Global Multi-Cancer Early Detection Market Forecast

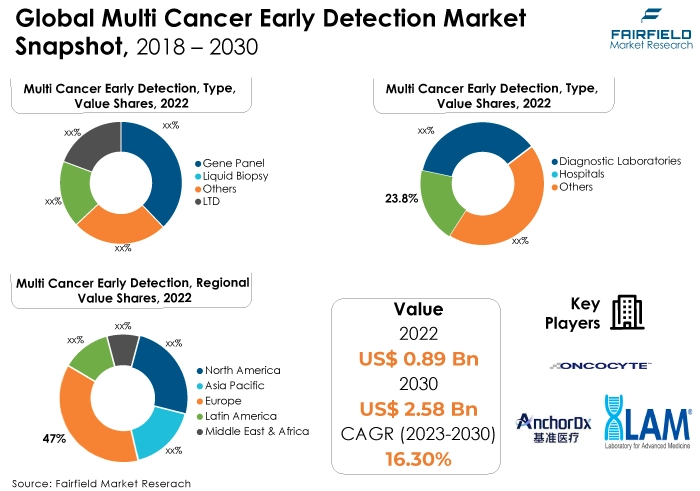

- Global multi-cancer early detection market size worth US$0.89 Bn in 2022 likely to reach around US$2.5 Bn by 2030-end

- Market valuation projected to observe a CAGR of 16.3% between 2023 and 2030

Quick Report Digest

- The multi-cancer early detection (MCED) market is predicted to expand as a result of factors such as the rising incidence of cancer and the government's increased emphasis on cancer early detection.

- The development of tests that can precisely and simultaneously search for signs of a variety of cancers, the majority of which lack an efficient screening approach at the moment, is also projected to fuel the market's growth.

- With more people becoming aware of the benefits of early cancer detection for enhancing patient survival and lowering treatment costs, the market presents fantastic potential.

- The availability of cutting-edge technology and investments, together with the high cost of multi cancer early detection, are expected to limit the market's overall growth in the ensuing years.

- In 2022, the gene panel category dominated the industry. A precise risk assessment and early detection are made possible by gene panels, which provide targeted study of several genes linked to various malignancies. Their widespread acceptance across medical contexts is fueled by their adaptability in detecting a wide range of cancer-related genomic abnormalities and changes.

- In terms of market share for multi-cancer early detection globally, the hospitals segment is anticipated to dominate. A major factor in the hospital segment's prominence as the largest market share holder in multi-cancer early detection (MCED) is its function as a focal point for all-inclusive medical services.

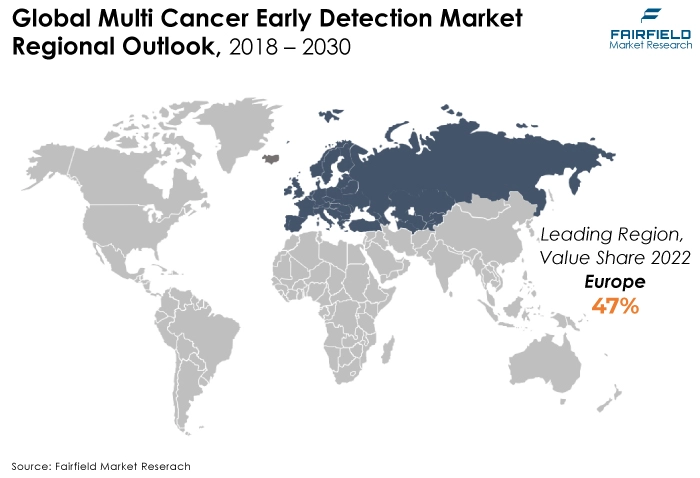

- The European area is anticipated to hold the greatest market share for multi-cancer early detection globally, owing to sophisticated healthcare infrastructure, which made it easier for cutting-edge technologies to be adopted. Innovative MCED solutions are developed as a result of strong research and development efforts along with significant financial investments in biotechnology and healthcare.

- The market for multi-cancer early detection is expanding in North America can be ascribed to outstanding R&D skills, which have accelerated MCED's technological developments. Innovation and commercialisation are accelerated by easy access to significant finance and a supportive regulatory framework.

A Look Back and a Look Forward - Comparative Analysis

The primary elements driving market revenue growth are the increased incidence of cancer and the need for early diagnosis diagnostics, which enable straightforward disease management and consequently lower the death rate. Government programs to encourage early cancer detection and the accessibility of MCED products with cutting-edge technology are the other two key market drivers for multi-cancer early detection.

The market witnessed staggered growth during the historical period 2018 - 2022. Around 10 million people died from cancer-related causes in 2020, making it the leading cause of death globally. In terms of new cases, malignancies of the lung, breast, prostate, skin, colon & rectum, and stomach were the most prevalent in 2020. Consequently, there was an increase in demand for MCEDs as cancer incidence rose.

Given the increasing awareness that early cancer detection can increase patient survival and save treatment costs, the industry offers a considerable opportunity in the future. To enhance diagnostic performance, MCED is undergoing significant research and development. The development of tests that can accurately and continuously search for signs of a variety of malignancies, the majority of which lack an efficient screening approach, is also projected to boost the market's growth in the coming years.

Key Growth Determinants

- Exploding Rate of Prevalence of Cancers Worldwide

The increasing prevalence of cancer is the major factor affecting market demand. American and international society are both significantly impacted by cancer. Estimates show that there were 1,735,350 new cases of cancer and 609,640 deaths from cancer in the US.

Chronic illnesses like cancer have disproportionately harmed the elderly population, particularly in high-income countries. Additionally, according to the WHO's Health and Ageing studies, there will be around 1.5 billion adults 65 and older in the world by 2050, up from an estimated 524 million in 2010, with a large increase in developing nations.

The market is therefore predicted to rise throughout the forecast period as a result of the increasing older population.

- Increasing Awareness Among Population

In the near future, rising government initiatives to increase public awareness of the benefits of early diagnosis will propel market growth for multi-cancer early detection. Cancer diagnostic products are less well-known and more difficult to find in developing and underdeveloped regions.

In an effort to improve this, governmental and non-governmental groups are conducting awareness campaigns to educate people about the need for early diagnosis. The need for early detection has been underlined, leading to an increase in demand for multi-cancer screening tests. This increased awareness is the consequence of public health campaigns, educational activities, and improvements in cancer research.

- Significant Benefits of Early Detection

Early cancer detection depends on being able to spot the disease when it's still relatively treatable and before it has spread or reached a precancerous stage.

The advantages of early cancer detection include better treatment outcomes, lower healthcare expenditures, and higher patient survival rates. The goal of early detection is to spot cancer or precancerous changes at the earliest opportunity, when treatment may increase survival or lower morbidity.

Better patient outcomes result from prompt intervention and specialised therapy made feasible by early diagnosis. Early detection benefits encourage people, healthcare professionals, and payers to adopt and invest in multi-cancer early detection technologies, promoting market expansion.

Major Growth Barriers

- High Costs of Diagnostic Systems

Issues include the high cost of diagnostic gadgets, tight regulatory regulations, and drawn-out clearance processes for new launches that are stifling the global market for multi-cancer early detection. According to NerdWallet Health, the average cost of an MRI in the US is US$2,611. Diagnostic imaging has recently become more expensive. Medical imaging costs increased by an average of 8.3% each year, or 7.8% on average, each year.

- Surge in Adoption of Refurbished Imaging Systems

Many hospitals in poorer countries are unable to invest in diagnostic imaging technology due to its higher cost, poor reimbursement rates, and financial constraints. With the increased demand for diagnostic imaging treatments in these nations, hospitals that are unable to invest in new imaging systems instead opt to employ refurbished ones.

Refurbished systems typically cost between 40% and 60% of the equipment's original cost and are more affordable than new systems. As a result, many industry titans are currently marketing refurbished devices through various initiatives.

Key Trends and Opportunities to Look at

- Technological Advancements

The development of new diagnostic technology has made it easier and more efficient to identify cancer at an early stage. Advancements have improved the accuracy and specificity of cancer detection tests in a number of approaches, including liquid biopsies, genomic profiling, and molecular diagnostics. These technological developments have increased market growth by making early detection more affordable and accessible.

- Government Initiatives and Support

Government agencies like National Cancer Institute, and the Centers for Disease Control and Prevention (CDC) aggressively promote cancer screening programs and provide significant resources for early cancer detection research and development. In order to support the market's expansion, the government is taking steps to increase access to cancer detection services and create widespread screening programs.

- Recommendations for Cancer Screening

Governments in wealthy nations and primary care physicians are advising cancer screening tests for individuals in an effort to find cancer in the early stages and reduce the mortality rate. In order to reduce disease occurrence and ensure early-stage treatment, in the US, colorectal cancer screening is advised to begin at age 50 and last until age 75, according to the US Preventive Services Task Force (USPSTF). The guidelines for biennial colorectal cancer screening for persons 50 to 74 years old have also been established in Canada.

How Does the Regulatory Scenario Shape this Industry?

National laws and regulations have been passed to increase cancer control, and several legal and regulatory frameworks have been used locally and globally to carry out political pledges. In accordance with the feasibility and cost-effectiveness of screening as determined by WHO, Member States are assisted in developing and implementing cancer early diagnosis and screening programs with sufficient capacity to prevent delays in diagnosis and treatment.

Under the countrywide Programme for Prevention and Control of Cancer, Cardiovascular Diseases and Stroke, and Diabetes, the Indian government introduced an operational framework for the first countrywide cancer screening program in the nation in 2016. Before the program is expanded to other regions, 100 districts in India will implement mandatory screening for oral, breast, and cervical cancer in those over 30.

In a similar vein, thanks to National Breast and Cervical Cancer Early Detection Programme of Centers for Disease Control and Prevention (CDC), women with low incomes, no insurance, and other marginalised groups have had access to timely breast and cervical cancer screening and diagnostic services.

Fairfield’s Ranking Board

Top Segments

- Gene Panel Category Continues to Dominate

The gene panel segment dominated the market in 2022 because it offers testing for many malignancies. A growing public awareness of hereditary disorders is fueling demand for genetic testing that can detect tumors early and increase patient survival rates. Gene panels are intended to identify hereditary malignancies.

Furthermore, the liquid biopsy category is projected to experience the fastest market growth. The great uptake and acceptance of cancer detection are credited with the segment's expansion.

One of the newest advances in diagnostics is liquid biopsy. Although scientists have long fantasised about the potential of identifying cancer through blood analysis and have known since the 1960s that free-floating DNA exists in the blood, the World Economic Forum has recognised liquid biopsy as one of the top 10 emerging technologies in the world.

- Hospitals Will Surge Ahead Throughout the Forecast Period

In 2022, the hospital's category dominated the industry. Because so many specialised medical professionals and healthcare professionals are involved in diagnosis and treatment, this category dominates. Hospitals are used as a forum to educate and increase public awareness of a variety of illnesses and conditions. The target market is very ignorant of the new technology known as MCED. Hospitals, therefore, check asymptomatic patients for a variety of sorts to aid in therapy.

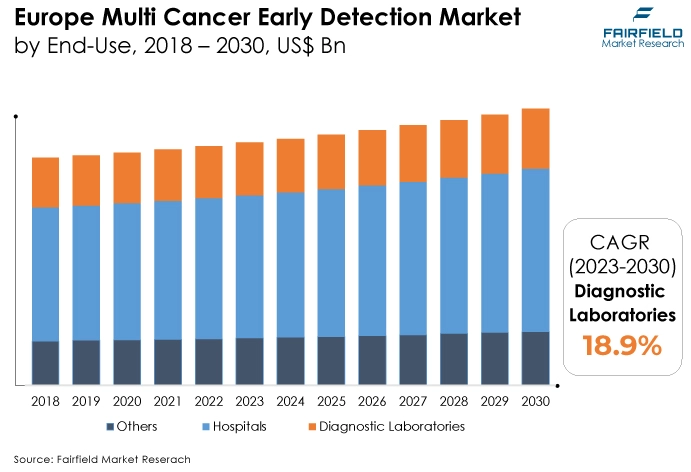

The diagnostic laboratories category is anticipated to grow substantially throughout the projected period due to an increase in testing and resources that can be used to conduct tests. Due to hospitals' increased reliance on diagnostic laboratories for testing and assessment, the market is growing at an accelerated rate.

Regional Frontrunners

Europe Remains the Largest Revenue Contributing Region

The rise of the region is attributed to rising cancer incidence and greater investment in R&D. For instance, by accelerating the commercialisation of the CellMate innovation, the EU-funded DeteCTCs effort seeks help to improve cancer patient detection and care standards.

The rise of the global market in Europe is anticipated to be supported by the expanding population, which is linked to a higher vulnerability to chronic cancer-related diseases and the economic diagnosis of chronic diseases in rural areas.

The market has expanded tremendously as a result of the rise in European cases. These concerns have led to the European Union launching and intensifying its attention on multi-cancer early detection programs throughout the region. These elements will drive market expansion in the ensuing years.

North America’s Growth Set for the Fastest Pace Through 2030

The fastest growth is anticipated in North America as a result of increased government and market participant activity. A substantial study of a single MCED test has just started in the US. Within the next 18 to 24 months, a significant NCI-funded trial with an unclear start date will probably get underway in the US, and will involve many MCED tests.

Additionally, it is projected that the region's expanding cancer incidence will support market growth. For instance, American Cancer Society predicts that 1.9 million new cancer cases will be diagnosed nationwide in 2021 and that over 600,000 individuals will pass away from the disease. This amounts to almost 1,650 fatalities every day.

Fairfield’s Competitive Landscape Analysis

The global market for multiple cancer early detection is consolidated, with few significant companies present worldwide. To increase their global footprint, the major firms are launching new items and enhancing their distribution networks. In addition, Fairfield Market Research anticipates that during the next few years, there will be further market consolidation.

Who are the Leaders in Global Multi-Cancer Early Detection Space?

- Grail, Llc

- Illumina, Inc.

- Exact Sciences Corporation.

- Foundation Medicine, Inc.

- AnchorDx

- Guardant Health, Inc.

- Burning Rock Biotech Limited

- GENECAST

- Laboratory for Advanced Medicine, Inc.

- Singlera Genomics Inc.

- Elypta

- Prenetics Global Limited (Prenetics)

- Oncocyte Corporation

- Micronoma Inc

- EarlyDiagnostics, Inc

Key Company Developments

Clinical Studies

- July 2022: GRAIL, LLC, a healthcare company aimed to detect cancer early, when it might be cured, disclosed that the NHS-Galleri trial successfully completed recruitment in less than 10 months. The project, the largest-ever investigation of a multi-cancer early detection (MCED) test, has enlisted 140,000 healthy volunteers aged 50-77 from select locations across England who have not had a cancer diagnosis or cancer treatment in the previous three years.

- April 2022: Elypta, a Swedish molecular diagnostics business, has announced the start of its second clinical investigation to evaluate the diagnostic performance of GAGomes, a comprehensive profile of human glycosaminoglycans, as metabolic indicators for Multi-Cancer Early Detection (MCED). The LEVANTIS-0093A (LEV93A) study seeks to detect any type of cancer in persons who are at high risk of getting cancer due to a history of heavy smoking.

FDA Approvals

- January 2023: The FDA has recognised the OverC Multi-Cancer Diagnosis Blood Test (MCDBT) as a breakthrough product for the early detection of cancers of the esophagus, ovary, lung, liver, and pancreas in people aged 50 to 75 years. OverC MCDBT achieved a 69.1% rate of sensitivity and a 98.9% rate of specificity in the THUNDER case-control trial.

Partnership Agreement

- January 2023: Prenetics Global Limited (Prenetics), a Hong Kong-based genomics-driven health sciences company, has formed a joint venture called Insighta with scientist Prof. Dennis Lo to develop breakthrough multi-cancer early detection screening. According to the terms of the deal, Prenetics will receive a 50% stock stake, while Prof. Lo's party will also receive a 50% equity stake.

Acquisition Agreement

- August 2021: GRAIL, a healthcare business specialising in the early detection of some cancers, has been bought by Illumina, Inc.; nevertheless, GRAIL will continue to operate independently while the European Commission conducts its ongoing regulatory assessment. GRAIL's Galleri blood test can detect 50 distinct tumors before symptoms occur. With Illumina's acquisition of GRAIL, this potentially life-saving test will become more widely available and used.

An Expert’s Eye

Demand and Future Growth

An increase in the prevalence of cancer is driving the market. The rising awareness regarding cancer may result in a growth in early cancer diagnosis, where gene panel testing is favoured in large quantities, increasing the need for multi-cancer early detection.

Furthermore, technological developments have greatly aided the growth and development of various multi-cancer early detection techniques in hospitals.

However, the multi-cancer early detection market is expected to face considerable challenges because of the high initial cost of diagnostic equipment.

Supply Side of the Market

According to our analysis, the manufacturers present in the multi-cancer early detection market are focusing on enhancing testing capacities and accuracy by introducing new techniques like liquid biopsy, which will help doctors detect cancer more accurately and efficiently.

Europe was the largest contributor in the multi-cancer early detection sector. The rising number of cancer cases in Europe may be responsible for this expansion. In Europe, it is anticipated that there will be over 4 million new cases of cancer and 1.9 million deaths from cancer in 2020.

In addition, the increased prevalence of cancer is expected to cause North America to grow at the fastest rate. In the United States, there will be 608,570 cancer deaths and an estimated 1.9 million newly diagnosed cancer cases in 2021.

In North America, the US is a major exporter of medical devices. Also, the growing number of cancer centres in the region is increasing the demand for multi-cancer early detection. There are 36 states with a total of 72 NCI-Designated Cancer Centres in the US.

Global Multi Cancer Early Detection Market is Segmented as Below:

By Type:

- Liquid Biopsy

- Gene Panel

- LDT

- Others

By End User:

- Hospitals

- Diagnostic Laboratories

- Others

By Geographic Coverage:

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Turkey

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Egypt

- Nigeria

- Rest of Middle East & Africa

1. Executive Summary

1.1. Global Multi Cancer Early Detection Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2022

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. COVID-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Global Multi Cancer Early Detection Market Outlook, 2018 - 2030

3.1. Global Multi Cancer Early Detection Market Outlook, by Type, Value (US$ Bn), 2018 - 2030

3.1.1. Key Highlights

3.1.1.1. Liquid Biopsy

3.1.1.2. Gene Panel

3.1.1.3. LDT

3.1.1.4. Others

3.2. Global Multi Cancer Early Detection Market Outlook, by End Use, Value (US$ Bn), 2018 - 2030

3.2.1. Key Highlights

3.2.1.1. Hospitals

3.2.1.2. Diagnostic Laboratories

3.2.1.3. Others

3.3. Global Multi Cancer Early Detection Market Outlook, by Region, Value (US$ Bn), 2018 - 2030

3.3.1. Key Highlights

3.3.1.1. North America

3.3.1.2. Europe

3.3.1.3. Asia Pacific

3.3.1.4. Latin America

3.3.1.5. Middle East & Africa

4. North America Multi Cancer Early Detection Market Outlook, 2018 - 2030

4.1. North America Multi Cancer Early Detection Market Outlook, by Type, Value (US$ Bn), 2018 - 2030

4.1.1. Key Highlights

4.1.1.1. Liquid Biopsy

4.1.1.2. Gene Panel

4.1.1.3. LDT

4.1.1.4. Others

4.2. North America Multi Cancer Early Detection Market Outlook, by End Use, Value (US$ Bn), 2018 - 2030

4.2.1. Key Highlights

4.2.1.1. Hospitals

4.2.1.2. Diagnostic Laboratories

4.2.1.3. Others

4.2.2. BPS Analysis/Market Attractiveness Analysis

4.3. North America Multi Cancer Early Detection Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

4.3.1. Key Highlights

4.3.1.1. U.S. Multi Cancer Early Detection Market by Type, Value (US$ Bn), 2018 - 2030

4.3.1.2. U.S. Multi Cancer Early Detection Market by End Use, Value (US$ Bn), 2018 - 2030

4.3.1.3. Canada Multi Cancer Early Detection Market by Type, Value (US$ Bn), 2018 - 2030

4.3.1.4. Canada Multi Cancer Early Detection Market by End Use, Value (US$ Bn), 2018 - 2030

4.3.2. BPS Analysis/Market Attractiveness Analysis

5. Europe Multi Cancer Early Detection Market Outlook, 2018 - 2030

5.1. Europe Multi Cancer Early Detection Market Outlook, by Type, Value (US$ Bn), 2018 - 2030

5.1.1. Key Highlights

5.1.1.1. Liquid Biopsy

5.1.1.2. Gene Panel

5.1.1.3. LDT

5.1.1.4. Others

5.2. Europe Multi Cancer Early Detection Market Outlook, by End Use, Value (US$ Bn), 2018 - 2030

5.2.1. Key Highlights

5.2.1.1. Hospitals

5.2.1.2. Diagnostic Laboratories

5.2.1.3. Others

5.2.2. BPS Analysis/Market Attractiveness Analysis

5.3. Europe Multi Cancer Early Detection Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

5.3.1. Key Highlights

5.3.1.1. Germany Multi Cancer Early Detection Market by Type, Value (US$ Bn), 2018 - 2030

5.3.1.2. Germany Multi Cancer Early Detection Market by End Use, Value (US$ Bn), 2018 - 2030

5.3.1.3. U.K. Multi Cancer Early Detection Market by Type, Value (US$ Bn), 2018 - 2030

5.3.1.4. U.K. Multi Cancer Early Detection Market by End Use, Value (US$ Bn), 2018 - 2030

5.3.1.5. France Multi Cancer Early Detection Market by Type, Value (US$ Bn), 2018 - 2030

5.3.1.6. France Multi Cancer Early Detection Market by End Use, Value (US$ Bn), 2018 - 2030

5.3.1.7. Italy Multi Cancer Early Detection Market by Type, Value (US$ Bn), 2018 - 2030

5.3.1.8. Italy Multi Cancer Early Detection Market by End Use, Value (US$ Bn), 2018 - 2030

5.3.1.9. Turkey Multi Cancer Early Detection Market by Type, Value (US$ Bn), 2018 - 2030

5.3.1.10. Turkey Multi Cancer Early Detection Market by End Use, Value (US$ Bn), 2018 - 2030

5.3.1.11. Russia Multi Cancer Early Detection Market by Type, Value (US$ Bn), 2018 - 2030

5.3.1.12. Russia Multi Cancer Early Detection Market by End Use, Value (US$ Bn), 2018 - 2030

5.3.1.13. Rest of Europe Multi Cancer Early Detection Market by Type, Value (US$ Bn), 2018 - 2030

5.3.1.14. Rest of Europe Multi Cancer Early Detection Market by End Use, Value (US$ Bn), 2018 - 2030

5.3.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Multi Cancer Early Detection Market Outlook, 2018 - 2030

6.1. Asia Pacific Multi Cancer Early Detection Market Outlook, by Type, Value (US$ Bn), 2018 - 2030

6.1.1. Key Highlights

6.1.1.1. Liquid Biopsy

6.1.1.2. Gene Panel

6.1.1.3. LDT

6.1.1.4. Others

6.2. Asia Pacific Multi Cancer Early Detection Market Outlook, by End Use, Value (US$ Bn), 2018 - 2030

6.2.1. Key Highlights

6.2.1.1. Hospitals

6.2.1.2. Diagnostic Laboratories

6.2.1.3. Others

6.2.2. BPS Analysis/Market Attractiveness Analysis

6.3. Asia Pacific Multi Cancer Early Detection Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

6.3.1. Key Highlights

6.3.1.1. China Multi Cancer Early Detection Market by Type, Value (US$ Bn), 2018 - 2030

6.3.1.2. China Multi Cancer Early Detection Market by End Use, Value (US$ Bn), 2018 - 2030

6.3.1.3. Japan Multi Cancer Early Detection Market by Type, Value (US$ Bn), 2018 - 2030

6.3.1.4. Japan Multi Cancer Early Detection Market by End Use, Value (US$ Bn), 2018 - 2030

6.3.1.5. South Korea Multi Cancer Early Detection Market by Type, Value (US$ Bn), 2018 - 2030

6.3.1.6. South Korea Multi Cancer Early Detection Market by End Use, Value (US$ Bn), 2018 - 2030

6.3.1.7. India Multi Cancer Early Detection Market by Type, Value (US$ Bn), 2018 - 2030

6.3.1.8. India Multi Cancer Early Detection Market by End Use, Value (US$ Bn), 2018 - 2030

6.3.1.9. Southeast Asia Multi Cancer Early Detection Market by Type, Value (US$ Bn), 2018 - 2030

6.3.1.10. Southeast Asia Multi Cancer Early Detection Market by End Use, Value (US$ Bn), 2018 - 2030

6.3.1.11. Rest of Asia Pacific Multi Cancer Early Detection Market by Type, Value (US$ Bn), 2018 - 2030

6.3.1.12. Rest of Asia Pacific Multi Cancer Early Detection Market by End Use, Value (US$ Bn), 2018 - 2030

6.3.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America Multi Cancer Early Detection Market Outlook, 2018 - 2030

7.1. Latin America Multi Cancer Early Detection Market Outlook, by Type, Value (US$ Bn), 2018 - 2030

7.1.1. Key Highlights

7.1.1.1. Liquid Biopsy

7.1.1.2. Gene Panel

7.1.1.3. LDT

7.1.1.4. Others

7.2. Latin America Multi Cancer Early Detection Market Outlook, by End Use, Value (US$ Bn), 2018 - 2030

7.2.1. Key Highlights

7.2.1.1. Hospitals

7.2.1.2. Diagnostic Laboratories

7.2.1.3. Others

7.2.2. BPS Analysis/Market Attractiveness Analysis

7.3. Latin America Multi Cancer Early Detection Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

7.3.1. Key Highlights

7.3.1.1. Brazil Multi Cancer Early Detection Market by Type, Value (US$ Bn), 2018 - 2030

7.3.1.2. Brazil Multi Cancer Early Detection Market by End Use, Value (US$ Bn), 2018 - 2030

7.3.1.3. Mexico Multi Cancer Early Detection Market by Type, Value (US$ Bn), 2018 - 2030

7.3.1.4. Mexico Multi Cancer Early Detection Market by End Use, Value (US$ Bn), 2018 - 2030

7.3.1.5. Argentina Multi Cancer Early Detection Market by Type, Value (US$ Bn), 2018 - 2030

7.3.1.6. Argentina Multi Cancer Early Detection Market by End Use, Value (US$ Bn), 2018 - 2030

7.3.1.7. Rest of Latin America Multi Cancer Early Detection Market by Type, Value (US$ Bn), 2018 - 2030

7.3.1.8. Rest of Latin America Multi Cancer Early Detection Market by End Use, Value (US$ Bn), 2018 - 2030

7.3.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Multi Cancer Early Detection Market Outlook, 2018 - 2030

8.1. Middle East & Africa Multi Cancer Early Detection Market Outlook, by Type, Value (US$ Bn), 2018 - 2030

8.1.1. Key Highlights

8.1.1.1. Liquid Biopsy

8.1.1.2. Gene Panel

8.1.1.3. LDT

8.1.1.4. Others

8.2. Middle East & Africa Multi Cancer Early Detection Market Outlook, by End Use, Value (US$ Bn), 2018 - 2030

8.2.1. Key Highlights

8.2.1.1. Hospitals

8.2.1.2. Diagnostic Laboratories

8.2.1.3. Others

8.2.2. BPS Analysis/Market Attractiveness Analysis

8.3. Middle East & Africa Multi Cancer Early Detection Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

8.3.1. Key Highlights

8.3.1.1. GCC Multi Cancer Early Detection Market by Type, Value (US$ Bn), 2018 - 2030

8.3.1.2. GCC Multi Cancer Early Detection Market by End Use, Value (US$ Bn), 2018 - 2030

8.3.1.3. South Africa Multi Cancer Early Detection Market by Type, Value (US$ Bn), 2018 - 2030

8.3.1.4. South Africa Multi Cancer Early Detection Market by End Use, Value (US$ Bn), 2018 - 2030

8.3.1.5. Egypt Multi Cancer Early Detection Market by Type, Value (US$ Bn), 2018 - 2030

8.3.1.6. Egypt Multi Cancer Early Detection Market by End Use, Value (US$ Bn), 2018 - 2030

8.3.1.7. Nigeria Multi Cancer Early Detection Market by Type, Value (US$ Bn), 2018 - 2030

8.3.1.8. Nigeria Multi Cancer Early Detection Market by End Use, Value (US$ Bn), 2018 - 2030

8.3.1.9. Rest of Middle East & Africa Multi Cancer Early Detection Market by Type, Value (US$ Bn), 2018 - 2030

8.3.1.10. Rest of Middle East & Africa Multi Cancer Early Detection Market by End Use, Value (US$ Bn), 2018 - 2030

8.3.2. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. Capacity vs Application Heatmap

9.2. Manufacturer vs Application Heatmap

9.3. Company Market Share Analysis, 2022

9.4. Competitive Dashboard

9.5. Company Profiles

9.5.1. Grail, LLC

9.5.1.1. Company Overview

9.5.1.2. Product Portfolio

9.5.1.3. Financial Overview

9.5.1.4. Business Strategies and Development

9.5.2. Illumina, Inc.

9.5.2.1. Company Overview

9.5.2.2. Product Portfolio

9.5.2.3. Financial Overview

9.5.2.4. Business Strategies and Development

9.5.3. Exact Sciences Corporation

9.5.3.1. Company Overview

9.5.3.2. Product Portfolio

9.5.3.3. Financial Overview

9.5.3.4. Business Strategies and Development

9.5.4. Foundation Medicine

9.5.4.1. Company Overview

9.5.4.2. Product Portfolio

9.5.4.3. Financial Overview

9.5.4.4. Business Strategies and Development

9.5.5. AnchorDx

9.5.5.1. Company Overview

9.5.5.2. Product Portfolio

9.5.5.3. Financial Overview

9.5.5.4. Business Strategies and Development

9.5.6. Guardant Health, Inc.

9.5.6.1. Company Overview

9.5.6.2. Product Portfolio

9.5.6.3. Financial Overview

9.5.6.4. Business Strategies and Development

9.5.7. Burning Rock Biotech Limited

9.5.7.1. Company Overview

9.5.7.2. Product Portfolio

9.5.7.3. Financial Overview

9.5.7.4. Business Strategies and Development

9.5.8. GENECAST

9.5.8.1. Company Overview

9.5.8.2. Product Portfolio

9.5.8.3. Financial Overview

9.5.8.4. Business Strategies and Development

9.5.9. Laboratory for Advanced Medicine, Inc

9.5.9.1. Company Overview

9.5.9.2. Product Portfolio

9.5.9.3. Business Strategies and Development

9.5.10. Singlera Genomics Inc

9.5.10.1. Company Overview

9.5.10.2. Product Portfolio

9.5.10.3. Financial Overview

9.5.10.4. Business Strategies and Development

9.5.11. Elypta

9.5.11.1. Company Overview

9.5.11.2. Product Portfolio

9.5.11.3. Financial Overview

9.5.11.4. Business Strategies and Development

9.5.12. Prenetics Global Limited (Prenetics)

9.5.12.1. Company Overview

9.5.12.2. Product Portfolio

9.5.12.3. Financial Overview

9.5.12.4. Business Strategies and Development

9.5.13. Oncocyte Corporation

9.5.13.1. Company Overview

9.5.13.2. Product Portfolio

9.5.13.3. Financial Overview

9.5.13.4. Business Strategies and Development

9.5.14. Micronoma Inc

9.5.14.1. Company Overview

9.5.14.2. Product Portfolio

9.5.14.3. Financial Overview

9.5.14.4. Business Strategies and Development

9.5.15. EarlyDiagnostics, Inc

9.5.15.1. Company Overview

9.5.15.2. Product Portfolio

9.5.15.3. Financial Overview

9.5.15.4. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2022 |

|

2018 - 2022 |

2023 - 2030 |

Value: US$ Million |

||

|

REPORT FEATURES |

DETAILS |

|

Type Coverage |

|

|

End User Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |