Global Power Electronics Market Forecast

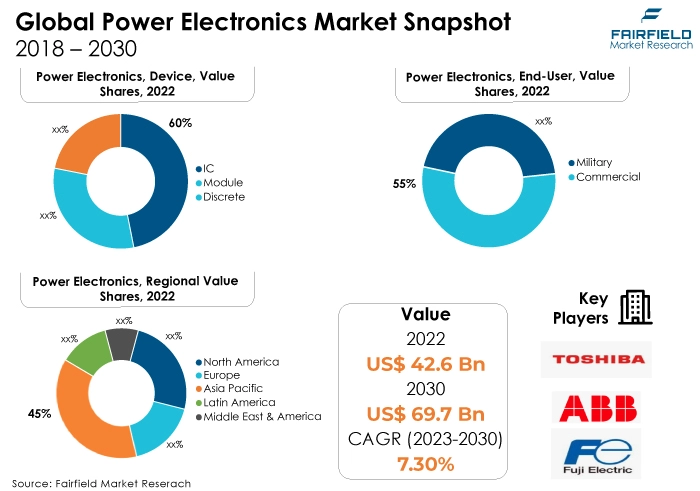

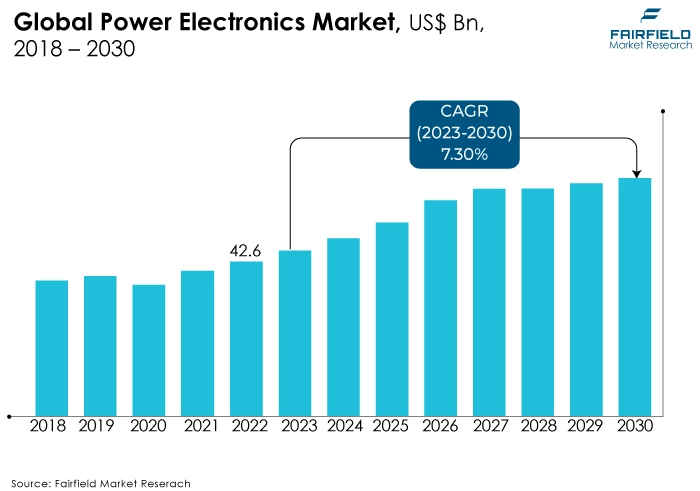

- Power electronics market size to be worth US$69.7 Bn in 2030, up from US$42.6 Bn in 2022

- Power electronics market revenue poised for expansion at a CAGR of 7.3% over 2023 - 2030

Quick Report Digest

- The key trend anticipated to fuel the power electronics market growth is the demand for sustainable practices and recycling solutions to fuel the optical sorter market.

- Another major market trend expected to fuel the power electronics market growth is the Integration of advanced technologies like AI and IoT, which presents lucrative business opportunities.

- In 2022, silicon carbide will dominate the market due to its superior thermal and electrical properties.

- In terms of market share for power electronics globally, the C. devices lead, driven by their extensive applications in consumer electronics and automotive sectors.

- In 2022, ICT applications, including smartphones and computers, are the major market dominators due to technological advancements.

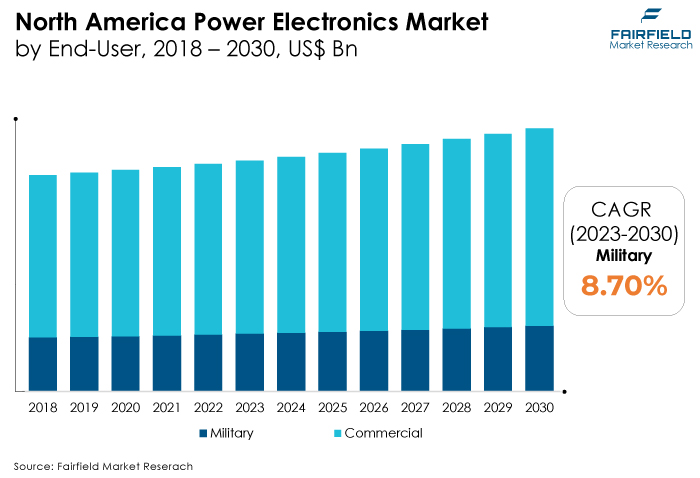

- The dominant category among end users is the commercial sector. This dominance is due to the widespread Integration of power electronic devices in various commercial applications such as industrial machinery, consumer electronics, automotive systems, and renewable energy systems.

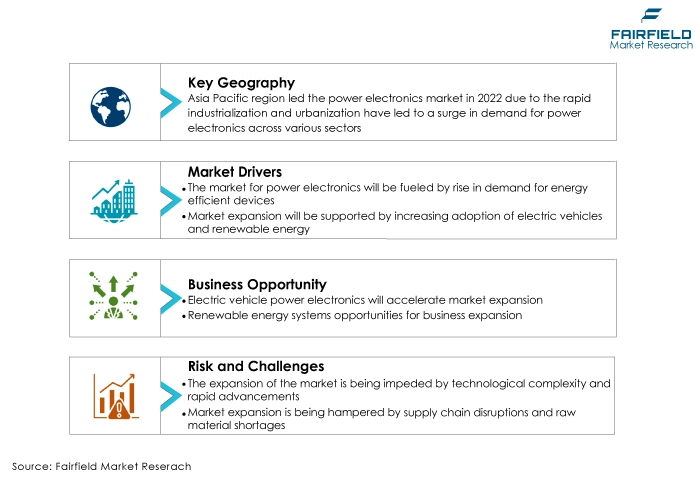

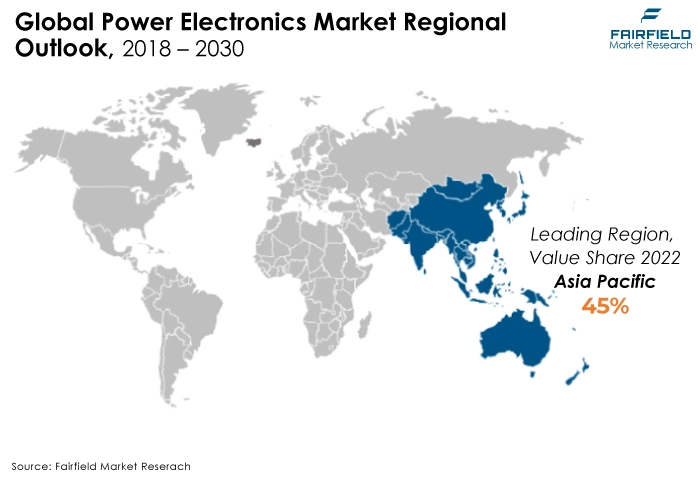

- Asia Pacific dominates the market, propelled by industrialisation and a strong focus on sustainable technologies.

- The market for power electronics is expanding in North America, witnessing rapid growth due to technological innovation and stringent environmental regulations, driving demand for optical sorting solutions.

A Look Back and a Look Forward - Comparative Analysis

In the current power electronics market, there's a robust demand driven by the increasing need for energy-efficient devices across various sectors. Commercial industries are adopting power electronic solutions for diverse applications, ensuring optimised energy consumption, and reduced operational costs.

Simultaneously, the military sector relies on power electronics for mission-critical systems, enhancing the efficiency and performance of electronic warfare systems and communication equipment. Technological advancements, including wide-bandgap semiconductors and smart power modules, are shaping the market, enabling higher efficiency and power density in electronic devices.

The market witnessed staggered growth during the historical period 2018 - 2022. This is due to the substantial growth of the major end-use application sectors such as snacks, confectionary items, cereals, chocolates, and others. However, in some applications, the demand for Power Electronics has increased, including frozen food, pet food, and packaged dairy products.

The power electronics market is poised for continued expansion. The future holds promising prospects due to the escalating demand for electric vehicles, the Integration of renewable energy sources, and the ongoing modernisation efforts in military technologies. The market will witness innovations focusing on compact designs, higher power density, and enhanced efficiency. With a growing emphasis on sustainable energy solutions and the development of smart cities, power electronics will play a pivotal role.

Furthermore, advancements in semiconductor materials and the evolution of IoT-driven applications will shape the market's trajectory, creating a dynamic landscape characterised by cutting-edge technologies and increased market penetration.

Key Growth Determinants

- Rapid Adoption of EVs

Rapid adoption of electric vehicles (EVs) stands as a significant market driver in the power electronics industry. With the global push toward sustainable transportation, EVs have gained immense popularity. Power electronics play a critical role in EVs, managing energy flow, controlling motors, and ensuring efficient charging.

The increasing focus on reducing carbon emissions and the development of supportive government policies incentivise consumers to switch to electric vehicles. Consequently, the demand for power electronic devices, such as inverters and converters, has surged. As automotive manufacturers invest heavily in EV technology, the power electronics market continues to grow, driven by the EV revolution.

- Growth in Renewable Energy Integration

The integration of renewable energy sources into the power grid is a key driver propelling the power electronics market forward. As the world transitions toward clean energy solutions, solar, wind, and other renewable sources are being harnessed on a larger scale. Power electronics facilitate the conversion and management of energy from these sources, ensuring it is compatible with the grid.

Advanced power electronic devices, like grid-tied inverters, enable seamless Integration, enhance grid stability, and support efficient power distribution. Governments worldwide are promoting renewable energy initiatives, leading to increased installations of solar panels and wind turbines.

- Industrial Automation and IoT Revolution

The ongoing industrial automation and the Internet of Things (IoT) revolution are significant market drivers for power electronics. In the era of Industry 4.0, smart factories and IoT-connected devices are becoming commonplace. Power electronic devices, such as motor drives, frequency converters, and voltage regulators, are essential components of automated systems. They enable precise control, energy efficiency, and real-time monitoring of industrial processes. As industries embrace automation to enhance productivity and reduce operational costs, the demand for advanced power electronics escalates.

Major Growth Barriers

- Supply Chain Disruptions, and Component Shortages

Supply chain disruptions, exacerbated by global events and geopolitical tensions, pose a significant restraint in the power electronics market. Shortages of critical components, such as semiconductors and rare-earth metals, impact manufacturing capacities and lead times. These challenges hinder the seamless production and timely delivery of power electronic devices, affecting market growth.

Moreover, the increased reliance on international suppliers and complex supply chains further amplifies the vulnerability of the power electronics market to disruptions. As companies struggle to secure necessary materials and navigate trade restrictions, they face increased costs and uncertainties, making it difficult to meet customer demands efficiently.

- Complexity and Cost of Technology Integration

The complexity and cost associated with integrating advanced power electronics technology act as a restraint. Implementing cutting-edge solutions like wide-bandgap semiconductors and complex control algorithms requires substantial R&D investments. Moreover, adapting existing infrastructures to accommodate these technologies often involves high retrofitting costs.

Industries, particularly small and medium enterprises, might find these investments prohibitive, limiting their adoption of advanced power electronic solutions. This complexity and cost barrier hinders the widespread adoption of innovative technologies, restraining market expansion.

Key Trends and Opportunities to Look at

- Transition to Wide-Bandgap Semiconductors

The power electronics market sees a notable trend in transitioning from traditional silicon-based semiconductors to wide-bandgap materials like SiC and GaN. This shift offers higher efficiency and power density, reducing energy losses. Globally, companies like Infineon and Cree are investing in R&D, making these materials more accessible. Brands leverage this trend for compact, energy-efficient devices, especially in electric vehicles and renewable energy systems.

- Embracing Digitalisation and IoT Integration

Digitalisation and IoT Integration in power electronics enable real-time monitoring, predictive maintenance, and enhanced control. This trend gains popularity globally as industries seek optimised operations. Companies like ABB and Schneider Electric develop smart power solutions. Brands leverage this by offering IoT-enabled devices, facilitating remote monitoring and control, and appealing to industries pursuing automation and efficiency.

- Sustainable and Eco-Friendly Solutions

A growing emphasis on sustainability drives the demand for eco-friendly power electronic solutions. Industries worldwide, spurred by environmental regulations, opt for green technologies. Companies such as Toshiba, and Mitsubishi Electric focus on eco-friendly power modules. Brands leverage this trend by offering energy-efficient devices, appealing to environmentally conscious consumers and industries, and fostering growth in regions prioritising green technologies.

How Does the Regulatory Scenario Shape this Industry?

The power electronics market is significantly influenced by the regulatory framework, encompassing various standards, acts, and guidelines set by regulatory entities worldwide. In the United States, the Department of Energy (DOE) enforces energy efficiency standards for electronic devices under the Energy Policy and Conservation Act (EPCA).

In the European Union, the Restriction of Hazardous Substances Directive (RoHS) restricts the use of hazardous materials in electronic products, ensuring environmental safety. Moreover, region-specific initiatives like the European Green Deal drive the adoption of eco-friendly power electronics.

In Asia, countries like Japan adhere to the Electrical Appliance and Material Safety Law (DENAN), ensuring the safety of electronic devices. China, through its Energy Conservation Law and the Made in China 2025 policy, promotes energy-efficient technologies, influencing the power electronics market positively. These regulations impact product design, efficiency standards, and materials used, fostering innovation in power electronics.

Fairfield’s Ranking Board

Top Segments

- Silicon Carbide Category Continues to Dominate over Gallium Nitride Segment

Silicon Carbide (SiC) stands out as the dominant material category in 2022, comprising approximately 55%. SiC power devices offer superior performance, including higher efficiency, faster switching speeds, and greater temperature tolerance compared to traditional silicon-based devices. These advantages make SiC ideal for high-power applications like electric vehicles, industrial equipment, and renewable energy systems.

Furthermore, Gallium Nitride (GaN) emerges as the fastest-growing market category. GaN devices exhibit remarkable efficiency at high frequencies, making them invaluable in applications like radio frequency (R.F.) amplifiers, 5G communication systems, and consumer electronics. The GaN market is experiencing rapid growth, with a compounded annual growth rate (CAGR) of around 30%.

- IC will Surge Ahead Throughout the Forecast Period

In 2022, Integrated Circuits (IC) emerged as the dominant category. Integrated Circuits, also known as chips, are widely used due to their compact design, versatility, and integration capabilities. They find applications in various sectors, including consumer electronics, automotive, and industrial automation. I.C.s hold a significant market share, constituting approximately 60% of the power electronics market.

Modules represent the fastest-growing market category. Power modules provide a combination of multiple discrete components within a single package, offering convenience and efficiency in power applications. They are gaining prominence due to their ease of Integration, reliability, and enhanced performance. The annual growth rate is remarkable, and driven by the increasing demand for simplified power solutions in emerging technologies like electric vehicles, renewable energy systems, and smart grids.

- Automotive Industry Leads

The automotive sector will emerge as the dominant application category IN 2022. The Automotive industry heavily relies on power electronics for electric and hybrid vehicles, driving systems, battery management, and various vehicle control systems. The Automotive sector holds a substantial market share, accounting for approximately 35% of the power electronics market.

The ICT sector represents the fastest-growing market category. With the rise of 5G technology, data centers, and high-performance computing, the ICT sector demands efficient power electronic solutions for servers, telecommunications equipment, and network infrastructure. The ICT sector is experiencing rapid growth, with a notable CAGR.

- Low Voltage (Below 1kV) Categories Expected to Spearhead

In 2022, Low Voltage (Below 1kV) systems emerged as the dominant category. Low-voltage power electronics find widespread use in consumer electronics, industrial automation, and residential applications. Due to their versatility, ease of Integration, and safety features, low-voltage systems hold a significant market share, accounting for approximately 60% of the power electronics market.

Moreover, the Medium Voltage (1.1 kV to 2.0 kV) category represents the fastest-growing segment. Medium voltage power electronics are increasingly utilised in renewable energy systems, electric vehicles, and industrial machinery.

- Commercial Sectors Generates the Maximum Demand

In 2022, the commercial sector stands out as the dominant category. Commercial industries extensively utilise power electronics in various applications, including industrial machinery, consumer electronics, automotive systems, and renewable energy solutions. The commercial sector commands a substantial market share, constituting approximately 65% of the power electronics market.

The military sector represents the fastest-growing market category. Military applications increasingly rely on power electronics for advanced radar systems, communication devices, electronic warfare equipment, and military vehicles. The military sector is experiencing rapid growth, shows research.

Regional Frontrunners

Global Market Revenue Concentrated in Asia Pacific

Asia Pacific dominates the global power electronics market, contributing to around 45% of the total revenue, primarily due to its robust manufacturing infrastructure, rapid industrialisation, and booming consumer electronics sector. Countries like China, Japan, and South Korea serve as key manufacturing hubs, ensuring a consistent supply of power electronic devices.

Additionally, the region's growing industrialisation drives the demand for efficient power management solutions, further fueling the market. Power electronic components are essential to consumer electronics, which are in high demand due to urbanisation and rising levels of disposable income in nations like China, and India. Moreover, supportive government initiatives, especially in renewable energy and electric vehicles sectors, bolster the adoption of power electronics.

Mounting R&D Investments Account for North America’s Growing Market Attractiveness

North America is poised for significant growth in the power electronics market, anticipated to contribute to about 30% of the market revenue during the forecast period. This growth is due to the region's strong focus on technological advancements, particularly in EVs, renewable energy, and smart grid systems. Increasing investments in research and development, coupled with supportive government policies, drive the adoption of power electronic solutions.

Additionally, the growing demand for energy-efficient devices in various sectors, such as automotive, aerospace, and industrial manufacturing, fuels the market. The region's proactive approach towards adopting green technologies, coupled with a robust consumer electronics market, positions North America as a key player in the global power electronics landscape, set for substantial sales growth in the coming years.

Fairfield’s Competitive Landscape Analysis

In the competitive landscape, adherence to regulations provides a competitive edge. Companies investing in research to meet regulatory requirements gain a favourable market position. For example, companies complying with China's energy efficiency standards have a significant advantage in the Chinese market. Additionally, adherence to international standards, such as ISO certifications, enhances a company's reputation and market reach.

Who are the Leaders in the Global Power Electronics Space?

- ABB Ltd.

- Fuji Electric Co. Ltd.

- Infineon Technologies AG

- NXP Semiconductors N.V.

- Microsemi Corporation

- Mitsubishi Electric Corporation

- Renesas Electronics Corporation

- Rockwell Automation Inc.

- STMicroelectronics N.V.

- Texas Instruments Incorporated

- Toshiba Corporation

- ON semiconductors Corporation

- TOMRA Sorting AS

- Eagle Vizion Inc.

- Bühler Holding AG

Significant Company Developments

New Product Launch

- May 2022: Cimbria has introduced a cutting-edge range of optical sorting machines known as the SEA. I.Q. series. These machines leverage multi-spectral vision systems to enable users to accurately identify the precise sequence of items during the production process. The SEA. I.Q. series is suitable for sorting various sizes of food and beverage items. This sorter is specifically designed for sorting seeds, cereals, coffee, nuts, recycling, and industrial products, thereby ensuring the delivery of high-quality goods.

- In June 2020, a worldwide manufacturer of sorting equipment introduced its newest cutting-edge sorting model for recycling facilities to address the need for improved efficiency, speed, and intelligence in material sorting. TOMRA has unveiled two innovative products, AUTOSORT and AUTOSORT SPEEDAIR, and is also preparing to release a third recycling solution known as AUTOSORT CYBOT.

- May 2022: Cimbria recently introduced a cutting-edge range of optical sorting machines called SEA.I.Q. These machines are equipped with multi-spectral vision systems, enabling users to accurately identify the correct sequence of items during the production process. Designed to accommodate various sorting needs in the food and beverage industry, this series is suitable for sorting seeds, cereals, coffee, nuts, recycling materials, and industrial products, ensuring the delivery of high-quality goods.

Distribution Agreement

- June 2022: TOMRA unveiled a high-end fruit and vegetable sorting machine with BSI technology.

- May 2022: To use Tomra's sorter technology in its

- potato sorting plant, Snow Valley Food, a frozen food company in Asia, worked together with Tomra.

An Expert’s Eye

Demand and Future Growth

An increase in consumer demand for food & beverages is driving the market. The rising demand for beverages may result in a growth in secondary packaging, where case packaging is favoured in large quantities, increasing the need for case packing machines. Furthermore, technological developments have greatly aided the growth and development of various power electronics in factory automation. However, the case packing machines market is expected to face considerable challenges because of high initial expenses.

Supply Side of the Market

According to our analysis, regulations impact manufacturing practices. The Restriction of Hazardous Substances (RoHS) directive limits hazardous materials, prompting suppliers to develop compliant components. For instance, the RoHS directive in Europe influences the supply chain, steering manufacturers towards eco-friendly materials. In the US, the Department of Energy (DOE) sets efficiency standards, guiding manufacturers in producing energy-saving power electronics.

Compliance ensures market access, shaping the supply side to align with global standards and fostering sustainable production practices. These regulations also encourage innovation in the industry as suppliers are pushed to find alternative materials and manufacturing processes that are both compliant and environmentally friendly. Additionally, compliance with these directives helps to protect the health and safety of consumers by reducing their exposure to hazardous substances in electronic products.

Global Power Electronics Market is Segmented as Below:

By Material:

- Silicon Carbide

- Silicon/Germanium

- Gallium Nitride

- Sapphire

- Others

By Device:

- Discrete

- Module

- I.C.

By Application:

- ICT

- Consumer Electronics

- Power

- Industrial

- Automotive

- Aerospace & Defence

- Others

By Voltage:

- Low Voltage (Below 1kV)

- Medium Voltage (1.1 kV to 2.0 kV)

- High Voltage (Above 2.0 kV)

By End-use Sector:

- Commercial

- Military

By Geographic Coverage:

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Turkey

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Egypt

- Nigeria

- Rest of the Middle East & Africa

1. Executive Summary

1.1. Global Power Electronics Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2022

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. COVID-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Global Power Electronics Market Outlook, 2018 – 2030

3.1. Global Power Electronics Market Outlook, by Material, Value (US$ Bn), 2018 – 2030

3.1.1. Key Highlights

3.1.1.1. Silicon Carbide

3.1.1.2. Silicon/Germanium

3.1.1.3. Gallium Nitride

3.1.1.4. Sapphire

3.1.1.5. Others

3.2. Global Power Electronics Market Outlook, by Device, Value (US$ Bn), 2018 – 2030

3.2.1. Key Highlights

3.2.1.1. Discrete

3.2.1.2. Module

3.2.1.3. IC

3.3. Global Power Electronics Market Outlook, by Application, Value (US$ Bn), 2018 – 2030

3.3.1. Key Highlights

3.3.1.1. ICT

3.3.1.2. Consumer Electronics

3.3.1.3. Power

3.3.1.4. Industrial

3.3.1.5. Automotive

3.3.1.6. Aerospace & Defense

3.3.1.7. Others

3.4. Global Power Electronics Market Outlook, by Voltage, Value (US$ Bn), 2018 – 2030

3.4.1. Key Highlights

3.4.1.1. Low Voltage (Below 1kV)

3.4.1.2. Medium Voltage (1.1 kV to 2.0 kV)

3.4.1.3. High Voltage (Above 2.0 kV)

3.5. Global Power Electronics Market Outlook, by End-Use, Value (US$ Bn), 2018 – 2030

3.5.1. Key Highlights

3.5.1.1. Commercial

3.5.1.2. Military

3.6. Global Power Electronics Market Outlook, by Region, Value (US$ Bn), 2018 – 2030

3.6.1. Key Highlights

3.6.1.1. North America

3.6.1.2. Europe

3.6.1.3. Asia Pacific

3.6.1.4. Latin America

3.6.1.5. Middle East & Africa

4. North America Power Electronics Market Outlook, 2018 – 2030

4.1. North America Power Electronics Market Outlook, by Material, Value (US$ Bn), 2018 – 2030

4.1.1. Key Highlights

4.1.1.1. Silicon Carbide

4.1.1.2. Silicon/Germanium

4.1.1.3. Gallium Nitride

4.2. North America Power Electronics Market Outlook, by Device, Value (US$ Bn), 2018 – 2030

4.2.1. Key Highlights

4.2.1.1. Discrete

4.2.1.2. Module

4.3. Global Power Electronics Market Outlook, by Application, Value (US$ Bn), 2018 – 2030

4.3.1. Key Highlights

4.3.1.1. ICT

4.3.1.2. Consumer Electronics

4.3.1.3. Power

4.3.1.4. Industrial

4.3.1.5. Automotive

4.3.1.6. Aerospace & Defense

4.3.1.7. Others

4.4. Global Power Electronics Market Outlook, by Voltage, Value (US$ Bn), 2018 – 2030

4.4.1. Key Highlights

4.4.1.1. Low Voltage (Below 1kV)

4.4.1.2. Medium Voltage (1.1 kV to 2.0 kV)

4.4.1.3. High Voltage (Above 2.0 kV)

4.5. Global Power Electronics Market Outlook, by End-Use, Value (US$ Bn), 2018 – 2030

4.5.1. Key Highlights

4.5.1.1. Commercial

4.5.1.2. Military

4.5.2. BPS Analysis/Market Attractiveness Analysis

4.6. North America Power Electronics Market Outlook, by Country, Value (US$ Bn), 2018 – 2030

4.6.1. Key Highlights

4.6.1.1. U.S. Power Electronics Market by Material, Value (US$ Bn), 2018 – 2030

4.6.1.2. U.S. Power Electronics Market Device, Value (US$ Bn), 2018 – 2030

4.6.1.3. U.S. Power Electronics Market Application, Value (US$ Bn), 2018 – 2030

4.6.1.4. U.S. Power Electronics Market, by End-use Sector, Value (US$ Bn), 2018 – 2030

4.6.1.5. Canada Power Electronics Market by Material, Value (US$ Bn), 2018 – 2030

4.6.1.6. Canada Power Electronics Market Device, Value (US$ Bn), 2018 – 2030

4.6.1.7. Canada Power Electronics Market Application, Value (US$ Bn), 2018 – 2030

4.6.1.8. Canada Power Electronics Market, by Voltage, Value (US$ Bn), 2018 – 2030

4.6.1.9. Canada Power Electronics Market, by End-Use, Value (US$ Bn), 2018 – 2030

4.6.2. BPS Analysis/Market Attractiveness Analysis

5. Europe Power Electronics Market Outlook, 2018 – 2030

5.1. Europe Power Electronics Market Outlook, by Material, Value (US$ Bn), 2018 – 2030

5.1.1. Key Highlights

5.1.1.1. Silicon Carbide

5.1.1.2. Silicon/Germanium

5.1.1.3. Gallium Nitride

5.2. Europe Power Electronics Market Outlook, by Device, Value (US$ Bn), 2018 – 2030

5.2.1. Key Highlights

5.2.1.1. Discrete

5.2.1.2. Module

5.3. Europe Power Electronics Market Outlook, by Application, Value (US$ Bn), 2018 – 2030

5.3.1. Key Highlights

5.3.1.1. ICT

5.3.1.2. Consumer Electronics

5.3.1.3. Power

5.3.1.4. Industrial

5.3.1.5. Automotive

5.3.1.6. Aerospace & Defense

5.3.1.7. Others

5.4. Europe Power Electronics Market Outlook, by Voltage, Value (US$ Bn), 2018 – 2030

5.4.1. Key Highlights

5.4.1.1. Low Voltage (Below 1kV)

5.4.1.2. Medium Voltage (1.1 kV to 2.0 kV)

5.4.1.3. High Voltage (Above 2.0 kV)

5.5. Europe Power Electronics Market Outlook, by End-Use, Value (US$ Bn), 2018 – 2030

5.5.1. Key Highlights

5.5.1.1. Commercial

5.5.1.2. Military

5.5.2. BPS Analysis/Market Attractiveness Analysis

5.6. Europe Power Electronics Market Outlook, by Country, Value (US$ Bn), 2018 – 2030

5.6.1. Key Highlights

5.6.1.1. Germany Power Electronics Market by Material, Value (US$ Bn), 2018 – 2030

5.6.1.2. Germany Power Electronics Market Device, Value (US$ Bn), 2018 – 2030

5.6.1.3. Germany Power Electronics Market Application, Value (US$ Bn), 2018 – 2030

5.6.1.4. Germany Power Electronics Market, by Voltage, Value (US$ Bn), 2018 – 2030

5.6.1.5. Germany Power Electronics Market, by End-use Sector, Value (US$ Bn), 2018 – 2030

5.6.1.6. U.K. Power Electronics Market by Material, Value (US$ Bn), 2018 – 2030

5.6.1.7. U.K. Power Electronics Market Device, Value (US$ Bn), 2018 – 2030

5.6.1.8. U.K. Power Electronics Market Application, Value (US$ Bn), 2018 – 2030

5.6.1.9. U.K. Power Electronics Market, by Voltage, Value (US$ Bn), 2018 – 2030

5.6.1.10. U.K. Power Electronics Market, by End-use Sector, Value (US$ Bn), 2018 – 2030

5.6.1.11. France Power Electronics Market by Material, Value (US$ Bn), 2018 – 2030

5.6.1.12. France Power Electronics Market Device, Value (US$ Bn), 2018 – 2030

5.6.1.13. France Power Electronics Market Application, Value (US$ Bn), 2018 – 2030

5.6.1.14. France Power Electronics Market, by Voltage, Value (US$ Bn), 2018 – 2030

5.6.1.15. France Power Electronics Market, by End-use Sector, Value (US$ Bn), 2018 – 2030

5.6.1.16. Italy Power Electronics Market by Material, Value (US$ Bn), 2018 – 2030

5.6.1.17. Italy Power Electronics Market Device, Value (US$ Bn), 2018 – 2030

5.6.1.18. Italy Power Electronics Market Application, Value (US$ Bn), 2018 – 2030

5.6.1.19. Italy Power Electronics Market, by Voltage, Value (US$ Bn), 2018 – 2030

5.6.1.20. Italy Power Electronics Market, by End-use Sector, Value (US$ Bn), 2018 – 2030

5.6.1.21. Turkey Power Electronics Market by Material, Value (US$ Bn), 2018 – 2030

5.6.1.22. Turkey Power Electronics Market Device, Value (US$ Bn), 2018 – 2030

5.6.1.23. Turkey Power Electronics Market Application, Value (US$ Bn), 2018 – 2030

5.6.1.24. Turkey Power Electronics Market, by Voltage, Value (US$ Bn), 2018 – 2030

5.6.1.25. Turkey Power Electronics Market, by End-use Sector, Value (US$ Bn), 2018 – 2030

5.6.1.26. Russia Power Electronics Market by Material, Value (US$ Bn), 2018 – 2030

5.6.1.27. Russia Power Electronics Market Device, Value (US$ Bn), 2018 – 2030

5.6.1.28. Russia Power Electronics Market Application, Value (US$ Bn), 2018 – 2030

5.6.1.29. Russia Power Electronics Market, by Voltage, Value (US$ Bn), 2018 – 2030

5.6.1.30. Russia Power Electronics Market, by End-use Sector, Value (US$ Bn), 2018 – 2030

5.6.1.31. Rest of Europe Power Electronics Market by Material, Value (US$ Bn), 2018 – 2030

5.6.1.32. Rest of Europe Power Electronics Market Device, Value (US$ Bn), 2018 – 2030

5.6.1.33. Rest of Europe Power Electronics Market Application, Value (US$ Bn), 2018 – 2030

5.6.1.34. Rest of Europe Power Electronics Market, by Voltage, Value (US$ Bn), 2018 – 2030

5.6.1.35. Rest of Europe Power Electronics Market, by End-use Sector, Value (US$ Bn), 2018 – 2030

5.6.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Power Electronics Market Outlook, 2018 – 2030

6.1. Asia Pacific Power Electronics Market Outlook, by Material, Value (US$ Bn), 2018 – 2030

6.1.1. Key Highlights

6.1.1.1. Silicon Carbide

6.1.1.2. Silicon/Germanium

6.1.1.3. Gallium Nitride

6.2. Asia Pacific Power Electronics Market Outlook, by Device, Value (US$ Bn), 2018 – 2030

6.2.1. Key Highlights

6.2.1.1. Discrete

6.2.1.2. Module

6.3. Asia Pacific Power Electronics Market Outlook, by Application, Value (US$ Bn), 2018 – 2030

6.3.1. Key Highlights

6.3.1.1. ICT

6.3.1.2. Consumer Electronics

6.3.1.3. Power

6.3.1.4. Industrial

6.3.1.5. Automotive

6.3.1.6. Aerospace & Defense

6.3.1.7. Others

6.4. Asia Pacific Power Electronics Market Outlook, by Voltage, Value (US$ Bn), 2018 – 2030

6.4.1. Key Highlights

6.4.1.1. Low Voltage (Below 1kV)

6.4.1.2. Medium Voltage (1.1 kV to 2.0 kV)

6.4.1.3. High Voltage (Above 2.0 kV)

6.5. Asia Pacific Power Electronics Market Outlook, by End-Use, Value (US$ Bn), 2018 – 2030

6.5.1. Key Highlights

6.5.1.1. Commercial

6.5.1.2. Military

6.5.2. BPS Analysis/Market Attractiveness Analysis

6.6. Asia Pacific Power Electronics Market Outlook, by Country, Value (US$ Bn), 2018 – 2030

6.6.1. Key Highlights

6.6.1.1. China Power Electronics Market by Material, Value (US$ Bn), 2018 – 2030

6.6.1.2. China Power Electronics Market Device, Value (US$ Bn), 2018 – 2030

6.6.1.3. China Power Electronics Market Application, Value (US$ Bn), 2018 – 2030

6.6.1.4. China Power Electronics Market, by Voltage, Value (US$ Bn), 2018 – 2030

6.6.1.5. China Power Electronics Market, by End-use Sector, Value (US$ Bn), 2018 – 2030

6.6.1.6. Japan Power Electronics Market by Material, Value (US$ Bn), 2018 – 2030

6.6.1.7. Japan Power Electronics Market Device, Value (US$ Bn), 2018 – 2030

6.6.1.8. Japan Power Electronics Market Application, Value (US$ Bn), 2018 – 2030

6.6.1.9. Japan Power Electronics Market, by Voltage, Value (US$ Bn), 2018 – 2030

6.6.1.10. Japan Power Electronics Market, by End-use Sector, Value (US$ Bn), 2018 – 2030

6.6.1.11. South Korea Power Electronics Market by Material, Value (US$ Bn), 2018 – 2030

6.6.1.12. South Korea Power Electronics Market Device, Value (US$ Bn), 2018 – 2030

6.6.1.13. South Korea Power Electronics Market Application, Value (US$ Bn), 2018 – 2030

6.6.1.14. South Korea Power Electronics Market, by Voltage, Value (US$ Bn), 2018 – 2030

6.6.1.15. South Korea Power Electronics Market, by End-use Sector, Value (US$ Bn), 2018 – 2030

6.6.1.16. India Power Electronics Market by Material, Value (US$ Bn), 2018 – 2030

6.6.1.17. India Power Electronics Market Device, Value (US$ Bn), 2018 – 2030

6.6.1.18. India Power Electronics Market Application, Value (US$ Bn), 2018 – 2030

6.6.1.19. India Power Electronics Market, by Voltage, Value (US$ Bn), 2018 – 2030

6.6.1.20. India Power Electronics Market, by End-use Sector, Value (US$ Bn), 2018 – 2030

6.6.1.21. Southeast Asia Power Electronics Market by Material, Value (US$ Bn), 2018 – 2030

6.6.1.22. Southeast Asia Power Electronics Market Device, Value (US$ Bn), 2018 – 2030

6.6.1.23. Southeast Asia Power Electronics Market Application, Value (US$ Bn), 2018 – 2030

6.6.1.24. Southeast Asia Power Electronics Market, by Voltage, Value (US$ Bn), 2018 – 2030

6.6.1.25. Southeast Asia Power Electronics Market, by End-use Sector, Value (US$ Bn), 2018 – 2030

6.6.1.26. Rest of Asia Pacific Power Electronics Market by Material, Value (US$ Bn), 2018 – 2030

6.6.1.27. Rest of Asia Pacific Power Electronics Market Device, Value (US$ Bn), 2018 – 2030

6.6.1.28. Rest of Asia Pacific Power Electronics Market Application, Value (US$ Bn), 2018 – 2030

6.6.1.29. Rest of Asia Pacific Power Electronics Market, by Voltage, Value (US$ Bn), 2018 – 2030

6.6.1.30. Rest of Asia Pacific Power Electronics Market, by End-use Sector, Value (US$ Bn), 2018 – 2030

6.6.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America Power Electronics Market Outlook, 2018 – 2030

7.1. Latin America Power Electronics Market Outlook, by Material, Value (US$ Bn), 2018 – 2030

7.1.1. Key Highlights

7.1.1.1. Silicon Carbide

7.1.1.2. Silicon/Germanium

7.1.1.3. Gallium Nitride

7.2. Latin America Power Electronics Market Outlook, by Device, Value (US$ Bn), 2018 – 2030

7.2.1. Key Highlights

7.2.1.1. Discrete

7.2.1.2. Module

7.3. Latin America Power Electronics Market Outlook, by Application, Value (US$ Bn), 2018 – 2030

7.3.1. Key Highlights

7.3.1.1. ICT

7.3.1.2. Consumer Electronics

7.3.1.3. Power

7.3.1.4. Industrial

7.3.1.5. Automotive

7.3.1.6. Aerospace & Defense

7.3.1.7. Others

7.4. Latin America Power Electronics Market Outlook, by Voltage, Value (US$ Bn), 2018 – 2030

7.4.1. Key Highlights

7.4.1.1. Low Voltage (Below 1kV)

7.4.1.2. Medium Voltage (1.1 kV to 2.0 kV)

7.4.1.3. High Voltage (Above 2.0 kV)

7.5. Latin America Power Electronics Market Outlook, by End-Use, Value (US$ Bn), 2018 – 2030

7.5.1. Key Highlights

7.5.1.1. Commercial

7.5.1.2. Military

7.5.2. BPS Analysis/Market Attractiveness Analysis

7.6. Latin America Power Electronics Market Outlook, by Country, Value (US$ Bn), 2018 – 2030

7.6.1. Key Highlights

7.6.1.1. Brazil Power Electronics Market by Material, Value (US$ Bn), 2018 – 2030

7.6.1.2. Brazil Power Electronics Market Device, Value (US$ Bn), 2018 – 2030

7.6.1.3. Brazil Power Electronics Market Application, Value (US$ Bn), 2018 – 2030

7.6.1.4. Brazil Power Electronics Market, by Voltage, Value (US$ Bn), 2018 – 2030

7.6.1.5. Brazil Power Electronics Market, by End-use Sector, Value (US$ Bn), 2018 – 2030

7.6.1.6. Mexico Power Electronics Market by Material, Value (US$ Bn), 2018 – 2030

7.6.1.7. Mexico Power Electronics Market Device, Value (US$ Bn), 2018 – 2030

7.6.1.8. Mexico Power Electronics Market Application, Value (US$ Bn), 2018 – 2030

7.6.1.9. Mexico Power Electronics Market, by Voltage, Value (US$ Bn), 2018 – 2030

7.6.1.10. Mexico Power Electronics Market, by End-use Sector, Value (US$ Bn), 2018 – 2030

7.6.1.11. Argentina Power Electronics Market by Material, Value (US$ Bn), 2018 – 2030

7.6.1.12. Argentina Power Electronics Market Device, Value (US$ Bn), 2018 – 2030

7.6.1.13. Argentina Power Electronics Market Application, Value (US$ Bn), 2018 – 2030

7.6.1.14. Argentina Power Electronics Market, by Voltage, Value (US$ Bn), 2018 – 2030

7.6.1.15. Argentina Power Electronics Market, by End-use Sector, Value (US$ Bn), 2018 – 2030

7.6.1.16. Rest of Latin America Power Electronics Market by Material, Value (US$ Bn), 2018 – 2030

7.6.1.17. Rest of Latin America Power Electronics Market Device, Value (US$ Bn), 2018 – 2030

7.6.1.18. Rest of Latin America Power Electronics Market Application, Value (US$ Bn), 2018 – 2030

7.6.1.19. Rest of Latin America Power Electronics Market, by Voltage, Value (US$ Bn), 2018 – 2030

7.6.1.20. Rest of Latin America Power Electronics Market, by End-use Sector, Value (US$ Bn), 2018 – 2030

7.6.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Power Electronics Market Outlook, 2018 – 2030

8.1. Middle East & Africa Power Electronics Market Outlook, by Material, Value (US$ Bn), 2018 – 2030

8.1.1. Key Highlights

8.1.1.1. Silicon Carbide

8.1.1.2. Silicon/Germanium

8.1.1.3. Gallium Nitride

8.2. Middle East & Africa Power Electronics Market Outlook, by Device, Value (US$ Bn), 2018 – 2030

8.2.1. Key Highlights

8.2.1.1. Discrete

8.2.1.2. Module

8.3. Middle East & Africa Power Electronics Market Outlook, by Application, Value (US$ Bn), 2018 – 2030

8.3.1. Key Highlights

8.3.1.1. ICT

8.3.1.2. Consumer Electronics

8.3.1.3. Power

8.3.1.4. Industrial

8.3.1.5. Automotive

8.3.1.6. Aerospace & Defense

8.3.1.7. Others

8.4. Middle East & Africa Power Electronics Market Outlook, by Voltage, Value (US$ Bn), 2018 – 2030

8.4.1. Key Highlights

8.4.1.1. Low Voltage (Below 1kV)

8.4.1.2. Medium Voltage (1.1 kV to 2.0 kV)

8.4.1.3. High Voltage (Above 2.0 kV)

8.5. Middle East & Africa Power Electronics Market Outlook, by End-Use, Value (US$ Bn), 2018 – 2030

8.5.1. Key Highlights

8.5.1.1. Commercial

8.5.1.2. Military

8.5.2. BPS Analysis/Market Attractiveness Analysis

8.6. Middle East & Africa Power Electronics Market Outlook, by Country, Value (US$ Bn), 2018 – 2030

8.6.1. Key Highlights

8.6.1.1. GCC Power Electronics Market by Material, Value (US$ Bn), 2018 – 2030

8.6.1.2. GCC Power Electronics Market Device, Value (US$ Bn), 2018 – 2030

8.6.1.3. GCC Power Electronics Market Application, Value (US$ Bn), 2018 – 2030

8.6.1.4. GCC Power Electronics Market, by Voltage, Value (US$ Bn), 2018 – 2030

8.6.1.5. GCC Power Electronics Market, by End-use Sector, Value (US$ Bn), 2018 – 2030

8.6.1.6. South Africa Power Electronics Market by Material, Value (US$ Bn), 2018 – 2030

8.6.1.7. South Africa Power Electronics Market Device, Value (US$ Bn), 2018 – 2030

8.6.1.8. South Africa Power Electronics Market Application, Value (US$ Bn), 2018 – 2030

8.6.1.9. South Africa Power Electronics Market, by Voltage, Value (US$ Bn), 2018 – 2030

8.6.1.10. South Africa Power Electronics Market, by End-use Sector, Value (US$ Bn), 2018 – 2030

8.6.1.11. Egypt Power Electronics Market by Material, Value (US$ Bn), 2018 – 2030

8.6.1.12. Egypt Power Electronics Market Device, Value (US$ Bn), 2018 – 2030

8.6.1.13. Egypt Power Electronics Market Application, Value (US$ Bn), 2018 – 2030

8.6.1.14. Egypt Power Electronics Market, by Voltage, Value (US$ Bn), 2018 – 2030

8.6.1.15. Egypt Power Electronics Market, by End-use Sector, Value (US$ Bn), 2018 – 2030

8.6.1.16. Nigeria Power Electronics Market by Material, Value (US$ Bn), 2018 – 2030

8.6.1.17. Nigeria Power Electronics Market Device, Value (US$ Bn), 2018 – 2030

8.6.1.18. Nigeria Power Electronics Market Application, Value (US$ Bn), 2018 – 2030

8.6.1.19. Nigeria Power Electronics Market, by Voltage, Value (US$ Bn), 2018 – 2030

8.6.1.20. Nigeria Power Electronics Market, by End-use Sector, Value (US$ Bn), 2018 – 2030

8.6.1.21. Rest of Middle East & Africa Power Electronics Market by Material, Value (US$ Bn), 2018 – 2030

8.6.1.22. Rest of Middle East & Africa Power Electronics Market Device, Value (US$ Bn), 2018 – 2030

8.6.1.23. Rest of Middle East & Africa Power Electronics Market Application, Value (US$ Bn), 2018 – 2030

8.6.1.24. Rest of Middle East & Africa Power Electronics Market, by Voltage, Value (US$ Bn), 2018 – 2030

8.6.1.25. Rest of Middle East & Africa Power Electronics Market, by End-use Sector, Value (US$ Bn), 2018 – 2030

8.6.2. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. Application vs ApplicationHeatmap

9.2. Manufacturer vsApplicationHeatmap

9.3. Company Market Share Analysis, 2022

9.4. Competitive Dashboard

9.5. Company Profiles

9.5.1. ABB Ltd.

9.5.1.1. Company Overview

9.5.1.2. Product Portfolio

9.5.1.3. Financial Overview

9.5.1.4. Business Strategies and Development

9.5.2. Fuji Electric Co. Ltd.

9.5.2.1. Company Overview

9.5.2.2. Product Portfolio

9.5.2.3. Financial Overview

9.5.2.4. Business Strategies and Development

9.5.3. Infineon Technologies AG

9.5.3.1. Company Overview

9.5.3.2. Product Portfolio

9.5.3.3. Financial Overview

9.5.3.4. Business Strategies and Development

9.5.4. NXP Semiconductors N.V.

9.5.4.1. Company Overview

9.5.4.2. Product Portfolio

9.5.4.3. Financial Overview

9.5.4.4. Business Strategies and Development

9.5.5. Microsemi Corporation

9.5.5.1. Company Overview

9.5.5.2. Product Portfolio

9.5.5.3. Financial Overview

9.5.5.4. Business Strategies and Development

9.5.6. MITSUBISHI ELECTRIC CORPORATION

9.5.6.1. Company Overview

9.5.6.2. Product Portfolio

9.5.6.3. Financial Overview

9.5.6.4. Business Strategies and Development

9.5.7. Renesas Electronics Corporation

9.5.7.1. Company Overview

9.5.7.2. Product Portfolio

9.5.7.3. Financial Overview

9.5.7.4. Business Strategies and Development

9.5.8. Rockwell Automation Inc.

9.5.8.1. Company Overview

9.5.8.2. Product Portfolio

9.5.8.3. Business Strategies and Development

9.5.9. Bühler Holding AG

9.5.9.1. Company Overview

9.5.9.2. Product Portfolio

9.5.9.3. Financial Overview

9.5.9.4. Business Strategies and Development

9.5.10. STMicroelectronics N.V.

9.5.10.1. Company Overview

9.5.10.2. Product Portfolio

9.5.10.3. Financial Overview

9.5.10.4. Business Strategies and Development

9.5.11. Texas Instruments Incorporated

9.5.11.1. Company Overview

9.5.11.2. Product Portfolio

9.5.11.3. Financial Overview

9.5.11.4. Business Strategies and Development

9.5.12. Toshiba Corporation

9.5.12.1. Company Overview

9.5.12.2. Product Portfolio

9.5.12.3. Financial Overview

9.5.12.4. Business Strategies and Development

9.5.13. ON semiconductors Corporation

9.5.13.1. Company Overview

9.5.13.2. Product Portfolio

9.5.13.3. Financial Overview

9.5.13.4. Business Strategies and Development

9.5.14. TOMRA SORTING AS

9.5.14.1. Company Overview

9.5.14.2. Product Portfolio

9.5.14.3. Financial Overview

9.5.14.4. Business Strategies and Development

9.5.15. Eagle Vizion Inc.

9.5.15.1. Company Overview

9.5.15.2. Product Portfolio

9.5.15.3. Financial Overview

9.5.15.4. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2022 |

|

2018 - 2022 |

2023 - 2030 |

Value: US$ Million |

||

|

REPORT FEATURES |

DETAILS |

|

Material Coverage |

|

|

Device Coverage |

|

|

Application Coverage |

|

|

Voltage Coverage |

|

|

End-use Sector Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |