Global Polyethylene Wax Market Forecast

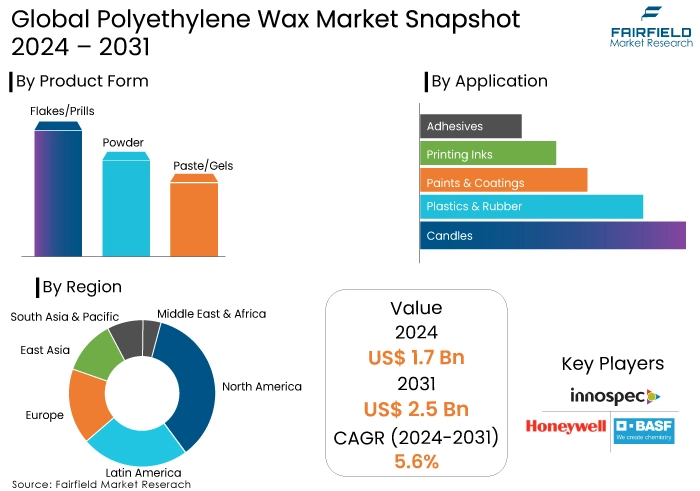

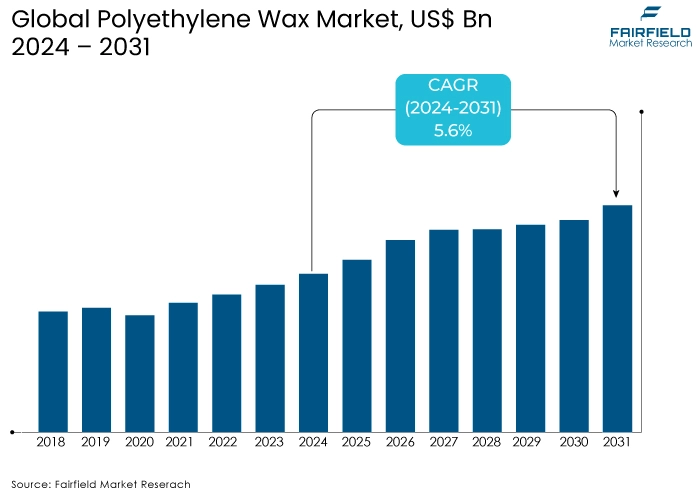

- The polyethylene wax market size poised to reach US$2.5 Bn in 2031, up from US$1.7 Bn attained in 2024

- Polyethylene wax market revenue projected to witness a CAGR of 5.6% during 2024-2031.

Polyethylene Wax Market Insights

- Growth driven by rising shale gas production in China and North America, and increasing demand from coatings and printing inks sectors.

- Market characterized by strict regulations by REACH, EPA, and FDA.

- Quality packaging in the food industry will drive demand for polyethylene wax.

- Industry players are incorporating advanced technologies for manufacturing processes.

- Polyethylene wax is a versatile product used in various sectors to enhance physical appearance and thermal properties.

- The textile industry is expected to expand, opening new channels for PE wax manufacturers.

- The increasing popularity of online sales is a key trend in the polyethylene wax space.

- E-commerce plays a vital role for small- and medium-scale PE wax producers in the supply chain.

A Look Back and a Look Forward - Comparative Analysis

The pre-2023 period for the polyethylene wax market showed positive growth trends. Market growth is driven by rising shale gas production in China and North America, as well as growing demand from the coatings and printing ink sectors. Additionally, the presence of a strong textile and apparel industry in Indonesia was expected to boost the consumption rate of polyolefin wax.

However, the post-2024 period is anticipated to bring even more significant growth opportunities for the polyethylene wax market growth. The global market is projected to grow at a CAGR of 6.3% from 2024 to 2031, with an estimated size of US$2.9 Bn in 2031.

The recovery from the pandemic crisis, coupled with increasing demand from end-use industries such as paints and coatings, adhesives, candles, and plastics and rubber, is expected to drive market growth. The US is estimated to create an incremental dollar opportunity of US$77.4 Mn for PE wax between 2024 and 2031, highlighting its significance as both a manufacturing and exporting country.

Key Growth Determinants

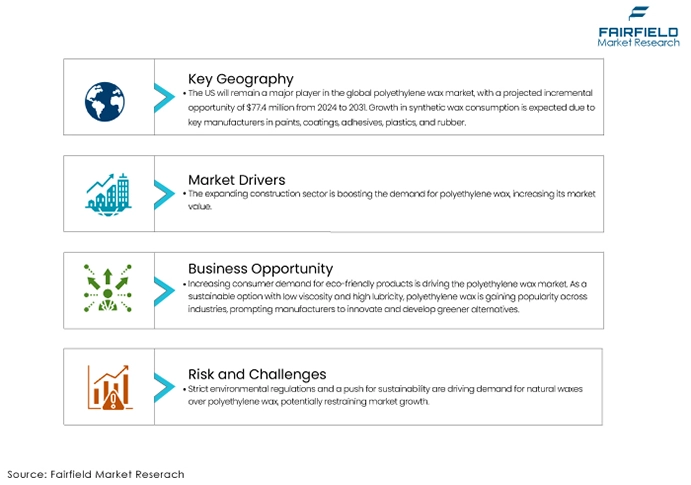

Growth in Construction Sector

The construction sector plays a significant role in driving the demand for polyethylene wax. The construction industry's value has been expanding rapidly, with a projected growth in the near future. This growth in the construction sector is augmenting the market value of polyethylene wax.

Increasing Demand for Lubricants in Plastic Processing

The demand for lubricants is rising in the plastic processing business, which is contributing to the polyethylene wax market growth. The utilization of plastic-based products, such as PVC, plasticizers, and antioxidants, in various end-use applications is driving the demand for lubricants and, in turn, fueling the polyethylene wax market demand.

Versatile Applications in Various End-Use Industries

Polyethylene wax has versatile applications in various industries, including packaging, plastics, coatings, paints, and printing inks. The increasing demand for polyethylene wax in these industries, driven by growing consumer preferences for sustainable and eco-friendly products, is expected to fuel the market growth. Additionally, the use of polyethylene wax in coatings and paints for improved gloss and scratch resistance is anticipated to contribute to polyethylene wax market expansion.

Key Growth Barriers

Strict Environmental Regulations

The strict regulations implemented by governments to protect the environment can act as a restraint for the polyethylene wax market revenue expansion. Governments worldwide are increasingly focusing on sustainability and reducing the environmental impact of industries. As a result, there is a growing emphasis on finding alternatives to polyethylene wax, such as natural waxes, which can be used in place of polyethylene wax. The availability of substitutes can impact the demand for polyethylene wax and act as a restraint for market growth.

Volatility in Raw Material Prices

The polyethylene wax market sales are influenced by the prices of raw materials, particularly crude oil and natural gas. Fluctuations in the prices of these raw materials can lead to volatility in the prices of polyethylene wax. Continued volatility in product prices can limit consumer spending and prompt customers to defer spending, which can restrain market growth. Manufacturers of polyethylene wax need to navigate these price fluctuations and manage their production costs to remain competitive in the market.

Polyethylene Wax Market Trends and Opportunities

Growing Boom Around Sustainable and Eco-Friendly Products

One of the prominent polyethylene wax market trends is the increasing demand for sustainable and eco-friendly products. Consumers are becoming more conscious of the environmental impact of the products they use and are actively seeking alternatives that are more sustainable. This trend is driving the demand for polyethylene wax, as it is considered a more environmentally friendly option compared to other types of waxes.

Polyethylene wax is derived from the polymerization of ethylene and is known for its low viscosity, high lubricity, and good heat resistance. It is widely used in various industries such as packaging, cosmetics, coatings, and plastics. Manufacturers in the polyethylene wax market are responding to this trend by focusing on product innovation and developing more sustainable alternatives.

Expansion in the Packaging Industry

An opportunity for the polyethylene wax market lies in the expansion of the packaging industry. The packaging industry is experiencing significant growth due to factors such as increasing e-commerce activities, rising consumer demand for convenience, and the need for sustainable packaging solutions.

Polyethylene wax is widely used in the packaging industry for applications such as film and sheet extrusion, laminating, and coating. It provides benefits such as improved slip, anti-blocking properties, and enhanced surface gloss. With the growing demand for packaging materials that offer better performance and sustainability, the demand for polyethylene wax is expected to increase.

How Does Regulatory Scenario Shape this Industry?

The regulatory scenario plays a significant role in shaping the polyethylene wax industry. The polyethylene wax market report highlight the presence of regulatory frameworks in well-established regions such as Europe, and North America. These regions have implemented stringent standards, such as REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals), EPA (Environment Protection Agency), and FDA (Food and Drug Administration), to ensure environmental protection, safety, health, and human rights.

In emerging regions like the Asia Pacific, the regulatory structure is still being enhanced to ensure proper protection of the environment and human health. As the regulatory frameworks in these regions continue to develop, it is expected that they will have an impact on the polyethylene wax market value. Compliance with regulations related to emissions, chemical usage, and product safety will become increasingly important for manufacturers and end-users.

The regulatory landscape can influence the production, distribution, and usage of polyethylene wax. Compliance with regulations may require manufacturers to invest in research and development to meet the required standards. Additionally, regulatory changes can impact the market dynamics by creating barriers to entry or affecting the supply chain.

Market Segmentation

Flakes/Prills Spearheads Demand Generation

The flakes/prills segment in the polyethylene wax market is projected to present an additional business opportunity of US$330.7 Mn between 2024 and 2031, with an expected growth rate of 4.9% during the same period.

The growth of this segment is primarily driven by the increasing demand for polyethylene wax flakes/prills, particularly in comparison to polyethylene wax powder and polyethylene wax paste/gels. This demand surge originates from various end-use industries such as paints & coatings, packaging, adhesives, printing inks, and others.

PE Wax Dominates as the Key Application Area

The demand for PE wax is witnessing significant growth across various end-use industries due to its versatile applications. It is utilized as a smoothening agent, a performance additive for hot melt adhesives, a lubrication and processing aid for plastics, PVC, and rubber, as well as a dry stir-in additive for inks and other applications. This increasing demand is particularly prominent in the plastics and rubber segment, which is estimated to contribute around 50% of the overall incremental market opportunity for PE wax. PE wax serves as an essential plastic additive in the manufacturing process of plastic products. The global production volume of plastics and rubber has witnessed a significant boost, thereby driving the polyethylene wax market sales.

Regional Analysis

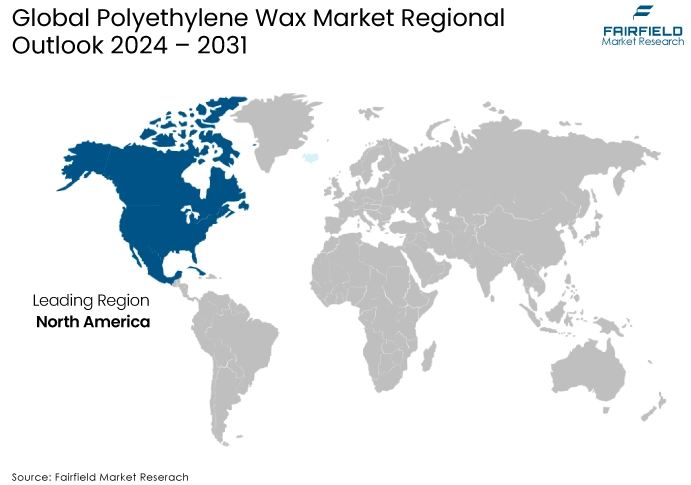

US Sets to Exhibit Notable Growth Rates in the Market

The US is expected to maintain its position as a prominent market in the global polyethylene wax market, both in terms of production and consumption. It is estimated that the US will generate an incremental dollar opportunity of US$77.4 Mn for PE wax between 2024 and 2031.

The consumption of synthetic wax is projected to experience significant growth in the US due to the presence of several key manufacturers in industries such as paints & coatings, adhesives, plastics & rubber, and other end-use products.

Indonesia Maintains a Central Position in the polyethylene wax Market

The polyethylene wax market in Indonesia is projected to grow at a CAGR of 6.1% during the forecast period. Indonesia is expected to maintain its position as a key manufacturing and exporting country for PE wax. The growth of the market in the country is primarily driven by the significant expansion of the industrial sector.

The presence of a strong textile and apparel industry in Indonesia is expected to contribute to the increased consumption of polyolefin wax in the coming years. Additionally, the development of the petroleum industry in the country is bolstering the production of polyethylene wax.

Recent Industry Developments

May 2024

Clariant is launching its new Licolub PED 1316, a new oxidized high-density polyethylene wax for easier processing and better surface properties in building and construction. Licolub PED 1316 offers excellent flow and surface properties, improved scratch resistance, and a clean, optically white appearance.

June 2023

BASF broke ground on a polyethylene (PE) plant at its Verbund site in Zhanjiang, China. The new plant, with a capacity of 500,000 metric tons of PE annually, aims to meet the fast-growing demand in China. The plant is scheduled to start up in 2025 and will cater to customers in various industries, including consumer goods, packaging, construction, and transportation. BASF's entry into the PE market in China is expected to strengthen its competitive production footprint and provide high-quality and reliable PE products for a wide range of applications.

Competitive Landscape Analysis

The polyethylene wax market is characterized by high competitiveness, with several leading companies competing for market shares. Here are some key leading companies:

- Yimei New Material Technology Co., Ltd.

- National Organic Chemicals Ltd. (NOCIL)

- Indian Petrochemical Corporation Ltd. (IPCL)

- Innospec Inc.

- Honeywell International Inc.

- BASF SE

- Mitsui Chemicals, Inc.

- Clariant AG

- SCG Chemicals Co., Ltd.

- Trecora Resources

- Westlake Chemical Corporation

- The Lubrizol Corporation

Polyethylene Wax Market Segmentation

By Product Form:

- Flakes/Prills

- Powder

- Paste/Gels

By Application:

- Candles

- Plastics & Rubber

- Paints & Coatings

- Printing Inks

- Adhesives

- Others

By Region:

- North America

- Latin America

- Europe

- East Asia

- South Asia & Pacific

- Middle East & Africa

1. Executive Summary

1.1. Global Polyethylene Wax Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2024

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. COVID-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Global Polyethylene Wax Market Outlook, 2019-2031

3.1. Global Polyethylene Wax Market Outlook, by Product Form, Value (US$ Bn), 2019-2031

3.1.1. Key Highlights

3.1.1.1. Flakes/Prills

3.1.1.2. Powder

3.1.1.3. Paste/Gels

3.2. Global Polyethylene Wax Market Outlook, by Production Process, Value (US$ Bn), 2019-2031

3.2.1. Key Highlights

3.2.1.1. Polymerization

3.2.1.1.1. HDPE Type

3.2.1.1.2. LDPE Type

3.2.1.1.3. Modified PE Wax

3.2.1.2. Thermal Degradation

3.2.1.2.1. LDPE Cracked Type

3.2.1.2.2. PP Cracked Type

3.3. Global Polyethylene Wax Market Outlook, by Application, Value (US$ Bn), 2019-2031

3.3.1. Key Highlights

3.3.1.1. Candles

3.3.1.2. Plastics & Rubber

3.3.1.3. Paints & Coatings

3.3.1.4. Printing Inks

3.3.1.5. Adhesives

3.3.1.6. Others

3.4. Global Polyethylene Wax Market Outlook, by Region, Value (US$ Bn), 2019-2031

3.4.1. Key Highlights

3.4.1.1. North America

3.4.1.2. Europe

3.4.1.3. Asia Pacific

3.4.1.4. Latin America

3.4.1.5. Middle East & Africa

4. North America Polyethylene Wax Market Outlook, 2019-2031

4.1. North America Polyethylene Wax Market Outlook, by Product Form, Value (US$ Bn), 2019-2031

4.1.1. Key Highlights

4.1.1.1. Flakes/Prills

4.1.1.2. Powder

4.1.1.3. Paste/Gels

4.2. North America Polyethylene Wax Market Outlook, by Production Process, Value (US$ Bn), 2019-2031

4.2.1. Key Highlights

4.2.1.1. Polymerization

4.2.1.1.1. HDPE Type

4.2.1.1.2. LDPE Type

4.2.1.1.3. Modified PE Wax

4.2.1.2. Thermal Degradation

4.2.1.2.1. LDPE Cracked Type

4.2.1.2.2. PP Cracked Type

4.3. North America Polyethylene Wax Market Outlook, by Application, Value (US$ Bn), 2019-2031

4.3.1. Key Highlights

4.3.1.1. Candles

4.3.1.2. Plastics & Rubber

4.3.1.3. Paints & Coatings

4.3.1.4. Printing Inks

4.3.1.5. Adhesives

4.3.1.6. Others

4.3.2. BPS Analysis/Market Attractiveness Analysis

4.4. North America Polyethylene Wax Market Outlook, by Country, Value (US$ Bn), 2019-2031

4.4.1. Key Highlights

4.4.1.1. U.S. Polyethylene Wax Market by Product Form, Value (US$ Bn), 2019-2031

4.4.1.2. U.S. Polyethylene Wax Market by Production Process, Value (US$ Bn), 2019-2031

4.4.1.3. U.S. Polyethylene Wax Market by Application, Value (US$ Bn), 2019-2031

4.4.1.4. Canada Polyethylene Wax Market by Product Form, Value (US$ Bn), 2019-2031

4.4.1.5. Canada Polyethylene Wax Market by Production Process, Value (US$ Bn), 2019-2031

4.4.1.6. Canada Polyethylene Wax Market by Application, Value (US$ Bn), 2019-2031

4.4.2. BPS Analysis/Market Attractiveness Analysis

5. Europe Polyethylene Wax Market Outlook, 2019-2031

5.1. Europe Polyethylene Wax Market Outlook, by Product Form, Value (US$ Bn), 2019-2031

5.1.1. Key Highlights

5.1.1.1. Flakes/Prills

5.1.1.2. Powder

5.1.1.3. Paste/Gels

5.2. Europe Polyethylene Wax Market Outlook, by Production Process, Value (US$ Bn), 2019-2031

5.2.1. Key Highlights

5.2.1.1. Polymerization

5.2.1.1.1. HDPE Type

5.2.1.1.2. LDPE Type

5.2.1.1.3. Modified PE Wax

5.2.1.2. Thermal Degradation

5.2.1.2.1. LDPE Cracked Type

5.2.1.2.2. PP Cracked Type

5.3. Europe Polyethylene Wax Market Outlook, by Application, Value (US$ Bn), 2019-2031

5.3.1. Key Highlights

5.3.1.1. Candles

5.3.1.2. Plastics & Rubber

5.3.1.3. Paints & Coatings

5.3.1.4. Printing Inks

5.3.1.5. Adhesives

5.3.1.6. Others

5.3.2. BPS Analysis/Market Attractiveness Analysis

5.4. Europe Polyethylene Wax Market Outlook, by Country, Value (US$ Bn), 2019-2031

5.4.1. Key Highlights

5.4.1.1. Germany Polyethylene Wax Market by Product Form, Value (US$ Bn), 2019-2031

5.4.1.2. Germany Polyethylene Wax Market by Production Process, Value (US$ Bn), 2019-2031

5.4.1.3. Germany Polyethylene Wax Market by Application, Value (US$ Bn), 2019-2031

5.4.1.4. U.K. Polyethylene Wax Market by Product Form, Value (US$ Bn), 2019-2031

5.4.1.5. U.K. Polyethylene Wax Market by Production Process, Value (US$ Bn), 2019-2031

5.4.1.6. U.K. Polyethylene Wax Market by Application, Value (US$ Bn), 2019-2031

5.4.1.7. France Polyethylene Wax Market by Product Form, Value (US$ Bn), 2019-2031

5.4.1.8. France Polyethylene Wax Market by Production Process, Value (US$ Bn), 2019-2031

5.4.1.9. France Polyethylene Wax Market by Application, Value (US$ Bn), 2019-2031

5.4.1.10. Italy Polyethylene Wax Market by Product Form, Value (US$ Bn), 2019-2031

5.4.1.11. Italy Polyethylene Wax Market by Production Process, Value (US$ Bn), 2019-2031

5.4.1.12. Italy Polyethylene Wax Market by Application, Value (US$ Bn), 2019-2031

5.4.1.13. Turkey Polyethylene Wax Market by Product Form, Value (US$ Bn), 2019-2031

5.4.1.14. Turkey Polyethylene Wax Market by Production Process, Value (US$ Bn), 2019-2031

5.4.1.15. Turkey Polyethylene Wax Market by Application, Value (US$ Bn), 2019-2031

5.4.1.16. Russia Polyethylene Wax Market by Product Form, Value (US$ Bn), 2019-2031

5.4.1.17. Russia Polyethylene Wax Market by Production Process, Value (US$ Bn), 2019-2031

5.4.1.18. Russia Polyethylene Wax Market by Application, Value (US$ Bn), 2019-2031

5.4.1.19. Rest of Europe Polyethylene Wax Market by Product Form, Value (US$ Bn), 2019-2031

5.4.1.20. Rest of Europe Polyethylene Wax Market by Production Process, Value (US$ Bn), 2019-2031

5.4.1.21. Rest of Europe Polyethylene Wax Market by Application, Value (US$ Bn), 2019-2031

5.4.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Polyethylene Wax Market Outlook, 2019-2031

6.1. Asia Pacific Polyethylene Wax Market Outlook, by Product Form, Value (US$ Bn), 2019-2031

6.1.1. Key Highlights

6.1.1.1. Flakes/Prills

6.1.1.2. Powder

6.1.1.3. Paste/Gels

6.2. Asia Pacific Polyethylene Wax Market Outlook, by Production Process, Value (US$ Bn), 2019-2031

6.2.1. Key Highlights

6.2.1.1. Polymerization

6.2.1.1.1. HDPE Type

6.2.1.1.2. LDPE Type

6.2.1.1.3. Modified PE Wax

6.2.1.2. Thermal Degradation

6.2.1.2.1. LDPE Cracked Type

6.2.1.2.2. PP Cracked Type

6.3. Asia Pacific Polyethylene Wax Market Outlook, by Application, Value (US$ Bn), 2019-2031

6.3.1. Key Highlights

6.3.1.1. Candles

6.3.1.2. Plastics & Rubber

6.3.1.3. Paints & Coatings

6.3.1.4. Printing Inks

6.3.1.5. Adhesives

6.3.1.6. Others

6.3.2. BPS Analysis/Market Attractiveness Analysis

6.4. Asia Pacific Polyethylene Wax Market Outlook, by Country, Value (US$ Bn), 2019-2031

6.4.1. Key Highlights

6.4.1.1. China Polyethylene Wax Market by Product Form, Value (US$ Bn), 2019-2031

6.4.1.2. China Polyethylene Wax Market by Production Process, Value (US$ Bn), 2019-2031

6.4.1.3. China Polyethylene Wax Market by Application, Value (US$ Bn), 2019-2031

6.4.1.4. Japan Polyethylene Wax Market by Product Form, Value (US$ Bn), 2019-2031

6.4.1.5. Japan Polyethylene Wax Market by Production Process, Value (US$ Bn), 2019-2031

6.4.1.6. Japan Polyethylene Wax Market by Application, Value (US$ Bn), 2019-2031

6.4.1.7. South Korea Polyethylene Wax Market by Product Form, Value (US$ Bn), 2019-2031

6.4.1.8. South Korea Polyethylene Wax Market by Production Process, Value (US$ Bn), 2019-2031

6.4.1.9. South Korea Polyethylene Wax Market by Application, Value (US$ Bn), 2019-2031

6.4.1.10. India Polyethylene Wax Market by Product Form, Value (US$ Bn), 2019-2031

6.4.1.11. India Polyethylene Wax Market by Production Process, Value (US$ Bn), 2019-2031

6.4.1.12. India Polyethylene Wax Market by Application, Value (US$ Bn), 2019-2031

6.4.1.13. Southeast Asia Polyethylene Wax Market by Product Form, Value (US$ Bn), 2019-2031

6.4.1.14. Southeast Asia Polyethylene Wax Market by Production Process, Value (US$ Bn), 2019-2031

6.4.1.15. Southeast Asia Polyethylene Wax Market by Application, Value (US$ Bn), 2019-2031

6.4.1.16. Rest of Asia Pacific Polyethylene Wax Market by Product Form, Value (US$ Bn), 2019-2031

6.4.1.17. Rest of Asia Pacific Polyethylene Wax Market by Production Process, Value (US$ Bn), 2019-2031

6.4.1.18. Rest of Asia Pacific Polyethylene Wax Market by Application, Value (US$ Bn), 2019-2031

6.4.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America Polyethylene Wax Market Outlook, 2019-2031

7.1. Latin America Polyethylene Wax Market Outlook, by Product Form, Value (US$ Bn), 2019-2031

7.1.1. Key Highlights

7.1.1.1. Flakes/Prills

7.1.1.2. Powder

7.1.1.3. Paste/Gels

7.2. Latin America Polyethylene Wax Market Outlook, by Production Process, Value (US$ Bn), 2019-2031

7.2.1. Key Highlights

7.2.1.1. Polymerization

7.2.1.1.1. HDPE Type

7.2.1.1.2. LDPE Type

7.2.1.1.3. Modified PE Wax

7.2.1.2. Thermal Degradation

7.2.1.2.1. LDPE Cracked Type

7.2.1.2.2. PP Cracked Type

7.3. Latin America Polyethylene Wax Market Outlook, by Application, Value (US$ Bn), 2019-2031

7.3.1. Key Highlights

7.3.1.1. Candles

7.3.1.2. Plastics & Rubber

7.3.1.3. Paints & Coatings

7.3.1.4. Printing Inks

7.3.1.5. Adhesives

7.3.1.6. Others

7.3.2. BPS Analysis/Market Attractiveness Analysis

7.4. Latin America Polyethylene Wax Market Outlook, by Country, Value (US$ Bn), 2019-2031

7.4.1. Key Highlights

7.4.1.1. Brazil Polyethylene Wax Market by Product Form, Value (US$ Bn), 2019-2031

7.4.1.2. Brazil Polyethylene Wax Market by Production Process, Value (US$ Bn), 2019-2031

7.4.1.3. Brazil Polyethylene Wax Market by Application, Value (US$ Bn), 2019-2031

7.4.1.4. Mexico Polyethylene Wax Market by Product Form, Value (US$ Bn), 2019-2031

7.4.1.5. Mexico Polyethylene Wax Market by Production Process, Value (US$ Bn), 2019-2031

7.4.1.6. Mexico Polyethylene Wax Market by Application, Value (US$ Bn), 2019-2031

7.4.1.7. Argentina Polyethylene Wax Market by Product Form, Value (US$ Bn), 2019-2031

7.4.1.8. Argentina Polyethylene Wax Market by Production Process, Value (US$ Bn), 2019-2031

7.4.1.9. Argentina Polyethylene Wax Market by Application, Value (US$ Bn), 2019-2031

7.4.1.10. Rest of Latin America Polyethylene Wax Market by Product Form, Value (US$ Bn), 2019-2031

7.4.1.11. Rest of Latin America Polyethylene Wax Market by Production Process, Value (US$ Bn), 2019-2031

7.4.1.12. Rest of Latin America Polyethylene Wax Market by Application, Value (US$ Bn), 2019-2031

7.4.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Polyethylene Wax Market Outlook, 2019-2031

8.1. Middle East & Africa Polyethylene Wax Market Outlook, by Product Form, Value (US$ Bn), 2019-2031

8.1.1. Key Highlights

8.1.1.1. Flakes/Prills

8.1.1.2. Powder

8.1.1.3. Paste/Gels

8.2. Middle East & Africa Polyethylene Wax Market Outlook, by Production Process, Value (US$ Bn), 2019-2031

8.2.1. Key Highlights

8.2.1.1. Polymerization

8.2.1.1.1. HDPE Type

8.2.1.1.2. LDPE Type

8.2.1.1.3. Modified PE Wax

8.2.1.2. Thermal Degradation

8.2.1.2.1. LDPE Cracked Type

8.2.1.2.2. PP Cracked Type

8.3. Middle East & Africa Polyethylene Wax Market Outlook, by Application, Value (US$ Bn), 2019-2031

8.3.1. Key Highlights

8.3.1.1. Candles

8.3.1.2. Plastics & Rubber

8.3.1.3. Paints & Coatings

8.3.1.4. Printing Inks

8.3.1.5. Adhesives

8.3.1.6. Others

8.3.2. BPS Analysis/Market Attractiveness Analysis

8.4. Middle East & Africa Polyethylene Wax Market Outlook, by Country, Value (US$ Bn), 2019-2031

8.4.1. Key Highlights

8.4.1.1. GCC Polyethylene Wax Market by Product Form, Value (US$ Bn), 2019-2031

8.4.1.2. GCC Polyethylene Wax Market by Production Process, Value (US$ Bn), 2019-2031

8.4.1.3. GCC Polyethylene Wax Market by Application, Value (US$ Bn), 2019-2031

8.4.1.4. South Africa Polyethylene Wax Market by Product Form, Value (US$ Bn), 2019-2031

8.4.1.5. South Africa Polyethylene Wax Market by Production Process, Value (US$ Bn), 2019-2031

8.4.1.6. South Africa Polyethylene Wax Market by Application, Value (US$ Bn), 2019-2031

8.4.1.7. Egypt Polyethylene Wax Market by Product Form, Value (US$ Bn), 2019-2031

8.4.1.8. Egypt Polyethylene Wax Market by Production Process, Value (US$ Bn), 2019-2031

8.4.1.9. Egypt Polyethylene Wax Market by Application, Value (US$ Bn), 2019-2031

8.4.1.10. Nigeria Polyethylene Wax Market by Product Form, Value (US$ Bn), 2019-2031

8.4.1.11. Nigeria Polyethylene Wax Market by Production Process, Value (US$ Bn), 2019-2031

8.4.1.12. Nigeria Polyethylene Wax Market by Application, Value (US$ Bn), 2019-2031

8.4.1.13. Rest of Middle East & Africa Polyethylene Wax Market by Product Form, Value (US$ Bn), 2019-2031

8.4.1.14. Rest of Middle East & Africa Polyethylene Wax Market by Production Process, Value (US$ Bn), 2019-2031

8.4.1.15. Rest of Middle East & Africa Polyethylene Wax Market by Application, Value (US$ Bn), 2019-2031

8.4.2. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. By Application vs by Production Process Heat map

9.2. Manufacturer vs by Production Process Heatmap

9.3. Company Market Share Analysis, 2022

9.4. Competitive Dashboard

9.5. Company Profiles

9.5.1. Innospec Inc.

9.5.1.1. Company Overview

9.5.1.2. Product Portfolio

9.5.1.3. Financial Overview

9.5.1.4. Business Strategies and Development

9.5.3. Mitsui Chemicals America, Inc.

9.5.2. BASF SE

9.5.4. Clariant International

9.5.5. Honeywell International

9.5.6. Trecora Resources

9.5.7. EUROCERAS

9.5.8. Westlake Chemical Corporation

9.5.9. The Lubrizol Corporation

9.5.10. Allied Signal

9.5.11. Qingdao Haihao Chemical Co., Ltd.

9.5.12. Prizm Marketing Inc.

9.5.13. Yimei New Material Technology Co., Ltd.

9.5.14. National Organic Chemicals Ltd., (NOCIL)

9.5.15. Indian Petrochemical Corporation Ltd.

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2023 |

|

2019 - 2023 |

2024 - 2031 |

Value: US$ Billion |

||

|

REPORT FEATURES |

DETAILS |

|

Product Coverage |

|

|

Application Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |