Global Nickel Alloys Market Forecast

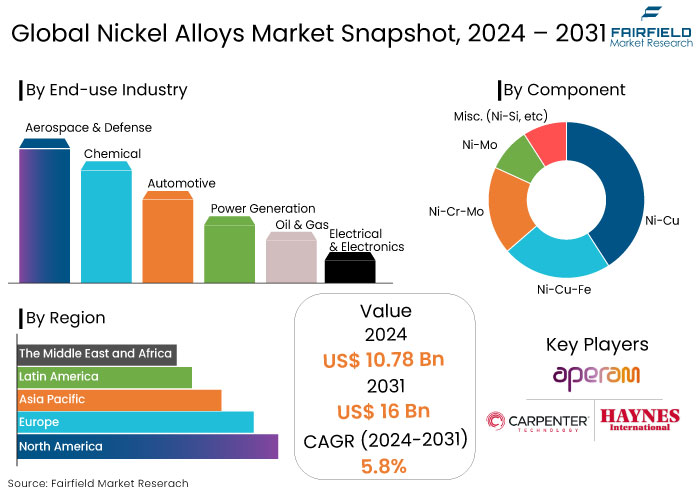

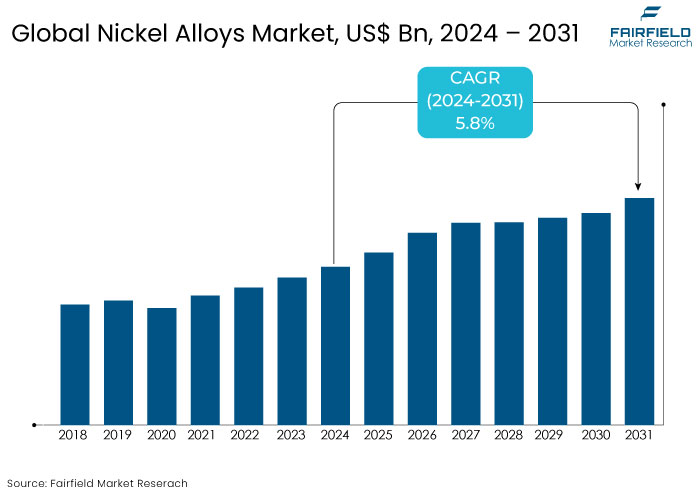

- The sales of nickel alloys are projected to be worth US$16 Bn by 2031, showing significant growth from the US$10.78 Bn achieved in 2024.

- The nickel alloys market is forecast to expand at a CAGR of 5.8% from 2024 to 2031.

Nickel Alloys Market Insights

- High-temperature resistance and durability make nickel alloys critical for jet engines, turbines, and spacecraft components.

- The transition to clean energy sources like wind and hydrogen significantly boost nickel alloy usage.

- Nickel alloys market growth is driven by applications in the aerospace, automotive, and renewable energy sectors.

- Rapid industrialization, especially in China and India, positions Asia Pacific as the leading regional market.

- Nickel alloys are preferred for harsh environments in oil and gas and chemical processing industries.

- Ni-Cr-Mo alloys dominate the market due to its superior performance and high corrosion resistance.

- Nickel Alloys, being the key raw material for the aerospace & defense sector, dominate the end user segment.

A Look Back and a Look Forward - Comparative Analysis

The nickel alloys market fueled by industrialization and the rising demand for high-performance materials across multiple sectors during the period from 2019 to 2023. Aerospace and defense emerged as leading contributors, leveraging nickel alloys for their exceptional strength and corrosion resistance in high-temperature environments.

The energy sector also spurred demand due to the increasing adoption of nickel alloys in oil and gas pipelines, nuclear reactors, and renewable energy systems. Growing investments in infrastructure and advanced manufacturing technologies further bolstered market growth. However, challenges such as fluctuating raw material prices and supply chain disruptions occasionally impacted the market.

The market is expected to gain significant momentum over the forecast period, driven by technological advancements and the increasing adoption of sustainable practices. Emerging applications in electric vehicles (EVs) and renewable energy systems, such as wind turbines and hydrogen production, are anticipated to expand the market significantly.

The aerospace sector’s recovery post-pandemic and investments in space exploration programs will also fuel demand. Moreover, Asia Pacific is set to lead market growth due to rapid industrialization and infrastructure development. Innovations in recycling technologies and alloy compositions to enhance performance and sustainability will likely further propel market expansion, addressing growing environmental concerns.

Key Growth Determinants

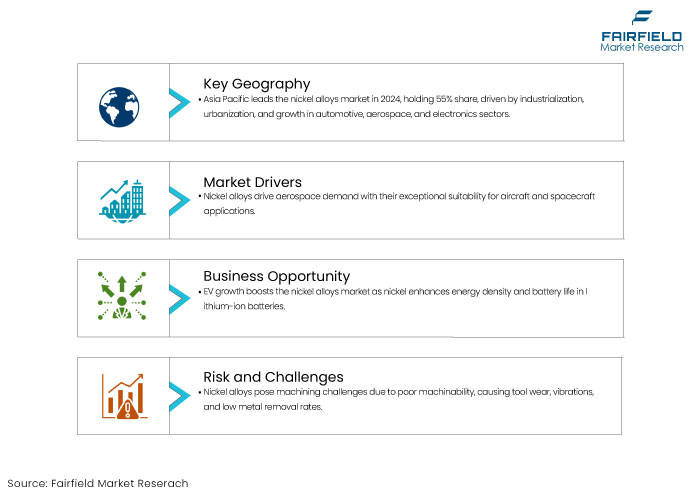

- Preference of Nickel Alloys in Commercial Aircraft & Spacecraft Drives the Market Forward

Nickel alloys are widely used in commercial aircraft and spacecraft due to their exceptional properties, which make them well-suited for the demanding environments of aerospace applications. This factor is a prominent driver for the nickel alloys market.

Nickel alloys offer high tensile strength and excellent corrosion resistance, making them capable of withstanding the harsh conditions encountered in aerospace environments. These factors make nickel alloys the prime choice in the aerospace industry.

Aerospace applications often involve exposure to extreme temperatures, especially during re-entry or supersonic flight. Nickel alloys can maintain their structural integrity at both high and low temperatures. Aerospace components undergo repeated loading and unloading cycles, which can lead to metal fatigue. They also have excellent fatigue resistance, ensuring critical components' structural integrity and longevity.

Nickel alloys are generally well-suited for welding and machining processes, allowing for the fabrication of complex and precise components required in aerospace applications. While they are denser than other metals, they balance weight and strength well. It is crucial in aerospace design, where minimizing weight is essential for fuel efficiency, driving the market forward.

- Additive Manufacturing to Reshape the Market

Additive manufacturing remains a primary driver for the nickel alloys market, which enables the production of highly intricate and complex parts that would be challenging or impossible to produce using traditional methods. It opens up new design possibilities for nickel alloy components in industries like aerospace, healthcare, and automotive.

Unlike traditional subtractive manufacturing processes, which often result in significant material waste, additive manufacturing adds material only where it is needed, leading to higher material efficiency and less waste. Also, additive manufacturing allows for the creation of lightweight structures with optimized internal geometries. It is crucial in industries like aerospace and automotive, where reducing weight can lead to significant fuel savings.

Additive manufacturing allows for the production of customized and personalized parts, which is particularly relevant in industries like healthcare, where implants and prosthetics can be tailored to individual patients.

Key Growth Barriers

- Complex Machinability May Restrict the Market Growth

The machining of nickel alloys remains a key industrial concern since they are classified as difficult-to-cut materials, which include tool wear, vibrations, and low metal removal rates. Nickel alloys still suffer from poor machinability compared to other metals owing to several inherent mechanical and material properties.

The machining of nickel alloys is challenging because of their high strength, low thermal conductivity, high chemical reactivity, and high stresses at the cutting tool edges. The cutting temperature, quality of the machined surface, burr formation, and tool wear are the major issues and increase the final product cost.

The production of nickel alloys is concentrated in specific regions, including Russia, the Philippines, and Canada, with the end-user industries consolidating. It creates challenges concerning the availability of products for other geographies, elevating the prices of nickel alloys.

- High Costs of Production and Raw Materials

One of the key restraints for the nickel alloys market is the high cost associated with their production and raw materials. Nickel itself is an expensive metal, and its extraction, refining, and alloying processes require significant energy and advanced technology, contributing to elevated costs.

The availability of nickel is subject to mining limitations and geopolitical tensions in key producing regions, which can further escalate prices. For industries like automotive and construction, cost-sensitive sectors, this poses a challenge, limiting the widespread adoption of nickel alloys.

As companies seek cost-effective alternatives, such as aluminum or stainless steel, in less demanding applications, the market growth faces potential constraints.

Nickel Alloys Market Trends and Opportunities

- Growing Demand in Electric Vehicles (EVs) and Battery Technology

The rapid adoption of electric vehicles presents a transformative opportunity for the nickel alloys market. Nickel is a critical component in high-performance lithium-ion batteries, particularly in cathode materials, due to its ability to increase energy density and improve battery life.

As governments globally push for clean transportation and EV adoption accelerates, the demand for nickel and its alloys is expected to surge. Advancements in EV battery technology, such as the development of solid-state batteries, are likely to increase the reliance on nickel-rich materials.

Beyond batteries, nickel alloys are being explored for use in EV components, including thermal management systems and lightweight structural parts, further expanding their application in the automotive sector. This growing intersection between nickel alloys and EV technology is set to redefine market dynamics, creating long-term growth prospects.

- Advancements in Aerospace and Space Exploration to Surge Sales

Advances in aerospace and space exploration technologies are creating new opportunities for the players in the nickel alloys market. As the aerospace sector prioritizes lightweight, high-strength, and heat-resistant materials, nickel alloys remain indispensable for manufacturing jet engines, turbines, and other critical components.

The growing interest in reusable spacecraft and interplanetary exploration further elevates the demand for nickel alloys, as they provide the durability and reliability required in extreme environments.

Emerging players in commercial space travel, coupled with increased government investments in space programs, are driving innovation and expanding the application scope of nickel alloys. Such advancements are likely to sustain and accelerate the market growth trajectory in the coming years.

How Does Regulatory Scenario Shape the Industry?

The regulatory environment plays a vital role in shaping nickel alloys market, influencing both opportunities and challenges for industry stakeholders. Governments and international bodies are imposing stringent environmental regulations on nickel mining and alloy production processes due to their significant environmental footprint, including greenhouse gas emissions, water pollution, and habitat destruction.

Compliance with these regulations has increased operational costs for manufacturers, prompting a shift toward adopting sustainable practices and cleaner technologies. Regulations supporting green energy transitions and clean transportation create growth opportunities for nickel alloys. Policies promoting renewable energy projects, such as wind and hydrogen systems, and the global push for electric vehicles (EVs) drive demand for nickel-rich materials.

Incentives for sustainable energy infrastructure further reinforce the market's growth potential. Additionally, aerospace and defense regulations mandating the use of high-performance materials to ensure safety and efficiency have sustained the demand for nickel alloys in critical applications.

As the regulatory landscape evolves, industry players are investing in advanced recycling technologies and environmentally friendly production methods to align with sustainability goals. Such initiatives help companies meet compliance standards and position them to capitalize on emerging opportunities in the market.

Segments Covered in the Report

- Ni-Cr-Mo Alloys Remain Dominant Due to its Superior Performance

Ni-Cr-Mo alloys (Nickel-Chromium-Molybdenum) dominate the nickel alloys market due to their exceptional versatility and superior performance in extreme environments. These alloys are widely used across industries such as chemical processing, marine, aerospace, and healthcare because of their unmatched resistance to corrosion, heat, and mechanical stress.

Ni-Cr-Mo alloys are renowned for their resistance to pitting, crevice corrosion, and stress corrosion cracking, even in highly aggressive environments such as acidic, alkaline, and high-chloride conditions. The said properties make them indispensable for applications like chemical reactors, heat exchangers, and piping systems in the chemical and petrochemical industries.

Adding chromium enhances oxidation resistance, while molybdenum provides superior strength and further corrosion protection. In aerospace, Ni-Cr-Mo alloys are essential for components like turbine blades and exhaust systems, where high-temperature strength and durability are critical.

The healthcare industry also benefits from these alloys in medical implants and surgical tools due to their biocompatibility and resistance to bodily fluids. Their widespread use and superior properties position Ni-Cr-Mo alloys as the dominant component in the market, driven by growing demand in industrial, energy, and high-performance applications.

- Aerospace & Defense Sector to Stand Out as the Dominant End User

The aerospace & defense segment stands as the dominant end user in the nickel alloys market, driven by its high demand for materials that combine strength, durability, and resistance to extreme conditions.

Nickel alloys play an essential role in aerospace and defense applications, including jet engines, turbine blades, rocket components, and structural parts due to their ability to withstand high temperatures and corrosive environments. In aerospace, nickel alloys are indispensable for jet engines, which endure extreme thermal and mechanical stress while maintaining high efficiency and performance.

The lightweight properties of nickel alloys also contribute to fuel efficiency and reduced emissions, aligning with the industry's sustainability goals. The defense sector relies on these alloys for military aircraft, naval ships, and armored vehicles, where durability and resistance to harsh operational conditions are paramount.

The resurgence of global air travels post-pandemic, coupled with significant investments in space exploration and the development of reusable spacecraft is propelling the demand for nickel alloys.

The defense industry's focus on modernizing fleets and expanding technological capabilities adds to the segment growth. As advancements in aerospace technology and defense systems continue, this segment is expected to retain its dominant position in the market.

Regional Analysis

- Asia Pacific Nickel Alloys Market Takes the Charge

Asia Pacific holds the largest share of the nickel alloys market, accounting for around 55% in 2024. The dominance of this region is attributed to rapid industrialization, urbanization, and substantial investments in key sectors such as automotive, aerospace, and electronics.

The region, particularly China and India, has seen a surge in electric vehicle (EV) production. China, for instance, experienced a 96.9% year-on-year increase in new energy vehicle production in December 2022. This growth drives demand for nickel alloys used in EV batteries and related components.

The evolving middle class and increased air travel have led to higher aircraft production. In India, passenger vehicle production reached 3,650,698 units for 2021-2022, marking a 19% increase compared to the previous year. The said factor necessitates materials like nickel alloys for their high-temperature and corrosion resistance properties.

Asia Pacific is further developing as a global hub for electronics manufacturing, requiring nickel alloys for components due to their excellent electrical conductivity and durability, which is a crucial factor for the dominance of Asia Pacific.

- North America to Emerges Lucrative Regional Market for Nickel Alloys

North America is another is another significant market for nickel alloys, driven by advanced industrial activities and technological innovations. The U.S. aerospace sector extensively utilizes nickel alloys in jet engines and turbines.

According to the Bureau of Transportation Statistics, passenger fare revenue for the U.S. airline industry totalled $86.7 billion in 2021, a 73.7% increase from 2020, indicating a robust recovery and demand for new aircraft. The region's oil and gas sector employs nickel alloys in pipelines and drilling equipment due to their corrosion resistance, essential for operations in harsh environments.

Ongoing research and development in North America led to the creation of advanced nickel alloys with enhanced properties, catering to emerging applications in renewable energy and electric vehicles.

Fairfield’s Competitive Landscape Analysis

The nickel alloys market is characterized by intense competition, driven by key players focusing on product innovation, strategic collaborations, and expanding production capabilities. Leading companies like Special Metals Corporation, VDM Metals, Haynes International, and ATI Inc. dominate the landscape. These companies provide a wide range of high-performance alloys for aerospace, energy, and chemical industries.

Regional players in Asia Pacific and Europe are strengthening their positions through cost-effective manufacturing and localized supply chains. The market is witnessing increased investments in research and development to develop sustainable and advanced alloys. Mergers and acquisitions are also prevalent, allowing companies to enhance their global footprint and meet the rising demand for high-performance materials.

Key Market Companies

- PJSC Mining & Metallurgical Co Norilsk Nickel

- Nippon Steels

- Aperam

- Carpenter Technology Corporation

- ThyssenKrupp AG

- Haynes International

- Precision Castparts Corp

- Allegheny Technologies Incorporated

- Voestalpine AG

Recent Industry Developments

- In July 2023, Aperam announced an investment in mecoradGmbH, a company specializing in providing in-line measurement and optimization solutions for the hot metal forming processes of both steel and non-ferrous metals.

- In Octoer 2023, Carpenter Technology Corporation has unveiled a strategic move by announcing a price adjustment plan. The company is set to implement an increase in base prices, ranging from 7% to 12%, specifically for new, non-contract orders related to a significant portion of its premium product portfolio.

An Expert’s Eye

- The increasing reliance on nickel alloys in the aerospace, energy, and automotive sectors is due to their exceptional strength and corrosion resistance.

- With environmental regulations tightening, industry leaders emphasize the need for sustainable production methods and recycling technologies in nickel alloy manufacturing.

- Advances in additive manufacturing and alloy composition are expected to unlock new applications, enhancing nickel alloy market growth.

- The shift toward renewable energy and hydrogen technologies drives significant demand for nickel alloys in wind turbines, electrolysis systems, and energy storage.

Global Nickel Alloys Market is Segmented as-

By Component

- Ni-Cu

- Ni-Cu-Fe

- Ni-Cr-Mo

- Ni-Mo

- (Ni-Si, etc)

By End-use Industry

- Aerospace & Defense

- Chemical

- Automotive

- Power Generation

- Oil & Gas

- Electrical & Electronics

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- The Middle East & Africa

- East Asia

- South Asia & Oceania

1. Executive Summary

1.1. Global Nickel Alloys Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2024

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. COVID-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Global Nickel Alloys Market Outlook, 2019 - 2031

3.1. Global Nickel Alloys Market Outlook, by Component, Value (US$ Bn) and Volume (Tons), 2019 - 2031

3.1.1. Key Highlights

3.1.1.1. Ni-Cu

3.1.1.2. Ni-Cu-Fe

3.1.1.3. Ni-Cr-Mo

3.1.1.4. Ni-Mo

3.1.1.5. Misc. (Ni-Si, etc)

3.2. Global Nickel Alloys Market Outlook, by End-use Industry, Value (US$ Bn) and Volume (Tons), 2019 - 2031

3.2.1. Key Highlights

3.2.1.1. Aerospace & Defense

3.2.1.2. Chemical

3.2.1.3. Automotive

3.2.1.4. Power Generation

3.2.1.5. Oil & Gas

3.2.1.6. Electrical & Electronics

3.3. Global Nickel Alloys Market Outlook, by Region, Value (US$ Bn) and Volume (Tons), 2019 - 2031

3.3.1. Key Highlights

3.3.1.1. North America

3.3.1.2. Europe

3.3.1.3. Asia Pacific

3.3.1.4. Latin America

3.3.1.5. The Middle East & Africa

3.3.1.6. East Asia

3.3.1.7. South Asia & Oceania

4. North America Nickel Alloys Market Outlook, 2019 - 2031

4.1. North America Nickel Alloys Market Outlook, by Component, Value (US$ Bn) and Volume (Tons), 2019 - 2031

4.1.1. Key Highlights

4.1.1.1. Ni-Cu

4.1.1.2. Ni-Cu-Fe

4.1.1.3. Ni-Cr-Mo

4.1.1.4. Ni-Mo

4.1.1.5. Misc. (Ni-Si, etc)

4.2. North America Nickel Alloys Market Outlook, by End-use Industry, Value (US$ Bn) and Volume (Tons), 2019 - 2031

4.2.1. Key Highlights

4.2.1.1. Aerospace & Defense

4.2.1.2. Chemical

4.2.1.3. Automotive

4.2.1.4. Power Generation

4.2.1.5. Oil & Gas

4.2.1.6. Electrical & Electronics

4.2.2. BPS Analysis/Market Attractiveness Analysis

4.3. North America Nickel Alloys Market Outlook, by Country, Value (US$ Bn) and Volume (Tons), 2019 - 2031

4.3.1. Key Highlights

4.3.1.1. U.S. Nickel Alloys Market by Component, Value (US$ Bn) and Volume (Tons), 2019 - 2031

4.3.1.2. U.S. Nickel Alloys Market by End-use Industry, Value (US$ Bn) and Volume (Tons), 2019 - 2031

4.3.1.3. Canada Nickel Alloys Market by Component, Value (US$ Bn) and Volume (Tons), 2019 - 2031

4.3.1.4. Canada Nickel Alloys Market by End-use Industry, Value (US$ Bn) and Volume (Tons), 2019 - 2031

4.3.2. BPS Analysis/Market Attractiveness Analysis

5. Europe Nickel Alloys Market Outlook, 2019 - 2031

5.1. Europe Nickel Alloys Market Outlook, by Component, Value (US$ Bn) and Volume (Tons), 2019 - 2031

5.1.1. Key Highlights

5.1.1.1. Ni-Cu

5.1.1.2. Ni-Cu-Fe

5.1.1.3. Ni-Cr-Mo

5.1.1.4. Ni-Mo

5.1.1.5. Misc. (Ni-Si, etc)

5.2. Europe Nickel Alloys Market Outlook, by End-use Industry, Value (US$ Bn) and Volume (Tons), 2019 - 2031

5.2.1. Key Highlights

5.2.1.1. Aerospace & Defense

5.2.1.2. Chemical

5.2.1.3. Automotive

5.2.1.4. Power Generation

5.2.1.5. Oil & Gas

5.2.1.6. Electrical & Electronics

5.2.2. BPS Analysis/Market Attractiveness Analysis

5.3. Europe Nickel Alloys Market Outlook, by Country, Value (US$ Bn) and Volume (Tons), 2019 - 2031

5.3.1. Key Highlights

5.3.1.1. Germany Nickel Alloys Market by Component, Value (US$ Bn) and Volume (Tons), 2019 - 2031

5.3.1.2. Germany Nickel Alloys Market by End-use Industry, Value (US$ Bn) and Volume (Tons), 2019 - 2031

5.3.1.3. U.K. Nickel Alloys Market by Component, Value (US$ Bn) and Volume (Tons), 2019 - 2031

5.3.1.4. U.K. Nickel Alloys Market by End-use Industry, Value (US$ Bn) and Volume (Tons), 2019 - 2031

5.3.1.5. France Nickel Alloys Market by Component, Value (US$ Bn) and Volume (Tons), 2019 - 2031

5.3.1.6. France Nickel Alloys Market by End-use Industry, Value (US$ Bn) and Volume (Tons), 2019 - 2031

5.3.1.7. Italy Nickel Alloys Market by Component, Value (US$ Bn) and Volume (Tons), 2019 - 2031

5.3.1.8. Italy Nickel Alloys Market by End-use Industry, Value (US$ Bn) and Volume (Tons), 2019 - 2031

5.3.1.9. Turkey Nickel Alloys Market by Component, Value (US$ Bn) and Volume (Tons), 2019 - 2031

5.3.1.10. Turkey Nickel Alloys Market by End-use Industry, Value (US$ Bn) and Volume (Tons), 2019 - 2031

5.3.1.11. Russia Nickel Alloys Market by Component, Value (US$ Bn) and Volume (Tons), 2019 - 2031

5.3.1.12. Russia Nickel Alloys Market by End-use Industry, Value (US$ Bn) and Volume (Tons), 2019 - 2031

5.3.1.13. Rest of Europe Nickel Alloys Market by Component, Value (US$ Bn) and Volume (Tons), 2019 - 2031

5.3.1.14. Rest of Europe Nickel Alloys Market by End-use Industry, Value (US$ Bn) and Volume (Tons), 2019 - 2031

5.3.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Nickel Alloys Market Outlook, 2019 - 2031

6.1. Asia Pacific Nickel Alloys Market Outlook, by Component, Value (US$ Bn) and Volume (Tons), 2019 - 2031

6.1.1. Key Highlights

6.1.1.1. Ni-Cu

6.1.1.2. Ni-Cu-Fe

6.1.1.3. Ni-Cr-Mo

6.1.1.4. Ni-Mo

6.1.1.5. Misc. (Ni-Si, etc)

6.2. Asia Pacific Nickel Alloys Market Outlook, by End-use Industry, Value (US$ Bn) and Volume (Tons), 2019 - 2031

6.2.1. Key Highlights

6.2.1.1. Aerospace & Defense

6.2.1.2. Chemical

6.2.1.3. Automotive

6.2.1.4. Power Generation

6.2.1.5. Oil & Gas

6.2.1.6. Electrical & Electronics

6.2.2. Others BPS Analysis/Market Attractiveness Analysis

6.3. Asia Pacific Nickel Alloys Market Outlook, by Country, Value (US$ Bn) and Volume (Tons), 2019 - 2031

6.3.1. Key Highlights

6.3.1.1. China Nickel Alloys Market by Component, Value (US$ Bn) and Volume (Tons), 2019 - 2031

6.3.1.2. China Nickel Alloys Market by End-use Industry, Value (US$ Bn) and Volume (Tons), 2019 - 2031

6.3.1.3. Japan Nickel Alloys Market by Component, Value (US$ Bn) and Volume (Tons), 2019 - 2031

6.3.1.4. Japan Nickel Alloys Market by End-use Industry, Value (US$ Bn) and Volume (Tons), 2019 - 2031

6.3.1.5. South Korea Nickel Alloys Market by Component, Value (US$ Bn) and Volume (Tons), 2019 - 2031

6.3.1.6. South Korea Nickel Alloys Market by End-use Industry, Value (US$ Bn) and Volume (Tons), 2019 - 2031

6.3.1.7. India Nickel Alloys Market by Component, Value (US$ Bn) and Volume (Tons), 2019 - 2031

6.3.1.8. India Nickel Alloys Market by End-use Industry, Value (US$ Bn) and Volume (Tons), 2019 - 2031

6.3.1.9. Southeast Asia Nickel Alloys Market by Component, Value (US$ Bn) and Volume (Tons), 2019 - 2031

6.3.1.10. Southeast Asia Nickel Alloys Market by End-use Industry, Value (US$ Bn) and Volume (Tons), 2019 - 2031

6.3.1.11. Rest of Asia Pacific Nickel Alloys Market by Component, Value (US$ Bn) and Volume (Tons), 2019 - 2031

6.3.1.12. Rest of Asia Pacific Nickel Alloys Market by End-use Industry, Value (US$ Bn) and Volume (Tons), 2019 - 2031

6.3.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America Nickel Alloys Market Outlook, 2019 - 2031

7.1. Latin America Nickel Alloys Market Outlook, by Component, Value (US$ Bn) and Volume (Tons), 2019 - 2031

7.1.1. Key Highlights

7.1.1.1. Ni-Cu

7.1.1.2. Ni-Cu-Fe

7.1.1.3. Ni-Cr-Mo

7.1.1.4. Ni-Mo

7.1.1.5. Misc. (Ni-Si, etc)

7.2. Latin America Nickel Alloys Market Outlook, by End-use Industry, Value (US$ Bn) and Volume (Tons), 2019 - 2031

7.2.1. Key Highlights

7.2.1.1. Aerospace & Defense

7.2.1.2. Chemical

7.2.1.3. Automotive

7.2.1.4. Power Generation

7.2.1.5. Oil & Gas

7.2.1.6. Electrical & Electronics

7.2.2. BPS Analysis/Market Attractiveness Analysis

7.3. Latin America Nickel Alloys Market Outlook, by Country, Value (US$ Bn) and Volume (Tons), 2019 - 2031

7.3.1. Key Highlights

7.3.1.1. Brazil Nickel Alloys Market by Component, Value (US$ Bn) and Volume (Tons), 2019 - 2031

7.3.1.2. Brazil Nickel Alloys Market by End-use Industry, Value (US$ Bn) and Volume (Tons), 2019 - 2031

7.3.1.3. Mexico Nickel Alloys Market by Component, Value (US$ Bn) and Volume (Tons), 2019 - 2031

7.3.1.4. Mexico Nickel Alloys Market by End-use Industry, Value (US$ Bn) and Volume (Tons), 2019 - 2031

7.3.1.5. Argentina Nickel Alloys Market by Component, Value (US$ Bn) and Volume (Tons), 2019 - 2031

7.3.1.6. Argentina Nickel Alloys Market by End-use Industry, Value (US$ Bn) and Volume (Tons), 2019 - 2031

7.3.1.7. Rest of Latin America Nickel Alloys Market by Component, Value (US$ Bn) and Volume (Tons), 2019 - 2031

7.3.1.8. Rest of Latin America Nickel Alloys Market by End-use Industry, Value (US$ Bn) and Volume (Tons), 2019 - 2031

7.3.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Nickel Alloys Market Outlook, 2019 - 2031

8.1. Middle East & Africa Nickel Alloys Market Outlook, by Component, Value (US$ Bn) and Volume (Tons), 2019 - 2031

8.1.1. Key Highlights

8.1.1.1. Ni-Cu

8.1.1.2. Ni-Cu-Fe

8.1.1.3. Ni-Cr-Mo

8.1.1.4. Ni-Mo

8.1.1.5. Misc. (Ni-Si, etc)

8.2. Middle East & Africa Nickel Alloys Market Outlook, by End-use Industry, Value (US$ Bn) and Volume (Tons), 2019 - 2031

8.2.1. Key Highlights

8.2.1.1. Aerospace & Defense

8.2.1.2. Chemical

8.2.1.3. Automotive

8.2.1.4. Power Generation

8.2.1.5. Oil & Gas

8.2.1.6. Electrical & Electronics

8.2.2. BPS Analysis/Market Attractiveness Analysis

8.3. Middle East & Africa Nickel Alloys Market Outlook, by Country, Value (US$ Bn) and Volume (Tons), 2019 - 2031

8.3.1. Key Highlights

8.3.1.1. GCC Nickel Alloys Market by Component, Value (US$ Bn) and Volume (Tons), 2019 - 2031

8.3.1.2. GCC Nickel Alloys Market by End-use Industry, Value (US$ Bn) and Volume (Tons), 2019 - 2031

8.3.1.3. South Africa Nickel Alloys Market by Component, Value (US$ Bn) and Volume (Tons), 2019 - 2031

8.3.1.4. South Africa Nickel Alloys Market by End-use Industry, Value (US$ Bn) and Volume (Tons), 2019 - 2031

8.3.1.5. Egypt Nickel Alloys Market by Component, Value (US$ Bn) and Volume (Tons), 2019 - 2031

8.3.1.6. Egypt Nickel Alloys Market by End-use Industry, Value (US$ Bn) and Volume (Tons), 2019 - 2031

8.3.1.7. Nigeria Nickel Alloys Market by Component, Value (US$ Bn) and Volume (Tons), 2019 - 2031

8.3.1.8. Nigeria Nickel Alloys Market by End-use Industry, Value (US$ Bn) and Volume (Tons), 2019 - 2031

8.3.1.9. Rest of Middle East & Africa Nickel Alloys Market by Component, Value (US$ Bn) and Volume (Tons), 2019 - 2031

8.3.1.10. Rest of Middle East & Africa Nickel Alloys Market by End-use Industry, Value (US$ Bn) and Volume (Tons), 2019 - 2031

8.3.2. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. Manufacturer vs by End Use Industry Heatmap

9.2. Company Market Share Analysis, 2024

9.3. Competitive Dashboard

9.4. Company Profiles

9.4.1. PJSC Mining & Metallurgical Co Norilsk Nickel

9.4.1.1. Company Overview

9.4.1.2. Product Portfolio

9.4.1.3. Financial Overview

9.4.1.4. Business Strategies and Development

9.4.2. Nippon Steels

9.4.2.1. Company Overview

9.4.2.2. Product Portfolio

9.4.2.3. Financial Overview

9.4.2.4. Business Strategies and Development

9.4.3. Aperam

9.4.3.1. Company Overview

9.4.3.2. Product Portfolio

9.4.3.3. Financial Overview

9.4.3.4. Business Strategies and Development

9.4.4. Carpenter Technology Corporation

9.4.4.1. Company Overview

9.4.4.2. Product Portfolio

9.4.4.3. Financial Overview

9.4.4.4. Business Strategies and Development

9.4.5. ThyssenKrupp AG

9.4.5.1. Company Overview

9.4.5.2. Product Portfolio

9.4.5.3. Financial Overview

9.4.5.4. Business Strategies and Development

9.4.6. Haynes International

9.4.6.1. Company Overview

9.4.6.2. Product Portfolio

9.4.6.3. Financial Overview

9.4.6.4. Business Strategies and Development

9.4.7. Precision Castparts Corp

9.4.7.1. Company Overview

9.4.7.2. Product Portfolio

9.4.7.3. Financial Overview

9.4.7.4. Business Strategies and Development

9.4.8. Allegheny Technologies Incorporated

9.4.8.1. Company Overview

9.4.8.2. Product Portfolio

9.4.8.3. Financial Overview

9.4.8.4. Business Strategies and Development

9.4.9. Voestalpine AG

9.4.9.1. Company Overview

9.4.9.2. Product Portfolio

9.4.9.3. Financial Overview

9.4.9.4. Business Strategies and Development

9.4.10. Other Players

9.4.10.1. Company Overview

9.4.10.2. Product Portfolio

9.4.10.3. Financial Overview

9.4.10.4. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2023 |

|

2019 - 2023 |

2024 - 2031 |

Value: US$ Billion |

||

|

REPORT FEATURES |

DETAILS |

|

Component Coverage |

|

|

End-use Industry Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |