Global Preclinical CRO Market Forecast

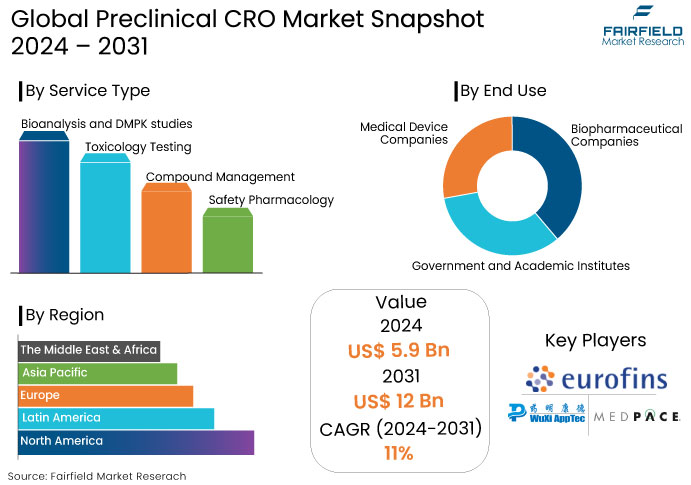

- The preclinical CRO market is projected to reach a size of US$12 Bn by 2031, showing significant growth from the US$5.9 Bn achieved in 2024.

- The market for preclinical CRO is expected to show a significant expansion rate with an estimated CAGR of 11% during the period from 2024 to 2031.

Preclinical CRO Market Insights

- The market is driven by increased outsourcing in pharmaceutical R&D and a rising focus on cost reduction and efficiency in drug development.

- AI, machine learning, and automation enhance preclinical research processes, improve accuracy, and shorten drug discovery timelines.

- The growing development of biologics, biosimilar, and gene therapies drives demand for specialized preclinical services.

- Strict global regulatory standards are pushing companies to rely more on CROs for expertise in navigating complex compliance requirements.

- Personalized medicine is increasing the need for customized preclinical testing, opening new avenues for CROs.

- Asia Pacific is emerging as a key growth region due to lower costs, improved R&D infrastructure, and increasing pharmaceutical investments.

- Intense competition is putting pressure on pricing leading CROs to focus on operational efficiency to maintain profitability.

- The rise of gene editing and cell therapies is creating new demands for advanced preclinical testing capabilities expanding the market scope.

A Look Back and a Look Forward - Comparative Analysis

The preclinical CRO (Contract Research Organization) market has experienced robust growth pre-2023 driven by an increase in pharmaceutical research and development activities, and the growing trend of outsourcing by pharmaceutical and biotechnology companies.

Factors like cost efficiency, regulatory pressures, and the need for specialized expertise encouraged companies to engage CROs for preclinical trials particularly in early-stage drug discovery and toxicology studies.

North America and Europe dominated the market given their advanced healthcare infrastructure and significant investments in drug development. Post-2024, the preclinical CRO market is expected to grow, driven by increasing demand for biologics, biosimilars, and personalized medicine.

The global shift toward precision medicine and gene therapies is expected to bolster the market. Notably, Asia Pacific is emerging as a key region offering lower operational costs and expanding research and development activities. This potential for growth in a new region should inspire optimism about the industry's global expansion.

Technological advancements such as AI-driven drug discovery, automation in toxicology studies, and in-silicon trials are not just anticipated, but are actively enhancing CRO capabilities. This should instil confidence in stakeholders about the industry's future as these advancements are expected to further propel market growth.

Key Growth Determinants

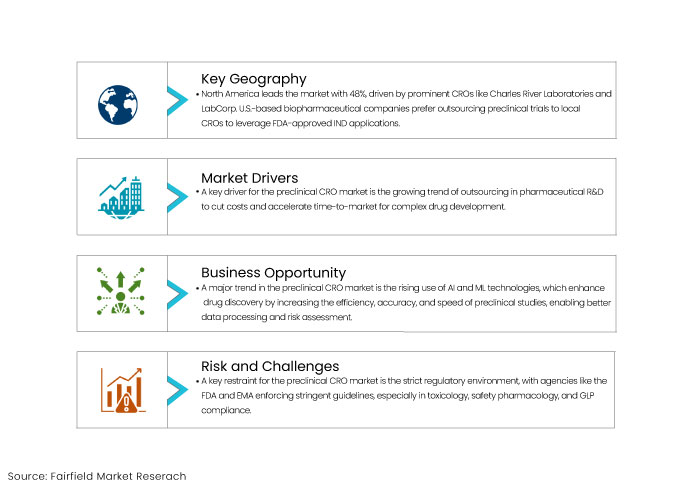

- Rising Outsourcing Trend in Pharmaceutical R&D

One of the key drivers for the preclinical CRO market is the increasing trend of outsourcing in pharmaceutical R&D. As drug development processes become more complex and costly, pharmaceutical and biotech companies outsource their preclinical research to CROs to reduce operational expenses and time-to-market.

By leveraging the specialized expertise of CROs, companies can focus on core competencies like marketing and drug commercialization. Outsourcing also helps small biotech firms without in-house capabilities to bring innovative therapies to market faster. This trend is amplified by the growing need for regulatory compliance, which preclinical CROs can efficiently manage, providing cost-effective solutions that speed up drug development.

- Technological Advancements in Drug Discovery

Technological innovations such as artificial intelligence (AI), machine learning, and automation significantly transform preclinical research. AI and machine learning are helping CROs improve drug discovery efficiency by identifying promising drug candidates more quickly. Automation in processes like toxicology studies and high-throughput screening enhances accuracy and reduces human error.

In-silico models are also being used to simulate drug interactions, minimizing the need for animal testing. These advancements are lowering costs and increasing the precision of preclinical trials making the services offered by CROs even more attractive to pharmaceutical companies.

- Expansion of Biologics and Precision Medicine

The rise of biologics, biosimilars, and personalized medicine is another significant driver for the preclinical CRO market. Biologics, which include complex therapies like monoclonal antibodies and gene therapies require specialized preclinical testing due to their unique biological properties.

CROs with expertise in these areas are in high demand, as developing biologics involves different preclinical approaches compared to small-molecule drugs. The global push toward precision medicine, which tailors treatments to individual genetic profiles requires more advanced and customized preclinical testing. This shift leads to increased outsourcing as companies look for CROs with cutting-edge technologies and expertise in these novel therapeutic areas.

Key Growth Barriers

- Regulatory Challenges and Delays

One of the key restraints for the preclinical CRO market is the complex and stringent regulatory environment governing drug development. Regulatory bodies such as the U.S. FDA, EMA (European Medicines Agency), and other global authorities impose strict guidelines that preclinical studies must adhere to particularly in areas like toxicology, safety pharmacology, and Good Laboratory Practices (GLP).

Non-compliance or delays in meeting these standards can lead to significant setbacks, including delayed approvals, increased costs, and even the rejection of a drug’s progression into clinical trials. These regulatory complexities increase operational burdens for CROs, which may limit their ability to deliver services efficiently. Navigating the varying requirements across different regions adds complexity reducing the overall speed and flexibility of preclinical research outsourcing.

- High Operational Costs and Competition

The high operational costs associated with conducting preclinical studies can act as a restraint for market growth. As drug development processes become more sophisticated, the demand for advanced technologies and specialized personnel increases, increasing operational expenses.

CROs must continually invest in cutting-edge infrastructure, equipment, and talent to remain competitive, which can strain profit margins particularly for small or mid-sized CROs. The market is highly competitive, with numerous CROs vying for contracts, often leading to pricing pressure.

Intense competition forces CROs to offer services at lower costs, which may only sometimes align with the rising operational expenditures creating financial constraints that could limit the overall market expansion.

Preclinical CRO Market Trends and Opportunities

- Adoption of Artificial Intelligence (AI) and Machine Learning in Preclinical Research

A significant trend in the preclinical CRO market is the increasing adoption of artificial intelligence (AI) and machine learning (ML) technologies. These advanced technologies are transforming drug discovery and development by improving preclinical studies' efficiency, accuracy, and speed.

AI algorithms can process vast amounts of data rapidly allowing researchers to identify potential drug candidates, predict their interactions, and assess toxicity risks precisely than traditional methods.

AI-driven platforms also help optimize drug design significantly reducing the time spent on iterative trial-and-error experiments. Machine learning models can analyze patterns in biological data, enabling more accurate predictions about how a drug might perform in humans, thus reducing the reliance on animal testing.

AI can assist in data management, automating data collection, analysis, and reporting, which helps maintain regulatory compliance. As pharmaceutical companies increasingly focus on reducing the high costs and lengthy timelines associated with drug development, CROs integrating AI and ML into their processes are becoming more attractive partners. This trend not only enhances the capabilities of CROs but also helps them stay competitive in a rapidly evolving market.

- Growing Demand for Specialized Services in Biologics and Gene Therapy

The growing demand for biologics, biosimilar, and gene therapies presents a significant opportunity for the preclinical CRO market. Biologics, which include complex molecules like monoclonal antibodies, vaccines, and cell-based therapies require specialized and comprehensive preclinical testing due to their unique biological properties and manufacturing processes.

Gene therapy, in particular is a burgeoning field that involves modifying or manipulating genes to treat or prevent diseases necessitating extensive preclinical research to assess safety, efficacy, and delivery mechanisms.

CROs that can offer expertise in biologics and gene therapy have the chance to differentiate themselves in the market. These therapies often involve cutting-edge technologies like CRISPR and mRNA platforms, which require a deep understanding of molecular biology, bioinformatics, and immunology.

The increasing regulatory scrutiny for these therapies, especially in terms of long-term safety, also drives the demand for more comprehensive preclinical evaluations. As a result, CROs that invest in specialized services and infrastructure to support the development of biologics and gene therapies are well-positioned to capture a growing share of this market.

How Does Regulatory Scenario Shape this Industry?

The regulatory landscape is playing a pivotal role in shaping the preclinical CRO market. Regulatory agencies such as the U.S. FDA, EMA (European Medicines Agency), and others are increasingly tightening the guidelines for drug development, particularly around safety and efficacy standards in preclinical studies.

Regulations ensure that drug candidates are thoroughly evaluated for toxicology, pharmacokinetics, and pharmacodynamics before moving to clinical trials. As regulatory bodies demand more comprehensive and rigorous preclinical data, pharmaceutical and biotech companies increasingly turn to CROs with specialized expertise to meet these requirements.

Regulatory trends are driving the need for adherence to Good Laboratory Practices (GLP) and data transparency, which CROs must comply with to remain competitive. Regional variations in regulations especially across North America, Europe, and Asia Pacific further compel CROs to be flexible and adaptive in their processes.

As new therapies like biologics and gene therapies emerge, the regulatory scrutiny on long-term safety evaluations is intensifying, encouraging CROs to enhance their capabilities in advanced preclinical testing thus shaping market demand and service offerings.

Segments Covered in the Report

- Toxicology Testing Service Type Takes the Lead

The toxicology testing segment represented the most significant revenue share of 27% in the global preclinical CRO market attributed to an increase in the outsourcing of noncore preclinical CRO studies and a substantial uptake of toxicity tests.

Toxicology is a primary function outsourced to contract research organizations (CROs) because of their enhanced skills in conducting toxicology assessments. The increasing trend of outsourcing noncore preclinical research to Contract Research Organizations (CROs) and the expanding capabilities of CROs to provide supplementary value-added services are anticipated to drive the expansion of this sector during the forecast period.

The market is anticipated to experience substantial expansion due to an increase in demand for pharmacokinetic services to facilitate toxicity tests for IND-enabling studies. Bioanalysis and DMPK investigations are essential in the comprehensive drug development process. They are conducted at every level of the drug development process and are not limited to the preclinical phase. These variables additionally facilitate the growth of the segment.

- Biopharmaceutical Companies are at Forefront

The rising trend of biopharmaceutical businesses outsourcing comprehensive services to tiny- and mid-sized firms without adequate competence in the preclinical phase of drug development is anticipated to enhance the need for preclinical CRO services.

The government and academic institutions sector is projected to experience the most rapid growth of 9.1% during the forecast period. Academic institutions and governmental organizations are pivotal in the preclinical stages of discovery and development. The growing trend of these entities outsourcing preclinical services to CROs will significantly enhance segment growth.

Academic institutions are a significant revenue stream for large Contract Research Organizations (CROs) like Charles River Laboratories and LabCorp.

Regional Analysis

- North America Preclinical CRO Market Takes the Charge

North America represented the largest segment with 48% attributed to the existence of prominent CROs focused on early drug discovery like Charles River Laboratories and LabCorp.

The United States is the significant market for preclinical trial outsourcing since numerous biopharmaceutical companies favor contracting their preclinical trials to U.S.-based CROs. It is to capitalize on the FDA-approved Investigational New Drug (IND) application.

The United States held the notable share of the worldwide preclinical trial outsourcing market due to the significant presence of pharmaceutical and life sciences businesses in the region. CROs in the nation offer many capabilities, including genotoxicity and immunotoxicity testing services predominantly conducted in the United States.

The anticipated expansion of personalized medicine, orphan pharmaceuticals, and bio-similars is predicted to drive the preclinical trial outsourcing market growth in the U.S.

- Asia Pacific to Grow Substantially with a 11.6% CAGR

Asia Pacific region is projected to experience the high growth rate of 11.6% throughout the projection period. The evolving business strategy of multinational corporations regarding outsourcing and the escalating expenses of research and development is anticipated to enhance preclinical outsourcing in Asia Pacific. It is due to the cost-effectiveness provided by contract research organizations in nations like India and China.

Established firms in Western Europe and the U.S. engage in analytical services, site research development, and clinical operations in the Asia Pacific to mitigate research-related costs. Japan is regarded as one of the major pharmaceutical markets worldwide. The expanding pharmaceutical sector in Japan is driving the rising need for preclinical trial outsourcing.

A significant boost to this trend is the Japanese government's proactive efforts to provide regulatory support and promote such trials. This is anticipated to invigorate the market for preclinical services, as preclinical testing necessitates proximity to core development facilities.

Fairfield’s Competitive Landscape Analysis

The preclinical CRO market is highly competitive with large, established players and small, specialized firms. Key players like Charles River Laboratories, Covance (LabCorp), and ICON Plc dominate the market due to their extensive service portfolios, global reach, and strong client relationships.

Larger CROs offer a full range of preclinical services from drug discovery to toxicology and safety assessment allowing them to capture significant market share. Small and mid-sized CROs focus on niche areas such as biologics, gene therapies, or specific preclinical phases, which allows them to carve out specialized markets. Increasing demand for personalized medicine and biologics encourages new entrants, intensifying competition and driving innovation.

Key Market Companies

- Eurofins Scientific

- PRA Health Sciences, Inc.

- Wuxi AppTec

- Medpace, Inc.

- Charles River Laboratories International, Inc.

- PPD (Thermo Fisher Scientific, Inc.)

- SGA SA

- Intertek Group Plc (IGP)

- LABCORP

- Crown Bioscience

Recent Industry Developments

- March 2023 -

Crown Bioscience and JSR Life Sciences Company announced the establishment of a new facility in Singapore to enhance their capacity for local and worldwide biotech and pharmaceutical enterprises. The site will assist preclinical and translational oncology medication research and development companies.

- February 2023 -

Apax Partners bought Porsolt, a prominent global contract research organization (CRO). This collaboration will augment Porsolt's service offerings while broadening its product portfolio and capabilities for drug screening, safety, and efficacy for global consumers.

An Expert’s Eye

- The rising complexity and cost of drug development drive more pharmaceutical and biotech companies to outsource preclinical research benefiting the CRO market.

- AI, machine learning, and automation are game-changers in preclinical research, improving efficiency, accuracy, and speed, making CROs more attractive partners for drug developers.

- With biologics, gene therapy, and personalized medicine expansion, experts predict heightened demand for CROs that offer specialized preclinical testing capabilities.

- Strict regulatory requirements for safety and efficacy in preclinical trials are compelling pharmaceutical companies to rely on CROs, which can better navigate these challenges.

Global Preclinical CRO Market is Segmented as-

By Service Type

- Bioanalysis and DMPK studies

- Toxicology Testing

- Compound Management

- Safety Pharmacology

By End Use

- Biopharmaceutical Companies

- Government and Academic Institutes

- Medical Device Companies

By Region

- North America

- Latin America

- Europe

- APAC

- MEA

1. Executive Summary

1.1. Global Preclinical CRO Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2024

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. COVID-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Global Preclinical CRO Market Outlook, 2019 - 2031

3.1. Global Preclinical CRO Market Outlook, by Service Type, Value (US$ Bn), 2019 - 2031

3.1.1. Key Highlights

3.1.1.1. Bioanalysis and DMPK studies

3.1.1.1.1. In vitro ADME

3.1.1.1.2. In-vivo PK

3.1.1.2. Toxicology Testing

3.1.1.2.1. GLP

3.1.1.2.2. Non-GLP

3.1.1.3. Compund Management

3.1.1.3.1. Process R&D

3.1.1.3.2. Custom Synthesis

3.1.1.3.3. Other Compound Management

3.1.1.4. Chemistry

3.1.1.4.1. Medicinal Chemistry

3.1.1.4.2. Computation Chemistry

3.1.1.5. Safety Pharmacology

3.1.1.6. Other Service Types

3.2. Global Preclinical CRO Market Outlook, by End User, Value (US$ Bn), 2019 - 2031

3.2.1. Key Highlights

3.2.1.1. Biopharmaceutical Companies

3.2.1.2. Government and Academic Institutes

3.2.1.3. Medical Device Companies

3.3. Global Preclinical CRO Market Outlook, by Region, Value (US$ Bn), 2019 - 2031

3.3.1. Key Highlights

3.3.1.1. North America

3.3.1.2. Europe

3.3.1.3. Asia Pacific

3.3.1.4. Latin America

3.3.1.5. Middle East & Africa

4. North America Preclinical CRO Market Outlook, 2019 - 2031

4.1. North America Preclinical CRO Market Outlook, by Service Type, Value (US$ Bn), 2019 - 2031

4.1.1. Key Highlights

4.1.1.1. Bioanalysis and DMPK studies

4.1.1.1.1. In vitro ADME

4.1.1.1.2. In-vivo PK

4.1.1.2. Toxicology Testing

4.1.1.2.1. GLP

4.1.1.2.2. Non-GLP

4.1.1.3. Compund Management

4.1.1.3.1. Process R&D

4.1.1.3.2. Custom Synthesis

4.1.1.3.3. Other Compound Management

4.1.1.4. Chemistry

4.1.1.4.1. Medicinal Chemistry

4.1.1.4.2. Computation Chemistry

4.1.1.5. Safety Pharmacology

4.1.1.6. Other Service Types

4.2. North America Preclinical CRO Market Outlook, by End User, Value (US$ Bn), 2019 - 2031

4.2.1. Key Highlights

4.2.1.1. Biopharmaceutical Companies

4.2.1.2. Government and Academic Institutes

4.2.1.3. Medical Device Companies

4.2.2. BPS Analysis/Market Attractiveness Analysis

4.3. North America Preclinical CRO Market Outlook, by Country, Value (US$ Bn), 2019 - 2031

4.3.1. Key Highlights

4.3.1.1. U.S. Preclinical CRO Market by Service Type, Value (US$ Bn), 2019 - 2031

4.3.1.2. U.S. Preclinical CRO Market by End User, Value (US$ Bn), 2019 - 2031

4.3.1.3. Canada Preclinical CRO Market by Service Type, Value (US$ Bn), 2019 - 2031

4.3.1.4. Canada Preclinical CRO Market by End User, Value (US$ Bn), 2019 - 2031

4.3.2. BPS Analysis/Market Attractiveness Analysis

5. Europe Preclinical CRO Market Outlook, 2019 - 2031

5.1. Europe Preclinical CRO Market Outlook, by Service Type, Value (US$ Bn), 2019 - 2031

5.1.1. Key Highlights

5.1.1.1. Bioanalysis and DMPK studies

5.1.1.1.1. In vitro ADME

5.1.1.1.2. In-vivo PK

5.1.1.2. Toxicology Testing

5.1.1.2.1. GLP

5.1.1.2.2. Non-GLP

5.1.1.3. Compund Management

5.1.1.3.1. Process R&D

5.1.1.3.2. Custom Synthesis

5.1.1.3.3. Other Compound Management

5.1.1.4. Chemistry

5.1.1.4.1. Medicinal Chemistry

5.1.1.4.2. Computation Chemistry

5.1.1.5. Safety Pharmacology

5.1.1.6. Other Service Types

5.2. Europe Preclinical CRO Market Outlook, by End User, Value (US$ Bn), 2019 - 2031

5.2.1. Key Highlights

5.2.1.1. Biopharmaceutical Companies

5.2.1.2. Government and Academic Institutes

5.2.1.3. Medical Device Companies

5.2.2. BPS Analysis/Market Attractiveness Analysis

5.3. Europe Preclinical CRO Market Outlook, by Country, Value (US$ Bn), 2019 - 2031

5.3.1. Key Highlights

5.3.1.1. Germany Preclinical CRO Market by Service Type, Value (US$ Bn), 2019 - 2031

5.3.1.2. Germany Preclinical CRO Market by End User, Value (US$ Bn), 2019 - 2031

5.3.1.3. U.K. Preclinical CRO Market by Service Type, Value (US$ Bn), 2019 - 2031

5.3.1.4. U.K. Preclinical CRO Market by End User, Value (US$ Bn), 2019 - 2031

5.3.1.5. France Preclinical CRO Market by Service Type, Value (US$ Bn), 2019 - 2031

5.3.1.6. France Preclinical CRO Market by End User, Value (US$ Bn), 2019 - 2031

5.3.1.7. Italy Preclinical CRO Market by Service Type, Value (US$ Bn), 2019 - 2031

5.3.1.8. Italy Preclinical CRO Market by End User, Value (US$ Bn), 2019 - 2031

5.3.1.9. Turkey Preclinical CRO Market by Service Type, Value (US$ Bn), 2019 - 2031

5.3.1.10. Turkey Preclinical CRO Market by End User, Value (US$ Bn), 2019 - 2031

5.3.1.11. Russia Preclinical CRO Market by Service Type, Value (US$ Bn), 2019 - 2031

5.3.1.12. Russia Preclinical CRO Market by End User, Value (US$ Bn), 2019 - 2031

5.3.1.13. Rest of Europe Preclinical CRO Market by Service Type, Value (US$ Bn), 2019 - 2031

5.3.1.14. Rest of Europe Preclinical CRO Market by End User, Value (US$ Bn), 2019 - 2031

5.3.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Preclinical CRO Market Outlook, 2019 - 2031

6.1. Asia Pacific Preclinical CRO Market Outlook, by Service Type, Value (US$ Bn), 2019 - 2031

6.1.1. Key Highlights

6.1.1.1. Bioanalysis and DMPK studies

6.1.1.1.1. In vitro ADME

6.1.1.1.2. In-vivo PK

6.1.1.2. Toxicology Testing

6.1.1.2.1. GLP

6.1.1.2.2. Non-GLP

6.1.1.3. Compund Management

6.1.1.3.1. Process R&D

6.1.1.3.2. Custom Synthesis

6.1.1.3.3. Other Compound Management

6.1.1.4. Chemistry

6.1.1.4.1. Medicinal Chemistry

6.1.1.4.2. Computation Chemistry

6.1.1.5. Safety Pharmacology

6.1.1.6. Other Service Types

6.2. Asia Pacific Preclinical CRO Market Outlook, by End User, Value (US$ Bn), 2019 - 2031

6.2.1. Key Highlights

6.2.1.1. Biopharmaceutical Companies

6.2.1.2. Government and Academic Institutes

6.2.1.3. Medical Device Companies

6.2.2. Others BPS Analysis/Market Attractiveness Analysis

6.3. Asia Pacific Preclinical CRO Market Outlook, by Country, Value (US$ Bn), 2019 - 2031

6.3.1. Key Highlights

6.3.1.1. China Preclinical CRO Market by Service Type, Value (US$ Bn), 2019 - 2031

6.3.1.2. China Preclinical CRO Market by End User, Value (US$ Bn), 2019 - 2031

6.3.1.3. Japan Preclinical CRO Market by Service Type, Value (US$ Bn), 2019 - 2031

6.3.1.4. Japan Preclinical CRO Market by End User, Value (US$ Bn), 2019 - 2031

6.3.1.5. South Korea Preclinical CRO Market by Service Type, Value (US$ Bn), 2019 - 2031

6.3.1.6. South Korea Preclinical CRO Market by End User, Value (US$ Bn), 2019 - 2031

6.3.1.7. India Preclinical CRO Market by Service Type, Value (US$ Bn), 2019 - 2031

6.3.1.8. India Preclinical CRO Market by End User, Value (US$ Bn), 2019 - 2031

6.3.1.9. Southeast Asia Preclinical CRO Market by Service Type, Value (US$ Bn), 2019 - 2031

6.3.1.10. Southeast Asia Preclinical CRO Market by End User, Value (US$ Bn), 2019 - 2031

6.3.1.11. Rest of Asia Pacific Preclinical CRO Market by Service Type, Value (US$ Bn), 2019 - 2031

6.3.1.12. Rest of Asia Pacific Preclinical CRO Market by End User, Value (US$ Bn), 2019 - 2031

6.3.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America Preclinical CRO Market Outlook, 2019 - 2031

7.1. Latin America Preclinical CRO Market Outlook, by Service Type, Value (US$ Bn), 2019 - 2031

7.1.1. Key Highlights

7.1.1.1. Bioanalysis and DMPK studies

7.1.1.1.1. In vitro ADME

7.1.1.1.2. In-vivo PK

7.1.1.2. Toxicology Testing

7.1.1.2.1. GLP

7.1.1.2.2. Non-GLP

7.1.1.3. Compund Management

7.1.1.3.1. Process R&D

7.1.1.3.2. Custom Synthesis

7.1.1.3.3. Other Compound Management

7.1.1.4. Chemistry

7.1.1.4.1. Medicinal Chemistry

7.1.1.4.2. Computation Chemistry

7.1.1.5. Safety Pharmacology

7.1.1.6. Other Service Types

7.2. Latin America Preclinical CRO Market Outlook, by End User, Value (US$ Bn), 2019 - 2031

7.2.1. Key Highlights

7.2.1.1. Biopharmaceutical Companies

7.2.1.2. Government and Academic Institutes

7.2.1.3. Medical Device Companies

7.2.2. BPS Analysis/Market Attractiveness Analysis

7.3. Latin America Preclinical CRO Market Outlook, by Country, Value (US$ Bn), 2019 - 2031

7.3.1. Key Highlights

7.3.1.1. Brazil Preclinical CRO Market by Service Type, Value (US$ Bn), 2019 - 2031

7.3.1.2. Brazil Preclinical CRO Market by End User, Value (US$ Bn), 2019 - 2031

7.3.1.3. Mexico Preclinical CRO Market by Service Type, Value (US$ Bn), 2019 - 2031

7.3.1.4. Mexico Preclinical CRO Market by End User, Value (US$ Bn), 2019 - 2031

7.3.1.5. Argentina Preclinical CRO Market by Service Type, Value (US$ Bn), 2019 - 2031

7.3.1.6. Argentina Preclinical CRO Market by End User, Value (US$ Bn), 2019 - 2031

7.3.1.7. Rest of Latin America Preclinical CRO Market by Service Type, Value (US$ Bn), 2019 - 2031

7.3.1.8. Rest of Latin America Preclinical CRO Market by End User, Value (US$ Bn), 2019 - 2031

7.3.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Preclinical CRO Market Outlook, 2019 - 2031

8.1. Middle East & Africa Preclinical CRO Market Outlook, by Service Type, Value (US$ Bn), 2019 - 2031

8.1.1. Key Highlights

8.1.1.1. Bioanalysis and DMPK studies

8.1.1.1.1. In vitro ADME

8.1.1.1.2. In-vivo PK

8.1.1.2. Toxicology Testing

8.1.1.2.1. GLP

8.1.1.2.2. Non-GLP

8.1.1.3. Compund Management

8.1.1.3.1. Process R&D

8.1.1.3.2. Custom Synthesis

8.1.1.3.3. Other Compound Management

8.1.1.4. Chemistry

8.1.1.4.1. Medicinal Chemistry

8.1.1.4.2. Computation Chemistry

8.1.1.5. Safety Pharmacology

8.1.1.6. Other Service Types

8.2. Middle East & Africa Preclinical CRO Market Outlook, by End User, Value (US$ Bn), 2019 - 2031

8.2.1. Key Highlights

8.2.1.1. Biopharmaceutical Companies

8.2.1.2. Government and Academic Institutes

8.2.1.3. Medical Device Companies

8.2.2. BPS Analysis/Market Attractiveness Analysis

8.3. Middle East & Africa Preclinical CRO Market Outlook, by Country, Value (US$ Bn), 2019 - 2031

8.3.1. Key Highlights

8.3.1.1. GCC Preclinical CRO Market by Service Type, Value (US$ Bn), 2019 - 2031

8.3.1.2. GCC Preclinical CRO Market by End User, Value (US$ Bn), 2019 - 2031

8.3.1.3. South Africa Preclinical CRO Market by Service Type, Value (US$ Bn), 2019 - 2031

8.3.1.4. South Africa Preclinical CRO Market by End User, Value (US$ Bn), 2019 - 2031

8.3.1.5. Egypt Preclinical CRO Market by Service Type, Value (US$ Bn), 2019 - 2031

8.3.1.6. Egypt Preclinical CRO Market by End User, Value (US$ Bn), 2019 - 2031

8.3.1.7. Nigeria Preclinical CRO Market by Service Type, Value (US$ Bn), 2019 - 2031

8.3.1.8. Nigeria Preclinical CRO Market by End User, Value (US$ Bn), 2019 - 2031

8.3.1.9. Rest of Middle East & Africa Preclinical CRO Market by Service Type, Value (US$ Bn), 2019 - 2031

8.3.1.10. Rest of Middle East & Africa Preclinical CRO Market by End User, Value (US$ Bn), 2019 - 2031

8.3.2. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. Manufacturer vs by End User Heatmap

9.2. Company Market Share Analysis, 2024

9.3. Competitive Dashboard

9.4. Company Profiles

9.4.1. Eurofins Scientific

9.4.1.1. Company Overview

9.4.1.2. Product Portfolio

9.4.1.3. Financial Overview

9.4.1.4. Business Strategies and Development

9.4.2. PRA Health Sciences

9.4.2.1. Company Overview

9.4.2.2. Product Portfolio

9.4.2.3. Financial Overview

9.4.2.4. Business Strategies and Development

9.4.3. Medpace

9.4.3.1. Company Overview

9.4.3.2. Product Portfolio

9.4.3.3. Financial Overview

9.4.3.4. Business Strategies and Development

9.4.5. Pharmaceutical Product Development

9.4.5.1. Company Overview

9.4.5.2. Product Portfolio

9.4.5.3. Financial Overview

9.4.5.4. Business Strategies and Development

9.4.6. Icon Plc

9.4.6.1. Company Overview

9.4.6.2. Product Portfolio

9.4.6.3. Financial Overview

9.4.6.4. Business Strategies and Development

9.4.7. Wuxi Apptec

9.4.7.1. Company Overview

9.4.7.2. Product Portfolio

9.4.7.3. Financial Overview

9.4.7.4. Business Strategies and Development

9.4.8. MPI Research

9.4.8.1. Company Overview

9.4.8.2. Product Portfolio

9.4.8.3. Financial Overview

9.4.8.4. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2023 |

|

2019 - 2023 |

2024 - 2031 |

Value: US$ Million |

||

|

REPORT FEATURES |

DETAILS |

|

Service Type Coverage |

|

|

End Use Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |