North America Vet Compounding Pharmacies Market Forecast

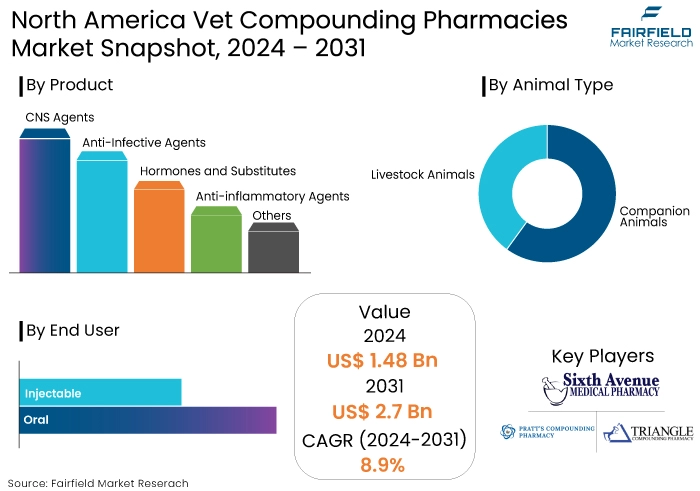

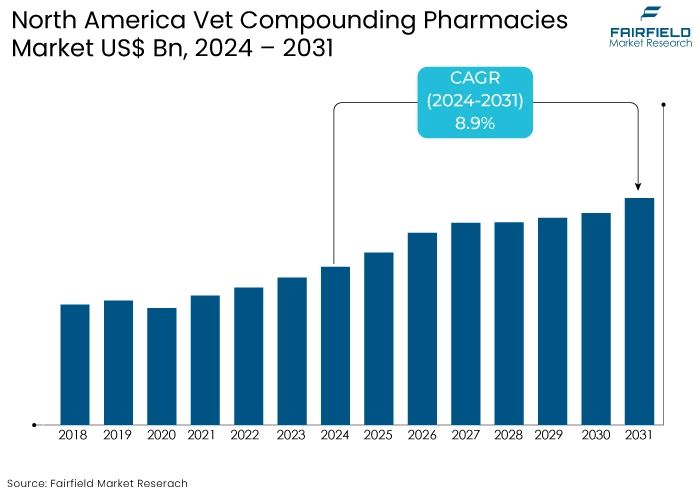

- North America vet compounding pharmacies market is projected to reach a size of US$2.7 Bn by 2031, showing significant growth from the US$1.48 Bn achieved in 2024.

- The market is expected to record a CAGR of 9% during the forecast period from 2024 to 2031.

North America Vet Compounding Pharmacies Market Insights

- Telemedicine, advanced diagnostic tools, and improved formulation techniques are revolutionizing the industry.

- By the end of 2024, the CNS agents segment is expected to capture about 36.7% of the market in North America.

- FDA's guidelines allow veterinarians and pharmacists to meet specific patient needs without compromising safety.

- The oral formulations segment is expected to account for around 75.6% of the market by the end of 2024.

- The compounding of veterinary medications requires specialized knowledge and expertise for market grow.

- The companion animal segment is projected to dominate the regional market with approximately 58.9% share.

- The growing humanization of pets is a prominent trend shaping the market.

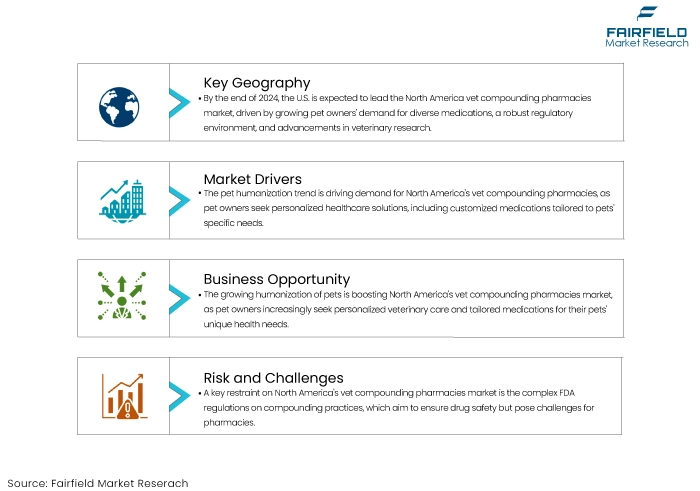

- The U.S. leads North America vet compounding pharmacies market by the end of 2024.

- The increasing focus on zoonotic diseases presents a lucrative growth avenue for compounding pharmacies in North America.

- Canada's growing role in the veterinary market is projected to capture around12.5% of the regional market by the end of 2024.

A Look Back and a Look Forward - Comparative Analysis

North America vet compounding pharmacies market experienced notable growth trends. The growing number of households with pets—approximately 84.9 million in 2020—has led to a higher demand for veterinary services and medications.

A few other market trends and factors also contribute to the growth of the market in North America. One of these includes a notable increase in chronic diseases among pets necessitating customized treatment options.

The market is projected to expand at a CAGR of 8.9% from 2024 to 2031. This growth trajectory reflects a robust demand for customized veterinary medications, particularly as the market adapts to the evolving needs of pet healthcare. As pet owners increasingly view their animals as family members, there is a rising demand for personalized and specialized medications.

The influx of medical information online has empowered pet owners to seek specialized treatments, further fueling the demand for compounding pharmacies. These factors collectively contribute to a dynamic and rapidly evolving market landscape, positioning veterinary compounding pharmacies as a crucial component of animal healthcare in North America.

Key Growth Determinants

- Humanization of Pets

The trend of pet humanization is a significant growth driver for North America vet compounding pharmacies market demand. As pet owners increasingly view their animals as family members, they are more willing to invest in personalized healthcare solutions for their pets. This shift in perception has led to a growing demand for customized medications that cater to the specific health needs of pets, including tailored dosages and flavors that enhance palatability.

This market trend is further supported by a rise in pet insurance policies, which often cover specialized treatments, making it more financially feasible for owners to seek bespoke veterinary care. As awareness of the importance of proper medication in maintaining pet health continues to grow, the veterinary compounding market is poised to benefit significantly from this ongoing humanization trend.

- Increasing Prevalence of Chronic Diseases in Pets

The increasing prevalence of chronic diseases among pets is another key driver fueling the North America vet compounding pharmacies market growth. Conditions such as diabetes, arthritis, and cancer are becoming more common in the pet population, largely due to factors such as obesity and longer lifespans. These chronic conditions often require long-term, specialized treatment regimens that standardized medications may not adequately address.

Veterinary compounding pharmacies provide tailored solutions that can accommodate unique dosage requirements, combinations of medications, and specific delivery methods, thereby enhancing treatment efficacy. Furthermore, as veterinarians become more aware of the benefits of compounded medications for managing chronic diseases, they are more likely to recommend these options to pet owners.

- Technological Advancements in Veterinary Medicine

Technological advancements in veterinary medicine are significantly shaping the landscape of the North America vet compounding pharmacies market expansion. Innovations such as telemedicine, advanced diagnostic tools, and improved formulation techniques have revolutionized how veterinary care is delivered and how compounded medications are developed.

Telemedicine, for instance, allows veterinarians to remotely assess and monitor pet health, facilitating timely adjustments to treatment plans that may include compounded medications.

Advancements in pharmaceutical technology enable compounding pharmacies to create more effective and safer formulations, including the development of unique delivery systems that can improve compliance among pet owners. These technologies will likely drive further growth in the compounding pharmacy market as pet owners increasingly seek advanced, customized medical solutions for their beloved animals.

Key Growth Barriers

- Complex Regulatory Environment

One of the primary restraints affecting the North America vet compounding pharmacies market sales is the complex regulatory environment. The U.S. Food and Drug Administration (FDA) has established stringent guidelines for compounding practices, particularly concerning the use of bulk drug substances and the compounding of medications for animals. These regulations are designed to ensure the safety and efficacy of compounded drugs, but they can also create barriers for compounding pharmacies.

Compliance with these regulations often requires significant investment in quality control, staff training, and facility upgrades to maintain a sterile environment. Small compounding pharmacies may struggle to meet these requirements limiting their ability to compete in the market. Additionally, the evolving nature of regulations can lead to uncertainty, making it challenging for pharmacies to plan for the future.

- Shortage of Skilled Professionals

Another significant restraint for North America vet compounding pharmacies market is the shortage of skilled professionals. The compounding of veterinary medications requires specialized knowledge and expertise, particularly in formulating drugs that meet the unique needs of different animal species.

There is a notable lack of trained pharmacists and technicians who are proficient in veterinary compounding. This shortage can lead to operational inefficiencies, longer turnaround times for prescriptions, and an inability to meet the growing demand for customized medications. Also, the high costs associated with training and retaining skilled personnel can strain the financial resources of compounding pharmacies, particularly smaller operations.

North America Vet Compounding Pharmacies Market Trends and Opportunities

- Growing Humanization of Pets

The growing humanization of pets is a prominent trend shaping the North America vet compounding pharmacies market share. As pet owners increasingly view their animals as integral family members, there is a heightened demand for personalized and specialized veterinary care. This trend is reflected in the willingness of pet owners to invest in tailored medications that cater to the unique health needs of their pets.

Compounding pharmacies play a crucial role in this landscape by providing customized formulations that are not typically available through standard pharmaceutical channels. Additionally, the rise in pet insurance coverage has made it more feasible for owners to seek out specialized treatments, further driving demand for compounded medications.

- Expansion into Zoonotic Disease Management

One of the key opportunities in the North America vet compounding pharmacies market is the increasing focus on zoonotic disease management. With the rising prevalence of zoonotic diseases means those that can be transmitted between animals and humans. There is a growing need for effective veterinary treatments that can address these health concerns.

Compounding pharmacies are well-positioned to develop specialized medications that cater to the treatment of zoonotic diseases in pets, which can help mitigate the risk of transmission to humans. Furthermore, as public health initiatives increasingly emphasize the importance of preventing zoonotic disease outbreaks, the demand for specialized veterinary care will likely rise presenting a lucrative growth avenue for compounding pharmacies in North America.

How Does Regulatory Scenario Shape this Industry?

The regulatory landscape for the market plays a pivotal role in shaping the industry. In the U.S. a solid regulatory framework ensures the safety and efficacy of compounded medications promoting innovation while maintaining high quality standards.

The FDA's guidelines, particularly those addressing compounding from bulk drug substances, provide a structured approach that allows veterinarians and pharmacists to meet specific patient needs without compromising safety.

The regulatory environment is generally more favorable compared to other regions, which encourages the growth of compounding pharmacies. This leniency allows these pharmacies to adapt quickly to changing healthcare demands, particularly as pet owners increasingly seek customized medications for their animals.

Regulatory scrutiny also poses challenges. Strict regulations can limit the scope of compounding practices, particularly concerning the transboundary compounding of drugs, which may hinder North America vet compounding pharmacies market expansion.

Segments Covered in the Report

- CNS Agents to Dominate North American Vet Compounding Market

The CNS agents segment is anticipated to capture about 36.7% of the veterinary compounding pharmacies market in North America by the end of 2024. These medications are primarily used to treat attention deficit disorder (ADD) and attention deficit hyperactivity disorder (ADHD) in companion animals, particularly dogs. While CNS medications can effectively address these conditions, they may also lead to various side effects in both affected and unaffected animals.

- Companion Animal Segment to Rule Market

As per North America vet compounding pharmacies market update, the companion animal segment is projected to dominate the regional market with around 58.9% share by the end of 2024. This growth is fueled by increasing pet adoption rates and a surge in animal welfare initiatives. Additionally, the growing availability and utilization of pet health insurance further contribute to the segment's dominance enhancing overall pet care and protection.

- Oral Formulations Set to Capture Major Market Share

By the end of 2024, the oral formulations segment is expected to account for around 75.6% of the market. This method of drug administration is favored for its non-invasive nature, high patient compliance, and ease of distribution. Factors such as improved drug absorption and mucosal permeability further enhance the effectiveness of oral formulations, solidifying their dominance in the veterinary market.

Regional Analysis

- U.S. Leads North American Vet Compounding Pharmacy Market

By the end of 2024, the U.S. is projected to command significant share in North America vet compounding pharmacies market. This dominance is supported by an expanding manufacturing sector and increased pet owners' demand for varied animal medications.

A strong regulatory environment fosters innovation, enhancing market growth. Additionally, ongoing research and development in pharmacies and growing veterinary collaborations address the therapeutic needs of various animal species, solidifying the U.S.'s long-term revenue prospects in this sector.

- Canada’s Prominent Role in the Veterinary Market

As per the Fairfield's North America vet compounding pharmacies market forecast, by the end of 2024, Canada is projected to capture around 12.5% of the regional market. This growth is driven by rising pet ownership and increasing public awareness of animal healthcare. Additionally, the industry is benefiting from high adoption rates and the introduction of new products by key players leveraging the established foundation of the animal health sector.

Fairfield’s Competitive Landscape Analysis

The competitive landscape of the North America vet compounding pharmacies market is characterized by a mix of established players and small, independent pharmacies. Leading companies like Triangle Compounding Pharmacy Inc., Lorraine's Pharmacy, and Wedgewood Pharmacy dominate the market.

Market players leverage their extensive resources and established reputations to offer a wide range of customized veterinary medications. These larger entities often benefit from economies of scale allowing them to invest in advanced technologies and maintain compliance with stringent regulatory standards.

Key Market Companies

- Smith Caldwell Drug Store

- Sixth Avenue Medical Pharmacy

- Hoye’s Pharmacy

- Vertisis Custom Pharmacy

- Pratt’s Compounding Pharmacy

- People’s Choice Pharmacy

- Dougherty Pharmacy

- Triangle Compounding Pharmacy Inc.

- Wedgewood Pharmacy

- Millers Pharmacy

- Chiron Compounding Pharmacy

- MEDS Canadian Compounding Pharmacy

- Aurora Compounding

- Pace Pharmacy

- Victoria Compounding Pharmacy

Recent Industry Developments

- May 2024

Walmart has added telehealth pet services for their Walmart+ members. Now they will have access to 24/7 telehealth pet services starting later in 2024 through virtual pet care company Pawp. Members will be able to consult veterinary professionals on questions outside of normal vet office hours.

The benefit was first launched as a pilot in 2023 and became the most popular limited-time offer of the year. Pawp aims to make high-quality, convenient pet care accessible to a larger part of the population. Walmart is also exiting other healthcare ventures, including its virtual healthcare operations, due to a challenging reimbursement environment and escalating operating costs.

- June 2023

Wedgewood Pharmacy, the largest veterinary compounding pharmacy in the US, has announced its merger with Blue Rabbit, an emerging leader in veterinary prescription management and pharmacy solutions.

The merger, led by Wedgewood's CEO Marcy Bliss, aims to provide fast service of high-quality medications to over 70,000 veterinary customers through an expanded network of licensed and accredited pharmacies dedicated exclusively to animal health. The combined company will empower veterinarians with a next-generation pharmacy platform for faster service and improved client experience.

An Expert’s Eye

- North America vet compounding pharmacies market is projected to expand at a CAGR of 8.9% from 2024 to 2031.

- The demand for customized veterinary medications is rising due to the growing number of pet households.

- The rise in chronic diseases among pets necessitates customized treatment options.

- The influx of medical information online has empowered pet owners to seek specialized treatments.

- Pet owners are more willing to invest in personalized healthcare solutions leading to a growing demand for customized medications.

- Conditions like diabetes, arthritis, and cancer are becoming more common in the pet population necessitating long-term and specialized treatment regimens.

North America Vet Compounding Pharmacies Market is Segmented as-

By Product

- CNS Agents

- Anti-Infective Agents

- Hormones and Substitutes

- Anti-inflammatory Agents

- Others

By Animal Type

- Companion Animals

- Dogs

- Cats

- Equine

- Others

- Livestock Animals

By End User

- Oral

- Injectable

- Others

By Country

- The United States

- Canada

1. Executive Summary

1.1. North America Vet Compounding Pharmacies Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2024

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Adoption Rate/Usage Analysis - Key Statistics

2.4. Value Chain Analysis

2.5. Regulatory Scenario

2.6. Product USP Analysis

2.7. Porter’s Five Forces Analysis

2.8. COVID-19 Impact Analysis

2.8.1. Supply

2.8.2. Demand

2.9. Economic Overview

2.9.1. World Economic Projections

2.10. PESTLE Analysis

3. North America Vet Compounding Pharmacies Market Outlook, 2019 - 2031

3.1. North America Vet Compounding Pharmacies Market Outlook, by Product, Value (US$ Mn), 2019 - 2031

3.1.1. Key Highlights

3.1.1.1. CNS Agents

3.1.1.2. Anti-Infective Agents

3.1.1.3. Hormones and Substitutes

3.1.1.4. Anti-inflammatory Agents

3.1.1.5. Others

3.2. North America Vet Compounding Pharmacies Market Outlook, by Animal Type, Value (US$ Mn), 2019 - 2031

3.2.1. Key Highlights

3.2.1.1. Companion Animals

3.2.1.1.1. Dogs

3.2.1.1.2. Cats

3.2.1.1.3. Equine

3.2.1.1.4. Others

3.2.1.2. Livestock Animals

3.3. North America Vet Compounding Pharmacies Market Outlook, by End User, Value (US$ Mn), 2019 - 2031

3.3.1. Key Highlights

3.3.1.1. Oral

3.3.1.2. Injectable

3.3.1.3. Others

3.4. North America Vet Compounding Pharmacies Market Outlook, by Country, Value (US$ Mn), 2019 - 2031

3.4.1. Key Highlights

3.4.1.1. U.S.

3.4.1.2. Canada

4. U.S. Vet Compounding Pharmacies Market Outlook, 2019 - 2031

4.1. U.S. Vet Compounding Pharmacies Market Outlook, by Product, Value (US$ Mn), 2019 - 2031

4.1.1. Key Highlights

4.1.1.1. CNS Agents

4.1.1.2. Anti-Infective Agents

4.1.1.3. Hormones and Substitutes

4.1.1.4. Anti-inflammatory Agents

4.1.1.5. Others

4.2. U.S. Vet Compounding Pharmacies Market Outlook, by Animal Type, Value (US$ Mn), 2019 - 2031

4.2.1. Key Highlights

4.2.1.1. Companion Animals

4.2.1.1.1. Dogs

4.2.1.1.2. Cats

4.2.1.1.3. Equine

4.2.1.1.4. Others

4.2.1.2. Livestock Animals

4.3. U.S. Vet Compounding Pharmacies Market Outlook, by End User, Value (US$ Mn), 2019 - 2031

4.3.1. Key Highlights

4.3.1.1. Oral

4.3.1.2. Injectable

4.3.1.3. Others

4.3.2. BPS Analysis/Market Attractiveness Analysis

5. Canada Vet Compounding Pharmacies Market Outlook, 2019 - 2031

5.1. Canada Vet Compounding Pharmacies Market Outlook, by Product, Value (US$ Mn), 2019 - 2031

5.1.1. Key Highlights

5.1.1.1. CNS Agents

5.1.1.2. Anti-Infective Agents

5.1.1.3. Hormones and Substitutes

5.1.1.4. Anti-inflammatory Agents

5.1.1.5. Others

5.2. Canada Vet Compounding Pharmacies Market Outlook, by Animal Type, Value (US$ Mn), 2019 - 2031

5.2.1. Key Highlights

5.2.1.1. Companion Animals

5.2.1.1.1. Dogs

5.2.1.1.2. Cats

5.2.1.1.3. Equine

5.2.1.1.4. Others

5.2.1.2. Livestock Animals

5.3. Canada Vet Compounding Pharmacies Market Outlook, by End User, Value (US$ Mn), 2019 - 2031

5.3.1. Key Highlights

5.3.1.1. Oral

5.3.1.2. Injectable

5.3.1.3. Others

5.3.2. BPS Analysis/Market Attractiveness Analysis

6. Competitive Landscape

6.1. Company Market Share Analysis, 2024

6.2. Competitive Dashboard

6.3. Company Profiles

6.3.1. Hoye’s Pharmacy

6.3.1.1. Company Overview

6.3.1.2. Product Portfolio

6.3.1.3. Financial Overview

6.3.1.4. Business Strategies and Development

6.3.2. Vertisis Custom Pharmacy

6.3.2.1. Company Overview

6.3.2.2. Product Portfolio

6.3.2.3. Financial Overview

6.3.2.4. Business Strategies and Development

6.3.3. Smith Caldwell Drug Store

6.3.3.1. Company Overview

6.3.3.2. Product Portfolio

6.3.3.3. Financial Overview

6.3.3.4. Business Strategies and Development

6.3.4. Sixth Avenue Medical Pharmacy

6.3.4.1. Company Overview

6.3.4.2. Product Portfolio

6.3.4.3. Financial Overview

6.3.4.4. Business Strategies and Development

6.3.5. Dougherty Pharmacy

6.3.5.1. Company Overview

6.3.5.2. Product Portfolio

6.3.5.3. Financial Overview

6.3.5.4. Business Strategies and Development

6.3.6. Triangle Compounding Pharmacy Inc.,

6.3.6.1. Company Overview

6.3.6.2. Product Portfolio

6.3.6.3. Financial Overview

6.3.6.4. Business Strategies and Development

6.3.7. Wedgewood Pharmacy

6.3.7.1. Company Overview

6.3.7.2. Product Portfolio

6.3.7.3. Financial Overview

6.3.7.4. Business Strategies and Development

6.3.8. Millers Pharmacy

6.3.8.1. Company Overview

6.3.8.2. Product Portfolio

6.3.8.3. Financial Overview

6.3.8.4. Business Strategies and Development

6.3.9. Chiron Compounding Pharmacy

6.3.9.1. Company Overview

6.3.9.2. Product Portfolio

6.3.9.3. Financial Overview

6.3.9.4. Business Strategies and Development

6.3.10. MEDS Canadian Compounding Pharmacy

6.3.10.1. Company Overview

6.3.10.2. Product Portfolio

6.3.10.3. Financial Overview

6.3.10.4. Business Strategies and Development

6.3.11. Aurora Compounding

6.3.11.1. Company Overview

6.3.11.2. Product Portfolio

6.3.11.3. Financial Overview

6.3.11.4. Business Strategies and Development

6.3.12. Pace Pharmacy

6.3.12.1. Company Overview

6.3.12.2. Product Portfolio

6.3.12.3. Financial Overview

6.3.12.4. Business Strategies and Development

7. Appendix

7.1. Research Methodology

7.2. Report Assumptions

7.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2023 |

|

2019 - 2023 |

2024 - 2031 |

Value: US$ Billion |

||

|

REPORT FEATURES |

DETAILS |

|

Product Coverage |

|

|

Animal Type Coverage |

|

|

End User Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |