Global Portable Tools Market Forecast

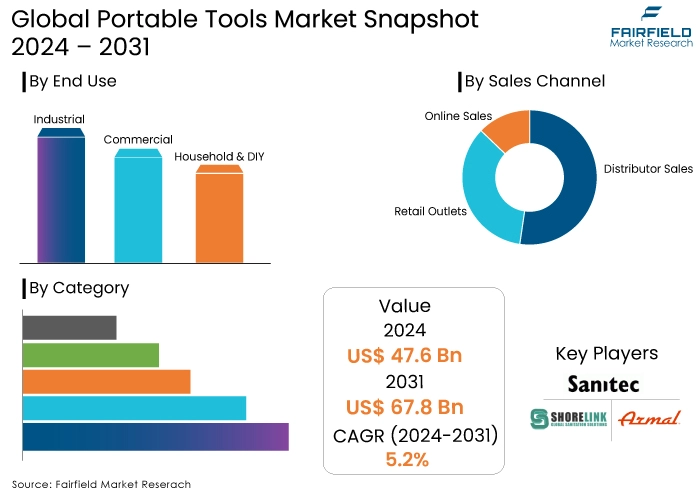

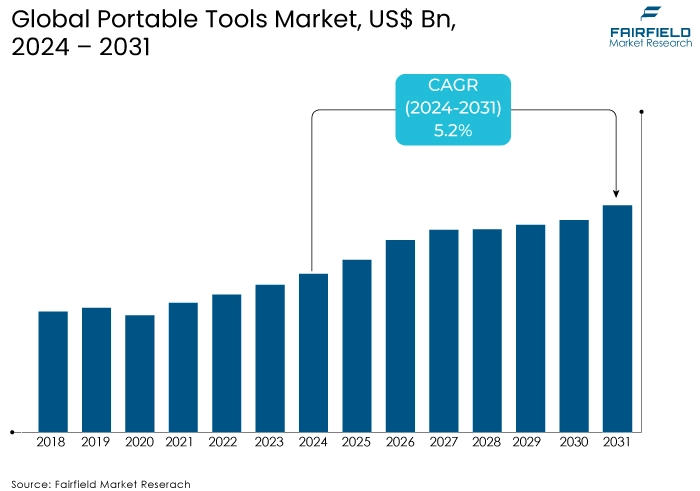

- The portable tools market size poised to reach US$67.8 Bn in 2031, up from US$47.6 Bn attained in 2024

- Global portable tools market revenue likely to witness a CAGR of 5.2% during 2024-2031

Portable Tools Market Insights

- Urbanization and infrastructural growth in developing economies like India, and China are driving demand for portable tools.

- Rising demand for landscaping on residential and commercial properties is driving the market.

- Macroeconomic factors like GDP, urbanization, economic growth, and industry value significantly impact portable tool market sales.

- DIY projects as a hobby are driving demand for portable tools in the residential segment.

- E-commerce platforms offer greater visibility and reach, with doorstep delivery, discounts, and detailed instructions.

- Government regulations fuel the adoption of personal protective equipment, especially in high-risk industries.

- Rising raw material costs are affecting the profit margins of portable tool manufacturers.

- The market is fragmented, with Asia Pacific witnessing new entrants.

A Look Back and a Look Forward - Comparative Analysis

The regulatory scenario plays a crucial role in shaping the portable tools industry. Regulatory changes and policies can have a significant impact on market dynamics, affecting factors such as manufacturing standards, safety regulations, and environmental requirements. These regulations can influence the production, distribution, and usage of portable tools. Some portable tools examples include circular saws, jigsaws, drills, hammer-drills, sanders, grinders, and routers.

For instance, organizations in the portable tools industry have faced challenges related to regulatory and policy changes, supply chain execution, and labor dependency. However, companies have responded by implementing strategic cost-saving plans to manage the impact of these challenges and ensure compliance with regulations.

The regulatory landscape also influences the adoption of new technologies and the development of innovative products in the portable tools market. Companies need to stay updated with regulatory requirements to ensure their products meet the necessary standards and certifications.

Key Growth Determinants

Increasing Industrialization and Infrastructure Development

The growth of the portable tools market is closely tied to the level of industrialization and infrastructure development in various regions. As industrial activities and construction projects increase, there is a higher demand for portable tools for tasks such as drilling, cutting, fastening, and material removal. The expansion of industries such as manufacturing, construction, and automotive drives the need for portable tools, contributing to market growth.

Rising Demand from Automotive Industry

The automotive industry is a major consumer of portable tools. These tools are essential for various applications in automotive manufacturing, repair, and maintenance. As the automotive industry continues to grow and evolve, the demand for portable tools also increases.

Advancements in automotive technology, such as electric vehicles and autonomous driving, require specialized portable tools list, further driving the portable tools market demand.

Growing Popularity of DIY Activities

The trend of do-it-yourself (DIY) activities has gained significant traction in recent years. More individuals are engaging in DIY projects, home improvements, and repairs. This has created a demand for portable tools among consumers who want to take on tasks themselves.

The accessibility of portable tools, along with the availability of online tutorials and resources, has empowered individuals to undertake various projects independently. The DIY trend contributes to the portable tools market expansion, as consumers seek tools that are easy to use, versatile, and portable.

Key Growth Barriers

High Cost of Advanced Portable Tools

The portable tools market offers a wide range of advanced and specialized tools that come with a higher price tag. The cost associated with these advanced portable tools can limit their adoption, especially for small-scale businesses or budget-conscious consumers.

The higher cost may deter potential buyers from investing in these tools, impacting portable tools market growth. Manufacturers need to find a balance between offering innovative features and maintaining affordability to address this restraint.

Complexity of Operating and Interpreting Spectrometer Data

In certain segments of the portable tools market, such as portable spectrometers, the complexity of operating and interpreting the data can be a challenge for users without specialized training. The accurate interpretation of spectrometer data requires technical expertise and knowledge. This complexity may limit the portable tools market reach.

As potential users may hesitate to invest in tools, they find it difficult to operate or understand. Manufacturers can address this restraint by providing user-friendly interfaces, simplified data interpretation, and offering training and support to users.

Portable Tools Market Trends and Opportunities

Technological Innovations Like Cordless and Battery-Operated Tools

The portable tools market is experiencing a significant trend in technological advancements, leading to enhanced performance, improved efficiency, and increased safety of these tools. Manufacturers are continuously innovating to meet the evolving demands of industries and consumers.

One notable innovation in the portable tools market is the development of cordless and battery-powered tools. These tools provide greater mobility and convenience, as they eliminate the need for power cords and allow users to work in various locations without restrictions.

Cordless tools also offer improved portability, enabling users to easily move around job sites or work in areas without access to electrical outlets. The advent of long-lasting and fast-charging batteries has further boosted the popularity of cordless tools, as they provide extended usage time and reduced downtime.

Rise of Environmental Awareness Driving Demand for Green and Sustainable Tools

One significant opportunity in the portable tools market is the growing demand for green and sustainable tools. As environmental awareness and sustainability practices become more prominent, consumers and industries are seeking tools that align with their eco-conscious values. Manufacturers have the chance to capitalize on this trend by developing and marketing tools that are energy-efficient, use eco-friendly materials, and have reduced carbon footprints.

Energy-efficient tools can help reduce overall energy consumption and lower operating costs for users. These tools may feature power-saving modes, intelligent power management systems, or the use of renewable energy sources.

Another aspect of sustainable tools lies in the materials used during production. Portable tool manufacturers can explore the use of recycled or recyclable materials in tool manufacturing to minimize waste and promote a circular economy.

How Does Regulatory Scenario Shape this Industry?

The regulatory scenario plays a crucial role in shaping the portable tools industry. Regulatory changes and policies can have a significant impact on market dynamics, affecting factors such as manufacturing standards, safety regulations, and environmental requirements. These regulations can influence the production, distribution, and usage of portable tools. For instance, organizations in the portable tools industry have faced challenges related to regulatory and policy changes, supply chain execution, and labor dependency.

However, companies have responded by implementing strategic cost-saving plans to manage the impact of these challenges and ensure compliance with regulations. The regulatory landscape also influences the adoption of new technologies and the development of innovative products in the portable tools market. Companies need to stay updated with regulatory requirements to ensure their products meet the necessary standards and certifications.

Fairfield’s Ranking Board

Top Segments

Electric Power Tools to be Dominant over Other Power Tools Categories

Within the power tools category, there are several dominant segments based on different types of tools. One dominant segment is electric power tools, such as drills, saws, and sanders. These portable tools and equipment are widely used in construction, woodworking, and metalworking applications due to their versatility, power, and ease of use. This is significantly driving the portable tools market shares.

Another dominant segment is pneumatic power tools, which are powered by compressed air. These tools, including pneumatic drills and impact wrenches, are commonly used in automotive, manufacturing, and construction industries where high torque and precision are required. Additionally, hydraulic power tools, which utilize hydraulic fluid to generate power, are dominant in sectors such as mining, oil and gas, and heavy machinery operations, where high forces and ruggedness are essential.

PPE Marches Ahead as Worker Safety Takes Center Stage

The personal protection equipment (PPE) category remains the top-selling segment, accounting for an estimated one-third of the portable tools market revenue share. This high demand for PPE is primarily attributed to the stringent occupational safety regulations in place and the increasing awareness of the importance of worker safety among end users.

Within the PPE segment, the demand for foot and leg protection equipment is particularly high. This can be attributed to the need for safeguarding workers' lower extremities from potential hazards in various industries. Following PPE, power tools represent the second-largest category in terms of portable tools market share. This shift is driven by a preference for power tools over hand tools due to factors such as increased efficiency and productivity.

Flooding Popularity of DIY to Rise Even Higher

The DIY trend is experiencing a surge in popularity, driven by various factors that include convenient doorstep delivery through e-commerce platforms and the availability of free instructional content on popular video streaming sites. As more individuals take up DIY projects as a hobby, there is a notable rise in the demand for portable tools in the residential segment.

This growing interest in DIY activities has created a market opportunity for manufacturers and suppliers of portable tools box, as homeowners and hobbyists seek the necessary tools to undertake their projects independently. The accessibility of tools and resources has empowered individuals to explore their creativity and tackle home improvement, crafting, and repair projects, contributing to the increased demand for portable tools in residential settings.

Regional Frontrunners

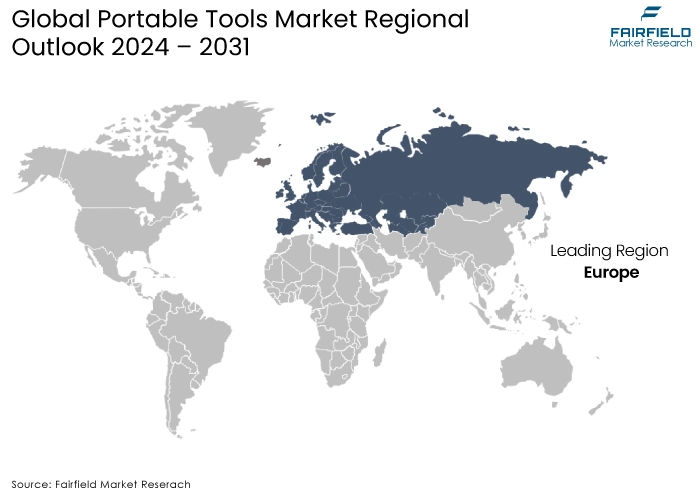

Europe Sets to Exhibit a Notable Growth Rate in the Market

Europe has long been a lucrative market for manufacturers of portable tools. The industrial sector in Europe has consistently generated steady demand for these tools, ensuring a reliable stream of opportunities for manufacturers. Additionally, the adoption of portable tools in carpentry, landscaping and do-it-yourself (DIY) segments has been steadily growing in the region.

However, it is worth noting that the demand for portable tools USB in Europe remains concentrated primarily in the EU5 countries, which include Germany, France, the UK, Italy, and Spain. These countries represent the largest markets within Europe and offer significant potential for manufacturers to tap into the robust demand for portable tools in various industries and consumer segments.

North America Maintains the Strategically Significant Position

North America is poised to dominate the portable tools market in the forecast period, driven by the increasing penetration of the automation industry in the region. This growing automation trend across various sectors is fueling the demand for portable tools, which are essential for maintenance and repair tasks.

Additionally, the high cost of labor in North America is incentivizing individuals to adopt portable tools for do-it-yourself (DIY) projects, leading to further market growth. The convenience, cost-effectiveness, and versatility of portable tools checklist make them an attractive choice for DIY enthusiasts, contributing to the overall expansion of the portable tools market in the region.

With these factors in play, North America is expected to offer significant opportunities and contribute significantly to the global growth of the portable tools market.

Fairfield’s Competitive Landscape Analysis

The portable tool market brims with moderate competition. Established giants like Stanley Black & Decker and Bosch hold sway with brand recognition and distribution networks. However, upstarts are challenging with innovation and specialization.

Price competition thrives alongside established brands refining offerings. Cordless tools powered by advancing battery tech are a hot trend, with both big names and startups vying for dominance. Niche markets and specialty tools see a rise in innovative players.

Smart tool integration with features like data tracking is another area witnessing a fight for user attention. As the landscape evolves, success hinges on balancing brand legacy with innovation, catering to user needs, and navigating distribution channels.

Key Market Companies

- Sanitech

- Shorelink International

- Armal

- Satellite Industries

- PolyJohn Enterprises

- B&B Portable Toilets

- DCO International

- Camco Manufacturing

- NuConcepts

- Akar Tools Ltd.

- Channellock, Inc.

- Emerson Electric Co. (RIDGID)

Recent Industry Developments

- In April 2024, Litheli, a leading innovator in smart energy-sharing tools, showcased its Infinity Power Share (IPS) at CES 2024. The innovative system consists of the U4 and U20 battery-powered tools and the IPS modular power station, offering power generation, storage, and interchangeability across various life scenarios. The IPS model addresses the limitations of the conventional battery platform (DC1.0) by turning the battery into an independent product rather than a mere accessory.

- In May 2024, Seesii is a leading industrial tool manufacturer known for its innovative products, including cordless mini chainsaws, impact wrenches, and other portable tools. It has developed the WH760 Cordless Impact Wrench, which is a popular choice for automotive tire repairs, with its exceptional performance and value for money. Equipped with two high-capacity 4.0AH batteries and a rapid charger, it offers a maximum breakaway torque of 1000 nm and a peak speed of 2400 rpm. The tool also features three-speed modes and a variable speed trigger for versatility. Seesii offers a 3-year warranty and customer support, ensuring a worry-free shopping experience. The company's commitment to quality is evident in its commitment to customer satisfaction.

Portable Tools Market Segmentation

By End Use

- Industrial

- Manufacturing Industry

- Constructional Industry

- Commercial

- Household & DIY

By Category

- Hand Tools

- Power Tools

- Garage Tools

- Lighting Tools

- Personal Protective Equipment (PPE)

By Sales Channel

- Distributor Sales

- Retail Outlets

- Online Sales

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Turkey

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

1. Executive Summary

1.1. Global Portable Tools Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2024

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. COVID-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Production Output and Trade Statistics, 2019-2023

3.1. Global Portable Tools, Production Output, by Region, 2019-2023

3.1.1. North America

3.1.2. Europe

3.1.3. Asia Pacific

3.1.4. Latin America

3.1.5. Middle East & Africa

4. Price Trend Analysis, 2019-2023

4.1. Key Highlights

4.2. Global Average Price Analysis, by End-Use/ Sales Channel, US$ per Unit

4.3. Prominent Factors Affecting Portable Tools Prices

4.4. Global Average Price Analysis, by Region, US$ per Unit

5. Global Portable Tools Market Outlook, 2019-2031

5.1. Global Portable Tools Market Outlook, by End-Use, Value (US$ Bn) & Volume (Units), 2019-2031

5.1.1. Key Highlights

5.1.1.1. Industrial

5.1.1.1.1. Manufacturing Industry

5.1.1.1.2. Construction Industry

5.1.1.2. Commercial (Repair shops, etc.)

5.1.1.3. Household & DIY

5.2. Global Portable Tools Market Outlook, by Sales Channel, Value (US$ Bn) & Volume (Units), 2019-2031

5.2.1. Key Highlights

5.2.1.1. Distributor Sales

5.2.1.2. Retail Outlets

5.2.1.3. Online Sales

5.3. Global Portable Tools Market Outlook, by Region, Value (US$ Bn) & Volume (Units), 2019-2031

5.3.1. Key Highlights

5.3.1.1. North America

5.3.1.2. Europe

5.3.1.3. Asia Pacific

5.3.1.4. Latin America

5.3.1.5. Middle East & Africa

6. North America Portable Tools Market Outlook, 2019-2031

6.1. North America Portable Tools Market Outlook, by End-Use, Value (US$ Bn) & Volume (Units), 2019-2031

6.1.1. Key Highlights

6.1.1.1. Industrial

6.1.1.1.1. Manufacturing Industry

6.1.1.1.2. Construction Industry

6.1.1.2. Commercial (Repair shops, etc.)

6.1.1.3. Household & DIY

6.2. North America Portable Tools Market Outlook, by Sales Channel, Value (US$ Bn) & Volume (Units), 2019-2031

6.2.1. Key Highlights

6.2.1.1. Distributor Sales

6.2.1.2. Retail Outlets

6.2.1.3. Online Sales

6.2.2. BPS Analysis/Market Attractiveness Analysis

6.3. North America Portable Tools Market Outlook, by Country, Value (US$ Bn) & Volume (Units), 2019-2031

6.3.1. Key Highlights

6.3.1.1. U.S. Portable Tools Market by End-Use, Value (US$ Bn) & Volume (Units), 2019-2031

6.3.1.2. U.S. Portable Tools Market by Sales Channel, Value (US$ Bn) & Volume (Units), 2019-2031

6.3.1.3. Canada Portable Tools Market by End-Use, Value (US$ Bn) & Volume (Units), 2019-2031

6.3.1.4. Canada Portable Tools Market by Sales Channel, Value (US$ Bn) & Volume (Units), 2019-2031

6.3.2. BPS Analysis/Market Attractiveness Analysis

7. Europe Portable Tools Market Outlook, 2019-2031

7.1. Europe Portable Tools Market Outlook, by End-Use, Value (US$ Bn) & Volume (Units), 2019-2031

7.1.1. Key Highlights

7.1.1.1. Industrial

7.1.1.1.1. Manufacturing Industry

7.1.1.1.2. Construction Industry

7.1.1.2. Commercial (Repair shops, etc.)

7.1.1.3. Household & DIY

7.2. Europe Portable Tools Market Outlook, by Sales Channel, Value (US$ Bn) & Volume (Units), 2019-2031

7.2.1. Key Highlights

7.2.1.1. Distributor Sales

7.2.1.2. Retail Outlets

7.2.1.3. Online Sales

7.2.2. BPS Analysis/Market Attractiveness Analysis

7.3. Europe Portable Tools Market Outlook, by Country, Value (US$ Bn) & Volume (Units), 2019-2031

7.3.1. Key Highlights

7.3.1.1. Germany Portable Tools Market by End-Use, Value (US$ Bn) & Volume (Units), 2019-2031

7.3.1.2. Germany Portable Tools Market by Sales Channel, Value (US$ Bn) & Volume (Units), 2019-2031

7.3.1.3. U.K. Portable Tools Market by End-Use, Value (US$ Bn) & Volume (Units), 2019-2031

7.3.1.4. U.K. Portable Tools Market by Sales Channel, Value (US$ Bn) & Volume (Units), 2019-2031

7.3.1.5. France Portable Tools Market by End-Use, Value (US$ Bn) & Volume (Units), 2019-2031

7.3.1.6. France Portable Tools Market by Sales Channel, Value (US$ Bn) & Volume (Units), 2019-2031

7.3.1.7. Italy Portable Tools Market by End-Use, Value (US$ Bn) & Volume (Units), 2019-2031

7.3.1.8. Italy Portable Tools Market by Sales Channel, Value (US$ Bn) & Volume (Units), 2019-2031

7.3.1.9. Turkey Portable Tools Market by End-Use, Value (US$ Bn) & Volume (Units), 2019-2031

7.3.1.10. Turkey Portable Tools Market by Sales Channel, Value (US$ Bn) & Volume (Units), 2019-2031

7.3.1.11. Russia Portable Tools Market by End-Use, Value (US$ Bn) & Volume (Units), 2019-2031

7.3.1.12. Russia Portable Tools Market by Sales Channel, Value (US$ Bn) & Volume (Units), 2019-2031

7.3.1.13. Rest of Europe Portable Tools Market by End-Use, Value (US$ Bn) & Volume (Units), 2019-2031

7.3.1.14. Rest of Europe Portable Tools Market by Sales Channel, Value (US$ Bn) & Volume (Units), 2019-2031

7.3.2. BPS Analysis/Market Attractiveness Analysis

8. Asia Pacific Portable Tools Market Outlook, 2019-2031

8.1. Asia Pacific Portable Tools Market Outlook, by End-Use, Value (US$ Bn) & Volume (Units), 2019-2031

8.1.1. Key Highlights

8.1.1.1. Industrial

8.1.1.1.1. Manufacturing Industry

8.1.1.1.2. Construction Industry

8.1.1.2. Commercial (Repair shops, etc.)

8.1.1.3. Household & DIY

8.2. Asia Pacific Portable Tools Market Outlook, by Sales Channel, Value (US$ Bn) & Volume (Units), 2019-2031

8.2.1. Key Highlights

8.2.1.1. Distributor Sales

8.2.1.2. Retail Outlets

8.2.1.3. Online Sales

8.2.2. BPS Analysis/Market Attractiveness Analysis

8.3. Asia Pacific Portable Tools Market Outlook, by Country, Value (US$ Bn) & Volume (Units), 2019-2031

8.3.1. Key Highlights

8.3.1.1. China Portable Tools Market by End-Use, Value (US$ Bn) & Volume (Units), 2019-2031

8.3.1.2. China Portable Tools Market by Sales Channel, Value (US$ Bn) & Volume (Units), 2019-2031

8.3.1.3. Japan Portable Tools Market by End-Use, Value (US$ Bn) & Volume (Units), 2019-2031

8.3.1.4. Japan Portable Tools Market by Sales Channel, Value (US$ Bn) & Volume (Units), 2019-2031

8.3.1.5. South Korea Portable Tools Market by End-Use, Value (US$ Bn) & Volume (Units), 2019-2031

8.3.1.6. South Korea Portable Tools Market by Sales Channel, Value (US$ Bn) & Volume (Units), 2019-2031

8.3.1.7. India Portable Tools Market by End-Use, Value (US$ Bn) & Volume (Units), 2019-2031

8.3.1.8. India Portable Tools Market by Sales Channel, Value (US$ Bn) & Volume (Units), 2019-2031

8.3.1.9. Southeast Asia Portable Tools Market by End-Use, Value (US$ Bn) & Volume (Units), 2019-2031

8.3.1.10. Southeast Asia Portable Tools Market by Sales Channel, Value (US$ Bn) & Volume (Units), 2019-2031

8.3.1.11. Rest of Asia Pacific Portable Tools Market by End-Use, Value (US$ Bn) & Volume (Units), 2019-2031

8.3.1.12. Rest of Asia Pacific Portable Tools Market by Sales Channel, Value (US$ Bn) & Volume (Units), 2019-2031

8.3.2. BPS Analysis/Market Attractiveness Analysis

9. Latin America Portable Tools Market Outlook, 2019-2031

9.1. Latin America Portable Tools Market Outlook, by End-Use, Value (US$ Bn) & Volume (Units), 2019-2031

9.1.1. Key Highlights

9.1.1.1. Industrial

9.1.1.1.1. Manufacturing Industry

9.1.1.1.2. Construction Industry

9.1.1.2. Commercial (Repair shops, etc.)

9.1.1.3. Household & DIY

9.2. Latin America Portable Tools Market Outlook, by Sales Channel, Value (US$ Bn) & Volume (Units), 2019-2031

9.2.1. Key Highlights

9.2.1.1. Distributor Sales

9.2.1.2. Retail Outlets

9.2.1.3. Online Sales

9.2.2. BPS Analysis/Market Attractiveness Analysis

9.3. Latin America Portable Tools Market Outlook, by Country, Value (US$ Bn) & Volume (Units), 2019-2031

9.3.1. Key Highlights

9.3.1.1. Brazil Portable Tools Market by End-Use, Value (US$ Bn) & Volume (Units), 2019-2031

9.3.1.2. Brazil Portable Tools Market by Sales Channel, Value (US$ Bn) & Volume (Units), 2019-2031

9.3.1.3. Mexico Portable Tools Market by End-Use, Value (US$ Bn) & Volume (Units), 2019-2031

9.3.1.4. Mexico Portable Tools Market by Sales Channel, Value (US$ Bn) & Volume (Units), 2019-2031

9.3.1.5. Argentina Portable Tools Market by End-Use, Value (US$ Bn) & Volume (Units), 2019-2031

9.3.1.6. Argentina Portable Tools Market by Sales Channel, Value (US$ Bn) & Volume (Units), 2019-2031

9.3.1.7. Rest of Latin America Portable Tools Market by End-Use, Value (US$ Bn) & Volume (Units), 2019-2031

9.3.1.8. Rest of Latin America Portable Tools Market by Sales Channel, Value (US$ Bn) & Volume (Units), 2019-2031

9.3.2. BPS Analysis/Market Attractiveness Analysis

10. Middle East & Africa Portable Tools Market Outlook, 2019-2031

10.1. Middle East & Africa Portable Tools Market Outlook, by End-Use, Value (US$ Bn) & Volume (Units), 2019-2031

10.1.1. Key Highlights

10.1.1.1. Industrial

10.1.1.1.1. Manufacturing Industry

10.1.1.1.2. Construction Industry

10.1.1.2. Commercial (Repair shops, etc.)

10.1.1.3. Household & DIY

10.2. Middle East & Africa Portable Tools Market Outlook, by Sales Channel, Value (US$ Bn) & Volume (Units), 2019-2031

10.2.1. Key Highlights

10.2.1.1. Distributor Sales

10.2.1.2. Retail Outlets

10.2.1.3. Online Sales

10.2.2. BPS Analysis/Market Attractiveness Analysis

10.3. Middle East & Africa Portable Tools Market Outlook, by Country, Value (US$ Bn) & Volume (Units), 2019-2031

10.3.1. Key Highlights

10.3.1.1. GCC Portable Tools Market by End-Use, Value (US$ Bn) & Volume (Units), 2019-2031

10.3.1.2. GCC Portable Tools Market by Sales Channel, Value (US$ Bn) & Volume (Units), 2019-2031

10.3.1.3. South Africa Portable Tools Market by End-Use, Value (US$ Bn) & Volume (Units), 2019-2031

10.3.1.4. South Africa Portable Tools Market by Sales Channel, Value (US$ Bn) & Volume (Units), 2019-2031

10.3.1.5. Egypt Portable Tools Market by End-Use, Value (US$ Bn) & Volume (Units), 2019-2031

10.3.1.6. Egypt Portable Tools Market by Sales Channel, Value (US$ Bn) & Volume (Units), 2019-2031

10.3.1.7. Nigeria Portable Tools Market by End-Use, Value (US$ Bn) & Volume (Units), 2019-2031

10.3.1.8. Nigeria Portable Tools Market by Sales Channel, Value (US$ Bn) & Volume (Units), 2019-2031

10.3.1.9. Rest of Middle East & Africa Portable Tools Market by End-Use, Value (US$ Bn) & Volume (Units), 2019-2031

10.3.1.10. Rest of Middle East & Africa Portable Tools Market by Sales Channel, Value (US$ Bn) & Volume (Units), 2019-2031

10.3.2. BPS Analysis/Market Attractiveness Analysis

11. Competitive Landscape

11.1. Industry vs Sales Channel Heatmap

11.2. Manufacturer vs Sales Channel Heatmap

11.3. Company Market Share Analysis, 2024

11.4. Competitive Dashboard

11.5. Company Profiles

11.5.1. Akar Tools Ltd.

11.5.1.1. Company Overview

11.5.1.2. Product Portfolio

11.5.1.3. Financial Overview

11.5.1.4. Business Strategies and Development

11.5.2. Apex Tools Group

11.5.2.1. Company Overview

11.5.2.2. Product Portfolio

11.5.2.3. Financial Overview

11.5.2.4. Business Strategies and Development

11.5.3. Atlas Copco AB

11.5.3.1. Company Overview

11.5.3.2. Product Portfolio

11.5.3.3. Financial Overview

11.5.3.4. Business Strategies and Development

11.5.4. Channellock, Inc.

11.5.4.1. Company Overview

11.5.4.2. Product Portfolio

11.5.4.3. Financial Overview

11.5.4.4. Business Strategies and Development

11.5.5. Danaher Corporation

11.5.5.1. Company Overview

11.5.5.2. Product Portfolio

11.5.5.3. Financial Overview

11.5.5.4. Business Strategies and Development

11.5.6. Emerson Electric Co. (RIDGID)

11.5.6.1. Company Overview

11.5.6.2. Product Portfolio

11.5.6.3. Financial Overview

11.5.6.4. Business Strategies and Development

11.5.7. Fiskars Group

11.5.7.1. Company Overview

11.5.7.2. Product Portfolio

11.5.7.3. Financial Overview

11.5.7.4. Business Strategies and Development

11.5.8. General Tools & Instruments LLC

11.5.8.1. Company Overview

11.5.8.2. Product Portfolio

11.5.8.3. Financial Overview

11.5.8.4. Business Strategies and Development

11.5.9. Makita Corporation

11.5.9.1. Company Overview

11.5.9.2. Product Portfolio

11.5.9.3. Financial Overview

11.5.9.4. Business Strategies and Development

11.5.10. JK Files (India) Limited

11.5.10.1. Company Overview

11.5.10.2. Product Portfolio

11.5.10.3. Financial Overview

11.5.10.4. Business Strategies and Development

11.5.11. Kennametal Inc.

11.5.11.1. Company Overview

11.5.11.2. Product Portfolio

11.5.11.3. Financial Overview

11.5.11.4. Business Strategies and Development

11.5.12. Klein Tools

11.5.12.1. Company Overview

11.5.12.2. Product Portfolio

11.5.12.3. Financial Overview

11.5.12.4. Business Strategies and Development

11.5.13. Robert Bosch GmbH

11.5.13.1. Company Overview

11.5.13.2. Product Portfolio

11.5.13.3. Financial Overview

11.5.13.4. Business Strategies and Development

11.5.14. Q.E.P. Co., Inc.

11.5.14.1. Company Overview

11.5.14.2. Product Portfolio

11.5.14.3. Financial Overview

11.5.14.4. Business Strategies and Development

11.5.15. Snap-On Inc.

11.5.15.1. Company Overview

11.5.15.2. Product Portfolio

11.5.15.3. Financial Overview

11.5.15.4. Business Strategies and Development

12. Appendix

12.1. Research Methodology

12.2. Report Assumptions

12.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2023 |

|

2019 - 2023 |

2024 - 2031 |

Value: US$ Billion |

||

|

REPORT FEATURES |

DETAILS |

|

End Use Coverage |

|

|

Category Coverage |

|

|

Sales Channel Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |