Global Primary Hepatocytes Market Forecast

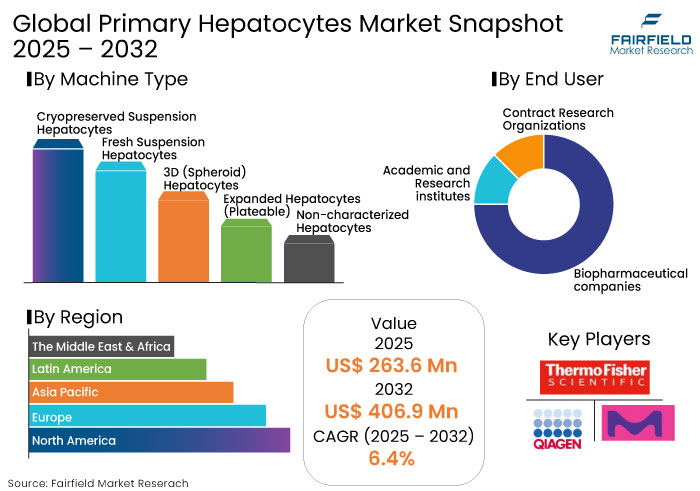

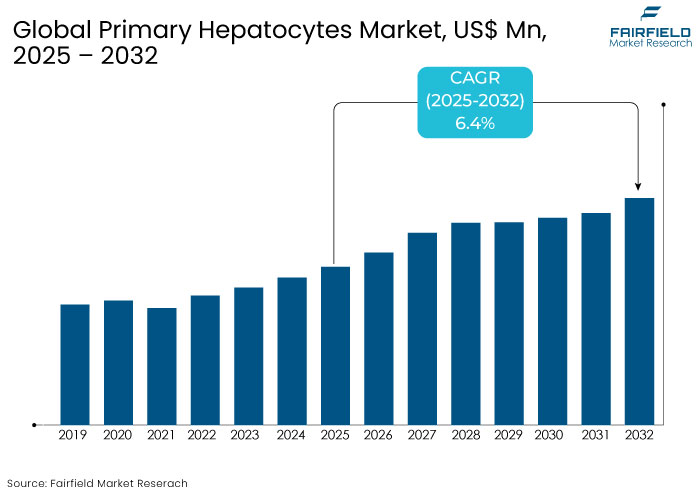

- The primary hepatocytes market is projected to be valued at US$ 406.9 Mn by 2032, exhibiting significant growth from the US$ 263.6 Mn achieved in 2025.

- The market for primary hepatocytes is expected to show a significant expansion rate with an a CAGR of 6.4% during the forecast period between 2025 and 2032.

Primary Hepatocytes Market Insights

- Increasing cases of liver conditions like NAFLD and hepatitis are driving demand for hepatocyte-based models to advance research and improve drug development outcomes.

- Innovations in 3D culture systems and co-culture techniques enhance hepatocyte performance, enabling better modeling of liver functions and disease mechanisms.

- The shift from traditional monolayer cultures to 3D systems is gaining traction, offering better mimicry of in vivo liver environments for more accurate drug testing.

- Researchers are increasingly exploring stem cell-derived hepatocytes as scalable alternatives, addressing supply limitations while maintaining functional relevance.

- Growing emphasis on reducing animal testing supports the use of hepatocyte-based in vitro systems in toxicology and pharmacokinetics

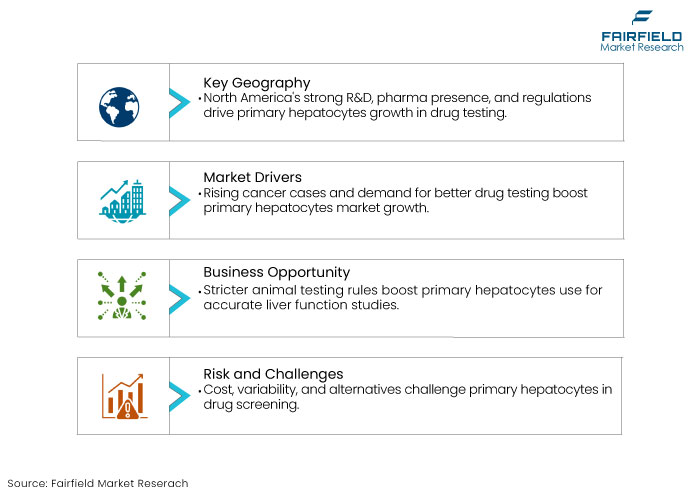

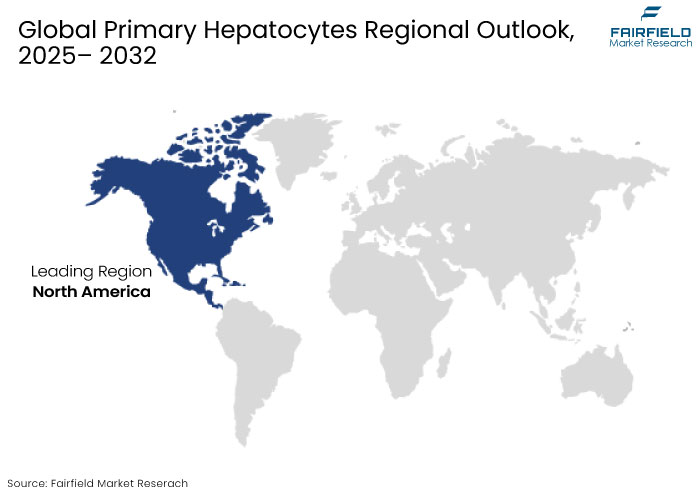

- North America is the market leader for hepatocytes because of its sophisticated healthcare system, expenditures on research and development, pharmaceutical presence, high incidence of liver disease, emphasis on safety regulations, and advancements in hepatocyte technology.

Key Growth Determinants

- Development of Novel Cancer Treatment Spurs Research and Development

Improvements in the development of cancer treatments and the growing need for precise drug metabolism investigations are driving the market for primary hepatocytes. Better preclinical models are desperately needed to evaluate the safety and effectiveness of drugs, as the WHO projects a 47% increase in cancer cases worldwide by 2040.

3D cell culture technology, which mimics the human liver’s microenvironment, is becoming a critical tool in oncology research, providing more predictive and reliable in vitro models for drug testing. Companies like Lonza and Thermo Fisher Scientific are investing in organ-on-a-chip technologies, which enhance hepatocyte functionality, enabling more precise toxicity screening and reducing reliance on animal testing.

The need for primary hepatocytes in preclinical studies has increased because of the FDA's more stringent drug safety requirements, which guarantee improved translation of laboratory data into clinical settings. 3D hepatocyte models will be crucial in maximizing therapeutic efficacy as individualized cancer therapies gain traction, propelling the market growth.

- Rising Concerns of Liver Diseases Spurs Adoption of In-Vitro Models in Drug Discovery

The increasing preference for in vitro models in drug research and development is driving a boom in the market for primary hepatocytes. These models provide vital physiological information and are critical for assessing drug metabolism, hepatotoxicity, and enzyme function.

Regulatory bodies such as the FDA and EMA place a strong emphasis on the use of in vitro research to enhance early-stage drug screening and lessen the need for animal testing. The requirement for safe and efficient medication candidates is driving the move to human-relevant cell models. By detecting hepatotoxic substances early in the development process, primary hepatocyte tests can save money and time.

The need for efficient in vitro models to investigate liver pathophysiology, assess treatment responses, and screen substances for possible hepatotoxic effects has increased due to the rising frequency of liver illnesses and hepatotoxicity concerns. Growing liver disease rates worldwide, especially in North America, Europe, and Asia Pacific, are anticipated to fuel the demand for primary hepatocytes.

Key Growth Barriers

- Availability of induced pluripotent stem cell (iPSC)-derived hepatocytes and hepatoma cell lines for Drug Screening

The availability of substitute cell types for drug screening is posing problems for the main hepatocyte business. The gold standard for assessing drug metabolism and toxicity specific to the liver is primary hepatocytes, which are generated from liver tissue. However, broad drug development is hampered by their high cost, batch variability, and restricted availability.

Alternative cell types, such as hepatoma cell lines and induced pluripotent stem cell (iPSC)-derived hepatocytes, have become popular in response because of their affordability, scalability, and accessibility. These substitutes lessen the need for primary hepatocytes, which influences the demand for them on the market. These cell types may further limit the main hepatocyte market in drug screening applications as their functionality and physiological significance continue to advance.

Primary Hepatocytes Market Trends and Opportunities

- Stringent Regulations Regarding Animal Testing Presents Novel Avenues

The growing focus on animal testing regulations presents opportunities for the use of primary hepatocytes in research and development. These cells, derived from human or animal liver tissue, offer a more accurate representation of human liver function than traditional animal models. They replicate in vivo liver metabolism and toxicity, making them invaluable in preclinical studies.

As researchers face regulatory pressure, the adoption of these cells in drug discovery and toxicity testing becomes increasingly appealing. The shift towards reducing animal testing aligns with the broader trend of promoting humane and ethical research practices.

By leveraging primary hepatocytes, companies can adhere to regulatory requirements, enhance the predictability of drug responses in humans, streamline the drug development process, and reduce the potential for late-stage failures. Additionally, primary hepatocytes can facilitate the development of more efficient screening methods and predictive models for liver-related diseases, advancing scientific understanding and therapeutic innovation.

- Advancement in Research using 3D Cultures Paves the Way for Innovation

Developments in the 3D cell cultures are transforming tissue engineering, cancer research, and medication development. By simulating the in vivo environment, these 3D cultures enable cells to grow in three dimensions, offering more precise insights into biological processes. Because they can reproduce the intricate structure and microenvironment of tumors, they are especially useful in cancer research because they allow for more accurate investigations of metastasis, treatment responses, and tumor activity.

This invention enhances forecasts of how well therapies will function in the human body and lowers the possibility of late-stage clinical trial failures. Organoids, which may be created from patient-specific cells and are useful for customized treatment, are produced in drug research using 3D culturing.

In October 2024, collaborations between InSphero and the FDA's NCTR led to the largest benchmarking study demonstrating early detection of liver toxicity using 3D liver microtissues, demonstrating the predictive accuracy of these models and revolutionizing drug development and safety assessment.

Segments Covered in the Report

- Human segment Remain Top of Primary Hepatocytes product type

The human segment leads the primary hepatocytes market, primarily due to its critical role in drug testing and liver disease research. Human hepatocytes offer precise data for pharmacokinetics and toxicity studies, meeting stringent regulatory requirements. The growing prevalence of liver conditions like hepatitis and NAFLD has heightened the need for human-based research models.

Advances in cell isolation techniques have enhanced the availability and performance of human hepatocytes. Pharmaceutical companies increasingly prioritize these cells for personalized medicine and to minimize reliance on animal models. Additionally, the rising use of in vitro systems further supports the segment's expansion across therapeutic and research domains.

- Cell Viability Assay Segment Takes the Lead in Application/Assay

The cell viability assay segment is experiencing significant growth in the primary hepatocytes market due to its vital role in drug development. These assays assess cell health, providing accurate insights into toxicity and efficacy.

Growing investments in pharmaceutical research and development are driving demand for dependable viability testing. Essential for evaluating liver cell responses to drugs, chemicals, and environmental toxins, these assays are becoming increasingly integral.

Advances in assay technologies have enhanced sensitivity and reproducibility, encouraging broader adoption. The rising focus on personalized medicine and in vitro testing, along with regulatory support for safer drug screening, further accelerates the segment's expansion.

Regional Analysis

- North America Cultivates Investment Avenues for Research and Development

North America's sophisticated healthcare system, significant investment in research and development, and high concentration of pharmaceutical and biotechnology firms make it a major growth engine for the primary hepatocytes industry. The use of primary hepatocytes in toxicity and pharmacokinetics investigations has increased due to the region's emphasis on creative medication development and strict adherence to regulatory norms.

A high prevalence of liver diseases such as non-alcoholic fatty liver disease (NAFLD) and hepatitis further propels research initiatives. Additionally, government funding for biomedical research and advancements in cell culture technologies and personalized medicine reinforce North America’s dominant position in this market.

- Europe's Robust Biotechnology & Pharmaceutical Industry Fuels Research

Pharmaceutical and biotechnology firms in Europe are making significant investments in preclinical research and drug development, with nations like France, Germany, and the UK spearheading innovation-driven projects. In order to create novel treatment candidates, leading firms are increasingly employing primary hepatocytes for toxicity screening, drug metabolism, and enzyme activity research.

To comply with strict medication safety and effectiveness testing criteria, European regulatory agencies such as the European Medicines Agency (EMA) are promoting in vitro models such as primary hepatocytes and decreasing animal testing. As a result, primary hepatocyte cultures are now more widely used in both industrial and academic settings.

Fairfield’s Competitive Landscape Analysis

Fairfield's competitive landscape analysis highlights key players and strategies shaping the primary hepatocytes market. Leading companies focus on innovations in cell isolation, cryopreservation, and culture technologies to meet the growing demand for reliable in vitro models.

Partnerships between pharmaceutical firms and academic institutions drive advancements in hepatocyte functionality for drug testing and toxicity studies. Emerging players leverage regional opportunities, particularly in Asia-Pacific, by offering cost-effective solutions.

The market also sees increased competition in providing hepatocyte-specific assay kits and personalized medicine applications. Fairfield's report emphasizes the critical role of technological innovation, regulatory alignment, and geographic expansion in sustaining competitive advantage.

Key Market Companies

- QIAGEN

- Thermo Fisher Scientific Inc.

- Merck KGaA

- Lonza

- Takara Bio Inc.

- American Type Culture Collection (ATCC)

- Corning Inc.

- Cell Biologics, Inc.

- Creative Bioarray

- Axol Bioscience Ltd.

- HiMedia Laboratories

- NEXEL Co., Ltd.

- AnaBios

- Cytes Biotechnologies S.L.

- ZenBio, Inc. (BioIVT)

- iXCells Biotechnologies

- ScienCell Research Laboratories, Inc.

- Kerafast

- Kosheeka

- XenoTech

- LifeNet Health LifeSciences

- Cell Guidance Systems LLC

- Applied Biological Materials Inc. (abm)

- Discovery Life Sciences

- Innoprot

- Novabiosis

Recent Industry Developments

- In March 2024, Merck invested US$ 14 Mn in Shanghai's M Lab™ Collaboration Center, adding a biology application lab, process development training center, and upstream application lab for biopharma customer support.

- In February 2024, Merck announced the opening of a new US$ 20 Mn distribution center in Cajamar, São Paulo, Brazil, aimed at enhancing service for its Life Science customers in the region.

- In February 2023, ATCC announced a long-term strategic collaboration with the U.S. Pharmacopeia (USP). This multi-year partnership aims to jointly provide co-branded reference materials and reference standards, enhancing the quality and development of biologic medicines and therapies.

Global Primary Hepatocytes Market is Segmented as-

By Product

- Cryopreserved Suspension Hepatocytes

- Fresh Suspension Hepatocytes

- 3D (Spheroid) Hepatocytes

- Expanded Hepatocytes (Plateable)

- Non-characterized Hepatocytes

By Species

- Human

- Rat

- Mouse

- Dog

- Monkey

- Horse

- Others

By Application/Assay

- Cell Viability Assay

- Cytochrome Enzyme Activity

- High Content Cytotoxicity

- Transporter Inhibition Assay

- In Vitro Intrinsic Clearance

- Phospholipids Assay

- Others

By End User

- Biopharmaceutical companies

- Academic and Research institutes

- Contract Research Organizations

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- The Middle East & Africa

1. Executive Summary

1.1. Global Primary Hepatocytes Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2025

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. COVID-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Economic Overview

2.6.1. World Economic Projections

2.7. PESTLE Analysis

2.8. Primary Hepatocytes Market, Product Adoption

2.9. Regulatory Scenario by Region

2.10. Value Chain Analysis

3. Global Primary Hepatocytes Market Outlook, 2019 - 2032

3.1. Global Primary Hepatocytes Market Outlook, by Product, Value (US$ Mn), 2019 - 2032

3.1.1. Key Highlights

3.1.1.1. Cryopreserved Suspension Hepatocytes

3.1.1.2. Fresh Suspension Hepatocytes

3.1.1.3. 3D (Spheroid) Hepatocytes

3.1.1.4. Expanded Hepatocytes (Plateable)

3.1.1.5. Non-characterized Hepatocytes

3.2. Global Primary Hepatocytes Market Outlook, by Species, Value (US$ Mn) and 2019 - 2032

3.2.1. Key Highlights

3.2.1.1. Human

3.2.1.2. Rat

3.2.1.3. Mouse

3.2.1.4. Dog

3.2.1.5. Monkey

3.2.1.6. Horse

3.2.1.7. Others

3.3. Global Primary Hepatocytes Market Outlook, Application/Assay, Value (US$ Mn), 2019 - 2032

3.3.1. Key Highlights

3.3.1.1. Cell Viability Assay

3.3.1.2. Cytochrome Enzyme Activity

3.3.1.3. High Content Cytotoxicity

3.3.1.4. Transporter Inhibition Assay

3.3.1.5. In Vitro Intrinsic Clearance

3.3.1.6. Phospholipids Assay

3.3.1.7. Others

3.4. Global Primary Hepatocytes Market Outlook, by End User, Value (US$ Mn), 2019 - 2032

3.4.1. Key Highlights

3.4.1.1. Biopharmaceutical companies

3.4.1.2. Academic and Research institutes

3.4.1.3. Contract Research Organizations

3.5. Global Primary Hepatocytes Market Outlook, by Region, Value (US$ Mn), 2019 - 2032

3.5.1. Key Highlights

3.5.1.1. North America

3.5.1.2. Europe

3.5.1.3. East Asia

3.5.1.4. Latin America

3.5.1.5. Middle East & Africa

4. North America Primary Hepatocytes Market Outlook, 2019 - 2032

4.1. North America Primary Hepatocytes Market Outlook, by Product, Value (US$ Mn), 2019 - 2032

4.1.1. Key Highlights

4.1.1.1. Cryopreserved Suspension Hepatocytes

4.1.1.2. Fresh Suspension Hepatocytes

4.1.1.3. 3D (Spheroid) Hepatocytes

4.1.1.4. Expanded Hepatocytes (Plateable)

4.1.1.5. Non-characterized Hepatocytes

4.2. North America Primary Hepatocytes Market Outlook, by Species, Value (US$ Mn) and 2019 - 2032

4.2.1. Key Highlights

4.2.1.1. Human

4.2.1.2. Rat

4.2.1.3. Mouse

4.2.1.4. Dog

4.2.1.5. Monkey

4.2.1.6. Horse

4.2.1.7. Others

4.3. North America Primary Hepatocytes Market Outlook, Application/Assay, Value (US$ Mn), 2019 - 2032

4.3.1. Key Highlights

4.3.1.1. Cell Viability Assay

4.3.1.2. Cytochrome Enzyme Activity

4.3.1.3. High Content Cytotoxicity

4.3.1.4. Transporter Inhibition Assay

4.3.1.5. In Vitro Intrinsic Clearance

4.3.1.6. Phospholipids Assay

4.3.1.7. Others

4.4. North America Primary Hepatocytes Market Outlook, by End User, Value (US$ Mn), 2019 - 2032

4.4.1. Key Highlights

4.4.1.1. Biopharmaceutical companies

4.4.1.2. Academic and Research institutes

4.4.1.3. Contract Research Organizations

4.4.2. BPS Analysis/Market Attractiveness Analysis

4.5. North America Primary Hepatocytes Market Outlook, by Country, Value (US$ Mn), 2019 - 2032

4.5.1. Key Highlights

4.5.1.1. U.S. Primary Hepatocytes Market by Product, Value (US$ Mn), 2019 - 2032

4.5.1.2. U.S. Primary Hepatocytes Market by Species, Value (US$ Mn), 2019 - 2032

4.5.1.3. U.S. Primary Hepatocytes Market by Application/Assay, Value (US$ Mn), 2019 - 2032

4.5.1.4. U.S. Primary Hepatocytes Market by End User, Value (US$ Mn), 2019 - 2032

4.5.1.5. Canada Primary Hepatocytes Market by Product, Value (US$ Mn), 2019 - 2032

4.5.1.6. Canada Primary Hepatocytes Market by Species, Value (US$ Mn), 2019 - 2032

4.5.1.7. Canada Primary Hepatocytes Market by Application/Assay, Value (US$ Mn), 2019 - 2032

4.5.1.8. Canada Primary Hepatocytes Market by End User, Value (US$ Mn), 2019 - 2032

4.5.2. BPS Analysis/Market Attractiveness Analysis

5. Europe Primary Hepatocytes Market Outlook, 2019 - 2032

5.1. Europe Primary Hepatocytes Market Outlook, by Product, Value (US$ Mn), 2019 - 2032

5.1.1. Key Highlights

5.1.1.1. Cryopreserved Suspension Hepatocytes

5.1.1.2. Fresh Suspension Hepatocytes

5.1.1.3. 3D (Spheroid) Hepatocytes

5.1.1.4. Expanded Hepatocytes (Plateable)

5.1.1.5. Non-characterized Hepatocytes

5.2. Europe Primary Hepatocytes Market Outlook, by Species, Value (US$ Mn) and 2019 - 2032

5.2.1. Key Highlights

5.2.1.1. Human

5.2.1.2. Rat

5.2.1.3. Mouse

5.2.1.4. Dog

5.2.1.5. Monkey

5.2.1.6. Horse

5.2.1.7. Others

5.3. Europe Primary Hepatocytes Market Outlook, Application/Assay, Value (US$ Mn), 2019 - 2032

5.3.1. Key Highlights

5.3.1.1. Cell Viability Assay

5.3.1.2. Cytochrome Enzyme Activity

5.3.1.3. High Content Cytotoxicity

5.3.1.4. Transporter Inhibition Assay

5.3.1.5. In Vitro Intrinsic Clearance

5.3.1.6. Phospholipids Assay

5.3.1.7. Others

5.4. Europe Primary Hepatocytes Market Outlook, by End User, Value (US$ Mn), 2019 - 2032

5.4.1. Key Highlights

5.4.1.1. Biopharmaceutical companies

5.4.1.2. Academic and Research institutes

5.4.1.3. Contract Research Organizations

5.4.2. BPS Analysis/Market Attractiveness Analysis

5.5. Europe Primary Hepatocytes Market Outlook, by Country, Value (US$ Mn), 2019 - 2032

5.5.1. Key Highlights

5.5.1.1. Germany Primary Hepatocytes Market by Product, Value (US$ Mn), 2019 - 2032

5.5.1.2. Germany Primary Hepatocytes Market by Species, Value (US$ Mn), 2019 - 2032

5.5.1.3. Germany Primary Hepatocytes Market by Application/Assay, Value (US$ Mn), 2019 - 2032

5.5.1.4. Germany Primary Hepatocytes Market by End User, Value (US$ Mn), 2019 - 2032

5.5.1.5. U.K. Primary Hepatocytes Market by Product, Value (US$ Mn), 2019 - 2032

5.5.1.6. U.K. Primary Hepatocytes Market by Species, Value (US$ Mn), 2019 - 2032

5.5.1.7. U.K. Primary Hepatocytes Market by Application/Assay, Value (US$ Mn), 2019 - 2032

5.5.1.8. U.K. Primary Hepatocytes Market by End User, Value (US$ Mn), 2019 - 2032

5.5.1.9. France Primary Hepatocytes Market by Product, Value (US$ Mn), 2019 - 2032

5.5.1.10. France Primary Hepatocytes Market by Species, Value (US$ Mn), 2019 - 2032

5.5.1.11. France Primary Hepatocytes Market by Application/Assay, Value (US$ Mn), 2019 - 2032

5.5.1.12. France Primary Hepatocytes Market by End User, Value (US$ Mn), 2019 - 2032

5.5.1.13. Spain Primary Hepatocytes Market by Product, Value (US$ Mn), 2019 - 2032

5.5.1.14. Spain Primary Hepatocytes Market by Species, Value (US$ Mn), 2019 - 2032

5.5.1.15. Spain Primary Hepatocytes Market by Application/Assay, Value (US$ Mn), 2019 - 2032

5.5.1.16. Spain Primary Hepatocytes Market by End User, Value (US$ Mn), 2019 - 2032

5.5.1.17. Italy Primary Hepatocytes Market by Product, Value (US$ Mn), 2019 - 2032

5.5.1.18. Italy Primary Hepatocytes Market by Species, Value (US$ Mn), 2019 - 2032

5.5.1.19. Italy Primary Hepatocytes Market by Application/Assay, Value (US$ Mn), 2019 - 2032

5.5.1.20. Italy Primary Hepatocytes Market by End User, Value (US$ Mn), 2019 - 2032

5.5.1.21. Russia Primary Hepatocytes Market by Product, Value (US$ Mn), 2019 - 2032

5.5.1.22. Russia Primary Hepatocytes Market by Species, Value (US$ Mn), 2019 - 2032

5.5.1.23. Russia Primary Hepatocytes Market by Application/Assay, Value (US$ Mn), 2019 - 2032

5.5.1.24. Russia Primary Hepatocytes Market by End User, Value (US$ Mn), 2019 - 2032

5.5.1.25. Rest of Europe Primary Hepatocytes Market by Product, Value (US$ Mn), 2019 - 2032

5.5.1.26. Rest of Europe Primary Hepatocytes Market by Species, Value (US$ Mn), 2019 - 2032

5.5.1.27. Rest of Europe Primary Hepatocytes Market by Application/Assay, Value (US$ Mn), 2019 - 2032

5.5.1.28. Rest of Europe Primary Hepatocytes Market by End User, Value (US$ Mn), 2019 - 2032

5.5.2. BPS Analysis/Market Attractiveness Analysis

6. Asia & Pacific Primary Hepatocytes Market Outlook, 2019 - 2032

6.1. Asia Pacific Primary Hepatocytes Market Outlook, by Product, Value (US$ Mn), 2019 - 2032

6.1.1. Key Highlights

6.1.1.1. Cryopreserved Suspension Hepatocytes

6.1.1.2. Fresh Suspension Hepatocytes

6.1.1.3. 3D (Spheroid) Hepatocytes

6.1.1.4. Expanded Hepatocytes (Plateable)

6.1.1.5. Non-characterized Hepatocytes

6.2. Asia Pacific Primary Hepatocytes Market Outlook, by Species, Value (US$ Mn) and 2019 - 2032

6.2.1. Key Highlights

6.2.1.1. Human

6.2.1.2. Rat

6.2.1.3. Mouse

6.2.1.4. Dog

6.2.1.5. Monkey

6.2.1.6. Horse

6.2.1.7. Others

6.3. Asia Pacific Primary Hepatocytes Market Outlook, Application/Assay, Value (US$ Mn), 2019 - 2032

6.3.1. Key Highlights

6.3.1.1. Cell Viability Assay

6.3.1.2. Cytochrome Enzyme Activity

6.3.1.3. High Content Cytotoxicity

6.3.1.4. Transporter Inhibition Assay

6.3.1.5. In Vitro Intrinsic Clearance

6.3.1.6. Phospholipids Assay

6.3.1.7. Others

6.4. Asia Pacific Primary Hepatocytes Market Outlook, by End User, Value (US$ Mn), 2019 - 2032

6.4.1. Key Highlights

6.4.1.1. Biopharmaceutical companies

6.4.1.2. Academic and Research institutes

6.4.1.3. Contract Research Organizations

6.4.2. BPS Analysis/Market Attractiveness Analysis

6.5. Asia & Pacific Primary Hepatocytes Market Outlook, by Country, Value (US$ Mn), 2019 - 2032

6.5.1. Key Highlights

6.5.1.1. China Primary Hepatocytes Market by Product, Value (US$ Mn), 2019 - 2032

6.5.1.2. China Primary Hepatocytes Market by Species, Value (US$ Mn), 2019 - 2032

6.5.1.3. China Primary Hepatocytes Market by Application/Assay, Value (US$ Mn), 2019 - 2032

6.5.1.4. China Primary Hepatocytes Market by End User, Value (US$ Mn), 2019 - 2032

6.5.1.5. Japan Primary Hepatocytes Market by Product, Value (US$ Mn), 2019 - 2032

6.5.1.6. Japan Primary Hepatocytes Market by Species, Value (US$ Mn), 2019 - 2032

6.5.1.7. Japan Primary Hepatocytes Market by Application/Assay, Value (US$ Mn), 2019 - 2032

6.5.1.8. Japan Primary Hepatocytes Market by End User, Value (US$ Mn), 2019 - 2032

6.5.1.9. South Korea Primary Hepatocytes Market by Product, Value (US$ Mn), 2019 - 2032

6.5.1.10. South Korea Primary Hepatocytes Market by Species, Value (US$ Mn), 2019 - 2032

6.5.1.11. South Korea Primary Hepatocytes Market by Application/Assay, Value (US$ Mn), 2019 - 2032

6.5.1.12. South Korea Primary Hepatocytes Market by End User, Value (US$ Mn), 2019 - 2032

6.5.1.13. India Primary Hepatocytes Market by Product, Value (US$ Mn), 2019 - 2032

6.5.1.14. India Primary Hepatocytes Market by Species, Value (US$ Mn), 2019 - 2032

6.5.1.15. India Primary Hepatocytes Market by Application/Assay, Value (US$ Mn), 2019 - 2032

6.5.1.16. India Primary Hepatocytes Market by End User, Value (US$ Mn), 2019 - 2032

6.5.1.17. Southeast Asia Primary Hepatocytes Market by Product, Value (US$ Mn), 2019 - 2032

6.5.1.18. Southeast Asia Primary Hepatocytes Market by Species, Value (US$ Mn), 2019 - 2032

6.5.1.19. Southeast Asia Primary Hepatocytes Market by Application/Assay, Value (US$ Mn), 2019 - 2032

6.5.1.20. Southeast Asia Primary Hepatocytes Market by End User, Value (US$ Mn), 2019 - 2032

6.5.1.21. Rest of Asia Pacific Primary Hepatocytes Market by Product, Value (US$ Mn), 2019 - 2032

6.5.1.22. Rest of Asia Pacific Primary Hepatocytes Market by Species, Value (US$ Mn), 2019 - 2032

6.5.1.23. Rest of Asia Pacific Primary Hepatocytes Market by Application/Assay, Value (US$ Mn), 2019 - 2032

6.5.1.24. Rest of Asia Pacific Primary Hepatocytes Market by End User, Value (US$ Mn), 2019 - 2032

6.5.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America Primary Hepatocytes Market Outlook, 2019 - 2032

7.1. Latin America Primary Hepatocytes Market Outlook, by Product, Value (US$ Mn), 2019 - 2032

7.1.1. Key Highlights

7.1.1.1. Cryopreserved Suspension Hepatocytes

7.1.1.2. Fresh Suspension Hepatocytes

7.1.1.3. 3D (Spheroid) Hepatocytes

7.1.1.4. Expanded Hepatocytes (Plateable)

7.1.1.5. Non-characterized Hepatocytes

7.2. Latin America Primary Hepatocytes Market Outlook, by Species, Value (US$ Mn) and 2019 - 2032

7.2.1. Key Highlights

7.2.1.1. Human

7.2.1.2. Rat

7.2.1.3. Mouse

7.2.1.4. Dog

7.2.1.5. Monkey

7.2.1.6. Horse

7.2.1.7. Others

7.3. Latin America Primary Hepatocytes Market Outlook, Application/Assay, Value (US$ Mn), 2019 - 2032

7.3.1. Key Highlights

7.3.1.1. Cell Viability Assay

7.3.1.2. Cytochrome Enzyme Activity

7.3.1.3. High Content Cytotoxicity

7.3.1.4. Transporter Inhibition Assay

7.3.1.5. In Vitro Intrinsic Clearance

7.3.1.6. Phospholipids Assay

7.3.1.7. Others

7.4. Latin America Primary Hepatocytes Market Outlook, by End User, Value (US$ Mn), 2019 - 2032

7.4.1. Key Highlights

7.4.1.1. Biopharmaceutical companies

7.4.1.2. Academic and Research institutes

7.4.1.3. Contract Research Organizations

7.4.2. BPS Analysis/Market Attractiveness Analysis

7.5. Latin America Primary Hepatocytes Market Outlook, by Country, Value (US$ Mn), 2019 - 2032

7.5.1. Key Highlights

7.5.1.1. Brazil Primary Hepatocytes Market by Product, Value (US$ Mn), 2019 - 2032

7.5.1.2. Brazil Primary Hepatocytes Market by Species, Value (US$ Mn), 2019 - 2032

7.5.1.3. Brazil Primary Hepatocytes Market by Application/Assay, Value (US$ Mn), 2019 - 2032

7.5.1.4. Brazil Primary Hepatocytes Market by End User, Value (US$ Mn), 2019 - 2032

7.5.1.5. Mexico Primary Hepatocytes Market by Product, Value (US$ Mn), 2019 - 2032

7.5.1.6. Mexico Primary Hepatocytes Market by Species, Value (US$ Mn), 2019 - 2032

7.5.1.7. Mexico Primary Hepatocytes Market by Application/Assay, Value (US$ Mn), 2019 - 2032

7.5.1.8. Mexico Primary Hepatocytes Market by End User, Value (US$ Mn), 2019 - 2032

7.5.1.9. Rest of Latin America Primary Hepatocytes Market by Product, Value (US$ Mn), 2019 - 2032

7.5.1.10. Rest of Latin America Primary Hepatocytes Market by Species, Value (US$ Mn), 2019 - 2032

7.5.1.11. Rest of Latin America Primary Hepatocytes Market by Application/Assay, Value (US$ Mn), 2019 - 2032

7.5.1.12. Rest of Latin America Primary Hepatocytes Market by End User, Value (US$ Mn), 2019 - 2032

7.5.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Primary Hepatocytes Market Outlook, 2019 - 2032

8.1. Middle East & Africa Primary Hepatocytes Market Outlook, by Product, Value (US$ Mn), 2019 - 2032

8.1.1. Key Highlights

8.1.1.1. Cryopreserved Suspension Hepatocytes

8.1.1.2. Fresh Suspension Hepatocytes

8.1.1.3. 3D (Spheroid) Hepatocytes

8.1.1.4. Expanded Hepatocytes (Plateable)

8.1.1.5. Non-characterized Hepatocytes

8.2. Middle East & Africa Primary Hepatocytes Market Outlook, by Species, Value (US$ Mn) and 2019 - 2032

8.2.1. Key Highlights

8.2.1.1. Human

8.2.1.2. Rat

8.2.1.3. Mouse

8.2.1.4. Dog

8.2.1.5. Monkey

8.2.1.6. Horse

8.2.1.7. Others

8.3. Middle East & Africa Primary Hepatocytes Market Outlook, Application/Assay, Value (US$ Mn), 2019 - 2032

8.3.1. Key Highlights

8.3.1.1. Cell Viability Assay

8.3.1.2. Cytochrome Enzyme Activity

8.3.1.3. High Content Cytotoxicity

8.3.1.4. Transporter Inhibition Assay

8.3.1.5. In Vitro Intrinsic Clearance

8.3.1.6. Phospholipids Assay

8.3.1.7. Others

8.4. Middle East & Africa Primary Hepatocytes Market Outlook, by End User, Value (US$ Mn), 2019 - 2032

8.4.1. Key Highlights

8.4.1.1. Biopharmaceutical companies

8.4.1.2. Academic and Research institutes

8.4.1.3. Contract Research Organizations

8.4.2. BPS Analysis/Market Attractiveness Analysis

8.5. Middle East & Africa Primary Hepatocytes Market Outlook, by Country, Value (US$ Mn), 2019 - 2032

8.5.1. Key Highlights

8.5.1.1. GCC Countries Primary Hepatocytes Market by Product, Value (US$ Mn), 2019 - 2032

8.5.1.2. GCC Countries Primary Hepatocytes Market by Species, Value (US$ Mn), 2019 - 2032

8.5.1.3. GCC Countries Primary Hepatocytes Market by Application/Assay, Value (US$ Mn), 2019 - 2032

8.5.1.4. GCC Countries Primary Hepatocytes Market by End User, Value (US$ Mn), 2019 - 2032

8.5.1.5. South Africa Primary Hepatocytes Market by Product, Value (US$ Mn), 2019 - 2032

8.5.1.6. South Africa Primary Hepatocytes Market by Species, Value (US$ Mn), 2019 - 2032

8.5.1.7. South Africa Primary Hepatocytes Market by Application/Assay, Value (US$ Mn), 2019 - 2032

8.5.1.8. GCC Countries Primary Hepatocytes Market by End User, Value (US$ Mn), 2019 - 2032

8.5.1.9. Nigeria Primary Hepatocytes Market by Product, Value (US$ Mn), 2019 - 2032

8.5.1.10. Nigeria Primary Hepatocytes Market by Species, Value (US$ Mn), 2019 - 2032

8.5.1.11. Nigeria Primary Hepatocytes Market by Application/Assay, Value (US$ Mn), 2019 - 2032

8.5.1.12. Nigeria Primary Hepatocytes Market by End User, Value (US$ Mn), 2019 - 2032

8.5.1.13. Nigeria Primary Hepatocytes Market by Product, Value (US$ Mn), 2019 - 2032

8.5.1.14. Nigeria Primary Hepatocytes Market by Species, Value (US$ Mn), 2019 - 2032

8.5.1.15. Nigeria Primary Hepatocytes Market by Application/Assay, Value (US$ Mn), 2019 - 2032

8.5.1.16. Nigeria Primary Hepatocytes Market by End User, Value (US$ Mn), 2019 - 2032

8.5.1.17. Rest of Middle East & Africa Primary Hepatocytes Market by Product, Value (US$ Mn), 2019 - 2032

8.5.1.18. Rest of Middle East & Africa Primary Hepatocytes Market by Species, Value (US$ Mn), 2019 - 2032

8.5.1.19. Rest of Middle East & Africa Primary Hepatocytes Market by Application/Assay, Value (US$ Mn), 2019 - 2032

8.5.2. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. Company Market Share Analysis, 2024

9.2. Competitive Dashboard

9.3. Company Profiles

9.3.1. Thermo Fisher Scientific Inc.

9.3.1.1. Company Overview

9.3.1.2. Product Portfolio

9.3.1.3. Financial Overview

9.3.1.4. Business Strategies and Development

9.3.2. Merck KGaA

9.3.2.1. Company Overview

9.3.2.2. Product Portfolio

9.3.2.3. Financial Overview

9.3.2.4. Business Strategies and Development

9.3.3. Lonza

9.3.3.1. Company Overview

9.3.3.2. Product Portfolio

9.3.3.3. Financial Overview

9.3.3.4. Business Strategies and Development

9.3.4. Takara Bio Inc.

9.3.4.1. Company Overview

9.3.4.2. Product Portfolio

9.3.4.3. Financial Overview

9.3.4.4. Business Strategies and Development

9.3.5. American Type Culture Collection (ATCC)

9.3.5.1. Company Overview

9.3.5.2. Product Portfolio

9.3.5.3. Financial Overview

9.3.5.4. Business Strategies and Development

9.3.6. Corning Inc.

9.3.6.1. Company Overview

9.3.6.2. Product Portfolio

9.3.6.3. Financial Overview

9.3.6.4. Business Strategies and Development

9.3.7. Cell Biologics, Inc.

9.3.7.1. Company Overview

9.3.7.2. Product Portfolio

9.3.7.3. Financial Overview

9.3.7.4. Business Strategies and Development

9.3.8. Creative Bioarray

9.3.8.1. Company Overview

9.3.8.2. Product Portfolio

9.3.8.3. Financial Overview

9.3.8.4. Business Strategies and Development

9.3.9. Axol Bioscience Ltd.

9.3.9.1. Company Overview

9.3.9.2. Product Portfolio

9.3.9.3. Financial Overview

9.3.9.4. Business Strategies and Development

9.3.10. HiMedia Laboratories

9.3.10.1. Company Overview

9.3.10.2. Product Portfolio

9.3.10.3. Financial Overview

9.3.10.4. Business Strategies and Development

9.3.11. NEXEL Co., Ltd.

9.3.11.1. Company Overview

9.3.11.2. Product Portfolio

9.3.11.3. Financial Overview

9.3.11.4. Business Strategies and Development

9.3.12. AnaBios

9.3.12.1. Company Overview

9.3.12.2. Product Portfolio

9.3.12.3. Financial Overview

9.3.12.4. Business Strategies and Development

9.3.13. Cytes Biotechnologies S.L.

9.3.13.1. Company Overview

9.3.13.2. Product Portfolio

9.3.13.3. Financial Overview

9.3.13.4. Business Strategies and Development

9.3.14. ZenBio, Inc. (BioIVT)

9.3.14.1. Company Overview

9.3.14.2. Product Portfolio

9.3.14.3. Financial Overview

9.3.14.4. Business Strategies and Development

9.3.15. iXCells Biotechnologies

9.3.15.1. Company Overview

9.3.15.2. Product Portfolio

9.3.15.3. Financial Overview

9.3.15.4. Business Strategies and Development

9.3.16. ScienCell Research Laboratories, Inc.

9.3.16.1. Company Overview

9.3.16.2. Product Portfolio

9.3.16.3. Financial Overview

9.3.16.4. Business Strategies and Development

9.3.17. Kerafast

9.3.17.1. Company Overview

9.3.17.2. Product Portfolio

9.3.17.3. Financial Overview

9.3.17.4. Business Strategies and Development

9.3.18. Kosheeka

9.3.18.1. Company Overview

9.3.18.2. Product Portfolio

9.3.18.3. Financial Overview

9.3.18.4. Business Strategies and Development

9.3.19. XenoTech

9.3.19.1. Company Overview

9.3.19.2. Product Portfolio

9.3.19.3. Financial Overview

9.3.19.4. Business Strategies and Development

9.3.20. LifeNet Health LifeSciences

9.3.20.1. Company Overview

9.3.20.2. Product Portfolio

9.3.20.3. Financial Overview

9.3.20.4. Business Strategies and Development

9.3.21. Cell Guidance Systems LLC

9.3.21.1. Company Overview

9.3.21.2. Product Portfolio

9.3.21.3. Financial Overview

9.3.21.4. Business Strategies and Development

9.3.22. Applied Biological Materials Inc. (abm)

9.3.22.1. Company Overview

9.3.22.2. Product Portfolio

9.3.22.3. Financial Overview

9.3.22.4. Business Strategies and Development

9.3.23. Discovery Life Sciences

9.3.23.1. Company Overview

9.3.23.2. Product Portfolio

9.3.23.3. Financial Overview

9.3.23.4. Business Strategies and Development

9.3.24. Innoprot

9.3.24.1. Company Overview

9.3.24.2. Product Portfolio

9.3.24.3. Financial Overview

9.3.24.4. Business Strategies and Development

9.3.25. Novabiosis

9.3.25.1. Company Overview

9.3.25.2. Product Portfolio

9.3.25.3. Financial Overview

9.3.25.4. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2024 |

|

2019 - 2024 |

2025 - 2032 |

Value: US$ Million |

||

|

REPORT FEATURES |

DETAILS |

|

Product Coverage |

|

|

Species Coverage |

|

|

Assays Coverage |

|

|

End User Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |