Global Polyalkylene Glycol Market Forecast

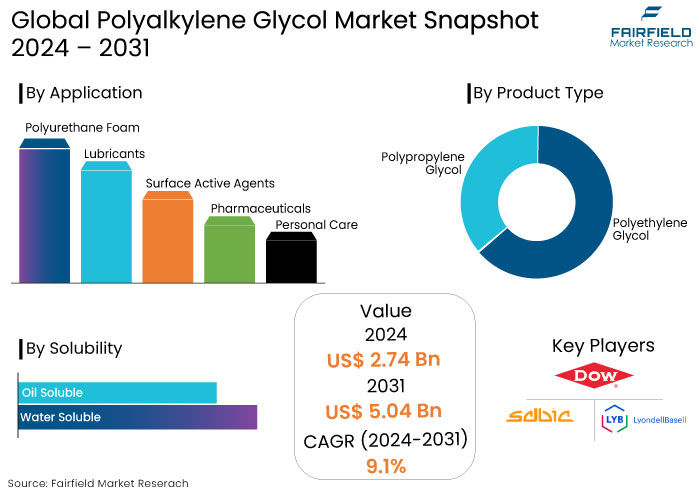

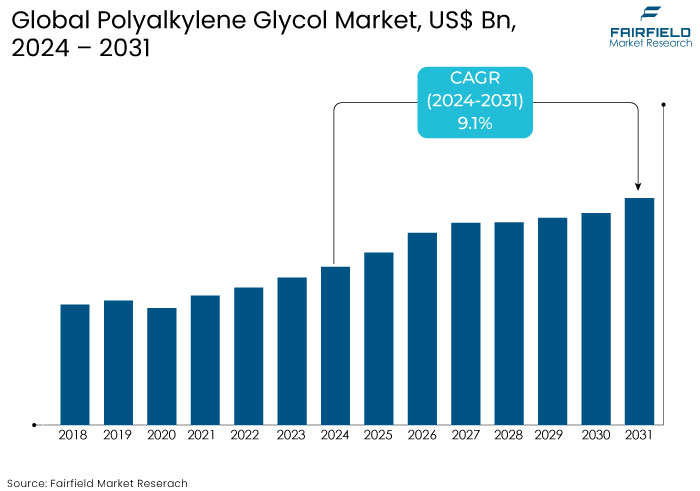

- The polyalkylene glycol market is projected to be valued at US$5.04 Bn by 2031, exhibiting significant growth from the US$2.74 Bn achieved in 2024.

- The market for polyalkylene glycol is expected to show a significant expansion rate with an estimated CAGR of 9.1% from 2024 to 2031.

Polyalkylene Glycol Market Insights

- The market is driven by increasing demand in automotive, industrial, and personal care applications.

- Growing environmental regulations and consumer demand for eco-friendly products are pushing the adoption of biodegradable PAGs.

- The rise of the electric vehicle (EV) market creates opportunities for PAGs in cooling and lubrication applications due to their thermal stability.

- PAGs are versatile and find applications in various industries, including lubricants, surfactants, cosmetics, and pharmaceuticals.

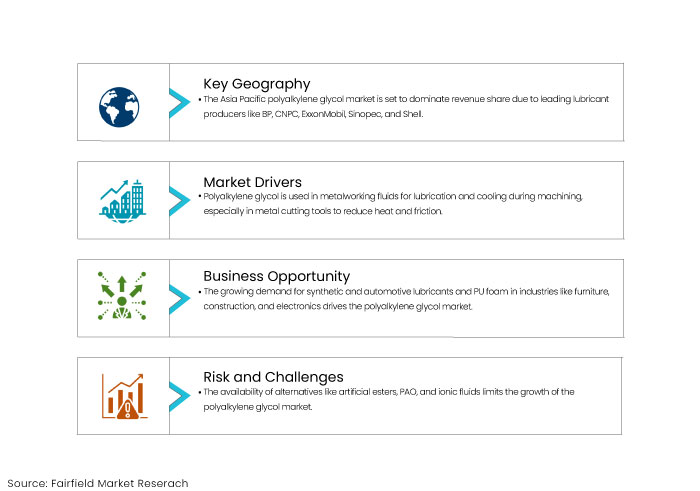

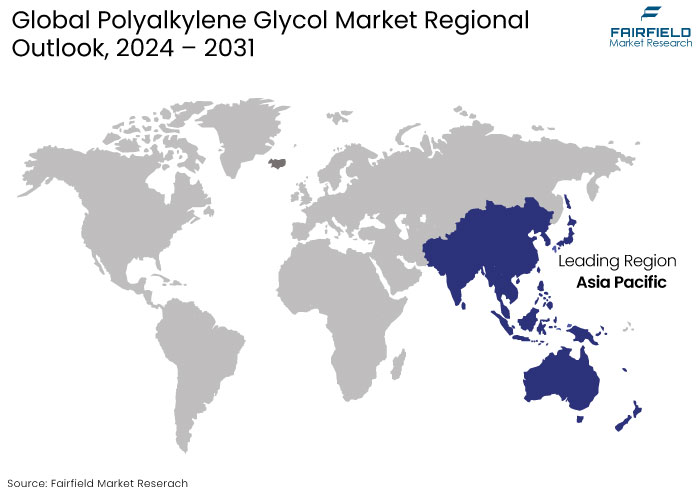

- Asia Pacific is growing regional market with rapid industrialization and increasing production capacities.

- Innovations in manufacturing processes are expected to enhance efficiency and reduce costs, promoting wider market acceptance.

- The market is characterized by intense competition among dominant players, leading to strategic partnerships and acquisitions.

- The production costs of PAGs remain a challenge, which may hinder adoption in price-sensitive markets.

A Look Back and a Look Forward - Comparative Analysis

The polyalkylene glycol market experienced steady growth before 2023, driven primarily by its expanding applications in automotive, industrial lubricants, and personal care sectors.

Before 2023, the PAG market saw a significant boost in consumption due to rising demand for environment-friendly lubricants. This was further propelled by regulatory pressures that mandated the adoption of less toxic chemicals, a factor that cannot be overlooked in understanding the market dynamics.

The market benefited from the increasing adoption of synthetic lubricants in the automotive and aerospace industries due to PAG's superior thermal stability and lubrication properties,

Post-2024, the PAG market is projected to accelerated growth, mainly due to biodegradable and sustainable formulation advancements.

The shift toward green chemistry and increasing investments in renewable and bio-based products are anticipated to fuel demand for PAG in diverse applications, such as metalworking fluids and pharmaceuticals.

The rising emphasis on energy efficiency and equipment longevity in various industrial settings is expected to drive the adoption of high-performance PAG lubricants. Emerging markets in Asia Pacific and Latin America will likely to play a crucial role in the post-2024 expansion, driven by rapid industrialization and increased focus on infrastructure development.

Key Growth Determinants

- Growing Demand from the Metallurgy Sector Boosts Polyalkylene Glycol Market

Polyalkylene glycol is used to make metalworking fluids primarily used in the metallurgy sector to provide lubrication and cooling during machining and shaping metals including iron, aluminium, manganese, and others. They are most frequently utilized in metal cutting tools to lessen heat and friction between the cutting tool and the workpiece.

The expanding automotive, construction, and industrial industries drive the need for metalworking fluids. The United States produced 91,67,214 vehicles overall in 2021, up 4% from 2020, according to the International Organization of Motor Vehicle Manufacturers (OICA); this figure includes both passenger cars and commercial vehicles. According to the United States Geological Survey (USGS) statistics, the market for polyalkylene glycol for metalworking fluids also benefits from expanding mining activities.

- Growing Application in Lubricants Fuels Market Growth

It is one of the key drivers for polyalkylene glycol market growth. Since polyalkylene glycol is excellent for metal-on-metal applications with operating temperatures ranging from -40°C to 200°C, it is used as a base oil for lubricants such as gear lubricants, metalworking lubricants, refrigeration oil, and hydraulic fluids, among others. They are also used in situations requiring thermal stability and elastomeric compatibility at high temperatures.

The development of high-performance lubricants for many end-use industries including automotive, textile, food & beverage is supported by the global lubricants industry participants use of synthetic base oils. Leading lubricant manufacturers are creating PAG-based hydraulic and gear lubricants, including Shell, Castrol, Cargill, and Exxon.

In October 2020, Shell Plc increased its lubricants business and added a few fire-resistant fluids based on polyalkylene glycol to its product line. In end-use industries, these items operate superbly, even under challenging situations.

Key Growth Barriers

- Availability of Competing Products to RestrainMarket Growth

It is one of the restraining factor for polyalkylene glycol market. With the evolution of several products, there are several alternatives to polyalkylene glycol, including artificial esters, polyalphaolefin (PAO), ionic fluids, and more. These replacements, with their equivalent chemical properties, functionalities, and other qualities including viscosity, temperature range, and more, are limiting the growth of the polyalkylene glycol industry.

Polyalphaolefin is commonly substituted in the manufacturing of lubricants (PAO). Its superiority over polyalkylene glycol is evident in its complete solubility in select mineral oils, a property that polyalkylene glycol lacks. The rolling wear property of polyalkylene glycol is also weaker than that of polyalphaolefin, highlighting the need for alternatives in the market.

- High Production Costs

One significant restraint for the polyalkylene glycol market is its high production costs compared to conventional lubricants. PAGs are often produced through advanced chemical processes involving ethylene oxide or propylene oxide. These are energy-intensive and require sophisticated manufacturing technologies leading to high raw materials and operational costs, passed on to the end consumers.

Industries that rely on cost-effective solutions may hesitate to adopt PAGs, despite their superior performance in areas like lubrication and thermal stability. This cost barrier becomes especially challenging in price-sensitive markets such as automotive manufacturing and metalworking, where cheaper alternatives like mineral-based lubricants or conventional synthetic options are more widely adopted.

As a result, the higher upfront costs of PAGs can limit their penetration, particularly in developing markets, thereby restraining overall growth.

Polyalkylene Glycol Market Trends and Opportunities

- Advantages of PAG over Petroleum-based Lubricants to Bring More Opportunities

The global rise in the use of synthetic lubricants, and automotive lubricants is anticipated to fuel the expansion of the polyalkylene glycol market. Demand for polyalkylene glycol (PAG) has increased due to the increased demand for polyurethane (PU) foam in many different industries. These industries include furniture, vehicles, sculpture, decorating, building and construction, electronics, adhesives, and footwear.

The automotive industry's need for accelerating lubricants fuels the expansion of the market for polyalkylene glycol. Polyethylene glycol is utilized in toothpaste for dispersion. It binds water during this process and aids in maintaining xanthan gum's even distribution throughout the toothpaste. Due to its advantages over petroleum-based lubricants and its application as chemical intermediates and surface active agents, it is predicted to expand.

Polyalkylene glycol offers the best lubrication for compressors, minimal volatility in high-temperature applications, notable energy economy, and easy equipment cleanup resulting in the market for polyalkylene glycol expansion. The expansion of the market is anticipated to be hampered by the volatility of crude oil prices.

- Shift Toward Bio-based and Sustainable Lubricants

A key trend shaping the polyalkylene glycol market by 2031 is the increasing demand for bio-based and sustainable lubricants. As environmental regulations tighten globally and industries prioritize sustainability, there is growing pressure to reduce the environmental impact of lubricants.

PAGs, known for their biodegradability and lower toxicity compared to traditional mineral oils, are well-positioned to meet this demand. Governments, particularly in Europe and North America, are pushing for stricter limits on volatile organic compounds (VOCs) and pollutants, encouraging industries to adopt greener alternatives.

Consumers and industries alike are gravitating towards eco-friendly products fueling research and development of bio-based PAGs. These bio-based PAGs, sourced from renewable raw materials, are gaining traction in sectors like automotive, aerospace, and industrial machinery due to their ability to offer superior performance, such as high thermal stability and better oxidation resistance.

The growing trend towards circular economy practices further drives this shift as companies seek to reduce carbon footprints through sustainable manufacturing. The push towards greener lubricants will likely dominate the PAG market in the coming years, with a sharp focus on innovations that enhance both performance and environmental compliance.

How Does Regulatory Scenario Shape this Industry?

The regulatory landscape is crucial in shaping the polyalkylene glycol market, particularly as governments and environmental bodies worldwide focus on promoting sustainability and reducing environmental impact.

One of the key drivers is the increasing regulations on hazardous chemicals and emissions, especially in regions like Europe and North America. For instance, the European Union’s REACH (Registration, Evaluation, Authorisation, and Restriction of Chemicals) regulation imposes stringent requirements on harmful chemicals pushing industries to adopt safes and environment-friendly alternatives like PAGs.

The Environmental Protection Agency (EPA) emphasizes reducing volatile organic compounds (VOCs) and greenhouse gas emissions in the United States. PAGs, being biodegradable and low toxicity align well with these regulations particularly for applications in industrial lubricants and automotive fluids, where sustainability is increasingly prioritized.

Regulations encouraging bio-based product development promote innovation in bio-based PAG formulations. These trends are expected to intensify driving demand for PAGs in sectors like automotive, manufacturing, and personal care, where compliance with environmental standards is becoming a significant competitive advantage.

Segments Covered in the Report

- Water Soluble PAG Category Takes the Lead with Less Toxic Attribute

The water-soluble segment held the significant polyalkylene glycol market share, and it is anticipated that it will continue to lead the market during the forecast period. Water-soluble PGA oils are the main focus of big businesses like Dow, BASF, and Clariant.

The feedstock used to produce water-soluble polyalkylene glycol is entirely renewable. Compared to conventional polyalkylene glycol, it cuts greenhouse gas emissions by about 80%. They are less eco-toxic than oil soluble and naturally biodegradable.

Water-soluble PAG oil has several characteristics that make it perfect for high-temperature lubrication, including high thermal stability, shear stability, viscosity, and low volatility. As a result, the need for water-soluble PAG is driven by the rising demand for metalworking fluids.

- Lubricants Lead the Application Segment of the Market

Polyalkylene glycols are used to make a variety of lubricants including compressor lubricants, textile lubricants, refrigeration oils, and gear lubricants. The PAG has a variety of qualities, including high viscosity indices, hydrolytic stability, and excellent deposit management, which makes them appropriate for lubricant manufacture.

The polyalkylene glycol market is supported by recent developments in lubricant technology and the expansion of lubricant producers during the anticipated period. For instance, a global leader in polyalkylene glycol lubricants, Idemitsu Kosan Company, Ltd., began operating its new lubricant production facility in China in August 2020.

The facility has a yearly production capacity of 120,000 kiloliters of lubricants. The BPCL company added two new lubricants to its product lineup in October 2020 such as Mak TitaniumCK4 and Mak BlazeSynth.

Regional Analysis

- Asia Pacific Stands Out with the Presence of Major Lubricant Producers

Asia Pacific polyalkylene glycol market is anticipated to account for the largest revenue share over the forecast period. Asia Pacific is experiencing rapid expansion in the market because of the presence of leading lubricant producers. These producers are B.P. Plc (Castrol), China National Petroleum Corporation, ExxonMobil Corporation, China Petroleum & Chemical Corporation, and Royal Dutch Shell Plc.

Asia Pacific is projected to rise during the forecast period due to the rising production of passenger vehicles in developing countries like China and India. China produced 2,60,82,220 automobiles in total in 2021, up from 2,52,25,242 in 2020 and 2,57,20,665 in 2019, according to the International Organization of Motor Vehicle Manufacturers (OICA).

Asia Pacific market growth is being supported by lubricant makers' rising investments in India during the forecast period. The Gujarati government and Indian oil inked an MOU in June 2021 for the "Investment Promotion" of a new petrochemical and lube integration (LuPech) project and acrylics/oxo alcohol projects in Gujarat, which further boosts the revenue of the region.

- North America to Exhibit a Steady Growth Rate

North America polyalkylene glycol market is anticipated to experience stable revenue growth throughout the forecast period. Consumption of polyalkylene glycol is increasing due to the substantial growth of North America's pharmaceutical and personal care industries.

Due to polyethylene glycol's solubility, excellent biocompatibility, lack of toxicity, and low immunogenicity, it is frequently used in surgical equipment materials for wound adhesion, hemostasis, anti-leakage, and adhesion therapy.

North America pharmaceutical and personal care businesses are expanding due to rising demand for multifunctional personal care products and an aging population. The growing P.U. foam, lubricants, and functional fluids markets, which consume a sizable amount of polyalkylene glycol, are driving rising demand.

Fairfield’s Competitive Landscape Analysis

The polyalkylene glycol market is characterized by intense competition, driven by both established chemical giants and emerging players focusing on specialty chemicals. Key market leaders include companies like Dow, BASF, and Royal Dutch Shell, which dominate through extensive product portfolios, strong R&D capabilities, and global distribution networks.

Market players leverage technological advancements to develop innovative PAG formulations, particularly bio-based variants catering to the growing demand for sustainable solutions. Emerging competitors, particularly in Asia Pacific focus on cost-effective manufacturing processes and localized supply chains to capture market share.

Strategic partnerships, product diversification, and mergers & acquisitions are common strategies to strengthen market presence. The growing focus on green lubricants and eco-friendly alternatives also fuels the market’s competitive intensity.

Key Market Companies

- BASF SE

- Dow

- INEOS

- SABIC

- LyondellBasell Industries Holdings B.V.

- DuPont

- Royal Dutch Shell PLC

- Bayer AG

- Clariant

- Huntsman International LLC

Recent Industry Developments

- February 2022-

Clariant, a prominent specialty chemical company, introduced a new range of 100% bio-based goods. Introducing Vita bio-based surfactants and polyethylene glycols (PEGs) is integral to the company's strategy for advancing a sustainable bio-economy and addressing the increasing demand for bio-based chemicals.

- May 2023-

BASF introduced a new line of PAG-based coolants tailored for electric vehicles (EVs), addressing the rising demand for advanced thermal management in the automotive sector.

An Expert’s Eye

- The growing shift towards bio-based and biodegradable lubricants will be a significant driver for the polyalkylene glycol market.

- The electric vehicle (EV) market is viewed as a key growth catalyst for PAGs due to their superior thermal management and energy efficiency performance making them ideal for EV lubricants and coolants.

- Innovations in high-performance PAG formulations will continue to open new market opportunities across sectors like automotive and aerospace.

- Asia Pacific market is expected to be a growing regional market due to rapid industrialization and increasing demand for eco-friendly lubricants.

Global Polyalkylene Glycol Market is Segmented as-

By Product Type

- Polyethylene Glycol

- Polypropylene Glycol

By Solubility

- Water Soluble

- Oil Soluble

By Application

- Polyurethane Foam

- Lubricants

- Surface Active Agents

- Pharmaceuticals

- Personal Care

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- The Middle East & Africa

1. Executive Summary

1.1. Global Polyalkylene Glycol Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2024

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. COVID-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Production Output and Trade Statistics, 2019-2023

3.1. Global Polyalkylene Glycol, Production Output, by Region, 2018 - 2023

3.1.1. North America

3.1.2. Europe

3.1.3. Asia Pacific

3.1.4. Latin America

3.1.5. Middle East & Africa

4. Global Polyalkylene Glycol Market Outlook, 2019 - 2031

4.1. Global Polyalkylene Glycol Market Outlook, by Product Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

4.1.1. Key Highlights

4.1.1.1. Polyethylene Glycol

4.1.1.2. Polypropylene Glycol

4.1.1.3. Others

4.2. Global Polyalkylene Glycol Market Outlook, by Solubility, Volume (Tons) and Value (US$ Bn), 2019 - 2031

4.2.1. Key Highlights

4.2.1.1. Water Soluble

4.2.1.2. Oil Soluble

4.3. Global Polyalkylene Glycol Market Outlook, by Application, Volume (Tons) and Value (US$ Bn), 2019 - 2031

4.3.1. Key Highlights

4.3.1.1. Polyurethane Foam

4.3.1.2. Lubricants

4.3.1.3. Surface Active Agents

4.3.1.4. Pharmaceuticals

4.3.1.5. Personal Care

4.3.1.6. Others

4.4. Global Polyalkylene Glycol Market Outlook, by Region, Volume (Tons) and Value (US$ Bn), 2019 - 2031

4.4.1. Key Highlights

4.4.1.1. North America

4.4.1.2. Europe

4.4.1.3. Asia Pacific

4.4.1.4. Latin America

4.4.1.5. Middle East & Africa

5. North America Polyalkylene Glycol Market Outlook, 2019 - 2031

5.1. North America Polyalkylene Glycol Market Outlook, by Product Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

5.1.1. Key Highlights

5.1.1.1. Polyethylene Glycol

5.1.1.2. Polypropylene Glycol

5.1.1.3. Others

5.2. North America Polyalkylene Glycol Market Outlook, by Solubility, Volume (Tons) and Value (US$ Bn), 2019 - 2031

5.2.1. Key Highlights

5.2.1.1. Water Soluble

5.2.1.2. Oil Soluble

5.3. North America Polyalkylene Glycol Market Outlook, by Application, Volume (Tons) and Value (US$ Bn), 2019 - 2031

5.3.1. Key Highlights

5.3.1.1. Polyurethane Foam

5.3.1.2. Lubricants

5.3.1.3. Surface Active Agents

5.3.1.4. Pharmaceuticals

5.3.1.5. Personal Care

5.3.1.6. Others

5.3.2. BPS Analysis/Market Attractiveness Analysis

5.4. North America Polyalkylene Glycol Market Outlook, by Country, Volume (Tons) and Value (US$ Bn), 2019 - 2031

5.4.1. Key Highlights

5.4.1.1. U.S. Polyalkylene Glycol Market by Product Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

5.4.1.2. U.S. Polyalkylene Glycol Market Solubility, Volume (Tons) and Value (US$ Bn), 2019 - 2031

5.4.1.3. U.S. Polyalkylene Glycol Market Application, Volume (Tons) and Value (US$ Bn), 2019 - 2031

5.4.1.4. Canada Polyalkylene Glycol Market by Product Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

5.4.1.5. Canada Polyalkylene Glycol Market Solubility, Volume (Tons) and Value (US$ Bn), 2019 - 2031

5.4.1.6. Canada Polyalkylene Glycol Market Application, Volume (Tons) and Value (US$ Bn), 2019 - 2031

5.4.2. BPS Analysis/Market Attractiveness Analysis

6. Europe Polyalkylene Glycol Market Outlook, 2019 - 2031

6.1. Europe Polyalkylene Glycol Market Outlook, by Product Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

6.1.1. Key Highlights

6.1.1.1. Polyethylene Glycol

6.1.1.2. Polypropylene Glycol

6.1.1.3. Others

6.2. Europe Polyalkylene Glycol Market Outlook, by Solubility, Volume (Tons) and Value (US$ Bn), 2019 - 2031

6.2.1. Key Highlights

6.2.1.1. Water Soluble

6.2.1.2. Oil Soluble

6.3. Europe Polyalkylene Glycol Market Outlook, by Application, Volume (Tons) and Value (US$ Bn), 2019 - 2031

6.3.1. Key Highlights

6.3.1.1. Polyurethane Foam

6.3.1.2. Lubricants

6.3.1.3. Surface Active Agents

6.3.1.4. Pharmaceuticals

6.3.1.5. Personal Care

6.3.1.6. Others

6.3.2. BPS Analysis/Market Attractiveness Analysis

6.4. Europe Polyalkylene Glycol Market Outlook, by Country, Volume (Tons) and Value (US$ Bn), 2019 - 2031

6.4.1. Key Highlights

6.4.1.1. Germany Polyalkylene Glycol Market by Product Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

6.4.1.2. Germany Polyalkylene Glycol Market Solubility, Volume (Tons) and Value (US$ Bn), 2019 - 2031

6.4.1.3. Germany Polyalkylene Glycol Market Application, Volume (Tons) and Value (US$ Bn), 2019 - 2031

6.4.1.4. U.K. Polyalkylene Glycol Market by Product Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

6.4.1.5. U.K. Polyalkylene Glycol Market Solubility, Volume (Tons) and Value (US$ Bn), 2019 - 2031

6.4.1.6. U.K. Polyalkylene Glycol Market Application, Volume (Tons) and Value (US$ Bn), 2019 - 2031

6.4.1.7. France Polyalkylene Glycol Market by Product Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

6.4.1.8. France Polyalkylene Glycol Market Solubility, Volume (Tons) and Value (US$ Bn), 2019 - 2031

6.4.1.9. France Polyalkylene Glycol Market Application, Volume (Tons) and Value (US$ Bn), 2019 - 2031

6.4.1.10. Italy Polyalkylene Glycol Market by Product Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

6.4.1.11. Italy Polyalkylene Glycol Market Solubility, Volume (Tons) and Value (US$ Bn), 2019 - 2031

6.4.1.12. Italy Polyalkylene Glycol Market Application, Volume (Tons) and Value (US$ Bn), 2019 - 2031

6.4.1.13. Turkey Polyalkylene Glycol Market by Product Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

6.4.1.14. Turkey Polyalkylene Glycol Market Solubility, Volume (Tons) and Value (US$ Bn), 2019 - 2031

6.4.1.15. Turkey Polyalkylene Glycol Market Application, Volume (Tons) and Value (US$ Bn), 2019 - 2031

6.4.1.16. Russia Polyalkylene Glycol Market by Product Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

6.4.1.17. Russia Polyalkylene Glycol Market Solubility, Volume (Tons) and Value (US$ Bn), 2019 - 2031

6.4.1.18. Russia Polyalkylene Glycol Market Application, Volume (Tons) and Value (US$ Bn), 2019 - 2031

6.4.1.19. Rest of Europe Polyalkylene Glycol Market by Product Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

6.4.1.20. Rest of Europe Polyalkylene Glycol Market Solubility, Volume (Tons) and Value (US$ Bn), 2019 - 2031

6.4.1.21. Rest of Europe Polyalkylene Glycol Market Application, Volume (Tons) and Value (US$ Bn), 2019 - 2031

6.4.2. BPS Analysis/Market Attractiveness Analysis

7. Asia Pacific Polyalkylene Glycol Market Outlook, 2019 - 2031

7.1. Asia Pacific Polyalkylene Glycol Market Outlook, by Product Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

7.1.1. Key Highlights

7.1.1.1. Polyethylene Glycol

7.1.1.2. Polypropylene Glycol

7.1.1.3. Others

7.2. Asia Pacific Polyalkylene Glycol Market Outlook, by Solubility, Volume (Tons) and Value (US$ Bn), 2019 - 2031

7.2.1. Key Highlights

7.2.1.1. Water Soluble

7.2.1.2. Oil Soluble

7.3. Asia Pacific Polyalkylene Glycol Market Outlook, by Application, Volume (Tons) and Value (US$ Bn), 2019 - 2031

7.3.1. Key Highlights

7.3.1.1. Polyurethane Foam

7.3.1.2. Lubricants

7.3.1.3. Surface Active Agents

7.3.1.4. Pharmaceuticals

7.3.1.5. Personal Care

7.3.1.6. Others

7.3.2. BPS Analysis/Market Attractiveness Analysis

7.4. Asia Pacific Polyalkylene Glycol Market Outlook, by Country, Volume (Tons) and Value (US$ Bn), 2019 - 2031

7.4.1. Key Highlights

7.4.1.1. China Polyalkylene Glycol Market by Product Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

7.4.1.2. China Polyalkylene Glycol Market Solubility, Volume (Tons) and Value (US$ Bn), 2019 - 2031

7.4.1.3. China Polyalkylene Glycol Market Application, Volume (Tons) and Value (US$ Bn), 2019 - 2031

7.4.1.4. Japan Polyalkylene Glycol Market by Product Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

7.4.1.5. Japan Polyalkylene Glycol Market Solubility, Volume (Tons) and Value (US$ Bn), 2019 - 2031

7.4.1.6. Japan Polyalkylene Glycol Market Application, Volume (Tons) and Value (US$ Bn), 2019 - 2031

7.4.1.7. South Korea Polyalkylene Glycol Market by Product Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

7.4.1.8. South Korea Polyalkylene Glycol Market Solubility, Volume (Tons) and Value (US$ Bn), 2019 - 2031

7.4.1.9. South Korea Polyalkylene Glycol Market Application, Volume (Tons) and Value (US$ Bn), 2019 - 2031

7.4.1.10. India Polyalkylene Glycol Market by Product Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

7.4.1.11. India Polyalkylene Glycol Market Solubility, Volume (Tons) and Value (US$ Bn), 2019 - 2031

7.4.1.12. India Polyalkylene Glycol Market Application, Volume (Tons) and Value (US$ Bn), 2019 - 2031

7.4.1.13. Southeast Asia Polyalkylene Glycol Market by Product Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

7.4.1.14. Southeast Asia Polyalkylene Glycol Market Solubility, Volume (Tons) and Value (US$ Bn), 2019 - 2031

7.4.1.15. Southeast Asia Polyalkylene Glycol Market Application, Volume (Tons) and Value (US$ Bn), 2019 - 2031

7.4.1.16. Rest of Asia Pacific Polyalkylene Glycol Market by Product Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

7.4.1.17. Rest of Asia Pacific Polyalkylene Glycol Market Solubility, Volume (Tons) and Value (US$ Bn), 2019 - 2031

7.4.1.18. Rest of Asia Pacific Polyalkylene Glycol Market Application, Volume (Tons) and Value (US$ Bn), 2019 - 2031

7.4.2. BPS Analysis/Market Attractiveness Analysis

8. Latin America Polyalkylene Glycol Market Outlook, 2019 - 2031

8.1. Latin America Polyalkylene Glycol Market Outlook, by Product Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

8.1.1. Key Highlights

8.1.1.1. Polyethylene Glycol

8.1.1.2. Polypropylene Glycol

8.1.1.3. Others

8.2. Latin America Polyalkylene Glycol Market Outlook, by Solubility, Volume (Tons) and Value (US$ Bn), 2019 - 2031

8.2.1. Key Highlights

8.2.1.1. Water Soluble

8.2.1.2. Oil Soluble

8.3. Latin America Polyalkylene Glycol Market Outlook, by Application, Volume (Tons) and Value (US$ Bn), 2019 - 2031

8.3.1. Key Highlights

8.3.1.1. Polyurethane Foam

8.3.1.2. Lubricants

8.3.1.3. Surface Active Agents

8.3.1.4. Pharmaceuticals

8.3.1.5. Personal Care

8.3.1.6. Others

8.3.2. BPS Analysis/Market Attractiveness Analysis

8.4. Latin America Polyalkylene Glycol Market Outlook, by Country, Volume (Tons) and Value (US$ Bn), 2019 - 2031

8.4.1. Key Highlights

8.4.1.1. Brazil Polyalkylene Glycol Market by Product Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

8.4.1.2. Brazil Polyalkylene Glycol Market Solubility, Volume (Tons) and Value (US$ Bn), 2019 - 2031

8.4.1.3. Brazil Polyalkylene Glycol Market Application, Volume (Tons) and Value (US$ Bn), 2019 - 2031

8.4.1.4. Mexico Polyalkylene Glycol Market by Product Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

8.4.1.5. Mexico Polyalkylene Glycol Market Solubility, Volume (Tons) and Value (US$ Bn), 2019 - 2031

8.4.1.6. Mexico Polyalkylene Glycol Market Application, Volume (Tons) and Value (US$ Bn), 2019 - 2031

8.4.1.7. Argentina Polyalkylene Glycol Market by Product Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

8.4.1.8. Argentina Polyalkylene Glycol Market Solubility, Volume (Tons) and Value (US$ Bn), 2019 - 2031

8.4.1.9. Argentina Polyalkylene Glycol Market Application, Volume (Tons) and Value (US$ Bn), 2019 - 2031

8.4.1.10. Rest of Latin America Polyalkylene Glycol Market by Product Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

8.4.1.11. Rest of Latin America Polyalkylene Glycol Market Solubility, Volume (Tons) and Value (US$ Bn), 2019 - 2031

8.4.1.12. Rest of Latin America Polyalkylene Glycol Market Application, Volume (Tons) and Value (US$ Bn), 2019 - 2031

8.4.2. BPS Analysis/Market Attractiveness Analysis

9. Middle East & Africa Polyalkylene Glycol Market Outlook, 2019 - 2031

9.1. Middle East & Africa Polyalkylene Glycol Market Outlook, by Product Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

9.1.1. Key Highlights

9.1.1.1. Polyethylene Glycol

9.1.1.2. Polypropylene Glycol

9.1.1.3. Others

9.2. Middle East & Africa Polyalkylene Glycol Market Outlook, by Solubility, Volume (Tons) and Value (US$ Bn), 2019 - 2031

9.2.1. Key Highlights

9.2.1.1. Water Soluble

9.2.1.2. Oil Soluble

9.3. Middle East & Africa Polyalkylene Glycol Market Outlook, by Application, Volume (Tons) and Value (US$ Bn), 2019 - 2031

9.3.1. Key Highlights

9.3.1.1. Polyurethane Foam

9.3.1.2. Lubricants

9.3.1.3. Surface Active Agents

9.3.1.4. Pharmaceuticals

9.3.1.5. Personal Care

9.3.1.6. Others

9.3.2. BPS Analysis/Market Attractiveness Analysis

9.4. Middle East & Africa Polyalkylene Glycol Market Outlook, by Country, Volume (Tons) and Value (US$ Bn), 2019 - 2031

9.4.1. Key Highlights

9.4.1.1. GCC Polyalkylene Glycol Market by Product Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

9.4.1.2. GCC Polyalkylene Glycol Market Solubility, Volume (Tons) and Value (US$ Bn), 2019 - 2031

9.4.1.3. GCC Polyalkylene Glycol Market Application, Volume (Tons) and Value (US$ Bn), 2019 - 2031

9.4.1.4. South Africa Polyalkylene Glycol Market by Product Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

9.4.1.5. South Africa Polyalkylene Glycol Market Solubility, Volume (Tons) and Value (US$ Bn), 2019 - 2031

9.4.1.6. South Africa Polyalkylene Glycol Market Application, Volume (Tons) and Value (US$ Bn), 2019 - 2031

9.4.1.7. Egypt Polyalkylene Glycol Market by Product Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

9.4.1.8. Egypt Polyalkylene Glycol Market Solubility, Volume (Tons) and Value (US$ Bn), 2019 - 2031

9.4.1.9. Egypt Polyalkylene Glycol Market Application, Volume (Tons) and Value (US$ Bn), 2019 - 2031

9.4.1.10. Nigeria Polyalkylene Glycol Market by Product Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

9.4.1.11. Nigeria Polyalkylene Glycol Market Solubility, Volume (Tons) and Value (US$ Bn), 2019 - 2031

9.4.1.12. Nigeria Polyalkylene Glycol Market End-use Industry, Volume (Tons) and Value (US$ Bn), 2019 - 2031

9.4.1.13. Rest of Middle East & Africa Polyalkylene Glycol Market by Product Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

9.4.1.14. Rest of Middle East & Africa Polyalkylene Glycol Market Solubility, Volume (Tons) and Value (US$ Bn), 2019 - 2031

9.4.1.15. Rest of Middle East & Africa Polyalkylene Glycol Market Application, Volume (Tons) and Value (US$ Bn), 2019 - 2031

9.4.2. BPS Analysis/Market Attractiveness Analysis

10. Competitive Landscape

10.1. Application vs Solubility Heatmap

10.2. Manufacturer vs Solubility Heatmap

10.3. Company Market Share Analysis, 2022

10.4. Competitive Dashboard

10.5. Company Profiles

10.5.1. BASF SE

10.5.1.1. Company Overview

10.5.1.2. Product Portfolio

10.5.1.3. Financial Overview

10.5.1.4. Business Strategies and Development

10.5.2. Dow

10.5.2.1. Company Overview

10.5.2.2. Product Portfolio

10.5.2.3. Financial Overview

10.5.2.4. Business Strategies and Development

10.5.3. Huntsman

10.5.3.1. Company Overview

10.5.3.2. Product Portfolio

10.5.3.3. Financial Overview

10.5.3.4. Business Strategies and Development

10.5.4. SABIC

10.5.4.1. Company Overview

10.5.4.2. Product Portfolio

10.5.4.3. Financial Overview

10.5.4.4. Business Strategies and Development

10.5.5. Shell

10.5.5.1. Company Overview

10.5.5.2. Product Portfolio

10.5.5.3. Financial Overview

10.5.5.4. Business Strategies and Development

10.5.6. LyondelBasell Industries

10.5.6.1. Company Overview

10.5.6.2. Product Portfolio

10.5.6.3. Financial Overview

10.5.6.4. Business Strategies and Development

10.5.7. INEOS

10.5.7.1. Company Overview

10.5.7.2. Product Portfolio

10.5.7.3. Financial Overview

10.5.7.4. Business Strategies and Development

10.5.8. Bayer AG

10.5.8.1. Company Overview

10.5.8.2. Product Portfolio

10.5.8.3. Financial Overview

10.5.8.4. Business Strategies and Development

10.5.9. Clariant

10.5.9.1. Company Overview

10.5.9.2. Product Portfolio

10.5.9.3. Financial Overview

10.5.9.4. Business Strategies and Development

10.5.10. Croda International

10.5.10.1. Company Overview

10.5.10.2. Product Portfolio

10.5.10.3. Financial Overview

10.5.10.4. Business Strategies and Development

10.5.11. Stepan Company

10.5.11.1. Company Overview

10.5.11.2. Product Portfolio

10.5.11.3. Financial Overview

10.5.11.4. Business Strategies and Development

10.5.12. PCC Group

10.5.12.1. Company Overview

10.5.12.2. Product Portfolio

10.5.12.3. Financial Overview

10.5.12.4. Business Strategies and Development

10.5.13. Idemitsu Kosan Co.

10.5.13.1. Company Overview

10.5.13.2. Product Portfolio

10.5.13.3. Financial Overview

10.5.13.4. Business Strategies and Development

10.5.14. Ashland Inc.

10.5.14.1. Company Overview

10.5.14.2. Product Portfolio

10.5.14.3. Financial Overview

10.5.14.4. Business Strategies and Development

10.5.15. ExxonMobil

10.5.15.1. Company Overview

10.5.15.2. Product Portfolio

10.5.15.3. Financial Overview

10.5.15.4. Business Strategies and Development

10.5.16. AkzoNobel N.V.

10.5.16.1. Company Overview

10.5.16.2. Product Portfolio

10.5.16.3. Financial Overview

10.5.16.4. Business Strategies and Development

11. Appendix

11.1. Research Methodology

11.2. Report Assumptions

11.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2023 |

|

2019 - 2023 |

2024 - 2031 |

Value: US$ Million |

||

|

REPORT FEATURES |

DETAILS |

|

Product Type Coverage |

|

|

Solubility Coverage |

|

|

Application Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |