Global MRI Systems Market Forecast

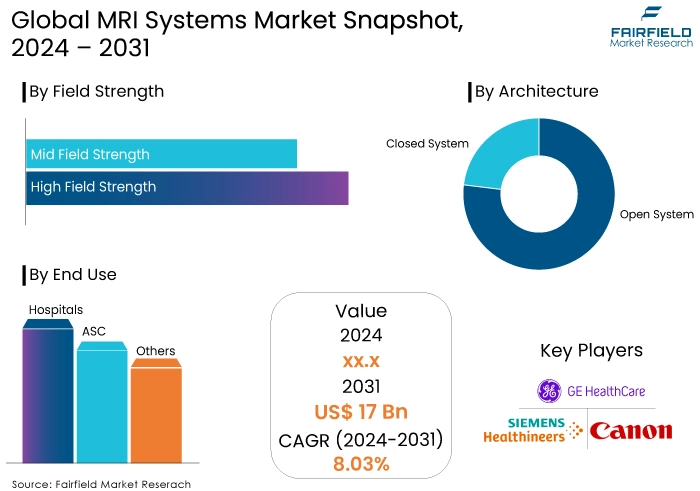

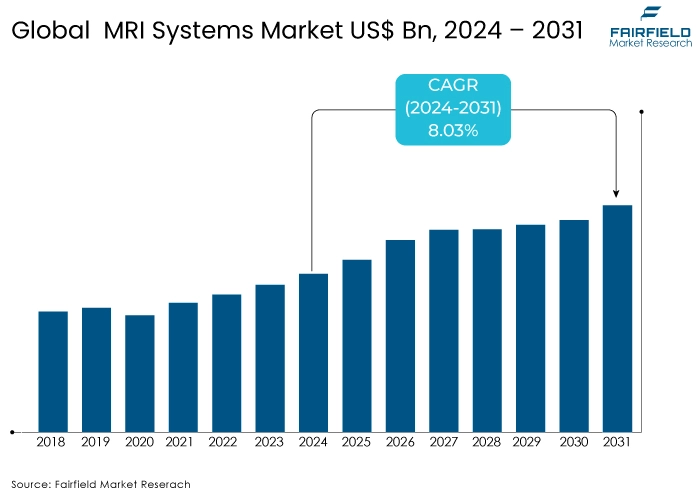

- MRI systems market estimated to reach a valuation of US$17 Bn by the year 2031

- Market revenue poised to witness healthy growth at a CAGR of 8.03% over the forecast period 2024 to 2031

Key Highlights of the Market

- The global MRI systems market is slated to exhibit a healthy growth rate of 8.03% over the forecast period, to be valued at US$17 Bn by 2031.

- A promising growth outlook has been indicated for the MRI systems market owing to expanding healthcare infrastructure, and the rising demand for advanced diagnostics.

- The increasing incidence of several chronic ailments, including cancer and neurological illnesses, among others, along with a rising number of trauma cases, is driving the global demand for medical equipment.

- The increasing attention from key market participants is driving technological breakthroughs in MRI scanners, including the development of high-strength scanners.

- Climbing adoption of rapid MRI (rMRI) technology for emergency and trauma centers will offer a string impetus to market growth.

- North America owns 37% of the global MRI systems market share.

- The Asia Pacific region is projected to experience the highest growth rate of 7.4% throughout the forecast period.

- The expanding medical tourism sector in Asian nations is expected to enhance the expansion of the advanced medical imaging business in Asian markets.

A Look Back and a Look Forward - Comparative Analysis

The global MRI systems market witnessed significant growth from 2018 to 2023, achieving a growth rate of 4.7%, driven by technological advancements, increasing healthcare expenditure, and expanding clinical applications across various medical specialities. The MRI systems market demonstrated resilience and growth from 2018 to 2023, driven by technological innovations and increasing healthcare investments globally. While the COVID-19 pandemic posed temporary challenges, the market rebounded swiftly, paving the way for continued expansion and innovation in the years ahead. Further, the MRI systems market is estimated to have a substantial rise in its market share.

How Does Regulatory Scenario Shape this Industry?

The regulatory scenario plays a crucial role in shaping the dynamics of the MRI systems market in several ways. Regulations in the MRI systems market ensure patient safety, image quality, and data privacy. They can influence costs, market accessibility, and drive innovation in areas like affordability and data security, shaping the overall landscape of the market.

Stringent regulations regarding patient safety during MRI scans are paramount. This influences the design and manufacturing of MRI systems, mandating features like patient monitoring, emergency stop procedures, and strict control of electromagnetic radiation. These regulations can increase development costs but ensure patient safety, a key factor for market acceptance.

Regulatory bodies establish guidelines for image quality and standardization. This ensures consistency and accuracy in diagnoses across different healthcare facilities. Manufacturers need to comply with these standards, influencing their research and development efforts to produce MRI systems that deliver high-resolution, standardized images.

Regulations might encourage the development of more affordable MRI systems, potentially increasing market accessibility. Additionally, regulations regarding insurance coverage for MRI scans can impact market demand. More insurance coverage could lead to higher MRI system adoption rates. Regulations regarding patient data privacy are crucial. This shapes how MRI systems handle and store sensitive patient information. Manufacturers need to implement robust security measures to comply with these regulations, impacting system design and potentially creating a market for data security solutions specifically designed for MRI systems.

Key Growth Determinants

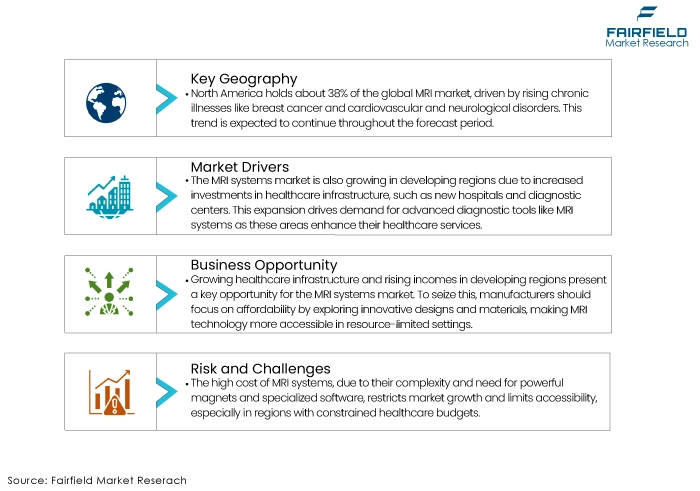

Expanding Healthcare Infrastructure

The growth of the MRI systems market is not limited to developed nations. Developing regions around the world are experiencing significant investments in healthcare infrastructure, including the establishment of new hospitals and diagnostic centres. This expansion creates a growing demand for advanced medical equipment, including MRI systems. As these regions strive to improve their healthcare services and cater to their growing populations, the need for accurate and reliable diagnostic tools like MRI becomes increasingly important.

Further, rising disposable incomes in these regions are leading to a greater focus on preventative healthcare and advanced medical treatments. This confluence of factors like infrastructure development, growing populations, and rising healthcare awareness – is creating a significant opportunity for the MRI systems market in developing regions. Manufacturers are likely to target these regions with cost-effective solutions and financing models to make MRI technology more accessible, further propelling market growth.

Rising Demand for Advanced Diagnostics

The increasing burden of chronic diseases globally is a major driver for the MRI systems market. Conditions like cancer, neurological disorders, and cardiovascular diseases are becoming more prevalent, and early diagnosis is crucial for effective treatment. MRI scans offer unparalleled soft tissue imaging, allowing for detailed visualization of abnormalities that might be missed by other techniques. This accuracy leads to better treatment outcomes and improved patient prognoses.

Additionally, growing public awareness about preventative healthcare is driving a shift towards early disease detection. MRI scans are playing a vital role in this trend, as they can identify potential issues before symptoms arise, enabling early intervention and potentially preventing disease progression. This growing demand for advanced diagnostics and early disease detection is expected to continue fuelling the MRI systems market in the coming years.

Widespread Adoption by Healthcare Facilities

Magnetic resonance imaging (MRI) equipment is widely utilized in many healthcare settings, such as hospitals and clinics, as a prevalent diagnostic imaging procedure. The apparatus employs powerful magnetic fields and radio waves to generate intricate images of the inside structures of the body. The increasing incidence of several chronic ailments, including cancer and neurological illnesses, among others, along with a rising number of trauma cases, is driving the global demand for medical equipment.

The strong emphasis placed by major contributors on developing and introducing highly improved products to meet the increasing global demand from healthcare professionals and patients is also a factor driving the growth of the magnetic resonance imaging (MRI) equipment market. The increasing attention from key market participants is driving technological breakthroughs in MRI scanners, including the development of high-strength scanners.

Traditionally, MRI scanning has employed 1.5T magnetic resonance imaging (MRI) equipment. However, in recent years, advancements in technology have led to the use of 3T MRI equipment, and even higher, such as the 7T MRI equipment. The increased field strength of the MRI equipment allows for the generation of cross-sectional images of the knee and head, specifically designed for individuals weighing above 66 lbs. These devices have diverse applications, including those for diagnostic purposes. The reason for this is that MRI technology improves the imaging process by displaying the functional and anatomical features that would otherwise be invisible at lesser strengths.

Key Growth Barriers

High Cost of MRI Systems

Despite the significant benefits of MRI technology, a major restraint on the market's growth is the high cost of MRI systems themselves. These machines are complex and require powerful magnets, specialized software, and controlled environments. This translates to a hefty upfront investment for healthcare providers, limiting accessibility, particularly in regions with limited healthcare budgets.

Furthermore, operational costs add to the burden. MRI systems require ongoing maintenance, trained personnel for operation, and the helium gas needed for cooling is a scarce resource with potentially rising costs. These combined factors can make MRI scans a relatively expensive diagnostic tool, potentially leading healthcare providers to prioritize more cost-effective alternatives for certain applications.

Declining Reimbursement Rates

Another potential hurdle for market growth is the trend of declining reimbursement rates for MRI procedures. Insurance companies and healthcare payers are increasingly scrutinizing the cost-effectiveness of medical procedures. While the diagnostic value of MRI scans is undeniable, some payers may view them as expensive compared to other imaging techniques. This can lead to reduced coverage for MRI scans, making them less affordable for patients and potentially leading healthcare providers to opt for less expensive alternatives.

Additionally, complex insurance procedures and prior authorization requirements may create hurdles for patients seeking MRI scans, further hindering market growth. Addressing these challenges through innovative financing models and demonstrating the cost-effectiveness of MRI scans in improved patient outcomes will be crucial for sustained market expansion.

Key Trends and Opportunities to Look at

Focus on Affordability and Accessibility in Developing Regions

Rapidly sophisticating healthcare infrastructure, and rising disposable incomes in developing regions present a significant opportunity for the MRI systems market. However, to fully capitalize on this opportunity, manufacturers need to address the challenge of affordability. Manufacturers can explore innovative design approaches and alternative materials to develop more affordable MRI systems without compromising on image quality. This would make MRI technology more accessible to healthcare providers in resource-limited settings.

Financing options like leasing or pay-per-use models can make MRI systems more attainable for healthcare providers, especially in regions with limited upfront capital. Governments in developing countries can play a crucial role in promoting the adoption of MRI technology by establishing financing programs and collaborating with private companies to make MRI systems more accessible.

Adoption of cloud-based solutions, and remote reading services marks an important market trend as it can allow healthcare providers in remote areas to access the expertise of radiologists located elsewhere. It potentially reduces the need for on-site specialists, making MRI scans more accessible to a wider patient population.

Fairfield’s Ranking Board

Top Segments

Medium Field Strength to Lead with over 48% Share

Based on field strength, the global MRI systems market is further sub segmented into mid and high field strength, where the mid field strength segment dominates the market segment. Machines with intermediate field strength are preferred for their capacity to acquire high-precision images. They are frequently offered at more reasonable pricing, which makes them a popular option among healthcare practitioners. The high-field segment is projected to have the highest growth rate of 7.9% during the forecast period.

Several ongoing research investigations are being conducted to evaluate the efficacy of high-field strength MRI machines in different therapeutic contexts. This sophisticated equipment is being utilized in hospitals and research centres.

Hospitals Continue to Dominate Adoption with More than 38% Market Share

Based on the end use segmentation, the global MRI systems market is further segmented into hospitals and ASCs, where the hospitals segment dominates the market. The increasing adoption of rapid MRI (rMRI) in emergency care and trauma centres, along with the expanding number of MRI installations in teaching hospitals, are anticipated to be major drivers of the expansion of this sector. During the forecast period, the imaging centres segment is expected to experience the highest growth rate, estimated at approximately 7.8%.

The growing need for non-invasive diagnostics is fuelling the creation of multiple autonomous centres that provide services, such as MRI. In response to the increasing need, numerous healthcare practitioners are establishing clinics that offer cost-effective MRI services. This tendency is fuelling the increased use of MRI technology in medical services, which is anticipated to stimulate growth in this sector throughout the projected timeframe.

The segment of ambulatory care centres is also projected to experience substantial growth. The growth can be ascribed to the rising number of government initiatives focused on improving and extending the number of ambulatory care centres, specifically to provide healthcare services to rural areas.

Regional Frontrunners

Dominance of North America Continues, Market Share Exceeds 37%

North America had the largest market share, accounting for around 38% of the global MRI systems market share. The increasing incidence of chronic illnesses in this area, such as breast cancer, cardiovascular disorders, and neurological diseases, is fuelling the need for sophisticated imaging analysis. This region is expected to maintain its supremacy during the entire projected era.

During the projected period, the growth of MRI technology is anticipated to be driven by a mix of technological developments and the rising prevalence of chronic illnesses. The Asia Pacific region is projected to experience the highest growth rate of 7.4% throughout the predicted timeframe, primarily driven by the rising number of elderly individuals and the growing need for improved imaging technologies.

Furthermore, the expanding medical tourism sector in Asian nations is expected to enhance the expansion of the advanced medical imaging business in the projected timeframe. Countries like India, China, and Japan are capitalizing on growth prospects in the healthcare service business due to their rapidly rising presence of trained healthcare workers and modern healthcare facilities and services. Moreover, these countries offer these services at a lesser cost compared to established countries in North America, and Europe.

Fairfield’s Competitive Landscape Analysis

The global MRI systems market is characterized by intense competition among key players striving to maintain and expand their market share through innovation, strategic partnerships, and geographic expansion.

The competitive dynamics within the MRI systems market are shaped by rapid technological advancements, regulatory compliance, and evolving healthcare policies globally. Companies are adapting by leveraging their core competencies in technology and service excellence to differentiate themselves and maintain competitive advantage.

Who are Leading Companies in MRI Systems Space?

- GE Healthcare

- Siemens Healthineers

- Koninklijke Philips N.V.

- Canon Medical Systems

- Hitachi Healthcare

- Hologic Inc.

- Bruker Corporation

- Esaote SPA

- Fujifilm Holdings Corporation

- Shimadzu Corporation

- Aurora Imaging Technologies, Inc.

Recent Industry Developments

In September 2023, Polarean Imaging plc and VIDA Diagnostics formed a partnership to enhance the capabilities of the Polarean xenon 129 MRI technology to expedite its adoption in clinical and research settings.

In June 2023, Imagion Biosystems Limited has recently declared an expansion of its partnership arrangement with Siemens Healthineers, specifically targeting collaboration in the United States through Siemens Medical Solutions USA.

In April 2023, Siemens Healthineers inaugurated a new production line at its Bengaluru location specifically for the fabrication of MRI devices. The company will produce MAGNETOM Free Star.

Global MRI Systems Market is Segmented as-

By Field Strength

- Mid Field Strength

- High Field Strength

By Architecture

- Open System

- Closed System

By End Use

- Hospitals

- ASC

- Others

By Region

- North America

- Latin America

- Europe

- South Asia & Oceania

- East Asia

- Middle East & Africa

1. Executive Summary

1.1. Global MRI Systems Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Volume and Value, 2024

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. Covid-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact Of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. Pestle Analysis

3. Production Output and Trade Statistics, 2019-2023

3.1. Global MRI Systems Market Production Output, by Region, Value (US$ Bn) and Volume (Million Units) and Volume (Million Units), 2019-2023

3.1.1. North America

3.1.2. Europe

3.1.3. Asia Pacific

3.1.4. Latin America

3.1.5. Middle East and Africa

4. Price Analysis, 2019-2023

4.1. Global Average Price Analysis, by Product/ Material, US$ Per Unit, 2019-2023

4.2. Prominent Factor Affecting MRI Systems Prices

4.3. Global Average Price Analysis, by Region, US$ Per Unit, 2019-2023

5. Global MRI Systems Market Outlook, 2019-2031

5.1. Global MRI Systems Market Outlook, by Strength, Value (US$ Bn) and Volume (Million Units), 2019-2031

5.1.1. Key Highlights

5.1.1.1. <0.5T

5.1.1.2. 1.5T

5.1.1.3. 3T

5.1.1.4. >3T

5.2. Global MRI Systems Market Outlook, by Architecture, Value (US$ Bn) and Volume (Million Units), 2019-2031

5.2.1. Key Highlights

5.2.1.1. Open

5.2.1.2. Closed

5.3. Global MRI Systems Market Outlook, by End User, Value (US$ Bn) and Volume (Million Units), 2019-2031

5.3.1. Key Highlights

5.3.1.1. Hospitals

5.3.1.2. Academics & Research Institute

5.3.1.3. Ambulatory Surgical Centers

5.3.1.4. Diagnostic Centers

5.4. Global MRI Systems Market Outlook, by Region, Value (US$ Bn) and Volume (Million Units), 2019-2031

5.4.1. Key Highlights

5.4.1.1. North America

5.4.1.2. Europe

5.4.1.3. Asia Pacific

5.4.1.4. Latin America

5.4.1.5. Middle East & Africa

6. North America MRI Systems Market Outlook, 2019-2031

6.1. North America MRI Systems Market Outlook, by Strength, Value (US$ Bn) and Volume (Million Units), 2019-2031

6.1.1. Key Highlights

6.1.1.1. <0.5T

6.1.1.2. 1.5T

6.1.1.3. 3T

6.1.1.4. >3T

6.2. North America MRI Systems Market Outlook, by Architecture, Value (US$ Bn) and Volume (Million Units), 2019-2031

6.2.1. Key Highlights

6.2.1.1. Open

6.2.1.2. Closed

6.3. North America MRI Systems Market Outlook, by End User, Value (US$ Bn) and Volume (Million Units), 2019-2031

6.3.1. Key Highlights

6.3.1.1. Hospitals

6.3.1.2. Academics & Research Institute

6.3.1.3. Ambulatory Surgical Centers

6.3.1.4. Diagnostic Centers

6.3.2. Bps Analysis/Market Attractiveness Analysis

6.4. North America MRI Systems Market Outlook, by Country, Value (US$ Bn) and Volume (Million Units), 2019-2031

6.4.1. Key Highlights

6.4.1.1. U.S. MRI Systems Market by Strength, Value (US$ Bn) and Volume (Million Units), 2019-2031

6.4.1.2. U.S. MRI Systems Market by Architecture, Value (US$ Bn) and Volume (Million Units), 2019-2031

6.4.1.3. U.S. MRI Systems Market by End User, Value (US$ Bn) and Volume (Million Units), 2019-2031

6.4.1.4. Canada MRI Systems Market by Strength, Value (US$ Bn) and Volume (Million Units), 2019-2031

6.4.1.5. Canada MRI Systems Market by Architecture, Value (US$ Bn) and Volume (Million Units), 2019-2031

6.4.1.6. Canada MRI Systems Market by End User, Value (US$ Bn) and Volume (Million Units), 2019-2031

6.4.2. Bps Analysis/Market Attractiveness Analysis

7. Europe MRI Systems Market Outlook, 2019-2031

7.1. Europe MRI Systems Market Outlook, by Strength, Value (US$ Bn) and Volume (Million Units), 2019-2031

7.1.1. Key Highlights

7.1.1.1. <0.5T

7.1.1.2. 1.5T

7.1.1.3. 3T

7.1.1.4. >3T

7.2. Europe MRI Systems Market Outlook, by Architecture, Value (US$ Bn) and Volume (Million Units), 2019-2031

7.2.1. Key Highlights

7.2.1.1. Open

7.2.1.2. Closed

7.3. Europe MRI Systems Market Outlook, by End User, Value (US$ Bn) and Volume (Million Units), 2019-2031

7.3.1. Key Highlights

7.3.1.1. Hospitals

7.3.1.2. Academics & Research Institute

7.3.1.3. Ambulatory Surgical Centers

7.3.1.4. Diagnostic Centers

7.3.2. Bps Analysis/Market Attractiveness Analysis

7.4. Europe MRI Systems Market Outlook, by Country, Value (US$ Bn) and Volume (Million Units), 2019-2031

7.4.1. Key Highlights

7.4.1.1. Germany MRI Systems Market by Strength, Value (US$ Bn) and Volume (Million Units), 2019-2031

7.4.1.2. Germany MRI Systems Market by Architecture, Value (US$ Bn) and Volume (Million Units), 2019-2031

7.4.1.3. Germany MRI Systems Market by End User, Value (US$ Bn) and Volume (Million Units), 2019-2031

7.4.1.4. U.K. MRI Systems Market by Strength, Value (US$ Bn) and Volume (Million Units), 2019-2031

7.4.1.5. U.K. MRI Systems Market by Architecture, Value (US$ Bn) and Volume (Million Units), 2019-2031

7.4.1.6. U.K. MRI Systems Market by End User, Value (US$ Bn) and Volume (Million Units), 2019-2031

7.4.1.7. France MRI Systems Market by Strength, Value (US$ Bn) and Volume (Million Units), 2019-2031

7.4.1.8. France MRI Systems Market by Architecture, Value (US$ Bn) and Volume (Million Units), 2019-2031

7.4.1.9. France MRI Systems Market by End User, Value (US$ Bn) and Volume (Million Units), 2019-2031

7.4.1.10. Italy MRI Systems Market by Strength, Value (US$ Bn) and Volume (Million Units), 2019-2031

7.4.1.11. Italy MRI Systems Market by Architecture, Value (US$ Bn) and Volume (Million Units), 2019-2031

7.4.1.12. Italy MRI Systems Market by End User, Value (US$ Bn) and Volume (Million Units), 2019-2031

7.4.1.13. Turkey MRI Systems Market by Strength, Value (US$ Bn) and Volume (Million Units), 2019-2031

7.4.1.14. Turkey MRI Systems Market by Architecture, Value (US$ Bn) and Volume (Million Units), 2019-2031

7.4.1.15. Turkey MRI Systems Market by End User, Value (US$ Bn) and Volume (Million Units), 2019-2031

7.4.1.16. Russia MRI Systems Market by Strength, Value (US$ Bn) and Volume (Million Units), 2019-2031

7.4.1.17. Russia MRI Systems Market by Architecture, Value (US$ Bn) and Volume (Million Units), 2019-2031

7.4.1.18. Russia MRI Systems Market by End User, Value (US$ Bn) and Volume (Million Units), 2019-2031

7.4.1.19. Rest Of Europe MRI Systems Market by Strength, Value (US$ Bn) and Volume (Million Units), 2019-2031

7.4.1.20. Rest Of Europe MRI Systems Market by Architecture, Value (US$ Bn) and Volume (Million Units), 2019-2031

7.4.1.21. Rest Of Europe MRI Systems Market by End User, Value (US$ Bn) and Volume (Million Units), 2019-2031

7.4.2. Bps Analysis/Market Attractiveness Analysis

8. Asia Pacific MRI Systems Market Outlook, 2019-2031

8.1. Asia Pacific MRI Systems Market Outlook, by Strength, Value (US$ Bn) and Volume (Million Units), 2019-2031

8.1.1. Key Highlights

8.1.1.1. <0.5T

8.1.1.2. 1.5T

8.1.1.3. 3T

8.1.1.4. >3T

8.2. Asia Pacific MRI Systems Market Outlook, by Architecture, Value (US$ Bn) and Volume (Million Units), 2019-2031

8.2.1. Key Highlights

8.2.1.1. Open

8.2.1.2. Closed

8.3. Asia Pacific MRI Systems Market Outlook, by End User, Value (US$ Bn) and Volume (Million Units), 2019-2031

8.3.1. Key Highlights

8.3.1.1. Hospitals

8.3.1.2. Academics & Research Institute

8.3.1.3. Ambulatory Surgical Centers

8.3.1.4. Diagnostic Centers

8.3.2. Bps Analysis/Market Attractiveness Analysis

8.4. Asia Pacific MRI Systems Market Outlook, by Country, Value (US$ Bn) and Volume (Million Units), 2019-2031

8.4.1. Key Highlights

8.4.1.1. China MRI Systems Market by Strength, Value (US$ Bn) and Volume (Million Units), 2019-2031

8.4.1.2. China MRI Systems Market by Architecture, Value (US$ Bn) and Volume (Million Units), 2019-2031

8.4.1.3. China MRI Systems Market by End User, Value (US$ Bn) and Volume (Million Units), 2019-2031

8.4.1.4. Japan MRI Systems Market by Strength, Value (US$ Bn) and Volume (Million Units), 2019-2031

8.4.1.5. Japan MRI Systems Market by Architecture, Value (US$ Bn) and Volume (Million Units), 2019-2031

8.4.1.6. Japan MRI Systems Market by End User, Value (US$ Bn) and Volume (Million Units), 2019-2031

8.4.1.7. South Korea MRI Systems Market by Strength, Value (US$ Bn) and Volume (Million Units), 2019-2031

8.4.1.8. South Korea MRI Systems Market by Architecture, Value (US$ Bn) and Volume (Million Units), 2019-2031

8.4.1.9. South Korea MRI Systems Market by End User, Value (US$ Bn) and Volume (Million Units), 2019-2031

8.4.1.10. India MRI Systems Market by Strength, Value (US$ Bn) and Volume (Million Units), 2019-2031

8.4.1.11. India MRI Systems Market by Architecture, Value (US$ Bn) and Volume (Million Units), 2019-2031

8.4.1.12. India MRI Systems Market by End User, Value (US$ Bn) and Volume (Million Units), 2019-2031

8.4.1.13. Southeast Asia MRI Systems Market by Strength, Value (US$ Bn) and Volume (Million Units), 2019-2031

8.4.1.14. Southeast Asia MRI Systems Market by Architecture, Value (US$ Bn) and Volume (Million Units), 2019-2031

8.4.1.15. Southeast Asia MRI Systems Market by End User, Value (US$ Bn) and Volume (Million Units), 2019-2031

8.4.1.16. Rest Of Asia Pacific MRI Systems Market by Strength, Value (US$ Bn) and Volume (Million Units), 2019-2031

8.4.1.17. Rest Of Asia Pacific MRI Systems Market by Architecture, Value (US$ Bn) and Volume (Million Units), 2019-2031

8.4.1.18. Rest Of Asia Pacific MRI Systems Market by End User, Value (US$ Bn) and Volume (Million Units), 2019-2031

8.4.2. Bps Analysis/Market Attractiveness Analysis

9. Latin America MRI Systems Market Outlook, 2019-2031

9.1. Latin America MRI Systems Market Outlook, by Strength, Value (US$ Bn) and Volume (Million Units), 2019-2031

9.1.1. Key Highlights

9.1.1.1. <0.5T

9.1.1.2. 1.5T

9.1.1.3. 3T

9.1.1.4. >3T

9.2. Latin America MRI Systems Market Outlook, by Architecture, Value (US$ Bn) and Volume (Million Units), 2019-2031

9.2.1. Key Highlights

9.2.1.1. Open

9.2.1.2. Closed

9.3. Latin America MRI Systems Market Outlook, by End User, Value (US$ Bn) and Volume (Million Units), 2019-2031

9.3.1. Key Highlights

9.3.1.1. Hospitals

9.3.1.2. Academics & Research Institute

9.3.1.3. Ambulatory Surgical Centers

9.3.1.4. Diagnostic Centers

9.3.2. Bps Analysis/Market Attractiveness Analysis

9.4. Latin America MRI Systems Market Outlook, by Country, Value (US$ Bn) and Volume (Million Units), 2019-2031

9.4.1. Key Highlights

9.4.1.1. Brazil MRI Systems Market by Strength, Value (US$ Bn) and Volume (Million Units), 2019-2031

9.4.1.2. Brazil MRI Systems Market by Architecture, Value (US$ Bn) and Volume (Million Units), 2019-2031

9.4.1.3. Brazil MRI Systems Market by End User, Value (US$ Bn) and Volume (Million Units), 2019-2031

9.4.1.4. Mexico MRI Systems Market by Strength, Value (US$ Bn) and Volume (Million Units), 2019-2031

9.4.1.5. Mexico MRI Systems Market by Architecture, Value (US$ Bn) and Volume (Million Units), 2019-2031

9.4.1.6. Mexico MRI Systems Market by End User, Value (US$ Bn) and Volume (Million Units), 2019-2031

9.4.1.7. Argentina MRI Systems Market by Strength, Value (US$ Bn) and Volume (Million Units), 2019-2031

9.4.1.8. Argentina MRI Systems Market by Architecture, Value (US$ Bn) and Volume (Million Units), 2019-2031

9.4.1.9. Argentina MRI Systems Market by End User, Value (US$ Bn) and Volume (Million Units), 2019-2031

9.4.1.10. Rest Of Latin America MRI Systems Market by Strength, Value (US$ Bn) and Volume (Million Units), 2019-2031

9.4.1.11. Rest Of Latin America MRI Systems Market by Architecture, Value (US$ Bn) and Volume (Million Units), 2019-2031

9.4.1.12. Rest Of Latin America MRI Systems Market by End User, Value (US$ Bn) and Volume (Million Units), 2019-2031

9.4.2. Bps Analysis/Market Attractiveness Analysis

10. Middle East & Africa MRI Systems Market Outlook, 2019-2031

10.1. Middle East & Africa MRI Systems Market Outlook, by Strength, Value (US$ Bn) and Volume (Million Units), 2019-2031

10.1.1. Key Highlights

10.1.1.1. <0.5T

10.1.1.2. 1.5T

10.1.1.3. 3T

10.1.1.4. >3T

10.2. Middle East & Africa MRI Systems Market Outlook, by Architecture, Value (US$ Bn) and Volume (Million Units), 2019-2031

10.2.1. Key Highlights

10.2.1.1. Open

10.2.1.2. Closed

10.3. Middle East & Africa MRI Systems Market Outlook, by End User, Value (US$ Bn) and Volume (Million Units), 2019-2031

10.3.1. Key Highlights

10.3.1.1. Hospitals

10.3.1.2. Academics & Research Institute

10.3.1.3. Ambulatory Surgical Centers

10.3.1.4. Diagnostic Centers

10.3.2. Bps Analysis/Market Attractiveness Analysis

10.4. Middle East & Africa MRI Systems Market Outlook, by Country, Value (US$ Bn) and Volume (Million Units), 2019-2031

10.4.1. Key Highlights

10.4.1.1. GCC MRI Systems Market by Strength, Value (US$ Bn) and Volume (Million Units), 2019-2031

10.4.1.2. GCC MRI Systems Market by Architecture, Value (US$ Bn) and Volume (Million Units), 2019-2031

10.4.1.3. GCC MRI Systems Market by End User, Value (US$ Bn) and Volume (Million Units), 2019-2031

10.4.1.4. South Africa MRI Systems Market by Strength, Value (US$ Bn) and Volume (Million Units), 2019-2031

10.4.1.5. South Africa MRI Systems Market by Architecture, Value (US$ Bn) and Volume (Million Units), 2019-2031

10.4.1.6. South Africa MRI Systems Market by End User, Value (US$ Bn) and Volume (Million Units), 2019-2031

10.4.1.7. Egypt MRI Systems Market by Strength, Value (US$ Bn) and Volume (Million Units), 2019-2031

10.4.1.8. Egypt MRI Systems Market by Architecture, Value (US$ Bn) and Volume (Million Units), 2019-2031

10.4.1.9. Egypt MRI Systems Market by End User, Value (US$ Bn) and Volume (Million Units), 2019-2031

10.4.1.10. Nigeria MRI Systems Market by Strength, Value (US$ Bn) and Volume (Million Units), 2019-2031

10.4.1.11. Nigeria MRI Systems Market by Architecture, Value (US$ Bn) and Volume (Million Units), 2019-2031

10.4.1.12. Nigeria MRI Systems Market by End User, Value (US$ Bn) and Volume (Million Units), 2019-2031

10.4.1.13. Rest Of Middle East & Africa MRI Systems Market by Strength, Value (US$ Bn) and Volume (Million Units), 2019-2031

10.4.1.14. Rest Of Middle East & Africa MRI Systems Market by Architecture, Value (US$ Bn) and Volume (Million Units), 2019-2031

10.4.1.15. Rest Of Middle East & Africa MRI Systems Market by End User, Value (US$ Bn) and Volume (Million Units), 2019-2031

10.4.2. Bps Analysis/Market Attractiveness Analysis

11. Competitive Landscape

11.1. By End User Vs by Architecture Heat Map

11.2. Manufacturer Vs by Architecture Heatmap

11.3. Company Market Share Analysis, 2024

11.4. Competitive Dashboard

11.5. Company Profiles

11.5.1. Siemens

11.5.1.1. Company Overview

11.5.1.2. Product Portfolio

11.5.1.3. Financial Overview

11.5.1.4. Business Strategies and Development

11.5.2. GE Healthcare

11.5.2.1. Company Overview

11.5.2.2. Product Portfolio

11.5.2.3. Financial Overview

11.5.2.4. Business Strategies and Development

11.5.3. Neusoft Medical Systems, Inc.

11.5.3.1. Company Overview

11.5.3.2. Product Portfolio

11.5.3.3. Financial Overview

11.5.3.4. Business Strategies and Development

11.5.4. Canon

11.5.4.1. Company Overview

11.5.4.2. Product Portfolio

11.5.4.3. Financial Overview

11.5.4.4. Business Strategies and Development

11.5.5. Philips

11.5.5.1. Company Overview

11.5.5.2. Product Portfolio

11.5.5.3. Financial Overview

11.5.5.4. Business Strategies and Development

11.5.6. AllTech Medical Systems.

11.5.6.1. Company Overview

11.5.6.2. Product Portfolio

11.5.6.3. Financial Overview

11.5.6.4. Business Strategies and Development

11.5.7. Hitachi Medical Corporation

11.5.7.1. Company Overview

11.5.7.2. Product Portfolio

11.5.7.3. Financial Overview

11.5.7.4. Business Strategies and Development

11.5.8. China Resources Wandong Medical Equipment Co Ltd.

11.5.8.1. Company Overview

11.5.8.2. Product Portfolio

11.5.8.3. Financial Overview

11.5.8.4. Business Strategies and Development

11.5.9. Shimadzu Corporation

11.5.9.1. Company Overview

11.5.9.2. Product Portfolio

11.5.9.3. Financial Overview

11.5.9.4. Business Strategies and Development

11.5.10. Toshiba Medical Systems Corporation

11.5.10.1. Company Overview

11.5.10.2. Product Portfolio

11.5.10.3. Financial Overview

11.5.10.4. Business Strategies and Development

11.5.11. Carestream Health

11.5.11.1. Company Overview

11.5.11.2. Product Portfolio

11.5.11.3. Financial Overview

11.5.11.4. Business Strategies and Development

11.5.12. Barco

11.5.12.1. Company Overview

11.5.12.2. Product Portfolio

11.5.12.3. Financial Overview

11.5.12.4. Business Strategies and Development

11.5.13. Nordion inc.

11.5.13.1. Company Overview

11.5.13.2. Product Portfolio

11.5.13.3. Financial Overview

11.5.13.4. Business Strategies and Development

12. Appendix

12.1. Research Methodology

12.2. Report Assumptions

12.3. Acronyms And Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2023 |

|

2019 - 2023 |

2024 - 2031 |

Value: US$ Billion |

||

|

REPORT FEATURES |

DETAILS |

|

Field Strength Coverage |

|

|

Architecture Coverage |

|

|

End Use Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |