Global Palm Oil Market Forecast

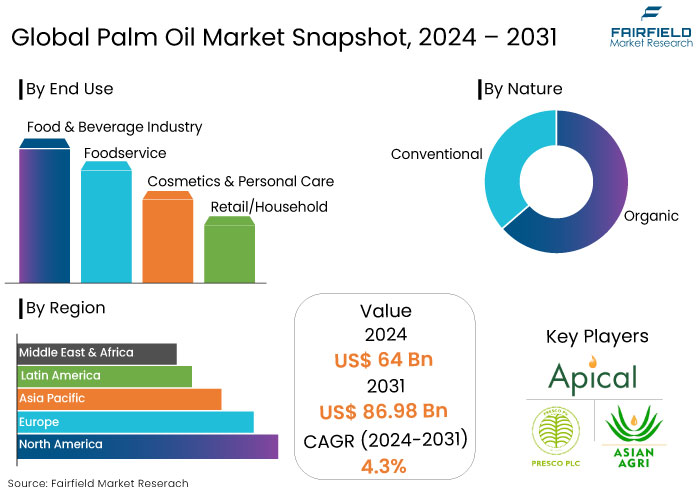

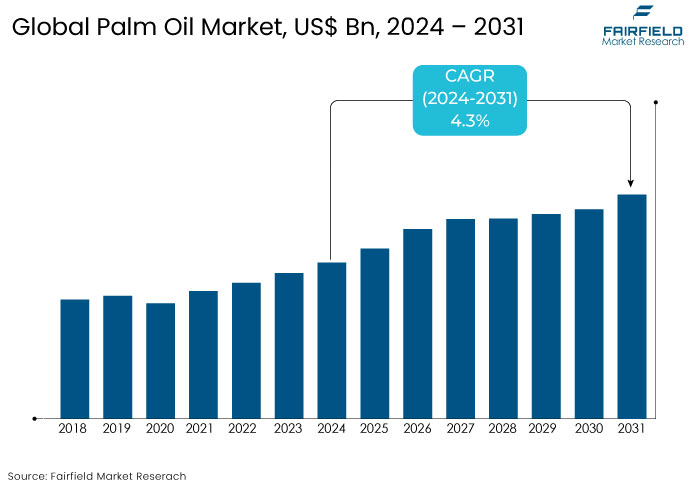

- The palm oil market is anticipated to be worth of US$64 Bn by 2024. It is estimated to reach a value of US$86.98 Bn by 2031.

- The market for palm oil is projected to expand at a CAGR of 4.3% over the assessment period from 2024 to 2031.

Palm Oil Market Insights

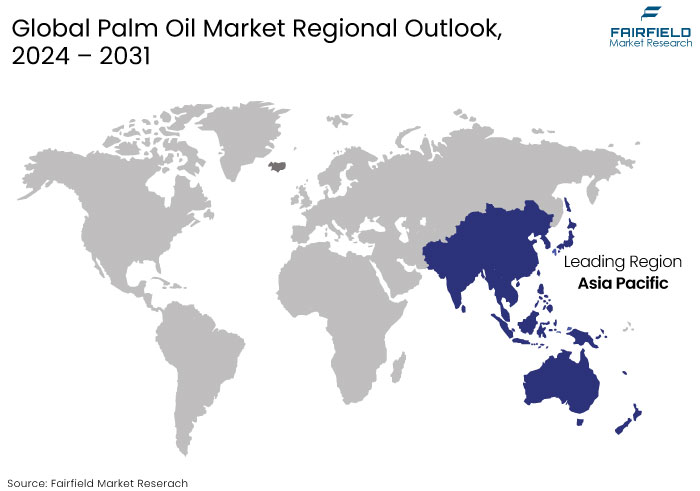

- Asia Pacific accounts for over 68% of the market share, driven by large-scale production in Indonesia and Malaysia.

- The food and beverage sector is the largest consumer of palm oil, representing approximately 66% of global usage.

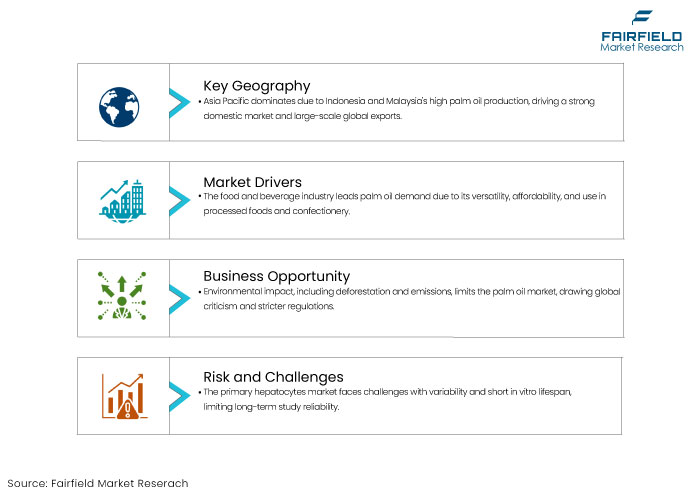

- Government mandates like Indonesia’s B30 program fuel demand for palm oil in the renewable energy sector.

- Rising consumer awareness is increasing the demand for certified sustainable palm oil (CSPO), especially in Europe and North America.

- Conventional palm oil dominates the palm oil market with its widespread availability & cost effectiveness.

- Advancements in yield optimization and sustainable farming techniques are reshaping production methods.

- Palm oil is preferred due to its low cost and high productivity per hectare, making it a staple in emerging markets.

- Countries like India and China are the largest importers, driving consumption in food, personal care, and household applications.

A Look Back and a Look Forward - Comparative Analysis

The palm oil market experienced consistent growth during the period from 2019 to 2023. The market fueled by rising demand in the food and beverage industry, where palm oil is used for cooking oils, margarine, and processed foods.

Compared to other vegetable oils, its affordability and versatility cemented its position as a global staple. Leading producers such as Indonesia and Malaysia dominated exports, while countries like India and China led imports.

The market also expanded into biofuel production, especially in Southeast Asia, due to government mandates like Indonesia's B30 biodiesel program. However, environmental concerns, deforestation, and sustainability challenges slowed market expansion in regions like Europe, where demand shifted toward certified sustainable palm oil (CSPO).

The market is projected to grow with demand increasingly influenced by sustainability trends and innovations in palm oil alternatives over the forecast period. Asia Pacific to remain dominant, but sustainable and organic segments are expected to see accelerated growth, fueled by rising consumer awareness of health and environmental impacts.

Government regulations promoting sustainable practices and biofuel adoption will further drive growth. Meanwhile, technological advancements in sustainable cultivation and adoption of RSPO-certified palm oil are anticipated to shape the palm oil market growth.

Key Growth Determinants

- Rising Demand in the Food and Beverage Industry

The food and beverage industry is the largest consumer of palm oil, accounting for a significant share of global demand. Palm oil’s versatility, semi-solid consistency at room temperature, and neutral taste make it a preferred ingredient in processed foods, baked goods, margarine, and confectionery. Compared to other vegetable oils, its affordability ensures widespread use in emerging economies, where food manufacturers prioritize cost-effective ingredients.

Growing urbanization and changing dietary patterns, especially in populous regions like Asia Pacific, have increased consumption of packaged and convenience foods, further driving demand. This trend is amplified by palm oil’s ability to enhance product shelf life and texture, making it an essential component for food producers worldwide.

- Growing Adoption of Sustainable Palm Oil Increases Sales

The increasing awareness of environmental and social concerns surrounding palm oil production drives demand for sustainably sourced products. Certifications like the Roundtable on Sustainable Palm Oil (RSPO) and government initiatives promoting sustainable practices are reshaping the palm oil market.

Consumers in Europe and North America increasingly opt for certified sustainable palm oil (CSPO), particularly in cosmetics, personal care, and food products. Companies are aligning with global sustainability standards to cater to eco-conscious consumers while addressing deforestation, biodiversity loss, and human rights issues in the supply chain. The said shift ensures market growth and encourages responsible production practices, benefiting the industry’s long-term sustainability.

Key Growth Barriers

- Environmental Concerns and Deforestation Remains a Key Barrier

One of the most significant restraints for the palm oil market is the environmental impact associated with its production. Large-scale cultivation of oil palm plantations has been linked to deforestation, loss of biodiversity, and increased greenhouse gas emissions, particularly in producing regions like Indonesia and Malaysia. These environmental challenges have led to global criticism from environmental organizations and stricter regulations in key markets such as Europe.

The European Union’s Renewable Energy Directive II (RED II) limits the use of biofuels derived from palm oil due to concerns over indirect land-use change (ILUC). The reputational damage associated with unsustainable practices has forced companies to shift to alternative oils or invest heavily in sustainability certifications like RSPO. These efforts, while necessary, increase costs and reduce profit margins for producers, potentially hindering market expansion.

- Market Volatility and Trade Restrictions

The palm oil market is highly sensitive to fluctuations in trade policies, import/export duties, and geopolitical tensions. India, one of the largest importers of palm oil, frequently adjusts import duties to balance domestic oilseed production with consumer demand, creating uncertainty for exporters.

Indonesia’s export restrictions during supply shortages in 2022 caused significant disruptions in global markets. Such volatility impacts pricing and supply chain stability, deterring long-term investments.

The increasing competition from alternative oils like sunflower, soybean, and rapeseed, especially in developed markets, adds pressure on palm oil’s market share. This combination of trade restrictions and competitive forces limits the market’s ability to grow steadily, making it susceptible to economic and political factors.

Palm Oil Market Trends and Opportunities

- Increasing Focus on Certified Sustainable Palm Oil (CSPO)

The shift toward sustainability is a dominant trend shaping the palm oil market. With growing awareness of the environmental and social issues associated with palm oil production, consumers and regulators are pushing for more sustainable practices.

Certification programs like the Roundtable on Sustainable Palm Oil (RSPO) and the Palm Oil Innovation Group (POIG) have gained traction, providing frameworks for sustainable production and ethical sourcing. Leading consumer markets, particularly Europe and North America, have preferred certified sustainable palm oil (CSPO) in food, cosmetics, and personal care products.

Retailers and manufacturers, under pressure to meet consumer expectations and corporate sustainability goals, are increasingly adopting CSPO in their supply chains. Companies like Unilever and Nestlé have committed to sourcing 100% sustainable palm oil. This trend is also reflected in the policies of governments and industry coalitions, driving transparency and traceability in the supply chain.

As more producers align with these certifications, the market gradually transforms toward environmentally responsible practices. The emphasis on sustainability is expected to continue, ensuring the market grows while mitigating its negative impacts.

- Expansion of Palm Oil in Biofuel Applications

The growing emphasis on renewable energy presents a significant opportunity for the palm oil market, particularly in biofuel production. Palm oil-based biodiesel, due to its high energy efficiency and cost-effectiveness, is a preferred alternative to fossil fuels.

Countries like Indonesia and Malaysia, leading palm oil producers, have implemented biodiesel blending mandates such as Indonesia’s B30 program (30% palm oil in biodiesel). These initiatives aim to reduce carbon emissions, boost domestic consumption, and lower dependence on imported fuels.

The global shift toward clean energy and decarbonisation aligns with the increased adoption of biodiesel, particularly in regions with ambitious renewable energy targets, such as the European Union and India. Technological advancements in biofuel production are improving efficiency and reducing the environmental footprint of palm oil-based biodiesel, making it more competitive.

The opportunity to integrate palm oil into broad bioenergy solutions, such as sustainable aviation fuels (SAFs), further expands its potential applications. As governments and industries strive to meet renewable energy goals, palm oil’s role in biofuels offers a lucrative growth avenue for producers and investors.

How Does Regulatory Scenario Shape the Industry?

The regulatory environment significantly influences the dynamics of the global palm oil market, balancing growth opportunities with sustainability and ethical considerations. In leading producing countries like Indonesia and Malaysia, regulations focus on enhancing production efficiency while addressing environmental concerns.

Programs such as Indonesia’s B30 mandate encourage the domestic use of palm oil in biodiesel production, reducing dependence on exports and fossil fuels. In consumer markets, particularly in Europe, stringent regulations target the environmental and social impacts of palm oil.

The European Union's Renewable Energy Directive II (RED II) limits palm oil-based biofuels due to concerns over deforestation and carbon emissions linked to land-use changes. Similarly, import restrictions tied to sustainability certifications, such as the Roundtable on Sustainable Palm Oil (RSPO), are gaining momentum in regions with eco-conscious consumers.

Corporate and voluntary initiatives also play a crucial role; as multinational companies commit to sourcing 100% certified sustainable palm oil. These efforts are complemented by consumer-driven policies requiring clear labelling and traceability in supply chains.

Regulations are steering the market toward more sustainable practices, pushing producers to adopt certified and transparent operations to retain market access while fostering environmentally and socially responsible growth.

Segments Covered in the Report

- Conventional Palm Oil Take the Lead with its Widespread availability & Cost Effectiveness

Conventional palm oil is produced on a large scale using high-yielding hybrid oil palm varieties and intensive farming techniques, making it cheaper to produce compared to organic alternatives. The affordability of conventional palm oil appeals to industries in food, cosmetics, and biofuels that require large quantities at competitive prices.

Palm oil plantations produce more oil per hectare compared to other vegetable oils like soybean or sunflower oil, making conventional farming methods a preferred choice for mass production. Conventional farming ensures a steady, high-volume output, essential for meeting global demand in key markets such as Asia, North America, and Europe.

Conventional palm oil benefits from a mature supply chain with established networks in leading producing countries like Indonesia and Malaysia. Policies in palm oil producing countries often prioritize conventional palm oil to support their economies and export revenue.

Despite growing concerns over environmental and social issues associated with conventional palm oil, its dominance is expected to continue due to its economic importance and versatility.

Versatility of Palm Oil in Food Applications to Lead with a 66% of Market Share

Semi-solid state of palm oil at room temperature and high oxidative stability make it ideal for culinary uses. It's a key ingredient in margarine, baked goods, and confectioneries, providing desirable textures and extending shelf life. Its neutral flavour allows it to be used without altering the taste of food products.

Palm oil is more affordable than other vegetable oils due to its high yield per hectare and efficient production processes. This cost advantage makes it a preferred choice for manufacturers aiming to manage production expenses while maintaining product quality.

Its functional properties and economic benefits drive the widespread use of palm oil in the food and beverage industry. As global populations grow and urbanize, the demand for processed and packaged foods increases, further solidifying palm oil's role in this sector.

Regional Analysis

- Asia Pacific Palm Oil Market Emerges Lucrative

The dominance of Asia Pacific is primarily attributed to the substantial production capacities of countries like Indonesia and Malaysia, which together account for a significant portion of the world's palm oil output. The extensive production supports a robust domestic market and facilitates large-scale exports to meet global demand.

The region's notably growing population and increasing urbanization have led to heightened consumption of palm oil-based products, particularly in the food and beverage industry. Also, the versatility and cost-effectiveness of palm oil make it a staple in various culinary applications, further solidifying its market dominance in this region.

Asia Pacific is home to a large and rapidly urbanizing population, has witnessed an increased demand for palm oil in processed foods, cooking oils, and ready-to-eat products. Markets like India, China, and Indonesia are leading consumers. India is the largest importer of palm oil globally, utilizing it extensively in food and household applications. China relies significantly on palm oil for cooking, food processing, and industrial uses.

- Europe Emerges as the Second-Largest Consumer of Palm Oil

The Europe market growth is driven by the extensive use of palm oil in processed foods, cosmetics, and biofuels. However, the region has witnessed a growing emphasis on sustainability and environmental concerns associated with palm oil production. It has led to increased demand for certified sustainable palm oil (CSPO) and a push toward more stringent sourcing policies.

Europe's significant consumption levels underscore its pivotal role in the global palm oil market despite these challenges. Europe maintains its position as a key consumer, influenced by industrial demand and sustainability considerations.

Fairfield’s Competitive Landscape Analysis

The palm oil market is highly competitive and dominated by key players like Wilmar International, Sime Darby Plantation, IOI Corporation, and Golden Agri-Resources. These companies control large portions of production, refining, and distribution, primarily in Indonesia and Malaysia, the leading palm oil-producing nations.

Competitors differentiate themselves through vertical integration, sustainability certifications like RSPO, and technological innovations to improve yield and reduce environmental impacts. Small players and regional firms face challenges meeting sustainability standards but remain active in local markets.

Rising consumer demand for certified sustainable palm oil (CSPO) has intensified competition, with companies investing in traceable and eco-friendly supply chains to secure market share in Europe and America.

Key Market Companies

- Olam International

- Archer Daniels Midland Company

- Presco PLC

- Agarwal Industries Pvt. Ltd.

- Asian Agri

- Apical Group Ltd.

- IOI Corp Bhd

- Oleo-Fats, Incorporated

- Agropalma Group

- Golden Agri-Resources Ltd.

- Sime Darby Oils Liverpool Refinery Ltd.

- Cargill, Incorporated

- Liberty Oil Mills Ltd.

- Adams Group, Inc.

Recent Industry Developments

- In October 2023, KTC, a leading UK edible oils supplier, introduced "Planet Palm," a new line of RSPO-certified sustainable palm oil products tailored for the UK bakery and food sectors.

- In December 2024, Indonesia announced plans to increase its biodiesel mandate to 40% (B40) by January 1, 2025. Industry stakeholders anticipate a gradual rollout due to infrastructure and funding challenges.

An Expert’s Eye

- The increasing adoption of sustainable practices, like RSPO certification, is critical for addressing environmental and social concerns while maintaining market growth.

- Industry specialists view biofuel mandates, such as Indonesia's B30 and the potential B40, as significant growth drivers, particularly in renewable energy markets.

- Environmentalists warn that the industry must prioritize reforestation and sustainable farming to combat deforestation and biodiversity loss associated with palm oil plantations.

- Increasing consumer demand for certified sustainable palm oil in developed markets reshaping global supply chains and enhancing transparency.

Global Palm Oil Market is Segmented as-

By Nature

- Organic

- Conventional

By End Use

- Food & Beverage Industry

- Foodservice

- Cosmetics & Personal Care

- Retail/Household

By Distribution Channel

- B2B

- B2C

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- The Middle East & Africa

1. Executive Summary

1.1. Global Palm Oil Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value and Volume, 2023

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. COVID-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Price Analysis, 2019 - 2023

3.1. Global Average Price Analysis, by Nature, US$ Per Unit, 2019 - 2023

3.2. Prominent Factor Affecting Palm oil Prices

3.3. Global Average Price Analysis, by Region, US$ Per Unit

4. Global Palm Oil Market Outlook, 2019 - 2031

4.1. Global Palm Oil Market Outlook, by Nature, Value (US$ Bn) and Volume (Tons), 2019 - 2031

4.1.1. Key Highlights

4.1.1.1. Organic Palm Oil

4.1.1.2. Conventional Palm Oil

4.2. Global Palm Oil Market Outlook, by End User, Value (US$ Bn) and Volume (Tons), 2019 - 2031

4.2.1. Key Highlights

4.2.1.1. Food & Beverage Industry

4.2.1.2. Foodservice

4.2.1.3. Cosmetics & Personal Care

4.2.1.4. Retail/Household

4.3. Global Palm Oil Market Outlook, by Distribution Channel, Value (US$ Bn) and Volume (Tons), 2019 - 2031

4.3.1. Key Highlights

4.3.1.1. Business to Business Sales of Palm Oil

4.3.1.2. Business to Consumer Sales of Palm Oi

4.4. Global Palm Oil Market Outlook, by Region, Value (US$ Bn) and Volume (Tons), 2019 - 2031

4.4.1. Key Highlights

4.4.1.1. North America

4.4.1.2. Europe

4.4.1.3. Asia Pacific

4.4.1.4. Latin America

4.4.1.5. Middle East & Africa

5. North America Palm Oil Market Outlook, 2019 - 2031

5.1. North America Palm Oil Market Outlook, by Nature, Value (US$ Bn) and Volume (Tons), 2019 - 2031

5.1.1. Key Highlights

5.1.1.1. Organic Palm Oil

5.1.1.2. Conventional Palm Oil

5.2. North America Palm Oil Market Outlook, by End User, Value (US$ Bn) and Volume (Tons), 2019 - 2031

5.2.1. Key Highlights

5.2.1.1. Food & Beverage Industry

5.2.1.2. Foodservice

5.2.1.3. Cosmetics & Personal Care

5.2.1.4. Retail/Household

5.3. North America Palm Oil Market Outlook, by Distribution Channel, Value (US$ Bn) and Volume (Tons), 2019 - 2031

5.3.1. Key Highlights

5.3.1.1. Business to Business Sales of Palm Oil

5.3.1.2. Business to Consumer Sales of Palm Oi

5.4. North America Palm Oil Market Outlook, by Country, Value (US$ Bn) and Volume (Tons), 2019 - 2031

5.4.1. Key Highlights

5.4.1.1. U.S. Palm Oil Market by Nature, Value (US$ Bn) and Volume (Tons), 2019 - 2031

5.4.1.2. U.S. Palm Oil Market by End User, Value (US$ Bn) and Volume (Tons), 2019 - 2031

5.4.1.3. U.S. Palm Oil Market by Distribution Channel, Value (US$ Bn) and Volume (Tons), 2019 - 2031

5.4.1.4. Canada Palm Oil Market by Nature, Value (US$ Bn) and Volume (Tons), 2019 - 2031

5.4.1.5. Canada Palm Oil Market by End User, Value (US$ Bn) and Volume (Tons), 2019 - 2031

5.4.1.6. Canada Palm Oil Market by Distribution Channel, Value (US$ Bn) and Volume (Tons), 2019 - 2031

5.4.2. BPS Analysis/Market Attractiveness Analysis

6. Europe Palm Oil Market Outlook, 2019 - 2031

6.1. Europe Palm Oil Market Outlook, by Nature, Value (US$ Bn) and Volume (Tons), 2019 - 2031

6.1.1. Key Highlights

6.1.1.1. Organic Palm Oil

6.1.1.2. Conventional Palm Oil

6.2. Europe Palm Oil Market Outlook, by End User, Value (US$ Bn) and Volume (Tons), 2019 - 2031

6.2.1. Key Highlights

6.2.1.1. Food & Beverage Industry

6.2.1.2. Foodservice

6.2.1.3. Cosmetics & Personal Care

6.2.1.4. Retail/Household

6.3. Europe Palm Oil Market Outlook, by Distribution Channel, Value (US$ Bn) and Volume (Tons), 2019 - 2031

6.3.1. Key Highlights

6.3.1.1. Business to Business Sales of Palm Oil

6.3.1.2. Business to Consumer Sales of Palm Oi

6.4. Europe Palm Oil Market Outlook, by Country, Value (US$ Bn) and Volume (Tons), 2019 - 2031

6.4.1. Key Highlights

6.4.1.1. Germany Palm Oil Market by Nature, Value (US$ Bn) and Volume (Tons), 2019 - 2031

6.4.1.2. Germany Palm Oil Market by End User, Value (US$ Bn) and Volume (Tons), 2019 - 2031

6.4.1.3. Germany Palm Oil Market by Distribution Channel, Value (US$ Bn) and Volume (Tons), 2019 - 2031

6.4.1.4. U.K. Palm Oil Market by Nature, Value (US$ Bn) and Volume (Tons), 2019 - 2031

6.4.1.5. U.K. Palm Oil Market by End User, Value (US$ Bn) and Volume (Tons), 2019 - 2031

6.4.1.6. U.K. Palm Oil Market by Distribution Channel, Value (US$ Bn) and Volume (Tons), 2019 - 2031

6.4.1.7. France Palm Oil Market by Nature, Value (US$ Bn) and Volume (Tons), 2019 - 2031

6.4.1.8. France Palm Oil Market by End User, Value (US$ Bn) and Volume (Tons), 2019 - 2031

6.4.1.9. France Palm Oil Market by Distribution Channel, Value (US$ Bn) and Volume (Tons), 2019 - 2031

6.4.1.10. Italy Palm Oil Market by Nature, Value (US$ Bn) and Volume (Tons), 2019 - 2031

6.4.1.11. Italy Palm Oil Market by End User, Value (US$ Bn) and Volume (Tons), 2019 - 2031

6.4.1.12. Italy Palm Oil Market by Distribution Channel, Value (US$ Bn) and Volume (Tons), 2019 - 2031

6.4.1.13. Turkey Palm Oil Market by Nature, Value (US$ Bn) and Volume (Tons), 2019 - 2031

6.4.1.14. Turkey Palm Oil Market by End User, Value (US$ Bn) and Volume (Tons), 2019 - 2031

6.4.1.15. Turkey Palm Oil Market by Distribution Channel, Value (US$ Bn) and Volume (Tons), 2019 - 2031

6.4.1.16. Russia Palm Oil Market by Nature, Value (US$ Bn) and Volume (Tons), 2019 - 2031

6.4.1.17. Russia Palm Oil Market by End User, Value (US$ Bn) and Volume (Tons), 2019 - 2031

6.4.1.18. Russia Palm Oil Market by Distribution Channel, Value (US$ Bn) and Volume (Tons), 2019 - 2031

6.4.1.19. Rest of Europe Palm Oil Market by Nature, Value (US$ Bn) and Volume (Tons), 2019 - 2031

6.4.1.20. Rest of Europe Palm Oil Market by End User, Value (US$ Bn) and Volume (Tons), 2019 - 2031

6.4.1.21. Rest of Europe Palm Oil Market by Distribution Channel, Value (US$ Bn) and Volume (Tons), 2019 - 2031

6.4.2. BPS Analysis/Market Attractiveness Analysis

7. Asia Pacific Palm Oil Market Outlook, 2019 - 2031

7.1. Asia Pacific Palm Oil Market Outlook, by Nature, Value (US$ Bn) and Volume (Tons), 2019 - 2031

7.1.1. Key Highlights

7.1.1.1. Organic Palm Oil

7.1.1.2. Conventional Palm Oil

7.2. Asia Pacific Palm Oil Market Outlook, by End User, Value (US$ Bn) and Volume (Tons), 2019 - 2031

7.2.1. Key Highlights

7.2.1.1. Food & Beverage Industry

7.2.1.2. Foodservice

7.2.1.3. Cosmetics & Personal Care

7.2.1.4. Retail/Household

7.3. Asia Pacific Palm Oil Market Outlook, by Distribution Channel, Value (US$ Bn) and Volume (Tons), 2019 - 2031

7.3.1. Key Highlights

7.3.1.1. Business to Business Sales of Palm Oil

7.3.1.2. Business to Consumer Sales of Palm Oi

7.4. Asia Pacific Palm Oil Market Outlook, by Country, Value (US$ Bn) and Volume (Tons), 2019 - 2031

7.4.1. Key Highlights

7.4.1.1. China Palm Oil Market by Nature, Value (US$ Bn) and Volume (Tons), 2019 - 2031

7.4.1.2. China Palm Oil Market by End User, Value (US$ Bn) and Volume (Tons), 2019 - 2031

7.4.1.3. China Palm Oil Market by Distribution Channel, Value (US$ Bn) and Volume (Tons), 2019 - 2031

7.4.1.4. Japan Palm Oil Market by Nature, Value (US$ Bn) and Volume (Tons), 2019 - 2031

7.4.1.5. Japan Palm Oil Market by End User, Value (US$ Bn) and Volume (Tons), 2019 - 2031

7.4.1.6. Japan Palm Oil Market by Distribution Channel, Value (US$ Bn) and Volume (Tons), 2019 - 2031

7.4.1.7. South Korea Palm Oil Market by Nature, Value (US$ Bn) and Volume (Tons), 2019 - 2031

7.4.1.8. South Korea Palm Oil Market by End User, Value (US$ Bn) and Volume (Tons), 2019 - 2031

7.4.1.9. South Korea Palm Oil Market by Distribution Channel, Value (US$ Bn) and Volume (Tons), 2019 - 2031

7.4.1.10. India Palm Oil Market by Nature, Value (US$ Bn) and Volume (Tons), 2019 - 2031

7.4.1.11. India Palm Oil Market by End User, Value (US$ Bn) and Volume (Tons), 2019 - 2031

7.4.1.12. India Palm Oil Market by Distribution Channel, Value (US$ Bn) and Volume (Tons), 2019 - 2031

7.4.1.13. Southeast Asia Palm Oil Market by Nature, Value (US$ Bn) and Volume (Tons), 2019 - 2031

7.4.1.14. Southeast Asia Palm Oil Market by End User, Value (US$ Bn) and Volume (Tons), 2019 - 2031

7.4.1.15. Southeast Asia Palm Oil Market by Distribution Channel, Value (US$ Bn) and Volume (Tons), 2019 - 2031

7.4.1.16. Rest of Asia Pacific Palm Oil Market by Nature, Value (US$ Bn) and Volume (Tons), 2019 - 2031

7.4.1.17. Rest of Asia Pacific Palm Oil Market by End User, Value (US$ Bn) and Volume (Tons), 2019 - 2031

7.4.1.18. Rest of Asia Pacific Palm Oil Market by Distribution Channel, Value (US$ Bn) and Volume (Tons), 2019 - 2031

7.4.2. BPS Analysis/Market Attractiveness Analysis

8. Latin America Palm Oil Market Outlook, 2019 - 2031

8.1. Latin America Palm Oil Market Outlook, by Nature, Value (US$ Bn) and Volume (Tons), 2019 - 2031

8.1.1. Key Highlights

8.1.1.1. Organic Palm Oil

8.1.1.2. Conventional Palm Oil

8.2. Latin America Palm Oil Market Outlook, by End User, Value (US$ Bn) and Volume (Tons), 2019 - 2031

8.2.1. Key Highlights

8.2.1.1. Food & Beverage Industry

8.2.1.2. Foodservice

8.2.1.3. Cosmetics & Personal Care

8.2.1.4. Retail/Household

8.3. Latin America Palm Oil Market Outlook, by Distribution Channel, Value (US$ Bn) and Volume (Tons), 2019 - 2031

8.3.1. Key Highlights

8.3.1.1. Business to Business Sales of Palm Oil

8.3.1.2. Business to Consumer Sales of Palm Oi

8.4. Latin America Palm Oil Market Outlook, by Country, Value (US$ Bn) and Volume (Tons), 2019 - 2031

8.4.1. Key Highlights

8.4.1.1. Brazil Palm Oil Market by Nature, Value (US$ Bn) and Volume (Tons), 2019 - 2031

8.4.1.2. Brazil Palm Oil Market by End User, Value (US$ Bn) and Volume (Tons), 2019 - 2031

8.4.1.3. Brazil Palm Oil Market by Distribution Channel, Value (US$ Bn) and Volume (Tons), 2019 - 2031

8.4.1.4. Mexico Palm Oil Market by Nature, Value (US$ Bn) and Volume (Tons), 2019 - 2031

8.4.1.5. Mexico Palm Oil Market by End User, Value (US$ Bn) and Volume (Tons), 2019 - 2031

8.4.1.6. Mexico Palm Oil Market by Distribution Channel, Value (US$ Bn) and Volume (Tons), 2019 - 2031

8.4.1.7. Argentina Palm Oil Market by Nature, Value (US$ Bn) and Volume (Tons), 2019 - 2031

8.4.1.8. Argentina Palm Oil Market by End User, Value (US$ Bn) and Volume (Tons), 2019 - 2031

8.4.1.9. Argentina Palm Oil Market by Distribution Channel, Value (US$ Bn) and Volume (Tons), 2019 - 2031

8.4.1.10. Rest of Latin America Palm Oil Market by Nature, Value (US$ Bn) and Volume (Tons), 2019 - 2031

8.4.1.11. Rest of Latin America Palm Oil Market by End User, Value (US$ Bn) and Volume (Tons), 2019 - 2031

8.4.1.12. Rest of Latin America Palm Oil Market by Distribution Channel, Value (US$ Bn) and Volume (Tons), 2019 - 2031

8.4.2. BPS Analysis/Market Attractiveness Analysis

9. Middle East & Africa Palm Oil Market Outlook, 2019 - 2031

9.1. Middle East & Africa Palm Oil Market Outlook, by Nature, Value (US$ Bn) and Volume (Tons), 2019 - 2031

9.1.1. Key Highlights

9.1.1.1. Organic Palm Oil

9.1.1.2. Conventional Palm Oil

9.2. Middle East & Africa Palm Oil Market Outlook, by End User, Value (US$ Bn) and Volume (Tons), 2019 - 2031

9.2.1. Key Highlights

9.2.1.1. Food & Beverage Industry

9.2.1.2. Foodservice

9.2.1.3. Cosmetics & Personal Care

9.2.1.4. Retail/Household

9.3. Middle East & Africa Palm Oil Market Outlook, by Distribution Channel, Value (US$ Bn) and Volume (Tons), 2019 - 2031

9.3.1. Key Highlights

9.3.1.1. Business to Business Sales of Palm Oil

9.3.1.2. Business to Consumer Sales of Palm Oil

9.4. Middle East & Africa Palm Oil Market Outlook, by Country, Value (US$ Bn) and Volume (Tons), 2019 - 2031

9.4.1. Key Highlights

9.4.1.1. GCC Palm Oil Market by Nature, Value (US$ Bn) and Volume (Tons), 2019 - 2031

9.4.1.2. GCC Palm Oil Market by End User, Value (US$ Bn) and Volume (Tons), 2019 - 2031

9.4.1.3. GCC Palm Oil Market by Distribution Channel, Value (US$ Bn) and Volume (Tons), 2019 - 2031

9.4.1.4. South Africa Palm Oil Market by Nature, Value (US$ Bn) and Volume (Tons), 2019 - 2031

9.4.1.5. South Africa Palm Oil Market by End User, Value (US$ Bn) and Volume (Tons), 2019 - 2031

9.4.1.6. South Africa Palm Oil Market by Distribution Channel, Value (US$ Bn) and Volume (Tons), 2019 - 2031

9.4.1.7. Egypt Palm Oil Market by Nature, Value (US$ Bn) and Volume (Tons), 2019 - 2031

9.4.1.8. Egypt Palm Oil Market by End User, Value (US$ Bn) and Volume (Tons), 2019 - 2031

9.4.1.9. Egypt Palm Oil Market by Distribution Channel, Value (US$ Bn) and Volume (Tons), 2019 - 2031

9.4.1.10. Nigeria Palm Oil Market by Nature, Value (US$ Bn) and Volume (Tons), 2019 - 2031

9.4.1.11. Nigeria Palm Oil Market by End User, Value (US$ Bn) and Volume (Tons), 2019 - 2031

9.4.1.12. Nigeria Palm Oil Market by Distribution Channel, Value (US$ Bn) and Volume (Tons), 2019 - 2031

9.4.1.13. Rest of Middle East & Africa Palm Oil Market by Nature, Value (US$ Bn) and Volume (Tons), 2019 - 2031

9.4.1.14. Rest of Middle East & Africa Palm Oil Market by End User, Value (US$ Bn) and Volume (Tons), 2019 - 2031

9.4.1.15. Rest of Middle East & Africa Palm Oil Market by Distribution Channel, Value (US$ Bn) and Volume (Tons), 2019 - 2031

9.4.2. BPS Analysis/Market Attractiveness Analysis

10. Competitive Landscape

10.1. Company Market Share Analysis, 2023

10.2. Competitive Dashboard

10.3. Company Profiles

10.3.1. Olam International

10.3.1.1. Company Overview

10.3.1.2. Product Portfolio

10.3.1.3. Financial Overview

10.3.1.4. Business Strategies and Development

10.3.2. Archer Daniels Midland Company

10.3.2.1. Company Overview

10.3.2.2. Product Portfolio

10.3.2.3. Financial Overview

10.3.2.4. Business Strategies and Development

10.3.3. Presco PLC

10.3.3.1. Company Overview

10.3.3.2. Product Portfolio

10.3.3.3. Financial Overview

10.3.3.4. Business Strategies and Development

10.3.4. Agarwal Industries Pvt. Ltd.

10.3.4.1. Company Overview

10.3.4.2. Product Portfolio

10.3.4.3. Financial Overview

10.3.4.4. Business Strategies and Development

10.3.5. Asian Agri

10.3.5.1. Company Overview

10.3.5.2. Product Portfolio

10.3.5.3. Financial Overview

10.3.5.4. Business Strategies and Development

10.3.6. Apical Group Ltd.

10.3.6.1. Company Overview

10.3.6.2. Product Portfolio

10.3.6.3. Financial Overview

10.3.6.4. Business Strategies and Development

10.3.7. IOI Corp Bhd

10.3.7.1. Company Overview

10.3.7.2. Product Portfolio

10.3.7.3. Financial Overview

10.3.7.4. Business Strategies and Development

10.3.8. Oleo-Fats, Incorporated

10.3.8.1. Company Overview

10.3.8.2. Product Portfolio

10.3.8.3. Financial Overview

10.3.8.4. Business Strategies and Development

10.3.9. Agropalma Group

10.3.9.1. Company Overview

10.3.9.2. Product Portfolio

10.3.9.3. Financial Overview

10.3.9.4. Business Strategies and Development

10.3.10. Golden Agri-Resources Ltd.

10.3.10.1. Company Overview

10.3.10.2. Product Portfolio

10.3.10.3. Financial Overview

10.3.10.4. Business Strategies and Development

10.3.11. Sime Darby Oils Liverpool Refinery Ltd.

10.3.11.1. Company Overview

10.3.11.2. Product Portfolio

10.3.11.3. Financial Overview

10.3.11.4. Business Strategies and Development

11. Appendix

11.1. Research Methodology

11.2. Report Assumptions

11.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2022 |

|

2019 - 2022 |

2024 - 2031 |

Value: US$ Million |

||

|

REPORT FEATURES |

DETAILS |

|

Nature Coverage |

|

|

End Use Coverage |

|

|

Distribution Channel Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |