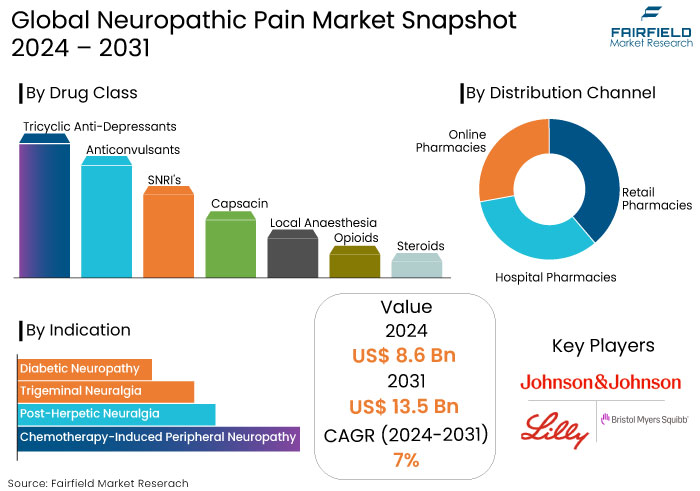

Global Neuropathic Pain Market Forecast

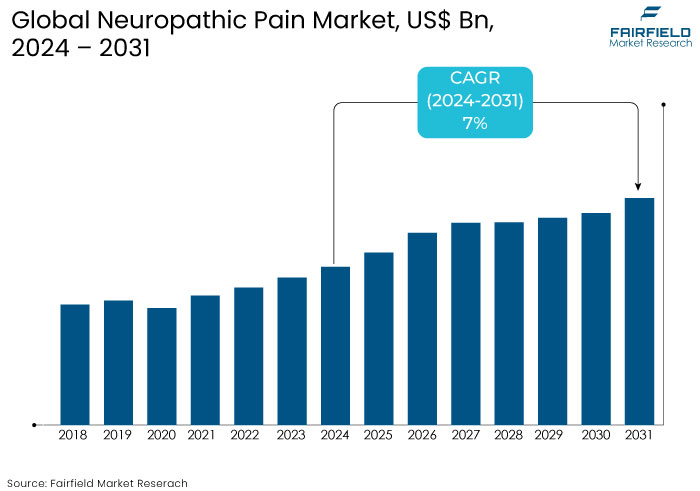

- The neuropathic pain market is projected to reach a size of US$13.5 Bn by 2031, showing significant growth from US$8.6 Bn achieved in 2024

- The market for neuropathic pain is expected to show a significant expansion rate, with an estimated CAGR of 7% from 2024 to 2031

Neuropathic Pain Market Insights

- The increasing incidence of chronic diseases such as diabetes and cancer is driving the demand for neuropathic pain treatments.

- The neuropathic pain market is projected to grow significantly, with an emphasis on innovative therapies and non-opioid treatments.

- Innovations in neuromodulation devices and digital health solutions are reshaping pain management strategies.

- Strict regulations on opioid prescriptions are pushing the development of alternative therapies.

- Tailoring treatments based on genetic and patient-specific factors is gaining traction, promising better outcomes.

- Pharmaceutical companies are investing significantly in research for safe and effective pain management options.

- The market landscape varies significantly across regions with North America leading but rapid growth observed in Asia Pacific.

- Increasing awareness about chronic pain conditions is enhancing patient engagement and driving demand for effective treatments.

A Look Back and a Look Forward - Comparative Analysis

Pre-2023, the neuropathic pain market experienced steady growth due to the rising incidence of conditions like diabetes, cancer, and neurological disorders all of which contribute to the prevalence of neuropathic pain.

Increased awareness among patients and healthcare providers about the chronic nature of neuropathic pain fuelled demand for treatments, including anticonvulsants, antidepressants, and opioids. Additionally, advancements in drug formulations such as extended-release options, and improved patient adherence.

Challenges like the risk of opioid addiction and the side effects of long-term medication use slowed growth. North America and Europe were the dominant regions due to their developed healthcare infrastructures and high patient awareness.

Post-2024, the market is expected to accelerate driven by emerging innovations such as gene therapy, regenerative medicine, and advancements in non-opioid pain management options like neuromodulator and cannabis-based therapies.

Increasing research into identifying pain pathways and biomarkers will also improve the precision of treatment options. The growing elderly population particularly in Asia Pacific and Latin America will boost demand for more effective and safe treatments.

The shift toward personalized medicine, coupled with strict regulations around opioid prescriptions will reshape the market leading to significant growth and the introduction of novel therapies.

Key Growth Determinants

- Rising Prevalence of Chronic Diseases

One of the key drivers of the neuropathic pain market is the increasing prevalence of chronic diseases such as diabetes, cancer, and multiple sclerosis, all of which are significant contributors to neuropathic pain. Diabetic neuropathy, for example is a common complication in patients with long-term diabetes affecting millions globally.

The rise in aging populations, particularly in developed regions, further exacerbates the incidence of these chronic conditions, leading to more cases of neuropathic pain. Cancer treatments such as chemotherapy are known to induce peripheral neuropathy in a significant percentage of patients.

With these diseases becoming more prevalent and patients living longer due to advances in medical care, the demand for effective treatments to manage neuropathic pain continues to grow. This creates an expanding market for both pharmaceutical interventions and alternative therapies aimed at managing chronic pain.

- Advancements in Pain Management Technologies

Technological innovations in pain management particularly non-pharmaceutical treatments are driving the neuropathic pain market growth.

Neuromodulation devices, such as spinal cord stimulators and transcutaneous electrical nerve stimulation (TENS) units offer non-invasive or minimally invasive options for pain relief. Such devices are gaining traction due to their ability to manage chronic pain without the risks associated with long-term drug use particularly opioids.

The growing interest in wearable pain relief technologies and advancements in neural interface devices are further expanding treatment options for neuropathic pain. Regenerative medicine, including stem cell therapies, holds promise for treating the underlying causes of nerve damage rather than just managing symptoms.

As these technologies become more refined and accessible, they are expected to attract a more extensive patient base seeking safer, more effective pain management solutions, thereby driving market growth.

Key Growth Barriers

- High Treatment Costs and Limited Accessibility

One of the key restraints to the growth of the neuropathic pain market is the high cost associated with many available treatments particularly advanced therapies such as neuromodulator devices, regenerative medicine, and innovative pharmaceutical drugs.

Patients in low- and middle-income countries where healthcare access is often limited may find these treatments financially inaccessible. Furthermore, healthcare systems in developing regions usually need more infrastructure to support the widespread use of advanced pain management technologies.

Insurance coverage can be inconsistent in developed markets especially for newer treatments like biologics and neuromodulator devices. This creates a barrier to market expansion as a significant portion of the global population cannot afford or access optimal care.

High costs deter healthcare providers from adopting advanced treatments widely, slowing their integration into clinical practice. These financial limitations restrict patient access to the most effective neuropathic pain treatments, limiting overall market growth.

- Side Effects and Limited Efficacy of Existing Therapies

Despite the availability of various treatment options, many current neuropathic pain therapies such as anticonvulsants, antidepressants, and opioids, have limited efficacy and are associated with significant side effects. For instance, drugs like gabapentin and pregabalin, commonly prescribed for neuropathic pain often provide only partial relief and can cause dizziness, weight gain, or sedation leading to poor patient adherence.

Long-term use of opioids while effective for pain relief, carries high risks of addiction, tolerance, and overdose, which has sparked a public health crisis in many countries. This limited efficacy and adverse side effects have left a significant unmet need in the neuropathic pain market for more effective and safer treatment options.

As a result, healthcare providers are cautious in prescribing certain medications, and patients are hesitant to continue using treatments that may offer only marginal benefits while posing health risks. This challenge curbs the adoption of existing therapies, restricting market growth until safer, more effective treatments become widely available.

Neuropathic Pain Market Trends and Opportunities

- Innovations in Gene Therapy and Regenerative Medicine

The emergence of gene therapy and regenerative medicine presents a transformative opportunity in the neuropathic pain market. These cutting-edge approaches aim to address the underlying causes of neuropathic pain by repairing or regenerating damaged nerve tissues.

Techniques such as gene editing and stem cell therapy can restore normal nerve function and alleviate pain, offering a long-term solution rather than just symptomatic relief. As research progresses and clinical trials demonstrate the efficacy of these treatments, they could redefine the standard of care for neuropathic pain.

Advancements in delivery mechanisms, such as targeted and localized therapies, could enhance treatment effectiveness while minimizing side effects. This innovation opens new revenue streams for pharmaceutical and biotech companies and improves patient quality of life, positioning these therapies as pivotal in the future of pain management.

- Integration of Digital Health Technologies

Integrating digital health technologies including telemedicine, mobile health apps, and wearable devices offers significant opportunities for enhancing the management of neuropathic pain. These technologies facilitate remote monitoring and provide patients with personalized treatment plans and real-time feedback on their pain management strategies.

Telehealth platforms enable healthcare providers to reach underserved populations ensuring patients can access expert advice and care without traveling. Mobile apps can help track symptoms, medication adherence, and triggers empowering patients to manage their conditions actively.

Wearable devices that monitor physiological markers can provide valuable data for tailoring treatments. As digital health solutions evolve, they can significantly improve patient engagement and adherence, leading to better treatment outcomes and a more comprehensive approach to managing neuropathic pain driving neuropathic pain market growth and innovation.

How Does Regulatory Scenario Shape this Industry?

The regulatory scenario plays a critical role in shaping the neuropathic pain market by influencing drug development, approval processes, and treatment accessibility.

Regulatory agencies, such as the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA), establish guidelines for clinical trials and the evaluation of new therapies ensuring that only safe and effective treatments reach the market. Stringent regulations can however create barriers for small biotech companies seeking to introduce innovative therapies potentially slowing the pace of innovation.

As the opioid crisis continues to impact public health, regulatory bodies are tightening controls on opioid prescriptions pushing healthcare providers to seek safe alternatives for managing neuropathic pain. This has spurred an increased focus on developing non-opioid therapies and innovative treatments, such as biologics and neuromodulator devices.

The approval of digital health solutions and telemedicine regulations expands treatment accessibility, enabling remote monitoring and patient engagement. The evolving regulatory landscape encourages innovation while promoting safety ultimately reshaping the market by driving the development and adoption of diverse treatment options.

Segments Covered in the Report

- Anticonvulsants is the most Prevalent Drug Class

Anticonvulsants are the most prevalent drug segment in 2024 with an overall neuropathic pain market share of around 44% among the various varieties or classes of drugs used to alleviate neuropathic pain. As a result of the increasing concern regarding opioid abuse, non-opioid alternatives for neuropathic pain management are being given more attention.

Market participants are providing innovative anticonvulsant painkillers to the trend toward safe and durable pain management solutions. The net worth of this segment is anticipated to reach a substantial market share by 2031 and the global demand for anticonvulsants is expected to increase over the forecast period.

- Diabetic Neuropathy Segment Maintains Dominance in the Market

The diabetic neuropathy segment is projected to account for 47% of the total neuropathic pain market share in 2024. The segment is expected to experience a significant growth rate during the forecast period. The segment is projected to have a business potential of US$ 5.8 billion by 2031, rising from US$ 3.8 billion in 2024.

The advancement and execution of remedies for chemotherapy-induced peripheral neuropathy have been enhanced through partnerships with pain specialists and multidisciplinary care teams.

Suppliers of neuropathic pain medications that collaborate closely with medical professionals to ensure comprehensive and patient-centred pain management strategies are anticipated to achieve more profitability in this sector.

Regional Analysis

- North America Market to Grow Substantially

North America has substantial population afflicted by numerous neurological disorders, including stroke, Parkinson's disease, brain cancer, epilepsy, traumatic brain injury, dementia, prion disease, Huntington's disease, multiple sclerosis, and various neuromuscular illnesses.

In the United States, over 235,000 cases of traumatic brain injuries are reported annually, exceeding the number of hospitalizations for spinal cord injuries by more than twentyfold. In 2020, approximately 2.8% of the U.S. population experienced peripheral neuropathy.

The National Institutes of Health estimates that around 165,813 individuals in the U.S. are currently afflicted with brain and other nervous system illnesses. The incidence of neuropathic illnesses in the region is rising at an alarming rate. To mitigate the prevalence, numerous organizations and pharmaceutical companies are concentrating on the advancement of sophisticated therapies for neuropathic pain.

The University of Maryland Medical Centre has developed an ultrasound therapy for neuropathic pain. The FDA has approved Lyrica for the treatment of neuropathic pain related to diabetic peripheral neuropathy.

- Asia Pacific Emerges as Lucrative Regional Market

The demand for neuropathic pain management in Asia Pacific is escalating due to the progressive increase in people with cancer, diabetes, and other conditions. The neuropathic pain market share in the region is expected to be affected by the government's initiatives to enhance patient care and the efforts to upgrade the current infrastructure for improved healthcare delivery.

The growth of the neuropathic pain management sector is expected to be supported by significant investments in research and development by key industry players, who are concentrating on the introduction of innovative solutions to increase their market share.

Heightened merger and acquisition activity among prominent entities aimed at broadening their product offerings and client base is facilitating the regional market growth. Microvascular and macrovascular complications associated with diabetes present a substantial burden in India.

With the rising prevalence of diabetes mellitus, the incidence of related complications also escalates. Diabetic peripheral neuropathy (DPN) is the most common diabetic consequence in India with a prevalence between 18.8% and 61.9%.

Fairfield’s Competitive Landscape Analysis

A mix of established pharmaceutical companies and emerging biotech firms characterize the competitive landscape of the neuropathic pain market. Leading players such as Pfizer, Eli Lilly, and Astellas Pharma dominate with various traditional treatments including anticonvulsants and antidepressants.

Companies like NeuroMetrix and Sorrento Therapeutics are pioneering innovative solutions including neuromodulation devices and regenerative therapies. The market is witnessing a shift towards non-opioid treatments due to the opioid crisis prompting investments in research and development for safe alternatives.

Collaborations and partnerships are becoming common as firms seek to leverage advancements in digital health technologies and gene therapy. The competitive landscape is evolving rapidly, driven by the demand for effective and safe pain management solutions.

Key Market Companies

- Pfizer Inc.

- Johnson & Johnson Services Inc.

- Bristol-Myers Squibb and Company

- Eli Lily and Company

- GlaxoSmithKline PLC

- Sanofi S.A.

- Biogen Idec Inc.

- Baxter Healthcare Corporation

- Depomed Inc.

Recent Industry Developments

July 2022 -

Novaremed AG and NeuroFront Therapeutics Limited entered an exclusive collaboration and commercialization agreement for Novaremed's novel non-opioid investigational drug, NRD.E1, to treat diabetes-related neuropathic pain and other neuropathic pain conditions.

September 2022 -

AlgoTx Corporation initiated a phase 2 clinical research to evaluate ATX01 for individuals suffering from chemotherapy-induced peripheral neuropathy (CIPN). The company conducted the clinical trial for the novel medicine, topical amitriptyline, at over 40 sites throughout Europe and the United States.

An Expert’s Eye

- The increasing need for effective non-opioid therapies due to the opioid crisis is driving innovation in the development of alternative pain management options.

- Using genetic profiling to tailor therapies will significantly enhance treatment outcomes for neuropathic pain patients consequently driving neuropathic pain market.

- Increased investment in research and development particularly regenerative medicine and neuromodulation promises to transform neuropathic pain management.

- Holistic approaches that combine pharmacological and non-pharmacological treatments, emphasizing the importance of addressing the multifaceted nature of neuropathic pain.

Global Neuropathic Pain Market is Segmented as-

By Drug Class

- Tricyclic Anti-Depressants

- Anticonvulsants

- SNRI's

- Capsacin Cream

- Local Anaesthesia

- Opioids

- Steroids

- Others

By Indication

- Diabetic Neuropathy

- Trigeminal Neuralgia

- Post-Herpetic Neuralgia

- Chemotherapy-Induced Peripheral Neuropathy

- Others

By Distribution Channel

- Retail Pharmacies

- Hospital Pharmacies

- Online Pharmacies

By Region

- North America

- Latin America

- Europe

- South Asia

- East Asia

- Oceania

- The Middle East and Africa

1. Executive Summary

1.1. Global Neuropathic Pain Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2024

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. COVID-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Global Neuropathic Pain Market Outlook, 2019-2031

3.1. Global Neuropathic Pain Market Outlook, by Drug Class, Value (US$ Bn), 2019-2031

3.1.1. Key Highlights

3.1.1.1. Tricyclic Anti-Depressants

3.1.1.2. Anticonvulsants

3.1.1.3. SNRI's

3.1.1.4. Capsacin Cream

3.1.1.5. Local Anaesthesia

3.1.1.6. Opioids

3.1.1.7. Steroids

3.1.1.8. Others

3.2. Global Neuropathic Pain Market Outlook, by Indication, Value (US$ Bn), 2019-2031

3.2.1. Key Highlights

3.2.1.1. Diabetic Neuropathy

3.2.1.2. Trigeminal Neuralgia

3.2.1.3. Post-Herpetic Neuralgia

3.2.1.4. Chemotherapy-Induced Peripheral Neuropathy

3.2.1.5. Others

3.3. Global Neuropathic Pain Market Outlook, by Distribution Channel, Value (US$ Bn), 2019-2031

3.3.1. Key Highlights

3.3.1.1. Retail Pharmacies

3.3.1.2. Hospital Pharmacies

3.3.1.3. Online Pharmacies

3.4. Global Neuropathic Pain Market Outlook, by Region, Value (US$ Bn), 2019-2031

3.4.1. Key Highlights

3.4.1.1. North America

3.4.1.2. Europe

3.4.1.3. Asia Pacific

3.4.1.4. Latin America

3.4.1.5. Middle East & Africa

4. North America Neuropathic Pain Market Outlook, 2019-2031

4.1. North America Neuropathic Pain Market Outlook, by Drug Class, Value (US$ Bn), 2019-2031

4.1.1. Key Highlights

4.1.1.1. Tricyclic Anti-Depressants

4.1.1.2. Anticonvulsants

4.1.1.3. SNRI's

4.1.1.4. Capsacin Cream

4.1.1.5. Local Anaesthesia

4.1.1.6. Opioids

4.1.1.7. Steroids

4.1.1.8. Others

4.2. North America Neuropathic Pain Market Outlook, by Indication, Value (US$ Bn), 2019-2031

4.2.1. Key Highlights

4.2.1.1. Diabetic Neuropathy

4.2.1.2. Trigeminal Neuralgia

4.2.1.3. Post-Herpetic Neuralgia

4.2.1.4. Chemotherapy-Induced Peripheral Neuropathy

4.2.1.5. Others

4.3. North America Neuropathic Pain Market Outlook, by Distribution Channel, Value (US$ Bn), 2019-2031

4.3.1. Key Highlights

4.3.1.1. Retail Pharmacies

4.3.1.2. Hospital Pharmacies

4.3.1.3. Online Pharmacies

4.3.2. BPS Analysis/Market Attractiveness Analysis

4.4. North America Neuropathic Pain Market Outlook, by Country, Value (US$ Bn), 2019-2031

4.4.1. Key Highlights

4.4.1.1. U.S. Neuropathic Pain Market by Drug Class, Value (US$ Bn), 2019-2031

4.4.1.2. U.S. Neuropathic Pain Market by Indication, Value (US$ Bn), 2019-2031

4.4.1.3. U.S. Neuropathic Pain Market by Distribution Channel, Value (US$ Bn), 2019-2031

4.4.1.4. Canada Neuropathic Pain Market by Drug Class, Value (US$ Bn), 2019-2031

4.4.1.5. Canada Neuropathic Pain Market by Indication, Value (US$ Bn), 2019-2031

4.4.1.6. Canada Neuropathic Pain Market by Distribution Channel, Value (US$ Bn), 2019-2031

4.4.2. BPS Analysis/Market Attractiveness Analysis

5. Europe Neuropathic Pain Market Outlook, 2019-2031

5.1. Europe Neuropathic Pain Market Outlook, by Drug Class, Value (US$ Bn), 2019-2031

5.1.1. Key Highlights

5.1.1.1. Tricyclic Anti-Depressants

5.1.1.2. Anticonvulsants

5.1.1.3. SNRI's

5.1.1.4. Capsacin Cream

5.1.1.5. Local Anaesthesia

5.1.1.6. Opioids

5.1.1.7. Steroids

5.1.1.8. Others

5.2. Europe Neuropathic Pain Market Outlook, by Indication, Value (US$ Bn), 2019-2031

5.2.1. Key Highlights

5.2.1.1. Diabetic Neuropathy

5.2.1.2. Trigeminal Neuralgia

5.2.1.3. Post-Herpetic Neuralgia

5.2.1.4. Chemotherapy-Induced Peripheral Neuropathy

5.2.1.5. Others

5.3. Europe Neuropathic Pain Market Outlook, by Distribution Channel, Value (US$ Bn), 2019-2031

5.3.1. Key Highlights

5.3.1.1. Retail Pharmacies

5.3.1.2. Hospital Pharmacies

5.3.1.3. Online Pharmacies

5.3.2. BPS Analysis/Market Attractiveness Analysis

5.4. Europe Neuropathic Pain Market Outlook, by Country, Value (US$ Bn), 2019-2031

5.4.1. Key Highlights

5.4.1.1. Germany Neuropathic Pain Market by Drug Class, Value (US$ Bn), 2019-2031

5.4.1.2. Germany Neuropathic Pain Market by Indication, Value (US$ Bn), 2019-2031

5.4.1.3. Germany Neuropathic Pain Market by Distribution Channel, Value (US$ Bn), 2019-2031

5.4.1.4. U.K. Neuropathic Pain Market by Drug Class, Value (US$ Bn), 2019-2031

5.4.1.5. U.K. Neuropathic Pain Market by Indication, Value (US$ Bn), 2019-2031

5.4.1.6. U.K. Neuropathic Pain Market by Distribution Channel, Value (US$ Bn), 2019-2031

5.4.1.7. France Neuropathic Pain Market by Drug Class, Value (US$ Bn), 2019-2031

5.4.1.8. France Neuropathic Pain Market by Indication, Value (US$ Bn), 2019-2031

5.4.1.9. France Neuropathic Pain Market by Distribution Channel, Value (US$ Bn), 2019-2031

5.4.1.10. Italy Neuropathic Pain Market by Drug Class, Value (US$ Bn), 2019-2031

5.4.1.11. Italy Neuropathic Pain Market by Indication, Value (US$ Bn), 2019-2031

5.4.1.12. Italy Neuropathic Pain Market by Distribution Channel, Value (US$ Bn), 2019-2031

5.4.1.13. Turkey Neuropathic Pain Market by Drug Class, Value (US$ Bn), 2019-2031

5.4.1.14. Turkey Neuropathic Pain Market by Indication, Value (US$ Bn), 2019-2031

5.4.1.15. Turkey Neuropathic Pain Market by Distribution Channel, Value (US$ Bn), 2019-2031

5.4.1.16. Russia Neuropathic Pain Market by Drug Class, Value (US$ Bn), 2019-2031

5.4.1.17. Russia Neuropathic Pain Market by Indication, Value (US$ Bn), 2019-2031

5.4.1.18. Russia Neuropathic Pain Market by Distribution Channel, Value (US$ Bn), 2019-2031

5.4.1.19. Rest of Europe Neuropathic Pain Market by Drug Class, Value (US$ Bn), 2019-2031

5.4.1.20. Rest of Europe Neuropathic Pain Market by Indication, Value (US$ Bn), 2019-2031

5.4.1.21. Rest of Europe Neuropathic Pain Market by Distribution Channel, Value (US$ Bn), 2019-2031

5.4.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Neuropathic Pain Market Outlook, 2019-2031

6.1. Asia Pacific Neuropathic Pain Market Outlook, by Drug Class, Value (US$ Bn), 2019-2031

6.1.1. Key Highlights

6.1.1.1. Tricyclic Anti-Depressants

6.1.1.2. Anticonvulsants

6.1.1.3. SNRI's

6.1.1.4. Capsacin Cream

6.1.1.5. Local Anaesthesia

6.1.1.6. Opioids

6.1.1.7. Steroids

6.1.1.8. Others

6.2. Asia Pacific Neuropathic Pain Market Outlook, by Indication, Value (US$ Bn), 2019-2031

6.2.1. Key Highlights

6.2.1.1. Diabetic Neuropathy

6.2.1.2. Trigeminal Neuralgia

6.2.1.3. Post-Herpetic Neuralgia

6.2.1.4. Chemotherapy-Induced Peripheral Neuropathy

6.2.1.5. Others

6.3. Asia Pacific Neuropathic Pain Market Outlook, by Distribution Channel, Value (US$ Bn), 2019-2031

6.3.1. Key Highlights

6.3.1.1. Retail Pharmacies

6.3.1.2. Hospital Pharmacies

6.3.1.3. Online Pharmacies

6.3.2. BPS Analysis/Market Attractiveness Analysis

6.4. Asia Pacific Neuropathic Pain Market Outlook, by Country, Value (US$ Bn), 2019-2031

6.4.1. Key Highlights

6.4.1.1. China Neuropathic Pain Market by Drug Class, Value (US$ Bn), 2019-2031

6.4.1.2. China Neuropathic Pain Market by Indication, Value (US$ Bn), 2019-2031

6.4.1.3. China Neuropathic Pain Market by Distribution Channel, Value (US$ Bn), 2019-2031

6.4.1.4. Japan Neuropathic Pain Market by Drug Class, Value (US$ Bn), 2019-2031

6.4.1.5. Japan Neuropathic Pain Market by Indication, Value (US$ Bn), 2019-2031

6.4.1.6. Japan Neuropathic Pain Market by Distribution Channel, Value (US$ Bn), 2019-2031

6.4.1.7. South Korea Neuropathic Pain Market by Drug Class, Value (US$ Bn), 2019-2031

6.4.1.8. South Korea Neuropathic Pain Market by Indication, Value (US$ Bn), 2019-2031

6.4.1.9. South Korea Neuropathic Pain Market by Distribution Channel, Value (US$ Bn), 2019-2031

6.4.1.10. India Neuropathic Pain Market by Drug Class, Value (US$ Bn), 2019-2031

6.4.1.11. India Neuropathic Pain Market by Indication, Value (US$ Bn), 2019-2031

6.4.1.12. India Neuropathic Pain Market by Distribution Channel, Value (US$ Bn), 2019-2031

6.4.1.13. Southeast Asia Neuropathic Pain Market by Drug Class, Value (US$ Bn), 2019-2031

6.4.1.14. Southeast Asia Neuropathic Pain Market by Indication, Value (US$ Bn), 2019-2031

6.4.1.15. Southeast Asia Neuropathic Pain Market by Distribution Channel, Value (US$ Bn), 2019-2031

6.4.1.16. Rest of Asia Pacific Neuropathic Pain Market by Drug Class, Value (US$ Bn), 2019-2031

6.4.1.17. Rest of Asia Pacific Neuropathic Pain Market by Indication, Value (US$ Bn), 2019-2031

6.4.1.18. Rest of Asia Pacific Neuropathic Pain Market by Distribution Channel, Value (US$ Bn), 2019-2031

6.4.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America Neuropathic Pain Market Outlook, 2019-2031

7.1. Latin America Neuropathic Pain Market Outlook, by Drug Class, Value (US$ Bn), 2019-2031

7.1.1. Key Highlights

7.1.1.1. Tricyclic Anti-Depressants

7.1.1.2. Anticonvulsants

7.1.1.3. SNRI's

7.1.1.4. Capsacin Cream

7.1.1.5. Local Anaesthesia

7.1.1.6. Opioids

7.1.1.7. Steroids

7.1.1.8. Others

7.2. Latin America Neuropathic Pain Market Outlook, by Indication, Value (US$ Bn), 2019-2031

7.2.1. Key Highlights

7.2.1.1. Diabetic Neuropathy

7.2.1.2. Trigeminal Neuralgia

7.2.1.3. Post-Herpetic Neuralgia

7.2.1.4. Chemotherapy-Induced Peripheral Neuropathy

7.2.1.5. Others

7.3. Latin America Neuropathic Pain Market Outlook, by Distribution Channel, Value (US$ Bn), 2019-2031

7.3.1. Key Highlights

7.3.1.1. Retail Pharmacies

7.3.1.2. Hospital Pharmacies

7.3.1.3. Online Pharmacies

7.3.2. BPS Analysis/Market Attractiveness Analysis

7.4. Latin America Neuropathic Pain Market Outlook, by Country, Value (US$ Bn), 2019-2031

7.4.1. Key Highlights

7.4.1.1. Brazil Neuropathic Pain Market by Drug Class, Value (US$ Bn), 2019-2031

7.4.1.2. Brazil Neuropathic Pain Market by Indication, Value (US$ Bn), 2019-2031

7.4.1.3. Brazil Neuropathic Pain Market by Distribution Channel, Value (US$ Bn), 2019-2031

7.4.1.4. Mexico Neuropathic Pain Market by Drug Class, Value (US$ Bn), 2019-2031

7.4.1.5. Mexico Neuropathic Pain Market by Indication, Value (US$ Bn), 2019-2031

7.4.1.6. Mexico Neuropathic Pain Market by Distribution Channel, Value (US$ Bn), 2019-2031

7.4.1.7. Argentina Neuropathic Pain Market by Drug Class, Value (US$ Bn), 2019-2031

7.4.1.8. Argentina Neuropathic Pain Market by Indication, Value (US$ Bn), 2019-2031

7.4.1.9. Argentina Neuropathic Pain Market by Distribution Channel, Value (US$ Bn), 2019-2031

7.4.1.10. Rest of Latin America Neuropathic Pain Market by Drug Class, Value (US$ Bn), 2019-2031

7.4.1.11. Rest of Latin America Neuropathic Pain Market by Indication, Value (US$ Bn), 2019-2031

7.4.1.12. Rest of Latin America Neuropathic Pain Market by Distribution Channel, Value (US$ Bn), 2019-2031

7.4.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Neuropathic Pain Market Outlook, 2019-2031

8.1. Middle East & Africa Neuropathic Pain Market Outlook, by Drug Class, Value (US$ Bn), 2019-2031

8.1.1. Key Highlights

8.1.1.1. Tricyclic Anti-Depressants

8.1.1.2. Anticonvulsants

8.1.1.3. SNRI's

8.1.1.4. Capsacin Cream

8.1.1.5. Local Anaesthesia

8.1.1.6. Opioids

8.1.1.7. Steroids

8.1.1.8. Others

8.2. Middle East & Africa Neuropathic Pain Market Outlook, by Indication, Value (US$ Bn), 2019-2031

8.2.1. Key Highlights

8.2.1.1. Diabetic Neuropathy

8.2.1.2. Trigeminal Neuralgia

8.2.1.3. Post-Herpetic Neuralgia

8.2.1.4. Chemotherapy-Induced Peripheral Neuropathy

8.2.1.5. Others

8.3. Middle East & Africa Neuropathic Pain Market Outlook, by Distribution Channel, Value (US$ Bn), 2019-2031

8.3.1. Key Highlights

8.3.1.1. Retail Pharmacies

8.3.1.2. Hospital Pharmacies

8.3.1.3. Online Pharmacies

8.3.2. BPS Analysis/Market Attractiveness Analysis

8.4. Middle East & Africa Neuropathic Pain Market Outlook, by Country, Value (US$ Bn), 2019-2031

8.4.1. Key Highlights

8.4.1.1. GCC Neuropathic Pain Market by Drug Class, Value (US$ Bn), 2019-2031

8.4.1.2. GCC Neuropathic Pain Market by Indication, Value (US$ Bn), 2019-2031

8.4.1.3. GCC Neuropathic Pain Market by Distribution Channel, Value (US$ Bn), 2019-2031

8.4.1.4. South Africa Neuropathic Pain Market by Drug Class, Value (US$ Bn), 2019-2031

8.4.1.5. South Africa Neuropathic Pain Market by Indication, Value (US$ Bn), 2019-2031

8.4.1.6. South Africa Neuropathic Pain Market by Distribution Channel, Value (US$ Bn), 2019-2031

8.4.1.7. Egypt Neuropathic Pain Market by Drug Class, Value (US$ Bn), 2019-2031

8.4.1.8. Egypt Neuropathic Pain Market by Indication, Value (US$ Bn), 2019-2031

8.4.1.9. Egypt Neuropathic Pain Market by Distribution Channel, Value (US$ Bn), 2019-2031

8.4.1.10. Nigeria Neuropathic Pain Market by Drug Class, Value (US$ Bn), 2019-2031

8.4.1.11. Nigeria Neuropathic Pain Market by Indication, Value (US$ Bn), 2019-2031

8.4.1.12. Nigeria Neuropathic Pain Market by Distribution Channel, Value (US$ Bn), 2019-2031

8.4.1.13. Rest of Middle East & Africa Neuropathic Pain Market by Drug Class, Value (US$ Bn), 2019-2031

8.4.1.14. Rest of Middle East & Africa Neuropathic Pain Market by Indication, Value (US$ Bn), 2019-2031

8.4.1.15. Rest of Middle East & Africa Neuropathic Pain Market by Distribution Channel, Value (US$ Bn), 2019-2031

8.4.2. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. By Drug Class vs by Indication Heat map

9.2. Manufacturer vs by Indication Heatmap

9.3. Company Market Share Analysis, 2024

9.4. Competitive Dashboard

9.5. Company Profiles

9.5.1. Pfizer Inc.

9.5.1.1. Company Overview

9.5.1.2. Product Portfolio

9.5.1.3. Financial Overview

9.5.1.4. Business Strategies and Development

9.5.2. Johnson & Johnson Services, Inc

9.5.2.1. Company Overview

9.5.2.2. Product Portfolio

9.5.2.3. Financial Overview

9.5.2.4. Business Strategies and Development

9.5.3. Bristol-Myers Squibb Company.

9.5.3.1. Company Overview

9.5.3.2. Product Portfolio

9.5.3.3. Financial Overview

9.5.3.4. Business Strategies and Development

9.5.4. Sanofi S.A

9.5.4.1. Company Overview

9.5.4.2. Product Portfolio

9.5.4.3. Financial Overview

9.5.4.4. Business Strategies and Development

9.5.5. Glaxosmithkline plc

9.5.5.1. Company Overview

9.5.5.2. Product Portfolio

9.5.5.3. Financial Overview

9.5.5.4. Business Strategies and Development

9.5.6. Eli Lilly and Company

9.5.6.1. Company Overview

9.5.6.2. Product Portfolio

9.5.6.3. Financial Overview

9.5.6.4. Business Strategies and Development

9.5.7. Teva Pharmaceutical Industries Ltd

9.5.7.1. Company Overview

9.5.7.2. Product Portfolio

9.5.7.3. Financial Overview

9.5.7.4. Business Strategies and Development

9.5.8. Baxter International Inc.

9.5.8.1. Company Overview

9.5.8.2. Product Portfolio

9.5.8.3. Financial Overview

9.5.8.4. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2023 |

|

2019 - 2023 |

2024 - 2031 |

Value: US$ Million |

||

|

REPORT FEATURES |

DETAILS |

|

Drug Class Coverage |

|

|

Indication Coverage |

|

|

Distribution Channel Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |