Global Pain Relief Patches Market Forecast

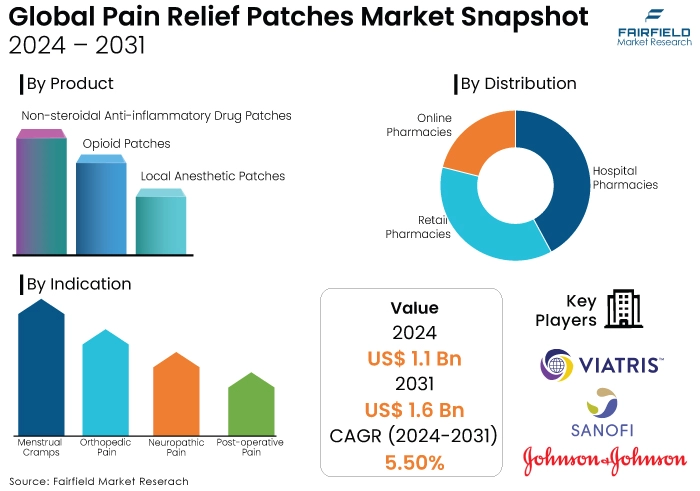

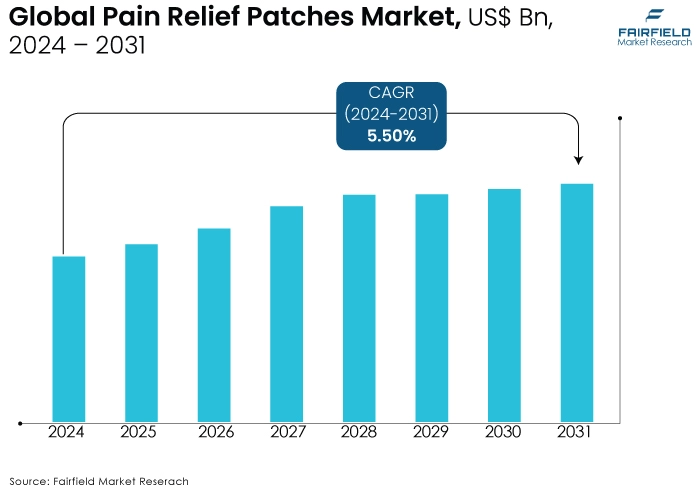

- Global pain relief patches market size to reach US$1.6 Bn in 2031, up from US$1.1 Bn attained in 2024

- Market revenue projected to exhibit a remarkable rate of expansion, at an estimated CAGR of 5.5% during 2024 - 2031

Quick Report Digest

- Key drivers for this market include rising geriatric population, advancements in transdermal drug delivery, and increasing prevalence of pain conditions like arthritis.

- Major growth determinants include increasing prevalence of chronic pain conditions, advancements in patch technology, and growing preference for non-pharmacological pain management.

- Regulatory hurdles, limited efficacy, and competition from alternative therapies are identified as major growth barriers.

- Growing demand for natural and non-invasive pain relief solutions, rising incidence of chronic pain conditions, and expansion into the geriatric care segment are key trends and opportunities.

- Regulatory scenario shapes the industry by ensuring safety and efficacy standards, controlling product claims, and conducting post-market surveillance.

- in the market include transdermal drug delivery systems, herbal and natural ingredients, and smart patches.

- North America leads the market, followed by Europe and Asia Pacific, with significant growth opportunities in emerging markets.

- Leading players in the pain relief patches market include Viatris, Johnson & Johnson, Teva Pharmaceutical, Novartis, and GlaxoSmithKline, among others.

A Look Back and a Look Forward - Comparative Analysis

The upward market trend can be attributed to several factors. The rising geriatric population globally creates a higher demand for pain management solutions. Pain relief patches offer a convenient and non-invasive option for chronic pain associated with ageing. Advancements in transdermal drug delivery technology are leading to more effective and targeted pain relief medications within these patches. This innovation is attracting new users seeking a more localised and sustained pain relief experience.

Furthermore, the increasing prevalence of pain conditions like arthritis and muscle aches is driving market growth. Busy lifestyles and growing awareness of pain management options are also contributing factors. The market witnessed significant activity during the period with players like Teva, and Amneal receiving approvals for generic pain relief patches, making them more accessible to patients. Looking ahead, the forecast for 2024-2031 remains positive.

The Asia Pacific region is expected to see the strongest growth due to factors like rising healthcare investments and growing adoption of personalised pain management approaches. This trend of increasing product innovation, rising demand from an ageing population, and growing acceptance of pain relief patches is expected to propel the market towards an impressive valuation by 2031.

Key Growth Determinants

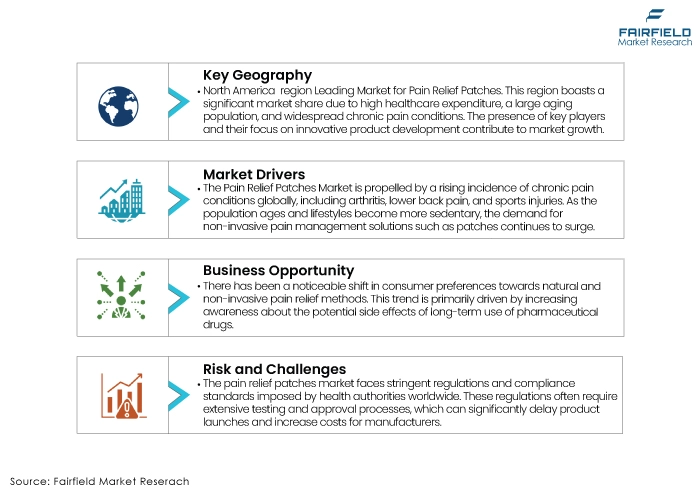

- Increasing Prevalence of Chronic Pain Conditions

The pain relief patches market is propelled by a rising incidence of chronic pain conditions globally, including arthritis, lower back pain, and sports injuries. As the population ages and lifestyles become more sedentary, the demand for non-invasive pain management solutions such as patches continues to surge.

- Consistent Advancements in Patch Technology

Technological advancements have led to the development of more effective and long-lasting pain relief patches. Innovations such as transdermal drug delivery systems and improved formulations enhance the efficacy and convenience of pain relief patches, driving their adoption among consumers seeking efficient pain management solutions.

- Growing Preference for Non-Pharmacological Pain Management

With increasing awareness of the potential risks associated with long-term use of oral pain medications, there is a growing preference for non-pharmacological alternatives like pain relief patches. These patches offer localised relief with minimal systemic side effects, appealing to individuals seeking safer and more targeted pain management options, thus contributing to the growth of the market.

Major Growth Barriers

- Regulatory Complexities

The pain relief patches market faces stringent regulations and compliance standards imposed by health authorities worldwide. These regulations often require extensive testing and approval processes, which can significantly delay product launches and increase costs for manufacturers.

- Limited Efficacy

While pain relief patches offer a convenient and non-invasive solution for managing various types of pain, their efficacy may vary depending on the individual's condition and the specific ingredients used in the patches. Consumers may be sceptical about the effectiveness of certain products, leading to slower adoption rates and constrained market growth.

- Competition from Alternative Therapies

The pain relief market is saturated with a variety of alternative therapies, including oral medications, topical creams, and physical therapy techniques. These alternatives often offer similar or complementary benefits to pain relief patches, creating stiff competition and limiting the market's potential for rapid expansion.

Key Trends and Opportunities to Look at

- Growing Demand for Natural and Non-Invasive Pain Relief Solutions

There has been a noticeable shift in consumer preferences towards natural and non-invasive pain relief methods. This trend is primarily driven by increasing awareness about the potential side effects of long-term use of pharmaceutical drugs. Consumers are actively seeking alternative solutions such as pain relief patches that contain natural ingredients like menthol, capsaicin, and CBD. Manufacturers are responding to this demand by innovating and introducing patches with botanical extracts and essential oils known for their analgesic properties.

- Rising Incidence of Chronic Pain Conditions

Another significant trend in the pain relief market is the escalating prevalence of chronic pain conditions worldwide. Factors such as ageing populations, sedentary lifestyles, and the growing incidence of conditions like arthritis, and fibromyalgia contribute to this trend. As a result, there is a sustained demand for effective pain management solutions, including topical patches. Consumers are increasingly turning to these patches for targeted relief from chronic pain, driving market growth.

- Expansion in Geriatric Care Segment

With the global population ageing rapidly, there is a substantial opportunity for pain relief patch manufacturers to target the geriatric care segment. Older adults often experience chronic pain related to age-related conditions such as osteoarthritis and neuropathy. Developing specialised patches catering to the unique needs of elderly individuals, such as those offering sustained release formulations or gentle adhesives suitable for delicate skin, can help companies tap into this lucrative market segment.

How Does the Regulatory Scenario Shape this Industry?

The regulatory scenario acts as a strong influencer in the pain relief patches market. From navigating market entry with approval processes by agencies like the FDA to restricting ingredients and their potencies, regulations ensure a baseline safety and efficacy standard. This can limit the variety of pain addressed and push some consumers towards prescriptions.

Additionally, regulations control what manufacturers can claim on packaging and marketing materials, preventing misleading information but also making product differentiation a challenge. Post-market surveillance ensures ongoing safety monitoring but adds complexity for manufacturers. In conclusion, regulations in the pain relief patches market play a balancing act between patient safety, fostering healthy competition, and driving innovation.

Fairfield’s Ranking Board

- TDDS Continues to be the Preferred Choice

Transdermal drug delivery systems (TDDS) patches have emerged as a cornerstone in the field of pain management, offering a convenient and effective way to administer medication directly through the skin. This segment is witnessing substantial growth driven by advancements in formulations that ensure sustained release of medication, particularly catering to individuals with chronic conditions such as arthritis and back pain. The convenience, and prolonged efficacy of TDDS patches make them a preferred choice for patients seeking non-invasive pain relief solutions.

- Herbal and Natural Ingredients Witness Exceptionally Growing Traction

The incorporation of herbal and natural ingredients in pain relief patches has gained significant traction, fuelled by the growing consumer preference for natural remedies. Ingredients like menthol, capsaicin, and camphor not only provide effective analgesic properties but also resonate with eco-conscious consumers who seek alternatives to synthetic medications. Pain relief patches featuring herbal and natural ingredients offer a holistic approach to pain management, addressing the needs of individuals who prioritise natural and sustainable healthcare solutions.

- Boom Around Smart Patches Grows Denser as Personalisation Takes Centre Stage

The integration of technology into pain relief patches has ushered in a new era of personalised pain management solutions. Smart patches, equipped with sensors and microelectronics, offer functionalities such as vital sign monitoring, medication adherence tracking, and real-time adjustment of drug delivery. This segment is experiencing rapid expansion driven by growing investments in healthcare IoT (Internet of Things), and wearable technology. Smart patches not only enhance the efficacy of pain relief but also empower patients with greater control over their treatment, ultimately improving overall health outcomes.

Regional Frontrunners

North America Remains the Leading Market for Pain Relief Patches

North America stands out as the leading market for pain relief patches, driven by factors such as high healthcare expenditure, a large ageing population, and the prevalence of chronic pain conditions. Key players in the region are focused on innovative product development, leveraging advanced technologies to meet the evolving needs of patients. The robust healthcare infrastructure and supportive regulatory environment further contribute to the growth of the pain relief patch market in North America.

Europe Thrives on Emerging Trends in Pain Relief Patch Market, Opportunities Flock Asia Pacific

In Europe, the pain relief patch market is thriving on emerging trends such as the rising prevalence of chronic diseases, a growing geriatric population, and increasing adoption of self-medication practices. Government initiatives aimed at promoting pain management and the presence of well-established healthcare infrastructure bolster market growth in the region.

Meanwhile, the Asia Pacific region presents lucrative opportunities for market expansion, driven by factors such as a large population base, rising healthcare expenditure, and growing awareness about pain management. Changing lifestyles, increasing urbanisation, and rising disposable incomes further fuel the demand for pain relief patches in the Asia Pacific region.

Fairfield’s Competitive Landscape Analysis

The pain relief patch market is seeing steady growth, driven by factors like rising chronic pain cases and patient preference for non-invasive pain management. The competition is strong, but some leading players include companies like Novartis, Johnson & Johnson, and Mentholatum. These key players are focusing on strategies like developing innovative patches with longer-lasting pain relief, expanding into non-opioid options for safer pain management, and increasing accessibility through both prescription and over-the-counter channels. This multi-pronged approach helps them cater to a wider range of pain needs and stay ahead in the competitive landscape.

Who are the Leaders in the Pain Relief Patches Market Space?

- Viatris, Inc.

- Johnson & Johnson Services, Inc.

- Teva Pharmaceutical Industries Ltd.

- Sanofi S.A.

- Hisamitsu Pharmaceutical Co., Inc.

- GlaxoSmithKline Plc.

- Novartis AG

- Nichiban Co., Ltd.

- Teikoku Seiyaku Co, Ltd.

- Mentholatum Company

- Purdue Pharma L.P.

- West-Ward Pharmaceuticals Corporation

- Pfizer, Inc

- Allergan PLC (Actavis)

- Endo International PLC

- Mylan N.V.

- Corium, Inc.

- Agile Therapeutics Inc.

Significant Company Developments

- August 2023: PainAway Inc. unveiled its latest innovation, the "UltraFlex Pain Relief Patch." Boasting advanced transdermal technology, the patch delivers targeted relief for chronic pain sufferers. With extended wear time and optimised adhesive, it offers unparalleled comfort and efficacy, capturing consumer interest and reshaping the competitive landscape.

- November 2023: November 2023 witnessed the introduction of "SootheEase Patches" by ReliefRx. These patches feature a unique blend of natural ingredients like menthol and camphor, providing fast-acting relief for muscle and joint discomfort. With a flexible design catering to various body contours, they cater to diverse consumer needs, enhancing the brand's presence in the pain relief market.

- February 2024: February 2024 marked a significant milestone as PainRelief Solutions secured a strategic distribution partnership with a leading pharmacy chain. This agreement expands the availability of their popular "FlexiPatch" line across nationwide retail outlets, enhancing accessibility for consumers seeking non-prescription pain management solutions.

- April 2024: HealWell Pharmaceuticals inked a distribution deal with an online health retailer, bolstering the reach of their "TheraPatch" range. This collaboration leverages the retailer's extensive digital platform to target tech-savvy consumers, tapping into a growing segment of the market seeking convenient pain relief options.

An Expert’s Eye

- Optimistic Perspective

Analyst A sees a promising trajectory for the pain relief patches market, driven by increasing awareness about non-invasive pain management solutions and the growing preference for drug-free alternatives. They highlight the expanding geriatric population globally, which is more prone to chronic pain conditions, as a significant market driver. Technological advancements in patch designs, such as longer-lasting and more effective formulations, are expected to further fuel market growth. The rise in sports-related injuries and the growing incidence of musculoskeletal disorders contribute to a widening consumer base for pain relief patches.

- Cautious Perspective

Analyst B acknowledges the market's growth potential but expresses concerns about regulatory challenges and quality control issues, particularly in developing regions. They emphasize the competitive landscape, with numerous players entering the market, leading to pricing pressures and potential commoditisation of products. Economic uncertainties and fluctuating raw material costs could impact the profitability of pain relief patch manufacturers. Consumer scepticism regarding the efficacy of patches compared to traditional oral medications might hinder market penetration in certain demographics.

The Global Pain Relief Patches Market is Segmented as Below:

By Product Type:

- Non-steroidal Anti-inflammatory Drug Patches

- Ketoprofen Patches

- Diclofenac Patches

- Flurbiprofen Patches

- Piroxicam Patches

- Opioid Patches

- Fentanyl Patches

- Buprenorphine Patches

- Local Anaesthetic Patches

- Nitroglycerine Patches

- Capsaicin Patches

- Lidocaine Patches

By Indication:

- Menstrual Cramps

- Orthopaedic Pain

- Neuropathic Pain

- Post-operative Pain

- Cardiovascular Pain

- Others

By Distribution Channel:

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

By Region:

- North America

- Latin America

- Europe

- South Asia

- East Asia

- Oceania

- Middle East and Africa (MEA)

1. Executive Summary

1.1. Global Pain Relief Patches Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2023

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. COVID-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Global Pain Relief Patches Market Outlook, 2019 - 2031

3.1. Global Pain Relief Patches Market Outlook, by Product, Value (US$ Bn), 2019 - 2031

3.1.1. Key Highlights

3.1.1.1. Non-Steroidal Anti- Inflammatory Drug Patches

3.1.1.2. Ketroprofen Patches

3.1.1.3. Diclofenac Patches

3.1.1.4. Flurbiprofen Patches

3.1.1.5. Piroxicam Patches

3.1.1.6. Opioid Patches

3.1.1.7. Fentanyl Patches

3.1.1.8. Buprenorphine

3.1.1.9. Local Anaesthetic Patches

3.1.1.10. Nitro-glycerin Patches

3.1.1.11. Capsaicin Patches

3.1.1.12. Lidocaine Patches

3.2. Global Pain Relief Patches Market Outlook, by Indication, Value (US$ Bn), 2019 - 2031

3.2.1. Key Highlights

3.2.1.1. Menstrual Cramps

3.2.1.2. Orthopedic Pain

3.2.1.3. Neuropathic Pain

3.2.1.4. Post-Operative Pain

3.2.1.5. Cardiovascular Pain

3.2.1.6. Others

3.3. Global Pain Relief Patches Market Outlook, by Distribution Channel, Value (US$ Bn), 2019 - 2031

3.3.1. Key Highlights

3.3.1.1. Hospital Pharmacies

3.3.1.2. Retail Pharmacies

3.3.1.3. Online Pharmacies

3.4. Global Pain Relief Patches Market Outlook, by Region, Value (US$ Bn), 2019 - 2031

3.4.1. Key Highlights

3.4.1.1. North America

3.4.1.2. Europe

3.4.1.3. Asia Pacific

3.4.1.4. Latin America

3.4.1.5. Middle East & Africa

4. North America Pain Relief Patches Market Outlook, 2019 - 2031

4.1. North America Pain Relief Patches Market Outlook, by Product, Value (US$ Bn), 2019 - 2031

4.1.1. Key Highlights

4.1.1.1. Non-Steroidal Anti- Inflammatory Drug Patches

4.1.1.2. Ketroprofen Patches

4.1.1.3. Diclofenac Patches

4.1.1.4. Flurbiprofen Patches

4.1.1.5. Piroxicam Patches

4.1.1.6. Opioid Patches

4.1.1.7. Fentanyl Patches

4.1.1.8. Buprenorphine

4.1.1.9. Local Anaesthetic Patches

4.1.1.10. Nitro-glycerin Patches

4.1.1.11. Capsaicin Patches

4.1.1.12. Lidocaine Patches

4.2. North America Pain Relief Patches Market Outlook, by Indication, Value (US$ Bn), 2019 - 2031

4.2.1. Key Highlights

4.2.1.1. Menstrual Cramps

4.2.1.2. Orthopedic Pain

4.2.1.3. Neuropathic Pain

4.2.1.4. Post-Operative Pain

4.2.1.5. Cardiovascular Pain

4.2.1.6. Others

4.3. North America Pain Relief Patches Market Outlook, by Distribution Channel, Value (US$ Bn), 2019 - 2031

4.3.1. Key Highlights

4.3.1.1. Hospital Pharmacies

4.3.1.2. Retail Pharmacies

4.3.1.3. Online Pharmacies

4.3.2. BPS Analysis/Market Attractiveness Analysis

4.4. North America Pain Relief Patches Market Outlook, by Country, Value (US$ Bn), 2019 - 2031

4.4.1. Key Highlights

4.4.1.1. U.S. Pain Relief Patches Market by Product, Value (US$ Bn), 2019 - 2031

4.4.1.2. U.S. Pain Relief Patches Market by Indication, Value (US$ Bn), 2019 - 2031

4.4.1.3. U.S. Pain Relief Patches Market by Distribution Channel, Value (US$ Bn), 2019 - 2031

4.4.1.4. Canada Pain Relief Patches Market by Product, Value (US$ Bn), 2019 - 2031

4.4.1.5. Canada Pain Relief Patches Market by Indication, Value (US$ Bn), 2019 - 2031

4.4.1.6. Canada Pain Relief Patches Market by Distribution Channel, Value (US$ Bn), 2019 - 2031

4.4.2. BPS Analysis/Market Attractiveness Analysis

5. Europe Pain Relief Patches Market Outlook, 2019 - 2031

5.1. Europe Pain Relief Patches Market Outlook, by Product, Value (US$ Bn), 2019 - 2031

5.1.1. Key Highlights

5.1.1.1. Non-Steroidal Anti- Inflammatory Drug Patches

5.1.1.2. Ketroprofen Patches

5.1.1.3. Diclofenac Patches

5.1.1.4. Flurbiprofen Patches

5.1.1.5. Piroxicam Patches

5.1.1.6. Opioid Patches

5.1.1.7. Fentanyl Patches

5.1.1.8. Buprenorphine

5.1.1.9. Local Anaesthetic Patches

5.1.1.10. Nitro-glycerin Patches

5.1.1.11. Capsaicin Patches

5.1.1.12. Lidocaine Patches

5.2. Europe Pain Relief Patches Market Outlook, by Indication, Value (US$ Bn), 2019 - 2031

5.2.1. Key Highlights

5.2.1.1. Menstrual Cramps

5.2.1.2. Orthopedic Pain

5.2.1.3. Neuropathic Pain

5.2.1.4. Post-Operative Pain

5.2.1.5. Cardiovascular Pain

5.2.1.6. Others

5.3. Europe Pain Relief Patches Market Outlook, by Distribution Channel, Value (US$ Bn), 2019 - 2031

5.3.1. Key Highlights

5.3.1.1. Hospital Pharmacies

5.3.1.2. Retail Pharmacies

5.3.1.3. Online Pharmacies

5.3.2. BPS Analysis/Market Attractiveness Analysis

5.4. Europe Pain Relief Patches Market Outlook, by Country, Value (US$ Bn), 2019 - 2031

5.4.1. Key Highlights

5.4.1.1. Germany Pain Relief Patches Market by Product, Value (US$ Bn), 2019 - 2031

5.4.1.2. Germany Pain Relief Patches Market by Indication, Value (US$ Bn), 2019 - 2031

5.4.1.3. Germany Pain Relief Patches Market by Distribution Channel, Value (US$ Bn), 2019 - 2031

5.4.1.4. U.K. Pain Relief Patches Market by Product, Value (US$ Bn), 2019 - 2031

5.4.1.5. U.K. Pain Relief Patches Market by Indication, Value (US$ Bn), 2019 - 2031

5.4.1.6. U.K. Pain Relief Patches Market by Distribution Channel, Value (US$ Bn), 2019 - 2031

5.4.1.7. France Pain Relief Patches Market by Product, Value (US$ Bn), 2019 - 2031

5.4.1.8. France Pain Relief Patches Market by Indication, Value (US$ Bn), 2019 - 2031

5.4.1.9. France Pain Relief Patches Market by Distribution Channel, Value (US$ Bn), 2019 - 2031

5.4.1.10. Italy Pain Relief Patches Market by Product, Value (US$ Bn), 2019 - 2031

5.4.1.11. Italy Pain Relief Patches Market by Indication, Value (US$ Bn), 2019 - 2031

5.4.1.12. Italy Pain Relief Patches Market by Distribution Channel, Value (US$ Bn), 2019 - 2031

5.4.1.13. Turkey Pain Relief Patches Market by Product, Value (US$ Bn), 2019 - 2031

5.4.1.14. Turkey Pain Relief Patches Market by Indication, Value (US$ Bn), 2019 - 2031

5.4.1.15. Turkey Pain Relief Patches Market by Distribution Channel, Value (US$ Bn), 2019 - 2031

5.4.1.16. Russia Pain Relief Patches Market by Product, Value (US$ Bn), 2019 - 2031

5.4.1.17. Russia Pain Relief Patches Market by Indication, Value (US$ Bn), 2019 - 2031

5.4.1.18. Russia Pain Relief Patches Market by Distribution Channel, Value (US$ Bn), 2019 - 2031

5.4.1.19. Rest of Europe Pain Relief Patches Market by Product, Value (US$ Bn), 2019 - 2031

5.4.1.20. Rest of Europe Pain Relief Patches Market by Indication, Value (US$ Bn), 2019 - 2031

5.4.1.21. Rest of Europe Pain Relief Patches Market by Distribution Channel, Value (US$ Bn), 2019 - 2031

5.4.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Pain Relief Patches Market Outlook, 2019 - 2031

6.1. Asia Pacific Pain Relief Patches Market Outlook, by Product, Value (US$ Bn), 2019 - 2031

6.1.1. Key Highlights

6.1.1.1. Non-Steroidal Anti- Inflammatory Drug Patches

6.1.1.2. Ketroprofen Patches

6.1.1.3. Diclofenac Patches

6.1.1.4. Flurbiprofen Patches

6.1.1.5. Piroxicam Patches

6.1.1.6. Opioid Patches

6.1.1.7. Fentanyl Patches

6.1.1.8. Buprenorphine

6.1.1.9. Local Anaesthetic Patches

6.1.1.10. Nitro-glycerin Patches

6.1.1.11. Capsaicin Patches

6.1.1.12. Lidocaine Patches

6.2. Asia Pacific Pain Relief Patches Market Outlook, by Indication, Value (US$ Bn), 2019 - 2031

6.2.1. Key Highlights

6.2.1.1. Menstrual Cramps

6.2.1.2. Orthopedic Pain

6.2.1.3. Neuropathic Pain

6.2.1.4. Post-Operative Pain

6.2.1.5. Cardiovascular Pain

6.2.1.6. Others

6.3. Asia Pacific Pain Relief Patches Market Outlook, by Distribution Channel, Value (US$ Bn), 2019 - 2031

6.3.1. Key Highlights

6.3.1.1. Hospital Pharmacies

6.3.1.2. Retail Pharmacies

6.3.1.3. Online Pharmacies

6.3.2. BPS Analysis/Market Attractiveness Analysis

6.4. Asia Pacific Pain Relief Patches Market Outlook, by Country, Value (US$ Bn), 2019 - 2031

6.4.1. Key Highlights

6.4.1.1. China Pain Relief Patches Market by Product, Value (US$ Bn), 2019 - 2031

6.4.1.2. China Pain Relief Patches Market by Indication, Value (US$ Bn), 2019 - 2031

6.4.1.3. China Pain Relief Patches Market by Distribution Channel, Value (US$ Bn), 2019 - 2031

6.4.1.4. Japan Pain Relief Patches Market by Product, Value (US$ Bn), 2019 - 2031

6.4.1.5. Japan Pain Relief Patches Market by Indication, Value (US$ Bn), 2019 - 2031

6.4.1.6. Japan Pain Relief Patches Market by Distribution Channel, Value (US$ Bn), 2019 - 2031

6.4.1.7. South Korea Pain Relief Patches Market by Product, Value (US$ Bn), 2019 - 2031

6.4.1.8. South Korea Pain Relief Patches Market by Indication, Value (US$ Bn), 2019 - 2031

6.4.1.9. South Korea Pain Relief Patches Market by Distribution Channel, Value (US$ Bn), 2019 - 2031

6.4.1.10. India Pain Relief Patches Market by Product, Value (US$ Bn), 2019 - 2031

6.4.1.11. India Pain Relief Patches Market by Indication, Value (US$ Bn), 2019 - 2031

6.4.1.12. India Pain Relief Patches Market by Distribution Channel, Value (US$ Bn), 2019 - 2031

6.4.1.13. Southeast Asia Pain Relief Patches Market by Product, Value (US$ Bn), 2019 - 2031

6.4.1.14. Southeast Asia Pain Relief Patches Market by Indication, Value (US$ Bn), 2019 - 2031

6.4.1.15. Southeast Asia Pain Relief Patches Market by Distribution Channel, Value (US$ Bn), 2019 - 2031

6.4.1.16. Rest of Asia Pacific Pain Relief Patches Market by Product, Value (US$ Bn), 2019 - 2031

6.4.1.17. Rest of Asia Pacific Pain Relief Patches Market by Indication, Value (US$ Bn), 2019 - 2031

6.4.1.18. Rest of Asia Pacific Pain Relief Patches Market by Distribution Channel, Value (US$ Bn), 2019 - 2031

6.4.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America Pain Relief Patches Market Outlook, 2019 - 2031

7.1. Latin America Pain Relief Patches Market Outlook, by Product, Value (US$ Bn), 2019 - 2031

7.1.1. Key Highlights

7.1.1.1. Non-Steroidal Anti- Inflammatory Drug Patches

7.1.1.2. Ketroprofen Patches

7.1.1.3. Diclofenac Patches

7.1.1.4. Flurbiprofen Patches

7.1.1.5. Piroxicam Patches

7.1.1.6. Opioid Patches

7.1.1.7. Fentanyl Patches

7.1.1.8. Buprenorphine

7.1.1.9. Local Anaesthetic Patches

7.1.1.10. Nitro-glycerin Patches

7.1.1.11. Capsaicin Patches

7.1.1.12. Lidocaine Patches

7.2. Latin America Pain Relief Patches Market Outlook, by Indication, Value (US$ Bn), 2019 - 2031

7.2.1. Key Highlights

7.2.1.1. Hospital Pharmacies

7.2.1.2. Retail Pharmacies

7.2.1.3. Online Pharmacies

7.3. Latin America Pain Relief Patches Market Outlook, by Distribution Channel, Value (US$ Bn), 2019 - 2031

7.3.1. Key Highlights

7.3.1.1. Menstrual Cramps

7.3.1.2. Orthopedic Pain

7.3.1.3. Neuropathic Pain

7.3.1.4. Post-Operative Pain

7.3.1.5. Cardiovascular Pain

7.3.1.6. Others

7.3.2. BPS Analysis/Market Attractiveness Analysis

7.4. Latin America Pain Relief Patches Market Outlook, by Country, Value (US$ Bn), 2019 - 2031

7.4.1. Key Highlights

7.4.1.1. Brazil Pain Relief Patches Market by Product, Value (US$ Bn), 2019 - 2031

7.4.1.2. Brazil Pain Relief Patches Market by Indication, Value (US$ Bn), 2019 - 2031

7.4.1.3. Brazil Pain Relief Patches Market by Distribution Channel, Value (US$ Bn), 2019 - 2031

7.4.1.4. Mexico Pain Relief Patches Market by Product, Value (US$ Bn), 2019 - 2031

7.4.1.5. Mexico Pain Relief Patches Market by Indication, Value (US$ Bn), 2019 - 2031

7.4.1.6. Mexico Pain Relief Patches Market by Distribution Channel, Value (US$ Bn), 2019 - 2031

7.4.1.7. Argentina Pain Relief Patches Market by Product, Value (US$ Bn), 2019 - 2031

7.4.1.8. Argentina Pain Relief Patches Market by Indication, Value (US$ Bn), 2019 - 2031

7.4.1.9. Argentina Pain Relief Patches Market by Distribution Channel, Value (US$ Bn), 2019 - 2031

7.4.1.10. Rest of Latin America Pain Relief Patches Market by Product, Value (US$ Bn), 2019 - 2031

7.4.1.11. Rest of Latin America Pain Relief Patches Market by Indication, Value (US$ Bn), 2019 - 2031

7.4.1.12. Rest of Latin America Pain Relief Patches Market by Distribution Channel, Value (US$ Bn), 2019 - 2031

7.4.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Pain Relief Patches Market Outlook, 2019 - 2031

8.1. Middle East & Africa Pain Relief Patches Market Outlook, by Product, Value (US$ Bn), 2019 - 2031

8.1.1. Key Highlights

8.1.1.1. Non-Steroidal Anti- Inflammatory Drug Patches

8.1.1.2. Ketroprofen Patches

8.1.1.3. Diclofenac Patches

8.1.1.4. Flurbiprofen Patches

8.1.1.5. Piroxicam Patches

8.1.1.6. Opioid Patches

8.1.1.7. Fentanyl Patches

8.1.1.8. Buprenorphine

8.1.1.9. Local Anaesthetic Patches

8.1.1.10. Nitro-glycerin Patches

8.1.1.11. Capsaicin Patches

8.1.1.12. Lidocaine Patches

8.2. Middle East & Africa Pain Relief Patches Market Outlook, by Indication, Value (US$ Bn), 2019 - 2031

8.2.1. Key Highlights

8.2.1.1. Menstrual Cramps

8.2.1.2. Orthopedic Pain

8.2.1.3. Neuropathic Pain

8.2.1.4. Post-Operative Pain

8.2.1.5. Cardiovascular Pain

8.2.1.6. Others

8.3. Middle East & Africa Pain Relief Patches Market Outlook, by Distribution Channel, Value (US$ Bn), 2019 - 2031

8.3.1. Key Highlights

8.3.1.1. Hospital Pharmacies

8.3.1.2. Retail Pharmacies

8.3.1.3. Online Pharmacies

8.3.2. BPS Analysis/Market Attractiveness Analysis

8.4. Middle East & Africa Pain Relief Patches Market Outlook, by Country, Value (US$ Bn), 2019 - 2031

8.4.1. Key Highlights

8.4.1.1. GCC Pain Relief Patches Market by Product, Value (US$ Bn), 2019 - 2031

8.4.1.2. GCC Pain Relief Patches Market by Indication, Value (US$ Bn), 2019 - 2031

8.4.1.3. GCC Pain Relief Patches Market by Distribution Channel, Value (US$ Bn), 2019 - 2031

8.4.1.4. South Africa Pain Relief Patches Market by Product, Value (US$ Bn), 2019 - 2031

8.4.1.5. South Africa Pain Relief Patches Market by Indication, Value (US$ Bn), 2019 - 2031

8.4.1.6. South Africa Pain Relief Patches Market by Distribution Channel, Value (US$ Bn), 2019 - 2031

8.4.1.7. Egypt Pain Relief Patches Market by Product, Value (US$ Bn), 2019 - 2031

8.4.1.8. Egypt Pain Relief Patches Market by Indication, Value (US$ Bn), 2019 - 2031

8.4.1.9. Egypt Pain Relief Patches Market by Distribution Channel, Value (US$ Bn), 2019 - 2031

8.4.1.10. Nigeria Pain Relief Patches Market by Product, Value (US$ Bn), 2019 - 2031

8.4.1.11. Nigeria Pain Relief Patches Market by Indication, Value (US$ Bn), 2019 - 2031

8.4.1.12. Nigeria Pain Relief Patches Market by Distribution Channel, Value (US$ Bn), 2019 - 2031

8.4.1.13. Rest of Middle East & Africa Pain Relief Patches Market by Product, Value (US$ Bn), 2019 - 2031

8.4.1.14. Rest of Middle East & Africa Pain Relief Patches Market by Indication, Value (US$ Bn), 2019 - 2031

8.4.1.15. Rest of Middle East & Africa Pain Relief Patches Market by Distribution Channel, Value (US$ Bn), 2019 - 2031

8.4.2. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. By Distribution Channel vs by Indication Heat map

9.2. Manufacturer vs by Indication Heatmap

9.3. Company Market Share Analysis, 2022

9.4. Competitive Dashboard

9.5. Company Profiles

9.5.1. Viatris, Inc. (Mylan)

9.5.1.1. Company Overview

9.5.1.2. Product Portfolio

9.5.1.3. Financial Overview

9.5.1.4. Business Strategies and Development

9.5.2. Obalon Therapeutics, Inc.

9.5.2.1. Company Overview

9.5.2.2. Product Portfolio

9.5.2.3. Financial Overview

9.5.2.4. Business Strategies and Development

9.5.3. Johnson & Johnson Services, Inc.

9.5.3.1. Company Overview

9.5.3.2. Product Portfolio

9.5.3.3. Financial Overview

9.5.3.4. Business Strategies and Development

9.5.4. Teva Pharmaceutical Industries Ltd.

9.5.4.1. Company Overview

9.5.4.2. Product Portfolio

9.5.4.3. Financial Overview

9.5.4.4. Business Strategies and Development

9.5.5. Sanofi S.A.

9.5.5.1. Company Overview

9.5.5.2. Product Portfolio

9.5.5.3. Financial Overview

9.5.5.4. Business Strategies and Development

9.5.6. Hisamitsu Pharmaceutical Co., Inc.

9.5.6.1. Company Overview

9.5.6.2. Product Portfolio

9.5.6.3. Financial Overview

9.5.6.4. Business Strategies and Development

9.5.7. GlaxoSmithKline Plc.

9.5.7.1. Company Overview

9.5.7.2. Product Portfolio

9.5.7.3. Financial Overview

9.5.7.4. Business Strategies and Development

9.5.8. Novartis AG

9.5.8.1. Company Overview

9.5.8.2. Product Portfolio

9.5.8.3. Financial Overview

9.5.8.4. Business Strategies and Development

9.5.9. Nichiban Co., Ltd.

9.5.9.1. Company Overview

9.5.9.2. Product Portfolio

9.5.9.3. Financial Overview

9.5.9.4. Business Strategies and Development

9.5.10. Teikoku Seiyaku Co, Ltd.

9.5.10.1. Company Overview

9.5.10.2. Product Portfolio

9.5.10.3. Financial Overview

9.5.10.4. Business Strategies and Development

9.5.11. Mentholatum Company.

9.5.11.1. Company Overview

9.5.11.2. Product Portfolio

9.5.11.3. Financial Overview

9.5.11.4. Business Strategies and Development

9.5.12. Purdue Pharma L.P.

9.5.12.1. Company Overview

9.5.12.2. Product Portfolio

9.5.12.3. Financial Overview

9.5.12.4. Business Strategies and Development

9.5.13. West-Ward Pharmaceuticals Corporation

9.5.13.1. Company Overview

9.5.13.2. Product Portfolio

9.5.13.3. Financial Overview

9.5.13.4. Business Strategies and Development

9.5.14. Pfizer, Inc

9.5.14.1. Company Overview

9.5.14.2. Product Portfolio

9.5.14.3. Financial Overview

9.5.14.4. Business Strategies and Development

9.5.15. Allergan Plc (Actavis)

9.5.15.1. Company Overview

9.5.15.2. Product Portfolio

9.5.15.3. Financial Overview

9.5.15.4. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2023 |

|

2019 - 2023 |

2024 - 2031 |

Value: US$ Billion |

||

|

REPORT FEATURES |

DETAILS |

|

Product Coverage |

|

|

Indication Coverage |

|

|

Distribution Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |