Global Organic Baby Food Market Forecast

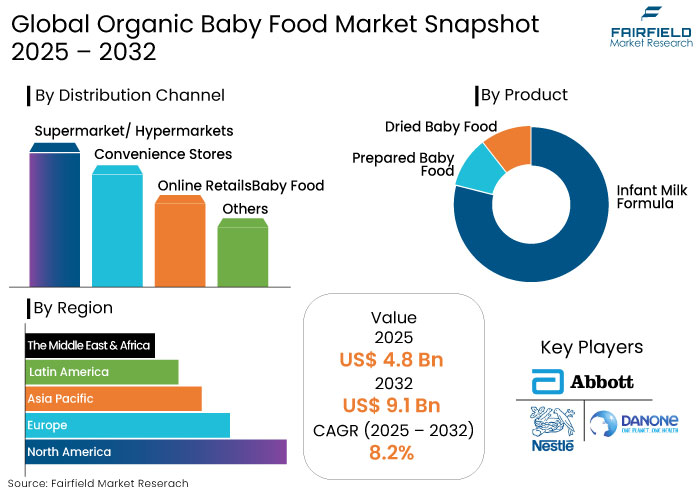

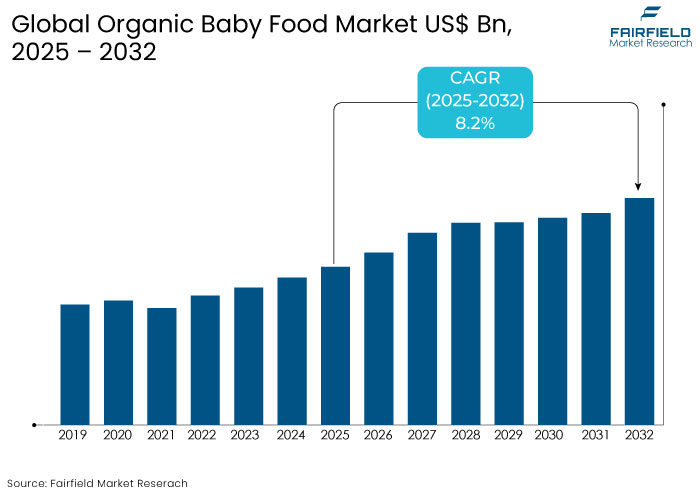

- The organic baby food market is projected to reach a size of US$ 9.1 Bn by 2032, showing significant growth from the US$ 4.8 Bn achieved in 2025.

- The market for organic baby food is expected to show a significant expansion rate, with an estimated CAGR of 8.2% from 2025 to 2032.

Organic Baby Food Market Insights

- Plant-based organic baby food options are becoming popular owing to growing interest in vegan and allergen-free diets.

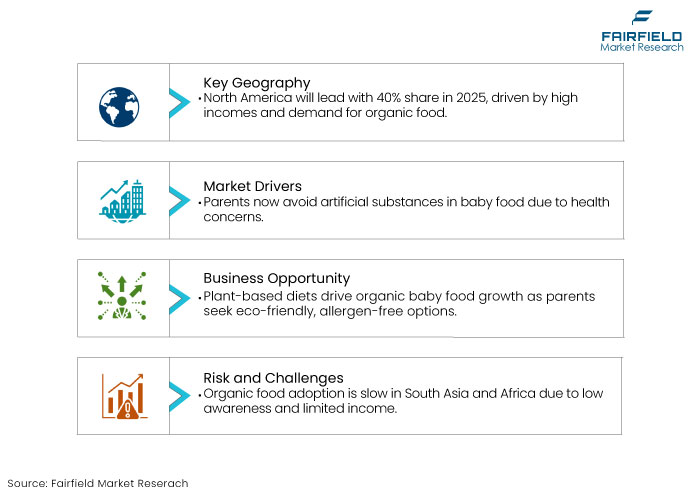

- North America is likely to dominate with a share of 40% in 2025 owing to the rise in health-oriented parenting patterns.

- Prepared baby food is projected to lead the product type segment with a share of 55% 2025.

- Supermarkets/Hypermarkets are estimated to emerge as the leading distribution channel with a share of 45% in 2025.

- Parents are seeking products having certified organic labels, like USDA Organic and EU Organic, ensuring food safety and compliance with health standards.

- New organic ingredients, like superfoods are gaining traction in baby food formulations as they offering added nutritional value.

- Ready-to-eat organic baby food options are becoming popular, catering to busy parents seeking convenient yet healthy meal solutions for their babies.

A Look Back and a Look Forward - Comparative Analysis

The organic baby food market growth during the historical period ranging between 2019 to 2023 was driven by rising parental awareness regarding the benefits of organic nutrition for infants. Increasing demand for chemical-free, non-GMO, and nutrient-rich baby food options prompted manufacturers to innovate and diversify product offerings.

Growing influence of e-commerce further amplified market accessibility. Online platforms have made organic baby food readily available to urban and rural consumers.

Over the forecast period, the market is likely to experience accelerated growth fueled by transformative trends and emerging opportunities. Rising adoption of plant-based organic baby food aligns with the global shift toward sustainable and allergen-free diets.

Expansion in developing regions is anticipated to drive significant growth owing to increasing urbanization, awareness campaigns, and supportive government initiatives promoting organic farming. With parents seeking transparency and quality, new organic baby food innovations along with robust regulatory support are projected to propel the market forward.

Key Growth Determinants

- Concerns Regarding Child Health Prompt Consumers to Opt for Organic Food Products

Recent years have witnessed rising concerns regarding the consumption of food products containing artificial substances by new-borns and young children. Parents have become increasingly conscious of various food elements.

The swift internet penetration has enabled parents to become aware of the latest market offerings that ideal for their children. Accessibility of organic products in smaller regions is witnessing growth, contributing to market expansion.

Prominent food manufacturers are keen on organic goods owing to their appeal within the infant food sector. Growing adoption of organic products in tier 2 and tier 3 cities has facilitated expansion in smaller communities, which is anticipated to enhance growth.

- Promotion and Marketing in Mainstream Distribution Channels

The market for organic baby food products is gradually transitioning from a niche to a substantial industry category. Availability of products varies significantly among countries, as it is contingent upon the market environment.

- Organic baby food products are in high demand in developed countries, such as Germany, where large retail chains account for 70% of the product sales.

Even though baby food products are relatively expensive, retailers offer great discounts, encouraging consumers to purchase. Market growth in developing countries is significantly influenced by the expansion of supermarkets and hypermarkets in tier 2 and 3 cities.

For the past few years, consumers have been aware of and purchased products through such retail channels. Continuous expansion in hypermarkets and supermarkets is anticipated to facilitate substantial growth in the future.

Key Growth Barriers

- Limited Availability in Developing Markets

Adoption rate of organic food items is sluggish in developing markets, particularly in South Asia and Africa. Several consumers' lack awareness and understanding which results in transient demand from a restricted income demographic.

Despite growing awareness of organic products, their availability in developing regions is limited. The lack of well-established distribution channels and fewer organic-certified local producers restricts accessibility in countries across Asia, Africa, and Latin America. Higher cost of importing organic baby food adds to affordability issues in these regions. Consumers in these regions often rely on locally available conventional baby food products.

Organic Baby Food Market Trends and Opportunities

- Rising Demand for Plant-Based Organic Baby Food

Increasing preference for plant-based diets impacts the organic baby food market, presenting numerous growth opportunities. Modern parents are more conscious about introducing eco-friendly and allergen-free foods in their children's diets.

Plant-based organic baby food, crafted from nutrient-rich ingredients like quinoa, lentils, and almond milk, are gaining traction as a healthier and sustainable alternative to conventional options. Such products cater to families seeking to align their dietary choices with environmental and ethical considerations.

The trend highlights plant-based nutrition's role in promoting infants' overall health and well-being. As consumers continue to embrace plant-based options, companies have an opportunity to create a niche and strengthen their brand equity.

- Expansion of Online Retail Channels

Rapid growth of e-commerce is revolutionizing how parents shop for organic baby food, as it offers substantial convenience and accessibility. Online platforms like Amazon, Walmart, and specialized baby food stores enable parents to explore a wide range of organic products. These channels allow parents to read detailed descriptions, compare prices, and even subscribe to regular deliveries.

The shift to online shopping appeals to time-strapped urban families who value convenience. Several online retailers now offer exclusive deals, fast delivery, and customer reviews, making the buying process smoother and more reliable.

How is Regulatory Scenario Shaping this Industry?

The organic baby food market is heavily influenced by evolving regulatory frameworks that ensure product safety, quality, and authenticity. Stringent government regulations, particularly in regions like North America and Europe, drive manufacturers to adhere to high standards for organic certification.

Certifications require compliance with stringent guidelines, like non-GMO ingredients, no synthetic pesticides, and environmentally sustainable farming practices. In emerging economies, governments are increasingly introducing initiatives to promote organic farming. They are also creating certification systems, paving the way for expansion.

Segment Covered in the Report

- Convenience of Prepared Baby Food to Augment Growth

Prepared baby food segment is anticipated to dominate owing to its convenience, uniformity, and nutritional reliability. Ready-to-eat organic baby foods conserve time for busy parents by obviating meal preparation. They also guarantee that each product adheres to rigorous quality control requirements for safety and consistency.

Prepared foods are specifically formulated to satisfy new-borns’ nutritional requirements and are available in various flavours and textures that is appealing to parents and infants. Extended shelf life of prepared infant foods diminishes the necessity for frequent grocery outings while enhancing the overall convenience. Certified organic alternatives from esteemed brands provide confidence regarding product safety and authenticity.

- Supermarkets/Hypermarkets are Gaining Traction as Parents can Evaluate Options

The supermarkets/ hypermarkets distribution channel is predicted to dominate with a share of 45% in 2025. This growth is attributed to their ability to offer consumers a wide range of products under one roof, providing convenience and variety.

Parents prefer shopping in supermarkets and hypermarkets as they can physically inspect the products and compare prices. Physical stores also enable them to evaluate options for ingredients, packaging, and certifications like USDA Organic.

Retail giants like Walmart, Tesco, and Carrefour play a significant role in this dominance, with dedicated sections for organic and health-focused products. The availability of in-store promotions and discounts encourages bulk purchases, particularly for families with infants.

Supermarkets and hypermarkets are evolving to meet the rising demand for organic products by expanding their inventory and collaborating with premium organic baby food brands. Consistent accessibility and tailored offerings in urban and suburban areas reinforce their dominant position in the market.

Regional Analysis

- Health Oriented Parenting Patterns to Bolster Growth in North America

North America is anticipated to dominate with a share of 40% in 2025. Growth in the region is primarily driven by elevated disposable incomes, health-oriented parenting patterns, and the extensive accessibility of organic food.

Parents in the North America are emphasizing their baby's health by selecting chemical-free, nutrient-dense, and environmentally sustainable baby food alternatives. Consumer preference for clean-label products with precise ingredient sourcing corresponds with the increasing recognition of the long-term advantages of organic nutrition.

Prominent organic baby food brands allocate substantial resources to research and innovation. They are also constantly launching new product variations to address changing consumer preferences, including plant-based and allergen-free alternatives.

- Europe Ranks as the Second Leading Region with 25% of the Market Share

Europe is predicted to emerge as the second-largest market with a share of 25% in 2025. High consumer awareness and an established preference for organic and sustainable products support the region's growth. Countries like Germany, the U.K., and France are at the forefront owing to robust government support for organic farming and eco-friendly initiatives.

Increasing availability of innovative product varieties, including gluten-free and allergen-free organic baby food, caters to specific dietary requirements, boosting demand. Europe's stringent organic certification standards and wide retail distribution networks have made organic baby food a staple choice among parents across the region.

Fairfield’s Competitive Landscape Analysis

The organic baby food market is highly competitive, with established brands and new entrants striving to capture market share. Key players like Nestlé, The Hain Celestial Group, and Danone are projected to dominate the market with extensive product portfolios and strong brand recognition. Companies are focusing on innovation, offering diverse options, like plant-based, allergen-free, and gluten-free baby food, to cater to evolving consumer needs.

Emergence of smaller regional players is reshaping the market dynamics by emphasizing on locally sourced organic ingredients. Distribution through e-commerce platforms and retail stores is critical for expansion, while certifications like USDA Organic are pivotal in building consumer trust.

Key Market Companies

- Nestle SA

- Abbott Laboratories

- Danone SA

- The Kraft Heinz Company

- Mead Johnson & Company, LLC

- Lactalis

- The Hain Celestial Group Inc.

- Hero Group

- Sprout Organic Foods, Inc

- Hipp Gmbh & Co Vertrieb KG

- Baby Gourmet Foods Inc.

- Amara Organic Foods

Recent Industry Developments

- In November 2024, Bonya, a new organic baby formula brand, was introduced in prominent supermarkets in U.K. like Tesco and Sainsbury's.

- In December 2024, Little Spoon expanded its product line to include fresh, nutritious, and ready-to-eat meals for children ranging from infants to older kids.

An Expert’s Eye

- Rising awareness among parents about the long-term health benefits of organic baby food is a key driver.

- Industry analysts highlight the significant role of strict regulatory standards in enhancing consumer trust.

- Expansion of e-commerce platforms has opened new doors for organic baby food brands, making it easier for parents to access a wider variety of products directly from home.

- Experts predict that continued innovation in flavours, such as exotic fruits and vegetables, will appeal to health-conscious parents.

Global Organic Baby Food Market is Segmented as-

By Product

- Infant Milk Formula

- Prepared Baby Food

- Dried Baby Food

By Distribution Channel

- Supermarket/ Hypermarkets

- Convenience Stores

- Online Retails

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

1. Executive Summary

1.1. Global Organic Baby Food Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2025

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. COVID-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Global Organic Baby Food Market Outlook, 2019 - 2032

3.1. Global Organic Baby Food Market Outlook, by Product, Value (US$ Bn), 2019 - 2032

3.1.1. Key Highlights

3.1.1.1. Infant Milk Formula

3.1.1.2. Prepared Baby Food

3.1.1.3. Dried Baby Food

3.2. Global Organic Baby Food Market Outlook, by Distribution Channel, Value (US$ Bn), 2019 - 2032

3.2.1. Key Highlights

3.2.1.1. Supermarket/ Hypermarkets

3.2.1.2. Convenience Stores

3.2.1.3. Online Retails

3.2.1.4. Others

3.3. Global Organic Baby Food Market Outlook, by Region, Value (US$ Bn), 2019 - 2032

3.3.1. Key Highlights

3.3.1.1. North America

3.3.1.2. Europe

3.3.1.3. Asia Pacific

3.3.1.4. Latin America

3.3.1.5. Middle East & Africa

4. North America Organic Baby Food Market Outlook, 2019 - 2032

4.1. North America Organic Baby Food Market Outlook, by Product, Value (US$ Bn), 2019 - 2032

4.1.1. Key Highlights

4.1.1.1. Infant Milk Formula

4.1.1.2. Prepared Baby Food

4.1.1.3. Dried Baby Food

4.2. North America Organic Baby Food Market Outlook, by Distribution Channel, Value (US$ Bn), 2019 - 2032

4.2.1. Key Highlights

4.2.1.1. Supermarket/ Hypermarkets

4.2.1.2. Convenience Stores

4.2.1.3. Online Retails

4.2.1.4. Others

4.2.2. BPS Analysis/Market Attractiveness Analysis

4.3. North America Organic Baby Food Market Outlook, by Country, Value (US$ Bn), 2019 - 2032

4.3.1. Key Highlights

4.3.1.1. U.S. Organic Baby Food Market by Product, Value (US$ Bn), 2019 - 2032

4.3.1.2. U.S. Organic Baby Food Market by Distribution Channel, Value (US$ Bn), 2019 - 2032

4.3.1.3. Canada Organic Baby Food Market by Product, Value (US$ Bn), 2019 - 2032

4.3.1.4. Canada Organic Baby Food Market by Distribution Channel, Value (US$ Bn), 2019 - 2032

4.3.2. BPS Analysis/Market Attractiveness Analysis

5. Europe Organic Baby Food Market Outlook, 2019 - 2032

5.1. Europe Organic Baby Food Market Outlook, by Product, Value (US$ Bn), 2019 - 2032

5.1.1. Key Highlights

5.1.1.1. Infant Milk Formula

5.1.1.2. Prepared Baby Food

5.1.1.3. Dried Baby Food

5.2. Europe Organic Baby Food Market Outlook, by Distribution Channel, Value (US$ Bn), 2019 - 2032

5.2.1. Key Highlights

5.2.1.1. Supermarket/ Hypermarkets

5.2.1.2. Convenience Stores

5.2.1.3. Online Retails

5.2.1.4. Others

5.2.2. BPS Analysis/Market Attractiveness Analysis

5.3. Europe Organic Baby Food Market Outlook, by Country, Value (US$ Bn), 2019 - 2032

5.3.1. Key Highlights

5.3.1.1. Germany Organic Baby Food Market by Product, Value (US$ Bn), 2019 - 2032

5.3.1.2. Germany Organic Baby Food Market by Distribution Channel, Value (US$ Bn), 2019 - 2032

5.3.1.3. U.K. Organic Baby Food Market by Product, Value (US$ Bn), 2019 - 2032

5.3.1.4. U.K. Organic Baby Food Market by Distribution Channel, Value (US$ Bn), 2019 - 2032

5.3.1.5. France Organic Baby Food Market by Product, Value (US$ Bn), 2019 - 2032

5.3.1.6. France Organic Baby Food Market by Distribution Channel, Value (US$ Bn), 2019 - 2032

5.3.1.7. Italy Organic Baby Food Market by Product, Value (US$ Bn), 2019 - 2032

5.3.1.8. Italy Organic Baby Food Market by Distribution Channel, Value (US$ Bn), 2019 - 2032

5.3.1.9. Turkey Organic Baby Food Market by Product, Value (US$ Bn), 2019 - 2032

5.3.1.10. Turkey Organic Baby Food Market by Distribution Channel, Value (US$ Bn), 2019 - 2032

5.3.1.11. Russia Organic Baby Food Market by Product, Value (US$ Bn), 2019 - 2032

5.3.1.12. Russia Organic Baby Food Market by Distribution Channel, Value (US$ Bn), 2019 - 2032

5.3.1.13. Rest of Europe Organic Baby Food Market by Product, Value (US$ Bn), 2019 - 2032

5.3.1.14. Rest of Europe Organic Baby Food Market by Distribution Channel, Value (US$ Bn), 2019 - 2032

5.3.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Organic Baby Food Market Outlook, 2019 - 2032

6.1. Asia Pacific Organic Baby Food Market Outlook, by Product, Value (US$ Bn), 2019 - 2032

6.1.1. Key Highlights

6.1.1.1. Infant Milk Formula

6.1.1.2. Prepared Baby Food

6.1.1.3. Dried Baby Food

6.2. Asia Pacific Organic Baby Food Market Outlook, by Distribution Channel, Value (US$ Bn), 2019 - 2032

6.2.1. Key Highlights

6.2.1.1. Supermarket/ Hypermarkets

6.2.1.2. Convenience Stores

6.2.1.3. Online Retails

6.2.1.4. Others

6.2.2. BPS Analysis/Market Attractiveness Analysis

6.3. Asia Pacific Organic Baby Food Market Outlook, by Country, Value (US$ Bn), 2019 - 2032

6.3.1. Key Highlights

6.3.1.1. China Organic Baby Food Market by Product, Value (US$ Bn), 2019 - 2032

6.3.1.2. China Organic Baby Food Market by Distribution Channel, Value (US$ Bn), 2019 - 2032

6.3.1.3. Japan Organic Baby Food Market by Product, Value (US$ Bn), 2019 - 2032

6.3.1.4. Japan Organic Baby Food Market by Distribution Channel, Value (US$ Bn), 2019 - 2032

6.3.1.5. South Korea Organic Baby Food Market by Product, Value (US$ Bn), 2019 - 2032

6.3.1.6. South Korea Organic Baby Food Market by Distribution Channel, Value (US$ Bn), 2019 - 2032

6.3.1.7. India Organic Baby Food Market by Product, Value (US$ Bn), 2019 - 2032

6.3.1.8. India Organic Baby Food Market by Distribution Channel, Value (US$ Bn), 2019 - 2032

6.3.1.9. Southeast Asia Organic Baby Food Market by Product, Value (US$ Bn), 2019 - 2032

6.3.1.10. Southeast Asia Organic Baby Food Market by Distribution Channel, Value (US$ Bn), 2019 - 2032

6.3.1.11. Rest of Asia Pacific Organic Baby Food Market by Product, Value (US$ Bn), 2019 - 2032

6.3.1.12. Rest of Asia Pacific Organic Baby Food Market by Distribution Channel, Value (US$ Bn), 2019 - 2032

6.3.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America Organic Baby Food Market Outlook, 2019 - 2032

7.1. Latin America Organic Baby Food Market Outlook, by Product, Value (US$ Bn), 2019 - 2032

7.1.1. Key Highlights

7.1.1.1. Infant Milk Formula

7.1.1.2. Prepared Baby Food

7.1.1.3. Dried Baby Food

7.2. Latin America Organic Baby Food Market Outlook, by Distribution Channel, Value (US$ Bn), 2019 - 2032

7.2.1. Key Highlights

7.2.1.1. Supermarket/ Hypermarkets

7.2.1.2. Convenience Stores

7.2.1.3. Online Retails

7.2.1.4. Others

7.2.2. BPS Analysis/Market Attractiveness Analysis

7.3. Latin America Organic Baby Food Market Outlook, by Country, Value (US$ Bn), 2019 - 2032

7.3.1. Key Highlights

7.3.1.1. Brazil Organic Baby Food Market by Product, Value (US$ Bn), 2019 - 2032

7.3.1.2. Brazil Organic Baby Food Market by Distribution Channel, Value (US$ Bn), 2019 - 2032

7.3.1.3. Mexico Organic Baby Food Market by Product, Value (US$ Bn), 2019 - 2032

7.3.1.4. Mexico Organic Baby Food Market by Distribution Channel, Value (US$ Bn), 2019 - 2032

7.3.1.5. Argentina Organic Baby Food Market by Product, Value (US$ Bn), 2019 - 2032

7.3.1.6. Argentina Organic Baby Food Market by Distribution Channel, Value (US$ Bn), 2019 - 2032

7.3.1.7. Rest of Latin America Organic Baby Food Market by Product, Value (US$ Bn), 2019 - 2032

7.3.1.8. Rest of Latin America Organic Baby Food Market by Distribution Channel, Value (US$ Bn), 2019 - 2032

7.3.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Organic Baby Food Market Outlook, 2019 - 2032

8.1. Middle East & Africa Organic Baby Food Market Outlook, by Product, Value (US$ Bn), 2019 - 2032

8.1.1. Key Highlights

8.1.1.1. Infant Milk Formula

8.1.1.2. Prepared Baby Food

8.1.1.3. Dried Baby Food

8.2. Middle East & Africa Organic Baby Food Market Outlook, by Distribution Channel, Value (US$ Bn), 2019 - 2032

8.2.1. Key Highlights

8.2.1.1. Supermarket/ Hypermarkets

8.2.1.2. Convenience Stores

8.2.1.3. Online Retails

8.2.1.4. Others

8.2.2. BPS Analysis/Market Attractiveness Analysis

8.3. Middle East & Africa Organic Baby Food Market Outlook, by Country, Value (US$ Bn), 2019 - 2032

8.3.1. Key Highlights

8.3.1.1. GCC Organic Baby Food Market by Product, Value (US$ Bn), 2019 - 2032

8.3.1.2. GCC Organic Baby Food Market by Distribution Channel, Value (US$ Bn), 2019 - 2032

8.3.1.3. South Africa Organic Baby Food Market by Product, Value (US$ Bn), 2019 - 2032

8.3.1.4. South Africa Organic Baby Food Market by Distribution Channel, Value (US$ Bn), 2019 - 2032

8.3.1.5. Egypt Organic Baby Food Market by Product, Value (US$ Bn), 2019 - 2032

8.3.1.6. Egypt Organic Baby Food Market by Distribution Channel, Value (US$ Bn), 2019 - 2032

8.3.1.7. Nigeria Organic Baby Food Market by Product, Value (US$ Bn), 2019 - 2032

8.3.1.8. Nigeria Organic Baby Food Market by Distribution Channel, Value (US$ Bn), 2019 - 2032

8.3.1.9. Rest of Middle East & Africa Organic Baby Food Market by Product, Value (US$ Bn), 2019 - 2032

8.3.1.10. Rest of Middle East & Africa Organic Baby Food Market by Distribution Channel, Value (US$ Bn), 2019 - 2032

8.3.2. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. Company Market Share Analysis, 2025

9.2. Competitive Dashboard

9.3. Company Profiles

9.3.1. Nestle SA

9.3.1.1. Company Overview

9.3.1.2. Therapy Portfolio

9.3.1.3. Financial Overview

9.3.1.4. Business Strategies and Development

9.3.2. Abbott Laboratories

9.3.2.1. Company Overview

9.3.2.2. Therapy Portfolio

9.3.2.3. Financial Overview

9.3.2.4. Business Strategies and Development

9.3.3. Danone SA

9.3.3.1. Company Overview

9.3.3.2. Therapy Portfolio

9.3.3.3. Financial Overview

9.3.3.4. Business Strategies and Development

9.3.4. The Kraft Heinz Company

9.3.4.1. Company Overview

9.3.4.2. Therapy Portfolio

9.3.4.3. Financial Overview

9.3.4.4. Business Strategies and Development

9.3.5. Mead Johnson & Company, LLC

9.3.5.1. Company Overview

9.3.5.2. Therapy Portfolio

9.3.5.3. Financial Overview

9.3.5.4. Business Strategies and Development

9.3.6. Lactalis

9.3.6.1. Company Overview

9.3.6.2. Therapy Portfolio

9.3.6.3. Financial Overview

9.3.6.4. Business Strategies and Development

9.3.7. The Hain Celestial Group Inc.

9.3.7.1. Company Overview

9.3.7.2. Therapy Portfolio

9.3.7.3. Financial Overview

9.3.7.4. Business Strategies and Development

9.3.8. Hero Group

9.3.8.1. Company Overview

9.3.8.2. Therapy Portfolio

9.3.8.3. Financial Overview

9.3.8.4. Business Strategies and Development

9.3.9. Sprout Organic Foods, Inc.

9.3.9.1. Company Overview

9.3.9.2. Therapy Portfolio

9.3.9.3. Financial Overview

9.3.9.4. Business Strategies and Development

9.3.10. Hipp Gmbh & Co Vertrieb KG

9.3.10.1. Company Overview

9.3.10.2. Therapy Portfolio

9.3.10.3. Financial Overview

9.3.10.4. Business Strategies and Development

9.3.11. Baby Gourmet Foods Inc.

9.3.11.1. Company Overview

9.3.11.2. Therapy Portfolio

9.3.11.3. Financial Overview

9.3.11.4. Business Strategies and Development

9.3.12. Amara Organic Foods

9.3.12.1. Company Overview

9.3.12.2. Therapy Portfolio

9.3.12.3. Financial Overview

9.3.12.4. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2023 |

|

2019 - 2023 |

2025 - 2032 |

Value: US$ Billion |

||

|

REPORT FEATURES |

DETAILS |

|

Product Coverage |

|

|

Distribution Channel Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysḍis, COVID-19 Impact Analysis (Demand and Supply Chain) |