Global Neonatal Hearing Screening Devices Market Forecast

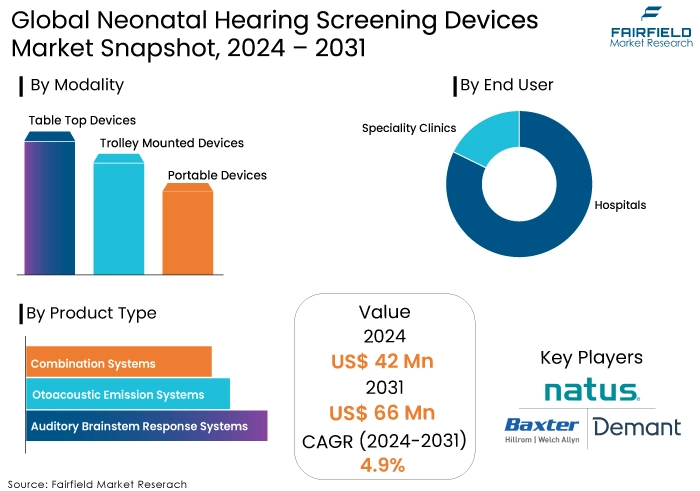

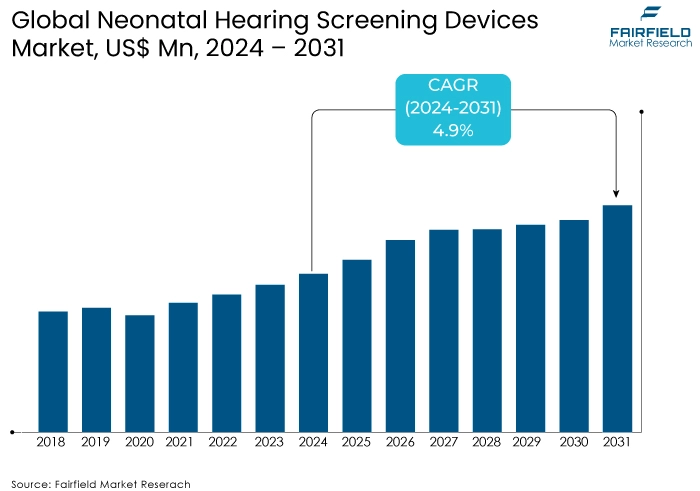

- Global neonatal hearing screening devices market size poised to reach US$66 Mn in 2031, up from US$42 Mn expected in 2024

- Global neonatal hearing screening devices market revenue projected to witness a CAGR of 4.9% during 2024-2031

Neonatal Hearing Screening Devices Market Insights

- The market is experiencing significant expansion, mostly due to the increased awareness and focus on early detection of hearing abnormalities in neonates.

- The spike in industry is driven by a combination of causes, including technological breakthroughs, increasing healthcare spending, and a growing incidence of hearing problems among new-borns.

- The need for neonatal hearing screening devices is rapidly increasing across hospitals, specialist clinics, and among healthcare professionals.

- These devices are increasingly perceived as a reliable aid in reducing the risks associated with hearing problems in neonates.

- Neonatal hearing screening market driven by awareness, government mandates, and technological advancements.

- High costs, limited healthcare resources, and skilled personnel shortages hinder market growth.

- AI and ML integration to enhance screening accuracy, efficiency, and accessibility.

- Emerging markets offer significant growth opportunities for device manufacturers.

- Auditory brainstem response systems dominate the neonatal hearing screening devices market, with hospitals as primary end-users.

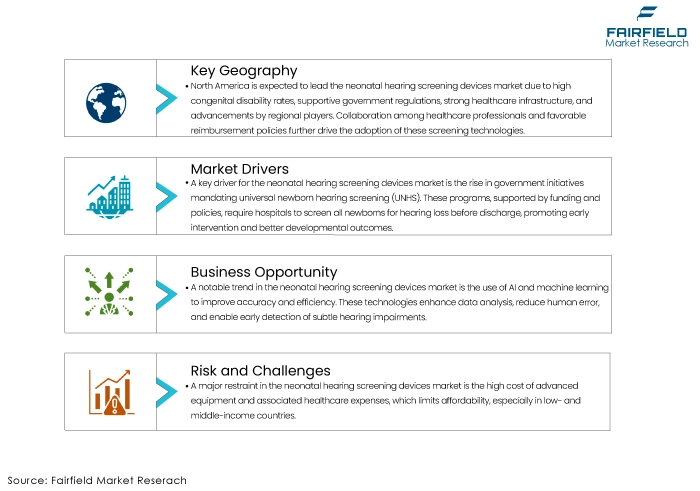

- North America leads the market due to robust healthcare infrastructure and government initiatives, followed by Europe.

A Look Back and a Look Forward - Comparative Analysis

Before 2023, the neonatal hearing screening devices market experienced steady growth driven by increasing awareness of early hearing loss detection and government initiatives mandating new-born hearing screening. Technological advancements, such as the development of more accurate and non-invasive screening methods, enhanced the efficiency and reliability of these devices.

Hospitals and clinics in developed regions, particularly North America and Europe, saw higher adoption rates due to better healthcare infrastructure and funding. However, market penetration was slower in developing regions due to limited healthcare resources and lower awareness levels. Key players focused on expanding their product portfolios and improving device portability and usability, contributing to gradual market expansion.

Despite these advances, high costs and limited access to advanced healthcare technologies in low-income countries remained significant barriers.

Post-2024, the market is expected to witness accelerated growth driven by several key factors. Technological innovations are anticipated to further improve these devices' accuracy, affordability, and ease of use, making them more accessible globally.

Expanding healthcare infrastructure in emerging markets and increasing government support and international funding for neonatal care will drive market penetration in previously underserved regions. The growing emphasis on early diagnosis and intervention for hearing impairments to improve long-term developmental outcomes will bolster demand. Additionally, rising public awareness and educational campaigns about the importance of neonatal hearing screening are expected to enhance adoption rates. The market is poised for significant growth, driven by technological advancements, broader accessibility, and enhanced global awareness and support for neonatal health.

Key Growth Determinants

- Increasing Government Initiatives and Mandates

One of the key drivers for the neonatal hearing screening devices market is the increasing number of government initiatives and mandates aimed at early detection of hearing impairments in new-borns. Many countries have implemented universal new-born hearing screening (UNHS) programs, making it mandatory for hospitals and birthing centres to screen all new-borns for hearing loss before discharge. These programs are often supported by government funding and policies that emphasize early intervention to improve long-term developmental outcomes.

By ensuring that all new-borns undergo hearing screening, these initiatives significantly boost the demand for neonatal hearing screening devices. Additionally, government support in the form of subsidies and grants for purchasing screening equipment helps healthcare facilities, especially in developing regions, adopt these technologies more readily.

- Technological Advancements and Innovations

Technological advancements and innovations in neonatal hearing screening devices are crucial growth drivers for the neonatal hearing screening devices market. Modern devices have become more accurate, portable, and user-friendly, which enhances their adoption in various healthcare settings. Innovations such as automated auditory brainstem response (AABR) and optoacoustic emissions (OAE) testing provide reliable and non-invasive methods for early detection of hearing impairments.

These technologies offer rapid results, reduce the need for skilled personnel to administer the tests, and improve the overall efficiency of the screening process. Furthermore, continuous research and development efforts are expected to introduce even more advanced screening solutions, such as wireless and AI-integrated devices, which will further drive market growth by making screening procedures more accessible and efficient.

- Growing Awareness and Emphasis on Early Diagnosis

Increasing awareness about the importance of early diagnosis and intervention for hearing impairments is a significant driver for the neonatal hearing screening devices market. Early detection of hearing loss is crucial for timely intervention, which can significantly improve language development, cognitive skills, and overall quality of life for affected children.

Public health campaigns, educational programs, and advocacy by healthcare professionals and organizations have played a pivotal role in raising awareness among parents and caregivers. As awareness grows, more parents are demanding hearing screening for their new-borns, leading to higher adoption rates of screening devices. Additionally, healthcare providers are increasingly emphasizing the benefits of early diagnosis, further driving the demand for reliable and efficient neonatal hearing screening technologies.

Key Growth Barriers

- High Costs, and Limited Healthcare Budgets

One of the significant restraints for the neonatal hearing screening devices market is the high cost of advanced screening equipment and associated healthcare expenditures. While technological advancements have improved the accuracy and efficiency of these devices, they have also increased their costs, making them less affordable for many healthcare facilities, particularly in low- and middle-income countries.

Limited healthcare budgets and competing priorities can hinder the widespread adoption of these devices in resource-constrained settings. Additionally, the costs associated with training healthcare professionals to use these devices and maintaining the equipment can further strain financial resources. This financial barrier restricts market growth by limiting the accessibility of neonatal hearing screening devices to only well-funded healthcare facilities.

- Lack of Skilled Personnel and Infrastructure

Another significant restraint for the neonatal hearing screening devices market is the lack of skilled personnel and adequate healthcare infrastructure, especially in developing regions. Effective neonatal hearing screening requires trained professionals who can operate the devices correctly and interpret the results accurately. However, many regions face a shortage of such trained healthcare providers.

Additionally, inadequate healthcare infrastructure, including a lack of well-equipped neonatal care units and follow-up care facilities, further impedes the implementation of comprehensive hearing screening programs. These challenges result in lower adoption rates and reduced effectiveness of screening initiatives, thereby restraining market growth. Addressing these issues requires substantial investments in healthcare training and infrastructure development, which can be challenging to achieve in resource-limited settings.

Neonatal Hearing Screening Devices Market Trends and Opportunities

- AI and ML Integration

A significant trend in the neonatal hearing screening devices market is the integration of artificial intelligence (AI) and machine learning (ML) technologies. These advanced technologies are being incorporated to enhance the accuracy, efficiency, and ease of use of screening devices. AI algorithms can analyse auditory data more quickly and precisely, reducing the chances of human error and improving diagnostic accuracy. Machine learning models can be trained to recognize patterns in hearing test results, facilitating early detection of subtle hearing impairments that might be missed by conventional methods.

Furthermore, AI-powered devices can offer real-time feedback and decision support to healthcare professionals, streamlining the screening process. The use of AI and ML also enables the development of more sophisticated, portable, and user-friendly devices, making neonatal hearing screening more accessible, especially in remote and resource-limited settings. As AI and ML technologies continue to evolve, their integration into neonatal hearing screening devices is expected to drive significant improvements in early detection and intervention outcomes, shaping the future of the market.

- Opportunities in Developing Regions

Expanding into emerging markets presents a substantial growth opportunity for the neonatal hearing screening devices market. Countries in regions such as Asia Pacific, Latin America, and Africa are experiencing improvements in healthcare infrastructure and rising healthcare expenditure, driven by economic growth and increasing government focus on public health. These regions have a high birth rate, creating a significant demand for neonatal care services, including hearing screening. However, current penetration of advanced neonatal hearing screening technologies remains low. By targeting these emerging markets, manufacturers can tap into a large, underserved population.

Strategic partnerships with local healthcare providers, government agencies, and non-governmental organizations can facilitate the introduction and adoption of these devices. Additionally, offering affordable and scalable screening solutions tailored to the needs and constraints of these markets can further drive adoption. Educational initiatives and awareness campaigns about the importance of early hearing screening will also play a crucial role in market expansion. Successfully entering and establishing a presence in these emerging markets can significantly boost the growth and profitability of companies in the neonatal hearing screening devices market.

How Does Regulatory Scenario Shape this Industry?

The regulatory landscape significantly shapes the neonatal hearing screening devices market. Stringent regulatory frameworks ensure device safety, efficacy, and performance standards, fostering trust among healthcare providers and parents. Mandated newborn hearing screening programs in many countries drive market growth by creating a legal requirement for these devices.

However, complex and time-consuming regulatory processes can hinder market entry for new players. Additionally, reimbursement policies for screening services impact device adoption rates. Balanced regulations that promote innovation while safeguarding patient safety are crucial for market growth. Moreover, harmonized regulatory standards across different countries can facilitate global market expansion for device manufacturers.

Segments Covered in Neonatal Hearing Screening Devices Market Report

- Auditory Brainstem Response Systems Contribute the Largest Share

The auditory brainstem response system segment is projected to account for 45.20% of the market share in 2024, based on the product type. The optoacoustic emission system segment is expected to simultaneously capture a 32.3% share, making a substantial contribution to the resource diversity and stability of the neonatal hearing screening devices market. The hospital segment is the dominant force in the new-born hearing screening equipment business, accounting for 56.4% of the market share in 2024.

- Hospitals Continue to be the primary End User Segment

Hospitals constitute a significant portion of the consumer base for the neonatal hearing screening devices market. These healthcare organizations utilize these devices because they enable the early detection of hearing abnormalities in babies. This allows for immediate intervention to mitigate the possible consequences of hearing impairment on a child's development, specifically regarding language and communication abilities.

Hospitals also depend on these devices as they assist healthcare personnel in monitoring and addressing any hearing problems. Hospitals utilize these devices to guarantee thorough and uniform care for all babies, facilitating the prompt identification of hearing problems. Hospitals are experiencing an increasing demand for neonatal hearing screening equipment due to their ability to accurately detect hearing abnormalities, which enables more accurate diagnostic assessments.

Regional Analysis

- Primacy of North America Prevails

The North American region is projected to dominate the neonatal hearing screening devices market due to the significant prevalence of congenital disabilities, government regulations, a robust healthcare infrastructure, and advancements in new-born screening technology by regional players. Close cooperation among healthcare professionals, including pediatricians, audiologists, and government agencies, facilitates the adoption of screening technologies. Favorable reimbursement structures for neonatal hearing screening encourage healthcare providers to adopt and utilize these devices.

According to the study, congenital disabilities like heart problems, chromosomal anomalies, and central nervous system disorders significantly raised the likelihood of death by more than ten times, eight times, and seventeen times, respectively. The risk of death was notably higher between days 28 and 364 of life, but it was also elevated at other times. Consequently, there is an anticipated rise in the need for new-born screening in the region, which is projected to drive market growth.

- Europe Represents the Second Largest Market

Europe boasts a robust healthcare system with a strong emphasis on early intervention for newborns. The region has a relatively high incidence of hearing impairment, driving the demand for screening devices. Many European countries have implemented mandatory newborn hearing screening programs, boosting market growth. The region is a hub for medical technology innovation, fostering the development of advanced screening devices. Significant investments in healthcare infrastructure and technology support the adoption of neonatal hearing screening devices.

There are some other key aspects contributing to Europe's strong position in the neonatal hearing screening devices market. Many European countries were pioneers in implementing universal newborn hearing screening, leading to a strong foundation for the market. A strong emphasis on early intervention and long-term care for children with hearing loss drives the demand for effective screening devices.

Fairfield’s Competitive Landscape Analysis

The neonatal hearing screening devices market is competitive, with key players including Natus Medical Incorporated, Maico Diagnostics GmbH, Interacoustics A/S, and Welch Allyn (Hill-Rom Holdings). These companies are recognized for their innovative and reliable screening technologies. The market is characterized by continuous advancements in technology, such as the integration of AI and machine learning, enhancing device accuracy and efficiency.

Emerging players are focusing on niche markets and cost-effective solutions to gain market share. Strategic collaborations, mergers, and acquisitions are common as companies aim to expand their product portfolios and geographic reach. Regulatory compliance and obtaining necessary certifications remain critical for market players to maintain a competitive edge and ensure product reliability and safety.

Key Market Companies

- Natus Medical Incorporated

- Welch Allyn (Hill-Rom Inc.)

- Demant A/S

- Path Medical GmbH

- Intelligent Hearing Systems

- Vivosonic Inc.

- Pilot Blankenfelde GmbH

- Echodia SAS

Recent Industry Developments

- In September 2023, the Turkish Cooperation and Coordination Agency (TIKA) donated ten health facilities with five newborn hearing screening machines.

- In February 2023, NICE issued a recommendation for the use of a genetic test to detect new-borns who are susceptible to developing deafness because of gentamicin exposure.

An Expert’s Eye

- The neonatal hearing screening devices market is poised for substantial growth and the increasing emphasis on early intervention, coupled with advancements in screening technology, is driving market expansion.

- The rising prevalence of hearing loss and the growing awareness of its impact on child development are key growth drivers.

- While the market has matured in regions like North America, and Europe, developing economies offer significant untapped potential.

- However, challenges such as cost-effectiveness, accessibility, and data management need to be addressed.

- The market is expected to witness steady growth, driven by the imperative to provide all newborns with equal opportunities to reach their full potential.

Global Neonatal Hearing Screening Devices Market is Segmented as-

By Product Type

- Auditory Brainstem Response (ABR) Systems

- Otoacoustic Emission (OAE) Systems

- Combination Systems

By Modality

- Table Top Devices

- Trolley Mounted Devices

- Portable Devices

By End User

- Hospitals

- Speciality Clinics

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

1. Executive Summary

1.1. Global Neonatal Hearing Screening Devices Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2024

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. Covid-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact Of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. Pestle Analysis

3. Global Neonatal Hearing Screening Devices Market Outlook, 2019-2031

3.1. Global Neonatal Hearing Screening Devices Market Outlook, by Product Type, Value (US$ Bn), 2019-2031

3.1.1. Key Highlights

3.1.1.1. Auditory Brainstem Response (ABR) Systems

3.1.1.2. Otoacoustic Emission (OAE) Systems

3.1.1.3. Combination Systems

3.2. Global Neonatal Hearing Screening Devices Market Outlook, by Modality, Value (US$ Bn), 2019-2031

3.2.1. Key Highlights

3.2.1.1. Tabletop Devices

3.2.1.2. Trolley Mounted Devices

3.2.1.3. Portable and Hand-held Devices

3.3. Global Neonatal Hearing Screening Devices Market Outlook, by End User, Value (US$ Bn), 2019-2031

3.3.1. Key Highlights

3.3.1.1. Hospitals

3.3.1.2. Specialty Clinics

3.3.1.3. Others

3.4. Global Neonatal Hearing Screening Devices Market Outlook, by Region, Value (US$ Bn), 2019-2031

3.4.1. Key Highlights

3.4.1.1. North America

3.4.1.2. Europe

3.4.1.3. Asia Pacific

3.4.1.4. Latin America

3.4.1.5. Middle East & Africa

4. North America Neonatal Hearing Screening Devices Market Outlook, 2019-2031

4.1. North America Neonatal Hearing Screening Devices Market Outlook, by Product Type, Value (US$ Bn), 2019-2031

4.1.1. Key Highlights

4.1.1.1. Auditory Brainstem Response (ABR) Systems

4.1.1.2. Otoacoustic Emission (OAE) Systems

4.1.1.3. Combination Systems

4.2. North America Neonatal Hearing Screening Devices Market Outlook, by Modality, Value (US$ Bn), 2019-2031

4.2.1. Key Highlights

4.2.1.1. Tabletop Devices

4.2.1.2. Trolley Mounted Devices

4.2.1.3. Portable and Hand-held Devices

4.3. North America Neonatal Hearing Screening Devices Market Outlook, by End User, Value (US$ Bn), 2019-2031

4.3.1. Key Highlights

4.3.1.1. Hospitals

4.3.1.2. Specialty Clinics

4.3.1.3. Others

4.3.2. BPS Analysis/Market Attractiveness Analysis

4.4. North America Neonatal Hearing Screening Devices Market Outlook, by Country, Value (US$ Bn), 2019-2031

4.4.1. Key Highlights

4.4.1.1. U.S. Neonatal Hearing Screening Devices Market by Product Type, Value (US$ Bn), 2019-2031

4.4.1.2. U.S. Neonatal Hearing Screening Devices Market by Modality, Value (US$ Bn), 2019-2031

4.4.1.3. U.S. Neonatal Hearing Screening Devices Market by End User, Value (US$ Bn), 2019-2031

4.4.1.4. Canada Neonatal Hearing Screening Devices Market by Product Type, Value (US$ Bn), 2019-2031

4.4.1.5. Canada Neonatal Hearing Screening Devices Market by Modality, Value (US$ Bn), 2019-2031

4.4.1.6. Canada Neonatal Hearing Screening Devices Market by End User, Value (US$ Bn), 2019-2031

4.4.2. BPS Analysis/Market Attractiveness Analysis

5. Europe Neonatal Hearing Screening Devices Market Outlook, 2019-2031

5.1. Europe Neonatal Hearing Screening Devices Market Outlook, by Product Type, Value (US$ Bn), 2019-2031

5.1.1. Key Highlights

5.1.1.1. Auditory Brainstem Response (ABR) Systems

5.1.1.2. Otoacoustic Emission (OAE) Systems

5.1.1.3. Combination Systems

5.2. Europe Neonatal Hearing Screening Devices Market Outlook, by Modality, Value (US$ Bn), 2019-2031

5.2.1. Key Highlights

5.2.1.1. Tabletop Devices

5.2.1.2. Trolley Mounted Devices

5.2.1.3. Portable and Hand-held Devices

5.3. Europe Neonatal Hearing Screening Devices Market Outlook, by End User, Value (US$ Bn), 2019-2031

5.3.1. Key Highlights

5.3.1.1. Hospitals

5.3.1.2. Specialty Clinics

5.3.1.3. Others

5.3.2. BPS Analysis/Market Attractiveness Analysis

5.4. Europe Neonatal Hearing Screening Devices Market Outlook, by Country, Value (US$ Bn), 2019-2031

5.4.1. Key Highlights

5.4.1.1. Germany Neonatal Hearing Screening Devices Market by Product Type, Value (US$ Bn), 2019-2031

5.4.1.2. Germany Neonatal Hearing Screening Devices Market by Modality, Value (US$ Bn), 2019-2031

5.4.1.3. Germany Neonatal Hearing Screening Devices Market by End User, Value (US$ Bn), 2019-2031

5.4.1.4. U.K. Neonatal Hearing Screening Devices Market by Product Type, Value (US$ Bn), 2019-2031

5.4.1.5. U.K. Neonatal Hearing Screening Devices Market by Modality, Value (US$ Bn), 2019-2031

5.4.1.6. U.K. Neonatal Hearing Screening Devices Market by End User, Value (US$ Bn), 2019-2031

5.4.1.7. France Neonatal Hearing Screening Devices Market by Product Type, Value (US$ Bn), 2019-2031

5.4.1.8. France Neonatal Hearing Screening Devices Market by Modality, Value (US$ Bn), 2019-2031

5.4.1.9. France Neonatal Hearing Screening Devices Market by End User, Value (US$ Bn), 2019-2031

5.4.1.10. Italy Neonatal Hearing Screening Devices Market by Product Type, Value (US$ Bn), 2019-2031

5.4.1.11. Italy Neonatal Hearing Screening Devices Market by Modality, Value (US$ Bn), 2019-2031

5.4.1.12. Italy Neonatal Hearing Screening Devices Market by End User, Value (US$ Bn), 2019-2031

5.4.1.13. Turkey Neonatal Hearing Screening Devices Market by Product Type, Value (US$ Bn), 2019-2031

5.4.1.14. Turkey Neonatal Hearing Screening Devices Market by Modality, Value (US$ Bn), 2019-2031

5.4.1.15. Turkey Neonatal Hearing Screening Devices Market by End User, Value (US$ Bn), 2019-2031

5.4.1.16. Russia Neonatal Hearing Screening Devices Market by Product Type, Value (US$ Bn), 2019-2031

5.4.1.17. Russia Neonatal Hearing Screening Devices Market by Modality, Value (US$ Bn), 2019-2031

5.4.1.18. Russia Neonatal Hearing Screening Devices Market by End User, Value (US$ Bn), 2019-2031

5.4.1.19. Rest Of Europe Neonatal Hearing Screening Devices Market by Product Type, Value (US$ Bn), 2019-2031

5.4.1.20. Rest Of Europe Neonatal Hearing Screening Devices Market by Modality, Value (US$ Bn), 2019-2031

5.4.1.21. Rest Of Europe Neonatal Hearing Screening Devices Market by End User, Value (US$ Bn), 2019-2031

5.4.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Neonatal Hearing Screening Devices Market Outlook, 2019-2031

6.1. Asia Pacific Neonatal Hearing Screening Devices Market Outlook, by Product Type, Value (US$ Bn), 2019-2031

6.1.1. Key Highlights

6.1.1.1. Auditory Brainstem Response (ABR) Systems

6.1.1.2. Otoacoustic Emission (OAE) Systems

6.1.1.3. Combination Systems

6.2. Asia Pacific Neonatal Hearing Screening Devices Market Outlook, by Modality, Value (US$ Bn), 2019-2031

6.2.1. Key Highlights

6.2.1.1. Tabletop Devices

6.2.1.2. Trolley Mounted Devices

6.2.1.3. Portable and Hand-held Devices

6.3. Asia Pacific Neonatal Hearing Screening Devices Market Outlook, by End User, Value (US$ Bn), 2019-2031

6.3.1. Key Highlights

6.3.1.1. Hospitals

6.3.1.2. Specialty Clinics

6.3.1.3. Others

6.3.2. BPS Analysis/Market Attractiveness Analysis

6.4. Asia Pacific Neonatal Hearing Screening Devices Market Outlook, by Country, Value (US$ Bn), 2019-2031

6.4.1. Key Highlights

6.4.1.1. China Neonatal Hearing Screening Devices Market by Product Type, Value (US$ Bn), 2019-2031

6.4.1.2. China Neonatal Hearing Screening Devices Market by Modality, Value (US$ Bn), 2019-2031

6.4.1.3. China Neonatal Hearing Screening Devices Market by End User, Value (US$ Bn), 2019-2031

6.4.1.4. Japan Neonatal Hearing Screening Devices Market by Product Type, Value (US$ Bn), 2019-2031

6.4.1.5. Japan Neonatal Hearing Screening Devices Market by Modality, Value (US$ Bn), 2019-2031

6.4.1.6. Japan Neonatal Hearing Screening Devices Market by End User, Value (US$ Bn), 2019-2031

6.4.1.7. South Korea Neonatal Hearing Screening Devices Market by Product Type, Value (US$ Bn), 2019-2031

6.4.1.8. South Korea Neonatal Hearing Screening Devices Market by Modality, Value (US$ Bn), 2019-2031

6.4.1.9. South Korea Neonatal Hearing Screening Devices Market by End User, Value (US$ Bn), 2019-2031

6.4.1.10. India Neonatal Hearing Screening Devices Market by Product Type, Value (US$ Bn), 2019-2031

6.4.1.11. India Neonatal Hearing Screening Devices Market by Modality, Value (US$ Bn), 2019-2031

6.4.1.12. India Neonatal Hearing Screening Devices Market by End User, Value (US$ Bn), 2019-2031

6.4.1.13. Southeast Asia Neonatal Hearing Screening Devices Market by Product Type, Value (US$ Bn), 2019-2031

6.4.1.14. Southeast Asia Neonatal Hearing Screening Devices Market by Modality, Value (US$ Bn), 2019-2031

6.4.1.15. Southeast Asia Neonatal Hearing Screening Devices Market by End User, Value (US$ Bn), 2019-2031

6.4.1.16. Rest Of Asia Pacific Neonatal Hearing Screening Devices Market by Product Type, Value (US$ Bn), 2019-2031

6.4.1.17. Rest Of Asia Pacific Neonatal Hearing Screening Devices Market by Modality, Value (US$ Bn), 2019-2031

6.4.1.18. Rest Of Asia Pacific Neonatal Hearing Screening Devices Market by End User, Value (US$ Bn), 2019-2031

6.4.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America Neonatal Hearing Screening Devices Market Outlook, 2019-2031

7.1. Latin America Neonatal Hearing Screening Devices Market Outlook, by Product Type, Value (US$ Bn), 2019-2031

7.1.1. Key Highlights

7.1.1.1. Auditory Brainstem Response (ABR) Systems

7.1.1.2. Otoacoustic Emission (OAE) Systems

7.1.1.3. Combination Systems

7.2. Latin America Neonatal Hearing Screening Devices Market Outlook, by Modality, Value (US$ Bn), 2019-2031

7.2.1. Key Highlights

7.2.1.1. Tabletop Devices

7.2.1.2. Trolley Mounted Devices

7.2.1.3. Portable and Hand-held Devices

7.3. Latin America Neonatal Hearing Screening Devices Market Outlook, by End User, Value (US$ Bn), 2019-2031

7.3.1. Key Highlights

7.3.1.1. Hospitals

7.3.1.2. Specialty Clinics

7.3.1.3. Others

7.3.2. Bps Analysis/Market Attractiveness Analysis

7.4. Latin America Neonatal Hearing Screening Devices Market Outlook, by Country, Value (US$ Bn), 2019-2031

7.4.1. Key Highlights

7.4.1.1. Brazil Neonatal Hearing Screening Devices Market by Product Type, Value (US$ Bn), 2019-2031

7.4.1.2. Brazil Neonatal Hearing Screening Devices Market by Modality, Value (US$ Bn), 2019-2031

7.4.1.3. Brazil Neonatal Hearing Screening Devices Market by End User, Value (US$ Bn), 2019-2031

7.4.1.4. Mexico Neonatal Hearing Screening Devices Market by Product Type, Value (US$ Bn), 2019-2031

7.4.1.5. Mexico Neonatal Hearing Screening Devices Market by Modality, Value (US$ Bn), 2019-2031

7.4.1.6. Mexico Neonatal Hearing Screening Devices Market by End User, Value (US$ Bn), 2019-2031

7.4.1.7. Argentina Neonatal Hearing Screening Devices Market by Product Type, Value (US$ Bn), 2019-2031

7.4.1.8. Argentina Neonatal Hearing Screening Devices Market by Modality, Value (US$ Bn), 2019-2031

7.4.1.9. Argentina Neonatal Hearing Screening Devices Market by End User, Value (US$ Bn), 2019-2031

7.4.1.10. Rest Of Latin America Neonatal Hearing Screening Devices Market by Product Type, Value (US$ Bn), 2019-2031

7.4.1.11. Rest Of Latin America Neonatal Hearing Screening Devices Market by Modality, Value (US$ Bn), 2019-2031

7.4.1.12. Rest Of Latin America Neonatal Hearing Screening Devices Market by End User, Value (US$ Bn), 2019-2031

7.4.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Neonatal Hearing Screening Devices Market Outlook, 2019-2031

8.1. Middle East & Africa Neonatal Hearing Screening Devices Market Outlook, by Product Type, Value (US$ Bn), 2019-2031

8.1.1. Key Highlights

8.1.1.1. Auditory Brainstem Response (ABR) Systems

8.1.1.2. Otoacoustic Emission (OAE) Systems

8.1.1.3. Combination Systems

8.2. Middle East & Africa Neonatal Hearing Screening Devices Market Outlook, by Modality, Value (US$ Bn), 2019-2031

8.2.1. Key Highlights

8.2.1.1. Tabletop Devices

8.2.1.2. Trolley Mounted Devices

8.2.1.3. Portable and Hand-held Devices

8.3. Middle East & Africa Neonatal Hearing Screening Devices Market Outlook, by End User, Value (US$ Bn), 2019-2031

8.3.1. Key Highlights

8.3.1.1. Hospitals

8.3.1.2. Specialty Clinics

8.3.1.3. Others

8.3.2. BPS Analysis/Market Attractiveness Analysis

8.4. Middle East & Africa Neonatal Hearing Screening Devices Market Outlook, by Country, Value (US$ Bn), 2019-2031

8.4.1. Key Highlights

8.4.1.1. GCC Neonatal Hearing Screening Devices Market by Product Type, Value (US$ Bn), 2019-2031

8.4.1.2. GCC Neonatal Hearing Screening Devices Market by Modality, Value (US$ Bn), 2019-2031

8.4.1.3. GCC Neonatal Hearing Screening Devices Market by End User, Value (US$ Bn), 2019-2031

8.4.1.4. South Africa Neonatal Hearing Screening Devices Market by Product Type, Value (US$ Bn), 2019-2031

8.4.1.5. South Africa Neonatal Hearing Screening Devices Market by Modality, Value (US$ Bn), 2019-2031

8.4.1.6. South Africa Neonatal Hearing Screening Devices Market by End User, Value (US$ Bn), 2019-2031

8.4.1.7. Egypt Neonatal Hearing Screening Devices Market by Product Type, Value (US$ Bn), 2019-2031

8.4.1.8. Egypt Neonatal Hearing Screening Devices Market by Modality, Value (US$ Bn), 2019-2031

8.4.1.9. Egypt Neonatal Hearing Screening Devices Market by End User, Value (US$ Bn), 2019-2031

8.4.1.10. Nigeria Neonatal Hearing Screening Devices Market by Product Type, Value (US$ Bn), 2019-2031

8.4.1.11. Nigeria Neonatal Hearing Screening Devices Market by Modality, Value (US$ Bn), 2019-2031

8.4.1.12. Nigeria Neonatal Hearing Screening Devices Market by End User, Value (US$ Bn), 2019-2031

8.4.1.13. Rest Of Middle East & Africa Neonatal Hearing Screening Devices Market by Product Type, Value (US$ Bn), 2019-2031

8.4.1.14. Rest Of Middle East & Africa Neonatal Hearing Screening Devices Market by Modality, Value (US$ Bn), 2019-2031

8.4.1.15. Rest Of Middle East & Africa Neonatal Hearing Screening Devices Market by End User, Value (US$ Bn), 2019-2031

8.4.2. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. By End User Vs by Modality Heat Map

9.2. Manufacturer Vs by Modality Heatmap

9.3. Company Market Share Analysis, 2024

9.4. Competitive Dashboard

9.5. Company Profiles

9.5.1. Natus Medical Incorporated

9.5.1.1. Company Overview

9.5.1.2. Product Type Portfolio

9.5.1.3. Financial Overview

9.5.1.4. Business Strategies and Development

9.5.2. Welch Allyn (Hill-Rom Inc.)

9.5.2.1. Company Overview

9.5.2.2. Product Type Portfolio

9.5.2.3. Financial Overview

9.5.2.4. Business Strategies and Development

9.5.3. Demant A/S

9.5.3.1. Company Overview

9.5.3.2. Product Type Portfolio

9.5.3.3. Financial Overview

9.5.3.4. Business Strategies and Development

9.5.4. Path Medical GmbH

9.5.4.1. Company Overview

9.5.4.2. Product Type Portfolio

9.5.4.3. Financial Overview

9.5.4.4. Business Strategies and Development

9.5.5. Intelligent Hearing Systems

9.5.5.1. Company Overview

9.5.5.2. Product Type Portfolio

9.5.5.3. Financial Overview

9.5.5.4. Business Strategies and Development

9.5.6. Vivosonic Inc.

9.5.6.1. Company Overview

9.5.6.2. Product Type Portfolio

9.5.6.3. Financial Overview

9.5.6.4. Business Strategies and Development

9.5.7. Pilot Blankenfelde GmbH

9.5.7.1. Company Overview

9.5.7.2. Product Type Portfolio

9.5.7.3. Financial Overview

9.5.7.4. Business Strategies and Development

9.5.8. Echodia SAS

9.5.8.1. Company Overview

9.5.8.2. Product Type Portfolio

9.5.8.3. Financial Overview

9.5.8.4. Business Strategies and Development

9.5.9. MAICO Diagnostics GmbH

9.5.9.1. Company Overview

9.5.9.2. Product Type Portfolio

9.5.9.3. Financial Overview

9.5.9.4. Business Strategies and Development

9.5.10. Bio-Rad Laboratories, Inc.

9.5.10.1. Company Overview

9.5.10.2. Product Type Portfolio

9.5.10.3. Financial Overview

9.5.10.4. Business Strategies and Development

9.5.11. Trivitron Healthcare

9.5.11.1. Company Overview

9.5.11.2. Product Type Portfolio

9.5.11.3. Financial Overview

9.5.11.4. Business Strategies and Development

9.5.12. Interacoustics A/S

9.5.12.1. Company Overview

9.5.12.2. Product Type Portfolio

9.5.12.3. Financial Overview

9.5.12.4. Business Strategies and Development

9.5.13. Otodynamics Ltd.

9.5.13.1. Company Overview

9.5.13.2. Product Type Portfolio

9.5.13.3. Financial Overview

9.5.13.4. Business Strategies and Development

9.5.14. Inventis Srl

9.5.14.1. Company Overview

9.5.14.2. Product Type Portfolio

9.5.14.3. Financial Overview

9.5.14.4. Business Strategies and Development

9.5.15. Otometrics A/S

9.5.15.1. Company Overview

9.5.15.2. Product Type Portfolio

9.5.15.3. Financial Overview

9.5.15.4. Business Strategies and Development

9.5.16. Grason-Stadler (GSI)

9.5.16.1. Company Overview

9.5.16.2. Product Type Portfolio

9.5.16.3. Financial Overview

9.5.16.4. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms And Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2023 |

|

2019 - 2023 |

2024 - 2031 |

Value: US$ Million |

||

|

REPORT FEATURES |

DETAILS |

|

Product Type Coverage |

|

|

Modality Coverage |

|

|

End User Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |