Peripheral Stent Implants Market Forecast

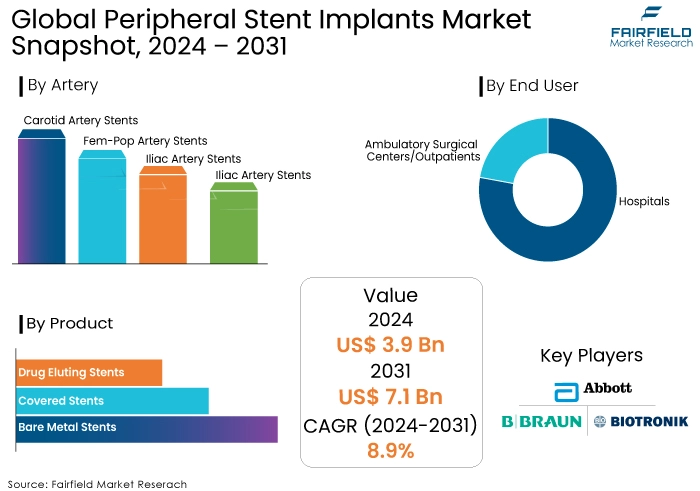

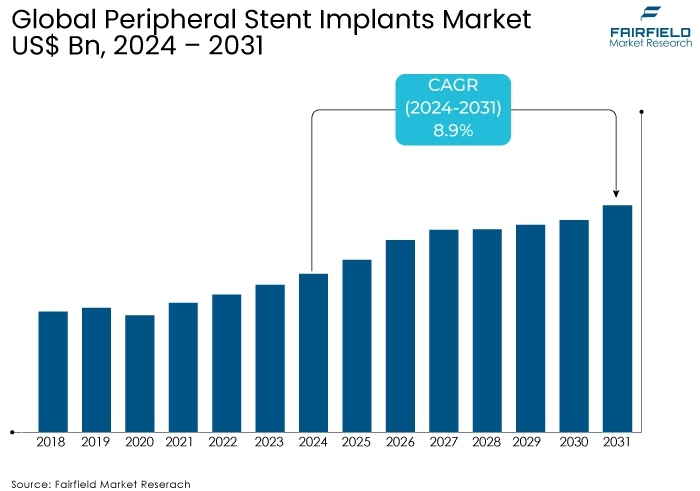

- Peripheral stent implants market size projected to reach US$7.1 Bn by 2031, showing significant growth from the US$3.9 Bn estimated in 2024

- Global peripheral stent implants market revenue likely to exhibit a strong CAGR of 8.90% from 2024 to 2031

Peripheral Stent Implants Market Insights

- The market is experiencing rapid growth driven by increasing PAD prevalence and technological advancements.

- Market valuation is expected to surpass US$7.1 Bn by 2031.

- Key growth drivers include increasing PAD incidence, technological advancements, and rising demand for minimally invasive procedures.

- Challenges include stringent regulatory approval processes and the impact of the COVID-19 pandemic.

- Market trends include increasing adoption of bio-absorbable stents and growing market potential in India, and China.

- Bare metal stents dominate the peripheral stent implants market due to non-invasive procedures.

- Iliac artery stents lead the product segment due to increasing atherosclerosis.

- Hospitals are the primary end-users of peripheral stent implants.

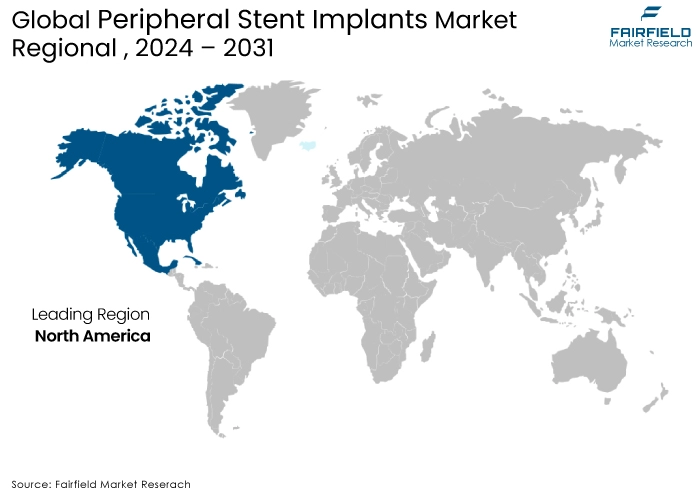

- North America, led by the US, is the dominant market.

- Germany is a leading country in the European market.

A Look Back and a Look Forward - Comparative Analysis

The market analysis shows rapid growth in the coming years. The market registered a historic CAGR of 5.6% from 2015 to 2022. The market is expected to reach a valuation of US$3.9 Bn in 2024, with a CAGR of 7.60%. Over 230 million people worldwide suffer from PAD. The demand for stents and longer life expectancies in the geriatric population has created opportunities for manufacturers. Advancements in radiotherapy, gene therapy, imaging technology, and implementation have expanded treatment options for PAD, including balloon angioplasty, excisional atherectomy, and drug-eluting technologies.

As per the Fairfield’s analysis, the peripheral stent implants market is projected to surpass US$7.1 Bn by 2031, with a CAGR of 8.90%. The market is expected to grow due to its low treatment risk, cost-effectiveness, and faster recovery time. Manufacturers can focus on developing innovative reabsorbable stents and peripheral local drug delivery for restenosis treatment. Further, cost-effective endovascular treatments are becoming more popular, and the longevity of these treatments contributes to increased surgeries. Outpatient reimbursement policies and growing end users in developing countries further fuel the market.

Key Growth Determinants

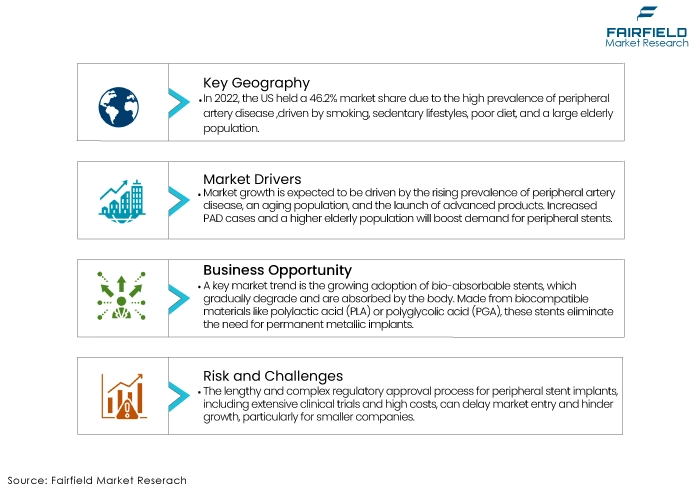

- Increasing Prevalence of Peripheral Artery Disease (PAD)

The rise in the prevalence of peripheral diseases, the increase in the geriatric population, and the launch of advanced products are expected to drive market growth. The rising prevalence of PAD is expected to increase the demand for peripheral stents, boosting market growth. The elderly population, more prone to developing peripheral vascular diseases, is expected to drive the market growth.

Peripheral artery disease is a common vascular condition that affects the arteries outside the heart and brain. The rising prevalence of PAD, particularly among the aging population, is expected to drive the peripheral stent implants market demand. As the population ages and the incidence of diabetes and obesity increases, the number of patients with PAD is also expected to rise. This, in turn, will lead to an increased demand for stents to treat blocked or narrowed arteries and improve blood flow to the extremities.

- Technological Advancements in Stent Design and Materials

Technological advancements in stent design and materials have significantly improved the safety and efficacy of peripheral stent implants. The development of drug-eluting stents, which release medication to prevent restenosis (re-narrowing of the artery), has revolutionized the treatment of peripheral artery disease. These advancements have led to better patient outcomes, reduced rates of revascularization procedures, and increased adoption by healthcare providers.

Additionally, the introduction of bioresorbable stents that gradually dissolve over time offers a promising alternative to traditional metallic stents. All these advancements are fueling the peripheral stent implants market expansion.

- Growing Demand for Minimally Invasive Procedures

There is a growing preference for minimally invasive procedures among patients and healthcare providers. Minimally invasive procedures offer several advantages, including shorter hospital stays, faster recovery times, and reduced risk of complications. Peripheral stent implants, which can be placed using minimally invasive techniques such as angioplasty, are increasingly preferred over open surgical procedures. The demand for these procedures is expected to drive the market revenue as more healthcare facilities invest in the necessary equipment and training to perform these interventions.

Key Growth Barriers

- Stringent Regulatory Approval Process

According to the peripheral stent implants market analysis, the regulatory approval process for medical devices can be lengthy and complex. Regulatory bodies, such as the FDA, require extensive clinical trials and evidence of safety and efficacy before granting approval for market entry. This rigorous process can significantly delay the introduction of new stent products into the market.

Additionally, the cost associated with obtaining regulatory approvals can be substantial, especially for smaller companies with limited resources. These factors can act as barriers to entry for new industry players and hinder the overall market growth.

- Impact of COVID-19 Pandemic

The market research report shows the COVID-19 pandemic has had a significant impact on the healthcare industry, and so on the industry. The prioritization of COVID-19-related diagnostic and treatment devices over cardiovascular procedures has led to a decrease in the number of elective procedures, including those related to peripheral stent implants.

Many surgical facilities and hospitals have considered canceling or delaying non-urgent procedures, which has affected the market growth to a certain extent. The operational and clinical difficulties faced by healthcare facilities during the pandemic have also contributed to the slowdown in peripheral stent implants market sales.

Peripheral Stent Implants Market Trends and Opportunities

- Increasing Adoption of Bio-absorbable Stents

One of the significant market trends is the increasing adoption of bio-absorbable stents. Bio-absorbable stents are designed to gradually degrade and be absorbed by the body over time, eliminating the need for a permanent metallic implant. These stents are made from materials such as polylactic acid (PLA) or polyglycolic acid (PGA), which are biocompatible and biodegradable.

The trend towards bio-absorbable stents is driven by several factors. They offer potential benefits in terms of reducing the risk of long-term complications associated with permanent metallic stents, such as in-stent restenosis or late thrombosis. Bio-absorbable stents may allow for better vessel healing and restoration of natural vessel function after the stent has dissolved. They also provide an alternative treatment option for patients who may require future interventions or have complex anatomies that make the use of permanent stents challenging.

Further, industry news shows that the adoption of bio-absorbable stents is supported by ongoing research and development efforts to improve their performance and safety. Manufacturers are investing in clinical trials and studies to evaluate the long-term outcomes and effectiveness of these stents. Additionally, regulatory bodies are actively involved in assessing the safety and efficacy of bio-absorbable stents and providing guidelines for their use. The increasing adoption of bio-absorbable stents represents a significant trend in the peripheral stent implants market, driven by the potential benefits they offer in terms of patient outcomes and long-term vessel health.

- Growing Market Potential in India, and China

As per the peripheral stent implant market overview, India, and China present significant opportunities for investors and stakeholders in the peripheral stent implant industry. These countries have large populations and a rising prevalence of PAD due to factors such as changing lifestyles, increasing rates of diabetes and obesity, and an aging population.

In India, the demand is expected to grow due to the increasing burden of PAD and the improving healthcare infrastructure. The Indian government has also taken initiatives to promote the use of advanced medical devices, including stents, by implementing price controls and streamlining regulatory processes. On the other hand, China offers lucrative peripheral stent implants market opportunities. The country has a large patient pool and a growing awareness of cardiovascular diseases. The Chinese government has implemented policies to improve healthcare access and affordability, which is expected to drive the demand.

How is Regulatory Scenario Shaping this Industry?

The regulatory scenario for the market growth is an important aspect that shapes the market landscape. The FDA plays a crucial role in regulating medical devices, including stents. They have specific guidelines and requirements for the approval and marketing of stents. According to the market update, regulatory bodies are focused on ensuring the safety and efficacy. They require manufacturers to adhere to specific standards and conduct non-clinical engineering tests to demonstrate the device's ability to withstand external loads and deformations.

The expansion of 3D printing technology has introduced unique regulatory challenges for device design, development, manufacturing, biocompatibility, and sterilization. The FDA is actively involved in developing consensus strategies for validating 3D-printed medical devices. The peripheral stent implants market players are investing in research and development activities to launch low-cost peripheral artery stents and develop effective products that simplify interventional procedures. These efforts are aimed at meeting the demands posed by rising peripheral artery disease.

Segments Covered in Peripheral Stent Implants Market Report

- Bare Metal Stents Dominate as Non-invasive Procedures Gain Traction

Bare metal stents accounted for a significant 75.9% share of the global market in 2022. These stents are highly favored due to their non-invasive nature and local anesthetic procedures. The peripheral stent implants market value is further driven by the development of bioresorbable stents and the growing number of cath labs. Among the bare metal stents segment, the balloon expandable stent is the preferred choice, offering higher radial stiffness and precise placement. These stents have demonstrated success in reducing restenosis and vessel closure, resulting in lower rates of target lesion revascularization (TLR).

- Iliac Artery Stents Take the Steer Through Technological Advancements

Iliac artery stents accounted for approximately 47% of the total peripheral stent implants market share in 2022, driven by various factors. The increasing global incidence of atherosclerosis and cardiovascular diseases is a primary driver for the growing demand for iliac artery stents. Additionally, rapid technological advancements and the widespread acceptance of stenting procedures among patients contribute to the rising demand for these stents. Furthermore, the growing geriatric population and the rising preference for minimally invasive surgeries further fuel the demand for iliac artery stents.

- Hospitals Dominate the Market as are Established to Offer Efficient Treatments

As per the peripheral stent implants market update, hospitals accounted for a significant market share of approximately 58.4% in 2022. The hospital segment emerged as the largest contributor by end user and is projected to maintain its leadership position in the forecast period. This can be attributed to several factors, including a growing number of patients choosing hospitals for angioplasty procedures, an increasing prevalence of coronary artery diseases, government initiatives to enhance medical infrastructure, rising awareness about disease treatment and management, and a rise in sedentary lifestyles.

Regional Analysis

- North America Surges Ahead of All, Led by US

As per the market forecast, the US held a significant market share of approximately 46.2% in 2022, driven by the increasing prevalence of peripheral artery disease in the country. Factors contributing to this prevalence include higher rates of smoking, sedentary lifestyles, poor dietary choices, cerebral and cardiovascular diseases, diabetes, and a large geriatric population.

According to the Centers for Disease Control and Prevention, an estimated 6.5 million individuals aged 40 and older in the US are projected to have PAD by 2022. The availability of drug-eluting stents and favorable medical reimbursement policies further propel the growth of the peripheral stent implants market.

- Germany at the Forefront of Market Growth in Europe, Set to Gain from Rising PAD Prevalence

Germany accounted for approximately 4.3% of the global market share in 2022. The growth of the stents market in Germany is driven by several factors, including the increasing prevalence of PAD, a preference for non-invasive stent procedures, and investments in the development of advanced stents by both the private and public sectors.

Additionally, the rising prevalence of obesity, an increase in percutaneous coronary intervention (PCI) operations, and high demand for minimally invasive surgeries (MIS) contribute to the peripheral stent implants market growth. The introduction of advanced drug-eluting stents (DES), the development of bioresorbable scaffolds, and the rise in cardiovascular illnesses (CVDs) also impact the market.

Recent Industry Developments

- In June 2024, Royal Philips announced the first implant of the Duo Venous Stent System, an implantable medical device designed to treat symptomatic venous outflow obstruction in patients with chronic venous insufficiency (CVI). The device is composed of two stents – Duo Hybrid and Duo Extend – of various sizes. These two stents are designed to work together and minimize the risk of stent fracture and corrosion while providing an option to stent within caudal veins with smaller diameters.

- In March 2024, BD announced to launch a single-arm clinical trial for a stent designed to track and oppose the vessel wall, providing long-term durability for patients with peripheral artery disease (PAD). The trial will enroll up to 40 patients across the US, Europe, Australia, and New Zealand. The device will be part of BD's strategy to grow its business through 2025, with peripheral vascular disease identified as one of six key platforms for growth. BD continues to drive market penetration in PAD with its Rotarex atherectomy system and venous portfolio.

Fairfield’s Competitive Landscape Analysis

The competitive landscape of the peripheral stent implants market concentration is characterized by the presence of several key players. These companies are recognized as key players in the peripheral stent implant market growth and are actively involved in the research, development, and manufacturing of stents. They have a significant market presence and contribute to the growth and innovation of the industry.

Key Market Companies

- Abbott Laboratories

- Braun Melsungen AG

- Biotronik SE & Co. KG

- Cook Medical, Inc.

- Boston Scientific Corporation

- iVascular SLU

- Cardinal Health, Inc.

- Terumo Corporation

- Medtronic Plc.

- L. Gore & Associates, Inc.

- R. Bard, Inc.

- MicroPort Scientific Corporation

An Expert’s Eye

- The market is poised for substantial growth due to increasing prevalence of PAD. The aging population is a key driver, as PAD incidence rises with age.

- Innovations in stent technology, such as drug-eluting stents, are expanding treatment options and improving outcomes. Reimbursement issues, device costs, and procedural complexities however may hinder market penetration.

- Increased spending on healthcare is fueling market growth. Developing countries offer untapped potential due to growing awareness of PAD, and the consistently improving healthcare infrastructure.

- The peripheral stent implants market is expected to witness robust growth in the coming years, driven by favorable demographic trends and technological advancements.

Peripheral Stent Implants Market Segmentation

By Product

- Bare Metal Stents (BMS)

- Covered Stents

- Drug Eluting Stents (DES)

By Artery

- Carotid Artery Stents

- Fem-Pop Artery Stents

- Iliac Artery Stents

- Infrapop Artery Stents

By End User

- Hospitals

- Ambulatory Surgical Centers/Outpatient

By Region

- North America

- Latin America

- Europe

- East Asia

- South Asia & Oceania

1. Executive Summary

1.1. Global Peripheral Stent Implants Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2023

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. COVID-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Production Output and Trade Statistics, 2019 - 2023

3.1. Global Peripheral Stent Implants Market Production Output, by Region, Value (US$ Bn) and Volume (‘000 Units), 2019 - 2023

3.1.1. North America

3.1.2. Europe

3.1.3. Asia Pacific

3.1.4. Latin America

3.1.5. Middle East and Africa

4. Price Analysis, 2019 - 2023

4.1. Global Average Price Analysis, by Product/ Material, US$ Per Unit, 2019 - 2023

4.2. Prominent Factor Affecting Peripheral Stent Implants Prices

4.3. Global Average Price Analysis, by Region, US$ Per Unit

5. Global Peripheral Stent Implants Market Outlook, 2019 - 2031

5.1. Global Peripheral Stent Implants Market Outlook, by Product, Value (US$ Bn) and Volume (‘000 Units), 2019 - 2031

5.1.1. Key Highlights

5.1.1.1. Bare Metal Stents (BMS)

5.1.1.2. Covered Stents

5.1.1.3. Drug Eluting Stents (DES)

5.2. Global Peripheral Stent Implants Market Outlook, by Artery, Value (US$ Bn) and Volume (‘000 Units), 2019 - 2031

5.2.1. Key Highlights

5.2.1.1. Carotid Artery Stents

5.2.1.2. Fem-Pop Artery Stents

5.2.1.3. Iliac Artery Stents

5.2.1.4. Infrapop Artery Stents

5.3. Global Peripheral Stent Implants Market Outlook, by End User, Value (US$ Bn) and Volume (‘000 Units), 2019 - 2031

5.3.1. Key Highlights

5.3.1.1. Hospitals

5.3.1.2. Ambulatory Surgical Centers/Outpatients

5.4. Global Peripheral Stent Implants Market Outlook, by Region, Value (US$ Bn) and Volume (‘000 Units), 2019 - 2031

5.4.1. Key Highlights

5.4.1.1. North America

5.4.1.2. Europe

5.4.1.3. Asia Pacific

5.4.1.4. Latin America

5.4.1.5. Middle East & Africa

6. North America Peripheral Stent Implants Market Outlook, 2019 - 2031

6.1. North America Peripheral Stent Implants Market Outlook, by Product, Value (US$ Bn) and Volume (‘000 Units), 2019 - 2031

6.1.1. Key Highlights

6.1.1.1. Bare Metal Stents (BMS)

6.1.1.2. Covered Stents

6.1.1.3. Drug Eluting Stents (DES)

6.2. North America Peripheral Stent Implants Market Outlook, by Artery, Value (US$ Bn) and Volume (‘000 Units), 2019 - 2031

6.2.1. Key Highlights

6.2.1.1. Carotid Artery Stents

6.2.1.2. Fem-Pop Artery Stents

6.2.1.3. Iliac Artery Stents

6.2.1.4. Infrapop Artery Stents

6.3. North America Peripheral Stent Implants Market Outlook, by End User, Value (US$ Bn) and Volume (‘000 Units), 2019 - 2031

6.3.1. Key Highlights

6.3.1.1. Hospitals

6.3.1.2. Ambulatory Surgical Centers/Outpatients

6.3.2. BPS Analysis/Market Attractiveness Analysis

6.4. North America Peripheral Stent Implants Market Outlook, by Country, Value (US$ Bn) and Volume (‘000 Units), 2019 - 2031

6.4.1. Key Highlights

6.4.1.1. U.S. Peripheral Stent Implants Market by Product, Value (US$ Bn) and Volume (‘000 Units), 2019 - 2031

6.4.1.2. U.S. Peripheral Stent Implants Market by Artery, Value (US$ Bn) and Volume (‘000 Units), 2019 - 2031

6.4.1.3. U.S. Peripheral Stent Implants Market by End User, Value (US$ Bn) and Volume (‘000 Units), 2019 - 2031

6.4.1.4. Canada Peripheral Stent Implants Market by Product, Value (US$ Bn) and Volume (‘000 Units), 2019 - 2031

6.4.1.5. Canada Peripheral Stent Implants Market by Artery, Value (US$ Bn) and Volume (‘000 Units), 2019 - 2031

6.4.1.6. Canada Peripheral Stent Implants Market by End User, Value (US$ Bn) and Volume (‘000 Units), 2019 - 2031

6.4.2. BPS Analysis/Market Attractiveness Analysis

7. Europe Peripheral Stent Implants Market Outlook, 2019 - 2031

7.1. Europe Peripheral Stent Implants Market Outlook, by Product, Value (US$ Bn) and Volume (‘000 Units), 2019 - 2031

7.1.1. Key Highlights

7.1.1.1. Bare Metal Stents (BMS)

7.1.1.2. Covered Stents

7.1.1.3. Drug Eluting Stents (DES)

7.2. Europe Peripheral Stent Implants Market Outlook, by Artery, Value (US$ Bn) and Volume (‘000 Units), 2019 - 2031

7.2.1. Key Highlights

7.2.1.1. Chemotherapy/ Oncology

7.2.1.2. Paediatrics/Neonatology

7.2.1.3. Analgesia

7.2.1.4. Hematology

7.3. Europe Peripheral Stent Implants Market Outlook, by End User, Value (US$ Bn) and Volume (‘000 Units), 2019 - 2031

7.3.1. Key Highlights

7.3.1.1. Hospitals

7.3.1.2. Ambulatory Surgical Centers/Outpatients

7.3.2. BPS Analysis/Market Attractiveness Analysis

7.4. Europe Peripheral Stent Implants Market Outlook, by Country, Value (US$ Bn) and Volume (‘000 Units), 2019 - 2031

7.4.1. Key Highlights

7.4.1.1. Germany Peripheral Stent Implants Market by Product, Value (US$ Bn) and Volume (‘000 Units), 2019 - 2031

7.4.1.2. Germany Peripheral Stent Implants Market by Artery, Value (US$ Bn) and Volume (‘000 Units), 2019 - 2031

7.4.1.3. Germany Peripheral Stent Implants Market by End User, Value (US$ Bn) and Volume (‘000 Units), 2019 - 2031

7.4.1.4. U.K. Peripheral Stent Implants Market by Product, Value (US$ Bn) and Volume (‘000 Units), 2019 - 2031

7.4.1.5. U.K. Peripheral Stent Implants Market by Artery, Value (US$ Bn) and Volume (‘000 Units), 2019 - 2031

7.4.1.6. U.K. Peripheral Stent Implants Market by End User, Value (US$ Bn) and Volume (‘000 Units), 2019 - 2031

7.4.1.7. France Peripheral Stent Implants Market by Product, Value (US$ Bn) and Volume (‘000 Units), 2019 - 2031

7.4.1.8. France Peripheral Stent Implants Market by Artery, Value (US$ Bn) and Volume (‘000 Units), 2019 - 2031

7.4.1.9. France Peripheral Stent Implants Market by End User, Value (US$ Bn) and Volume (‘000 Units), 2019 - 2031

7.4.1.10. Italy Peripheral Stent Implants Market by Product, Value (US$ Bn) and Volume (‘000 Units), 2019 - 2031

7.4.1.11. Italy Peripheral Stent Implants Market by Artery, Value (US$ Bn) and Volume (‘000 Units), 2019 - 2031

7.4.1.12. Italy Peripheral Stent Implants Market by End User, Value (US$ Bn) and Volume (‘000 Units), 2019 - 2031

7.4.1.13. Turkey Peripheral Stent Implants Market by Product, Value (US$ Bn) and Volume (‘000 Units), 2019 - 2031

7.4.1.14. Turkey Peripheral Stent Implants Market by Artery, Value (US$ Bn) and Volume (‘000 Units), 2019 - 2031

7.4.1.15. Turkey Peripheral Stent Implants Market by End User, Value (US$ Bn) and Volume (‘000 Units), 2019 - 2031

7.4.1.16. Russia Peripheral Stent Implants Market by Product, Value (US$ Bn) and Volume (‘000 Units), 2019 - 2031

7.4.1.17. Russia Peripheral Stent Implants Market by Artery, Value (US$ Bn) and Volume (‘000 Units), 2019 - 2031

7.4.1.18. Russia Peripheral Stent Implants Market by End User, Value (US$ Bn) and Volume (‘000 Units), 2019 - 2031

7.4.1.19. Rest of Europe Peripheral Stent Implants Market by Product, Value (US$ Bn) and Volume (‘000 Units), 2019 - 2031

7.4.1.20. Rest of Europe Peripheral Stent Implants Market by Artery, Value (US$ Bn) and Volume (‘000 Units), 2019 - 2031

7.4.1.21. Rest of Europe Peripheral Stent Implants Market by End User, Value (US$ Bn) and Volume (‘000 Units), 2019 - 2031

7.4.2. BPS Analysis/Market Attractiveness Analysis

8. Asia Pacific Peripheral Stent Implants Market Outlook, 2019 - 2031

8.1. Asia Pacific Peripheral Stent Implants Market Outlook, by Product, Value (US$ Bn) and Volume (‘000 Units), 2019 - 2031

8.1.1. Key Highlights

8.1.1.1. Bare Metal Stents (BMS)

8.1.1.2. Covered Stents

8.1.1.3. Drug Eluting Stents (DES)

8.2. Asia Pacific Peripheral Stent Implants Market Outlook, by Artery, Value (US$ Bn) and Volume (‘000 Units), 2019 - 2031

8.2.1. Key Highlights

8.2.1.1. Carotid Artery Stents

8.2.1.2. Fem-Pop Artery Stents

8.2.1.3. Iliac Artery Stents

8.2.1.4. Infrapop Artery Stents

8.3. Asia Pacific Peripheral Stent Implants Market Outlook, by End User, Value (US$ Bn) and Volume (‘000 Units), 2019 - 2031

8.3.1. Key Highlights

8.3.1.1. Hospitals

8.3.1.2. Ambulatory Surgical Centers/Outpatients

8.3.2. BPS Analysis/Market Attractiveness Analysis

8.4. Asia Pacific Peripheral Stent Implants Market Outlook, by Country, Value (US$ Bn) and Volume (‘000 Units), 2019 - 2031

8.4.1. Key Highlights

8.4.1.1. China Peripheral Stent Implants Market by Product, Value (US$ Bn) and Volume (‘000 Units), 2019 - 2031

8.4.1.2. China Peripheral Stent Implants Market by Artery, Value (US$ Bn) and Volume (‘000 Units), 2019 - 2031

8.4.1.3. China Peripheral Stent Implants Market by End User, Value (US$ Bn) and Volume (‘000 Units), 2019 - 2031

8.4.1.4. Japan Peripheral Stent Implants Market by Product, Value (US$ Bn) and Volume (‘000 Units), 2019 - 2031

8.4.1.5. Japan Peripheral Stent Implants Market by Artery, Value (US$ Bn) and Volume (‘000 Units), 2019 - 2031

8.4.1.6. Japan Peripheral Stent Implants Market by End User, Value (US$ Bn) and Volume (‘000 Units), 2019 - 2031

8.4.1.7. South Korea Peripheral Stent Implants Market by Product, Value (US$ Bn) and Volume (‘000 Units), 2019 - 2031

8.4.1.8. South Korea Peripheral Stent Implants Market by Artery, Value (US$ Bn) and Volume (‘000 Units), 2019 - 2031

8.4.1.9. South Korea Peripheral Stent Implants Market by End User, Value (US$ Bn) and Volume (‘000 Units), 2019 - 2031

8.4.1.10. India Peripheral Stent Implants Market by Product, Value (US$ Bn) and Volume (‘000 Units), 2019 - 2031

8.4.1.11. India Peripheral Stent Implants Market by Artery, Value (US$ Bn) and Volume (‘000 Units), 2019 - 2031

8.4.1.12. India Peripheral Stent Implants Market by End User, Value (US$ Bn) and Volume (‘000 Units), 2019 - 2031

8.4.1.13. Southeast Asia Peripheral Stent Implants Market by Product, Value (US$ Bn) and Volume (‘000 Units), 2019 - 2031

8.4.1.14. Southeast Asia Peripheral Stent Implants Market by Artery, Value (US$ Bn) and Volume (‘000 Units), 2019 - 2031

8.4.1.15. Southeast Asia Peripheral Stent Implants Market by End User, Value (US$ Bn) and Volume (‘000 Units), 2019 - 2031

8.4.1.16. Rest of Asia Pacific Peripheral Stent Implants Market by Product, Value (US$ Bn) and Volume (‘000 Units), 2019 - 2031

8.4.1.17. Rest of Asia Pacific Peripheral Stent Implants Market by Artery, Value (US$ Bn) and Volume (‘000 Units), 2019 - 2031

8.4.1.18. Rest of Asia Pacific Peripheral Stent Implants Market by End User, Value (US$ Bn) and Volume (‘000 Units), 2019 - 2031

8.4.2. BPS Analysis/Market Attractiveness Analysis

9. Latin America Peripheral Stent Implants Market Outlook, 2019 - 2031

9.1. Latin America Peripheral Stent Implants Market Outlook, by Product, Value (US$ Bn) and Volume (‘000 Units), 2019 - 2031

9.1.1. Key Highlights

9.1.1.1. Bare Metal Stents (BMS)

9.1.1.2. Covered Stents

9.1.1.3. Drug Eluting Stents (DES)

9.2. Latin America Peripheral Stent Implants Market Outlook, by Artery, Value (US$ Bn) and Volume (‘000 Units), 2019 - 2031

9.2.1. Key Highlights

9.2.1.1. Carotid Artery Stents

9.2.1.2. Fem-Pop Artery Stents

9.2.1.3. Iliac Artery Stents

9.2.1.4. Infrapop Artery Stents

9.3. Latin America Peripheral Stent Implants Market Outlook, by End User, Value (US$ Bn) and Volume (‘000 Units), 2019 - 2031

9.3.1. Key Highlights

9.3.1.1. Hospitals

9.3.1.2. Ambulatory Surgical Centers/Outpatients

9.3.2. BPS Analysis/Market Attractiveness Analysis

9.4. Latin America Peripheral Stent Implants Market Outlook, by Country, Value (US$ Bn) and Volume (‘000 Units), 2019 - 2031

9.4.1. Key Highlights

9.4.1.1. Brazil Peripheral Stent Implants Market by Product, Value (US$ Bn) and Volume (‘000 Units), 2019 - 2031

9.4.1.2. Brazil Peripheral Stent Implants Market by Artery, Value (US$ Bn) and Volume (‘000 Units), 2019 - 2031

9.4.1.3. Brazil Peripheral Stent Implants Market by End User, Value (US$ Bn) and Volume (‘000 Units), 2019 - 2031

9.4.1.4. Mexico Peripheral Stent Implants Market by Product, Value (US$ Bn) and Volume (‘000 Units), 2019 - 2031

9.4.1.5. Mexico Peripheral Stent Implants Market by Artery, Value (US$ Bn) and Volume (‘000 Units), 2019 - 2031

9.4.1.6. Mexico Peripheral Stent Implants Market by End User, Value (US$ Bn) and Volume (‘000 Units), 2019 - 2031

9.4.1.7. Argentina Peripheral Stent Implants Market by Product, Value (US$ Bn) and Volume (‘000 Units), 2019 - 2031

9.4.1.8. Argentina Peripheral Stent Implants Market by Artery, Value (US$ Bn) and Volume (‘000 Units), 2019 - 2031

9.4.1.9. Argentina Peripheral Stent Implants Market by End User, Value (US$ Bn) and Volume (‘000 Units), 2019 - 2031

9.4.1.10. Rest of Latin America Peripheral Stent Implants Market by Product, Value (US$ Bn) and Volume (‘000 Units), 2019 - 2031

9.4.1.11. Rest of Latin America Peripheral Stent Implants Market by Artery, Value (US$ Bn) and Volume (‘000 Units), 2019 - 2031

9.4.1.12. Rest of Latin America Peripheral Stent Implants Market by End User, Value (US$ Bn) and Volume (‘000 Units), 2019 - 2031

9.4.2. BPS Analysis/Market Attractiveness Analysis

10. Middle East & Africa Peripheral Stent Implants Market Outlook, 2019 - 2031

10.1. Middle East & Africa Peripheral Stent Implants Market Outlook, by Product, Value (US$ Bn) and Volume (‘000 Units), 2019 - 2031

10.1.1. Key Highlights

10.1.1.1. Bare Metal Stents (BMS)

10.1.1.2. Covered Stents

10.1.1.3. Drug Eluting Stents (DES)

10.2. Middle East & Africa Peripheral Stent Implants Market Outlook, by Artery, Value (US$ Bn) and Volume (‘000 Units), 2019 - 2031

10.2.1. Key Highlights

10.2.1.1. Carotid Artery Stents

10.2.1.2. Fem-Pop Artery Stents

10.2.1.3. Iliac Artery Stents

10.2.1.4. Infrapop Artery Stents

10.3. Middle East & Africa Peripheral Stent Implants Market Outlook, by End User, Value (US$ Bn) and Volume (‘000 Units), 2019 - 2031

10.3.1. Key Highlights

10.3.1.1. Hospitals

10.3.1.2. Ambulatory Surgical Centers/Outpatients

10.3.2. BPS Analysis/Market Attractiveness Analysis

10.4. Middle East & Africa Peripheral Stent Implants Market Outlook, by Country, Value (US$ Bn) and Volume (‘000 Units), 2019 - 2031

10.4.1. Key Highlights

10.4.1.1. GCC Peripheral Stent Implants Market by Product, Value (US$ Bn) and Volume (‘000 Units), 2019 - 2031

10.4.1.2. GCC Peripheral Stent Implants Market by Artery, Value (US$ Bn) and Volume (‘000 Units), 2019 - 2031

10.4.1.3. GCC Peripheral Stent Implants Market by End User, Value (US$ Bn) and Volume (‘000 Units), 2019 - 2031

10.4.1.4. South Africa Peripheral Stent Implants Market by Product, Value (US$ Bn) and Volume (‘000 Units), 2019 - 2031

10.4.1.5. South Africa Peripheral Stent Implants Market by Artery, Value (US$ Bn) and Volume (‘000 Units), 2019 - 2031

10.4.1.6. South Africa Peripheral Stent Implants Market by End User, Value (US$ Bn) and Volume (‘000 Units), 2019 - 2031

10.4.1.7. Egypt Peripheral Stent Implants Market by Product, Value (US$ Bn) and Volume (‘000 Units), 2019 - 2031

10.4.1.8. Egypt Peripheral Stent Implants Market by Artery, Value (US$ Bn) and Volume (‘000 Units), 2019 - 2031

10.4.1.9. Egypt Peripheral Stent Implants Market by End User, Value (US$ Bn) and Volume (‘000 Units), 2019 - 2031

10.4.1.10. Nigeria Peripheral Stent Implants Market by Product, Value (US$ Bn) and Volume (‘000 Units), 2019 - 2031

10.4.1.11. Nigeria Peripheral Stent Implants Market by Artery, Value (US$ Bn) and Volume (‘000 Units), 2019 - 2031

10.4.1.12. Nigeria Peripheral Stent Implants Market by End User, Value (US$ Bn) and Volume (‘000 Units), 2019 - 2031

10.4.1.13. Rest of Middle East & Africa Peripheral Stent Implants Market by Product, Value (US$ Bn) and Volume (‘000 Units), 2019 - 2031

10.4.1.14. Rest of Middle East & Africa Peripheral Stent Implants Market by Artery, Value (US$ Bn) and Volume (‘000 Units), 2019 - 2031

10.4.1.15. Rest of Middle East & Africa Peripheral Stent Implants Market by End User, Value (US$ Bn) and Volume (‘000 Units), 2019 - 2031

10.4.2. BPS Analysis/Market Attractiveness Analysis

11. Competitive Landscape

11.1. By End User vs by Artery Heat map

11.2. Manufacturer vs by Artery Heatmap

11.3. Company Market Share Analysis, 2023

11.4. Competitive Dashboard

11.5. Company Profiles

11.5.1. Abbott Laboratories

11.5.1.1. Company Overview

11.5.1.2. Product Portfolio

11.5.1.3. Financial Overview

11.5.1.4. Business Strategies and Development

11.5.2. B. Braun Melsungen AG

11.5.2.1. Company Overview

11.5.2.2. Product Portfolio

11.5.2.3. Financial Overview

11.5.2.4. Business Strategies and Development

11.5.3. Biotronik SE & Co. KG

11.5.3.1. Company Overview

11.5.3.2. Product Portfolio

11.5.3.3. Financial Overview

11.5.3.4. Business Strategies and Development

11.5.4. Boston Scientific Corporation

11.5.4.1. Company Overview

11.5.4.2. Product Portfolio

11.5.4.3. Financial Overview

11.5.4.4. Business Strategies and Development

11.5.5. Cook Medical, Inc.

11.5.5.1. Company Overview

11.5.5.2. Product Portfolio

11.5.5.3. Financial Overview

11.5.5.4. Business Strategies and Development

11.5.6. Cardinal Health, Inc.

11.5.6.1. Company Overview

11.5.6.2. Product Portfolio

11.5.6.3. Financial Overview

11.5.6.4. Business Strategies and Development

11.5.7. iVascular SLU

11.5.7.1. Company Overview

11.5.7.2. Product Portfolio

11.5.7.3. Financial Overview

11.5.7.4. Business Strategies and Development

11.5.8. Medtronic Plc.

11.5.8.1. Company Overview

11.5.8.2. Product Portfolio

11.5.8.3. Financial Overview

11.5.8.4. Business Strategies and Development

11.5.9. Terumo Corporation

11.5.9.1. Company Overview

11.5.9.2. Product Portfolio

11.5.9.3. Financial Overview

11.5.9.4. Business Strategies and Development

11.5.10. W. L. Gore & Associates Inc.

11.5.10.1. Company Overview

11.5.10.2. Product Portfolio

11.5.10.3. Financial Overview

11.5.10.4. Business Strategies and Development

12. Appendix

12.1. Research Methodology

12.2. Report Assumptions

12.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2023 |

|

2019 - 2023 |

2024 - 2031 |

Value: US$ Billion |

||

|

REPORT FEATURES |

DETAILS |

|

Product Coverage |

|

|

Artery Coverage |

|

|

End Use Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |