Global Prostate Cancer Screening Market Forecast

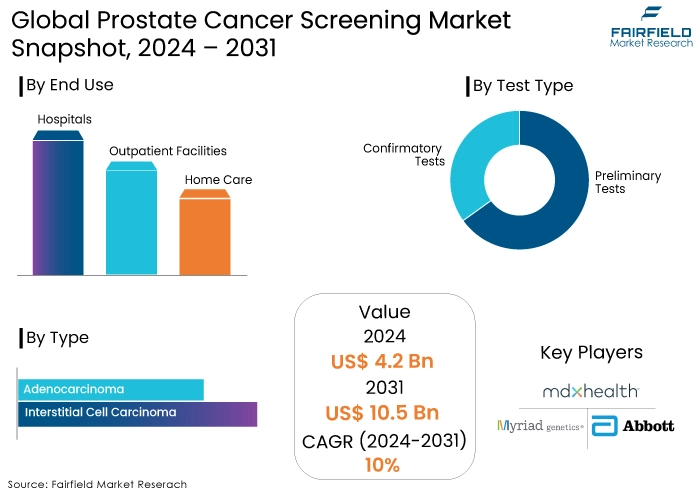

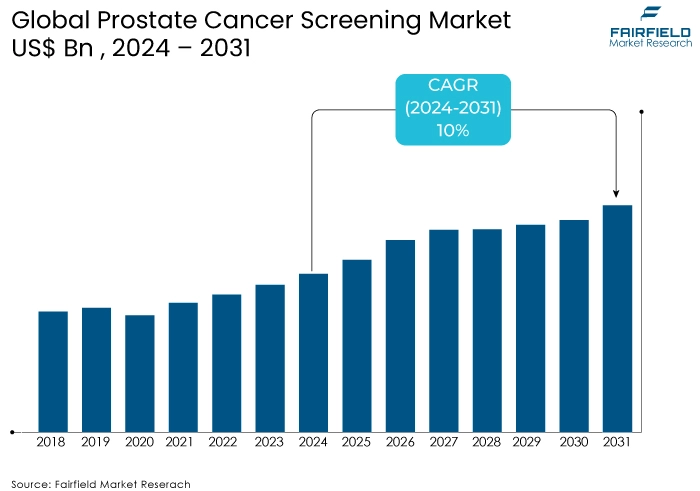

- Prostate cancer screening market size poised to reach US$10.5 Bn in 2031, up from US$4.2 Bn estimated in 2024

- Global prostate cancer screening market revenue projected to witness a CAGR of 10% during 2024-2031

Prostate Cancer Screening Market Insights

- The market experienced steady growth before 2023 due to increased awareness and technological advancements.

- Post-2024, market expected to accelerate driven by AI integration and expansion into emerging markets.

- Technological advancements, particularly in MRI and genetic testing, are key growth drivers for the prostate cancer screening market.

- Aging population and rising prostate cancer prevalence fuel market growth.

- High costs of advanced screenings and risk of overdiagnosis hinder market expansion.

- Integration of AI in screening for improved accuracy and efficiency is a major trend.

- Expansion into developing markets offers significant growth opportunities.

- Confirmatory tests and adenocarcinoma represent key market segments.

- North America dominates the market due to higher awareness and infrastructure.

- Market growth is driven by the need for early detection and improved patient outcomes.

A Look Back and a Look Forward - Comparative Analysis

Before 2023, the prostate cancer screening market experienced steady growth driven by increasing awareness of prostate cancer and the importance of early detection. Advances in screening technologies, such as developing more sensitive prostate-specific antigen (PSA) tests and adopting digital rectal exams (DRE), contributed to higher detection rates. The rising prevalence of prostate cancer, especially among aging male populations, further fuelled the demand for effective screening methods.

Public health campaigns and education initiatives also highlighted the benefits of early diagnosis, encouraging more men to undergo regular screenings. The market also grew due to healthcare infrastructure and access improvements, particularly in developed regions, where routine screenings became more common practice.

Post-2024, the prostate cancer screening market is expected to accelerate, driven by technological advancements and personalized medicine approaches. Innovations such as multi-parametric MRI (mpMRI) and genomic testing are anticipated to enhance the accuracy and specificity of screenings, reducing false positives and unnecessary biopsies. The integration of artificial intelligence (AI) in interpreting screening results will further improve diagnostic precision and streamline clinical workflows.

Additionally, the expansion of screening programs in emerging markets, supported by increasing healthcare investments and growing awareness, will contribute to market growth. Efforts to reduce costs and improve accessibility of advanced screening methods will make these technologies more widely available. The ongoing focus on preventive healthcare and early detection, coupled with an aging global population, will sustain strong demand for prostate cancer screening, ensuring continued market expansion beyond 2024.

Key Growth Determinants

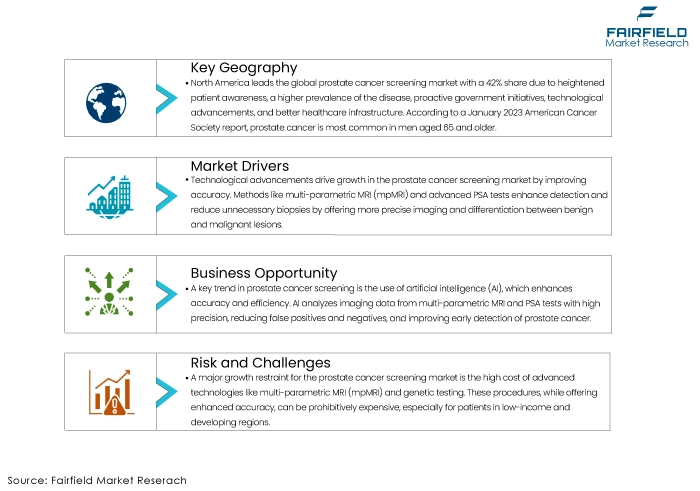

- Technological Advancements in Screening Methods

Technological advancements are a major driver of growth in the prostate cancer screening market. The development and adoption of more precise and less invasive screening methods, such as multi-parametric MRI (mpMRI) and advanced PSA tests, have significantly improved the accuracy of prostate cancer detection. mpMRI especially offers detailed imaging that can better differentiate between benign and malignant lesions, reducing the need for unnecessary biopsies.

Additionally, genetic and molecular testing is emerging as a promising tool for identifying individuals at higher risk and tailoring personalized screening protocols. These technological innovations enhance the effectiveness of screenings, leading to earlier and more accurate diagnoses, which is crucial for improving patient outcomes and driving market growth.

- Aging Population and Increased Prevalence

The aging population and the rising prevalence of prostate cancer significantly contribute to the growth of the prostate cancer screening market. Prostate cancer is more common in older men, and as the global population ages, the number of men at risk of developing the disease increases. Improved life expectancy means that a larger proportion of the population is living to an age where prostate cancer screening becomes relevant. This demographic shift creates a higher demand for screening services.

Additionally, lifestyle changes and increased prevalence of risk factors such as obesity and sedentary behaviour are contributing to a higher incidence of prostate cancer. The need for effective screening solutions to manage this growing burden of disease is driving the expansion of the market.

Key Growth Barriers

- High Costs and Limited Accessibility

One of the major growth restraints for the prostate cancer screening market is the high cost associated with advanced screening technologies. Procedures such as multi-parametric MRI (mpMRI) and genetic testing, while offering improved accuracy and diagnostic capabilities, can be expensive. These costs can be prohibitive for many patients, particularly in low-income and developing regions.

Limited accessibility to these advanced screening methods due to financial constraints or inadequate healthcare infrastructure further exacerbates the issue.

Insurance coverage for such procedures is often limited, making it difficult for a significant portion of the population to afford regular screenings. This financial barrier limits the widespread adoption of advanced screening technologies, restraining market growth.

- Risk of Over-diagnosis and Overtreatment

The risk of over-diagnosis and overtreatment is another significant restraint for the prostate cancer screening market. Prostate cancer screening, particularly using PSA tests, can sometimes detect slow-growing tumours that may never cause symptoms or affect a man's lifespan. This can lead to over-diagnosis, where men are diagnosed with prostate cancer that would not have impacted their health.

Over-diagnosis often results in overtreatment, including unnecessary surgeries, radiation, or hormonal therapies, which can have serious side effects and impact the quality of life. These concerns have led to debates and differing guidelines on the routine use of PSA screening, causing some healthcare providers and patients to be cautious about widespread screening. This hesitation can limit market growth.

Prostate Cancer Screening Market Trends and Opportunities

- Integration of AI in Screening

A prominent trend in the prostate cancer screening market is the integration of artificial intelligence (AI) in diagnostic processes. AI technologies, including machine learning algorithms and deep learning models, are being increasingly utilized to enhance the accuracy and efficiency of prostate cancer screening. AI can analyse vast amounts of imaging data from multi-parametric MRI (mpMRI) scans, and PSA tests with high precision, identifying patterns and abnormalities that might be missed by human radiologists. This technology significantly reduces false positives and false negatives, providing more reliable results and aiding in early detection of prostate cancer.

AI's ability to learn and improve over time further enhances its diagnostic capabilities, making it an invaluable tool for radiologists. It streamlines the workflow, allowing for faster and more accurate interpretations of screening results, ultimately leading to better patient outcomes. As AI technology continues to advance and become more integrated into healthcare systems, its application in prostate cancer screening is expected to grow, driving market expansion. This trend aligns with the broader movement towards precision medicine, where technology plays a crucial role in improving diagnostic and treatment processes.

- Expansion Opportunity in Developing Markets

An important opportunity for the prostate cancer screening market lies in the expansion into emerging markets. Rapid economic growth, increasing healthcare infrastructure investments, and growing awareness of prostate cancer in regions such as Asia Pacific, Latin America, and the Middle East create significant growth potential. These regions are experiencing demographic shifts, including aging populations and rising prevalence of risk factors, leading to an increased need for effective prostate cancer screening solutions.

Government initiatives and public health campaigns in these emerging markets are beginning to emphasize the importance of early detection and regular screenings. Partnerships between local healthcare providers and international organizations can facilitate the introduction of advanced screening technologies and best practices. Additionally, mobile screening units and community outreach programs can help overcome barriers related to accessibility and affordability. By targeting these regions, companies can tap into a large, underserved market, driving growth while contributing to improved healthcare outcomes. Expanding into emerging and developing markets not only increases market shares but also addresses a critical need for early prostate cancer detection in these areas, making it a win-win scenario for both businesses and public health.

How is Regulatory Scenario Shaping this Industry?

The prostate cancer screening market is significantly influenced by regulatory bodies like the FDA in the U.S., EMA in Europe, and equivalent authorities in other regions. These entities set stringent standards for screening tests, ensuring accuracy, reliability, and patient safety. Compliance with these regulations is crucial for market entry and commercial success. While regulations often increase development costs and time-to-market, they also instil confidence among healthcare providers and patients. For instance, FDA approval of a screening test can significantly boost its adoption rate. However, the evolving regulatory landscape, especially around new technologies like AI and liquid biopsies, poses challenges for market players.

It is imperative to note that regulatory variations across countries can impact market penetration. A recent study indicates that the countries with stricter regulations often have lower screening rates, highlighting the need for a harmonized approach. The regulatory environment plays a pivotal role in shaping the market, influencing innovation, market entry, and ultimately, patient access to life-saving screenings.

Segments Covered in Prostate Cancer Screening Market Report

- Demand for Confirmatory Tests Leads, Accounts for over 65% Revenue Share

The prevalence of prostate cancer metastasizing to other organs, such as the genital and urinary system, is increasing in the US. As stated in the May 2023 article from the American Cancer Society, patients who have abnormal results in their PSA and digital rectal exam (DRE) tests after preliminary testing must undergo additional confirmatory tests to diagnose prostate cancer. When cancer has metastasized to other organs, imaging tests are conducted to evaluate the likelihood of metastasis. The increasing incidence of prostate cancer has led to a rise in the utilization of different diagnostic tests, hence expected to drive the expansion of the prostate cancer screening market.

- Adenocarcinoma Represents the Largest Share of Market Size

Patients with adenocarcinoma of the prostate typically experience difficulties with urination, such as a weak stream, occasional blood in the urine, incomplete bladder emptying, and chronic back pain. This indication contributes the largest share to the prostate cancer screening market revenue. During examination, an enlarged prostate and abnormal findings on a digital rectal exam (DRE) are commonly observed, although the accuracy of the DRE is limited.

According to a study published by the National Centre for Biotechnology Information (NCBI) in June 2023, adenocarcinoma of the prostate is the second most prevalent cancer among men worldwide and the third leading cause of death in the US. However, the mortality rate of prostate cancer has been decreasing, particularly in the US, due to increased screening and the use of additional therapies. Furthermore, a WebMD LLC article from May 2023 states that more than 95% of prostate cancers are adenocarcinomas, while other forms of prostate cancer are extremely rare.

Regional Analysis

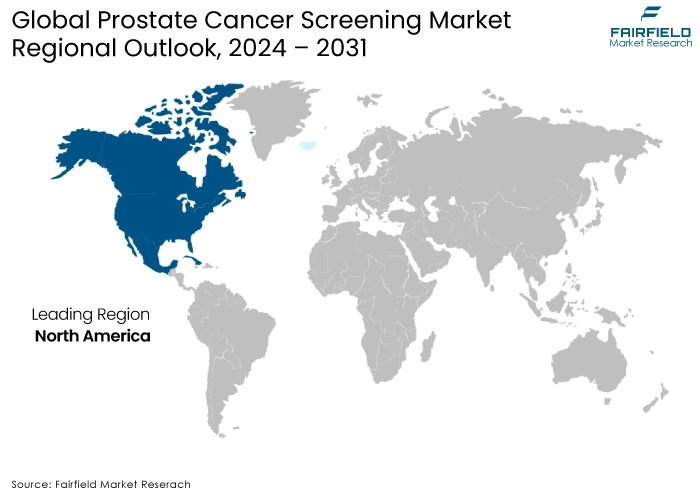

- North America Maintains Dominance in Global Market

North America had the largest share of 42% in the global prostate cancer screening market because of factors such as increased patient awareness, a higher prevalence of prostate cancer, proactive government actions, technological breakthroughs, and improvements in healthcare infrastructure. As per the January 2023 publication by the American Cancer Society, prostate cancer is more commonly observed in elderly men, especially those aged 65 and above.

Instances are infrequent among individuals who are younger than 40. Typically, the diagnosis of about 10 out of 6 instances is observed in men who are above the age of 65. After being diagnosed, men with prostate cancer typically have a life expectancy of approximately 66 years, highlighting the importance of early identification in determining the likely course of the disease. Comprehending these demographic patterns is essential for customized screening and intervention techniques.

Fairfield’s Competitive Landscape Analysis

The prostate cancer screening market is highly competitive, featuring key players that lead through innovation, offering advanced technologies like multi-parametric MRI (mpMRI) and AI-driven diagnostic tools. Major competitors in the industry invest heavily in research and development to enhance screening accuracy and patient outcomes.

The market also includes smaller firms and start-ups that focus on niche technologies and personalized screening approaches. As companies aim to expand their product portfolios and global reach, strategic partnerships, acquisitions, and collaborations are expected. The competitive landscape drives continuous innovation, improving the effectiveness and accessibility of prostate cancer screening solutions and contributing to overall market growth.

Key Market Companies

- MDx Health

- Myriad Genetics, Inc.

- Abbott Laboratories

- F. Hoffman-La Roche AG

- Bayer AG

- Siemens Healthcare GmbH

- OPKO Health, Inc.

- Genomic Health.

- Pfizer Inc.

Recent Industry Developments

- In September 2023, MDxHealth SA partnered with the University of Oxford. The collaboration seeks to investigate the relationship between the Genomic Prostate Score (GPS) test and the advancement of prostate cancer after treatment for localized prostate cancer.

- In August 2023, the U.S. Food and Drug Administration (FDA) approved FoundationOneCDx as a companion diagnostic for Janssen's AKEEGA (abiraterone acetate Dual Action Tablet and niraparib).

- In July 2023, Quest Diagnostics introduced a novel prostate cancer biomarker test called AmeriPath through its subspecialty pathology division.

An Expert’s Eye

- The prostate cancer screening market is poised for significant growth. The aging male population, a primary risk factor, is driving demand.

- Advancements in screening technologies, such as MRI and molecular diagnostics, are enhancing early detection rates and improving patient outcomes. However, challenges like overdiagnosis and cost-benefit analysis persist.

- The industry is likely to witness increased adoption of AI-driven screening tools and personalized medicine approaches.

- The market is expected to expand steadily due to a growing awareness of prostate cancer and the importance of early intervention.

Global Prostate Cancer Screening Market is Segmented as-

By Test Type

- Preliminary Tests

- Confirmatory Tests

By Type

- Adenocarcinoma

- Interstitial Cell Carcinoma

By End Use

- Hospitals

- Outpatient Facilities

- Home Care

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

1. Executive Summary

1.1. Global Prostate Cancer Screening Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2024

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. COVID-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Global Prostate Cancer Screening Market Outlook, 2019 - 2031

3.1. Global Prostate Cancer Screening Market Outlook, by Various Tests, Value (US$ Bn), 2019 - 2031

3.1.1. Key Highlights

3.1.1.1. Physical Exam

3.1.1.2. Laboratory Tests

3.1.1.2.1. Prostate-Specific Antigen (PSA) Blood Test

3.1.1.3. Imaging Tests

3.1.1.3.1. Transrectal ultrasound (TRUS)

3.1.1.3.2. Bone scan

3.1.1.3.3. Computed tomography (CT) scan

3.1.1.3.4. Magnetic resonance imaging (MRI)

3.1.1.3.5. Lymph node biopsy

3.1.1.3.6. Positron Emission Tomography

3.1.1.4. Gleason Score

3.1.1.5. TNM Score

3.1.1.6. Genetic Tests

3.1.1.7. Digital Rectal Exam (DRE)

3.1.1.8. Biopsy

3.1.1.8.1. Fine-Needle Aspiration

3.2. Global Prostate Cancer Screening Market Outlook, by End User, Value (US$ Bn), 2019 - 2031

3.2.1. Key Highlights

3.2.1.1. Hospitals

3.2.1.2. Clinics

3.2.1.3. Research Labs

3.2.1.4. Cancer Institutes

3.2.1.5. Diagnostic Centers

3.2.1.6. Others

3.3. Global Prostate Cancer Screening Market Outlook, by Region, Value (US$ Bn), 2019 - 2031

3.3.1. Key Highlights

3.3.1.1. North America

3.3.1.2. Europe

3.3.1.3. Asia Pacific

3.3.1.4. Latin America

3.3.1.5. Middle East & Africa

4. North America Prostate Cancer Screening Market Outlook, 2019 - 2031

4.1. North America Prostate Cancer Screening Market Outlook, by Various Tests, Value (US$ Bn), 2019 - 2031

4.1.1. Key Highlights

4.1.1.1. Physical Exam

4.1.1.2. Laboratory Tests

4.1.1.2.1. Prostate-Specific Antigen (PSA) Blood Test

4.1.1.3. Imaging Tests

4.1.1.3.1. Transrectal ultrasound (TRUS)

4.1.1.3.2. Bone scan

4.1.1.3.3. Computed tomography (CT) scan

4.1.1.3.4. Magnetic resonance imaging (MRI)

4.1.1.3.5. Lymph node biopsy

4.1.1.3.6. Positron Emission Tomography

4.1.1.4. Gleason Score

4.1.1.5. TNM Score

4.1.1.6. Genetic Tests

4.1.1.7. Digital Rectal Exam (DRE)

4.1.1.8. Biopsy

4.1.1.8.1. Fine-Needle Aspiration

4.2. North America Prostate Cancer Screening Market Outlook, by End User, Value (US$ Bn), 2019 - 2031

4.2.1. Key Highlights

4.2.1.1. Hospitals

4.2.1.2. Clinics

4.2.1.3. Research Labs

4.2.1.4. Cancer Institutes

4.2.1.5. Diagnostic Centers

4.2.1.6. Others

4.2.2. BPS Analysis/Market Attractiveness Analysis

4.3. North America Prostate Cancer Screening Market Outlook, by Country, Value (US$ Bn), 2019 - 2031

4.3.1. Key Highlights

4.3.1.1. U.S. Prostate Cancer Screening Market by Various Tests, Value (US$ Bn), 2019 - 2031

4.3.1.2. U.S. Prostate Cancer Screening Market by End User, Value (US$ Bn), 2019 - 2031

4.3.1.3. Canada Prostate Cancer Screening Market by Various Tests, Value (US$ Bn), 2019 - 2031

4.3.1.4. Canada Prostate Cancer Screening Market by End User, Value (US$ Bn), 2019 - 2031

4.3.2. BPS Analysis/Market Attractiveness Analysis

5. Europe Prostate Cancer Screening Market Outlook, 2019 - 2031

5.1. Europe Prostate Cancer Screening Market Outlook, by Various Tests, Value (US$ Bn), 2019 - 2031

5.1.1. Key Highlights

5.1.1.1. Physical Exam

5.1.1.2. Laboratory Tests

5.1.1.2.1. Prostate-Specific Antigen (PSA) Blood Test

5.1.1.3. Imaging Tests

5.1.1.3.1. Transrectal ultrasound (TRUS)

5.1.1.3.2. Bone scan

5.1.1.3.3. Computed tomography (CT) scan

5.1.1.3.4. Magnetic resonance imaging (MRI)

5.1.1.3.5. Lymph node biopsy

5.1.1.3.6. Positron Emission Tomography

5.1.1.4. Gleason Score

5.1.1.5. TNM Score

5.1.1.6. Genetic Tests

5.1.1.7. Digital Rectal Exam (DRE)

5.1.1.8. Biopsy

5.1.1.8.1. Fine-Needle Aspiration

5.2. Europe Prostate Cancer Screening Market Outlook, by End User, Value (US$ Bn), 2019 - 2031

5.2.1. Key Highlights

5.2.1.1. Hospitals

5.2.1.2. Clinics

5.2.1.3. Research Labs

5.2.1.4. Cancer Institutes

5.2.1.5. Diagnostic Centers

5.2.1.6. Others

5.2.2. BPS Analysis/Market Attractiveness Analysis

5.3. Europe Prostate Cancer Screening Market Outlook, by Country, Value (US$ Bn), 2019 - 2031

5.3.1. Key Highlights

5.3.1.1. Germany Prostate Cancer Screening Market by Various Tests, Value (US$ Bn), 2019 - 2031

5.3.1.2. Germany Prostate Cancer Screening Market by End User, Value (US$ Bn), 2019 - 2031

5.3.1.3. U.K. Prostate Cancer Screening Market by Various Tests, Value (US$ Bn), 2019 - 2031

5.3.1.4. U.K. Prostate Cancer Screening Market by End User, Value (US$ Bn), 2019 - 2031

5.3.1.5. France Prostate Cancer Screening Market by Various Tests, Value (US$ Bn), 2019 - 2031

5.3.1.6. France Prostate Cancer Screening Market by End User, Value (US$ Bn), 2019 - 2031

5.3.1.7. Italy Prostate Cancer Screening Market by Various Tests, Value (US$ Bn), 2019 - 2031

5.3.1.8. Italy Prostate Cancer Screening Market by End User, Value (US$ Bn), 2019 - 2031

5.3.1.9. Turkey Prostate Cancer Screening Market by Various Tests, Value (US$ Bn), 2019 - 2031

5.3.1.10. Turkey Prostate Cancer Screening Market by End User, Value (US$ Bn), 2019 - 2031

5.3.1.11. Russia Prostate Cancer Screening Market by Various Tests, Value (US$ Bn), 2019 - 2031

5.3.1.12. Russia Prostate Cancer Screening Market by End User, Value (US$ Bn), 2019 - 2031

5.3.1.13. Rest of Europe Prostate Cancer Screening Market by Various Tests, Value (US$ Bn), 2019 - 2031

5.3.1.14. Rest of Europe Prostate Cancer Screening Market by End User, Value (US$ Bn), 2019 - 2031

5.3.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Prostate Cancer Screening Market Outlook, 2019 - 2031

6.1. Asia Pacific Prostate Cancer Screening Market Outlook, by Various Tests, Value (US$ Bn), 2019 - 2031

6.1.1. Key Highlights

6.1.1.1. Physical Exam

6.1.1.2. Laboratory Tests

6.1.1.2.1. Prostate-Specific Antigen (PSA) Blood Test

6.1.1.3. Imaging Tests

6.1.1.3.1. Transrectal ultrasound (TRUS)

6.1.1.3.2. Bone scan

6.1.1.3.3. Computed tomography (CT) scan

6.1.1.3.4. Magnetic resonance imaging (MRI)

6.1.1.3.5. Lymph node biopsy

6.1.1.3.6. Positron Emission Tomography

6.1.1.4. Gleason Score

6.1.1.5. TNM Score

6.1.1.6. Genetic Tests

6.1.1.7. Digital Rectal Exam (DRE)

6.1.1.8. Biopsy

6.1.1.8.1. Fine-Needle Aspiration

6.2. Asia Pacific Prostate Cancer Screening Market Outlook, by End User, Value (US$ Bn), 2019 - 2031

6.2.1. Key Highlights

6.2.1.1. Hospitals

6.2.1.2. Clinics

6.2.1.3. Research Labs

6.2.1.4. Cancer Institutes

6.2.1.5. Diagnostic Centers

6.2.1.6. Others

6.2.2. Others BPS Analysis/Market Attractiveness Analysis

6.3. Asia Pacific Prostate Cancer Screening Market Outlook, by Country, Value (US$ Bn), 2019 - 2031

6.3.1. Key Highlights

6.3.1.1. China Prostate Cancer Screening Market by Various Tests, Value (US$ Bn), 2019 - 2031

6.3.1.2. China Prostate Cancer Screening Market by End User, Value (US$ Bn), 2019 - 2031

6.3.1.3. Japan Prostate Cancer Screening Market by Various Tests, Value (US$ Bn), 2019 - 2031

6.3.1.4. Japan Prostate Cancer Screening Market by End User, Value (US$ Bn), 2019 - 2031

6.3.1.5. South Korea Prostate Cancer Screening Market by Various Tests, Value (US$ Bn), 2019 - 2031

6.3.1.6. South Korea Prostate Cancer Screening Market by End User, Value (US$ Bn), 2019 - 2031

6.3.1.7. India Prostate Cancer Screening Market by Various Tests, Value (US$ Bn), 2019 - 2031

6.3.1.8. India Prostate Cancer Screening Market by End User, Value (US$ Bn), 2019 - 2031

6.3.1.9. Southeast Asia Prostate Cancer Screening Market by Various Tests, Value (US$ Bn), 2019 - 2031

6.3.1.10. Southeast Asia Prostate Cancer Screening Market by End User, Value (US$ Bn), 2019 - 2031

6.3.1.11. Rest of Asia Pacific Prostate Cancer Screening Market by Various Tests, Value (US$ Bn), 2019 - 2031

6.3.1.12. Rest of Asia Pacific Prostate Cancer Screening Market by End User, Value (US$ Bn), 2019 - 2031

6.3.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America Prostate Cancer Screening Market Outlook, 2019 - 2031

7.1. Latin America Prostate Cancer Screening Market Outlook, by Various Tests, Value (US$ Bn), 2019 - 2031

7.1.1. Key Highlights

7.1.1.1. Physical Exam

7.1.1.2. Laboratory Tests

7.1.1.2.1. Prostate-Specific Antigen (PSA) Blood Test

7.1.1.3. Imaging Tests

7.1.1.3.1. Transrectal ultrasound (TRUS)

7.1.1.3.2. Bone scan

7.1.1.3.3. Computed tomography (CT) scan

7.1.1.3.4. Magnetic resonance imaging (MRI)

7.1.1.3.5. Lymph node biopsy

7.1.1.3.6. Positron Emission Tomography

7.1.1.4. Gleason Score

7.1.1.5. TNM Score

7.1.1.6. Genetic Tests

7.1.1.7. Digital Rectal Exam (DRE)

7.1.1.8. Biopsy

7.1.1.8.1. Fine-Needle Aspiration

7.2. Latin America Prostate Cancer Screening Market Outlook, by End User, Value (US$ Bn), 2019 - 2031

7.2.1. Key Highlights

7.2.1.1. Hospitals

7.2.1.2. Clinics

7.2.1.3. Research Labs

7.2.1.4. Cancer Institutes

7.2.1.5. Diagnostic Centers

7.2.1.6. Others

7.2.2. BPS Analysis/Market Attractiveness Analysis

7.3. Latin America Prostate Cancer Screening Market Outlook, by Country, Value (US$ Bn), 2019 - 2031

7.3.1. Key Highlights

7.3.1.1. Brazil Prostate Cancer Screening Market by Various Tests, Value (US$ Bn), 2019 - 2031

7.3.1.2. Brazil Prostate Cancer Screening Market by End User, Value (US$ Bn), 2019 - 2031

7.3.1.3. Mexico Prostate Cancer Screening Market by Various Tests, Value (US$ Bn), 2019 - 2031

7.3.1.4. Mexico Prostate Cancer Screening Market by End User, Value (US$ Bn), 2019 - 2031

7.3.1.5. Argentina Prostate Cancer Screening Market by Various Tests, Value (US$ Bn), 2019 - 2031

7.3.1.6. Argentina Prostate Cancer Screening Market by End User, Value (US$ Bn), 2019 - 2031

7.3.1.7. Rest of Latin America Prostate Cancer Screening Market by Various Tests, Value (US$ Bn), 2019 - 2031

7.3.1.8. Rest of Latin America Prostate Cancer Screening Market by End User, Value (US$ Bn), 2019 - 2031

7.3.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Prostate Cancer Screening Market Outlook, 2019 - 2031

8.1. Middle East & Africa Prostate Cancer Screening Market Outlook, by Various Tests, Value (US$ Bn), 2019 - 2031

8.1.1. Key Highlights

8.1.1.1. Physical Exam

8.1.1.2. Laboratory Tests

8.1.1.2.1. Prostate-Specific Antigen (PSA) Blood Test

8.1.1.3. Imaging Tests

8.1.1.3.1. Transrectal ultrasound (TRUS)

8.1.1.3.2. Bone scan

8.1.1.3.3. Computed tomography (CT) scan

8.1.1.3.4. Magnetic resonance imaging (MRI)

8.1.1.3.5. Lymph node biopsy

8.1.1.3.6. Positron Emission Tomography

8.1.1.4. Gleason Score

8.1.1.5. TNM Score

8.1.1.6. Genetic Tests

8.1.1.7. Digital Rectal Exam (DRE)

8.1.1.8. Biopsy

8.1.1.8.1. Fine-Needle Aspiration

8.2. Middle East & Africa Prostate Cancer Screening Market Outlook, by End User, Value (US$ Bn), 2019 - 2031

8.2.1. Key Highlights

8.2.1.1. Hospitals

8.2.1.2. Clinics

8.2.1.3. Research Labs

8.2.1.4. Cancer Institutes

8.2.1.5. Diagnostic Centers

8.2.1.6. Others

8.2.2. BPS Analysis/Market Attractiveness Analysis

8.3. Middle East & Africa Prostate Cancer Screening Market Outlook, by Country, Value (US$ Bn), 2019 - 2031

8.3.1. Key Highlights

8.3.1.1. GCC Prostate Cancer Screening Market by Various Tests, Value (US$ Bn), 2019 - 2031

8.3.1.2. GCC Prostate Cancer Screening Market by End User, Value (US$ Bn), 2019 - 2031

8.3.1.3. South Africa Prostate Cancer Screening Market by Various Tests, Value (US$ Bn), 2019 - 2031

8.3.1.4. South Africa Prostate Cancer Screening Market by End User, Value (US$ Bn), 2019 - 2031

8.3.1.5. Egypt Prostate Cancer Screening Market by Various Tests, Value (US$ Bn), 2019 - 2031

8.3.1.6. Egypt Prostate Cancer Screening Market by End User, Value (US$ Bn), 2019 - 2031

8.3.1.7. Nigeria Prostate Cancer Screening Market by Various Tests, Value (US$ Bn), 2019 - 2031

8.3.1.8. Nigeria Prostate Cancer Screening Market by End User, Value (US$ Bn), 2019 - 2031

8.3.1.9. Rest of Middle East & Africa Prostate Cancer Screening Market by Various Tests, Value (US$ Bn), 2019 - 2031

8.3.1.10. Rest of Middle East & Africa Prostate Cancer Screening Market by End User, Value (US$ Bn), 2019 - 2031

8.3.2. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. Manufacturer vs by End User Heatmap

9.2. Company Market Share Analysis, 2022

9.3. Competitive Dashboard

9.4. Company Profiles

9.4.1. Abbott Laboratories

9.4.1.1. Company Overview

9.4.1.2. Product Portfolio

9.4.1.3. Financial Overview

9.4.1.4. Business Strategies and Development

9.4.2. Almac Group

9.4.2.1. Company Overview

9.4.2.2. Product Portfolio

9.4.2.3. Financial Overview

9.4.2.4. Business Strategies and Development

9.4.3. Bayer AG

9.4.3.1. Company Overview

9.4.3.2. Product Portfolio

9.4.3.3. Financial Overview

9.4.3.4. Business Strategies and Development

9.4.4. Beckman Coulter, Inc.

9.4.4.1. Company Overview

9.4.4.2. Product Portfolio

9.4.4.3. Financial Overview

9.4.4.4. Business Strategies and Development

9.4.5. bioMérieux SA

9.4.5.1. Company Overview

9.4.5.2. Product Portfolio

9.4.5.3. Financial Overview

9.4.5.4. Business Strategies and Development

9.4.6. General Electric Company

9.4.6.1. Company Overview

9.4.6.2. Product Portfolio

9.4.6.3. Financial Overview

9.4.6.4. Business Strategies and Development

9.4.7. Genomic Health

9.4.7.1. Company Overview

9.4.7.2. Product Portfolio

9.4.7.3. Financial Overview

9.4.7.4. Business Strategies and Development

9.4.8. Mayo Clinic

9.4.8.1. Company Overview

9.4.8.2. Product Portfolio

9.4.8.3. Financial Overview

9.4.8.4. Business Strategies and Development

9.4.9. MDxHealth

9.4.9.1. Company Overview

9.4.9.2. Product Portfolio

9.4.9.3. Financial Overview

9.4.9.4. Business Strategies and Development

9.4.10. Roche Diagnostics

9.4.10.1. Company Overview

9.4.10.2. Product Portfolio

9.4.10.3. Financial Overview

9.4.10.4. Business Strategies and Development

9.4.11. Rosetta Genomics

9.4.11.1. Company Overview

9.4.11.2. Product Portfolio

9.4.11.3. Financial Overview

9.4.11.4. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2023 |

|

2019 - 2023 |

2024 - 2031 |

Value: US$ Billion |

||

|

REPORT FEATURES |

DETAILS |

|

Test Type Coverage |

|

|

Type Coverage |

|

|

End Use Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |