Global Mitral Valve Disease Market Forecast

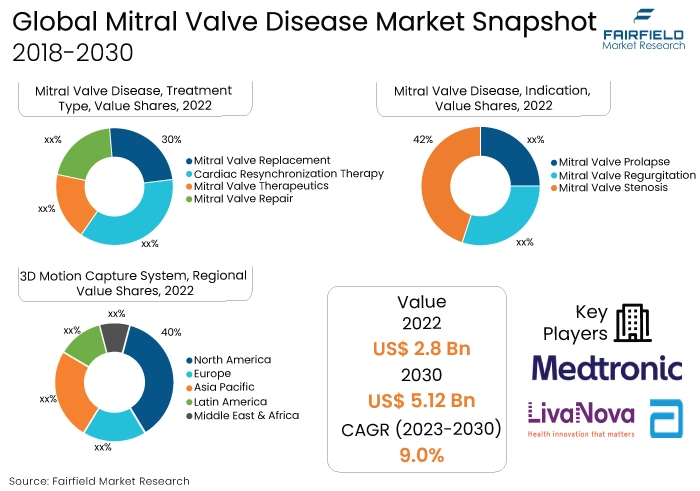

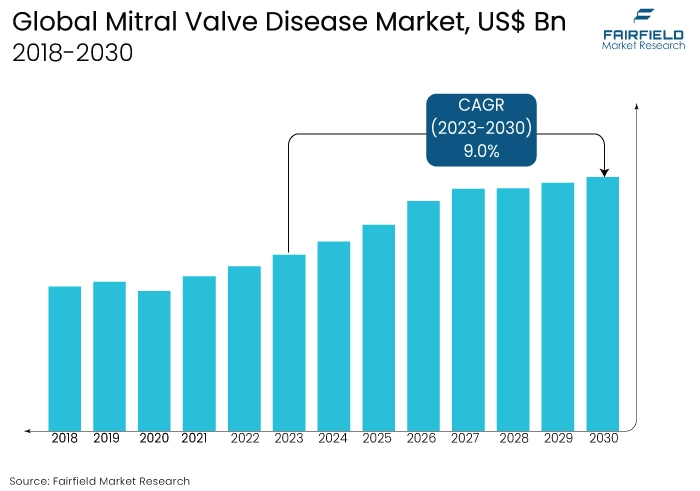

- Mitral valve disease market size to jump from its currently valuation of US$2.8 Bn to US$5.12 Bn by 2030

- The market revenue will see a robust CAGR of 9% between 2023 and 2030

Quick Report Digest

- The market for mitral valve disease is expanding due to the increased prevalence of mitral valve problems brought on by congenital abnormalities and infections. The mitral valve's structure may be impacted by congenital abnormalities. Mitral valve stenosis or regurgitation can result from congenital problems that cause the valve to be too tiny, too big, or to have an irregular shape.

- The increase in the population of elderly people is one of the main factors driving the market for mitral valve disease. The prevalence of mitral valve disease is anticipated to rise as the world's population continues to age, creating a demand for new therapies to treat the condition's symptoms.

- The development of mitral heart valves and drugs are constrained by factors including the strict controls imposed by the regulating bodies on their use, approval, and development. Additionally, precise guidelines must be followed during the production of mitral valve repair, replacement, and cardiac resynchronization devices to guarantee their quality and safety.

- In terms of revenue, the mitral valve repair segment dominated the mitral valve disease market in 2022. The benefits of the repair technique, such as the preservation of the natural valve and speedier recuperation, are credited with this rise.

- The segment with the highest revenue in 2022 was mitral valve regurgitation. Growth in the mitral valve regurgitation market is attributable to the key players' development of enhanced mitral valve devices for treating mitral regurgitation as well as an increase in the incidence of mitral prolapse, which causes mitral regurgitation.

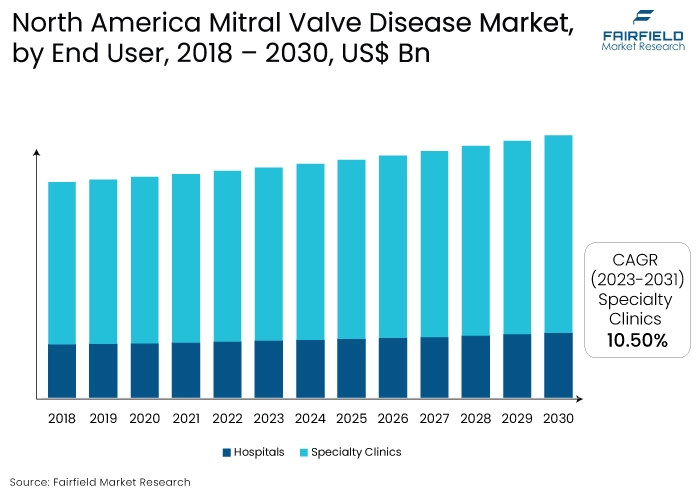

- Since hospitals are the principal location for mitral valve replacement and repair procedures, the hospitals segment held the greatest market share in 2022 and is anticipated to expand at the quickest rate during the forecast period.

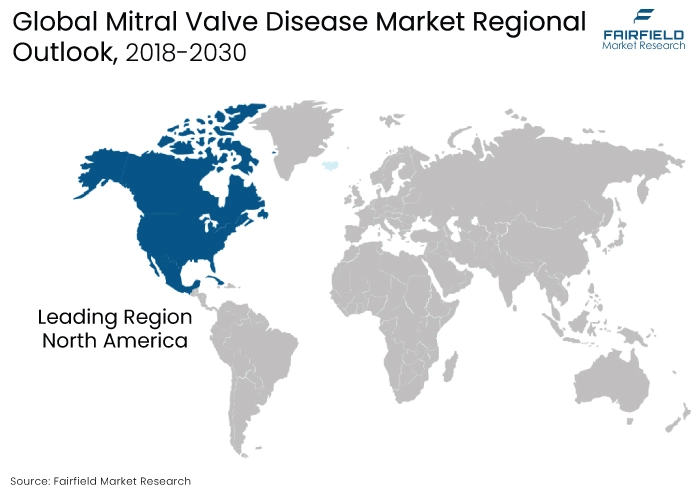

- In terms of revenue, North America held a sizable market share for mitral valve disease in 2022. This is mostly linked to the region's advanced healthcare system, increased consumer knowledge of mitral valve disorders, and an increase in the prevalence of mitral valve diseases there.

- The region with the highest projected growth rate is Asia-Pacific. This is linked to the enormous population base and rising purchasing power of populous nations like China and India. Players in the mitral valve disease market have access to lucrative opportunities in these nations.

A Look Back and a Look Forward - Comparative Analysis

The increase in mitral valve illnesses, surge in demand for cutting-edge pharmaceuticals and technology for treating mitral valves, and increased public knowledge of mitral valve disease and its cutting-edge treatment choices are the primary drivers of the mitral valve disease market size growth. This can be attributable to an ageing population, an increase in risk factors including high BP and high cholesterol, and modifications in lifestyle choices.

Throughout the historical period of 2018-2022, the market had staggered growth. Due to factors including ageing populations and improved diagnostic tools, mitral valve disease has grown more common, especially mitral regurgitation and mitral stenosis. The rise in disease prevalence has fuelled market expansion. Additionally, mitral valve disease has been the focus of a sizable amount of clinical research and development. The market has grown due to the development of novel treatments, medications, and equipment.

Medical technology advancements and enhanced therapeutic approaches have enabled better management of mitral valve diseases, which may aid market growth. Additionally, the market is expanding as a result of an increase in the need for minimally invasive therapies for mitral valve diseases and the following growth of such therapies.

Key Growth Determinants

- Growing Prevalence of Mitral Valve Disease

The market for mitral valve disease is primarily driven by the disease's rising prevalence. One of the most prevalent heart valve conditions, mitral valve disease affects millions of people globally. Around 26 million people worldwide are thought to have mitral valve disease, according to the World Health Organization (WHO).

According to estimates, 2.5% of people in the US suffer from mitral valve disease. The likelihood of getting mitral valve disease rises with population age. This is due to the fact that the mitral valve can age-relatedly deteriorate, resulting in leakage or narrowing. Mitral valve dysfunction is a risk factor for both diabetes and obesity. In addition, obesity and diabetes can produce high blood pressure and high cholesterol, both of which can harm the mitral valve.

- Advancements in Technology

Medical technology advancements and new treatment approaches have made it feasible to manage mitral valve disorders better, which may boost market expansion. For instance, the MitraClip, a particular type of TMVR device, can be used to repair the mitral valve. The valve leaflets are attached to a small clip as part of the system to help with proper closing.

MitraClip has been demonstrated to be effective in reducing mitral regurgitation and relieving symptoms in people who are not candidates for traditional surgery. The mitral valve disease market is boosted by these technological advancements since they promote the utilisation of these cutting-edge technologies.

- Increasing Adoption for Minimally Invasive Techniques

The market is growing because of the rise in demand for minimally invasive techniques for the treatment of mitral valve disorders and the ensuing development of minimally invasive products. For instance, the

Intrepid transcatheter mitral valve replacement (TMVR) system from Medtronic Plc has been approved for an early feasibility study (EFS) by the US Food and Drug Administration (FDA) as of September 2019. This technique uses a minimally invasive transfemoral access approach to replace the mitral valve in the heart. The market projection for mitral valve disease is expected to rise due to these recent advances in the industry.

Major Restraints

- High Costs Associated with Mitral Valve Replacement

The risk involved in the procedure and the high cost of mitral valve replacement and repair surgeries restrained market expansion. Surgical techniques to replace or repair the mitral valve are costly. The cost of therapy might vary depending on a variety of variables, such as the disease's severity, the type of procedure used, and the facility where it is carried out.

- Potentially Unfavourable Health Consequences

Strict regulations by the governing organisations for their use, approval, and use in medical procedures are just one of the issues limiting the development of mitral heart valves and medications. Furthermore, certain regulations must be observed throughout the production of cardiac resynchronization, mitral valve repair, and other associated equipment to ensure the safety and quality of these devices. Such regulations limiting the development and use of mitral valves restrict the market's growth.

Key Trends and Opportunities for Mitral valve disease Market

- Growing Screening and Awareness Initiatives

The market is positively impacted by enhanced awareness campaigns, early diagnosis programs, and increased patient screening efforts that lead to early identification and rapid treatment of mitral valve illnesses. Early diagnosis by healthcare professionals increases the likelihood of effective therapies and enhances general patient wellbeing.

- Increased Presence of Key Companies

Companies have the chance to grow their market share through working with healthcare organisations, forming alliances, and looking into underserved areas for future expansion. Increased market penetration can also result from expanding product portfolios and delivery networks.

- Increasing Demand for Targeted Therapies and Personalised Medicine

With the potential to improve treatment and patient satisfaction, personalised medicine approaches could modify therapies based on the unique traits of patients and the severity of their diseases. Optimising therapy approaches and influencing the market's overall growth can be accomplished by incorporating genetic testing and biomarker analysis into treatment decisions.

How Does the Regulatory Scenario Shape this Industry?

The regulatory environment has a big impact on the mitral valve disease sector because it establishes standards, ensures patient safety, and affects product development and market access. Prior to going on the market, regulatory organisations like the FDA in the United States or the EMA in Europe demand that medical devices and drugs for mitral valve disease go through extensive testing and review.

Furthermore, products must adhere to safety and efficacy requirements before they can be approved. In addition, clinical trials are required by businesses creating therapies for mitral valve disease to prove their efficacy. The design, conduct, and reporting of these trials are governed by regulatory restrictions, which sculpts the body of knowledge for novel therapies.

Fairfield’s Ranking Board

Top Segments

- Mitral Valve Repair to be the Sought-After Treatment Type

The mitral valve repair segment dominated the market in 2022. This surgical surgery fixes the damaged valve tissue to get the mitral valve back to working normally. When practicable, it is the treatment of choice since it offers superior long-term results and less risks when compared to valve replacement.

The mitral valve replacement category is expected to grow significantly over the forecast period. The damaged or diseased mitral valve may be surgically removed and replaced with a prosthetic valve. When the valve damage is too serious to be repaired, this approach is used. It successfully restores healthy blood flow to the heart.

- Mitral Valve Stenosis Category Takes the Lead

In 2022, the mitral valve stenosis category dominated the market, and it is predicted to grow significantly over the course of the forecast period. The narrowing of the mitral valve, which prevents blood flow from the left atrium to the left ventricle, is a defining feature of mitral valve stenosis. The market for mitral valve disease focuses on creating drugs to cure the condition's symptoms, enhance valve performance, and bring about normal blood flow.

Furthermore, the mitral valve regurgitation category is expected to expand significantly. When blood backflows from the left ventricle into the left atrium during a heartbeat, it is referred to as mitral valve regurgitation. The goal of the market for mitral valve disease is to create procedures and tools for addressing regurgitation, treating the mitral valve, and reestablishing adequate blood flow to enhance patients' cardiac function.

- Stage D Mitral Valve Disease Dominant

The stage D category dominated the market in 2022, stage D of mitral valve disease often represents advanced and severe conditions where symptoms are significant. At this point, the available treatment choices could include intricate and expensive procedures like mitral valve replacement or repair. These treatments greatly increase healthcare income and are usually more resource-intensive.

Additionally, in stage D cases, technological advancements in medicine, like transcatheter mitral valve treatments, might be more frequently utilised. The cost of these modern treatments could get higher due to these novel procedures, which increases revenue for healthcare facilities that provide treatments.

- Hospitals Represent the Largest End User Category

The hospitals category held a majority of the market share. With their comprehensive diagnostic, therapeutic, and surgical services, hospitals are important end users in the market for mitral valve disease. The use of less invasive procedures, improvements in surgical methods, and the incorporation of digital health tools are among the trends that will enhance patient outcomes and streamline the delivery of healthcare.

During the forecasted years, the ambulatory surgical centres category is expected to grow at a substantial rate. Surgical treatments are carried out in outpatient settings known as ambulatory surgical centres. These facilities provide minimally invasive mitral valve repair and replacement operations, which are more convenient for patients than standard hospital settings and result in quicker recoveries and lower expenses.

Regional Frontrunners

North America at the Forefront

The region with the biggest market share for mitral valve disease is expected to be North America during that forecast period. The fast acceptance of transcatheter mitral valve repair and replacement technology is a significant trend in the mitral valve disease market in North America. Significant improvements in minimally invasive operations are being made in the area, which improves patient outcomes and shortens hospital stays.

The growth is mostly linked to the region's advanced healthcare system, increased consumer knowledge of mitral valve disorders, and an increase in the prevalence of mitral valve diseases there. Moreover, the prevalence of mitral valve goods among North American consumers is also rising due to the presence of key businesses in the US and its extensive offering in the mitral valve treatment sector.

Europe Likely to Witness the Significant Growth

The market for mitral valve disease is expanding at the fastest rate in Europe, which presents a significant opportunity for the industry. Increased funding for the study and creation of cutting-edge treatments for mitral valve disease is a notable trend in Europe. European nations are concentrating on creating cutting-edge medical technologies and treatments like tissue-engineered heart valves, and individualised medical strategies.

Additionally, the demand for mitral valve repair, replacement, and cardiac resynchronization devices is expected to rise due to the developing healthcare infrastructure, an increase in the number of healthcare reforms, and an increase in healthcare spending in emerging countries. The market is also expanding because of the ageing population and unexplored market potential.

Fairfield’s Competitive Landscape Analysis

With several producers and retailers operating on a global scale, the mitral valve disease market is extremely competitive. Additionally, the mergers and acquisitions have aided businesses in growing their product portfolios, enhancing their market presence, and seizing expansion possibilities in the mitral valve disease market.

Who are the Leaders in Global Mitral Valve Disease Space?

- Abbott Laboratories

- Medtronic plc

- Edwards Lifesciences Corporation

- Boston Scientific Corporation

- LivaNova PLC

- Micro Interventional Devices Inc.

- XELTIS AG

- Lepu Medical Technology (Beijing) Co. Ltd.

- CryoLife Inc.

- Colibri Heart Valve LLC

- Valcare Medical

- Affluent Medical

- Teva Pharmaceutical Industries Ltd.

- Pfizer Inc.

- Bayer AG

Significant Company Developments

New Product Launch

- November 2021: Using the transfemoral access route, patients with severe, symptomatic mitral valve regurgitation (MR) were treated with the Intrepid transcatheter mitral valve replacement (TMVR) device, according to preliminary data published by Medtronic plc. In an Early Feasibility Study of the Intrepid Transfemoral System, the data from the first five patients demonstrated 100% survival, no strokes, and no or barely detectable MR in any of the patients 30 days after implant.

- September 2021: Epic Plus and Epic Plus Supra Stented Tissue Valves were given the go-ahead by the US Food and Drug Administration (FDA). These new gadgets, which expand treatment options for those with aortic or mitral valve disease, are built on Abbott's Epic surgical valve platform.

- January 2020: For usage in Europe, Abbott's Tendyne Transcatheter Mitral Valve Implantation (TMVI) system, which is used to treat mitral regurgitation (MR) in patients who need a heart valve replacement, has obtained the CE Mark certification.

Investments

- March 2019: The structural heart disease technologies were involved in two significant deals that Edwards Lifesciences Corporation has announced. The deal entails a $35 million investment in an exclusive right to purchase Corvia Medical, Inc. as well as the purchase of several assets from Mitralign, Inc., a business that specialises in creating tools for the treatment of mitral valve regurgitation.

Mergers & Acquisitions

- June 2021: Gyrus Capital's purchase of the heart valve division of LivaNova Plc. gave rise to Corcym, which just announced the beginning of its operations on a global scale. The brand-new, independent medical device business will be committed to offering patients and cardiac surgeons the top treatments for structural heart disease.

An Expert’s Eye

Demand and Future Growth

As per Fairfield’s Analysis, the ageing population is one of the main reasons anticipated to fuel the growth of the mitral valve devices market during the forecast period. Furthermore, it is projected that rising technical advancements would further fuel the market for mitral valve devices. In the upcoming years, the market for mitral valve devices may also see growth due to rising healthcare costs and an increase in cardiovascular disorders in developed nations.

Supply Side of the Market

Due to its highly developed healthcare system and capacity for producing medical devices, the US was a significant supplier in the mitral valve disease market. Manufacturers of medical equipment, the state of the healthcare system, and research institutions can all have an impact on this. Additionally, there are companies in this nation that create drugs to treat the symptoms or stop the progression of mitral valve disease, even though surgery is frequently the first line of treatment.

Furthermore, companies that design and produce instruments used in minimally invasive procedures, such as catheters, annuloplasty rings, and mitral valve repair or replacement devices in US play a crucial growth in the market. On the other hand, organisations involved in the distribution and supply chain management of medical items connected to mitral valve disease make sure they get to healthcare institutions.

Global Mitral Valve Disease Market is Segmented as Below:

By Treatment Type

- Mitral Valve Repair

- Mitral Valve Replacement

- Cardiac Resynchronization Therapy

- Mitral Valve Therapeutics

- Diuretics

- Anticoagulants

- Hypertension Drugs

By Indication

- Mitral Valve Stenosis

- Mitral Valve Prolapse

- Mitral Valve Regurgitation

By Stage

- Stage C

- Stage D

By End User

- Hospitals

- Specialty Clinics

By Geographic Coverage:

- North America

- US

- Canada

- Europe

- Germany

- K.

- France

- Italy

- Turkey

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Egypt

- Nigeria

- Rest of Middle East & Africa

1. Executive Summary

1.1. Global Mitral Valve Disease Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2022

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Disease Epidemiology

2.4. Regulatory Scenario

2.5. Technology Advancement

2.6. Disease Diagnostics Landscape

2.7. Number of procedures

2.7.1. Mitral Valve Repair

2.7.2. Mitral Valve Replacement

2.8. Value Chain Analysis

2.9. Porter’s Five Forces Analysis

2.10. COVID-19 Impact Analysis

2.10.1. Supply

2.10.2. Demand

2.11. Impact of Ukraine-Russia Conflict

2.12. Economic Overview

2.12.1. World Economic Projections

2.13. PESTLE Analysis

3. Global Mitral Valve Disease Market Outlook, 2018 - 2030

3.1. Global Mitral Valve Disease Market Outlook, by Treatment Type, Value (US$ Bn), 2018 - 2030

3.1.1. Key Highlights

3.1.1.1. Mitral Valve Repair

3.1.1.2. Mitral Valve Replacement

3.1.1.3. Cardiac Resynchronization Therapy

3.1.1.4. Mitral Valve Therapeutics

3.1.1.4.1. Diuretics

3.1.1.4.2. Anticoagulants

3.1.1.4.3. Hypertension Drugs

3.2. Global Mitral Valve Disease Market Outlook, by Indication, Value (US$ Bn), 2018 - 2030

3.2.1. Key Highlights

3.2.1.1. Mitral Valve Stenosis

3.2.1.2. Mitral Valve Prolapse

3.2.1.3. Mitral Valve Regurgitation

3.3. Global Mitral Valve Disease Market Outlook, by Stage, Value (US$ Bn), 2018 - 2030

3.3.1. Key Highlights

3.3.1.1. Stage C

3.3.1.2. Stage D

3.4. Global Mitral Valve Disease Market Outlook, by End User, Value (US$ Bn), 2018 - 2030

3.4.1. Key Highlights

3.4.1.1. Hospitals

3.4.1.2. Specialty Clinics

3.5. Global Mitral Valve Disease Market Outlook, by Region, Value (US$ Bn), 2018 - 2030

3.5.1. Key Highlights

3.5.1.1. North America

3.5.1.2. Europe

3.5.1.3. Asia Pacific

3.5.1.4. Latin America

3.5.1.5. Middle East & Africa

4. North America Mitral Valve Disease Market Outlook, 2018 - 2030

4.1. North America Mitral Valve Disease Market Outlook, by Treatment Type, Value (US$ Bn), 2018 - 2030

4.1.1. Key Highlights

4.1.1.1. Mitral Valve Repair

4.1.1.2. Mitral Valve Replacement

4.1.1.3. Cardiac Resynchronization Therapy

4.1.1.4. Mitral Valve Therapeutics

4.1.1.4.1. Diuretics

4.1.1.4.2. Anticoagulants

4.1.1.4.3. Hypertension Drugs

4.2. North America Mitral Valve Disease Market Outlook, by Indication, Value (US$ Bn), 2018 - 2030

4.2.1. Key Highlights

4.2.1.1. Mitral Valve Stenosis

4.2.1.2. Mitral Valve Prolapse

4.2.1.3. Mitral Valve Regurgitation

4.3. North America Mitral Valve Disease Market Outlook, by Stage, Value (US$ Bn), 2018 - 2030

4.3.1. Key Highlights

4.3.1.1. Stage C

4.3.1.2. Stage D

4.4. North America Mitral Valve Disease Market Outlook, by End User, Value (US$ Bn), 2018 - 2030

4.4.1. Key Highlights

4.4.1.1. Hospitals

4.4.1.2. Specialty Clinics

4.4.2. BPS Analysis/Market Attractiveness Analysis

4.5. North America Mitral Valve Disease Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

4.5.1. Key Highlights

4.5.1.1. U.S. Mitral Valve Disease Market by Treatment Type, Value (US$ Bn), 2018 - 2030

4.5.1.2. U.S. Mitral Valve Disease Market by Indication, Value (US$ Bn), 2018 - 2030

4.5.1.3. U.S. Mitral Valve Disease Market by Stage, Value (US$ Bn), 2018 - 2030

4.5.1.4. U.S. Mitral Valve Disease Market by End User, Value (US$ Bn), 2018 - 2030

4.5.1.5. Canada Mitral Valve Disease Market by Treatment Type, Value (US$ Bn), 2018 - 2030

4.5.1.6. Canada Mitral Valve Disease Market by Indication, Value (US$ Bn), 2018 - 2030

4.5.1.7. Canada Mitral Valve Disease Market by Stage, Value (US$ Bn), 2018 - 2030

4.5.1.8. Canada Mitral Valve Disease Market by End User, Value (US$ Bn), 2018 - 2030

4.5.2. BPS Analysis/Market Attractiveness Analysis

5. Europe Mitral Valve Disease Market Outlook, 2018 - 2030

5.1. Europe Mitral Valve Disease Market Outlook, by Treatment Type, Value (US$ Bn), 2018 - 2030

5.1.1. Key Highlights

5.1.1.1. Mitral Valve Repair

5.1.1.2. Mitral Valve Replacement

5.1.1.3. Cardiac Resynchronization Therapy

5.1.1.4. Mitral Valve Therapeutics

5.1.1.4.1. Diuretics

5.1.1.4.2. Anticoagulants

5.1.1.4.3. Hypertension Drugs

5.2. Europe Mitral Valve Disease Market Outlook, by Indication, Value (US$ Bn), 2018 - 2030

5.2.1. Key Highlights

5.2.1.1. Mitral Valve Stenosis

5.2.1.2. Mitral Valve Prolapse

5.2.1.3. Mitral Valve Regurgitation

5.3. Europe Mitral Valve Disease Market Outlook, by Stage, Value (US$ Bn), 2018 - 2030

5.3.1. Key Highlights

5.3.1.1. Stage C

5.3.1.2. Stage D

5.4. Europe Mitral Valve Disease Market Outlook, by End User, Value (US$ Bn), 2018 - 2030

5.4.1. Key Highlights

5.4.1.1. Hospitals

5.4.1.2. Specialty Clinics

5.4.2. BPS Analysis/Market Attractiveness Analysis

5.5. Europe Mitral Valve Disease Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

5.5.1. Key Highlights

5.5.1.1. Germany Mitral Valve Disease Market by Treatment Type, Value (US$ Bn), 2018 - 2030

5.5.1.2. Germany Mitral Valve Disease Market by Indication, Value (US$ Bn), 2018 - 2030

5.5.1.3. Germany Mitral Valve Disease Market by Stage, Value (US$ Bn), 2018 - 2030

5.5.1.4. Germany Mitral Valve Disease Market by End User, Value (US$ Bn), 2018 - 2030

5.5.1.5. U.K. Mitral Valve Disease Market by Treatment Type, Value (US$ Bn), 2018 - 2030

5.5.1.6. U.K. Mitral Valve Disease Market by Indication, Value (US$ Bn), 2018 - 2030

5.5.1.7. U.K. Mitral Valve Disease Market by Stage, Value (US$ Bn), 2018 - 2030

5.5.1.8. U.K. Mitral Valve Disease Market by End User, Value (US$ Bn), 2018 - 2030

5.5.1.9. France Mitral Valve Disease Market by Treatment Type, Value (US$ Bn), 2018 - 2030

5.5.1.10. France Mitral Valve Disease Market by Indication, Value (US$ Bn), 2018 - 2030

5.5.1.11. France Mitral Valve Disease Market by Stage, Value (US$ Bn), 2018 - 2030

5.5.1.12. France Mitral Valve Disease Market by End User, Value (US$ Bn), 2018 - 2030

5.5.1.13. Italy Mitral Valve Disease Market by Treatment Type, Value (US$ Bn), 2018 - 2030

5.5.1.14. Italy Mitral Valve Disease Market by Indication, Value (US$ Bn), 2018 - 2030

5.5.1.15. Italy Mitral Valve Disease Market by Stage, Value (US$ Bn), 2018 - 2030

5.5.1.16. Italy Mitral Valve Disease Market by End User, Value (US$ Bn), 2018 - 2030

5.5.1.17. Turkey Mitral Valve Disease Market by Treatment Type, Value (US$ Bn), 2018 - 2030

5.5.1.18. Turkey Mitral Valve Disease Market by Indication, Value (US$ Bn), 2018 - 2030

5.5.1.19. Turkey Mitral Valve Disease Market by Stage, Value (US$ Bn), 2018 - 2030

5.5.1.20. Turkey Mitral Valve Disease Market by End User, Value (US$ Bn), 2018 - 2030

5.5.1.21. Russia Mitral Valve Disease Market by Treatment Type, Value (US$ Bn), 2018 - 2030

5.5.1.22. Russia Mitral Valve Disease Market by Indication, Value (US$ Bn), 2018 - 2030

5.5.1.23. Russia Mitral Valve Disease Market by Stage, Value (US$ Bn), 2018 - 2030

5.5.1.24. Russia Mitral Valve Disease Market by End User, Value (US$ Bn), 2018 - 2030

5.5.1.25. Rest of Europe Mitral Valve Disease Market by Treatment Type, Value (US$ Bn), 2018 - 2030

5.5.1.26. Rest of Europe Mitral Valve Disease Market by Indication, Value (US$ Bn), 2018 - 2030

5.5.1.27. Rest of Europe Mitral Valve Disease Market by Stage, Value (US$ Bn), 2018 - 2030

5.5.1.28. Rest of Europe Mitral Valve Disease Market by End User, Value (US$ Bn), 2018 - 2030

5.5.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Mitral Valve Disease Market Outlook, 2018 - 2030

6.1. Asia Pacific Mitral Valve Disease Market Outlook, by Treatment Type, Value (US$ Bn), 2018 - 2030

6.1.1. Key Highlights

6.1.1.1. Mitral Valve Repair

6.1.1.2. Mitral Valve Replacement

6.1.1.3. Cardiac Resynchronization Therapy

6.1.1.4. Mitral Valve Therapeutics

6.1.1.4.1. Diuretics

6.1.1.4.2. Anticoagulants

6.1.1.4.3. Hypertension Drugs

6.2. Asia Pacific Mitral Valve Disease Market Outlook, by Indication, Value (US$ Bn), 2018 - 2030

6.2.1. Key Highlights

6.2.1.1. Mitral Valve Stenosis

6.2.1.2. Mitral Valve Prolapse

6.2.1.3. Mitral Valve Regurgitation

6.3. Asia Pacific Mitral Valve Disease Market Outlook, by Stage, Value (US$ Bn), 2018 - 2030

6.3.1. Key Highlights

6.3.1.1. Stage C

6.3.1.2. Stage D

6.4. Asia Pacific Mitral Valve Disease Market Outlook, by End User, Value (US$ Bn), 2018 - 2030

6.4.1. Key Highlights

6.4.1.1. Hospitals

6.4.1.2. Specialty Clinics

6.4.2. BPS Analysis/Market Attractiveness Analysis

6.5. Asia Pacific Mitral Valve Disease Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

6.5.1. Key Highlights

6.5.1.1. China Mitral Valve Disease Market by Treatment Type, Value (US$ Bn), 2018 - 2030

6.5.1.2. China Mitral Valve Disease Market by Indication, Value (US$ Bn), 2018 - 2030

6.5.1.3. China Mitral Valve Disease Market by Stage, Value (US$ Bn), 2018 - 2030

6.5.1.4. China Mitral Valve Disease Market by End User, Value (US$ Bn), 2018 - 2030

6.5.1.5. Japan Mitral Valve Disease Market by Treatment Type, Value (US$ Bn), 2018 - 2030

6.5.1.6. Japan Mitral Valve Disease Market by Indication, Value (US$ Bn), 2018 - 2030

6.5.1.7. Japan Mitral Valve Disease Market by Stage, Value (US$ Bn), 2018 - 2030

6.5.1.8. Japan Mitral Valve Disease Market by End User, Value (US$ Bn), 2018 - 2030

6.5.1.9. South Korea Mitral Valve Disease Market by Treatment Type, Value (US$ Bn), 2018 - 2030

6.5.1.10. South Korea Mitral Valve Disease Market by Indication, Value (US$ Bn), 2018 - 2030

6.5.1.11. South Korea Mitral Valve Disease Market by Stage, Value (US$ Bn), 2018 - 2030

6.5.1.12. South Korea Mitral Valve Disease Market by End User, Value (US$ Bn), 2018 - 2030

6.5.1.13. India Mitral Valve Disease Market by Treatment Type, Value (US$ Bn), 2018 - 2030

6.5.1.14. India Mitral Valve Disease Market by Indication, Value (US$ Bn), 2018 - 2030

6.5.1.15. India Mitral Valve Disease Market by Stage, Value (US$ Bn), 2018 - 2030

6.5.1.16. India Mitral Valve Disease Market by End User, Value (US$ Bn), 2018 - 2030

6.5.1.17. Southeast Asia Mitral Valve Disease Market by Treatment Type, Value (US$ Bn), 2018 - 2030

6.5.1.18. Southeast Asia Mitral Valve Disease Market by Indication, Value (US$ Bn), 2018 - 2030

6.5.1.19. Southeast Asia Mitral Valve Disease Market by Stage, Value (US$ Bn), 2018 - 2030

6.5.1.20. Southeast Asia Mitral Valve Disease Market by End User, Value (US$ Bn), 2018 - 2030

6.5.1.21. Rest of Asia Pacific Mitral Valve Disease Market by Treatment Type, Value (US$ Bn), 2018 - 2030

6.5.1.22. Rest of Asia Pacific Mitral Valve Disease Market by Indication, Value (US$ Bn), 2018 - 2030

6.5.1.23. Rest of Asia Pacific Mitral Valve Disease Market by Stage, Value (US$ Bn), 2018 - 2030

6.5.1.24. Rest of Asia Pacific Mitral Valve Disease Market by End User, Value (US$ Bn), 2018 - 2030

6.5.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America Mitral Valve Disease Market Outlook, 2018 - 2030

7.1. Latin America Mitral Valve Disease Market Outlook, by Treatment Type, Value (US$ Bn), 2018 - 2030

7.1.1. Key Highlights

7.1.1.1. Mitral Valve Repair

7.1.1.2. Mitral Valve Replacement

7.1.1.3. Cardiac Resynchronization Therapy

7.1.1.4. Mitral Valve Therapeutics

7.1.1.4.1. Diuretics

7.1.1.4.2. Anticoagulants

7.1.1.4.3. Hypertension Drugs

7.2. Latin America Mitral Valve Disease Market Outlook, by Indication, Value (US$ Bn), 2018 - 2030

7.2.1. Key Highlights

7.2.1.1. Mitral Valve Stenosis

7.2.1.2. Mitral Valve Prolapse

7.2.1.3. Mitral Valve Regurgitation

7.3. Latin America Mitral Valve Disease Market Outlook, by Stage, Value (US$ Bn), 2018 - 2030

7.3.1. Key Highlights

7.3.1.1. Stage C

7.3.1.2. Stage D

7.4. Latin America Mitral Valve Disease Market Outlook, by End User, Value (US$ Bn), 2018 - 2030

7.4.1. Key Highlights

7.4.1.1. Hospitals

7.4.1.2. Specialty Clinics

7.4.2. BPS Analysis/Market Attractiveness Analysis

7.5. Latin America Mitral Valve Disease Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

7.5.1. Key Highlights

7.5.1.1. Brazil Mitral Valve Disease Market by Treatment Type, Value (US$ Bn), 2018 - 2030

7.5.1.2. Brazil Mitral Valve Disease Market by Indication, Value (US$ Bn), 2018 - 2030

7.5.1.3. Brazil Mitral Valve Disease Market by Stage, Value (US$ Bn), 2018 - 2030

7.5.1.4. Brazil Mitral Valve Disease Market by End User, Value (US$ Bn), 2018 - 2030

7.5.1.5. Mexico Mitral Valve Disease Market by Treatment Type, Value (US$ Bn), 2018 - 2030

7.5.1.6. Mexico Mitral Valve Disease Market by Indication, Value (US$ Bn), 2018 - 2030

7.5.1.7. Mexico Mitral Valve Disease Market by Stage, Value (US$ Bn), 2018 - 2030

7.5.1.8. Mexico Mitral Valve Disease Market by End User, Value (US$ Bn), 2018 - 2030

7.5.1.9. Argentina Mitral Valve Disease Market by Treatment Type, Value (US$ Bn), 2018 - 2030

7.5.1.10. Argentina Mitral Valve Disease Market by Indication, Value (US$ Bn), 2018 - 2030

7.5.1.11. Argentina Mitral Valve Disease Market by Stage, Value (US$ Bn), 2018 - 2030

7.5.1.12. Argentina Mitral Valve Disease Market by End User, Value (US$ Bn), 2018 - 2030

7.5.1.13. Rest of Latin America Mitral Valve Disease Market by Treatment Type, Value (US$ Bn), 2018 - 2030

7.5.1.14. Rest of Latin America Mitral Valve Disease Market by Indication, Value (US$ Bn), 2018 - 2030

7.5.1.15. Rest of Latin America Mitral Valve Disease Market by Stage, Value (US$ Bn), 2018 - 2030

7.5.1.16. Rest of Latin America Mitral Valve Disease Market by End User, Value (US$ Bn), 2018 - 2030

7.5.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Mitral Valve Disease Market Outlook, 2018 - 2030

8.1. Middle East & Africa Mitral Valve Disease Market Outlook, by Treatment Type, Value (US$ Bn), 2018 - 2030

8.1.1. Key Highlights

8.1.1.1. Mitral Valve Repair

8.1.1.2. Mitral Valve Replacement

8.1.1.3. Cardiac Resynchronization Therapy

8.1.1.4. Mitral Valve Therapeutics

8.1.1.4.1. Diuretics

8.1.1.4.2. Anticoagulants

8.1.1.4.3. Hypertension Drugs

8.2. Middle East & Africa Mitral Valve Disease Market Outlook, by Indication, Value (US$ Bn), 2018 - 2030

8.2.1. Key Highlights

8.2.1.1. Mitral Valve Stenosis

8.2.1.2. Mitral Valve Prolapse

8.2.1.3. Mitral Valve Regurgitation

8.3. Middle East & Africa Mitral Valve Disease Market Outlook, by Stage, Value (US$ Bn), 2018 - 2030

8.3.1. Key Highlights

8.3.1.1. Stage C

8.3.1.2. Stage D

8.4. Middle East & Africa Mitral Valve Disease Market Outlook, by End User, Value (US$ Bn), 2018 - 2030

8.4.1. Key Highlights

8.4.1.1. Hospitals

8.4.1.2. Specialty Clinics

8.4.2. BPS Analysis/Market Attractiveness Analysis

8.5. Middle East & Africa Mitral Valve Disease Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

8.5.1. Key Highlights

8.5.1.1. GCC Mitral Valve Disease Market by Treatment Type, Value (US$ Bn), 2018 - 2030

8.5.1.2. GCC Mitral Valve Disease Market by Indication, Value (US$ Bn), 2018 - 2030

8.5.1.3. GCC Mitral Valve Disease Market by Stage, Value (US$ Bn), 2018 - 2030

8.5.1.4. GCC Mitral Valve Disease Market by End User, Value (US$ Bn), 2018 - 2030

8.5.1.5. South Africa Mitral Valve Disease Market by Treatment Type, Value (US$ Bn), 2018 - 2030

8.5.1.6. South Africa Mitral Valve Disease Market by Indication, Value (US$ Bn), 2018 - 2030

8.5.1.7. South Africa Mitral Valve Disease Market by Stage, Value (US$ Bn), 2018 - 2030

8.5.1.8. South Africa Mitral Valve Disease Market by End User, Value (US$ Bn), 2018 - 2030

8.5.1.9. Egypt Mitral Valve Disease Market by Treatment Type, Value (US$ Bn), 2018 - 2030

8.5.1.10. Egypt Mitral Valve Disease Market by Indication, Value (US$ Bn), 2018 - 2030

8.5.1.11. Egypt Mitral Valve Disease Market by Stage, Value (US$ Bn), 2018 - 2030

8.5.1.12. Egypt Mitral Valve Disease Market by End User, Value (US$ Bn), 2018 - 2030

8.5.1.13. Nigeria Mitral Valve Disease Market by Treatment Type, Value (US$ Bn), 2018 - 2030

8.5.1.14. Nigeria Mitral Valve Disease Market by Indication, Value (US$ Bn), 2018 - 2030

8.5.1.15. Nigeria Mitral Valve Disease Market by Stage, Value (US$ Bn), 2018 - 2030

8.5.1.16. Nigeria Mitral Valve Disease Market by End User, Value (US$ Bn), 2018 - 2030

8.5.1.17. Rest of Middle East & Africa Mitral Valve Disease Market by Treatment Type, Value (US$ Bn), 2018 - 2030

8.5.1.18. Rest of Middle East & Africa Mitral Valve Disease Market by Indication, Value (US$ Bn), 2018 - 2030

8.5.1.19. Rest of Middle East & Africa Mitral Valve Disease Market by Stage, Value (US$ Bn), 2018 - 2030

8.5.1.20. Rest of Middle East & Africa Mitral Valve Disease Market by End User, Value (US$ Bn), 2018 - 2030

8.5.2. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. Treatment Type vs Indication Heatmap

9.2. Company Market Share Analysis, 2022

9.3. Competitive Dashboard

9.4. Company Profiles

9.4.1. Abbott Laboratories

9.4.1.1. Company Overview

9.4.1.2. Product Portfolio

9.4.1.3. Financial Overview

9.4.1.4. Business Strategies and Development

9.4.2. Medtronic plc

9.4.2.1. Company Overview

9.4.2.2. Product Portfolio

9.4.2.3. Financial Overview

9.4.2.4. Business Strategies and Development

9.4.3. Edwards Lifesciences Corporation

9.4.3.1. Company Overview

9.4.3.2. Product Portfolio

9.4.3.3. Financial Overview

9.4.3.4. Business Strategies and Development

9.4.4. Boston Scientific Corporation

9.4.4.1. Company Overview

9.4.4.2. Product Portfolio

9.4.4.3. Financial Overview

9.4.4.4. Business Strategies and Development

9.4.5. LivaNova PLC

9.4.5.1. Company Overview

9.4.5.2. Product Portfolio

9.4.5.3. Financial Overview

9.4.5.4. Business Strategies and Development

9.4.6. Micro Interventional Devices Inc.

9.4.6.1. Company Overview

9.4.6.2. Product Portfolio

9.4.6.3. Financial Overview

9.4.6.4. Business Strategies and Development

9.4.7. XELTIS AG

9.4.7.1. Company Overview

9.4.7.2. Product Portfolio

9.4.7.3. Financial Overview

9.4.7.4. Business Strategies and Development

9.4.8. Lepu Medical Technology (Beijing) Co. Ltd.

9.4.8.1. Company Overview

9.4.8.2. Product Portfolio

9.4.8.3. Financial Overview

9.4.8.4. Business Strategies and Development

9.4.9. CryoLife Inc.

9.4.9.1. Company Overview

9.4.9.2. Product Portfolio

9.4.9.3. Financial Overview

9.4.9.4. Business Strategies and Development

9.4.10. Colibri Heart Valve LLC

9.4.10.1. Company Overview

9.4.10.2. Product Portfolio

9.4.10.3. Financial Overview

9.4.10.4. Business Strategies and Development

9.4.11. Valcare Medical

9.4.11.1. Company Overview

9.4.11.2. Product Portfolio

9.4.11.3. Financial Overview

9.4.11.4. Business Strategies and Development

9.4.12. Affluent Medical

9.4.12.1. Company Overview

9.4.12.2. Product Portfolio

9.4.12.3. Financial Overview

9.4.12.4. Business Strategies and Development

9.4.13. Teva Pharmaceutical Industries Ltd.

9.4.13.1. Company Overview

9.4.13.2. Product Portfolio

9.4.13.3. Financial Overview

9.4.13.4. Business Strategies and Development

9.4.14. Pfizer Inc.

9.4.14.1. Company Overview

9.4.14.2. Product Portfolio

9.4.14.3. Financial Overview

9.4.14.4. Business Strategies and Development

9.4.15. Bayer AG

9.4.15.1. Company Overview

9.4.15.2. Product Portfolio

9.4.15.3. Financial Overview

9.4.15.4. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2022 |

|

2018 - 2022 |

2023 - 2030 |

Value: US$ Million |

||

|

REPORT FEATURES |

DETAILS |

|

Treatment Type Coverage |

|

|

Indication Coverage |

|

|

Stage Coverage |

|

|

End User Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |