volatile

4.1.1.1.1. DRAM

4.1.1.1.2. SRAM

4.1.1.2. Non-volatile

4.1.1.2.1. PROM

4.1.1.2.2. EEPROM

4.1.1.2.3. NAND Flash

4.1.1.2.4. Others

4.2. North America Memory Chip Market Outlook, by Application, Value (US$ Mn), 2018 - 2030

4.2.1. Key Highlights

4.2.1.1. Laptop/PC

4.2.1.2. Camera

4.2.1.3. Smartphone

4.2.1.4. Others

4.3. North America Memory Chip Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

4.3.1. Key Highlights

4.3.1.1. U.S. Memory Chip Market by Type, Value (US$ Mn), 2018 - 2030

4.3.1.2. U.S. Memory Chip Market Application, Value (US$ Mn), 2018 - 2030

4.3.1.3. Canada Memory Chip Market by Type, Value (US$ Mn), 2018 - 2030

4.3.1.4. Canada Memory Chip Market Application, Value (US$ Mn), 2018 - 2030

4.3.2. BPS Analysis/Market Attractiveness Analysis

5. Europe Memory Chip Market Outlook, 2018 - 2030

5.1. Europe Memory Chip Market Outlook, by Type, Value (US$ Mn), 2018 - 2030

5.1.1. Key Highlights

5.1.1.1. Volatile

5.1.1.1.1. DRAM

5.1.1.1.2. SRAM

5.1.1.2. Non-volatile

5.1.1.2.1. PROM

5.1.1.2.2. EEPROM

5.1.1.2.3. NAND Flash

5.1.1.2.4. Others

5.2. Europe Memory Chip Market Outlook, by Application, Value (US$ Mn), 2018 - 2030

5.2.1. Key Highlights

5.2.1.1. Laptop/PC

5.2.1.2. Camera

5.2.1.3. Smartphone

5.2.1.4. Others

5.2.2. BPS Analysis/Market Attractiveness Analysis

5.3. Europe Memory Chip Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

5.3.1. Key Highlights

5.3.1.1. Germany Memory Chip Market by Type, Value (US$ Mn), 2018 - 2030

5.3.1.2. Germany Memory Chip Market Application, Value (US$ Mn), 2018 - 2030

5.3.1.3. U.K. Memory Chip Market by Type, Value (US$ Mn), 2018 - 2030

5.3.1.4. U.K. Memory Chip Market Application, Value (US$ Mn), 2018 - 2030

5.3.1.5. France Memory Chip Market by Type, Value (US$ Mn), 2018 - 2030

5.3.1.6. France Memory Chip Market Application, Value (US$ Mn), 2018 - 2030

5.3.1.7. Italy Memory Chip Market by Type, Value (US$ Mn), 2018 - 2030

5.3.1.8. Italy Memory Chip Market Application, Value (US$ Mn), 2018 - 2030

5.3.1.9. Turkey Memory Chip Market by Type, Value (US$ Mn), 2018 - 2030

5.3.1.10. Turkey Memory Chip Market Application, Value (US$ Mn), 2018 - 2030

5.3.1.11. Russia Memory Chip Market by Type, Value (US$ Mn), 2018 - 2030

5.3.1.12. Russia Memory Chip Market Application, Value (US$ Mn), 2018 - 2030

5.3.1.13. Rest of Europe Memory Chip Market by Type, Value (US$ Mn), 2018 - 2030

5.3.1.14. Rest of Europe Memory Chip Market Application, Value (US$ Mn), 2018 - 2030

5.3.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Memory Chip Market Outlook, 2018 - 2030

6.1. Asia Pacific Memory Chip Market Outlook, by Type, Value (US$ Mn), 2018 - 2030

6.1.1. Key Highlights

6.1.1.1. Volatile

6.1.1.1.1. DRAM

6.1.1.1.2. SRAM

6.1.1.2. Non-volatile

6.1.1.2.1. PROM

6.1.1.2.2. EEPROM

6.1.1.2.3. NAND Flash

6.1.1.2.4. Others

6.2. Asia Pacific Memory Chip Market Outlook, by Application, Value (US$ Mn), 2018 - 2030

6.2.1. Key Highlights

6.2.1.1. Laptop/PC

6.2.1.2. Camera

6.2.1.3. Smartphone

6.2.1.4. Others

6.3. Asia Pacific Memory Chip Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

6.3.1. Key Highlights

6.3.1.1. China Memory Chip Market by Type, Value (US$ Mn), 2018 - 2030

6.3.1.2. China Memory Chip Market Application, Value (US$ Mn), 2018 - 2030

6.3.1.3. Japan Memory Chip Market by Type, Value (US$ Mn), 2018 - 2030

6.3.1.4. Japan Memory Chip Market Application, Value (US$ Mn), 2018 - 2030

6.3.1.5. South Korea Memory Chip Market by Type, Value (US$ Mn), 2018 - 2030

6.3.1.6. South Korea Memory Chip Market Application, Value (US$ Mn), 2018 - 2030

6.3.1.7. India Memory Chip Market by Type, Value (US$ Mn), 2018 - 2030

6.3.1.8. India Memory Chip Market Application, Value (US$ Mn), 2018 - 2030

6.3.1.9. Southeast Asia Memory Chip Market by Type, Value (US$ Mn), 2018 - 2030

6.3.1.10. Southeast Asia Memory Chip Market Application, Value (US$ Mn), 2018 - 2030

6.3.1.11. Rest of Asia Pacific Memory Chip Market by Type, Value (US$ Mn), 2018 - 2030

6.3.1.12. Rest of Asia Pacific Memory Chip Market Application, Value (US$ Mn), 2018 - 2030

6.3.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America Memory Chip Market Outlook, 2018 - 2030

7.1. Latin America Memory Chip Market Outlook, by Type, Value (US$ Mn), 2018 - 2030

7.1.1. Key Highlights

7.1.1.1. Volatile

7.1.1.1.1. DRAM

7.1.1.1.2. SRAM

7.1.1.2. Non-volatile

7.1.1.2.1. PROM

7.1.1.2.2. EEPROM

7.1.1.2.3. NAND Flash

7.1.1.2.4. Others

7.2. Latin America Memory Chip Market Outlook, by Application, Value (US$ Mn), 2018 - 2030

7.2.1. Key Highlights

7.2.1.1. Laptop/PC

7.2.1.2. Camera

7.2.1.3. Smartphone

7.2.1.4. Others

7.3. Latin America Memory Chip Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

7.3.1. Key Highlights

7.3.1.1. Brazil Memory Chip Market by Type, Value (US$ Mn), 2018 - 2030

7.3.1.2. Brazil Memory Chip Market Application, Value (US$ Mn), 2018 - 2030

7.3.1.3. Mexico Memory Chip Market by Type, Value (US$ Mn), 2018 - 2030

7.3.1.4. Mexico Memory Chip Market Application, Value (US$ Mn), 2018 - 2030

7.3.1.5. Argentina Memory Chip Market by Type, Value (US$ Mn), 2018 - 2030

7.3.1.6. Argentina Memory Chip Market Application, Value (US$ Mn), 2018 - 2030

7.3.1.7. Rest of Latin America Memory Chip Market by Type, Value (US$ Mn), 2018 - 2030

7.3.1.8. Rest of Latin America Memory Chip Market Application, Value (US$ Mn), 2018 - 2030

7.3.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Memory Chip Market Outlook, 2018 - 2030

8.1. Middle East & Africa Memory Chip Market Outlook, by Type, Value (US$ Mn), 2018 - 2030

8.1.1. Key Highlights

8.1.1.1. Volatile

8.1.1.1.1. DRAM

8.1.1.1.2. SRAM

8.1.1.2. Non-volatile

8.1.1.2.1. PROM

8.1.1.2.2. EEPROM

8.1.1.2.3. NAND Flash

8.1.1.2.4. Others

8.2. Middle East & Africa Memory Chip Market Outlook, by Application, Value (US$ Mn), 2018 - 2030

8.2.1. Key Highlights

8.2.1.1. Laptop/PC

8.2.1.2. Camera

8.2.1.3. Smartphone

8.2.1.4. Others

8.3. Middle East & Africa Memory Chip Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

8.3.1. Key Highlights

8.3.1.1. GCC Memory Chip Market by Type, Value (US$ Mn), 2018 - 2030

8.3.1.2. GCC Memory Chip Market Application, Value (US$ Mn), 2018 - 2030

8.3.1.3. South Africa Memory Chip Market by Type, Value (US$ Mn), 2018 - 2030

8.3.1.4. South Africa Memory Chip Market Application, Value (US$ Mn), 2018 - 2030

8.3.1.5. Egypt Memory Chip Market by Type, Value (US$ Mn), 2018 - 2030

8.3.1.6. Egypt Memory Chip Market Application, Value (US$ Mn), 2018 - 2030

8.3.1.7. Nigeria Memory Chip Market by Type, Value (US$ Mn), 2018 - 2030

8.3.1.8. Nigeria Memory Chip Market Application, Value (US$ Mn), 2018 - 2030

8.3.1.9. Rest of Middle East & Africa Memory Chip Market by Type, Value (US$ Mn), 2018 - 2030

8.3.1.10. Rest of Middle East & Africa Memory Chip Market Application, Value (US$ Mn), 2018 - 2030

8.3.2. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. Capacity vs Application Heatmap

9.2. Manufacturer vs Application Heatmap

9.3. Company Market Share Analysis, 2022

9.4. Competitive Dashboard

9.5. Company Profiles

9.5.1. Intel Corporation

9.5.1.1. Company Overview

9.5.1.2. Product Portfolio

9.5.1.3. Financial Overview

9.5.1.4. Business Strategies and Development

9.5.2. Kingston Technology Corporation

9.5.2.1. Company Overview

9.5.2.2. Product Portfolio

9.5.2.3. Financial Overview

9.5.2.4. Business Strategies and Development

9.5.3. Samsung Electronics Co Ltd.

9.5.3.1. Company Overview

9.5.3.2. Product Portfolio

9.5.3.3. Financial Overview

9.5.3.4. Business Strategies and Development

9.5.4. Taiwan Semiconductor Manufacturing Company Ltd

9.5.4.1. Company Overview

9.5.4.2. Product Portfolio

9.5.4.3. Financial Overview

9.5.4.4. Business Strategies and Development

9.5.5. Toshiba Corporation

9.5.5.1. Company Overview

9.5.5.2. Product Portfolio

9.5.5.3. Financial Overview

9.5.5.4. Business Strategies and Development

9.5.6. Transcend Information Inc.

9.5.6.1. Company Overview

9.5.6.2. Product Portfolio

9.5.6.3. Financial Overview

9.5.6.4. Business Strategies and Development

9.5.7. ADAT Technology Co Ltd.

9.5.7.1. Company Overview

9.5.7.2. Product Portfolio

9.5.7.3. Financial Overview

9.5.7.4. Business Strategies and Development

9.5.8. Sony Corporation

9.5.8.1. Company Overview

9.5.8.2. Product Portfolio

9.5.8.3. Business Strategies and Development

9.5.9. Fujitsu Limited

9.5.9.1. Company Overview

9.5.9.2. Product Portfolio

9.5.9.3. Financial Overview

9.5.9.4. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2022 |

|

2018 - 2022 |

2023 - 2030 |

Value: US$ Million |

||

|

REPORT FEATURES |

DETAILS |

|

Type Coverage |

|

|

Application Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |