Global Mortgage Lending Market Forecast

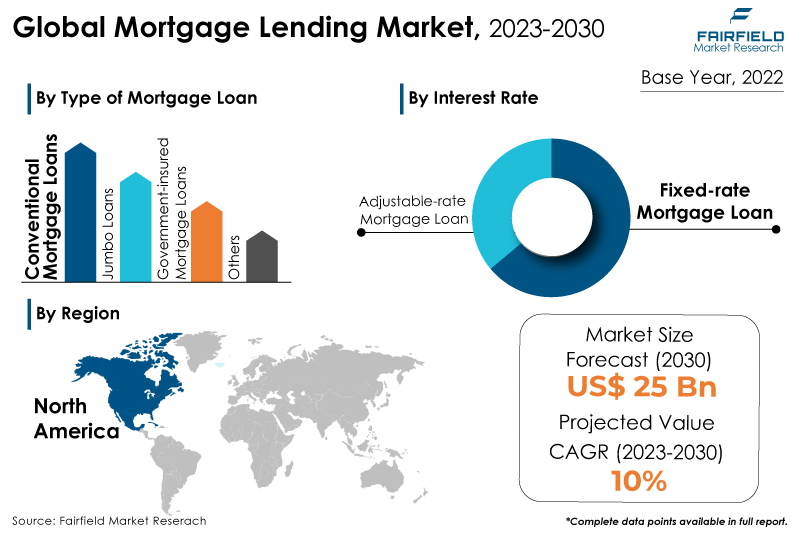

- Global mortgage lending market to rise high at a significant pace of 10% CAGR during 2023 - 2030

- Mortgage lending market size to reach a market value of around US$25 Bn by the end of 2030

Market Analysis in Brief

The mortgage lending is the financial institution name that lent customers money. A financial organisation or mortgage bank that offers and underwrites house loans is known as a mortgage lending. The terms, interest rate, repayment plan, and other important mortgage components are determined by mortgage lending. Mortgage lending will examine your creditworthiness and capacity to repay a loan before you are approved for a loan. A contract involving a lender of mortgages and an applicant to buy or refinance real estate without having to pay the entire amount up front is known as a mortgage, sometimes known as a mortgage loan. This agreement gives lenders the legal authority to seize the property if the borrower violates the mortgage conditions, which is commonly performed by failing to repay the amount owing plus interest. The desire to purchase a home remains a major driving force for the mortgage lending industry.

In the back drop of large investments made by numerous nonbank lenders in digital interfaces that simplify the filing of applications, the uploading of supporting documentation, and the connection with lenders, consumers now have more options when choosing mortgage lending processes. Additionally, the growth of the mortgage lending business is aided by a surge in software design advancements that speed up the mortgage application process, reduce expenses for the lender, and enhance overall client satisfaction. This element significantly encourages the market for mortgage lending to expand. However, constraints limiting market expansion include higher mortgage loan interest rates and broker fees.

Key Report Findings

- The mortgage lending market will demonstrate substantial revenue expansion over 2023 and 2030.

- The growth of the mortgage lending sector is anticipated to be fueled by rising technological advancements in underwriting automation and the application of machine learning in lending markets.

- Demand for conventional loans remains higher in the mortgage lending market.

- In 2022, the 30-year mortgage category accounted for more than half of the market, holding the highest share.

- The fixed-rate mortgage interest category held the highest mortgage lending market revenue share in 2022.

- In 2022, the primary mortgage lending category retained the highest proportion.

- North America will continue to lead its way, whereas Europe's mortgage lending market will experience the strongest growth till 2030.

Growth Drivers

Streamlined Loan Application Procedures

Loan applications are intended to be approved within 24 hours in mortgage lending. As a home finance application entails filling out an online form, delivering a few papers through email, and discussing loan terms in person, it typically takes less time. This quick application process allows Small company owners to apply for a mortgage loan. The mortgage lending uses these records to determine if the borrowers are eligible for financing. Lenders use this information to determine the loan amount if the borrower is eligible.

Additionally, mortgage financing gives borrowers the financial infusion they require to pay for other business expenses, make payroll, or invest in new equipment. As a result, this component spurs market expansion.

Greater Emphasis on Loan Process Digitisation

Digitisation is one of the most often employed strategies in the financial services sector to improve core processing capabilities and offer improved client services and insights. Additionally, it has been stated that FinTech companies have raised their sales % by concentrating on digitalising their financial services. According to a report, investments in financial technologies grew significantly in 2018, nearly double those made in 2015.

Furthermore, loans and payments have been connected to over half of these investments. Digitalisation of the lending industry has aided FinTech companies and their clients in making better judgments regarding loan management and expediting the application and disbursement processes. The worldwide mortgage lending market is expanding because organisations emphasize digitising their lending process to improve business efficiency and outcomes.

Widespread Availability of Enormous Sums of Money

Small business owners frequently need more resources to borrow capital through loans or stock markets. This can make starting a business very costly and dangerous. However, obtaining a mortgage loan makes it easy to pay for all initial costs for a firm. This also makes getting a pretty large sum of capital significantly less scary for business entrepreneurs without significant resources.

Mortgage lending also makes it easier for small firms to acquire big sums of money by bundling all financing into one loan. As a result, this is a significant market-driving element for mortgage lending.

Growth Challenges

Rising Rates of Mortgage Interest

One of the major issues that limit market expansion includes rising mortgage interest. The supply and demand of credit are influenced by interest rate levels: a rise in demand for money or credit will result in higher interest rates, while a fall in demand for credit will result in lower interest rates. However, a rise in credit availability will lead to lower interest rates, whilst a decline in credit availability will lead to higher rates. Inflation will also affect interest rate ranges. The higher the inflation rate, the more likely interest rates will rise. Lenders will request higher interest rates to compensate for the diminishing purchasing power of the money they will eventually be paid, which leads to this situation.

Overview of Key Segments

Conventional Loans to Dominate

Government-insured loans might be accessible sooner, but they might also take longer to process than normal loans. Mortgage lending can approve conventional loans without the typical wait times associated with FHA or government-backed loans. Also, sellers do not have to endure a thorough FHA inspection with a standard loan, occasionally requiring lengthy repairs.

Internationally renowned industrial houses are now entering the housing market due to the introduction of many economic reforms and increased demand for housing infrastructure across cities. Prospective purchasers currently receive loans from public, private, and international banks. The use of APIs and open banking in the mortgage lending sector is anticipated to accelerate market growth in the years to come.

Additionally, government-insured mortgage loans witnessed the fastest growth rate. The government neither issues the mortgage nor makes a direct loan to the borrower. A mortgage firm is the one who generated (or funded) the loan. The government then insures (or guarantees) the loan.

Government-insured loans are a good option when a conventional loan is not an option for some borrowers owing to a lack of income, the need for a down payment, or problems with their credit. Lenders frequently demand a down payment to guarantee repayment. As was already said, having the government back a loan reduces the lender's risk and enables them to give a loan with less down payment.

Fixed Rate Mortgage Interest Rate Rises High

A home loan with a fixed interest rate that does not change throughout the course of the loan is commonly referred to as a fixed-rate mortgage. This indicates that the interest rate on the mortgage is fixed from start to finish. The steadiness of a dependable monthly payment is the main benefit of a fixed-rate mortgage. The applicant will always be aware of the exact amount of their monthly payment because the interest rate will be fixed for the duration of the loan.

Furthermore, if you have a mortgage with a fixed interest rate, despite rising interest rates, the applicant can rest easy knowing that their monthly payment will not. Thanks to this, borrowers can more easily finance their mortgage, even if their income stays the same over time.

Furthermore, the adjustable-rate mortgage interest rate type experienced a significant growth rate. A house loan with a variable interest rate is called an adjustable-rate mortgage (ARM). The starting interest rate on an ARM is set for a specific amount of time.

Following then, the interest rate charged on the unpaid balance resets sporadically, sometimes every month. As general interest rates climb, ARMs become more alluring. This is because interest rates on ARMs are typically much lower than those on fixed-rate loans. Consumers heaper monthly payments as a result of decreased interest rates. When selecting an ARM, the beginning interest rate and the fixed rate period should be considered. Your overall rate will be better the shorter the fixed rate period you select.

Growth Opportunities Across Regions

North America Continues to Spearhead

The mortgage lending market will continue to dominate North America. This was ascribed to the federal government establishing numerous programs or government-sponsored businesses to encourage mortgage banking, building, and home ownership. These include the Federal National Mortgage Corporation (also known as Freddie Mac), the Federal Home Loan Mortgage Corporation (also known as Ginnie Mae), and the Government National Mortgage Association. As a result, the area is home to the biggest mortgage lending on the planet. As a result, the government's expanding measures promote mortgage lending market expansion in the area.

Additionally, lending and mortgages have undergone a significant transformation akin to that experienced by other banking sectors, redefining and reinventing this crucial area for both present and future market participants. The loan brokers industry has profited from increasing customer confidence and competitive lending rates in recent years. The booming property market is another sign of rising consumer demand. The loan brokers industry is predicted to expand throughout the five years leading up to 2022 as consumer incomes and credit availability increase.

Favourable economic conditions and low-interest rates have encouraged consumer spending over the past five years, and the demand for mortgages and auto loans has surged due to housing and vehicle purchases. As family spending on expensive items increases, demand for mortgage lending services is projected to increase.

Europe Emerges as One of the Fastest Growing Markets

The demand for homes in this market is anticipated to increase because of favourable factors like rising income levels, increased affordability, and financial support. Europe's real estate market is booming. Today's developers are more financially stable and organised. Housing finance companies (HFCs) and banks provide mortgage financing in Europe.

Internationally renowned industrial houses are now entering the housing market due to the introduction of many economic reforms and increased demand for housing infrastructure across cities. Prospective purchasers currently receive loans from public, private, and international banks.

Residential or real estate investing is still one of the most well-liked investment options available in Europe and worldwide. Approximately 77% of all adjusted loans are for housing. Lending to consumers has grown steadily throughout the years, peaking at 4.2% last year. Approximately 77% of all adjusted loans are for housing. Lending to consumers has grown steadily throughout the years, peaking at 4.2% last year.

The adoption of housing finance services by people and businesses for various purposes, including the purchase of new lands, the purchase of new homes, and various residential construction projects, is anticipated to fuel the growth of the mortgage lending market during the forecast period.

Mortgage lending Market: Competitive Landscape

Some of the leading players at the forefront in the mortgage lending market space include Standard Chartered PLC, BNP Paribas, Royal Bank of Canada, Qatar National Bank, Clear Capital, Ally, Mitsubishi UFJ Financial Group, JP Morgan & Chase, Rocket Mortgage, LLC, Sofi, Federal National Mortgage Association (FNMA), Bank of America Corporation, Roostify, Mr. Cooper, Truist financial corporation, China Zheshang Bank, and PT Bank Central Asia Tbk.

Recent Notable Developments

In November 2022, Tata Capital Housing Finance, a Tata Capital subsidiary, wants to push into the house credit sector substantially. To that purpose, it is seeking INR 3,000 crore in financing from the National Housing Bank and plans to raise INR 1,000 crore through bonds. The organisation's financing will be available to retail and real estate developers.

In November 2022, Snapdocs announced the deployment of its new Snapdocs eVault and digital closing platform by Primary Residential Mortgage, Inc. (PRMI) to scale electronic promissory note (eNote) adoption. Snapdocs worked closely with the major mortgage lending to build and sell its purpose-built eVault solution. Several other major mortgage lending have also adopted the Snapdocs eVault to provide the enormous benefits that eNotes provide to their organisations and the customers they service.

The Global Mortgage Lending Market is Segmented as Below:

By Type of Mortgage Loan

- Conventional Mortgage Loans

- Jumbo Loans

- Government-insured Mortgage Loans

- Others

By Mortgage Loan Terms

- 30-year Mortgage

- 20-year Mortgage

- 15-year Mortgage

- Others

By Interest Rate

- Fixed-rate Mortgage Loan

- Adjustable-rate Mortgage Loan

By Provider

- Primary Mortgage lending

- Secondary Mortgage lending

By Geographic Coverage

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

1. Executive Summary

1.1. Global Mortgage Lender Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2022

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. Covid-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Global Mortgage Lender Market Outlook, 2018 - 2030

3.1. Global Mortgage Lender Market Outlook, by Type of Mortgage Loan, Value (US$ Bn), 2018 - 2030

3.1.1. Key Highlights

3.1.1.1. Conventional Mortgage Loans

3.1.1.2. Jumbo Loans

3.1.1.3. Government-insured Mortgage Loans

3.1.1.4. Others

3.2. Global Mortgage Lender Market Outlook, by Mortgage Loan Terms, Value (US$ Bn), 2018 - 2030

3.2.1. Key Highlights

3.2.1.1. 30-year Mortgage

3.2.1.2. 20-year Mortgage

3.2.1.3. 15-year Mortgage

3.2.1.4. Others

3.3. Global Mortgage Lender Market Outlook, by Interest Rate, Value (US$ Bn), 2018 - 2030

3.3.1. Key Highlights

3.3.1.1. Fixed-rate Mortgage Loan

3.3.1.2. Adjustable-rate Mortgage Loan

3.4. Mortgage Lender Market Outlook, by Provider, Value (US$ Bn), 2018 - 2030

3.4.1. Key Highlights

3.4.1.1. Primary Mortgage Lender

3.4.1.2. Secondary Mortgage Lender

3.5. Global Mortgage Lender Market Outlook, by Region, Value (US$ Bn), 2018 - 2030

3.5.1. Key Highlights

3.5.1.1. North America

3.5.1.2. Europe

3.5.1.3. Asia Pacific

3.5.1.4. Latin America

3.5.1.5. Middle East & Africa

4. North America Mortgage Lender Market Outlook, 2018 - 2030

4.1. North America Mortgage Lender Market Outlook, by Type of Mortgage Loan, Value (US$ Bn), 2018 - 2030

4.1.1. Key Highlights

4.1.1.1. Conventional Mortgage Loans

4.1.1.2. Jumbo Loans

4.1.1.3. Government-insured Mortgage Loans

4.1.1.4. Others

4.2. North America Mortgage Lender Market Outlook, by Mortgage Loan Terms, Value (US$ Bn), 2018 - 2030

4.2.1. Key Highlights

4.2.1.1. 30-year Mortgage

4.2.1.2. 20-year Mortgage

4.2.1.3. 15-year Mortgage

4.2.1.4. Others

4.3. North America Mortgage Lender Market Outlook, by Interest Rate, Value (US$ Bn), 2018 - 2030

4.3.1. Key Highlights

4.3.1.1. Fixed-rate Mortgage Loan

4.3.1.2. Adjustable-rate Mortgage Loan

4.4. North America Mortgage Lender Market Outlook, by Provider, Value (US$ Bn), 2018 - 2030

4.4.1. Key Highlights

4.4.1.1. Primary Mortgage Lender

4.4.1.2. Secondary Mortgage Lender

4.4.2. Market Attractiveness Analysis

4.5. North America Mortgage Lender Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

4.5.1. Key Highlights

4.5.1.1. U.S. Mortgage Lender Market by Type of Mortgage Loan, Value (US$ Bn), 2018 - 2030

4.5.1.2. U.S. Mortgage Lender Market by Mortgage Loan Terms, Value (US$ Bn), 2018 - 2030

4.5.1.3. U.S. Mortgage Lender Market by Interest Rate, Value (US$ Bn), 2018 - 2030

4.5.1.4. U.S. Mortgage Lender Market by Provider, Value (US$ Bn), 2018 - 2030

4.5.1.5. Canada Mortgage Lender Market by Type of Mortgage Loan, Value (US$ Bn), 2018 - 2030

4.5.1.6. Canada Mortgage Lender Market by Mortgage Loan Terms, Value (US$ Bn), 2018 - 2030

4.5.1.7. Canada Mortgage Lender Market by Interest Rate, Value (US$ Bn), 2018 - 2030

4.5.1.8. Canada Mortgage Lender Market by Provider, Value (US$ Bn), 2018 - 2030

4.5.2. BPS Analysis/Market Attractiveness Analysis

5. Europe Mortgage Lender Market Outlook, 2018 - 2030

5.1. Europe Mortgage Lender Market Outlook, by Type of Mortgage Loan, Value (US$ Bn), 2018 - 2030

5.1.1. Key Highlights

5.1.1.1. Conventional Mortgage Loans

5.1.1.2. Jumbo Loans

5.1.1.3. Government-insured Mortgage Loans

5.1.1.4. Others

5.2. Europe Mortgage Lender Market Outlook, by Mortgage Loan Terms, Value (US$ Bn), 2018 - 2030

5.2.1. Key Highlights

5.2.1.1. 30-year Mortgage

5.2.1.2. 20-year Mortgage

5.2.1.3. 15-year Mortgage

5.2.1.4. Others

5.2.2. BPS Analysis/Market Attractiveness Analysis

5.3. Europe Mortgage Lender Market Outlook, by Interest Rate, Value (US$ Bn), 2018 - 2030

5.3.1. Key Highlights

5.3.1.1. Fixed-rate Mortgage Loan

5.3.1.2. Adjustable-rate Mortgage Loan

5.4. Europe Mortgage Lender Market Outlook, by Provider, Value (US$ Bn), 2018 - 2030

5.4.1. Key Highlights

5.4.1.1. Primary Mortgage Lender

5.4.1.2. Secondary Mortgage Lender

5.5. Europe Mortgage Lending Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

5.5.1. Key Highlights

5.5.1.1. Germany Mortgage Lending Market by Type of Mortgage Loan, Value (US$ Bn), 2018 - 2030

5.5.1.2. Germany Mortgage Lending Market by Mortgage Loan Terms, Value (US$ Bn), 2018 - 2030

5.5.1.3. Germany Mortgage Lending Market by Interest Rate, Value (US$ Bn), 2018 - 2030

5.5.1.4. Germany Mortgage Lending Market by Provider, Value (US$ Bn), 2018 - 2030

5.5.1.5. U.K. Mortgage Lending Market by Type of Mortgage Loan, Value (US$ Bn), 2018 - 2030

5.5.1.6. U.K. Mortgage Lending Market by Mortgage Loan Terms, Value (US$ Bn), 2018 - 2030

5.5.1.7. U.K. Mortgage Lending Market by Interest Rate, Value (US$ Bn), 2018 - 2030

5.5.1.8. U.K. Mortgage Lending Market by Provider, Value (US$ Bn), 2018 - 2030

5.5.1.9. France Mortgage Lending Market by Type of Mortgage Loan, Value (US$ Bn), 2018 - 2030

5.5.1.10. France Mortgage Lending Market by Mortgage Loan Terms, Value (US$ Bn), 2018 - 2030

5.5.1.11. France Mortgage Lending Market by Interest Rate, Value (US$ Bn), 2018 - 2030

5.5.1.12. France Mortgage Lending Market by Provider, Value (US$ Bn), 2018 - 2030

5.5.1.13. Italy Mortgage Lending Market by Type of Mortgage Loan, Value (US$ Bn), 2018 - 2030

5.5.1.14. Italy Mortgage Lending Market by Mortgage Loan Terms, Value (US$ Bn), 2018 - 2030

5.5.1.15. Italy Mortgage Lending Market by Interest Rate, Value (US$ Bn), 2018 - 2030

5.5.1.16. Italy Mortgage Lending Market by Provider, Value (US$ Bn), 2018 - 2030

5.5.1.17. Spain Mortgage Lending Market by Type of Mortgage Loan, Value (US$ Bn), 2018 - 2030

5.5.1.18. Spain Mortgage Lending Market by Mortgage Loan Terms, Value (US$ Bn), 2018 - 2030

5.5.1.19. Spain Mortgage Lending Market by Interest Rate, Value (US$ Bn), 2018 - 2030

5.5.1.20. Spain Mortgage Lending Market by Provider, Value (US$ Bn), 2018 - 2030

5.5.1.21. Russia Mortgage Lending Market by Type of Mortgage Loan, Value (US$ Bn), 2018 - 2030

5.5.1.22. Russia Mortgage Lending Market by Mortgage Loan Terms, Value (US$ Bn), 2018 - 2030

5.5.1.23. Russia Mortgage Lending Market by Interest Rate, Value (US$ Bn), 2018 - 2030

5.5.1.24. Russia Mortgage Lending Market by Provider, Value (US$ Bn), 2018 - 2030

5.5.1.25. Rest of Europe Mortgage Lending Market by Type of Mortgage Loan, Value (US$ Bn), 2018 - 2030

5.5.1.26. Rest of Europe Mortgage Lending Market by Mortgage Loan Terms, Value (US$ Bn), 2018 - 2030

5.5.1.27. Rest of Europe Mortgage Lending Market by Interest Rate, Value (US$ Bn), 2018 - 2030

5.5.1.28. Rest of Europe Mortgage Lending Market by Provider, Value (US$ Bn), 2018 - 2030

5.5.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Mortgage Lending Market Outlook, 2018 - 2030

6.1. Asia Pacific Mortgage Lending Market Outlook, by Type of Mortgage Loan, Value (US$ Bn), 2018 - 2030

6.1.1. Key Highlights

6.1.1.1. Conventional Mortgage Loans

6.1.1.2. Jumbo Loans

6.1.1.3. Government-insured Mortgage Loans

6.1.1.4. Others

6.2. Asia Pacific Mortgage Lending Market Outlook, by Mortgage Loan Terms, Value (US$ Bn), 2018 - 2030

6.2.1. Key Highlights

6.2.1.1. 30-year Mortgage

6.2.1.2. 20-year Mortgage

6.2.1.3. 15-year Mortgage

6.2.1.4. Others

6.2.2. BPS Analysis/Market Attractiveness Analysis

6.3. Asia Pacific Mortgage Lending Market Outlook, by Interest Rate, Value (US$ Bn), 2018 - 2030

6.3.1. Key Highlights

6.3.1.1. Fixed-rate Mortgage Loan

6.3.1.2. Adjustable-rate Mortgage Loan

6.4. Asia Pacific Mortgage Lending Market Outlook, by Provider, Value (US$ Bn), 2018 - 2030

6.4.1. Key Highlights

6.4.1.1. Primary Mortgage Lending

6.4.1.2. Secondary Mortgage Lending

6.5. Asia Pacific Mortgage Lending Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

6.5.1. Key Highlights

6.5.1.1. China Mortgage Lending Market by Type of Mortgage Loan, Value (US$ Bn), 2018 - 2030

6.5.1.2. China Mortgage Lending Market by Mortgage Loan Terms, Value (US$ Bn), 2018 - 2030

6.5.1.3. China Mortgage Lending Market by Interest Rate, Value (US$ Bn), 2018 - 2030

6.5.1.4. China Mortgage Lending Market by Provider, Value (US$ Bn), 2018 - 2030

6.5.1.5. Japan Mortgage Lending Market by Type of Mortgage Loan, Value (US$ Bn), 2018 - 2030

6.5.1.6. Japan Mortgage Lending Market by Mortgage Loan Terms, Value (US$ Bn), 2018 - 2030

6.5.1.7. Japan Mortgage Lending Market by Interest Rate, Value (US$ Bn), 2018 - 2030

6.5.1.8. Japan Mortgage Lending Market by Provider, Value (US$ Bn), 2018 - 2030

6.5.1.9. South Korea Mortgage Lending Market by Type of Mortgage Loan, Value (US$ Bn), 2018 - 2030

6.5.1.10. South Korea Mortgage Lending Market by Mortgage Loan Terms, Value (US$ Bn), 2018 - 2030

6.5.1.11. South Korea Mortgage Lending Market by Interest Rate, Value (US$ Bn), 2018 - 2030

6.5.1.12. South Korea Mortgage Lending Market by Provider, Value (US$ Bn), 2018 - 2030

6.5.1.13. India Mortgage Lending Market by Type of Mortgage Loan, Value (US$ Bn), 2018 - 2030

6.5.1.14. India Mortgage Lending Market by Mortgage Loan Terms, Value (US$ Bn), 2018 - 2030

6.5.1.15. India Mortgage Lending Market by Interest Rate, Value (US$ Bn), 2018 - 2030

6.5.1.16. India Mortgage Lending Market by Provider, Value (US$ Bn), 2018 - 2030

6.5.1.17. Southeast Asia Mortgage Lending Market by Type of Mortgage Loan, Value (US$ Bn), 2018 - 2030

6.5.1.18. Southeast Asia Mortgage Lending Market by Mortgage Loan Terms, Value (US$ Bn), 2018 - 2030

6.5.1.19. Southeast Asia Mortgage Lending Market by Interest Rate, Value (US$ Bn), 2018 - 2030

6.5.1.20. Southeast Asia Mortgage Lending Market by Provider, Value (US$ Bn), 2018 - 2030

6.5.1.21. Rest of Asia Pacific Mortgage Lending Market by Type of Mortgage Loan, Value (US$ Bn), 2018 - 2030

6.5.1.22. Rest of Asia Pacific Mortgage Lending Market by Mortgage Loan Terms, Value (US$ Bn), 2018 - 2030

6.5.1.23. Rest of Asia Pacific Mortgage Lending Market by Interest Rate, Value (US$ Bn), 2018 - 2030

6.5.1.24. Rest of Asia Pacific Mortgage Lending Market by Provider, Value (US$ Bn), 2018 - 2030

6.5.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America Mortgage Lending Market Outlook, 2018 - 2030

7.1. Latin America Mortgage Lending Market Outlook, by Type of Mortgage Loan, Value (US$ Bn), 2018 - 2030

7.1.1. Key Highlights

7.1.1.1. Conventional Mortgage Loans

7.1.1.2. Jumbo Loans

7.1.1.3. Government-insured Mortgage Loans

7.1.1.4. Others

7.2. Latin America Mortgage Lending Market Outlook, by Mortgage Loan Terms, Value (US$ Bn), 2018 - 2030

7.2.1. Key Highlights

7.2.1.1. 30-year Mortgage

7.2.1.2. 20-year Mortgage

7.2.1.3. 15-year Mortgage

7.2.1.4. Others

7.2.2. BPS Analysis/Market Attractiveness Analysis

7.3. Latin America Mortgage Lending Market Outlook, by Interest Rate, Value (US$ Bn), 2018 - 2030

7.3.1. Key Highlights

7.3.1.1. Fixed-rate Mortgage Loan

7.3.1.2. Adjustable-rate Mortgage Loan

7.4. Latin America Mortgage Lending Market Outlook, by Provider, Value (US$ Bn), 2018 - 2030

7.4.1. Key Highlights

7.4.1.1. Primary Mortgage Lending

7.4.1.2. Secondary Mortgage Lending

7.5. Latin America Mortgage Lending Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

7.5.1. Key Highlights

7.5.1.1. Brazil Mortgage Lending Market by Type of Mortgage Loan, Value (US$ Bn), 2018 - 2030

7.5.1.2. Brazil Mortgage Lending Market by Mortgage Loan Terms, Value (US$ Bn), 2018 - 2030

7.5.1.3. Brazil Mortgage Lending Market by Interest Rate, Value (US$ Bn), 2018 - 2030

7.5.1.4. Brazil Mortgage Lending Market by Provider, Value (US$ Bn), 2018 - 2030

7.5.1.5. Mexico Mortgage Lending Market by Type of Mortgage Loan, Value (US$ Bn), 2018 - 2030

7.5.1.6. Mexico Mortgage Lending Market by Mortgage Loan Terms, Value (US$ Bn), 2018 - 2030

7.5.1.7. Mexico Mortgage Lending Market by Interest Rate, Value (US$ Bn), 2018 - 2030

7.5.1.8. Mexico Mortgage Lending Market by Provider, Value (US$ Bn), 2018 - 2030

7.5.1.9. Rest of Latin America Mortgage Lending Market by Type of Mortgage Loan, Value (US$ Bn), 2018 - 2030

7.5.1.10. Rest of Latin America Mortgage Lending Market by Mortgage Loan Terms, Value (US$ Bn), 2018 - 2030

7.5.1.11. Rest of Latin America Mortgage Lending Market by Interest Rate, Value (US$ Bn), 2018 - 2030

7.5.1.12. Rest of Latin America Mortgage Lending Market by Provider, Value (US$ Bn), 2018 - 2030

7.5.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Mortgage Lending Market Outlook, 2018 - 2030

8.1. Middle East & Africa Mortgage Lending Market Outlook, by Type of Mortgage Loan, Value (US$ Bn), 2018 - 2030

8.1.1. Key Highlights

8.1.1.1. Conventional Mortgage Loans

8.1.1.2. Jumbo Loans

8.1.1.3. Government-insured Mortgage Loans

8.1.1.4. Others

8.2. Middle East & Africa Mortgage Lending Market Outlook, by Mortgage Loan Terms, Value (US$ Bn), 2018 - 2030

8.2.1. Key Highlights

8.2.1.1. 30-year Mortgage

8.2.1.2. 20-year Mortgage

8.2.1.3. 15-year Mortgage

8.2.1.4. Others

8.2.2. BPS Analysis/Market Attractiveness Analysis

8.3. Middle East & Africa Mortgage Lending Market Outlook, by Interest Rate, Value (US$ Bn), 2018 - 2030

8.3.1. Key Highlights

8.3.1.1. Fixed-rate Mortgage Loan

8.3.1.2. Adjustable-rate Mortgage Loan

8.4. Middle East & Africa Mortgage Lending Market Outlook, by Provider, Value (US$ Bn), 2018 - 2030

8.4.1. Key Highlights

8.4.1.1. Primary Mortgage Lending

8.4.1.2. Secondary Mortgage Lending

8.5. Middle East & Africa Mortgage Lending Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

8.5.1. Key Highlights

8.5.1.1. GCC Mortgage Lending Market by Type of Mortgage Loan, Value (US$ Bn), 2018 - 2030

8.5.1.2. GCC Mortgage Lending Market by Mortgage Loan Terms, Value (US$ Bn), 2018 - 2030

8.5.1.3. GCC Mortgage Lending Market by Interest Rate, Value (US$ Bn), 2018 - 2030

8.5.1.4. GCC Mortgage Lending Market by Provider, Value (US$ Bn), 2018 - 2030

8.5.1.5. South Africa Mortgage Lending Market by Type of Mortgage Loan, Value (US$ Bn), 2018 - 2030

8.5.1.6. South Africa Mortgage Lending Market by Mortgage Loan Terms, Value (US$ Bn), 2018 - 2030

8.5.1.7. South Africa Mortgage Lending Market by Interest Rate, Value (US$ Bn), 2018 - 2030

8.5.1.8. South Africa Mortgage Lending Market by Provider, Value (US$ Bn), 2018 - 2030

8.5.1.9. Rest of Middle East & Africa Mortgage Lending Market by Type of Mortgage Loan, Value (US$ Bn), 2018 - 2030

8.5.1.10. Rest of Middle East & Africa Mortgage Lending Market by Mortgage Loan Terms, Value (US$ Bn), 2018 - 2030

8.5.1.11. Rest of Middle East & Africa Mortgage Lending Market by Interest Rate, Value (US$ Bn), 2018 - 2030

8.5.1.12. Rest of Middle East & Africa Mortgage Lending Market by Provider, Value (US$ Bn), 2018 - 2030

8.5.2. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. Company Market Share Analysis, 2022

9.2. Competitive Dashboard

9.3. Company Profiles

9.3.1. Qatar National Bank

9.3.1.1. Company Overview

9.3.1.2. Product Portfolio

9.3.1.3. Financial Overview

9.3.1.4. Business Strategies and Development

9.3.2. Standard Chartered PLC

9.3.2.1. Company Overview

9.3.2.2. Product Portfolio

9.3.2.3. Financial Overview

9.3.2.4. Business Strategies and Development

9.3.3. BNP Paribas

9.3.3.1. Company Overview

9.3.3.2. Product Portfolio

9.3.3.3. Financial Overview

9.3.3.4. Business Strategies and Development

9.3.4. Clear Capital

9.3.4.1. Company Overview

9.3.4.2. Product Portfolio

9.3.4.3. Financial Overview

9.3.4.4. Business Strategies and Development

9.3.5. Ally

9.3.5.1. Company Overview

9.3.5.2. Product Portfolio

9.3.5.3. Financial Overview

9.3.5.4. Business Strategies and Development

9.3.6. Mitsubishi UFJ Financial Group

9.3.6.1. Company Overview

9.3.6.2. Product Portfolio

9.3.6.3. Financial Overview

9.3.6.4. Business Strategies and Development

9.3.7. Royal Bank of Canada

9.3.7.1. Company Overview

9.3.7.2. Product Portfolio

9.3.7.3. Financial Overview

9.3.7.4. Business Strategies and Development

9.3.8. JPMorgan Chase & Co.

9.3.8.1. Company Overview

9.3.8.2. Product Portfolio

9.3.8.3. Business Strategies and Development

9.3.9. Rocket Mortgage, LLC

9.3.9.1. Company Overview

9.3.9.2. Product Portfolio

9.3.9.3. Financial Overview

9.3.9.4. Business Strategies and Development

9.3.10. Sofi.

9.3.10.1. Company Overview

9.3.10.2. Product Portfolio

9.3.10.3. Financial Overview

9.3.10.4. Business Strategies and Development

9.3.11. Federal National Mortgage Association (FNMA)

9.3.11.1. Company Overview

9.3.11.2. Product Portfolio

9.3.11.3. Financial Overview

9.3.11.4. Business Strategies and Development

9.3.12. Bank of America Corporation

9.3.12.1. Company Overview

9.3.12.2. Product Portfolio

9.3.12.3. Financial Overview

9.3.12.4. Business Strategies and Development

9.3.13. Roostify

9.3.13.1. Company Overview

9.3.13.2. Product Portfolio

9.3.13.3. Financial Overview

9.3.13.4. Business Strategies and Development

9.3.14. Mr. Cooper

9.3.14.1. Company Overview

9.3.14.2. Product Portfolio

9.3.14.3. Financial Overview

9.3.14.4. Business Strategies and Development

9.3.15. Truist financial corporation

9.3.15.1. Company Overview

9.3.15.2. Product Portfolio

9.3.15.3. Financial Overview

9.3.15.4. Business Strategies and Development

9.3.16. China Zheshang Bank

9.3.16.1. Company Overview

9.3.16.2. Product Portfolio

9.3.16.3. Financial Overview

9.3.16.4. Business Strategies and Development

9.3.17. PT Bank Central Asia Tbk

9.3.17.1. Company Overview

9.3.17.2. Product Portfolio

9.3.17.3. Financial Overview

9.3.17.4. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2022 |

|

2018 - 2022 |

2023 - 2030 |

Value: US$ Million |

||

|

REPORT FEATURES |

DETAILS |

|

Type of Mortgage Loan Coverage |

|

|

Mortgage Loan Terms Coverage |

|

|

Interest Rate Coverage |

|

|

Provider Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |