Global Pea Starch Market Forecast

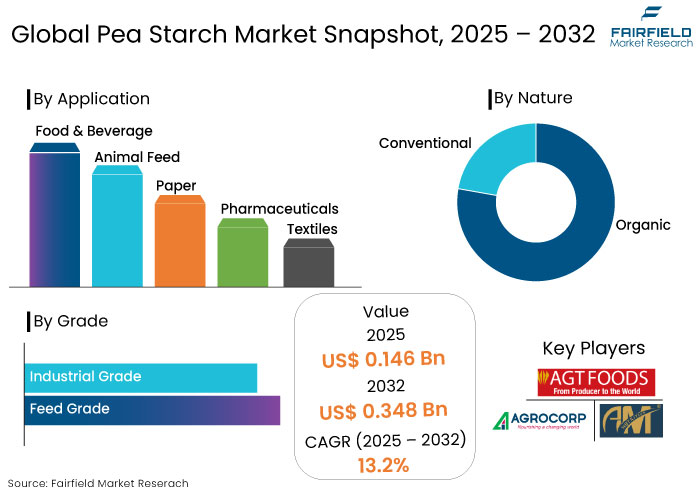

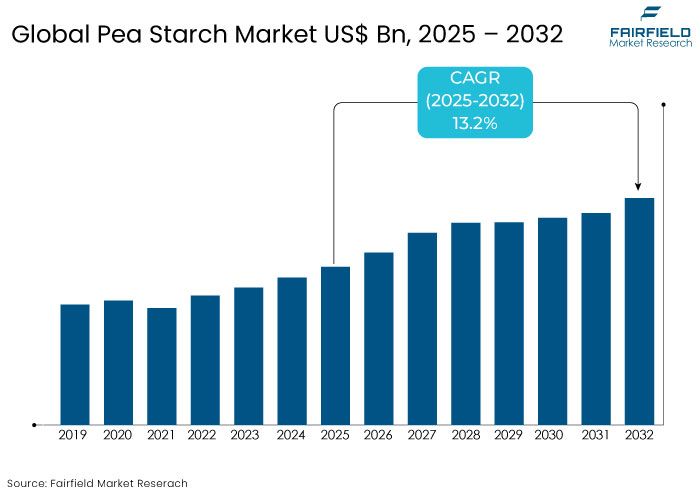

- The pea starch market is projected to reach a size of US$0.348 Bn by 2032, showing significant growth from the US$0.146 Bn achieved in 2025.

- The market for pea starch is expected to show a significant expansion rate, with an estimated CAGR of 13.2% from 2025 to 2032.

Pea Starch Market Insights

- The increasing popularity of plant-based diets and health-conscious food choices is driving the adoption of pea starch.

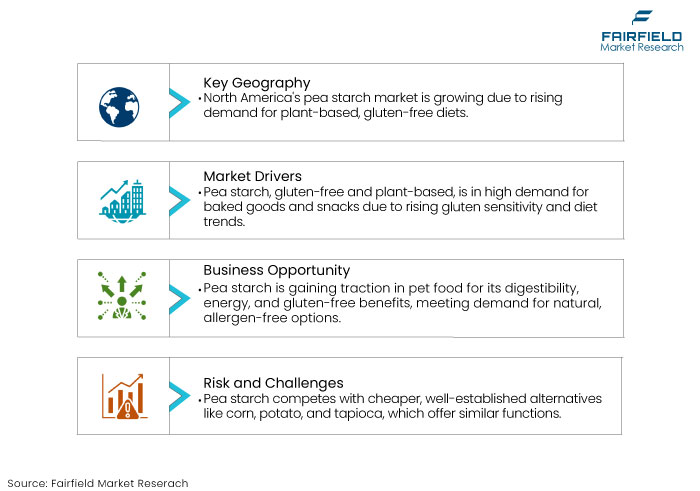

- North America is projected to account for over 48% of the global market share by 2032.

- Pea starch is gaining traction in the bioplastics industry due to its biodegradable properties and is expected to hold a CAGR of 13.2% over the forecast period.

- Pea starch is favoured for its sustainability, as it requires less water and fertilizers than other crops like corn, supporting the market’s growth.

- Pea starch is gaining momentum in the cosmetics sector due to its ability to act as a natural thickener and oil-absorbing agent in clean beauty formulations.

- By application, the food and beverages segment held the larger share of the market.

- Based on grade, the food grade segment leads with a 45% of market share.

A Look Back and a Look Forward - Comparative Analysis

The global pea starch market experienced steady growth from 2019 to 2023, driven by the rising demand for plant-based and gluten-free food products. Increased health consciousness among consumers and a growing preference for clean-label ingredients were significant growth drivers.

The food and beverage sector dominated, with applications in bakery, snacks, and convenience foods. Industrial applications in textiles, adhesives, and paper further boosted demand. Asia-Pacific and Europe emerged as key regions, benefiting from increasing urbanization and advancements in food processing technologies.

The market is projected to witness accelerated growth over the forecast period, with a surge in applications across diverse industries. The rising adoption of pea starch in cosmetics, pharmaceuticals, and pet food is expected to fuel demand.

Sustainability trends and regulatory support for plant-based ingredients will further drive growth. Emerging markets in Asia Pacific, particularly China and India, will play a pivotal role in shaping the market, supported by robust industrial expansion and consumer preference for natural, sustainable ingredients. The market is poised for strong growth, fueled by evolving consumer trends and industrial innovation.

Key Growth Determinants

- Increasing Demand for Gluten-Free and Plant-Based Products Augments Market Growth

The rising incidence of gluten sensitivity, celiac disease, and the growing consumer inclination towards plant-based diets are primary catalysts for the pea starch industry. Pea starch, being inherently gluten-free, is extensively utilized in baked goods, snacks, and processed foods to accommodate the dietary requirements of gluten-sensitive individuals.

The increasing vegan and flexitarian demographic has increased demand for plant-based protein sources, with pea starch significantly contributing to texture and stability enhancement. The clean-label movement, which prioritizes natural and minimally processed ingredients, further promotes the incorporation of pea starch in food formulations. These tendencies are most evident in North America and Europe, while Asia Pacific is swiftly advancing due to urbanization and changes in dietary habits.

- According to reports, 63% of global consumers prefer products with a clean label, and more than 50% shop actively seeking natural, plant-based, and non-GMO products.

- Sustainability and Regulatory Support for Plant-Based Ingredients

Sustainability has become a significant factor driving the pea starch market. Peas are a low-input crop, requiring less water and fertilizers compared to other starch sources like corn and wheat, making their cultivation more environmentally friendly. Governments and organizations worldwide promote sustainable agriculture and plant-based ingredients to combat climate change and reduce resource consumption.

Regulatory support, including labelling laws and incentives for eco-friendly practices, further accelerates the adoption of pea starch across industries. As consumers and businesses prioritize sustainability, the demand for eco-conscious ingredients like pea starch continues to rise, positioning it as a key driver of market growth.

- A recent survey found that 45% of food and beverage companies plan to increase their use of sustainable ingredients, with plant-based options like pea starch being a key area of focus.

- Almost 73% of global consumers are willing to pay more for sustainable products, driving demand for ingredients like pea starch that align with eco-conscious values.

Key Growth Barriers

- Availability of Substitutes May Restrain Sales

The pea starch market faces stiff competition from alternative starches like corn, potato, and tapioca, which are well-established and widely used in various applications. These substitutes often offer similar functional properties, such as thickening, gelling, and stabilizing, but are available at lower costs due to higher production volumes and well-developed supply chains.

The global dominance of corn and wheat-based starches makes them more accessible, particularly in price-sensitive regions. For pea starch manufacturers, the challenge lies in differentiating their product and demonstrating its unique advantages, such as being allergen-free and plant-based, to capture market share. The competition, combined with the relatively higher cost of pea starch, can restrain its growth in specific markets.

- Supply Chain and Raw Material Challenges

The supply of pea starch directly depends on pea cultivation, which is influenced by climatic conditions, agricultural practices, and crop rotation cycles. Variability in pea crop yields due to adverse weather conditions or pests can lead to supply shortages, disrupting pea starch production.

Limited cultivation in some regions and the need to import raw materials can increase costs and create supply chain inefficiencies. Fluctuating demand in the food, feed, and industrial sectors further exacerbates such challenges, making it difficult for manufacturers to maintain consistent production levels. As a result, the dependency on stable and sustainable raw material sources remains a significant restraint on the pea starch market’s growth.

Pea Starch Market Trends and Opportunities

- Growing Utilization in Pet Nutrition and Livestock Feed Promotes Market Growth

The pet food and animal feed sectors are swiftly incorporating pea starch as a functional component owing to its digestibility, energy content, and gluten-free characteristics. With pet owners' rising demand for premium, natural, and allergen-free pet food, pea starch presents a sustainable and nutritional substitute for traditional starches.

Pea starch is increasingly favoured in livestock feed as a carbohydrate source to enhance feed efficiency and animal health. The increasing global investment in pet care and sustainable agriculture establishes this sector as a pivotal opportunity for the pea starch industry.

Another benefit is that pea starch is an environmentally sustainable product derived from a renewable plant source. Consumers are more inclined to advocate for pet food items that are both environmentally sustainable and ethically sourced.

- Growing Use in Clean Beauty and Cosmetics Sector

The clean beauty trend has arisen as a revolutionary influence in the cosmetics and personal care sector, propelled by consumers' increasing inclination towards natural, sustainable, and non-toxic materials. Pea starch functions as a natural thickener, stabilizer, and oil absorber, rendering it an exceptional substitute for synthetic chemicals and petroleum-derived components commonly employed in cosmetic compositions.

Pea starch is predominantly utilized in cosmetics as a mattifying component in powders, foundations, and various makeup products. Its capacity to absorb surplus oil while delivering a smooth texture promotes product efficacy and attractiveness. This starch is increasingly utilized in skincare products, including lotions, creams, and masks, due to its biocompatibility and hypoallergenic characteristics, rendering it appropriate for sensitive skin.

Pea starch, sourced from renewable botanical origins, corresponds with these sustainability objectives. Regulatory agencies are examining synthetic chemicals' safety and environmental implications, prompting producers to investigate natural alternatives such as pea starch.

- According to a survey, 71% of consumers prefer products with natural ingredients, and 45% say they would choose a product based on its sustainability credentials, driving the demand for pea starch in cosmetics.

- Plant-based ingredients like pea starch in cosmetics have surged by 35% over the past five years, particularly in foundations, powders, and skincare products.

How is Does Scenario Shape the Industry?

The regulatory landscape significantly influences the pea starch market, affecting production, labelling, and application across various industries. Pea starch producers must adhere to stringent food safety standards set by regulatory bodies such as the U.S. Food and Drug Administration (FDA) and the European Food Safety Authority (EFSA). Such regulations ensure that pea starch used in food products meets safety and quality criteria, impacting production processes and market entry.

Consumers increasingly demand transparency in food labelling, seeking products with natural and minimally processed ingredients. Regulations mandating clear labelling of ingredients, including using terms like natural or organic, influence manufacturers to adopt pea starch as a clean-label ingredient.

Environmental regulations promoting sustainable agricultural practices influence the sourcing of peas for starch production. Manufacturers are encouraged to adopt eco-friendly practices to meet regulatory standards and consumer expectations for sustainability.

Global trade of pea starch necessitates compliance with international regulations, including tariffs, quality standards, and certification requirements, which can impact market dynamics and accessibility.

Segment Covered in the Report

- Food Grade Pea Starch to Grow Substantially

The food grade segment is expected to lead the pea starch market due to increasing consumer preference for healthier, cleaner, and more sustainable food ingredients. Pea starch is a flexible, functional ingredient with thickening, stabilizing, and emulsifying qualities. It is a significant component in diverse food applications, including sauces, soups, dairy replacements, gluten-free baked goods, and plant-based meat products.

Pea starch has gained popularity as it is inherently gluten-free and non-GMO, aligning with the clean-label trend and due to the increasing demand for plant-based and gluten-free diets.

The nutritional advantages of pea starch, characterized by its elevated fibre content and low glycaemic index, render it an essential component for health-conscious consumers. These advantages further endorse the utilization of pea starch in processed foods. It enhances the texture and uniformity while maintaining the product's quality. Pea starch is increasingly favoured as customers seek transparency, sustainability, and functional health advantages in their dietary selections.

- Food & Beverage Sector Maintains Primacy in the Market

Pea starch is extensively utilized as a natural thickening agent, emulsifier, and stabilizer in diverse culinary goods and plant-based meat alternatives. With the increasing popularity of plant-based and gluten-free diets, food producers are seeking alternative ingredients. Pea starch is utilized in the manufacturing of plant-based dairy and meat substitutes and gluten-free baked goods.

Pea starch attracts consumers' attention due to the clean-label trend, as customers seek natural, minimally processed substitutes for artificial ingredients. The enhanced texture and uniformity of food products, without compromising taste or quality, also augment their attractiveness to manufacturers.

Regional Analysis

- North America to Experience Notable Growth

The pea starch market in North America is expected to witness significant growth during the forecast period. The evolving consumer preferences for healthier dietary habits and awareness about the advantages of a plant-based and gluten-free diet propel the demand for alternative starches, such as pea starch.

The robustness of the North America food and beverage sector emphasizes novel plant-based products. It propels pea starch as a key component in plant-based meat alternatives, dairy substitutes, and gluten-free baked goods.

Corporations are increasingly emphasizing the functional advantages of pea starch in food formulations, including enhancements in texture, emulsification, and shelf-life stability. North America, particularly Canada, is a significant producer of peas, and its abundance of raw materials further solidifies its leadership in the global pea starch industry. Collectively, these elements render North America the most rapidly expanding region in the pea starch market.

- Asia Pacific to Grow Substantially with Rising Demand for Processed Foods

Asia Pacific is one of the fastest-growing markets for pea starch, driven by several factors, including rising demand for processed foods, growing health awareness, and the rapid expansion of industries like cosmetics and pharmaceuticals.

With urbanization and an increase in disposable incomes, countries like China, India, and Japan are witnessing significant growth in processed and convenience food consumption. Pea starch, a natural thickener and stabilizer, is widely used in these products.

Increasing awareness about health benefits and the rising prevalence of gluten intolerance and celiac disease have fueled the demand for gluten-free alternatives such as pea starch in the region. The use of pea starch in non-food industries, such as paper, textiles, and adhesives, is also growing. Expanding cosmetics industry in countries like South Korea and Japan leverages pea starch for its natural and sustainable properties, which boosts the region's growth prospects.

Fairfield’s Competitive Landscape Analysis

The presence of established and emerging players characterizes the competitive landscape of the pea starch market. Key companies, including Roquette Frères, Cargill, and Ingredion Incorporated, dominate the market, leveraging their extensive distribution networks, strong R&D capabilities, and diversified product portfolios.

Leading companies focus on developing innovative pea starch derivatives for a wide range of applications in food, pharmaceuticals, and non-food industries. The market also sees new entrants and regional players striving to capitalize on the growing demand for plant-based and gluten-free ingredients.

Companies increasingly invest in sustainable practices, such as sourcing peas from eco-friendly farms, to differentiate themselves in the competitive market. Strategic collaborations, acquisitions, and product innovations remain key tactics for strengthening market positions and expanding reach.

Key Market Companies

- ADM

- Agrocorp International Pte Ltd

- AGT Food and Ingredients

- AM Nutrition

- American Key Food Products

- Aminola

- Axiom Foods Inc.

- Cosucra

- Dsm-Firmenich

- Ebro Foods, S.A.

- Emsland-Stärke Gesellschaft

- Ingredion

- Meelunie B.V.

- Nutri-Pea

- Organicway Food Ingredients Inc.

- P&H Milling, Inc.

- Puris

- Roquette Frères

- Sinofi Ingredients

- STDM Food and Beverages Private Limited

- The Scoular Company

- The Shandong Jianyuan Group

- Yantai Oriental Protein Tech Co., Ltd.

- Yantai Shuangta Food Co., Ltd

- Yosin Biotechnology Co., Ltd

Recent Industry Developments

- In April 2024, the French firm Roquette introduced the LYCAGEL Flex hydroxypropyl pea starch premix for pharmaceutical and nutraceutical softgel capsules. It intends to enhance the company's competence and customer base while addressing the increasing demand from various industries.

- In June 2024, Bunge signed a partnership deal with Golden Fields, a prominent European agricultural firm specializing in dry milling peas and faba beans. Golden Fields has established a specialized production facility in Liepaja, Latvia, designated solely for delivering innovative protein concentrates to Bunge.

An Expert’s Eye

- Pea starch, being a clean-label, sustainable, and gluten-free option, is poised for continued growth, particularly in the food and beverage sector.

- The push for eco-friendly solutions in various industries, from food packaging to bioplastics, is driving the adoption of pea starch.

- Analysts predict significant opportunities for pea starch in non-food industries such as cosmetics, pharmaceuticals, and bioplastics.

- Regulatory frameworks encouraging the use of plant-based, allergen-free ingredients and clean-label formulations are seen as a major driver of pea starch adoption.

Global Pea Starch Market is Segmented as-

By Grade

- Feed Grade

- Food Grade

- Industrial Grade

By Nature

- Organic

- Conventional

By Application

- Food & Beverage

- Animal Feed

- Paper

- Pharmaceuticals

- Textiles

By Function

- Gelling

- Thickeners

- Texturizing

- Film Forming

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- The Middle East & Africa

1. Executive Summary

1.1. Global Pea Starch Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2025

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. COVID-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Global Pea Starch Market Outlook, 2019 - 2032

3.1. Global Pea Starch Market Outlook, by Grade, Value (US$ Bn) and Volume (Tons), 2019 - 2032

3.1.1. Key Highlights

3.1.1.1. Feed grade

3.1.1.2. Food Grade

3.1.1.3. Industrial Grade

3.2. Global Pea Starch Market Outlook, by Nature, Value (US$ Bn) and Volume (Tons), 2019 - 2032

3.2.1. Key Highlights

3.2.1.1. Organic

3.2.1.2. Conventional

3.3. Global Pea Starch Market Outlook, by Application, Value (US$ Bn) and Volume (Tons), 2019 - 2032

3.3.1. Key Highlights

3.3.1.1. Food & Beverage

3.3.1.2. Animal Feed

3.3.1.3. Paper

3.3.1.4. Pharmaceuticals

3.3.1.5. Textiles

3.4. Global Pea Starch Market Outlook, by Function, Value (US$ Bn) and Volume (Tons), 2019 - 2032

3.4.1. Key Highlights

3.4.1.1. Gelling

3.4.1.2. Thickeners

3.4.1.3. Texturizing

3.4.1.4. Film Forming

3.4.1.5. Others

3.5. Global Pea Starch Market Outlook, by Region, Value (US$ Bn) and Volume (Tons), 2019 - 2032

3.5.1. Key Highlights

3.5.1.1. North America

3.5.1.2. Europe

3.5.1.3. Asia Pacific

3.5.1.4. Latin America

3.5.1.5. Middle East & Africa

4. North America Pea Starch Market Outlook, 2019 - 2032

4.1. North America Pea Starch Market Outlook, by Grade, Value (US$ Bn) and Volume (Tons), 2019 - 2032

4.1.1. Key Highlights

4.1.1.1. Feed grade

4.1.1.2. Food Grade

4.1.1.3. Industrial Grade

4.2. North America Pea Starch Market Outlook, by Nature, Value (US$ Bn) and Volume (Tons), 2019 - 2032

4.2.1. Key Highlights

4.2.1.1. Organic

4.2.1.2. Conventional

4.3. North America Pea Starch Market Outlook, by Application, Value (US$ Bn) and Volume (Tons), 2019 - 2032

4.3.1. Key Highlights

4.3.1.1. Food & Beverage

4.3.1.2. Animal Feed

4.3.1.3. Paper

4.3.1.4. Pharmaceuticals

4.3.1.5. Textiles

4.4. North America Pea Starch Market Outlook, by Function, Value (US$ Bn) and Volume (Tons), 2019 - 2032

4.4.1. Key Highlights

4.4.1.1. Gelling

4.4.1.2. Thickeners

4.4.1.3. Texturizing

4.4.1.4. Film Forming

4.4.1.5. Others

4.4.2. BPS Analysis/Market Attractiveness Analysis

4.5. North America Pea Starch Market Outlook, by Country, Value (US$ Bn) and Volume (Tons), 2019 - 2032

4.5.1. Key Highlights

4.5.1.1. U.S. Pea Starch Market by Grade, Value (US$ Bn) and Volume (Tons), 2019 - 2032

4.5.1.2. U.S. Pea Starch Market by Nature, Value (US$ Bn) and Volume (Tons), 2019 - 2032

4.5.1.3. U.S. Pea Starch Market by Application, Value (US$ Bn) and Volume (Tons), 2019 - 2032

4.5.1.4. U.S. Pea Starch Market by Function, Value (US$ Bn) and Volume (Tons), 2019 - 2032

4.5.1.5. Canada Pea Starch Market by Grade, Value (US$ Bn) and Volume (Tons), 2019 - 2032

4.5.1.6. Canada Pea Starch Market by Nature, Value (US$ Bn) and Volume (Tons), 2019 - 2032

4.5.1.7. Canada Pea Starch Market by Application, Value (US$ Bn) and Volume (Tons), 2019 - 2032

4.5.1.8. Canada Pea Starch Market by Function, Value (US$ Bn) and Volume (Tons), 2019 - 2032

4.5.2. BPS Analysis/Market Attractiveness Analysis

5. Europe Pea Starch Market Outlook, 2019 - 2032

5.1. Europe Pea Starch Market Outlook, by Grade, Value (US$ Bn) and Volume (Tons), 2019 - 2032

5.1.1. Key Highlights

5.1.1.1. Feed grade

5.1.1.2. Food Grade

5.1.1.3. Industrial Grade

5.2. Europe Pea Starch Market Outlook, by Nature, Value (US$ Bn) and Volume (Tons), 2019 - 2032

5.2.1. Key Highlights

5.2.1.1. Organic

5.2.1.2. Conventional

5.3. Europe Pea Starch Market Outlook, by Application, Value (US$ Bn) and Volume (Tons), 2019 - 2032

5.3.1. Key Highlights

5.3.1.1. Food & Beverage

5.3.1.2. Animal Feed

5.3.1.3. Paper

5.3.1.4. Pharmaceuticals

5.3.1.5. Textiles

5.4. Europe Pea Starch Market Outlook, by Function, Value (US$ Bn) and Volume (Tons), 2019 - 2032

5.4.1. Key Highlights

5.4.1.1. Gelling

5.4.1.2. Thickeners

5.4.1.3. Texturizing

5.4.1.4. Film Forming

5.4.1.5. Others

5.4.2. BPS Analysis/Market Attractiveness Analysis

5.5. Europe Pea Starch Market Outlook, by Country, Value (US$ Bn) and Volume (Tons), 2019 - 2032

5.5.1. Key Highlights

5.5.1.1. Germany Pea Starch Market by Grade, Value (US$ Bn) and Volume (Tons), 2019 - 2032

5.5.1.2. Germany Pea Starch Market by Nature, Value (US$ Bn) and Volume (Tons), 2019 - 2032

5.5.1.3. Germany Pea Starch Market by Application, Value (US$ Bn) and Volume (Tons), 2019 - 2032

5.5.1.4. Germany Pea Starch Market by Function, Value (US$ Bn) and Volume (Tons), 2019 - 2032

5.5.1.5. U.K. Pea Starch Market by Grade, Value (US$ Bn) and Volume (Tons), 2019 - 2032

5.5.1.6. U.K. Pea Starch Market by Nature, Value (US$ Bn) and Volume (Tons), 2019 - 2032

5.5.1.7. U.K. Pea Starch Market by Application, Value (US$ Bn) and Volume (Tons), 2019 - 2032

5.5.1.8. U.K. Pea Starch Market by Function, Value (US$ Bn) and Volume (Tons), 2019 - 2032

5.5.1.9. France Pea Starch Market by Grade, Value (US$ Bn) and Volume (Tons), 2019 - 2032

5.5.1.10. France Pea Starch Market by Nature, Value (US$ Bn) and Volume (Tons), 2019 - 2032

5.5.1.11. France Pea Starch Market by Application, Value (US$ Bn) and Volume (Tons), 2019 - 2032

5.5.1.12. France Pea Starch Market by Function, Value (US$ Bn) and Volume (Tons), 2019 - 2032

5.5.1.13. Italy Pea Starch Market by Grade, Value (US$ Bn) and Volume (Tons), 2019 - 2032

5.5.1.14. Italy Pea Starch Market by Nature, Value (US$ Bn) and Volume (Tons), 2019 - 2032

5.5.1.15. Italy Pea Starch Market by Application, Value (US$ Bn) and Volume (Tons), 2019 - 2032

5.5.1.16. Italy Pea Starch Market by Function, Value (US$ Bn) and Volume (Tons), 2019 - 2032

5.5.1.17. Turkey Pea Starch Market by Grade, Value (US$ Bn) and Volume (Tons), 2019 - 2032

5.5.1.18. Turkey Pea Starch Market by Nature, Value (US$ Bn) and Volume (Tons), 2019 - 2032

5.5.1.19. Turkey Pea Starch Market by Application, Value (US$ Bn) and Volume (Tons), 2019 - 2032

5.5.1.20. Turkey Pea Starch Market by Function, Value (US$ Bn) and Volume (Tons), 2019 - 2032

5.5.1.21. Russia Pea Starch Market by Grade, Value (US$ Bn) and Volume (Tons), 2019 - 2032

5.5.1.22. Russia Pea Starch Market by Nature, Value (US$ Bn) and Volume (Tons), 2019 - 2032

5.5.1.23. Russia Pea Starch Market by Application, Value (US$ Bn) and Volume (Tons), 2019 - 2032

5.5.1.24. Russia Pea Starch Market by Function, Value (US$ Bn) and Volume (Tons), 2019 - 2032

5.5.1.25. Rest of Europe Pea Starch Market by Grade, Value (US$ Bn) and Volume (Tons), 2019 - 2032

5.5.1.26. Rest of Europe Pea Starch Market by Nature, Value (US$ Bn) and Volume (Tons), 2019 - 2032

5.5.1.27. Rest of Europe Pea Starch Market by Application, Value (US$ Bn) and Volume (Tons), 2019 - 2032

5.5.1.28. Rest of Europe Pea Starch Market by Function, Value (US$ Bn) and Volume (Tons), 2019 - 2032

5.5.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Pea Starch Market Outlook, 2019 - 2032

6.1. Asia Pacific Pea Starch Market Outlook, by Grade, Value (US$ Bn) and Volume (Tons), 2019 - 2032

6.1.1. Key Highlights

6.1.1.1. Feed grade

6.1.1.2. Food Grade

6.1.1.3. Industrial Grade

6.2. Asia Pacific Pea Starch Market Outlook, by Nature, Value (US$ Bn) and Volume (Tons), 2019 - 2032

6.2.1. Key Highlights

6.2.1.1. Organic

6.2.1.2. Conventional

6.3. Asia Pacific Pea Starch Market Outlook, by Application, Value (US$ Bn) and Volume (Tons), 2019 - 2032

6.3.1. Key Highlights

6.3.1.1. Food & Beverage

6.3.1.2. Animal Feed

6.3.1.3. Paper

6.3.1.4. Pharmaceuticals

6.3.1.5. Textiles

6.4. Asia Pacific Pea Starch Market Outlook, by Function, Value (US$ Bn) and Volume (Tons), 2019 - 2032

6.4.1. Key Highlights

6.4.1.1. Gelling

6.4.1.2. Thickeners

6.4.1.3. Texturizing

6.4.1.4. Film Forming

6.4.1.5. Others

6.4.2. BPS Analysis/Market Attractiveness Analysis

6.5. Asia Pacific Pea Starch Market Outlook, by Country, Value (US$ Bn) and Volume (Tons), 2019 - 2032

6.5.1. Key Highlights

6.5.1.1. China Pea Starch Market by Grade, Value (US$ Bn) and Volume (Tons), 2019 - 2032

6.5.1.2. China Pea Starch Market by Nature, Value (US$ Bn) and Volume (Tons), 2019 - 2032

6.5.1.3. China Pea Starch Market by Application, Value (US$ Bn) and Volume (Tons), 2019 - 2032

6.5.1.4. China Pea Starch Market by Function, Value (US$ Bn) and Volume (Tons), 2019 - 2032

6.5.1.5. Japan Pea Starch Market by Grade, Value (US$ Bn) and Volume (Tons), 2019 - 2032

6.5.1.6. Japan Pea Starch Market by Nature, Value (US$ Bn) and Volume (Tons), 2019 - 2032

6.5.1.7. Japan Pea Starch Market by Application, Value (US$ Bn) and Volume (Tons), 2019 - 2032

6.5.1.8. Japan Pea Starch Market by Function, Value (US$ Bn) and Volume (Tons), 2019 - 2032

6.5.1.9. South Korea Pea Starch Market by Grade, Value (US$ Bn) and Volume (Tons), 2019 - 2032

6.5.1.10. South Korea Pea Starch Market by Nature, Value (US$ Bn) and Volume (Tons), 2019 - 2032

6.5.1.11. South Korea Pea Starch Market by Application, Value (US$ Bn) and Volume (Tons), 2019 - 2032

6.5.1.12. South Korea Pea Starch Market by Function, Value (US$ Bn) and Volume (Tons), 2019 - 2032

6.5.1.13. India Pea Starch Market by Grade, Value (US$ Bn) and Volume (Tons), 2019 - 2032

6.5.1.14. India Pea Starch Market by Nature, Value (US$ Bn) and Volume (Tons), 2019 - 2032

6.5.1.15. India Pea Starch Market by Application, Value (US$ Bn) and Volume (Tons), 2019 - 2032

6.5.1.16. India Pea Starch Market by Function, Value (US$ Bn) and Volume (Tons), 2019 - 2032

6.5.1.17. Southeast Asia Pea Starch Market by Grade, Value (US$ Bn) and Volume (Tons), 2019 - 2032

6.5.1.18. Southeast Asia Pea Starch Market by Nature, Value (US$ Bn) and Volume (Tons), 2019 - 2032

6.5.1.19. Southeast Asia Pea Starch Market by Application, Value (US$ Bn) and Volume (Tons), 2019 - 2032

6.5.1.20. Southeast Asia Pea Starch Market by Function, Value (US$ Bn) and Volume (Tons), 2019 - 2032

6.5.1.21. Rest of Asia Pacific Pea Starch Market by Grade, Value (US$ Bn) and Volume (Tons), 2019 - 2032

6.5.1.22. Rest of Asia Pacific Pea Starch Market by Nature, Value (US$ Bn) and Volume (Tons), 2019 - 2032

6.5.1.23. Rest of Asia Pacific Pea Starch Market by Application, Value (US$ Bn) and Volume (Tons), 2019 - 2032

6.5.1.24. Rest of Asia Pacific Pea Starch Market by Function, Value (US$ Bn) and Volume (Tons), 2019 - 2032

6.5.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America Pea Starch Market Outlook, 2019 - 2032

7.1. Latin America Pea Starch Market Outlook, by Grade, Value (US$ Bn) and Volume (Tons), 2019 - 2032

7.1.1. Key Highlights

7.1.1.1. Feed grade

7.1.1.2. Food Grade

7.1.1.3. Industrial Grade

7.2. Latin America Pea Starch Market Outlook, by Nature, Value (US$ Bn) and Volume (Tons), 2019 - 2032

7.2.1. Key Highlights

7.2.1.1. Organic

7.2.1.2. Conventional

7.3. Latin America Pea Starch Market Outlook, by Application, Value (US$ Bn) and Volume (Tons), 2019 - 2032

7.3.1. Key Highlights

7.3.1.1. Food & Beverage

7.3.1.2. Animal Feed

7.3.1.3. Paper

7.3.1.4. Pharmaceuticals

7.3.1.5. Textiles

7.4. Latin America Pea Starch Market Outlook, by Function, Value (US$ Bn) and Volume (Tons), 2019 - 2032

7.4.1. Key Highlights

7.4.1.1. Gelling

7.4.1.2. Thickeners

7.4.1.3. Texturizing

7.4.1.4. Film Forming

7.4.1.5. Others

7.4.2. BPS Analysis/Market Attractiveness Analysis

7.5. Latin America Pea Starch Market Outlook, by Country, Value (US$ Bn) and Volume (Tons), 2019 - 2032

7.5.1. Key Highlights

7.5.1.1. Brazil Pea Starch Market by Grade, Value (US$ Bn) and Volume (Tons), 2019 - 2032

7.5.1.2. Brazil Pea Starch Market by Nature, Value (US$ Bn) and Volume (Tons), 2019 - 2032

7.5.1.3. Brazil Pea Starch Market by Application, Value (US$ Bn) and Volume (Tons), 2019 - 2032

7.5.1.4. Brazil Pea Starch Market by Function, Value (US$ Bn) and Volume (Tons), 2019 - 2032

7.5.1.5. Mexico Pea Starch Market by Grade, Value (US$ Bn) and Volume (Tons), 2019 - 2032

7.5.1.6. Mexico Pea Starch Market by Nature, Value (US$ Bn) and Volume (Tons), 2019 - 2032

7.5.1.7. Mexico Pea Starch Market by Application, Value (US$ Bn) and Volume (Tons), 2019 - 2032

7.5.1.8. Mexico Pea Starch Market by Function, Value (US$ Bn) and Volume (Tons), 2019 - 2032

7.5.1.9. Argentina Pea Starch Market by Grade, Value (US$ Bn) and Volume (Tons), 2019 - 2032

7.5.1.10. Argentina Pea Starch Market by Nature, Value (US$ Bn) and Volume (Tons), 2019 - 2032

7.5.1.11. Argentina Pea Starch Market by Application, Value (US$ Bn) and Volume (Tons), 2019 - 2032

7.5.1.12. Argentina Pea Starch Market by Function, Value (US$ Bn) and Volume (Tons), 2019 - 2032

7.5.1.13. Rest of Latin America Pea Starch Market by Grade, Value (US$ Bn) and Volume (Tons), 2019 - 2032

7.5.1.14. Rest of Latin America Pea Starch Market by Nature, Value (US$ Bn) and Volume (Tons), 2019 - 2032

7.5.1.15. Rest of Latin America Pea Starch Market by Application, Value (US$ Bn) and Volume (Tons), 2019 - 2032

7.5.1.16. Rest of Latin America Pea Starch Market by Function, Value (US$ Bn) and Volume (Tons), 2019 - 2032

7.5.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Pea Starch Market Outlook, 2019 - 2032

8.1. Middle East & Africa Pea Starch Market Outlook, by Grade, Value (US$ Bn) and Volume (Tons), 2019 - 2032

8.1.1. Key Highlights

8.1.1.1. Feed grade

8.1.1.2. Food Grade

8.1.1.3. Industrial Grade

8.2. Middle East & Africa Pea Starch Market Outlook, by Nature, Value (US$ Bn) and Volume (Tons), 2019 - 2032

8.2.1. Key Highlights

8.2.1.1. Organic

8.2.1.2. Conventional

8.3. Middle East & Africa Pea Starch Market Outlook, by Application, Value (US$ Bn) and Volume (Tons), 2019 - 2032

8.3.1. Key Highlights

8.3.1.1. Food & Beverage

8.3.1.2. Animal Feed

8.3.1.3. Paper

8.3.1.4. Pharmaceuticals

8.3.1.5. Textiles

8.4. Middle East & Africa Pea Starch Market Outlook, by Function, Value (US$ Bn) and Volume (Tons), 2019 - 2032

8.4.1. Key Highlights

8.4.1.1. Gelling

8.4.1.2. Thickeners

8.4.1.3. Texturizing

8.4.1.4. Film Forming

8.4.1.5. Others

8.4.2. BPS Analysis/Market Attractiveness Analysis

8.5. Middle East & Africa Pea Starch Market Outlook, by Country, Value (US$ Bn) and Volume (Tons), 2019 - 2032

8.5.1. Key Highlights

8.5.1.1. GCC Pea Starch Market by Grade, Value (US$ Bn) and Volume (Tons), 2019 - 2032

8.5.1.2. GCC Pea Starch Market by Nature, Value (US$ Bn) and Volume (Tons), 2019 - 2032

8.5.1.3. GCC Pea Starch Market by Application, Value (US$ Bn) and Volume (Tons), 2019 - 2032

8.5.1.4. GCC Pea Starch Market by Function, Value (US$ Bn) and Volume (Tons), 2019 - 2032

8.5.1.5. South Africa Pea Starch Market by Grade, Value (US$ Bn) and Volume (Tons), 2019 - 2032

8.5.1.6. South Africa Pea Starch Market by Nature, Value (US$ Bn) and Volume (Tons), 2019 - 2032

8.5.1.7. South Africa Pea Starch Market by Application, Value (US$ Bn) and Volume (Tons), 2019 - 2032

8.5.1.8. South Africa Pea Starch Market by Function, Value (US$ Bn) and Volume (Tons), 2019 - 2032

8.5.1.9. Egypt Pea Starch Market by Grade, Value (US$ Bn) and Volume (Tons), 2019 - 2032

8.5.1.10. Egypt Pea Starch Market by Nature, Value (US$ Bn) and Volume (Tons), 2019 - 2032

8.5.1.11. Egypt Pea Starch Market by Application, Value (US$ Bn) and Volume (Tons), 2019 - 2032

8.5.1.12. Egypt Pea Starch Market by Function, Value (US$ Bn) and Volume (Tons), 2019 - 2032

8.5.1.13. Nigeria Pea Starch Market by Grade, Value (US$ Bn) and Volume (Tons), 2019 - 2032

8.5.1.14. Nigeria Pea Starch Market by Nature, Value (US$ Bn) and Volume (Tons), 2019 - 2032

8.5.1.15. Nigeria Pea Starch Market by Application, Value (US$ Bn) and Volume (Tons), 2019 - 2032

8.5.1.16. Nigeria Pea Starch Market by Function, Value (US$ Bn) and Volume (Tons), 2019 - 2032

8.5.1.17. Rest of Middle East & Africa Pea Starch Market by Grade, Value (US$ Bn) and Volume (Tons), 2019 - 2032

8.5.1.18. Rest of Middle East & Africa Pea Starch Market by Nature, Value (US$ Bn) and Volume (Tons), 2019 - 2032

8.5.1.19. Rest of Middle East & Africa Pea Starch Market by Application, Value (US$ Bn) and Volume (Tons), 2019 - 2032

8.5.1.20. Rest of Middle East & Africa Pea Starch Market by Function, Value (US$ Bn) and Volume (Tons), 2019 - 2032

8.5.2. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. Manufacturer vs by Nature Heatmap

9.2. Company Market Share Analysis, 2024

9.3. Competitive Dashboard

9.4. Company Profiles

9.4.1. ADM

9.4.1.1. Company Overview

9.4.1.2. Product Portfolio

9.4.1.3. Financial Overview

9.4.1.4. Business Strategies and Development

9.4.2. Agrocorp International Pte Ltd

9.4.2.1. Company Overview

9.4.2.2. Product Portfolio

9.4.2.3. Financial Overview

9.4.2.4. Business Strategies and Development

9.4.3. AGT Food and Ingredients

9.4.3.1. Company Overview

9.4.3.2. Product Portfolio

9.4.3.3. Financial Overview

9.4.3.4. Business Strategies and Development

9.4.4. AM Nutrition

9.4.4.1. Company Overview

9.4.4.2. Product Portfolio

9.4.4.3. Financial Overview

9.4.4.4. Business Strategies and Development

9.4.5. American Key Food Products

9.4.5.1. Company Overview

9.4.5.2. Product Portfolio

9.4.5.3. Financial Overview

9.4.5.4. Business Strategies and Development

9.4.6. Aminola

9.4.6.1. Company Overview

9.4.6.2. Product Portfolio

9.4.6.3. Financial Overview

9.4.6.4. Business Strategies and Development

9.4.7. Axiom Foods Inc.

9.4.7.1. Company Overview

9.4.7.2. Product Portfolio

9.4.7.3. Financial Overview

9.4.7.4. Business Strategies and Development

9.4.8. Cosucra

9.4.8.1. Company Overview

9.4.8.2. Product Portfolio

9.4.8.3. Financial Overview

9.4.8.4. Business Strategies and Development

9.4.9. Dsm-Firmenich

9.4.9.1. Company Overview

9.4.9.2. Product Portfolio

9.4.9.3. Financial Overview

9.4.9.4. Business Strategies and Development

9.4.10. Ebro Foods, S.A.

9.4.10.1. Company Overview

9.4.10.2. Product Portfolio

9.4.10.3. Financial Overview

9.4.10.4. Business Strategies and Development

9.4.11. Emsland-Stärke Gesellschaft

9.4.11.1. Company Overview

9.4.11.2. Product Portfolio

9.4.11.3. Financial Overview

9.4.11.4. Business Strategies and Development

9.4.12. Ingredion

9.4.12.1. Company Overview

9.4.12.2. Product Portfolio

9.4.12.3. Financial Overview

9.4.12.4. Business Strategies and Development

9.4.13. Meelunie B.V.

9.4.13.1. Company Overview

9.4.13.2. Product Portfolio

9.4.13.3. Financial Overview

9.4.13.4. Business Strategies and Development

9.4.14. Nutri-Pea

9.4.14.1. Company Overview

9.4.14.2. Product Portfolio

9.4.14.3. Financial Overview

9.4.14.4. Business Strategies and Development

9.4.15. Organicway Food Ingredients Inc.

9.4.15.1. Company Overview

9.4.15.2. Product Portfolio

9.4.15.3. Financial Overview

9.4.15.4. Business Strategies and Development

9.4.16. P&H Milling, Inc.

9.4.16.1. Company Overview

9.4.16.2. Product Portfolio

9.4.16.3. Financial Overview

9.4.16.4. Business Strategies and Development

9.4.17. Puris

9.4.17.1. Company Overview

9.4.17.2. Product Portfolio

9.4.17.3. Financial Overview

9.4.17.4. Business Strategies and Development

9.4.18. Roquette Frères

9.4.18.1. Company Overview

9.4.18.2. Product Portfolio

9.4.18.3. Financial Overview

9.4.18.4. Business Strategies and Development

9.4.19. Sinofi Ingredients

9.4.19.1. Company Overview

9.4.19.2. Product Portfolio

9.4.19.3. Financial Overview

9.4.19.4. Business Strategies and Development

9.4.20. STDM Food And Beverages Private Limited

9.4.20.1. Company Overview

9.4.20.2. Product Portfolio

9.4.20.3. Financial Overview

9.4.20.4. Business Strategies and Development

9.4.21. The Scoular Company

9.4.21.1. Company Overview

9.4.21.2. Product Portfolio

9.4.21.3. Financial Overview

9.4.21.4. Business Strategies and Development

9.4.22. The Shandong Jianyuan Group

9.4.22.1. Company Overview

9.4.22.2. Product Portfolio

9.4.22.3. Financial Overview

9.4.22.4. Business Strategies and Development

9.4.23. Yantai Oriental Protein Tech Co., Ltd.

9.4.23.1. Company Overview

9.4.23.2. Product Portfolio

9.4.23.3. Financial Overview

9.4.23.4. Business Strategies and Development

9.4.24. Yantai Shuangta Food Co., Ltd

9.4.24.1. Company Overview

9.4.24.2. Product Portfolio

9.4.24.3. Financial Overview

9.4.24.4. Business Strategies and Development

9.4.25. Yosin Biotechnology Co., Ltd

9.4.25.1. Company Overview

9.4.25.2. Product Portfolio

9.4.25.3. Financial Overview

9.4.25.4. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2023 |

|

2019 - 2023 |

2024 - 2032 |

Value: US$ Billion |

||

|

REPORT FEATURES |

DETAILS |

|

Grade Coverage |

|

|

Nature Coverage |

|

|

Application Coverage |

|

|

Function Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |