Global Online Project Management Software Market Forecast

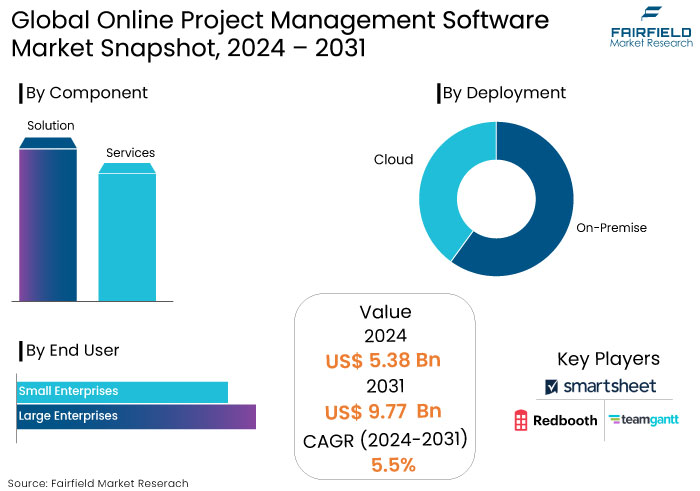

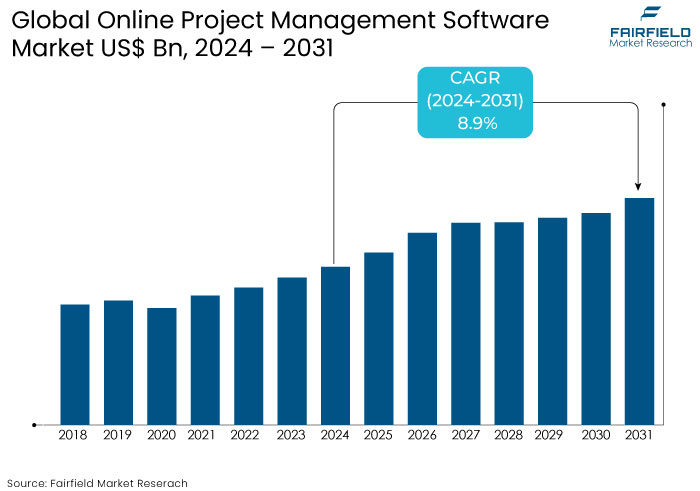

- The online project management software market is projected to reach a size of US$9.77 Bn by 2031, showing significant growth from the US$5.38 Bn achieved in 2024.

- The market for online project management software is expected to show a significant expansion rate with an estimated CAGR of 8.9% during the period from 2024 to 2031.

Online Project Management Software Market Insights

- The market is experiencing rapid growth due to the increasing need for remote collaboration and digital transformation across industries.

- AI-driven features like predictive analytics, task automation, and intelligent recommendations are becoming key differentiators for the market.

- Rising need for collaborative project management among large enterprises remains a key factor for the online project management software market

- Cloud-based project management tools are in high demand for their scalability, ease of use, and lower infrastructure costs.

- Small and medium-sized enterprises (SMEs) are driving demand, attracted by affordable pricing and freemium models.

- Regulatory compliance (GDPR, HIPAA) and data security influence software adoption, especially in regulated industries.

- Tools offering customizable workflows and seamless integration with enterprise software (CRM, ERP) are gaining popularity.

A Look Back and a Look Forward - Comparative Analysis

The online project management software market witnessed robust growth during the period from 2019 to 2023, driven by increasing digital transformation, the rise of remote and hybrid work models, and the need for collaborative tools to manage distributed teams.

The market expanded as companies of all sizes adopted cloud-based solutions to enhance efficiency, transparency, and collaboration. Key players like Monday.com, Asana, and Trello saw strong demand across industries, especially IT, healthcare, and construction.

The market is expected to continue its growth trajectory, primarily fueled by advancements in AI, machine learning, and automation over the forecast period, which will enhance predictive analytics, task automation, and workflow optimization.

Integrating project management tools with other enterprise software, such as CRM and ERP systems, provides comprehensive solutions, driving adoption in larger enterprises. The rise of quick-moving methodologies and the growing demand for real-time analytics and reporting will contribute to market growth. The expansion will also be supported by increasing adoption in emerging markets and the growing presence of small and medium-sized enterprises (SMEs).

Key Growth Determinants

- Remote and Hybrid Work Models

One of the most significant drivers of the online project management software market is the shift toward remote and hybrid work models. The COVID-19 pandemic hastened the need for companies to adapt to remote work culture teams, and even as the world moves toward a post-pandemic landscape, the demand for flexible work arrangements remains high.

Online project management tools enable seamless collaboration across different locations, time zones, and devices ensuring teams can communicate effectively and stay aligned on organizational goals.

Features like real-time updates, shared dashboards, and task management features help businesses maintain productivity regardless of geographical barriers. As remote work becomes a more permanent fixture in many industries, the need for robust, scalable, and cloud-based project management solutions will continue to grow.

- Increased Digital Transformation

The rise of digital transformation across industries is one of the major drivers for the online project management software market. Companies increasingly adopt digital tools to streamline operations, enhance customer experiences, and drive innovation.

Project management software is an integral part of these transformations, enabling organizations to automate workflows, manage resources efficiently, and track real-time progress.

Integration with other business systems, such as Customer Relationship Management (CRM) and Enterprise Resource Planning (ERP) platforms, allows for a more holistic project management approach.

As businesses continue to embrace technology-driven change, the adoption of online project management tools is expected to rise, driven by the need for efficiency, flexibility, and improved decision-making.

Key Growth Barriers

- Resistance to Change the Traditional Work Model

One of the significant growth restraints for the online project management software market is the resistance to change the conventional work models within organizations. Many companies, especially those with established processes and workflows, may hesitate to adopt new software solutions due to concerns about disrupting their existing operations.

Employees accustomed to traditional project management methods may be reluctant to transition to digital tools, fearing that this change could lead to confusion, decreased productivity, or the learning curve associated with new systems.

Organizational inertia can prevent decision-makers from investing in modern project management solutions, as they may prefer to stick with familiar practices. Such resistance can result in underutilization of available features, leading to dissatisfaction with the software and ultimately restricting the market's growth as companies seek alternatives that better fit their existing workflows.

- High Implementation Costs

One of the key restraints for the online project management software market is the high implementation costs associated with such tools. While cloud-based solutions generally reduce the need for extensive on-premises infrastructure, businesses often face significant expenses for software subscriptions, training, and integration with existing systems.

Small and medium-size enterprises may struggle to allocate sufficient budgets for adopting comprehensive project management software, which can deter them from leveraging these tools fully.

The ongoing costs for upgrades, maintenance, and user licenses can add to the financial burden over time, which can lead to a lack of adoption, particularly among small to medium-sized enterprises (SMEs) that may opt for more affordable or simplistic solutions, limiting the overall market growth potential.

Online Project Management Software Market Trends and Opportunities

Digitalization and Automation of Industries

The digitalization and automation of industries compel organizations to implement software to automate and optimize their business processes. Project management is a challenging task, as it requires coordinating and overseeing all work components and resource allocation within a specified timeframe.

Enhancing the project management process has compelled suppliers to implement automated project management software. The online project management program can plan, schedule, organize, collaborate, and manage all project workflows and resources within a specified deadline.

The beneficial attributes of the software, such as real-time monitoring, feedback sharing, and status updates, incentivize vendors to implement project management software. Cloud-based online project management software provides mobility, improved storage capacity, and centralization of project data, augmenting the system's demand.

The easy integration capabilities with other programs and remote accessibility render cloud-based project management software more advantageous. The capacity to mitigate project risks and expenses has prompted small and medium-sized enterprises to implement the software for project management optimization. Further, the increasing demand for automation in corporate process management is anticipated to propel the growth of the online project management market.

How Does Regulatory Scenario Shape this Industry?

The regulatory scenario shapes the online project management software market by influencing data security, privacy, and compliance requirements.

As organizations increasingly adopt cloud-based solutions, they must navigate various regulations, such as the General Data Protection Regulation (GDPR) in Europe, the Health Insurance Portability and Accountability Act (HIPAA) in the U.S., and other industry-specific standards.

Compliance with these regulations is vital to protect sensitive information and avoid legal repercussions, which can impact the choice and adoption of project management tools. Software providers must ensure that their platforms comply with these regulations by incorporating features like data encryption, user access controls, and audit trails.

Such compliance builds trust with users and becomes a competitive advantage in a crowded market. Furthermore, evolving regulations can lead to increased demand for software that offers robust compliance management capabilities, prompting providers to innovate and enhance their solutions.

As organizations become more aware of the importance of regulatory compliance, the demand for project management software that facilitates adherence to these standards is expected to grow, driving market expansion and influencing feature development.

Segments Covered in the Report

- Solution Category Retains the Top Position with Significant Market Share

Solution segment leads the online project management software market with significant market share. The project management system provides instruments and methodologies for managing organizational projects and tasks, encompassing scheduling, planning, resource allocation, task oversight, and document administration. It enables businesses, stakeholders, and users to regulate expenses by overseeing budget, quality, and resources while monitoring their performance. Consequently, it guarantees the prompt completion of projects while alleviating dangers and obstacles.

Similar to the solutions segment, the services sector is projected to expand at a growth rate throughout the forecast period. As enterprises increasingly use project management software, the demand for software deployment and integration services is concurrently escalating. The support and maintenance services are intended to aid customers in resolving mistakes and challenges encountered throughout various jobs.

- Highest Sales Contribution Comes from Large Enterprises

Large enterprises to account for 65% of the market share. Large organizations usually deal with complex projects that involve several key stakeholders, varied teams, and elaborate workflows. Project management software equips large-scale enterprises with comprehensive functionalities for project planning, scheduling, resource allocation, and risk management.

Large enterprises necessitate scalable project management solutions to accommodate their rising project portfolios, increasing teams, and dynamic business needs. Online project management software provides scalability, flexibility, and customization, enabling major organizations to adjust to evolving project dynamics, and facilitate organizational growth without substantial disruptions.

Project management software assists large organizations in concurrently managing several projects and activities, necessitating resource usage and management, task planning and scheduling, and task oversight.

Project management software facilitates seamless and efficient communication within large-scale organizations where teams are divided across various geographic locations, and departments are the principal drivers of the market for online project management software solutions among large enterprises.

Regional Analysis

- Increased Demand for Business Software from Software Companies Fuel North America Market

The online project management software market in North America is anticipated to experience steady growth. This growth is due to the increasing demand for business software from key sectors, including IT and Telecom, BFSI, and healthcare, which is projected to propel market expansion in the region.

Leading regional key players including Microsoft Corporation, Oracle Corporation, Liquid Planner Inc., and Smartsheet, Inc., are implementing various strategic initiatives to augment and improve their regional project management software offerings. These subsequent elements are anticipated to propel market expansion in the North American.

The United States market is further projected to grow at a staggering growth rate over the forecast period. The United States has been a leader in the adoption of Agile techniques in project management. Agile frameworks like Scrum and Kanban are extensively utilized across multiple industries, increasing the demand for project management software that facilitates Agile practices and methodology.

The United States serves as a center for technological innovation and entrepreneurship while ongoing technological breakthroughs, such as artificial intelligence, machine learning, and automation, augment the capabilities and usefulness of project management software, fostering innovation and competitiveness in the market.

Fairfield’s Competitive Landscape Analysis

The online project management software market is highly competitive with both established players and emerging startups contributing to market share. Key players such as Asana, Monday.com, Trello, and Microsoft Project dominate due to their extensive feature sets, strong brand presence, and integration capabilities with other enterprise tools.

Startups and niche providers like ClickUp and Wrike are gaining traction by offering highly customizable solutions and competitive pricing models. Free or freemium offerings also attract small and medium-sized enterprises (SMEs).

Innovation is critical in this market, with AI-driven automation, user-friendly interfaces, and enhanced collaboration features becoming key differentiators. Continuous product development and strategic partnerships define the competitive dynamics.

Key Market Companies

- ActiveCollab LLC

- Codleo Consulting

- SAP

- Apptio Inc

- Asana Inc.

- Atlassian Corp. Plc

- Basecamp LLC

- Citrix Systems Inc.

- Clarizen Inc.

- LiquidPlanner Inc.

- Mavenlink Inc.

- Microsoft Corp.

- Planbox Inc

- Premiere Global Services Inc.

- ProjectManager.com Inc.

- Redbooth

- Smartsheet Inc.

- TeamGantt

- Teamwork Crew Ltd.

- Workfront Inc.

- Wrike Inc.

- Zoho Corp. Pvt. Ltd.

Recent Industry Developments

- February 2023 -

Asana introduced a new suite of AI-powered tools to improve task automation and forecast project risks, which helps leverage machine learning to predict project bottlenecks and recommend adjustments in real-time, helping teams stay on track.

- June 2023 -

Trello released its enhanced "Views" feature, allowing users to visualize projects in multiple formats like timeline, calendar, and map views. This offers greater flexibility in tracking project progress.

An Expert’s Eye

- The increasing role of AI in enhancing productivity, task automation, and predictive analytics makes project management tools smarter and more efficient.

- Rising demand for customizable solutions tailored to industry-specific needs caters to the online project management software market.

- Experts predict that platforms offering greater flexibility and user-centric design will dominate the market over the forecast period.

- Seamless integration with CRM, ERP, and other business software is becoming essential, and it will continue to drive adoption especially in large enterprises.

Global Online Project Management Software Market is Segmented as-

By Component

- Solution

- Services

By Deployment

- On-Premise

- Cloud

By End User

- Large Enterprises

- Small Enterprises

By Region

- North America

- Europe

- Latin America

- Asia Pacific

- The Middle East and Africa

1. Executive Summary

1.1. Global Online Project Management Software Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2024

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. COVID-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Global Online Project Management Software Market Outlook, 2019 - 2031

3.1. Global Online Project Management Software Market Outlook, by End-user, Value (US$ Bn), 2019 - 2031

3.1.1. Key Highlights

3.1.1.1. Small and Medium Sized Enterprises

3.1.1.2. Large Enterprises

3.1.1.3. Government

3.2. Global Online Project Management Software Market Outlook, by Region, Value (US$ Bn), 2019 - 2031

3.2.1. Key Highlights

3.2.1.1. North America

3.2.1.2. Europe

3.2.1.3. Asia Pacific

3.2.1.4. Latin America

3.2.1.5. Middle East & Africa

4. North America Online Project Management Software Market Outlook, 2019 - 2031

4.1. North America Online Project Management Software Market Outlook, by End-user, Value (US$ Bn), 2019 - 2031

4.1.1. Key Highlights

4.1.1.1. Small and Medium Sized Enterprises

4.1.1.2. Large Enterprises

4.1.1.3. Government

4.1.2. BPS Analysis/Market Attractiveness Analysis

4.2. North America Online Project Management Software Market Outlook, by Country, Value (US$ Bn), 2019 - 2031

4.2.1. Key Highlights

4.2.1.1. U.S. Online Project Management Software Market by End-user, Value (US$ Bn), 2019 - 2031

4.2.1.2. Canada Online Project Management Software Market by End-user, Value (US$ Bn), 2019 - 2031

4.2.2. BPS Analysis/Market Attractiveness Analysis

5. Europe Online Project Management Software Market Outlook, 2019 - 2031

5.1. Europe Online Project Management Software Market Outlook, by End-user, Value (US$ Bn), 2019 - 2031

5.1.1. Key Highlights

5.1.1.1. Small and Medium Sized Enterprises

5.1.1.2. Large Enterprises

5.1.1.3. Government

5.1.2. BPS Analysis/Market Attractiveness Analysis

5.2. Europe Online Project Management Software Market Outlook, by Country, Value (US$ Bn), 2019 - 2031

5.2.1. Key Highlights

5.2.1.1. Germany Online Project Management Software Market by End-user, Value (US$ Bn), 2019 - 2031

5.2.1.2. U.K. Online Project Management Software Market by End-user, Value (US$ Bn), 2019 - 2031

5.2.1.3. France Online Project Management Software Market by End-user, Value (US$ Bn), 2019 - 2031

5.2.1.4. Italy Online Project Management Software Market by End-user, Value (US$ Bn), 2019 - 2031

5.2.1.5. Turkey Online Project Management Software Market by End-user, Value (US$ Bn), 2019 - 2031

5.2.1.6. Russia Online Project Management Software Market by End-user, Value (US$ Bn), 2019 - 2031

5.2.1.7. Rest of Europe Online Project Management Software Market by End-user, Value (US$ Bn), 2019 - 2031

5.2.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Online Project Management Software Market Outlook, 2019 - 2031

6.1. Asia Pacific Online Project Management Software Market Outlook, by End-user, Value (US$ Bn), 2019 - 2031

6.1.1. Key Highlights

6.1.1.1. Small and Medium Sized Enterprises

6.1.1.2. Large Enterprises

6.1.1.3. Government

6.1.2. BPS Analysis/Market Attractiveness Analysis

6.2. Asia Pacific Online Project Management Software Market Outlook, by Country, Value (US$ Bn), 2019 - 2031

6.2.1. Key Highlights

6.2.1.1. China Online Project Management Software Market by End-user, Value (US$ Bn), 2019 - 2031

6.2.1.2. Japan Online Project Management Software Market by End-user, Value (US$ Bn), 2019 - 2031

6.2.1.3. South Korea Online Project Management Software Market by End-user, Value (US$ Bn), 2019 - 2031

6.2.1.4. India Online Project Management Software Market by End-user, Value (US$ Bn), 2019 - 2031

6.2.1.5. Southeast Asia Online Project Management Software Market by End-user, Value (US$ Bn), 2019 - 2031

6.2.1.6. Rest of Asia Pacific Online Project Management Software Market by End-user, Value (US$ Bn), 2019 - 2031

6.2.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America Online Project Management Software Market Outlook, 2019 - 2031

7.1. Latin America Online Project Management Software Market Outlook, by End-user, Value (US$ Bn), 2019 - 2031

7.1.1. Key Highlights

7.1.1.1. Small and Medium Sized Enterprises

7.1.1.2. Large Enterprises

7.1.1.3. Government

7.1.2. BPS Analysis/Market Attractiveness Analysis

7.2. Latin America Online Project Management Software Market Outlook, by Country, Value (US$ Bn), 2019 - 2031

7.2.1. Key Highlights

7.2.1.1. Brazil Online Project Management Software Market by End-user, Value (US$ Bn), 2019 - 2031

7.2.1.2. Mexico Online Project Management Software Market by End-user, Value (US$ Bn), 2019 - 2031

7.2.1.3. Argentina Online Project Management Software Market by End-user, Value (US$ Bn), 2019 - 2031

7.2.1.4. Rest of Latin America Online Project Management Software Market by End-user, Value (US$ Bn), 2019 - 2031

7.2.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Online Project Management Software Market Outlook, 2019 - 2031

8.1. Middle East & Africa Online Project Management Software Market Outlook, by End-user, Value (US$ Bn), 2019 - 2031

8.1.1. Key Highlights

8.1.1.1. Small and Medium Sized Enterprises

8.1.1.2. Large Enterprises

8.1.1.3. Government

8.1.2. BPS Analysis/Market Attractiveness Analysis

8.2. Middle East & Africa Online Project Management Software Market Outlook, by Country, Value (US$ Bn), 2019 - 2031

8.2.1. Key Highlights

8.2.1.1. GCC Online Project Management Software Market by End-user, Value (US$ Bn), 2019 - 2031

8.2.1.2. South Africa Online Project Management Software Market by End-user, Value (US$ Bn), 2019 - 2031

8.2.1.3. Egypt Online Project Management Software Market by End-user, Value (US$ Bn), 2019 - 2031

8.2.1.4. Nigeria Online Project Management Software Market by End-user, Value (US$ Bn), 2019 - 2031

8.2.1.5. Rest of Middle East & Africa Online Project Management Software Market by End-user, Value (US$ Bn), 2019 - 2031

8.2.2. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. Company Market Share Analysis, 2024

9.2. Competitive Dashboard

9.3. Company Profiles

9.3.1. ActiveCollab LLC

9.3.1.1. Company Overview

9.3.1.2. Therapy Portfolio

9.3.1.3. Financial Overview

9.3.1.4. Business Strategies and Development

9.3.2. Codleo Consulting

9.3.2.1. Company Overview

9.3.2.2. Therapy Portfolio

9.3.2.3. Financial Overview

9.3.2.4. Business Strategies and Development

9.3.3. SAP

9.3.3.1. Company Overview

9.3.3.2. Therapy Portfolio

9.3.3.3. Financial Overview

9.3.3.4. Business Strategies and Development

9.3.4. Apptio Inc

9.3.4.1. Company Overview

9.3.4.2. Therapy Portfolio

9.3.4.3. Financial Overview

9.3.4.4. Business Strategies and Development

9.3.5. Asana Inc.

9.3.5.1. Company Overview

9.3.5.2. Therapy Portfolio

9.3.5.3. Financial Overview

9.3.5.4. Business Strategies and Development

9.3.6. Atlassian Corp. Plc

9.3.6.1. Company Overview

9.3.6.2. Therapy Portfolio

9.3.6.3. Financial Overview

9.3.6.4. Business Strategies and Development

9.3.7. Basecamp LLC

9.3.7.1. Company Overview

9.3.7.2. Therapy Portfolio

9.3.7.3. Financial Overview

9.3.7.4. Business Strategies and Development

9.3.8. Citrix Systems Inc.

9.3.8.1. Company Overview

9.3.8.2. Therapy Portfolio

9.3.8.3. Financial Overview

9.3.8.4. Business Strategies and Development

9.3.9. Clarizen Inc.

9.3.9.1. Company Overview

9.3.9.2. Therapy Portfolio

9.3.9.3. Financial Overview

9.3.9.4. Business Strategies and Development

9.3.10. LiquidPlanner Inc.

9.3.10.1. Company Overview

9.3.10.2. Therapy Portfolio

9.3.10.3. Financial Overview

9.3.10.4. Business Strategies and Development

9.3.11. Mavenlink Inc.

9.3.11.1. Company Overview

9.3.11.2. Therapy Portfolio

9.3.11.3. Financial Overview

9.3.11.4. Business Strategies and Development

9.3.12. Microsoft Corp.

9.3.12.1. Company Overview

9.3.12.2. Therapy Portfolio

9.3.12.3. Financial Overview

9.3.12.4. Business Strategies and Development

9.3.13. Planbox Inc

9.3.13.1. Company Overview

9.3.13.2. Therapy Portfolio

9.3.13.3. Financial Overview

9.3.13.4. Business Strategies and Development

9.3.14. Premiere Global Services Inc.

9.3.14.1. Company Overview

9.3.14.2. Therapy Portfolio

9.3.14.3. Financial Overview

9.3.14.4. Business Strategies and Development

9.3.15. ProjectManager.com Inc.

9.3.15.1. Company Overview

9.3.15.2. Therapy Portfolio

9.3.15.3. Financial Overview

9.3.15.4. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2023 |

|

2019 - 2023 |

2024 - 2031 |

Value: US$ Billion |

||

|

REPORT FEATURES |

DETAILS |

|

Component Coverage |

|

|

Deployment Coverage |

|

|

End User Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |