Global Pedestrian Entrance Control Systems Market Forecast

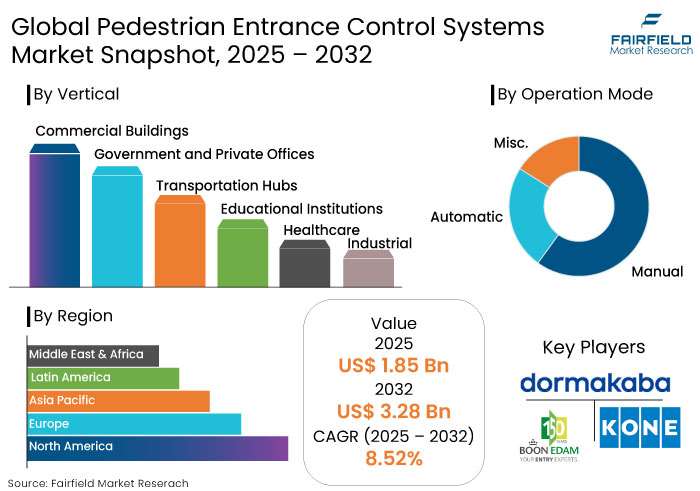

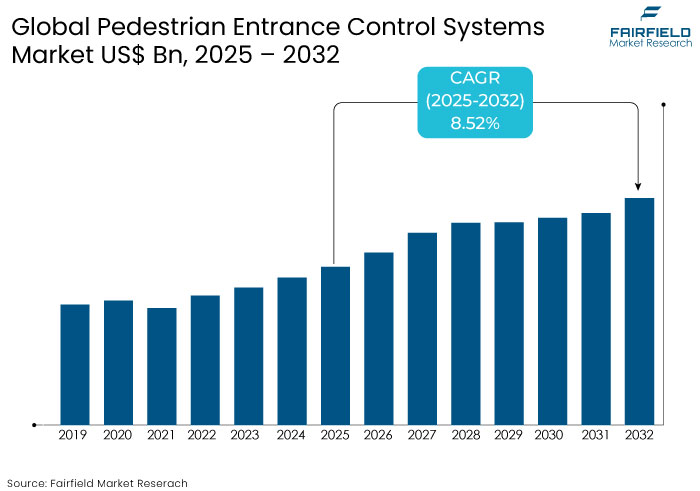

- The pedestrian entrance control systems market is predicted to reach a size of US$ 3.28 Bn by 2032, showing significant growth from US$ 1.85 Bn attained in 2025.

- The pedestrian entrance control systems industry is anticipated to expand at a CAGR of 8.52% from 2025 to 2032.

Pedestrian Entrance Control Systems Market Insights

- Global surge in public transportation usage is increasing the demand for pedestrian entrance control systems to safely manage large volumes of passengers.

- Rapid growth of smart cities is accelerating the adoption of advanced pedestrian entrance control systems, as these cities focus on enhancing safety and security.

- The COVID-19 pandemic significantly accelerated the adoption of touchless solutions, like facial recognition, QR code scanning, and mobile app-based entry, owing to concerns over surface transmission.

- Growth in the market is estimated to be fueled by advancements in automation, artificial intelligence (AI), and machine learning (ML).

- Integration of IoT-enabled devices is likely to propel growth by enabling real-time tracking and seamless connectivity with building infrastructure, ensuring a robust and interconnected security ecosystem.

- Managing multiple access points with differing security protocols can create vulnerabilities and operational inefficiencies.

- Optical turnstiles, which offer high throughput and seamless integration in modern security frameworks, are projected to dominate the market.

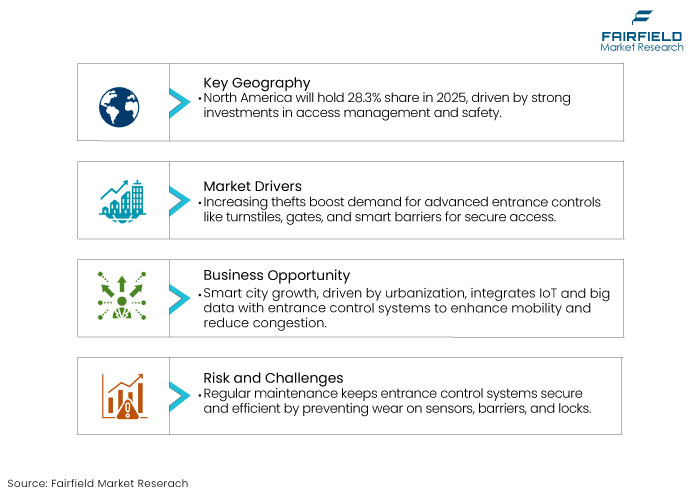

- North America is predicted to hold a share of 28.3% in 2025, driven by substantial investments in advanced access management and safety solutions.

A Look Back and a Look Forward - Comparative Analysis

The pedestrian entrance control systems market growth during the historical period was driven by increasing security concerns, particularly in high-traffic areas. The industry exhibited a CAGR of 3.1% from 2019 to 2023. Rising threats of terrorism, vandalism, and workplace violence prompted organizations to prioritize safety and access management.

Advanced technologies like biometric authentication, smart cards, and RFID-based systems became pivotal in streamlining access control and ensuring that only authorized personnel gain entry to secure areas. Rising investments from commercial and government sectors in smart city initiatives and modern infrastructure projects propelled expansion.

Looking forward, the market is projected to grow at a CAGR of 8.52%, owing to advancements in automation, artificial intelligence (AI), and machine learning (ML). Integration of these technologies enhance predictive analytics, adaptive security measures, and user experiences while improving detection of unauthorized access.

IoT-enabled devices are estimated to further propel growth as they enable real-time tracking and seamless connectivity with building infrastructure. This ensures a robust and interconnected security ecosystem.

Key Growth Determinants

- Increasing Rates of Burglaries and Thefts

Rising prevalence of burglaries and thefts is driving the demand for advanced pedestrian entrance control systems, including turnstiles, access gates, and smart barriers. These solutions are essential for preventing unauthorized access and ensuring secure authentication through technologies like biometrics, key cards, and PINs.

High-risk areas like gated communities, corporate offices, and urban public spaces, are increasingly adopting these systems to safeguard assets and individuals. In cities with high crime rates, like New York, the integration of advanced technologies like facial recognition and alarm systems have proven effective in decreasing crime.

- In 2022, the FBI reported 847,522 burglaries, equating to an estimated 269.8 incidents per 100,000 people. Despite a downward trend in burglaries, 26% lower in 2023, the need for proactive security remains critical.

- According to a survey, a break-in occurs every 26 seconds in the U.S., and homes without a security system are 300% more likely to be burglarized.

Access control systems offer a cost-effective way to mitigate financial and security risks. Leading manufacturers are investing in innovative products like the Tourniket revolving door, featuring advanced burglar-resistant technologies.

- Rise in Public Transport Usage

Global surge in public transportation usage is being driven by urbanization, environmental considerations, and enhanced public transit infrastructure. Several cities are witnessing record ridership as commuters increasingly seek sustainable and cost-effective travel alternatives.

- In 2023, the London Underground achieved its highest passenger numbers since the pandemic, surpassing 4 million single-day rides. Similarly, public transit systems worldwide are experiencing a steady uptick in ridership.

- According to the American Public Transportation Association (APTA), public transit ridership rebounded to 79% of its former levels. In 2023, public transportation recorded 7.1 billion trips, reflecting a 16% increase over the previous year.

The European Union Agency for Railways has noted a significant rise in rail passengers across the EU, with several cities setting new ridership records. This growth is putting increasing pressure on transit systems to manage large volumes of passengers in a safe and efficient manner. To address the increasing pressure on transit systems, the European Union’s Connecting Europe Facility (CEF) allocated funding for transport infrastructure projects.

Key Growth Barriers

- Impact of Maintenance and Operational Costs

Routine maintenance is critical to ensure the optimal performance and security of pedestrian entrance control systems. Over time, components like sensors, barriers, and locks experience wear and tear, necessitating timely replacements.

- On average, the cost of maintaining automated barriers ranges from 5% to 10% of the initial installation cost annually.

As these systems age, certain parts may become obsolete or require replacement, necessitating significant investment in new components. This can be particularly burdensome for organizations with large and geographically dispersed networks of systems.

Operational costs extend beyond maintenance to include electricity consumption. Automated barriers, turnstiles, and gates rely on power to operate motors and sensors, with energy usage varying significantly based on the system type.

Pedestrian Entrance Control Systems Market Trends and Opportunities

- Growth in Smart Cities

Rapid growth of smart cities is primarily driven by urbanization, as increasing number of individuals relocate to urban centers in pursuit of enhanced economic prospects, superior amenities, and an improved quality of life. Smart cities leverage cutting-edge technologies like the Internet of Things (IoT) and big data analytics to optimize operations and resource management. Pedestrian entrance control systems are evolving and can be seamlessly connected to smart city platforms. This enables the collection and analysis of data to optimize the movement of people, reduce congestion, and eliminate bottlenecks.

- Amsterdam’s smart city initiative, launched in 2009, serves as a prime example, featuring over 170 operations across the city. Amsterdam utilizes renewable energy for electric garbage trucks, solar-powered infrastructure, and floating villages to address overcrowding and land reclamation challenges.

- Indian government's Smart Cities Mission has introduced advanced security measures, like RFID-enabled pedestrian turnstiles and biometric verification, to secure high-risk areas, including critical infrastructure and financial districts.

- Shift Towards Touchless Solutions

The COVID-19 pandemic significantly accelerated the adoption of touchless solutions across multiple sectors, including pedestrian entrance control systems. Concerns regarding the transmission of viruses and bacteria via surfaces prompted a paradigm shift toward systems that facilitate contactless access.

Solutions like facial recognition, QR code scanning, and mobile app-based entry gained traction owing to their ability to enhance safety while maintaining social distancing protocols. Advancements in biometric technologies, including facial recognition and iris scanning, have significantly improved the reliability and accessibility of these touchless systems.

Integration of mobile applications has further driven this transition, enabling users to access buildings via their smartphones, eliminating the need for physical keys or access cards.

- In New York City, mobile-based access systems have experienced a 35% to 40% increase in adoption, enabling residents to seamlessly enter their buildings using their smartphones.

Segments Covered in the Report

- Automatic Operation Mode to Dominate Owing to Stringent Government Regulations

The automatic segment has established a dominant position in the market, capturing an impressive share of 69.5% in 2025. This mode provides seamless, hands-free access, reducing manual intervention and minimizing human error.

- In the U.S., the adoption of automatic pedestrian entrance control systems is particularly pronounced, with the market projected to reach $ 456.1 Bn by 2032, driven largely by automatic operation modes. This trend reflects a strong preference for automation to improve security and operational efficiency.

Government regulations and standards have been instrumental in accelerating the adoption of automatic systems. Such regulations underscore the critical role of automation in safety applications, influencing its broader implementation across industries.

- The Federal Motor Vehicle Safety Standards in the U.S. mandate automatic emergency braking systems, including pedestrian AEB, in light vehicles.

Key sectors are increasingly adopting automatic turnstiles and security revolving doors to optimize access control processes. These systems not only strengthen security protocols but also enhance user experience by enabling smooth and efficient entry and exit.

- Transportation Hubs Set to Witness Rapid Growth

Transportation hubs, including airports, train stations, and bus terminals, are high-traffic environments that face heightened security risks. The imperative to safeguard passengers and infrastructure has accelerated the deployment of sophisticated entrance control systems designed to prevent unauthorized access, identify potential threats, and enhance traveler safety.

Leading U.S. airports have implemented biometric screening technologies, streamlining passenger flow, reducing wait times, and elevating the overall travel experience. This strategic integration of technology not only fortifies security but also optimizes operational performance.

Technological advancements have been instrumental in enhancing the functionality of pedestrian entrance control systems. Innovations like biometric authentication, mobile access solutions, and automated turnstiles have significantly improved system efficiency and reliability.

Regional Analysis

- Government Backing to Facilitate Growth in North America

North America is projected to hold a significant share of 28.3% in 2025. This leadership is driven by substantial investments from government agencies, commercial enterprises, and public venues in advanced access management and safety solutions.

- The U.S. Department of Homeland Security has mandated stringent security protocols in federal facilities, necessitating the deployment of sophisticated pedestrian entrance control technologies.

- Corporate offices accounted for 25% of the pedestrian entrance control systems market in North America in 2023.

The region's strategic focus on integrating cutting-edge technologies into security infrastructure has catalyzed the adoption of advanced systems, like biometric authentication and AI-driven surveillance tools.

Robust investments in urban development and public transportation have fueled demand for efficient crowd management solutions. For instance, leading airports and transit hubs in North America have implemented state-of-the-art entrance control systems to optimize passenger flow and strengthen security measures.

- Expanding Metro Rail Projected to Facilitate Growth in Asia Pacific

Asia Pacific is at the forefront of adopting biometric based entrance systems, including facial recognition and fingerprint scanning. Expanding metro rail projects in cities like Beijing, Delhi, and Tokyo are major contributors to market growth.

- In 2023, India added 350 km of metro rail lines, with plans for further expansion, increasing demand for automated turnstiles and gates.

Government authorities in countries like China, India, and Japan are heavily investing in smart cities and infrastructure. Increased security threats and rising incidences of unauthorized access have spurred the adoption of high-tech pedestrian entrance control system.

- China’s ongoing urbanization initiatives and India’s Smart Cities Mission, which aims to develop 100 smart cities, are driving demand for advanced entrance control systems.

Fairfield’s Competitive Landscape Analysis

Manufacturers are increasingly focusing on research and development to incorporate cutting-edge technologies, including facial recognition, biometric authentication, and AI-driven monitoring systems. By leveraging IoT and real-time data analytics, companies are optimizing the efficiency, security, and user experience of their entrance control systems.

Customization is a key differentiator, enabling manufacturers to offer tailored solutions that meet specific client needs. This adaptability not only broadens their customer base but also strengthens client relationships. Strategic partnerships with system integrators, construction firms, and security consultants further bolster market penetration and growth.

Key Market Companies

- Royal Boon Edam International B.V.

- Dormakaba Holding

- KONE Corporation

- ZKTECO

- Honeywell

- ASSA ABLOY Global Solutions

- Johnson Control

- Automatic Systems

- PERCo

- Neptune Automatic Pvt. Ltd

- Gunnebo Entrance Control

- Hayward Turnstiles

- Turnstile Security

- URSA Gates Ltd.

- CAME Group

Recent Industry Developments

- In August 2024, Automatic Systems announced that its FirstLane and FirstLane PLUS speed gates are now UL Listed.

- In December 2023, Honeywell announced its plans to enhance and strengthen its building automation capabilities with the acquisition of Carrier Global Corporation’s Global Access Solutions business for US$ 4.95 Bn, in an all-cash transaction.

- In July 2023, Integrated Design Limited (IDL) announced the addition of two new items to its Glassgate turnstile range: the 300 Slimline and the 150 Plus.

An Expert’s Eye

- Manufacturers are focusing on research and development to integrate cutting-edge technologies like facial recognition, biometric authentication, and AI-driven monitoring systems.

- Customization and strategic partnerships with system integrators and security consultants are key to expanding market reach.

- Teleoperation addresses driver shortages while enhancing efficiency by enabling remote vehicle management and offering better work-life balance for operators.

- The market is predicted to continue growing, with AI, IoT, and biometric authentication driving the evolution of pedestrian entrance control systems.

- Innovations in automation and smart technologies is likely to improve efficiency, security, and user experience.

- While challenges like maintenance costs and managing multiple access points exist, the future of the market is promising with continuous innovations in security and operational efficiency.

Global Pedestrian Entrance Control Systems Market is Segmented as-

By Component

- Access Type

- Entrance gates

- Full-Height Turnstiles

- Optical Turnstiles

- Security Doors

- Speed Gates

- Tripod Turnstiles

- Misc.

- Access Control Software

- Services

- Consulting and Design

- Installation and Integration

- Maintenance and Repair

By Operation Mode

- Manual

- Automatic

- Misc.

By Vertical

- Commercial Buildings

- Government and Private Offices

- Transportation Hubs

- Educational Institutions

- Healthcare

- Industrial

- Misc.

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- The Middle East & Africa

1. Executive Summary

1.1. Global Pedestrian Entrance Control Systems Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2025

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. COVID-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Global Pedestrian Entrance Control Systems Market Outlook, 2019 - 2032

3.1. Global Pedestrian Entrance Control Systems Market Outlook, by Component, Value (US$ Bn) and Volume (Units), 2019 - 2032

3.1.1. Key Highlights

3.1.1.1. Access Type

3.1.1.1.1. Entrance gates

3.1.1.1.2. Full-Height Turnstiles

3.1.1.1.3. Optical Turnstiles

3.1.1.1.4. Security Doors

3.1.1.1.5. Speed Gates

3.1.1.1.6. Tripod Turnstiles

3.1.1.1.7. Misc.

3.1.1.2. Access Control Software

3.1.1.3. Services

3.1.1.3.1. Consulting and Design

3.1.1.3.2. Installation and Integration

3.1.1.3.3. Maintenance and Repair Other Components

3.2. Global Pedestrian Entrance Control Systems Market Outlook, by Operation Mode, Value (US$ Bn) and Volume (Units), 2019 - 2032

3.2.1. Key Highlights

3.2.1.1. Manual

3.2.1.2. Automatic

3.2.1.3. Misc.

3.3. Global Pedestrian Entrance Control Systems Market Outlook, by Vertical, Value (US$ Bn) and Volume (Units), 2019 - 2032

3.3.1. Key Highlights

3.3.1.1. Commercial Buildings

3.3.1.2. Govt & Private Offices

3.3.1.3. Transportation Hubs

3.3.1.4. Educational Institutions

3.3.1.5. Healthcare

3.3.1.6. Industrial

3.3.1.7. Misc.

3.4. Global Pedestrian Entrance Control Systems Market Outlook, by Region, Value (US$ Bn) and Volume (Units), 2019 - 2032

3.4.1. Key Highlights

3.4.1.1. North America

3.4.1.2. Europe

3.4.1.3. Asia Pacific

3.4.1.4. Latin America

3.4.1.5. Middle East & Africa

4. North America Pedestrian Entrance Control Systems Market Outlook, 2019 - 2032

4.1. North America Pedestrian Entrance Control Systems Market Outlook, by Component, Value (US$ Bn) and Volume (Units), 2019 - 2032

4.1.1. Key Highlights

4.1.1.1. Access Type

4.1.1.1.1. Entrance gates

4.1.1.1.2. Full-Height Turnstiles

4.1.1.1.3. Optical Turnstiles

4.1.1.1.4. Security Doors

4.1.1.1.5. Speed Gates

4.1.1.1.6. Tripod Turnstiles

4.1.1.1.7. Misc.

4.1.1.2. Access Control Software

4.1.1.3. Services

4.1.1.3.1. Consulting and Design

4.1.1.3.2. Installation and Integration

4.1.1.3.3. Maintenance and Repair Other Components

4.2. North America Pedestrian Entrance Control Systems Market Outlook, by Operation Mode, Value (US$ Bn) and Volume (Units), 2019 - 2032

4.2.1. Key Highlights

4.2.1.1. Manual

4.2.1.2. Automatic

4.2.1.3. Misc.

4.3. North America Pedestrian Entrance Control Systems Market Outlook, by Vertical, Value (US$ Bn) and Volume (Units), 2019 - 2032

4.3.1. Key Highlights

4.3.1.1. Commercial Buildings

4.3.1.2. Govt & Private Offices

4.3.1.3. Transportation Hubs

4.3.1.4. Educational Institutions

4.3.1.5. Healthcare

4.3.1.6. Industrial

4.3.1.7. Misc.

4.3.2. BPS Analysis/Market Attractiveness Analysis

4.4. North America Pedestrian Entrance Control Systems Market Outlook, by Country, Value (US$ Bn) and Volume (Units), 2019 - 2032

4.4.1. Key Highlights

4.4.1.1. U.S. Pedestrian Entrance Control Systems Market by Component, Value (US$ Bn) and Volume (Units), 2019 - 2032

4.4.1.2. U.S. Pedestrian Entrance Control Systems Market by Operation Mode, Value (US$ Bn) and Volume (Units), 2019 - 2032

4.4.1.3. U.S. Pedestrian Entrance Control Systems Market by Vertical, Value (US$ Bn) and Volume (Units), 2019 - 2032

4.4.1.4. Canada Pedestrian Entrance Control Systems Market by Component, Value (US$ Bn) and Volume (Units), 2019 - 2032

4.4.1.5. Canada Pedestrian Entrance Control Systems Market by Operation Mode, Value (US$ Bn) and Volume (Units), 2019 - 2032

4.4.1.6. Canada Pedestrian Entrance Control Systems Market by Vertical, Value (US$ Bn) and Volume (Units), 2019 - 2032

4.4.2. BPS Analysis/Market Attractiveness Analysis

5. Europe Pedestrian Entrance Control Systems Market Outlook, 2019 - 2032

5.1. Europe Pedestrian Entrance Control Systems Market Outlook, by Component, Value (US$ Bn) and Volume (Units), 2019 - 2032

5.1.1. Key Highlights

5.1.1.1. Access Type

5.1.1.1.1. Entrance gates

5.1.1.1.2. Full-Height Turnstiles

5.1.1.1.3. Optical Turnstiles

5.1.1.1.4. Security Doors

5.1.1.1.5. Speed Gates

5.1.1.1.6. Tripod Turnstiles

5.1.1.1.7. Misc.

5.1.1.2. Access Control Software

5.1.1.3. Services

5.1.1.3.1. Consulting and Design

5.1.1.3.2. Installation and Integration

5.1.1.3.3. Maintenance and Repair Other Components

5.2. Europe Pedestrian Entrance Control Systems Market Outlook, by Operation Mode, Value (US$ Bn) and Volume (Units), 2019 - 2032

5.2.1. Key Highlights

5.2.1.1. Manual

5.2.1.2. Automatic

5.2.1.3. Misc.

5.3. Europe Pedestrian Entrance Control Systems Market Outlook, by Vertical, Value (US$ Bn) and Volume (Units), 2019 - 2032

5.3.1. Key Highlights

5.3.1.1. Commercial Buildings

5.3.1.2. Govt & Private Offices

5.3.1.3. Transportation Hubs

5.3.1.4. Educational Institutions

5.3.1.5. Healthcare

5.3.1.6. Industrial

5.3.1.7. Misc.

5.3.2. BPS Analysis/Market Attractiveness Analysis

5.4. Europe Pedestrian Entrance Control Systems Market Outlook, by Country, Value (US$ Bn) and Volume (Units), 2019 - 2032

5.4.1. Key Highlights

5.4.1.1. Germany Pedestrian Entrance Control Systems Market by Component, Value (US$ Bn) and Volume (Units), 2019 - 2032

5.4.1.2. Germany Pedestrian Entrance Control Systems Market by Operation Mode, Value (US$ Bn) and Volume (Units), 2019 - 2032

5.4.1.3. Germany Pedestrian Entrance Control Systems Market by Vertical, Value (US$ Bn) and Volume (Units), 2019 - 2032

5.4.1.4. U.K. Pedestrian Entrance Control Systems Market by Component, Value (US$ Bn) and Volume (Units), 2019 - 2032

5.4.1.5. U.K. Pedestrian Entrance Control Systems Market by Operation Mode, Value (US$ Bn) and Volume (Units), 2019 - 2032

5.4.1.6. U.K. Pedestrian Entrance Control Systems Market by Vertical, Value (US$ Bn) and Volume (Units), 2019 - 2032

5.4.1.7. France Pedestrian Entrance Control Systems Market by Component, Value (US$ Bn) and Volume (Units), 2019 - 2032

5.4.1.8. France Pedestrian Entrance Control Systems Market by Operation Mode, Value (US$ Bn) and Volume (Units), 2019 - 2032

5.4.1.9. France Pedestrian Entrance Control Systems Market by Vertical, Value (US$ Bn) and Volume (Units), 2019 - 2032

5.4.1.10. Italy Pedestrian Entrance Control Systems Market by Component, Value (US$ Bn) and Volume (Units), 2019 - 2032

5.4.1.11. Italy Pedestrian Entrance Control Systems Market by Operation Mode, Value (US$ Bn) and Volume (Units), 2019 - 2032

5.4.1.12. Italy Pedestrian Entrance Control Systems Market by Vertical, Value (US$ Bn) and Volume (Units), 2019 - 2032

5.4.1.13. Turkey Pedestrian Entrance Control Systems Market by Component, Value (US$ Bn) and Volume (Units), 2019 - 2032

5.4.1.14. Turkey Pedestrian Entrance Control Systems Market by Operation Mode, Value (US$ Bn) and Volume (Units), 2019 - 2032

5.4.1.15. Turkey Pedestrian Entrance Control Systems Market by Vertical, Value (US$ Bn) and Volume (Units), 2019 - 2032

5.4.1.16. Russia Pedestrian Entrance Control Systems Market by Component, Value (US$ Bn) and Volume (Units), 2019 - 2032

5.4.1.17. Russia Pedestrian Entrance Control Systems Market by Operation Mode, Value (US$ Bn) and Volume (Units), 2019 - 2032

5.4.1.18. Russia Pedestrian Entrance Control Systems Market by Vertical, Value (US$ Bn) and Volume (Units), 2019 - 2032

5.4.1.19. Rest of Europe Pedestrian Entrance Control Systems Market by Component, Value (US$ Bn) and Volume (Units), 2019 - 2032

5.4.1.20. Rest of Europe Pedestrian Entrance Control Systems Market by Operation Mode, Value (US$ Bn) and Volume (Units), 2019 - 2032

5.4.1.21. Rest of Europe Pedestrian Entrance Control Systems Market by Vertical, Value (US$ Bn) and Volume (Units), 2019 - 2032

5.4.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Pedestrian Entrance Control Systems Market Outlook, 2019 - 2032

6.1. Asia Pacific Pedestrian Entrance Control Systems Market Outlook, by Component, Value (US$ Bn) and Volume (Units), 2019 - 2032

6.1.1. Key Highlights

6.1.1.1. Access Type

6.1.1.1.1. Entrance gates

6.1.1.1.2. Full-Height Turnstiles

6.1.1.1.3. Optical Turnstiles

6.1.1.1.4. Security Doors

6.1.1.1.5. Speed Gates

6.1.1.1.6. Tripod Turnstiles

6.1.1.1.7. Misc.

6.1.1.2. Access Control Software

6.1.1.3. Services

6.1.1.3.1. Consulting and Design

6.1.1.3.2. Installation and Integration

6.1.1.3.3. Maintenance and Repair Other Components

6.2. Asia Pacific Pedestrian Entrance Control Systems Market Outlook, by Operation Mode, Value (US$ Bn) and Volume (Units), 2019 - 2032

6.2.1. Key Highlights

6.2.1.1. Manual

6.2.1.2. Automatic

6.2.1.3. Misc.

6.3. Asia Pacific Pedestrian Entrance Control Systems Market Outlook, by Vertical, Value (US$ Bn) and Volume (Units), 2019 - 2032

6.3.1. Key Highlights

6.3.1.1. Commercial Buildings

6.3.1.2. Govt & Private Offices

6.3.1.3. Transportation Hubs

6.3.1.4. Educational Institutions

6.3.1.5. Healthcare

6.3.1.6. Industrial

6.3.1.7. Misc.

6.3.2. BPS Analysis/Market Attractiveness Analysis

6.4. Asia Pacific Pedestrian Entrance Control Systems Market Outlook, by Country, Value (US$ Bn) and Volume (Units), 2019 - 2032

6.4.1. Key Highlights

6.4.1.1. China Pedestrian Entrance Control Systems Market by Component, Value (US$ Bn) and Volume (Units), 2019 - 2032

6.4.1.2. China Pedestrian Entrance Control Systems Market by Operation Mode, Value (US$ Bn) and Volume (Units), 2019 - 2032

6.4.1.3. China Pedestrian Entrance Control Systems Market by Vertical, Value (US$ Bn) and Volume (Units), 2019 - 2032

6.4.1.4. Japan Pedestrian Entrance Control Systems Market by Component, Value (US$ Bn) and Volume (Units), 2019 - 2032

6.4.1.5. Japan Pedestrian Entrance Control Systems Market by Operation Mode, Value (US$ Bn) and Volume (Units), 2019 - 2032

6.4.1.6. Japan Pedestrian Entrance Control Systems Market by Vertical, Value (US$ Bn) and Volume (Units), 2019 - 2032

6.4.1.7. South Korea Pedestrian Entrance Control Systems Market by Component, Value (US$ Bn) and Volume (Units), 2019 - 2032

6.4.1.8. South Korea Pedestrian Entrance Control Systems Market by Operation Mode, Value (US$ Bn) and Volume (Units), 2019 - 2032

6.4.1.9. South Korea Pedestrian Entrance Control Systems Market by Vertical, Value (US$ Bn) and Volume (Units), 2019 - 2032

6.4.1.10. India Pedestrian Entrance Control Systems Market by Component, Value (US$ Bn) and Volume (Units), 2019 - 2032

6.4.1.11. India Pedestrian Entrance Control Systems Market by Operation Mode, Value (US$ Bn) and Volume (Units), 2019 - 2032

6.4.1.12. India Pedestrian Entrance Control Systems Market by Vertical, Value (US$ Bn) and Volume (Units), 2019 - 2032

6.4.1.13. Southeast Asia Pedestrian Entrance Control Systems Market by Component, Value (US$ Bn) and Volume (Units), 2019 - 2032

6.4.1.14. Southeast Asia Pedestrian Entrance Control Systems Market by Operation Mode, Value (US$ Bn) and Volume (Units), 2019 - 2032

6.4.1.15. Southeast Asia Pedestrian Entrance Control Systems Market by Vertical, Value (US$ Bn) and Volume (Units), 2019 - 2032

6.4.1.16. Rest of Asia Pacific Pedestrian Entrance Control Systems Market by Component, Value (US$ Bn) and Volume (Units), 2019 - 2032

6.4.1.17. Rest of Asia Pacific Pedestrian Entrance Control Systems Market by Operation Mode, Value (US$ Bn) and Volume (Units), 2019 - 2032

6.4.1.18. Rest of Asia Pacific Pedestrian Entrance Control Systems Market by Vertical, Value (US$ Bn) and Volume (Units), 2019 - 2032

6.4.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America Pedestrian Entrance Control Systems Market Outlook, 2019 - 2032

7.1. Latin America Pedestrian Entrance Control Systems Market Outlook, by Component, Value (US$ Bn) and Volume (Units), 2019 - 2032

7.1.1. Key Highlights

7.1.1.1. Access Type

7.1.1.1.1. Entrance gates

7.1.1.1.2. Full-Height Turnstiles

7.1.1.1.3. Optical Turnstiles

7.1.1.1.4. Security Doors

7.1.1.1.5. Speed Gates

7.1.1.1.6. Tripod Turnstiles

7.1.1.1.7. Misc.

7.1.1.2. Access Control Software

7.1.1.3. Services

7.1.1.3.1. Consulting and Design

7.1.1.3.2. Installation and Integration

7.1.1.3.3. Maintenance and Repair Other Components

7.2. Latin America Pedestrian Entrance Control Systems Market Outlook, by Operation Mode, Value (US$ Bn) and Volume (Units), 2019 - 2032

7.2.1. Key Highlights

7.2.1.1. Manual

7.2.1.2. Automatic

7.2.1.3. Misc.

7.3. Latin America Pedestrian Entrance Control Systems Market Outlook, by Vertical, Value (US$ Bn) and Volume (Units), 2019 - 2032

7.3.1. Key Highlights

7.3.1.1. Commercial Buildings

7.3.1.2. Govt & Private Offices

7.3.1.3. Transportation Hubs

7.3.1.4. Educational Institutions

7.3.1.5. Healthcare

7.3.1.6. Industrial

7.3.1.7. Misc.

7.3.2. BPS Analysis/Market Attractiveness Analysis

7.4. Latin America Pedestrian Entrance Control Systems Market Outlook, by Country, Value (US$ Bn) and Volume (Units), 2019 - 2032

7.4.1. Key Highlights

7.4.1.1. Brazil Pedestrian Entrance Control Systems Market by Component, Value (US$ Bn) and Volume (Units), 2019 - 2032

7.4.1.2. Brazil Pedestrian Entrance Control Systems Market by Operation Mode, Value (US$ Bn) and Volume (Units), 2019 - 2032

7.4.1.3. Brazil Pedestrian Entrance Control Systems Market by Vertical, Value (US$ Bn) and Volume (Units), 2019 - 2032

7.4.1.4. Mexico Pedestrian Entrance Control Systems Market by Component, Value (US$ Bn) and Volume (Units), 2019 - 2032

7.4.1.5. Mexico Pedestrian Entrance Control Systems Market by Operation Mode, Value (US$ Bn) and Volume (Units), 2019 - 2032

7.4.1.6. Mexico Pedestrian Entrance Control Systems Market by Vertical, Value (US$ Bn) and Volume (Units), 2019 - 2032

7.4.1.7. Argentina Pedestrian Entrance Control Systems Market by Component, Value (US$ Bn) and Volume (Units), 2019 - 2032

7.4.1.8. Argentina Pedestrian Entrance Control Systems Market by Operation Mode, Value (US$ Bn) and Volume (Units), 2019 - 2032

7.4.1.9. Argentina Pedestrian Entrance Control Systems Market by Vertical, Value (US$ Bn) and Volume (Units), 2019 - 2032

7.4.1.10. Rest of Latin America Pedestrian Entrance Control Systems Market by Component, Value (US$ Bn) and Volume (Units), 2019 - 2032

7.4.1.11. Rest of Latin America Pedestrian Entrance Control Systems Market by Operation Mode, Value (US$ Bn) and Volume (Units), 2019 - 2032

7.4.1.12. Rest of Latin America Pedestrian Entrance Control Systems Market by Vertical, Value (US$ Bn) and Volume (Units), 2019 - 2032

7.4.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Pedestrian Entrance Control Systems Market Outlook, 2019 - 2032

8.1. Middle East & Africa Pedestrian Entrance Control Systems Market Outlook, by Component, Value (US$ Bn) and Volume (Units), 2019 - 2032

8.1.1. Key Highlights

8.1.1.1. Access Type

8.1.1.1.1. Entrance gates

8.1.1.1.2. Full-Height Turnstiles

8.1.1.1.3. Optical Turnstiles

8.1.1.1.4. Security Doors

8.1.1.1.5. Speed Gates

8.1.1.1.6. Tripod Turnstiles

8.1.1.1.7. Misc.

8.1.1.2. Access Control Software

8.1.1.3. Services

8.1.1.3.1. Consulting and Design

8.1.1.3.2. Installation and Integration

8.1.1.3.3. Maintenance and Repair Other Components

8.2. Middle East & Africa Pedestrian Entrance Control Systems Market Outlook, by Operation Mode, Value (US$ Bn) and Volume (Units), 2019 - 2032

8.2.1. Key Highlights

8.2.1.1. Manual

8.2.1.2. Automatic

8.2.1.3. Misc.

8.3. Middle East & Africa Pedestrian Entrance Control Systems Market Outlook, by Vertical, Value (US$ Bn) and Volume (Units), 2019 - 2032

8.3.1. Key Highlights

8.3.1.1. Commercial Buildings

8.3.1.2. Govt & Private Offices

8.3.1.3. Transportation Hubs

8.3.1.4. Educational Institutions

8.3.1.5. Healthcare

8.3.1.6. Industrial

8.3.1.7. Misc.

8.3.2. BPS Analysis/Market Attractiveness Analysis

8.4. Middle East & Africa Pedestrian Entrance Control Systems Market Outlook, by Country, Value (US$ Bn) and Volume (Units), 2019 - 2032

8.4.1. Key Highlights

8.4.1.1. GCC Pedestrian Entrance Control Systems Market by Component, Value (US$ Bn) and Volume (Units), 2019 - 2032

8.4.1.2. GCC Pedestrian Entrance Control Systems Market by Operation Mode, Value (US$ Bn) and Volume (Units), 2019 - 2032

8.4.1.3. GCC Pedestrian Entrance Control Systems Market by Vertical, Value (US$ Bn) and Volume (Units), 2019 - 2032

8.4.1.4. South Africa Pedestrian Entrance Control Systems Market by Component, Value (US$ Bn) and Volume (Units), 2019 - 2032

8.4.1.5. South Africa Pedestrian Entrance Control Systems Market by Operation Mode, Value (US$ Bn) and Volume (Units), 2019 - 2032

8.4.1.6. South Africa Pedestrian Entrance Control Systems Market by Vertical, Value (US$ Bn) and Volume (Units), 2019 - 2032

8.4.1.7. Egypt Pedestrian Entrance Control Systems Market by Component, Value (US$ Bn) and Volume (Units), 2019 - 2032

8.4.1.8. Egypt Pedestrian Entrance Control Systems Market by Operation Mode, Value (US$ Bn) and Volume (Units), 2019 - 2032

8.4.1.9. Egypt Pedestrian Entrance Control Systems Market by Vertical, Value (US$ Bn) and Volume (Units), 2019 - 2032

8.4.1.10. Nigeria Pedestrian Entrance Control Systems Market by Component, Value (US$ Bn) and Volume (Units), 2019 - 2032

8.4.1.11. Nigeria Pedestrian Entrance Control Systems Market by Operation Mode, Value (US$ Bn) and Volume (Units), 2019 - 2032

8.4.1.12. Nigeria Pedestrian Entrance Control Systems Market by Vertical, Value (US$ Bn) and Volume (Units), 2019 - 2032

8.4.1.13. Rest of Middle East & Africa Pedestrian Entrance Control Systems Market by Component, Value (US$ Bn) and Volume (Units), 2019 - 2032

8.4.1.14. Rest of Middle East & Africa Pedestrian Entrance Control Systems Market by Operation Mode, Value (US$ Bn) and Volume (Units), 2019 - 2032

8.4.1.15. Rest of Middle East & Africa Pedestrian Entrance Control Systems Market by Vertical, Value (US$ Bn) and Volume (Units), 2019 - 2032

8.4.2. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. Manufacturer vs by Operation Mode Heatmap

9.2. Company Market Share Analysis, 2023

9.3. Competitive Dashboard

9.4. Company Profiles

9.4.1. Royal Boon Edam International B.V.

9.4.1.1. Company Overview

9.4.1.2. Product Portfolio

9.4.1.3. Financial Overview

9.4.1.4. Business Strategies and Development

9.4.2. Dormakaba Holding

9.4.2.1. Company Overview

9.4.2.2. Product Portfolio

9.4.2.3. Financial Overview

9.4.2.4. Business Strategies and Development

9.4.3. KONE Corporation

9.4.3.1. Company Overview

9.4.3.2. Product Portfolio

9.4.3.3. Financial Overview

9.4.3.4. Business Strategies and Development

9.4.4. ZKTECO

9.4.4.1. Company Overview

9.4.4.2. Product Portfolio

9.4.4.3. Financial Overview

9.4.4.4. Business Strategies and Development

9.4.5. Honeywell

9.4.5.1. Company Overview

9.4.5.2. Product Portfolio

9.4.5.3. Financial Overview

9.4.5.4. Business Strategies and Development

9.4.6. ASSA ABLOY Global Solutions

9.4.6.1. Company Overview

9.4.6.2. Product Portfolio

9.4.6.3. Financial Overview

9.4.6.4. Business Strategies and Development

9.4.7. Johnson Control

9.4.7.1. Company Overview

9.4.7.2. Product Portfolio

9.4.7.3. Financial Overview

9.4.7.4. Business Strategies and Development

9.4.8. Automatic Systems

9.4.8.1. Company Overview

9.4.8.2. Product Portfolio

9.4.8.3. Financial Overview

9.4.8.4. Business Strategies and Development

9.4.9. PERCo

9.4.9.1. Company Overview

9.4.9.2. Product Portfolio

9.4.9.3. Financial Overview

9.4.9.4. Business Strategies and Development

9.4.10. Neptune Automatic Pvt. Ltd

9.4.10.1. Company Overview

9.4.10.2. Product Portfolio

9.4.10.3. Financial Overview

9.4.10.4. Business Strategies and Development

9.4.11. Gunnebo Entrance Control

9.4.11.1. Company Overview

9.4.11.2. Product Portfolio

9.4.11.3. Financial Overview

9.4.11.4. Business Strategies and Development

9.4.12. Hayward Turnstiles

9.4.12.1. Company Overview

9.4.12.2. Product Portfolio

9.4.12.3. Financial Overview

9.4.12.4. Business Strategies and Development

9.4.13. Turnstile Security

9.4.13.1. Company Overview

9.4.13.2. Product Portfolio

9.4.13.3. Financial Overview

9.4.13.4. Business Strategies and Development

9.4.14. URSA Gates Ltd.

9.4.14.1. Company Overview

9.4.14.2. Product Portfolio

9.4.14.3. Financial Overview

9.4.14.4. Business Strategies and Development

9.4.15. CAME Group

9.4.15.1. Company Overview

9.4.15.2. Product Portfolio

9.4.15.3. Financial Overview

9.4.15.4. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2023 |

|

2019 - 2023 |

2025 - 2032 |

Value: US$ Billion |

||

|

REPORT FEATURES |

DETAILS |

|

Component Coverage |

|

|

Operation Mode Coverage |

|

|

Vertical Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2024), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |