Micro-Fulfillment Market Forecast

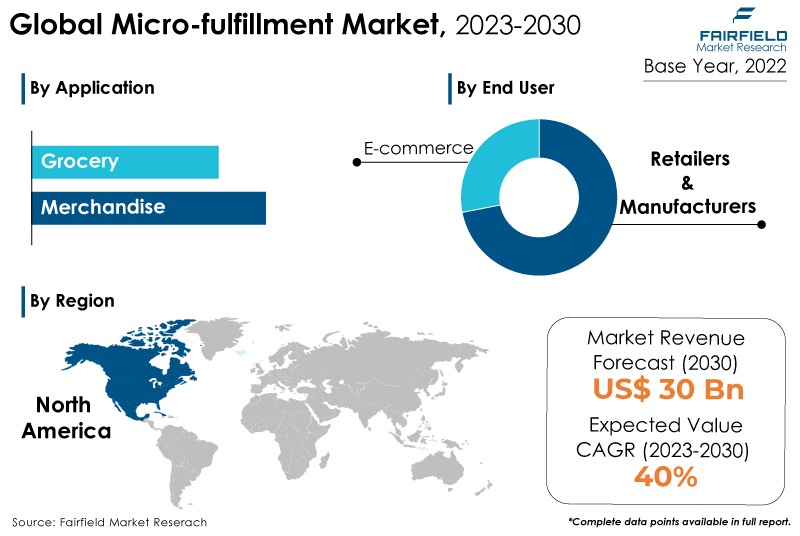

- Global micro-fulfillment market size to inflate at a stellar CAGR of 40% during 2023 - 2030

- Market valuation to reach beyond US$30 Bn by the end of 2030

Market Analysis in Brief

Micro-fulfillment is a solution within the eCommerce and retail industry that aims to optimise and expedite the process of order fulfillment for online purchases. It involves setting up compact and highly automated fulfillment centres in strategic locations, often within urban or densely populated areas, to facilitate the efficient picking, packing, and dispatching of online orders. Micro-fulfillment centres heavily rely on automation technologies and robotic systems to perform tasks such as product retrieval from shelves, sorting items, and assembling orders. This lowers the requirement for manual labor and improves operational efficiency.

The rapid growth of online shopping, especially during the COVID-19 pandemic, has fueled the need for efficient and fast order fulfillment solutions like micro-fulfillment. Retailers are increasingly adopting these systems to meet the rising eCommerce demand. Micro-fulfillment centres are strategically positioned in urban and suburban areas to reduce last-mile delivery times. This trend aligns with consumer expectations for quick deliveries, leading to the proliferation of localised fulfillment hubs. Moreover, retailers are partnering with technology providers and startups specializing in automation, robotics, and Fulfillment solutions to effectively implement and manage Micro-fulfillment systems.

Key Report Findings

- The tremendous expansion of online shopping, particularly during the COVID-19 epidemic, has increased the demand for effective and quick order fulfillment solutions such as micro-fulfilment. To address expanding eCommerce demand, retailers are progressively using these technologies.

- Demand for merchandise remains higher in the micro-fulfillment market.

- The manufacturers and distributors category held the largest share of the market revenue in 2022.

- North America will continue to lead, whereas the Asia Pacific micro-fulfillment market will experience the strongest growth till 2030.

Growth Drivers

Rapid Growth in eCommerce Order Fulfillment

One of the major drivers propelling the Micro-fulfillment market is the rapidly growing demand for fast and convenient eCommerce order fulfillment. As online shopping continues to gain traction and consumers expect shorter delivery times, Micro-fulfillment has emerged as a solution that directly addresses this demand. The surge in eCommerce activities, especially in recent years and further accelerated by the COVID-19 pandemic, has increased online orders.

Micro-fulfillment centres offer a way to process these orders and ensure timely deliveries efficiently. Modern consumers expect quick and reliable delivery of their online orders. Micro-fulfillment centres closer to urban areas enable retailers to meet these expectations by reducing delivery times and offering same-day or next-day delivery options.

Micro-fulfillment centres, strategically positioned in urban and suburban locations, minimise the distance between the fulfillment centre and the end customer. This proximity reduces last-mile delivery costs and contributes to faster order deliveries. The trend of urbanisation, with more people living in densely populated urban areas, has driven the need for fulfillment centres that can operate efficiently within limited space. Micro-fulfillment centres are designed to fit into urban landscapes and serve local populations.

The demand for expedited eCommerce order fulfillment, driven by consumer expectations for fast deliveries and the growth of online shopping, is a major driver pushing the Micro-fulfillment market forward. Retailers are adopting this solution to stay competitive and provide superior customer experiences in the evolving digital landscape.

Technological Innovations

Technology innovations drive the Micro-fulfillment market by enabling enhanced efficiency, accuracy, scalability, and customer satisfaction within the eCommerce and retail supply chain. These innovations introduce advanced capabilities that optimise various aspects of Micro-fulfillment operations, contributing to its growth and adoption. Technological advancements in robotics and automation enable micro-fulfillment centres to streamline tasks such as order picking, sorting, packing, and inventory management.

Robots can work alongside human employees, accelerating the fulfillment process and reducing the reliance on manual labor. Artificial Intelligence (AI), and machine learning (ML) algorithms can analyse historical data, order patterns, and real-time inventory levels to optimise order processing and inventory management. These technologies enhance predictive analytics, improving demand forecasting and reducing stockouts.

Seamless data integration from various sources, including online orders, inventory systems, and delivery tracking, provides real-time visibility into operations. This ensures accurate order status updates, minimises errors and enhances transparency. AI-powered algorithms can optimise delivery routes for last-mile logistics, reducing delivery times and costs. This is particularly relevant for micro-fulfillment centres located in densely populated areas.

Advanced sorting systems equipped with sensors and AI can efficiently sort items based on various criteria, such as size, weight, and fragility. This enhances the accuracy and speed of order fulfillment. Technology innovations drive the micro-fulfillment market by enhancing operational efficiency, accuracy, scalability, and customer experience. As retailers seek to meet the demands of eCommerce growth and consumer expectations, integrating advanced technologies becomes a critical enabler for successful micro-fulfillment operations.

Growth Challenges

High Initial Investments

The high initial investment required for setting up micro-fulfillment centres can significantly restrain the market. Implementing micro-fulfillment centres involves substantial costs, including purchasing automation technologies, robotics, software systems, warehouse infrastructure, and facility modifications. This initial financial commitment can be daunting, especially for small and medium-sized businesses with limited capital resources.

Many businesses, particularly startups and smaller retailers, might need help to allocate funds for the upfront investment required for micro-fulfillment. This can delay or even prevent their entry into the market. Organisations need to carefully assess the potential ROI from implementing micro-fulfillment centres. Considering factors like increased order volumes and operational efficiency gains, the time it takes to recoup the initial investment can impact the decision-making process.

Operational complexities can be a significant restraint for the micro-fulfillment market, posing challenges for businesses looking to implement and manage micro-fulfillment solutions. Integrating new automation and robotics technologies into existing fulfillment processes can be complex.

Micro-fulfillment solutions must seamlessly connect with eCommerce platforms, inventory management systems, and order processing software. micro-fulfillment centres must often accommodate a diverse range of products, sizes, and order volumes. Adapting automation systems to handle different types of merchandise while maintaining efficiency can be operationally complex.

Overview of Key Segments

Demand from Manufacturers and Distributors Higher

Manufacturers and distributors are the prominent end users driving the growth of the micro-fulfillment market. As the eCommerce landscape evolves and consumers' expectations for fast and efficient order fulfillment rise, manufacturers and distributors increasingly adopt micro-fulfillment solutions to optimise their supply chain operations. Manufacturers and distributors often serve business-to-business (B2B) and business-to-consumer (B2C) customers.

Micro-fulfillment centres can accommodate both orders, offering a versatile solution for various customer segments. They usually face the challenge of processing a high volume of orders efficiently. Micro-fulfillment centres with automation and robotics streamline order picking, sorting, and packing, leading to faster and more accurate order fulfillment.

Micro-fulfillment centres strategically located near manufacturing and distribution facilities enhance the overall supply chain efficiency. Products can be quickly transferred from production to fulfillment, reducing lead times. Manufacturers can leverage Micro-fulfillment to maintain a just-in-time inventory approach, ensuring that products are available for immediate fulfillment based on real-time demand.

Manufacturers and distributors can position Micro-fulfillment centres in urban areas, allowing them to reach customers more quickly in densely populated regions. This localised approach aids in faster last-mile delivery.

The adoption of Micro-fulfillment solutions by manufacturers and distributors demonstrates their commitment to meeting the evolving demands of modern consumers and enhancing their supply chain capabilities in the dynamic eCommerce landscape.

Merchandise Application Largest

Micro-fulfillment plays a pivotal role in merchandise applications within the retail and eCommerce sectors. It revolutionises how merchandise is processed, packed, and delivered, bringing numerous advantages to retailers and customers alike. Micro-fulfillment centres leverage automation and robotics to swiftly process orders, ensuring that

Merchandise is picked, packed, and prepared for delivery with exceptional speed and accuracy. Retailers can achieve faster last-mile deliveries by strategically locating Micro-fulfillment centres in urban areas, meeting consumers' expectations for swift product arrivals. Micro-fulfillment employs real-time inventory tracking and management systems to monitor merchandise levels, reducing stockouts and ensuring optimal product availability.

Retailers can tailor merchandise applications through micro-fulfillment centres, enabling personalised packaging, bundling, and order assembly that enhances the customer experience.

Micro-fulfillment's scalability allows retailers to efficiently manage increased order volumes and fulfill customer expectations during high-demand periods, such as sales events or holidays. Micro-fulfillment aligns seamlessly with omnichannel strategies, enabling retailers to offer customers various fulfillment options, including in-store pickups or curbside delivery.

Micro-fulfillment has redefined how merchandise applications are executed, enabling retailers to offer faster, more personalised, and responsive services that cater to the evolving demands of today's digital-savvy consumers.

Growth Opportunities Across Regions

North America Leads on the Back of eCommerce Expansion

North America dominated the global micro-fulfillment market in 2022. North America is indeed a significant leader in the micro-fulfillment market. The region's advanced eCommerce infrastructure, tech-savvy consumer base, and favorable business environment have contributed to its prominence in adopting and implementing micro-fulfillment solutions.

North America has a well-established and rapidly growing eCommerce sector driven by the popularity of online shopping among consumers. The demand for efficient order fulfillment solutions aligns with the proliferation of micro-fulfillment centres. Many major cities in North America have high population densities, making micro-fulfillment centres strategically viable. These centres can cater to densely populated areas, facilitating faster last-mile deliveries.

North America is known for its early adoption of technology and innovation. This readiness to embrace automation, robotics, and advanced logistics technologies has accelerated the implementation of micro-fulfillment solutions. North American consumers expect fast and reliable delivery options, and micro-fulfillment helps retailers meet these expectations by providing quick order processing and same-day or next-day delivery choices.

Both established retail giants and innovative startups in North America have recognised the potential of micro-fulfillment. This diverse range of players has contributed to the growth of the market. These factors are expected to drive the growth of the micro-fulfillment market in the region during the forecast period.

Asia Pacific to Witness the Fastest Growth

Asia Pacific was indeed emerging as a lucrative and promising market for micro-fulfillment. The region's rapid urbanisation, growing eCommerce adoption, and technological innovation were contributing factors. Asia Pacific has experienced a significant surge in eCommerce activities, with a large population embracing online shopping. The demand for efficient order fulfillment solutions like micro-fulfillment has followed suit.

Many nations in the Asia Pacific, including China, India, and southeast Asian nations, have densely populated urban centres. Micro-fulfillment centres can cater to these urban populations, reducing last-mile delivery distances. The region has demonstrated a penchant for adopting new technologies and innovations. This trend bodes well for implementing

Micro-fulfillment solutions, which rely heavily on automation and robotics. The growing need for streamlined logistics and supply chain operations has increased interest in advanced fulfillment solutions like micro-fulfillment. Asia Pacific consumers have preferred online shopping due to its convenience.

Micro-fulfillment can enhance this convenience by ensuring fast and accurate order deliveries. Both established retailers and tech startups in Asia Pacific are investing in and exploring micro-fulfillment solutions to capitalise on the evolving eCommerce landscape. These factors are expected to drive the growth of the micro-fulfillment market in the region during the forecast period.

Micro-fulfillment Market: Competitive Landscape

Some of the leading players at the forefront in the micro-fulfillment market space include Honeywell International Inc., Flowspace, LOCAD, Instacart, Ahold Delhaize, Fortna, Inc., HÖRMANN, Inc., The Kroger Company, Dematic, Alert Innovation, Bastian Solutions, LLC, PACK and SEND Holdings Pty Ltd, Swisslog, Davinci Micro-fulfillment, KPI Integrated Solutions, Pacline Overhead Conveyors, and OPEX.

Recent Notable Developments

In September 2023, Global marine container carrier A.P. Moller-Maersk announced that it will open a 38,000-square-foot automated eCommerce fulfillment centre in Dallas that is powered by robotic and software technology from micro-fulfillment centre (MFC) provider Fabric.

In February 2023, Fulfil, a startup that offers robotic micro-fulfillment centre (MFC) solutions for grocers to more efficiently pick and pack eCommerce orders, announced that it has raised $60 million in its Series B round.

In March 2022, Instacart launched key new Fulfillment, advertising, and insights capabilities for retailers like Publix, ALDI, Schnuck Markets Inc., Good Food Holdings, Plum Market, Key Food, Food Bazaar, and others.

In March 2021, Flowspace announced $31 million in new funding. The new Series B investment was led by BuildGroup of Austin, Texas, with participation from existing investors. Flowspace helps businesses manage their warehousing and Fulfillment through its proprietary software platform, which now runs in hundreds of partnering fulfillment centres across the US.

Global Micro-fulfillment Market is Segmented as Below:

By End User

- Retailers

- Manufacturers

- eCommerce

By Component

- Control Systems

- Material Handling

By Application

- Grocery

- Merchandise

By Geographic Coverage

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Turkey

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Egypt

- Nigeria

- Rest of the Middle East & Africa

1. Executive Summary

1.1. Global Micro-fulfillment Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2022

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. Covid-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Global Micro-fulfillment Market Outlook, 2018 - 2030

3.1. Global Micro-fulfillment Market Outlook, by End User, Value (US$ Bn), 2018 - 2030

3.1.1. Key Highlights

3.1.1.1. Retailers

3.1.1.2. Manufacturers

3.1.1.3. E-commerce

3.2. Global Micro-fulfillment Market Outlook, by Component, Value (US$ Bn), 2018 - 2030

3.2.1. Key Highlights

3.2.1.1. Control Systems

3.2.1.2. Material Handling

3.3. Global Micro-fulfillment Market Outlook, by Application, Value (US$ Bn), 2018 - 2030

3.3.1. Key Highlights

3.3.1.1. Grocery

3.3.1.2. Merchandise

3.4. Global Micro-fulfillment Market Outlook, by Region, Value (US$ Bn), 2018 - 2030

3.4.1. Key Highlights

3.4.1.1. North America

3.4.1.2. Europe

3.4.1.3. Asia Pacific

3.4.1.4. Latin America

3.4.1.5. Middle East & Africa

4. North America Micro-fulfillment Market Outlook, 2018 - 2030

4.1. North America Micro-fulfillment Market Outlook, by End User, Value (US$ Bn), 2018 - 2030

4.1.1. Key Highlights

4.1.1.1. Retailers

4.1.1.2. Manufacturers

4.1.1.3. E-commerce

4.2. North America Micro-fulfillment Market Outlook, by Component, Value (US$ Bn), 2018 - 2030

4.2.1. Key Highlights

4.2.1.1. Control Systems

4.2.1.2. Material Handling

4.3. North America Micro-fulfillment Market Outlook, by Application, Value (US$ Bn), 2018 - 2030

4.3.1. Key Highlights

4.3.1.1. Grocery

4.3.1.2. Merchandise

4.3.2. Market Attractiveness Analysis

4.4. North America Micro-fulfillment Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

4.4.1. Key Highlights

4.4.1.1. U.S. Micro-fulfillment Market by End User, Value (US$ Bn), 2018 - 2030

4.4.1.2. U.S. Micro-fulfillment Market, by Component, Value (US$ Bn), 2018 - 2030

4.4.1.3. U.S. Micro-fulfillment Market by Application, Value (US$ Bn), 2018 - 2030

4.4.1.4. Canada Micro-fulfillment Market by End User, Value (US$ Bn), 2018 - 2030

4.4.1.5. Canada Micro-fulfillment Market, by Component, Value (US$ Bn), 2018 - 2030

4.4.1.6. Canada Micro-fulfillment Market by Application, Value (US$ Bn), 2018 - 2030

4.4.2. BPS Analysis/Market Attractiveness Analysis

5. Europe Micro-fulfillment Market Outlook, 2018 - 2030

5.1. Europe Micro-fulfillment Market Outlook, by End User, Value (US$ Bn), 2018 - 2030

5.1.1. Key Highlights

5.1.1.1. Retailers

5.1.1.2. Manufacturers

5.1.1.3. E-commerce

5.2. Europe Micro-fulfillment Market Outlook, by Component, Value (US$ Bn), 2018 - 2030

5.2.1. Key Highlights

5.2.1.1. Control Systems

5.2.1.2. Material Handling

5.3. Europe Micro-fulfillment Market Outlook, by Application, Value (US$ Bn), 2018 - 2030

5.3.1. Key Highlights

5.3.1.1. Grocery

5.3.1.2. Merchandise

5.3.2. Market Attractiveness Analysis

5.4. Europe Micro-fulfillment Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

5.4.1. Key Highlights

5.4.1.1. Germany Micro-fulfillment Market by End User, Value (US$ Bn), 2018 - 2030

5.4.1.2. Germany Micro-fulfillment Market, by Component, Value (US$ Bn), 2018 - 2030

5.4.1.3. Germany Micro-fulfillment Market by Application, Value (US$ Bn), 2018 - 2030

5.4.1.4. U.K. Micro-fulfillment Market by End User, Value (US$ Bn), 2018 - 2030

5.4.1.5. U.K. Micro-fulfillment Market, by Component, Value (US$ Bn), 2018 - 2030

5.4.1.6. U.K. Micro-fulfillment Market by Application, Value (US$ Bn), 2018 - 2030

5.4.1.7. France Micro-fulfillment Market by End User, Value (US$ Bn), 2018 - 2030

5.4.1.8. France Micro-fulfillment Market, by Component, Value (US$ Bn), 2018 - 2030

5.4.1.9. France Micro-fulfillment Market by Application, Value (US$ Bn), 2018 - 2030

5.4.1.10. Italy Micro-fulfillment Market by End User, Value (US$ Bn), 2018 - 2030

5.4.1.11. Italy Micro-fulfillment Market, by Component, Value (US$ Bn), 2018 - 2030

5.4.1.12. Italy Micro-fulfillment Market by Application, Value (US$ Bn), 2018 - 2030

5.4.1.13. Turkey Micro-fulfillment Market by End User, Value (US$ Bn), 2018 - 2030

5.4.1.14. Turkey Micro-fulfillment Market, by Component, Value (US$ Bn), 2018 - 2030

5.4.1.15. Turkey Micro-fulfillment Market by Application, Value (US$ Bn), 2018 - 2030

5.4.1.16. Russia Micro-fulfillment Market by End User, Value (US$ Bn), 2018 - 2030

5.4.1.17. Russia Micro-fulfillment Market, by Component, Value (US$ Bn), 2018 - 2030

5.4.1.18. Russia Micro-fulfillment Market by Application, Value (US$ Bn), 2018 - 2030

5.4.1.19. Rest of Europe Micro-fulfillment Market by End User, Value (US$ Bn), 2018 - 2030

5.4.1.20. Rest of Europe Micro-fulfillment Market, by Component, Value (US$ Bn), 2018 - 2030

5.4.1.21. Rest of Europe Micro-fulfillment Market by Application, Value (US$ Bn), 2018 - 2030

5.4.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Micro-fulfillment Market Outlook, 2018 - 2030

6.1. Asia Pacific Micro-fulfillment Market Outlook, by End User, Value (US$ Bn), 2018 - 2030

6.1.1. Key Highlights

6.1.1.1. Retailers

6.1.1.2. Manufacturers

6.1.1.3. E-commerce

6.2. Asia Pacific Micro-fulfillment Market Outlook, by Component, Value (US$ Bn), 2018 - 2030

6.2.1. Key Highlights

6.2.1.1. Control Systems

6.2.1.2. Material Handling

6.3. Asia Pacific Micro-fulfillment Market Outlook, by Application, Value (US$ Bn), 2018 - 2030

6.3.1. Key Highlights

6.3.1.1. Grocery

6.3.1.2. Merchandise

6.3.2. Market Attractiveness Analysis

6.4. Asia Pacific Micro-fulfillment Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

6.4.1. Key Highlights

6.4.1.1. China Micro-fulfillment Market by End User, Value (US$ Bn), 2018 - 2030

6.4.1.2. China Micro-fulfillment Market, by Component, Value (US$ Bn), 2018 - 2030

6.4.1.3. China Micro-fulfillment Market by Application, Value (US$ Bn), 2018 - 2030

6.4.1.4. Japan Micro-fulfillment Market by End User, Value (US$ Bn), 2018 - 2030

6.4.1.5. Japan Micro-fulfillment Market, by Component, Value (US$ Bn), 2018 - 2030

6.4.1.6. Japan Micro-fulfillment Market by Application, Value (US$ Bn), 2018 - 2030

6.4.1.7. South Korea Micro-fulfillment Market by End User, Value (US$ Bn), 2018 - 2030

6.4.1.8. South Korea Micro-fulfillment Market, by Component, Value (US$ Bn), 2018 - 2030

6.4.1.9. South Korea Micro-fulfillment Market by Application, Value (US$ Bn), 2018 - 2030

6.4.1.10. India Micro-fulfillment Market by End User, Value (US$ Bn), 2018 - 2030

6.4.1.11. India Micro-fulfillment Market, by Component, Value (US$ Bn), 2018 - 2030

6.4.1.12. India Micro-fulfillment Market by Application, Value (US$ Bn), 2018 - 2030

6.4.1.13. Southeast Asia Micro-fulfillment Market by End User, Value (US$ Bn), 2018 - 2030

6.4.1.14. Southeast Asia Micro-fulfillment Market, by Component, Value (US$ Bn), 2018 - 2030

6.4.1.15. Southeast Asia Micro-fulfillment Market by Application, Value (US$ Bn), 2018 - 2030

6.4.1.16. Rest of Asia Pacific Micro-fulfillment Market by End User, Value (US$ Bn), 2018 - 2030

6.4.1.17. Rest of Asia Pacific Micro-fulfillment Market, by Component, Value (US$ Bn), 2018 - 2030

6.4.1.18. Rest of Asia Pacific Micro-fulfillment Market by Application, Value (US$ Bn), 2018 - 2030

6.4.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America Micro-fulfillment Market Outlook, 2018 - 2030

7.1. Latin America Micro-fulfillment Market Outlook, by End User, Value (US$ Bn), 2018 - 2030

7.1.1. Key Highlights

7.1.1.1. Retailers

7.1.1.2. Manufacturers

7.1.1.3. E-commerce

7.2. Latin America Micro-fulfillment Market Outlook, by Component, Value (US$ Bn), 2018 - 2030

7.2.1. Key Highlights

7.2.1.1. Control Systems

7.2.1.2. Material Handling

7.3. Latin America Micro-fulfillment Market Outlook, by Application, Value (US$ Bn), 2018 - 2030

7.3.1. Key Highlights

7.3.1.1. Grocery

7.3.1.2. Merchandise

7.3.2. Market Attractiveness Analysis

7.4. Latin America Micro-fulfillment Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

7.4.1. Key Highlights

7.4.1.1. Brazil Micro-fulfillment Market by End User, Value (US$ Bn), 2018 - 2030

7.4.1.2. Brazil Micro-fulfillment Market, by Component, Value (US$ Bn), 2018 - 2030

7.4.1.3. Brazil Micro-fulfillment Market by Application, Value (US$ Bn), 2018 - 2030

7.4.1.4. Mexico Micro-fulfillment Market by End User, Value (US$ Bn), 2018 - 2030

7.4.1.5. Mexico Micro-fulfillment Market, by Component, Value (US$ Bn), 2018 - 2030

7.4.1.6. Mexico Micro-fulfillment Market by Application, Value (US$ Bn), 2018 - 2030

7.4.1.7. Argentina Micro-fulfillment Market by End User, Value (US$ Bn), 2018 - 2030

7.4.1.8. Argentina Micro-fulfillment Market, by Component, Value (US$ Bn), 2018 - 2030

7.4.1.9. Argentina Micro-fulfillment Market by Application, Value (US$ Bn), 2018 - 2030

7.4.1.10. Rest of Latin America Micro-fulfillment Market by End User, Value (US$ Bn), 2018 - 2030

7.4.1.11. Rest of Latin America Micro-fulfillment Market, by Component, Value (US$ Bn), 2018 - 2030

7.4.1.12. Rest of Latin America Micro-fulfillment Market by Application, Value (US$ Bn), 2018 - 2030

7.4.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Micro-fulfillment Market Outlook, 2018 - 2030

8.1. Middle East & Africa Micro-fulfillment Market Outlook, by End User, Value (US$ Bn), 2018 - 2030

8.1.1. Key Highlights

8.1.1.1. Retailers

8.1.1.2. Manufacturers

8.1.1.3. E-commerce

8.2. Middle East & Africa Micro-fulfillment Market Outlook, by Component, Value (US$ Bn), 2018 - 2030

8.2.1. Key Highlights

8.2.1.1. Control Systems

8.2.1.2. Material Handling

8.3. Middle East & Africa Micro-fulfillment Market Outlook, by Application, Value (US$ Bn), 2018 - 2030

8.3.1. Key Highlights

8.3.1.1. Grocery

8.3.1.2. Merchandise

8.3.2. Market Attractiveness Analysis

8.4. Middle East & Africa Micro-fulfillment Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

8.4.1. Key Highlights

8.4.1.1. GCC Micro-fulfillment Market by End User, Value (US$ Bn), 2018 - 2030

8.4.1.2. GCC Micro-fulfillment Market, by Component, Value (US$ Bn), 2018 - 2030

8.4.1.3. GCC Micro-fulfillment Market by Application, Value (US$ Bn), 2018 - 2030

8.4.1.4. South Africa Micro-fulfillment Market by End User, Value (US$ Bn), 2018 - 2030

8.4.1.5. South Africa Micro-fulfillment Market, by Component, Value (US$ Bn), 2018 - 2030

8.4.1.6. South Africa Micro-fulfillment Market by Application, Value (US$ Bn), 2018 - 2030

8.4.1.7. Egypt Micro-fulfillment Market by End User, Value (US$ Bn), 2018 - 2030

8.4.1.8. Egypt Micro-fulfillment Market, by Component, Value (US$ Bn), 2018 - 2030

8.4.1.9. Egypt Micro-fulfillment Market by Application, Value (US$ Bn), 2018 - 2030

8.4.1.10. Nigeria Micro-fulfillment Market by End User, Value (US$ Bn), 2018 - 2030

8.4.1.11. Nigeria Micro-fulfillment Market, by Component, Value (US$ Bn), 2018 - 2030

8.4.1.12. Nigeria Micro-fulfillment Market by Application, Value (US$ Bn), 2018 - 2030

8.4.1.13. Rest of Middle East & Africa Micro-fulfillment Market by End User, Value (US$ Bn), 2018 - 2030

8.4.1.14. Rest of Middle East & Africa Micro-fulfillment Market, by Component, Value (US$ Bn), 2018 - 2030

8.4.1.15. Rest of Middle East & Africa Micro-fulfillment Market by Application, Value (US$ Bn), 2018 - 2030

8.4.2. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. Application vs Component Heatmap

9.2. Manufacturer vs Component Heatmap

9.3. Company Market Share Analysis, 2022

9.4. Competitive Dashboard

9.5. Company Profiles

9.5.1. Flowspace

9.5.1.1. Company Overview

9.5.1.2. Product Portfolio

9.5.1.3. Financial Overview

9.5.1.4. Business Strategies and Development

9.5.2. Fortna Inc.

9.5.2.1. Company Overview

9.5.2.2. Product Portfolio

9.5.2.3. Financial Overview

9.5.2.4. Business Strategies and Development

9.5.3. LOCAD

9.5.3.1. Company Overview

9.5.3.2. Product Portfolio

9.5.3.3. Financial Overview

9.5.3.4. Business Strategies and Development

9.5.4. Instacart

9.5.4.1. Company Overview

9.5.4.2. Product Portfolio

9.5.4.3. Financial Overview

9.5.4.4. Business Strategies and Development

9.5.5. Ahold Delhaize

9.5.5.1. Company Overview

9.5.5.2. Product Portfolio

9.5.5.3. Financial Overview

9.5.5.4. Business Strategies and Development

9.5.6. HÖRMANN

9.5.6.1. Company Overview

9.5.6.2. Product Portfolio

9.5.6.3. Financial Overview

9.5.6.4. Business Strategies and Development

9.5.7. Alert Innovation, Inc.

9.5.7.1. Company Overview

9.5.7.2. Product Portfolio

9.5.7.3. Financial Overview

9.5.7.4. Business Strategies and Development

9.5.8. The Kroger Company

9.5.8.1. Company Overview

9.5.8.2. Product Portfolio

9.5.8.3. Business Strategies and Development

9.5.9. Dematic

9.5.9.1. Company Overview

9.5.9.2. Product Portfolio

9.5.9.3. Financial Overview

9.5.9.4. Business Strategies and Development

9.5.10. Honeywell International Inc

9.5.10.1. Company Overview

9.5.10.2. Product Portfolio

9.5.10.3. Financial Overview

9.5.10.4. Business Strategies and Development

9.5.11. Bastian Solutions, LLC

9.5.11.1. Company Overview

9.5.11.2. Product Portfolio

9.5.11.3. Financial Overview

9.5.11.4. Business Strategies and Development

9.5.12. PACK and SEND Holdings Pty Ltd

9.5.12.1. Company Overview

9.5.12.2. Product Portfolio

9.5.12.3. Financial Overview

9.5.12.4. Business Strategies and Development

9.5.13. Swisslog

9.5.13.1. Company Overview

9.5.13.2. Product Portfolio

9.5.13.3. Financial Overview

9.5.13.4. Business Strategies and Development

9.5.14. PACLINE OVERHEAD CONVEYORS

9.5.14.1. Company Overview

9.5.14.2. Product Portfolio

9.5.14.3. Financial Overview

9.5.14.4. Business Strategies and Development

9.5.15. Davinci Micro-fulfillment

9.5.15.1. Company Overview

9.5.15.2. Product Portfolio

9.5.15.3. Financial Overview

9.5.15.4. Business Strategies and Development

9.5.16. KPI Integrated Solutions

9.5.16.1. Company Overview

9.5.16.2. Product Portfolio

9.5.16.3. Business Strategies and Development

9.5.17. OPEX

9.5.17.1. Company Overview

9.5.17.2. Product Portfolio

9.5.17.3. Financial Overview

9.5.17.4. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2022 |

|

2018 - 2022 |

2023 - 2030 |

Value: US$ Million |

||

|

REPORT FEATURES |

DETAILS |

|

End User Coverage |

|

|

Component Coverage |

|

|

Application Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |