Global Obesity Surgery Devices Market Forecast

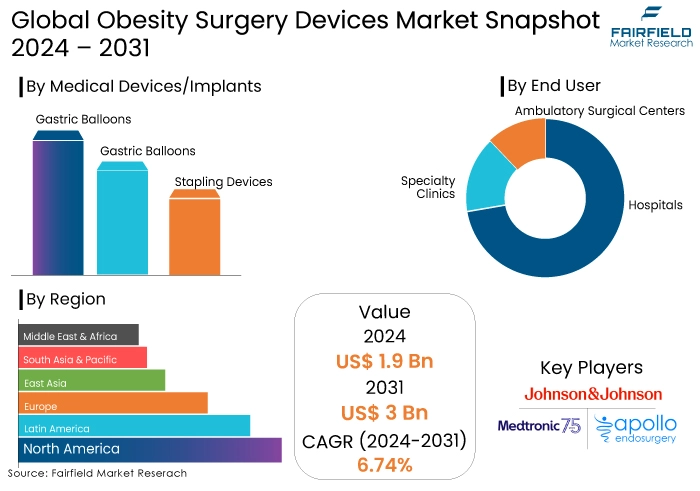

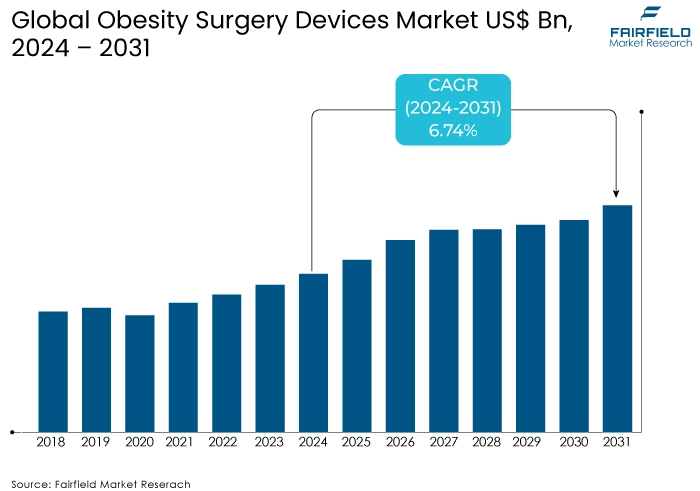

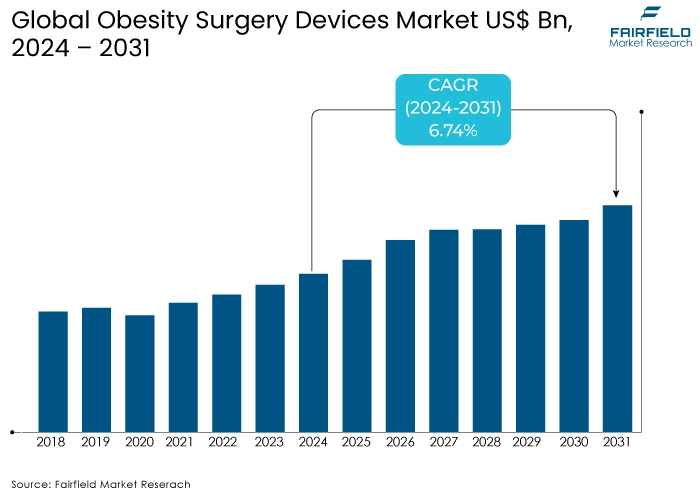

- Obesity surgery devices market size poised to reach US$3 Bn by 2031 from US$1.9 Bn estimated in 2024

- Global obesity surgery devices market revenue predicted to rise at a CAGR of 6.74% between 2024 and 2031

Obesity Surgery Devices Market Insights

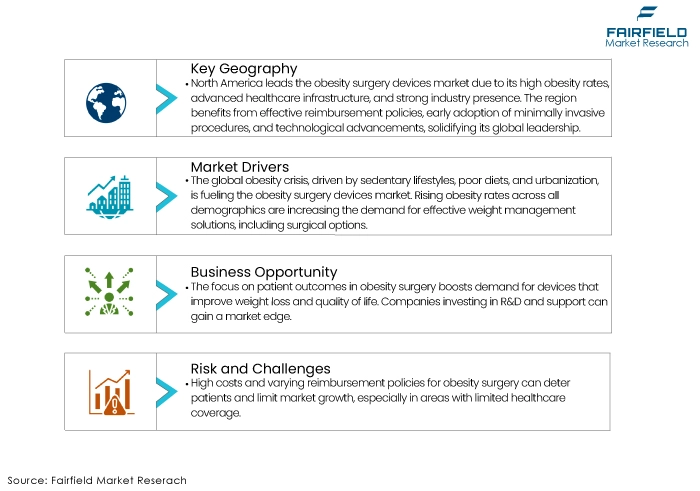

- The market growth is driven by the rising obesity rates, increasing obesity-related comorbidities, technological advancements

- The key market challenges include high costs, reimbursement issues, post-operative complications

- The most prominent trends in obesity surgery devices market are the growing focus on patient outcomes, increasing acceptance of obesity surgery, expansion into developing markets

- North America continues to lead the global market, whereas Asia Pacific is emerging as a high-growth region.

- Growing healthcare budgets are enabling greater access to surgical interventions.

- Changes in insurance coverage, and reimbursement policies impact market dynamics.

- Digital health solutions are influencing patient care and device usage.

- Collecting and analysing patient-reported data can enhance device development and marketing.

- Collaborative approaches involving healthcare providers, payers, and patients can improve outcomes and reduce costs.

- Targeting specific patient populations with tailored devices can create new growth opportunities.

A Look Back and a Look Forward - Comparative Analysis

The obesity surgery devices market experienced robust growth, primarily driven by the escalating global obesity epidemic. Factors such as sedentary lifestyles, unhealthy diets, and genetic predispositions contributed to this surge. The market witnessed increased adoption of minimally invasive procedures, technological advancements in devices, and rising healthcare expenditure fueling its expansion. However, challenges like high procedure costs and limited reimbursement policies acted as restraints.

Going forward, the market is anticipated to continue its growth trajectory, propelled by the growing prevalence of obesity-related comorbidities like diabetes, heart disease, and sleep apnea. The aging population, with a higher susceptibility to obesity, is expected to drive demand. Moreover, the focus on patient outcomes and the development of innovative devices, such as robotic-assisted systems, will contribute to market expansion. Nevertheless, the industry may face challenges related to device safety, reimbursement uncertainties, and the emergence of alternative weight management solutions.

How is Regulatory Scenario Shaping this Industry?

The regulatory landscape significantly impacts the obesity surgery devices market. Stringent regulatory approvals, such as those from the FDA and EMA, are essential for device commercialization. These regulations ensure device safety, efficacy, and performance standards. While rigorous, these guidelines contribute to patient safety and industry credibility.

However, the complex and evolving regulatory environment can pose challenges for device manufacturers. The time-consuming and expensive approval process can hinder market entry. Additionally, post-market surveillance requirements and adverse event reporting can increase operational costs. On the other hand, clear regulatory frameworks can foster innovation and investor confidence. The industry is increasingly collaborating with regulatory bodies to streamline approval processes and facilitate the development of life-changing devices.

Key Growth Determinants

Rising Prevalence of Obesity

The escalating global obesity crisis is a primary driver for the obesity surgery devices market. The condition is becoming increasingly prevalent across all age groups and socioeconomic strata. This surge is attributed to factors such as sedentary lifestyles, unhealthy dietary habits, and rapid urbanization. As obesity rates continue to climb, the demand for effective weight management solutions, including surgical interventions, is expected to rise correspondingly.

Increasing Incidence of Obesity-Related Comorbidities

The association between obesity and chronic diseases is well-established. Conditions such as type 2 diabetes, cardiovascular diseases, sleep apnea, and certain types of cancer are closely linked to excessive weight. As the burden of these comorbidities grows, the need for surgical weight loss options to manage and prevent associated health complications is increasing. This trend is driving the demand in the obesity surgery devices market.

Advancements in Surgical Techniques and Device Technology

Technological innovations have significantly transformed the obesity surgery landscape. The development of minimally invasive procedures, such as laparoscopic and robotic surgery, has reduced surgical risks and recovery times. Moreover, the introduction of advanced devices, including staplers, trocars, and visualization systems, has enhanced surgical precision and efficiency. These advancements have expanded the scope of patient eligibility and contributed to the overall growth of the obesity surgery devices market.

Major Growth Barriers

High Costs, and Reimbursement Challenges

Obesity surgery and associated devices are often associated with high costs, including surgical fees, hospital stays, and device expenses. These financial burdens can deter patients from seeking treatment, particularly in regions with limited healthcare coverage. Additionally, reimbursement policies vary across different healthcare systems, with some insurers imposing restrictions on coverage for obesity surgery. These factors can hinder the growth of the obesity surgery devices market by limiting access to treatment.

Post-Operative Complications, and Long-Term Management

While obesity surgery can be highly effective, it is not without risks. Patients may experience complications such as infections, blood clots, and nutrient deficiencies. Moreover, long-term management, including dietary changes, physical activity, and regular medical follow-ups, is crucial for maintaining weight loss and overall health. The potential for complications and the requirement for ongoing care can influence patient decisions and impact market growth.

Obesity Surgery Devices Market Trends and Opportunities

Growing Emphasis on Patient Outcomes

There is a growing emphasis on patient-centered care and the long-term outcomes of obesity surgery. Healthcare providers and payers are increasingly focusing on the overall impact of treatment, including weight loss, improvement in quality of life, and reduction in comorbidities. This trend presents an opportunity for device manufacturers to develop products that contribute to better patient outcomes and demonstrate their value proposition. By investing in research and development to address specific patient needs and providing comprehensive support programs, companies can gain a competitive advantage in the obesity surgery devices market.

Acceptance and Normalization of Obesity Surgery

Obesity surgery is gradually shedding its stigma and becoming more accepted as a viable treatment option. This shift in societal perception is driven by increased awareness of the health risks associated with obesity, as well as the success stories of patients who have undergone the procedure. As a result, more individuals are considering obesity surgery as a potential solution, driving market growth.

Expansion into Developing Markets

Developing economies in regions like Latin America, the Middle East, and Africa present significant growth opportunities for the obesity surgery devices market. These regions are experiencing rapid urbanization, dietary changes, and rising obesity rates. By tailoring products and services to meet the specific needs of these markets and investing in local infrastructure and education, companies can capitalize on the growing demand for obesity care solutions.

Rise in Medical Tourism

Medical tourism is significantly impacting the obesity surgery devices market, particularly in regions with high procedure costs. Countries offering affordable yet high-quality bariatric surgeries are attracting patients from developed nations. This surge in medical tourism drives demand for obesity surgery devices in these destinations. However, it also presents challenges related to device standardization, supply chain management, and ensuring consistent postoperative care for patients traveling across borders.

Segments Covered in Obesity Surgery Devices Market Report

Minimally Invasive Surgical Devices Reign Supreme by Medical Devices/Implants

This segment dominates the market due to the growing preference for less invasive procedures. These devices, including laparoscopic instruments and staplers, are crucial for performing bariatric surgeries with reduced patient discomfort, shorter recovery times, and lower complication rates.

- Gastric Balloons

Gastric balloons are temporary weight management devices inserted into the stomach to reduce appetite. They are primarily used in patients with moderate obesity who are not candidates for surgery. Due to their minimally invasive nature and shorter treatment duration, these devices are gaining popularity. The market for gastric balloons is characterized by rapid growth and innovation, with a focus on improving balloon technology and patient comfort.

- Gastric Bands

Gastric bands are adjustable devices placed around the upper part of the stomach to create a smaller pouch. They are a less invasive option compared to gastric bypass surgery but require more postoperative adjustments. The market for gastric bands has seen a decline in recent years due to the emergence of more effective and durable alternatives like gastric sleeves and bypass surgeries. However, they still hold a niche market for specific patient populations.

Stapling Devices Eye a Growing Rate of Adoption

On the other side, the stapling devices, a subset of minimally invasive devices, hold a significant position. They are indispensable for creating precise tissue folds and incisions during various bariatric procedures, contributing to surgical efficiency and patient outcomes.

Stapling devices are essential instruments used in various bariatric surgeries, including gastric bypass, sleeve gastrectomy, and gastric banding. These devices create precise tissue folds and incisions, minimizing surgical time and complications. The stapling device market is dominated by a few key players offering a range of products for different surgical procedures. Advancements in stapler technology, such as improved tissue handling and sealing capabilities, are driving the obesity surgery devices market growth.

Hospitals to be the Primary End User Category

Hospitals remain the primary end users due to their comprehensive infrastructure, surgical expertise, and ability to handle complex procedures. The presence of specialized bariatric surgery units in larger hospitals further strengthens their dominance in this segment. On the other hand, specialty clinics are emerging as key players due to their focused approach to weight management. They offer specialized care, often in collaboration with hospitals, catering to a specific patient population and contributing towards the expansion of the obesity surgery devices market.

Hospitals are the primary end-users of obesity surgery devices, offering a comprehensive range of bariatric services. They have the necessary infrastructure, surgical expertise, and support staff to handle complex procedures. Large, tertiary care hospitals with dedicated bariatric surgery units tend to dominate the market. However, the trend towards minimally invasive procedures and shorter hospital stays is increasing the role of smaller hospitals.

Specialty clinics focused on weight management have emerged as significant end-users of obesity surgery devices. These clinics offer specialized care and personalized treatment plans for patients with obesity. They often collaborate with hospitals for surgical procedures but provide pre- and postoperative care, nutritional counseling, and behavior modification programs. The growth of specialty clinics is driven by the increasing demand for specialized weight management services.

Ambulatory surgical centers (ASCs) are playing a growing role in the obesity surgery device market. These facilities offer a cost-effective and convenient alternative to hospitals for minimally invasive procedures like gastric balloon placement and some types of bariatric surgery. The expansion of ASCs is driven by factors such as increasing healthcare costs, patient preference for outpatient settings, and the development of advanced minimally invasive techniques.

Regional Analysis

North America Holds a Dominant Market Revenue Share

North America, particularly the United States, is the dominant regional market for obesity surgery devices. The region has the highest prevalence of obesity and related comorbidities, driving the demand for effective weight management solutions. Advanced healthcare infrastructure, a strong presence of key industry players, and robust reimbursement policies contribute to the region's dominance in the obesity surgery devices market. Additionally, early adoption of minimally invasive procedures and technological advancements in obesity surgery devices have solidified North America's position as a global leader in this field.

Asia Pacific Emerges as a High-Growth Regional Market

The Asia Pacific region is emerging as a high-growth market for obesity surgery devices. Rapid urbanization, changing lifestyles, and increasing disposable incomes have led to a surge in obesity rates. While still in its early stages compared to North America, the region is witnessing a growing demand for bariatric surgeries. Factors such as increasing healthcare expenditure, government initiatives to address obesity, and the development of medical tourism are driving the growth of the obesity surgery devices market. Countries like India, China, and South Korea are expected to be major contributors to the region's expansion.

Fairfield’s Competitive Landscape Analysis

The obesity surgery devices market is characterized by a mix of established medical device companies and specialized bariatric surgery device manufacturers. Key players often possess strong research and development capabilities, extensive distribution networks, and a robust portfolio of products.

However, the market is also witnessing increased competition from emerging players focusing on innovative device technologies and patient-centric solutions. Strategic partnerships, mergers, and acquisitions are common strategies employed by companies to expand their market share and product offerings.

Key Market Players

- Johnson & Johnson

- Medtronic, Plc.

- Apollo Endosurgery Inc.

- Aspire Bariatrics Inc.

- Spatz FGIA Inc.

- MetaCure

- IntraPace Inc.

- TransEnterrix Inc

- Allergenc, Inc

- ReShape Medical, Inc

- Entero Medica, Inc

Recent Industry Developments

- In May 2024, the world witnessed the first live bariatric surgery utilizing Apple Vision Pro technology. It delves into the specifics of the technology employed during the surgery and incorporates quotes from the participants. The surgery was successful, and there is optimism that this technology will significantly impact obesity surgical procedures.

- In February 2024, BariaTek Medical launched a new weight loss implant designed to be a minimally invasive alternative to bariatric surgery. This reversible implant can be delivered via endoscopy in an outpatient clinic. The article also mentions the potential impact of weight loss drugs on the medical technology market.

Global Obesity Surgery Devices Market is Segmented as-

By Medical Devices/ Implants

- Gastric Balloons

- Gastric Bands

- Stapling Devices

By End User

- Hospitals

- Specialty Clinics

- Ambulatory Surgical Centers

By Region

- North America

- Latin America

- Europe

- East Asia

- South Asia & Pacific

- Middle East & Africa

1. Executive Summary

1.1. Global Obesity Surgery Devices Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value and Volume, 2024

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. COVID-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Production Output and Trade Statistics, 2019 - 2023

3.1. Global Obesity Surgery Devices Production Output, by Region, Value (US$ Mn) and Volume (Units), 2019 - 2023

3.1.1. North America

3.1.2. Europe

3.1.3. Asia Pacific

3.1.4. Latin America

3.1.5. Middle East and Africa

4. Price Analysis, 2019 - 2023

4.1. Global Average Price Analysis, by Medical Devices/ Implants, US$ Per Unit, 2019 - 2023

4.2. Prominent Factor Affecting Obesity Surgery Devices Prices

4.3. Global Average Price Analysis, by Region, US$ Per Unit

5. Global Obesity Surgery Devices Market Outlook, 2019 - 2031

5.1. Global Obesity Surgery Devices Market Outlook, by Medical Devices/ Implants, Value (US$ Mn) and Volume (Units), 2019 - 2031

5.1.1. Key Highlights

5.1.1.1. Gastric Balloons

5.1.1.2. Gastric Bands

5.1.1.3. Stapling Devices

5.2. Global Obesity Surgery Devices Market Outlook, by End User, Value (US$ Mn) and Volume (Units), 2019 - 2031

5.2.1. Key Highlights

5.2.1.1. Hospitals

5.2.1.2. Specialty Clinics

5.2.1.3. Ambulatory Surgical Centers

5.3. Global Obesity Surgery Devices Market Outlook, by Region, Value (US$ Mn) and Volume (Units), 2019 - 2031

5.3.1. Key Highlights

5.3.1.1. North America

5.3.1.2. Europe

5.3.1.3. Asia Pacific

5.3.1.4. Latin America

5.3.1.5. Middle East & Africa

6. North America Obesity Surgery Devices Market Outlook, 2019 - 2031

6.1. North America Obesity Surgery Devices Market Outlook, by Medical Devices/ Implants, Value (US$ Mn) and Volume (Units), 2019 - 2031

6.1.1. Key Highlights

6.1.1.1. Gastric Balloons

6.1.1.2. Gastric Bands

6.1.1.3. Stapling Devices

6.2. North America Obesity Surgery Devices Market Outlook, by End User, Value (US$ Mn) and Volume (Units), 2019 - 2031

6.2.1. Key Highlights

6.2.1.1. Hospitals

6.2.1.2. Specialty Clinics

6.2.1.3. Ambulatory Surgical Centers

6.2.2. BPS Analysis/Market Attractiveness Analysis

6.3. North America Obesity Surgery Devices Market Outlook, by Country, Value (US$ Mn) and Volume (Units), 2019 - 2031

6.3.1. Key Highlights

6.3.1.1. U.S. Obesity Surgery Devices Market by Medical Devices/ Implants, Value (US$ Mn) and Volume (Units), 2019 - 2031

6.3.1.2. U.S. Obesity Surgery Devices Market by End User, Value (US$ Mn) and Volume (Units), 2019 - 2031

6.3.1.3. Canada Obesity Surgery Devices Market by Medical Devices/ Implants, Value (US$ Mn) and Volume (Units), 2019 - 2031

6.3.1.4. Canada Obesity Surgery Devices Market by End User, Value (US$ Mn) and Volume (Units), 2019 - 2031

6.3.2. BPS Analysis/Market Attractiveness Analysis

7. Europe Obesity Surgery Devices Market Outlook, 2019 - 2031

7.1. Europe Obesity Surgery Devices Market Outlook, by Medical Devices/ Implants, Value (US$ Mn) and Volume (Units), 2019 - 2031

7.1.1. Key Highlights

7.1.1.1. Gastric Balloons

7.1.1.2. Gastric Bands

7.1.1.3. Stapling Devices

7.2. Europe Obesity Surgery Devices Market Outlook, by End User, Value (US$ Mn) and Volume (Units), 2019 - 2031

7.2.1. Key Highlights

7.2.1.1. Hospitals

7.2.1.2. Specialty Clinics

7.2.1.3. Ambulatory Surgical Centers

7.2.2. Attractiveness Analysis

7.3. Europe Obesity Surgery Devices Market Outlook, by Country, Value (US$ Mn) and Volume (Units), 2019 - 2031

7.3.1. Key Highlights

7.3.1.1. Germany Obesity Surgery Devices Market by Medical Devices/ Implants, Value (US$ Mn) and Volume (Units), 2019 - 2031

7.3.1.2. Germany Obesity Surgery Devices Market by End User, Value (US$ Mn) and Volume (Units), 2019 - 2031

7.3.1.3. U.K. Obesity Surgery Devices Market by Medical Devices/ Implants, Value (US$ Mn) and Volume (Units), 2019 - 2031

7.3.1.4. U.K. Obesity Surgery Devices Market by End User, Value (US$ Mn) and Volume (Units), 2019 - 2031

7.3.1.5. France Obesity Surgery Devices Market by Medical Devices/ Implants, Value (US$ Mn) and Volume (Units), 2019 - 2031

7.3.1.6. France Obesity Surgery Devices Market by End User, Value (US$ Mn) and Volume (Units), 2019 - 2031

7.3.1.7. Italy Obesity Surgery Devices Market by Medical Devices/ Implants, Value (US$ Mn) and Volume (Units), 2019 - 2031

7.3.1.8. Italy Obesity Surgery Devices Market by End User, Value (US$ Mn) and Volume (Units), 2019 - 2031

7.3.1.9. Turkey Obesity Surgery Devices Market by Medical Devices/ Implants, Value (US$ Mn) and Volume (Units), 2019 - 2031

7.3.1.10. Turkey Obesity Surgery Devices Market by End User, Value (US$ Mn) and Volume (Units), 2019 - 2031

7.3.1.11. Russia Obesity Surgery Devices Market by Medical Devices/ Implants, Value (US$ Mn) and Volume (Units), 2019 - 2031

7.3.1.12. Russia Obesity Surgery Devices Market by End User, Value (US$ Mn) and Volume (Units), 2019 - 2031

7.3.1.13. Rest of Europe Obesity Surgery Devices Market by Medical Devices/ Implants, Value (US$ Mn) and Volume (Units), 2019 - 2031

7.3.1.14. Rest of Europe Obesity Surgery Devices Market by End User, Value (US$ Mn) and Volume (Units), 2019 - 2031

7.3.2. BPS Analysis/Market Attractiveness Analysis

8. Asia Pacific Obesity Surgery Devices Market Outlook, 2019 - 2031

8.1. Asia Pacific Obesity Surgery Devices Market Outlook, by Medical Devices/ Implants, Value (US$ Mn) and Volume (Units), 2019 - 2031

8.1.1. Key Highlights

8.1.1.1. Gastric Balloons

8.1.1.2. Gastric Bands

8.1.1.3. Stapling Devices

8.2. Asia Pacific Obesity Surgery Devices Market Outlook, by End User, Value (US$ Mn) and Volume (Units), 2019 - 2031

8.2.1. Key Highlights

8.2.1.1. Hospitals

8.2.1.2. Specialty Clinics

8.2.1.3. Ambulatory Surgical Centers

8.2.2. BPS Analysis/Market Attractiveness Analysis

8.3. Asia Pacific Obesity Surgery Devices Market Outlook, by Country, Value (US$ Mn) and Volume (Units), 2019 - 2031

8.3.1. Key Highlights

8.3.1.1. China Obesity Surgery Devices Market by Medical Devices/ Implants, Value (US$ Mn) and Volume (Units), 2019 - 2031

8.3.1.2. China Obesity Surgery Devices Market by End User, Value (US$ Mn) and Volume (Units), 2019 - 2031

8.3.1.3. Japan Obesity Surgery Devices Market by Medical Devices/ Implants, Value (US$ Mn) and Volume (Units), 2019 - 2031

8.3.1.4. Japan Obesity Surgery Devices Market by End User, Value (US$ Mn) and Volume (Units), 2019 - 2031

8.3.1.5. South Korea Obesity Surgery Devices Market by Medical Devices/ Implants, Value (US$ Mn) and Volume (Units), 2019 - 2031

8.3.1.6. South Korea Obesity Surgery Devices Market by End User, Value (US$ Mn) and Volume (Units), 2019 - 2031

8.3.1.7. India Obesity Surgery Devices Market by Medical Devices/ Implants, Value (US$ Mn) and Volume (Units), 2019 - 2031

8.3.1.8. India Obesity Surgery Devices Market by End User, Value (US$ Mn) and Volume (Units), 2019 - 2031

8.3.1.9. Southeast Asia Obesity Surgery Devices Market by Medical Devices/ Implants, Value (US$ Mn) and Volume (Units), 2019 - 2031

8.3.1.10. Southeast Asia Obesity Surgery Devices Market by End User, Value (US$ Mn) and Volume (Units), 2019 - 2031

8.3.1.11. Rest of Asia Pacific Obesity Surgery Devices Market by Medical Devices/ Implants, Value (US$ Mn) and Volume (Units), 2019 - 2031

8.3.1.12. Rest of Asia Pacific Obesity Surgery Devices Market by End User, Value (US$ Mn) and Volume (Units), 2019 - 2031

8.3.2. BPS Analysis/Market Attractiveness Analysis

9. Latin America Obesity Surgery Devices Market Outlook, 2019 - 2031

9.1. Latin America Obesity Surgery Devices Market Outlook, by Medical Devices/ Implants, Value (US$ Mn) and Volume (Units), 2019 - 2031

9.1.1. Key Highlights

9.1.1.1. Gastric Balloons

9.1.1.2. Gastric Bands

9.1.1.3. Stapling Devices

9.2. Latin America Obesity Surgery Devices Market Outlook, by End User, Value (US$ Mn) and Volume (Units), 2019 - 2031

9.2.1. Key Highlights

9.2.1.1. Hospitals

9.2.1.2. Specialty Clinics

9.2.1.3. Ambulatory Surgical Centers

9.2.2. BPS Analysis/Market Attractiveness Analysis

9.3. Latin America Obesity Surgery Devices Market Outlook, by Country, Value (US$ Mn) and Volume (Units), 2019 - 2031

9.3.1. Key Highlights

9.3.1.1. Brazil Obesity Surgery Devices Market by Medical Devices/ Implants, Value (US$ Mn) and Volume (Units), 2019 - 2031

9.3.1.2. Brazil Obesity Surgery Devices Market by End User, Value (US$ Mn) and Volume (Units), 2019 - 2031

9.3.1.3. Mexico Obesity Surgery Devices Market by Medical Devices/ Implants, Value (US$ Mn) and Volume (Units), 2019 - 2031

9.3.1.4. Mexico Obesity Surgery Devices Market by End User, Value (US$ Mn) and Volume (Units), 2019 - 2031

9.3.1.5. Argentina Obesity Surgery Devices Market by Medical Devices/ Implants, Value (US$ Mn) and Volume (Units), 2019 - 2031

9.3.1.6. Argentina Obesity Surgery Devices Market by End User, Value (US$ Mn) and Volume (Units), 2019 - 2031

9.3.1.7. Rest of Latin America Obesity Surgery Devices Market by Medical Devices/ Implants, Value (US$ Mn) and Volume (Units), 2019 - 2031

9.3.1.8. Rest of Latin America Obesity Surgery Devices Market by End User, Value (US$ Mn) and Volume (Units), 2019 - 2031

9.3.2. BPS Analysis/Market Attractiveness Analysis

10. Middle East & Africa Obesity Surgery Devices Market Outlook, 2019 - 2031

10.1. Middle East & Africa Obesity Surgery Devices Market Outlook, by Medical Devices/ Implants, Value (US$ Mn) and Volume (Units), 2019 - 2031

10.1.1. Key Highlights

10.1.1.1. Gastric Balloons

10.1.1.2. Gastric Bands

10.1.1.3. Stapling Devices

10.2. Middle East & Africa Obesity Surgery Devices Market Outlook, by End User, Value (US$ Mn) and Volume (Units), 2019 - 2031

10.2.1. Key Highlights

10.2.1.1. Hospitals

10.2.1.2. Specialty Clinics

10.2.1.3. Ambulatory Surgical Centers

10.2.2. BPS Analysis/Market Attractiveness Analysis

10.3. Middle East & Africa Obesity Surgery Devices Market Outlook, by Country, Value (US$ Mn) and Volume (Units), 2019 - 2031

10.3.1. Key Highlights

10.3.1.1. GCC Obesity Surgery Devices Market by Medical Devices/ Implants, Value (US$ Mn) and Volume (Units), 2019 - 2031

10.3.1.2. GCC Obesity Surgery Devices Market by End User, Value (US$ Mn) and Volume (Units), 2019 - 2031

10.3.1.3. South Africa Obesity Surgery Devices Market by Medical Devices/ Implants, Value (US$ Mn) and Volume (Units), 2019 - 2031

10.3.1.4. South Africa Obesity Surgery Devices Market by End User, Value (US$ Mn) and Volume (Units), 2019 - 2031

10.3.1.5. Egypt Obesity Surgery Devices Market by Medical Devices/ Implants, Value (US$ Mn) and Volume (Units), 2019 - 2031

10.3.1.6. Egypt Obesity Surgery Devices Market by End User, Value (US$ Mn) and Volume (Units), 2019 - 2031

10.3.1.7. Nigeria Obesity Surgery Devices Market by Medical Devices/ Implants, Value (US$ Mn) and Volume (Units), 2019 - 2031

10.3.1.8. Nigeria Obesity Surgery Devices Market by End User, Value (US$ Mn) and Volume (Units), 2019 - 2031

10.3.1.9. Rest of Middle East & Africa Obesity Surgery Devices Market by Medical Devices/ Implants, Value (US$ Mn) and Volume (Units), 2019 - 2031

10.3.1.10. Rest of Middle East & Africa Obesity Surgery Devices Market by End User, Value (US$ Mn) and Volume (Units), 2019 - 2031

10.3.2. BPS Analysis/Market Attractiveness Analysis

11. Competitive Landscape

11.1. By End User vs by Medical Devices/ Implants Heatmap

11.2. Company Market Share Analysis, 2022

11.3. Competitive Dashboard

11.4. Company Profiles

11.4.1. Johnson & Johnson

11.4.1.1. Company Overview

11.4.1.2. Product Portfolio

11.4.1.3. Financial Overview

11.4.1.4. Business Strategies and Development

11.4.2. Medtronic, Inc

11.4.2.1. Company Overview

11.4.2.2. Product Portfolio

11.4.2.3. Financial Overview

11.4.2.4. Business Strategies and Development

11.4.3. Apollo Endosurgery Inc.

11.4.3.1. Company Overview

11.4.3.2. Product Portfolio

11.4.3.3. Financial Overview

11.4.3.4. Business Strategies and Development

11.4.4. Aspire Bariatrics

11.4.4.1. Company Overview

11.4.4.2. Product Portfolio

11.4.4.3. Financial Overview

11.4.4.4. Business Strategies and Development

11.4.5. Spatz FGIA Inc.

11.4.5.1. Company Overview

11.4.5.2. Product Portfolio

11.4.5.3. Financial Overview

11.4.5.4. Business Strategies and Development

11.4.6. MetaCure

11.4.6.1. Company Overview

11.4.6.2. Product Portfolio

11.4.6.3. Financial Overview

11.4.6.4. Business Strategies and Development

11.4.7. IntraPace Inc

11.4.7.1. Company Overview

11.4.7.2. Product Portfolio

11.4.7.3. Financial Overview

11.4.7.4. Business Strategies and Development

12. Appendix

12.1. Research Methodology

12.2. Report Assumptions

12.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2023 |

|

2019 - 2023 |

2024 - 2031 |

Value: US$ Billion |

||

|

REPORT FEATURES |

DETAILS |

|

Medical Devices/Implants Coverage |

|

|

End User Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |