Global Metallurgical Coke Market Forecast

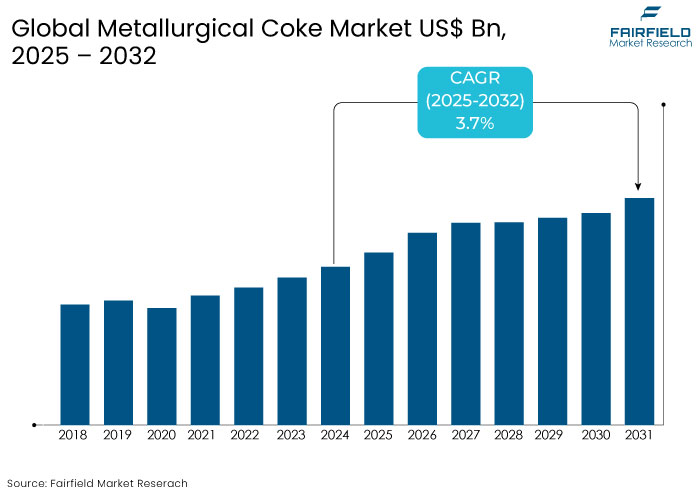

- The metallurgical coke market is projected to reach a size of US$74.9 Bn by 2032, showing significant growth from the US$55.1 Bn achieved in 2025.

- The market for metallurgical coke is expected to show a significant expansion rate, with an estimated CAGR of 3.7% from 2025 to 2032.

Metallurgical Coke Market Insights

- The global steel industry drives metallurgical coke demand, which is primarily driven by the construction, automotive, and infrastructure sectors.

- Producers leverage AI, IoT, and advanced desulfurization to enhance quality and efficiency.

- Countries like India are boosting domestic coke production to reduce import dependency amid volatile coal prices.

- Waste heat recovery and by-product recycling improve sustainability and efficiency.

- Collaborations with steel manufacturers ensure stable supply chains and foster sustainable technology investments.

- Blast furnace coke accounts for about 45% of the market share.

- Asia Pacific leads the metallurgical coke market as the notably growing region, which accounts for the 80% market share in 2025.

A Look Back and a Look Forward - Comparative Analysis

According to the findings of the historical study, the market expanded at a CAGR of 3.3% from 2019 to 2023. The demand for metallurgical coke has significantly grown over the past few years due to the robust expansion of the steel industry and improved advancements in coke-producing technologies.

The market for metallurgical coke has experienced a slow development rate over the historical period from 2019 to 2023, which was caused by a considerable decrease in global steel output in 2022 compared to 2021. A number of macroeconomic causes are primarily responsible for the fall, including high inflation and rising interest rates around the world, rising energy costs, and similar concerns.

It is anticipated that the metallurgical coke market is estimated to be propelled globally by a considerable increase in the number of new infrastructure projects and a slight recovery of the real estate market among several emerging economies. The construction industry in countries such as China, India, Brazil, and others is anticipated to experience significant expansion in the coming years.

The demand for products is projected to increase in the coming years due to the growing applications of metallurgical coke in various industries, including the processing of iron and steel and the production of glass.

Key Growth Determinants

- Increase in Vehicle Manufacturing Remains a Key Driver

Steel constitutes approximately 60% of the weight of a typical automobile, making it a crucial raw material in the automotive sector. Approximately 900 kg of steel are utilized in each vehicle. The World Steel Association reports that the automotive industry constitutes approximately 10% to 12% of worldwide steel usage.

Steel is extensively utilized in the production of vehicle body constructions, drivetrains, cast iron engine blocks, suspensions, and gasoline tanks. The ACEA - European Automobile Manufacturers' Association reports that almost 50 million passenger vehicles were produced worldwide during the first three quarters of 2022. It reflects an increase of nearly 9% compared to the corresponding nine-month period in 2021.

The substantial rise in the production and sales of automotive vehicles, including passenger cars, light commercial vehicles, and heavy commercial vehicles is anticipated to accelerate the expansion of steel demand globally.

- Augmented Construction Activities and Infrastructure Advancement

The relationship between urbanization, construction projects, infrastructure development, and the demand for metallurgical coke is significant, as these sectors mostly rely on steel, which necessitates metallurgical coke for its production. The rise in urbanization and development projects has resulted in a corresponding increase in steel consumption, necessitating higher output levels in mills to meet this increasing requirement.

Metallurgical coke is crucial in the steelmaking process, particularly in the blast furnace method; hence, its demand is closely linked to the production levels of the steel industry. Thus, heightened demand for steel requires a large amount of metallurgical coke for its manufacturing.

The construction industry is a primary consumer of steel. Steel is a crucial component, fundamental to the structural integrity of structures and the reinforcement of concrete. Significant construction projects, such as skyscrapers, bridges, and stadiums, require substantial quantities of steel.

Key Growth Barriers

- Capital-Intensive Attributes of Coke Manufacturing

Metallurgical coke is a crucial raw material in steel production, particularly in blast furnace operations, hence variations in steel demand directly influence coke usage. In a burgeoning economy, steel mills augment production to meet the escalating demand for commodities, hence intensifying the need for metallurgical coke.

In an economic recession, steel production declines, leading to a decreased need for coke. Economic recessions can generate uncertainty and volatility in the growth of the metallurgical coke sector.

The variability of steel demand is influenced by global economic factors, complicates production planning and inventory management for coke manufacturers. This situation is occasionally exacerbated by the typically high fixed costs and capital-intensive nature of coke production, which can impede swift adaptations to demand fluctuations.

- Shift Toward Electric Arc Furnace (EAF) Technology in Steel Production

The global steel industry, a primary consumer of metallurgical coke is experiencing a notable shift toward electric arc furnace (EAF) technology. Unlike traditional blast furnace steelmaking, which relies mainly on metallurgical coke as a reducing agent to convert iron ore into molten iron, EAF technology primarily uses scrap steel as its raw material and electricity as its energy source. The said transition presents a significant challenge for the metallurgical coke market.

Governments and environmental agencies are imposing strict regulations on carbon emissions and pollution. Traditional blast furnaces, which require large amounts of coke, are highly carbon-intensive. In contrast, EAF technology produces significantly fewer emissions, making it an attractive alternative for steel manufacturers aiming to meet sustainability goals.

The decline in coke demand is particularly pronounced in developed regions like North America and Europe, where EAF technology is widely embraced. However, the impact is less severe in regions like Asia Pacific, where blast furnaces remain dominant due to high demand for primary steel production.

Metallurgical Coke Market Trends and Opportunities

- Increased focus on Coal Tar Production by Manufacturers

The chemical industry's heightened emphasis on coal tar production is anticipated to drive the expansion of the global metallurgical coke market over the projected period. Coal tar is extensively employed in the production of aromatic chemicals, rendering it economically significant for the chemical industry.

Advancements in coke production technology have bolstered the growth potential of the metallurgical coke market. Heat recovery coke production technology is gaining significance in industrialized nations like the United States.

Many developing countries have recognized the considerable market potential of uncomplicated designs and user-friendliness. The carbon footprint associated with the production of metallurgical coke has been markedly diminished.

The increasing desire for lower operating and maintenance expenses is a principal element propelling the innovation of new products. Future studies are planned to emphasize the performance of blast furnaces utilized by metallurgical coke makers, enhancing focus on efficiency and serving as a stimulus for industry expansion.

Nippon Steel augmented its production and processing of coal tar in 2023, leveraging the escalating demand from the chemical sector for raw materials utilized to produce aromatic compounds and carbon-based products.

- Resurgence of Blast Furnace Operations

Blast furnace operations remain a dominant force in certain regions, particularly in Asia Pacific and the Middle East Despite the global shift toward environment-friendly steel production methods, such as electric arc furnace (EAF) technology. This ongoing reliance presents an opportunity for the metallurgical coke market to thrive in these areas.

Rapid urbanization and industrialization in regions like China, India, and Southeast Asia have spurred massive demand for steel in construction, automotive manufacturing, and infrastructure projects. Since these economies still rely significantly on blast furnace-basic oxygen furnace (BF-BOF) technology for steelmaking, the demand for metallurgical coke remains high.

Blast furnaces are still considered cost-effective for producing large volumes of primary steel, especially when integrated with basic oxygen furnaces. This makes them a preferred choice for large steel mills in emerging economies with high production capacities.

Ongoing reliance ensures a steady demand for metallurgical coke, offering producers a viable market to capitalize on for the foreseeable future. However, as these regions mature economically and adopt greener technologies, the metallurgical coke market must innovate and diversify to remain competitive.

How Does Regulatory Scenario Shape the Industry?

The regulatory landscape significantly influences the metallurgical coke market. Governments and environmental agencies worldwide impose strict policies to curb carbon emissions and environmental degradation.

Traditional coke production and its downstream use in blast furnaces are highly carbon-intensive, leading to increased scrutiny and compliance requirements. Key regulations, such as the Paris Agreement and net-zero emission targets, push steel and coke producers to adopt cleaner technologies. These include waste heat recovery systems, desulfurization processes, and improved carbon capture and storage (CCS) techniques to reduce their environmental footprint.

Countries like the EU are implementing carbon taxes and emission trading systems, making it costlier for companies that fail to reduce emissions. Emerging economies like India and China are balancing growth needs with sustainability. They promote domestic coke production while setting stricter pollution control norms for coke ovens and steel plants.

Regulatory support for sustainable practices and renewable energy integration reshapes operational strategies, encourages investments in green technologies, and drives collaborations between governments and industry players. This evolving scenario compels the metallurgical coke market to innovate and align with global sustainability goals.

Segments Covered in the Report

- Blast Furnace Coke Remains Dominant with Metallurgical Coke being an Essential Feedstock

The blast furnace coke segment is projected to have a significant market share; as metallurgical coke is a crucial feedstock in blast furnace coke production. Anthracite has historically been utilized in blast furnaces for iron smelting; nevertheless, it does not possess the pore space characteristic of the metallurgical coke that subsequently supplanted it.

Metallurgical coke is stratified within a blast furnace with the pulverized coal injection method to transform iron ore into metallic iron. Blast furnace coke commands a substantial market share owing to its myriad advantages, such as its appropriateness for large-scale continuous production, uninterrupted feeding and tapping, established technology.

- Iron & Steel Production Leads with a 60% Market Share

The iron and steel production sector is anticipated to command a significant market share and experience an impressive CAGR over the forecast period. Iron and steel industry processes, including foundries, sintering plants, and blast furnaces, require substantial quantities of metallurgical coke to transform iron ore into iron.

Coke is frequently utilized in the manufacturing of iron, a fundamental element of steel, which accounts for 70% of total steel output. Iron manufacturing necessitates metallurgical coke, which provides the heat and carbon essential for the blast furnace (BF) to process heated metal and chemically reduce the iron load (HM). Coking coal, or metallurgical coal, is essential in steel production.

Regional Analysis

- Asia Pacific being the Global Leader in the Market with Huge Investments by Iron & Steel Companies in India

Asia Pacific metallurgical coke market held an 80% share in 2024, owing to the substantial investments from iron and steel enterprises. India, the second-largest steel-producing nation worldwide, is expected to represent a significant share of the global market in both volume and value.

According to the India Brand Equity Foundation, the production of crude steel and finished steel from April to October 2022 was 71.56 MT and 68.17 MT, respectively. The cost-effectiveness of labor and the local availability of raw resources such as iron ore have been the primary catalysts for expansion in the Indian steel sector.

Significant economic changes, increasing consumer per capita income, and a growing number of infrastructure projects are key factors enhancing the country's steel demand. The anticipated need for high-strength steel, which offers enhanced tensile strength and stiffness in the construction industry, is expected to drive the metallurgical coke market over the forecast period.

In August 2023, NMDC Limited, a government-owned iron mining company in India, announced the commencement of operations at its blast furnaces in Chhattisgarh, which is the second-largest blast furnace in India, expected to produce 9,500 tons of molten metal daily. This technology is an environmentally sustainable and energy-efficient blast furnace method for steel production.

China is projected to possess a considerable portion of the global metallurgical coke market and is expected to see a large compound annual growth rate throughout the forecast period. The nation is projected to be one of the principal producers of crude steel worldwide.

A significant number of steel manufacturing facilities and rising automobile production are key elements enhancing product demand in the country, hence contributing to the expansion of the global market.

Fairfield’s Competitive Landscape Analysis

The global metallurgical coke market is among the notably expanding market sectors, characterized by numerous prominent players with substantial market share. These manufacturers are substantially investing in augmenting product quality through the adoption of innovative technologies to enhance the strength of Coke.

Manufacturers also emphasize strategies for manufacturing high-strength coke from coal with minimal inert material content.

Key players are not solely focused on augmenting their sales network and purchasing smaller and regional entities. They are strategically establishing long-term agreements with dealers and suppliers. These contracts pertain to revenue stability and fostering growth, illustrating the players' commitment to stability and expansion.

Key Market Companies

- OKK Koksovny, A.S.

- SunCoke Energy Inc.

- Ennore Coke Limited

- Hickman, Williams & Company

- MECHEL PAO

- China Risun Coal Chemicals Group Limited

- YILCOQUE S.A.S.

- Sino Hua-An International Berhad

- China Shenhua Energy Company Limited

- ArcelorMittal

- Drummond Company, Inc.

- Jiangsu Surun High Carbon Co., Ltd.

- Nippon Steel & Sumitomo Metal

- Haldia Coke

- Baosteel Group

- Shanxi Sunlight Coking Group Company Ltd.

- Taiyuan Coal Gasification (Group) Co. Ltd.

- Shanxi Lubao Coking Group Co. Ltd.

Recent Industry Developments

- In November 2023, Glencore disclosed an agreement to purchase a 77% interest in Teck Resources' steel-making coal unit, Elk Valley Resources, for USD 6.93 billion.

- In November 2023, Warrior Met Coal Inc., a U.S.-based company, designated USD 127.8 million for its Blue Creek Growth project in the fourth quarter, culminating in a total investment of USD 319.1 million for the year 2023.

An Expert’s Eye

- The market growth is closely tied to the steel industry's performance, particularly in construction and infrastructure-driven economies.

- Growing consensus that sustainability-focused regulations will drive the adoption of cleaner production methods like waste heat recovery and carbon capture.

- Industry specialists highlight the importance of integrating AI, IoT, and desulfurization processes to enhance Coke quality and operational efficiency.

- Strategic alliances between coke producers and steel manufacturers are seen as vital for ensuring supply chain stability and fostering innovation in green technologies.

Global Metallurgical Coke Market is Segmented as-

By Product Type

- Blast Furnace Coke

- Foundry Coke

- Technical Coke

By Ash Content

- Low Ash Content

- High Ash Content

By End Use

- Iron & Steel Production

- Non-Ferrous Metal Casting

- Chemical Industry

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- The Middle East & Africa

- Beta

1. Executive Summary

1.1. Global Metallurgical Coke Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2024

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. COVID-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Global Metallurgical Coke Market Outlook, 2019 - 2032

3.1. Global Metallurgical Coke Market Outlook, by Product Type, Value (US$ Mn) and Volume (Tons), 2019 - 2032

3.1.1. Key Highlights

3.1.1.1. Blast Furnace Coke

3.1.1.2. Foundry Coke

3.1.1.3. Technical Coke

3.2. Global Metallurgical Coke Market Outlook, by Ash Content, Value (US$ Mn) and Volume (Tons), 2019 - 2032

3.2.1. Key Highlights

3.2.1.1. Low Ash

3.2.1.2. High Ash

3.3. Global Metallurgical Coke Market Outlook, by End Use, Value (US$ Mn) and Volume (Tons), 2019 - 2032

3.3.1. Key Highlights

3.3.1.1. Non-Ferrous Metal Casting

3.3.1.2. Iron and Steel Production

3.3.1.3. Chemical Industry

3.3.1.4. Others

3.4. Global Metallurgical Coke Market Outlook, by Region, Value (US$ Mn) and Volume (Tons), 2019 - 2032

3.4.1. Key Highlights

3.4.1.1. North America

3.4.1.2. Europe

3.4.1.3. Asia Pacific

3.4.1.4. Latin America

3.4.1.5. Middle East & Africa

4. North America Metallurgical Coke Market Outlook, 2019 - 2032

4.1. North America Metallurgical Coke Market Outlook, by Product Type, Value (US$ Mn) and Volume (Tons), 2019 - 2032

4.1.1. Key Highlights

4.1.1.1. Blast Furnace Coke

4.1.1.2. Foundry Coke

4.1.1.3. Technical Coke

4.2. North America Metallurgical Coke Market Outlook, by Ash Content, Value (US$ Mn) and Volume (Tons), 2019 - 2032

4.2.1. Key Highlights

4.2.1.1. Low Ash

4.2.1.2. High Ash

4.3. North America Metallurgical Coke Market Outlook, by End Use, Value (US$ Mn) and Volume (Tons), 2019 - 2032

4.3.1. Key Highlights

4.3.1.1. Non-Ferrous Metal Casting

4.3.1.2. Iron and Steel Production

4.3.1.3. Chemical Industry

4.3.1.4. Others

4.3.2. BPS Analysis/Market Attractiveness Analysis

4.4. North America Metallurgical Coke Market Outlook, by Country, Value (US$ Mn) and Volume (Tons), 2019 - 2032

4.4.1. Key Highlights

4.4.1.1. U.S. Metallurgical Coke Market by Product Type, Value (US$ Mn) and Volume (Tons), 2019 - 2032

4.4.1.2. U.S. Metallurgical Coke Market by Ash Content, Value (US$ Mn) and Volume (Tons), 2019 - 2032

4.4.1.3. U.S. Metallurgical Coke Market by End Use, Value (US$ Mn) and Volume (Tons), 2019 - 2032

4.4.1.4. Canada Metallurgical Coke Market by Product Type, Value (US$ Mn) and Volume (Tons), 2019 - 2032

4.4.1.5. Canada Metallurgical Coke Market by Ash Content, Value (US$ Mn) and Volume (Tons), 2019 - 2032

4.4.1.6. Canada Metallurgical Coke Market by End Use, Value (US$ Mn) and Volume (Tons), 2019 - 2032

4.4.2. BPS Analysis/Market Attractiveness Analysis

5. Europe Metallurgical Coke Market Outlook, 2019 - 2032

5.1. Europe Metallurgical Coke Market Outlook, by Product Type, Value (US$ Mn) and Volume (Tons), 2019 - 2032

5.1.1. Key Highlights

5.1.1.1. Blast Furnace Coke

5.1.1.2. Foundry Coke

5.1.1.3. Technical Coke

5.2. Europe Metallurgical Coke Market Outlook, by Ash Content, Value (US$ Mn) and Volume (Tons), 2019 - 2032

5.2.1. Key Highlights

5.2.1.1. Low Ash

5.2.1.2. High Ash

5.3. Europe Metallurgical Coke Market Outlook, by End Use, Value (US$ Mn) and Volume (Tons), 2019 - 2032

5.3.1. Key Highlights

5.3.1.1. Non-Ferrous Metal Casting

5.3.1.2. Iron and Steel Production

5.3.1.3. Chemical Industry

5.3.1.4. Others

5.3.2. BPS Analysis/Market Attractiveness Analysis

5.4. Europe Metallurgical Coke Market Outlook, by Country, Value (US$ Mn) and Volume (Tons), 2019 - 2032

5.4.1. Key Highlights

5.4.1.1. Germany Metallurgical Coke Market by Product Type, Value (US$ Mn) and Volume (Tons), 2019 - 2032

5.4.1.2. Germany Metallurgical Coke Market by Ash Content, Value (US$ Mn) and Volume (Tons), 2019 - 2032

5.4.1.3. Germany Metallurgical Coke Market by End Use, Value (US$ Mn) and Volume (Tons), 2019 - 2032

5.4.1.4. U.K. Metallurgical Coke Market by Product Type, Value (US$ Mn) and Volume (Tons), 2019 - 2032

5.4.1.5. U.K. Metallurgical Coke Market by Ash Content, Value (US$ Mn) and Volume (Tons), 2019 - 2032

5.4.1.6. U.K. Metallurgical Coke Market by End Use, Value (US$ Mn) and Volume (Tons), 2019 - 2032

5.4.1.7. France Metallurgical Coke Market by Product Type, Value (US$ Mn) and Volume (Tons), 2019 - 2032

5.4.1.8. France Metallurgical Coke Market by Ash Content, Value (US$ Mn) and Volume (Tons), 2019 - 2032

5.4.1.9. France Metallurgical Coke Market by End Use, Value (US$ Mn) and Volume (Tons), 2019 - 2032

5.4.1.10. Italy Metallurgical Coke Market by Product Type, Value (US$ Mn) and Volume (Tons), 2019 - 2032

5.4.1.11. Italy Metallurgical Coke Market by Ash Content, Value (US$ Mn) and Volume (Tons), 2019 - 2032

5.4.1.12. Italy Metallurgical Coke Market by End Use, Value (US$ Mn) and Volume (Tons), 2019 - 2032

5.4.1.13. Turkey Metallurgical Coke Market by Product Type, Value (US$ Mn) and Volume (Tons), 2019 - 2032

5.4.1.14. Turkey Metallurgical Coke Market by Ash Content, Value (US$ Mn) and Volume (Tons), 2019 - 2032

5.4.1.15. Turkey Metallurgical Coke Market by End Use, Value (US$ Mn) and Volume (Tons), 2019 - 2032

5.4.1.16. Russia Metallurgical Coke Market by Product Type, Value (US$ Mn) and Volume (Tons), 2019 - 2032

5.4.1.17. Russia Metallurgical Coke Market by Ash Content, Value (US$ Mn) and Volume (Tons), 2019 - 2032

5.4.1.18. Russia Metallurgical Coke Market by End Use, Value (US$ Mn) and Volume (Tons), 2019 - 2032

5.4.1.19. Rest of Europe Metallurgical Coke Market by Product Type, Value (US$ Mn) and Volume (Tons), 2019 - 2032

5.4.1.20. Rest of Europe Metallurgical Coke Market by Ash Content, Value (US$ Mn) and Volume (Tons), 2019 - 2032

5.4.1.21. Rest of Europe Metallurgical Coke Market by End Use, Value (US$ Mn) and Volume (Tons), 2019 - 2032

5.4.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Metallurgical Coke Market Outlook, 2019 - 2032

6.1. Asia Pacific Metallurgical Coke Market Outlook, by Product Type, Value (US$ Mn) and Volume (Tons), 2019 - 2032

6.1.1. Key Highlights

6.1.1.1. Blast Furnace Coke

6.1.1.2. Foundry Coke

6.1.1.3. Technical Coke

6.2. Asia Pacific Metallurgical Coke Market Outlook, by Ash Content, Value (US$ Mn) and Volume (Tons), 2019 - 2032

6.2.1. Key Highlights

6.2.1.1. Low Ash

6.2.1.2. High Ash

6.3. Asia Pacific Metallurgical Coke Market Outlook, by End Use, Value (US$ Mn) and Volume (Tons), 2019 - 2032

6.3.1. Key Highlights

6.3.1.1. Non-Ferrous Metal Casting

6.3.1.2. Iron and Steel Production

6.3.1.3. Chemical Industry

6.3.1.4. Others

6.3.2. BPS Analysis/Market Attractiveness Analysis

6.4. Asia Pacific Metallurgical Coke Market Outlook, by Country, Value (US$ Mn) and Volume (Tons), 2019 - 2032

6.4.1. Key Highlights

6.4.1.1. China Metallurgical Coke Market by Product Type, Value (US$ Mn) and Volume (Tons), 2019 - 2032

6.4.1.2. China Metallurgical Coke Market by Ash Content, Value (US$ Mn) and Volume (Tons), 2019 - 2032

6.4.1.3. China Metallurgical Coke Market by End Use, Value (US$ Mn) and Volume (Tons), 2019 - 2032

6.4.1.4. Japan Metallurgical Coke Market by Product Type, Value (US$ Mn) and Volume (Tons), 2019 - 2032

6.4.1.5. Japan Metallurgical Coke Market by Ash Content, Value (US$ Mn) and Volume (Tons), 2019 - 2032

6.4.1.6. Japan Metallurgical Coke Market by End Use, Value (US$ Mn) and Volume (Tons), 2019 - 2032

6.4.1.7. South Korea Metallurgical Coke Market by Product Type, Value (US$ Mn) and Volume (Tons), 2019 - 2032

6.4.1.8. South Korea Metallurgical Coke Market by Ash Content, Value (US$ Mn) and Volume (Tons), 2019 - 2032

6.4.1.9. South Korea Metallurgical Coke Market by End Use, Value (US$ Mn) and Volume (Tons), 2019 - 2032

6.4.1.10. India Metallurgical Coke Market by Product Type, Value (US$ Mn) and Volume (Tons), 2019 - 2032

6.4.1.11. India Metallurgical Coke Market by Ash Content, Value (US$ Mn) and Volume (Tons), 2019 - 2032

6.4.1.12. India Metallurgical Coke Market by End Use, Value (US$ Mn) and Volume (Tons), 2019 - 2032

6.4.1.13. Southeast Asia Metallurgical Coke Market by Product Type, Value (US$ Mn) and Volume (Tons), 2019 - 2032

6.4.1.14. Southeast Asia Metallurgical Coke Market by Ash Content, Value (US$ Mn) and Volume (Tons), 2019 - 2032

6.4.1.15. Southeast Asia Metallurgical Coke Market by End Use, Value (US$ Mn) and Volume (Tons), 2019 - 2032

6.4.1.16. Rest of Asia Pacific Metallurgical Coke Market by Product Type, Value (US$ Mn) and Volume (Tons), 2019 - 2032

6.4.1.17. Rest of Asia Pacific Metallurgical Coke Market by Ash Content, Value (US$ Mn) and Volume (Tons), 2019 - 2032

6.4.1.18. Rest of Asia Pacific Metallurgical Coke Market by End Use, Value (US$ Mn) and Volume (Tons), 2019 - 2032

6.4.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America Metallurgical Coke Market Outlook, 2019 - 2032

7.1. Latin America Metallurgical Coke Market Outlook, by Product Type, Value (US$ Mn) and Volume (Tons), 2019 - 2032

7.1.1. Key Highlights

7.1.1.1. Blast Furnace Coke

7.1.1.2. Foundry Coke

7.1.1.3. Technical Coke

7.2. Latin America Metallurgical Coke Market Outlook, by Ash Content, Value (US$ Mn) and Volume (Tons), 2019 - 2032

7.2.1. Key Highlights

7.2.1.1. Low Ash

7.2.1.2. High Ash

7.3. Latin America Metallurgical Coke Market Outlook, by End Use, Value (US$ Mn) and Volume (Tons), 2019 - 2032

7.3.1. Key Highlights

7.3.1.1. Non-Ferrous Metal Casting

7.3.1.2. Iron and Steel Production

7.3.1.3. Chemical Industry

7.3.1.4. Others

7.3.2. BPS Analysis/Market Attractiveness Analysis

7.4. Latin America Metallurgical Coke Market Outlook, by Country, Value (US$ Mn) and Volume (Tons), 2019 - 2032

7.4.1. Key Highlights

7.4.1.1. Brazil Metallurgical Coke Market by Product Type, Value (US$ Mn) and Volume (Tons), 2019 - 2032

7.4.1.2. Brazil Metallurgical Coke Market by Ash Content, Value (US$ Mn) and Volume (Tons), 2019 - 2032

7.4.1.3. Brazil Metallurgical Coke Market by End Use, Value (US$ Mn) and Volume (Tons), 2019 - 2032

7.4.1.4. Mexico Metallurgical Coke Market by Product Type, Value (US$ Mn) and Volume (Tons), 2019 - 2032

7.4.1.5. Mexico Metallurgical Coke Market by Ash Content, Value (US$ Mn) and Volume (Tons), 2019 - 2032

7.4.1.6. Mexico Metallurgical Coke Market by End Use, Value (US$ Mn) and Volume (Tons), 2019 - 2032

7.4.1.7. Argentina Metallurgical Coke Market by Product Type, Value (US$ Mn) and Volume (Tons), 2019 - 2032

7.4.1.8. Argentina Metallurgical Coke Market by Ash Content, Value (US$ Mn) and Volume (Tons), 2019 - 2032

7.4.1.9. Argentina Metallurgical Coke Market by End Use, Value (US$ Mn) and Volume (Tons), 2019 - 2032

7.4.1.10. Rest of Latin America Metallurgical Coke Market by Product Type, Value (US$ Mn) and Volume (Tons), 2019 - 2032

7.4.1.11. Rest of Latin America Metallurgical Coke Market by Ash Content, Value (US$ Mn) and Volume (Tons), 2019 - 2032

7.4.1.12. Rest of Latin America Metallurgical Coke Market by End Use, Value (US$ Mn) and Volume (Tons), 2019 - 2032

7.4.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Metallurgical Coke Market Outlook, 2019 - 2032

8.1. Middle East & Africa Metallurgical Coke Market Outlook, by Product Type, Value (US$ Mn) and Volume (Tons), 2019 - 2032

8.1.1. Key Highlights

8.1.1.1. Blast Furnace Coke

8.1.1.2. Foundry Coke

8.1.1.3. Technical Coke

8.2. Middle East & Africa Metallurgical Coke Market Outlook, by Ash Content, Value (US$ Mn) and Volume (Tons), 2019 - 2032

8.2.1. Key Highlights

8.2.1.1. Low Ash

8.2.1.2. High Ash

8.3. Middle East & Africa Metallurgical Coke Market Outlook, by End Use, Value (US$ Mn) and Volume (Tons), 2019 - 2032

8.3.1. Key Highlights

8.3.1.1. Non-Ferrous Metal Casting

8.3.1.2. Iron and Steel Production

8.3.1.3. Chemical Industry

8.3.1.4. Others

8.3.2. BPS Analysis/Market Attractiveness Analysis

8.4. Middle East & Africa Metallurgical Coke Market Outlook, by Country, Value (US$ Mn) and Volume (Tons), 2019 - 2032

8.4.1. Key Highlights

8.4.1.1. GCC Metallurgical Coke Market by Product Type, Value (US$ Mn) and Volume (Tons), 2019 - 2032

8.4.1.2. GCC Metallurgical Coke Market by Ash Content, Value (US$ Mn) and Volume (Tons), 2019 - 2032

8.4.1.3. GCC Metallurgical Coke Market by End Use, Value (US$ Mn) and Volume (Tons), 2019 - 2032

8.4.1.4. South Africa Metallurgical Coke Market by Product Type, Value (US$ Mn) and Volume (Tons), 2019 - 2032

8.4.1.5. South Africa Metallurgical Coke Market by Ash Content, Value (US$ Mn) and Volume (Tons), 2019 - 2032

8.4.1.6. South Africa Metallurgical Coke Market by End Use, Value (US$ Mn) and Volume (Tons), 2019 - 2032

8.4.1.7. Egypt Metallurgical Coke Market by Product Type, Value (US$ Mn) and Volume (Tons), 2019 - 2032

8.4.1.8. Egypt Metallurgical Coke Market by Ash Content, Value (US$ Mn) and Volume (Tons), 2019 - 2032

8.4.1.9. Egypt Metallurgical Coke Market by End Use, Value (US$ Mn) and Volume (Tons), 2019 - 2032

8.4.1.10. Rest of Middle East & Africa Metallurgical Coke Market by Product Type, Value (US$ Mn) and Volume (Tons), 2019 - 2032

8.4.1.11. Rest of Middle East & Africa Metallurgical Coke Market by Ash Content, Value (US$ Mn) and Volume (Tons), 2019 - 2032

8.4.1.12. Rest of Middle East & Africa Metallurgical Coke Market by End Use, Value (US$ Mn) and Volume (Tons), 2019 - 2032

8.4.2. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. By End Use vs by Ash Content Heat map

9.2. Manufacturer vs by Ash Content Heatmap

9.3. Company Market Share Analysis, 2023

9.4. Competitive Dashboard

9.5. Company Profiles

9.5.1. SunCoke Energy Inc.

9.5.1.1. Company Overview

9.5.1.2. Product Portfolio

9.5.1.3. Financial Overview

9.5.1.4. Business Strategies and Development

9.5.2. OKK Koksovny, A.S.

9.5.2.1. Company Overview

9.5.2.2. Product Portfolio

9.5.2.3. Financial Overview

9.5.2.4. Business Strategies and Development

9.5.3. Ennore Coke Limited

9.5.3.1. Company Overview

9.5.3.2. Product Portfolio

9.5.3.3. Financial Overview

9.5.3.4. Business Strategies and Development

9.5.4. Hickman, Williams & Company

9.5.4.1. Company Overview

9.5.4.2. Product Portfolio

9.5.4.3. Financial Overview

9.5.4.4. Business Strategies and Development

9.5.5. MECHEL PAO

9.5.5.1. Company Overview

9.5.5.2. Product Portfolio

9.5.5.3. Financial Overview

9.5.5.4. Business Strategies and Development

9.5.6. China Risun Coal Chemicals Group Limited

9.5.6.1. Company Overview

9.5.6.2. Product Portfolio

9.5.6.3. Financial Overview

9.5.6.4. Business Strategies and Development

9.5.7. YILCOQUE S.A.S.

9.5.7.1. Company Overview

9.5.7.2. Product Portfolio

9.5.7.3. Financial Overview

9.5.7.4. Business Strategies and Development

9.5.8. Sino Hua-An International Berhad

9.5.8.1. Company Overview

9.5.8.2. Product Portfolio

9.5.8.3. Financial Overview

9.5.8.4. Business Strategies and Development

9.5.9. China Shenhua Energy Company Limited

9.5.9.1. Company Overview

9.5.9.2. Product Portfolio

9.5.9.3. Financial Overview

9.5.9.4. Business Strategies and Development

9.5.10. ArcelorMittal

9.5.10.1. Company Overview

9.5.10.2. Product Portfolio

9.5.10.3. Financial Overview

9.5.10.4. Business Strategies and Development

9.5.11. Drummond Company, Inc.

9.5.11.1. Company Overview

9.5.11.2. Product Portfolio

9.5.11.3. Financial Overview

9.5.11.4. Business Strategies and Development

9.5.12. Jiangsu Surun High Carbon Co., Ltd.

9.5.12.1. Company Overview

9.5.12.2. Product Portfolio

9.5.12.3. Financial Overview

9.5.12.4. Business Strategies and Development

9.5.13. Nippon Steel & Sumitomo Metal

9.5.13.1. Company Overview

9.5.13.2. Product Portfolio

9.5.13.3. Financial Overview

9.5.13.4. Business Strategies and Development

9.5.14. Haldia Coke

9.5.14.1. Company Overview

9.5.14.2. Product Portfolio

9.5.14.3. Financial Overview

9.5.14.4. Business Strategies and Development

9.5.15. Baosteel Group

9.5.15.1. Company Overview

9.5.15.2. Product Portfolio

9.5.15.3. Financial Overview

9.5.15.4. Business Strategies and Development

9.5.16. Shanxi Sunlight Coking Group Company Ltd.

9.5.16.1. Company Overview

9.5.16.2. Product Portfolio

9.5.16.3. Financial Overview

9.5.16.4. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2024 |

|

2019 - 2024 |

2025 - 2032 |

Value: US$ Billion |

||

|

REPORT FEATURES |

DETAILS |

|

Product Type Coverage |

|

|

Ash Content Coverage |

|

|

End Use Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |