Global Modular UPS Market Forecast

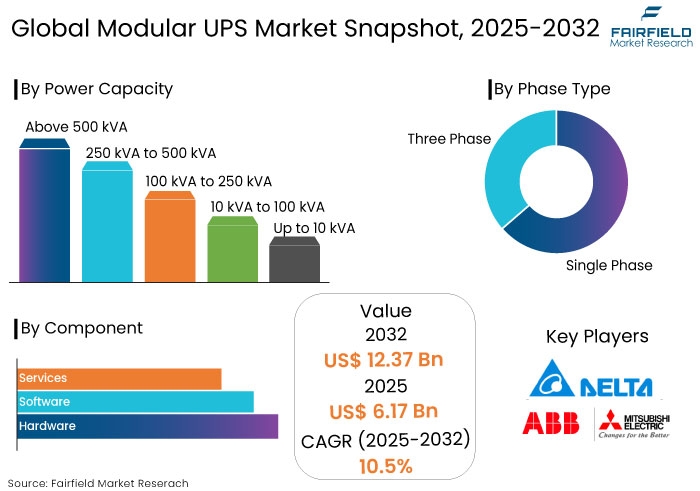

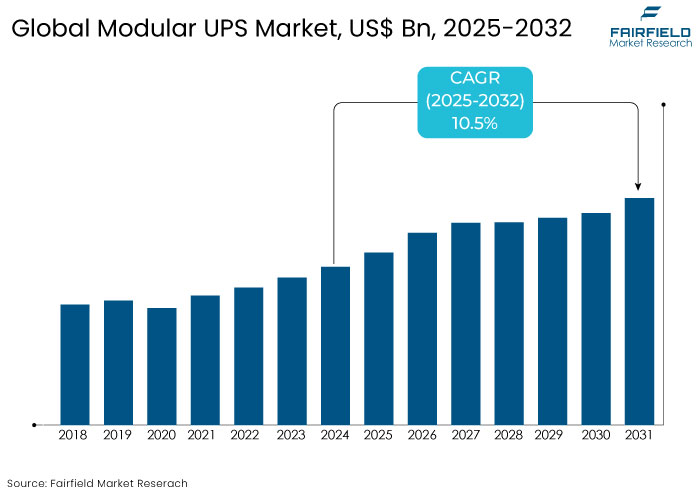

- The modular UPS market is likely to reach a valuation of US$12.37 Bn by 2032, showing significant growth from the US$6.17 Bn obtained in 2025.

- The market for modular UPS is anticipated to exhibit a notable expansion rate, with projected CAGR of 10.5% from 2025 to 2032.

Modular UPS Market Insights

- Increased reliance on data centres and cloud computing drives the demand for modular UPS systems to ensure continuous power.

- Businesses are adopting modular UPS solutions to reduce energy consumption, meet sustainability goals, and cut operational costs.

- Modular systems offer scalability, allowing users to expand UPS capacity as their power needs grow and offer great operational flexibility.

- Innovations in battery technologies and integrated monitoring systems are enhancing the reliability and performance of modular UPS solutions.

- Hospitals and medical facilities increasingly use modular UPS systems to maintain critical equipment uptime and ensure patient safety.

- Increasing industrialization in emerging economies, particularly in Asia-Pacific and Africa, contributes to the growing demand for modular UPS systems.

- As industries move toward green energy solutions, modular UPS systems with low power consumption and sustainable designs are gaining traction.

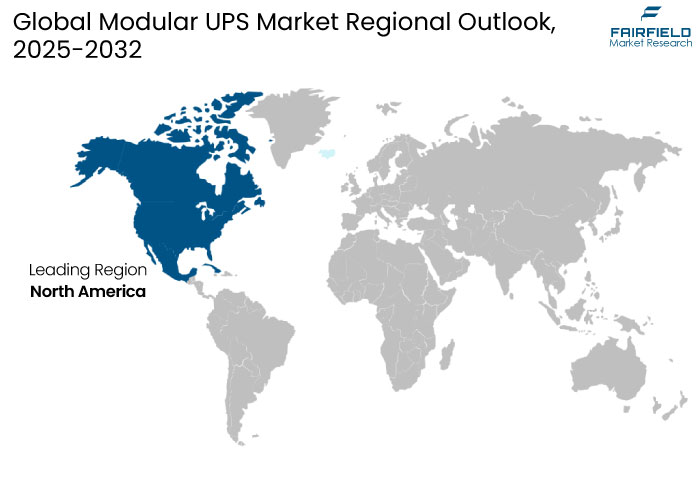

- North America leads the global market share with high number of data centres in the region.

A Look Back and a Look Forward - Comparative Analysis

The global modular UPS market growth was fueled by increasing industrialization, the expansion of data centres, and growing demand for reliable power backup solutions in critical infrastructure. Businesses seeking flexible, scalable, and energy-efficient systems to support their evolving power requirements also fueled the market growth in the historical period.

Key sectors such as telecommunications, healthcare, and manufacturing, which require high system uptime drove demand for modular UPS systems. Technological advancements, such as improved battery technologies and integrated monitoring systems, also expanded the market.

The modular UPS market is projected to experience accelerated growth over the forecast period due to several factors. The increasing focus on sustainability, energy efficiency, and rising electricity costs drive demand for more efficient UPS solutions.

Data centres remain a key driver, alongside the healthcare and industrial sectors with growing cloud computing and internet traffic. The adoption of Industry 4.0 and IoT technologies is boosting the need for uninterrupted power supply systems.

Developing advanced modular UPS systems with remote monitoring, battery optimization, and predictive maintenance is expected to enhance market attractiveness. As economies continue digitizing, the market is projected to grow significantly in the coming years.

Key Growth Determinants

- Increase in the Numbers of Data Centers Globally Fuels Demand

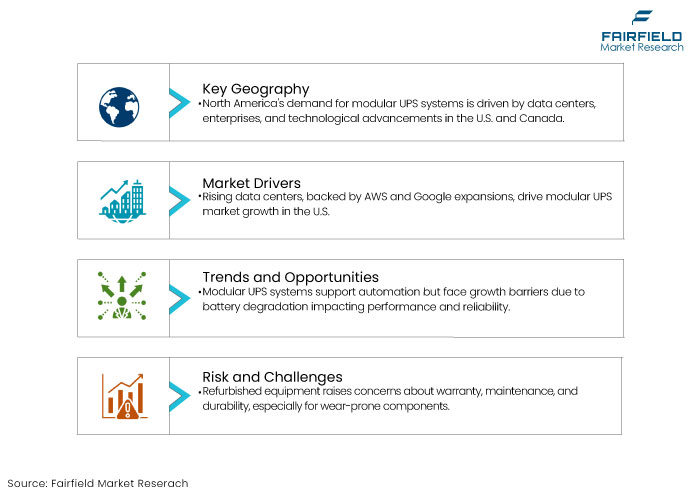

The increasing number of data centres is anticipated to boost the demand for modular UPS systems. This factor remains a key driver for modular UPS market growth. Corporations like AWS and Google allocate resources to establish data centres in many locations in the United States.

Nations in Asia Pacific like India is experiencing substantial investments in data centres to accommodate the growing digital economy. The growing number of data centres necessitated by rapidly increasing data volumes demands reliable power protection solutions.

Modular UPS systems offer the adaptability to accommodate the evolving power needs of expanding operations while guaranteeing continuous operation and data protection. Substantial expenditures in data centre infrastructure stimulate the demand for robust power solutions, including modular UPS systems that enhance data centre expansion and resilience.

Modular UPS systems ensure uninterrupted power supply to data centres, which is crucial for the efficient operation of IT systems. It provides auxiliary power during interruptions, improves power quality by regulating voltage and minimizing disruptions, and may be readily scaled to accommodate the increasing demands of data centers.

- As of December 2023, there are approximately 10,978 data centre locations worldwide. The U.S. leads with 5,381 data centers as of March 2024, underscoring its pivotal role in global data infrastructure.

- Rising Incidence of Power Outages Accelerates Market Expansion

Power outages and voltage fluctuations frequently occur due to aging infrastructure, natural disasters, and rapid urbanization. Industries such as healthcare, manufacturing, and telecommunications are significantly impacted by these interruptions, resulting in operational downtime and financial losses.

Modular UPS systems provide a reliable and flexible solution to these challenges, ensuring uninterrupted power supply during outages. The modular design enables businesses to add or replace power modules without disrupting operations, offering flexibility and stability lacking in traditional UPS systems.

The increased recognition of the financial and reputational hazards linked to power outages has prompted enterprises to invest in sophisticated backup power solutions, which is a key growth catalyst for the modular UPS market.

- According to the reports, storm-related power outages cost the American economy between US$20 billion and US$55 billion annually. The decade from 2011 to 2021 experienced 64% more leading power outages compared to the previous decade, indicating a rising trend.

Key Growth Barriers

- Limited Lifespan of Modular UPS Systems Batteries

Automation systems, vital for maintaining efficiency and seamless operations in sectors like manufacturing, require continuous power sources to function without disruptions. Modular UPS systems provide flexible power backup; however, their performance and longevity are majorly determined by their batteries. As time passes, batteries degrade, impacting the dependability and efficiency of modular UPS systems. This factor remains a key barrier for modular UPS market growth.

Regular battery replacement and maintenance results in increased expenses and potential operational interruptions. The equilibrium of performance, cost-effectiveness, and battery longevity in modular UPS systems may impede market expansion.

Power outages and voltage fluctuations frequently occur due to aging infrastructure, natural disasters, and rapid urbanization. These interruptions significantly impact industries such as healthcare, manufacturing, and telecommunications, resulting in operational downtime and financial losses.

- Complex System Integration Remains a Key Barrier

One of the key market restraints for the modular UPS market growth is the complexity of the entire modular UPS system installation into the current infrastructure. Modular UPS systems are efficient and adaptable and require specialized knowledge and technical proficiency for appropriate installation and maintenance. For organizations without an internal IT or electrical team, this may result in supplementary costs for external services.

Incorporating modular UPS solutions into outdated power infrastructure or legacy systems can be labour-intensive and susceptible to technical complications. This complexity can deter businesses from adopting these systems, particularly if they fear prolonged downtime during the transition.

In sectors such as healthcare or manufacturing, where power continuity is essential, any disruption resulting from integration difficulties may appear excessively risky. Although progress in plug-and-play designs is mitigating these challenges, the perceived complexity of system integration continues to dissuade numerous prospective consumers.

Modular UPS Market Trends and Opportunities

- Growing Demand for Edge Computing

The rise of edge computing offers a transformative opportunity for the modular UPS market players. The need for localized power solutions has grown as businesses move closer to processing data at the source, whether in remote offices, manufacturing plants, or IoT-enabled devices.

Modular UPS systems are ideal for these environments because they are compact, scalable, and easy to deploy, ensuring uninterrupted power for edge data centres. Industries like healthcare, where real-time data analysis is critical, or retail, where edge computing supports personalized customer experiences, are driving this demand. This trend diversifies the application areas for modular UPS systems and encourages innovation in lightweight and efficient power solutions tailored for edge environments.

- Sustainability and Energy Efficiency Trends Shapes Market Growth

The growing emphasis on sustainability and energy efficiency is reshaping the modular UPS market. With climate change concerns and rising energy costs driving global priorities, organizations seek solutions that minimize environmental impact while optimizing operational costs.

Modular UPS systems are uniquely positioned to address these needs due to their energy-efficient design and adaptability. Unlike traditional UPS systems, which often operate at fixed capacities and consume unnecessary energy, modular UPS systems dynamically adjust their power output based on real-time demand.

Modular UPS systems enable data centers to meet stringent efficiency standards, such as the Power Usage Effectiveness (PUE) metric, while supporting their expansion and operational reliability. Regulatory bodies and certifications like Energy Star and LEED encourage businesses to adopt energy-efficient technologies, driving demand for modular UPS solutions.

Modular UPS systems are becoming indispensable tools for companies aiming to align with sustainability goals while maintaining robust and reliable power infrastructure as the global push for carbon neutrality intensifies.

- According to reports, data center power consumption in the U.S. is expected to reach 35 gigawatts by 2030, nearly doubling from 2022 levels, driven by the growing demand for AI and machine learning capabilities.

How does Regulatory Scenario Shape the Industry?

The regulatory landscape is pivotal in shaping the global modular UPS market by driving the adoption of energy-efficient and sustainable technologies. Governments and regulatory bodies globally are introducing stringent guidelines and standards to reduce carbon emissions and enhance energy efficiency across industries.

In data centers, key drivers include metrics like Power Usage Effectiveness (PUE), which measures the energy efficiency of facilities. Meeting such benchmarks has become essential as operators aim to balance operational reliability with reduced environmental impact. Regulations targeting grid reliability and renewable energy integration have further underscored the importance of advanced UPS solutions.

As companies increasingly align with these frameworks, the demand for modular UPS systems, known for their scalability and energy-saving features, continues to rise, making regulatory policies a significant market catalyst.

Segment Covered in the Report

- 100kVA to 250 kVA Remains a Dominant Power Capacity

The 100 kVA to 250 kVA power capacity segment is expected to dominate the global modular UPS market. This segment balances scalability, efficiency, and cost-effectiveness, making it a preferred choice for medium to large-scale enterprises.

The 100 kVA to 250 kVA range is widely adopted by data centres, which are increasingly critical in supporting global digital transformation. This capacity range provides reliable power backup and ensures seamless operations for mid-sized data centres handling moderate to high workloads.

Industries like healthcare, manufacturing, and IT often operate facilities that require robust power solutions within this capacity. The modular design allows businesses to scale their UPS systems as their power demands grow without initially overcommitting to higher capacities.

Modular UPS systems within this power range are economically viable, offering a high return on investment by combining operational reliability with energy efficiency, which is a crucial reason for the segment's dominance.

- Large Enterprises Maintain Primacy in the Market

Large enterprises emerge as the dominant enterprise size, as these often require more robust and scalable power solutions to maintain the uptime and efficiency of their critical operations.

The infrastructure, which includes data centres, manufacturing units, and office buildings, demands higher capacities for power backup, making modular UPS systems an ideal choice due to their flexibility and scalability. Small and medium-sized enterprises (SMEs) are increasingly adopting modular UPS systems but on a lower scale.

While SMEs recognize the importance of power reliability for business continuity, they may not need the large-scale solutions that big corporations do. However, modular UPS still appeals to SMEs for its cost-efficiency, ease of upgrade, and reliability, which are essential for their growing operations.

Regional Analysis

- North America Remains Dominant with High Numbers of Data Centers in the Region

The demand for modular UPS systems in North America is primarily driven by the robust presence of data centres, large-scale enterprises, and technological advancements. North America, particularly the U.S. and Canada, is at the forefront of technological innovations, driving demand for modular UPS systems.

The region strongly focuses on automation, cloud computing, and data management, requiring reliable and scalable power solutions. The region's high reliance on uninterrupted power supply for critical infrastructure like healthcare facilities, financial institutions, and IT services places significant demand on modular UPS systems.

The rise in cloud computing, digitalization, and the expansion of renewable energy projects continue to bolster the need for scalable and efficient backup power solutions. The region's government regulations promoting energy efficiency and sustainability have encouraged the adoption of energy-efficient power backup systems.

Modular UPS offers a green, scalable solution aligned with these regulatory frameworks. With significant investments in energy management technologies and a strong push towards reducing operational costs, industries in North America favour modular UPS for their flexibility and cost-effectiveness.

- Asia Pacific Emerges Lucrative with Increased Demand for Power Reliability

Asia Pacific is witnessing rapid industrialization, urbanization, and technological growth, especially in countries like China, India, and Japan. The growing adoption of digital infrastructure and cloud-based services across various sectors, such as manufacturing, healthcare, and telecom, is fuelling the demand for modular UPS systems.

The region is also home to many SMEs turning to modular UPS for scalable solutions to ensure business continuity amid frequent power outages. The ongoing industrial automation and the government's focus on enhancing energy efficiency contribute to the rising demand for modular UPS solutions.

Modular UPS Market

Fairfield’s Competitive Landscape Analysis

The global modular UPS market is highly competitive, with key players focusing on technological advancements, strategic partnerships, and product innovations. Leading companies include Schneider Electric, Vertiv, Eaton, ABB, and Siemens, which dominate the market through extensive product portfolios.

Regional players such as Huawei and Delta Electronics also contribute to the competitive environment by offering affordable and customizable modular UPS solutions. Companies differentiate themselves through value-added services, including remote monitoring, battery management, and hybrid solutions, enhancing product reliability and performance.

Key Market Companies

- Schneider Electric

- Eaton Corporation

- ABB Ltd.

- Vertiv

- Ametek Powervar

- Legrand

- Mitsubishi Electric

- Huawei Technologies Co., Ltd.

- Toshiba Corporation

- Delta Electronics

Recent Industry Developments

- In October 2024, Vertiv introduced a comprehensive 7MW reference architecture for the NVIDIA GB200 NVL72 platform, co-developed with NVIDIA to convert conventional data centers into AI factories that facilitate enterprise AI applications.

- In September 2024, Huawei and Talaat Moustafa Group (TMG) signed a partnership deal to provide cloud technology services for Egypt's New Administrative Capital.

An Expert’s Eye

- The market is driven by increasing demand for modular UPS systems in data centers, healthcare, and industrial sectors due to their scalability and flexibility.

- A key trend is the focus on energy-efficient solutions to reduce operational costs, driven by growing environmental concerns and regulatory standards.

- Experts point to ongoing innovations in digitalization, including remote monitoring and predictive maintenance, improving UPS system efficiency and uptime.

- The market is expected to grow as industries seek reliable, cost-effective power backup solutions amidst rising electricity demand and power outages.

Global Modular UPS Market is Segmented as-

By Component

- Hardware

- Power Modules

- Control Module

- Bypass Module

- Battery Modules

- Enclosure and Rack

- Software

- Services

- Professional Services

- Managed Services

By Power Capacity

- Up to 10 kVA

- 10 kVA to 100 kVA

- 100 kVA to 250 kVA

- 250 kVA to 500 kVA

- Above 500 kVA

By Phase Type

- Single Phase

- Three Phase

By Enterprise Size

- Small & Medium Sized Enterprises (SMEs)

- Large Enterprises

By Vertical

- Data Centers

- IT & Telecom

- Healthcare

- Industrial

- BFSI

- Energy

- Government & Defence

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- The Middle East & Africa

1. Executive Summary

1.1. Global Modular UPS Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2025

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. Regulatory Landscape

2.6. COVID-19 Impact Analysis

2.6.1. Supply

2.6.2. Demand

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Price Trend Analysis, 2019-2032,

3.1. Key Highlights

3.2. Global Average Price Analysis, by Component, US$

3.3. Prominent Factors Affecting Modular UPS Prices

4. Global Modular UPS Market Outlook, 2019 - 2032

4.1. Global Modular UPS Market Outlook, by Component, Value (US$ Mn), 2019 - 2032

4.1.1. Key Highlights

4.1.1.1. Hardware

4.1.1.1.1. Power Modules

4.1.1.1.2. Control Module

4.1.1.1.3. Bypass Module

4.1.1.1.4. Battery Modules

4.1.1.1.5. Enclosure and Rack

4.1.1.1.6. Misc.

4.1.1.2. Software

4.1.1.3. Services

4.1.1.3.1. Professional Services

4.1.1.3.2. Managed Services

4.2. Global Modular UPS Market Outlook, by Power Capacity, Value (US$ Mn), 2019 - 2032

4.2.1. Key Highlights

4.2.1.1. Up to 10 kVA

4.2.1.2. 10 kVA to 100 kVA

4.2.1.3. 100 kVA to 250 kVA

4.2.1.4. 250 kVA to 500 kVA

4.2.1.5. Above 500 kVA

4.3. Global Modular UPS Market Outlook, by Phase Type, Value (US$ Mn), 2019 - 2032

4.3.1. Key Highlights

4.3.1.1. Single Phase

4.3.1.2. Three Phase

4.4. Global Modular UPS Market Outlook, by Enterprise Size, Value (US$ Mn), 2019 - 2032

4.4.1. Key Highlights

4.4.1.1. Small & Medium Sized Enterprises (SMEs)

4.4.1.2. Large Enterprises

4.5. Global Modular UPS Market Outlook, by Vertical, Value (US$ Mn), 2019 - 2032

4.5.1. Key Highlights

4.5.1.1. Data Centers

4.5.1.2. IT & Telecom

4.5.1.3. Healthcare

4.5.1.4. Industrial

4.5.1.5. BFSI

4.5.1.6. Energy

4.5.1.7. Government & Defense

4.5.1.8. Misc.

4.6. Global Modular UPS Market Outlook, by Region, Value (US$ Mn), 2019 - 2032

4.6.1. Key Highlights

4.6.1.1. North America

4.6.1.2. Europe

4.6.1.3. Asia Pacific

4.6.1.4. Latin America

4.6.1.5. Middle East & Africa

4.6.2. BPS Analysis/Market Attractiveness Analysis

5. North America Modular UPS Market Outlook, 2019 - 2032

5.1. North America Modular UPS Market Outlook, by Component, Value (US$ Mn), 2019 - 2032

5.1.1. Key Highlights

5.1.1.1. Hardware

5.1.1.1.1. Power Modules

5.1.1.1.2. Control Module

5.1.1.1.3. Bypass Module

5.1.1.1.4. Battery Modules

5.1.1.1.5. Enclosure and Rack

5.1.1.1.6. Misc.

5.1.1.2. Software

5.1.1.3. Services

5.1.1.3.1. Professional Services

5.1.1.3.2. Managed Services

5.2. North America Modular UPS Market Outlook, by Power Capacity, Value (US$ Mn), 2019 - 2032

5.2.1. Key Highlights

5.2.1.1. Up to 10 kVA

5.2.1.2. 10 kVA to 100 kVA

5.2.1.3. 100 kVA to 250 kVA

5.2.1.4. 250 kVA to 500 kVA

5.2.1.5. Above 500 kVA

5.3. North America Modular UPS Market Outlook, by Phase Type, Value (US$ Mn), 2019 - 2032

5.3.1. Key Highlights

5.3.1.1. Single Phase

5.3.1.2. Three Phase

5.4. North America Modular UPS Market Outlook, by Enterprise Size, Value (US$ Mn), 2019 - 2032

5.4.1. Key Highlights

5.4.1.1. Small & Medium Sized Enterprises (SMEs)

5.4.1.2. Large Enterprises

5.5. North America Modular UPS Market Outlook, by Vertical, Value (US$ Mn), 2019 - 2032

5.5.1. Key Highlights

5.5.1.1. Data Centers

5.5.1.2. IT & Telecom

5.5.1.3. Healthcare

5.5.1.4. Industrial

5.5.1.5. BFSI

5.5.1.6. Energy

5.5.1.7. Government & Defense

5.5.1.8. Misc.

5.6. North America Modular UPS Market Outlook, by Country, Value (US$ Mn), 2019 - 2032

5.6.1. Key Highlights

5.6.1.1. U.S. Modular UPS Market by Component, Value (US$ Mn), 2019 - 2032

5.6.1.2. U.S. Modular UPS Market by Power Capacity, Value (US$ Mn), 2019 - 2032

5.6.1.3. U.S. Modular UPS Market by Phase Type, Value (US$ Mn), 2019 - 2032

5.6.1.4. U.S. Modular UPS Market by Enterprise Size, Value (US$ Mn), 2019 - 2032

5.6.1.5. U.S. Modular UPS Market by Vertical, Value (US$ Mn), 2019 - 2032

5.6.1.6. Canada Modular UPS Market by Component, Value (US$ Mn), 2019 - 2032

5.6.1.7. Canada Modular UPS Market by Power Capacity, Value (US$ Mn), 2019 - 2032

5.6.1.8. Canada Modular UPS Market by Phase Type, Value (US$ Mn), 2019 - 2032

5.6.1.9. Canada Modular UPS Market by Enterprise Size, Value (US$ Mn), 2019 - 2032

5.6.1.10. Canada Modular UPS Market by Vertical, Value (US$ Mn), 2019 - 2032

5.6.2. BPS Analysis/Market Attractiveness Analysis

6. Europe Modular UPS Market Outlook, 2019 - 2032

6.1. Europe Modular UPS Market Outlook, by Component, Value (US$ Mn), 2019 - 2032

6.1.1. Key Highlights

6.1.1.1. Hardware

6.1.1.1.1. Power Modules

6.1.1.1.2. Control Module

6.1.1.1.3. Bypass Module

6.1.1.1.4. Battery Modules

6.1.1.1.5. Enclosure and Rack

6.1.1.1.6. Misc.

6.1.1.2. Software

6.1.1.3. Services

6.1.1.3.1. Professional Services

6.1.1.3.2. Managed Services

6.2. Europe Modular UPS Market Outlook, by Power Capacity, Value (US$ Mn), 2019 - 2032

6.2.1. Key Highlights

6.2.1.1. Up to 10 kVA

6.2.1.2. 10 kVA to 100 kVA

6.2.1.3. 100 kVA to 250 kVA

6.2.1.4. 250 kVA to 500 kVA

6.2.1.5. Above 500 kVA

6.3. Europe Modular UPS Market Outlook, by Phase Type, Value (US$ Mn), 2019 - 2032

6.3.1. Key Highlights

6.3.1.1. Single Phase

6.3.1.2. Three Phase

6.4. Europe Modular UPS Market Outlook, by Enterprise Size, Value (US$ Mn), 2019 - 2032

6.4.1. Key Highlights

6.4.1.1. Small & Medium Sized Enterprises (SMEs)

6.4.1.2. Large Enterprises

6.5. Europe Modular UPS Market Outlook, by Vertical, Value (US$ Mn), 2019 - 2032

6.5.1. Key Highlights

6.5.1.1. Data Centers

6.5.1.2. IT & Telecom

6.5.1.3. Healthcare

6.5.1.4. Industrial

6.5.1.5. BFSI

6.5.1.6. Energy

6.5.1.7. Government & Defense

6.5.1.8. Misc.

6.5.2. BPS Analysis/Market Attractiveness Analysis

6.6. Europe Modular UPS Market Outlook, by Country, Value (US$ Mn), 2019 - 2032

6.6.1. Key Highlights

6.6.1.1. Germany Modular UPS Market by Component, Value (US$ Mn), 2019 - 2032

6.6.1.2. Germany Modular UPS Market by Power Capacity, Value (US$ Mn), 2019 - 2032

6.6.1.3. Germany Modular UPS Market by Phase Type, Value (US$ Mn), 2019 - 2032

6.6.1.4. Germany Modular UPS Market by Enterprise Size, Value (US$ Mn), 2019 - 2032

6.6.1.5. Germany Modular UPS Market by Vertical, Value (US$ Mn), 2019 - 2032

6.6.1.6. U.K. Modular UPS Market by Component, Value (US$ Mn), 2019 - 2032

6.6.1.7. U.K. Modular UPS Market by Power Capacity, Value (US$ Mn), 2019 - 2032

6.6.1.8. U.K. Modular UPS Market by Phase Type, Value (US$ Mn), 2019 - 2032

6.6.1.9. U.K. Modular UPS Market by Enterprise Size, Value (US$ Mn), 2019 - 2032

6.6.1.10. U.K. Modular UPS Market by Vertical, Value (US$ Mn), 2019 - 2032

6.6.1.11. France Modular UPS Market by Component, Value (US$ Mn), 2019 - 2032

6.6.1.12. France Modular UPS Market by Power Capacity, Value (US$ Mn), 2019 - 2032

6.6.1.13. France Modular UPS Market by Phase Type, Value (US$ Mn), 2019 - 2032

6.6.1.14. France Modular UPS Market by Enterprise Size, Value (US$ Mn), 2019 - 2032

6.6.1.15. France Modular UPS Market by Vertical, Value (US$ Mn), 2019 - 2032

6.6.1.16. Italy Modular UPS Market by Component, Value (US$ Mn), 2019 - 2032

6.6.1.17. Italy Modular UPS Market by Power Capacity, Value (US$ Mn), 2019 - 2032

6.6.1.18. Italy Modular UPS Market by Phase Type, Value (US$ Mn), 2019 - 2032

6.6.1.19. Italy Modular UPS Market by Enterprise Size, Value (US$ Mn), 2019 - 2032

6.6.1.20. Italy Modular UPS Market by Vertical, Value (US$ Mn), 2019 - 2032

6.6.1.21. Turkey Modular UPS Market by Component, Value (US$ Mn), 2019 - 2032

6.6.1.22. Turkey Modular UPS Market by Power Capacity, Value (US$ Mn), 2019 - 2032

6.6.1.23. Turkey Modular UPS Market by Phase Type, Value (US$ Mn), 2019 - 2032

6.6.1.24. Turkey Modular UPS Market by Enterprise Size, Value (US$ Mn), 2019 - 2032

6.6.1.25. Turkey Modular UPS Market by Vertical, Value (US$ Mn), 2019 - 2032

6.6.1.26. Russia Modular UPS Market by Component, Value (US$ Mn), 2019 - 2032

6.6.1.27. Russia Modular UPS Market by Power Capacity, Value (US$ Mn), 2019 - 2032

6.6.1.28. Russia Modular UPS Market by Phase Type, Value (US$ Mn), 2019 - 2032

6.6.1.29. Russia Modular UPS Market by Enterprise Size, Value (US$ Mn), 2019 - 2032

6.6.1.30. Russia Modular UPS Market by Vertical, Value (US$ Mn), 2019 - 2032

6.6.1.31. Rest of Europe Modular UPS Market by Component, Value (US$ Mn), 2019 - 2032

6.6.1.32. Rest of Europe Modular UPS Market by Power Capacity, Value (US$ Mn), 2019 - 2032

6.6.1.33. Rest of Europe Modular UPS Market by Phase Type, Value (US$ Mn), 2019 - 2032

6.6.1.34. Rest of Europe Modular UPS Market by Enterprise Size, Value (US$ Mn), 2019 - 2032

6.6.1.35. Rest of Europe Modular UPS Market by Vertical, Value (US$ Mn), 2019 - 2032

6.6.2. BPS Analysis/Market Attractiveness Analysis

7. Asia Pacific Modular UPS Market Outlook, 2019 - 2032

7.1. Asia Pacific Modular UPS Market Outlook, by Component, Value (US$ Mn), 2019 - 2032

7.1.1. Key Highlights

7.1.1.1. Hardware

7.1.1.1.1. Power Modules

7.1.1.1.2. Control Module

7.1.1.1.3. Bypass Module

7.1.1.1.4. Battery Modules

7.1.1.1.5. Enclosure and Rack

7.1.1.1.6. Misc.

7.1.1.2. Software

7.1.1.3. Services

7.1.1.3.1. Professional Services

7.1.1.3.2. Managed Services

7.2. Asia Pacific Modular UPS Market Outlook, by Power Capacity, Value (US$ Mn), 2019 - 2032

7.2.1. Key Highlights

7.2.1.1. Up to 10 kVA

7.2.1.2. 10 kVA to 100 kVA

7.2.1.3. 100 kVA to 250 kVA

7.2.1.4. 250 kVA to 500 kVA

7.2.1.5. Above 500 kVA

7.3. Asia Pacific Modular UPS Market Outlook, by Phase Type, Value (US$ Mn), 2019 - 2032

7.3.1. Key Highlights

7.3.1.1. Single Phase

7.3.1.2. Three Phase

7.4. Asia Pacific Modular UPS Market Outlook, by Enterprise Size, Value (US$ Mn), 2019 - 2032

7.4.1. Key Highlights

7.4.1.1. Small & Medium Sized Enterprises (SMEs)

7.4.1.2. Large Enterprises

7.5. Asia Pacific Modular UPS Market Outlook, by Vertical, Value (US$ Mn), 2019 - 2032

7.5.1. Key Highlights

7.5.1.1. Data Centers

7.5.1.2. IT & Telecom

7.5.1.3. Healthcare

7.5.1.4. Industrial

7.5.1.5. BFSI

7.5.1.6. Energy

7.5.1.7. Government & Defense

7.5.1.8. Misc.

7.5.2. BPS Analysis/Market Attractiveness Analysis

7.6. Asia Pacific Modular UPS Market Outlook, by Country, Value (US$ Mn), 2019 - 2032

7.6.1. Key Highlights

7.6.1.1. China Modular UPS Market by Component, Value (US$ Mn), 2019 - 2032

7.6.1.2. China Modular UPS Market by Power Capacity, Value (US$ Mn), 2019 - 2032

7.6.1.3. China Modular UPS Market by Phase Type, Value (US$ Mn), 2019 - 2032

7.6.1.4. China Modular UPS Market by Enterprise Size, Value (US$ Mn), 2019 - 2032

7.6.1.5. China Modular UPS Market by Vertical, Value (US$ Mn), 2019 - 2032

7.6.1.6. Japan Modular UPS Market by Component, Value (US$ Mn), 2019 - 2032

7.6.1.7. Japan Modular UPS Market by Power Capacity, Value (US$ Mn), 2019 - 2032

7.6.1.8. Japan Modular UPS Market by Phase Type, Value (US$ Mn), 2019 - 2032

7.6.1.9. Japan Modular UPS Market by Enterprise Size, Value (US$ Mn), 2019 - 2032

7.6.1.10. Japan Modular UPS Market by Vertical, Value (US$ Mn), 2019 - 2032

7.6.1.11. South Korea Modular UPS Market by Component, Value (US$ Mn), 2019 - 2032

7.6.1.12. South Korea Modular UPS Market by Power Capacity, Value (US$ Mn), 2019 - 2032

7.6.1.13. South Korea Modular UPS Market by Phase Type, Value (US$ Mn), 2019 - 2032

7.6.1.14. South Korea Modular UPS Market by Enterprise Size, Value (US$ Mn), 2019 - 2032

7.6.1.15. South Korea Modular UPS Market by Vertical, Value (US$ Mn), 2019 - 2032

7.6.1.16. India Modular UPS Market by Component, Value (US$ Mn), 2019 - 2032

7.6.1.17. India Modular UPS Market by Power Capacity, Value (US$ Mn), 2019 - 2032

7.6.1.18. India Modular UPS Market by Phase Type, Value (US$ Mn), 2019 - 2032

7.6.1.19. India Modular UPS Market by Enterprise Size, Value (US$ Mn), 2019 - 2032

7.6.1.20. India Modular UPS Market by Vertical, Value (US$ Mn), 2019 - 2032

7.6.1.21. Southeast Asia Modular UPS Market by Component, Value (US$ Mn), 2019 - 2032

7.6.1.22. Southeast Asia Modular UPS Market by Power Capacity, Value (US$ Mn), 2019 - 2032

7.6.1.23. Southeast Asia Modular UPS Market by Phase Type, Value (US$ Mn), 2019 - 2032

7.6.1.24. Southeast Asia Modular UPS Market by Enterprise Size, Value (US$ Mn), 2019 - 2032

7.6.1.25. Southeast Asia Modular UPS Market by Vertical, Value (US$ Mn), 2019 - 2032

7.6.1.26. Rest of Asia Pacific Modular UPS Market by Component, Value (US$ Mn), 2019 - 2032

7.6.1.27. Rest of Asia Pacific Modular UPS Market by Power Capacity, Value (US$ Mn), 2019 - 2032

7.6.1.28. Rest of Asia Pacific Modular UPS Market by Phase Type, Value (US$ Mn), 2019 - 2032

7.6.1.29. Rest of Asia Pacific Modular UPS Market by Enterprise Size, Value (US$ Mn), 2019 - 2032

7.6.1.30. Rest of Asia Pacific Modular UPS Market by Vertical, Value (US$ Mn), 2019 - 2032

7.6.2. BPS Analysis/Market Attractiveness Analysis

8. Latin America Modular UPS Market Outlook, 2019 - 2032

8.1. Latin America Modular UPS Market Outlook, by Component, Value (US$ Mn), 2019 - 2032

8.1.1. Key Highlights

8.1.1.1. Hardware

8.1.1.1.1. Power Modules

8.1.1.1.2. Control Module

8.1.1.1.3. Bypass Module

8.1.1.1.4. Battery Modules

8.1.1.1.5. Enclosure and Rack

8.1.1.1.6. Misc.

8.1.1.2. Software

8.1.1.3. Services

8.1.1.3.1. Professional Services

8.1.1.3.2. Managed Services

8.2. Latin America Modular UPS Market Outlook, by Power Capacity, Value (US$ Mn), 2019 - 2032

8.2.1. Key Highlights

8.2.1.1. Up to 10 kVA

8.2.1.2. 10 kVA to 100 kVA

8.2.1.3. 100 kVA to 250 kVA

8.2.1.4. 250 kVA to 500 kVA

8.2.1.5. Above 500 kVA

8.3. Latin America Modular UPS Market Outlook, by Phase Type, Value (US$ Mn), 2019 - 2032

8.3.1. Key Highlights

8.3.1.1. Single Phase

8.3.1.2. Three Phase

8.4. Latin America Modular UPS Market Outlook, by Enterprise Size, Value (US$ Mn), 2019 - 2032

8.4.1. Key Highlights

8.4.1.1. Small & Medium Sized Enterprises (SMEs)

8.4.1.2. Large Enterprises

8.5. Latin America Modular UPS Market Outlook, by Vertical, Value (US$ Mn), 2019 - 2032

8.5.1. Key Highlights

8.5.1.1. Data Centers

8.5.1.2. IT & Telecom

8.5.1.3. Healthcare

8.5.1.4. Industrial

8.5.1.5. BFSI

8.5.1.6. Energy

8.5.1.7. Government & Defense

8.5.1.8. Misc.

8.5.2. BPS Analysis/Market Attractiveness Analysis

8.6. Latin America Modular UPS Market Outlook, by Country, Value (US$ Mn), 2019 - 2032

8.6.1. Key Highlights

8.6.1.1. Brazil Modular UPS Market by Component, Value (US$ Mn), 2019 - 2032

8.6.1.2. Brazil Modular UPS Market by Power Capacity, Value (US$ Mn), 2019 - 2032

8.6.1.3. Brazil Modular UPS Market by Phase Type, Value (US$ Mn), 2019 - 2032

8.6.1.4. Brazil Modular UPS Market by Enterprise Size, Value (US$ Mn), 2019 - 2032

8.6.1.5. Brazil Modular UPS Market by Vertical, Value (US$ Mn), 2019 - 2032

8.6.1.6. Mexico Modular UPS Market by Component, Value (US$ Mn), 2019 - 2032

8.6.1.7. Mexico Modular UPS Market by Power Capacity, Value (US$ Mn), 2019 - 2032

8.6.1.8. Mexico Modular UPS Market by Phase Type, Value (US$ Mn), 2019 - 2032

8.6.1.9. Mexico Modular UPS Market by Enterprise Size, Value (US$ Mn), 2019 - 2032

8.6.1.10. Mexico Modular UPS Market by Vertical, Value (US$ Mn), 2019 - 2032

8.6.1.11. Argentina Modular UPS Market by Component, Value (US$ Mn), 2019 - 2032

8.6.1.12. Argentina Modular UPS Market by Power Capacity, Value (US$ Mn), 2019 - 2032

8.6.1.13. Argentina Modular UPS Market by Phase Type, Value (US$ Mn), 2019 - 2032

8.6.1.14. Argentina Modular UPS Market by Enterprise Size, Value (US$ Mn), 2019 - 2032

8.6.1.15. Argentina Modular UPS Market by Vertical, Value (US$ Mn), 2019 - 2032

8.6.1.16. Rest of Latin America Modular UPS Market by Component, Value (US$ Mn), 2019 - 2032

8.6.1.17. Rest of Latin America Modular UPS Market by Power Capacity, Value (US$ Mn), 2019 - 2032

8.6.1.18. Rest of Latin America Modular UPS Market by Phase Type, Value (US$ Mn), 2019 - 2032

8.6.1.19. Rest of Latin America Modular UPS Market by Enterprise Size, Value (US$ Mn), 2019 - 2032

8.6.1.20. Rest of Latin America Modular UPS Market by Vertical, Value (US$ Mn), 2019 - 2032

8.6.2. BPS Analysis/Market Attractiveness Analysis

9. Middle East & Africa Modular UPS Market Outlook, 2019 - 2032

9.1. Middle East & Africa Modular UPS Market Outlook, by Component, Value (US$ Mn), 2019 - 2032

9.1.1. Key Highlights

9.1.1.1. Hardware

9.1.1.1.1. Power Modules

9.1.1.1.2. Control Module

9.1.1.1.3. Bypass Module

9.1.1.1.4. Battery Modules

9.1.1.1.5. Enclosure and Rack

9.1.1.1.6. Misc.

9.1.1.2. Software

9.1.1.3. Services

9.1.1.3.1. Professional Services

9.1.1.3.2. Managed Services

9.2. Middle East & Africa Modular UPS Market Outlook, by Power Capacity, Value (US$ Mn), 2019 - 2032

9.2.1. Key Highlights

9.2.1.1. Up to 10 kVA

9.2.1.2. 10 kVA to 100 kVA

9.2.1.3. 100 kVA to 250 kVA

9.2.1.4. 250 kVA to 500 kVA

9.2.1.5. Above 500 kVA

9.3. Middle East & Africa Modular UPS Market Outlook, by Phase Type, Value (US$ Mn), 2019 - 2032

9.3.1. Key Highlights

9.3.1.1. Single Phase

9.3.1.2. Three Phase

9.4. Middle East & Africa Modular UPS Market Outlook, by Enterprise Size, Value (US$ Mn), 2019 - 2032

9.4.1. Key Highlights

9.4.1.1. Small & Medium Sized Enterprises (SMEs)

9.4.1.2. Large Enterprises

9.5. Middle East & Africa Modular UPS Market Outlook, by Vertical, Value (US$ Mn), 2019 - 2032

9.5.1. Key Highlights

9.5.1.1. Data Centers

9.5.1.2. IT & Telecom

9.5.1.3. Healthcare

9.5.1.4. Industrial

9.5.1.5. BFSI

9.5.1.6. Energy

9.5.1.7. Government & Defense

9.5.1.8. Misc.

9.5.2. BPS Analysis/Market Attractiveness Analysis

9.6. Middle East & Africa Modular UPS Market Outlook, by Country, Value (US$ Mn), 2019 - 2032

9.6.1. Key Highlights

9.6.1.1. GCC Modular UPS Market by Component, Value (US$ Mn), 2019 - 2032

9.6.1.2. GCC Modular UPS Market by Power Capacity, Value (US$ Mn), 2019 - 2032

9.6.1.3. GCC Modular UPS Market by Phase Type, Value (US$ Mn), 2019 - 2032

9.6.1.4. GCC Modular UPS Market by Enterprise Size, Value (US$ Mn), 2019 - 2032

9.6.1.5. GCC Modular UPS Market by Vertical, Value (US$ Mn), 2019 - 2032

9.6.1.6. South Africa Modular UPS Market by Component, Value (US$ Mn), 2019 - 2032

9.6.1.7. South Africa Modular UPS Market by Power Capacity, Value (US$ Mn), 2019 - 2032

9.6.1.8. South Africa Modular UPS Market by Phase Type, Value (US$ Mn), 2019 - 2032

9.6.1.9. South Africa Modular UPS Market by Enterprise Size, Value (US$ Mn), 2019 - 2032

9.6.1.10. South Africa Modular UPS Market by Vertical, Value (US$ Mn), 2019 - 2032

9.6.1.11. Egypt Modular UPS Market by Component, Value (US$ Mn), 2019 - 2032

9.6.1.12. Egypt Modular UPS Market by Power Capacity, Value (US$ Mn), 2019 - 2032

9.6.1.13. Egypt Modular UPS Market by Phase Type, Value (US$ Mn), 2019 - 2032

9.6.1.14. Egypt Modular UPS Market by Enterprise Size, Value (US$ Mn), 2019 - 2032

9.6.1.15. Egypt Modular UPS Market by Vertical, Value (US$ Mn), 2019 - 2032

9.6.1.16. Nigeria Modular UPS Market by Component, Value (US$ Mn), 2019 - 2032

9.6.1.17. Nigeria Modular UPS Market by Power Capacity, Value (US$ Mn), 2019 - 2032

9.6.1.18. Nigeria Modular UPS Market by Phase Type, Value (US$ Mn), 2019 - 2032

9.6.1.19. Nigeria Modular UPS Market by Enterprise Size, Value (US$ Mn), 2019 - 2032

9.6.1.20. Nigeria Modular UPS Market by Vertical, Value (US$ Mn), 2019 - 2032

9.6.1.21. Rest of Middle East & Africa Modular UPS Market by Component, Value (US$ Mn), 2019 - 2032

9.6.1.22. Rest of Middle East & Africa Modular UPS Market by Power Capacity, Value (US$ Mn), 2019 - 2032

9.6.1.23. Rest of Middle East & Africa Modular UPS Market by Phase Type, Value (US$ Mn), 2019 - 2032

9.6.1.24. Rest of Middle East & Africa Modular UPS Market by Enterprise Size, Value (US$ Mn), 2019 - 2032

9.6.1.25. Rest of Middle East & Africa Modular UPS Market by Vertical, Value (US$ Mn), 2019 - 2032

9.6.2. BPS Analysis/Market Attractiveness Analysis

10. Competitive Landscape

10.1. Company Market Share Analysis, 2024

10.2. Competitive Dashboard

10.3. Company Profiles

10.3.1. Schneider Electric

10.3.1.1. Company Overview

10.3.1.2. Product Portfolio

10.3.1.3. Financial Overview

10.3.1.4. Business Strategies and Development

10.3.2. Eaton Corporation

10.3.2.1. Company Overview

10.3.2.2. Product Portfolio

10.3.2.3. Financial Overview

10.3.2.4. Business Strategies and Development

10.3.3. ABB Ltd.

10.3.3.1. Company Overview

10.3.3.2. Product Portfolio

10.3.3.3. Financial Overview

10.3.3.4. Business Strategies and Development

10.3.4. Vertiv

10.3.4.1. Company Overview

10.3.4.2. Product Portfolio

10.3.4.3. Financial Overview

10.3.4.4. Business Strategies and Development

10.3.5. Ametek Powervar

10.3.5.1. Company Overview

10.3.5.2. Product Portfolio

10.3.5.3. Financial Overview

10.3.5.4. Business Strategies and Development

10.3.6. Legrand

10.3.6.1. Company Overview

10.3.6.2. Product Portfolio

10.3.6.3. Financial Overview

10.3.6.4. Business Strategies and Development

10.3.7. Mitsubishi Electric

10.3.7.1. Company Overview

10.3.7.2. Product Portfolio

10.3.7.3. Financial Overview

10.3.7.4. Business Strategies and Development

10.3.8. Huawei Technologies Co., Ltd.

10.3.8.1. Company Overview

10.3.8.2. Product Portfolio

10.3.8.3. Financial Overview

10.3.8.4. Business Strategies and Development

10.3.9. Toshiba Corporation

10.3.9.1. Company Overview

10.3.9.2. Product Portfolio

10.3.9.3. Financial Overview

10.3.9.4. Business Strategies and Development

10.3.10. Delta Electronics

10.3.10.1. Company Overview

10.3.10.2. Product Portfolio

10.3.10.3. Financial Overview

10.3.10.4. Business Strategies and Development

11. Appendix

11.1. Research Methodology

11.2. Report Assumptions

11.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2023 |

|

2019 - 2023 |

2025 - 2032 |

Value: US$ Billion |

||

|

REPORT FEATURES |

DETAILS |

|

Component Coverage |

|

|

Power Capacity Coverage |

|

|

Phase Type Coverage |

|

|

Enterprise Size Coverage |

|

|

Vertical Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |