Global Pressure Ulcer Devices Market Forecast

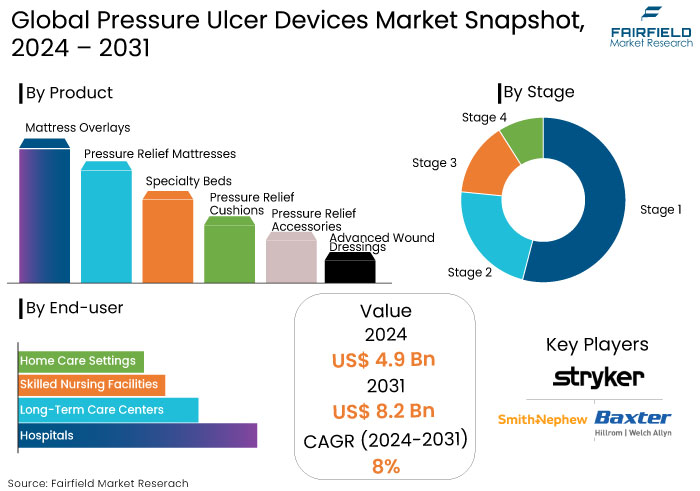

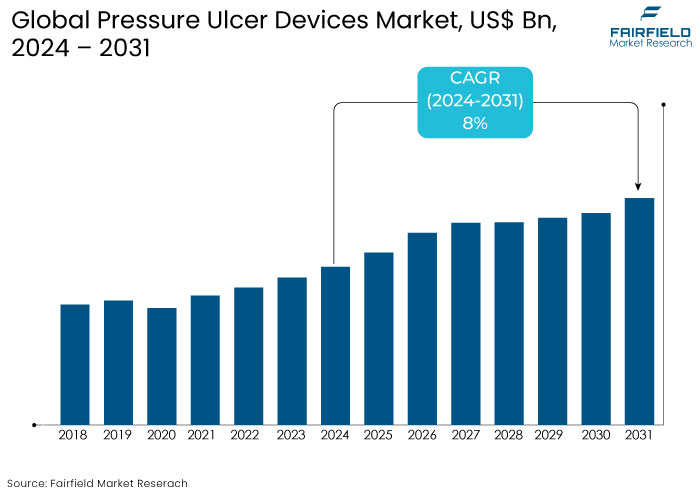

- The pressure ulcer devices market is expected to reach a size of US$8.2 Bn by 2031, showing significant growth from the US$4.9 Bn obtained in 2024.

- The market for pressure ulcer devices is likely show a significant expansion rate, with an estimated CAGR of 8% from 2024 to 2031.

Pressure Ulcer Devices Market Insights

- The increasing number of elderly and bedridden patients is driving the demand for pressure ulcer prevention and treatment devices.

- The market is witnessing innovations such as smart pressure relief devices with integrated sensors and pressure-adjusting technologies.

- Rising healthcare budgets globally, especially in developed economies, are promoting investments in pressure ulcer management devices.

- Improved awareness among healthcare providers about pressure ulcer prevention and the adoption of specialized devices are expanding the market.

- The market includes various devices like pressure-relieving mattresses, cushions, overlays, and therapeutic beds catering to different patient needs.

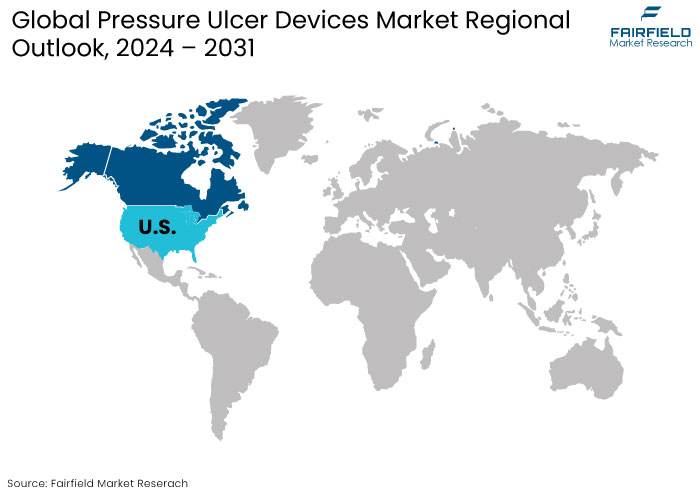

- North America and Europe dominate the market, but the Asia-Pacific region is emerging as a high-growth area due to improving healthcare infrastructure.

- The rise in chronic conditions like diabetes and immobility-related diseases is contributing to higher demand for pressure ulcer management solutions.

- Devices that offer long-term prevention benefits are becoming increasingly popular as they help reduce the cost burden associated with prolonged hospitalization.

A Look Back and a Look Forward - Comparative Analysis

The pressure ulcer devices market was steadily growing during the period from 2019 to 2023. This growth was due to increasing awareness about the prevention and treatment of pressure ulcers, especially in the aging population and patients with limited mobility.

Traditional wound care products dominated the market, but innovation emerged with the introduction of advanced pressure ulcer devices such as dynamic mattresses, cushions, and dressings. The market growth was also supported by increased hospitalizations, leading to a higher incidence of pressure ulcers.

The market is expected to experience a significant surge due to advancements in technology and healthcare infrastructure over the forecast period. Key factors driving this growth include adopting smart devices with pressure-relieving capabilities, such as electronic sensors that monitor pressure and offer real-time feedback.

The increased focus on reducing healthcare-associated infections (HAIs) and improving patient care in hospitals and home settings will increase demand. The rising geriatric population and growing awareness about wound care will further expand market opportunities. Also, integrating AI and machine learning in developing personalized treatment plans for pressure ulcer management will drive innovation, making treatment more effective and efficient.

Key Growth Determinants

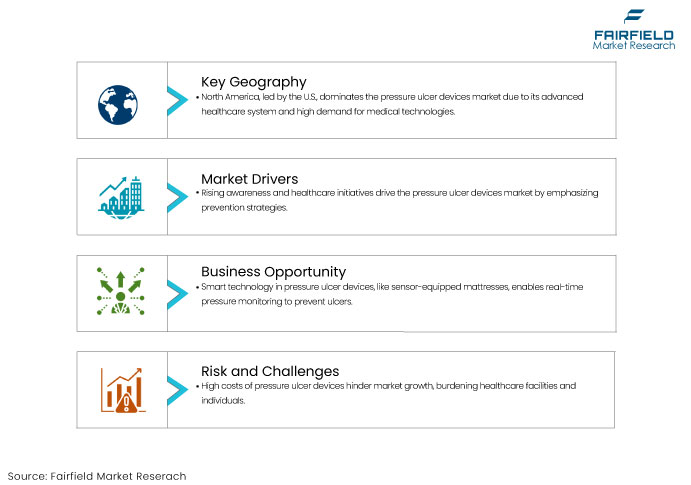

- Increasing Awareness and Initiatives for Pressure Ulcer Prevention

Increasing awareness about the impact of pressure ulcers, coupled with various healthcare initiatives, is a crucial growth driver for the pressure ulcer devices market. Pressure ulcers are preventable, and the healthcare industry increasingly focuses on educating patients, caregivers, and healthcare professionals about prevention strategies.

Awareness campaigns, workshops, and guidelines from health organizations such as the National Pressure Injury Advisory Panel (NPIAP) and the WHO are helping to drive the adoption of preventive care. Moreover, healthcare providers are becoming more proactive in using pressure ulcer prevention devices, incorporating them into standard care protocols, and monitoring patients closely to prevent the development of ulcers.

Governments and healthcare institutions are also incentivizing using advanced pressure ulcer management devices to reduce healthcare costs and improve patient outcomes. As the focus on patient safety and quality of care intensifies, the pressure ulcer devices market is expected to grow significantly.

- Technological Advancements in Wound Care Devices

Technological innovations are fueling market growth. Over the years, the development of advanced technologies, such as air-fluidized beds, alternating pressure mattresses, and smart wound care devices, has greatly improved the prevention and management of pressure ulcers. Such innovations use sensors and smart technology to detect and adjust pressure levels to prevent the formation of ulcers, significantly enhancing patient comfort and healing rates.

The introduction of wound healing devices, such as negative pressure wound therapy (NPWT) systems, has made it easy to treat existing pressure ulcers with great efficacy and speed. The technological advancements allow for more personalized care, reducing the need for manual intervention and minimizing the risk of infection.

As wound healing devices continue to evolve, their increased efficacy and the growing availability of new features will drive further adoption across hospitals, nursing homes, and home care settings, thus contributing to pressure ulcer devices market growth.

Key Growth Barriers

- Expensive Pressure Ulcer Relief Devices Impede the Market Expansion

A limiting aspect related to pressure ulcer devices is their relatively high cost, which is a significant hurdle to the expansion of the pressure ulcer devices market, as the management of pressure ulcers incurs substantial financial burdens for healthcare facilities and individuals globally.

Aside from the exorbitant financial expenses, the management of pressure ulcers consumes significant nursing time and can considerably impact hospital performance ranking, resulting in heightened treatment unaffordability. Consequently, hindering the expansion of the market.

- Lack of Awareness and Training Among Healthcare Providers

Another key growth restraint for the pressure ulcer devices market is the lack of awareness and insufficient training among healthcare providers regarding these devices' proper use and benefits. Many healthcare professionals, particularly in low and middle-income countries, may need to be adequately trained on advanced technology and best practices for pressure ulcer prevention and treatment.

Pressure ulcers may need to be identified early or managed effectively, diminishing the demand for specialized devices. Furthermore, a lack of awareness of the long-term cost benefits and improved patient outcomes associated with pressure ulcer management can lead to hesitancy in adopting new devices.

The knowledge gap among healthcare providers results in suboptimal patient care, slowing the adoption of advanced pressure ulcer treatment solutions and hindering the overall growth of the market.

Pressure Ulcer Devices Market Trends and Opportunities

- Advancements in Smart Pressure Ulcer Devices

The integration of smart technology into pressure ulcer devices is one of the most transformative opportunities in the pressure ulcer devices market. Devices like smart mattresses and pressure-relieving cushions are now equipped with sensors that monitor and adjust pressure distribution in real time, helping prevent pressure ulcers before they develop.

Smart beds with automated pressure adjustment features can identify high-risk areas and make immediate adjustments to alleviate pressure. Such devices can also provide valuable data for healthcare professionals, enabling them to make informed decisions on patient care. This shift toward AI-enabled and data-driven care is paving the way for personalized and proactive management of pressure ulcers.

- Personalized and Patient-Centric Solutions

The growing shift toward personalized, patient-specific care for the treatment of pressure ulcers is driving the demand for customized pressure ulcer devices. These take into account individual body types, skin conditions, and other medical factors.

3D printing technology is also being explored to create personalized wound care devices, such as custom-made pressure-relieving cushions or bandages. Such tailored solutions improve comfort, enhance healing, and significantly reduce the risk of further ulcers. Also, the growing focus on patient-centric innovation is poised to transform the market by enhancing the effectiveness of pressure ulcer prevention and treatment.

How Does Regulatory Scenario Shape the Industry?

The regulatory landscape plays a crucial role in shaping the pressure ulcer devices market by ensuring product safety, efficacy, and market access. Regulatory bodies like the U.S. FDA (Food and Drug Administration) and the European Medicines Agency (EMA) enforce stringent guidelines for medical devices. Consequently, these guidelines impact the development and commercialization of pressure ulcer devices.

The FDA classifies these devices based on risk in the U.S with most pressure ulcer prevention and treatment devices requiring FDA clearance or approval. The process involves clinical trials and evidence of safety and performance, which can be time-consuming and costly but ensures that only effective products reach the market.

The introduction of the Medical Device Regulation (MDR) has further tightened requirements, ensuring that pressure ulcer devices meet high standards for safety, performance, and traceability in Europe. Also, regulatory requirements may slow product launches, but they also promote innovation, ensuring that only high-quality and safe devices are available to patients, which ultimately supports market growth and consumer confidence.

Segments Covered in the Report

- Pressure Relief Mattresses Top the Market with its Even Pressure Distribution Leads

Pressure relief mattresses play a critical role in preventing and treating pressure ulcers, which are common among patients who are immobile or bedridden for extended periods, such as those in hospitals, long-term care facilities, or home care settings.

Pressure relief mattresses are designed to redistribute pressure from key body areas like the back, hips, and heels at high risk for developing pressure ulcers. By preventing prolonged pressure on vulnerable areas, these mattresses help reduce the occurrence and severity of ulcers.

Pressure relief mattresses offer long-term value compared to other pressure ulcer prevention products such as advanced wound dressings or specialty beds. They can be used continuously for patient care and are less costly in the long run, especially in institutional settings.

- Stage 1 Pressure Ulcers Occupy Substantial Market Share

A significant percentage of inpatient admissions demonstrate a common incidence of superficial wounds and sores. As a result, Stage I pressure ulcers occupy a substantial market share owing to their prevalence in this patient demographic.

Stage I pressure ulcers signify the early step of tissue injury. Healthcare practitioners emphasize preventive strategies to impede the advancement of the ulcer. Pressure ulcer devices are essential instruments in this preventive strategy, dispersing pressure and reducing the danger of additional tissue damage.

Prompt utilization of pressure ulcer devices in Stage I promotes expedited healing. Such devices offer essential support and alleviation to the impacted regions, facilitating the restoration of skin integrity and reducing the duration of ulceration.

Regional Analysis

- North America Pressure Ulcer Devices Market Retains the Top Position

North American currently dominates the market for pressure ulcer devices. North America, particularly the United States, has a highly developed healthcare system with cutting-edge medical facilities, technologies, and a high demand for advanced medical devices, including pressure ulcer care devices.

The region reports a high prevalence of pressure ulcers, particularly among the aging population, which drives the demand for effective treatment solutions. The elderly population in North America is significantly increasing due to the aging Baby Boomer generation, creating a larger patient pool in need of pressure ulcer care.

North America is home to several leading manufacturers and innovators in the healthcare sector, providing advanced and innovative pressure ulcer devices. These include dynamic support surfaces, specialized dressings, and devices that promote wound healing. The region also leads in terms of research and development, which further strengthens its dominance in the market.

- Europe Pressure Ulcer Devices Market Emerges as a Significant Market

The growing aging population in Europe is a key factor driving the demand for pressure ulcer devices. Elderly individuals are more susceptible to pressure ulcers due to decreased mobility, thinner skin, and other age-related health issues. As the population of senior citizens continues to rise, so does the incidence of pressure ulcers.

Increasing awareness about the risks of pressure ulcers and educating healthcare professionals about prevention techniques and timely intervention has heightened the demand for advanced devices for pressure ulcer care. Healthcare providers focus more on preventing pressure ulcers than just treating them once they occur.

Fairfield’s Competitive Landscape Analysis

The competitive landscape of the Europe pressure ulcer devices market is characterized by a mix of established medical device manufacturers and emerging players offering innovative solutions. Key players such as Smith & Nephew, Hill-Rom, and Stryker Corporation dominate the market with advanced pressure ulcer prevention and treatment devices like specialized mattresses, cushions, and wound care products.

Companies focus on product innovations, such as low-air-loss therapy systems and pressure-reducing beds, to meet the growing demand for effective ulcer prevention. Additionally, emerging companies leverage technology, such as smart monitoring systems and AI-driven solutions, to provide enhanced care.

The market remains competitive, focusing on strategic partnerships, acquisitions, and expanding product portfolios to capture a larger market share.

Key Market Companies

- Stryker Corp.

- Smith & Nephew Plc.

- Hill-Rom Services Inc.

- Paramount Bed Holdings Co., Ltd.

- ArjoHuntleigh

- Talley Group Limited

- Drive DeVilbiss Healthcare Ltd (Sidhil Limited)

- Apex Medical Corp.

- Medtronic

- PROMA REHA, s. r. o.

- Linet spol. S R.O.

- DARCO International

- DeRoyal Industries

- BSN Medical (Essity)

- Mölnlycke Health Care

- TrueKAST (Wound Kair Concepts)

- Thuasne SAS

- DJO Global

- ORTHOSERVICE AG

- Breg, Inc.

- Advanced Orthopaedics

- ALGEOS

- Hollister Incorporated

- ConvaTec Group plc

- Coloplast A/S

- Medline Industries Inc.

- Invacare Corporation

Recent Industry Developments

- In March 2024, Arjo, a leading player in medical devices for patient handling and skin integrity, expanded its product range with an innovative wound care and pressure ulcer prevention device.

- In January 2024, Invacare Corporation announced positive results from a clinical trial evaluating its new dynamic mattress replacement system for pressure ulcer prevention.

An Expert’s Eye

- The increasing prevalence of chronic diseases like diabetes and immobility-related conditions is driving the demand for pressure ulcer treatment devices.

- Innovation in devices, such as smart wound dressings and pressure relief mattresses, enhances treatment outcomes and patient comfort.

- The global aging population is a significant driver as elderly individuals are more prone to developing pressure ulcers.

- Increased awareness about pressure ulcer prevention and treatment is prompting more healthcare providers to invest in these devices.

Global Pressure Ulcer Devices Market is Segmented as-

By Product

- Mattress Overlays

- Pressure Relief Mattresses

- Specialty Beds

- Pressure Relief Cushions

- Pressure Relief Accessories

- Advanced Wound Dressings

By Stage

- Stage 1

- Stage 2

- Stage 3

- Stage 4

By End User

- Hospitals

- Long-Term Care Centers

- Skilled Nursing Facilities

- Home Care Settings

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- The Middle East & Africa

1. Executive Summary

1.1. Global Pressure Ulcer Devices Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value and Volume, 2024

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. COVID-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Production Output and Trade Statistics, 2019 - 2023

3.1. Global Pressure Ulcer Devices Production Output, by Region, Value (US$ Bn) and Volume (Million Units), 2019 - 2023

3.1.1. North America

3.1.2. Europe

3.1.3. Asia Pacific

3.1.4. Latin America

3.1.5. Middle East and Africa

4. Price Analysis, 2019 - 2023

4.1. Global Average Price Analysis, by Product/ Stage/ End User, US$ Per Unit, 2019 - 2023

4.2. Prominent Factor Affecting Pressure Ulcer Devices Prices

4.3. Global Average Price Analysis, by Region, US$ Per Unit

5. Global Pressure Ulcer Devices Market Outlook, 2019 - 2031

5.1. Global Pressure Ulcer Devices Market Outlook, by Product, Value (US$ Bn) and Volume (Units), 2019 - 2031

5.1.1. Key Highlights

5.1.1.1. Mattress Overlays

5.1.1.2. Pressure Relief Mattresses

5.1.1.2.1. Foam-based Mattress

5.1.1.2.2. Gel-based Mattress

5.1.1.2.3. Fiber-filled Mattress

5.1.1.2.4. Water/Fluid-filled Mattress

5.1.1.2.5. Air-filled Mattress

5.1.1.3. Speciality Beds

5.1.1.3.1. Kinetic Beds

5.1.1.3.2. Air-Fluidized Beds

5.1.1.4. Pressure Relief Cushions

5.1.1.5. Alternating Pressure Wheelchair's Cushions

5.1.1.6. Off-Loading Devices

5.1.1.6.1. Total Contact Casting Systems

5.1.1.6.1.1. Casting System with Boots

5.1.1.6.1.2. Casting System without Boot

5.1.1.6.2. Off-loading Shoes

5.1.1.6.2.1. Post-Operative Offloading Shoes

5.1.1.6.2.2. Wedge-based Shoes

5.1.1.6.2.3. All Purpose Shoes

5.1.1.6.2.4. Off-loading insoles

5.1.1.7. Pressure Relief Accessories

5.1.1.8. Advanced Wound Dressings

5.1.1.8.1. Alginate Dressings

5.1.1.8.2. Collagens Dressings

5.1.1.8.3. Films Dressing

5.1.1.8.4. Foam Dressings

5.1.1.8.4.1. Anti-microbial Foam Dressing

5.1.1.8.4.2. Non-Anti-Microbial Foam Dressing

5.1.1.8.5. Hydrocolloids Dressing

5.1.1.8.6. Hydrofibers Dressings

5.1.1.8.7. Hydrogels Dressings

5.1.1.8.8. Superabsorbent Dressing

5.1.1.8.9. Wound Contact Layers

5.2. Global Pressure Ulcer Devices Market Outlook, by Stage, Value (US$ Bn) and Volume (Units), 2019 - 2031

5.2.1. Key Highlights

5.2.1.1. Stage I Pressure Ulcer Devices

5.2.1.2. Stage II Pressure Ulcer Devices

5.2.1.3. Stage III Pressure Ulcer Devices

5.2.1.4. Stage IV Pressure Ulcer Devices

5.3. Global Pressure Ulcer Devices Market Outlook, by End User, Value (US$ Bn) and Volume (Units), 2019 - 2031

5.3.1. Key Highlights

5.3.1.1. Hospitals

5.3.1.2. Long-term Care Centres

5.3.1.3. Skilled Nursing Facilities

5.3.1.4. Home Care Settings

5.4. Global Pressure Ulcer Devices Market Outlook, by Region, Value (US$ Bn) and Volume (Units), 2019 - 2031

5.4.1. Key Highlights

5.4.1.1. North America

5.4.1.2. Europe

5.4.1.3. Asia Pacific

5.4.1.4. Latin America

5.4.1.5. Middle East & Africa

6. North America Pressure Ulcer Devices Market Outlook, 2019 - 2031

6.1. North America Pressure Ulcer Devices Market Outlook, by Product, Value (US$ Bn) and Volume (Units), 2019 - 2031

6.1.1. Key Highlights

6.1.1.1. Mattress Overlays

6.1.1.2. Pressure Relief Mattresses

6.1.1.2.1. Foam-based Mattress

6.1.1.2.2. Gel-based Mattress

6.1.1.2.3. Fiber-filled Mattress

6.1.1.2.4. Water/Fluid-filled Mattress

6.1.1.2.5. Air-filled Mattress

6.1.1.3. Speciality Beds

6.1.1.3.1. Kinetic Beds

6.1.1.3.2. Air-Fluidized Beds

6.1.1.4. Pressure Relief Cushions

6.1.1.5. Alternating Pressure Wheelchair's Cushions

6.1.1.6. Off-Loading Devices

6.1.1.6.1. Total Contact Casting Systems

6.1.1.6.1.1. Casting System with Boots

6.1.1.6.1.2. Casting System without Boot

6.1.1.6.2. Off-loading Shoes

6.1.1.6.2.1. Post-Operative Offloading Shoes

6.1.1.6.2.2. Wedge-based Shoes

6.1.1.6.2.3. All Purpose Shoes

6.1.1.6.2.4. Off-loading insoles

6.1.1.7. Pressure Relief Accessories

6.1.1.8. Advanced Wound Dressings

6.1.1.8.1. Alginate Dressings

6.1.1.8.2. Collagens Dressings

6.1.1.8.3. Films Dressing

6.1.1.8.4. Foam Dressings

6.1.1.8.4.1. Anti-microbial Foam Dressing

6.1.1.8.4.2. Non-Anti-Microbial Foam Dressing

6.1.1.8.5. Hydrocolloids Dressing

6.1.1.8.6. Hydrofibers Dressings

6.1.1.8.7. Hydrogels Dressings

6.1.1.8.8. Superabsorbent Dressing

6.1.1.8.9. Wound Contact Layers

6.2. North America Pressure Ulcer Devices Market Outlook, by Stage, Value (US$ Bn) and Volume (Units), 2019 - 2031

6.2.1. Key Highlights

6.2.1.1. Stage I Pressure Ulcer Devices

6.2.1.2. Stage II Pressure Ulcer Devices

6.2.1.3. Stage III Pressure Ulcer Devices

6.2.1.4. Stage IV Pressure Ulcer Devices

6.3. North America Pressure Ulcer Devices Market Outlook, by End User, Value (US$ Bn) and Volume (Units), 2019 - 2031

6.3.1. Key Highlights

6.3.1.1. Hospitals

6.3.1.2. Long-term Care Centres

6.3.1.3. Skilled Nursing Facilities

6.3.1.4. Home Care Settings

6.3.2. BPS Analysis/Market Attractiveness Analysis

6.4. North America Pressure Ulcer Devices Market Outlook, by Country, Value (US$ Bn) and Volume (Units), 2019 - 2031

6.4.1. Key Highlights

6.4.1.1. U.S. Pressure Ulcer Devices Market by Product, Value (US$ Bn) and Volume (Units), 2019 - 2031

6.4.1.2. U.S. Pressure Ulcer Devices Market by Stage, Value (US$ Bn) and Volume (Units), 2019 - 2031

6.4.1.3. U.S. Pressure Ulcer Devices Market by End User, Value (US$ Bn) and Volume (Units), 2019 - 2031

6.4.1.4. Canada Pressure Ulcer Devices Market by Product, Value (US$ Bn) and Volume (Units), 2019 - 2031

6.4.1.5. Canada Pressure Ulcer Devices Market by Stage, Value (US$ Bn) and Volume (Units), 2019 - 2031

6.4.1.6. Canada Pressure Ulcer Devices Market by End User, Value (US$ Bn) and Volume (Units), 2019 - 2031

6.4.2. BPS Analysis/Market Attractiveness Analysis

7. Europe Pressure Ulcer Devices Market Outlook, 2019 - 2031

7.1. Europe Pressure Ulcer Devices Market Outlook, by Product, Value (US$ Bn) and Volume (Units), 2019 - 2031

7.1.1. Key Highlights

7.1.1.1. Mattress Overlays

7.1.1.2. Pressure Relief Mattresses

7.1.1.2.1. Foam-based Mattress

7.1.1.2.2. Gel-based Mattress

7.1.1.2.3. Fiber-filled Mattress

7.1.1.2.4. Water/Fluid-filled Mattress

7.1.1.2.5. Air-filled Mattress

7.1.1.3. Speciality Beds

7.1.1.3.1. Kinetic Beds

7.1.1.3.2. Air-Fluidized Beds

7.1.1.4. Pressure Relief Cushions

7.1.1.5. Alternating Pressure Wheelchair's Cushions

7.1.1.6. Off-Loading Devices

7.1.1.6.1. Total Contact Casting Systems

7.1.1.6.1.1. Casting System with Boots

7.1.1.6.1.2. Casting System without Boot

7.1.1.6.2. Off-loading Shoes

7.1.1.6.2.1. Post-Operative Offloading Shoes

7.1.1.6.2.2. Wedge-based Shoes

7.1.1.6.2.3. All Purpose Shoes

7.1.1.6.2.4. Off-loading insoles

7.1.1.7. Pressure Relief Accessories

7.1.1.8. Advanced Wound Dressings

7.1.1.8.1. Alginate Dressings

7.1.1.8.2. Collagens Dressings

7.1.1.8.3. Films Dressing

7.1.1.8.4. Foam Dressings

7.1.1.8.4.1. Anti-microbial Foam Dressing

7.1.1.8.4.2. Non-Anti-Microbial Foam Dressing

7.1.1.8.5. Hydrocolloids Dressing

7.1.1.8.6. Hydrofibers Dressings

7.1.1.8.7. Hydrogels Dressings

7.1.1.8.8. Superabsorbent Dressing

7.1.1.8.9. Wound Contact Layers

7.2. Europe Pressure Ulcer Devices Market Outlook, by Stage, Value (US$ Bn) and Volume (Units), 2019 - 2031

7.2.1. Key Highlights

7.2.1.1. Stage I Pressure Ulcer Devices

7.2.1.2. Stage II Pressure Ulcer Devices

7.2.1.3. Stage III Pressure Ulcer Devices

7.2.1.4. Stage IV Pressure Ulcer Devices

7.3. Europe Pressure Ulcer Devices Market Outlook, by End User, Value (US$ Bn) and Volume (Units), 2019 - 2031

7.3.1. Key Highlights

7.3.1.1. Hospitals

7.3.1.2. Long-term Care Centres

7.3.1.3. Skilled Nursing Facilities

7.3.1.4. Home Care Settings

7.3.2. BPS Analysis/Market Attractiveness Analysis

7.4. Europe Pressure Ulcer Devices Market Outlook, by Country, Value (US$ Bn) and Volume (Units), 2019 - 2031

7.4.1. Key Highlights

7.4.1.1. Germany Pressure Ulcer Devices Market by Product, Value (US$ Bn) and Volume (Units), 2019 - 2031

7.4.1.2. Germany Pressure Ulcer Devices Market by Stage, Value (US$ Bn) and Volume (Units), 2019 - 2031

7.4.1.3. Germany Pressure Ulcer Devices Market by End User, Value (US$ Bn) and Volume (Units), 2019 - 2031

7.4.1.4. U.K. Pressure Ulcer Devices Market by Product, Value (US$ Bn) and Volume (Units), 2019 - 2031

7.4.1.5. U.K. Pressure Ulcer Devices Market by Stage, Value (US$ Bn) and Volume (Units), 2019 - 2031

7.4.1.6. U.K. Pressure Ulcer Devices Market by End User, Value (US$ Bn) and Volume (Units), 2019 - 2031

7.4.1.7. France Pressure Ulcer Devices Market by Product, Value (US$ Bn) and Volume (Units), 2019 - 2031

7.4.1.8. France Pressure Ulcer Devices Market by Stage, Value (US$ Bn) and Volume (Units), 2019 - 2031

7.4.1.9. France Pressure Ulcer Devices Market by End User, Value (US$ Bn) and Volume (Units), 2019 - 2031

7.4.1.10. Italy Pressure Ulcer Devices Market by Product, Value (US$ Bn) and Volume (Units), 2019 - 2031

7.4.1.11. Italy Pressure Ulcer Devices Market by Stage, Value (US$ Bn) and Volume (Units), 2019 - 2031

7.4.1.12. Italy Pressure Ulcer Devices Market by End User, Value (US$ Bn) and Volume (Units), 2019 - 2031

7.4.1.13. Turkey Pressure Ulcer Devices Market by Product, Value (US$ Bn) and Volume (Units), 2019 - 2031

7.4.1.14. Turkey Pressure Ulcer Devices Market by Stage, Value (US$ Bn) and Volume (Units), 2019 - 2031

7.4.1.15. Turkey Pressure Ulcer Devices Market by End User, Value (US$ Bn) and Volume (Units), 2019 - 2031

7.4.1.16. Russia Pressure Ulcer Devices Market by Product, Value (US$ Bn) and Volume (Units), 2019 - 2031

7.4.1.17. Russia Pressure Ulcer Devices Market by Stage, Value (US$ Bn) and Volume (Units), 2019 - 2031

7.4.1.18. Russia Pressure Ulcer Devices Market by End User, Value (US$ Bn) and Volume (Units), 2019 - 2031

7.4.1.19. Rest of Europe Pressure Ulcer Devices Market by Product, Value (US$ Bn) and Volume (Units), 2019 - 2031

7.4.1.20. Rest of Europe Pressure Ulcer Devices Market by Stage, Value (US$ Bn) and Volume (Units), 2019 - 2031

7.4.1.21. Rest of Europe Pressure Ulcer Devices Market by End User, Value (US$ Bn) and Volume (Units), 2019 - 2031

7.4.2. BPS Analysis/Market Attractiveness Analysis

8. Asia Pacific Pressure Ulcer Devices Market Outlook, 2019 - 2031

8.1. Asia Pacific Pressure Ulcer Devices Market Outlook, by Product, Value (US$ Bn) and Volume (Units), 2019 - 2031

8.1.1. Key Highlights

8.1.1.1. Mattress Overlays

8.1.1.2. Pressure Relief Mattresses

8.1.1.2.1. Foam-based Mattress

8.1.1.2.2. Gel-based Mattress

8.1.1.2.3. Fiber-filled Mattress

8.1.1.2.4. Water/Fluid-filled Mattress

8.1.1.2.5. Air-filled Mattress

8.1.1.3. Speciality Beds

8.1.1.3.1. Kinetic Beds

8.1.1.3.2. Air-Fluidized Beds

8.1.1.4. Pressure Relief Cushions

8.1.1.5. Alternating Pressure Wheelchair's Cushions

8.1.1.6. Off-Loading Devices

8.1.1.6.1. Total Contact Casting Systems

8.1.1.6.1.1. Casting System with Boots

8.1.1.6.1.2. Casting System without Boot

8.1.1.6.2. Off-loading Shoes

8.1.1.6.2.1. Post-Operative Offloading Shoes

8.1.1.6.2.2. Wedge-based Shoes

8.1.1.6.2.3. All Purpose Shoes

8.1.1.6.2.4. Off-loading insoles

8.1.1.7. Pressure Relief Accessories

8.1.1.8. Advanced Wound Dressings

8.1.1.8.1. Alginate Dressings

8.1.1.8.2. Collagens Dressings

8.1.1.8.3. Films Dressing

8.1.1.8.4. Foam Dressings

8.1.1.8.4.1. Anti-microbial Foam Dressing

8.1.1.8.4.2. Non-Anti-Microbial Foam Dressing

8.1.1.8.5. Hydrocolloids Dressing

8.1.1.8.6. Hydrofibers Dressings

8.1.1.8.7. Hydrogels Dressings

8.1.1.8.8. Superabsorbent Dressing

8.1.1.8.9. Wound Contact Layers

8.2. Asia Pacific Pressure Ulcer Devices Market Outlook, by Stage, Value (US$ Bn) and Volume (Units), 2019 - 2031

8.2.1. Key Highlights

8.2.1.1. Stage I Pressure Ulcer Devices

8.2.1.2. Stage II Pressure Ulcer Devices

8.2.1.3. Stage III Pressure Ulcer Devices

8.2.1.4. Stage IV Pressure Ulcer Devices

8.3. Asia Pacific Pressure Ulcer Devices Market Outlook, by End User, Value (US$ Bn) and Volume (Units), 2019 - 2031

8.3.1. Key Highlights

8.3.1.1. Hospitals

8.3.1.2. Long-term Care Centres

8.3.1.3. Skilled Nursing Facilities

8.3.1.4. Home Care Settings

8.3.2. BPS Analysis/Market Attractiveness Analysis

8.4. Asia Pacific Pressure Ulcer Devices Market Outlook, by Country, Value (US$ Bn) and Volume (Units), 2019 - 2031

8.4.1. Key Highlights

8.4.1.1. China Pressure Ulcer Devices Market by Product, Value (US$ Bn) and Volume (Units), 2019 - 2031

8.4.1.2. China Pressure Ulcer Devices Market by Stage, Value (US$ Bn) and Volume (Units), 2019 - 2031

8.4.1.3. China Pressure Ulcer Devices Market by End User, Value (US$ Bn) and Volume (Units), 2019 - 2031

8.4.1.4. Japan Pressure Ulcer Devices Market by Product, Value (US$ Bn) and Volume (Units), 2019 - 2031

8.4.1.5. Japan Pressure Ulcer Devices Market by Stage, Value (US$ Bn) and Volume (Units), 2019 - 2031

8.4.1.6. Japan Pressure Ulcer Devices Market by End User, Value (US$ Bn) and Volume (Units), 2019 - 2031

8.4.1.7. South Korea Pressure Ulcer Devices Market by Product, Value (US$ Bn) and Volume (Units), 2019 - 2031

8.4.1.8. South Korea Pressure Ulcer Devices Market by Stage, Value (US$ Bn) and Volume (Units), 2019 - 2031

8.4.1.9. South Korea Pressure Ulcer Devices Market by End User, Value (US$ Bn) and Volume (Units), 2019 - 2031

8.4.1.10. India Pressure Ulcer Devices Market by Product, Value (US$ Bn) and Volume (Units), 2019 - 2031

8.4.1.11. India Pressure Ulcer Devices Market by Stage, Value (US$ Bn) and Volume (Units), 2019 - 2031

8.4.1.12. India Pressure Ulcer Devices Market by End User, Value (US$ Bn) and Volume (Units), 2019 - 2031

8.4.1.13. Southeast Asia Pressure Ulcer Devices Market by Product, Value (US$ Bn) and Volume (Units), 2019 - 2031

8.4.1.14. Southeast Asia Pressure Ulcer Devices Market by Stage, Value (US$ Bn) and Volume (Units), 2019 - 2031

8.4.1.15. Southeast Asia Pressure Ulcer Devices Market by End User, Value (US$ Bn) and Volume (Units), 2019 - 2031

8.4.1.16. Rest of Asia Pacific Pressure Ulcer Devices Market by Product, Value (US$ Bn) and Volume (Units), 2019 - 2031

8.4.1.17. Rest of Asia Pacific Pressure Ulcer Devices Market by Stage, Value (US$ Bn) and Volume (Units), 2019 - 2031

8.4.1.18. Rest of Asia Pacific Pressure Ulcer Devices Market by End User, Value (US$ Bn) and Volume (Units), 2019 - 2031

8.4.2. BPS Analysis/Market Attractiveness Analysis

9. Latin America Pressure Ulcer Devices Market Outlook, 2019 - 2031

9.1. Latin America Pressure Ulcer Devices Market Outlook, by Product, Value (US$ Bn) and Volume (Units), 2019 - 2031

9.1.1. Key Highlights

9.1.1.1. Mattress Overlays

9.1.1.2. Pressure Relief Mattresses

9.1.1.2.1. Foam-based Mattress

9.1.1.2.2. Gel-based Mattress

9.1.1.2.3. Fiber-filled Mattress

9.1.1.2.4. Water/Fluid-filled Mattress

9.1.1.2.5. Air-filled Mattress

9.1.1.3. Speciality Beds

9.1.1.3.1. Kinetic Beds

9.1.1.3.2. Air-Fluidized Beds

9.1.1.4. Pressure Relief Cushions

9.1.1.5. Alternating Pressure Wheelchair's Cushions

9.1.1.6. Off-Loading Devices

9.1.1.6.1. Total Contact Casting Systems

9.1.1.6.1.1. Casting System with Boots

9.1.1.6.1.2. Casting System without Boot

9.1.1.6.2. Off-loading Shoes

9.1.1.6.2.1. Post-Operative Offloading Shoes

9.1.1.6.2.2. Wedge-based Shoes

9.1.1.6.2.3. All Purpose Shoes

9.1.1.6.2.4. Off-loading insoles

9.1.1.7. Pressure Relief Accessories

9.1.1.8. Advanced Wound Dressings

9.1.1.8.1. Alginate Dressings

9.1.1.8.2. Collagens Dressings

9.1.1.8.3. Films Dressing

9.1.1.8.4. Foam Dressings

9.1.1.8.4.1. Anti-microbial Foam Dressing

9.1.1.8.4.2. Non-Anti-Microbial Foam Dressing

9.1.1.8.5. Hydrocolloids Dressing

9.1.1.8.6. Hydrofibers Dressings

9.1.1.8.7. Hydrogels Dressings

9.1.1.8.8. Superabsorbent Dressing

9.1.1.8.9. Wound Contact Layers

9.2. Latin America Pressure Ulcer Devices Market Outlook, by Stage, Value (US$ Bn) and Volume (Units), 2019 - 2031

9.2.1. Key Highlights

9.2.1.1. Stage I Pressure Ulcer Devices

9.2.1.2. Stage II Pressure Ulcer Devices

9.2.1.3. Stage III Pressure Ulcer Devices

9.2.1.4. Stage IV Pressure Ulcer Devices

9.3. Latin America Pressure Ulcer Devices Market Outlook, by End User, Value (US$ Bn) and Volume (Units), 2019 - 2031

9.3.1. Key Highlights

9.3.1.1. Hospitals

9.3.1.2. Long-term Care Centres

9.3.1.3. Skilled Nursing Facilities

9.3.1.4. Home Care Settings

9.3.2. BPS Analysis/Market Attractiveness Analysis

9.4. Latin America Pressure Ulcer Devices Market Outlook, by Country, Value (US$ Bn) and Volume (Units), 2019 - 2031

9.4.1. Key Highlights

9.4.1.1. Brazil Pressure Ulcer Devices Market by Product, Value (US$ Bn) and Volume (Units), 2019 - 2031

9.4.1.2. Brazil Pressure Ulcer Devices Market by Stage, Value (US$ Bn) and Volume (Units), 2019 - 2031

9.4.1.3. Brazil Pressure Ulcer Devices Market by End User, Value (US$ Bn) and Volume (Units), 2019 - 2031

9.4.1.4. Mexico Pressure Ulcer Devices Market by Product, Value (US$ Bn) and Volume (Units), 2019 - 2031

9.4.1.5. Mexico Pressure Ulcer Devices Market by Stage, Value (US$ Bn) and Volume (Units), 2019 - 2031

9.4.1.6. Mexico Pressure Ulcer Devices Market by End User, Value (US$ Bn) and Volume (Units), 2019 - 2031

9.4.1.7. Argentina Pressure Ulcer Devices Market by Product, Value (US$ Bn) and Volume (Units), 2019 - 2031

9.4.1.8. Argentina Pressure Ulcer Devices Market by Stage, Value (US$ Bn) and Volume (Units), 2019 - 2031

9.4.1.9. Argentina Pressure Ulcer Devices Market by End User, Value (US$ Bn) and Volume (Units), 2019 - 2031

9.4.1.10. Rest of Latin America Pressure Ulcer Devices Market by Product, Value (US$ Bn) and Volume (Units), 2019 - 2031

9.4.1.11. Rest of Latin America Pressure Ulcer Devices Market by Stage, Value (US$ Bn) and Volume (Units), 2019 - 2031

9.4.1.12. Rest of Latin America Pressure Ulcer Devices Market by End User, Value (US$ Bn) and Volume (Units), 2019 - 2031

9.4.2. BPS Analysis/Market Attractiveness Analysis

10. Middle East & Africa Pressure Ulcer Devices Market Outlook, 2019 - 2031

10.1. Middle East & Africa Pressure Ulcer Devices Market Outlook, by Product, Value (US$ Bn) and Volume (Units), 2019 - 2031

10.1.1. Key Highlights

10.1.1.1. Mattress Overlays

10.1.1.2. Pressure Relief Mattresses

10.1.1.2.1. Foam-based Mattress

10.1.1.2.2. Gel-based Mattress

10.1.1.2.3. Fiber-filled Mattress

10.1.1.2.4. Water/Fluid-filled Mattress

10.1.1.2.5. Air-filled Mattress

10.1.1.3. Speciality Beds

10.1.1.3.1. Kinetic Beds

10.1.1.3.2. Air-Fluidized Beds

10.1.1.4. Pressure Relief Cushions

10.1.1.5. Alternating Pressure Wheelchair's Cushions

10.1.1.6. Off-Loading Devices

10.1.1.6.1. Total Contact Casting Systems

10.1.1.6.1.1. Casting System with Boots

10.1.1.6.1.2. Casting System without Boot

10.1.1.6.2. Off-loading Shoes

10.1.1.6.2.1. Post-Operative Offloading Shoes

10.1.1.6.2.2. Wedge-based Shoes

10.1.1.6.2.3. All Purpose Shoes

10.1.1.6.2.4. Off-loading insoles

10.1.1.7. Pressure Relief Accessories

10.1.1.8. Advanced Wound Dressings

10.1.1.8.1. Alginate Dressings

10.1.1.8.2. Collagens Dressings

10.1.1.8.3. Films Dressing

10.1.1.8.4. Foam Dressings

10.1.1.8.4.1. Anti-microbial Foam Dressing

10.1.1.8.4.2. Non-Anti-Microbial Foam Dressing

10.1.1.8.5. Hydrocolloids Dressing

10.1.1.8.6. Hydrofibers Dressings

10.1.1.8.7. Hydrogels Dressings

10.1.1.8.8. Superabsorbent Dressing

10.1.1.8.9. Wound Contact Layers

10.2. Middle East & Africa Pressure Ulcer Devices Market Outlook, by Stage, Value (US$ Bn) and Volume (Units), 2019 - 2031

10.2.1. Key Highlights

10.2.1.1. Stage I Pressure Ulcer Devices

10.2.1.2. Stage II Pressure Ulcer Devices

10.2.1.3. Stage III Pressure Ulcer Devices

10.2.1.4. Stage IV Pressure Ulcer Devices

10.3. Middle East & Africa Pressure Ulcer Devices Market Outlook, by End User, Value (US$ Bn) and Volume (Units), 2019 - 2031

10.3.1. Key Highlights

10.3.1.1. Hospitals

10.3.1.2. Long-term Care Centres

10.3.1.3. Skilled Nursing Facilities

10.3.1.4. Home Care Settings

10.3.2. BPS Analysis/Market Attractiveness Analysis

10.4. Middle East & Africa Pressure Ulcer Devices Market Outlook, by Country, Value (US$ Bn) and Volume (Units), 2019 - 2031

10.4.1. Key Highlights

10.4.1.1. GCC Pressure Ulcer Devices Market by Product, Value (US$ Bn) and Volume (Units), 2019 - 2031

10.4.1.2. GCC Pressure Ulcer Devices Market by Stage, Value (US$ Bn) and Volume (Units), 2019 - 2031

10.4.1.3. GCC Pressure Ulcer Devices Market by End User, Value (US$ Bn) and Volume (Units), 2019 - 2031

10.4.1.4. South Africa Pressure Ulcer Devices Market by Product, Value (US$ Bn) and Volume (Units), 2019 - 2031

10.4.1.5. South Africa Pressure Ulcer Devices Market by Stage, Value (US$ Bn) and Volume (Units), 2019 - 2031

10.4.1.6. South Africa Pressure Ulcer Devices Market by End User, Value (US$ Bn) and Volume (Units), 2019 - 2031

10.4.1.7. Egypt Pressure Ulcer Devices Market by Product, Value (US$ Bn) and Volume (Units), 2019 - 2031

10.4.1.8. Egypt Pressure Ulcer Devices Market by Stage, Value (US$ Bn) and Volume (Units), 2019 - 2031

10.4.1.9. Egypt Pressure Ulcer Devices Market by End User, Value (US$ Bn) and Volume (Units), 2019 - 2031

10.4.1.10. Nigeria Pressure Ulcer Devices Market by Product, Value (US$ Bn) and Volume (Units), 2019 - 2031

10.4.1.11. Nigeria Pressure Ulcer Devices Market by Stage, Value (US$ Bn) and Volume (Units), 2019 - 2031

10.4.1.12. Nigeria Pressure Ulcer Devices Market by End User, Value (US$ Bn) and Volume (Units), 2019 - 2031

10.4.1.13. Rest of Middle East & Africa Pressure Ulcer Devices Market by Product, Value (US$ Bn) and Volume (Units), 2019 - 2031

10.4.1.14. Rest of Middle East & Africa Pressure Ulcer Devices Market by Stage, Value (US$ Bn) and Volume (Units), 2019 - 2031

10.4.1.15. Rest of Middle East & Africa Pressure Ulcer Devices Market by End User, Value (US$ Bn) and Volume (Units), 2019 - 2031

10.4.2. BPS Analysis/Market Attractiveness Analysis

11. Competitive Landscape

11.1. By Product vs by Stage Heatmap

11.2. Company Market Share Analysis, 2024

11.3. Competitive Dashboard

11.4. Company Profiles

11.4.1. Stryker Corp.

11.4.1.1. Company Overview

11.4.1.2. Product Portfolio

11.4.1.3. Financial Overview

11.4.1.4. Business Strategies and Development

11.4.2. Smith & Nephew Plc.

11.4.2.1. Company Overview

11.4.2.2. Product Portfolio

11.4.2.3. Financial Overview

11.4.2.4. Business Strategies and Development

11.4.3. Hill-Rom Services Inc.

11.4.3.1. Company Overview

11.4.3.2. Product Portfolio

11.4.3.3. Financial Overview

11.4.3.4. Business Strategies and Development

11.4.4. ArjoHuntleigh

11.4.4.1. Company Overview

11.4.4.2. Product Portfolio

11.4.4.3. Financial Overview

11.4.4.4. Business Strategies and Development

11.4.5. Paramount Bed Holdings Co., Ltd.

11.4.5.1. Company Overview

11.4.5.2. Product Portfolio

11.4.5.3. Financial Overview

11.4.5.4. Business Strategies and Development

11.4.6. Talley Group Limited

11.4.6.1. Company Overview

11.4.6.2. Product Portfolio

11.4.6.3. Financial Overview

11.4.6.4. Business Strategies and Development

11.4.7. Drive DeVilbiss Healthcare Ltd (Sidhil Limited)

11.4.7.1. Company Overview

11.4.7.2. Product Portfolio

11.4.7.3. Financial Overview

11.4.7.4. Business Strategies and Development

11.4.8. Apex Medical Corp.

11.4.8.1. Company Overview

11.4.8.2. Product Portfolio

11.4.8.3. Financial Overview

11.4.8.4. Business Strategies and Development

11.4.9. Medtronic

11.4.9.1. Company Overview

11.4.9.2. Product Portfolio

11.4.9.3. Financial Overview

11.4.9.4. Business Strategies and Development

11.4.10. PROMA REHA, s. r. o.

11.4.10.1. Company Overview

11.4.10.2. Product Portfolio

11.4.10.3. Financial Overview

11.4.10.4. Business Strategies and Development

11.4.11. Linet spol. S R.O.

11.4.11.1. Company Overview

11.4.11.2. Product Portfolio

11.4.11.3. Financial Overview

11.4.11.4. Business Strategies and Development

11.4.12. DARCO International

11.4.12.1. Company Overview

11.4.12.2. Product Portfolio

11.4.12.3. Financial Overview

11.4.12.4. Business Strategies and Development

11.4.13. DeRoyal Industries

11.4.13.1. Company Overview

11.4.13.2. Product Portfolio

11.4.13.3. Financial Overview

11.4.13.4. Business Strategies and Development

11.4.14. BSN Medical (Essity)

11.4.14.1. Company Overview

11.4.14.2. Product Portfolio

11.4.14.3. Financial Overview

11.4.14.4. Business Strategies and Development

11.4.15. Mölnlycke Health Care

11.4.15.1. Company Overview

11.4.15.2. Product Portfolio

11.4.15.3. Financial Overview

11.4.15.4. Business Strategies and Development

11.4.16. TrueKAST (Wound Kair Concepts)

11.4.16.1. Company Overview

11.4.16.2. Product Portfolio

11.4.16.3. Financial Overview

11.4.16.4. Business Strategies and Development

11.4.17. Thuasne SAS

11.4.17.1. Company Overview

11.4.17.2. Product Portfolio

11.4.17.3. Financial Overview

11.4.17.4. Business Strategies and Development

11.4.18. DJO Global

11.4.18.1. Company Overview

11.4.18.2. Product Portfolio

11.4.18.3. Financial Overview

11.4.18.4. Business Strategies and Development

11.4.19. ORTHOSERVICE AG

11.4.19.1. Company Overview

11.4.19.2. Product Portfolio

11.4.19.3. Financial Overview

11.4.19.4. Business Strategies and Development

11.4.20. Breg, Inc.

11.4.20.1. Company Overview

11.4.20.2. Product Portfolio

11.4.20.3. Financial Overview

11.4.20.4. Business Strategies and Development

12. Appendix

12.1. Research Methodology

12.2. Report Assumptions

12.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2023 |

|

2019 - 2023 |

2024 - 2031 |

Value: US$ Billion |

||

|

REPORT FEATURES |

DETAILS |

|

Product Coverage |

|

|

Stage Coverage |

|

|

End User Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |