Global Molecular Diagnostics Market Forecast

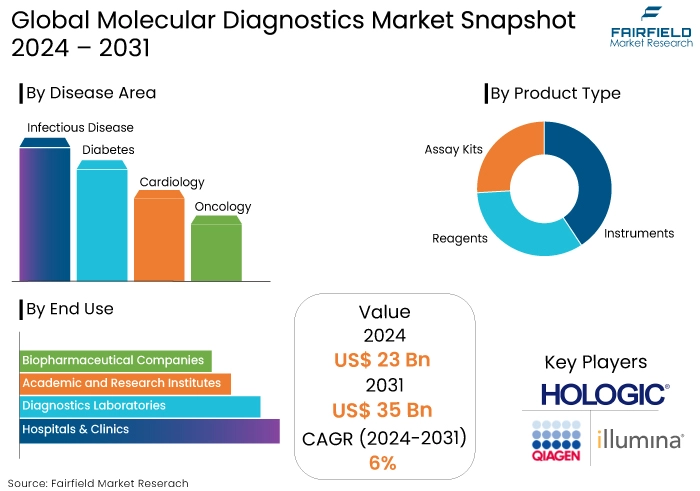

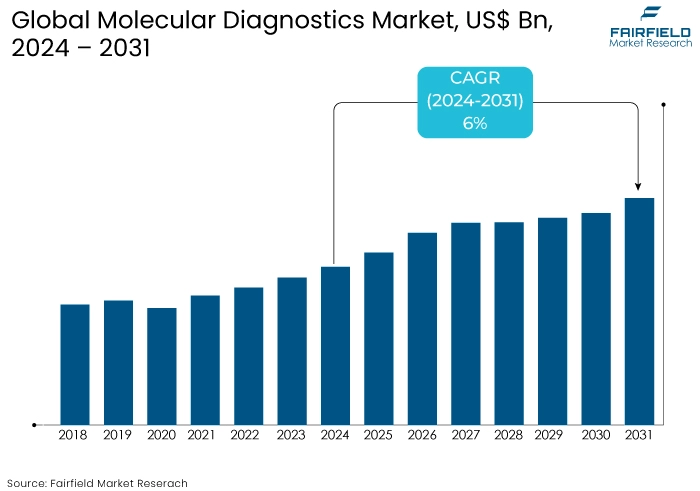

- The molecular diagnostics market is projected to reach a size of US$35 Bn by 2031, showing significant growth from the US$23 Bn achieved in 2024.

- The market for molecular diagnostics is expected to show a significant expansion rate, with an estimated CAGR of 6% from 2024 to 2031.

Molecular Diagnostics Market Insights

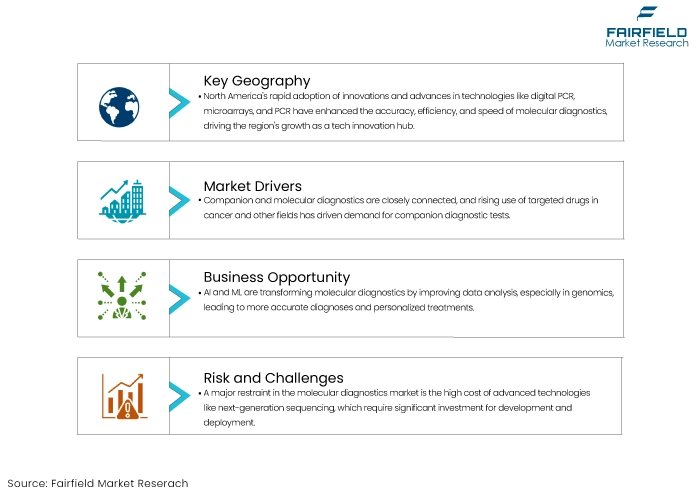

- North America molecular diagnostics market dominates the global market.

- The advent of companion diagnostics is a key factor for market growth.

- The increased prevalence of infectious diseases is influencing the market demand.

- Integration of AI and Machine Learning into molecular diagnostics offers lucrative opportunities for market players.

- The robust healthcare infrastructure in certain regions caters to the market’s substantial growth.

- The growing demand for advanced diagnostics can boost the market’s revenue over the forecast period.

- The market is estimated to exhibit a growth rate of 6% over the forecast period.

- High reimbursement costs can hinder the market’s growth trajectory in some regions.

A Look Back and a Look Forward - Comparative Analysis

The molecular diagnostics market experienced significant growth up to 2023 driven by advancements in personalized medicine, increasing prevalence of infectious diseases, and rising awareness of early disease detection. The market for molecular diagnostics expanded at a notable CAGR.

Adopting point-of-care (POC) diagnostics and integrating AI and machine learning for data analysis are anticipated to further enhance market growth. Emerging markets in Asia Pacific and Latin America are likely to play significant role contributing to a projected CAGR of 6% during the forecast period from 2024 to 2031.

Regulatory approvals and strategic collaborations between diagnostic companies and pharmaceutical firms are not just important but pivotal in shaping the future trajectory of the molecular diagnostics market.

Key Growth Determinants

- Advent of Companion Diagnostics

Companion and molecular diagnostics are closely linked, and understanding molecular diagnostics helps understand companion diagnostics. The growing utilization of specific drugs in cancer and other fields has increased the demand for companion diagnostic tests.

Next-generation sequencing (NGS) utilizes a multi-analyte approach to offer a thorough understanding of biomarkers making it a perfect tool for incorporating precision medicine into routine clinical practice.

The FDA and other regulatory authorities play a crucial role in promoting the development and implementation of companion diagnostics. Their approval is often necessary to ensure the safety and effectiveness of these tests when prescribing the associated drugs.

Companion diagnostics extend beyond cancer therapy. The company is expanding into more treatment fields, such as infectious diseases, cardiovascular issues, and neurological disorders, thereby increasing the potential market for diagnostic tools.

- Increasing Prevalence of Infectious Diseases

One key growth driver for the molecular diagnostics market is the increasing prevalence of infectious diseases particularly those caused by emerging and re-emerging pathogens. As global travel, urbanization, and environmental changes contribute to the spread of infectious diseases, there is a growing demand for accurate, rapid, and reliable diagnostic tools.

Molecular diagnostics especially techniques like PCR (polymerase chain reaction), NGS (next-generation sequencing), and CRISPR-based assays offer precise identification of pathogens, enabling timely and targeted treatment.

As healthcare systems worldwide prioritize the containment and management of infectious diseases, the market for molecular diagnostics is expected to witness sustained growth. It is driven by the necessity for early detection, personalized treatment approaches, and the prevention of disease outbreaks on a global scale.

Key Growth Barriers

- High Costs and Reimbursement Challenges

One significant restraint for the molecular diagnostics market is the high cost of advanced diagnostic technologies. The development, production, and deployment of molecular diagnostic tests particularly those involving next-generation sequencing (NGS) and other sophisticated platforms require substantial investment.

High costs are often passed on to healthcare providers and patients making these tests less accessible especially in low- and middle-income countries. Reimbursement policies for molecular diagnostics vary significantly across regions with many insurance companies and public health systems hesitant to cover the total cost of these tests.

The pressing need for standardized and adequate reimbursement is a critical factor that can deter widespread adoption, thereby limiting the market's potential growth. It is particularly in markets where out-of-pocket expenses are a significant barrier to healthcare access.

- Regulatory and Ethical Challenges

Regulatory and ethical challenges are not to be underestimated as they pose significant restraints on the molecular diagnostics market. The development and commercialization of molecular diagnostic tests require navigating complex regulatory environments that vary widely between countries.

Consistent or clear regulatory pathways can lead to delays in product approvals, increased costs, and challenges in bringing new technologies to market. Ethical concerns particularly around genetic testing and data privacy can profoundly impact molecular diagnostics market growth.

The use of molecular diagnostics, especially in areas like genetic predisposition testing, raises questions about data security, informed consent, and the potential for discrimination based on genetic information. These concerns can lead to stricter regulations and slower adoption rates, especially in regions with stringent privacy laws, further restraining the market's expansion.

Molecular Diagnostics Market Trends and Opportunities

- Integration of Artificial Intelligence (AI) in Molecular Diagnostics

A prominent trend shaping the molecular diagnostics market is the integration of artificial intelligence (AI) and machine learning (ML) technologies. AI's ability to analyse vast amounts of complex data with unprecedented speed and accuracy is revolutionizing molecular diagnostics.

AI algorithms are increasingly being used to enhance the precision of diagnostic tests particularly in areas like genomics where interpreting large-scale sequencing data can be challenging. For instance, AI can identify patterns in genetic data that may be missed by traditional methods leading to accurate diagnoses and personalized treatment plans.

AI-driven tools are being developed to assist in real-time monitoring of disease progression, predicting patient outcomes, and identifying the most effective therapies based on a patient's genetic profile.

The application of AI in molecular diagnostics also streamlines workflows in laboratories reducing the time and cost associated with manual data analysis. AI-powered automated systems can handle large volumes of samples ensuring consistency and reducing human error.

As AI continues to evolve, its role in molecular diagnostics is expected to expand, driving further innovation and efficiency. This trend is particularly significant in personalized medicine, where the ability to quickly and accurately analyse genetic information is critical to tailoring treatments to individual patients.

- Favourable Government Initiatives

Real-time PCR (RT PCR) was perceived as a highly specialized technology employed by a limited number of laboratories nationwide. The pandemic has exerted significant pressure on the diagnostics sector leading to a rapid expansion. In India alone, more than 3000 testing laboratories are dedicated to doing genetic testing.

The increasing prevalence of RT PCR, viral amplification, and genome sequencing is poised to bring about a significant transformation in molecular diagnosis. The legislative positions of the United States and the European Union on laboratory-developed tests (LDTs) and in-house testing vary creating a unique opportunity for molecular diagnostic companies.

To ensure compliance with local rules and regulations, designing molecular diagnostic devices meticulously is crucial. Businesses might emphasize FDA-compliant testing for the US molecular diagnostics market to showcase their adherence to rigorous requirements. They can also position themselves within the EU as partners who endorse enhanced internal testing capabilities by offering supplementary and innovative molecular diagnostic solutions.

By employing this strategic approach, organizations can leverage the diverse regulatory frameworks in each region to optimize their market dominance and product offerings.

How Does Regulatory Scenario Shape this Industry?

The regulatory scenario plays a crucial role in shaping the molecular diagnostics market, influencing its growth and challenges. As molecular diagnostics involve cutting-edge technologies like next-generation sequencing (NGS) and CRISPR, regulatory bodies worldwide are working to establish clear and consistent frameworks to ensure the safety, efficacy, and reliability of these tests.

In regions like the United States and Europe regulatory agencies such as the FDA and EMA are increasingly focusing on validating and standardizing molecular diagnostic tests, which includes implementing rigorous approval processes, which, while ensuring high-quality standards, can also lengthen time-to-market and increase costs for manufactures.

Recent trends indicate a move towards more adaptive regulatory pathways, especially in response to the rapid advancements seen during the COVID-19 pandemic. Emerging markets are also adapting their regulatory frameworks, with many countries striving to balance stringent regulations with the need to improve healthcare access.

Harmonization efforts across global regulatory bodies are expected to facilitate smoother molecular diagnostics market entry and expansion, potentially accelerating innovation and adoption in the molecular diagnostics space.

Segments Covered in the Report

- Reagents Product Type Accounts for around 62% of the Total Market Share

Due to extensive use of reagents in research and clinical settings and the growing popularity of new tests, these are anticipated to continue to be the dominant force in the market for the foreseeable future. In April 2023, Cepheid, a subsidiary of Danaher, revealed its intention to launch innovative diagnostics for several infectious diseases such as respiratory ailments and tuberculosis.

The company has partnered with experts at Rutgers University to create this innovative technology that enables the detection of 10 distinct targets in a single reaction. Furthermore, the molecular diagnostics market expansion is expected to be supported by standardized findings, enhanced efficiency, and cost-effectiveness.

- Infectious Disease Area Leads the Market Accumulating 28% Market Share

The infectious diseases segment had the high proportion of the molecular diagnostics market revenue owing to the growing utilization of molecular diagnostics specifically PCR tests for the diagnosis of COVID-19, which has substantially raised the market share of this category.

The increasing occurrence of infectious diseases globally further amplifies the need for innovative molecular diagnostic tools. In May 2023, the U.S. FDA granted 510(k) clearance to Hologic's Panther Fusion SARS-CoV-2/Flu A/B/RSV assay.

The said assay is a molecular diagnostic test distinguishing the four most prevalent respiratory viruses. In April 2023, Oxford Nanopore and bioMérieux established a strategic agreement to utilize nanopore technology to develop innovative medicines for infectious diseases.

Regional Analysis

- North America’s Dominance Prevails in Molecular Diagnostics Market

North America is seen as a technological innovation center, and the rapid adoption of new innovations aids the region's growth. Also, the continuous development of technologies such as digital polymerase chain reaction (PCR), microarrays, and polymerase chain reaction (PGR) has led to improvements in the accuracy, efficiency, and speed of molecular diagnostic testing.

Methods of diagnosis that are both accurate and early are becoming increasingly important in North America as a result of the increasing prevalence of chronic diseases. These diseases include cancer, cardiovascular disorders, diabetes, and genetic abnormalities.

Molecular diagnostics make it possible to detect illnesses with pinpoint accuracy enabling early intervention and the development of tailored treatment programs.

Fairfield’s Competitive Landscape Analysis

The molecular diagnostics market is highly competitive with key players including Roche Diagnostics, Abbott Laboratories, Thermo Fisher Scientific, and Qiagen dominating the space. These companies are known for their extensive product portfolios, robust research and development capabilities, and global distribution networks.

The market also sees significant competition from emerging biotech firms specializing in niche areas like liquid biopsy, next-generation sequencing (NGS), and CRISPR-based diagnostics. Strategic collaborations, mergers, and acquisitions are expected as companies seek to enhance their technological capabilities and market reach.

Innovation is a critical competitive factor, with companies investing signifianlty in developing advanced diagnostic platforms and personalized medicine solutions. Also, the competitive landscape is further intensified by the entry of new players and the growing emphasis on cost-effective and point-of-care diagnostics.

Key Market Companies

- Becton, Dickinson and Company

- Bio-Rad Laboratories In

- Merck KgaA

- Thermo Fisher Scientific Inc

- Agilent Technologies, Inc.

- F. Hoffman - La Roche Ltd.

- Illumina, Inc.

- Qiagen N.V.

- Hologic Inc.

- Siemens Healthineers AG

- Seegene, Inc.

- DiaSorin S.p.A

- Grifols, S.A.

- bioMérieux

- QuidelOrtho Corporation

- RapidBio

- Abbott Laboratories

- Danaher Corporation

Recent Industry Developments

- July 2023 -

Illumina Inc. and Pillar Biosciences Inc., the pioneers of Decision Medicine™, announced a strategic partnership to make Pillar's oncology assays commercially available globally as part of the Illumina portfolio of oncology products.

- October 2023 -

Roche announced that the US Food and Drug Administration (FDA) approved the PATHWAY anti-HER2/neu (4B5) Rabbit Monoclonal Primary Antibody to identify metastatic breast cancer patients with low HER2 expression.

An Expert’s Eye

- Innovations in next-generation sequencing (NGS) and CRISPR remains a key driver for market growth.

- Growth of personalized diagnostics and digital health technologies may bring larger revenue.

- The incorporation of AI and machine learning will revolutionize the market by enhancing diagnostic accuracy and efficiency.

- Improved healthcare infrastructure and increasing demand for advanced diagnostics will drive the molecular diagnostics market

Global Molecular Diagnostics Market is Segmented as-

By Product Type

- Instruments

- Reagents

- Assay Kits

By Disease Area

- Infectious Disease

- Diabetes

- Cardiology

- Oncology

By End Use

- Hospitals & Clinics

- Diagnostics Laboratories

- Academic and Research Institutes

- Biopharmaceutical Companies

By Region

- North America

- Europe

- East Asia

- South Asia & Oceania

- Latin America

- The Middle East and Africa

1. Executive Summary

1.1. Global Molecular Diagnostics Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value and Volume, 2022

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. COVID-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Economic Overview

2.6.1. World Economic Projections

2.7. PESTLE Analysis

3. Global Molecular Diagnostics Market Outlook, 2018 - 2031

3.1. Global Molecular Diagnostics Market Outlook, by Product Type, Value (US$ Mn) and Volume (Units), 2018 - 2031

3.1.1. Key Highlights

3.1.1.1. Instruments

3.1.1.1.1. Polymerase Chain Reaction (PCR) Systems

3.1.1.1.2. Hybridization (In-Situ Hybridization & Fish) Systems

3.1.1.1.3. DNA Sequencing and Next-Generation Sequencing Platforms

3.1.1.1.4. Microarrays

3.1.1.2. Reagent

3.1.1.2.1. Antibodies

3.1.1.2.2. DNA Template

3.1.1.2.3. DNA Polymerase

3.1.1.2.4. Oligonucleotide Primers

3.1.1.2.5. Deoxyribonucleotide Triphosphate (dNTPs)

3.1.1.2.6. Buffer

3.1.1.3. Assay Kits

3.1.1.4. Consumables

3.2. Global Molecular Diagnostics Market Outlook, by Disease Area, Value (US$ Mn) and 2018 - 2031

3.2.1. Key Highlights

3.2.1.1. Infectious Disease

3.2.1.2. Diabetes

3.2.1.3. Cardiology

3.2.1.4. Oncology

3.2.1.5. Nephrology

3.2.1.6. Autoimmune Disease

3.2.1.7. Dermatology

3.2.1.8. Wound Care

3.2.1.9. Others

3.3. Global Molecular Diagnostics Market Outlook, by End User, Value (US$ Mn), 2018 - 2031

3.3.1. Key Highlights

3.3.1.1. Hospitals & Clinics

3.3.1.2. Diagnostics Laboratories

3.3.1.3. Academic and Research Institutes

3.3.1.4. Biopharmaceutical Companies

3.4. Global Molecular Diagnostics Market Outlook, by Region, Value (US$ Mn) and Volume (Units), 2018 - 2031

3.4.1. Key Highlights

3.4.1.1. North America

3.4.1.2. Europe

3.4.1.3. Asia Pacific

3.4.1.4. Latin America

3.4.1.5. Middle East & Africa

4. North America Molecular Diagnostics Market Outlook, 2018 - 2031

4.1. North America Molecular Diagnostics Market Outlook, by Product Type, Value (US$ Mn) and Volume (Units), 2018 - 2031

4.1.1. Key Highlights

4.1.1.1. Instruments

4.1.1.1.1. Polymerase Chain Reaction (PCR) Systems

4.1.1.1.2. Hybridization (In-Situ Hybridization & Fish) Systems

4.1.1.1.3. DNA Sequencing and Next-Generation Sequencing Platforms

4.1.1.1.4. Microarrays

4.1.1.2. Reagent

4.1.1.2.1. Antibodies

4.1.1.2.2. DNA Template

4.1.1.2.3. DNA Polymerase

4.1.1.2.4. Oligonucleotide Primers

4.1.1.2.5. Deoxyribonucleotide Triphosphate (dNTPs)

4.1.1.2.6. Buffer

4.1.1.3. Assay Kits

4.1.1.4. Consumables

4.2. North America Molecular Diagnostics Market Outlook, by Disease Area, Value (US$ Mn) and 2018 - 2031

4.2.1. Key Highlights

4.2.1.1. Infectious Disease

4.2.1.2. Diabetes

4.2.1.3. Cardiology

4.2.1.4. Oncology

4.2.1.5. Nephrology

4.2.1.6. Autoimmune Disease

4.2.1.7. Dermatology

4.2.1.8. Wound Care

4.2.1.9. Others

4.3. North America Molecular Diagnostics Market Outlook, by End User, Value (US$ Mn), 2018 - 2031

4.3.1. Key Highlights

4.3.1.1. Hospitals & Clinics

4.3.1.2. Diagnostics Laboratories

4.3.1.3. Academic and Research Institutes

4.3.1.4. Biopharmaceutical Companies

4.3.2. BPS Analysis/Market Attractiveness Analysis

4.4. North America Molecular Diagnostics Market Outlook, by Country, Value (US$ Mn) and Volume (Units), 2018 - 2031

4.4.1. Key Highlights

4.4.1.1. U.S. Molecular Diagnostics Market by Product Type, Value (US$ Mn) and Volume (Units), 2018 - 2031

4.4.1.2. U.S. Molecular Diagnostics Market by Disease Area, Value (US$ Mn) and Volume (Units), 2018 - 2031

4.4.1.3. U.S. Molecular Diagnostics Market by End User, Value (US$ Mn) and Volume (Units), 2018 - 2031

4.4.1.4. Canada Molecular Diagnostics Market by Product Type, Value (US$ Mn) and Volume (Units), 2018 - 2031

4.4.1.5. Canada Molecular Diagnostics Market by Disease Area, Value (US$ Mn) and Volume (Units), 2018 - 2031

4.4.1.6. Canada Molecular Diagnostics Market by End User, Value (US$ Mn) and Volume (Units), 2018 - 2031

4.4.2. BPS Analysis/Market Attractiveness Analysis

5. Europe Molecular Diagnostics Market Outlook, 2018 - 2031

5.1. Europe Molecular Diagnostics Market Outlook, by Product Type, Value (US$ Mn) and Volume (Units), 2018 - 2031

5.1.1. Key Highlights

5.1.1.1. Instruments

5.1.1.1.1. Polymerase Chain Reaction (PCR) Systems

5.1.1.1.2. Hybridization (In-Situ Hybridization & Fish) Systems

5.1.1.1.3. DNA Sequencing and Next-Generation Sequencing Platforms

5.1.1.1.4. Microarrays

5.1.1.2. Reagent

5.1.1.2.1. Antibodies

5.1.1.2.2. DNA Template

5.1.1.2.3. DNA Polymerase

5.1.1.2.4. Oligonucleotide Primers

5.1.1.2.5. Deoxyribonucleotide Triphosphate (dNTPs)

5.1.1.2.6. Buffer

5.1.1.3. Assay Kits

5.1.1.4. Consumables

5.2. Europe Molecular Diagnostics Market Outlook, by Disease Area, Value (US$ Mn) and 2018 - 2031

5.2.1. Key Highlights

5.2.1.1. Infectious Disease

5.2.1.2. Diabetes

5.2.1.3. Cardiology

5.2.1.4. Oncology

5.2.1.5. Nephrology

5.2.1.6. Autoimmune Disease

5.2.1.7. Dermatology

5.2.1.8. Wound Care

5.2.1.9. Others

5.3. Europe Molecular Diagnostics Market Outlook, by End User, Value (US$ Mn), 2018 - 2031

5.3.1. Key Highlights

5.3.1.1. Hospitals & Clinics

5.3.1.2. Diagnostics Laboratories

5.3.1.3. Academic and Research Institutes

5.3.1.4. Biopharmaceutical Companies

5.3.2. BPS Analysis/Market Attractiveness Analysis

5.4. Europe Molecular Diagnostics Market Outlook, by Country, Value (US$ Mn) and Volume (Units), 2018 - 2031

5.4.1. Key Highlights

5.4.1.1. Germany Molecular Diagnostics Market by Product Type, Value (US$ Mn) and Volume (Units), 2018 - 2031

5.4.1.2. Germany Molecular Diagnostics Market by Disease Area, Value (US$ Mn) and Volume (Units), 2018 - 2031

5.4.1.3. Germany Molecular Diagnostics Market by End User, Value (US$ Mn) and Volume (Units), 2018 - 2031

5.4.1.4. U.K. Molecular Diagnostics Market by Product Type, Value (US$ Mn) and Volume (Units), 2018 - 2031

5.4.1.5. U.K. Molecular Diagnostics Market by Disease Area, Value (US$ Mn) and Volume (Units), 2018 - 2031

5.4.1.6. U.K. Molecular Diagnostics Market by End User, Value (US$ Mn) and Volume (Units), 2018 - 2031

5.4.1.7. France Molecular Diagnostics Market by Product Type, Value (US$ Mn) and Volume (Units), 2018 - 2031

5.4.1.8. France Molecular Diagnostics Market by Disease Area, Value (US$ Mn) and Volume (Units), 2018 - 2031

5.4.1.9. France Molecular Diagnostics Market by End User, Value (US$ Mn) and Volume (Units), 2018 - 2031

5.4.1.10. Italy Molecular Diagnostics Market by Product Type, Value (US$ Mn) and Volume (Units), 2018 - 2031

5.4.1.11. Italy Molecular Diagnostics Market by Disease Area, Value (US$ Mn) and Volume (Units), 2018 - 2031

5.4.1.12. Italy Molecular Diagnostics Market by End User, Value (US$ Mn) and Volume (Units), 2018 - 2031

5.4.1.13. Spain Molecular Diagnostics Market by Product Type, Value (US$ Mn) and Volume (Units), 2018 - 2031

5.4.1.14. Spain Molecular Diagnostics Market by Disease Area, Value (US$ Mn) and Volume (Units), 2018 - 2031

5.4.1.15. Spain Molecular Diagnostics Market by End User, Value (US$ Mn) and Volume (Units), 2018 - 2031

5.4.1.16. Russia Molecular Diagnostics Market by Product Type, Value (US$ Mn) and Volume (Units), 2018 - 2031

5.4.1.17. Russia Molecular Diagnostics Market by Disease Area, Value (US$ Mn) and Volume (Units), 2018 - 2031

5.4.1.18. Russia Molecular Diagnostics Market by End User, Value (US$ Mn) and Volume (Units), 2018 - 2031

5.4.1.19. Rest of Europe Molecular Diagnostics Market by Product Type, Value (US$ Mn) and Volume (Units), 2018 - 2031

5.4.1.20. Rest of Europe Molecular Diagnostics Market by Disease Area, Value (US$ Mn) and Volume (Units), 2018 - 2031

5.4.1.21. Rest of Europe Molecular Diagnostics Market by End User, Value (US$ Mn) and Volume (Units), 2018 - 2031

5.4.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Molecular Diagnostics Market Outlook, 2018 - 2031

6.1. Asia Pacific Molecular Diagnostics Market Outlook, by Product Type, Value (US$ Mn) and Volume (Units), 2018 - 2031

6.1.1. Key Highlights

6.1.1.1. Instruments

6.1.1.1.1. Polymerase Chain Reaction (PCR) Systems

6.1.1.1.2. Hybridization (In-Situ Hybridization & Fish) Systems

6.1.1.1.3. DNA Sequencing and Next-Generation Sequencing Platforms

6.1.1.1.4. Microarrays

6.1.1.2. Reagent

6.1.1.2.1. Antibodies

6.1.1.2.2. DNA Template

6.1.1.2.3. DNA Polymerase

6.1.1.2.4. Oligonucleotide Primers

6.1.1.2.5. Deoxyribonucleotide Triphosphate (dNTPs)

6.1.1.2.6. Buffer

6.1.1.3. Assay Kits

6.1.1.4. Consumables

6.2. Asia Pacific Molecular Diagnostics Market Outlook, by Disease Area, Value (US$ Mn) and 2018 - 2031

6.2.1. Key Highlights

6.2.1.1. Infectious Disease

6.2.1.2. Diabetes

6.2.1.3. Cardiology

6.2.1.4. Oncology

6.2.1.5. Nephrology

6.2.1.6. Autoimmune Disease

6.2.1.7. Dermatology

6.2.1.8. Wound Care

6.2.1.9. Others

6.3. Asia Pacific Molecular Diagnostics Market Outlook, by End User, Value (US$ Mn), 2018 - 2031

6.3.1. Key Highlights

6.3.1.1. Hospitals & Clinics

6.3.1.2. Diagnostics Laboratories

6.3.1.3. Academic and Research Institutes

6.3.1.4. Biopharmaceutical Companies

6.3.2. BPS Analysis/Market Attractiveness Analysis

6.4. Asia Pacific Molecular Diagnostics Market Outlook, by Country, Value (US$ Mn) and Volume (Units), 2018 - 2031

6.4.1. Key Highlights

6.4.1.1. China Molecular Diagnostics Market by Product Type, Value (US$ Mn) and Volume (Units), 2018 - 2031

6.4.1.2. China Molecular Diagnostics Market by Disease Area, Value (US$ Mn) and Volume (Units), 2018 - 2031

6.4.1.3. China Molecular Diagnostics Market by End User, Value (US$ Mn) and Volume (Units), 2018 - 2031

6.4.1.4. Japan Molecular Diagnostics Market by Product Type, Value (US$ Mn) and Volume (Units), 2018 - 2031

6.4.1.5. Japan Molecular Diagnostics Market by Disease Area, Value (US$ Mn) and Volume (Units), 2018 - 2031

6.4.1.6. Japan Molecular Diagnostics Market by End User, Value (US$ Mn) and Volume (Units), 2018 - 2031

6.4.1.7. South Korea Molecular Diagnostics Market by Product Type, Value (US$ Mn) and Volume (Units), 2018 - 2031

6.4.1.8. South Korea Molecular Diagnostics Market by Disease Area, Value (US$ Mn) and Volume (Units), 2018 - 2031

6.4.1.9. South Korea Molecular Diagnostics Market by End User, Value (US$ Mn) and Volume (Units), 2018 - 2031

6.4.1.10. India Molecular Diagnostics Market by Product Type, Value (US$ Mn) and Volume (Units), 2018 - 2031

6.4.1.11. India Molecular Diagnostics Market by Disease Area, Value (US$ Mn) and Volume (Units), 2018 - 2031

6.4.1.12. India Molecular Diagnostics Market by End User, Value (US$ Mn) and Volume (Units), 2018 - 2031

6.4.1.13. Southeast Asia Molecular Diagnostics Market by Product Type, Value (US$ Mn) and Volume (Units), 2018 - 2031

6.4.1.14. Southeast Asia Molecular Diagnostics Market by Disease Area, Value (US$ Mn) and Volume (Units), 2018 - 2031

6.4.1.15. Southeast Asia Molecular Diagnostics Market by End User, Value (US$ Mn) and Volume (Units), 2018 - 2031

6.4.1.16. Russia Molecular Diagnostics Market by Product Type, Value (US$ Mn) and Volume (Units), 2018 - 2031

6.4.1.17. Russia Molecular Diagnostics Market by Disease Area, Value (US$ Mn) and Volume (Units), 2018 - 2031

6.4.1.18. Russia Molecular Diagnostics Market by End User, Value (US$ Mn) and Volume (Units), 2018 - 2031

6.4.1.19. Rest of Asia Pacific Molecular Diagnostics Market by Product Type, Value (US$ Mn) and Volume (Units), 2018 - 2031

6.4.1.20. Rest of Asia Pacific Molecular Diagnostics Market by Disease Area, Value (US$ Mn) and Volume (Units), 2018 - 2031

6.4.1.21. Rest of Asia Pacific Molecular Diagnostics Market by End User, Value (US$ Mn) and Volume (Units), 2018 - 2031

6.4.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America Molecular Diagnostics Market Outlook, 2018 - 2031

7.1. Latin America Molecular Diagnostics Market Outlook, by Product Type, Value (US$ Mn) and Volume (Units), 2018 - 2031

7.1.1. Key Highlights

7.1.1.1. Instruments

7.1.1.1.1. Polymerase Chain Reaction (PCR) Systems

7.1.1.1.2. Hybridization (In-Situ Hybridization & Fish) Systems

7.1.1.1.3. DNA Sequencing and Next-Generation Sequencing Platforms

7.1.1.1.4. Microarrays

7.1.1.2. Reagent

7.1.1.2.1. Antibodies

7.1.1.2.2. DNA Template

7.1.1.2.3. DNA Polymerase

7.1.1.2.4. Oligonucleotide Primers

7.1.1.2.5. Deoxyribonucleotide Triphosphate (dNTPs)

7.1.1.2.6. Buffer

7.1.1.3. Assay Kits

7.1.1.4. Consumables

7.2. Latin America Molecular Diagnostics Market Outlook, by Disease Area, Value (US$ Mn) and 2018 - 2031

7.2.1. Key Highlights

7.2.1.1. Infectious Disease

7.2.1.2. Diabetes

7.2.1.3. Cardiology

7.2.1.4. Oncology

7.2.1.5. Nephrology

7.2.1.6. Autoimmune Disease

7.2.1.7. Dermatology

7.2.1.8. Wound Care

7.2.1.9. Others

7.3. Latin America Molecular Diagnostics Market Outlook, by End User, Value (US$ Mn), 2018 - 2031

7.3.1. Key Highlights

7.3.1.1. Hospitals & Clinics

7.3.1.2. Diagnostics Laboratories

7.3.1.3. Academic and Research Institutes

7.3.1.4. Biopharmaceutical Companies

7.3.2. BPS Analysis/Market Attractiveness Analysis

7.4. Latin America Molecular Diagnostics Market Outlook, by Country, Value (US$ Mn) and Volume (Units), 2018 - 2031

7.4.1. Key Highlights

7.4.1.1. Brazil Molecular Diagnostics Market by Product Type, Value (US$ Mn) and Volume (Units), 2018 - 2031

7.4.1.2. Brazil Molecular Diagnostics Market by Disease Area, Value (US$ Mn) and Volume (Units), 2018 - 2031

7.4.1.3. Brazil Molecular Diagnostics Market by End User, Value (US$ Mn) and Volume (Units), 2018 - 2031

7.4.1.4. Mexico Molecular Diagnostics Market by Product Type, Value (US$ Mn) and Volume (Units), 2018 - 2031

7.4.1.5. Mexico Molecular Diagnostics Market by Disease Area, Value (US$ Mn) and Volume (Units), 2018 - 2031

7.4.1.6. Mexico Molecular Diagnostics Market by End User, Value (US$ Mn) and Volume (Units), 2018 - 2031

7.4.1.7. Rest of Latin America Molecular Diagnostics Market by Product Type, Value (US$ Mn) and Volume (Units), 2018 - 2031

7.4.1.8. Rest of Latin America Molecular Diagnostics Market by Disease Area, Value (US$ Mn) and Volume (Units), 2018 - 2031

7.4.1.9. Rest of Latin America Molecular Diagnostics Market by End User, Value (US$ Mn) and Volume (Units), 2018 - 2031

7.4.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Molecular Diagnostics Market Outlook, 2018 - 2031

8.1. Middle East & Africa Molecular Diagnostics Market Outlook, by Product Type, Value (US$ Mn) and Volume (Units), 2018 - 2031

8.1.1. Key Highlights

8.1.1.1. Instruments

8.1.1.1.1. Polymerase Chain Reaction (PCR) Systems

8.1.1.1.2. Hybridization (In-Situ Hybridization & Fish) Systems

8.1.1.1.3. DNA Sequencing and Next-Generation Sequencing Platforms

8.1.1.1.4. Microarrays

8.1.1.2. Reagent

8.1.1.2.1. Antibodies

8.1.1.2.2. DNA Template

8.1.1.2.3. DNA Polymerase

8.1.1.2.4. Oligonucleotide Primers

8.1.1.2.5. Deoxyribonucleotide Triphosphate (dNTPs)

8.1.1.2.6. Buffer

8.1.1.3. Assay Kits

8.1.1.4. Consumables

8.2. Middle East & Africa Molecular Diagnostics Market Outlook, by Disease Area, Value (US$ Mn) and 2018 - 2031

8.2.1. Key Highlights

8.2.1.1. Infectious Disease

8.2.1.2. Diabetes

8.2.1.3. Cardiology

8.2.1.4. Oncology

8.2.1.5. Nephrology

8.2.1.6. Autoimmune Disease

8.2.1.7. Dermatology

8.2.1.8. Wound Care

8.2.1.9. Others

8.3. Middle East & Africa Molecular Diagnostics Market Outlook, by End User, Value (US$ Mn), 2018 - 2031

8.3.1. Key Highlights

8.3.1.1. Hospitals & Clinics

8.3.1.2. Diagnostics Laboratories

8.3.1.3. Academic and Research Institutes

8.3.1.4. Biopharmaceutical Companies

8.3.2. BPS Analysis/Market Attractiveness Analysis

8.4. Middle East & Africa Molecular Diagnostics Market Outlook, by Country, Value (US$ Mn) and Volume (Units), 2018 - 2031

8.4.1. Key Highlights

8.4.1.1. GCC Molecular Diagnostics Market by Product Type, Value (US$ Mn) and Volume (Units), 2018 - 2031

8.4.1.2. GCC Molecular Diagnostics Market by Disease Area, Value (US$ Mn) and Volume (Units), 2018 - 2031

8.4.1.3. GCC Molecular Diagnostics Market by End User, Value (US$ Mn) and Volume (Units), 2018 - 2031

8.4.1.4. South Africa Molecular Diagnostics Market by Product Type, Value (US$ Mn) and Volume (Units), 2018 - 2031

8.4.1.5. South Africa Molecular Diagnostics Market by Disease Area, Value (US$ Mn) and Volume (Units), 2018 - 2031

8.4.1.6. South Africa Molecular Diagnostics Market by End User, Value (US$ Mn) and Volume (Units), 2018 - 2031

8.4.1.7. Egypt Molecular Diagnostics Market by Product Type, Value (US$ Mn) and Volume (Units), 2018 - 2031

8.4.1.8. Egypt Molecular Diagnostics Market by Disease Area, Value (US$ Mn) and Volume (Units), 2018 - 2031

8.4.1.9. Egypt Molecular Diagnostics Market by End User, Value (US$ Mn) and Volume (Units), 2018 - 2031

8.4.1.10. Rest of Middle East & Africa Molecular Diagnostics Market by Product Type, Value (US$ Mn) and Volume (Units), 2018 - 2031

8.4.1.11. Rest of Middle East & Africa Molecular Diagnostics Market by Disease Area, Value (US$ Mn) and Volume (Units), 2018 - 2031

8.4.1.12. Rest of Middle East & Africa Molecular Diagnostics Market by End User, Value (US$ Mn) and Volume (Units), 2018 - 2031

8.4.2. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. Manufacturer vs by Disease Area Heatmap

9.2. Company Market Share Analysis, 2022

9.3. Competitive Dashboard

9.4. Company Profiles

9.4.1. F. Hoffman - La Roche Ltd.

9.4.1.1. Company Overview

9.4.1.2. Product Portfolio

9.4.1.3. Financial Overview

9.4.1.4. Business Strategies and Development

9.4.2. Becton, Dickinson, and Company

9.4.2.1. Company Overview

9.4.2.2. Product Portfolio

9.4.2.3. Financial Overview

9.4.2.4. Business Strategies and Development

9.4.3. Bio-Rad Laboratories In

9.4.3.1. Company Overview

9.4.3.2. Product Portfolio

9.4.3.3. Financial Overview

9.4.3.4. Business Strategies and Development

9.4.4. Merck KgaA

9.4.4.1. Company Overview

9.4.4.2. Product Portfolio

9.4.4.3. Financial Overview

9.4.4.4. Business Strategies and Development

9.4.5. Thermo Fisher Scientific Inc

9.4.5.1. Company Overview

9.4.5.2. Product Portfolio

9.4.5.3. Financial Overview

9.4.5.4. Business Strategies and Development

9.4.6. Agilent Technologies, Inc.

9.4.6.1. Company Overview

9.4.6.2. Product Portfolio

9.4.6.3. Financial Overview

9.4.6.4. Business Strategies and Development

9.4.7. Illumina, Inc.

9.4.7.1. Company Overview

9.4.7.2. Product Portfolio

9.4.7.3. Financial Overview

9.4.7.4. Business Strategies and Development

9.4.8. Qiagen N.V.

9.4.8.1. Company Overview

9.4.8.2. Product Portfolio

9.4.8.3. Financial Overview

9.4.8.4. Business Strategies and Development

9.4.9. Hologic Inc.

9.4.9.1. Company Overview

9.4.9.2. Product Portfolio

9.4.9.3. Financial Overview

9.4.9.4. Business Strategies and Development

9.4.10. Siemens Healthineers AG

9.4.10.1. Company Overview

9.4.10.2. Product Portfolio

9.4.10.3. Financial Overview

9.4.10.4. Business Strategies and Development

9.4.11. Seegene, Inc.

9.4.11.1. Company Overview

9.4.11.2. Product Portfolio

9.4.11.3. Financial Overview

9.4.11.4. Business Strategies and Development

9.4.12. DiaSorin S.p.A

9.4.12.1. Company Overview

9.4.12.2. Product Portfolio

9.4.12.3. Financial Overview

9.4.12.4. Business Strategies and Development

9.4.13. Grifols, S.A.

9.4.13.1. Company Overview

9.4.13.2. Product Portfolio

9.4.13.3. Financial Overview

9.4.13.4. Business Strategies and Development

9.4.14. BioMérieux

9.4.14.1. Company Overview

9.4.14.2. Product Portfolio

9.4.14.3. Financial Overview

9.4.14.4. Business Strategies and Development

9.4.15. QuidelOrtho Corporation

9.4.15.1. Company Overview

9.4.15.2. Product Portfolio

9.4.15.3. Financial Overview

9.4.15.4. Business Strategies and Development

9.4.16. RapidBio

9.4.16.1. Company Overview

9.4.16.2. Product Portfolio

9.4.16.3. Financial Overview

9.4.16.4. Business Strategies and Development

9.4.17. Abbott Laboratories

9.4.17.1. Company Overview

9.4.17.2. Product Portfolio

9.4.17.3. Financial Overview

9.4.17.4. Business Strategies and Development

9.4.18. Danaher Corporation

9.4.18.1. Company Overview

9.4.18.2. Product Portfolio

9.4.18.3. Financial Overview

9.4.18.4. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2023 |

|

2019 - 2023 |

2023 - 2031 |

Value: US$ Billion |

||

|

REPORT FEATURES |

DETAILS |

|

By Product Type |

|

|

By Application |

|

|

By End User |

|

|

Geographic Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Market Estimates and Forecast (Value), Market Dynamics, Regulatory Guidelines, Technological Advancements, COVID-19 Impact Analysis, Product Insights, Disease Area Insights, Regional and Country Insights, Competitive Landscape, Company Profiles. |